- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel insurance for Canada

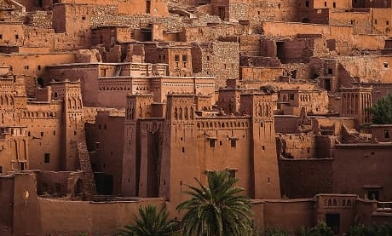

Canada is a vast country of diverse delights – everything from bustling cities to snow-capped mountains, deep forests and crystal clear lakes. If you're thinking of experiencing them, it's time to consider your travel insurance.

The call of Canada

As the world’s second-largest country, it’s only right to expect Canada to be a land of diversity. This is cultural as well as geographical, with its rich mix of indigenous cultures and Scottish, French and English heritages. But its more famous residents are those who have less respect for national borders: grizzly bears, polar bears, wolves, beavers and moose all call Canada home.

It’s got vistas of forest, miles of tundra, glinting glaciers and some of the world’s most impressive mountains. But it also has some of the world’s most sophisticated cities, with fine food, high culture, vibrant nightlife and spectacular architecture.

Protect what matters when you go with good travel insurance

Healthcare for brits in canada.

Travel insurance is a necessary contingency for getting sick or injured in Canada. Unlike other Commonwealth countries such as Australia, there isn’t a reciprocal health agreement between Canada and the UK, so while healthcare is readily available, it could be very expensive.

The emergency services number is 911 or 0. It’s imperative that you have travel insurance and contact your provider as soon as you have covered the most urgent needs of your medical care. It is also advisable to have some extra funds available for any costs that you may need to pay up-front like taxis to and from the hospital. These can be claimed for on your travel insurance policy. Canada has walk-in clinics where you can go without an appointment if your condition isn’t serious enough to warrant a trip to hospital.

Travel risks in Canada

Crime in Canada is uncommon. However, it’s always important to take precautions against theft and danger, such as never leaving bags unattended, not walking alone at night in unfamiliar places and avoiding the use of drugs or becoming too drunk. Always make sure your travel documents are safe and well looked after .

Most of Canada’s travel risks are associated with its notorious weather. Whether its heaps of snow in the winter or wild fires in summer, Canada’s raw landscape makes it prone to some heavy weather. It’s always important to keep on top of local weather reports and plan ahead. If your onward journey involves travel through an area that could soon be affected by hurricanes or heavy snow, you might want to amend your travel plans.

Make sure you understand what the local laws are surrounding winter travel. In some areas, winter tyres are a legal requirement while in others, roads are closed during the winter due to being impassable. Unlike the UK, Canadian rail networks are equipped to deal with heavy snowfall and this shouldn’t affect your travel plans, however it’s always a good idea to check the schedule if there is a dump.

Canadian culture

Canada is famous as a liberal, accepting and multicultural place with progressive politics. It is a mistake to think that Canadian and American cultures are the same or even broadly similar, however there has been a significant amount of US influence on things like architecture. There is an emphasis on the importance of immigration in Canada, especially considering that much of its infrastructural, culinary and high culture comes from European sources.

While it’s impossible to make total generalisations, Canadians are thought of as kind, hospitable and friendly. Arts and culture are an important part of the Canadian lifestyle, with several enormous festivals across artistic disciplines including theatre, dance, art, literature and, of course, music. The great outdoors is readily accessible and something that the Canadians are proud of, in particular their national park system.

The currency of Canada is the Canadian dollar , so make sure you have enough notes for your trip or have loaded the currency onto a secure prepaid travel money card before you go to easily access your holiday cash while you're there.

Getting around

The Trans-Canada Highway stretches, as one might imagine, across Canada, covering some 4,860 miles and a fair few time zones. It largely sticks to a route that tracks the US border as this is where the majority of Canada’s biggest cities are located (though it does not intersect the border at any point), and is a great route for a road trip.

Long-distance bus travel is more popular than in other countries and if you don’t mind the length of time it can take to get between places is a cost-effective way of getting between major cities.

Air travel is the speediest way of covering long distances, however it is not as cheap as American domestic air travel and it can sometimes be cheaper to transit into the US and out again. However, if that’s something you’re planning on doing, it’s crucial to make sure you have the necessary visas.

A fascinating way to see the entire country is to take the Canadian – that is to say a passenger train that traverses Canada. It can also be a way of getting from two major cities and seeing some of Canada’s amazing scenery at the same time. Unfortunately, for many people, it is more expensive than flying. Visit the VIA Rail Canada website to find out if you qualify for any of their discount schemes.

Driving across the country, or between places you want to visit, offers the freedom of being able to stop and change your destination on a whim, as well as giving you views of the country. It’s very important to make sure you know what the weather is going to be (as accurately as possible) as becoming stuck somewhere remote, especially in winter, can rapidly become very serious. Take all the local safety advice, as laws and regulations change between provinces and territories.

You do not need an International Driving Permit to drive in Canada – a full, valid UK driver’s licence is enough.

An important hazard on roads, particular outside of cities, is wild animals wandering out in front of you. Always be cautious when driving at night and reduce your speed if you are in an area of wilderness.

Wherever you are driving, make sure to have checked the latest travel news for that area and make sure your car has the necessary safety precautions (for instance, snow tyres or two, rather than one, spare tyres).

Do I need travel insurance for Canada?

Travel insurance is essential if you want health cover in Canada. While the health system there is well-respected, the costs of being treated – even for non-life-threatening conditions – can quickly escalate. Make sure the policy you choose has the level of Covid-19 cover you need. You may be able to add additional coronavirus cover for an extra premium with some insurers.

A good-quality travel insurance policy should cover you for damage to, loss or theft of your belongings, like passports and luggage. It should also safeguard against and reimburse you for cancellation, delay to or cutting short your trip – check the policy wording for the circumstances when it will.

Regardless of when you’re going to Canada – whether to hit the slopes of Whistler or do some hiking in the summer greenery – make sure your travel insurance covers you for the activities you want to do and that you’ve bought any add-ons you might need, like ski insurance or cruise cover. Take your policy document with you so you can check your cover for any activities you want to do spontaneously.

Remember that travel insurance doesn’t cover car insurance on rental vehicles, so this is something you will need to arrange separately if you intend on renting a car. Make sure that whatever car insurance you get, it is as comprehensive as possible. Always make sure that you have good breakdown cover if this doesn’t come as part of a rental agreement or your car insurance.

Always check the latest travel advice

Before you travel, check the latest Foreign, Commonwealth and Development Office (FCDO) advice for your destination, as travelling against this advice may invalidate your travel insurance.

Interested in travel insurance?

Other travel products.

Order foreign currency online or in selected branches. Pick up in any branch or get it delivered to your home.

One prepaid Mastercard™ that stores up to 22 currencies.

Get your passport application right the first time. We can even complete and submit it for you digitally.

This might interest you

Perched on the northern tip of Africa, Morocco’s long been a popular ...

It may be a short hop away, but a trip to France is not without its travel ...

For many UK holidaymakers, India is an intriguing and diverse culture with ...

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting ...

The status of Schengen visas for international students resident in the UK is ...

Every year, millions of holidaymakers from the UK head to Spain for its ...

The famous cliché of America is that it's big. And it is. Across its six time ...

Heading down under for a trip to or around Australia? Make sure you’ve got the ...

Today, Cuba is more accessible than it has been for many decades, and those who ...

Do UK residents need travel insurance for Ireland? And what healthcare is ...

Planning on living the high life with a trip to the UAE’s iconic mega-city, ...

Booking a last-minute holiday can get the blood pumping with the sudden thrill ...

Find out about medical care available to Brits in Mexico, as well as travel ...

Find out about the safety of travelling to Italy as well as the medical care ...

Make sure you’re travelling safely in Egypt with the latest advice and risks, ...

If you’re jetting off to Japan soon make sure you have good travel insurance to ...

How safe is South Africa to visit and why is having travel insurance important ...

Find out what medical care Brits can access in New Zealand and travel risks to ...

Travel’s a great way to unwind, see the world, open the mind and expand ...

People flock to the Canary Islands from all over Europe. No wonder, with such ...

Greece and the Greek islands have long been a popular travel destination for us ...

Dark mornings, cold hands, heating bills and chapped lips are among the most ...

Travelling solo means freedom and independence, making new connections and ...

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder ...

It’s one of the most popular holiday hotspots for UK holidaymakers. But what ...

Exploring the globe can be scary, but there’s so much to find at the edge of ...

Holidays for teenagers can take some imagination to make sure they’ve got the ...

If you're the type of sunchaser who looks forward to that sizzling summer ...

- Help and Support

- Travel Insurance

Travel Insurance Canada

Enjoy all canada has to offer.

Whether you're hiking in the Rocky Mountains or exploring Montreal, we've got you covered.

What comes to mind when you think of Canada? Glaciers and mountains? Grizzly bears and moose?

The great outdoors isn’t all Canada has to offer. If you’re as much a fan of vibrant cities and delicious food as you are of getting back to nature, Canada could be the perfect destination for you.

Covid-19 - what our travel insurance covers

Our travel insurance now covers you for certain events related to Coronavirus (COVID-19), provided you have proof of a positive Covid-19 test and your cover is active at the time of the event.

What we cover

We provide cover for some costs related to Covid-19: please see Section 1 'emergency medical costs and repatriation' and Section 2 'cancelling or cutting short your trip' in your policy book for full details on what's covered.

We'll cover you if:

- you were diagnosed with Covid-19 before your trip was due to start

- a close relative died or became seriously ill as a result of Covid-19 before your trip was due to start

- you weren't allowed to board your pre-booked outbound travel due to symptoms of Covid-19

- an insured person or a close relative died during the trip because of Covid-19

- you couldn't take part in an excursion due to you self-isolating after getting Covid-19

What we don’t cover

You won't be covered if:

- you had reason to believe your trip may be cancelled, postponed or cut short when you booked it, purchased your policy or started your trip

- any government or public authority imposes travel restrictions or quarantine on a community, location, or vessel because of Covid-19 (this includes, but is not limited to, local lockdowns, entry requirements, being denied entry and airspace closures)

- you have to quarantine after arriving in the UK or abroad

- the Foreign Commonwealth & Development Office (FCDO) change their advice to avoid ‘all travel’ or ‘all but essential travel’ to your destination because of Covid-19

For more information about how Coronavirus (COVID-19) affects your travel cover, see our FAQ page . And remember to check the policy booklet carefully before you buy to make sure our cover meets your needs.

If you’re taking a trip to Canada, it’s a good idea to go prepared with travel insurance . It isn’t compulsory, but it protects you if the worst were to happen such as:

- Having to cancel or cut short your trip

- Theft of personal belongings

- The airline losing your luggage

Medical treatment in Canada can be very expensive. As there are no special arrangements for travellers from the UK, Canada travel insurance is vital to make sure you’re not hit by high treatment costs.

Our basic level of travel insurance gives you up to £10 million of cover for emergency medical treatment and repatriation, and this rises to up to £20 million with our Platinum level.

Choose from three levels of cover

Read the full list of benefits in the policy summary booklet .

Holiday insurance Canada: what cover do I need?

Travel cover is divided up into different geographical areas. We use three zones:

- Worldwide excluding USA, Canada, Caribbean and Mexico

For trips to Canada, you’ll need the third option – worldwide travel insurance . Make sure you don’t choose the second option, worldwide excluding USA, Canada, Caribbean and Mexico, as you won’t be covered.

Canada travel tips

To make life easier when travelling in Canada, there are a couple of things you should bear in mind:

- One parent travelling with children must carry a letter of consent from the parent who isn’t travelling. Immigration officers can question children if there’s any concern around child abduction.

- If you’re travelling on to the United States, you should check the entry requirements of the US to make sure you won’t be denied entry.

Driving in Canada

If you’re planning to drive when you’re in Canada, you can usually do so as long as you have a full UK driving licence. Make sure you always carry it with you.

Some car hire companies may need you to have an International Driving Permit, though, so make sure you check before you travel so you don’t get caught out. The FCDO recommends you take out full insurance when hiring a car.

If you’re planning on driving during the winter, be aware that conditions can be extreme. Roads in some provinces, such as Alberta and British Columbia, can be closed due to avalanches and snow storms.

Follow the weather forecast and make sure you’re prepared – that includes checking if you need snow tyres for the province you’re in.

Skiing and snowboarding

If you’re heading to Canada to hit the slopes at one of the many legendary ski resorts, you’ll need our Winter Sports upgrade to be covered for the trip. This makes sure you’re covered should the worst happen and you’re injured or your equipment is lost or damaged.

We cover a range of popular winter sports:

- Piste skiing

- Snowboarding

- Glacier skiing

- Big foot skiing

- Tobogganing

There’s a full list of all the activities we cover in the policy document .

Hiking and camping

If you’re intending to go hiking or camping while travelling in Canada, take care and be considerate. Follow any park rules and regulations, take your rubbish with you and don’t feed any animals you see.

Be wary of animals with young as they’ll be more likely to act aggressively to protect them. Research how to deal with any animals you might encounter, and make sure you know if you’re going to be in an area where you might see bears.

Do you need a visa for Canada?

Canada visa requirements for British citizens are straightforward – if you’re travelling to Canada for a short period of time you don’t usually need a visa. If you’re travelling to Canada for a longer period of time – to work or study, for example – you should check if you need a visa with the Canadian High Commission.

If you’re flying into the country, as many British travellers do, you’ll need an electronic travel authorisation (eTA). You won’t be able to board your flight without one. Any travellers entering Canada by land or sea don’t need an eTA, but they’ll still need the usual valid travel documents.

For more information about the eTA and to apply online, visit the official Canadian government website.

What if I have a pre-existing condition?

A pre-existing condition is a short or long term illness or injury you have or have had before you buy travel insurance. This includes having symptoms, tests, diagnosis or medical treatment for a condition.

You can declare your pre-existing conditions during the quote process to see if we can offer cover. If you’re unsure what needs to be declared or if you're unable to find your condition on the medical conditions list, please contact us on 0333 234 9913 .

Your pre-existing conditions won’t be covered unless you’ve:

- Declared them all on your policy

- Received written confirmation that we’ll cover your medical condition

- Paid any additional premium in full

Policy terms and conditions apply. Please note, if you’ve had a positive diagnosis of Covid-19 and been prescribed medication, received treatment, or had a consultation with a doctor or hospital specialist for any medical condition in the past two years, this needs to be declared on your policy.

If you don’t tell us about your pre-existing conditions or give us incorrect information, your policy may be invalid, and we may refuse all or part of any claim you submit.

For a quote with us, click the green button above.

The MoneyHelper directory

If you require cover for more serious medical conditions, MoneyHelper may be able to help you find specialist travel insurance through their medical directory.

If you wish to get in touch with them you can call them on 0800 138 7777 or find them online . (Monday to Friday 8:00-18:00, closed on Saturday, Sunday and bank holidays.)

Your questions answered

Do i need a visa for canada.

British citizens don’t usually need a visa for short term travel in Canada, but you may need one if you’re staying for a longer period for study or work. Find out if you need a visa by checking the Canadian High Commission website.

If you’re flying into Canada, you’ll need an electronic travel authorisation (eTA), and you won’t be allowed on your flight without one. Find out more about the eTA and apply online by visiting the official Canadian government website .

Do I need travel insurance for Canada?

It’s not compulsory to have travel insurance when travelling in Canada, but it’s definitely worth having. Could you afford to pay for medical treatment or replace lost luggage out of your own pocket if the worst were to happen?

How much time do I need on my passport to visit Canada?

As long as you have enough time to cover the duration of your stay, you’ll be fine. You don’t need any additional time on your passport when travelling in Canada.

Does my travel insurance cover me to drive in Canada with a UK licence?

You can drive a car in Canada if you have a full UK licence, but you should always carry your licence with you. Some car hire companies require you to have an International Driving Permit, so check with your car hire company before you travel. You should also take out full insurance to make sure you’re covered, as your travel insurance won’t cover you.

What are the requirements to enter Canada?

British citizens don’t usually need a visa for short visits to Canada – you’ll need an Electronic Travel Authorisation (eTA), which you must apply for before you travel. To find about more about the eTA and apply online, visit the official Canadian government website .

Do I need any vaccinations for travel to Canada from the UK?

If your routine vaccinations as recommended in the UK are up to date, you don’t currently need any other vaccinations when travelling to Canada – although you should check if you need a rabies booster.

For more information on where, when and how to get vaccines, take a look at our guide to travel vaccinations .

Is travel insurance mandatory for Canada?

You don’t have to have travel insurance for Canada but it’s a good idea to make sure you’re covered if you fall ill or have an accident when travelling there. Medical care in Canada can be expensive, and the average cost of medical procedures is £14,615 – find out more in the cost of getting ill abroad .

Can I travel to Canada if I have a pre-existing condition?

You can travel to Canada if you have a pre-existing condition as long as you declare it when you’re buying your cover. Read more about travelling with medical conditions .

Getting the most out of your trip

Going anywhere nice.

Off to one of the destinations below? Take a look at our guides for some hints and tips on what you need to remember.

Travel insurance that suits you

Whether you're travelling solo, with your family, or with a little one on the way, read our guides to make sure our cover is right for you.

Family Travel Insurance

Student travel insurance, travelling while pregnant, travel insurance over 65, travelling with medical conditions, travel insurance upgrades.

Whether you want the adrenaline rush of a skiing holiday, or fancy taking to the seas on a cruise, you'll need to add extra cover to your policy.

Cruise Travel Insurance

Ski travel insurance, gadget travel insurance, adventurous sports insurance, single trip insurance, annual trip insurance.

Our partner, Cigna, offers newcomers peace of mind. Get a free quote !

Find the best immigration program for you. Take our free immigration quiz and we’ll tell you the best immigration programs for you!

Canadian travel insurance for British travellers to Canada

Updated on December 21, 2023

Find the best immigration programs for you

Advertisement

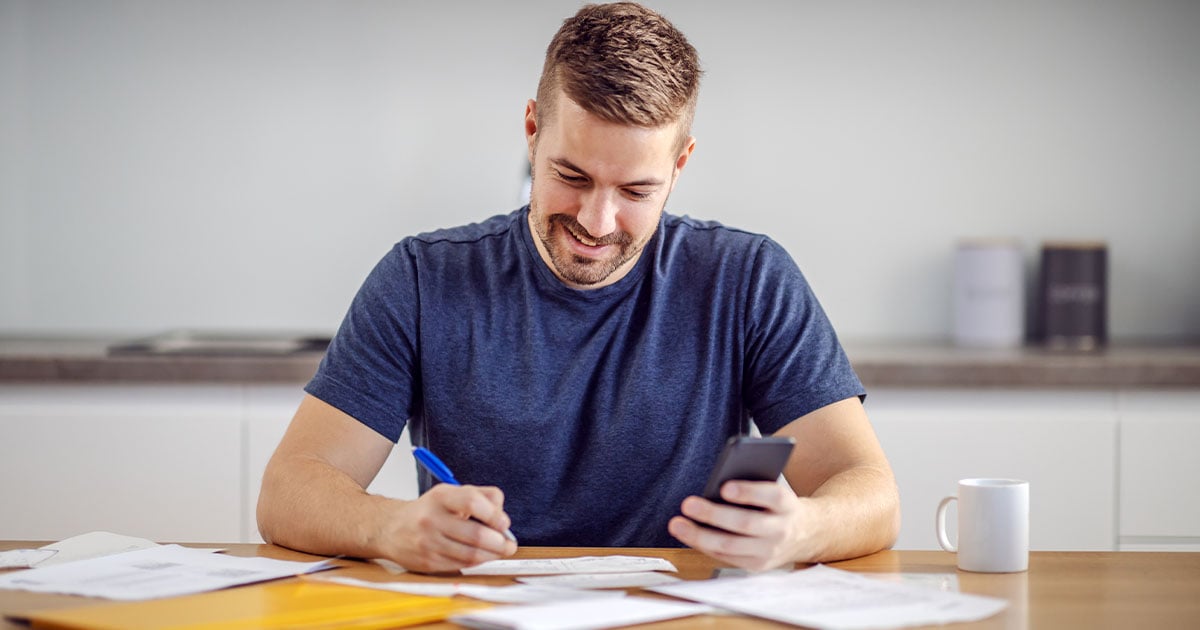

If you’re considering travelling to Canada from the United Kingdom, it’s important to understand your Canadian travel insurance needs.

Canada and the United Kingdom have always enjoyed a close relationship — after all, they’re both commonwealth countries. British citizens have been coming to Canada for centuries, and the drive to explore our beautiful country remains strong. An average of 724,000 British nationals visit Canada every year.

As a UK resident planning travel to Canada, you should take the time to consider your Canadian travel insurance and health insurance plans in advance. Today, we’ll help you determine which types of travel insurance for Canada are ideal for your next trip.

Why Do British Citizens Need Travel Insurance for Canada?

Whether you’re planning to move, looking for a new job, or just booking your next vacation, you should always ensure that you have health and travel insurance before you arrive in Canada. Even though both Canada and the United Kingdom enjoy similar types of publicly funded universal healthcare , the two systems do not overlap.

Regardless of whether you have private insurance in addition to your regular NHS coverage, this typically won’t cover you in a foreign country. It’s up to you to arrange for the necessary insurance to ensure your trip goes off without a hitch.

Many Brits who are tempted to take a trip to Canada without Canadian travel insurance can easily find themselves out thousands of dollars or even more if they miss their flight, or if they find themselves sick or injured with no way to pay for treatment.

To help protect yourself against these unexpected expenses, make sure you purchase insurance before you leave the United Kingdom. Moving2Canada’s partner Cigna offers fast and affordable travel insurance plans. Find out if Cigna could be an option for you by getting a free quote — it only takes a minute!

As a traveller from the United Kingdom, what should my Canadian travel insurance cover?

As a traveller from the United Kingdom, when you’re buying Canadian travel insurance, it’s hard not to get overwhelmed. However, learning more about the coverage options can help you make the right decision.

Here are some types of coverage you should know about before purchasing traveller’s insurance for Canada.

- Emergency medical & hospitalization: Having coverage for unexpected medical expenses is one of the most important elements of any travel insurance plan. In order to avoid extremely costly medical bills, ensure your Canadian travel insurance and/or international health insurance covers emergency medical expenses like ambulance services, medical bills, and hospitalization.

- Medical evacuation : Unlike the United Kingdom, Canada is huge! If you’re away from medical facilities and get ill or injured, you may need to be airlifted to the nearest or most appropriate medical facility. A great travel health insurance plan should offer some coverage for medical evacuation.

- Pre-existing conditions : Anyone with a pre-existing condition should make sure that any travel insurance they purchase offers pre-existing condition coverage. When in doubt, call the insurance provider and ask whether your specific condition is covered.

- Repatriation : If you were to die while in Canada, bringing your remains home is an incredible expense. This coverage offers a set amount of money towards the repatriation of your remains if the worst were to occur while you were away from the UK.

- Trip Cancellation/Trip Interruption : No one wants to pay out of pocket if their trip was cancelled, delayed, or interrupted. Purchasing trip cancellation or trip interruption insurance helps to offset these sometimes unavoidable costs.

- Baggage Loss/Delay : Hate dealing with lost or delayed luggage? This type of coverage makes it simple. If your baggage is lost or delayed on your flight, you’ll get a set amount of money to cover the cost of new clothes and other necessary items.

Canadian Travel Insurance Considerations for Different Types of British Travellers

When you travel to Canada from the United Kingdom, your insurance needs will change depending on the length of your visit and your immigration status in Canada. Here are some considerations you should keep in mind depending on your situation.

If you enter Canada from the UK as a tourist or visitor , typically you are eligible to stay for a maximum of 6 months. Regardless of whether your visit will last for months or just days, you should plan to be protected by travel and health insurance for the duration.

Travel insurance protects against loss, delays, and other unavoidable situations that can occur when you’re dealing with things like car rentals, airlines, and more. Travel or international health insurance can reimburse you for unexpected medical expenses that may come up during your trip.

Even though the premiums are minimal, the reassurance they offer is priceless. Start exploring your travel insurance and health insurance options by getting a free quote from Cigna !

Depending on where you’re studying, some provinces (like British Columbia and Alberta) will cover international students under their provincial healthcare plans. Generally, you must intend to be in the province for at least six months and must apply for coverage as soon as you arrive.

However, most of the time applications for provincial health insurance take weeks to process, at which time you are not covered. It’s always recommended that students purchase private health insurance that can cover them in the interim. Oftentimes, your college or university will offer some type of insurance plan for international students, so it’s best to check with your school first!

IEC Working Holiday Participants

Going on an International Experience Canada (IEC) Working Holiday is a great opportunity for young British citizens aged 18 to 30 to explore Canada while gaining valuable employment experience. Thousands of Brits travel to Canada each year through this popular program.

These short-term Working Holiday visas are easy to apply for, but require any participants coming into Canada to have travel insurance that covers them for their entire stay. This insurance must cover medical care, hospitalization, and repatriation.

Moving2Canada’s partner BestQuote helps to compare different IEC travel insurance options available on the market so you can make the best decision for your needs. Check out BestQuote’s travel insurance comparison tool here .

Temporary Workers

If you’re entering Canada on a work permit , you may be eligible for provincial health care depending on the length of your contract. In most provinces, workers present in Canada for 6 months or more are eligible — but the exact requirements vary by province.

However, depending on your province of residence, there may be a wait time of 3 months where you will be without health insurance. During this time, it’s wise to have a private alternative that can cover you until you receive your health card. We recommend getting started with a free quote from Cigna to explore their Canadian travel insurance options.

Permanent Residents

In every province, legal permanent residents of Canada are eligible to receive health coverage under their new province’s healthcare system. However, it can still take anywhere from a week up to a few months to collect all the documentation you need to fill out your application.

Before you arrive in Canada, we always recommend that newcomers to Canada from the United Kingdom purchase private health insurance that can cover them while they’re settling in and completing their provincial healthcare application. You can start exploring your insurance options by getting a free quote from Cigna .

Finding the Best Travel Insurance in Canada as a British Traveller

Whether you arrive in Canada as a visitor, student, or temporary or permanent resident, there are lots of things to see and do during your trip. Worrying about trip cancellations, illness, or injuries shouldn’t be on your list.

To protect yourself, we always recommend purchasing both health and travel insurance that’s valid for the entire length of your trip.

Looking for an easy, responsive, and convenient insurance provider? Check out Cigna, a trusted partner of Moving2Canada, who provides simple, fast estimates in just a few moments. Get started with a free quote today !

Related Content

Understanding Canada vs US Healthcare

Pregnant and Moving to Canada: What You Need to Know

How to Deal with Loneliness After Moving to Canada

How to get a PEI Health Card as a newcomer

Get immigration help you can trust

Book a consultation with one of Moving2Canada's recommended Canadian immigration consultants. You deserve the best in the business.

Get the latest news & updates

Sign up for the Moving2Canada newsletter to get the latest immigration news and other updates to help you succeed in Canada.

Popular Topics

Search results

results for “ ”

Immigration

Learn everything you need to know about Canadian immigration

If you need help with your immigration, one of our recommended immigration consultant partners can help.

Calculate your estimated CRS score and find out if you're in the competitive range for Express Entry.

Take the quiz

Your guide to becoming a student in Canada

Take our quiz and find out what are the top programs for you.

Watch on YouTube

This guide will help you choose the best bank in Canada for your needs.

Get your guide

News & Features

latest articles

Our Partners

Privacy overview.

Canada Travel Insurance

Travel insurance for canada: a guide for us travelers .

From exploring Banff National Park's breathtaking landscapes to experiencing Toronto's vibrant culture or the historic sites of Quebec City, Canada offers a wide range of popular locations and activities. However, before you dive into your adventure, there's a crucial detail to address: securing your travel insurance.

Discover all the ins and outs of travel insurance for Canada in this guide. We've got you covered with details on costs, requirements, essential coverage, COVID-19 restrictions, and some handy tips for your trip.

What should your Travel insurance cover for a trip to Canada?

How does travel insurance work for canada, do i need travel insurance for canada , how much does travel insurance cost for canada .

- Travel Insurance Requirements for Canada

Are there any COVID-19 restrictions for US Visitors?

Are there any required travel vaccinations for canada , traveling with pre-existing medical conditions , our suggested axa travel protection plan .

At a minimum, your travel insurance to Canada should cover trip cancellation, trip interruption and emergency medical expenses. Regarding international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Canada.

Let’s say you’re exploring Ottawa's stunning architecture or skiing down Banff's slopes with AXA Travel Protection. If you were to fall ill or face an unexpected travel hiccup, AXA Travel Protection steps in to help support you. Whether assisting in medical transportation or finding the best alternative for a trip delay, AXA Travel Protection ensures you’re supported in your time of need.

How AXA Travel Protection Can Benefit Visitors to Canada

Here’s the entire list of benefits travelers can have access to with an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Americans aren't required to purchase domestic or international travel insurance to visit Canada. But it’s still highly recommended to have a travel insurance plan before embarking on your next trip.

Why? There are several reasons:

- Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in Canada, travel insurance offers the means to receive prompt and quality medical care.

- Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

- Flight Delays: Travel disruptions like flight delays can happen. If you miss a connecting flight or incur additional expenses due to delays, travel insurance can help cover the costs.

In general, travel insurance to Canada costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Canada will be offered three tiers of insurance: Silver, Gold , and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Travel Insurance requirements for Canada

Travel insurance is not mandatory for US travelers coming to Canada, but having coverage for medical emergencies is a smart move. It's also worth checking if your visa, entry requirements, or tour operator call for extra coverage.

As of October 2023, Canada has eliminated all COVID-19 entry requirements. However, it's crucial to be mindful of your health. If you develop COVID-19 symptoms before your trip, consider postponing your travel plans to Canada. Having Cancel for Any Reason as part of your travel insurance plan becomes invaluable in such a scenario. This optional benefit provides the flexibility to cancel your trip, even for a reason beyond standard coverage.

Canada does not have specific vaccine requirements for travelers. However, due to COVID-19, travel requirements may change from time to time. Stay up-to-date on vaccine requirements and recommendations by consulting official sources such as the Government of Canada's website.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Canadian hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is your go-to choice if you're looking for extra coverage aligned with the Canadian experience. " Cancel for Any Reason " offers greater flexibility for those unexpected twists in your travel plans and the " Rental Car (Collision Damage Waiver) " offers assistance when you're out exploring Canada's stunning landscapes in a rental car.

Additionally, part of the Platinum Plan is the " Lost Skier Days " benefit, offering potential reimbursement if ski resorts unexpectedly close due to ever-changing snow conditions. These perks make the Platinum Plan an excellent option for anyone seeking comprehensive protection during their exciting Canadian adventures.

FAQs about Canada Travel Insurance

1. can you buy travel insurance after booking a flight .

Absolutely, travelers have the option to purchase travel insurance for Canada after they've booked their flights.

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

2. Do US citizens need travel insurance to Canada?

Travel insurance to Canada from the USA is not mandatory, but it is highly recommended. While Canada’s healthcare system is fantastic, it might not cover all your medical expenses as a non-resident and medical bills can add up fast.

3. What type of medical conditions does AXA Travel Protection cover? AXA covers three types of medical expenses:

- Emergency medical expenses

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency medical expenses are unexpected incidents that arise, such as broken bones, burns, unexpected illnesses, and allergic reactions. Emergency evacuation and repatriation can cover your immediate transportation home in the event of an accidental injury or illness. Non-medical emergency evacuation and repatriation can cover evacuation assistance when you immediately leave a destination for non-medical-related events. These could be things like natural disasters or civil unrest.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

- Collision Damage Waiver

- Sport & Leisure

- Medical Conditions

- Travel Insurance for Non-UK Residents

- Group Travel Insurance

- Travel Insurance for Couples

- Covid-19 travel insurance

- About Our Travel Insurance

- Holiday Cancellation Insurance

- Emergency Medical Assistance Cover

- Emergency Medical Cover for Travel Insurance

- Repatriation Insurance

- Baggage Cover

- Travel Insurance for Under 18s

- Comprehensive

- What's Covered

- Excluded Vehicles

- Range Rover

- Car Hire Excess Insurance

- Policy Information

- File a Claim

- Insurance Glossary

- Coronavirus - Annual Multi-trip Policy

Travel Insurance for Canada

Canada is the world’s second largest country and, as a result, it’s a place of great diversity. Home to vast mountains, craggy coastlines, awe-inspiring cities and beautiful fjords, it boasts striking natural landscapes and the best of modern life too.

Canada has a mixed culture and heritage which is best experienced in the cuisine of its major cities. You can sample a macaron in the distinctly French Montreal, wander around the Asian night markets in Vancouver or sample the best of everything in Toronto, which is regularly voted as the most cosmopolitan city in the world. Just make sure you travel with plenty of Canadian dollars so you can grab food as you go.

Away from the city, Canada gives holiday-makers the chance to reconnect with nature. Tourists flock to the Canadian Rockies, where snow-capped mountains draw Winter Sports and Ski enthusiasts every year. If you’re looking for something more laid back, you’ll have the opportunity to explore one of Canada’s 46 incredible national parks.

Whatever you plan on doing, it's important that you get travel insurance for Canada to help protect yourself against any unforeseen eventualities.

Below is some more information about our products, for which Terms and Conditions apply. Please visit the policy information hub for full details.

What does our travel insurance for Canada cover?

If you fall ill or get injured in Canada, travel insurance can help cover the cost of your care. Unlike many Commonwealth countries such as Australia, the UK and Canada don’t have a reciprocal health agreement, so although healthcare is still available for tourists, it can be incredibly expensive if you travel without insurance.

Similarly, if your journey is disrupted due to one of Canada’s infamous snowstorms, your travel insurance for Canada can help cover you if you are delayed because your airport is snowbound, or if you miss your flight. It can also provide you with cover if any of your personal possessions are lost, stolen or damaged.

At Allianz Assistance, we can provide you with a Single Trip , Annual or Backpacker travel insurance policy. We also offer three different levels of cover across our Single Trip and Annual policies: Bronze, Silver and Gold. They can protect you against:

- Cancelling or curtailing your trip

- Emergency medical and associated expenses

- Loss of passport*

- Delayed personal possessions

- Lost, stolen or damaged personal possessions*

- Loss of personal money*

- Personal accident cover

- Missed departures

- Delayed departures

- Personal liability

- Legal expenses

- End-supplier failure**

- *Not available with Bronze level cover

- **Only available with Gold level cover

- Terms and Conditions apply.

Frequently Asked Questions

Depending on how often you travel, you may find that Single Trip or multi-trip travel insurance for Canada is best suited to your needs.

If you’re only making one trip this year, then Single Trip travel insurance for Canada is the best option for you. But, if you’re planning multiple trips, then Annual travel insurance to include Canada may prove to be more cost effective than buying several Single Trip policies.

Similarly, if you’re travelling the world on a backpacking holiday and are stopping off in Canada, then you may find that our Backpacker travel insurance is right for you.

The cost of travel insurance for Canada will vary depending on a number of factors, including:

- The number of people travelling

- The age of the people travelling

- The length of your holiday

- Whether you have any medical conditions to declare, as this will affect your eligibility

- Whether you need any additional cover

The best way to find out how much your travel insurance for Canada will cost is to get a quote online. By supplying us with a few basic details about you and your trip, we’ll be able to provide you with a quote.

From 5th May 2021 we will no longer be offering travel insurance policies to cover people’s pre-existing medical conditions. This is only a temporary measure while we make improvements to our online booking engine. Please keep an eye on the Allianz Assistance website in the future so you are aware when we are able to offer this additional cover again. Policies purchased before 5th May 2021 aren't affected and your cover won't change.

Once the updates have been made, and we're able to offer travel insurance to cover pre-existing medical conditions again, before you buy your Canada travel insurance policy, you should make sure that you declare any pre-existing medical conditions you have through our medical screening process. If you fail to declare your conditions, they won’t be covered by your policy.

You will be able to see if we can cover your conditions, simply click ‘Get a Quote’ and select your policy type before providing us with some basic information about your trip. If you have any questions about the medical screening process, or you’re unsure what pre-existing conditions are not covered, please call us on 0371 200 0428 (from 9am to 5pm - Monday to Friday).

One of the impreovments we are making is to extend the offer of pre-existing medical condition cover onto our Annual travel insurance policy.

If you’re a British citizen, you won’t need a visa to visit Canada if you’re only staying for a short period. But you will need to get an Electronic Travel Authorisation (eTA) if you’re travelling by air. You can apply for an eTA online via the official Canadian government website .

If you’re travelling by land or sea, you won’t need an eTA when you enter Canada. However, you must travel with acceptable travel documents and identification .

Almost 750,000 Brits visit Canada every year and, even though Canada is considered to be a relatively safe country to visit, there are a number of things that you should be aware of before you travel to Canada.

Firstly, you should visit your healthcare practitioner 6-8 weeks before you travel, to check whether you require any vaccinations for your trip. Generally speaking, you’ll need to ensure all of your primary courses and boosters are up to date, and you may need diphtheria and tetanus vaccinations (these are recommended for most travellers). If your healthcare practitioner believes you’re at an increased risk, then they may also recommend hepatitis A, hepatitis B and rabies vaccinations. 1

You should also be wary of heavy snowfall in the winter months. During this time, highways are often closed in British Columbia and other Provinces because of snowstorms and avalanches. To understand conditions, you should check local news and weather reports and visit Environment Canada before you make a journey. You should also be aware that, because Canada is so vast, journeys often take longer than they do in the UK.

Although crime rates in Canada are relatively low, you should be wary of pickpockets. Many pickpockets can target tourists in busy areas, particularly around monuments and popular photo spots. Never leave your valuables on show and ensure they’re always stored away safely when not in use.

When browsing shops or looking at menus in restaurants, you should also be aware that the price of an item may not be the final price you pay. This is because a Goods and Service Tax is added to the bill. In addition to this, tipping is preferred in bars, restaurants and hotels.

1 Source: TravelHealthPro

Popular products from Allianz Assistance

Single Trip Travel Insurance

Annual Multi-Trip Travel Insurance

Backpacker Travel Insurance

Winter Sports & Ski Travel Insurance

Family Travel Insurance

Travel Insurance for Seniors

Sports & Leisure Insurance

Need help? Call us on: 0371 200 0428

Make a claim, policy documents.

HelloSafe » Travel Insurance

Best travel insurance in Canada for 2024

comparatorTitles.name

Travel, whether for leisure, business, or work, has become integral to our modern lives. While it opens doors to diverse experiences, travel insurance is crucial in providing peace of mind against unforeseen expenses like medical emergencies and trip disruptions, particularly during unpredictable events.

But choosing the right travel insurance can be a challenge and demands careful consideration of factors like coverage, individual needs, exceptions, and more. We've got you covered.

In this guide, we take you through everything from coverage types and costs to the best plans and how to find cheap travel insurance. You can use our comparator at the top of this page to compare plans, get free quotes , and find a policy that truly fits your needs.

Top 10 travel insurance Canada plans

- soNomad travel insurance: Straightforward and affordable

- Allianz travel insurance: Affordable Plans Starting At $27

- Tugo travel insurance: Tailored solutions

- Destination travel insurance: Specialized coverage

- Manulife travel insurance: Flexible policies

- Blue Cross Travel Insurance Canada: Flexible plans for every need

- CAA travel insurance: Best for CAA members

- RBC travel insurance: Coverage from a reputed bank

- TD travel insurance: High coverage limits

- BCAA travel insurance: Budget-friendly options

Before we explore the best plans in the market, let's look at the basics of this coverage first.

What is travel insurance?

Travel insurance is a policy that protects your investment in a trip. It reimburses for financial losses of a canceled or interrupted trip, as well as emergency medical care during travel, emergency evacuation, damage to a rental car, lost luggage, and more. The medical care component is critical in a country like Canada. Out-of-province care costs more and offers less than in patients' home province.

It takes different forms. You can purchase it as an individual policy or as an add-on to a travel purchase like a flight. It may even be included as a credit card benefit when you use yours to make a travel purchase.

What is international travel insurance?

International travel insurance is a subset of travel insurance, specifically tailored for trips abroad, while the latter can cover domestic and international trips. The key difference is that international coverage is designed to address the unique challenges and risks associated with international journeys, such as medical emergencies, visa issues, and currency exchange, in addition to covering the same aspects as standard travel coverage, like trip cancellations and lost baggage.

How does travel insurance work?

Here's how it typically works:

- Purchase a Policy: Before your trip, you buy a policy, specifying the coverage, trip duration, and other relevant details.

- Traveling: During your trip, if you encounter covered events like medical emergencies, trip cancellations, lost baggage, or other unexpected issues, you can contact your insurance provider or its 24/7 assistance line.

- Claim Submission: Submit a claim with the required documentation, such as medical bills or receipts for lost items, to your insurer for reimbursement.

- Reimbursement: If your claim is approved, the insurance provider reimburses you for eligible expenses, helping you manage unexpected costs and disruptions during your travels.

What does travel insurance cover?

What is covered depends on the insurer and the level of coverage you choose. It commonly covers emergency medical care, trip cancellation, trip interruption, and lost or damaged baggage.

Travel insurance is customized based on the needs of your specific trip. A basic plan covering just flight cancellation may be fine if you already have supplemental individual medical coverage and are traveling within Canada. On the other hand, if you are planning a ski trip to the French Alps, a comprehensive plan with emergency medical care and evacuation back home could help set your mind at ease if you experience a bad fall on the slopes.

Manulife’s CoverMe is one of the most popular providers in Canada, and here is what their Single Trip All-inclusive plan offers:

What does it not cover?

Common exclusions typically include:

- Pre-existing Medical Conditions: Coverage may not extend to pre-existing medical conditions without a specific waiver or rider.

- High-Risk Activities: Activities like extreme sports or dangerous hobbies may require additional coverage or be excluded.

- Traveling Against Advisories: Trips to countries under travel advisories or travel restrictions may not be covered, depending on the policy.

What are the different types of travel insurance?

The most common categories are:

- Baggage insurance - Did you make it to that Caribbean island or European capital, but your luggage did not? It does not have to ruin your trip. This insurance will give you some spending money to get essentials due to a delay or replace it in case it is lost.

- Emergency medical insurance - You cannot put a price on your health. This protects you if you get injured or sick while away.

- Trip cancellation - Have an emergency back home before your trip? If you are unable to travel, this coverage will reimburse what you spent on nonrefundable travel.

- Trip interruption - Miss a connection flight? Maybe you need to return home early? That is okay, you are covered. This is similar to trip cancellation insurance but covers you during a trip rather than before it.

- All-inclusive policies - Want to be prepared for anything? These policies include all of the above insurance types.

Finally, consider how much you will be traveling in the year. Single-trip and annual coverage options exist. Annual plans may save you money if you intend to travel two or more times per year.

What is travel medical insurance?

Travel medical insurance provides coverage for medical emergencies during your trip, including doctor's visits, hospitalization, and emergency medical evacuation. It is a subset of travel insurance, which covers a wider range of risks such as trip cancellations, lost baggage, and non-medical aspects of travel. You can often purchase stand-alone medical coverage if you primarily need health-related coverage for your trip.

How much is travel insurance?

A basic plan for a 30-year-old single traveler could be as little as $26 for a week, while a comprehensive plan could cost that same traveler $125.

How much travel insurance costs depends on the length of your trip, the destination, the desired coverage, and your age. We recommend plans that include emergency medical coverage.

How much is travel insurance in Canada?

On average, a basic single-trip policy for a one-week trip may cost around $25 to $50 CAD for an individual, while an annual multi-trip policy can range from $100 to $300 CAD. More comprehensive coverage or longer trips can increase the cost. Seniors and individuals with pre-existing conditions may pay higher premiums.

It's essential to compare quotes from different providers to find a policy that suits your needs and budget. Try our comparison tool below to get free personalized travel insurance quotes for your upcoming trip. Compare rates, explore options, and find the best policy for you in just seconds.

Prepare for your trip Compare. Choose. Save.

What does travel insurance for seniors cover?

Travel insurance for seniors offers increased medical coverage over other plans and coverage for stable pre-existing conditions. It works like any other emergency medical insurance plan but is adapted to the needs of senior travelers.

Leading plans medical travel insurance for seniors Canada plans offer:

You can use our comparator at the top of this page to find the best Canadian travel insurance for seniors based on their unique needs. It only takes a few steps and you have free quotes in seconds.

How much is travel insurance for Canadian seniors?

The cost of travel insurance for Canadian seniors can vary based on factors like age, health, destination, and trip duration. On average, a comprehensive single-trip policy for a senior traveler may range from $50 to $200 or more, while an annual multi-trip plan could cost approximately $300 to $1,000 or higher, depending on coverage limits and individual circumstances. Pre-existing conditions may also alter the coverage you can access.

What is the best travel insurance for visitors to Canada?

Leading Canadian travel insurance companies offer medical travel insurance to visitors. These can be perfect for non-residents in the country on vacation, business, or visiting family. These plans can be a lifeline for people living in Canada who have not yet qualified for public healthcare.

The best travel insurance for visitors to Canada depends on the traveler’s needs. Additionally, plans may be available to them from their home country.

Is it mandatory to have travel insurance to visit Canada?

No, you do not need private travel coverage to visit Canada. It is not mandatory for all visitors to Canada, but it is highly recommended. Canada's public healthcare system does not cover visitors, and some provinces may require health insurance for entry. Having travel coverage provides financial protection and peace of mind for medical emergencies and unexpected events. Policies and requirements can change, so check with Canadian authorities for the latest information.

Good to know

If you are sponsoring a parent or grandparent to visit you in Canada, did you know that you are required to purchase super visa insurance? Learn more and compare the best super visa insurance plan in Canada in our super visa guide .

How to get the cheapest travel insurance Canada plans?

So how to get travel insurance? Most importantly, how to get the most affordable plans? Follow these 5 steps to get the best deals.

- Compare Multiple Quotes: Obtain quotes from various insurance providers to find the best price for your desired coverage.

- Choose Essential Coverage: Select coverage that matches your specific travel needs, avoiding unnecessary add-ons.

- Consider Annual Policies: If you travel frequently, annual policies often offer more value than single-trip coverage.

- Review Deductibles: Higher deductibles can lower your premium, but be prepared to pay more in case of a claim.

- Utilize Membership Discounts: Check if your memberships or affiliations offer discounted coverage options.

While finding the cheapest travel insurance Canada plan or to other regions may seem like a daunting process, we've got you covered. You can simply use our free comparator below to compare plans, and coverage, check on discounts, and get free quotes in no time.

When should I buy travel insurance?

Travel insurance can be purchased anytime between booking and departure, but we recommend buying a plan at the same time that you book your trip.

Booking as soon as possible ensures greater protection. The ideal time to purchase is right after making your initial trip payment, typically within 10-21 days. Buying it early allows you to access coverage for pre-existing medical conditions and other benefits . You can often obtain last-minute insurance up to the day before departure, but some coverages may be limited.

But when is it too late to buy travel insurance? Once you've begun your trip or used any part of it, you generally cannot purchase coverage for trip cancellations or interruptions. However, annual multi-trip policies can be purchased at any time, with coverage beginning from the policy's start date.

What are the best travel insurance plans in 2024?

Please note that the specific coverage, terms, and pricing may vary based on individual circumstances and plan options. It's essential to review the policies in detail and obtain personalized quotes to make an informed decision for your needs. You can do that using our comparator below. Compare multiple plans and get free quotes in no time right here.

Other popular companies include the following :

You can find more on these options by clicking on them:

- AMA travel insurance

- CIBC travel insurance

- Costco travel insurance Canada

- BMO travel insurance (also includes BMO World Elite Mastercard travel insurance)

- Medipac travel insurance

- Medoc travel insurance

- World nomads travel insurance

- Scotiabank travel insurance

What are the FAQs on travel insurance Canada plans?

How does credit card travel insurance work.

Travel coverage is a benefit on many credit cards. It is worth checking what your card includes before purchasing a separate policy. You may already have sufficient coverage.

Credit cards with travel insurance usually only cover expenses purchased on that card. Buy your plane tickets on one card, but the hotel on another? The first company will not reimburse you for a hotel issue. Additionally, terms and exclusions may be more restrictive than a standalone plane. Credit card travel insurance is a wonderful benefit, but weigh whether its coverage is sufficient for you and your trip.

The best travel insurance credit cards have offerings like this:

Does travel insurance cover COVID-19?

Many plans now specifically cover COVID-19 cancellation and medical expenses or offer stand-alone COVID travel insurance. They may reimburse costs incurred from a mandatory quarantine, COVID-19 medical expenses, and trip interruption and cancellation . Some specific COVID plans only cover COVID-19 expenses and do not automatically include coverage for other medical needs.

It is worth verifying details carefully before deciding on a Covid-19 travel insurance policy. Covid-19 coverage and news change frequently, so check with your service providers for the latest information.

There are a few important points to consider:

- Coverage may be explicitly excluded in your policy if the destination countries or regions are under an “avoid non-essential travel” or “avoid all travel” advisory at the time of purchase.

- Your Covid-19 vaccination status may affect your coverage. If you are unvaccinated by choice, your insurer may declare your claims ineligible.

Do I need private health care coverage when traveling outside Canada?

Yes, we always recommend travel medical insurance when traveling abroad. Healthcare prices and standards can be very different while traveling. Some public provincial plans offer some coverage, but it may be insufficient. Your provincial plan covers may only pay what the cost would be back at home, not the actual price at your destination. Even then, you likely have to pay out-of-pocket and request reimbursement later.

In some countries, healthcare facilities may request treatment upfront. They may refuse treatment if you are unable to pay. This alone makes emergency medical insurance extremely valuable.

Do I need travel insurance to USA from Canada?

Getting a private travel protection plan is highly recommended when traveling from Canada to the USA, as it provides essential medical coverage. Medical expenses in the USA can be exorbitant, and without insurance, a simple hospital visit can lead to substantial bills, potentially running into thousands of dollars.

For example, a basic emergency room visit for minor treatment might cost around $1,000 to $2,000 , while more serious medical procedures or surgeries can lead to bills that range from $10,000 to tens of thousands of dollars, or even more for complex surgeries or prolonged hospital stays.

Do I need travel insurance within Canada?

We recommend getting medical travel insurance Canada plans while traveling within the country. Specific plans are available for domestic travelers. While Canadian citizens and residents are guaranteed basic emergency care by the Canada Health Act, this does not include prescription drugs and ambulance services. Your OHIP coverage from Ontario will not cover you for a private hospital, laboratory, or paramedic services while visiting British Columbia.

Additionally, payment for medical services may be required upfront, leaving you responsible for seeking reimbursement from your home province upon your return. Canadian residents traveling within Canada may qualify for a discount on their medical travel insurance.

When traveling outside of your province or territory without adequate coverage, you assume risk. Note that you may already have sufficient coverage if you have a supplemental individual or group private health insurance policy.

Want to protect yourself while traveling in Canada? Compare the best travel insurance medical plans anonymously today using our comparator at the top of this page.

What does travel insurance for snowbirds cover?

Travel medical insurance for snowbirds commonly covers the following medical expenses:

- Medical treatments

- Prescription medications

- Paramedics and ambulance rides

- Repatriation to Canada

- Emergency dental care

Snowbird insurance policies do not usually cover elective treatments. Those should wait until you have returned to Canada.

But who are Snowbirds? Snowbirds are people who travel to warmer climates during the cold Canadian winter. They are usually retirees. Therefore, getting adequate protection for their travels is particularly important for these groups. Many of them go to warm parts of the United States, the country with the world’s highest medical care costs.

Snowbirds may be more at risk for a medical emergency while away due to the length of their trips and underlying health conditions.

To learn more, see our guide to snowbird travel insurance.

How do I buy travel insurance online?

The easiest way to purchase a travel plan is by using an online comparison tool like ours. See rates and coverage options quickly without giving up personal data. Alternatively, you may purchase it through an agent, a broker, your private individual or group health insurer, or a travel credit card.

How much travel insurance do I need?

The amount of coverage you need depends on various factors, including the destination, duration, and activities of your trip. As a general guideline, consider coverage for emergency medical expenses, trip cancellations, and lost baggage.

Aim for a coverage amount that provides financial protection for potential unexpected costs while keeping your budget and specific travel plans in mind. It's essential to balance adequate protection with affordability.

What is the best travel insurance for cancer patients?

The best protection plan for cancer patients depends on individual circumstances, including the stage of cancer and current health. It's advisable to look for insurance providers that specialize in covering pre-existing medical conditions, offer comprehensive coverage, and have experience handling cancer-related claims.

Companies like Allianz and IMG Global among others often provide options for travelers with pre-existing conditions, including cancer*. However, it's essential for cancer patients to compare policies, disclose their medical history accurately, and consider consulting their healthcare providers when selecting the most suitable coverage.

Does travel insurance cover cruises?

Yes, travel coverage plans frequently cover cruises. When shopping for a plan, be sure to verify that yours offers cruise coverage. To give an example, RBC offers two popular examples, their Deluxe and TravelCare (for seniors) packages.

They cover:

- Cruise cancellation or interruption due to mechanical failure or weather

- Catch-up costs for a missed departure due to a canceled flight

- Unused shore excursion tickets (due to illness or injury)

- Last-minute cancellations due to a covered reason

- Lost luggage, passports, and medications

- Eligible emergency medical expenses

- 24-hour worldwide emergency medical and travel assistance

- Repatriation costs

See our guides on travel insurance in Canada:

- Is soNomad insurance best for you? Review 2024

- Is Red Cross Travel Insurance Good in 2024?

- Best Travel Insurance South Africa Plans 2024

- Expat Travel Insurance: A Complete Guide (2024)

- What is the best Travel Insurance Hong Kong for 2024?

- What is Canada's best travel health insurance (2024)?

- What are the Best Travel Insurance BC Plans in 2024?

- Best Travel Insurance Dubai Plans for Canadians (2024)

- What is the best group travel insurance in 2024?

- Best Travel Insurance for Backpackers 2024

- Travel Insurance UK: Complete Guide (2024)

- Annual Travel Insurance Canada: Full Guide 2024

- Travel Insurance for Schengen Visa: 2024 Guide

- How does Multi Trip Travel Insurance work? Full guide 2024

- How does student travel insurance work? A full guide 2024

- Is CoverMe Travel Insurance worth it? Review 2024

- Is Air Canada travel insurance worth it? 2024 Review

- Is Cooperators Travel Insurance worth it? Review 2024

- How to get the best European travel insurance in 2024?

- Is Sun Life Travel Insurance the best in 2024? Review

- Is Canada Life Travel Insurance worth it? Review 2024

- How to get travel insurance for visitors to Canada in 2024?

- Is TuGo Travel Insurance right for you? Review 2024

- Is World Nomads travel insurance the best in 2024?

- Is Green Shield travel insurance the best in 2024?

- Is RIMI travel insurance the best in 2024?

- Is MEDOC Travel Insurance the best in 2024?

- Is Travel Guardian insurance the best in 2024?

- Is Costco Travel Insurance worth it? Review 2024

- Is WestJet Travel Insurance the Best in 2024?

- How to get the best travel Insurance for seniors in 2024?

- Is Blue Cross Travel Insurance in Canada worth it? 2024 Review

- How does trip cancellation insurance work in Canada in 2024?

- Should you buy travel insurance to the USA?

- Is RBC travel insurance the best in 2024?

- Is AIG Travel Insurance Canada Good? Review 2024

- [Map] In which countries of the world is it common to tip and how much?

- Is PC Financial travel Insurance good? Review 2024

- Which is the best Credit Card with Travel Insurance in 2024?

- Is TD travel insurance the best in ?

- Is CIBC travel insurance the best in ?

- Is BMO travel insurance the best in ?

- Is Scotiabank travel insurance the best in ?

- Is Medipac travel insurance the best in ?

- Is Johnson travel insurance the best in ?

- Is Goose travel insurance the best in ?

- Is GMS travel insurance the best in ?

- Is CARP travel insurance the best in ?

- Is BCAA travel insurance the best in ?

- Is 21st Century travel insurance the best in ?

- Is Desjardins travel insurance the best in 2024?

- Is AMA travel insurance worth it in 2024?

- Is Allianz travel insurance the best in 2024?

- Is Manulife travel insurance the best in 2024?

- Is CAA the best travel insurance in Canada in 2024?

- [Survey] Only 25% of Canadians plan to go on holiday this summer

- [Survey] Only 29% of Ontarians plan to go on holiday this summer

- What is the best Covid travel insurance in Canada for 2024?

- [Travel] Covid travel insurance still mandatory in 41 countries across the world this summer

- What's the best Super Visa insurance in Canada for 2024?

- [Survey] The pandemic has reduced the desire to travel for over 51% of Canadians

- Best travel insurance for snowbirds in 2024

- [Map] How is the vaccination passport applied worldwide?

- [Tourism] Another $ 52 billion loss for the industry across Canada in 2021 compared to 2019