We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Get 7 Days Free

China Tourism And Culture Investment Group Co Ltd Class A 600358

About quantitative ratings.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.

Price vs Fair Value

Trading information, key statistics, company profile, comparables.

- Emei Shan Tourism Co Ltd Class A 000888

- Zhang Jia Jie Tourism Group Co Ltd Class A 000430

- Wuhan Sante Cableways Group Co Ltd 002159

Financial Strength

Profitability, leisure industry comparables, sponsor center.

- Client log in

China Tourism And Culture Investment Group Co.,Ltd (China)

The company is a listed enterprise of China International Travel Service, the largest international travel agency in China. Main businesses involve leisure real estate development, lottery equipment and related services, and high-speed craft passenger services. Company mainly engages in Nanjing Tangshan Hot Spring Resort, which include leisure, health, business conference and many other function services aiming to form a world-class spa vacation resort. The company holds share of Shenzhen Sile which owns lottery machine sales and maintenance business. Betting machine equipment has been supplied to Shandong, Liaoning, Jiangxi, Jiangsu and other 13 provinces, autonomous regions for welfare lottery distribution. Xidu Real Estate Development Co., under the company mainly engages rebuilding of old downtown areas of Guanyuan and Taoyuan in Xicheng District, Beijing. In addition, the company's wholly owned subsidiary Yichang Sanxiajianshan Shipping Co., Ltd. runs high-speed hydrofoil passenger service covering from Yichang to Wanxian and Chongqing. The shipping company is the largest franchised passenger high-speed hydrofoil service enterprises in Three Gorges region. “One Day Trip to Three Gorges on Jinshan Hydrofoil” now is the most well-know tourist service brand.

Headquarters Blk 4 No 8 Wenquan Road Tangshan Sub-District Jiangning District Nanjing Jiangsu Fuzhou; Fujian; Postal Code: 330006

Contact Details: Purchase the China Tourism And Culture Investment Group Co.,Ltd report to view the information.

Website: http://www.cutc.com.cn

EMIS company profiles are part of a larger information service which combines company, industry and country data and analysis for over 145 emerging markets.

Similar companies

To view more information, Request a demonstration of the EMIS service

Destinations in 70+ Countries and Regions

- Markets Data

China Tourism and Culture Investment Group Co Ltd

Select symbol.

- 600358:SHH Shanghai Stock Exchange

- Add to watchlist

- Add to portfolio

- Add an alert

- Price (CNY) 3.26

- Today's Change -0.08 / -2.40%

- Shares traded 16.54m

- 1 Year change -44.84%

- Beta 1.0180

Apply Cancel Actions

Your alerts done.

- Military briefing: Russia’s narrowing advantage in Ukraine Apr 26 2024

- Ban on non-compete agreements sends shockwave across Wall Street Apr 26 2024

- Federal Reserve’s preferred inflation metric rose to 2.7% in March Apr 26 2024

- Markets Data

China Tourism and Culture Investment Group Co Ltd

Select symbol.

- 600358:SHH Shanghai Stock Exchange

- Add to watchlist

- Add to portfolio

- Add an alert

- Price (CNY) 3.97

- Today's Change -0.01 / -0.25%

- Shares traded 18.30m

- 1 Year change -32.83%

- Beta 1.0180

Apply Cancel Actions

Your alerts done.

- Military briefing: Russia’s narrowing advantage in Ukraine Apr 26 2024

- Ban on non-compete agreements sends shockwave across Wall Street Apr 26 2024

- Federal Reserve’s preferred inflation metric rose to 2.7% in March Apr 26 2024

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- ALPHABET INC.

- MICROSOFT CORPORATION

- NIPPON ACTIVE VALUE FUND PLC

- ANGLO AMERICAN PLC

- META PLATFORMS, INC.

- TESLA, INC.

- AMD (ADVANCED MICRO DEVICES)

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Growth stocks at reasonable prices

- Momentum stocks

- Yield stocks

- Quality stocks

- Quality stocks at a reasonable price

- Artificial Intelligence

- The Cannabis Industry

- Israeli innovation

- Digital Health and Telemedicine

- Circular economy

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- The genomic revolution

- Oligopolies

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- ProRealTime Trading

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

China Tourism And Culture Investment Group Co.,Ltd

Cne0000014t3, advertising & marketing.

- China Tourism And Culture Investment Group Co.,Ltd completed the acquisition of Jiangxi Haijigou Import and Export Co., Ltd. from Jiangxi Tourism Group Co., Ltd.

Latest news about China Tourism And Culture Investment Group Co.,Ltd

Chart china tourism and culture investment group co.,ltd.

Company Profile

Income statement evolution, sector advertising agency.

- Stock Market

- 600358 Stock

- News China Tourism And Culture Investment Group Co.,Ltd

Stock Analysis

- Hospitality

- SHSE:600358

Retail investors in China Tourism And Culture Investment Group Co.,Ltd (SHSE:600358) are its biggest bettors, and their bets paid off as stock gained 23% last week

Key Insights

- Significant control over China Tourism And Culture Investment GroupLtd by retail investors implies that the general public has more power to influence management and governance-related decisions

- 45% of the business is held by the top 10 shareholders

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

Every investor in China Tourism And Culture Investment Group Co.,Ltd ( SHSE:600358 ) should be aware of the most powerful shareholder groups. We can see that retail investors own the lion's share in the company with 55% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, retail investors collectively scored the highest last week as the company hit CN¥2.0b market cap following a 23% gain in the stock.

Let's take a closer look to see what the different types of shareholders can tell us about China Tourism And Culture Investment GroupLtd.

See our latest analysis for China Tourism And Culture Investment GroupLtd

What Does The Institutional Ownership Tell Us About China Tourism And Culture Investment GroupLtd?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

We can see that China Tourism And Culture Investment GroupLtd does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of China Tourism And Culture Investment GroupLtd, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in China Tourism And Culture Investment GroupLtd. Jiangxi Tourism Group Co., Ltd. is currently the largest shareholder, with 20% of shares outstanding. In comparison, the second and third largest shareholders hold about 11% and 4.7% of the stock.

Our studies suggest that the top 10 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of China Tourism And Culture Investment GroupLtd

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that China Tourism And Culture Investment Group Co.,Ltd insiders own under 1% of the company. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. It appears that the board holds about CN¥311k worth of stock. This compares to a market capitalization of CN¥2.0b. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, mostly comprising of individual investors, collectively holds 55% of China Tourism And Culture Investment GroupLtd shares. With this amount of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to vote on acquisitions or mergers that may not improve profitability.

Private Company Ownership

It seems that Private Companies own 39%, of the China Tourism And Culture Investment GroupLtd stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Take risks for example - China Tourism And Culture Investment GroupLtd has 4 warning signs (and 2 which are concerning) we think you should know about.

Of course this may not be the best stock to buy . So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're helping make it simple.

Find out whether China Tourism And Culture Investment GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600358

China tourism and culture investment groupltd.

China Tourism And Culture Investment Group Co.,Ltd engages in the investment and operation of cultural, tourism, and sports projects in China.

Slightly overvalued with imperfect balance sheet.

Market Insights

- China Daily PDF

- China Daily E-paper

Hilton's first lifestyle brand hotel in Shanghai signed, next to Legoland

Hilton recently signed an agreement with Shanghai Jinshan Urban Construction Investment Group Co Ltd to jointly build Hilton's first lifestyle brand hotel in Shanghai to further elevate the tourism experiences for the upcoming Legoland resort in Jinshan district.

The hotel - Canopy by Hilton Shanghai Binfenli, is scheduled to open in 2025 and will offer 251 guestrooms.

It will be located in Fengjing Town, Jinshan District, near the upcoming Legoland Shanghai, which is scheduled to open next year.

Xia Nong, president of Development for Hilton Greater China & Mongolia, said this will mark Hilton's expansion plan of its lifestyle branded hotels in mega-cities in China.

IMAGES

COMMENTS

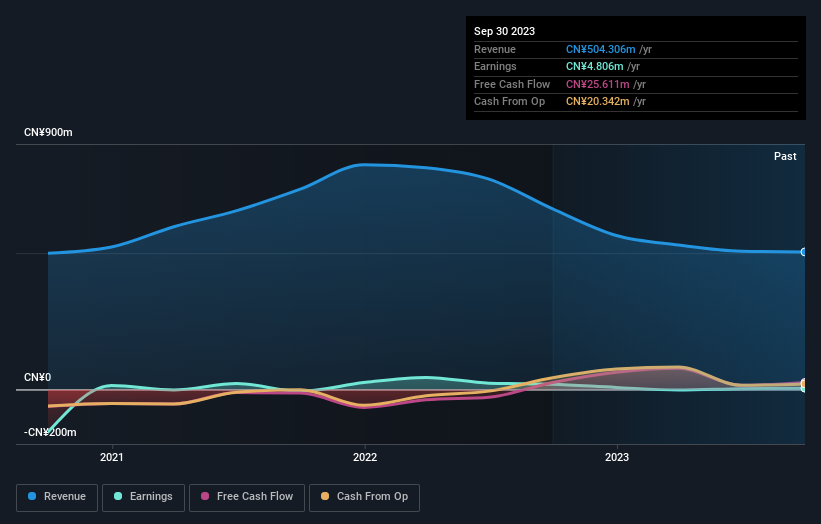

Year on year China Tourism and Culture Investment Group Co Ltd 's revenues fell -3.82% from 564.58m to 543.01m. This along with an increase in selling, general and administrative costs has contributed to a reduction in net income from a gain of 7.59m to a loss of 12.53m. View all financials

Company profile page for China Tourism And Culture Investment Group Co Ltd including stock price, company news, executives, board members, and contact information

On Friday, China Tourism and Culture Investment Group Co Ltd (600358:SHH) closed at 3.99, 50.00% above the 52 week low of 2.66 set on Feb 08, 2024. Data delayed at least 15 minutes, as of Apr 12 2024 04:17 BST. All markets data located on FT.com is subject to the FT Terms & Conditions.

Find company research, competitor information, contact details & financial data for China Tourism And Culture Investment Group Co., Ltd. of Nanchang, Jiangxi. Get the latest business insights from Dun & Bradstreet.

China Tourism And Culture Investment Group Co.,Ltd announced that it expects to receive CNY 162.4568 million in funding 23-05-31: CI China Tourism And Culture Investment Group Co.,Ltd Reports Earnings Results for the First Quarter Ended March 31, 2023 23-04-28

Stock analysis for China Tourism And Culture Investment Group Co Ltd (600358:Shanghai) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

See the latest China Tourism And Culture Investment Group Co Ltd Class A stock price (600358:XSHG), related news, valuation, dividends and more to help you make your investing decisions.

China Tourism & Culture Investment Group Co., Ltd. engages in the investment, development, and operation of water sports and marine leisure tourism, planning and construction of sports and ...

Latest China Tourism and Culture Investment Group Co Ltd (600358:SHH) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and more. China Tourism and Culture Investment Group Co Ltd, 600358:SHH interactive chart - FT.com

China Tourism And Culture Investment Group Co.,Ltd: Company profile, business summary, shareholders, managers, financial ratings, industry, sector and market information | Shanghai S.E.: 600358 | Shanghai S.E. ... China Tourism and Culture Investment Group Co Ltd is a China-based company mainly engaged in providing outdoor sports and ...

Financial values in the chart are available after China Tourism And Culture Investment Group Co.,Ltd report is purchased. Looking for more than just a company report? EMIS company profiles are part of a larger information service which combines company, industry and country data and analysis for over 145 emerging markets.

About Us. China Tourism Group Co., Ltd. (hereinafter referred to as CTG), has been adhering to the enterprise development concept of science and technology as core of hard power, and is committed to improving the comprehensive service level of the tourism industry with the most advanced technology. With the world's top 500 enterprises ...

China Tourism And Culture Investment Group Co.,Ltd engages in the investment and operation of cultural, tourism, and sports projects in China. It is also involved in the internet digital marketing business; tourist destination development and operation business; advertising business; and provision of personalized customized travel services.

Latest China Tourism and Culture Investment Group Co Ltd (600358:SHH) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and more. China Tourism and Culture Investment Group Co Ltd, 600358:SHH historical prices - FT.com

China Tourism And Culture Investment Group Co.,Ltd: Forcasts, revenue, earnings, analysts expectations, ratios for China Tourism And Culture Investment Group Co.,Ltd Stock | 600358 | CNE0000014T3 fd5c38.JWkHVSBp-l4Yg9XsrWJGnv_AVAi85C21SjXcBu11onI.Th9JF2IHvQ9VwLmGmgd-roimHz_OyWblP3_tULk65R4QClMbGAW7B3zOhA

China Tourism and Culture Investment Group Co Ltd (600358:SHH) company profile with history, revenue, mergers & acquisitions, peer analysis, institutional shareholders and more. China Tourism and Culture Investment Group Co Ltd, 600358:SHH profile - FT.com

Company profile for China Tourism & Culture Investment Co. Ltd. A including key executives, insider trading, ownership, revenue and average growth rates. View detailed 600358.CN description & address.

China Tourism and Culture Investment Group Co Ltd (600358:SHH) financials, including income statements, growth rates, balance sheets and cash flow information. China Tourism and Culture Investment Group Co Ltd, 600358:SHH financials - FT.com

China Tourism And Culture Investment Group Co.,Ltd engages in the investment and operation of cultural, tourism, and sports projects in China. ... Simply Wall Street Pty Ltd (ACN 600 056 611), is a Corporate Authorised Representative (Authorised Representative Number: 467183) of Sanlam Private Wealth Pty Ltd (AFSL No. 337927). ...

Learn about China Tourism And Culture Investment Group Co.,Ltd (600358) stock's management team. Comprehensive performance, salary and tenure analysis for the CEO, board and leadership team. ... China Tourism And Culture Investment Group Co.,Ltd to Report Fiscal Year 2023 Results on Mar 30, 2024 Dec 29. Third quarter 2023 earnings released: CN ...

As of December 30, 2023, Jiangxi Provincial State-owned Capital Operation Holding Group Co., Ltd. agrees that China Tourism And Culture Investment Group Co.,Ltd will acquire a 100% in Jiangxi Haijigou Import and Export Co., Ltd. from Jiangxi Tourism Group Co., Ltd. China Tourism And Culture Investment Group Co.,Ltd (SHSE:600358) completed the ...

Using data from company's past performance alongside ownership research, one can better assess the future performance of a company ; Every investor in China Tourism And Culture Investment Group Co.,Ltd (SHSE:600358) should be aware of the most powerful shareholder groups. We can see that retail investors own the lion's share in the company with ...

Hilton recently signed an agreement with Shanghai Jinshan Urban Construction Investment Group Co Ltd to jointly build Hilton's first lifestyle brand hotel in Shanghai - Canopy by Hilton Shanghai ...