Example sentences travel schedule

It shows the time in 29 time zones (27 cities) and has five alarm settings - just the job for a busy travel schedule .

Whose travel schedule or promotion opportunity takes precedence?

Everyone had to admit the travel schedule was intensive.

He claimed they split due to his travel schedule .

My travel schedule follows the fashion shows to all the main cities.

Definition of 'schedule' schedule

Definition of 'travel' travel

COBUILD Collocations travel schedule

Browse alphabetically travel schedule.

- travel regularly

- travel restrictions

- travel schedule

- travel section

- travel separately

- travel shot

- All ENGLISH words that begin with 'T'

Quick word challenge

Quiz Review

Score: 0 / 5

Wordle Helper

Scrabble Tools

Plan, Ready, Go

How to Plan a Travel Itinerary: The Complete Guide

You’ve chosen your destination, booked your transportation, and maybe even your accommodations. Now…you just have to figure out what in the world you’re going to do while you’re there.

In this post, we’re going to take a deep dive into how to plan a travel itinerary , the nitty-gritty of how to put together your schedule of sites, museums, and activities.

Key takeaways

- Prioritize and list your “must-do” sites and activities.

- Do thorough research on your destination

- Organize your wish list into “must-do,” “want-to-do,” and “nice-to-do” categories.

- Compile all the practical details for each activity, such as operating hours, fees, and booking requirements.

- Build your itinerary by scheduling must-do activities first and filling in with want-to-dos and nice-to-dos.

This post includes affiliate links. If you make a purchase through one of these links, I may earn a small commission at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases. See disclaimer.

I’m a very detail-oriented kind of person (you know, the kind of person who makes lists for EVERYTHING), so this method of itinerary planning may not be of interest to the fly-by-the-seat-of-your-pants kind of traveler.

If you’re not as hyper-organized as I am, you can easily modify this method for how you like to travel. It’s logical itinerary planning at its best.

I won’t be going over in this post how I research and plan for dining options since that’s a more complicated topic for me and my husband (as a celiac and a vegetarian) than the average traveler.

That’s probably a topic for a separate post. So, let’s get planning.

Getting started on your itinerary planning

“I’m heading to Rome/New York City/Paris/Mexico City for X number of days. What should I do and see while I’m there?”

I see similar questions all over Facebook literally every day, and I understand why. It can be overwhelming to plan a travel itinerary.

Let’s say you’re planning to spend five days in New York . How do you decide what to do for those five days? Where do you even start your search for the best ideas for sites to visit?

Side note: for simplicity’s sake, throughout this post, I’m going to use the word “site” to refer to anything (not eating) that you will want to make time for on your trip. These could be monuments, national parks, palaces, museums, activities, guided tours, etc.

There’s no real wrong way to plan your itinerary…just kidding. You have to do it my way.

No, seriously.

Okay…let’s get started.

When I’m planning a travel itinerary, I go through five phases of the process before I arrive at my final draft.

- Preliminary brainstorming

- Destination research

- Fleshing out my wish list

- Site/activity research

- Building my itinerary

I know this seems like a lot, but trust me, you’ll want to know you’ve considered all your options before you go on your trip.

You’ll thank me later.

Read More → Travel Planning Resources

Planning an itinerary starts with brainstorming your wish list

So, you’ve booked your trip, but your itinerary is completely blank. Your destination is your oyster, but where and how do you start?

Your first step is to do some preliminary brainstorming. If you’re heading to a top tourist destination, you probably already have some idea of the specific sites you want to visit (e.g., the Colosseum, Eiffel Tower, Chichen Itza, etc.).

If you’re going someplace completely unfamiliar to you, your brainstorming phase may be quite short but it can also be less specific if that helps (e.g., important historical sites, whatever the most important art museum is, popular beach, etc.).

To help yourself with your brainstorming, you can ask yourself the following questions:

- What are the famous/popular sites my destination is most known for?

- What are the top, must-do sites or activities I already know I want to do on this trip?

- Why are my spouse’s/travel partner’s must-do sites or activities for this trip? If children are traveling with you, why not include them in the brainstorming? They’ll love feeling like they’ve been a part of planning the trip.

- What are the kinds of activities we most enjoy while traveling in general?

Great! Write all of this down. Don’t worry. Nothing’s set in stone yet.

And the sky’s the limit. We’re not yet worrying about the costs involved or how much time we have.

Write it all down. Go ahead. I’ll wait.

[cue Jeopardy! theme music]

Okay, keep this list handy; it’s time to do some basic research on your destination.

Research your destination

This is where I start to go crazy with research. I’ll take in anything and everything I can about my destination. The more good information I have, the better equipped I am to make good decisions about my itinerary.

And don’t assume you already know enough about where you’re headed.

Before I started researching Paris, I had never heard of Sacré-Coeur (which is one of the great free things to do in Paris , by the way) or Les Invalides.

We ended up visiting both on our trip.

Here are the questions I keep in mind as I do this research:

- What is my destination known for? Is it art, the natural landscape, history, architecture, etc.?

- What season will it be at my destination? Are there any popular seasonal activities I’d like to try while I’m there?

- Are there any special holiday events or festivals taking place there that I’d be interested in attending?

- What is the weather typically like there that time of the year and month? In other words, will I be comfortable spending long periods outdoors, or will I want to spend more time indoors?

- What are the public transportation options at my destination? Is there a good metro/public transportation system or will I have to rely on taxis, ride-sharing, or walking to get around?

- Where are my accommodations in relation to the major site on my list?

- Does my destination offer any kind of city or museum pass?

Side note: If you haven’t yet booked your accommodations, now is a good time to take a look at a map. Do a large number of must-do sites on your wish list cluster in a certain area? If so, you might want to consider booking accommodations nearby to simplify your transportation needs. This isn’t always a good idea but consider it.

Read More → Is it Worth it to Use Booking.com?

Read More → Booking.com or Direct with Hotel: Which is Better?

Where do I find this information? Here are a few suggestions:

- Do some simple Google searches and look around the different results for up-to-date information about your destination.

- Head over to Pinterest to discover what travel bloggers ( ahem ) have to say.

- Buy some good travel guidebooks and start reading.

- Watch YouTube videos about your destination.

- Armed with this pile of new information, you’re going to go back to your list.

Flesh out your wish list

As you researched your destination, you likely noticed certain sightseeing ideas or recommendations coming up over and over again.

- If they’re already on your brainstorm list, great! Leave them there.

- If you’ve never heard of or considered them, but they now sound interesting, add them to your list.

- If there’s something you’ve changed your mind about, go ahead and take it off your list if you really want to, otherwise, leave it on the list. You can always remove it later.

It’s okay at this point if your list has far more ideas on it than you can possibly fit into your trip. We’ll work on narrowing it down later.

After doing my research, I discovered a lot more ideas for things to do in Paris and sites to visit than were on my first brainstorming list. But…what if you’re finding the opposite to be the case?

What if you’ve booked yourself a round-trip plane ticket to your destination, but you’re finding only enough you’re interested in doing to fill a much shorter time than you’re planning to be there?

You have a couple of options:

- If you haven’t booked your accommodations yet, or you can still change/cancel your reservation, consider adding a destination to your trip. For example, if you’re flying into and out of Zurich, Switzerland, but are finding more that interests you perhaps in Lucerne (or beyond), consider spending at least a portion of your trip outside Zurich.

- If you have booked your accommodations and your reservation cannot be changed, consider adding day trips to your itinerary. For example, if you’re staying in Florence, Italy, you could take the train to Pisa or Lucca for the day.

By now you should have a good sense of what your itinerary could look like; it’s starting to take shape.

Specific site or activity research

Okay, so you have this beautiful, and probably fairly lengthy list of things you’d like to see and do on your trip.

Now you get to do research on each of these items individually. Yay! Seriously…I love this part.

To start, you’re going to break down your wish list into four sections. If your list is pretty long, you can re-write it into these four sections, but if it’s on the shorter side, it’s okay to do this mentally.

Must-do sites.

These are the places people traverse the globe to see…the Eiffel Tower, St. Peter’s Basilica, the Pyramids of Giza, Great Wall of China. You get it.

These are the non-negotiable ones. They go in the itinerary no matter what.

Want-to-do sites.

These are the second-tier sites for your trip, the things you want to make room for, but won’t necessarily dissolve into tears if you can’t manage it.

Examples from my travels would include the Rodin Museum (Paris), Trevi Fountain (Rome), or walking the entire High Line in New York City.

Nice-to-do sites.

These are the minor sites and activities that will become the filler in your itinerary. On my itineraries, these are things like “sit on the Spanish Steps” or “buy cheese from a fromagerie.”

I don’t care if we do this or not.

These are the sites that are first on the chopping block once we start to build the actual itinerary. Or you may have cut them already once you did your destination research.

Now that you have your sites grouped, the next thing to do is your research. For at least each of your must-do and want-to-do sites you need to know the following:

- What days of the week is it open and what are the operating hours?

- What is the entrance fee (if any)?

- What is the best day of the week to visit?

- Do you need to book tickets or make a reservation ahead of time? If so, how far in advance can you book/should you book?

- Where is it and how do I get there? I especially want to know how far it is from my accommodations and how far it is from other major sites on my list.

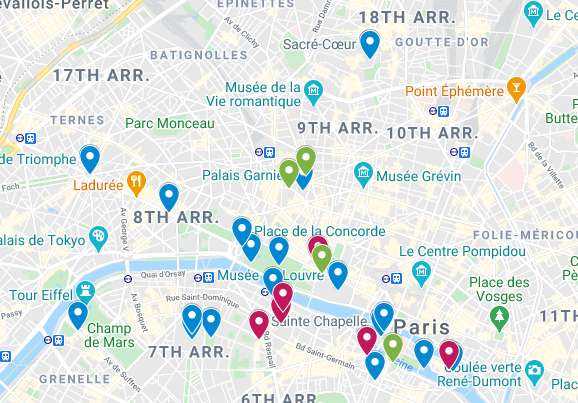

Side note: The My Maps feature in Google Maps is an invaluable part of this phase of the itinerary planning process for me. You can pin locations, organize and color code sites to visit, and even add personal notes.

Narrowing it down

Okay, now you have even more information about your destination. Here’s where you start making some changes to your list.

At this stage, I may move sites from one section of my wish list to another. Something might move up on the list, for example, if I discover that it’s very near one of my must-do’s, or if it’s free to visit.

This is how we ended up going to Les Invalides; it wasn’t anywhere near the top of our list, but it’s right across the street from the Rodin Museum (which was something I wanted to do) AND it’s covered by the Paris Museum Pass. It was super easy to just pop in for a bit after the Rodin Museum, but we probably wouldn’t have made a separate trip.

Something might move down the list (or come off the list entirely) if I learn it’s very out of the way or more of a financial investment than my particular budget for this trip can support.

Should I purchase a city or museum pass?

Let’s revisit the city/museum pass question from the destination research phase.

If your destination offers one (or a few), take the time to consider if it’s worth it for you to purchase for your trip. We used the Museum Pass on our trip to Paris (and highly recommend it), but decided against buying the Firenze Card for our trip to Florence, Italy .

Here are some criteria I use to judge whether a city or museum pass is worth it for us to purchase for a particular trip:

- What sites are covered? Will you have to book entrance to many of your must-do/want-to-do sites separately or are most covered by the pass?

- Does the pass offer you unlimited entry to covered sites or can you use it one time only?

- Will you save money if you buy the pass? It’s not necessarily a deal breaker if it doesn’t. The convenience of not having to book entrance reservations to sites ahead of time can outweigh some financial disincentives.

- Does the pass cover any public transportation you’re planning to use or just site entrance fees?

- For how many days is the pass valid versus how many days you will be at your destination? For example, we chose not to buy the Firenze Card on our trip to Florence, because it’s only good for 72 hours, and we were spending 8 nights there. Purchasing two cards each would have cost us far more than paying for our chosen sites individually.

How do I decide what to cut from my itinerary?

This part of the process is highly personal. Only you can really decide if a particular site or activity is “worth it” to you.

The decision to buy or not to buy a city or museum pass may affect how you narrow down your list. If you have to purchase entrance tickets to all of your sites individually, you may end up having to spend more money to see everything (or cut sites to stay within your budget).

Or if you do decide to purchase a pass but a site on your list is not covered, you may find yourself considering leaving it off your list.

On the other hand, if you have a pass you may see more sites overall because you’ve already paid for admission.

…If that makes sense.

At this stage of the itinerary planning process, if there’s anything on my list that makes us say “meh” it goes on the “I don’t care” list.

Build the trip itinerary

Okay. You’ve done your research, you’ve decided whether you’re buying that city pass and you’ve refined your site wish list.

You’re ready to build your itinerary! I’m going to use our recent trip to Paris to demonstrate how I put it all together.

The non-negotiables get top priority.

For each full day on your trip, choose one or two of your must-do’s or want-to-do’s: one first thing in the morning and one for later that day.

Your must-do’s (your non-negotiables) go on the schedule first and as early in your trip as you possibly can.

If you arrived in Paris on April 14, 2019, and decided to put off seeing Notre-Dame until later in the week, you were probably pretty disappointed on April 15 as the world watched the devastating fire that closed it down.

Don’t. Put. It. Off.

For our trip to Paris, we each had one non-negotiable: the Louvre and the Palais Garnier. We did them both on our first full day there.

Then add any other must-dos that require advanced booking or warrant a full day on your itinerary or both. So, I needed to choose days for Versailles and the Eiffel Tower.

My research told me that I should plan a full day at Versailles and that it is quite busy on the weekends and on Tuesdays (when the Louvre is closed).

I also learned that the Eiffel Tower is open every day until late, that I should plan to spend about three hours there, and that I needed to book tickets for the summit as far ahead as possible.

Add in your want-to-do’s.

With the must-dos scheduled, I’m ready to schedule the want-to-do’s. I added Musee d’Orsay and Musee Rodin, then Musee de l’Orangerie, Champs-Élysées, Arc de Triomphe, etc.

Nice-to-do’s fill in any remaining gaps.

I then fill in the rest of the itinerary with the nice-to-do’s, leaving our last full day intentionally blank.

When staying in one place for four days or more, we try to keep our last full day completely open. This is so we can return to any place we want to see again, or so that we can add more of the items from our “nice to do” list depending on what we’re in the mood for. It helps us create a good balance between sightseeing and relaxation .

If you’re taking a trip that includes multiple stops, you can just repeat this process for each place you’ll be staying.

Keep in mind as you’re planning a trip itinerary that if you’re bouncing from city to city every other day, you’ll be spending a lot of time traveling from one destination to the next.

I do feel like I need to say, that even though you now have a meticulously planned itinerary it doesn’t mean you can’t be spontaneous. We often find that we spend far less time at some sites than we think we need to allow for, giving us time to do even more on our trip than we hoped.

Or sometimes we just don’t feel like doing something on our schedule…and that’s okay too.

Now you have the tools to build the perfect itinerary for your next trip. Enjoy!

More articles to help you plan your travel itinerary

- 5 easy steps to planning a trip

- Travel planning resources you need

- The best travel guides (online resources and books)

Pin this post!

Darcy Vierow is a busy professional and travel planning expert with years of experience maximizing travel with limited time and on a less-than-average salary. Her tips have been published by Forbes, MSN.com, Yahoo! News, Yahoo! Finance, Aol, Newsbreak and GOBankingRates. Read more about Darcy Vierow .

10 Comments

Absolutely love this perspective on travel! It beautifully captures the essence of what it means to explore the world. Travel isn’t just about ticking off destinations; it’s about slowing down, immersing yourself in new cultures, savoring moments, and absorbing the rich tapestry of life that the world has to offer. 🌍✈️🌏

My sister wants to travel for her honeymoon, so she’s interested in starting to plan it this month. I liked what you explained about choosing a destination and the places you’d like to visit, so I’ll share this with my sister right away. I appreciate your insight on considering what you want to see and visit and booking accommodation near those places.

You are so much more organized than we are – we usually book places the day of or the day before and figure out what we are doing day by day. We like to leave things pretty wide open to see what happens and what we find. This is such a great guide though for planning a vacation!

Thanks for your comment! Yeah, I actually have a hard time just going with the flow…it’s something I’m working on.

This is so perfect! I enjoy the entire planning process, so this definitely speaks to me. I particularly enjoy researching locally owned restaurants and off the beaten path places. Thanks so sharing such a great way to plan

Thank you for your kind comment!

This post resonates a lot with me as like you, I too plan extensively before I travel. I believe planning well helps us make the most of our time and also gives more peace of mind. Excellent tips!

Thank you! And I definitely agree with you about how helpful good travel planning is for traveling well.

It is so helpful to find a guide on how to organize and plan a trip! For a lot of people (me included) this is the most traumatic experience about traveling as you want everything to go perfect and smoothly. I plan trips all the time and this guide was literally how I do my planning! Thank you so much for sharing and I hope it helps a lot of travelers out there too!

Thanks so much for reading and for your kind comment. I really do hope a lot of travelers find this guide helpful.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

By using this form you agree with the storage and handling of your data by this website. *

Privacy Overview

Difference between AGENDA, ITINERARY, and SCHEDULE

An agenda is a list or program of things to be done. Workers who are well-organized will often have an agenda for meetings – a list of specific topics to discuss, or things to accomplish during the meeting.

If something is “on the agenda” or “on your agenda,” it means that people are willing to discuss it or work on it.

We also have the expression “a hidden agenda,” meaning a secret plan that you are hiding by pretending you have a different intention.

Some people also use the word agenda to mean their calendar. If someone asks if you are free for lunch next week, you might say, “Let me check my agenda” to find out which day you are available.

The word itinerary is a list or plan of things to do during a trip. On an organized tour, the travel agency will give the travelers an itinerary describing the different places they will go and things they will see.

A schedule is a list of things to be done at a certain time. A conference, for example, might have a schedule like this:

- Breakfast 7-9 AM

- Main speaker 9-10:30 AM

- Workshop 11-12

- Lunch 12-2 PM

Public transportation like buses and trains also have schedules. Another word for schedule, when used as a noun, is “timetable.”

Schedules can also be for long-term projects – the schedule defines what tasks must be done by a certain date. For example, the construction of a building:

- Lay the foundation – by Feb. 1

- Build the structure – by July 1

- Install the electrical systems – by August 1

If something is done or progressing faster than expected, it is “ahead of schedule” – and if something is delayed, it is “behind schedule.”

Finally, the word schedule is used as a verb for establishing an appointment or action at a certain time, for example: “I scheduled my dentist appointment for next Thursday.”

Clear up your doubts about confusing words… and use English more confidently!

More Espresso English Lessons:

About the author.

Shayna Oliveira

Shayna Oliveira is the founder of Espresso English, where you can improve your English fast - even if you don’t have much time to study. Millions of students are learning English from her clear, friendly, and practical lessons! Shayna is a CELTA-certified teacher with 10+ years of experience helping English learners become more fluent in her English courses.

How to Write a Travel Itinerary (Template and Tips)

Being able to write a good itinerary is a powerful tool in the travel industry. A travel itinerary isn’t just a list of things to do. It’s a stop-by-stop break down of how a traveler should spend their time.

Whether you’re a travel agent, blogger, content writer, or anything in between, itineraries are fundamental.

Creating effective itineraries is also a valuable skill if you’re a traveler. If you can craft a compelling trip plan, you’re in for a holiday that will show you and your loved ones an amazing time.

Why take our advice? We’re highly experienced in the itinerary game. 🙂 The Travel Tractions content team has crafted over 500,000 words worth of travel itineraries in the last 3 months alone.

We know our stuff, and we’re here to share it with you. The following is a detailed guide on how to make a travel itinerary.

Travel Itinerary Template

An itinerary will pretty much always be broken down into days (unless it’s a 24-hour itinerary). Each day is further broken down into individual stops , which are typically the recommended points of interest and attractions.

The days and stops are the meat of the itinerary, but most itineraries will be supplemented with additional information to further help the reader.

Have a look at how we added a practical packing list in this 3 day London itinerary .

We recommend structuring your vacation itinerary in a similar way to the following:

Introduction

Every good blog post needs an introduction. For your itinerary, this will be a brief overview of the destination and why it’s an attractive place to visit. Sell the itinerary here. Give the reader a good reason to stay engaged and continue reading.

Brief Overview

Offer a bullet-pointed breakdown of the itinerary, outlining the stops. This allows the reader to understand if it’s right for them before reading in full.

Day 1, etc.

This is where you lay out the stops for each day. Give some insightful and interesting information about each stop.

The aim here is to get them excited about what you’re suggesting / offering. Don’t overwhelm them with information, just whet their appetite.

Make each stop a heading, and include useful information such as opening hours, cost, and which kind of traveler is best catered for here. You can add must-visit food stops as well, or simply leave that choice up to the reader.

Check out how we helped our readers organize a 7-day trip to Bali .

Looking to generate more income with your content? Click here to view our Content Marketing Strategy packages

Other Useful Information

In this section, offer some extra information that will help the user get the most out of their experience. Some things you can add include:

- Tell the reader a bit about how to get around, transport options, and things to be prepared for.

- Discuss the best places to stay and suggest a few options for accommodation that you know are great.

- Make some restaurant recommendations and mention any other foodie stops that haven’t made it into your itinerary stops.

- Include a packing list if you feel it’s an important aspect (or write a separate packing list post and take advantage of some internal linking).

This section exists to help close the itinerary in a satisfying way. Offer a brief summary and some final thoughts. Reaffirm the reasons why the destination is attractive, and why your itinerary is the best on offer.

Important Considerations for Writing an Itinerary

So, now you’ve got the outline for a successful itinerary. But you’ll need to fill this skeleton with high-quality content in order to produce something valuable. Taking into account the following considerations and tips will help you do so.

Decide the Length of the Itinerary

Before writing anything, you’ll need to decide the length of your itinerary. Are you offering an itinerary for three days? five days? one week?

The best option will largely depend on the size of the destination and how much it offers in terms of things to do. For example, most travelers will probably spend at least a week in Bali but perhaps just two or three days in Amsterdam.

This can generally be determined with some logical thinking or past experience. But a bit of keyword research can really help uncover what your audience is truly looking for.

If you already have an idea of what you’d like the reader to see and do, you can base the length of the trip on the time it’ll take them to see it all.

Decide on the Stops & Attractions

Once you’ve decided on a number of days, you’ll need to figure out how the reader should fill their time.

Ask yourself questions like:

- What are the most popular landmarks, attractions, and points of interest?

- What will offer the most memorable experience?

- Are there any unheard of spots that will enrich the experience and make it unique?

Deciding on the stops can be done through a combination of experience, prior knowledge, and research.

Looking for expertly-written, SEO content? Click here to view our affordable content writing packages

What’s Achievable?

How much can the reader realistically fit in the time allotted? We know it’s easy to get excited about all the amazing things that a travel destination has to offer. But it’s important to keep it realistic.

The last thing you want is to over-promise on what can be achieved during a trip, only to leave the reader rushing from one attraction to the next without time to appreciate each one. They could even end up abandoning the itinerary altogether.

Plan Out Logical Routes

It’s very important that you consider the geography of the destination when structuring an itinerary. You need to plan out logical routes between stops in order to minimize travel and maximize efficiency. If two or more attractions are close to one another geographically, it only makes sense to visit them at the same time.

Use your knowledge of the area in combination with Google Maps to plot out a route for each day’s itinerary.

Offer Insider Tips

Try to offer unique insights and ideas, insider tips, and some off-the-beaten-track gems.

The reader wants to know that they’re in reliable and experienced hands. Unique and valuable guidance will also help your itinerary stand out against those offering more generic advice.

You can provide these at any point throughout the itinerary. Wherever they fit best.

Be Specific and Unambiguous

Itineraries provide insightful guidance to those who want to be guided. To those who want their trip to be planned for them.

Therefore, it is your job to guide them fully . Don’t offer too much in the way of flexibility. Display conviction in your chosen stops. Show confidence that if they follow your itinerary to a T, they’ll have a great time.

Include Captivating Images

High-quality images transport the reader to the destination before they’ve left their seats. They’re one of the strongest mediums for generating excitement and anticipation for an upcoming trip. They also help break up long blocks of text.

Including images frequently is a great way to keep your reader’s attention and enhance their experience.

You can use images from your own trip, or curate some top-notch stock images .

Implement SEO

Data-focused, strategic SEO (Search Engine Optimisation) underpins all of our content. And if your itinerary is being written for the web, it should underpin yours too. Good SEO can help ensure that your itinerary is seen by as many people as possible. And if you’re in the travel business, getting your travel material seen should be a top priority.

Final Thoughts

If you were wondering how to write an itinerary, you landed in the right place. We hope this trip itinerary template helps you craft well-rounded, engaging, and realistic itineraries that leave readers delighted.

More to explorer

9 Common SEO Mistakes You Should Avoid + How to Fix Them

Storytelling in Digital Marketing for Travel Websites

How to Find the Best PPC Agency for Travel Businesses

Book a call with an digital strategist.

Travel Schedule

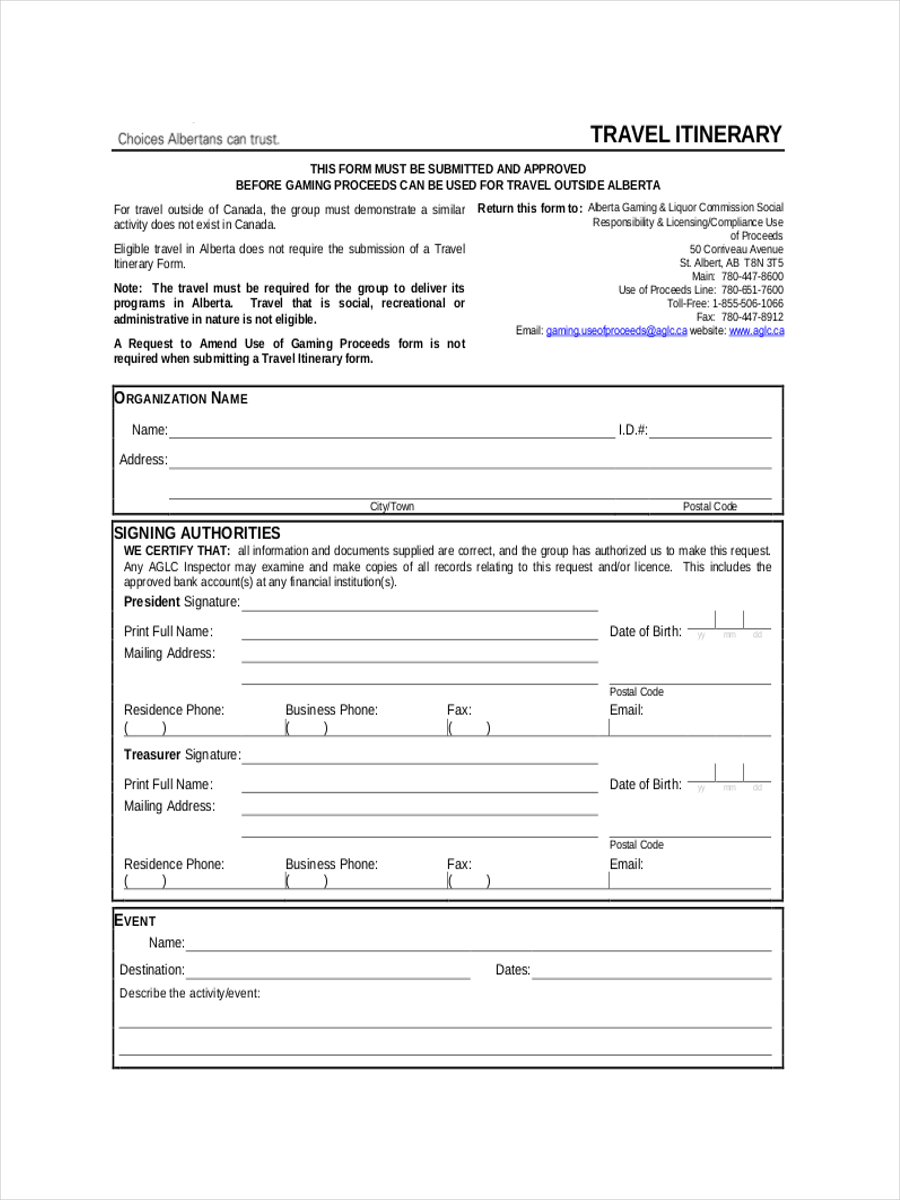

Whether it is international or domestic, travel can be nerve wracking since you have to stay organized. Sure, a lot of people would rather go with the flow than have something set out for them. After all, it’s about living in the moment, right? The truth is, this kind of mindset won’t always deliver good outcomes. There’s always the odds of missing the train or not having enough time to explore a location because it closes in a few minutes. Like a time management schedule, your travel schedule will allow you to maximize the amount of time given.

6+ Travel Schedule Examples

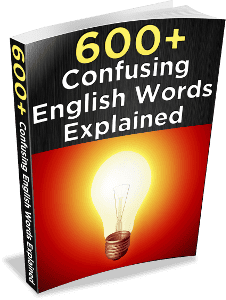

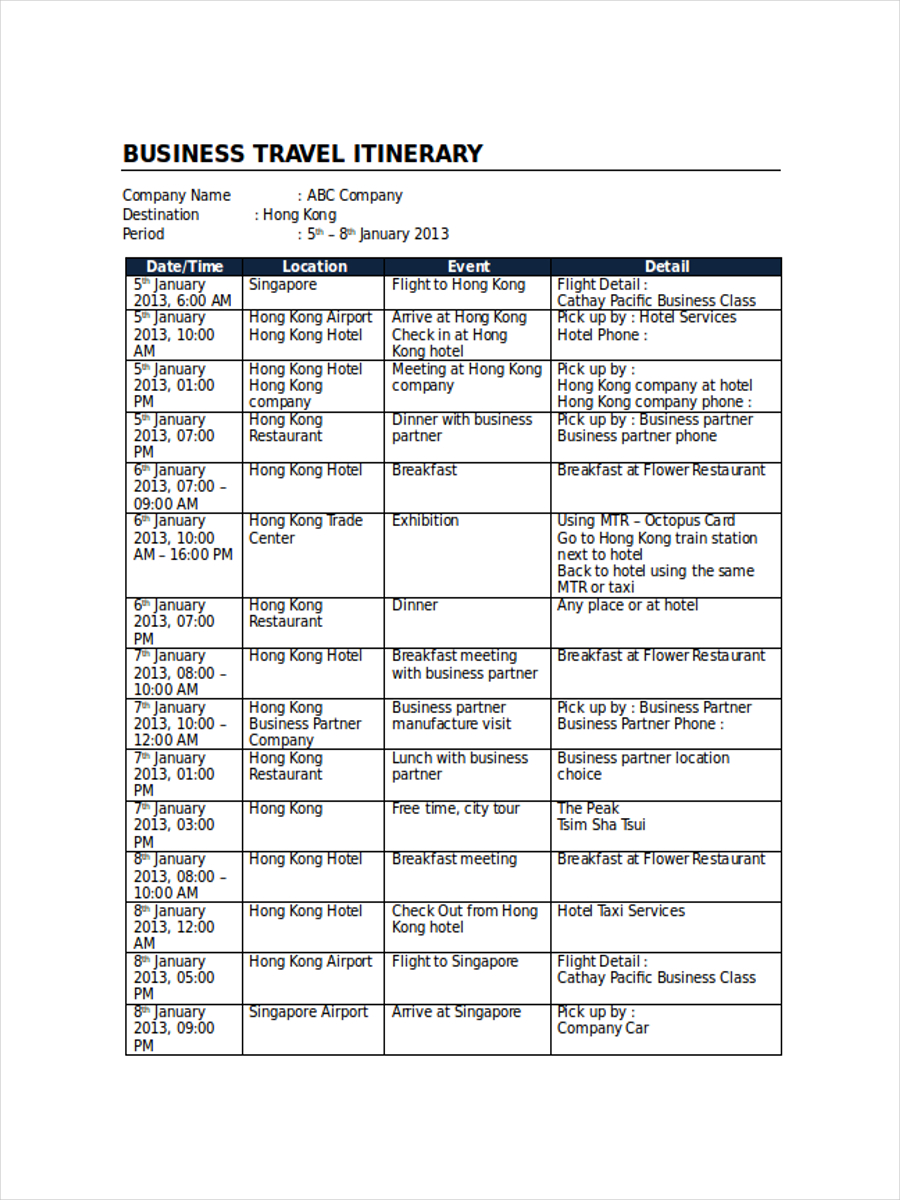

Travel schedule template.

- Google Docs

Size: A4 & US

Travel Itinerary Schedule

Size: 180 KB

As you can imagine, travelling can be very hectic. You need to make sure that you have enough resources to survive the next couple of days or weeks in foreign soil. There’s also the pressure of making the most out of a trip at such a limited amount of time.

Family Travel Schedule

Business Travel Schedule

Air Travel Schedule

Size: 31 KB

Sample Travel Schedule

Size: 350 KB

Daily Travel Schedule

Size: 186 KB

What is a Travel Schedule?

A travel schedule is exactly what you think it is, a schedule fit for every traveler’s needs. Like a daily schedule, a travel schedule consists of a list of activities planned out for a certain period. This would include destinations, transportation details, distance, and the like. People use travel schedules to help them keep track of important things to remember while they are on the move. They can also contain important details like departure time, travel document details, and the daily agenda .

How to Produce a Travel Schedule?

Before the frequency of travel went down due to in the year 2020, the amount of U.S citizens travelling overseas peaked at 2018 with around 41.77 million at that time as shown by this graph by Statista. With so many people travelling alongside each other it can be quite challenging to get things done while on the move. Remembering to do something while on the move can also be an issue. That is why it is helpful to keep a travel schedule in order to get your travelling affairs in order.

Step 1: Lay Out All Your Plans

You need to know how to fit everything that you want to do and the places you want to see in a given amount of time. To do this, it’s best to make a list of all the activities that you want to accomplish. Think about the places you want to visit and how you could get there. When listing the next item on your travel schedule, be sure to consider how much time it will take. After you are done writing all the things you have to do try to see which important plans must be done right away and which can be done at your own preferred time.

Step 2: Organize Them Chronologically

Creating a travel schedule isn’t just about writing things down, but taking time into account as well. After writing down all your plans write down the time for each of them. When it starts, how long it will be, and when it will end. Allocate a considerable amount of time for each to ensure that you’ll have enough time if you need to move from one place to another. Strategics at the time well to make your travel schedule a lot more effective.

Step 3: Use a Format

Once you have figured out the order of your travel schedule, arrange them in a way that makes it easy for you to check it. You can put it into a table or a list for a start. You can look into planners and calendars to help you figure out how to design and organize your travel schedule. Use whatever format makes it easy for you to look into your schedule and understand right away.

Step 4: Take Down Notes

Finally, jot down important notes or reminders that you have to remember. This could be anything from the estimated fee schedule and expenses as well as the transport details. That way you won’t forget about the little things you need to do while you are on the move. Colors have a great effect on memory, so you can use highlighters or different pens to make your travel schedule a lot more effective. You can assign a different color for the level of priority on your notes.

What is the quickest scheduled flight in the world?

The shortest flight in the world is a mile hop between two islands in the North of Scotland called Papa Westray and Westray. The flight itself lasts for two minutes officially. One of the few cases where flying doesn’t take the most of your time while travelling through the airport.

What are the advantages of keeping a travel schedule?

Keeping a travel schedule allows you to remember the important times involving your travel. You can record details such as the departure and arrival time of your journey or information about your destination. You can also add other details about your travel to ensure that you will not forget it.

What makes a travel itinerary different from a travel schedule?

While the two may contain similar information they both serve a different use. A travel itinerary is a plan or list of activities to do while on a trip. It contains details on the places you are going to as well. A travel schedule lists out tasks you have to do in a specific time.

What can I use to make a travel schedule?

As long as you have a pen and paper then you are good to go with making a travel schedule. Note down the important things you need to do and what time you have to do it. You can opt to use your phone or laptop if you prefer that than writing it down.

It is always important to stay organized whether you are on a professional trip or a family vacation . But, it’s important to keep in mind that creating a schedule is not enough. This would mean sticking to what you have listed and making adjustments only when it is necessary. It’s also best to make estimations with your given time to prevent stress on being late for something. Organize and follow your travel schedule so you’ll know where you should be at a given time and you’ll get to enjoy every moment of your trip.

Schedule Generator

Text prompt

- Instructive

- Professional

Create a personalized class schedule to keep track of your school subjects and homework due dates.

Design a weekly planner for students to organize school assignments and exam preparation efficiently.

10 Types Of Itineraries, What’s The Best Travel Method? 2024

Are you overwhelmed by the sheer number of options when it comes to planning out the perfect vacation itinerary? With documents, spreadsheets, mobile templates, pen and paper, and printable templates all vying for your attention (not to mention your time!), how can you determine which is the best tool to use? I get it. As someone who has traveled extensively and lived abroad for 90 days exploring Europe— and visited over 50 cities in total—I know just how daunting it can be to pick the right itinerary style. That’s why I set out on a mission to figure out the best way to plan and carry your itinerary with you on your travels. This blog post will equip you with the knowledge of what makes a great itinerary and explain why using a combination of different tools could be key. I’ll compare and contrast different styles of planning; from high-tech digital maps to traditional paper-based methods. We’ll also take a look at some pros and cons so that you can decide which is most suitable for you. No matter what style works best for you when it comes to vacation planning, this post will help ensure that organizing your itinerary won’t add any extra stress or hassle to your travel plans!

This page has affiliate links . I may earn a commission if you click and make a purchase at no cost to you.

Here Are 10 Itineraries For Travel Planning!

1. using a document for your travel itinerary.

A Word document is a versatile tool commonly used for creating travel itineraries. It offers flexibility, allowing users to easily modify and reorganize their plans while on the go. With the convenience of cloud storage services, these documents can be accessed from any device, making them highly portable. One key advantage of using a Word document for itinerary planning is the ease of sharing with other travelers.

However, it’s important to note that compared to specialized itinerary tools, Word documents may lack structure and visual appeal. Additionally, if not regularly updated, the information in the document may become outdated. Some recommended services to check out include Google Docs, Microsoft OneDrive, and Dropbox. I started out using this method but just like Goldilocks, this porridge was too cold for me.

- Offers flexibility for adding, deleting, and rearranging components of the itinerary

- Highly portable with accessibility from any device

- Easy to share with other travelers

- Lack of structure may make it challenging to keep track of intricate plans

- Lacks the visual appeal of itineraries created with specialized tools

- Difficulty in visualizing routes or distances between multiple destinations

- Individuals who value flexibility and portability

- Those comfortable navigating through text-heavy information.

2. Using a Spreadsheet for Your Travel Itinerary

A spreadsheet is a versatile tool commonly used for tracking data. These programs offer a flexible and powerful way to design your travel plans. With individual cells for each component of your trip, you can easily view, edit, and organize your itinerary in a structured format.

This method is particularly useful for multi-destination trips, allowing you to create separate columns for each location and include details like accommodation, points of interest, and travel times. Spreadsheets also offer calculation functions to track your budget and bucket list. However, compared to maps or pictures, spreadsheets may lack visual context and can be overwhelming with excessive data.

The best services to check out are Microsoft Excel and Google Sheets. This is the next method that I used and still do when planning group trips but just like Goldilocks, it was too hot for me and so I have to keep trying new ways!

- Flexible and powerful tool for designing travel itineraries

- Structured format for easy viewing, editing, and organizing

- Ideal for planning multi-destination trips

- Calculation functions for tracking budget and bucket list

- Lacks rich visual context provided by maps or pictures

- Can be overwhelming with excessive data

- Those who prefer a clear, structured format and are planning multi-destination trips or working with a tight budget.

3. Using Etsy Mobile Templates For Your Travel Itinerary

Etsy’s Mobile Templates offer a unique and visually appealing approach to creating travel itineraries. These templates use Canva, a graphic designing platform, provide an easy-to-use interface that allows users to design professional-looking itineraries with customizable templates, images, and fonts. What sets Etsy Mobile Templates apart is their convenience and accessibility.

With pre-made templates at affordable prices, travelers can make quick on-the-go edits and updates, ensuring that their plans are always accessible. However, it’s worth noting that managing complex, multi-destination trips may not be as efficient with Canva compared to traditional itineraries.

Additionally, there might be a learning curve for those accustomed to other systems, and editing Canva itineraries without an internet connection can be problematic while traveling. I have not tried this method yet but it is on my To-Do list as the templates are quite beautiful and tempting to buy!

- Unique and visually appealing templates

- Easy-to-use interface for designing professional-looking itineraries

- Customizable templates, images, and fonts

- Affordable prices for pre-made mobile itinerary templates

- Quick on-the-go edits and updates

- Adds convenience for travelers

- May not be as efficient for managing complex, multi-destination trips

- The learning curve for users accustomed to other systems

- Editing without an internet connection can be problematic

- Those who value aesthetics and simplicity in travel itineraries

- Travelers on less complicated trips

- Individuals with reliable internet access

4. Using A Custom Brochure For Your Travel Itinerary

Custom itinerary brochures are a fantastic tool for creating and organizing travel plans. Unlike other methods, these brochures offer a visually engaging way to present your itinerary, combining text and images for easy comprehension and an aesthetically pleasing view.

You can download my template that I made for free , by signing up below. It can be printed and carried along, providing access to your itinerary even without an internet connection. This porridge is just right for me as I use this method after figuring out every detail of my trip in combination with method #10. I don’t know why more people aren’t using or creating itinerary templates as a brochure but they are simple, effective, and fun to use!

- Visually engaging

- A balanced blend of text and images

- Easy planning process: With predefined structures, these templates simplify the planning process, helping you create an organized itinerary effortlessly.

- Accessible offline

- Limited detailed information: Due to space constraints, custom brochure templates may not accommodate extensive details for each location or activity.

- Lack of easy editing: Once printed, these brochures cannot be easily edited or updated, which may pose challenges if your travel plans change.

- Travelers seeking a visually appealing, tangible record of their travel plans.

- Those who have finalized their itinerary and do not anticipate last-minute alterations.

I created a fun and really cool itinerary template . It’s made to be in brochure form that way you can easily walk around with it or store it in a bag. You can download it for FREE by signing up below!

5. Using Pen & Paper For Your Travel Itinerary

A pen-and-paper itinerary is a traditional method where you can jot down anything really. It involves manually writing out all the details and plans for a trip, such as flight schedules, accommodation information, and activities. Unlike other methods that rely on digital tools, a pen-and-paper offers a tangible and flexible approach to planning.

However, there are drawbacks to this method. It can be time-consuming to write everything by hand, especially for longer and more complex trips. Changes to the itinerary may result in a messy and unorganized document, and there is a risk of losing all the planning if the paper is lost or damaged.

Despite these limitations, some travelers value the charm and tangibility of handwritten notes. I use pen and paper when I want to make quick notes I don’t want to forget or when I was working but secretly planning trips in my head (shhh don’t tell anyone!)

- Tangible and flexible approach

- Charming and traditional

- No reliance on digital tools or devices

- Time-consuming to write everything by hand

- Potential lack of organization and messiness

- Risk of losing the itinerary if paper is lost or damaged

- Travelers who value the flexibility and tangibility of handwritten notes

- Those who don’t mind potential organization issues

- Individuals who prefer a traditional and non-digital approach to planning.

6. Using A Notes App For Your Travel Itinerary

A Notes App is a digital tool that offers accessibility and convenience for creating travel itineraries. Unlike other methods, a Notes App allows users to update their itineraries on the go, offering flexibility for spontaneous adjustments. With features like syncing between devices, checklists, and attachments, it helps in organizing and structuring travel plans effectively.

However, it may lack the level of detail and customization provided by dedicated travel planner apps. Sharing the itinerary with others using different operating systems or devices can also pose challenges. But it is simple and anyone with a smart phone can use them.

- Harnesses accessibility and convenience

- Allows for on-the-go adjustments

- Syncs between devices

- Offers features like checklists, attachments, and tagging

- Easy inclusion of packing lists

- Limited functionality compared to dedicated travel planner apps

- Difficulties in sharing with fellow travelers using different devices

- Non-tech-savvy travelers

- Those who value convenience and flexibility

- Users who don’t prioritize organizational features and make on-the-go adjustments

Here is your Minimalist Packing List for all Vacations!

7. Using Google Maps For Your Travel Itinerary

Google Maps is a highly practical tool for creating travel itineraries. Its standout feature is its interactive nature, allowing users to visualize their travel route, calculate travel time, and explore nearby attractions. The integration with Google’s extensive database provides real-time traffic updates and public transit options, making it great for urban exploration.

Offline use is also possible, enabling access to itineraries without an internet connection. However, Google Maps may lack intricate details and collaborative editing features. It can also be a bit tricky or have a slight learning curve to add in all your destinations in plus the fact that Google Maps has a 10-stop limit. The good thing is you can use My Maps to get around that, a sub-page offered by Google.

- Interactive nature for visualizing travel routes

- Real-time traffic updates and public transit options

- Offline use for accessing itineraries without internet

- Integration with Google’s comprehensive database

- Lack of detailed features like scheduled timeline and personal notes

- Tricky management of editing rights for collaborative itineraries

- Preparation required for offline maps and storage space usage

- Individuals who prioritize route visualization and real-time updates

- Travelers who need offline access to their itineraries

- Those who do not require extensive details or collaborative editing features

8. Using Printable Templates For Your Travel Itinerary

Printable templates are a classic method of creating travel itineraries that continue to be valuable. These templates provide a tangible copy of your travel plans, ensuring that you have access to them regardless of battery life or internet connectivity. What sets printable templates apart is their customizability – you can tailor the layout and format to suit your preferences, allowing for a more personalized travel experience.

They also offer flexibility, as you can easily adjust them with personal notes, reminders, or changes. However, it’s important to note that printable templates lack interactive features like real-time updates or location tagging, and any adjustments to your travel plans would require manual editing and reprinting. They may be less convenient and portable compared to the Brochure itinerary, but they are both not environmentally friendly. The ones to check out are on Etsy , and Pinterest

- Tangible copy of travel plans

- Customizable layout and format

- Flexibility for personal notes and changes

- Lack of interactive features

- Manual editing and reprinting for adjustments

- Less convenience and portability

- Not environmentally friendly

- Travelers who value a tangible, customizable, and independent travel plan

- Don’t rely heavily on digital conveniences or real-time updates.

If you want to know How You Can Travel More read here!

9. Using A Calendar For Your Travel Itinerary

A calendar is an effective tool for organizing and keeping track of dates, providing a systematic way to plan and schedule activities. Calendars offer a clear visual representation of your travel schedule, allowing you to set specific times for each event. They are particularly beneficial for individuals who prefer a time-based breakdown of their plans.

Many calendar apps come with built-in alert features to ensure you don’t miss any planned activities. The down side is that calendars lack extensive details about each activity or location, and they may not have features for keeping track of budgets or lists. Managing overlapping events can also be challenging, especially for busy itineraries.

- Efficiently organizes travel schedule

- Provides a clear visual representation of the itinerary

- Built-in alert features to avoid missing activities

- Allows for synchronization with travel companions

- Lack of visual details about each activity or location

- Limited features for tracking budgets or lists

- Difficulty in managing overlapping events

- Potential confusion when multiple people edit the schedule simultaneously

- Individuals who prefer a meticulous, time-based plan

- Those who value the convenience of sharing itinerary details with fellow travelers.

10. Using A Travel Planner For Your Travel Itinerary

The best method for planning your trips is my Personal Travel Planner ! This planner is meticulously designed with travelers in mind, offering an organized and aesthetic way to prepare for your journey. It features dedicated spaces for all your travel details, from flight times to accommodation addresses, and even areas to jot down notes and memories.

Packed with inspiring quotes , this planner goes beyond just an itinerary planner. Its physical nature provides the advantage of offline usage, and the act of writing enhances memory retention. But that’s not all! My travel planner also includes a packing list, travel planning checklist, and so much more. You can plan for 12 incredible 10-day trips. It’s everything you need and more!

Once I started traveling more I was tired of buying planners that lacked realistic planning details that we travelers actually needed. As well as ample time frames for each destination. Even though this is my product that I created with LOVE and truly believe it is better than what’s out there on the market, I still think it’s fair to go over the pros and cons of it as it won’t be for everyone.

However, if it is perfect for you, get ready to plan your trips like never before with my exceptional travel planner!

- A tangible, organized approach with aesthetic and inspirational content

- Above and beyond pages to plan every aspect of your trip including Emergency Contacts, Trip Details, Travel Budget, Monthly and Weekly Itineraries, Meal Plans, Outfit Planners, Packing Lists, Trip Planning Checklist, Sitter Notes, and a Reflection Page!

- One planner will last you all year if you take a trip every month!

- You can plan your Bucket List and mark where you’ve been!

- Compact so you can travel with it

- may lack the flexibility and convenience of digital alternatives

- its physical nature could pose challenges such as space constraints or the risk of loss or damage

- those who appreciate a tangible, organized approach to travel planning

- Value aesthetic and inspirational content

- Individuals who don’t heavily rely on digital conveniences for itinerary management

Like I said earlier I use a combination of two methods and that’s my Travel Planner where I use the workbook to plan my entire trip with all the information I can and will need. Then I make a neat and aesthetically pleasing Travel Brochure with the template I made on Canva. I can carry the brochure with me everywhere I go on my trip and it hosts as an overview detail of my travels.

What Is The Difference Between Itinerary and Schedule?

There are various itineraries, including both an itinerary and a schedule. While they both serve to organize plans, they differ in their focus and level of detail.

An itinerary is a planned route or journey that outlines the places you plan to visit during your trip. It provides a broad overview of your travel plans and can be flexible.

On the other hand, a schedule is more specific and breaks down the itinerary into smaller time slots.

It details the timing of activities or events, specifying what you will be doing at each moment. Both are valuable tools for organizing your trips effectively.

How Many Types Of itineraries Can You Create?

There are various itineraries to create for your trip. Ten notable options for creating different types of itineraries.

These include using a document (such as Word or Google Docs), a spreadsheet (such as Excel or Google Sheets), or a graphic design tool (like Canva).

More ways are a custom-made brochure, traditional pen & paper, a notes app on your smartphone, Google Maps, a printable template, a calendar, or utilizing a travel planner.

The specific type of itinerary you choose largely depends on your personal preference, level of tech-savviness, and the level of detail you wish to include in your travel plans.

How Do I Organize My Perfect Trip?

To plan your ideal trip, you can follow a series of steps. First, decide on your destination and the duration of your trip.

Next, research and select the activities and places you wish to explore. Then, based on your findings, create various types of itineraries to suit your preferences.

You can organize them using different formats such as documents, spreadsheets, printable templates, or digital calendars.

Once you have your itineraries ready, proceed with making reservations for accommodations, restaurants, or activities , if required.

Finally, pack accordingly by considering the weather and cultural norms of your destination. Remember to stay flexible as plans can change, and be open to adjusting your itineraries as needed.

I love my Travel Planner because it has everything I need to make a great trip!

What Are My Recommended Resources For Planning A Trip?

When planning my trip, I use my trusted trio of CheapOair, Viator, and Booking.com to provide a comprehensive solution for everything I need.

CheapOair is a go-to resource for affordable flight tickets. With its extensive network of over 600 airlines, it offers a wide array of choices, enabling you to easily compare prices and select the best deal that suits your budget and travel schedule.

Viator on the other hand, is an excellent platform for booking tours and activities. It provides access to thousands of sightseeing tours, attractions, and events in over 1,500 locations worldwide. It ensures you don’t miss out on the unique experiences each destination has to offer.

Booking.com is your reliable partner for accommodations. With over 28 million listings including hotels, apartments, and hostels, you can find the perfect place to stay that fits your budget and preference.

Together, these platforms make trip planning convenient, cost-effective, and fun. They ensure you have everything you need, from flights and accommodations to activities – at your fingertips.

Check Out My Resources Page For All My Recommended Travel Tools!

Final Thoughts-

There are a variety of tools available to assist with travel planning. Documents, spreadsheets, mobile templates, brochures, pen and paper, notes app, Google Maps, printable templates, calendars, and my travel planner have been discussed as potential options for planning your trip.

Each option offers its own pros and cons which should be considered when selecting the most suitable method for you. My expertise in using most of these methods led me to make my travel itinerary brochure and travel planner. I believe they are an excellent choice for those looking for the best way to plan their trip.

Happy exploring!

Read More About Fulfilling Your Bucket List Dream!

How To Make A Travel Bucket List!

What To Name Your Bucket List?

How To Travel More and Fulfill Your Bucket List!

Find Your Perfect Travel Style!

How To Plan Your Dream Vacation For Your Bucket List!

10 Types Of Itineraries, What’s The Best Travel Method?

A Carry-On Packing List for All Vacations!

How To Make An Adventure Travel Budget & Stick To It!

25 Awesome Ways On How To Document Your Travels

Elevate Your Travels With Your Personal Travel Planner!

I'm Kaylee, a traveler ticking off 100+ bucket list destinations worldwide. I’ve spent 90 days in Italy studying abroad and explored over 50 cities globally. With this travel blog, I show other travelers how to fulfill their dream trips with the thrill of crossing off their bucket list, one checkbox at a time.

Similar Posts

How To Plan Your Dream Vacation For Your Bucket List! (2024)

DIY 1st Aid Kit For Travel and Vacations.

7 Essential Travel Tech Items You Need on Vacation!

Why You’ll Want Heritage Travel On Your Bucket List! (2024)

How To Make An Adventure Travel Budget & Stick To It! (2024)

Best 15 Tips For Studying Abroad In Europe (2024)

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Daily Crossword

- Word Puzzle

- Word Finder

- Word of the Day

- Synonym of the Day

- Word of the Year

- Language stories

- All featured

- Gender and sexuality

- All pop culture

- Grammar Coach ™

- Writing hub

- Grammar essentials

- Commonly confused

- All writing tips

- Pop culture

- Writing tips

a detailed plan for a journey, especially a list of places to visit; plan of travel.

a line of travel; route.

an account of a journey; record of travel.

a book describing a route or routes of travel with information helpful to travelers; guidebook for travelers.

of or relating to travel or travel routes.

Obsolete . itinerant .

Origin of itinerary

Words nearby itinerary.

- ithyphallic

- itinerarium

- It is a far, far better thing that I do, than I have ever done

Dictionary.com Unabridged Based on the Random House Unabridged Dictionary, © Random House, Inc. 2024

How to use itinerary in a sentence

Look for a professional who has corporate travel experience or who plans lengthy, complicated itineraries, such as cruises or safaris.

The passengers stayed on board for up to a month, depending on the itinerary .

It’s a similar story for cruise lines, most of which plan to resume operations in March, but with occupancies down as much as 50% on some itineraries.

Public health experts have advised that in addition to reducing risks via transportation, travelers should be equally mindful of the destination and activities on their itinerary .

Its website includes helpful travel info, such as the closest airport and itinerary highlights.

Based on my input, the next stop on my globe-trotting itinerary should be…Vermont!

Of course, anything resembling a real Joycean itinerary is long gone.

Over 600 police personnel have been deployed around places which form part of the royal couple's itinerary , officials said.

Chris shared his ideal itinerary if he only had two days at Aspen.

Just a short walk from the metro, this hidden gem is well worth an addition to the itinerary .

Meanwhile we resume our itinerary of the Portsmouth Road where we broke off, at Esher.

But while the itinerary of the planets was suppressed, a few words were retained about the adventure of the moon.

For particulars concerning Armentires, see pp. 49—55, first itinerary .

Afternoons, the suspect followed a more or less regular itinerary .

He was taking the rest cure by means of a sea voyage to San Francisco and deflected his itinerary for a week's land journey.

British Dictionary definitions for itinerary

/ ( aɪˈtɪnərərɪ , ɪ- ) /

a plan or line of travel; route

a record of a journey

a guidebook for travellers

of or relating to travel or routes of travel

a less common word for itinerant

Collins English Dictionary - Complete & Unabridged 2012 Digital Edition © William Collins Sons & Co. Ltd. 1979, 1986 © HarperCollins Publishers 1998, 2000, 2003, 2005, 2006, 2007, 2009, 2012

- Dictionaries home

- American English

- Collocations

- German-English

- Grammar home

- Practical English Usage

- Learn & Practise Grammar (Beta)

- Word Lists home

- My Word Lists

- Recent additions

- Resources home

- Text Checker

Definition of itinerary noun from the Oxford Advanced American Dictionary

- have/take a vacation/a break/a day off/a year off/time off

- go on/be on vacation/leave/honeymoon/safari/sabbatical/a trip/a tour/a cruise/a pilgrimage

- go backpacking/camping/sightseeing

- plan a trip/a vacation/your itinerary

- reserve a hotel room/a flight/tickets

- have/make/cancel a reservation

- rent a condo/a vacation home/a cabin

- rent a car/bicycle/moped/scooter/Jet Ski

- stay in a hotel/a bed and breakfast/a youth hostel/a villa/a trailer/a vacation home/a resort/a timeshare

- cost/charge $100 a/per night for a suite/a single/double/twin room

- check into/out of a hotel/a motel/your room

- pack/unpack your suitcase/bags

- call/order room service

- cancel/cut short a trip/vacation

- apply for/get/renew a/your passport

- take out/buy/get travel insurance

- catch/miss your plane/train/ferry/connecting flight

- fly (in)/travel (in) first/business/economy class

- make/have a brief/two-day/twelve-hour layover/stopover in Hong Kong

- experience/cause/lead to delays

- check (in)/collect/get/lose your baggage/luggage

- be charged for/pay excess baggage fees

- board/get on/leave/get off the aircraft/plane/ship/ferry

- taxi down/leave/approach/hit/overshoot the runway

- experience/hit/encounter (mild/severe) turbulence

- suffer from/recover from/get over your jet lag/motion sickness

- be seasick/carsick

- attract/draw/bring tourists/visitors

- encourage/promote/hurt tourism

- promote/develop ecotourism

- build/develop/visit a tourist/tropical/beach/ski resort

- work for/be operated by a major hotel chain

- be served by/compete with low-fare/low-cost/budget airlines

- use/go to/have a travel agent

- contact/check with your travel agent/tour operator

- buy/be on/go on a package deal/vacation/tour

- buy/bring back (tacky/overpriced) souvenirs

Take your English to the next level

The Oxford Learner’s Thesaurus explains the difference between groups of similar words. Try it for free as part of the Oxford Advanced Learner’s Dictionary app

Scheduled Flight Travel: What is it and Why Is It Important?

- Posted on August, 25, 2022

Planned Travelling: Types and Importance: The definition of the term “Flight Itinerary,” despite the fact that it frequently causes misunderstandings, is relatively simple and straightforward. Even though many individuals mistakenly believe that air tickets to India from USA and itineraries are the same things, they’re not. There’s no need to infer how the two names vary or their actual connotations. Here, in this article, we have adhered to the definition of this term that you need to understand.

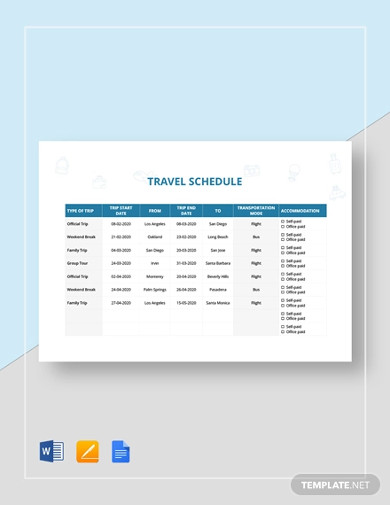

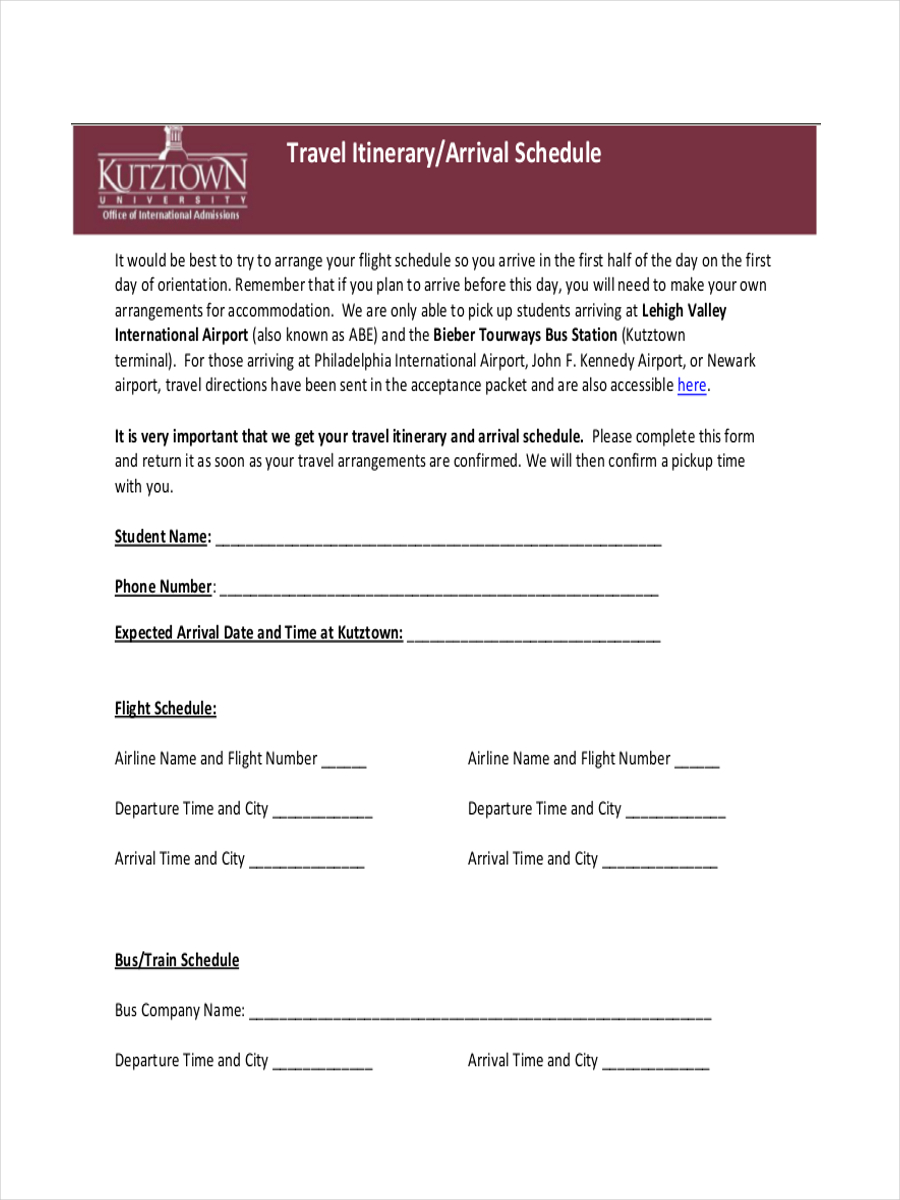

What is Flight Itinerary or Planned Travel Plans?

- The Aviation Route

- A flight’s number

- Schedule for departure and arrival

- Airports of Origin and Destination

- Layovers and Connecting Airports

- The specifics of your flight path.

- Verification id and other crucial information

But purchasing a ticket for a flight is essential. You won’t be able to fly, to put it simply. As per the airline guidance, You won’t be able to check in and fly at the same time. On a plane ticket, the following information will be written over it:

- The traveler’s name

- Airline issuing

- Ticket quantity

- Three-digit airline code

Not only that, but you can share your flight itinerary with those closest to you. You can view your itinerary on the airline’s website after receiving a copy by email. All that will be needed is for you to sign in with your credentials on the airline’s website. Henceforth, you will be able to find your flight’s itinerary by visiting the travel area.

- Expenditure within Budget

A flight schedule will allow you to manage your trip’s expenses. You have the option to calculate and decide on the overall cost of your trip in advance. It becomes much simpler to conclude your travel budget once you are informed of the expected travel costs.

- Permits Necessities

Prioritizing the requirements and essentials is always made easier with a schedule for your trip. Additionally, it will provide you the chance to visit the more uncharted territory. Without a doubt, you will have enough time to travel to all of your favorite places. You have the opportunity to choose how and where you truly want to spend your trip if you make ahead plans.

- Time Management

A schedule for your flight, in particular, will help you plan ahead and manage your time. The timetable and the travel dates will also be included. You can also assess any unforeseen circumstances that may arise while traveling. For instance, terrible weather, a rush of passengers, etc. This enables you to organize and arrange your air tickets to India from USA suitably. You can make the greatest possible use of your time.

- Keep Track of All the Travel Essentials

You may be cautious about packing all the necessary items for the trip by creating a thorough travel plan. After all, doing so enables you to unwind and enjoy your long-haul journey. It’s crucial to understand that packing basics are one of the best travel advice for international flights from USA to India . You can therefore bring things like appropriate clothing, footwear, medications, and emergency contact information.

Different Types of Flight Itineraries

- One-Way Routes

When you travel one way alone, you are flying from your starting point to your final destination. Therefore, it implies that you purchase a one-way ticket to the location. You only receive a one-way itinerary, too. Consider purchasing your air tickets to India from USA . You will only have a one-way itinerary.

- Round-Trip Plan

An itinerary that includes both a flight to a specific location and a flight back is referred to as a round trip. In other words, if you purchase round-way tickets for your vacation. You will then receive a round-trip schedule. Take the case of round-trip international flights from USA to India . The itinerary will be regarded as a round-trip.

- Open Jaw Travel Schedule

When you purchase a ticket for yourself on a return flight, however, there is a small error. This means that the airport from which you will be returning and the final destination may be different. In a nutshell, imagine that you fly from New York to Delhi and then take a flight from Chicago to Bangalore for your return. You will therefore receive an open-jaw itinerary.

- Itinerary Including Several Airlines

When you decide to fly on numerous airlines on the same aircraft, that is referred to as a multiple airlines itinerary. Take the scenario where you take an Air India aircraft from New York to Delhi and a United Airlines flight to return. You will receive multiple airline itineraries with the best travel offers as a result.

- Multiple-City Route

You will receive a multiple-city itinerary if you want to visit several cities. In other words, we can state that you have more than two destinations on your flight bookings. For instance, you arrange your travel from Hyderabad to New York. Booking flights from Hyderabad to Delhi and then Delhi to New York is another option. You receive a multiple-city itinerary in this situation.

Some Frequently Asked Questions: For your Better Understanding

Q. Are a flight’s itinerary and tickets for that flight distinct? Ans: Yes, a flight schedule differs greatly from a ticket. It can vary in a wide variety of ways. A flight ticket is only a piece of paper that verifies your participation in a certain flight. An itinerary, on the other hand, is a well-planned schedule for your flight travel to a specific location.

Q. What is contained in a flight schedule? Ans: An itinerary for your flight contains all of the detailed information regarding your trip. It lists the routes, the destinations, and the departure and arrival times.

Q. Why is a flying itinerary required? Ans: It is necessary since it helps to avoid a variety of problems related to flying travel. Consequently, you can organize your trip appropriately. Additionally, it aids in preventing unplanned events of any kind.

It is our hope that the above-mentioned article was useful and that you now understand the difference between flight tickets and flight itineraries.

Get started

- Project management

- CRM and Sales

- Work management

- Product development life cycle

- Comparisons

- Construction management

- monday.com updates

Plan a trip to perfection with a vacation itinerary template

Whether you’re planning a weekend city break, or organizing a year-long, around-the-world journey, planning a trip requires organizing dozens of details. A vacation itinerary template helps you manage the schedule, budget, and logistical information of your trip. In this article, we’ll explain what a vacation itinerary template is, why you need one, and share examples and templates to help you plan your perfect vacation.

Get the template

What is a vacation itinerary template?

A vacation itinerary template is a document you can use to create a travel plan and centralize all the details of your trip — it’s basically a travel schedule with space for other useful travel information such as:

- Flight departure and arrival times

- Accommodation name and address

- Contact details

- Any excursions or events planned for the trip

- Trip essentials, such as sunscreen or protective clothing

- Information about the destination and how to respect the local people and culture

- Useful phrases in the local language

The itinerary format depends on your needs — you might create a travel spreadsheet template in Excel if you’re focused on costs or try a Google Docs itinerary template for more general planning. If you want a simpler visual of your schedule, a Gantt chart view might be a good choice, as you can see in the example below. However, a capable Work OS is a more flexible option than Word or Excel because it allows you to do both — but more on this later. First, let’s cover why you should use a vacation itinerary template in the first place.

Download Excel template

Why use a vacation itinerary template?

Whether you’re a solo traveler or the official trip planner for a 20-person European tour, an event itinerary template helps ensure you don’t skip over any important details. It’s especially helpful when traveling in groups as it’s a way to make sure everyone has all the information they need. Ultimately, an itinerary planner template can improve the quality of your trips by allowing you to:

1. Centralize your travel information in one place

Travel often involves using more than one form of transport or catching a connecting flight. A travel itinerary enables you to keep your travel information all in one place, including departure and arrival times, flight numbers, and public transport information. So it’s much easier for you to reach your destination on time without getting lost.

2. Make the most of your time

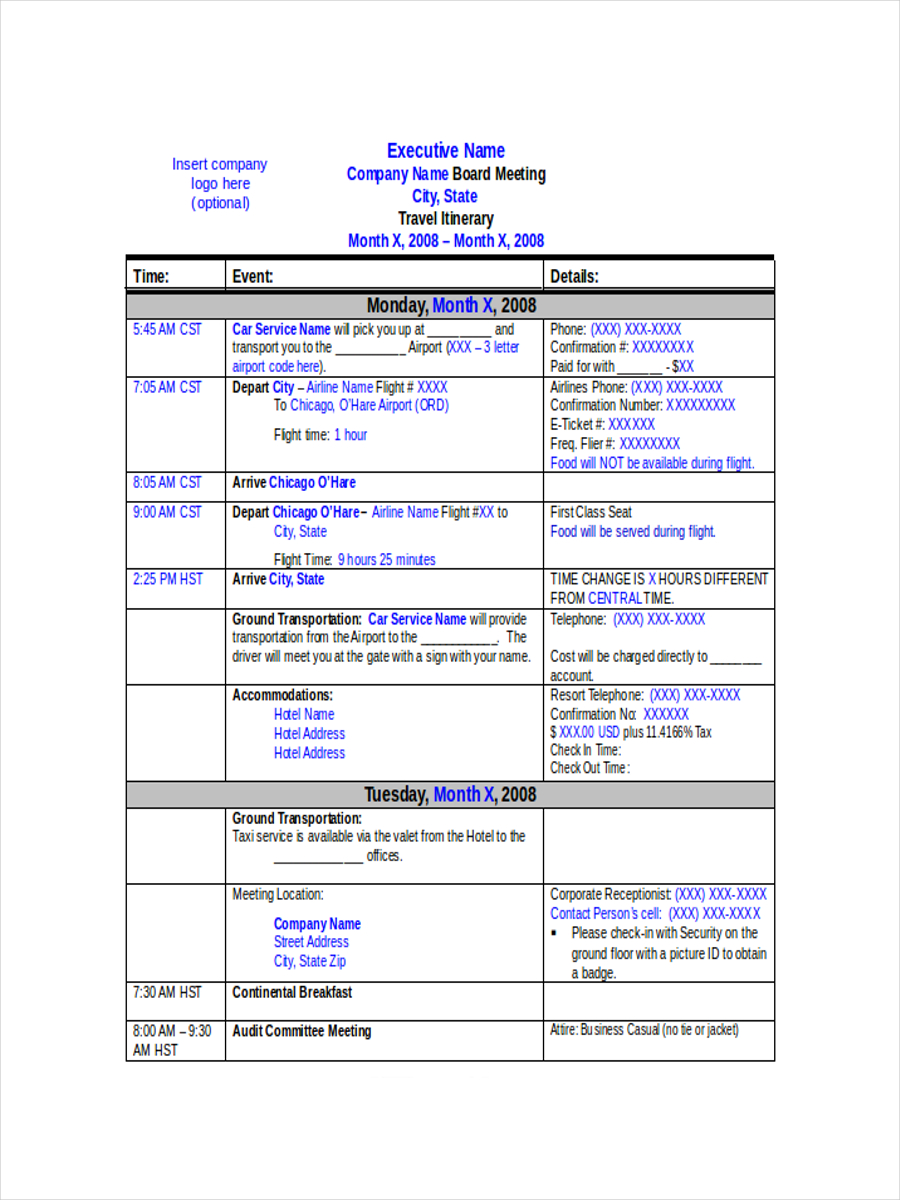

With limited time in an amazing location, you want to make the most of it and ensure you don’t miss any once-in-a-lifetime experiences. A vacation itinerary template helps you plan out your vacation — to the day or even to the hour — just like a business travel itinerary helps you schedule your work trips.

3. Manage your budget

Even when you’re traveling for leisure, it’s always a good idea to have a cost management system in place. When you’re dealing with foreign currency, expenditures can quickly get out of hand. Some robust itinerary templates provide space to estimate the costs and track the expenses of your trip.

4. Pack everything you need

Once you’ve planned where you’re jetting off to, you need to know exactly what you’ll need when you get there. A vacation itinerary template is the perfect place to list your travel essentials, especially if your trip involves several destinations or different types of activities. You can also make a note of any medicines you’ll need as well as local emergency numbers.

What are some examples of a vacation itinerary template?

Ready to start bringing your trip ideas to life with a travel schedule template? Take a look at these four examples of vacation itinerary templates to get your inspiration flowing.

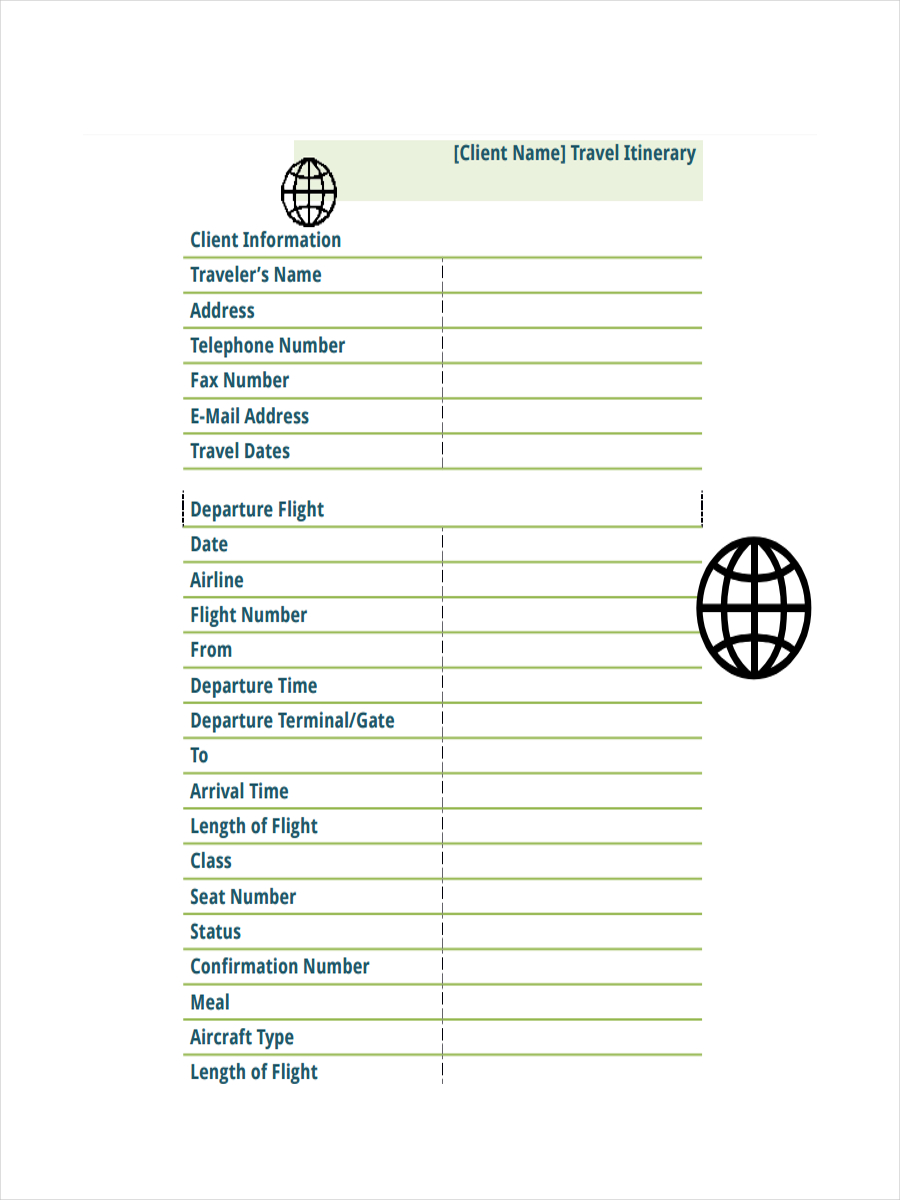

Flight itinerary template example

This classic example of a flight itinerary contains all the details a traveler needs for a smooth and carefree flight, including:

- Information about passports and visas

- Departure airport

- Travel destination

- Departure time

- Flight number

- Connecting flight and layover details

- Booking reference

- Airline rules and regulations

Juggling all of that information without an organization system could quickly become overwhelming. A flight itinerary template ensures that all of your important flight information is contained in one place and is clear and easy to understand.

( Image Source )

Daily itinerary template example

There are almost unlimited ways to create a daily itinerary — which is best for you will depend on the type of activities you planned. One way to do it is to lay it out like the example below. It has a schedule column on the left and a checklist of must-see sights on the right.

This enables you to plan your route in the way that makes the most sense and make sure you don’t miss anything important. It also has space for meal planning , so no one gets hangry, and the weather forecast, so everyone dresses appropriately.

Family holiday itinerary template example