Capital One Aspire Travel World Elite MasterCard Review

The Capital One Aspire Travel World Elite MasterCard offers arguably the best value for everyday travellers. The flagship credit card from Capital One has been one of the top travel rewards cards in Canada for many years, and a recent facelift made it even better.

I’ve been using the Aspire Travel World Elite MasterCard for several years now and this latest update – which removed the tiered redemption structure and made it incredibly simple to redeem miles – further cemented its claim as the go-to rewards credit card for all of my spending, including when I travel.

Capital One Aspire Travel World Elite MasterCard

What’s so special about the Capital One Aspire Travel World Elite MasterCard? For starters, new sign-up’s get a 40,000 reward mile bonus when they spend $1,000 in the first 3 months. That’s worth $400 in travel rewards! Cardholders also get 2 reward miles for every $1 spent – regardless of spending category. That means your points will continue to add up quickly even after the early-spend bonus becomes a distant memory.

What about redeeming your reward miles? Most travel rewards programs are inflexible when it comes to redemptions; forcing members to book through a specific travel provider, putting up restrictions on when and where you can book, and then adding fuel surcharges and taxes onto your bill.

With Capital One’s Aspire Travel program you can use your card to book with any airline or hotel and then simply redeem your miles online afterwards. There are no tiers – for example if you redeem a charge for $149 it will cost you 14,900, and if you redeem a charge for $550 it will cost you 55,000.

Don’t have enough reward miles to erase that $550 travel charge? No problem! Just make a partial redemption against that charge with the miles that you have. In this case, you might only have 39,500 miles, which means you can make a partial redemption of $395 and apply against the $550 charge.

That’s why I’ve declared the Capital One Aspire Travel World Elite MasterCard to be the best value for everyday travellers today and why I now funnel all of my spending onto this card to reap the juicy rewards.

Capital One Aspire Travel World Elite MasterCard benefits

Here’s what this best in class travel rewards credit card has to offer:

• Early-spend bonus: 40,000 points = $400 in travel rewards once you spend $1,000 within the first 3 months • Earn rate: 2 reward miles for every $1 spent = 2% back in travel rewards • Booking travel: Book your own trip – including the hotel, airline or rental car of your choice • Points redemption: Redeem your miles to cover any travel expenses with no minimum requirements. 100 points = $1 in travel. • Partial redemption: Redeem on a portion of a transaction – for example, redeem half of an overseas flight. • Annual fee: $150

Apply for this card here and earn $400 in bonus travel rewards

• Interest rate: 19.8% interest on card purchases • Additional card fee: $0 additional card fee • Insurance: 22-day travel emergency medical coverage, trip cancellation, trip Interruption, flight delay, baggage loss, baggage delay, purchase assurance, extended warranty, and car rental • Eligibility: $70,000 personal annual income OR $120,000 annual household income

How much can you earn with the Capital One Aspire Travel World Elite MasterCard?

• Spend $2,000 on your card each month • Earn $480 in travel rewards each year • Add $400 travel rewards early-spend bonus in the first year • = $880 travel rewards this year

Final thoughts

Many of the top travel rewards credit cards offer a generous sign-up bonus but the everyday value of the program, combined with the hassle and difficulty of redeeming points, fails to live up to the early hype.

With the Capital One Aspire Travel World Elite MasterCard, you get the best of both worlds. A generous early-spend bonus, plus a healthy 2% earn rate on everyday spending that keeps points accruing quickly. The best part is how easy it is to redeem points. After all, there’s not much point to earning reward miles if you can’t use them when, where, and how you want to.

Does Capital Qne still give an annual 80000 point bonus, some what offsetting the $150 annual fee????

Hi james, Cap1 has never given an 80,000 point bonus. The old Cap1 Aspire Travel World MasterCard gave 10,000 miles each year on your card anniversary, and that bonus was grandfathered to the new card for existing cardholders.

The new Aspire Travel World Elite MasterCard does NOT come with an annual bonus – just the early spend bonus.

Join 3,500 Canadian Subscribers!

Sign up today to learn all about the best cash back and travel rewards credit cards, plus how to maximize your rewards and loyalty programs.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Benefits Come With a World Elite Mastercard?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

"World Elite" is the highest of the three levels of Mastercard benefits . It includes all the benefits of the lower two tiers — "Standard" and "World" — plus a few of its own, including concierge service and benefits at specific merchants.

The benefits listed here are offered by Mastercard, but individual card issuers have some discretion in which benefits are actually included on a specific card. Plus, issuers often offer benefits beyond those provided by Mastercard. The Mastercard benefits website warns: "Additional terms, conditions and exclusions apply. Contact your issuing financial institution for complete coverage terms and conditions."

Standard benefits included in World Elite

These benefits are included on all Mastercard credit cards, at all levels:

Zero fraud liability.

Mastercard Global Service, a worldwide hotline for emergency assistance.

Identity theft protection, which monitors your credit for suspicious activity.

World benefits included in World Elite

The biggest jump in value occurs when you move from the Standard level to World level. These benefits are included on middle-tier World Mastercard cards, and they roll up to the World Elite level:

Cell phone insurance. (World Elite cardholders get a bigger claim limit than World cardholders. See below.)

"Mastercard Travel & Lifestyle Services," a suite of benefits that includes trip planning assistance, a lowest hotel rate guarantee, a hotel satisfaction guarantee, luxury hotel benefits and an airport concierge service.

Discounts and memberships, including for Shoprunner, Onefinestay and "exclusive golf offers and experiences."

World Elite-only benefits

Cell phone insurance. Pay your monthly cell bill with your card and get coverage against damage or theft for up to $800 per claim (maximum $1,000 per year). There's a $50 deductible. (At the World level, the per-claim limit is $600.)

Concierge service. Help with getting tickets, making dinner reservations and other tasks is available by phone. This benefit used to be offered at the World level but has been kicked up to World Elite.

Fandango. Get $5 off future movie tickets or at-home purchases for every two movie tickets you buy.

Lyft. Earn a $10 Lyft credit when you take at least five Lyft rides in a calendar month and pay with your card. The credit expires after 30 days and is good only for future rides. (It's not a credit for past rides.)

Boxed. Earn 5% "cash rewards" on purchases from this online wholesale club. Rewards apply only to the price of goods, not taxes, fees, shipping and handling. Rewards can be used for future Boxed purchases.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Capital One ® Aspire Travel™ Platinum Mastercard ® Review

- Rates & Fees

1x Earn 1 Reward Mile for every $1 spent.

$0 Annual Fee Add an authorized user for $0.

21.90% Purchase APR

21.90% Cash Advance APR

21.90% Balance Transfer Rate

Fair Recommended Credit Score

By Money.ca

Play article

( mins)

( )

Capital One ® Aspire Travel™ Platinum Mastercard ® rewards Structure

Rewards miles come at a steady and unrestricted rate of 1 for every $1 spent. With no ambiguous purchase eligibility, cardholders can be confident that they’re earning rewards miles every time they use their card. The miles themselves are some of the most flexible travel rewards we’ve seen, and can be used retroactively to cover travel-related purchases that show up on a monthly statement. Travel can therefore be booked everywhere, and cardholders won’t be limited by in-house booking sites, seating restrictions, or blackout dates.

Miles can also be redeemed in other ways, like gift cards and cash back against the card’s statement. For more information on the nuances of Capital One miles, check out our Loyalty Rewards Bible .

Pros and cons

Earn 1 mile per $1 with no purchase ambiguity

Flexible miles for retroactive travel purchases

- $0 annual fee

Price protection for marked-down items

Basic travel insurance coverage

Redeem miles for gift cards and cash back

Basic travel insurance compared to some competitors

$100/item limit on price protection

Limited features for high-end travel benefits

No specific travel perks or elite status

May not suit high-spenders seeking premium rewards

Feature breakdown

- Earn 1 mile for every $1 spent on purchases

- Book your own travel, pay with rewards miles

- Price protection services

- Solid array of insurance benefits

The peripheral benefits of the Aspire Travel Platinum card include Price Protection and insurance perks, both of which help cardholders save money. Price Protection is rather unusual among travel credit cards, and it allows cardholders to get reimbursed if they discover that something they purchased is later marked down. With Capital One ® cards there’s a $100 limit per item and collective $500 limit per year, and cardholders can only use the feature on items that were marked down within 60 days of their initial purchase. For example, if a cardholder were to buy a $500 item and then find the same item listed for $400 a month later, they could claim the difference (and still have $400 left to claim against other purchases for the remainder of the year).

The Aspire Travel card comes with basic travel insurance as well, though the key word here is ‘basic’: it’s missing some of the more valuable travel coverage that is provided by some competing travel cards. Capital One ® provides coverage for common carrier travel accidents, car rental collisions and damage, baggage delay, and travel assistance. While it’s logical that a no-fee card would only have the most basic insurance options , some other no-fee travel cards have managed to raise the bar a bit. The Rogers World Elite Mastercard, for instance, offers a different travel insurance package that some travellers might prefer, including out-of-province/out-of-country medical coverage.

Who’s the card for?

Travellers who want the simplicity of earning a flat rate of travel rewards on all their purchases, want to book their arrangements wherever they like, and dislike annual fees are well-suited to the Capital One ® Aspire Travel™ Platinum Mastercard ® . Those who appreciate flexibility will also enjoy the opportunity to spend their miles on cash back and gift cards as well.

Read: Best Capital One credit cards in Canada

The Money.ca Editorial Team is a group of passionate financial experts, seasoned journalists, and content creators who are deeply committed to providing unbiased, relevant, and accurate financial information. With years of combined industry experience, our team is dedicated to maintaining the highest journalistic standards and delivering informative and engaging content. From personal finance and investing to retirement planning and business finance, we cover a broad range of topics to suit the financial needs of our diverse readership. You can trust the Money.ca Editorial Team to empower you with the knowledge and tools necessary to make wise financial decisions.

Latest Articles

Environment commissioner says liability for northern contaminated sites growing, canadian cannabis stocks spike as u.s. reportedly set to reclassify marijuana, td takes us$450m provision related to u.s. inquiry over anti-money laundering program, trans mountain pipeline expansion gets green light to open for may 1, what to know about instalment plans, most actively traded companies on the toronto stock exchange.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Foreign transaction fees: What you need to know

August 10, 2023 | 8 min read

Getting ready to travel abroad? There’s a lot to take care of before you leave. Plane tickets? Already bought. Travel insurance ? Got it. Planning for foreign transaction and currency conversion fees on your trip? Wait, what?

It’s true. With some credit cards, debit cards and even prepaid cards , fees may be added when you make transactions abroad or online with foreign merchants. Keep reading to learn about foreign transaction and currency conversion fees—and how you might be able to avoid them.

Key takeaways

- A foreign transaction fee is a surcharge on credit card purchases made outside of the U.S. They might also apply to purchases made with debit and prepaid cards.

- Fees can vary, depending on the card issuer, card network and product but typically range from 1% to 3% of the transaction.

- Some credit card issuers offer cards that don’t charge any foreign transaction fees.

- Card payment processors or ATM networks can charge fees for converting foreign purchases into U.S. dollars. These currency conversion fees are different from foreign transaction fees.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is a foreign transaction fee?

A foreign transaction fee is an additional charge added to credit, debit and prepaid card transactions made outside of the U.S. If you plan to use a credit, debit or prepaid card while shopping abroad , it’s helpful to know if your card charges foreign transaction fees.

Say you buy a new camera while out shopping in Tokyo. If you pay with a credit, debit or prepaid card, it might cost more than what the price tag says.

When you use your card in a foreign country, you may have to pay a foreign transaction fee for any of your transactions there. If your card charges one, it can also be tacked on to your online transactions with merchants based outside of the U.S.

The fee can be made up of smaller charges by the card network —like American Express®, Discover®, Visa® or Mastercard®—as well as the bank or credit card issuer.

Some cards—like Capital One’s U.S.-issued credit cards and debit cards —don’t charge foreign transaction fees. View important rates and disclosures . But if your card does, the actual cost can vary depending on which credit, debit or prepaid card you use. The fees may generally be in the area of 1% to 3% of your purchase, though. You should check your card’s terms and conditions to see what they are.

How much do foreign transaction fees cost?

The cost of foreign transaction fees—sometimes listed as foreign purchase transaction fees or international transaction fees—can vary from one card to another.

Foreign transaction fees typically range from 1% to 3% of each transaction. So if someone has a card with a 3% foreign transaction fee, they could pay an additional $3 for every $100 they spend. If a traveler uses their card to make a large international purchase—or several smaller purchases—these fees could add up quickly.

If you use a credit, debit or prepaid card to shop outside of the U.S., understanding your card’s foreign transaction fees could help you estimate some of your travel costs . You can review the terms and conditions to learn how foreign transaction fees apply to your card.

Currency conversion fees vs. foreign transaction fees

Currency conversion fees can be included in foreign transaction fees, but there’s a slight technical difference. With foreign transaction fees, the card issuer charges a fee for purchases made abroad or online from foreign merchants. A currency conversion fee, meanwhile, is charged by the credit card or debit card payment network or ATM network for converting one currency to another.

Capital One doesn’t charge a currency conversion fee, but other issuers might. View important rates and disclosures . If you’re charged a currency conversion fee, you might find that it’s 1% of the purchase with both fees combined and referred to as the foreign transaction fee.

Dynamic currency conversion fee example

Remember that great new camera you bought in Tokyo? If it costs 345,199 yen, how much is that in U.S. dollars? Not many people can do that math in real time.

That’s why foreign merchants sometimes offer to perform a dynamic currency conversion (DCC). This optional service converts the foreign price to your home currency, giving you a better idea of what cost to expect.

But merchants don’t usually provide this service for free. A DCC could cost you more, but the good news is you’re not required to use and pay for it. It’s helpful to talk to your card issuer and research your intended travel destinations before visiting.

If I pay a DCC fee, will I still pay a foreign transaction fee?

If you request a DCC, you’ll likely be paying that fee on top of your foreign transaction fee—if your card has one.

DCC fees can cause your travel or online shopping expenses to increase. However, merchants typically aren’t allowed to perform a DCC without cardholder consent, so you can decide whether you’d like to pay for it.

Additionally, you may want to look for other ways to determine the price in your home currency, like currency conversion apps you can download onto your phone.

Do all credit cards have foreign transaction fees?

Not all card issuers charge foreign transaction fees. Capital One’s U.S.-issued credit cards, for example, don’t charge fees for foreign currency transactions. View important rates and disclosures .

That being said, foreign transaction fees can vary by card issuer and product. Other types of cards—like debit cards or prepaid travel cards—could also charge these fees. That’s why it’s a good idea to review your card’s specific terms and conditions.

How can I avoid paying foreign transaction fees?

Don’t let foreign transaction fees rain on your travel parade. There are several options to explore when it comes to avoiding these types of fees.

Use travel credit cards

Some travel rewards credit cards are designed with international travel in mind. They may have additional benefits too, like rewards miles. For example, Capital One’s travel and miles rewards credit cards allow you to earn unlimited miles per dollar on every purchase you make and even more rewards for travel-related bookings.

While some travel rewards credit cards charge an annual fee , the perks can make it worthwhile. For instance, the Capital One Venture X card has an annual fee, but it doesn’t charge foreign transaction fees. View important rates and disclosures . And it also offers an early spend bonus, an anniversary bonus, an annual travel credit and more.

If you decide to apply for a new card for international travel , make sure you leave enough time for the card to arrive .

Consider a debit card without foreign transaction fees

Using your debit card to withdraw cash while abroad could be a way to avoid foreign transaction fees if your card doesn’t charge them.

But you might be charged international ATM fees with some types of bank accounts. For example, Capital One doesn’t charge any additional international ATM withdrawal fees when you use 360 Checking and MONEY products abroad. But you could be charged a fee by the ATM operator. And there may be fees for non-360 products —like Total Control Checking, Essential Checking and other products—when you use an ATM outside of the U.S. and its territories.

According to the Consumer Financial Protection Bureau, some banks don’t charge their customers ATM withdrawal fees or debit card foreign transaction fees. But they might charge you if you’re not a customer—and that could be in addition to a fee charged by the ATM operator.

Before you leave the country, you might want to check whether your current card charges these fees. If so, you may want to find out if there’s a branch location or partner bank where you’re headed. You might be able to make free cash withdrawals from those locations.

Pay in the local currency

Wondering about whether to use cash or a card when traveling ? Having local currency on hand can be a convenient way to avoid foreign transaction fees if you don’t mind carrying cash. But remember, there could be other fees for using a foreign ATM. Currency exchange kiosks may be available at the airport but might charge higher conversion rates than your bank or credit card.

So consider researching the exchange rate and exchanging currencies before you start traveling, especially if you’re unfamiliar with the country you’re traveling to.

How to calculate a foreign transaction fee

Generally, the foreign transaction fee is a percentage of the total purchase. So, you’ll need to find out the percentage a card charges and multiply that by your total purchase. For example, if you purchase a $100 item and the foreign transaction fee is 3%, you will pay an additional $3 on top of the cost of your item.

Foreign transaction fees in a nutshell

Foreign transaction fees don’t have to put a dent in your travel plans . These fees can add up quickly, but there are some steps you could take to possibly avoid them. Using local currency is one option. You could also consider applying for a credit card—or using a debit or prepaid card—that doesn’t charge fees for foreign transactions.

If you’re a frequent traveler, you might consider Capital One’s Venture X card. It has no foreign transaction fees and comes with plenty of other elevated travel rewards designed to take you further. View important rates and disclosures .

Other ways to maximize your travel benefits

Who wouldn’t want to get the most out of their credit card? Here are some things to know about Capital One travel rewards credit cards:

Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. ( View important rates and disclosures .)

Earn unlimited 2X miles per dollar on every purchase, every day and get 75,000 bonus miles upon signup with the Capital One Venture card . ( View important rates and disclosures .)

Earn unlimited 1.25X miles with no annual fee with the Venture One card from Capital One . ( View important rates and disclosures .)

Explore travel rewards card options by comparing Capital One Venture cards .

Learn how Venture X cardholders can get access to a worldwide network of airport lounges thanks to a complimentary Priority Pass membership .

Related Content

7 tips for using a credit card internationally.

article | April 23, 2024 | 8 min read

Cash or card: What’s best to use when traveling?

article | February 22, 2022 | 5 min read

How do travel credit cards work?

article | February 8, 2024 | 7 min read

- In the Media

Capital One Aspire Travel World Elite MASTERCARD Consumer Reviews

- Last 3 months

- Last 6 months

- Last 24 months

Top positive trending topics ?

Top negative trending topics , looking for the best credit card.

Earn 10% cash back on all purchases for the first 3 months ( up to $2,000 in total purchases ). Plus, no annual fee in the first year , including on supplementary cards. A welcome offer value of $350 .

Get this credit card

Are you interested in?

- Home Insurance

- Car Insurance

- Life Insurance

- Business Insurance

It is quite easy to accumulate travel points

1 of 1 people found this review helpful. Did you?

All the experiences I have had with Capital one customer service have been top notch. The card gives good value for the cost and has an easy redemption policy.

Secure and Certified

Your information privacy and security is very important to us. We use the same 256-bit encryption and data security levels as all major banks. Our practices are monitored and verified by VeriSign and Digicert.

Independent

InsurEye is not owned by any bank, insurance company, insurance brokerage or any other financial services institution. We collect, validate, and analyze insurance experiences of real consumers.

We aspire to equip you with insights, data and knowledge to help in making informed decisions around personal finance, insurance quotes, and other important matters. We are always open for your comments.

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow-City: 7 surprising facts about the Russian capital’s business center

1. Guinness World Record in highlining

The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the ‘Moscow-City Day’ is celebrated. The cord was stretched at the height of 350 m between the ‘OKO’ (“Eye”) and ‘Neva Towers’ skyscrapers. The distance between them is 245 m. The first of the athletes to cross was Friede Kuhne from Germany. The athletes didn't just walk, but also performed some daredevil tricks. Their record is 103 meters higher than the previous one set in Mexico City in December 2016.

2. Domination of Europe's top-10 highest skyscrapers

7 out of 10 Europe’s highest skyscrapers are located in Moscow-City. Earlier, the ‘Federation Tower’ complex’s ‘Vostok’ (“East”) skyscraper was the considered the tallest in Europe.

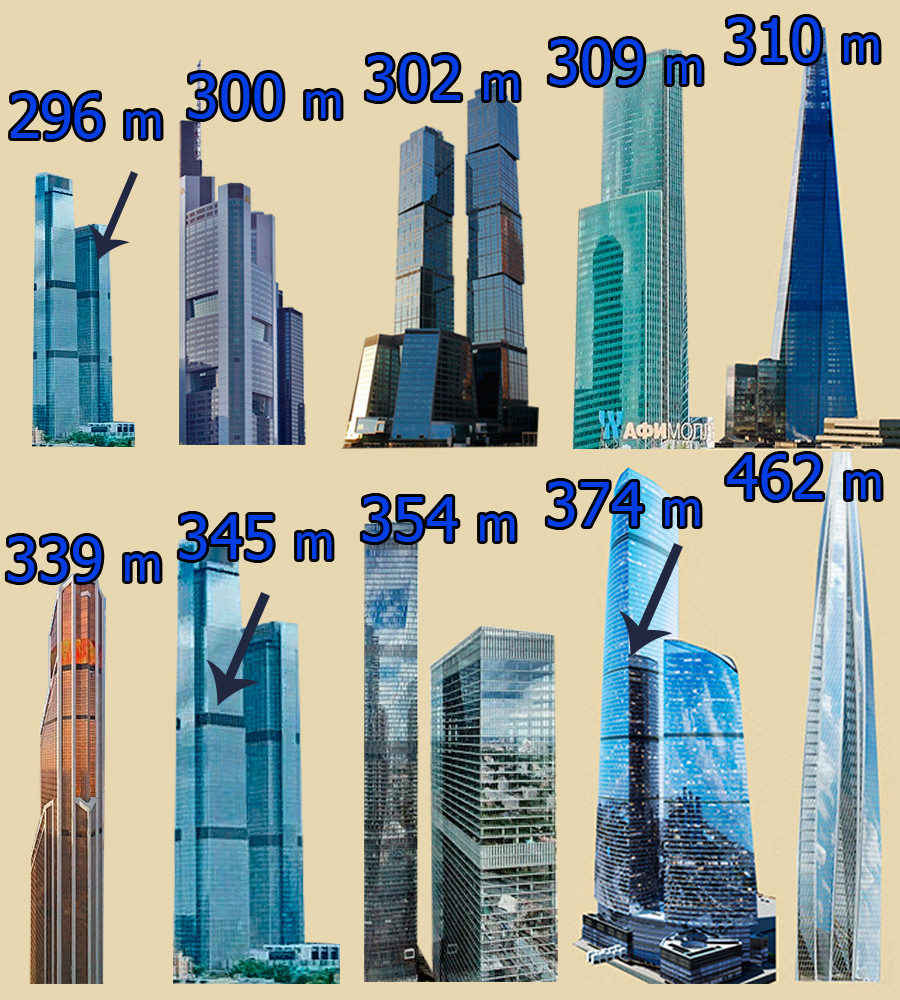

Left to right: the lower of the ‘Neva Towers’ (296 m), Commerzbank Tower in Frankfurt (300 m), Gorod Stolits (“City of Capitals”) Moscow tower (302 m), Eurasia tower (309 m), The Shard’ skyscraper in London (310 m), Mercury City Tower (339 m), Neva Towers (345 m).

However, in 2018, the construction of the 462 meter tall ‘Lakhta Center’ in Saint-Petersburg was completed, pushing ‘Vostok’ (374 m) into 2nd place. The 3rd place is taken by OKO’s southern tower (354 m).

3. The unrealized ‘Rossiya’ tower

If all the building plans of Moscow-City were realized, the ‘Lakhta Center’ in St. Petersburg wouldn't have a chance to be Europe's highest skyscraper. Boris Tkhor, the architect who designed the concept of Moscow-City, had planned for the ‘Rossiya’ tower to be the tallest. In his project, it was a 600 meter tall golden cylindrical skyscraper ending with a spire that was inspired by traditional Russian bell towers. Then, the project was reinvented by famous British architect Sir Norman Foster. He had designed ‘Rossiya’ as a pyramid ending with a spire. The skyscraper itself would have been 612 meters tall, and the height including the spire would have reached 744,5 meters (for comparison, the ‘Burj Khalifa’ in Dubai, UAE, would have been just 83,5 meters taller). Unfortunately, the investors faced a lot of economic problems, due to the 2008 financial crisis, so the ‘Rossiya’ skyscraper was never built. A shopping mall and the ‘Neva Towers’ complex was constructed at its place in 2019.

4. Changed appearance of ‘Federation Tower’

In its first project, the ‘Federation Tower’ was designed to resemble a ship with a mast and two sails. The mast was to be represented by a tall glass spire with passages between the towers. It was planned to make a high-speed lift in it. The top of the spire was going to be turned into an observation deck. But the ship lost its mast in the middle of its construction. Experts at the Moscow-city Museum based in the ‘Imperia’ (“Empire”) tower say, that the construction of the spire was stopped, firstly, due to fire safety reasons and secondly, because it posed a threat to helicopter flights – the flickering glass of the spire could potentially blind the pilots. So, the half-built construction was disassembled. However, an observation deck was opened in the ‘Vostok’ tower.

5. Open windows of ‘Federation Tower’

We all know that the windows of the upper floors in different buildings don’t usually open. Experts say that it’s not actually for people’s safety. Falling from a big height is likely to be fatal in any building. The actual reason is the ventilation system. In a skyscraper, it’s managed with a mechanical system, and the building has its own climate. But in the ‘Zapad’ (“West”) tower of the ‘Federation Tower’ complex, the windows can open. The 62nd and last floor of the tower are taken up by a restaurant called ‘Sixty’. There, the windows are equipped with a special hydraulic system. They open for a short period of time accompanied by classical music, so the guests can take breathtaking photos of Moscow.

6. Broken glass units of ‘Federation Tower’

The guests of the ‘Sixty’ restaurant at the top of the ‘Zapad’ tower can be surprised to see cracked glass window panes. It is particularly strange, if we take into consideration the special type of this glass. It is extremely solid and can’t be broken once installed. For example, during experiments people threw all sorts of heavy items at the windows, but the glass wouldn’t break. The broken glass units of ‘Zapad’ were already damaged during shipment . As each of them is curved in its own way to make the tower’s curvature smooth, making a new set of window panes and bringing them to Russia was deemed too expensive . Moreover, the investors had financial problems (again, due to the 2008 financial crisis), so the ‘Vostok’ tower even stood unfinished for several years. Eventually, the cracked window panes were installed in their place.

7. The highest restaurant in Europe

‘Birds’, another restaurant in Moscow-City, is remarkable for its location. It was opened at the end of 2019 on the 84th floor of the ‘OKO’ complex’s southern tower. Guests at the restaurant can enjoy an amazing panoramic view at a height of 336 meters. On January 28, the experts of ‘Kniga Recordov Rossii’ (“Russian Records Book”) declared ‘Birds’ the highest restaurant in Europe, a step toward an application for a Guinness World Record.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- The evolution of Russia's No. 1 news program - from the USSR to now

- The Khodynka tragedy: A coronation ruined by a stampede

- ‘Moskvitch’: the triumph and sad end of a famous Moscow car plant (PHOTOS)

This website uses cookies. Click here to find out more.

2018 Primetime Emmy & James Beard Award Winner

R&K Insider

Join our newsletter to get exclusives on where our correspondents travel, what they eat, where they stay. Free to sign up.

A History of Moscow in 13 Dishes

Featured city guides.

Journey to Moscow

Welcome to Moscow - the capital of Russia, its political, scientific, historical, architectural and business centre, from which power and might of the Russian state developed.

IMAGES

VIDEO

COMMENTS

Capital One® World Elite Mastercard® Guide to Benefits Important information. Please read and save. This Guide to Benefits contains detailed information about insurance and retail protection services you can access as a preferred cardholder. This Guide supersedes any guide or program description you may have received earlier.

To file a claim or for more information on any of these services, call the Mastercard Assistance Center at 1-877-288-6784, or en Español: 1-800-633-4466. "Card" refers to World Elite Mastercard card and "Cardholder"refers to a World Elite Mastercard ® cardholder. To file a claim, call 1-877-288-6784, or en Español: 1-800-633-4466.

Capital One Aspire Travel World Elite MasterCard benefits. Here's what this best in class travel rewards credit card has to offer: • Early-spend bonus: 40,000 points = $400 in travel rewards once you spend $1,000 within the first 3 months. • Earn rate: 2 reward miles for every $1 spent = 2% back in travel rewards.

Simply call Capital One Travel at 844-422-6922 to submit a price match claim with the customer support team. If the agent can verify the lower price while on the phone with you, you'll get a travel credit for the price difference. If the Capital One Travel support team can't verify the lower price during the call, they'll review your ...

World Elite Mastercard Digital Merchant Offers 4-5 Concierge Services 5. Mastercard ID Theft Protection™ 5-6 Travel Assistance Services 6-7. MasterRental Coverage 7-8 Common Carrier Trip Cancellation and Trip Interruption 8-9. Lost or Damaged Luggage 9-10 Lounge Key Airport Lounge Access 10.

Mastercard Travel & Lifestyle Services As a World Mastercard® cardholder, you have access to Mastercard® Travel & Lifestyle Services, a suite of benefits, amenities and upgrades, preferential treatment and premium travel offers from best-in-class travel companies across hotels, air travel, tours, cruises, car rentals and more*. Get the most ...

World Elite-only benefits. Cell phone insurance. Pay your monthly cell bill with your card and get coverage against damage or theft for up to $800 per claim (maximum $1,000 per year). There's a ...

One-time bonus of 40,000 miles - equal to $400 in travel - once you spend $1,000 on purchases within the first 3 months. No limit to the amount of miles you can earn. Please note: You must meet the minimum requirement of either a personal income of $70,000 or a household income of $120,000. Book your own trip - including the hotel ...

It was discontinued a few years ago, but the Capital One Aspire World Elite Mastercard was a popular travel rewards credit card. Earning 2% in travel rewards, an anniversary bonus of $100 in travel every year you had the card, and top travel insurance, it's not hard to see why.

There are several Capital One travel cards that offer the opportunity to earn bonus miles*: Capital One VentureOne Rewards: Earn 20,000 in bonus miles once you spend $500 in the first 3 months.; Capital One Venture Rewards: Earn 75,000 bonus miles once you spend $4,000 in the first 3 months.; Capital One Venture X Rewards: Earn 75,000 bonus miles once you spend $4,000 in the first 3 months.

Capital One ® Aspire Travel™ Platinum Mastercard ® rewards Structure. Rewards miles come at a steady and unrestricted rate of 1 for every $1 spent. With no ambiguous purchase eligibility ...

Want travel rewards with no annual fee? No problem. - Capital One Canada

The cost of foreign transaction fees—sometimes listed as foreign purchase transaction fees or international transaction fees—can vary from one card to another. Foreign transaction fees typically range from 1% to 3% of each transaction. So if someone has a card with a 3% foreign transaction fee, they could pay an additional $3 for every $100 ...

10% cash back up to $2,000 in total purchases no annual fee in the first year value of $350. Get this credit card. N/A. by Trudy M. on Feb 11, 2017. 3.5 out of 5 stars. It is quite easy to accumulate travel points. 1 of 1 people found this review helpful.

Earning elite status with airlines American, Delta and United is much easier with cobranded travel credit cards that can get you most (or all) of the way to the finish line without ever stepping ...

Moscow's burgeoning gastronomic scene has been causing a stir locally and internationally. Published for the first time in 2021, the Michelin Moscow Guide awarded its prestigious stars to no ...

Mastercard Travel & Lifestyle Services As a World Elite Mastercard® cardholder, you have access to Mastercard® Travel & Lifestyle Services, a suite of benefits, amenities and upgrades, preferential treatment and premium travel offers from best-in-class travel companies across hotels, air travel, tours, cruises, car rentals and more*. Get the ...

1. Guinness World Record in highlining. The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the 'Moscow-City Day ...

1: Off-kilter genius at Delicatessen: Brain pâté with kefir butter and young radishes served mezze-style, and the caviar and tartare pizza. Head for Food City. You might think that calling Food City (Фуд Сити), an agriculture depot on the outskirts of Moscow, a "city" would be some kind of hyperbole. It is not.

This Guide supersedes any guide or program description you may have received earlier. To file a claim or for more information on any of these services, call the Mastercard Assistance Center at 1-877-288-6784, or en Español: 1-800-633-4466. "Card" refers to World Elite Mastercard card and "Cardholder"refers to a World Elite Mastercard ...

Our company offers you various tours to Moscow - from short to long - term and for different budget. You can choose any you like from the list of popular tours on our page or order a special one. You only have to inform us about your preferences, approximate amount you plan to spend on the tour and the level of the hotel you want to live at.