- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Trip Interruption Insurance Explained

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is trip interruption insurance?

What does trip interruption insurance cover, what is not covered by trip interruption insurance, how much does trip interruption insurance cost, what's the difference between trip cancellation and trip interruption insurance, trip delay vs. trip interruption coverage, how do i get trip interruption insurance, which insurance coverage is best for me.

Trip insurance is an important consideration if you plan on traveling, and understanding the difference between plan benefits is crucial. Some benefits protect you before your trip begins, such as trip cancellation, while others offer coverage during your travels like trip interruption.

Trip interruption insurance will reimburse the unused portion of your trip if it has already begun and an unexpected incident forces you to return home early. This post-departure benefit is particularly useful when booking expensive trips. Here’s what you need to know about trip interruption insurance and how to get it.

If you miss a portion of your trip due to a covered reason, you can use trip interruption benefits to get reimbursed for any unused, prepaid, nonrefundable trip expenses, such as hotel nights or excursion bookings. You may also be reimbursed for additional charges such as booking a new flight home, additional hotel nights and airport taxi fare. Importantly, trip interruption also applies if your trip is cut short due to a covered COVID-related medical reason .

Because trip interruption insurance kicks in after your trip has begun, it's considered a post-departure benefit. A list of valid reasons for coverage are stated in each policy, but they are usually extraordinary and unforeseen circumstances. For example: illness, injury, the death of the traveler or traveling companion, severe weather, terrorist action, job loss, etc.

Many comprehensive travel insurance plans and some premium travel credit cards offer trip interruption insurance. Depending on the policy, the coverage can range from 100% to 200% of the total trip cost, be capped at a predetermined dollar amount or purchased as an optional add-on.

» Learn more: How to find the best travel insurance

Imagine you go on a $5,000, two-week hiking trip to Bariloche, Argentina, and on the third day of the trip, you fall and hurt your ankle. You go to a local hospital and the doctor tells you that it's sprained and advises you to stay off your feet and not do any hiking. After a few days of taking it easy, the pain becomes worse and you decide to cut your trip short and head home for X-rays and an appointment with a specialist.

If you have trip interruption insurance, you will be reimbursed for the unused, prepaid, nonrefundable hotel stay, your original return flight, the cost of new airplane tickets to return home early and additional transportation expenses such as a taxi to the airport and from your return airport home. The reason for the interruption is considered covered since you’ve sustained a serious injury that prevents your continued participation in the trip. You will need to notify the insurer of the incident within a specified time frame (which will be stated in the policy) and follow the protocol to ensure you receive reimbursement.

Using the Argentina trip example above, if your policy reimburses up to 200% of the trip cost, the benefit payable to you can be up to $10,000. The percentage can be above 100% to account for extra costs that a policyholder may incur to return home. Generally, the reimbursement of your return transportation cannot exceed the cost of economy plane tickets (or the same airfare class as the original ticket), and will be reduced by the amount of any refunds already received from the airline and must usually be the most direct route.

If you don’t have trip interruption insurance, you’ll be at the mercy of the hotel when trying to negotiate a refund for the unused portion of your hotel stay. You would also be liable for the additional costs to get home (a new flight, change fees, and transportation to the airport and from the airport to your home). So, if a last-minute flight home costs $1,000, you’d have to absorb that entire amount.

If you plan on traveling during the ongoing pandemic, ensure that you find a policy that offers COVID-19 coverage .

» Learn more: What kinds of trips should you protect with travel insurance?

Not every reason for interrupting your trip qualifies as a covered reason. Losses sustained due to intentional acts (such as self-harm), pregnancy or childbirth, mountain climbing, war, illegal acts, drug use, and trips taken against the advice of a physician will not be covered. Other exclusions may apply; check your policy for specifics.

Some policies also exclude pre-existing conditions that have occurred within a specified time frame prior to departure. The list of exclusions can vary based on the insurer and the state you live in, so you’ll need to check your policy's fine print to ensure you’re aware of what is and isn’t covered.

» Learn more: The majority of Americans plan to travel in 2022

Trip interruption coverage is usually included within comprehensive travel insurance plans.

Using the same $5,000, two-week trip to Argentina, a search of policies on travel insurance broker SquareMouth (a NerdWallet partner) ranged from $115 to $361, representing 2.3% to 7.2% of the total trip cost. The coverage ranged from 100% to 200% of the trip cost, and some of the lower-priced plans offered coverage in excess of 100%. The more expensive plans usually offered higher limits on medical expenses and evacuation.

If you have a premium travel credit card that offers trip interruption insurance, this coverage is provided free of charge as long as the trip is purchased with the applicable credit card.

Trip cancellation coverage applies in situations where you cancel your trip before it starts. If you haven't left yet, and you have to scrap your plans for a covered reason (such as an injury or illness), you can get some or all of your trip expenses reimbursed through trip cancellation coverage.

Trip interruption insurance, on the other hand, is about when something happens during your trip. Let's say you're on a trip and you suddenly have to get home to deal with a death or injury in the family. Trip interruption insurance will cover this situation, recompensing some or all of the remaining expenses in the trip.

Trip delay insurance covers situations where your trip is delayed, such as when an airline bumps your flight to a later date (which may entitle you to additional flight delay compensation ). The expenses accrued from a delay, such as rebooking fees for hotel rooms, will be covered by trip delay insurance.

Trip interruption insurance, meanwhile, only applies if something happens that makes you cancel the remainder of your plans altogether — rather than just having them delayed.

In general, trip delay insurance will apply when your transportation goes awry. Trip interruption coverage applies when something else (like a medical emergency ) affects your trip.

The two most common ways to get trip interruption coverage are by buying a travel insurance policy or applying for a premium travel credit card that has trip insurance benefits.

The Business Platinum Card® from American Express and many other American Express cards provide up to $10,000 per trip ($20,000 per year) in trip interruption benefits. Terms apply. The Chase Sapphire Reserve® will also reimburse you or your immediate family members up to $10,000 in losses per trip interruption.

These premium cards also include other insurance benefits like trip cancellation, trip delay , emergency assistance and more. If you frequently purchase trip protection benefits, applying for one of the cards that offer travel insurance could make a lot of sense. All these cards offer a multitude of useful travel benefits and various statement credits that will usually offset at least part of the annual fee.

If you’re going on a trip that is more expensive than the limit provided by the credit card, purchasing a separate travel insurance policy is a good bet. Also check that your credit card will cover COVID-related claims before you decide to forego a separate policy.

If you’re going on an expensive trip, getting a travel insurance plan that includes trip interruption coverage makes a lot of sense. If the trip is relatively inexpensive or you already have coverage through your credit card, you may not need to purchase a trip insurance coverage.

However, if you’re looking for additional coverage like travel medical insurance , Cancel For Any Reason (CFAR) and/or your credit card doesn’t have sufficient limits, consider a comprehensive travel insurance policy from providers such as AAA , Allianz , or AIG .

In some cases, purchasing travel insurance may not be necessary . So familiarize yourself with all available options before you decide whether or not you should purchase a policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Trip Interruption

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

We’re getting your search results.

- Customer support

- Customer login

- Report a claim

- Find an agent

- Roadside assistance

- Manage policy

- Hanover Mobile

- Choose paperless

- Education and training

- The Hanover Risk Solutions

- COVID-19 information center

- Preparation and prevention

- Coverage made clear

- Claims made clear

- Media contacts

- Login to TAP

- Personal lines

- Commercial lines

- Resource library

- Become an agent

- Investors overview

- Statutory results

- Annual reports

- Event calendar

- Historical prices

- Presentations

- Press releases

- Quarterly results

- Stock quote

- ESG overview

- Inclusion and diversity

- Sustainability report

- Early in career opportunities

- Forgot username

- Forgot password

- Create an account

- Report a claim without logging in

- Individuals

- About The Hanover

- I'm looking to...

- Adding a new driver

- Buying a first motorcycle

- Moving out and moving up

- Ready for retirement

- Updating your home

- Buying a boat

- Buying a home

- Buying or selling a car

- Getting married

- Starting a family

- Recreational vehicles

- Condominium

- Home business

- Valuable items

- Hanover Platinum

- Hanover Prestige

- Get a quote from a local agent

- Manage my policy

- Manage my account

- Partners in Protection

- Water damage prevention

- Construction

- Cultural institutions

- Educational institutions

- Financial institutions

- Human services

- Life sciences

- Manufacturers

- Professional services

- Real estate

- Wholesalers

- Business owner's policy

- General liability

- International

- Management liability

- Professional liability

- Workers' compensation

- Customer onboarding

- Sickness prevention center

- About Hanover claims

- Claims resources and FAQs

- Reviews and testimonials

- What to expect with your claim

- Prepare now. Learn how.

- Weather resource center

- Our companies

- Our history

- Our leadership

- Board of directors

- Our governance

- Our locations

- Sustainability

- Inclusion, diversity and equity

- Recognitions and awards

- Global reporting initiative index

- Community impact

- News releases

- In the media

- Find out what coverage I need

- Explore insurance products

- Save with bundled coverages

- Contact an agent for a quote

- Learn about The Hanover

- Find out what coverage my business needs

- Pay my bill

- File a claim

- Talk to an agent

- Get roadside assistance

- Sign up for paperless

- Set up Hanover mobile

- Print ID card

- Get tips on preparedness

- Agent Solutions

- Discover employee benefits

- Look for a job

- See our locations

- Auto coverages

Travel Right

The Hanover’s Travel Right endorsement cannot solve every problem you might encounter on the road — nevertheless, for many reasons, this extra protection is the right way to go — wherever you happen to be going.

Here’s why.

We make traveling more comfortable.

A lot can go wrong when you’re on the road trying to get from point A to point B — and back again. Sometimes troubling events can happen when you’re in your own vehicle; sometimes when you’re in a rented vehicle. And occasionally, as hard as it is to think about, it can involve your family pet. Travel Right can help.

Trip interruption coverage

Chances are you’ve been more than 100 miles away from home on many occasions. Now suppose if on one of these excursions, your vehicle was damaged and could not be driven safely. What then? The answer is Travel Right featuring Trip Interruption coverage. With Trip Interruption, we’ll cover lodging and travel expenses — up to $1,000 worth — when you are unable to continue to your destination as a result from a covered loss. And with no deductible.

The $1,000 applies to reasonable and necessary expenses for:

- Food and lodging

- Travel costs to your home or intended destination

- Return of your covered auto to your home or place of garaging — except in the case of a total loss

Just be sure to keep your receipts and we’ll take care of the rest.

Rental car coverage

You can have an accident with a rental car, too. In fact, an accident could be more likely to happen if you are unfamiliar with your surroundings. And did you know rental car companies can come after you when that happens — not just to repair the rental car, but for other “damages” such as lost income due to the vehicle being out of service? Now you will not have to worry if you get into an accident with a rental car; Travel Right is there for you with its second feature, Rental Car Coverage. This coverage pays for:

- Loss of use (the rental value of the duration the car is out of service for which you are liable)

- Diminished value (the difference in the car’s resale value after it has been repaired)

- Reasonable fees (expenses the rental company incurs handling/processing the claim for which you are liable)

What’s more, we’ll pay for any damage to your rented auto regardless of fault, just as if the coverage described in the insuring agreements for Collision and Other Than Collision coverages apply. No deductible applies to loss of use, diminished value, or reasonable fees.

Pet injury protection

Traveling with your pet can be a very enjoyable and rewarding experience, but unfortunately if involved in an accident pets can get hurt sometimes, too.And the costs for care can be considerable.For example, the average veterinary cost to treat a dog’s broken leg is $350. A torn ligament would run $388. X-rays alone generally run $50 – $60.Worse case scenario, if your pet dies as a result of injuries, burial could cost hundreds of dollars. Travel Right’s Pet Injury Protection can assume much of these costs, paying up to $500, for veterinary fees related to injuries to your dog or cat as a result of being in the vehicle at the time of the accident, and up to $500 for burial if they pass on as a result of those injuries. No deductible applies.

Unfortunately, bad things can and do happen to good drivers — and to good pets. And with potential disruption such events can have on your life, it makes good sense to eliminate as many of the costs associated with your losses as you can. That’s why The Hanover’s Travel Right may be right for you.

Ask your local Hanover agent for more details or a listing of agents in your area.

Contact an agent

112-2811 (8/14) LC 09-215

Trip Interruption Benefits

What is trip interruption.

Trip Interruption offers coverage if a trip is disrupted or cut short due to unforeseen circumstances such as sicknesses, severe weather conditions, or other eligible events that are out of the traveler's control. Trip Interruption Coverage typically covers expenses such as the cost of additional transportation, accommodation, and other expenses incurred because of the interruption. The exact coverage and benefits vary depending on the insurance policy.

Is Trip Interruption necessary?

Whether Trip Interruption insurance is necessary or not depends on several factors, including the type of trip you're taking, the cost of the trip, and your personal risk tolerance. The Trip Interruption benefit can provide coverage for unexpected events such as sickness, weather-related cancellations, and other eligible events that can cause you to interrupt your trip. Trip Interruption also allows travelers to rejoin their trip after an interruption has occurred. In general, having a trip interruption is a personal decision that should be based on the traveler's specific needs and circumstances. However, it's always a good idea to consider trip interruption coverage, especially if the trip involves a significant investment of time and resources. This can help to protect against financial losses if the trip is interrupted for a covered reason.

What Qualifies as Trip Interruption

1. Sickness, accidental injury, or death that results in medically imposed restrictions as certified by a physician during your trip preventing your continued participation in the trip A physician must advise to cancel the trip on or before the scheduled return date 2. If a family member or traveling companion booked to travel with you incurs sickness, accidental injury, or death. A & B must occur: a.) While you are on Your trip b.) Requires necessary treatment at the time of interruption, certified by a physician that results in medically imposed restrictions to prevent that person’s continued participation on the trip 3. In case of sickness, injury, or death of a non-traveling family member 4. The death or Hospitalization of Your Host at the Destination during Your trip 5. If you are terminated or laid off from your full-time employment by your company through no fault of your own, one year or more after starting employment, during your trip 6. You transfer your employment more than 250 miles away from your home during the trip. This applies if you have been employed by the transferring employer since your policy's effective date and the transfer requires you to relocate your home 7. If your previously approved military leave is revoked or you experience a military reassignment during the trip 8. If you, your traveling companion, or a family member who is military personnel is called to provide aid or relief in the event of a natural disaster (excluding war) 9. Severe weather causes the complete cessation of services for at least 48 consecutive hours of the common carrier (e.g., airline), preventing you from reaching your destination. Note: This benefit does not apply if the natural disaster was predicted or a storm was named before you purchased this policy 10. If a natural disaster at your destination renders your accommodations uninhabitable 11. If a terrorist incident occurs in your departure city or in a city listed on your trip itinerary during your trip, and the travel supplier does not offer a substitute itinerary. Note: This does not cover flight connections or transportation arrangements to reach your destination. The scheduled departure date must be within 15 months from your policy's effective date. Terrorist incidents that occur on an in-flight aircraft are not covered 12. If you or your traveling companion are victims of a felonious assault during the trip 13. If you or your traveling companion are hijacked, quarantined, required to serve on a jury, or subpoenaed if your home is made uninhabitable by a natural disaster or experience a burglary at your principal place of residence during the trip 14. You or Your Traveling Companion are directly involved in a traffic accident en route to departure. Note: This must be substantiated by a police report obtained by you and presented along with other claim forms and documentation. 15. If a travel supplier goes bankrupt or defaults during your trip, resulting in a complete halt of their services. However, these benefits will only be provided if there is no other transportation option available. If there is an alternative way to reach your destination, the benefits will be limited to covering the change fee required to transfer to another airline. Note: This coverage applies only if your scheduled departure date is within 15 months from the start date of your insurance policy 16. Strike that causes complete cessation of services of the common carrier affecting you or your traveling companion who is scheduled to travel. Note: Strike must last for at least forty-eight (48) consecutive hours File for a free quote

Do I need Trip Interruption coverage?

Having trip interruption coverage is a savvy idea. It offers coverage for multiple reasons to help you get your trip back on track. All three of AXA’s travel plans include Trip Interruption coverage, maximum coverage per person is up to:

Maximum Benefit: 100% of Trip Cost Reasonable Expenses Per Day: $100

Maximum Benefit: 150% of Trip Cost Reasonable Expenses Per Day: $100

Maximum Benefit: 150% of Trip Cost Reasonable Expenses Per Day: $100

Receive a free quote within minutes, and decide which plan fits best for your travel needs!

Why choose axa travel protection.

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include: • Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency • 24/7 global team of travel experts that offers assistance and assurance while traveling

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Trip Interruption Insurance FAQs

How much does trip interruption cost.

- Length of Stay

- Destination

- Type of Trip

- Number of Travelers

- Extent of Guarantees

What types of vacations does Trip Interruption apply to?

When does trip interruption coverage begin.

- Trip Interruption coverage begins when a specific travel package has been selected

- Trip Interruption coverage will begin on the day after the required premium for such coverage is received by the authorized representative

When does Trip Interruption coverage end?

- The scheduled return date as stated on the travel tickets

- The date and time you return to your origination point if prior to the scheduled return date

- The date and time you deviate from, leave, or change the original trip itinerary (unless due to unforeseen and unavoidable circumstances covered by the policy)

- If you extend the return date, coverage will terminate at 11:59 P.M., local time, at your location on the scheduled return date unless otherwise authorized by the Company in advance of the scheduled return date

- When your trip exceeds ninety (90) days

- The return date as stated on your purchase confirmation

How to get a Travel Protection Quote?

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation protection, our team of travel experts will help you choose the right coverage.

What is trip cancellation and interruption insurance?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Rewards credit cards

- • Credit card comparisons

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Whether you get travel insurance through a policy you purchase or from a travel credit card , you’ve probably noticed that most plans include a trip cancellation and interruption insurance benefit. This perk is one of the most common travel insurance benefits , and it’s also one of the most valuable. After all, travelers who have this protection can often get reimbursed when their trip is canceled or interrupted for certain reasons beyond their control, such as an unexpected illness, an injury or a flight cancellation.

Before you invest in trip cancellation coverage or trip interruption insurance, however, you should know how these coverages actually work and when they apply. So, what is trip interruption insurance, and how does trip cancellation protection work? Let’s dive into these insurance products to find out what they’re all about.

While trip cancellation coverage and trip interruption coverage are often grouped together, these two coverages actually apply in different situations. For instance, trip cancellation coverage reimburses travelers when their trip is canceled altogether for eligible reasons, whereas trip interruption coverage provides reimbursement for some prepaid travel expenses when a trip is interrupted after it has already started.

Note that, with both types of insurance protection, reimbursement only applies in scenarios that are beyond a traveler’s control. This means that you can’t just cancel your trip for any reason and get your money back, nor can you decide to leave your trip early and successfully file for reimbursement.

Also, note that you may be able to purchase trip cancellation and interruption insurance separately or it may be a part of the included benefits within a travel insurance plan . You may also be able to get this coverage automatically from certain travel credit cards .

What does trip cancellation and interruption insurance cover?

Trip cancellation insurance is meant to reimburse you for prepaid travel expenses you already booked when your trip is canceled for reasons beyond your control. Some common scenarios where trip cancellation coverage can apply includes (but is not limited to):

- Injury, illness or death of a traveler or close family member

- Financial default of an airline or travel provider

- Inclement weather that leads to trip cancellation

- Work issues that cause you to miss a trip

- Being called into active duty military service

- Acts of terrorism in the travel destination

Meanwhile, trip interruption insurance can apply when a trip is forced to an early end for an eligible reason. Common situations covered by a trip interruption benefit include the following:

- Injury, illness or death of a traveler or close family member during a trip

- Diagnosis of COVID-19 or required quarantine during a trip

- Destination made uninhabitable due to severe weather

- Terrorist activity taking place in your travel destination

- Lost passport or travel documents during a trip

- Travel strikes that impact your trip

What does trip cancellation and interruption insurance not cover?

While the list of covered scenarios for trip cancellation or interruption coverage above is not exhaustive, you should know that not everything is covered by either type of protection. Common scenarios that are typically not covered by travel insurance include:

- Travel interruptions caused by acts of war

- Travel interruptions caused by civil unrest

- Government-issued travel bulletins or warnings

- Natural disasters

- Nuclear reaction, radiation or radioactive contamination

- Terrorist events

That said, it’s important to note that it’s possible to purchase trip cancellation and interruption coverage that applies in a broader range of scenarios. For example, you can purchase “cancel for any reason” (CFAR) insurance that lets you cancel your trip for any reason at all and get part of your prepaid travel expenses back. Likewise, an “interrupt for any reason” (IFAR) insurance policy lets you end your trip for any reason and get part of your prepaid travel expenses back.

Both types of optional coverage will make your travel insurance policy cost more, but CFAR and IFAR insurance can provide peace of mind if you’re unsure your trip will happen and you want a way to get at least some of your prepaid costs toward hotels and airfare back if you decide to stay home.

Best credit cards for trip cancellation/interruption insurance

Several travel credit cards with travel insurance offer trip cancellation and interruption insurance automatically for cardholders, including the following:

Chase Sapphire Preferred Card

The Chase Sapphire Preferred® Card comes with trip cancellation and interruption coverage of up to $10,000 per person and up to $20,000 per trip. This insurance covers pre-paid, non-refundable travel expenses (like passenger fares, hotels and tours) in the event a covered situation (such as sickness or severe weather) occurs.

Other travel insurance perks include primary rental car coverage, baggage delay insurance, trip delay reimbursement and travel and emergency assistance services. A $95 annual fee applies for this card.

Chase Sapphire Reserve

The Chase Sapphire Reserve® also comes with trip cancellation and interruption coverage of up to $10,000 per person and up to $20,000 per trip. Like the Chase Sapphire Preferred, this insurance applies to covered situations and will reimburse you for eligible, pre-paid and non-refundable travel expenses.

Other notable travel benefits include primary rental car coverage, lost luggage reimbursement, trip delay reimbursement and emergency evacuation and transportation coverage. A $550 annual fee applies for this card.

The Platinum Card from American Express

The Platinum Card® from American Express comes with trip cancellation and interruption insurance of up to $10,000 per trip and up to $20,000 per eligible card every 12 months. Insurance applies to covered reasons (additional terms and conditions apply).

Other travel protections for cardholders include car rental loss and damage insurance, emergency assistance services and trip delay insurance. A $695 annual fee applies for this card.

The World of Hyatt Credit Card

The World of Hyatt Credit Card *, which is issued by Chase, comes with several travel protections, including trip cancellation and interruption coverage (for eligible events and expenses) of up to $5,000 per person and up to $10,000 per trip. Cardholders will also get baggage delay insurance, lost luggage reimbursement, secondary auto rental coverage and Visa Signature concierge services. A $95 annual fee applies for this card.

The bottom line

Trip cancellation and interruption insurance can help you get some of your money back when your trip is canceled or interrupted for reasons beyond your control. However, you’ll want to read over the policies you’re considering so you know what is and isn’t covered, as well as how much coverage you’ll get per traveler and per trip. Also, note that many top travel credit cards offer this benefit for free, but you’ll have to pay for your trip with your eligible credit card for travel insurance benefits to apply.

At the end of the day, having coverage for trip cancellations and interruptions can be worth it regardless of whether you buy a travel insurance plan or book a trip with your favorite travel credit card. While travel can be stressful and expensive, having travel insurance can help .

*The information about The World of Hyatt Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

What is business travel insurance?

How credit cards can help you deal with lost luggage

When and how to cancel your car insurance policy

What is indemnity insurance?

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Understanding Trip Interruption Coverage: Benefits and Tips (2024)

Get a free quote for trip interruption travel insurance by clicking below.

in under 2 minutes

Amelia Canty is a U.K.-based writer. Her specialities include all things travel, covering everything from destination guides to more technical travel issues such as insurance queries. As a big foodie, you will often find Amelia sampling the latest restaurants for food and drinks with friends when she’s not writing.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Nobody wants to cut a vacation short, but sometimes accidents or emergencies happen. In these situations, the last thing you want to worry about is the money you could lose and the vacation time that slipped away.

Imagine you and a traveling companion are on vacation at a luxury resort in Mexico, and one of you trips and severely sprains an ankle. You can no longer enjoy your vacation as planned, nor can you partake in your prepaid activities. All you want is to get home, get comfortable and see a doctor.

Trip interruptions often bring expense, particularly if you have to pay for new flights while losing money from deposits for previous non-refundable bookings. This is where trip interruption travel insurance coverage comes in.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Is Trip Interruption Coverage?

If a traveler has to cut a trip short, trip interruption coverage offers the chance to seek financial reimbursement for unused, pre-paid and non-refundable travel expenses. An example of when trip interruption coverage would apply is if a traveler suffered a serious injury while on vacation, or if a government ordered an evacuation of an area the traveler is visiting.

Trip interruption coverage differs from other types of travel insurance as it covers travelers post-departure. This type of insurance coverage is perfect for expensive trips. Fortunately, most comprehensive travel insurance plans offer it.

How Does Trip Interruption Coverage Work?

Trip interruption coverage exists to cover you for any unexpected or uncontrollable circumstances that may force a premature return home from your trip. Examples include a serious injury, illness, a family emergency back home, quarantine, evacuation or an early departure. Anything that prohibits you from continuing your trip as intended should be protected by trip interruption coverage.

Insurance offers travelers reimbursement of some or all the prepaid or unused money from a trip cut short for covered reasons. Covered reasons include:

- Rental cars

Sometimes insurance covers added costs incurred from the cancellation, such as an early flight home.

What Does Trip Interruption Insurance Cover?

Covered reasons for guaranteeing trip interruption insurance vary from policy to policy. They’re typically defined as uncontrollable and unexpected circumstances.

Examples include a serious illness or injury, required quarantine or evacuation, severe weather, a family emergency at home, natural disasters or a terror-related attack, or a legal obligation such as jury duty, which prevents continued participation in the trip.

The amount of coverage can also differ. Some policies cover 100% to 200% of the total trip cost. Others cap coverage at a predetermined amount, and if customers want more protection, they can buy it as an add-on.

Imagine you’re in the position of having a severely sprained ankle on a romantic vacation. You can no longer do the things you planned and want to get back home to receive treatment for your injury before it worsens.

Trip interruption insurance would protect you for an unused hotel stay, your original return flight, the cost of new plane tickets, and additional transportation costs (taxis, Ubers or a rental car). You’re fully covered to fly back because you can’t continue the vacation as you intended.

Once you decide to return home, notify your insurance provider. Consult your travel insurance policy to confirm that you’re acting within the policy’s declaration times and other protocols. If you don’t abide by the protocol, you risk giving up a reimbursement.

Trip Interruption Insurance vs. Trip Cancellation Insurance

Trip cancellation insurance refers to pre-departure situations where you’re forced to cancel a trip before it starts for covered reasons. Trip interruption insurance deals with cancellations mid-trip from any situation that arises post-departure.

The reasons that are covered under trip cancellation coverage are largely the same as trip interruption coverage, with a few exceptions in each policy.

Trip Interruption Insurance vs. Trip Delay Insurance

Trip interruptions are when you need coverage for a trip unexpectedly cut short, and you return home for several covered reasons. Trip delay insurance covers travel plans that have been delayed, such as a late or canceled flight, which created a domino effect on other travel plans and reservations.

Coverage exists to reimburse you for the extra costs of rearranging your travel plans. If you have had a flight canceled or missed a connecting flight because of a covered delay and had to make alternative arrangements to catch up with a cruise or a travel group , you would be reimbursed for some or all of the additional costs.

Both types of insurance cover costs lost because of events that happened that are beyond your control. But with trip delay coverage, you wouldn’t be covered if you forgot to renew your passport or arrived late at an airport, triggering your travel losses.

How Much Does Trip Interruption Coverage Cost?

Most basic travel insurance policies cost between 5% and 10% of a trip’s total cost. A good travel insurance policy will be comprehensive and include trip interruption coverage. If it doesn’t, consider the price of adding a specific trip interruption rider and any other coverage you want.

Here are some examples of travel insurance quotes with basic trip interruption coverage for a 30-year-old man traveling from Alabama to Mexico for a week, costing $1,000.

A Travelsafe classic travel insurance plan would cost $60, which includes trip interruption coverage up to 150% of the non-refundable insured trip cost and $1,000 toward a return plane ticket, $500 for unused shore excursions and $150 for traveling companion hospitalization (limited to five days).

A Seven Corners trip protection choice plan would cost $65, which includes trip interruption coverage up to 150% of the insured trip cost, as well as $1000 toward your return airfare. You can also buy interruption-for-any-reason coverage for an extra $1.95 within 20 days of your trip, whereby Seven Corners will reimburse you for trip interruptions outside of the covered reasons list.

Each travel insurance company supplies a comprehensive list alongside each policy of the covered reasons.

Benefits of Trip Interruption Coverage

Although intended to be exciting and enjoyable, traveling can be stressful and unpredictable. Trip interruption coverage protects travelers from the unexpected, giving you peace of mind for circumstances that are beyond your control.

If your trip ends early for an unavoidable reason, can you comfortably deal with the inevitable financial consequences? Or would it add to the already emotional stress of the unfortunate circumstances?

Trip interruption coverage acts as a traveler’s safety net in the worst-case scenarios.

How To Get Trip Interruption Insurance

To obtain trip interruption insurance, you will need to purchase travel insurance with the appropriate coverage. You can also apply for a premium travel credit card with trip insurance benefits. To find travel insurance, you can compare providers online or ask your tour provider for recommendations.

If you prefer to go directly through a travel insurance provider, we recommend obtaining quotes from multiple travel insurance providers to compare coverage and cost. You can refer to our guide to the best travel insurance providers to get started. To get a quote, you will have to fill in basic information, including travel dates and your destination. You then can go through each policy and evaluate which offers the most appropriate coverage for your travel needs.

Factors To Consider When Choosing Trip Interruption Coverage

When evaluating travel insurance companies and their policies, there are certain things to inspect. Policies have varying coverage amounts, exclusions and conditions you must be aware of.

If you and a traveling companion must return from a trip unexpectedly, your insurance coverage policy would determine whether some or all of the unused portion of your accommodation cost would be reimbursed to you. It also varies from policy to policy how much, if any, additional transportation expenses will be covered, such as your new return flight or taxis to and from the airport.

Certain policies also cover you for all or some of any extra trip expenses on your way home, such as a necessary hotel stay. But your insurance provider may have specific limits on hotel expenses or may only cover certain types of accommodations.

The Bottom Line

Trip interruption insurance can be a saving grace if something unexpected happens on your vacation. Nobody wants to think about planning for the worst. But if something happens and forces you to cut your trip short, you want travel protection for you and your family and the knowledge that you won’t face unmanageable financial consequences and unnecessary emotional stress.

Frequently Asked Questions About Trip Interruption Coverage

What is a trip interruption benefit.

The benefit of trip interruption coverage is that it protects travelers post-departure. If you or your traveling companion fall ill or suffer a serious injury that prohibits further participation in your vacation — or any other covered reason — you would be reimbursed for the unused portion of your accommodation and extra travel expenses you could incur.

What is the difference between trip interruption and trip delay insurance?

Trip interruption insurance covers you for when your trip is unexpectedly cut short, and you return home for a reason that’s covered by your policy.

Trip delay insurance refers to travel plans that were delayed, such as a late or canceled flight, thereby having a domino effect on the rest of your travel plans. You would be covered for any added travel expenses you have incurred because of the delay.

What are valid reasons for trip cancellation insurance?

Covered reasons vary from policy to policy. They’re usually defined as reasons that are unexpected and outside of your control. Examples include:

- A serious illness or injury that stops you from traveling

- You’re called for jury duty

- The government advises against traveling to your destination country

- An immediate family member falls ill or dies

If you have questions about this page, please reach out to our editors at [email protected] .

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Member News AAA's Take KeeKee's Corner AAA Traveler Worldwise Foodie Finds Good Question Minute Escapes Car Reviews

- Trip Interruption Expense Reimbursement

Trip Interruption Expenses

When a good trip goes bad

If a car accident interrupts your road trip, AAA will reimburse you for expenses such as car rental fees, lodging, and meals. Here's how it works:

You're on your way to visit an old friend from college (or taking the kids to visit your parents, heading to a spa with the girls, taking a fishingm trip — whatever!) and partway there...kaboom. Out of nowhere a vehicle clips your bumper. No one is hurt. But your car won't move. It needs a few parts and you're going to have to wait—overnight—far from home and far from your destination.

Even though you may lose a day of vacation, at least you'll have help with the extra expenses. As a AAA Member, you may request reimbursement for reasonable, unanticipated costs for your hotel, meals, and substitute transportation, up to $500 for Classic Members, up to $1,000 for Plus Members and Premier Members are reimbursed up to $1,500 .

If you're on a planned leisure trip that included at least one overnight stay and you're involved in a car crash, call us. One of our friendly Associates will review the rules (your vehicle must be involved in an accident in the United States or Canada, 100 miles or more from home, and vehicle must be inoperable for a minimum of 8 hours) and go over what we can reimburse you for (car rental fees, lodging, and meals).

We'll also remind you that expenses must be incurred withing 72 hours (3 days) of the accident. And that your request for reimbursement must include a police report and original itemized receipts for expenses. So you know exactly what to do and what to expect. Because even when your trip takes a turn for the unexpected, you can depend on AAA.

For information on Trip Interruption Expense Reimbursement and ALL your benefits, download your Member Benefits Guide(PDF) and consult pages 17.

- Vehicle Theft and Vandalism

- A Mechanic You Can Trust

- AAA For Recreational Vehicles

- AAA Mobile Battery

- Bicycle Roadside Assistance

Welcome to AAA

To enjoy customized local content, please enter your ZIP Code below.

Limited Time Offer!

Please wait....

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Guide to chase sapphire® travel insurance.

Planning a vacation or honeymoon can be exciting. That excitement might include the worries that something unexpected could interrupt those plans. The following overview of Chase Sapphire travel protections may make your next trip less stressful if you are a cardmember.

How does Chase Sapphire travel protection work

Certain benefits that may give you peace of mind when using your card for travel are available to Sapphire Reserve and Sapphire Preferred ® cardmembers:

- Travel and Emergency Assistance Services: If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

- Trip Delay Reimbursement: If your common carrier travel is delayed more than 12 hours (six hours for Sapphire Reserve) or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

- Baggage Delay Insurance: Reimburses you for essential purchases like toiletries and clothing for baggage delays over six hours by passenger carrier up to $100 a day for 5 days.

- Lost Luggage Reimbursement: If you or an immediate family member check or carry-on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger.

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. For Sapphire Reserve cardmembers, coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad. Sapphire Preferred Cardmembers can be reimbursed up to the actual cash value of the vehicle, but coverage excludes certain cars, such as high value and exotic vehicles.

- Travel Accident Insurance: When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000 ($1,000,000 for Sapphire Reserve).

Additional Benefits covered with Chase Sapphire Reserve travel insurance

Certain travel reimbursement, cancellation protection and emergency services are available to Chase Sapphire Reserve ® cardmembers on eligible travel booked with their credit card. Here’s some more information about the benefits offered with the card.

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year.

Emergency Medical and Dental Benefit

If you're 100 miles or more from home on a trip, you can be reimbursed up to $2,500 for medical expenses if you or your immediate family member become sick or injured.

If you have a Sapphire credit card, travel protection applies to plane tickets, rental cars and cruise line reservations booked using a Sapphire card or Ultimate Rewards ® points. You will be able to claim reimbursement for trip cancellations or interruptions, lost luggage, baggage that’s delayed or flight delays.

Whether it’s a long-awaited vacation or flying across the country to see family for the holidays, the Chase Sapphire family of cards offers benefits to give travelers more confidence in their plans.

- card travel tips

- credit card benefits

What to read next

Credit card basics how to find your frequent flyer number.

How do you find your frequent flyer number? Learn several ways you may be able to track down your number so you can use it when booking that flight.

credit card basics The Chase Sapphire Lounge at the Sundance Film Festival

Discover the perks and benefits of being a Sapphire Reserve cardmember at Sundance Film Festival.

credit card basics Priority Pass San Diego: What to know

There is one lounge in the San Diego airport that is in the Priority Pass network, plus two spa locations and a restaurant.

credit card basics What to know about Denver airport United lounges

Airport lounges can offer a little extra comfort while you’re traveling. Learn about the United lounges at Denver airport as well as other amenities.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AXA Travel Insurance Review — Is it Worth It?

Jessica Merritt

Editor & Content Contributor

85 Published Articles 484 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3142 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Why Get Travel Insurance?

Travel insurance and covid-19, types of policies available with axa, how to get a quote, axa vs. credit card travel insurance, axa vs. other travel insurance companies, how to file a claim with axa travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Whether you’re traveling the world or crossing state lines, travel insurance such as the policies offered by AXA Travel Insurance can offer a safety net in case you have to cancel or interrupt your trip or need support along the way for medical emergencies, lost bags, or missed connections.

For more than 60 years, AXA Travel Insurance has provided peace of mind and financial stability to travelers. With solid ratings and underwriting by Nationwide Mutual Insurance, travel insurance plans sold by AXA are backed by an A.M. Best Excellent financial strength rating. AXA offers travel insurance with trip interruption and cancellation coverage, medical emergency and evacuation benefits, lost or delayed baggage, and more.

Let’s examine AXA’s travel insurance coverage options, benefits, and service and compare it to alternatives such as credit card travel coverage and other travel insurance providers.

Travel insurance can protect what you’ve invested in an upcoming trip. When the unexpected occurs, such as a trip cancellation or medical need , travel insurance can offer the benefits you need to cover it.

You might choose travel insurance for these reasons:

- Your trip has deposits or payments that you can’t get refunded if you need to cancel your trip.

- The health insurance you use at home doesn’t work at your destination.

- You’re planning activities that aren’t covered by your health insurance.

- Medical care is subpar at your destination and you may need to be evacuated to another location with adequate medical facilities.

- You’re concerned about the possibility of lost bags, delays, or missed connections, especially if you have multiple flights or transfers.

Travel insurance isn’t necessary for every trip, such as if you’re traveling domestically where your health insurance works and you don’t have major nonrefundable expenses. But travel insurance is worth it if you’ve got a lot of nonrefundable expenses invested in your trip or you’ll need medical coverage at your destination.

COVID-19 can interrupt your travel plans, whether you get sick and have to cancel a trip, need to quarantine or get medical treatment while traveling, or plan to visit a destination with high COVID-19 numbers. While some travel insurance companies exclude COVID-19 from insurance coverage , AXA offers COVID-19 coverage as part of its travel protection plans , including trip cancellation and trip interruption and emergency medical and evacuation coverage.

Why Purchase Travel Insurance From AXA?

Any travel insurance company you purchase a policy from should be reputable, reliable, and stable. After all, you’re relying on the company to be there for you when you need it most. It pays to verify reviews and ratings — AXA offers good reassurance in this area.

With 64 years in business, AXA has an A- Better Business Bureau rating . On the travel insurance website Squaremouth , AXA has an overall 4.22/5 rating , with 0.1% negative reviews among more than 69,000 policies sold . AXA’s travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best. With 6 decades in business and solid ratings , AXA is a travel insurance company you can trust.

AXA offers travel insurance with medical and emergency evacuation benefits, trip cancellation and interruption, baggage loss, and Cancel for Any Reason (CFAR) options. Let’s look at the details of AXA travel insurance policies.

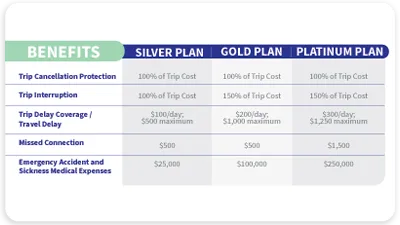

AXA offers 3 levels of travel insurance : Silver, Gold, and Platinum . Each level offers different limits, but all of AXA’s policies have 100% trip cancellation coverage, emergency medical coverage and medical evacuation, baggage delay and loss, and missed connection coverage.

Let’s compare what you get with each policy:

With plans as low as $16 and minimal coverage, AXA recommends the Silver plan for domestic travel. You can cover 100% of your trip cost for trip cancellation and interruption coverage. If your travel is delayed, you can get up to $100 per day for expenses, up to $500 total, and $200 for delayed baggage.

There’s also $500 in missed connection coverage. The $25,000 in emergency medical expense coverage isn’t much, but it might be adequate for domestic travel if you’re using your primary health insurance first.

Gold plans start at $36 but add more coverage and are appropriate for cruises or Schengen travel . Like the Silver plan, the Gold plan offers up to 100% trip cancellation coverage but bumps trip interruption to 150% of your trip cost. Limits for all coverages are higher, with $200 per day and $1,000 maximum in trip delay coverage and $1,000 for missed connections. Baggage delays offer up to $300, and you can get up to $1,500 for lost baggage and personal effects.

The health coverage is also much higher at $100,000, and it adds a $50,000 non-medical emergency evacuation option on top of the $500,000 medical emergency evacuation benefit. This plan also offers an optional $35,000 collision damage waiver.

The Platinum plan , starting at $52, steps up coverage and offers additional options. You’ll get 100% trip cost coverage for trip cancellation and 150% for trip interruption. Trip delay coverage offers up to $300 per day and a $1,250 maximum, plus $600 for baggage delays and $3,000 for lost baggage and personal effects.

Emergency medical treatment is also higher at $250,000, and you’re covered for $1 million in emergency medical evacuation — $100,000 for non-medical evacuation.

The Platinum plan also offers additional coverage for sports, with $25 per day for lost skier days, $500 for lost golf rounds, and $1,000 for sports equipment rental. It also offers optional coverage for up to 75% of trip cost with Cancel for Any Reason coverage and a $50,000 collision damage waiver.

You can get a quote directly from AXA by visiting the AXA Travel Insurance website . The quote form is the first thing you’ll see on the homepage.

To start your quote, you’ll fill out the quote form, including your state of residence, destination country, travel dates, first deposit date, total trip cost, number of travelers (up to 10), and the age of travelers.

Once you fill out the form, you’ll be presented with plan options. For a 60-year-old visiting Japan and spending $2,500, we were offered a Silver ($155), Gold ($183), or Platinum ($218) plan .

If you select a Platinum plan, you will be able to add CFAR optional coverage for up to 75% of your trip cost.

With your plan and options selected, the next and final step to secure coverage is entering your traveler information including your name and contact information, then making your payment for the policy.

How AXA Compares — Summary

AXA is a good option for travel insurance, but it’s not your only option. Let’s see how AXA compares to the coverage you can get from popular travel credit cards and travel insurance competitors .

Many travel credit cards offer travel insurance as a complimentary benefit, whether it’s car rental collision waivers , trip cancellation coverage , or emergency medical and evacuation benefits. This coverage can be helpful if you’re using your card to pay for your travel expenses, but it’s often not as comprehensive as the coverage you can get from a travel insurance policy like what AXA offers .

Let’s compare AXA’s best travel insurance policy against The Platinum Card ® from American Express and the Chase Sapphire Reserve ® , which both offer some of the best travel protections available with credit card benefits.

Unless you’re taking a trip with expenses higher than $10,000, the trip cancellation coverage should be about the same whether you’re using an Amex Platinum card, Chase Sapphire Reserve card, or the AXA Platinum plan. However, the AXA Platinum plan comes out ahead with 150% of your trip cost for trip interruption.

We see a major difference in coverage for emergency medical treatment and evacuation. The Amex Platinum card doesn’t offer emergency medical coverage, but you can arrange an emergency medical evacuation using the Premium Global Assist Hotline. The Chase Sapphire Reserve card offers up to $2,500 in emergency medical coverage and $100,000 for emergency evacuation. Neither of these offerings compares to the $250,000 in emergency medical coverage and $1 million in emergency medical evacuation coverage you can get from AXA Platinum.

Credit card travel insurance coverage is complimentary if you already have the card, but it is lacking in some areas. It’s a good idea to use your card’s travel insurance as a backup for trip cancellation, interruption, travel delays, or lost baggage, but use the AXA Platinum plan for its superior emergency medical and evacuation coverage.

It’s always a good idea to compare travel insurance quotes across multiple providers so you can find the best price and coverage. We used Squaremouth , a travel insurance comparison website, to see how AXA’s policies compare to those of other companies.

As with the initial price quotes we pulled from AXA’s website, our sample trip on Squaremouth had:

- Traveling to Japan a month from now

- Trip cost: $2,500

- Initial trip deposit paid within the last 24 hours

- State of residence: Texas

We limited results to policies that offer at least as much coverage as the AXA Platinum policy does on major benefits:

- COVID-19 coverage

- Minimum $250,000 emergency medical benefit

- Minimum $1 million emergency medical benefit

- 100% trip cancellation

- 150% trip interruption

Each policy offered nearly identical coverage for these major benefits, and Tin Leg ‘s Silver plan had the lowest cost at $164.35, followed closely by $165.84 from HTH Worldwide ‘s TripProtector Classic plan.

If you’re mainly concerned with full coverage for trip cancellation and interruption along with $250,000 in emergency medical and $1 million for emergency medical evacuation, you can save if you go with Tin Leg .

However, the higher-priced policies offer additional coverage and options. For example, AXA Platinum offers the option to add Cancel for Any Reason coverage and includes sports equipment rentals and missed ski days or golf rounds. Tin Leg doesn’t have missed connection coverage, but Seven Corners Trip Protection Choice and AXA Platinum offer up to $1,500 for missed connections on cruises or tours.

All of the policies we quoted except for Tin Leg Silver offer employment layoff as a covered cancellation reason, and AXA Platinum allows you to cancel your trip for work reasons, though none of the other policies do. AXA Platinum also offers $100,000 in non-medical evacuation , which Tin Leg Silver and HTH Worldwide TripProtector Classic policies do not, and is much higher than the $20,000 benefit offered by the Seven Corners Trip Protection Choice policy.

AXA Platinum has a higher cost than competitors but offers more robust coverage. If you’re mainly concerned with major coverage for trip cancellation and interruption, emergency medical, and emergency evacuation, other travel insurance companies may offer a better quote. But if you want additional coverage and options such as non-medical evacuation and expanded cancellation reasons, check out the details on what AXA Platinum offers.

You can file a claim with AXA in a few ways:

- Using the claim administrator portal

If you’d like to file your claim online, you can visit the portal for Co-Ordinated Benefit Plans and enter your policy number and last name to get started.

Alternatively, you can call AXA toll-free at 888-957-5015 or collect at 727-450-8794 .

If you’d like to submit your claim via email or mail, you can download claim forms on the AXA website.