Our website doesn't support your browser so please upgrade .

Premier Worldwide Travel Insurance

As an HSBC Premier customer, you could enjoy the benefits of Premier Worldwide Travel Insurance at no extra cost

For the latest coronavirus travel guidance, take a look at what’s covered under HSBC Travel Insurance .

Premier Worldwide Travel Insurance is available to HSBC Premier account holders. Check eligibility .

What's covered?

Our cover gives you, your partner, your dependent children and grandchildren worldwide protection.

Premier Worldwide Travel Insurance is underwritten by Aviva Insurance Limited. Policy terms and conditions apply.

Please review the Premier Worldwide Travel Insurance Product Information Document below for an overview of the features, limitations and policy exclusions.

- Premier Worldwide Travel Insurance Product Information (PDF, 156KB) Premier Worldwide Travel Insurance Product Information (PDF, 156KB) Download

HSBC Premier

Travel insurance claims, are you eligible .

- do you hold an HSBC Premier account?

- are you under 70 years of age?

- are you resident in the UK?

- are any dependent children/grandchildren under 23 years of age, on the start date of the trip?

Children are only covered when travelling with you or your partner, or travelling with close relatives who are over 23 years of age, or travelling independently on a school/college trip with teachers/lecturers.

Grandchildren are only covered under the policy when travelling with you or your partner.

Medical conditions:

To make a medical claim you must be registered with a doctor in the UK.

You will need to call the HSBC Medical Risk Assessment Helpline on 0800 051 7457 before booking your trip if you or any insured person in the last 12 months have:

- been prescribed medication

- received or are awaiting medical treatment

- undergone or are awaiting tests or investigations

- been referred to a specialist, or admitted to hospital

for any condition not listed on the accepted conditions list.

Pre-existing medical conditions:

We can't offer cover for certain medical conditions on this product. You may be able to get cover for these from a specialist insurer. MoneyHelper has a list of these insurers – you can check its travel directory or call 0800 1387 777 . Please note, you may not be able to find cover for undiagnosed symptoms and you may need to wait until you have a diagnosis before getting cover elsewhere.

Before you travel

Coronavirus advice.

Read our guide to how coronavirus might affect your Travel Insurance .

For full details of the policy cover and our privacy notices please review the Policy Wording and Privacy Notice below.

If you're travelling in the EU, see how Brexit could affect you .

- HSBC Premier Worldwide Travel Insurance Policy Wording (PDF) HSBC Premier Worldwide Travel Insurance Policy Wording (PDF) Download

- Privacy Notice (PDF) Privacy Notice (PDF) Download

If you need to prove you have Travel Insurance, you can ask Aviva for confirmation of cover .

Make a claim

Be sure to contact the relevant helpline number for assistance as soon as you can, quoting your policy number if possible.

If you don't need urgent medical attention, you can make a claim online .

Travel claims line, 0800 051 7459.

Lines are open 24 hours a day, 365 days a year. We may monitor or record calls.

Customer services

03457 707070

Textphone 03457 125 563

Lines are open 24 hours a day, 365 days a year. We may monitor or record calls.

Medical assessment

0800 051 7457

Lines are open 08:00 to 21:00 every day, except Christmas Day, Boxing Day and New Year's Day – although this may be subject to change because of coronavirus. We may monitor or record calls.

Medical emergency

Outside the UK (+44) 1603 605 135

Inside the UK 0800 051 7458

Frequently Asked Questions

Who will be covered by this policy .

The cover is for you (the HSBC Premier account holder) and your domestic partner - provided that you are both under 70 years of age on the start date of your trip - and any dependent children or grandchildren travelling with you.

Your children are also covered if they're staying with a close relative, travelling with a relative who's over the age of 23, or going on a school/college trip independently with a teacher.

Children covered by this policy must be under 23. Grandchildren covered by the policy must be under the age of 23 and don’t have to live with you.

All insured persons must be residents of the UK, Channel Islands or Isle of Man.

Do I need to inform you about any medical conditions?

Before you book your trip, you'll need to call the HSBC Medical Risk Assessment Helpline on 0800 051 7457 if in the last 12 months you or any insured person have:

- been referred to a specialist

- been admitted to a hospital

for any condition not listed on the accepted conditions list in the 'Your Health' section of the policy booklet

Before you travel, you should also tell us if there have been any changes to your health or if you've been referred to a consultant or specialist or admitted to a hospital.

Undiagnosed symptoms are not covered. There's no cover for any claim where you knew at the time you opened your HSBC Premier Account or booked your trip (whichever is later) that you or your travelling companion might be unable to travel or might need to come home early - for example if one of you fell ill.

If you have any pre-existing medical conditions, check to see if they're covered in the 'accepted conditions' section of the policy booklet. If not, you need to call the Medical Risk Assessment Helpline who will confirm in writing whether they can be covered.

Are holidays in the UK covered?

Yes. Holidays taken solely in the UK, Channel Islands or Isle of Man are covered if they include at least 2 consecutive nights away from home and either pre-booked accommodation or pre-paid public transport.

Please see our definition of 'pre-booked holiday accommodation' in your policy document.

Are business trips covered?

Yes. You're covered for up to 31 days in any calendar year if you travel outside the UK in connection with an insured person’s job to carry out non-manual work. This includes administrative tasks, meetings and conferences.

We don't cover any claim in connection with an insured person’s job where the trip involves:

- manual or physical work of any kind

- working with children

- providing healthcare, policing, security or military service

- an insured person’s role as a politician, religious leader, professional entertainer or sportsperson

Can I extend the trip duration?

You may be able to purchase a policy upgrade for an individual trip. This will extend the trip duration to a maximum of 120 days.

Please call us on 0800 328 1562 at the point of booking your trip, and one of our advisors.

Will I be covered if I go on a cruise?

Yes. While this isn’t a specific cruise policy, cruises are covered as standard since they're simply another type of holiday. However, there is no cover for some items that cruise policies may specifically cover, e.g. missed ports, unused excursions, and change of itinerary.

Customer support

Your Travel Insurance Claim

Please tell us about yourself

Please tell us about you and your policy. If you have a single trip or annual travel insurance policy, please enter the name, date of birth and postcode of someone insured on the policy.

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

Explore the best things about your

HSBC Premier Credit Card

Explore your Rewards

All reward options are available to redeem online anytime, anywhere. 10

Enroll to earn 2X Points on fashion purchases

Bonus Points are available by invitation only and you must enroll. Elevate your style this Spring and earn more Points. Earn 2X Points (up to $2,000 spend) when you enroll, and use your credit card to pay at women’s, men’s and family clothing stores, shoe stores and cosmetic stores from April 01, 2024, through June 30, 2024.

- Learn More Learn More Modal link

Let your 25% TAP Miles&Go bonus take you further

Transfer your HSBC Points to TAP Miles&Go between May 1 and May 31, 2024 (ET) and receive 25% Bonus Miles. TAP Miles&Go is the rewards programme for TAP Air Portugal.

- Learn more Learn more Modal link

home&Away

Welcome to home&Away , a unique program offering valuable benefits here and around the world. Enjoy a variety of offers from worldwide travel, shopping & unique experiences.

- How to use How to use Modal link

- Travel benefits

- Manage my account

- Lost or stolen card?

Rewards for Miles

Rewards for Miles has expanded to include 11 airlines and 2 hotel partners.

Up to $85 TSA Precheck® Credit

Receive one Statement Credit every 54 months, to cover up to $85 towards your TSA Precheck Application fee.

(Not applicable towards the Global Entry Fee)

Booking.com

Make the most of your travel. Get up to 7% off prepaid bookings for accommodation.

Mastercard Travel Rewards

Get exclusive offers from top brands in over 15 countries outside the U.S. including France, Hong Kong, U.K. and more when you use your HSBC Elite or Premier Credit Card. 8

- Explore 200+ Offers Explore 200+ Offers Modal link

2024 Priceless Surprises

Your next purchase could be a chance to win big! From now until September 30, 2024, use your HSBC Credit Card and earn entries for each eligible purchase for a grand prize trip that suits your taste. Your HSBC Mastercard Credit Card could get you closer to your choice of one of the 14 dream destinations! Let your purchases create lasting memories for you.

Everyday Value

Get 2 months of Instacart+ and $10 off your second order each month with your HSBC Premier Credit Card.

New subscribers get $3 off Peacock Premium each month when they use their HSBC Premier credit card to subscribe. Stream new movies from theaters, hit series, exclusive originals, live sports, and more.

Shop your favorite items and top deals all in one place. Plus, sign up for a complimentary ShopRunner membership to enjoy free 2-day shipping, exclusive discounts and more.

Take 3 rides, get a $5 Lyft App credit every month with your HSBC Credit Card.

Amazon Shop with Points TM

Unlock the power of your rewards with Amazon Shop with Points. Redeeming your Credit Card Rewards Points on Amazon.com is easy. Simply link your credit card to Amazon, shop the incredible selection of products, and select HSBC Rewards at checkout to pay with your Points.

Peace of Mind

Cell Phone Coverage 2

Get reimbursed up to $600 per claim, if your cell phone is stolen or damaged.

ID Theft Protection 2

Get access to a number of Identity Theft resolution services , should you believe you are victim of Identify Theft.

Mastercard Global Service TM

Mastercard Global Service™ provides worldwide, 24-hour assistance with Lost and Stolen Card Reporting, Emergency Card Replacement, and Emergency Cash Advance.

Feel better knowing you’re not being overbilled. Get a complimentary HealthLock membership with a no-cost trial upgrade.

Purchase Assurance

Get coverage for most new items purchased that are damaged or stolen within 90 days of the date of purchase, up to $1000 per claim.

Hotel and motel burglary insurance

Receive reimbursement for the cost of replacing or repairing items that have been stolen or damaged as the result of a burglary by forcible entry into your hotel or motel room.

MLB® Postseason™ Sweepstakes

You could be at the ballpark to see your favorite team play in the MLB® Postseason™ – compliments of your HSBC Premier Mastercard® Credit Card. Enter weekly until 9/29/24, and if your team makes it to the 2024 MLB® Postseason™ , you could win two (2) tickets to a home game – even the World Series®

Visit baseballsweeps.mastercard.com to enter.

Travel & Experiences

Priceless tm experiences.

Enjoy hidden-gem experiences and special-access events virtually and worldwide.

Mastercard Travel & Lifestyle Services™

Get benefits, amenities and upgrades, preferential treatment and premium travel offers from best-in-class companies across hotels, air travel, tours, cruises, car rentals and more.

Priceless Golf®

Play like never before, with priceless offers and global golf experiences.

Enjoy exclusive day passes to luxury resorts. Earn a $20 statement credit on your next ResortPass booking.

Trip Cancellation Insurance 2

Pays a benefit of up to $1,500 per insured person in the event your trip is cancelled for a covered reason.

Travel Accident Insurance 2

Receive accidental death or dismemberment insurance coverage up to $1 million when travelling.

Mastercard Airport Concierge™ 2

Your passport to the finer side of air travel. Enjoy a 15% savings on Airport Meet and Greet services.

Hotel/Motel Burglary 2

Get reimbursed up to $1,500 per claim for personal property stolen or damaged from your hotel or motel room as a result of burglary by forcible entry.

Coverage is limited to the actual cost, up to $1,500 per claim, to replace or repair your personal property that has been stolen or damaged as a result of a burglary. There is a maximum of two claim(s) per twelve month period.

Lost or Damaged Luggage 2

Get reimbursed for checked or carry-on luggage that is lost or damaged while traveling on a common carrier - up to $1,500 per claim.

Coverage is limited to the actual cost, up to $1,500 per incident of repairing or replacing your checked and/or carry-on luggage and any personal property contained within. There is a maximum of two claim(s) per twelve month period.

MasterRental TM Coverage 2

Receive coverage on most rental vehicles when you rent for 31 consecutive days or less with your HSBC Premier Credit Card.

Travel

Rewards that take you further.

Get rewarded for every purchase you make 1 .

2 × Points on Travel

Earn two Points per dollar spent on new airline, hotel, car rental purchases and more.

Enroll to Earn Bonus Points 9

Earn 2X points on fashion purchases from April 1, 2024, through June 30, 2024 .

Earn one Point per dollar spent on all other purchases.

Monthly spend chart is for illustration purposes only. Your spending and Rewards Points may vary.

48,000 Points, annually

Redeem your points, your way!

10,000 Points

Can be redeemed for:

- $100 Cash Back

- $100 Charity Gift Card

- $100 Gas Gift Card

20,000 Points

- $200 Cash Back

- $200 Dining Gift Card

- $200 Electronics Retailer Gift Card

40,000 Points

- $400 Cash Back

- Home Security Equipment

- AirFryer Oven

Manage your card online 24/7

Tap & go® for quick, secure payments .

With Tap & Go® contactless payments, your HSBC Credit Card never leaves your hand. It’s not only secure but easier and faster than inserting or swiping your card for payments.

So the next time you’re racing through a subway turnstile or grabbing a coffee on the way to work, make sure to keep your HSBC Credit Card at the top of your wallet.

You use your phone for everything else, why not purchases?

Add your HSBC Credit Card to a digital wallet and you can simply tap your phone to checkout at participating retailers. It’s quick, secure, and simple to set up.

Plus, when you pay with mobile, you’ll also make it easier to:

- Shop online

- Make in-app purchases

- Pay with your smartwatch or tablet

Get started by adding your HSBC Credit Card today.

- Apple Pay®³ Apple Pay®³ This link will open in a new window

- Google Pay™⁴ Google Pay™⁴ This link will open in a new window

- Samsung Pay™⁵ Samsung Pay™⁵ This link will open in a new window

- Fitbit Pay™⁶ Fitbit Pay™⁶ This link will open in a new window

- Garmin Pay™ Garmin Pay™ This link will open in a new window

Important documents

- Download your HSBC Premier World Mastercard® credit card Rewards & Benefits and Mastercard Guide to Benefits brochure Download your HSBC Premier World Mastercard® credit card Rewards & Benefits and Mastercard Guide to Benefits brochure Download link

- Download your HSBC Mastercard credit card Cardmember Agreement. Download your HSBC Mastercard credit card Cardmember Agreement. Download link

Please note: This Cardmember Agreement contains the Terms & Conditions for all HSBC consumer credit card products. For information about your credit card account pricing and fees, contact us via Live Chat at or call the number located on the back of your card.

Financial Wellness

Financial Wellness Center

Your Money Counts

Seven Reasons It’s Time to Go Cashless

1 How Points are earned: You earn Points when you use your card to make new purchases (minus returns, credits and adjustments). Rewards Points earn rate applies after any introductory period. Monthly spend chart is for illustration purposes only. Your spending and Rewards Points may vary.

All Reward option items are subject to limited availability and to the terms, conditions and restrictions imposed by suppliers. New items may replace selections, and certain items may be discontinued at any time, without advance notice. When necessary, HSBC Bank USA, N.A. may substitute a Reward of equal or greater value without advance notice. The customer will be notified of such a change when ordering. Redemption levels, Point values and availability are subject to change without prior notice.

You can receive Cash Back redemptions as a direct deposit or as a statement credit to your HSBC Premier World Mastercard credit card. If you select Cash Back as a direct deposit, only HSBC Bank USA, N.A. consumer checking and savings accounts in your name alone or as a joint accountholder are eligible.

2 Certain terms, conditions and exclusions apply. Cardholders need to register for this service. This service is provided by Iris® Powered by Generali. Please see your HSBC Premier World Mastercard® credit card Rewards & Benefits and Mastercard Guide to Benefits brochure for details or call 1-800-MASTERCARD.

3 Apple Pay works with iPhone 6 and later in stores, apps, and websites in Safari; with Apple Watch in stores and apps; with iPad Pro, iPad Air 2, and iPad mini 3 and later in apps and websites; and with Mac in Safari with an Apple Pay enabled iPhone 6 or later or Apple Watch. For a list of compatible Apple Pay devices, see https://support.apple.com/km207105 .

Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, Mac, Safari, and Touch ID are trademarks of Apple, Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

4 Google Pay is a trademark of Google LLC.

5 Samsung, Samsung Pay, Galaxy S7 and Samsung Knox are trademarks or registered trademarks of Samsung Electronics Co., Ltd. Other company and product names mentioned may be trademarks of their respective owners. Screen images are simulated; actual appearance may vary. Samsung Pay is available on select Samsung devices.

6 Fitbit, Fitbit Pay and the Fitbit Logo are trademarks, service marks and/or registered trademarks of Fitbit, Inc. in the Unites States and in other countries.

7 Garmin and Garmin logo are trademarks of Garmin, Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

8 As an HSBC Premier credit cardholder, you do not need to enroll or register for the Mastercard Travel Rewards program. This program is available to you automatically, at no additional cost. Merchants may provide to eligible HSBC Premier Mastercard credit cardholders (“cardholder”) certain discounts, rebates or other benefits on the purchases of goods and services ("Offers") that will be available on the Mastercard Site. Merchants may also have different payment acceptance criteria for online purchases (e.g., debit or prepaid cards may not be accepted). Such Offers are subject to certain Terms & Conditions and may change at any time without notice to you. Payment acceptance criteria is determined by the merchant in its discretion and may be visible on the Merchant website. HSBC or Mastercard will not be liable for any loss or damage incurred as a result of any interaction between you and a merchant with respect to such Offers. Except as set forth herein, all matters, including but not limited to delivery of goods and services, returns, and warranties are solely and strictly between you and the applicable merchants. You acknowledge that HSBC or Mastercard does not endorse or warrant the merchants that are accessible through the Mastercard Site nor the Offers that they provide. If applicable, all offer redemption is dependent on merchant shipping policies and availability to cardholder's shipping address. For all offers that are specified as “unlock additional online offers” cashback is not earned on shipping, handling, tax or the purchase and/or use of gift vouchers, which for avoidance of doubt, includes gift cards, gift certificates, or any other similar cash equivalents. Terms and conditions apply, visit https://mtr.mastercardservices.com/en/i/3705/faq for additional information. All third party-trademarks are the property of the respective owners.

9 To be eligible for the campaign benefit, you must successfully enroll in the program within the specified enrollment period beginning April 1, 2024, through June 30, 2024. Bonus Points accumulation starts on the date after which you successfully enrolled into the program through the end of the campaign period June 30, 2024. Transactions made outside of this period are not eligible. Bonus points accrue based on Elite or Premier Credit Card type at the time of enrollment and will not change if account is moved to another HSBC credit card. Your credit card account must remain open, active, and in good standing to continue receiving the campaign benefit. By enrolling in the credit card campaign benefit, you confirm that you have read, understood, and agreed to the above terms and conditions and, you consent to receiving communications regarding the campaign benefit and related promotions via email or other means of communication provided by you. HSBC Bank USA, N.A. reserves the right to modify, suspend, or terminate the campaign benefit and its terms at any time without prior notice.

From April 1, 2024, through June 30, 2024, HSBC Premier Mastercard credit cardholders in good standing and after successful enrollment, will earn two (2) Rewards Program Points (one Rewards Program Point and one promotional Point), up to $2,000 on net new purchases made at stores or retailers classified under the following merchant category codes (MCC): (5311) Department stores, (5611) Men’s and boys’ clothing and accessory shops, (5621) Women’s Ready to Wear Clothes (5651) FAMILY CLOTHING STORES, (5661) SHOE STORES, (5691) MEN’S AND WOMEN’S CLOTHING STORES , (5977) COSMETIC STORES. HSBC is not responsible for 1) the merchant’s transaction description, 2) the exclusion of merchants within a merchant category code, 3) delays in the merchant submitting the transaction, or 4) if the transaction date provided by the merchant differs from your actual purchase date. If at any point during the campaign you are no longer a Premier credit cardholder, you may no longer qualify to receive this offer.

10 Certain restrictions, limits and exclusions may apply. Please see your HSBC Premier World or HSBC Elite World Elite Mastercard® credit card Rewards & Benefits and Mastercard Guide to Benefits brochure for details.

Connect with us

- Saving & banking

- Cost of living & bills

- Cards & loans

The three best bank accounts with travel insurance bolted on: We pick our favourites and whether they're worth paying for

- Some bank accounts include annual worldwide travel insurance

- They often also include car breakdown cover and mobile phone insurance

- Although there is a monthly cost, having such an account may make sense

By Ed Magnus For Thisismoney.co.uk

Updated: 03:28 EDT, 9 August 2022

View comments

Many Britons will feel a bank account isn't something they're prepared to pay for - after all, most current accounts are 'free'.

However, some packaged bank accounts offer a host of benefits that added together could justify their monthly cost.

The typical perks include free annual worldwide travel insurance, car breakdown cover and mobile phone insurance, often with family members included.

There is also the convenience factor of having three insurance policies taken care of saving both time and effort in having to organise it separately.

Some bank accounts charge a monthly fee, but throw in perks such as annual worldwide travel insurance.

Michelle Stevens, banking expert at comparison site Finder, says: 'If you and your family are frequent travellers, then a current account with packaged travel insurance could be well worth the monthly fee, especially given the rising cost of travel insurance premiums in the last two years.

'But before signing up to any premium current account, it’s important you check that the terms of the travel insurance policy - as well as the other account features and perks - suit your needs.'

RELATED ARTICLES

Share this article

How this is money can help.

- Best savings rates: Compare branch and online savings accounts

She adds: 'Another benefit of getting free travel insurance with a current account is that a lot of people usually forgo it - up to 8.6million in 2019 - which is not an advisable move.

'If you get seriously injured abroad then the bill can reach hundreds of thousands of pounds, so having travel insurance included with a current account may result in a lot of people getting covered who may not have done so otherwise.'

We pick our three favourite current account deals for travel insurance, taking into account the monthly cost and the additional perks on offer.

1. Nationwide Flex Plus

This account offers worldwide travel insurance as well as mobile phone and European breakdown cover.

It does come with a £13 monthly charge, which, compared to other packaged bank accounts looks relatively cheap.

Its worldwide family travel insurance, includes winter sports, golf, weddings and business cover.

Nationwide offers worldwide travel, mobile phone and European breakdown cover and charges £13 a month for maintaining the account.

Cover for travel essentials includes luggage, documents and cash as well as protecting against travel-specific problems like delays, cancellations and medical expenses.

Then cancellation cover is up to £5,000, the medical expenses cover up to £10 million, whilst cover for travel disruption will be eligible when caused by natural disasters, or airline or travel end supplier failure.

The policy doesn't cover medical conditions unless they have been declared to Nationwide and accepted. In some instances, you can pay for a medical upgrade to your insurance policy.

Two other clauses to be aware of is that the longest trip length allowed is 31 consecutive days.

For any person to be insured who is aged 70 or over, they must buy an age upgrade to cover them.

Although the monthly cost will add up to £156 a year, it's possible to offset much of this during the the first year, thanks to Nationwide's current account switching incentive.

Non-Nationwide members can currently get £100 for switching, whilst members who switch to the Flex Plus account could get £125.

Saves the extra admin: Nationwide's annual travel insurance policy is worldwide, and covers a whole family for multiple trips, not just the individual account holder.

On top of travel insurance, account holders get vehicle breakdown cover both in the UK and the rest of Europe and mobile phone insurance for the whole family.

The car insurance is valid whether someone is a driver or a passenger in a vehicle, and comes with no excess to pay and unlimited callouts.

The mobile insurance covers mobiles belonging to the account holder and those belonging to their partner and dependent children. It covers for loss, theft, damage and faults.

2. Virgin Money's Club M Account

Virgin's Club M Account comes with a £14.50 monthly charge.

Similar to Nationwide, it offers 31 days' worldwide cover per trip. It will cover the account holder and a partner living with them if there're both under 75, so it's a little more generous on that front.

Virgin's worldwide family multi-trip travel insurance - includes winter sports, golf and weddings. Plus, 24 hour access to a doctor at home or abroad.

There's also cover for up to four dependents under 18 - either in full time education or living with the account holder.

Emergency medical treatment, includes falling ill with coronavirus while away, and cover for the journey home, if it's medically necessary.

It also covers lost, damaged or stolen items, and if the baggage is delayed, any essentials will be paid for in the interim period. It also includes cover for delays or missed departures and winter sports as standard.

Account holders are also covered when cancelling or cutting short a trip if they fall ill with coronavirus as long as they didn't know they had it and weren't being tested for it when they booked their trip.

The cover includes emergency medical, surgical, hospital, treatment and ambulance costs, as well as any additional accommodation and travel expenses if someone cannot return to the United Kingdom.

There is a maximum allowance of 31 days of worldwide cover per trip.

It covers the account holder and their partner living with them if they're both under 75. There's also cover for up to four dependents under 18.

A claim will be void if it relates to any medical treatment received because of a medical condition or an illness related to a medical condition which a person knew about at the time of opening the account.

What else?

On top of the travel insurance it also offers UK breakdown cover with no call out charges, whether as the driver or the passenger and offers help at the roadside and at home.

It also offers worldwide mobile phone and gadget insurance covering against loss theft, damage, and breakdown

Just make sure you've declared any pre-existing medical conditions and don't leave your valuables unattended to be fully covered.

Its Worldwide family multi-trip travel insurance - including winter sports, golf and weddings. Plus, 24 hour access to a doctor at home or abroad.

Virgin current account holders also benefit from various other perks.

It offers access to an easy-access linked savings account paying 1.71 per cent on balances up to £25,000. C ustomers can also benefit from 2.02 per cent on balances up to £1,000 in their bank account.

New customers switching to the Virgin Money Club M Account can also receive a bonus of 20,000 Virgin Points to spend with Virgin Red, thanks to Virgin Money's latest current account switching offer.

Virgin Red is a rewards club that turns everyday spending into points. Once you are a member, you can earn and spend Virgin Points across almost 200 different rewards.

The 20,000 Virgin Points boost means travellers could get a return flight to Barbados, the Bahamas or St Lucia, while bakery enthusiasts could turn their points into 100 sausage or vegan sausage rolls, 61 coffees or teas or 100 doughnuts or muffins.

3. Halifax Ultimate Reward Current Account

Halifax Ultimate Reward current account costs £17 per month, the equivalent of £204 per year. However, there are ways to dramatically reduce this via its cashback and switching offers.

The account includes a family travel insurance policy for the account holder, their spouse or partner and children aged 18 or under, or up to 24 if they're in full time education.

It includes cover for personal belongings, certain sports and activities such as winter sports golf trips.

At £17 a month Halifax is the most expensive of our three top picks. However, its £150 cash incentive and £5 monthly cashback could help account holders to significantly reduce the cost.

Its cover includes, up to £10million for hospital fees, repatriation, medical confinement, funeral and dental costs incurred if taken ill or injured on your trip.

Up to £5,000 in total for loss of pre-paid travel and accommodation expenses in the case of cancellation or curtailment.

It covers personal baggage up to £2,500 if it is lost, damaged or stolen. This includes up to £500 for valuables, and up to £500 for a single item or pair or set of items.

It also covers personal money up to £750 for loss, or theft. This includes up to £300 cover for cash. This is limited to £50 for under 16s.

Watch out:

Existing medical conditions are not covered, unless these are agreed with the insurer first, and an additional premium may be payable.

The longest trip length is 31 consecutive days. For winter sports, a maximum of 31 days cover in a calendar year.

Halifax's travel insurance covers personal Baggage up to £2,500 if it is lost, damaged or stolen.

It's also worth noting that a £75 excess per adult per incident may apply and to be covered trips must start and end in the UK.

All cover ends when the account holder turns 71. As long as the account holder is less than 71, their spouse or partner will also be covered until they reach 71.

Eligible children can also be covered so long as they are travelling with the spouse, partner or civil partner of the policyholder.

What else:

It also offers car breakdown cover with the AA. This covers any vehicle the account holder is travelling in, at the roadside or at home. But only in the UK.

For mobile insurance, it covers breakdown, accidental damage, loss and theft up to £2,000.

However, it only Covers one phone per account holder or two in the case of a joint account. An excess of £100 is payable on all successful claims.

The £17 fee makes it a little more expensive than a few others but there are ways to reduce the cost.

Halifax is currently offering a £150 switching incentive for those who switch from another current account.

On top of the £150 bribe there are other perks to take advantage of. There is a choice of £5 a month paid into the account, two film rentals or three magazine rentals, or a free cinema ticket each month.

In order to benefit from this account holders must choose to either Spend £500 on their debit card each month or Keep at least £5,000 in the account at all times.

They must also pay in £1,500 or more into your account each month and stay in credit - keeping your balance at £0 or above.

THIS IS MONEY'S FIVE OF THE BEST CURRENT ACCOUNTS

Chase Bank will pay £1% cashback on spending for the first 12 months . Customers also get access to an easy-access linked savings account paying 3.8% on balances up to £250,000. The account is completely free to set up and is entirely app based. Also no charges when using the card abroad.

Nationwide's FlexDirect Account offers 5% in-credit interest to new joiners when they switch on balances up to £1,500. This rate only lasts for one year. The account is fee free.

Halifax Reward Account pays £150 when you switch. Also earn up to an extra £75 cashback when you spend £750 each month for 3 months. There is a £3 monthly account fee, but that’s stopped by paying in at least £1,500 each month.

First Direct will give newcomers £175 when they switch their account . It also offers a £250 interest-free overdraft. Customers must pay in at least £1,000 within three months of opening the account.

NatWest's Select Account account pays £200 when you switch. The account has no monthly charges, but to be elligible for the £200, you'll need to deposit £1,250 into the account and log into mobile banking app within 60 days.

Share or comment on this article: Best bank accounts with travel insurance included

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Most watched Money videos

- The new Volkswagen Passat - a long range PHEV that's only available as an estate

- 2025 Aston Martin DBX707: More luxury but comes with a higher price

- Iconic Dodge Charger goes electric as company unveils its Daytona

- How to invest for income and growth: SAINTS' James Dow

- Skoda reveals Skoda Epiq as part of an all-electric car portfolio

- How to invest to beat tax raids and make more of your money

- Mini unveil an electrified version of their popular Countryman

- Tesla unveils new Model 3 Performance - it's the fastest ever!

- Mercedes has finally unveiled its new electric G-Class

- Mini celebrates the release of brand new all-electric car Mini Aceman

- MailOnline asks Lexie Limitless 5 quick fire EV road trip questions

- 'Now even better': Nissan Qashqai gets a facelift for 2024 version

MOST READ MONEY

Comments 31

Share what you think

- Worst rated

The comments below have not been moderated.

The views expressed in the contents above are those of our users and do not necessarily reflect the views of MailOnline.

We are no longer accepting comments on this article.

More top stories

- Best savings rates tables

- Find the best mortgage calculator

- Power Portfolio investment tracker

- Stock market data and share prices

- This is Money's podcast

- This is Money's newsletter

- The best DIY investing platforms

- The best bank accounts

- The best cash Isas

- The best credit cards

- Save on energy bills

- Compare broadband and TV deals

- How to find cheaper car insurance

- Investing Show videos

- Financial calculators

Best buy savings tables

- Cash Isa rates

- Instant access rates

- Fixed-rate bonds

- Bonus boosters

- Monthly income rates

- Phone/postal accounts

- Junior Isas and children's accounts

- National Savings & Investments

- MORE...

THIS IS MONEY PODCAST

- Is the UK stock market finally due its moment in the sun?

- Looking to fix your savings? A two-year deal is my tip, says SYLVIA MORRIS

- Young people more likely to quit their JOB than their bank... but switching could make them hundreds in interest

- The best investment of last year? Premium Bond saver wins £100k from £100 bond - check all the winners

- Premium Bonds winning numbers for May 2024 - see all the prizes from £1,000 to £1m and use our interactive tables to search for yours

- Shawbrook didn't transfer my cash Isa and paid just 0.1% interest - has it taken advantage of me?

- Savers could gain £680 a year - just by switching to one of these top accounts

- Savings platforms to bag a better rate and let you manage your money in one place: Top deals include a 5.2% three-month fix & one-year fix at 5.16%

- Last chance to bag a FREE railcard by signing up to these Santander bank accounts

- I transferred £61,000 into a new HSBC Isa - and my money vanished

- Revitalised corner of Scotland that proves banking hubs CAN save the High Street

MORE HEADLINES

DON'T MISS...

Inside saving & banking.

Premium Bonds Winners

More must reads....

Head Start to Home Cooked

This is Money is part of the Daily Mail , Mail on Sunday & Metro media group

Changing your address

You can now change your address via our phone banking service. You'll still be able to change it via online banking or in a branch. Find out how to change your address .

Our website doesn't support your browser so please upgrade .

Travel insurance

Free travel insurance for you and your loved ones

Travelling away from home without travel insurance puts you at risk of a number of situations. Needing medical treatment for illness, cancelled trips and other financial emergencies can turn your dream holiday into an overseas nightmare.

If you're a Premier or Advance customer, HSBC offers you free travel insurance. All you need to do is settle full or part payment of your flight, marine transport service and/or accommodation with a valid HSBC Premier/Advance debit or credit card.

Eligible accounts

What’s included.

Cover applies to you (the HSBC Premier or Advance customer) and your eligible family members* provided you are under 76 years of age for a maximum period of 90 days (HSBC Premier customer) or 60 days (HSBC Advance customer) per trip.

- free multi-trip worldwide cover

- personal accidents cover for unexpected injuries or fatal accidents

- medical expenses cover for medical treatment including hospital stays

- 24-hour emergency assistance for help when you need it most

- personal belongings cover for accidental loss, damage or theft of possessions

- travel cancellation and delay cover for when your holiday plans are disrupted

- personal liability cover for injury to someone else or damage to their property

- hire vehicle excess cover for Premier customers

A printable summary of the table of benefits highlighting your limits and excess can be found in our Important Documents page .

As with all insurance policies, terms and conditions, exclusions and limitations apply, so before each trip we recommend that you check carefully the policy documentation.

If you require additional cover, you are requested to contact Mediterranean Insurance Brokers (Malta) Ltd.

*Eligible members include partners living at the same address, as well as children living with you, under the age of 18 or under 25 if in full-time education.

Any questions

Policy queries.

Mediterranean Insurance Brokers

+356 2343 3234

Monday to Friday 08:30 - 17:00

Email Mediterranean Insurance Brokers

Premier customers

Premier Direct

+356 2148 9100

24 hours a day, 7 days a week

Advance customers

Advance dedicated line

+356 2148 9101

Monday to Saturday 08:00 - 18:00

In case of a medical emergency

In the event of a medical emergency during your trip, you must contact Global Response as soon as possible. Global Response is a world-wide organisation specialising in emergency assistance services. The service operates 24/7, 365 days a year for advice and assistance when making arrangements for hospital admission, repatriation and authorisation of medical expenses.

Over the phone: +44 (0) 292 066 2438

By email: [email protected]

Premier customers should quote Atlas Policy Certificate number - Travel: 167064 299 002

Advance customers should quote Atlas Policy Certificate number - Travel: 167064 299 001

How to make a claim

By phone.

+ 356 2343 3234

Monday to Friday from 08:30 to 17:00

Zentrum Business Centre

Level 2, Triq l-Imdina

Ħal Qormi, QRM 9010

This insurance is provided by Atlas Insurance PCC Limited and administered by Mediterranean Insurance Brokers (Malta) Ltd. A list of necessary information and documents required when making a claim can be found in our Important Documents page .

Important documents

You can download all the documents relating to our travel insurance, including terms and conditions, as well as information about what's covered and how to claim from our Important Documents page .

Frequently Asked Questions

Can i buy extra cover for a trip .

Yes, you can arrange additional cover for a trip at your own cost.

These optional extensions are available:

- Increased limit for rental vehicle excess (free up to €500 for Premier customers and can be bought separately by Advance customers)

- Winter sports extension

- Specified items extension

- Increase in baggage limit for cruises

- Cancellation of trip (extreme weather conditions)

- Maximum duration of trip extension

- Covid-19 extension

To discuss your needs and obtain a quotation, contact Mediterranean Insurance Brokers on +356 2343 3234 or email [email protected]

How long will I be covered for?

If you're a Premier customer you'll be covered for a single trip of up to 90 days; it's 60 days for Advance customers.

Am I covered for business trips?

Yes, the insurance covers both holidays and business travel.

Are eligible members travelling without being accompanied by the main cardholder still covered?

They are covered irrespective of whether travelling with the cardholder or not.

Eligible members include partners living at the same address, as well as children living with you, under the age of 18 or under 25 if in full-time education.

What information do I need when making a claim?

When making a claim it is important that you provide the necessary information and documents required, to enable Mediterranean Insurance Brokers to proceed with the handling of your claim. These may differ from one benefit to the other, however as a minimum the following documentation will be required:

- Completed claim form

- Passport Copy

- Copy of ID card of Main Card Holder

- Flight Tickets or e-tickets (departure and arrival)

- Luggage Tags

Depending on the claim being made, additional documentation may be required such as:

- Damage report by Airline/Cruise Line (Property Irregularity Report) if claiming for damaged luggage

- Police report for lost or stolen items, within 24 hours of discovery

- Medical Report/s (if claiming any medical expenses or cancellation of travel)

- Hotel Accommodation Vouchers

- Flight & Accommodation invoices & Receipts;

- Documentation to confirm reason/s for cancellation or curtailment;

- Cancellation confirmation from Airline / Agent indicating any refund due (if any);

- Evidence of money taken abroad – this may take the form of foreign exchange receipts or cash withdrawals in case of Euros.

For further guidance contact Mediterranean Insurance Brokers on +356 2343 3234 or email [email protected]

You might be interested in

Premier purchase protection.

Protect your purchases by using your Premier card.

HSBC Premier

Discover exclusive services and support for every aspect of your finances and lifestyle.

HSBC Advance

Enjoy rewards and preferential rates with the account that rewards you.

Connect with us

Our website doesn't support your browser so please upgrade .

Get ahead this tax year

Invest up to £20,000 with a stocks & shares ISA this tax year and your money could work harder.

Capital at risk. T&Cs and eligibility criteria apply.

- Current accounts

- Loans

- Mortgages

- International

- Credit cards

- Investing

- Savings

- Insurance

Looking for help?

Find answers to your questions and get the latest guidance.

How safe is my money?

When times are tough, knowing your money's safe can be reassuring.

Growing your money

Explore ways you could make the most of your money to help reach your goals.

Support and security

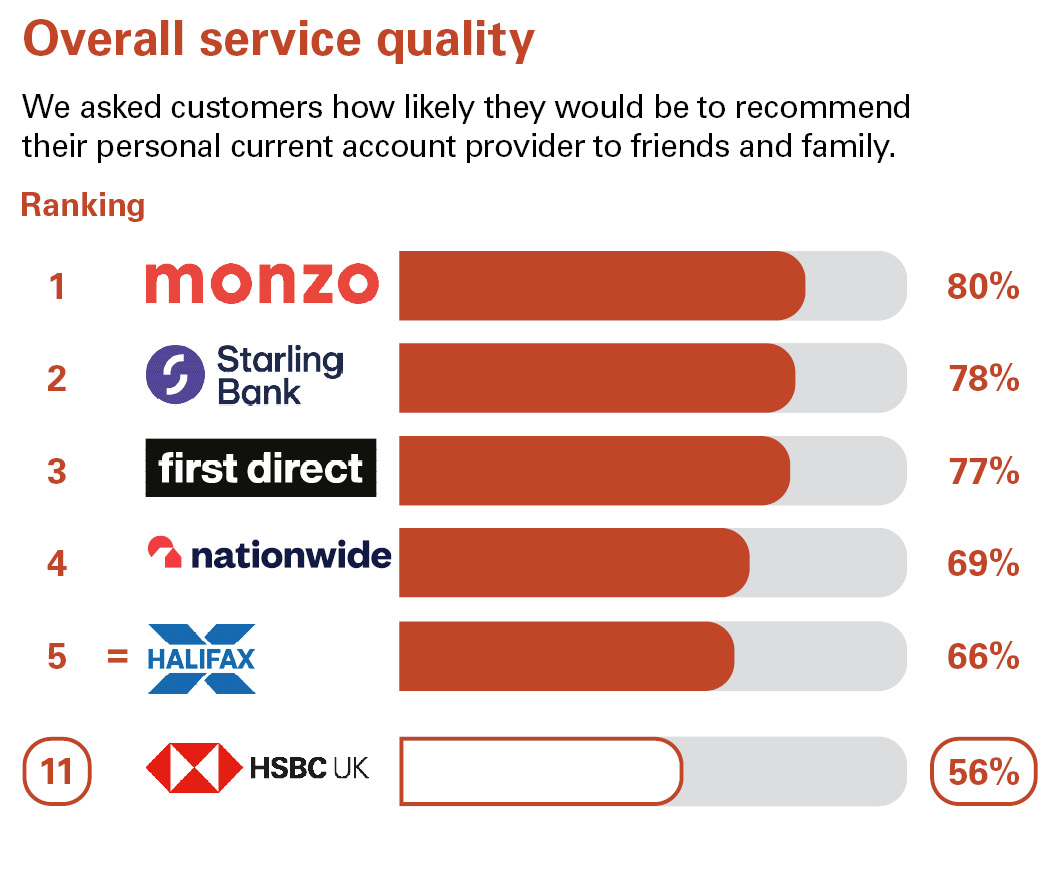

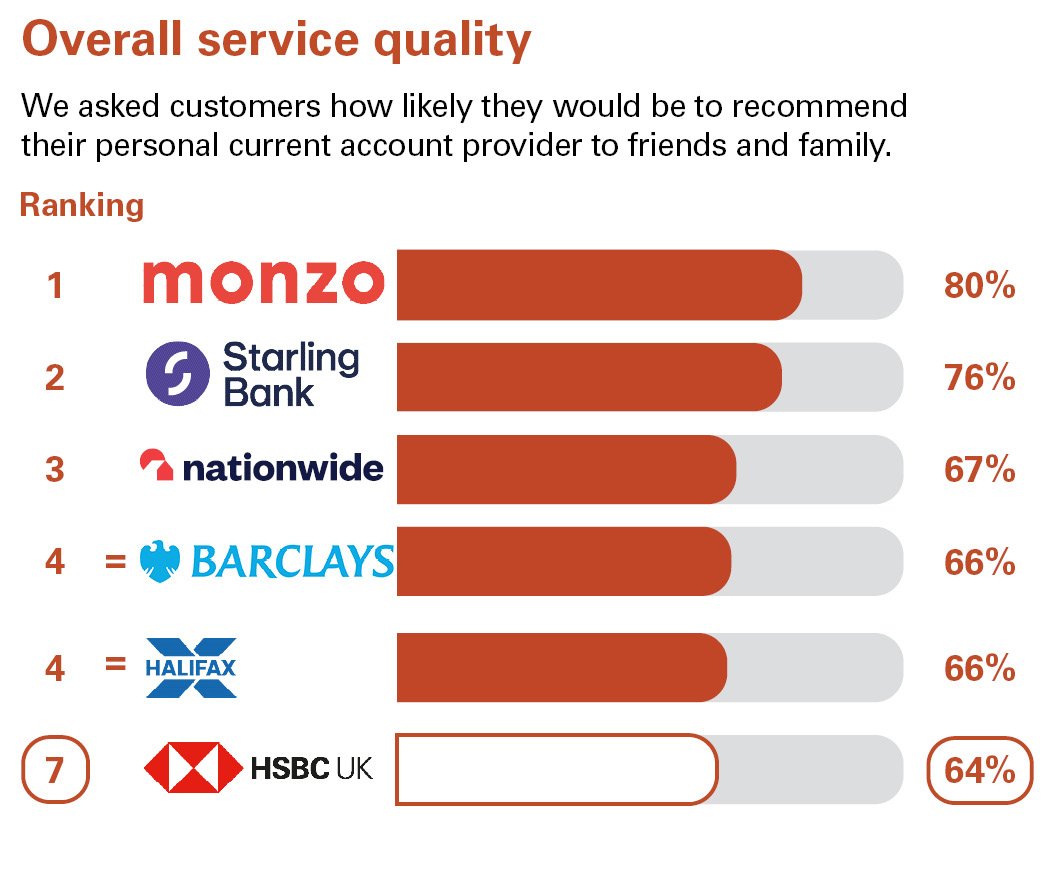

Tools and guides, more products, independent service quality survey results, personal current accounts.

Published February 2024

As part of a regulatory requirement, independent surveys were conducted to ask customers of the largest personal current account providers in Great Britain and Northern Ireland if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Great Britain - view full results

Northern Ireland - view full results

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found on the SQI page .

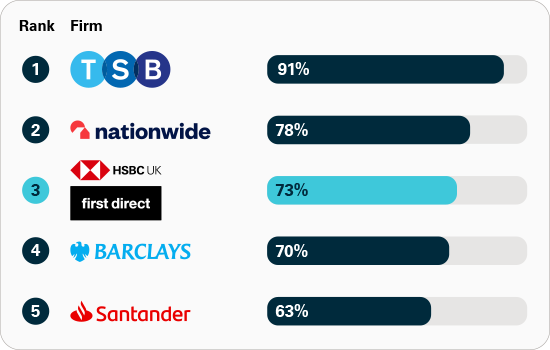

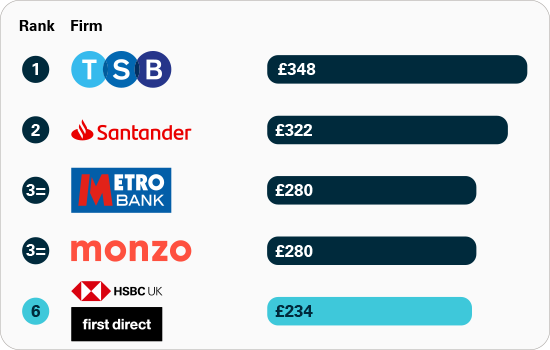

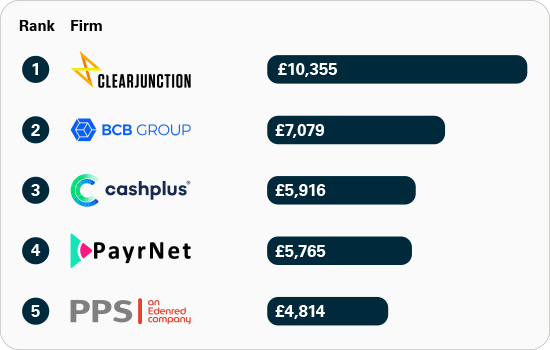

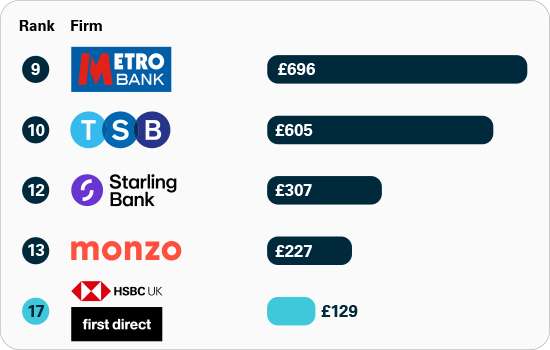

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2022.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

Share of APP fraud refunded

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

See full results

APP fraud sent per £million transactions

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.

APP fraud received per £million transactions: smaller UK banks and payment firms

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.

APP fraud received per £million transactions: major UK banks and building societies

This data shows the amount of APP fraud received per million pounds of transactions, ranked out of 20 firms. Lower figure is better.

Customer support

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Hsbc holdings plc (nyse:hsbc) q1 2024 earnings call transcript.

HSBC Holdings plc (NYSE: HSBC ) Q1 2024 Earnings Call Transcript April 30, 2024

HSBC Holdings plc isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter ( see the details here ).

Operator: Welcome, ladies and gentlemen, to the analyst and investor webinar on the 2024 first quarter results for HSBC Holdings plc. For your information, this webinar is being recorded. We are now ready to start the webinar, so I will hand over to Mark Tucker, Group Chairman.

Mark Tucker: Good morning to those of you in London, and good afternoon to those of you in Hong Kong. I'm joining you today from London and have alongside me know enjoy. I'll be making some short opening remarks before handing over to Noel. As you may have already seen, we have announced today that Noel has informed the Board of his intention to retire from the bank after nearly 5 years in the law. The Board and I would like to pay tribute to Noel's exceptional [indiscernible] As Group Chief Executive, he drags both our transformation strategy as well as creating a simpler, more focused business through the disposal of assets in the U.S., France and Canada. This has enabled us to deliver an improved performance, achieving record profits last year and create a platform for future growth and development.

Now, you'll hear from him in a second, has decided it's the right time to step back and find a better balance between his personal and business commitments. As you would expect, the Board keeps succession planning under constant review. We already have started a robust and rigorous process to find our next group Chief Executive. This process will look at both internal and external candidates. I'm very pleased that now has agreed to remain in his role while this process takes place, ensuring a smooth and orderly transition. And on a personal note, I'd like to thank Noel for his unwavering commitment and dedication to HSBC, which he joined 37 years ago. Now, it's been a pleasure and privilege to work with and alongside you.

Noel Quinn: Thank you, Mark. I'm very grateful for your support, guidance, friendship and partnership. I'm proud of what my HSBC colleagues and I have achieved together over the past 5 years. Over that period, we have hit some significant milestones, record profits last year, the strongest returns in a decade and the highest dividend since 2008. As Mark mentioned, we have created a more focused business, and I believe we have built a strong platform for the bank's next phase of development and growth. That's why I feel this is the right time to step back to find a better balance between my personal and business commitments with the intention going forward after a break of pursuing a portfolio career. When I reflect back on the last 37 years, I have held intensive leadership roles, particularly since I took over the U.K. Commercial Bank in October of 2008.

After 16 years of intensive leadership, I'm ready for a change. But it's also a natural inflection point for the bank as it comes to the end of the current transformation phase. It's an ideal time to bring in new leadership. The Board has now started a process to find my successor, and I'm very happy to continue in my role as that process takes place. Rest assured, I will be working hard to ensure a smooth and orderly transition for my successor and to keep the momentum going in this business, as you have seen in Q1. Until then, it's business as usual. So, let's now turn to our Q1 results, which have showed continued progress. We had a good first quarter. Reported profit before tax was $12.7 billion. Excluding notable items, profit before tax was $9 billion.

Our return on tangible equity was 16.4%, excluding notable items. I'm also pleased with the further capital distributions of $8.8 billion, which brings the total amount of distributed capital by way of dividends and buybacks over the last 15 months to almost $28 billion. And we are on track to meet all of our previously communicated guidance for 2024. I will now hand over to George to take you through the numbers.

Georges Elhedery: Thank you, Noel. I'd like to open by paying tribute to the enormous contribution Noel has made to the bank. I've greatly enjoyed working alongside him. And I know everyone at the bank has appreciated this strong and effective leadership. I'm also grateful for the support he has shown me personally since my appointment as CFO, 15 months ago. The Board has announced the process to find a successor, and I know Non and I will continue to remain very focused on the job at hand until that process has been completed. Turning now to the numbers. Reported profit before tax of $12.7 billion was down $0.3 billion in the first quarter of 2023 on a constant currency basis. Excluding notable items, profit before tax was $9 billion, down $0.4 billion on last year's first quarter.

On an annualized basis, we delivered a return on tangible equity of 26.1% or 16.4%, excluding notable items. We completed the $2 billion share buyback announced in February in 2 months. This means that since the end of 2022, we have bought back 6% of our outstanding shares. And the trend of strong shareholder distributions continues this quarter. We have announced, as Noel said, a further $8.8 billion of distributions consisting of first interim dividend for '24 of $0.10 per share. The special dividend of $0.21 per share from the Canada sale proceeds and a new share buyback of up to $3 billion, which we plan to begin right after the AGM and complete within 3 months. Finally, we are reconfirming all of our 2024 guidance, including a mid-teens return on tangible equity, excluding notable items and our commitment to limit cost growth to around 5% on a target basis.

So, on the next slide, reported profit before tax of $12.7 billion included $4.8 billion gain on the sale of Canada, partly offset by the $1.1 billion impairment on the classification of Argentina as held for sale. Excluding notable items, profit before tax was $9 billion with revenue growth offset primarily by higher costs and ECLs. Revenue of $20.8 billion was up $0.5 billion on the first quarter of last year. Excluding notable items, revenue was $17 billion, which was up $0.5 billion on the first quarter of last year, with growth in banking NII, partly offset by lower fee and other income. Within that, we saw high single-digit growth in multi-jurisdictional revenue in the first quarter, which underlines the value of our global network. Banking NII of $11.3 billion was up $0.6 billion on the fourth quarter on the reported FX basis, mainly driven by Argentina banking NII as well as the nonrecurrence of the cash flow hedge reclassification in the last quarter.

Looking ahead to the rest of the year, a few things to keep in mind. First, our Q1 banking NII included $0.3 billion from Canada, which will not repeat in future quarters due to the completion of the sale in March this year. Second, first quarter banking NII also included $0.5 billion from Argentina. This contribution will continue to be highly volatile until the sale is completed, which we expect to be within the next 12 months. Please, therefore, do not extrapolate the $0.5 billion run rate for the remainder of the year. Our banking NII guidance assumes a contribution of around $1 billion in full year '24 for Argentina, which is in line with full year 2023. Third, the banking NII outlook has improved in several respects since we announced our full year results in February.

The Hong Kong time deposit mix remained stable as a percentage of customer deposits in the quarter and markets are now pricing in more modest cuts to interest rates. However, it is still early in the year, and these things can change. So, we are maintaining our 2024 banking NII guidance of at least $41 billion. Turning to fee and other income. Wholesale transaction banking was down by 9%, primarily due to the normalization of FX revenues compared to a very strong foreign exchange performance in the first quarter of last year, which benefited from higher market volatility. Fees from Global Payment Solutions had another good quarter, up by 6%. Wealth is another growth area that had a very good quarter, up by 14% on the same period last year as our investment continued to drive improved results.

Private Banking was a standout performer, mainly driven by increased customer activity in brokerage and trading in Asia, but growth in wealth has been broad-based. To illustrate this, we acquired around 135,000 new-to-bank retail wealth customers in Hong Kong in the quarter. Approximately 60% of these were nonresidents attracted by our service and product capabilities in Hong Kong. Building on previous quarters, we attracted $27 billion of net new invested assets, of which $19 billion were in Asia. And our insurance new business CSM was $0.8 billion, up from $0.4 billion in the first quarter of last year. On credit, expected credit losses were $0.7 billion in the quarter, equivalent to 30 basis points of average loans. These were primarily Stage 3 charges across retail and wholesale.

There was a $54 million charge related to our Mainland China commercial real estate portfolio. While challenges remain within the sector, we expect a more benign ECL contribution from it than last year. We remain comfortable with our current level of provisions and continue monitoring developments closely. And we are reconfirming our 2024 ECL guidance of around 40 basis points of average loans, recognizing the overall uncertainty from the flow-through effect of higher rates on the economy. Next, we are on track to meet our target of limiting 2024 cost growth to around 5% on a target basis. This quarter's year-on-year cost growth was impacted by 3 items. First, we chose to face the accrual of our performance-related pay more evenly this year than we did last year.

This accounted for 2 percentage points of cost growth this quarter. We do not currently expect the total amount of performance-related pay for 2024 to be significantly different to 2023. So, the accrual will be lower over the next 3 quarters than it was in the same period last year. Second, HSBC Innovation Banking contributed to 1 percentage point of cost growth this quarter as we only acquired SBB U.K. in the middle of March last year. We intend to provide you with a fuller update on that business at the half year, but I'm pleased that it has good momentum. In the U.K., we onboarded 183 new-to-bank innovation banking client groups in the quarter, the best quarter since acquisition. Finally, another percentage point of the cost growth in the quarter was due to the Bank Finland levy and the incremental FDIC special assessment.

We remain committed to cost discipline, and we are reconfirming our guidance of limiting 2024 cost growth to circa 5% on a target basis, inclusive of all the above items. On lending and deposits. There was good loan growth in the U.K., the Middle East, Mexico and Asia, excluding Hong Kong. Loan demand in Hong Kong remains subdued, largely due to the high interest rate differential with Mainland China. Overall, we continue to expect mid-single-digit loan growth over the medium to long term, but we expect demand to remain subdued in the near term. Deposits were down 2%. This was due to a range of factors, including seasonality, the switch from time deposits to wealth products in Hong Kong and our deliberate choice to forsake some highly price-sensitive deposits.

Next, our CET 1 ratio was 15.2%, up 40 basis points on the fourth quarter. Organic capital generation and the gain from the sale of the Canadian business enabled us to announce $8.8 billion of capital distributions this quarter. This includes a share buyback of up to $3 billion, which is expected to have an impact of around 40 basis points on our CET1 ratio in the second quarter. For modeling purposes, please note that the $5.8 billion of dividends announced today as well as the $5.9 billion in respect of the ordinary dividend announced at the full year results in February will both be reflected in TNAV in the second quarter. At closing of the sale of HSBC Argentina, which is expected within 12 months, we will also recognize $4.9 billion of foreign exchange reserve recycling losses subject to any movement in this reserve up until completion.

These losses have already been accumulated in capital over the previous years. Therefore, recognition in the P&L will have no impact on CET1 nor on TNAV. Finally, looking forward to the rest of the year, our good first quarter puts us on track and we are reconfirming all of our 2024 guidance. A mid-teens return on tangible equity, excluding notable items, a banking NII of at least $41 billion, ECLs of around 40 basis points cost growth limited to around 5% on a target basis and a 50% dividend payout ratio. And with that, Louis, can we please go to Q&A.

23 Cheapest Housing Markets in Canada and

20 Countries with the Highest Renewable Energy Consumption in the World .

To continue reading the Q&A session, please click here .

Recommended Stories

Cvs health dives to 3-year low on medicare cost surge.

CVS Health earnings tumbled more than expected on a surge in Medicare costs due to higher utilization. CVS stock dived, weighing on UNH and HUM.

CVS Health (CVS) Reports Q1 Earnings: What Key Metrics Have to Say

The headline numbers for CVS Health (CVS) give insight into how the company performed in the quarter ended March 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

New York Community Bancorp (NYCB) Reports Q1 Loss, Lags Revenue Estimates

New York Community Bancorp (NYCB) delivered earnings and revenue surprises of -92.31% and 18.79%, respectively, for the quarter ended March 2024. Do the numbers hold clues to what lies ahead for the stock?

Pfizer Stock Rises as Outlook Rises After Earnings Beat

Pfizer bumped up its earnings guidance on Wednesday while reporting better financial results than expected as it works to regain investors’ confidence after a disastrous 2023. More notable was the increase in earnings guidance. “This increase takes into consideration both our improving line of sight to our cost savings target, and continued strength in our underlying business,” CFO David Denton said in prepared remarks distributed ahead of the company’s Wednesday morning investor call.

Can These 3 Wireless Equipment Stocks Hit Earnings Targets?

Qualcomm (QCOM), Motorola (MSI) and InterDigital (IDCC) are lined up to report their quarterly numbers this week.

GSK raises forecasts on strong vaccine, HIV drug sales

Sales of the shingles vaccine Shingrix and the RSV shot Arexvy helped fuel quarterly revenue totals that surpassed analyst expectations, though the company warned momentum could slow in the months ahead.

CVS Health chops 2024 forecast as cost struggles with Medicare Advantage persist

CVS Health missed first-quarter expectations and chopped its 2024 outlook more than a dollar below Wall Street’s forecast. Shares of the health care giant plunged Wednesday after the company said it was still struggling with rising costs from care use in its Medicare Advantage business. Company leaders told analysts they were still dealing with rising use from outpatient care and in supplemental benefits.

Cruise operator Norwegian's Q1 revenue miss overshadows raised outlook

(Reuters) -Shares of Norwegian Cruise Line Holdings fell more than 12% after the operator's downbeat first-quarter revenue overshadowed a raise in annual profit forecast on Wednesday. Expectations for cruise operators have generally become high after strong booking trends and demand drove up their results and shares last year. Meanwhile, peer Royal Caribbean Group's shares have seen 5% growth this year, as it hiked its profit outlook twice since February on the back of booming demand and higher ticket prices.

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

Investment Daily: US Treasuries rose after Fed policy decision and Powell comment

Key takeaways

- US stocks were mixed as Treasuries gained after Fed policy decision.

- European equity and bond markets were shut for holiday.

- Asian markets were mostly closed.

US equities ended a choppy session mixed on Wednesday as investors digested the Fed policy decision and Chair Powell’s post meeting press conference. The S&P 500 slid 0.3%, as the Dow Jones Industrial Average edged up 0.2%

US Treasuries rose (yields fell) after Powell said it is unlikely that the next Fed policy move will be a rate hike. 10-year yields edged 5bp lower to 4.63%.

European stock markets were closed for the Labour Day holiday. In the UK, the FTSE-100 index fell 0.3%.

European government bond markets were closed for a holiday. In the UK, 10-year gilt yields gained 2bp to 4.37%, ahead of the Fed meeting and Fed Chair Powell’s press conference.

Most Asia stock markets were closed for a holiday on Wednesday. One exception was Japan, with the Nikkei 225 down 0.3%.

Crude oil prices fell on Wednesday, as a large rise in US weekly crude stockpiles raised concerns about the demand outlook. WTI crude for June delivery settled 3.6% lower at USD79.0 a barrel.

Key Data Releases and Events

The US Federal Reserve (Fed) left the target range for the federal funds rate unchanged at 5.25-5.50%, in line with market expectations. Meanwhile, the Fed will slow its pace of quantitative tightening beginning June, reducing the runoff cap on Treasury securities from USD60bn to USD25bn each month while keeping the cap for mortgage-backed securities unchanged at USD35bn.The Fed added language to the statement that acknowledges the recent lack of further progress toward the 2% inflation target. During a press conference, Chair Powell indicated that it will probably take longer than previously expected for the Fed to gain enough confidence on the disinflation progress to start cutting interest rates. However, he also said that he is confident that policy is restrictive and thinks it is unlikely that the next rate move will be a hike.

In the US , the ISM manufacturing index fell to 49.2 in April, compared to 50.3 in March, below market expectations. New orders and production declined last month with the employment index remaining in negative territory. The price component increased to 60.9 in April, from 55.8 in March, its highest level since June 2022. The ADP employment index surprised on the upside, rising 192k in April, with March’s data revising higher. JOLTS job openings measure fell to 8.49 million in March compared to a revised 8.81 million in February, the lowest level since February 2021, hinting at a cooling in labour market conditions. The quits rate dropped to 3.145 million in March compared to 3.33 million in February, its lowest level since August 2020, pointing to slower wage growth in coming months.

The UK manufacturing PMI fell to 49.1 in April, from 50.3 in March, signaling a return to negative territory amid widespread weakness. Both the input and output price indices increased in April, hinting at rising price pressures in manufacturing.

Releases due today (2 May 2024)

In Brazil , the S&P Global Manufacturing PMI is expected to remain in expansion territory in April after March’s reading of 53.6, pointing to steady growth in early Q2 2024.

Related Insights

Investment Monthly: Increasing equity allocation on synchronised policy pivot

Thematic Videos: Unlocking investment trends with Financial Times

Special Coverage: Dovish Fed comments boost markets despite recent inflation concerns

Investment Outlook: HSBC Perspectives Q2 2024

This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (the "Bank") in the conduct of its regulated business in Hong Kong and may be distributed in other jurisdictions where its distribution is lawful. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.