- FULLY COMPREHENSIVE INSURANCE

- TEMPORARY INSURANCE

- NEW DRIVER INSURANCE

- CAR INSURANCE FOR 17 YEAR OLDS

- MULTI CAR INSURANCE

- CLASSIC CAR INSURANCE

- YOUNG DRIVER INSURANCE

- CAR INSURANCE GROUP CHECKER

- CAR INSURANCE CALCULATOR

- CAR INSURANCE CLAIM CHECK

- CREDIT CHECK IMPACT ON INSURANCE

- ADMIRAL CAR INSURANCE REVIEW

- HASTINGS DIRECT CAR INSURANCE REVIEW

- TESCO BANK CAR INSURANCE REVIEW

- 1ST CENTRAL CAR INSURANCE REVIEW

- CHURCHILL CAR INSURANCE REVIEW

- ESURE CAR INSURANCE REVIEW

- AVIVA CAR INSURANCE REVIEW

- WHY IS CAR INSURANCE EXPENSIVE?

- WHAT TO DO IF I HIT A PARKED CAR?

- PRICE OF INSURANCE AFTER AN ACCIDENT

- WHY INSURERS CANCEL POLICIES

- NON-FAULT ACCIDENT IMPACT ON INSURANCE

- INSURANCE FOR LEASED CARS

- IS MY CAR INSURED?

- FIBRE BROADBAND

- BROADBAND ONLY PACKAGES

- BROADBAND AND PHONE

- BROADBAND AND TV

- BROADBAND FOR GAMING

- WIRELESS BROADBAND

- NO CONTRACT BROADBAND

- EE BROADBAND

- VIRGIN MEDIA BROADBAND

- BT BROADBAND

- SKY BROADBAND

- TALKTALK BROADBAND

- VODAFONE BROADBAND

- SHELL ENERGY BROADBAND

- BROADBAND LONDON

- BROADBAND MANCHESTER

- BROADBAND BIRMINGHAM

- BROADBAND GLASGOW

- BROADBAND LIVERPOOL

- BROADBAND HULL

- BROADBAND SPEED CHECKER

- SOLAR PANELS COST GUIDE

- BEST SOLAR PANELS

- BEST SOLAR PANEL INSTALLERS

- BEST SOLAR INVERTER GUIDE

- SOLAR BATTERY STORAGE GUIDE

- SOLAR PANEL GRANTS EXPLAINED

- WINDOWS PRICES

- DOUBLE GLAZED WINDOWS PRICES

- BEST DOUBLE GLAZING COMPANIES

- COST OF DOUBLE GLAZING A 3 BED HOUSE

- TRIPLE GLAZED WINDOWS

- WINDOWS GRANTS EXPLAINED

- SIMPLISAFE REVIEW

- VERISURE REVIEW

- RING REVIEW

- YALE REVIEW

- EUFY REVIEW

- HOME INSURANCE

- CONTENTS INSURANCE EXPLAINED

- BUILDINGS INSURANCE EXPLAINED

- POLICY EXPERT REVIEW

- ADMIRAL REVIEW

- BEST VPN FOR IPHONE

- BEST VPN FOR MAC

- BEST VPN FOR ANDROID

- BEST VPN FOR FIRE STICK

- BEST VPN FOR CHROME

- BEST CHEAP VPN

- BEST VPN DEALS

- EXPRESSVPN REVIEW

- NORDVPN REVIEW

- SURFSHARK VPN REVIEW

- CYBERGHOST VPN REVIEW

- PROTON VPN REVIEW

- PRIVATE INTERNET ACCESS VPN REVIEW

- PROTON VPN FREE REVIEW

- ATLAS VPN FREE REVIEW

- WINDSCRIBE VPN FREE REVIEW

- PRIVADOVPN FREE VPN REVIEW

- HIDE.ME VPN FREE REVIEW

- VPN FREE TRIALS

- LIVE DATA BREACHES

- VPN DEFINITIONS

- BEST HEARING AIDS

- HEARING AIDS

- HOW TO GET A HEARING TEST

- HOW WE COVER HEARING AIDS

The Independent’s journalism is supported by our readers. When you purchase through links on our site, we may earn commission. Why trust us?

Best travel insurance UK 2024 guide

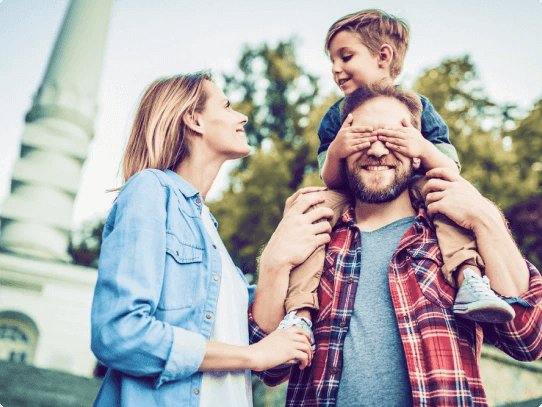

We all deserve a break now and then. And the last thing you want to think of when booking your holiday is something going wrong. But it’s better to be prepared than caught off guard. That’s why you should always consider travel insurance when going on a trip.

But how can you find the best travel insurance policy for your needs? Read our guide below to find out more.

Why do I need travel insurance?

Travel insurance protects you financially if your trip away doesn’t go as planned and you incur unexpected expenses for delays, losses or medical treatment.

All travellers can benefit from travel insurance. But travel insurance is particularly important if you are going on an independent trip without a tour operator, because if something goes wrong, you will have no other help.

There are three main types of travel insurance:

- Single-trip cover: this is the most typical form of travel insurance, covering you for a one-off trip or holiday. There will be a time limit on the cover that can range anywhere between one month and 365 days

- Annual multi-trip cover: this allows you to make multiple trips, or have multiple holidays, in a 12-month period, all under the same travel insurance policy. There may be a cap on how long each individual trip can be

- Long stay, or backpacker, cover: this is normally used for around the world trips, gap years, and longer cruises, and can last for up to 18 months

To find the best UK travel insurance, compare policies before you go to ensure you get the right coverage for you and the specific trip you’re planning.

How to find the best travel insurance policy

When comparing policies to find the best travel insurance for your trip, you should consider:

- Type of cover you need

- Excess (how much you’ll be expected to pay out yourself before the policy will cover you)

- Amount of medical coverage, and why pre-existing conditions aren’t included

- Limit on baggage claims

- Coverage for specific sports and activities

- Any potential rewards and discounts

- Add-ons, such as gadget insurance

Best travel insurance deals and discounts

Looking for the best travel insurance deals from the best travel insurance companies? In most cases, the easiest way to find the best travel insurance deals is to use a comparison website. Travel insurance comparison websites let you compare costs and coverage side by side to find the best UK travel insurance.

The four main comparison websites – Moneysupermarket, Comparethemarket, Confused.com and GoCompare – also often have certain deals and discounts when you buy travel insurance from them, offering some of the best travel insurance deals on the market.

Moneysupermarket : Find the same deal for less, and it will price match and give you a choice of a £20 gift card. Only on annual travel insurance.

Comparethemarket : Two for one cinema tickets with Meerkat Movies and savings at restaurants when you dine out or order pizza in with Meerkat Meals, as well as 25 per cent off coffee and pastries at Caffè Nero every day of the week through the Meerkat app.

(In November 2023, Confused.com and GoCompare had no deals or discounts for travel insurance).

Price is obviously a big consideration when you are looking for the best travel insurance – you’ve probably already spent a lot on your holiday. But you may be able to get much better coverage for just a few pounds extra, so it’s worth scrolling down the comparison site’s list of providers before buying.

Medical costs abroad will undoubtedly be the biggest expense you face if you fall ill abroad, so don’t scrimp on those.

Then think about your next biggest expense (probably cancellation/interruption of your trip) and make sure that you have high-value coverage for that.

If you find you can get much higher coverage (the maximum amount you can claim per type of claim, such as medical or baggage) for not very much more money, go for the slightly more expensive option.

Going direct

Comparison sites won’t always find you the cheapest deals, however. For example, Direct Line offers some of the best travel insurance with Covid cover and is not on comparison websites.

Some of the best travel insurance companies also offer discounts for buying directly from them, as follows:

Bundled coverage options

When looking for the best travel insurance for your holiday, it can make sense to buy a bundle of coverage under one policy.

Comparison websites will often offer add-on gadget cover, winter sports cover or cruise cover all under the one policy. If you need that extra cover, it is typically cheaper to buy your travel insurance this way rather than as separate policies.

What is covered by travel insurance?

The best travel insurance companies will offer you comprehensive coverage across all types of claims. It’s easy to compare the best travel insurance deals using a comparison website.

Medical coverage

This covers you for medical expenses you incur if you become ill or have an accident while away. The best UK travel insurance will have a high level of medical coverage.

For example, medical coverage will pay for any necessary treatment if you come down with severe food poisoning or you fall through a window and have to be taken to hospital in an ambulance.

- Avoid hefty bills or debt for medical assistance outside the UK

- Access better treatment – for example, at private vs public hospitals

- Often, as long as you declare existing conditions or pending treatment or tests, you are covered if you fall ill during your trip (check policy exclusions)

- Even the best travel insurance companies will likely charge you more if you have a pre-existing medical condition

- You might have to pay part or all your medical expenses first, then claim on the policy afterwards

- Even the best travel insurance companies do not cover events that happen after you have consumed alcohol excessively or taken recreational drugs or other substances

Trip cancellation/interruption

This insurance pays out the cost of your missed trip if you have to cancel or cut your holiday short due to unforeseen circumstances.

For example, cancellation insurance would normally pay out if you broke your leg just before you were due to travel and had to cancel your trip.

Interruption insurance would cover you if you had to come home early for certain reasons beyond your control – for example, if the area you were staying in was engulfed in wildfires.

- Money you would have lost on pre-paid, non-refundable travel expenses is paid to you under the policy

- It can be especially valuable if the trip you are planning is very expensive, as this is money you would lose if you couldn’t go

- You’ll usually only be covered if your trip is cancelled or cut short for specific reasons listed in your policy

- You usually won’t be covered if you miss your flight because you are held by customs or cancel because of a work issue or a pre-existing medical condition that is not covered

Baggage cover

This insurance covers the cost of replacing your luggage if it is lost or stolen.

For example, if an airline loses your luggage in transit or your suitcase is stolen from your hostel while you’re away, you can make a claim for the cost of replacing its contents.

You may also be able to claim for costs related to baggage delay if the airline temporarily misplaced your baggage.

- You can claim for the actual cash value of your belongings or the cost of replacing them (whichever is less)

- High-value items, such as jewellery or sports equipment, can be very expensive to replace without travel insurance

- Standard policies usually place per item and total limits on claims.

- If you are taking very expensive items away, check your policy carefully to ensure that you’re covered (and potentially get a separate policy)

- Some items could be covered by your home insurance policy, so check your policy carefully to see what is any isn’t. It’s also important to note that, should a lost item be covered by both policies, you can only claim once; an attempt to claim twice would be considered fraud

Personal liability

This insurance covers you if you are held responsible for harming another person or damaging their property.

For example, it covers you in situations where you cause serious damage to your holiday accommodation or accidentally stumble into someone else, causing them to need medical treatment.

- The cost of defending yourself in a legal case or repairing/replacing damage could be extremely costly without travel insurance

- Your travel insurance company will take over dealing with a foreign legal system

- You’re covered for the cost of any compensation (up to certain limits)

Limits:

- Not all travel insurance provides personal liability as standard

- Policies may exclude personal liability while you partake in adventure activities

- Claims related to you committing a crime or damage by wilful negligence won’t be covered

- You likely will not be covered if you admit liability or make an offer to pay before talking to your insurer

Finding the best travel insurance with Covid cover

Looking for the best travel insurance with Covid cover? Many travel insurance policies now include cancellation cover for reasons related to Covid. This often applies within two weeks of being due to travel, according to the Association of British Insurers, but individual policies can vary.

To make a claim, insurers often require proof in the form of a medically approved positive Covid test. A lateral flow test or self-diagnosis is usually not accepted.

What Covid-related cover to look for

The best travel insurance with Covid cover should include the following:

- Cover if you can’t start your trip because you tested positive for Covid before travelling

- Cover if you or family members cannot return home because you/they test positive for Covid during the holiday

- Cover for additional costs, such as alternative flights, accommodation and Covid tests

- Cover if you cannot reach your final destination during transit due to Covid-19

Travel insurance providers with comprehensive Covid cover

Looking for the best travel insurance providers with Covid cover? Most travel insurance policies now offer some kind of Covid cover, but Churchill, Direct Line, M&S and Aviva have some of the most comprehensive offerings, with cover for cancellations and expenses related to Covid.

- Covid covered as standard on travel insurance policies

- Cover for trip cancellations if you, a close relative or a travelling companion is diagnosed with Covid-19 or another pandemic disease

- Cover if you or a person you’re planning to stay with must quarantine (abroad or in the UK)

- Cover if you can’t use pre-booked and pre-paid accommodation affected by Covid-19

- Cover for quarantine or where the Foreign, Commonwealth & Development Office (FCDO) advises against travel within 28 days of departure

- Cover for emergency medical expenses abroad due to Covid-19

Direct Line

- Cover for travel to a destination where the FCDO is advising against all but essential travel

- Cover for medical expenses if you catch Covid-19 while you’re away

- Cover for additional accommodation and transport if you have to quarantine due to Covid

- Cover for cancellation costs if you or a close relative get Covid-19 before you go

- Cover for quarantine or if the FCDO changes its advice after you book your trip

- Cover if you have to cut your trip short if the FCDO changes its country advice unexpectedly

- Cover for emergency medical expenses if you catch Covid-19 during your trip

- Cover for unrecoverable costs up to £6,000 if you must cancel your trip or return early, including if you have to self-isolate or quarantine before you travel due to Covid-19

- Cover for if you need to cancel your trip due to a positive Covid-19 test or if the FCDO advise against travel to your destination in the 31 days leading up to your trip

- Providing you haven’t travelled against FCDO advice, you’ll also be covered if you catch Covid-19 while abroad

- Coverage of up to £5,000 per person if you must cancel your trip due to getting Covid (you’ll need to provide confirmation and evidence of a positive test result)

- Cover for Covid-related emergency medical treatment and expenses while away

- Cover if you unexpectedly need to quarantine, including extra travel and accommodation costs to get home (provided a return trip was booked)

- Cover for costs for any accommodation and excursions unused due to getting Covid where the costs can’t be recovered elsewhere

- No cover you if you travel against FCDO advice*

- No cover if you can’t travel because you don’t meet the entry requirements of a country (such as having had Covid vaccinations)*

* It’s worth noting that these clauses are not unusual and the majority of providers will have something similar

Tips for selecting the best UK travel insurance packages

Need some help picking the best UK travel insurance packages to make sure that you get the best travel insurance deals? Here are some tips for picking the best policy features for you.

Coverage limits

When looking for the best travel insurance companies to go with, check coverage limits. These are the maximum amounts your travel insurer will pay if you need to claim. You’ll see when you compare travel insurance policies that coverage limits vary for each type of claim and between policies.

The government-backed MoneyHelper website recommends that the best UK travel insurance should have the following minimum coverage for each type of claim:

- Medical: £1m or more for travel to Europe and £2m or more for the US

- Cancellation/interruption: £2,000 or more

- Missed departure: £500 or more

- Delay: £200 or more

- Baggage cover: £1,500 or more

- Personal liability cover: £2 million or more

Deductibles/excess

Deductibles, also known as the excess, is the amount you have to pay out of your own pocket before your travel insurance will start paying for your claim.

You have to make a trade-off when it comes to choosing the excess and the best travel insurance policy for you.

The lower the excess on a travel insurance policy, the better for you if you have to claim because you will have less to pay from your own pocket (or, more often, deducted from your claim).

But lower excess travel insurance policies are more expensive because the insurer knows it has more to pay out if you claim. Higher excess policies are cheaper, but you’ll have more deducted from your claim.

An exclusion on a travel insurance policy is an event the policy will not cover you for.

Common exclusions on a standard travel insurance policy may not be obvious. According to the ABTA – The Travel Association, these include:

- Incidents that occur after drinking too much alcohol or taking drugs

- Theft of unattended possessions

- Sports, extreme sports and activities such as skiing, white water rafting and bungee jumping

- Medical treatment resulting from existing medical conditions you have not declared or conditions preventable by vaccine or advisable medication, such as antimalarials

- Medical costs if you stay abroad after your doctor says you are fit to return to the UK

- Strikes and industrial action if it was known when you booked your trip

- Rescheduled flights where the airline has cancelled and then rescheduled your flight

- Travel to destinations where the FCDO advises against all but essential travel

To get the best travel insurance deals, one way around some of these exclusions is to buy add-ons for adventure activities. In addition, make sure to declare all pre-existing conditions and keep an eye out for any travel disruptions before you book.

Pre-existing conditions

Pre-existing conditions are illnesses or medical conditions you have and are aware of before you travel.

Travel insurance companies will ask you to disclose any pre-existing conditions. If you use a comparison website, it will be among the first questions you’re asked before it shows you quotes. It’s important to be honest.

Some travel insurance companies, but not all, will offer cover for pre-existing medical conditions, while others will offer cover but exclude any claims arising from that medical condition. This will depend on the person being covered and the medical condition.

Most price comparison websites include an option to show insurers who do offer coverage for pre-existing conditions, so that would be a good place to start.

The following are likely to be considered pre-existing conditions you should disclose, according to the government-backed MoneyHelper website:

- A condition where you are on a list for an operation

- A condition where you are waiting for test results

- Anything you have been to the doctor about in the last year, including minor things

- Any serious conditions you’ve ever had – for example, cancer, heart trouble, respiratory problems or a mental health breakdown

A good tip for everyone, but especially if you have a pre-existing condition, is to buy your travel insurance as soon as you book your holiday. If your condition gets worse and forces you to cancel your plans, you’ll be covered from the day the policy starts.

On family group policies, the cost will be determined based on the riskiest traveller (according to insurers), which could be someone with a pre-existing condition or an older individual. In this case, it is often cheaper for the group for that person to get a separate policy.

Add-on options

Add-ons are extras you can purchase in addition to a standard travel insurance policy. They cost a bit more, but you may find you’re not covered without them.

Gadget insurance

This covers things that a standard policy may not, such as your mobile phone or laptop. If these items are covered, you may find the claim limits are far less than the cost of replacing them.

Before you add this option to your travel insurance, check your home insurance policy, because you may already be covered.

Winter sports/adventure activities

Riskier activities, such as skiing or white water rafting, often require extra holiday insurance because insurers think that you are more likely to need to make a claim doing these things.

Winter sports/adventure activities cover is worth getting, or you may find you are not covered for medical expenses if something goes wrong.

Standard travel insurance is generally meant for land-based holidays so you’ll need to opt for a specialist cruise policy if your holiday is a cruise.

European FCDO travel advice extension

Most standard travel insurance policies are invalid if you travel when the FCDO advises against “all but essential travel”.

This add-on allows you to travel to Europe with a valid travel insurance policy, even if the FCDO has advised against it.

This can be an expensive add-on, but if you really must travel to a risky area, you will need this extension in order to make sure you have cover.

Best holiday insurance summary

Choosing the right travel insurance is an essential part of enjoying peace of mind while you are on holiday.

When looking for the best travel insurance deals, don’t just pick the cheapest policy. Instead, look for the cover limits that match your requirements. For example, baggage cover of £5,000 isn’t worth having if your baggage is worth £1,000; cancellation cover up to £10,000 isn’t worth having if your holiday cost you £2,000.

The easiest way to compare the best travel insurance is usually by using a travel insurance comparison website.

Think about the sort of activities you’ll be doing while you’re away. You may need extra holiday insurance for things such as winter sports or scuba diving or if you are going on a cruise.

Be honest about any pre-existing conditions when buying your travel insurance, or you won’t be covered if you have to claim.

The best travel insurance is a safety net for you and your family to enjoy your trip away stress-free, knowing that you’re covered for everything from medical expenses to cancellations if things go wrong.

Frequently asked questions about the best travel insurance UK packages

Is travel insurance necessary for domestic travel within the uk.

Even where medical costs in the UK are covered by the NHS, a sudden illness could lead to other expenses, forcing you to cancel your trip, the costs of which travel insurance would cover.

Lost or stolen luggage and broken gadgets or other claims for damage can just as easily occur in the UK as abroad.

What is annual travel insurance, and is it a good option for frequent travellers?

Annual travel insurance is a policy that covers you for multiple trips away within any 12-month period. It is often cheaper than buying a separate policy for each trip if you are planning to go away multiple times in one year.

Annual travel insurance is also useful if you are planning a long trip visiting several countries, as often insurers require you to buy travel insurance before you leave the UK rather than abroad mid-trip.

Are there any travel insurance companies that specialise in certain types of trips or travellers?

Specialist travel insurers cater to specific groups of people. It can make sense to seek out travel insurers that cover your needs.

Adventures Insurance, Sports Cover Direct and Snowcard tailor their travel insurance to those who enjoy activity holidays and extreme sports, for example.

Senior travellers are the focus of policies from All Clear, Avanti, Co-op Insurance Services, Free Spirit Flex, Good 2 Go Extra, Goodtogo Insurance, Saga, Staysure and Total Travel Protection.

Insurers offering business trip cover include Allianz, Direct Line, Coverwise and Insure & Go.

How do I make a claim with my travel insurance company?

To claim on your travel insurance while you are away, make sure that you take your policy number with you and the emergency number for your insurer. If you are travelling abroad, take any international numbers too.

Call your insurer as soon as you realise you need to make a claim. Keep all receipts and medical expense forms. If you are travelling with other people, make them aware of your policy details and the insurer’s phone number in case they need to call on your behalf.

To make a claim when you return home, check the following:

- You haven’t left it too late to make a claim

- What you’re claiming for is covered

- The excess is not more than the value of your claim (if so, it’s not worth claiming)

Notify your insurer as soon as possible for a claim form, send it back fast and keep a copy of it. You should also include copies of paperwork to support your claim, such as receipts or medical certificates (keep copies of the originals in case your claim is queried or refused).

Laura Miller

Laura Miller is a freelance journalist, editor, and producer. She has a wealth of consumer finance experience, having written about money matters and business for over 15 years.

During her tenure as a freelance writer, she has worked for ITN, Wired, and The Sunday Times, as well as financial institutions such as Aegon, the Chartered Insurance Institute, and Pension Bee, where she’s presenter of the Pension Confident Podcast.

Laura has previously held roles at The Times, where she was the Acting Editor of Times Money Mentor, The Telegraph as a senior finance reporter and was the co-host of the It’s Your Money Podcast, which was renowned for making complex finance issues accessible, and The Financial Times, where she worked as a News Editor. Laura has also worked at CNN, Politics.co.uk, and as a producer at Radio 5 Live.

Connor Campbell

Connor Campbell is an experienced personal and business finance writer who has been producing online content for almost a decade.

Connor is the personal finance expert for Independent Advisor, guiding readers through everything they need to know about car insurance and home insurance. From how much it costs to the best insurance providers in the UK, he’s here to help you find the right policy for your needs.

In his capacity as writer and spokesperson at NerdWallet , Connor explored a number of topics close to his heart, such as the impact of our increasingly cashless society, and the hardships and heroics of British entrepreneurs. His commentary was featured in sites such as The Mirror , the Daily Express and Business Insider .

At financial trading firm Spreadex, meanwhile, his market commentary was featured in outlets such as The Guardian , BBC , Reuters and the Evening Standard .

Connor is a voracious reader with an MA in English, and is dedicated to making life’s financial decisions a little bit easier by doing away with jargon and needless complexity.

- Best home insurance

- Best life insurance

- Best pet insurance

- Car insurance

- Home insurance guide

- Buildings insurance

- Contents insurance

- Home insurance glossary

- Admiral home insurance review

- Aviva home insurance review

- AXA home insurance review

- Churchill home insurance review

- Compare the market review

- Direct Line home insurance review

- Esure home insurance review

- LV home insurance review

- More Than home insurance review

- Policy Expert home insurance review

- Rias home insurance review

- How we cover home insurance companies

The Independent Advisor brand is operated by 3S Media International Limited. 3S Media International Ltd is an introducer appointed representative of Moneysupermarket.com Financial Group Limited, which is authorised and regulated by the Financial Conduct Authority (FCA FRN 303190).

Helping you make the most out of your money

Searching Money Mentor . . .

The best travel insurance providers.

Updated March 26, 2024

In this guide

If you’re looking to escape the UK winter, or if you’re saving your holiday for the height of summer, you may wish to consider travel insurance. We explain what travel insurance is and some of the best policies on the market for your holiday.

In 2022, UK residents made 71 million visits abroad. This was over three times the amount made in 2021, when COVID restrictions kept many people at home.

So if you’re part of a growing number of people spending time abroad, have you considered travel insurance? By taking out one of these policies you could be protected for lost baggage, delayed flights, and medical emergencies abroad among other unforeseen events.

In this article we explain:

- What is travel insurance

What does travel insurance cover?

The best travel insurance.

- Travel insurance and medical conditions

Read more: Passport renewal costs and waiting times

What is travel insurance?

Travel insurance covers the cost of unforeseen events and mishaps that either stop you from going on holiday or affect you while you’re away.

Depending on the policy, travel insurance might cover you for:

- Medical bills if you suffer illness or have an accident while you’re away

- Cancellation of your trip for reasons outside of your control

- Lost or stolen baggage

Policies are usually relatively inexpensive and can give you the peace of mind that your costs will be covered if something bad happens while you are on holiday.

According to the Association of British Insurers (ABI), a trade body, the average claim on travel insurance in 2022 was a little over £970. So while travel insurance won’t stop bad things from happening, but it can prevent you from having to find the money to pay for unexpected costs even after you return from your holiday.

Read more: Ten budget travel tips

Many people opt to take out travel insurance to cover potential medical care while away.

Every week, 3,000 Brits need emergency medical treatment while abroad, according to the ABI. But travel insurance isn’t just about covering medical costs. It can protect you against a range of unplanned events:

- Cancellation or trip interruption for reasons outside your control

- Missed transport or delayed departure for reasons outside your control

- Personal injury and death, including medical evacuation

- Lost, stolen or damaged items, including baggage, passports and money – check if your home contents insurance covers you

- Accidental damage or injury caused by you

Does travel insurance cover cancelled flights?

Most travel insurers provide a basic level of cover for cancelled flights. Aviva’s travel insurance, for example, will pay out if your flight is cancelled due to an airport shutdown.

If your airline cancels your flight then you should claim a refund directly with them, so your travel insurance could cover other costs such as hotel bookings, vehicle rentals, and other possible excursions.

What are my rights during strike action?

If your flights are cancelled because air staff are striking, which they have over last summer, you might be entitled to compensation from the airline. But for this to apply, customers must have been given less than 14 days’ notice.

It also depends on whether the airline was at fault or not: so if it’s the airline’s staff who are striking, you should be entitled to compensation.

If you’re worried that your flights might be delayed or cancelled, you should also check your travel insurance policy.

Some policies cover you for a cancelled or delayed flight, provided you took out the policy before the strikes were announced.

But if you haven’t yet bought your insurance, you may be out of luck. This is because most insurers won’t cover you for strikes which were already known about.

Read how travel insurance could catch you out.

Below we’ve listed some of the best travel insurance providers on the market, all of which were nominated in Times Money Mentor awards 2023.

Times Money Mentor award winning cover

Best for over-50s

Post Office

Best for those with pre-existing medical conditions

Best for those wanting substantial medical cover

Best for a range of unique add-ons

Looking for a new holiday destination?

Make sure to visit Times Travel for your holiday inspiration this year. From palm beaches in Fiji to the beautiful Italian coastline, Times Travel caters to all different tastes. Unlike other parts of the site, you also don’t need a subscription to enjoy their high-quality content.

Another notable provider

Despite not winning a nomination at the Times Money Mentor awards, this provider also offers a decent level of cover:

Switched On

The best travel insurance for cruises.

If you’re thinking about taking a cruise, it’s important to take out special additional cover such as a cruise insurance to protect you.

Cruise insurance is normally offered as an add-on to travel policies, and protects you if you:

- Miss connections to reach the departure

- Fail to get back on board after planned stops

- End up being confined to your cabin

Though if you want a dedicated travel insurance policy for a cruise, here’s an option to consider:

Just Travel Cover*

Best for cruise holidays

The best winter sports cover

If you’re planning a skiing and snowboarding trip then it’s important you have insurance that will cover you if you’re involved in an accident on the slopes.

Most travel insurers will offer winter sports cover as an optional add-on to their regular cover and will protect you if you:

- Need to be airlifted off the slopes or rescued and need medical treatment

- Turn up and there’s no snow

- Can’t start skiing and snowboarding because of avalanche risk

- Find out your equipment – such as skis, snowboard and boots – has been stolen

It’s difficult to predict what the next ski season will look like. But if you’re booking now and want cover for the essentials, here’s a policy to factor into your calculations.

InsureandGo*

Best for winter sports

What should a basic travel policy cover?

When shopping for travel insurance, you should ensure your policy comes with the following seven things as standard:

1. Medical expenses

This covers the costs of any emergency medical and surgical treatment while you’re away.

It usually costs more for cover in the US as medical bills can run into the tens or hundreds of thousands of dollars. Any treatment that can wait until you get home is not usually included.

Most policies offer cover of £1 million for medical costs in Europe. This is usually £2 million in the US.

2. Repatriation

This is where you might need to be evacuated from the country you’re visiting.

Repatriation usually happens when you need to get back home to the UK in the event of a medical emergency and is usually covered as standard in most travel insurance policies.

3. Cancellation/curtailment

This covers any travel and accommodation costs you have paid for and can’t use or claim back.

You need a good reason to cancel your trip, so make sure you double check the terms and conditions of your policy.

4. Missed departure

This covers your extra accommodation costs and travel expenses should you miss your departure due to situations outside your control.

It usually includes your car breaking down or being involved in an accident. Leaving home at the last minute won’t count.

This covers you for delays to your travel plans, such as severe weather conditions.

Delays known about before (such as strikes) won’t be covered.

6. Baggage cover

This should cover you if your baggage is lost, stolen, damaged or destroyed.

You might need extra cover for gadgets or valuable possessions as there are usually limits on separate items.

Losses need to be reported within a certain time frame and you must have a written report from your airline if it loses your baggage.

7. Personal liability cover

This should cover you if you are liable to pay damages due to:

- Accidental bodily injury to someone

- Or for loss or damage to someone else’s property

- Claims made by family members or employees won’t be covered

Choose a smooth private healthcare journey with Saga Insurance

• Easy access to a specialist

• Fast tests, scans and treatment

• Comfortable hospital stay

Get a Saga Health Insurance quote

For people over 50. Saga Health Insurance is a unique product designed by us specifically for our customers, and it’s only available through us. Together with our underwriter, Bupa Insurance Limited, we are committed to providing high standards of quality and service.

What extra cover can you buy?

To provide a peace of mind you might be able to add the following onto your policy too:

- Wedding cover – If you’re travelling abroad for a wedding, some providers might include an add-on which covers damage to your possessions. If you think you need something more comprehensive, then consider a separate wedding insurance policy

- Gadget insurance – While you’re abroad you may wish to cover your laptop, phone, or tablet from theft or damage

- Golf equipment cover – Planning to tee off abroad? Then consider cover for moving your clubs overseas. This type of add on includes cover for your equipment if it is lost, stolen, or accidentally damaged

Read more: Is credit card travel insurance any good?

What is not covered by travel insurance?

Travel insurance won’t cover you for a risk that is known about.

For example, if you have a long-standing medical condition that means you can’t go on holiday, your insurer might not cover you for the cancellation costs.

Insurers also won’t cover you if you have to cancel your trip for reasons within your control. For example, if you miss your flight because you woke up late, your claim is likely to be rejected.

Travel insurance is also unlikely to cover you if you have been irresponsible. For example, if you leave your valuables in your hold luggage then your policy won’t cover you if these items are damaged.

Each travel insurance policy will have specific things it won’t cover and this will vary depending on the provider. So it’s important to read the terms and conditions carefully.

What types of travel insurance can you buy?

There are two main options to choose from when taking out a travel insurance policy:

- Single trip — covers you for one trip of a specified length only

- Annual multi-trip — covers you for all your trips for one year (if you travel a lot this can work out cheaper than lots of single policies)

You need to make sure that either option of travel insurance covers you for where you are going, such as:

- Europe only

- Or the more expensive, worldwide policies (these either include or exclude the US)

But check first which exact countries providers include in their policies. For example, some policies include Turkey, Morocco, Tunisia and Egypt in their Europe insurance.

There is also specific travel insurance for backpackers, which offers extra cover for those who are likely to be away for an extended period of time or travelling to multiple destinations.

Also bear in mind that if you are doing any extreme sports like skiing or going on a cruise then you might need to buy an add-on.

When should I take out travel insurance?

It’s usually best to take out travel insurance as soon as you have booked your trip.

While many people think of travel insurance as something that covers problems while they are away, some policies cover you for issues, accidents and illnesses that stop you from being able to travel.

Cancellation is one of the main reasons that people claim on a travel insurance policy. If the cancellation happens before you have bought insurance then you wouldn’t be able to claim.

How much should I pay for travel insurance?

Your travel insurance premium will depend on a range of factors such as your age, health, type of policy, and destination. This is why an average travel insurance premium will likely be meaningless, so make sure to do your research and get a quote from several different providers before deciding on a policy.

Do I need travel insurance?

Unlike car insurance, travel insurance isn’t a legal requirement. However, it does come with a host of benefits such as cover for medical expenses.

We’ve already listed the benefits of having protection for unexpected medical costs above, and it remains pertinent if you’re travelling abroad and won’t have access to the NHS. According to the ABI, there is one recorded case in 2022 when a traveller in Thailand contracted a serious blood infection which needed intensive medical treatment. The bill eventually came up to £250,000 which was paid in full by their travel insurance provider.

Also consider that some visa applications require you to have a suitable travel insurance policy in place before you apply. If you’re applying for a Schengen visa to travel Europe you’ll need a policy in place which covers medical expenses up to €30,000 during your trip.

FAQs: Travel insurance and medical conditions

Many people solely take out travel insurance to protect themselves from medical expenses. According to the ABI, the average medical claim on travel cover is more than £1,300. Notoriously in the US, these figures run into the tens or hundreds of thousands of pounds.

So below we’ve answered some of the most common medical related questions on travel insurance:

Q. Does travel insurance cover pre-existing medical conditions?

Some insurers do provide cover for pre-existing conditions. However, it is vital that youflag these conditions during the application stage. If you don’t it could invalidate your policy.

Q. Do you need to tell your travel insurance provider if you have a new medical condition?

If there is a significant change to your personal health then you’ll need to inform your travel insurance provider. This includes being diagnosed with a new long-term illness.

Failure to do so could invalidate your policy.

Q. Can you get travel insurance if you’re over 75 with medical conditions?

Yes. In fact, there are some providers on the market which tailor their policies towards an older demographic. For example, Saga has dedicated policies for over 50s and 70s.

* All products, brands or properties mentioned in this article are selected by our writers and editors based on first-hand experience or customer feedback, and are of a standard that we believe our readers expect. This article contains links from which we can earn revenue. This revenue helps us to support the content of this website and to continue to invest in our award-winning journalism. For more, see How we make our money and Editorial promise

Important information

Some of the products promoted are from our affiliate partners from whom we receive compensation. While we aim to feature some of the best products available, we cannot review every product on the market.

What is travel insurance and is it worth it?

A technical issue with UK air traffic control systems left thousands of travellers facing long delays on one of the busiest days of the year in August. You have travel rights, so is it worth having travel insurance? Hundreds of flights were delayed and cancelled on bank holiday Monday due to the fault. The incident […]

Am I entitled to flight delay compensation?

In September, hundreds of flights were cancelled or delayed due to a “technical issue” with UK air traffic control systems. It left hundreds of passengers stranded. Here we explain your rights when it comes to flight compensation. Air traffic control faults are classified as “extraordinary circumstances” and therefore airlines do not have to give you […]

Is credit card travel insurance any good?

We explain how travel insurance on credit card works and look at the pros and cons of using it. Some rewards credit cards offer travel insurance. However, your credit card is unlikely to give you all the cover you need as full medical insurance is not included. This article will cover: Related content: What are […]

Sign up to our newsletter

For the latest money tips, tricks and deals, sign up to our weekly newsletter today

Your information will be used in accordance with our Privacy Policy.

Thanks for signing up

You’re now subscribed to our newsletter, you’ll receive the first one within the next week.

Travel insurance

Find the right travel insurance policy with allianz assistance.

AWP Assistance UK Ltd , trading as Allianz Assistance and Allianz Global Assistance , is a subsidiary company of Allianz Partners SAS. AWP Assistance UK Ltd is authorised and regulated by the Financial Conduct Authority in the United Kingdom to provide insurance products and services.

Please note that, whilst AWP and Allianz Insurance are part of the global Allianz SE group of companies, AWP and Allianz insurance are separate companies and not part of the same group of companies in the UK. Any communications regarding Allianz Assistance services should therefore be addressed to AWP .

A range of cover options are available including single and multi-trip, 24/7 medical cover, backpacker, winter sports and more.

Whatever type of trip you're taking, Allianz Assistance will help you find a plan that covers the "what ifs?".

Extended Car Warranty

Allianz Assistance is the trusted car warranty provider for ten of the UK’s leading car brands. Find out more on Allianz Assistance about the three levels of car warranty that are available.

Not what you were looking for?

Pet insurance, musical insurance, home insurance.

Your cookie preferences

We use cookies and similar technologies. You can use the settings below to accept all cookies (which we recommend to give you the best experience) or to enable specific categories of cookies as explained below. Find out more by reading our Cookie Policy .

Select cookie preferences

- Performance

- Functionality

- Account Overview

Popular Search Terms

- Samsung Galaxy deals

- iPhone deals

- SIM Only deals

- Credit Cards

- Pay as you Go

- Uswitch.com >

- Travel insurance

Compare travel insurance quotes

Search for single-trip, annual and specialist travel insurance,, with money.co.uk and uswitch travel insurance options..

What is travel insurance?

Travel insurance is a policy that can protect you should an accident or loss occur, prior or during your trip in the UK or abroad.

The protection can cover you in case your flight is cancelled, your hotel is unavailable, you fall sick or are injured while you are away. Or your belongings, gadgets or money are lost or stolen.

You can buy individual, couple or family travel insurance, and you can choose from a single trip to a named destination, or a multi-trip policy which lasts for a year.

You might need to take out a specialist policy or specify if you plan to undertake water sports or skiing, if you're going on a cruise, or if you have any existing medical conditions.

How it works

Enter your details.

Enter your details Tell us a bit about your business – such as name, industry and turnover.

Compare covers

See how much different types of insurance would cost you.

Apply or save

Start your policy straight away, or save your personalised quote for 30 days.

COVID-19 and travel insurance

It's important to get travel insurance to cover a range of risks, and find out how much you insurer will provide for COVID-19 related issues.

If you decide to travel against government advice or to a country that the FCO advises against travelling to, then you will not be covered by a travel insurance policy.

Do I need travel insurance?

It's not a legal requirement to have travel insurance, but is a very good idea. Firstly, you will be covered if your holiday is cancelled or your hotel is unavailable.

You will also be covered for medical expenses, which is very important when you are outside the UK as most countries do not offer free healthcare.

If you were to need urgent medical treatment in the US or Europe, you would be charged for your care. That could run into hundreds and maybe thousands of pounds.

What our customers say

Types of travel insurance, single trip travel insurance.

Single trip travel insurance , covers you just for one holiday to one destination and is the cheapest option if you just have one trip arranged.

Annual travel insurance

Annual travel insurance , covers multiple trips abroad during a 12-month period. You will need to specify what countries you are planning to visit. For example, if you are only planning to travel within Europe it will be cheaper than a worldwide policy.

Worldwide policy

If you're travelling outside Europe, you will need to buy a worldwide policy. The price will depend on where you are going to visit. For example, a trip to the US will increase the cost of your travel insurance because medical care there is very expensive.

When to take out travel insurance

When you book a trip it's a good idea to book travel insurance at the same time

Be prepared to change your travel plans and/or cancel

Flexible flights or holiday packages make it easier to make alternations in the future

At this point in time, no one can reliably predict how travel rules and regulations might change this summer.

Although travel insurance can cover you for some risks, it will not cover every possible problem connected with the coronavirus.

What is the best travel insurance to get?

The best type of travel insurance is the one that best fits the holiday you are going on.

If you're making a single trip and don’t plan any more holidays this year, a straightforward policy to the country you are visiting will be most suitable.

However, if you're planning a couple of holidays, or have an itinerary with multiple trips, you may be better getting an annual travel insurance policy.

The whole process should only take a couple of minutes:

put in the details of your party

destination

dates of travel

When you have chosen which cover you would like to buy you can filter the results based on medical cover, cancellation cover, baggage cover or the amount of excess you need to accept.

What cover is there for healthcare post Brexit?

Many people may still have a European Health Insurance Card (EHIC) which entitles UK citizens to healthcare within the EU. It is not a substitute for travel insurance, but it does cover you if you are ill or have an accident in an EU country. The Brexit agreement means that the EHIC cards can still be used until their expiry date. They cover pre-existing medical conditions and there are an estimated 27 million in issue.

Once your EHIC has expired, or if you have never had a EHIC, you will need to apply for a new Global Health Insurance Card (GHIC). Unlike the EHIC, the GHIC does not cover medical treatment in Norway, Iceland, Liechtenstein or Switzerland. The GHIC is not a substitute for travel insurance as it does not cover repatriation, cancelled flights, or problems with your accommodation.

What does travel insurance cover?

Travel insurance can help cover your costs or reimburse you if:

You fall ill or are injured while you’re away

Your possessions are lost, damaged or stolen

Your trip is cancelled or abandoned for a specified reason

Depending on the type of policy you choose, you could be covered for extras such as delayed baggage, loss of travel documents, missed excursions and many more.

You might need to take out a specialist policy or specify if you plan to undertake any extreme or winter sports, if you are going on a cruise, or if you have any existing medical conditions.

Some policies exclude more dangerous activities such as riding jet skis or scuba diving.

You can take out a travel insurance policy for just yourself, joint cover for you and partner, or insurance for your whole family or group.

Find more details on what travel insurance covers .

Why would you need travel insurance?

In the UK we are used to having free healthcare and free treatment at hospitals for Accident and Emergency, but this is not the case in the rest of the world.

Many countries ask people to pay for medical treatment and this can end up being very expensive if you need medical help while you are abroad particularly in the United States with some medical bills reaching tens of thousands of pounds. Some private hospitals will refuse to treat you unless you can prove that you will be able to settle your medical bill, or you have travel insurance policy documents to show them.

A travel insurance policy will mean that you can claim back any costs that you incur if you are sick or injured while you are away, as well as the cost of flying you home if you need further treatment in the UK.

A holiday insurance policy also covers you if your flight is cancelled or your hotel is not available, and if you lose valuables or money during your trip. It gives you peace of mind so you can enjoy your holiday

When should I buy travel insurance cover?

It might be tempting to put it off until your suitcases are packed, but it’s advisable to get travel insurance as soon as your holiday is booked.

If you buy travel insurance with cancellation cover, you’ll be covered from the moment you buy the policy, rather than the start of your trip. That means you can claim if your flight or holiday is cancelled due to circumstances beyond your control.

It’s worth checking the policy details as most insurers will lay out specific circumstances in which they will pay out on cancellation cover, for example if you can no longer travel because you fall ill, become unemployed, or have to deal with the death of a family member.

How much does travel insurance cost?

Cover could cost as little as a few pounds for a short trip in Europe, for example, but the cost will vary depending on how comprehensive the policy is and any extras that are included.

The price will depend on many factors including where you are travelling to, your age, and how much cover you need.

You might find it’s more expensive to cover cruises, winter sports and existing medical conditions — but it’s important to weigh up the value of the cover compared to the cost of your holiday. You should also consider the cost of receiving emergency medical care, as this can quickly build up to thousands in the worst case.

You can find out how much travel insurance will cost you by getting a quote below. It takes just a few minutes and you don’t need to provide many details.

How to compare travel insurance

Don’t just choose the cheapest travel insurance. Use our travel insurance comparison tool to look at the options available and select the best travel insurance for you based on where you are going and what cover you will need.

Getting a travel insurance quote

Our travel insurance comparison tool means when you need to compare travel insurance, getting a quote is simple and easy. Firstly, put in where you are going and for how long, then provide details of yourself and the other people in your party. You will need to let us know if anyone has a pre-existing medical condition. Once you have put in all the details, we will give you a quote or a range of quotes. The whole process should only take a couple of minutes. When you have chosen which cover you would like to buy you can filter the results based on medical cover, cancellation cover, baggage cover or the amount of excess you need to accept.

If you have a pre-existing condition, you can still get a quote. These conditions could include cancer, stroke, serious heart, respiratory and terminal conditions.

Some insurers might not cover you if you already have a serious medical condition, or if you have a number of conditions. Others might only offer insurance at a much higher price. If you're unable to find suitable cover, the Money and Pension Service (MaPS) has also set up a directory of insurers willing to cover customers with pre-existing medical conditions.

You can contact the Money and Pensions Service (MaPS) or you can telephone 0800 138 7777.

Then when you have chosen the right travel insurance cover for you, you can buy online by clicking through. It is that simple!

COVID-19 restrictions

Am i covered for covid-19 by travel insurance.

A travel insurance policy should cover you if you're unable to travel because you have tested positive for COVID-19. You'll likely need to provide proof of this when you make your claim.

However, each insurance policy will be different, therefore, it's important to look at the small print when you are comparing policies.

What if my destination goes into lockdown or won’t admit me?

UK travel insurance companies will most likely follow the advice of the Foreign Office regarding travelling abroad if there's another lockdown.

If the Foreign Office advice is not to travel, your UK travel insurance will probably not cover you for travel. In this event you may be able to rearrange flights for a later date or different destination.

Explore related products

How do I make a travel insurance claim?

How do I claim on my travel insurance? Find out how to make a successful travel insurance claim if the worst does happen on your holiday.

Find out if a single trip travel insurance policy is the best choice for you. Your questions on how to get cheap single trip travel insurance answered.

Find out if annual travel insurance (also known as multi-trip cover) is the best choice for you. All your questions answered, plus tips for getting the best deal.

Holiday checklist for your finances

This is a holiday checklist with in a difference; instead of telling you what to put in your suitcase, it tells you what you need in your wallet.

Privacy policy

Customer Reviews

Good quick easy

Everything ok!

So easy to check the tariffs and switch.

Last updated: July 27, 2023

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Foreign travel insurance

If you’re travelling abroad, it's important to take out appropriate travel insurance before you go.

If you travel internationally you should buy appropriate travel insurance before you go. If you already have a travel insurance policy, check what cover it provides for coronavirus-related events, including medical treatment and travel disruption, and any planned activities such as adventure sports. If you are choosing a new policy, make sure you check how it covers these issues.

If you do not have appropriate insurance before you travel, you could be liable for emergency expenses, including medical treatment, which may cost thousands of pounds.

For example:

You should buy your travel insurance as soon as possible after booking your trip. Read the small print, and familiarise yourself with any exclusion clauses for the policy.

When you travel, make sure you take your insurance policy details with you, including the policy number and your insurer’s emergency assistance telephone number. Share your policy details with people you’re travelling with and friends or family at home, in case they need to contact your insurance company on your behalf.

The Association of British Insurers (ABI) represents over 200 insurance companies. Read ABI’s advice on travel insurance , including how COVID-19 can affect it, and their guide on choosing the right travel insurance policy .

In addition to making sure you have appropriate insurance, you should check and sign up to travel advice for your destination.

What to consider when you buy travel insurance for you and your family

- emergency treatment and hospital bills can be expensive. Check whether your policy covers treatment in public or private hospitals

- emergency transport, such as an ambulance, is often charged separately to other medical expenses, and emergency travel home on medical grounds can also be expensive

- pre-existing medical conditions: declare existing conditions or pending treatment or tests so that you are covered if anyone gets ill during your trip. Failing to declare something may invalidate your travel insurance

- all activities you may undertake on holiday, such as sports or adventure tourism (you may need specialist insurance for some activities). Also consider all the places you intend to visit, even if you are in transit, in case anyone needs emergency treatment in another country

- cruises generally require an additional level of cover because it is more difficult to get to hospital for treatment. Check the booking conditions of the operator you plan to sail with

- repatriation costs if you or a family member die abroad

- getting home after medical treatment if you cannot use your original ticket

- reasonable costs for a family member or friend to stay with you, or travel out to accompany you home, if required

- 24-hour assistance helplines to offer support and advice about appropriate treatment

- COVID 19 cover for if you or family members cannot return home because you/they test positive for COVID during your travel. Check your insurance covers additional costs such as alternative flights, accommodation and COVID tests. You should also check your insurance provides cover if you cannot reach your final destination during transit due to COVID-19

- within Europe, some insurers may waive any excess on medical treatment if you use a European Health Insurance Card (EHIC) or UK Global Health Insurance Card (GHIC). Check the terms of your policy or contact your insurer to see if this is the case. EHIC and GHIC allow you to access state-provided medically necessary healthcare within the EU and Switzerland on the same terms as residents of these countries. Note that EHIC and GHIC are not alternatives to travel insurance as they do not cover any private medical healthcare costs, repatriation or additional costs such as mountain rescue in ski resorts. Find out more about the EHIC and GHIC, including how to apply for one free of charge

- ATOL is a consumer protection scheme for air holidays and flights, managed by the Civil Aviation Authority (CAA) . Some insurance policies do not provide cover for when airlines or suppliers go out of business. Choose an ATOL-protected holiday or a travel insurance policy that includes airline or supplier failure cover

Policy exclusions

Check how an insurance policy covers:

- alcohol and drugs: most travel insurance policies do not cover events that happen after you have drunk excessive alcohol or taken recreational drugs or other substances

- high risk destinations: many travel insurance policies will not cover travel to a high risk destination where the Foreign, Commonwealth & Development Office (FCDO) advises against all but essential travel or all travel. Check your policy wording and the relevant country travel advice pages before booking your trip and buying insurance

- mental health conditions: some policies may exclude cover for treatment related to a pre-existing mental health condition. For more guidance see foreign travel advice for people with mental health issues

- age restrictions: check whether there are any age-related restrictions if you are buying an annual policy. The Money Advice Service provides guidance on how to choose the right level of cover, get the best deal, and make a travel insurance claim. It also has specific guidance for travellers over the age of 65 or with pre-existing medical conditions

- sports such as bungee jumping, jet skiing, winter sports or skydiving: these are not usually included in standard policies. Use of quad bikes and hire of mopeds is also usually not covered

- driving overseas: check Driving abroad . If you’re hiring a car, check what cover the hire company provides. If you are driving your own vehicle, check your motor insurance policy to see what it covers

- terrorist acts: most policies offer only limited cover for terrorist acts. As a minimum, make sure your policy covers you for emergency medical expenses and travel home if you are caught up in a terrorist attack. Some travel insurers offer policy add-ons to provide additional cover if there is a terrorist attack in your destination. This may include cancellation cover, if your destination is affected by a terrorist attack before your trip and you decide you no longer wish to travel

- other incidents: some policies only offer limited cover for claims related to or caused by a natural disaster (such as an earthquake or tropical cyclone) or civil unrest. You may also not be covered for some claims that arise from an incident (such as strikes or other industrial action) that was known publicly when you booked your trip and/or bought your travel insurance policy

Insurance for extended periods of travel

‘Long-stay’ travel insurance can cover extended periods of continuous travel. Check carefully the maximum duration allowed in any policy you consider buying to ensure that it meets your needs.

Make sure that the entire policy meets your needs, including specific activities and work (paid or unpaid) you may undertake.

Insurance if you live abroad or go for work or study

Travel insurance is not intended for permanent residence abroad. If you live overseas, or you’re planning to move to a different country to live, work or study, you should consider your insurance needs carefully. Local law may require you to have medical insurance, including as part of a visa application.

Read the healthcare guidance in the Living in guide for the country where you live to ensure you have the right healthcare arrangements for your circumstances.

You can buy private medical insurance for UK expatriates. You can also buy insurance from local providers overseas. You should always check policies carefully, including seeing whether you could transfer medical cover if you re-locate to other countries in future.

Support for British nationals abroad

Support for British Nationals Abroad explains how the FCDO can provide support to British nationals if things go wrong abroad.

Reviewed and updated guidance in full.

Updated guidance on using an EHIC or GHIC to access healthcare in Switzerland.

Updated to reflect new rules for travelling to amber list countries.

Updated COVID-19 section on new rules for international travel from 17 May.

Updated to reflect current COVID-19 travel guidance

New link to the declaration form for international travel (for England), from 8 March.

Edited grey box at top of page to provide further information on requirements coming into affect from 15 February

From 15 February you will need to quarantine in a government-approved hotel if you arrive in the UK from countries on the travel ban list.

Updated with new requirements coming into effect from 4am on 18 January 2021.

Updated with information on pre-departure testing for everyone travelling into England and Scotland.

Updated to reflect latest UK COVID-19 restrictions.

Updated the section on travel to Iceland, Liechtenstein, Norway and Switzerland, to reflect changes from 1 January 2021.

Updated ‘Travel to the EU’ section to reflect that UK-issued European Health Insurance Cards (EHIC) will still be accepted in EU countries, with different guidance for people travelling to Norway, Iceland, Liechtenstein and Switzerland from 1 January 2021.

Updated COVID-19 travel guidance

Updated to reflect the latest Tier-based COVID-19 rules for England

Updated to reflect the 5 November national restrictions for England relating to travel

Updated EU travel section with information on EHIC validity

New information on making sure your travel insurance covers you for coronavirus-related events

Update to contents including addition of new segments; travel insurance after starting travel or changing your plans, making a travel insurance claim, other financial protection and if you’re not covered.

Added information on financial protection of package holidays.

Information on the use of European Health Insurance cards (EHIC) in the event of a no deal added to the EU Exit update section

EU Exit update with advice on checking insurance coverage when travelling to Europe after the UK leaves the EU.

Content and format changes

Inclusion of Association of Travel Insurance Intermediaries (ATII) information.

Updated information on travel insurance

First published.

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

All medical conditions considered

Includes Medical Assistance Plus

Kids go free on family policies (1)

A choice of travel insurance to suit you

We have different types of cover for whatever you have planned. And we consider all medical conditions.

Offering cover for anything from a short UK break to a year of travelling around the world

- Covers you for a one-off trip up to 365 days (2)

- Perfect for short or long trips for anywhere in the UK or abroad

- No age limit

Travelling more than once this year? An annual multi-trip policy could save you time and money

- Cover for multiple-trips for a 12-month period

- 31-day trip limit, with extensions available up to 45 and 60 days

- Available for everyone aged up to 75 years

Looking for a gap year, career break or to travel the world? We could have the cover you're after

- Cover for a one-off trip up to 18 months

- Option to return home for up to 7 days on 3 occasions

- Available for those aged 18 – 60

Medical Assistance Plus: 24/7 holiday health support

Have peace of mind when you travel knowing that health professionals are just one click away.

Medical Assistance Plus (3), powered by Air Doctor, comes free with all our travel insurance policies. It gives you access to outpatient medical support while you’re abroad.

Through the service you can book an in-person or video consultation with a doctor. You can also get prescriptions delivered to your nearest pharmacy.

We’ll send you an SMS reminder about the service the day before you travel (for single-trip and backpacker cover) or the day before your policy begins (for annual multi-trip cover).

Living with a medical condition shouldn’t stop you seeing the world. And, with the right travel insurance in place, you can enjoy peace of mind on your adventures – just in case something unfortunate happens.

At Post Office, we cover most pre-existing conditions. Contact us for a quote to see if we can cover you. It’s important to declare upfront all your medical conditions and any medication you're taking.

If we can’t help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777.

Choose a travel insurance cover level

We can offer you a choice of economy, standard and premier cover levels.

Policy wording

Upgrade your cover with ease

Need cover for your policy that's not included as standard? Just pay a little more to add these upgrades – optional or mandatory depending on the trip type.

This optional extra helps protect you from the impact of airspace disruption, natural catastrophes, terrorist acts or Covid-19 (5)

If you’re happy with the cover offered, but worried about excess fees, you can opt for an excess waiver. For an additional premium, you can add it to any Post Office level of cover for zero excess fees (5)

Insure all your devices with our easy-to-add gadget cover. It’s perfect to protect all your smartphones, tablets, laptops and consoles (5)

Specialist cover is mandatory for winter sports like skiing and snowboarding. There’s greater risk of emergency costs. Make sure you’re protected on the pistes (5)

If you're going on a cruise, specialist cover is both important and mandatory. It covers missed departure due to breakdown, falling ill on board, being confined to your cabin, lost baggage and more (5)

Trip extensions are available up to 45 or 60 days, increasing from the standard 31 days (5)

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

What is travel insurance?

Travel insurance may be able to protect you against a range of unexpected events. From losing valuables to medical emergencies, and anything else that could spoil your holiday. Take a look at our policy documents to make sure that you’re getting the cover that meets your needs.

Cancellation and cutting short your trip

- Emergency medical expenses

- Missed departure

- Delayed departure

Personal liability and legal costs

We'll repay you for any non-refundable, unused travel and accommodation costs if you have to cancel or cut short a trip due to reasons set out in the policy. This includes pre-booked activities and excursions, car hire, cattery and kennel fees, up to the limits shown

We may be able to help if you need emergency medical treatment, return to the UK (getting you back home) and more while you’re abroad

Missed departure (6)

We’ll also cover any extra travel and accommodation costs you're charged if you arrive too late to travel on your booked transport. As long as they match the reasons set out in the policy

Delayed departure (6)

You’re covered if your first outbound or final inbound international departure is delayed by 4 or more hours. As long as it matches certain reasons set out in the policy wording

Items that are usually carried or worn during a trip are covered if they get lost, stolen or damaged

You'll also get protection for any unexpected legal costs you might be charged while you're away

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

An award-winning provider

Best travel insurance provider.

Post Office won a ‘Best Travel Insurance Provider’ award at the Your Money Awards in 2021, 2022 and 2023

Post Office won a “Best Travel Insurance Provider” award at the British Travel Awards in 2023

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Cover you can count on. We’ve paid out over £177 million in travel insurance claims since 2007

Common travel insurance questions, what does travel insurance cover.

Post Office Travel Insurance can cover you for a single trip of up to 365 days(2), or multiple trips in a single year. This applies to trips taken anywhere in the UK and abroad too. We also offer backpacker cover(7) for a single trip of up to 18 months.

The type and level of cover provided depends on the insurance policy type and options you choose. It can include cover for:

- Cancellation

- Cutting your trip short and abandonment of your trip

- Lost, stolen or damaged baggage