Update April 12, 2024

Information for u.s. citizens in the middle east.

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents.

Share this page:

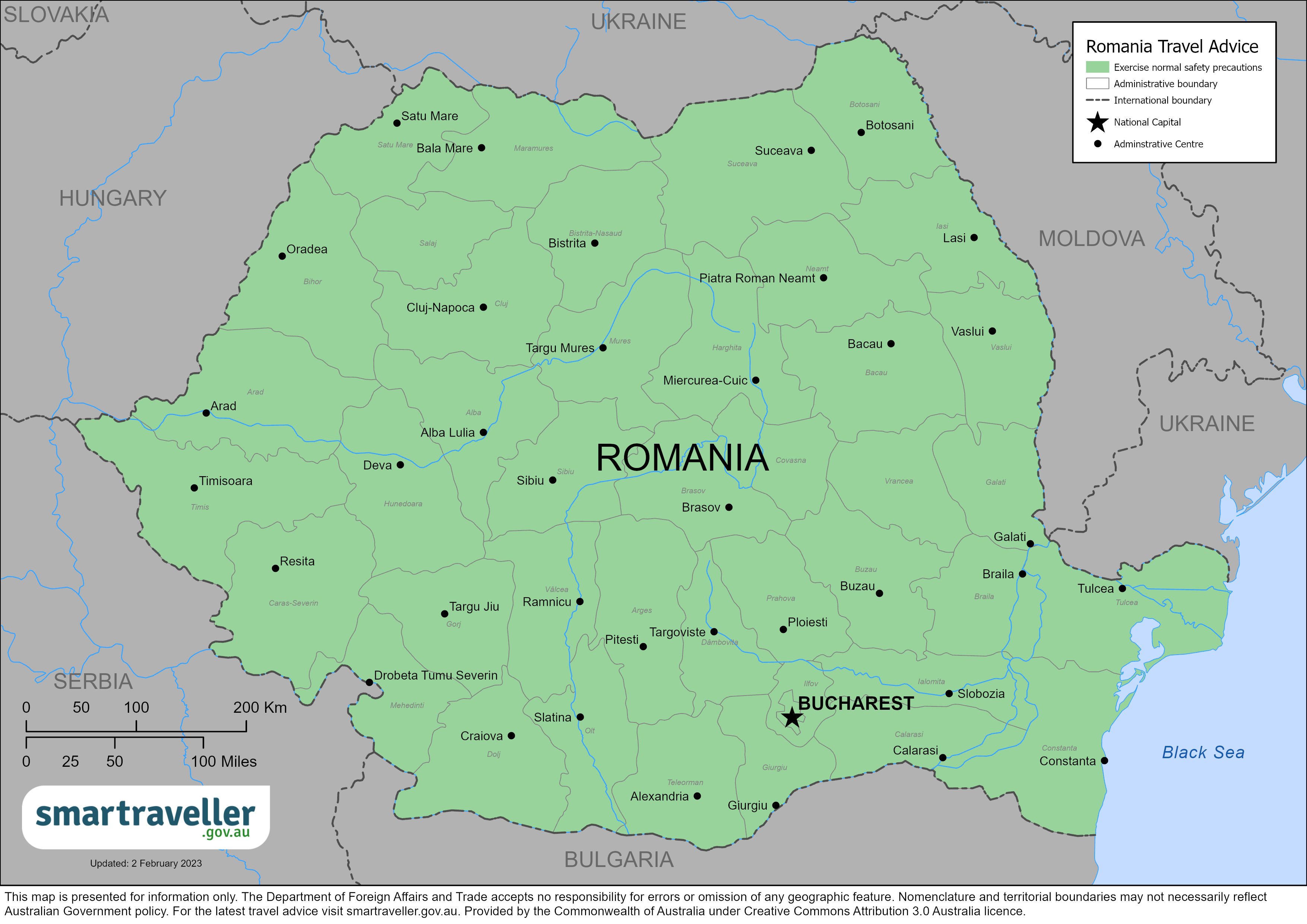

Romania Travel Advisory

Travel advisory july 26, 2023, romania - level 1: exercise normal precautions.

Reissued with obsolete COVID-19 page links removed .

Exercise normal precautions in Romania.

Read the country information page for additional information on travel to Romania.

If you decide to travel to Romania:

- Enroll in the Smart Traveler Enrollment Program ( STEP ) to receive Alerts and make it easier to locate you in an emergency.

- Follow the Department of State on Facebook and Twitter .

- Review the Country Security Report for Romania.

- Visit the CDC page for the latest Travel Health Information related to your travel.

- U.S. citizens who travel abroad should always have a contingency plan for emergency situations. Review the Traveler’s Checklist .

Travel Advisory Levels

Assistance for u.s. citizens, romania map, search for travel advisories, external link.

You are about to leave travel.state.gov for an external website that is not maintained by the U.S. Department of State.

Links to external websites are provided as a convenience and should not be construed as an endorsement by the U.S. Department of State of the views or products contained therein. If you wish to remain on travel.state.gov, click the "cancel" message.

You are about to visit:

COVID-19 travel: Entry regulations & national restrictions in Romania

Irina Marica

Like this article? Share it with your friends!

Are you planning to start the year with a trip to Romania? We’ve compiled a short guide to help you stay updated with the country’s entry & quarantine rules and national restrictions.

Rules for entering Romania - required documents and quarantine regulations

Starting December 20, 2021, all persons entering Romania must complete the Passenger Locator Form (PLF). You have to fill it in online (at plf.gov.ro) in the 24 hours before entering Romania or within 24 hours of crossing the border. Further details here .

Further entry requirements vary depending on the country you’re coming from. There’s a list of risk areas published weekly (usually on Fridays), which classifies countries as red, yellow or green, depending on their COVID-19 situation. The updated lists can be found here .

Rules for travellers coming from EU Member States + Norway, Iceland, Lichtenstein, and Switzerland:

Those arriving from green or yellow countries don’t have to quarantine if they have a Digital COVID Certificate showing that they were vaccinated or have recovered from COVID-19 (in the past six months). However, a 14-day quarantine applies to travellers who don’t show proof of vaccination, recovery from COVID-19 (within the past six months) or a negative RT-PCR test (made 72 hours before). Those finding themselves in this situation can quarantine at home, at a declared address, or in a specially arranged space.

Travellers arriving from red areas are exempted from the quarantine requirement if they show proof of vaccination or recovery from COVID-19 infection. A 10-day quarantine is imposed for those who can’t provide any of these documents but have a negative RT-PCR test (made 72 hours before). The quarantine period increases to 14 days for those who can’t show any of the required documents and don’t have a negative test either.

Rules for travellers coming from outside the EU, Norway, Iceland, Liechtenstein, Switzerland:

Travellers will not be quarantined if they were vaccinated or have recovered from COVID-19 and have a negative RT-PCR test (made 48 hours before travelling). Those who can’t show a negative test will be quarantined for 10 days.

A 10-day quarantine is also imposed on travellers who can’t show proof of vaccination or recovery from infection but have a negative RT-PCR test (made 48 hours before). A 14-day quarantine is imposed on those who don’t show any of the required documents and don’t have a negative test either.

Other exemptions from the quarantine requirement include children younger than 12; children between 12 and 16 years of age who present a negative RT-PCR test, regardless of the state they come from; travellers who can’t show proof of vaccination or recovery from COVID-19 but stay for less than 3 days in Romania and have a negative RT-PCR test; or travellers in transit (less than 24 hours).

Individuals from countries whose authorities do not issue the EU Digital COVID Certificate or documents compatible with such certificates shall provide other documents issued by the respective state showing proof of vaccination, testing or recovery from COVID-19.

Special Omicron rules: Amid growing concerns over the Omicron variant, the Romanian authorities decided that all Romanian citizens, EU citizens, citizens of the European Economic Area or the Swiss Confederation arriving in Romania from Botswana, Eswatini, Lesotho, Mozambique, Namibia, South Africa and Zimbabwe have to quarantine for 14 days. At the same time, other foreign travellers arriving from these counties are banned from entering Romania. Read more about it here .

Important: The rules listed above are valid until January 8, 2022, and can be changed or reviewed after this date. Travellers can check the most recent decisions of the Romanian authorities on the Government’s website - here , the national platform for emergency preparedness - here , or the official platform on COVID-19 information - here . To plan your travel, you can also check the Re-open EU platform - data for Romania is available here .

Restrictions in Romania

The Romanian authorities decided to ease some of the general restrictions just before the winter holidays. As such, there are no more movement restrictions in place and wearing a mask is no longer mandatory in open public spaces that are not crowded.

However, people are still required to wear masks in all closed public spaces, crowded open public spaces, public transport, workplaces, markets, or fairs. Exemptions include children younger than 5, those who are alone in the office, or those who play sports or do intense physical activities.

The green pass is required to access several locations such as shopping malls, restaurants, coffee shops, or public institutions. However, the green pass requirement doesn’t apply to grocery stores, pharmacies, gas stations or small non-food shops (up to 200 sqm).

The clubs and bars are closed, and private events such as weddings or baptisms are not allowed.

The complete list of restrictions is available here (in Romanian).

Important: The rules could change in the coming period as the Romanian authorities are considering tightening the restrictions ahead of the fifth wave of the pandemic.

(Photo source: Inquam Photos/Virgil Simonescu)

Recommended stories

Romania Insider Free Newsletters

Editor's picks, latest press releases, from our partners.

- Employer of Record

- I'm an Employee

- Available Countries

- Global Taxes

- Case Studies

- Guides & eBooks

- HR Glossary

- Video Series

- Partnerships

- Get Started

Taxes in Romania

- Employment cost calculator

- Employee rights

- Employment conditions

- Remote work

- Hours of work

- End of employment

- Independent contracting

- Local employment solution

Employer Contributions in Romania

Work insurance contribution.

Employers in Romania pay a 2.25% work insurance contribution based on the employee’s total taxable monthly income.

Employee Contributions in Romania

Social insurance.

Employees in Romania must make mandatory contributions to the social security insurance monthly. The social security system finances old-age pension, sickness, and unemployment benefits. Employees contribute at a rate of 25% of their gross salary, including taxable benefits and allowances.

Health insurance

Employees in Romania make mandatory contributions to health insurance monthly. Employees contribute at a rate of 10% of their gross salary, including taxable benefits and allowances.

Employees pay a 10% net income tax which is based on the gross salary minus pension, health, and personal deductions.

Employers must withhold each employee’s income tax contribution monthly and remit it to the tax authorities. Thus, employees don’t have to do any individual tax filing related to their salary income.

Benefits-in-kind taxation

Benefits in kind received as a result of employment are taxable income, except for a few minor exceptions, and are valued in principle at open-market values. A few exceptions include:

- Meal tickets: subject to income tax only, with the corresponding tax deducted from the net salary

- Gift tickets: granted for special occasions and non-taxable up to RON 300

- Private pension and private health insurance: tax-free up to EUR 400 per year; once above the limit, taxed as a salary benefit

- Vacation/tourism tickets: subject only to income tax if the cost is less than six minimum gross salaries; used for internal destinations/services

- Travel allowance: granted to employees and family members within the limit of a medium gross salary (RON 6,095), based on an expense report

- Cultural tickets: subject to income tax when up to RON 170 per month or RON 350 infrequently

- Mobility indemnity: RON 1,000 net non-taxable, for employees not carrying out their activities from a specific workplace (e.g., sales agents), with no additional travel allowance permitted

Teleworking allowance used to be a non-taxable benefit but will be starting from 2024. All amounts granted will be taxed with social contributions (public pension 25%, public health fund 10%) and income tax (10%).

The reimbursement of travel expenses in excess of fairly low statutory limits is also a taxable benefit for employees. Certain non-monetary educational and health benefits aren’t taxable under certain conditions.

Temporary accommodation provided by an employer as a non-monetary benefit is generally taxable with very few exceptions. A cash accommodation allowance is taxable.

On January 1, 2023, a new fiscal rule came into force, changing the benefit taxation. The limit for non-taxable benefits is 33% of the base salary. It means that if the total amount of monthly benefits received by the employee exceeds the 33% limit, the amount will be taxed as a salary benefit (pension, health, income tax).

The following benefits are exempt from the new regulation:

- meal tickets, holiday tickets, gift tickets, cultural tickets, daycare tickets

- burial assistance, serious and incurable disease assistance, medical devices, birth/adoption assistance, assistance granted for losses resulting from natural calamities

- employee’s transportation costs (to and from work)

- meal allowances if under the applicable regulations no food is permitted in the workspace

- delegation and detachment indemnities, indemnities received by mobile workers

- phone subscription costs

- employer-supported professional development expenses

- stock options plan benefits

As a general rule, all benefits are subject to the employer’s decision to grant them and should be detailed in the internal regulations.

Romania doesn’t have a system of tax credits, but it does have a limited system of deductions for income tax calculations.

Employees with gross salaries under RON 3,600 benefit from a personal income tax deduction, depending on salary thresholds and the number of dependents.

Employees suffering from certain degrees of handicap (serious or pronounced) are exempt from paying income tax. They also benefit from three additional vacation days.

Private pension contributions

Employees making personal monthly contributions to a private pension fund are eligible for a corresponding income tax deduction of up to EUR 400 per year; however, they must provide their employers with proof of such contributions.

Employment expenses

Employees receive no deductions for expenditures incurred in connection with taxable income from employment. However, sums received by way of reimbursement for travel expenses, based on supporting documents and travel allowance, are exempt from tax as long as they don’t exceed statutory limits.

Employees working from home (teleworkers) are allowed to receive up to RON 400 per month tax-free to cover related utilities expenses, with no receipts or other supporting documents required.

Boundless for employers

Boundless for employees.

- Advice Accounting

- Qualified staff

- Business process outsourcing

- Links to Timişoara

- SRL Romania

- Romanian company registration

- IT Solutions

- Payroll and human resources

- Legal advice

- Notary services and consultancy

- Romania dividend tax

- Romanian tax system

- Eu VAT number Romania

- VAT number Romania

- VAT registration Romania

- Virtual Office

- Life of a Romanian accountant

The non-taxable daily allowance within the country is increasing from 01.01.2019

According with the Government Decision no. 714/2018 with respect to the rights and obligations of the personnel employed in the public sector, during the delegation in another locality, as well as in the case of the missions, published in the Official Gazette no. 797 from 13.09.2018, new values for internal travel, detachment, and accommodation allowance were established.

The main changes refer to:

– increase for delegation allowance from 17 to 20 RON, regardless of the function performed for the public authority or institution in which the respective employee is working, and

– the accommodation allowance is increased to 230 RON per day (within this limit all the accommodation costs must be covered).

The most recent increase in the amount of allowances for travel and detachment has been enacted more than three years ago.

Starting with January 2019, the non-taxable amount of the daily allowance will increase from 42.5 RON per day, as it is now, to 50 RON per day, for the employers in the private sector.

More precisely, according with the Romanian Fiscal Code, the non-taxable amount of the daily travel allowance, for delegations and detachments within the country, is 2.5 times the legal level established for the state budget, according to the calculation:

20 RON / day x 2,5 = 50 lei / day.

If an employer grants daily allowances exceeding the statutory rate, he is required to pay:

– income tax (10%)

– contributions to pensions (25%)

– health insurance (10%) and

– work insurance (2.5%)

The international limits of daily allowance remain in the limits established by the Government Decision 518/1995.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Introducing Romania

- About Romania

- Images of Romania

- History, language & culture

- Weather & geography

- Doing business & staying in touch

Plan your trip

- Travel to Romania

- Where to stay

While you’re there

- Things to see & do

- Shopping & nightlife

- Food & drink

- Getting around

Before you go

- Passport & visa

- Public Holidays

- Money & duty free

Book your flights

- Bucharest Henri Coanda International Airport

- Cluj Avram Iancu International Airport

- Sibiu International Airport

- Timisoara Traian Vuia International Airport

Money and duty free for Romania

Currency and money, currency information.

New Leu (RON; symbol (plural) Lei) = 100 bani. Notes are in denominations of Lei500, 100, 50, 10, 5 and 1. Coins are in denominations of Bani50, 10, 5 and 1. (Old notes were in denominations of Lei1,000,000, 500,000, 100,000, 50,000 and 10,000 and coins in denominations of Lei5,000, 1,000, 500 and 100.)

Credit cards

American Express, Diners Club, MasterCard and Visa are accepted by large hotels, car hire firms and some restaurants and shops.

ATMs ( bancomat ) accepting MasterCard and Visa can be found in main banks, airports and shopping centres but should not be relied upon as a sole source of cash.

Travellers cheques

Like credit and debit cards, these are usually only useful in hotels and for obtaining cash at the bank or selected exchange offices. To avoid additional exchange rate charges, travellers are advised to take traveller's cheques in US Dollars or Euros.

Banking hours

Mon-Fri 0900-1300.

Currency restrictions

The import and export of local currency is prohibited. The import and export of foreign currency is limited to €10,000.

Currency exchange

It is recommended that visitors bring Euros, as these can be easily exchanged by shops, restaurants and hotels. Pounds Sterling can be easily exchanged in most resorts. All hard foreign currencies can be exchanged at banks, larger hotels and airports and at authorised exchange offices ( Birou de Schimb Valutar ). Rates can vary from one place to another, so visitors are advised to shop around for the best rate of exchange. Exchanges on the black market are made frequently, but visitors are advised to exchange money through proper exchange channels and to receive a currency exchange receipt, as certain services require visitors to show the receipt as proof of having made at least one financial transaction.

Romania duty free

Romania is within the European Union. If you are travelling from outside of the EU , you are entitled to buy fragrance, skincare, cosmetics, Champagne, wine, selected spirits, fashion accessories, gifts and souvenirs - all at tax-free equivalent prices.

Romania’s duty-free allowance for travellers from EU countries:

If you are over 17 years old, you are free to buy and take goods with you when travelling between EU countries, provided that you have paid tax on these goods and they are for your own use (not for sale). However, if you bring in more than the following, customs officials are likely to question you:

• 800 cigarettes or 400 cigarillos or 200 cigars or 1kg of tobacco. • 90L of wine of which a maximum of 60L can be sparkling wine. • 10L of alcoholic beverages stronger than 22% or 20L of fortified wine or other liqueurs up to 22%.

Beware that each EU country has different rules for travellers under 17 years old. Please check before you travel.

Romania’s duty-free allowance for travellers from non-EU countries:

If you are arriving from a non-EU country, the following goods may be imported into Romania by travellers with a minimum age of 17 years without incurring customs duty:

• 40 cigarettes or 20 cigarillos (max. 3 grams each) or 10 cigars or 50g of tobacco. You may combine any of these tobacco products provided you do not exceed the total limit. • 4L of wine and 16L of beer and 1L of spirits over 22% volume or 2L of alcoholic beverages less than 22% volume or a proportional mix of these products provided the total limit is not exceeded. • Other goods up to the value of €430 for air and sea travellers and €300 for other travellers (reduced to €150 for children under 15).

Banned Imports

Ammunition, weapons, explosives, narcotics and counterfeit goods.

There are restrictions on the import of meat, fish and dairy products from outside the EU.

You must obtain a permit to import protected species.

Banned Exports

Articles of cultural, historical or artistic value.

Related Articles

City Highlight: Bucharest

A vibrant collision of old traditions and growing reinvention, Bucharest is an ideal destination for your next city break

Central European historic spas and resorts

Take a spa break in Central Europe where you can immerse yourself in history and the steamiest salubrious waters

Book a Hotel

© Columbus Travel Media Ltd. All rights reserved 2024

- Skip to main content

- Skip to footer

[email protected] Client login

Sign up for news

- Locations and contact

TULIP Simply Future

Rediscover business simplicity!

Business trip legislation in Europe | Series – part 3: Romania

27 Feb 2023

What are the rights and obligations for employees for their business trip? What is necessary for business trip settlement, how are advances and refunds provided? What is the difference between domestic and foreign business trip?

This is what our series of Business trip legislation is about. The first part was dedicated to Slovak legislation , the second part described details of business trip legislation in the Czech Republic and for the third time, we will focus on legislation in Romania.

Duration of a business trip:

The number of calendar days during which a person is on a business trip is calculated from the day and time of departure to the day and time of the return. For one day of the business trip, it is considered every 24 hours of the duration of the business trip.

Vehicles used for business trips :

Expenses related to vehicles that are used exclusively for economic activity are fully admissible , but the company has the obligation to draw up a log of kilometres driven, in which it will justify that the car was used only for the purposes of economic activity. At the beginning of each trip, the employee must enter in the mileage report the number of kilometres travelled, which is displayed on the dashboard of the car, and which represents the number of kilometres driven by the vehicle immediately before this trip. At the end of each trip, the employee should once again enter the number of kilometres driven in the mileage report. The difference between these two numbers represents the number of kilometres the car travelled during the trip. In order to justify the number of kilometres driven for each trip, it is necessary for the employee to submit fuel receipts for the work trip. Using the average fuel consumption (litre per km, information in the vehicle’s technical book), it is possible to calculate the approximate number of litres consumed by the car during driving and determine the value of fuel expenses. The price of fuel for the calculation is the average price based on the documents submitted by the employees. If the employee presents proof of purchase of fuel from abroad with an amount in foreign currency, the price is calculated at the rate of the National Bank of Romania valid on the date of receipt of the fuel.

Meals by a domestic business trip:

During a domestic business trip, the employee is entitled to daily per diems that cover food and/or other unforeseen expenses . In that case, the employee should not submit additional documents for meals during the business trip. Both diem and food are claimed as part of the business trip, the cumulative amount is determined and what exceeds the deductible limit is subject to income tax from wages and social contributions.

The deductible limit is set at RON 50/day-, and/or in the limit of 3 base salaries corresponding to the job held by the Romanian Tax Code. The ceiling of 3 base salaries corresponding to the post occupied is calculated by dividing the 3 salaries by the number of working days in the month in question and multiplying the result by the number of days during the period of secondment to another place in the country.

If business trips on the territory of Romania last several calendar days, the number of days of the business trip is calculated from the date and time of departure to the date and time of return to the location where the employee has a permanent residence or place of work. The resulting period is then divided into 24 hours, and each resulting interval represents 1 day of business travel . A person seconded to a locality more than 5 km from the locality where he or she has his or her permanent place of work shall receive a secondment allowance. The secondment allowance is granted only if the duration of the secondment is at least 12 hours.

Meals by a foreign business trip:

Foreign per diems are granted in the amount determined for each country in which the trip takes place, considering the values established by law and in this situation the Government’s decision must be verified for Romanian personnel sent abroad for temporary assignments . In most countries of the European Union, the same daily allowance is provided: 35 euro/day, with the possibility of a fiscal maximum of 87.5 euro/day and within the limit of 3 base salaries corresponding to the job held. The ceiling of 3 base salaries corresponding to the post occupied is calculated by dividing the 3 salaries by the number of working days in the month in question and multiplying the result by the number of days of the period of secondment abroad.

The period for which the foreign daily allowance is granted for foreign delegations is determined according to the means of transport used by the employee, considering

- the moment of take-off of the plane when going abroad and the moment of landing of the plane after arriving in the country and from the airports that form the crossings of the state border of Romania;

- the moment of crossing by train or car through border crossings or the Romanian state, both when going abroad and when returning to the country.

For external journeys, 50% of the value of the daily diet is granted for periods not exceeding 12 hours and 100% for periods exceeding 12 hours.

Reduction of a meal allowance :

According to Romanian law, if the employer grants and bears all the expenses incurred for business trips, then the employee is not granted a delegation allowance, but this aspect, in our opinion, must be stipulated in the individual employment contract and in the internal regulations and/or other internal procedures of the employer and made known to the employee.

In order to avoid any interpretation to the contrary, our recommendation is that private employers, when granting the delegation allowance, should take into account the provisions of the government decisions establishing the conditions for granting the daily allowance for staff in public institutions.

Compensation and settlement

Advances for compensations:.

The employer can provide the employee with a cash advance, based on which it is necessary to create a Statement of Expenses. The Statement of Expenses must outline the specific costs covered by the advance and be supported by relevant documentation and must include all expenses incurred, including daily subsistence allowance, on return from the trip. If the amount of expenses plus per diem is less than the advance granted then the employee will receive the difference, and if the ratio is reversed, the employee will have to repay the excess.

Travel reimbursements:

For example, the employer must reimburse the following items:

- Travel expenses (travel ticket, plane ticket, taxi, public transport ticket);

- Accommodation expenses ;

- Incidental expenses (phone fee, fax fee, Internet fee, parking fee, highway fee).

If an employee goes on vacation following a business trip and returns to the workplace, the cost of return transportation is not covered and will not be reimbursed.

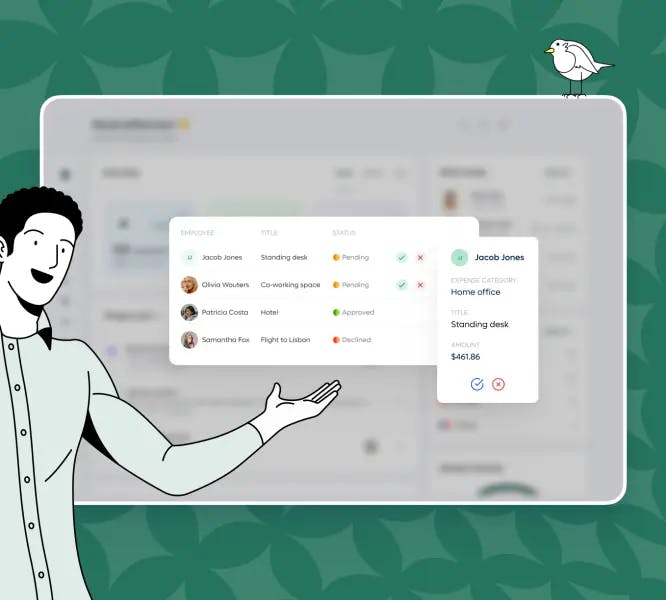

TULIP and business trips

Business trip management in TULIP is separated to 2 parts:

- business trip request (plan)

If the employer agrees with the employee on a work trip, the employee must enter the work trip plan in TULIP. The plan allows TULIP to state:

- place of departure for the work trip,

- place of work (country, city, company),

- duration of the business trip,

- type of transport,

- place of end of the business trip,

- the reason for the business trip,

- planned expenses,

- attachments, or other necessary information.

BT request can be submitted by HR, the employee’s supervisor or another authorized person . In this section, the employee has the option to request a deposit in RON or a foreign currency. The duration for which the employee entered the plan is also automatically displayed in his attendance for the purposes of payroll processing.

After the plan has been approved by the competent persons and after the employee’s return from the business trip, the employee is obliged to fill out the business trip statemen t. The work trip statement shows all the information that the employee entered in his plan with the possibility of editing this data according to reality.

The employee has 5 sections at his disposal :

- crossing borders,

- attachments,

- compensation for the use of a private vehicle.

TULIP automatically calculates meal reimbursements based on the time zone and border crossing, which the employee is required to indicate in the Border Crossing and Meals sections. If the employee passes through several countries, he/she has the option to fill in all the countries of transit during the work trip and the exact time of the plane’s departure, or border crossing. The employee is also obliged to indicate the free meals provided by the employer. Based on this, TULIP automatically reduces the amount of the meal allowance for the given day . If the employee states that he/she was reimbursed for the free breakfast, the amount of the meal allowance will not be reduced.

The employee has the option to enter all travel expenses in the Expenses section, indicating the date of the expense, the type of expense, the amount of the expense, in the case of payment by card, the amount of the expense abroad in the domestic currency. Expenses paid by the employee with the company card are indicated in TULIP and the amount of these expenses is subsequently deducted from the total result of the statement. All conversions to the domestic currency are calculated automatically.

If the employee used a private vehicle, in TULIP he/she indicates the number of kilometres travelled, the type of private vehicle and the price from the receipt for the purchase of fuel. The employee has the option of specifying a larger number of prices from receipts for the purchase of fuel, then TULIP calculates the average price for the purchase of fuel and automatically recalculates the total compensation for the fuel consumed from this price.

The employee sees the result of the bill immediately after entering all the information in his/her bill and can change it until the bill is sent for approval and processing. All participants in the workflow have the opportunity to download the work trip form.

Do you want to see TULIP’s business trip module? Plan a meeting with us:

Soon, we will publish other countries’ legislation of business trips. Are you interested? Submit for newsletter delivery or follow our social media where we will share new content.

STAY IN THE LOOP

Subscribe to our newsletter to receive the latest news right into your inbox.

Email: [email protected]

TULIP – cloud platform for business trip management | Case study – how do employees in Alpiq manage their business trips?

The four-day work week. What’s the situation now and what is its future?

The biggest myths about attendance systems, time and attendance management system for retail, what was it like on the websummit 2023, business trip legislation in europe | series – part 5: hungary, how to manage the payroll agenda in-house or with help from an outsourcing provider, digital processes save not only your wallets but also the planet. we do not exaggerate, unleashing the full potential of cloud computing: a guide to the digital transformation, business trip legislation in europe | series – part 4: poland, single sign-on: how to increase security and comfort for employees in your company, about tulip.

TULIP allows you to manage your back-office functions in the cloud, to achieve more simplicity, transparency and efficiency. It serves as a highly secure and traceable self-service portal that eliminates the burden of paper work, offline processes and the risks involved, over full data digitization and smart automation of workflows. During the past decade, TULIP has become a global platform, accommodating more than 2,800 companies, with over 115,000 users beyond 30 locations.

WHAT WE OFFER

Time & Attendance HR Administration Accounting Automation

GET IN TOUCH

Locations and contact Request for proposal Request a demo Sign up for news

@TULIP Solutions, all rights reserved | Privacy | GDPR statement | Cookie policy

GET HOOKED ON THE LATEST NEWS, TRENDS AND INSIGHTS

Stay on top of the hottest industry news with our expert opinions and handy tips on business processes simplification, time and attendance management, HR administration, accounting automation and much more. Be the first one to read about TULIP’s new features and usability improvements. Subscribe to our mailing list now to receive the latest news directly in your mailbox.

Check out our blog to see what is included!

We will send you only relevant information we consider may be of your interest and treat your personal data in compliance with our privacy policy and GDPR statement .

Unable to subscribe? Try this page .

BOOK A TAILORED DEMO SESSION

- Recent Currently selected

Marzena Rączkiewicz

Tax adviser (Poland)

Send inquiry

- Legal notice

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Passports, travel and living abroad

- Travel abroad

- Foreign travel advice

Entry requirements

This advice reflects the UK government’s understanding of current rules for people travelling on a full ‘British citizen’ passport from the UK, for the most common types of travel.

The authorities in Romania set and enforce entry rules. If you’re not sure how these requirements apply to you, contact Romania’s Embassy in the UK .

COVID-19 rules

There are no COVID-19 testing or vaccination requirements for travellers entering Romania.

Passport validity requirements

Romania is now part of the Schengen area, you must follow the Schengen area passport requirements to travel there.

To enter Romania (and all Schengen countries) your passport must:

- have a ‘date of issue’ less than 10 years before the date you arrive. Passports issued after 1 October 2018 are now valid for only 10 years, but for passports issued before 1 October 2018, extra months may have been added if you renewed a passport early

- have an ‘expiry date’ at least 3 months after the day you plan to leave

Check the Ministry of Foreign Affairs for the latest guidance on passport validity.

Contact the Romanian embassy in the UK if you think that your passport does not meet both these requirements. Renew your passport if you need to.

Passport stamping

At the Romanian border your passport may be stamped when you enter and exit Romania or another country in the Schengen area. Border guards will use passport stamps to check you have not overstayed the 90-day visa-free limit for short stays in the Schengen area.

You can show tickets or boarding passes as evidence of when and where you entered or exited the Schengen area. Ask the border guards to add this date and location in your passport.

If you have a Withdrawal Agreement residency document for another country, your passport might still be stamped if you are a visitor to Romania.

You may also need to:

- show a return or onward ticket

- show you have enough money for your stay

Read about passport stamping if you live in Romania .

Visa requirements

Romania is now part of the Schengen area. Visits to Romania now count towards your 90-day visa-free limit in the Schengen area.

You can visit the Schengen area for up to 90 days in any 180-day period without a visa. This applies if you travel:

- as a tourist

- to visit for family or friends

- to attend business meetings, cultural or sports events

- for short-term studies or training

On 31 March, Romania joined Schengen for border control-free travel via air and sea. Border controls will continue to remain at all land and river borders, including those within the Schengen zone. You will need to show your passport at land and river borders, although your passport should not be stamped.

Visits to any other Schengen countries in the 180 days before you travel to Romania will count towards your 90 day visa-free limit.

If you’re travelling to Romania (and all other Schengen countries) without a visa, make sure your whole visit to the Schengen area is within the 90-day limit.

To stay longer (to work or study, for business travel or for other reasons) you will need to meet the Romanian government’s entry requirements. Check with the Romanian Embassy in the UK what type of visa and/or work permit you may need.

Your passport must be valid for at least 6 months after the end date of the visa.

If you stay in Romania with a Romanian residence permit or long-stay visa, this time does not count towards your 90-day visa-free limit for travel to the Schengen area.

Vaccination requirements

At least 8 weeks before your trip, check the vaccinations and certificates you need in TravelHealthPro’s Romania guide .

Customs rules

There are strict rules about goods that you can take into or out of Romania (in Romanian). You must declare anything that may be prohibited or subject to tax or duty.

Leaving Romania with children aged 17 and under

If you’re travelling with a child who holds Romanian citizenship, and you are not the child’s parent, or you are a parent but the other parent is not travelling with you, you may need to show notarised parental consent.

A list of the public notaries can be found on the website of the National Union of Public Notaries of Romania.

Related content

Invasion of ukraine.

- UK visa support for Ukrainian nationals

- Move to the UK if you're coming from Ukraine

- Homes for Ukraine: record your interest

- Find out about the UK’s response

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Total or partial outsourcing of the accounting activity.

Recomposition, analysis and expert reports.

Examination according to the International Standards on Auditing.

Specialized consultancy services on taxes and duties. Specialized assistance.

Payroll services, human resources consultancy, and other related services.

Start-up assistance. Preparation of the required documents.

Legal assistance and representation of the clients.

Valuation services for trading, financial reporting, tax issues. .

Businesses sales and acquisitions, finding, management of the trading process.

- Useful information

Employees business trips and the granting of the travel allowance. Legal and fiscal aspects.

What are business trips.

Travel in the interest of work represents the exercise of the duties of employees of a company in another place of work than normal, in the interest of the employer.

Travel in the interest of work is required by the employer, according to labor law. In practice, there are two types of travel, depending on the specifics of each job:

- extraordinary, when the employee’s job does not normally involve the employee’s movement (accountants, secretary departament, etc.);

- usual, when the employee’s job involves his travel (service, sales, interventions, etc.).

Employee travel can be arranged in the country or abroad.

What are the rights and obligations of the employee on the go?

According to the Labor Code, the workplace can be changed unilaterally by the employer, by delegating or posting the employee to a place other than where he usually performs his duties. The employee cannot legally refuse the movement ordered by the employer.

The employer has the obligation to grant the employee during the trip all the facilities he usually benefits from the employment contract. In addition, the employee must be covered by the employer for travel and accommodation expenses for the entire period of travel, plus a travel compensation, which is usually called a travel allowance.

What is the travel allowance, when and how is it granted?

- The travel allowance is the compensation that the employer pays to the employee for changing his working place.

- The legislation incidental to the granting of the travel allowance is: Law 53/2003 – Labor Code, Government Decision 714/2018 and Government Decision 518/1995 for issues related to external travel allowance.

- The travel allowance is granted for each calendar day of travel, even if it involves weekends.

- For the private system, the granting of the allowance for internal movements is conditional only on the existence of a temporary change of place of work, without any other conditions relating to the distance from the normal place of work or the number of hours of travel.

- For employees in the public system, by GD 714/2018, a series of conditions are regulated that must be met in order to receive travel allowance: – the movement must be in another town or more than 5 km from the place where the employee carries out his work normally; – business trip time to exceeds 12 hours.

- For external trips ,GD 518/1995 establishes the amount of the travel allowance, but also that the travel allowance is granted as follows: for fractions of time not exceeding 24 hours, the travel allowance is granted as follows: 50% to 12 hours and 100% for the period exceeding 12 hours.

What are the documents needed to justify a trip in the interest of work?

The basic document that must be prepared by companies to justify the travel of employees in the interest of work is the travel order .

- What is mentioned on the travel order:

-the name of the employee and the position;

-purpose and place of travel;

-date and time of departure, date and time of arrival.

- At the same time, companies should also issue a decision setting the amount of travel allowance granted to employees during travel.

- If during the trip the employee must pay from his own money certain expenses that require reimbursement from the employer, he must also fill in an Expense Statement, to which he must attach all the supporting documents (invoices, tax receipts). They must be issued with the employer’s identification data (name, CUI, ONRC registration number, etc.) and not on the employee’s name.

- Also, the statement of expenses must be completed to highlight the daily allowance that the employee receives during the trip, even if it is paid in cash or by bank transfer.

- If the employee received a cash advance from the employer before the trip, this advance must be highlighted by completing a Payment / Collection document. The maximum amount that can be granted in cash as an advance to the employee is 10,000 lei, according to Law 70/2015.

- The employee is not allowed to get a new advance until he settles the previous one, according to Decree no. 209 of July 5, 1976.

What is the minimum and maximum travel allowance?

The travel allowance level is established by GD 714/2018 for trips within the country and by the annex to GD 518/1995 for external trips.

- Day trip for travel in the country

-The travel allowance for the employees of the public system is 20 lei.

-The maximum daily deductible travel allowance for employees in the private sector is 2.5 times the level established for employees of the public system, so 20 x 2.5 = 50 lei.

The travel allowance for travel abroad is set for each country, as follows:

Tax and interest issues

- Is there a minimum travel allowance? A: NO, but the usual practice of the controls carried out by the Labor Inspectors is to give instructions to the employers in order to grant a sufficient level of travel allowance, related to the place where the employees travel. This practice refers more to the amounts granted for travelling abroad.

- Is there a maximum travel allowance? A: For employees of the state YES, the maximum limit is set by the legal regulations presented above. For employees of the private sector there is NO upper limit of the travel allowance, but the amount that exceeds the fiscal limit (2.5 times the limit for the budgetary apparatus) must be taxed as a salary bonus, with all taxes related to salaries.

Annexes: draft Travel order, adapted according to the legislation .

Note: The text is valid on the date of its publication, is for guidance purposes and is an interpretation of the specialists of the company Cont Consulting, without intending to replace the legal provisions in force. We are not liable for any damages caused by the use of this material for legal purposes or as evidence in any dispute.

Distribuie postarea pe platforma ta preferată!

Related posts.

Changes Needed When Adjusting the VAT Rate: Analysis and Tax Implications

OSS (One-Stop Shop) for VAT: Simplifying VAT Registration and Reporting for Companies

How to register, declare, and pay social contributions for foreign employees. Procedure for obtaining the NIF (Tax Identification Number)

Tax exemption of reinvested profit

Establishment of LLC – information, documents and necessary steps

Romania — 12 min

Employee benefits in Romania: All you need to know

If you’re looking to expand your team globally, you’ll soon discover that hiring employees in other countries can get complicated. Employers need to understand the statutory benefits required in a foreign country like Romania (as well as the in-market expectations for compensation) before developing a compliant employment contract.

Remote has been built for this exact purpose. Our team of global HR experts makes it easy to understand your obligations as an employer of Romanians or any other workers from around the world.

As an experienced employer of record with entities all over the world, Remote’s team can take the risk and the hassle out of managing a competitive and compliant benefits package across multiple countries (including Romania).

Which workers are entitled to benefits in Romania

Statutory employee benefits, supplemental benefits to consider for romanian employees, how to set up and manage benefits for international employees, when should you use an employer of record.

In this guide to benefits for Romanian employees, we’ll explain the mandatory benefits you must provide as well as additional perks you can offer to give your business an edge in attracting top talent. We’ll walk you through the following key elements of hiring in Romania:

Which workers are entitled to benefits in Romania?

What are the statutory benefits you must provide by law

Additional benefits to attract quality Romanian talent

(All ready to start hiring in Romania? Visit Remote’s Guide to hiring employees and contractors in Romania for more detailed information that will help you get started right away.)

Statutory benefits, also known as mandatory benefits, are entitlements that employers are obligated by law to provide to their employees. Common examples include benefits like paid annual leave, parental leave, worker's compensation insurance, and paid sick leave.

The Romanian government, like many others, requires employers to provide their workers with a minimum amount of employee benefits. Employees in Romania are entitled to standard employee benefits as required by the Romanian government. Employees are any people who work for an employer and get paid a wage.

You must minimize misclassification risk

Independent contractors in Romania are not entitled to any specific statutory benefits. Any benefits or remuneration are determined by the specific contractual agreement between your business and the contractor.

Employers need to understand the nuances involved in this determination, and when you’re attempting to classify employment relationships – your global hiring can start to get more complicated.

Regardless of whether you consider a worker to be an employee or a contractor, legislators will make the only determination that matters. If you’re found to have an employment relationship and you haven’t provided the required entitlements, your company will face the risks of misclassification and any subsequent fines or penalties.

For more detailed information about understanding this concept, be sure to read our dedicated guide to employee misclassification .

Download your Global Benefits Guide and attract top global talent

Remote's global HR experts share practical advice for building a locally relevant and globally compliant benefits program to help you attract and keep the world's best talent.

The government of Romania sets the standards for statutory employee benefits. These benefits are generally required for all employees, with a few exceptions. The most common benefits include maternity leave, sick leave, vacation, and social security.

There are several standard employee benefits mandated by the Romanian government, which employers are obligated to provide by law.

Annual leave in Romania

Employees are entitled to 20 days of paid annual leave per year, prorated according to the period worked. Employers are required to pay staff their salary at least five working days before the leave begins.

If an employee is unable to take all or part of their annual leave allowance in a year, the employer must carry it over to the first six months of the next year.

Employees who are covered by the pension and social insurance system and have made required payments are entitled to up to 180 days of sick leave within one year, with a potential 90-day extension, under the Labor Code.

The employer pays the employee a daily rate during the first five calendar days; from then on, the FUNASS (Unique National Fund of Health Insurances) covers the payment of sick leave.

Sick pay is 75% to 100% of an employee's average monthly earnings during the previous six months of work, depending on the type of illness.

Maternity and parental leave

Romanian legislation allows a standard of 126 days of maternity leave, with 63 days allowed before the expected date and 63 days after the expected date. The employee can get more than 63 days for each of the phases, but he or she must be able to take at least 42 days' worth of benefits after the due date.

Maternity leave is regarded as medical leave, with the employee's physician determining how many days are assigned to each part of the period. This benefit amounts to 85.00% of the average salary paid for the previous 12 months before childbirth.

In addition to maternity leave, parents may take advantage of a separate paid leave provision to raise a young child, up to age two, or if the child has a disability. During this time off, the parent is compensated at a rate proportionate to the income they had before taking leave. If a parent returns to work before the two-year period ends, he or she is eligible for incentives. The employer does not pay the indemnity.

Parents also have the legal right to paid leave if their children are under the age of 12 and are attending schools where classes were canceled owing to exceptional circumstances such as extreme weather or a medical emergency. However, this type of leave is only available to one parent and can only be utilized if both parents do not work from home.

Pension plans and retirement contributions

The retirement age for men is 65 and for women 63. To be insured, both employees and employers in Romania are required to pay into the social and health insurance system. Old-age pensions are given to Romanian individuals who have completed the required length of contribution in the public pension system and have reached the stipulated retirement age.

Individuals who have worked for at least 15 years and made a minimum number of contributions are eligible for pension benefits. For both genders, the period is calculated as 35 years.

If non-Romanian citizens have a residence permit, they are entitled to all benefits provided by Romanian law in the field of social security. The share of the employee's gross salary that is paid is set yearly, differentiated between employee and employer, and calculated on total salary.

For employees, the general amounts contributed are as follows:

social insurance is 25%

health insurance contribution is 10%

Employers must also make contributions of 2.25% for labor insurance for all workers and pension contributions of 4% or 8% for each employee depending on the circumstances. There are a small collection of other mandatory contributions:

Medical Leave Indemnity contribution is 0.47%

Work Accident or Professional Disease Indemnities contribution is 0.05%

Residual collection - work insurance contribution is 1.1%

There is no additional social insurance contribution paid by the employer for employees in ordinary working conditions. However, some exceptions apply in particular circumstances.

Along with this, employers are obligated to pay a labor insurance contribution of 2.25%. The law does contain certain exceptions in the case of the construction industry.

Overtime and minimum wage

From January 1, 2022, the Romanian minimum wage in the country is now RON 2,300 to RON 2,550 per month. Individuals with at least one year of seniority in higher education are eligible to receive RON 2,350.00 a month or RON 13.88 an hour.

Romania's labor law sets a maximum of five eight-hour days per week and no more than 48 hours weekly (including overtime). A part-time employee must work at least ten hours each week, two hours every day. Employees under the age of 18 are not permitted to work more than six hours a day or thirty hours per week.

Employers must keep track of each employee's daily work hours and submit records to the labor inspection control as needed.

Employers must provide a 24-hour rest period after completing a 12-hour day. Paid time off is required for work completed outside of the normal 8 hours per day, 40 hours per week. This paid time off must be given within 60 days of overtime work being performed.

If compensatory time off is not feasible, the employee must be compensated by adding a benefit that shall not be less than 75% of his or her base wage, prorated for any overtime worked.

Workers under the age of 18, part-time employees, and pregnant workers who are unable to work normal working hours for health reasons are not authorized to work overtime.

Health insurance

There are no mandated insurance provisions for employees under Romanian law. This means employers don’t need to provide health insurance.

However, Remote strongly advises all companies hiring Romanian employees to offer private health insurance as part of an equitable benefits plan. This communicates your genuine care and helps build a stronger connection with your globally distributed team.

Some global companies may opt out of offering private health insurance in this instance, but it is still relatively common for progressive local employers to offer health insurance to their employees.

Indeed, offering a health insurance benefit, or other additional insurance benefits (like dental insurance, vision insurance, and life insurance), can be such an effective way to build trust with new hires and separate your offer from that of a competitor.

Beyond what is government-mandated, we strongly encourage employers to offer extra incentives and provisions to all of their employees regardless of minimum statutory requirements.

Remote cares passionately about providing perks and benefits to enable your global team to enjoy security, stability, and work-life balance. Our team of internal HR specialists and global benefits experts are constantly working with our customers to create customized and competitive benefits packages to attract top talent .

Romania is one of Europe’s more competitive emerging labor markets, especially in the field of software engineering. Offering the bare minimum will reduce your chances of hiring the best local talent. Workers are starting to seek out certain perks now that remote work is readily available with businesses across the world (we explain in more detail in our values-based benefits guide ).

Additional perks can act as powerful motivators for star candidates to join and stay with a given company and we’ve gathered a short list below for you to consider:

personal learning and development budget

therapy or coaching allowances

mentorship programs

volunteering days

birthday leave

meal and travel expenses

gym or health club membership

The size of your business shouldn’t prevent you from sourcing international talent either. If you’re a smaller business looking to employ a Romanian (or any other international worker), your benefits plan can still be both attractive and affordable. This small business guide to affordable global benefits will help you find inexpensive perks that international employees will love.

Whether you’re hiring a software engineer from Romania , a CFO from India , or an SEO manager from Singapore , you need to understand how benefits work in each nation to maintain compliance and (and keep your offer competitive in the local market).

But how can you manage to stay compliant with all of the ever-changing local labor laws in each country you are hiring across the globe?

Instead of building a fully-owned local legal entity with a specialist HR function in each new market, an employer of record provides a cost-effective, fast, and secure alternative to help you grow your team across borders.

If you don’t have an established process to manage the complicated parts of scaling global hiring (in Romania or further afield), an employer of record like Remote will give you immediate relief.

Remote’s EOR service gives you the advantage of dedicated local employment experts that can offer the insight you need to create a strong benefits package, a compliant employment contract, and a competitive offer to your candidate.

We’ve previously dedicated an entire guide to when should you use an employer of record , but there are a few critical trigger areas where an EOR can dramatically minimize your risk:

Creating a competitive and compliant global benefits package

Managing the delivery of benefits in the safest, simplest, most efficient way

Setting up payroll for employees in multiple countries

Terminating an employee in compliance with local regulations, and

Protecting any IP & patents produced by your remote employees

An employer of record like Remote can manage the complicated parts of international employment so you don’t have to worry.

The combination of Remote’s simple software hub and our team of global HR experts combine to organize all the tiny details of managing a distributed team.

Learn how Remote simplifies international hiring so you can scale your distributed team faster.

Start hiring with Remote, the new standard in global HR

Create an account with G2's top-ranked multi-country payroll software and start onboarding your first employees in minutes.

Subscribe to receive the latest Remote blog posts and updates in your inbox.

You may also like

Global Payroll — 12 min

How to conduct payroll audits as a global company

Global HR — 9 min

How to manage expenses for remote employees

Visas and Work Permits — 8 min

Work permits and visas in Ecuador: an employer’s guide

Global HR — 8 min

Absence Management: Why Employee Are Taking More Time off

Search Smartraveller

Latest update

Exercise normal safety precautions in Romania.

Romania (PDF 324.49 KB)

Europe (PDF 2.62 MB)

Local emergency contacts

Fire and rescue services, medical emergencies.

Call 112 or go to the hospital.

Call 112 or go to the local police station.

Advice levels

- The Russian invasion of Ukraine is ongoing. The security situation continues to be volatile. Do not travel from Romania to Ukraine.

- Pickpocketing and bag-snatching occur. Thefts from hotel rooms are common. Assault and theft happen on intercity trains. Keep your personal belongings close. Lock hotel and train compartment doors from the inside.

- Drink spiking is an issue, especially in Bucharest's Old Town. Don't accept food, drinks, gum or cigarettes from people you've just met.

- Thieves posing as police officers may ask to see your ID and wallet. Romanian police won't stop you at random to do this. If you suspect someone is posing as a police officer, ask to see their identification.

- Financial, dating and marriage scams occur. Only use ATMs in banks, shops and shopping centres, especially at night. Always keep your credit card in sight. Be wary of people you've met online.

Full travel advice: Safety

- Rabies occurs in wild and domestic animals. If an animal scratches or bites you, get medical treatment immediately.

- West Nile virus can occur. Make sure your accommodation is insect-proof. Use insect repellent.

- Measles has occurred in recent years. Ensure your vaccinations are up to date before you travel.

- Waterborne, foodborne and other infectious diseases are common. Drink boiled or bottled water. Avoid ice cubes and raw or undercooked food.

- Medical facilities and supplies are limited. You'll need to be evacuated if you become seriously ill or injured. Make sure your insurance covers this.

Full travel advice: Health

- Penalties for drug offences are severe. They can include jail sentences of up to 20 years.

- By law, you must always carry a photo ID. Keep your passport in a safe place. Carry a photocopy.

- Taking photos of airports, military sites, or other secure locations is illegal.

- It's illegal to engage in sex work or have sexual relations with a person under 18.

- Same-sex relationships are legal in Romania but not widely accepted.

Full travel advice: Local laws

- You don't need a visa if you're a tourist staying for less than 90 days or transiting through Romania. For other types of travel, you'll need a visa.

- Romania partially joined the Schengen area on 31 March. Border checks will cease between Romania and other Schengen countries for air or sea travel. Checks continue to be undertaken at land borders between Romania and other Schengen countries.

Entry and exit conditions can change at short notice. Contact an Embassy or Consulate of Romania for details about visas, customs and quarantine rules.

Full travel advice: Travel

Local contacts

- The Consular Services Charter tells you what the Australian Government can and can't do to help when you're overseas.

- The Australian Consulate in Bucharest provides limited consular and passport assistance.

- You can get full consular help from the Australian Embassy in Athens .

- Follow the embassy's social media accounts to stay up to date with local information.

Full travel advice: Local contacts

Full advice

Border with ukraine.

The Russian invasion of Ukraine is ongoing. Heavy fighting is occurring in parts of eastern and southern Ukraine. Missile strikes and attacks are ongoing in some locations across the country, including in major cities. There have also been attacks on Ukraine's Danube ports along the border with Romania. The security situation continues to be volatile. Do not travel from Romania to Ukraine. There's a risk to life.

If you have arrived in Romania from Ukraine and are in need of assistance, contact the Consular Emergency Centre on 1300 555 135 in Australia or +61 2 6261 3305 outside Australia.

Pickpocketing and bag-snatching can happen, usually:

- near hotels

- on public transport, especially to and from the airport

- in train stations

- in airport terminals

Organised groups of thieves target travellers. These groups may include children.

Thefts from hotel rooms are common.

Thefts and assaults take place on intercity trains.

Drink spiking is an issue, especially in Centrul Vechi (the old town in Bucharest).

To protect yourself from crime:

- keep your personal belongings close, particularly near hotels and on public transport

- avoid walking in quiet and poorly lit streets, especially at night

- lock hotel and train compartment doors from the inside

- don't leave luggage unattended in your train compartment

- don't accept food, drinks, gum or cigarettes from people you've just met

- don't leave food or drinks unattended

More information:

- Avoiding danger

- Partying safely

Sometimes thieves pretend to be police officers and ask for ID and wallets.

Romanian police won't stop you at random to ask for your ID or wallet. However, they may conduct checks if you don't comply with local laws.

If you suspect someone is posing as a police officer:

- ask to see their identification

- don't hand over your personal belongings

- offer to go to the nearest police station with them to check their identity

Financial scams , including credit card and ATM fraud, are common.

Internet fraud, including dating and marriage scams, also occur in Romania.

To reduce your risk of card theft and scams:

- only use ATMs in banks, shops and shopping centres, especially at night

- always keep your credit card in sight

- be alert to internet scams and other fraud

- be cautious if someone asks for your bank account details

- be wary of connections you make through internet dating schemes or chat rooms

Cyber security

You may be at risk of cyber-based threats during overseas travel to any country. Digital identity theft is a growing concern. Your devices and personal data can be compromised, especially if you're connecting to Wi-Fi, using or connecting to shared or public computers, or to Bluetooth.

Social media can also be risky in destinations where there are social or political tensions or laws that may seem unreasonable by Australian standards. Travellers have been arrested for things they have said on social media. Don't comment on local or political events on your social media.

More information:

- Cyber security when travelling overseas

Civil unrest and political tension

Protests occur in Bucharest and other major cities.

Public protests and events that draw large groups of people can turn violent.

They may also disrupt services, traffic and public transport.

To stay safe:

- avoid demonstrations

- follow the advice of local authorities

- monitor local media

- Demonstrations and civil unrest

While there have been no recent terrorist attacks in Romania, they can still happen.

In recent years, terrorists have attacked several European cities.

European security services have also disrupted several planned attacks.

To protect yourself:

- be alert to possible threats

- report anything suspicious to the police

- monitor the media for possible threats

- take official warnings seriously

If there's an attack, leave the area as soon as it's safe. Avoid the affected area in case of secondary attacks.

Terrorism is a threat worldwide.

Tours and adventure travel

Transport and tour operators don't always follow safety and maintenance standards. This includes operators of adventure activities.

If you plan to do an adventure activity :

- check if your travel insurance policy covers it

- ask about and insist on minimum safety requirements

- always use available safety gear, such as life jackets or seatbelts

If proper safety equipment isn't available, use another provider.

Climate and natural disasters

Serious earthquakes are rare, but Romania is in a seismically active region and earth tremors are common.

Wildfires are becoming more frequent in the summer months. Torrential rain and flash flooding can happen throughout the year.

If there's a natural disaster or severe weather :

- secure your passport in a safe, waterproof place

- keep in contact with your friends and family

- closely monitor the media and other local sources of information

Register with the Global Disaster Alert and Coordination System to receive alerts on major disasters.

Travel insurance

Get comprehensive travel insurance before you leave.

Your policy needs to cover all overseas medical costs, including medical evacuation. The Australian Government won't pay for these costs.

If you can't afford travel insurance, you can't afford to travel. This applies to everyone, no matter how healthy and fit you are.

If you're not insured, you may have to pay many thousands of dollars up-front for medical care.

- what activities and care your policy covers

- that your insurance covers you for the whole time you'll be away

Physical and mental health

Consider your physical and mental health before you travel, especially if you have an existing medical condition.

See your doctor or travel clinic to:

- have a basic health check-up

- ask if your travel plans may affect your health

- plan any vaccinations you need.

Do this at least 8 weeks before you leave.

If you have immediate concerns for your welfare, or the welfare of another Australian, call the 24-hour Consular Emergency Centre on +61 2 6261 3305 or contact your nearest Australian Embassy, High Commission or Consulate to discuss counselling hotlines and services available in your location.

- General health advice

- Healthy holiday tips (Healthdirect Australia)

Medications

Not all medication available over the counter or by prescription in Australia is available in other countries. Some may even be considered illegal or a controlled substance, even if prescribed by an Australian doctor.

If you plan to bring medication, check if it's legal in Romania. Take enough legal medication for your trip.

Carry a copy of your prescription or a letter from your doctor stating:

- what the medication is

- your required dosage

- that it's for personal use

Health risks

Rabies occurs in wild and domestic animals.

Ask your travel doctor about getting the rabies vaccine before you travel.

Get medical treatment immediately if an animal scratches or bites you.

- Infectious diseases

Tick-borne encephalitis

Tick-borne encephalitis is a risk, especially if you travel through forests and rural areas.

Ticks are active in spring from March to June and autumn from September to December.

West Nile virus

West Nile virus (WNV) is a disease spread by mosquitoes. There's no vaccine to prevent it.

The Romanian Health Ministry has confirmed cases of West Nile virus in:

To protect yourself from disease:

- make sure your accommodation is insect-proof

- use insect repellent

- wear long, loose, light-coloured clothing

An outbreak of measles has spread across Romania in recent years.

Make sure your vaccinations are up to date before you travel.

Other health risks

Waterborne, foodborne and other infectious diseases are common. These include:

- tuberculosis

Serious outbreaks sometimes occur.

To reduce your risk of illness:

- drink boiled or bottled water with intact seals

- avoid ice cubes

- avoid raw and undercooked food

Get medical advice if you have a fever or diarrhoea.

Medical care

Medical facilities.

Medical facilities in Romania are below Australian standards.

Some medical supplies are limited, particularly outside major cities.

Treatment can be expensive, and doctors often require payment up-front.

Ambulance services are unreliable in some areas outside larger cities. Psychological and psychiatric services are limited outside major cities.

Romania has 3 decompression chambers. All are in the port city of Constanta on the Black Sea coast.

If you become seriously ill or injured, you'll need to be evacuated to a place with better facilities. Medical evacuation can be very expensive.

You're subject to all local laws and penalties, including those that may appear harsh by Australian standards. Research local laws before travelling.

If you're arrested or jailed, the Australian Government will do what it can to help you under our Consular Services Charter . But we can't get you out of trouble or out of jail.

Penalties for drug offences are severe. They can include prison sentences of up to 20 years.

- Carrying or using drugs

Always carry a photo ID.

Keep your passport in a safe place and carry a photocopy.

In Romania, it's illegal to:

- take photos of airports, military sites or other secure locations

- engage in sex work or pay for sexual services

- have sexual relations with a person under 18

Australian laws

Some Australian criminal laws still apply when you're overseas. If you break these laws, you may face prosecution in Australia.

- Staying within the law and respecting customs

Local customs

Same-sex relationships are legal. However, they're not widely accepted in Romanian society.

Avoid public displays of affection.

- Advice for LGBTI travellers

Dual citizenship

Dual nationals are legally recognised in Romania.

- Dual nationals

Visas and border measures

Every country or territory decides who can enter or leave through its borders. For specific information about the evidence you'll need to enter a foreign destination, check with the nearest embassy, consulate or immigration department of the destination you're entering.

You don't need a visa to enter as a tourist for up to 90 days. You'll need a visa for other types of travel.

Romania partially joined the Schengen area on 31 March. Border checks will cease between Romania and other Schengen countries for air or sea travel.

Checks continue at land borders between Romania and other Schengen countries.

If you're travelling without a visa, ensure your entire visit to the Schengen area, including your stay in Romania, is within the 90-day limit. This applies to all arrivals (air, land and sea).

- Visas and entry requirements in Europe and the Schengen Area

Other formalities

Travel with children.

Special entry rules apply to children aged under 18 years, including Australian-Romanian dual nationals.

The child must be accompanied by an adult and have their own passport.

If you're a parent or guardian travelling alone with a child , you must carry a legal permission document signed by the non-travelling parent.

If this isn't possible, you'll need:

- a death certificate of a parent registered on the child's birth certificate

- a court order granting sole custody to the travelling (or authorising) parent

The documents must be translated into Romanian.

- Advice for people travelling with children

- Embassy or consulate of Romania

Some countries won't let you enter unless your passport is valid for 6 months after you plan to leave that country. This can apply even if you're just transiting or stopping over.

Some foreign governments and airlines apply the rule inconsistently. Travellers can receive conflicting advice from different sources.

You can end up stranded if your passport is not valid for more than 6 months.

The Australian Government does not set these rules. Check your passport's expiry date before you travel. If you're not sure it'll be valid for long enough, consider getting a new passport .

Lost or stolen passport

Your passport is a valuable document. It's attractive to people who may try to use your identity to commit crimes.

Some people may try to trick you into giving them your passport. Always keep it in a safe place.

If your passport is lost or stolen, tell the Australian Government as soon as possible:

- In Australia, contact the Australian Passport Information Service

- If you're overseas, contact the nearest Australian embassy or consulate

Passport with 'X' gender identifier

Although Australian passports comply with international standards for sex and gender, we can't guarantee that a passport showing 'X' in the sex field will be accepted for entry or transit by another country. Contact the nearest embassy, high commission or consulate of your destination before you arrive at the border to confirm if authorities will accept passports with 'X' gender markers.

- LGBTI travellers

The local currency is the Romanian Leu (RON).

Romania is a member of the European Union (EU).