- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Travel Risk Management Services Market Size, Share, Competitive Landscape and Trend Analysis Report by Service type, by Enterprize Size, by Industry : Global Opportunity Analysis and Industry Forecast, 2021-2031

CG : Travel & Luxury Travel

Report Code: A06585

Tables: 155

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

Travel Risk Management Services Market Research, 2031

The global travel risk management services market was valued at $96.26 billion in 2021, and is projected to reach $223.62 billion by 2031, growing at a CAGR of 8.1% from 2022 to 2031.

Identification, analysis, and decision-making on the threats to a location or organization are all part of the travel risk management services market. They are methodical, logical approaches to problem solving and making decisions in faith of businesses and business travellers. Travel risk management services are lightweight and simple to set up, making them an essential part of outdoor gear. The report on the travel risk management services market size presents a detailed analysis of the trends, future estimations, and thorough study of the market based on services, industry, traveller, and region.

Globalization is one of the major factors supporting the market growth. Companies are increasingly sending their workers to more international locations for the purpose of business needs. Some locations are far away or in dangerous areas that can affect the business and travellers. The amount of danger in some countries is also becoming harder to assess, especially as it is rising even in places that were once thought to be low-risk. Thus, the companies are looking for effective travel risk management services to avoid unprecedented risks during the travel.

Globalization in business refers to change in a business from a company associated with a single country to one that operates in multiple countries. The leading business organizations such as Toyota Motor Corporation, Mc Donald's, Wal-Mart stores Inc., and Amazon, Inc. are venturing beyond national boundaries to tap more business opportunities and supporting Travel Risk Management Services Market demand.

The travel risk management services industry is supported by the growth of multinational companies and their international movements for their business perspective. The growth of information and communication technology (ICT) in Asian countries has favoured the growth of multinational companies in Asia-Pacific region. Moreover, the availability of different resources and cheap labor in emerging nations such as China, India, Malaysia, and Indonesia have attracted the many foreign companies to operate their business in these regions. The lucrative offers made by the governments of developing nations to attract foreign investment has led to the establishment of multinational enterprises ultimately boosting the business travel. Developing countries such as China, have become a manufacturing hub that accounted for around 28.7% of the global manufacturing output in 2019, as per the data published by United Nations Statistics Division. As a result, Asia-Pacific has become the largest business travel market across the globe. In addition, liberalization in market entry strategies in countries such as India, encourages the global business organizations to expand their market size. To operate global firms, activities such as geocentric or cross-culture employee training, and international marketing have notably increased, which is one of the prime factors that promote the travel risk management services market growth.Â

There are various technological advancements that emerged in the recent years and are being adopted by the business travel service providers. The popular technologies such as artificial intelligence, chat bots, voice search & voice control technology, and internet of things (IoT) are used by the players operating in the market. Voice search, chat bots are used in the websites to provide customers the convenience and ease of booking risk management services.

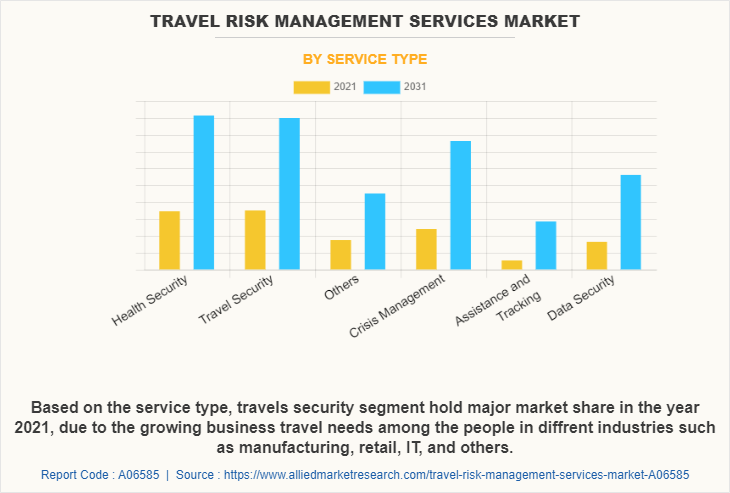

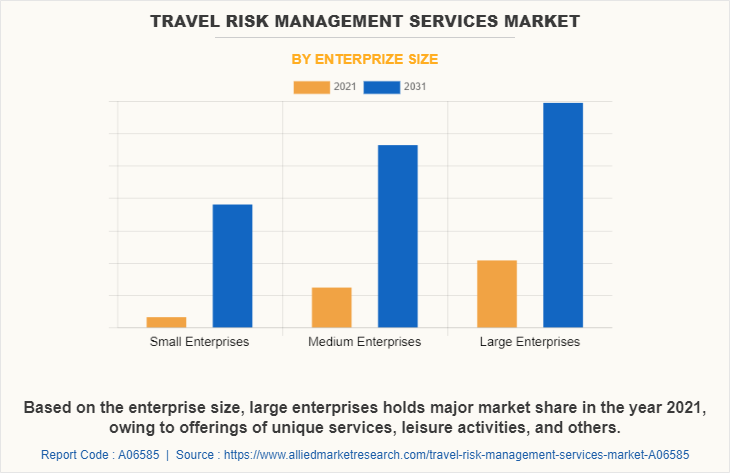

The travel risk management services market is segmented into Service type, Enterprize Size and Industry.

By service type, it is categorized into health security, travel security, crisis management, assistance & tracking, data security, and others. By enterprise size, it is segmented into small enterprise, medium enterprise, and large enterprise. On the basis of industry, it is bifurcated in to pharmaceutical and healthcare, agri, food, & beverages, hospitality, business services & consultant, technology & telecom, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Argentina, and Rest of LAMEA).

Based on the service type, travel security services holds major share in the year 2021, owing to the increasing travel fradulent activities and increasing concerns of travelers regarding their safety during the tour.

Large enterprises segment is gaining huge popularity among the business travelers, owing to increased facilities in these properties, increased offerings of risk management services and flexibilities among the people.

On the basis of industry, agri, food & baverages segment is dominating the global travel risk management services market share owing to the well established food sectors all across the world and increasing innovations in the industry leads to the higher business tours globally.

Based on the region, Asia-Pacific would exhibit the highest CAGR of 7.3% during 2021-2028, owing to the increasing industrialization, westernization, and rise in business opportunities in the region.

The key players operating in the travel risk management services market include BCD Group, Carlson, Inc., Everbridge, FocusPoint International, Inc., Global Rescue LLC, Healix, Kroll, LLC., Millbank Solutions, The Collinson Group Limited, and Tokio Marine Holdings, Inc.

Travel Risk Management Services Market Report Highlights

Analyst Review

The travel risk management services industry has witnessed steady growth even under several turbulence such as global uncertainty, weakened global economy, terrorist attacks, world health issues, and others. This is attributed to the positive impact of business travel, which has a high return on investment, and further increases the interest of top-level management of business organizations across the world to invest heavily in this market. According to the insights of the CXOs, Asia-Pacific region is expected to grow at a significant rate during the Travel Risk Management Services Market Forecast, owing to increase in government initiatives to carry out business activities conveniently. Moreover, economic development is a prime factor in the market, as it plays a major role in managing relationships, investments, supply chains, and logistics, which further influences trade in the domestic & international markets. Rise in trend of online booking & fund transfer has increased the convenience and lowered the cost of service expenses, thereby offering a pleasurable experience to the business travelers to book travel risk management services.

- Travel Destinations

- Luxury Accommodations

- Travel Packages

- Adventure Travel

- Travel Experiences

- Adventure Destinations

- Travel Safety

- Outdoor Activities

The global travel risk management services market was valued at $96,262.8 million in 2021, and is estimated to reach $2,23,617.7 million by 2031 with a CAGR of 8.1% from 2022 to 2031.

The forecast period in the market report would be 2022-2031.

The market value of travel risk management services in 2021 is $96,262.8 million.

The year 2021 is base year calculated in the travel risk management services report.

The travel risk management services market is supported by the growth of multinational companies and their international movements for their business perspective.

The impact of COVID-19 has decreased the demand and revenue of global travel risk management services market in the year 2020 and is expected to normalize the trend in the next couple of years. Cancellation of MICE events severely damaged business travel of the international travellers. The outbreak of COVID-19 resulted in cancellations of almost all the MICE events across the globe which has impacted the travel risk management services market globally.

Asia-Pacific will dominate the market by the end of 2031.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Travel Risk Management Services Market

Global Opportunity Analysis and Industry Forecast, 2021-2031

- Technology, Media, and IT

- IT and Software

North America Travel Risk Management Market

North America Travel Risk Management Market Size, Share: By Service: Travel Security, Crisis Management, Assistance and Tracking, Data Security, Health Security, Others; By Enterprise Size: Small Enterprise, Medium Enterprise, Large Enterprise; By Industry Vertical: Hospitality, Others; Regional Analysis; Competitive Landscape; 2024-2032

- Report Summary

- Table of Contents

- Pricing Detail

- Request Sample

North America Travel Risk Management Market Outlook

The North America travel risk management market size reached approximately USD 0.83 billion in 2023. The market is projected to grow at a CAGR of 9.5% between 2024 and 2032, reaching a value of around USD 1.90 billion by 2032.

Key Takeaways

- As per 2023 State of Employee Safety report, 41% of travellers have never been informed of potential business travel risks.

- Regulations such as ISO 31030 guiding on managing travel risks to organisations are aiding the market.

- Growing political and geopolitical unrest, along with rising safety issues, are driving the requirement for optimal TRM strategies.

Travel risk management (TRM) is a comprehensive practice of identifying, assessing, and mitigating risks that are primarily involved with business travel. It includes providing employees with emergency assistance in case of potential crises or threats such as terrorism, natural disasters, and health risks, among others.

Rising demand for travel risk management solutions to prevent financial loss associated with travel disruption is one of the major trends aiding the North America travel risk management market growth. By planning for the potential risk or crisis in advance, an organisation can avoid additional expenses due to cancellations, delays, evacuation, or medical emergencies and save money.

Key Trends and Developments

Digitisation of travel risk management; evolving regulatory landscape; expanding travel risk management strategies beyond travel; and integration of AI in TRM solutions are positively impacting the North America travel risk management market growth

Sep 12th 2023

OnSolve® showcased its advancements in machine learning and AI to support organisations to make better-informed, faster, and smarter decisions for travelling employees.

Apr 11th 2023

AlertMedia announced its new offering, Travel Risk Management, to enable organisations to identify potential travel risks and reach travellers during emergencies.

Nov 16th 2021

Everbridge, Inc. introduced its advanced Travel Risk Management (TRM) solution to support businesses in efficiently locating and communicating with remote workers and travelling employees.

Surge in business travel

A surge in international and domestic business travel in the region is boosting the adoption of TRM solutions to protect employees and identify potential risks and threats.

Digitisation of travel risk management

The rising adoption of digitisation in travel risk management aids the North America travel risk management market.

Evolving regulatory landscape

Organisations are increasingly focused on regulatory compliance, including travel risk management practices that comply with standards such as ISO 31030, to enhance employee safety.

Expansion of travel risk management beyond travel

With growing numbers of hybrid workers, remote workers, and digital nomads, organisations are expanding the scope of travel risk management.

Integration of artificial intelligence in travel risk management

AI and automation tools are increasingly integrated into travel risk management to monitor real-time information from multiple sources and avoid unexpected costs.

Digitalisation has been gaining prominence in travel risk management practices in recent years to enhance communication and crisis assistance. This involves mobile applications and platforms that offer updates on flight changes, weather conditions, security assessments of the place, emergency contact, and critical alerts, among other services.

Growing capital investment by market players to enhance the emergency SOS service is another prominent trend assisting the North America travel risk management market expansion. For example, in February 2023, Focus Point International, a crisis management company in the region, secured USD 20 million from Dalton Capital to expand the capacity and capabilities of its satellite-enabled emergency SOS service.

Market Segmentation

“North America Travel Risk Management Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Service

- Travel Security

- Crisis Management

- Assistance and Tracking

- Data Security

- Health Security

Market Division by Enterprise Size

- Small Enterprise

- Medium Enterprise

- Large Enterprise

Market Classification by Industry Vertical

- Hospitality

- Business Services and Consulting

- IT and Technology

- Pharmaceutical and Healthcare

- Agriculture

- Food and Beverage

Market Breakup by Country

- United States of America

The demand for travel security services is increasing amid rising concerns regarding security of business travellers

Travel security service occupies a substantial portion of the North America travel risk management market share, owing to surging concerns regarding the security of business travellers. It involves the usage of technologies for real-time tracking of travellers, emergency response coordination, and efficient communication tools for emergency contact to enhance the overall security of travellers.

Additionally, travel security ensures that organisations are aware of their employees' location, during business travels to provide rapid response in case of any geopolitical emergency, health risk, or natural disaster, among others.

Moreover, there is a rising demand for comprehensive crisis management solutions that can minimise the adverse effects of a crisis and safeguard the well-being of business travellers. Businesses are also conducting thorough risk assessments and establishing crisis teams with optimised responsibilities to enhance the safety of their employees.

Large enterprises are increasingly adopting TRM solutions due to the high number of employees travelling globally and domestic

As per the North America travel risk management market analysis, large enterprises account for a significant market share, due to the high number of employees travelling globally and domestically. They also possess more extensive budgets and facilities compared to small and medium enterprises, which allows them to invest in high-end travel risk management systems.

Moreover, medium enterprises are expected to gain robust growth in the forecast period, due to their rapidly evolving presence in the business sphere, which boosts the demand for effective risk management policies regarding travel. Besides, small businesses are adopting travel risk management tools that can reduce the financial impacts of risks on travel budgets and provide immediate assistance for issues like travel changes or lost passports.

Competitive Landscape

Some of the major players in the market are adopting advanced tools and technologies such as AI to improve their travel risk management capabilities

Focus Point International, Inc.

Focus Point International, Inc., established in 2011, is a critical event management company, based in Ohio, the United States. Some of its major specialities include due diligence, global asset tracking, intelligence and advisory, and security consulting, among others.

Everbridge, Inc.

Everbridge, Inc., founded in 2002 and headquartered in California, the United States, is a provider of enterprise software for critical events. It offers a product suite of critical event management that harnesses the power of communications, collaboration, and risk intelligence, among others.

Global Rescue LLC

Global Rescue LLC is a crisis response company, incorporated in 2004 and headquartered in Lebanon, the United States. The company offers services such as business travel risk mitigation, travel services membership, and travel intelligence platform, among others.

OnSolve, LLC

OnSolve, LLC is a prominent event management company that was founded in 1998. Based in Georgia, the United States, the company’s platform enables organisations to mitigate physical threats and safeguard critical infrastructure.

Other North America travel risk management market players include BCD Travel Services B.V., AEA International Holdings, Pte. Ltd., Customized Services Administrators, Inc. (Generali Global Assistance & Insurance Services), CWT Global B.V., Corporate Travel Management Limited, and AG Global Strategies Limited, among others.

In the North America travel risk management market, the United States is witnessing significant growth. This can be attributed to booming business travel in the country, coupled with the increasing focus by organisations to identify and mitigate risks associated with business travel. The growing norm of work-from-anywhere is also prompting employers to adopt travel risk management strategies that can enhance the safety and security of employees working remotely.

Besides, the market in Canada is expected to grow in the coming years due to the introduction of various initiatives by governments and organisations to promote a safe working environment. Employers are also adopting innovative travel risk technologies that can provide customised health and security risks to employees and efficiently locate employees in case of emergencies.

Key Highlights of the Report

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface 2 Report Coverage – Key Segmentation and Scope 3 Report Description 3.1 Market Definition and Outlook 3.2 Properties and Applications 3.3 Market Analysis 3.4 Key Players 4 Key Assumptions 5 Executive Summary 5.1 Overview 5.2 Key Drivers 5.3 Key Developments 5.4 Competitive Structure 5.5 Key Industrial Trends 6 Market Snapshot 7 Opportunities and Challenges in the Market 8 Global Travel Risk Management Market Overview 8.1 Key Industry Highlights 8.2 Global Travel Risk Management Historical Market (2018-2023) 8.3 Global Travel Risk Management Market Forecast (2024-2032) 8.4 Global Travel Risk Management Market Share by Region 8.4.1 North America 8.4.2 Europe 8.4.3 Asia Pacific 8.4.4 Latin America 8.4.5 Middle East and Africa 9 North America Travel Risk Management Market Overview 9.1 Key Industry Highlights 9.2 North America Travel Risk Management Historical Market (2018-2023) 9.3 North America Travel Risk Management Market Forecast (2024-2032) 10 North America Travel Risk Management Market by Service 10.1 Travel Security 10.1.1 Historical Trend (2018-2023) 10.1.2 Forecast Trend (2024-2032) 10.2 Crisis Management 10.2.1 Historical Trend (2018-2023) 10.2.2 Forecast Trend (2024-2032) 10.3 Assistance and Tracking 10.3.1 Historical Trend (2018-2023) 10.3.2 Forecast Trend (2024-2032) 10.4 Data Security 10.4.1 Historical Trend (2018-2023) 10.4.2 Forecast Trend (2024-2032) 10.5 Health Security 10.5.1 Historical Trend (2018-2023) 10.5.2 Forecast Trend (2024-2032) 10.6 Others 11 North America Travel Risk Management Market by Enterprise Size 11.1 Small Enterprise 11.1.1 Historical Trend (2018-2023) 11.1.2 Forecast Trend (2024-2032) 11.2 Medium Enterprise 11.2.1 Historical Trend (2018-2023) 11.2.2 Forecast Trend (2024-2032) 11.3 Large Enterprise 11.3.1 Historical Trend (2018-2023) 11.3.2 Forecast Trend (2024-2032) 12 North America Travel Risk Management Market by Industry Vertical 12.1 Hospitality 12.1.1 Historical Trend (2018-2023) 12.1.2 Forecast Trend (2024-2032) 12.2 Business Services and Consulting 12.2.1 Historical Trend (2018-2023) 12.2.2 Forecast Trend (2024-2032) 12.3 IT and Technology 12.3.1 Historical Trend (2018-2023) 12.3.2 Forecast Trend (2024-2032) 12.4 Telecom 12.4.1 Historical Trend (2018-2023) 12.4.2 Forecast Trend (2024-2032) 12.5 Pharmaceutical and Healthcare 12.5.1 Historical Trend (2018-2023) 12.5.2 Forecast Trend (2024-2032) 12.6 Agriculture 12.6.1 Historical Trend (2018-2023) 12.6.2 Forecast Trend (2024-2032) 12.7 Food and Beverage 12.7.1 Historical Trend (2018-2023) 12.7.2 Forecast Trend (2024-2032) 12.8 Others 13 North America Travel Risk Management Market by Country 13.1 United States of America 13.1.1 Historical Trend (2018-2023) 13.1.2 Forecast Trend (2024-2032) 13.2 Canada 13.2.1 Historical Trend (2018-2023) 13.2.2 Forecast Trend (2024-2032) 14 Market Dynamics 14.1 SWOT Analysis 14.1.1 Strengths 14.1.2 Weaknesses 14.1.3 Opportunities 14.1.4 Threats 14.2 Porter’s Five Forces Analysis 14.2.1 Supplier’s Power 14.2.2 Buyer’s Power 14.2.3 Threat of New Entrants 14.2.4 Degree of Rivalry 14.2.5 Threat of Substitutes 14.3 Key Indicators for Demand 14.4 Key Indicators for Price 15 Competitive Landscape 15.1 Market Structure 15.2 Company Profiles 15.2.1 Focus Point International, Inc. 15.2.1.1 Company Overview 15.2.1.2 Product Portfolio 15.2.1.3 Demographic Reach and Achievements 15.2.1.4 Certifications 15.2.2 Everbridge, Inc. 15.2.2.1 Company Overview 15.2.2.2 Product Portfolio 15.2.2.3 Demographic Reach and Achievements 15.2.2.4 Certifications 15.2.3 Global Rescue LLC 15.2.3.1 Company Overview 15.2.3.2 Product Portfolio 15.2.3.3 Demographic Reach and Achievements 15.2.3.4 Certifications 15.2.4 BCD Travel Services B.V. 15.2.4.1 Company Overview 15.2.4.2 Product Portfolio 15.2.4.3 Demographic Reach and Achievements 15.2.4.4 Certifications 15.2.5 AEA International Holdings, Pte. Ltd. 15.2.5.1 Company Overview 15.2.5.2 Product Portfolio 15.2.5.3 Demographic Reach and Achievements 15.2.5.4 Certifications 15.2.6 Customized Services Administrators, Inc. (Generali Global Assistance & Insurance Services) 15.2.6.1 Company Overview 15.2.6.2 Product Portfolio 15.2.6.3 Demographic Reach and Achievements 15.2.6.4 Certifications 15.2.7 CWT Global B.V. 15.2.7.1 Company Overview 15.2.7.2 Product Portfolio 15.2.7.3 Demographic Reach and Achievements 15.2.7.4 Certifications 15.2.8 Corporate Travel Management Limited 15.2.8.1 Company Overview 15.2.8.2 Product Portfolio 15.2.8.3 Demographic Reach and Achievements 15.2.8.4 Certifications 15.2.9 AG Global Strategies Limited 15.2.9.1 Company Overview 15.2.9.2 Product Portfolio 15.2.9.3 Demographic Reach and Achievements 15.2.9.4 Certifications 15.2.10 OnSolve, LLC 15.2.10.1 Company Overview 15.2.10.2 Product Portfolio 15.2.10.3 Demographic Reach and Achievements 15.2.10.4 Certifications 15.2.11 Others 16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Travel Risk Management Market: Key Industry Highlights, 2018 and 2032 2. North America Travel Risk Management Market: Key Industry Highlights, 2018 and 2032 3. North America Travel Risk Management Historical Market: Breakup by Service (USD Billion), 2018-2023 4. North America Travel Risk Management Market Forecast: Breakup by Service (USD Billion), 2024-2032 5. North America Travel Risk Management Historical Market: Breakup by Enterprise Size (USD Billion), 2018-2023 6. North America Travel Risk Management Market Forecast: Breakup by Enterprise Size (USD Billion), 2024-2032 7. North America Travel Risk Management Historical Market: Breakup by Industry Vertical (USD Billion), 2018-2023 8. North America Travel Risk Management Market Forecast: Breakup by Industry Vertical (USD Billion), 2024-2032 9. North America Travel Risk Management Historical Market: Breakup by Country (USD Billion), 2018-2023 10. North America Travel Risk Management Market Forecast: Breakup by Country (USD Billion), 2024-2032 11. North America Travel Risk Management Market Structure

What was the North America travel risk management market value in 2023?

In 2023, the market reached an approximate value of USD 0.83 billion.

What is the growth rate of the North America travel risk management market?

The market is estimated to grow at a CAGR of 9.5% between 2024 and 2032.

What is the North America travel risk management market forecast for 2024-2032?

The market is estimated to witness a healthy growth during 2024-2032 to reach around USD 1.90 billion by 2032.

What are the key trends of the market?

The key trends aiding the market expansion include rising demand for travel risk management to prevent financial loss associated with travel disruption, growing popularity of digitalisation, increased focus on regulatory compliance by enterprises, and growing capital investment by market players to enhance the emergency SOS service.

Who are the key market players, according to the North America travel risk management market report?

The major players in the market are Focus Point International, Inc., Everbridge, Inc., Global Rescue LLC, BCD Travel Services B.V., AEA International Holdings, Pte. Ltd., Customized Services Administrators, Inc. (Generali Global Assistance & Insurance Services), CWT Global B.V., Corporate Travel Management Limited, AG Global Strategies Limited, and OnSolve, LLC, among others.

Purchase Options 10% off

Methodology

Request Customisation

Report Sample

Request Brochure

Ask an Analyst

( USA & Canada ) +1-415-325-5166 [email protected]

( United Kingdom ) +44-702-402-5790 [email protected]

Mini Report

- Selected Sections, One User

- Printing Not Allowed

- Email Delivery in PDF

- Free Limited Customisation

- Post Sales Analyst Support

- 50% Discount on Next Update

Single User License

- All Sections, One User

- One Print Allowed

Five User License

- All Sections, Five Users

- Five Prints Allowed

Corporate License

- All Sections, Unlimited Users

- Unlimited Prints Allowed

- Email Delivery in PDF + Excel

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.

Stay informed with our free industry updates.

We use cookies, just to track visits to our website, we store no personal details. Privacy Policy X

Press Release

Industry Statistics

Travel Risk Management Services Market 2019 2027

Travel risk management services market, by services (trip authorization, essential tracking and alerts, interactive communications, high risk tracking and response, advisory services); by end users (medium size enterprises, large enterprises); by region (u.s., canada, mexico, rest of north america, france, the uk, spain, germany, italy, nordic countries, benelux union, rest of europe, china, japan, india, new zealand, australia, south korea, southeast asia, rest of asia pacific, saudi arabia, uae, egypt, kuwait, south africa, rest of middle east & africa, brazil, argentina, rest of latin america) – global insights, growth, size, comparative analysis, trends and forecast, 2019 – 2027.

Industry Trends

The global travel risk management services market revenue stood at US$ 1,389.13 Million in 2018 and is expected to grow at a CAGR of over 9.1% during the forecast period of 2019 - 2027.

Travelers at all times are required to be educated on their destinations prior to departure. Information on health and safety issues, cultural etiquette, vaccination, climate conditions and prominent approach to avoid risks are essential to be shared with all travelers. Organizations require these travel risk management services for protecting their employees against any emergency crisis. The travel risk management services market participants, proficiently manage the travel-related requirements of individuals, corporate travelers, and group travelers. These companies offer cost-effective travel solution including travel guides to keep control on policies and save customer’s time from travel arrangements. In recent years, business travel has been enhanced by adding leisure services to it, which is leading to increased demand for travel risk management services. These services offer respite and hassle free trip experience to customers throughout their journey. Lack of awareness amongst travelers about the company policies and procedures regarding maximum coverage of travel expenses has often led to rejection of reimbursement claims raised by the employees. However, to tackle this challenge, companies are now adopting risk management solutions to integrate travel risk management into the broader travel program. Thus, transformation of company policies and leisure service offerings have influenced the growth of global travel risk management services market.

Travel risk management services market players are focusing on providing services such as trip authorization, essential tracking and alerts, interactive communications, high risk tracking, response and advisory services. These services play a vital role in customer retention and thus encouraging businesses to adopt travel risk management services. The trip authorization segment was valued at US$ 377.30 Mn in 2018 making it the highest shareholder in the services segment. This is owing to the increased number of trips by employees due to the diversification of business environment. For instance, Danske Bank, a financial enterprise based in Northern Europe implemented GBT Travel Services UK Limited’s consolidated online travel program which allows the bank to track and audit the booking of each employee and thereby maintain proper financial and travel records. This helps the bank to track fraudulent bookings and in regulatory compliance.

Travel risk management companies caters services to large and medium size enterprises in which large enterprises held the major share in 2018 and is estimated to grows at a CAGR of 8.7% over the forecast period. Corporate travel management program supports employees in organizing trips which includes security measures, data protection, guidelines for better hotels and airlines, timeframe for bookings and covers different aspects of the travel process. Owing to the benefits offered by travel management programs, companies are increasingly adopting travel management programs containing travel risk management. For instance, Mahindra and Mahindra collaborated with the International SOS to extend support to its expatriates and travelers on the needs of business travel, medical and security issues. Travel risk management service provider companies cover crisis management, medical support, security assistance, and other emergencies. In terms of regional bifurcation, travel risk management services market is growing rapidly in North America, which held a major share of 36.5% in 2018. Adoption of customer interface software amongst U.S. consumers along with an established travel industry in the U.S., is contributing for the highest share in the North America region.

In terms of revenue, the global travel risk management services market was valued at US$ 1,389.13 Mn in 2018 and is growing at a CAGR of 9.1% over the forecast period. The study analyzes the market in terms of revenue across all the major regions, which is further bifurcated into countries.

Travel Risk Management Services Market Revenue & Forecasts (US$ Million),

2015 - 2027

Competitive Landscape

The report provides both, qualitative and quantitative research of travel risk management services market, as well as provides worthy insights into the rational scenario and favored development methods adopted by key contenders. The report also offers extensive research on the key players in travel risk management services market and detailed insights on the competitiveness of these players. Key business strategies such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts adopted by the major players are also recognized and analyzed in the report. For each company, the report recognizes their headquarters, competitors, product/service type, application and specification.

Some of the players operating in global travel risk management services market are BCD Travel, Collinson Group Ltd, Control Risks, Drum Cassac, FocusPoint International, Inc., GBT Travel Services UK Limited, Healix, Carlson Wagonlit Travel Inc., iJET International, Inc., Kroll Inc, Millbank Solutions, NC4, Anvil Group, and Ovation Travel Group amongst others.

Global Travel Risk Management Services Market

- Trip Authorization

- Essential Tracking and Alerts

- Interactive Communications

- High Risk Tracking and Response

- Advisory Services

- Medium size enterprises

- Large Enterprises

- Rest of North America

- The Netherlands

- Rest of Europe

- New Zealand

- South Korea

- Rest of Southeast Asia

- Rest of Asia Pacific

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- Rest of Latin America

Table of Contents

1. Market Scope

1.1. Market Segmentation

1.2. Years Considered

1.2.1. Historic Years: 2013 - 2017

1.2.2. Base Year: 2018

1.2.3. Forecast Years: 2019 – 2027

2. Key Target Audiences

3. Research Methodology

3.1. Primary Research

3.1.1. Research Questionnaire

3.1.2. Global Percentage Breakdown

3.1.3. Primary Interviews: Key Opinion Leaders (KOLs)

3.2. Secondary Research

3.2.1. Paid Databases

3.2.2. Secondary Sources

3.3. Market Size Estimates

3.3.1. Top-Down Approach

3.3.2. Bottom-Up Approach

3.4. Data Triangulation Methodology

3.5. Research Assumptions

4. Recommendations and Insights from AMI’s Perspective**

5. Holistic Overview of Travel Risk Management Services Market

6. Market Synopsis: Travel Risk Management Services Market

7. Travel Risk Management Services Market Analysis: Qualitative Perspective

7.1. Introduction

7.1.1. Product Definition

7.1.2. Industry Development

7.2. Market Dynamics

7.2.1. Drivers

7.2.2. Restraints

7.2.3. Opportunities

7.3. Trends in Travel Risk Management Services Market

7.4. Market Determinants Radar Chart

7.5. Macro-Economic and Micro-Economic Indicators: Travel Risk Management Services Market

7.6. Porter’s Five Force Analysis

8. Global Travel Risk Management Services Market Analysis and Forecasts, 2019 – 2027

8.1. Overview

8.1.1. Global Travel Risk Management Services Market Revenue (US$ Mn)

8.2. Global Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

8.2.1. Trip Authorization

8.2.1.1. Definition

8.2.1.2. Market Estimation and Penetration, 2013 – 2018

8.2.1.3. Market Forecast, 2019 – 2027

8.2.1.4. Compound Annual Growth Rate (CAGR)

8.2.1.5. Regional Bifurcation

8.2.1.5.1. North America

8.2.1.5.1.1. Market Estimation, 2013 – 2018

8.2.1.5.1.2. Market Forecast, 2019 – 2027

8.2.1.5.2. Europe

8.2.1.5.2.1. Market Estimation, 2013 – 2018

8.2.1.5.2.2. Market Forecast, 2019 – 2027

8.2.1.5.3. Asia Pacific

8.2.1.5.3.1. Market Estimation, 2013 – 2018

8.2.1.5.3.2. Market Forecast, 2019 – 2027

8.2.1.5.4. Middle East and Africa

8.2.1.5.4.1. Market Estimation, 2013 – 2018

8.2.1.5.4.2. Market Forecast, 2019 – 2027

8.2.1.5.5. Latin America

8.2.1.5.5.1. Market Estimation, 2013 – 2018

8.2.1.5.5.2. Market Forecast, 2019 – 2027

8.2.2. Essential Tracking and Alerts

8.2.2.1. Definition

8.2.2.2. Market Estimation and Penetration, 2013 – 2018

8.2.2.3. Market Forecast, 2019 – 2027

8.2.2.4. Compound Annual Growth Rate (CAGR)

8.2.2.5. Regional Bifurcation

8.2.2.5.1. North America

8.2.2.5.1.1. Market Estimation, 2013 – 2018

8.2.2.5.1.2. Market Forecast, 2019 – 2027

8.2.2.5.2. Europe

8.2.2.5.2.1. Market Estimation, 2013 – 2018

8.2.2.5.2.2. Market Forecast, 2019 – 2027

8.2.2.5.3. Asia Pacific

8.2.2.5.3.1. Market Estimation, 2013 – 2018

8.2.2.5.3.2. Market Forecast, 2019 – 2027

8.2.2.5.4. Middle East and Africa

8.2.2.5.4.1. Market Estimation, 2013 – 2018

8.2.2.5.4.2. Market Forecast, 2019 – 2027

8.2.2.5.5. Latin America

8.2.2.5.5.1. Market Estimation, 2013 – 2018

8.2.2.5.5.2. Market Forecast, 2019 – 2027

8.2.3. Interactive Communications

8.2.3.1. Definition

8.2.3.2. Market Estimation and Penetration, 2013 – 2018

8.2.3.3. Market Forecast, 2019 – 2027

8.2.3.4. Compound Annual Growth Rate (CAGR)

8.2.3.5. Regional Bifurcation

8.2.3.5.1. North America

8.2.3.5.1.1. Market Estimation, 2013 – 2018

8.2.3.5.1.2. Market Forecast, 2019 – 2027

8.2.3.5.2. Europe

8.2.3.5.2.1. Market Estimation, 2013 – 2018

8.2.3.5.2.2. Market Forecast, 2019 – 2027

8.2.3.5.3. Asia Pacific

8.2.3.5.3.1. Market Estimation, 2013 – 2018

8.2.3.5.3.2. Market Forecast, 2019 – 2027

8.2.3.5.4. Middle East and Africa

8.2.3.5.4.1. Market Estimation, 2013 – 2018

8.2.3.5.4.2. Market Forecast, 2019 – 2027

8.2.3.5.5. Latin America

8.2.3.5.5.1. Market Estimation, 2013 – 2018

8.2.3.5.5.2. Market Forecast, 2019 – 2027

8.2.4. High Risk Tracking and Response

8.2.4.1. Definition

8.2.4.2. Market Estimation and Penetration, 2013 – 2018

8.2.4.3. Market Forecast, 2019 – 2027

8.2.4.4. Compound Annual Growth Rate (CAGR)

8.2.4.5. Regional Bifurcation

8.2.4.5.1. North America

8.2.4.5.1.1. Market Estimation, 2013 – 2018

8.2.4.5.1.2. Market Forecast, 2019 – 2027

8.2.4.5.2. Europe

8.2.4.5.2.1. Market Estimation, 2013 – 2018

8.2.4.5.2.2. Market Forecast, 2019 – 2027

8.2.4.5.3. Asia Pacific

8.2.4.5.3.1. Market Estimation, 2013 – 2018

8.2.4.5.3.2. Market Forecast, 2019 – 2027

8.2.4.5.4. Middle East and Africa

8.2.4.5.4.1. Market Estimation, 2013 – 2018

8.2.4.5.4.2. Market Forecast, 2019 – 2027

8.2.4.5.5. Latin America

8.2.4.5.5.1. Market Estimation, 2013 – 2018

8.2.4.5.5.2. Market Forecast, 2019 – 2027

8.2.5. Advisory Services

8.2.5.1. Definition

8.2.5.2. Market Estimation and Penetration, 2013 – 2018

8.2.5.3. Market Forecast, 2019 – 2027

8.2.5.4. Compound Annual Growth Rate (CAGR)

8.2.5.5. Regional Bifurcation

8.2.5.5.1. North America

8.2.5.5.1.1. Market Estimation, 2013 – 2018

8.2.5.5.1.2. Market Forecast, 2019 – 2027

8.2.5.5.2. Europe

8.2.5.5.2.1. Market Estimation, 2013 – 2018

8.2.5.5.2.2. Market Forecast, 2019 – 2027

8.2.5.5.3. Asia Pacific

8.2.5.5.3.1. Market Estimation, 2013 – 2018

8.2.5.5.3.2. Market Forecast, 2019 – 2027

8.2.5.5.4. Middle East and Africa

8.2.5.5.4.1. Market Estimation, 2013 – 2018

8.2.5.5.4.2. Market Forecast, 2019 – 2027

8.2.5.5.5. Latin America

8.2.5.5.5.1. Market Estimation, 2013 – 2018

8.2.5.5.5.2. Market Forecast, 2019 – 2027

8.3. Key Segment for Channeling Investments

8.3.1. By Services

9. Global Travel Risk Management Services Market Analysis and Forecasts, 2019 – 2027

9.1. Overview

9.2. Global Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

9.2.1. Medium size enterprises

9.2.1.1. Definition

9.2.1.2. Market Estimation and Penetration, 2013 – 2018

9.2.1.3. Market Forecast, 2019 – 2027

9.2.1.4. Compound Annual Growth Rate (CAGR)

9.2.1.5. Regional Bifurcation

9.2.1.5.1. North America

9.2.1.5.1.1. Market Estimation, 2013 – 2018

9.2.1.5.1.2. Market Forecast, 2019 – 2027

9.2.1.5.2. Europe

9.2.1.5.2.1. Market Estimation, 2013 – 2018

9.2.1.5.2.2. Market Forecast, 2019 – 2027

9.2.1.5.3. Asia Pacific

9.2.1.5.3.1. Market Estimation, 2013 – 2018

9.2.1.5.3.2. Market Forecast, 2019 – 2027

9.2.1.5.4. Middle East and Africa

9.2.1.5.4.1. Market Estimation, 2013 – 2018

9.2.1.5.4.2. Market Forecast, 2019 – 2027

9.2.1.5.5. Latin America

9.2.1.5.5.1. Market Estimation, 2013 – 2018

9.2.1.5.5.2. Market Forecast, 2019 – 2027

9.2.2. Large Enterprises

9.2.2.1. Definition

9.2.2.2. Market Estimation and Penetration, 2013 – 2018

9.2.2.3. Market Forecast, 2019 – 2027

9.2.2.4. Compound Annual Growth Rate (CAGR)

9.2.2.5. Regional Bifurcation

9.2.2.5.1. North America

9.2.2.5.1.1. Market Estimation, 2013 – 2018

9.2.2.5.1.2. Market Forecast, 2019 – 2027

9.2.2.5.2. Europe

9.2.2.5.2.1. Market Estimation, 2013 – 2018

9.2.2.5.2.2. Market Forecast, 2019 – 2027

9.2.2.5.3. Asia Pacific

9.2.2.5.3.1. Market Estimation, 2013 – 2018

9.2.2.5.3.2. Market Forecast, 2019 – 2027

9.2.2.5.4. Middle East and Africa

9.2.2.5.4.1. Market Estimation, 2013 – 2018

9.2.2.5.4.2. Market Forecast, 2019 – 2027

9.2.2.5.5. Latin America

9.2.2.5.5.1. Market Estimation, 2013 – 2018

9.2.2.5.5.2. Market Forecast, 2019 – 2027

9.3. Key Segment for Channeling Investments

9.3.1. By End User

10. North America Travel Risk Management Services Market Analysis and Forecasts, 2019 - 2027

10.1. Overview

10.1.1. North America Travel Risk Management Services Market Revenue (US$ Mn)

10.2. North America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

10.2.1. Trip Authorization

10.2.2. Essential Tracking and Alerts

10.2.3. Interactive Communications

10.2.4. High Risk Tracking and Response

10.2.5. Advisory Services

10.3. North America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

10.3.1. Medium size enterprises

10.3.2. Large Enterprises

10.4. North America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

10.4.1. U.S

10.4.1.1. U.S Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

10.4.1.1.1. Trip Authorization

10.4.1.1.2. Essential Tracking and Alerts

10.4.1.1.3. Interactive Communications

10.4.1.1.4. High Risk Tracking and Response

10.4.1.1.5. Advisory Services

10.4.1.2. U.S Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

10.4.1.2.1. Medium size enterprises

10.4.1.2.2. Large Enterprises

10.4.2. Canada

10.4.2.1. Canada Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

10.4.2.1.1. Trip Authorization

10.4.2.1.2. Essential Tracking and Alerts

10.4.2.1.3. Interactive Communications

10.4.2.1.4. High Risk Tracking and Response

10.4.2.1.5. Advisory Services

10.4.2.2. Canada Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

10.4.2.2.1. Medium size enterprises

10.4.2.2.2. Large Enterprises

10.4.3. Mexico

10.4.3.1. Mexico Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

10.4.3.1.1. Trip Authorization

10.4.3.1.2. Essential Tracking and Alerts

10.4.3.1.3. Interactive Communications

10.4.3.1.4. High Risk Tracking and Response

10.4.3.1.5. Advisory Services

10.4.3.2. Mexico Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

10.4.3.2.1. Medium size enterprises

10.4.3.2.2. Large Enterprises

10.4.4. Rest of North America

10.4.4.1. Rest of North America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

10.4.4.1.1. Trip Authorization

10.4.4.1.2. Essential Tracking and Alerts

10.4.4.1.3. Interactive Communications

10.4.4.1.4. High Risk Tracking and Response

10.4.4.1.5. Advisory Services

10.4.4.2. Rest of North America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

10.4.4.2.1. Medium size enterprises

10.4.4.2.2. Large Enterprises

10.5. Key Segment for Channeling Investments

10.5.1. By Country

10.5.2. By Services

10.5.3. By End User

11. Europe Travel Risk Management Services Market Analysis and Forecasts, 2019 - 2027

11.1. Overview

11.1.1. Europe Travel Risk Management Services Market Revenue (US$ Mn)

11.2. Europe Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.2.1. Trip Authorization

11.2.2. Essential Tracking and Alerts

11.2.3. Interactive Communications

11.2.4. High Risk Tracking and Response

11.2.5. Advisory Services

11.3. Europe Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.3.1. Medium size enterprises

11.3.2. Large Enterprises

11.4. Europe Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

11.4.1. France

11.4.1.1. France Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.1.1.1. Trip Authorization

11.4.1.1.2. Essential Tracking and Alerts

11.4.1.1.3. Interactive Communications

11.4.1.1.4. High Risk Tracking and Response

11.4.1.1.5. Advisory Services

11.4.1.2. France Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.1.2.1. Medium size enterprises

11.4.1.2.2. Large Enterprises

11.4.2. The UK

11.4.2.1. The UK Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.2.1.1. Trip Authorization

11.4.2.1.2. Essential Tracking and Alerts

11.4.2.1.3. Interactive Communications

11.4.2.1.4. High Risk Tracking and Response

11.4.2.1.5. Advisory Services

11.4.2.2. The UK Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.2.2.1. Medium size enterprises

11.4.2.2.2. Large Enterprises

11.4.3. Spain

11.4.3.1. Spain Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.3.1.1. Trip Authorization

11.4.3.1.2. Essential Tracking and Alerts

11.4.3.1.3. Interactive Communications

11.4.3.1.4. High Risk Tracking and Response

11.4.3.1.5. Advisory Services

11.4.3.2. Spain Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.3.2.1. Medium size enterprises

11.4.3.2.2. Large Enterprises

11.4.4. Germany

11.4.4.1. Germany Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.4.1.1. Trip Authorization

11.4.4.1.2. Essential Tracking and Alerts

11.4.4.1.3. Interactive Communications

11.4.4.1.4. High Risk Tracking and Response

11.4.4.1.5. Advisory Services

11.4.4.2. Germany Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.4.2.1. Medium size enterprises

11.4.4.2.2. Large Enterprises

11.4.5. Italy

11.4.5.1. Italy Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.5.1.1. Trip Authorization

11.4.5.1.2. Essential Tracking and Alerts

11.4.5.1.3. Interactive Communications

11.4.5.1.4. High Risk Tracking and Response

11.4.5.1.5. Advisory Services

11.4.5.2. Italy Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.5.2.1. Medium size enterprises

11.4.5.2.2. Large Enterprises

11.4.6. Nordic Countries

11.4.6.1. Nordic Countries Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.6.1.1. Trip Authorization

11.4.6.1.2. Essential Tracking and Alerts

11.4.6.1.3. Interactive Communications

11.4.6.1.4. High Risk Tracking and Response

11.4.6.1.5. Advisory Services

11.4.6.2. Nordic Countries Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.6.2.1. Medium size enterprises

11.4.6.2.2. Large Enterprises

11.4.6.3. Nordic Countries Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

11.4.6.3.1. Denmark

11.4.6.3.2. Finland

11.4.6.3.3. Iceland

11.4.6.3.4. Sweden

11.4.6.3.5. Norway

11.4.7. Benelux Union

11.4.7.1. Benelux Union Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.7.1.1. Trip Authorization

11.4.7.1.2. Essential Tracking and Alerts

11.4.7.1.3. Interactive Communications

11.4.7.1.4. High Risk Tracking and Response

11.4.7.1.5. Advisory Services

11.4.7.2. Benelux Union Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.7.2.1. Medium size enterprises

11.4.7.2.2. Large Enterprises

11.4.7.3. Benelux Union Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

11.4.7.3.1. Belgium

11.4.7.3.2. The Netherlands

11.4.7.3.3. Luxembourg

11.4.8. Rest of Europe

11.4.8.1. Rest of Europe Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

11.4.8.1.1. Trip Authorization

11.4.8.1.2. Essential Tracking and Alerts

11.4.8.1.3. Interactive Communications

11.4.8.1.4. High Risk Tracking and Response

11.4.8.1.5. Advisory Services

11.4.8.2. Rest of Europe Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

11.4.8.2.1. Medium size enterprises

11.4.8.2.2. Large Enterprises

11.5. Key Segment for Channeling Investments

11.5.1. By Country

11.5.2. By Services

11.5.3. By End User

12. Asia Pacific Travel Risk Management Services Market Analysis and Forecasts, 2019 - 2027

12.1. Overview

12.1.1. Asia Pacific Travel Risk Management Services Market Revenue (US$ Mn)

12.2. Asia Pacific Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.2.1. Trip Authorization

12.2.2. Essential Tracking and Alerts

12.2.3. Interactive Communications

12.2.4. High Risk Tracking and Response

12.2.5. Advisory Services

12.3. Asia Pacific Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.3.1. Medium size enterprises

12.3.2. Large Enterprises

12.4. Asia Pacific Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

12.4.1. China

12.4.1.1. China Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.1.1.1. Trip Authorization

12.4.1.1.2. Essential Tracking and Alerts

12.4.1.1.3. Interactive Communications

12.4.1.1.4. High Risk Tracking and Response

12.4.1.1.5. Advisory Services

12.4.1.2. China Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.1.2.1. Medium size enterprises

12.4.1.2.2. Large Enterprises

12.4.2. Japan

12.4.2.1. Japan Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.2.1.1. Trip Authorization

12.4.2.1.2. Essential Tracking and Alerts

12.4.2.1.3. Interactive Communications

12.4.2.1.4. High Risk Tracking and Response

12.4.2.1.5. Advisory Services

12.4.2.2. Japan Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.2.2.1. Medium size enterprises

12.4.2.2.2. Large Enterprises

12.4.3. India

12.4.3.1. India Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.3.1.1. Trip Authorization

12.4.3.1.2. Essential Tracking and Alerts

12.4.3.1.3. Interactive Communications

12.4.3.1.4. High Risk Tracking and Response

12.4.3.1.5. Advisory Services

12.4.3.2. India Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.3.2.1. Medium size enterprises

12.4.3.2.2. Large Enterprises

12.4.4. New Zealand

12.4.4.1. New Zealand Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.4.1.1. Trip Authorization

12.4.4.1.2. Essential Tracking and Alerts

12.4.4.1.3. Interactive Communications

12.4.4.1.4. High Risk Tracking and Response

12.4.4.1.5. Advisory Services

12.4.4.2. New Zealand Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.4.2.1. Medium size enterprises

12.4.4.2.2. Large Enterprises

12.4.5. Australia

12.4.5.1. Australia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.5.1.1. Trip Authorization

12.4.5.1.2. Essential Tracking and Alerts

12.4.5.1.3. Interactive Communications

12.4.5.1.4. High Risk Tracking and Response

12.4.5.1.5. Advisory Services

12.4.5.2. Australia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.5.2.1. Medium size enterprises

12.4.5.2.2. Large Enterprises

12.4.6. South Korea

12.4.6.1. South Korea Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.6.1.1. Trip Authorization

12.4.6.1.2. Essential Tracking and Alerts

12.4.6.1.3. Interactive Communications

12.4.6.1.4. High Risk Tracking and Response

12.4.6.1.5. Advisory Services

12.4.6.2. South Korea Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.6.2.1. Medium size enterprises

12.4.6.2.2. Large Enterprises

12.4.7. Southeast Asia

12.4.7.1. Southeast Asia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.7.1.1. Trip Authorization

12.4.7.1.2. Essential Tracking and Alerts

12.4.7.1.3. Interactive Communications

12.4.7.1.4. High Risk Tracking and Response

12.4.7.1.5. Advisory Services

12.4.7.2. Southeast Asia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.7.2.1. Medium size enterprises

12.4.7.2.2. Large Enterprises

12.4.7.3. Southeast Asia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

12.4.7.3.1. Indonesia

12.4.7.3.2. Thailand

12.4.7.3.3. Malaysia

12.4.7.3.4. Singapore

12.4.7.3.5. Rest of Southeast Asia

12.4.8. Rest of Asia Pacific

12.4.8.1. Rest of Asia Pacific Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

12.4.8.1.1. Trip Authorization

12.4.8.1.2. Essential Tracking and Alerts

12.4.8.1.3. Interactive Communications

12.4.8.1.4. High Risk Tracking and Response

12.4.8.1.5. Advisory Services

12.4.8.2. Rest of Asia Pacific Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

12.4.8.2.1. Medium size enterprises

12.4.8.2.2. Large Enterprises

12.5. Key Segment for Channeling Investments

12.5.1. By Country

12.5.2. By Services

12.5.3. By End User

13. Middle East and Africa Travel Risk Management Services Market Analysis and Forecasts, 2019 - 2027

13.1. Overview

13.1.1. Middle East and Africa Travel Risk Management Services Market Revenue (US$ Mn)

13.2. Middle East and Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.2.1. Trip Authorization

13.2.2. Essential Tracking and Alerts

13.2.3. Interactive Communications

13.2.4. High Risk Tracking and Response

13.2.5. Advisory Services

13.3. Middle East and Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.3.1. Medium size enterprises

13.3.2. Large Enterprises

13.4. Middle East and Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

13.4.1. Saudi Arabia

13.4.1.1. Saudi Arabia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.4.1.1.1. Trip Authorization

13.4.1.1.2. Essential Tracking and Alerts

13.4.1.1.3. Interactive Communications

13.4.1.1.4. High Risk Tracking and Response

13.4.1.1.5. Advisory Services

13.4.1.2. Saudi Arabia Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.4.1.2.1. Medium size enterprises

13.4.1.2.2. Large Enterprises

13.4.2. UAE

13.4.2.1. UAE Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.4.2.1.1. Trip Authorization

13.4.2.1.2. Essential Tracking and Alerts

13.4.2.1.3. Interactive Communications

13.4.2.1.4. High Risk Tracking and Response

13.4.2.1.5. Advisory Services

13.4.2.2. UAE Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.4.2.2.1. Medium size enterprises

13.4.2.2.2. Large Enterprises

13.4.3. Egypt

13.4.3.1. Egypt Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.4.3.1.1. Trip Authorization

13.4.3.1.2. Essential Tracking and Alerts

13.4.3.1.3. Interactive Communications

13.4.3.1.4. High Risk Tracking and Response

13.4.3.1.5. Advisory Services

13.4.3.2. Egypt Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.4.3.2.1. Medium size enterprises

13.4.3.2.2. Large Enterprises

13.4.4. Kuwait

13.4.4.1. Kuwait Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.4.4.1.1. Trip Authorization

13.4.4.1.2. Essential Tracking and Alerts

13.4.4.1.3. Interactive Communications

13.4.4.1.4. High Risk Tracking and Response

13.4.4.1.5. Advisory Services

13.4.4.2. Kuwait Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.4.4.2.1. Medium size enterprises

13.4.4.2.2. Large Enterprises

13.4.5. South Africa

13.4.5.1. South Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.4.5.1.1. Trip Authorization

13.4.5.1.2. Essential Tracking and Alerts

13.4.5.1.3. Interactive Communications

13.4.5.1.4. High Risk Tracking and Response

13.4.5.1.5. Advisory Services

13.4.5.2. South Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.4.5.2.1. Medium size enterprises

13.4.5.2.2. Large Enterprises

13.4.6. Rest of Middle East & Africa

13.4.6.1. Rest of Middle East & Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

13.4.6.1.1. Trip Authorization

13.4.6.1.2. Essential Tracking and Alerts

13.4.6.1.3. Interactive Communications

13.4.6.1.4. High Risk Tracking and Response

13.4.6.1.5. Advisory Services

13.4.6.2. Rest of Middle East & Africa Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

13.4.6.2.1. Medium size enterprises

13.4.6.2.2. Large Enterprises

13.5. Key Segment for Channeling Investments

13.5.1. By Country

13.5.2. By Services

13.5.3. By End User

14. Latin America Travel Risk Management Services Market Analysis and Forecasts, 2019 - 2027

14.1. Overview

14.1.1. Latin America Travel Risk Management Services Market Revenue (US$ Mn)

14.2. Latin America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

14.2.1. Trip Authorization

14.2.2. Essential Tracking and Alerts

14.2.3. Interactive Communications

14.2.4. High Risk Tracking and Response

14.2.5. Advisory Services

14.3. Latin America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

14.3.1. Medium size enterprises

14.3.2. Large Enterprises

14.4. Latin America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Country

14.4.1. Brazil

14.4.1.1. Brazil Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

14.4.1.1.1. Trip Authorization

14.4.1.1.2. Essential Tracking and Alerts

14.4.1.1.3. Interactive Communications

14.4.1.1.4. High Risk Tracking and Response

14.4.1.1.5. Advisory Services

14.4.1.2. Brazil Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

14.4.1.2.1. Medium size enterprises

14.4.1.2.2. Large Enterprises

14.4.2. Argentina

14.4.2.1. Argentina Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

14.4.2.1.1. Trip Authorization

14.4.2.1.2. Essential Tracking and Alerts

14.4.2.1.3. Interactive Communications

14.4.2.1.4. High Risk Tracking and Response

14.4.2.1.5. Advisory Services

14.4.2.2. Argentina Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

14.4.2.2.1. Medium size enterprises

14.4.2.2.2. Large Enterprises

14.4.3. Rest of Latin America

14.4.3.1. Rest of Latin America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By Services

14.4.3.1.1. Trip Authorization

14.4.3.1.2. Essential Tracking and Alerts

14.4.3.1.3. Interactive Communications

14.4.3.1.4. High Risk Tracking and Response

14.4.3.1.5. Advisory Services

14.4.3.2. Rest of Latin America Travel Risk Management Services Market Revenue (US$ Mn) and Forecasts, By End User

14.4.3.2.1. Medium size enterprises

14.4.3.2.2. Large Enterprises

14.5. Key Segment for Channeling Investments

14.5.1. By Country

14.5.2. By Services

14.5.3. By End User

15. Competitive Benchmarking

15.1. Market Share Analysis, 2018

15.2. Global Presence and Growth Strategies

15.2.1. Mergers and Acquisitions

15.2.2. Product Launches

15.2.3. Investments Trends

15.2.4. R&D Initiatives

16. Player Profiles

16.1. Anvil Group

16.1.1. Company Details

16.1.2. Company Overview

16.1.3. Product Offerings

16.1.4. Key Developments

16.1.5. Financial Analysis

16.1.6. SWOT Analysis

16.1.7. Business Strategies

16.2. BCD Travel

16.2.1. Company Details

16.2.2. Company Overview

16.2.3. Product Offerings

16.2.4. Key Developments

16.2.5. Financial Analysis

16.2.6. SWOT Analysis

16.2.7. Business Strategies

16.3. Carlson Wagonlit Travel, Inc.

16.3.1. Company Details

16.3.2. Company Overview

16.3.3. Product Offerings

16.3.4. Key Developments

16.3.5. Financial Analysis

16.3.6. SWOT Analysis

16.3.7. Business Strategies

16.4. Collinson Group Ltd.

16.4.1. Company Details

16.4.2. Company Overview

16.4.3. Product Offerings

16.4.4. Key Developments

16.4.5. Financial Analysis

16.4.6. SWOT Analysis

16.4.7. Business Strategies

16.5. Control Risks

16.5.1. Company Details

16.5.2. Company Overview

16.5.3. Product Offerings

16.5.4. Key Developments

16.5.5. Financial Analysis

16.5.6. SWOT Analysis

16.5.7. Business Strategies

16.6. Drum Cassac

16.6.1. Company Details

16.6.2. Company Overview

16.6.3. Product Offerings

16.6.4. Key Developments

16.6.5. Financial Analysis

16.6.6. SWOT Analysis

16.6.7. Business Strategies

16.7. FocusPoint International, Inc.

16.7.1. Company Details

16.7.2. Company Overview

16.7.3. Product Offerings

16.7.4. Key Developments

16.7.5. Financial Analysis

16.7.6. SWOT Analysis

16.7.7. Business Strategies

16.8. GBT Travel Services UK Limited

16.8.1. Company Details

16.8.2. Company Overview

16.8.3. Product Offerings

16.8.4. Key Developments

16.8.5. Financial Analysis

16.8.6. SWOT Analysis

16.8.7. Business Strategies

16.9. Healix

16.9.1. Company Details

16.9.2. Company Overview

16.9.3. Product Offerings

16.9.4. Key Developments

16.9.5. Financial Analysis

16.9.6. SWOT Analysis

16.9.7. Business Strategies

16.10. iJET International, Inc

16.10.1. Company Details

16.10.2. Company Overview

16.10.3. Product Offerings

16.10.4. Key Developments

16.10.5. Financial Analysis

16.10.6. SWOT Analysis

16.10.7. Business Strategies

16.11. Kroll Inc.

16.11.1. Company Details

16.11.2. Company Overview

16.11.3. Product Offerings

16.11.4. Key Developments

16.11.5. Financial Analysis

16.11.6. SWOT Analysis

16.11.7. Business Strategies

16.12. Millbank Solutions

16.12.1. Company Details

16.12.2. Company Overview

16.12.3. Product Offerings

16.12.4. Key Developments

16.12.5. Financial Analysis

16.12.6. SWOT Analysis

16.12.7. Business Strategies

16.13.1. Company Details

16.13.2. Company Overview

16.13.3. Product Offerings

16.13.4. Key Developments

16.13.5. Financial Analysis

16.13.6. SWOT Analysis

16.13.7. Business Strategies

16.14. Ovation Travel Group

16.14.1. Company Details

16.14.2. Company Overview

16.14.3. Product Offerings

16.14.4. Key Developments

16.14.5. Financial Analysis

16.14.6. SWOT Analysis

16.14.7. Business Strategies

16.15. Other Market Participants

17. Key Findings

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

At Absolute Markets Insights, we are engaged in building both global as well as country specific reports. As a result, the approach taken for deriving the estimation and forecast for a specific country is a bit unique and different in comparison to the global research studies. In this case, we not only study the concerned market factors & trends prevailing in a particular country (from secondary research) but we also tend to calculate the actual market size & forecast from the revenue generated from the market participants involved in manufacturing or distributing the any concerned product. These companies can also be service providers. For analyzing any country specifically, we do consider the growth factors prevailing under the states/cities/county for the same. For instance, if we are analyzing an industry specific to United States, we primarily need to study about the states present under the same(where the product/service has the highest growth). Similar analysis will be followed by other countries. Our scope of the report changes with different markets.

Our research study is mainly implement through a mix of both secondary and primary research. Various sources such as industry magazines, trade journals, and government websites and trade associations are reviewed for gathering precise data. Primary interviews are conducted to validate the market size derived from secondary research. Industry experts, major manufacturers and distributors are contacted for further validation purpose on the current market penetration and growth trends.

Prominent participants in our primary research process include:

- Key Opinion Leaders namely the CEOs, CSOs, VPs, purchasing managers, amongst others

- Research and development participants, distributors/suppliers and subject matter experts

Secondary Research includes data extracted from paid data sources:

Research Methodology

Key Inclusions

Request A Sample

Ask for Discount

Enquiry Before Buying

Request For Customization

Purchase Options

Reach to us.

+91-74002-42424

Drop us an email at

Why Absolute Markets Insights?

An effective strategy is the entity that influences a business to stand out of the crowd. An organization with a phenomenal strategy for success dependably has the edge over the rivals in the market. It offers the organizations a head start in planning their strategy. Absolute Market Insights is the new initiation in the industry that will furnish you with the lead your business needs. Absolute Market Insights is the best destination for your business intelligence and analytical solutions; essentially because our qualitative and quantitative sources of information are competent to give one-stop solutions. We inventively combine qualitative and quantitative research in accurate proportions to have the best report, which not only gives the most recent insights but also assists you to grow.

Modal Header

Some text in the modal.

+91 7400242424

- Consumer Goods and Services /

- Travel and Tourism /

- Travel Risk Management

Global Travel Risk Management Services Market Size, Share & Industry Trends Analysis Report By Service Type, By Enterprise Size (Large Enterprises, Medium Enterprises and Small Enterprises), By Industry, By Regional Outlook and Forecast, 2023 - 2030

- September 2023

- Region: Global

- Marqual IT Solutions Pvt. Ltd (KBV Research)

- ID: 5903487

- Description

Table of Contents

Companies mentioned, methodology, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Service Type Outlook

Enterprise size outlook, industry outlook, regional outlook, strategies deployed in the market.

- Jul-2023: BCD Travel revealed GetGoing, an all-in-one platform. The new platform is designed for companies searching for a digital self-service solution to handle all facets of business travel, supported by assistance from travel. With the launch of GetGoing, the company aims to offer a self-service option backed by a team of travel industry professionals to the quickly expanding small and midsize market.

- May-2023: Healix unveiled an online tool, Healix Travel Safe. In order to ensure that safety precautions are followed in accordance with a global best practice standard, Healix's Travel Safe makes sure that all aspects are thoroughly analyzed for hazards and security.

- Jun-2022: FocusPoint International revealed the CAP Tripside Assistance (CAP) service plan for the consumer travel market. CAP offers urgent help to travelers who are stuck, experiencing a crisis, or who are only facing the threat of a crisis, together with advanced domestic and international travel assistance.

- Feb-2022: Collinson entered into partnership with AETOS, a leading unified security and safety solutions provider, and Crisis24, a leading provider of integrated risk management, crisis response, consulting, and global protective solutions firm. Through this partnership, the company aims to offer risk mitigation services and support to its clients, enabling them to efficiently assess, mitigate, and manage risks in the face of a constantly changing threat environment.

- Dec-2021: Tokio Marine Insurance Vietnam Co., Ltd. ("TMIV"), the Vietnamese subsidiary of Tokio Marine Holdings, Inc. unveiled TM Care, an insurance app for Japanese companies operating in Vietnam. The new software offers paperless, cashless, and contactless insurance policy processing to Vietnamese-based employees of Japanese corporations by utilizing Tokio Marine Group's expertise in online insurance sales in Japan.

- Jul-2021: FocusPoint International Inc. partnered with Globalstar, Inc., an America-based satellite communications company that operates a low Earth orbit (LEO) satellite constellation. With this partnership, the company would provide a comprehensive solution that keeps Globalstar and SPOT customers connected and secured from medical emergencies and security situations that can happen nearby or halfway around the world through the Global Overwatch & Rescue Plan.

- Jun-2021: Tokio Marine Holdings entered into a partnership with RMS, a Catastrophe risk solutions company. With this partnership, the company aims to utilize RMS models, data, and applications, as well as the RMS cloud platform, Risk Intelligence.

- Aug-2019: Everbridge, Inc. completed the acquisition of NC4, a leading global provider of threat intelligence solutions. Through this partnership, the company aims to enhance its offering from incident identification to response, mitigation, or ultimately, avoidance and prevention.

- Aug-2019: BCD Travel took over Adelman Travel Group, a full-service travel management company in North America. Through this acquisition, the company aims to expand its business, and its global network, and to assist companies in utilizing the newest technology for their travel programs.

- Jun-2019: Collinson formed a partnership with Travel Risk & Incident Prevention (TRIP) Group, a Travel Risk Management community. With this partnership, the company aims to provide solutions that precisely suit the needs of our clients and sometimes even go above and beyond their duty of care duties.

Scope of the Study

Market segments covered in the report:.

- Travel Security

- Crisis Management

- Data Security

- Health Security

- Assistance & Tracking

- Large Enterprises

- Medium Enterprises

- Small Enterprises

- Agri, Food & Beverage

- Pharmaceutical & Healthcare

- Hospitality

- Business Services & Consulting

- IT, Technology & Telecom

- North America

- Rest of North America

- Rest of Europe

- Asia Pacific

- South Korea

- Rest of Asia Pacific

- Saudi Arabia

- South Africa

- Rest of LAMEA

Key Market Players

List of companies profiled in the report:.

- FocusPoint International, Inc.

- Collinson International Limited

- Tokio Marine Holdings, Inc.

- CWT Global B.V

- Global Rescue LLC

- Everbridge, Inc

- Chubb Limited

- Healix Group of companies

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

- Travel And Tourism

LAMEA Travel Risk Management Services Market Size, Share & Industry Trends Analysis Report By Service Type, By Enterprise Size (Large Enterprises, Medium Enterprises and Small Enterprises), By Industry, By Country and Growth Forecast, 2023 - 2030

- Report

- Africa, Middle East

Asia Pacific Travel Risk Management Services Market Size, Share & Industry Trends Analysis Report By Service Type, By Enterprise Size (Large Enterprises, Medium Enterprises and Small Enterprises), By Industry, By Country and Growth Forecast, 2023 - 2030

Travel Technology Market By Component, By Application, By End User: Global Opportunity Analysis and Industry Forecast, 2023-2032

- October 2023

Global Travel Management Solution Market (2023-2028) Competitive Analysis, Impact of Covid-19, Ansoff Analysis

- February 2024

Bleisure Travel Market By Employee, By Age Group, By Industries: Global Opportunity Analysis and Industry Forecast, 2023-2032

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

+1(646) 600-5072

- Automotive Reports

- Electronics & Semiconductor

- Telecom & IT

- Technology & IT

- Consumer Goods

- Food & Beverages

- Media Mentions

- Consulting Services

- Market Research Report

- Full Time Engagement

- Custom Research Services

- Press Release

- Our Clients

- Subscription Model