- Privacy Policy

- Disclosures

- Do Not Sell My Information

Guide on How To Use United’s TravelBank

by The Frugal Tourist | Jan 6, 2024 | American Express , Travel , United | 22 comments

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. All information about the Hilton Honors American Express Aspire Card has been collected independently by The Frugal Tourist. The card details on this page have not been reviewed or provided by the card issuer.

In this blog post, I will walk you through the steps on how to fund and use United’s TravelBank.

Since some credit cards provide travel credits that expire within a year, depositing money in United’s TravelBank is a viable option to utilize those credits so they won’t go to waste.

Funds diverted into United’s TravelBank have a 5-year lifespan, offering some level of longevity and a lot of flexibility, especially since travel is not expected to pick up again anytime soon.

Whether you have plans this year or in the near future, funding your United TravelBank with free cash from your credit cards is a wallet-friendly strategy that can potentially save you a few hundred dollars when the time comes that you need to book your next flight.

United TravelBank

According to United, your TravelBank funds can either be used alone or in combination with select forms of payment only when booking United or United Express flights .

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

I was also unsuccessful in tapping my TravelBank reserves to pay for taxes when booking an award ticket or paying additional fees to cover the airfare difference when redeeming a voucher or rebooking a travel credit.

However, I did not encounter any roadblocks when I booked paid United tickets, even if the airfare was Basic Economy .

Terms and Conditions

The information below was taken from United.com

- Passengers can select from six purchase amount options, and once purchased, the value remains valid for five years from the date it is deposited in your TravelBank account.

- Purchases are not refundable and are limited to $5,000 per day per MileagePlus account.

- This purchase is also subject to all of the TravelBank terms and conditions .

- United has the right to terminate this promotion or to change the promotion’s terms and conditions, rules, regulations, policies and procedures, benefits, and/or conditions of participation, in whole or in part, at any time, with or without notice.

Guide on How to Fund United’s TravelBank

Access United TravelBank by clicking the button below. You will need to log in to your United Mileage Plus Account to purchase.

Do not have a United membership yet?

It is free and easy to register. Click the button below to enroll in United’s Mileage Plus Program.

After logging in, you will see your United Mileage Account, any United miles you have available for redemption, and your TravelBank Cash Balance.

Plus Points – a points system that passengers can utilize to upgrade their flights – will also show up, but we will not go over that in this post. You can read more about this program here.

Select the amount of travel cash you want to purchase.

As previously stated, there are six possible amounts that you can elect to deposit to your TravelBank.

The next page will ask for you to type in your Payment Information.

In this case, you would want to use a credit card that provides an Airline Credit.

I will list these credit cards in one of the sections below.

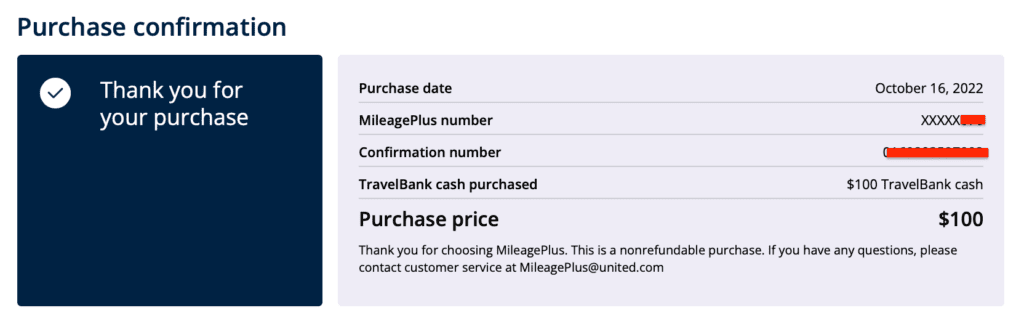

You will then get confirmation that your purchase was successful. A receipt will be emailed immediately after as well.

In this example, I used my The Business Platinum Card® from American Express to buy $100 worth of travel cash in United’s TravelBank.

Guide on How to Use Your United Travel Bank Cash

Thankfully, we are generously given five years to spend our travel cash.

Once you are ready to book your flight, log back on to your United.com profile and enter your travel details.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

Select your particular flight, verify your personal information, and pick your seat.

Afterward, you will be directed to the Payment Page.

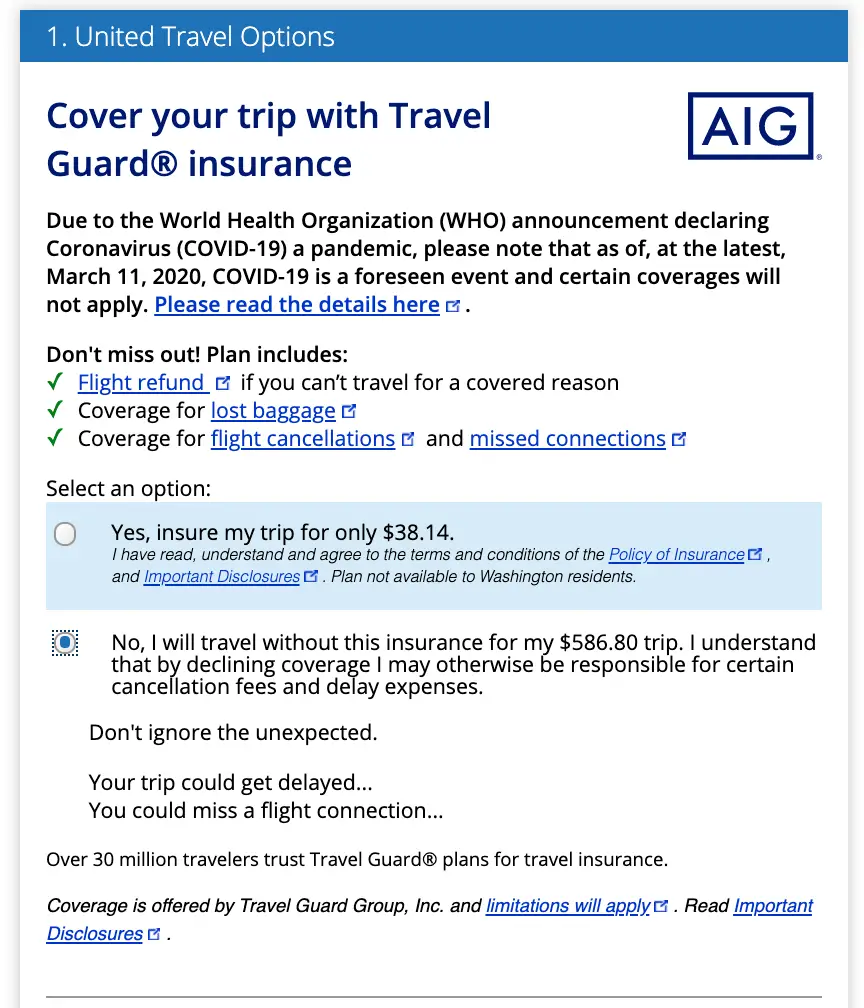

Next, United will offer you travel insurance (select yes/no), priority boarding, and miles for purchase.

Regardless of whether you decide or decline to purchase these additional bells and whistles, the payment section comes right after.

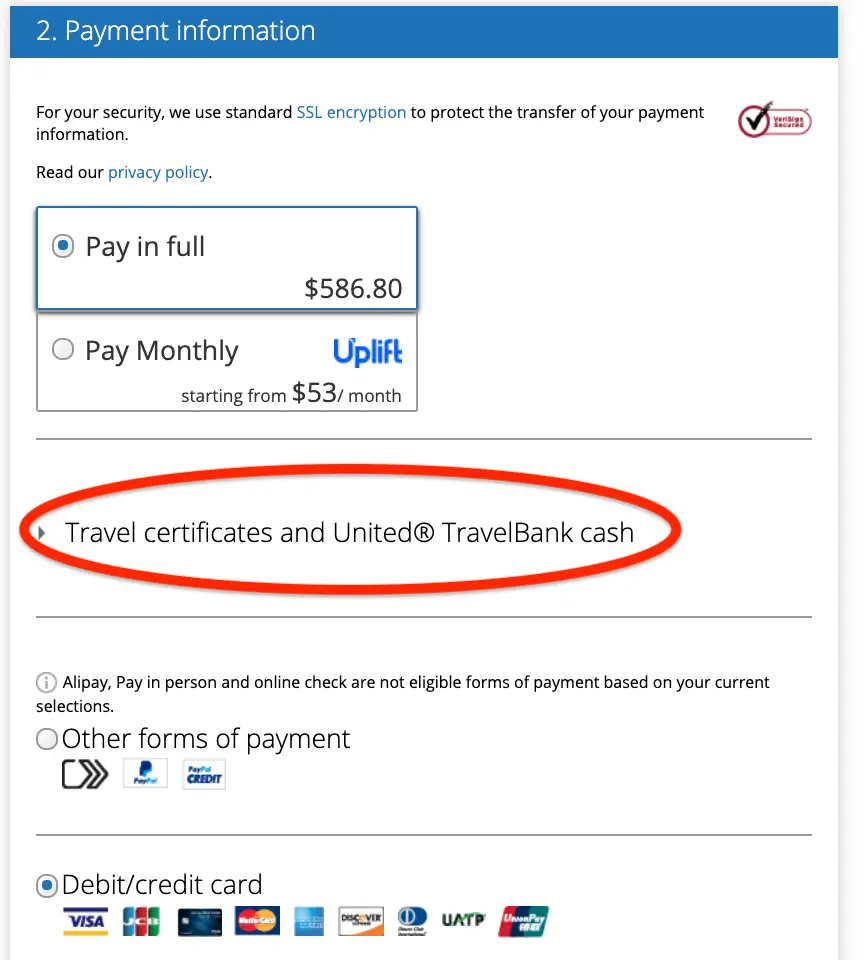

You have the following payment options:

- Pay In Full

- Pay Monthly

- Travel Certificates and United TravelBank Cash (if this option does not appear, then the ticket you’re buying is not a permitted purchase using travel cash.)

- Other Forms of Payments (PayPal, etc)

- Debit / Credit Card

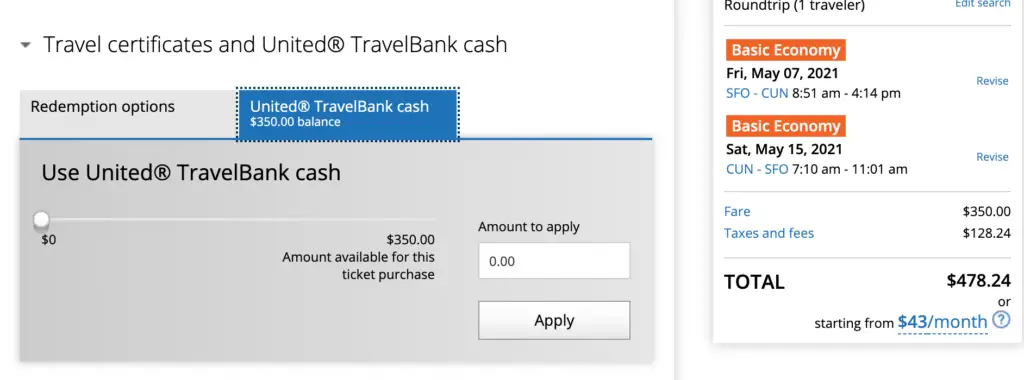

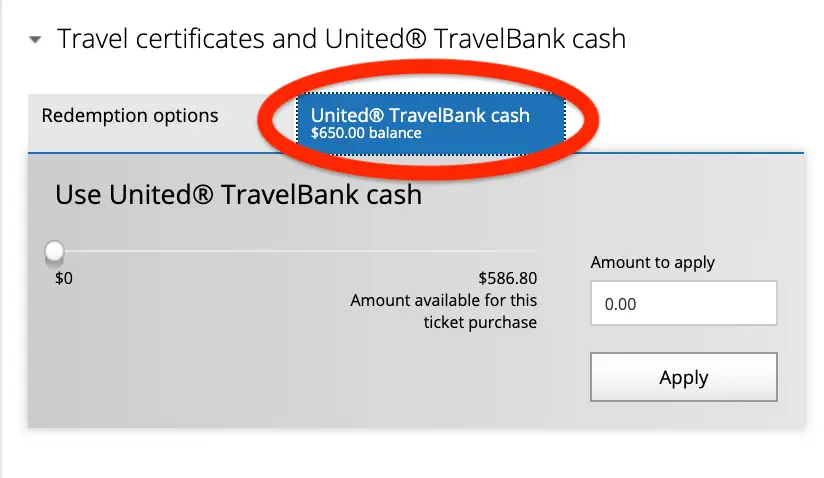

Select “Travel Certificates and United TravelBank Cash.”

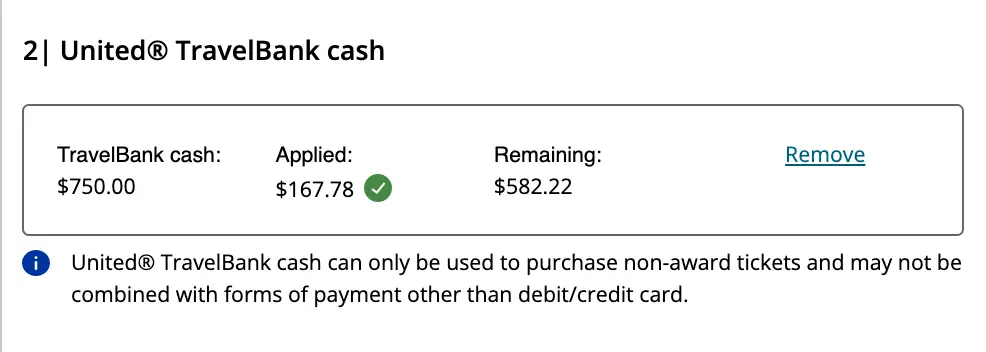

As you can see, my $100 travel bank deposit is already reflected in my account.

Next, enter the amount you want to use for the flight you wish to book.

It is not necessary to spend your entire stash of United travel cash if you have other plans to spend it later.

Once you have a final amount in mind, click apply.

In this example, I decided to spend $75 of the $100 currently in my United TravelBank.

After your travel cash is deducted, the total amount you still owe will automatically be calculated.

Continue with your purchase by selecting the mode of payment you want to use for the remaining balance.

I highly recommend paying a portion of the flight with a credit card that offers travel protections, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Alternatively, you can purchase travel insurance to cover your entire trip.

Where Do I Find My TravelBank Account?

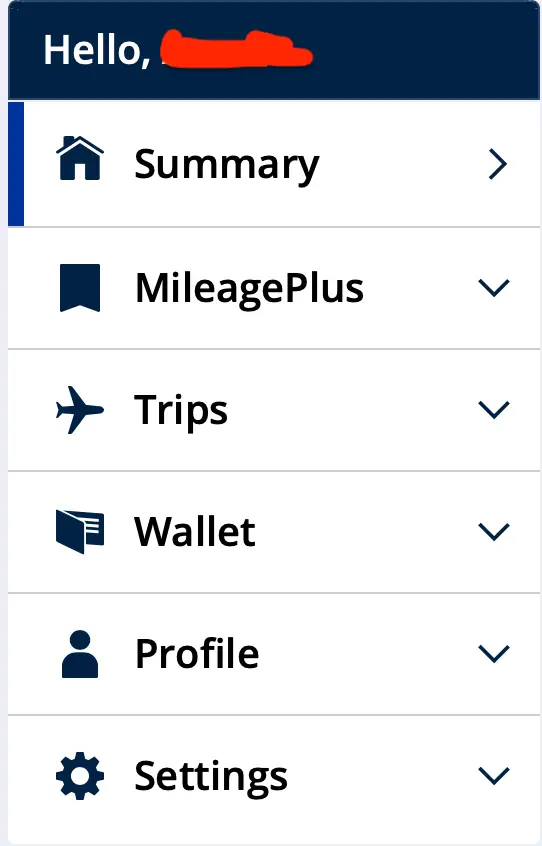

United has recently updated its website. You can find your United TravelBank account information and balance by navigating to your United Wallet on the app and the computer.

Troubleshooting Potential Issues

Issue 1: united travelbank does not show up.

A few readers have expressed that they are having difficulty locating the TravelBank option on United’s website.

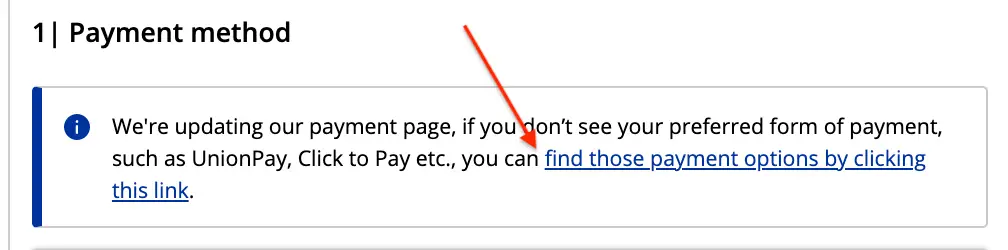

It appears that United’s site is currently updating its payment page. When you see the notice below under “Payment Method, ” click the “find those payment options…” link.

This link will direct you to the “United Travel Options” section, where you can add travel insurance to your purchase. Make your selection.

Afterward, you will be directed to “Payment Information,” where the TravelBank option appears.

Click “Travel Certificates and United TravelBank Cash” and select Travel Cash as your mode of payment.

Type the amount you would like to spend.

As suggested, charge a small portion of your airfare on a credit card that provides travel insurance, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

You may also elect to purchase travel insurance for additional coverage.

Issue 2: United TravelBank Keeps On Freezing

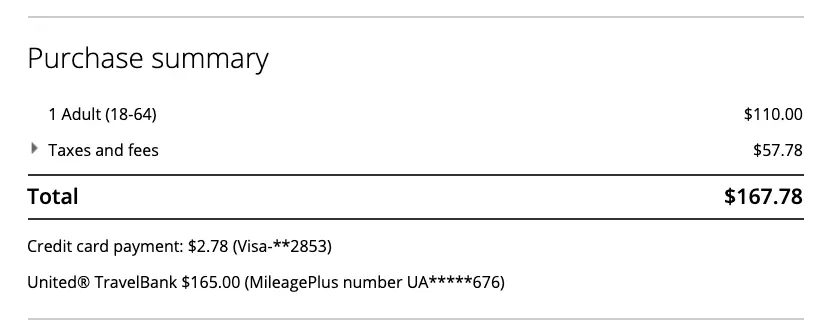

While booking a plane ticket to Cabo costing $167.78 recently, I found the United website struggling to process my TravelBank payment, ultimately freezing the payment page.

After attempting various troubleshooting strategies, I eventually made it work by typing a whole number into the TravelBank box.

In this case, I redeemed $165 of my TravelBank credits towards the purchase of this ticket and used a credit card that gives travel protections ( Chase Sapphire Reserve® ) to cover the remaining amount ($2.78).

Issue 3: TravelBank is Unable to Add a New Credit Card (Payment Error)

United.com can only save a certain number of credit cards on your profile.

If the website is not allowing you to add another credit card to your United TravelBank account, you will need to log in to your main United.com account, go to “Wallet,” remove the credit cards that you no longer use, and then add the ones you would like saved.

Once your new credit card is linked, note the last four digits of your card and its expiration date so you can easily find it on your list of saved cards when you try to purchase United TravelBank funds again.

Issue 4: Unable to Purchase

As mentioned above, your United TravelBank funds can either be used alone or in combination with select forms of payment when booking United or United Express flights only.

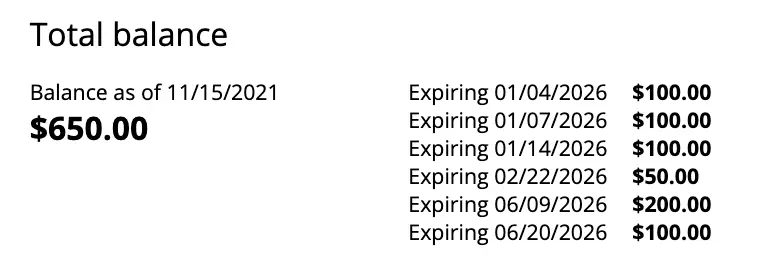

When Do United TravelBank Funds Expire?

As of this update, TravelBank funds appear to expire after five years.

The screenshot below, captured from my TravelBank account, supports this assertion.

While the money deposited in our United TravelBank accounts has a 5-year validity, it can be forfeited if no activity is recorded in our TravelBank accounts for 18 consecutive months.

Therefore, ensure that you either add money to your TravelBank or use your TravelBank funds to purchase tickets at least once every 18 months.

Heads Up: United also stipulated that any re-deposited funds originating from canceled tickets purchased with TravelBank money do not qualify as an eligible activity. In short, any re-deposited funds will NOT reset the expiration date.

United may also change the expiration date of subsequent deposits or discontinue the program altogether. Only time will tell.

For now, this option to convert our credit card airline credits to some form of flexible currency is available, so certainly consider this method if you are running out of ways to redeem your expiring credits.

Which Credit Cards to Use?

You should only purchase TravelBank funds when you anticipate no other eligible travel-related purchases for the remainder of the year.

Chase Credit Cards

Chase sapphire reserve® (csr).

The Chase Sapphire Reserve (CSR) comes with a $300 travel credit that resets every year on the card member’s anniversary date and does not roll over onto the following year; therefore, you either use it or lose it.

I do not recommend using your CSR travel credits to purchase funds on United’s TravelBank, given that Chase provides an extensive array of valuable avenues to redeem this credit.

In addition to the traditional airfare purchase, you can also trigger the travel credit when paying for public transit, ride-sharing services, parking, hotels, campgrounds, cruises, etc.

Citi Credit Cards

Citi prestige® credit card.

This card is no longer available to new applicants.

This credit card comes with a $250 travel credit, which can now be conveniently spent on groceries, restaurants, and take-out.

Like the Chase Sapphire Reserve, this credit resets every calendar year and likewise does not roll over.

I do not suggest using your Citi Prestige travel credits to purchase United TravelBank funds because of other beneficial spending options you have at your disposal.

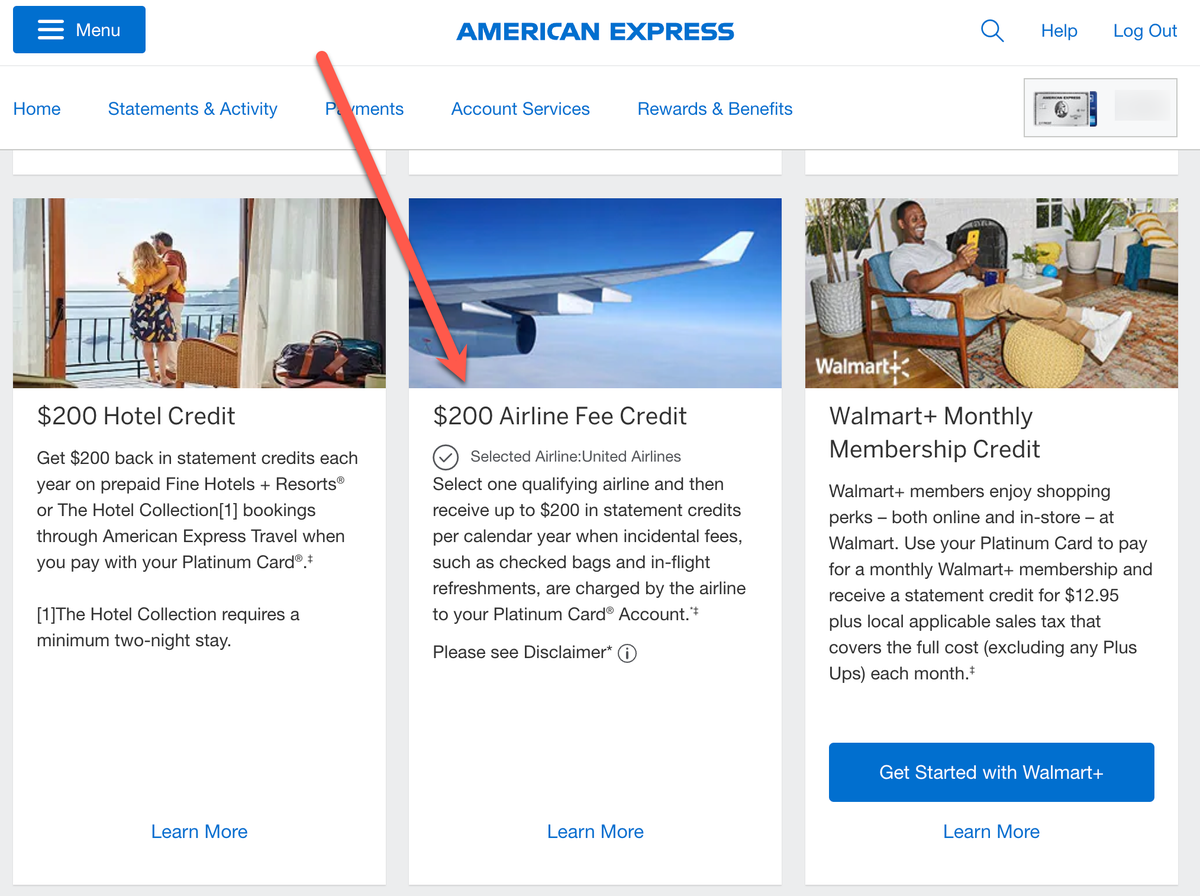

American Express Credit Cards

American express® credit cards with airline fee credits.

- The Platinum Card® from American Express ($200 Annual Airline Credit)

- The Business Platinum Card® from American Express ($200 Annual Airline Credit)

- Hilton Honors American Express Aspire Card ($50 Quarterly Airline Credit)

American Express’s airline fee credit is challenging to redeem compared to Chase’s and Citi’s more flexible identical offerings.

In the past several years, consumers consistently find themselves jumping through hoops in search of effective methods to capitalize on these generous offers.

First and foremost, Chase and Citi do not require activation – their credits apply to all airlines and other forms of travel.

Whereas Amex’s airline fee credit will not work unless you activate it.

Plus, it can only be used on one airline you pre-select, ideally at the beginning of the year.

Even though there are data points (DP) that Amex has been lenient in allowing the preferred airline to be changed via chat as of late, there is no way to predict until when they will allow this.

AMEX Airline Fee Credit Restrictions

AMEX has strict restrictions on what fees qualify under this credit.

Technically, only incidental purchases, such as seat assignments, baggage fees, change fees, lounge access fees, and food/beverage inflight purchases, are eligible.

As such, traditional expenses such as award fees, plane tickets, upgrades, and gift cards do not qualify.

But occasionally, we see additional methods that temporarily open up that trigger this airline fee credit – and for now, United TravelBank is one of them.

While no language explicitly states this particular purchase will not qualify, I have to underscore that Amex can undoubtedly claw back this credit at any moment if they deem that TravelBank is not eligible. So, just be aware of that possibility.

Hence, please utilize this tactic only if you do not anticipate using your airline fee credit throughout the rest of the year.

Steps in Selecting Your Airline With Amex

Before you go ahead with your purchase, follow the steps below on selecting your preferred airline, as AMEX does not make it simple to locate where to activate this benefit.

To optimize this TravelBank strategy, make sure that the airline you selected is United.

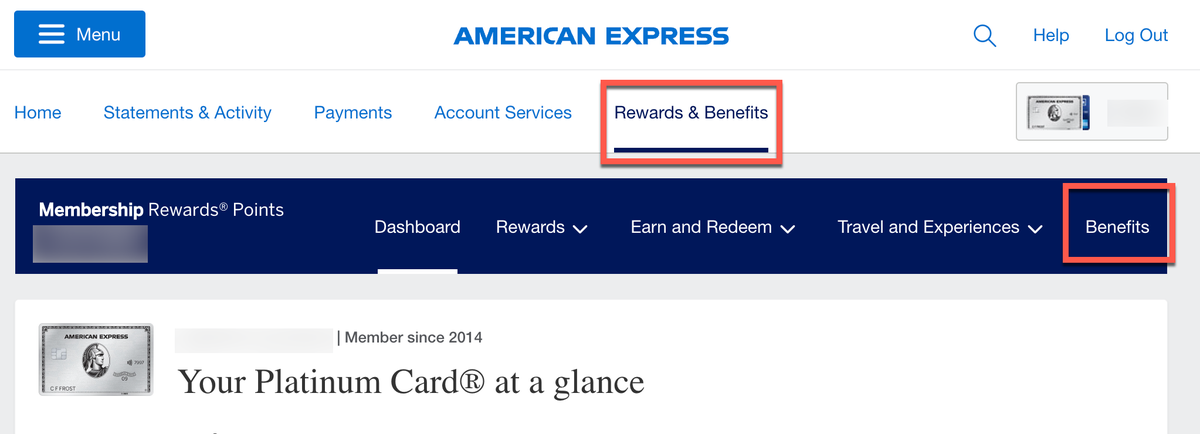

Go to AmericanExpress.com, then log in to your account.

Select the particular AMEX credit card that currently offers an airline fee credit.

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Hilton Honors American Express Aspire Card

On the main page, click “More, ” then select “ Benefits .”

On the Benefits page, scroll down to locate “ Airline Fee Credit. ”

This is where you can also change your selected airline for the year.

It bears repeating that you’re technically not allowed to change your preferred airline mid-year, so choose wisely.

With that said, there are data points from people reporting that they have successfully modified their airline choice by contacting AMEX through chat, but this is YMMV (your mileage might vary).

As of this writing, you can use your airline fee credit with the following U.S. carriers:

While on the Benefits page, enroll in all the offers available to you even if you are not sure you will use them.

It is practically money you had already paid for when you paid your annual fee, so you might as well take advantage of it.

At any rate, maximizing this airline fee credit is a fantastic way to offset the steep annual fees Amex charges on their ultra-premium cards.

Add funds to your travel credit using your AMEX card.

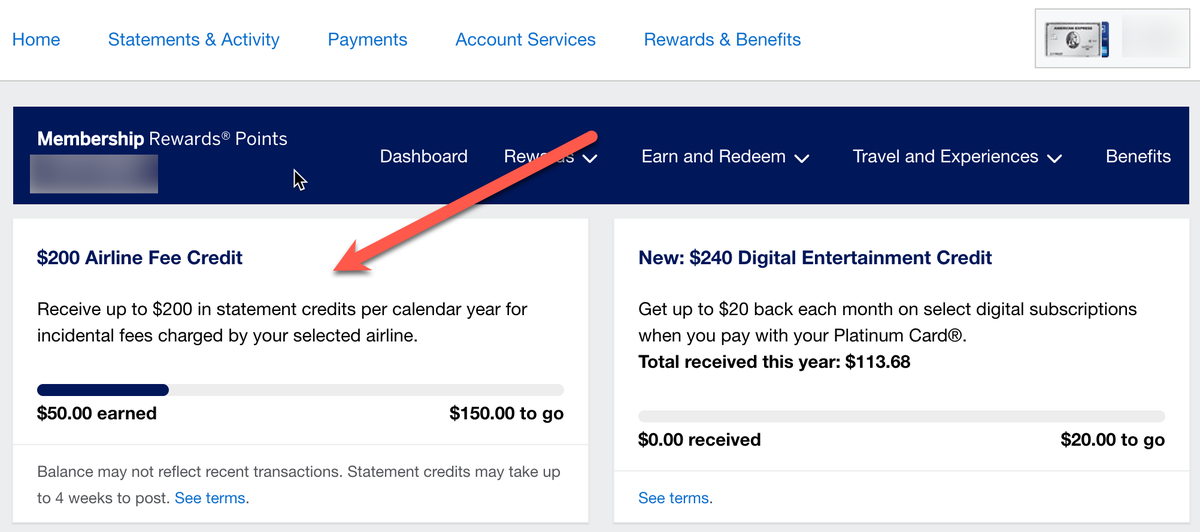

If you are unsure how much airline credit you have left, AMEX generates a tracker under this benefit to display your remaining funds.

Periodically check your Amex credit card to see if the airline fee credit was successfully triggered.

If not, Amex has likely terminated this redemption method.

Final Thoughts

Indeed, United’s TravelBank is a wonderful addition to the dwindling menu of possible purchases that can activate Amex’s elusive airline credit.

Being fully aware that this method is temporary, I try to take advantage of it while it’s still possible, especially when I am on the verge of running out of redemption alternatives for my Amex airline fee credit.

I hope that Amex follows Chase’s and Citi’s lead and relaxes this benefit, making it much easier to redeem in the future.

Until then, we will have to adjust to American Express’ policies.

Ultimately, I am glad that United’s TravelBank provides us with another fantastic alternative for using our travel credits.

Not only does it prolong the shelf-life of our funds, but it also affords us the flexibility we genuinely need.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Related posts:

22 comments.

Bank of America Premium card also include benefits of $100 incidental travel credits, can I use it to purchase United Travel Bank fund too?

Hi Angie, I am not familiar with Bank of America rules but upon checking what qualifies under “incidental”, I got the following info: Get up to $100 in Airline Incidental Statement Credits annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees – automatically applied to your card statement.

It seems to me that this is similar to Amex. I would suggest purchasing the lowest allowed denomination of $50 to see if it would trigger it but if you have anticipated travel in the near future, I suggest redeeming the credits there instead.

Hi, I booked the ticket and when I entered the payment page, there is no Travel Bank part, I got 200+ dollars in travel bank and cannot seem to use it. Why is this? I can only see “Travel certificates” instead of “Travel certificates and United Travel Bank Cash”. What should i do?

Hi Tristan, thanks for asking. Sorry about that. Not all purchases in United.com are eligible. I wonder if the ticket you are purchasing includes a partner airline. From the Terms and Conditions: “TravelBank Cash is valid for air travel purchases on United and United Express® flights and as otherwise permitted by United. After a TravelBank Award is issued, a service charge may be imposed for each change or cancellation requested by the Member.”

I have encountered this exact problem and I am definitely booking a United airline airfare (from LAX – EWR): any more update on this?

HI Cindy, I had updated the post with hopefully a potential solution to your problem. Jump to the section “What to do? United Travel Bank Does Not Show Up”. I tried your route (LAX-EWR) and the steps I outlined worked in making Travel bank re-appear! Good luck and please let me know if it worked for you too!

Thank you for this post and the very detailed instructions!!! Really helpful as I’ll be using this as long as we can get that $200 credit from Amex Plat!

Thank you Tony for the kind feedback. I am glad you found it useful. Please feel free to ask questions anytime.

Great information, thank you!

Thank you so much!

Its unfortunate you can’t use your Travel Bank just to upgrade your seat. Or pay for the bundles upon checkout

I am sorry! Sadly, it is just not as flexible 🙁 But United might make some changes in the future that will allow us to use it for incidentals.

Newbie to United Travel Funds.

Is it possible to use it for booking a ticket for anyone else, any restrictions?

You can book it for anyone else. When they cancel though, the travel credits will be under their account.

This article saved me 30mins! I was typing a non-whole number to use my United Travel Bank and it would NOT take it. Apparently, it needs to be a WHOLE NUMBER. Thanks for the tip!

Glad you found it useful!

Can you combine miles and a travel bank balance? I have 33k miles I need to use and $600 in travel bank credits.

Unfortunately, you can not mix miles and travel bank balance. I’d use the travel bank first if you find cheap tickets as those expire. United miles do not expire.

Hi, how long does the Amex Airline Credit usually take? It’s been a week now and my credits have not shown up yet.

HI Kunal. It’s been about 10 days, on average, for me.

I wanted to add that you Travel Bank does not come up as an option to pay if your flight involves a leg operated by a partner airline (eg. Swiss Air).

I called United to see if they could book the ticket but it errored out for the representative and he gave me that as the reason.

This might be helpful to incorporate in your article.

HI Stephanie, thank you for sharing. That’s correct. Apologies that it was not clear in the article. Yes, it is sadly for United and United Express flights only. I highlighted that part of the article and added additional language under Troubleshooting so it’s much clearer. Thanks so much again for the feedback and Safe travels!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

JOIN OUR FREE FACEBOOK TRAVEL MILES AND POINTS COMMUNITY!

TRAVEL MILES AND POINTS

- $15 Discount On $300+ Mastercard Gift Cards At Office Max / Depot

- Earn 5X Chase Points Per Dollar: Staples Fee-Free Visa Gift Cards

- Earn 5X Travel Points: Staples Fee-Free Mastercard Gift Cards

- $15 Discount On $300+ Visa Gift Cards At Office Max / Depot

- Top Things to Do in Porto on a Rainy Day

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

The Amex Platinum Card: How To Best Use Your $200 Airline Credit [Every Year]

Andrew Kunesh

Former Content Contributor

69 Published Articles

Countries Visited: 28 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3209 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![platinum united travel bank The Amex Platinum Card: How To Best Use Your $200 Airline Credit [Every Year]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Platinum-Upgraded-Points-LLC-06-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex platinum card – snapshot, what is the amex platinum card’s airline incidental credit, the best ways to use your airline incidental fee credit, what if my purchase isn’t automatically reimbursed, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Platinum Card ® from American Express is one of the top premium travel credit cards on the market, but also one of the most expensive.

The card’s annual fee is substantially higher than other cards. Still, it also comes with an extensive list of benefits like airport lounge access, Hilton Honors and Marriott Bonvoy hotel elite status, major bonus earnings on flights booked with airlines, and much more.

While the card’s fee may seem like a shocker at first, it’s not so bad when you take a look at the multiple statement credits offered, including an airline incidental credit of up to $200 (enrollment required).

Many travelers often aren’t sure how to take advantage of the airline incidental credit and what it can cover. After all, it doesn’t let you cover paid plane tickets but does let you cover other fees incurred from an airline — whether inflight or at the airport.

In this article, you’ll finally get clarity as to precisely what the Amex Platinum card’s airline incidental credit is and your best options for redeeming your card’s $200 annual credit. After all, what use is a benefit if you don’t know how to use it, right?

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Both the Amex Platinum card and The Business Platinum Card ® from American Express offer a $200 airline incidental fee credit upon enrollment.

According to American Express, this credit will be used to cover inflight expenses on your selected airline. Some of the items American Express lists as eligible for reimbursement include inflight refreshments and checked bag fees. Airline tickets, gift cards, and points or miles purchases aren’t eligible for reimbursement.

Here’s what the terms and conditions have to say:

“Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee.”

Once you’ve selected your airline, you can charge these expenses to your Amex Platinum card. You’ll automatically be reimbursed in the form of a statement credit within 6 to 8 weeks of the charge posting to your account.

If the statement credit has not posted after 8 weeks from the date of purchase, it is best to call the number on the back of the card.

Hot Tip: You receive the airline incidental once per calendar year. The credit is dispersed on January 1st each year and doesn’t roll over.

Selecting an Airline for Your Airline Incidental Credit

Unlike the Chase Sapphire Reserve ® ‘s $300 travel credit, you’re limited to using your Amex Platinum card’s incidental fee credit on a single airline. You can select your airline when you receive your card and change it once per year in January. However, we at Upgraded Points have had luck changing the airline more than once when chatting (nicely) with an American Express representative.

You can pick from the following airlines:

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

You must select an airline before you can use the airline incidental credit. Charges made to your account before choosing an airline are not eligible for reimbursement , so select your airline as soon as you receive your Amex Platinum card and have a trip booked.

Thankfully, selecting your Amex Platinum card airline choice is easy. Just head over to the American Express website , log in, and select your Amex Platinum card (should you have more than 1 American Express card).

Click on the Rewards & Benefits tab on the bar at the top of the screen. And then click on the Benefits tab.

Here, you’ll see the balance of your Airline Fee Credit — how much you’ve used and how much you have left.

Scroll down the page for a list of benefits included with your Amex Platinum card . There will be an option labeled $200 Airline Fee Credit. Click on the Learn More button, and from there you can select your airline using the drop-down menu at the center of the screen.

As mentioned earlier, the Amex Platinum card’s airline incidental fee credit cannot be used toward plane tickets, points purchases, or gift cards.

Frustrating, yes. But, thankfully, there are still plenty of great ways that you can spend the credit over the year.

Here are our favorite ways of utilizing the flight credit. We’ve split this section into 2 parts: official and unofficial ways to redeem the incidental fee credit.

Official Ways To Redeem the Incidental Fee Credit

Airport Lounge Day Passes and Annual Memberships

While the Amex Platinum card includes extensive lounge access , it doesn’t include access to all of the U.S. carrier’s lounges. You can use your Amex Platinum card’s credit to buy day passes to:

- Alaska Lounge

- American Airlines Admirals Club

- Delta Sky Club

- United Club

Just remember, you have to select the applicable airline for the lounge charge to be covered. So if you choose Delta as your preferred airline, your charges to the Admirals Club won’t be covered by your incidental fees.

United American and American Airlines both sell day passes, which could be an option if you don’t have access to a lounge on a long layover. You must be flying with the airline to have lounge access.

Hot Tip: If you purchase an annual lounge membership with your Amex Platinum card that costs more than $200, you’ll be credited the entirety of the incidental fee credit at once. So, in this case, you can think of it as a $200 discount on your lounge membership of choice.

Further, note that Amex Platinum cardmembers do not receive complimentary guest access at Delta Sky Clubs . However, guest access can be purchased for $50 for a standard day pass. If you purchase Delta Sky Club guest access and Delta is selected as your Amex Platinum card’s airline, you will be reimbursed for your entry fee.

Change Fees

Changing a trip’s date can be expensive, but your Amex Platinum card’s incidental fee credit covers the itinerary change fee. Note that the incidental fee will not likely cover the airfare difference as this is often charged like a plane ticket.

Hot Tip: Want more information on airline change fees? Learn how to avoid airline change fees in our dedicated article.

Checked Baggage Fees

So you planned on checking a bag, but it isn’t included with your ticket? Just charge it to your Amex Platinum card. This is especially helpful if you’ve selected a low-cost carrier, such as Spirit, as your airline, as these carriers generally charge more for baggage. Remember that the incidental fee credit only covers baggage fees on your selected airline.

Most airlines have a co-branded credit card that provides perks such as free checked baggage. If you carry an airline’s co-branded credit card , check if that card provides free checked baggage. This allows you to use your Amex airline incidental fee credit elsewhere.

Inflight Entertainment Fees

The incidental fee credit covers inflight entertainment fees including TV, movies, and tablet rentals charged directly by the airline. A good example of this is renting an Alaska Airlines entertainment tablet in flight. The airline charges a fee to rent these in economy class.

Unfortunately, this does not cover inflight internet, as a third party generally bills this . However, we have heard of United inflight entertainment being reimbursed, as it is usually charged by United directly. Proceed with caution, though, as there’s no guarantee it will be refunded.

Inflight Amenities

Most other inflight purchases are covered, too. Think amenities like headphones, blankets on budget carriers, food, and drink. The airline almost always charges for these directly, and you’re automatically reimbursed for them by your Amex Platinum card’s incidental fee credit.

Seat Selection Fees

Seat selection fees are another great way to redeem your airline incidental fee credit. You can use this when flying low-cost carriers or on a basic economy fare that doesn’t include free seat selection. Note that this does include things like Even More Space seating on JetBlue and Economy Plus on United Airlines.

Most airlines charge anywhere from $10 up to $50 for a seat assignment on domestic flights.

Pet Flight Fees

If you’re taking a furry companion with you , use your Amex Platinum card’s incidental credit to cover the pet fee. This can take out a nice chunk of your reimbursement, though — for example, JetBlue charges $125 per one-way flight.

Phone Booking Fees

You can usually avoid these by booking online, but there may be instances where you need to call to book an award ticket or a flight with special routing. If you can’t get the agent to waive this fee, your Amex Platinum card’s incidental fee credit should cover it.

Priority Boarding

Priority boarding purchases work on virtually all airlines. This can be especially valuable when flying Southwest Airlines, as it gives you first dibs on the best seats . Again, remember that the incidental fees only cover priority boarding fees on your selected airline.

Unofficial Ways To Redeem the Incidental Fee Credit

The methods below are ways our team members have either tried or seen work for other travelers. Proceed with caution . There’s no guarantee that these will work for you, too. While we try to keep this section as up-to-date as possible, these things can change on a dime, and we can’t be held liable for a charge not being reimbursed.

Fill Your United TravelBank Account

This might be the easiest unofficial way to use your Amex incidental fee credit. United’s TravelBank allows you to fund the account with cash to use on future United flights. Any money you put in your TravelBank account does not expire for 5 years, provided there is account activity at least every 18 months.

You can fund your account in different increments up to $1,000. However, it is best to fund with how much you have available with your credit. You need to make sure United is selected as your preferred airline.

Admirals Club Food or Drink Purchases

A number of American Airlines Admirals Club locations have premium food and drink available for purchase. American Express has reimbursed these purchases, as they’re billed directly by American Airlines.

Unfortunately, we don’t have data for purchases at other lounges at this time. Again, proceed with caution.

Delta Airfare Purchased Partially With a Gift Card

There are reports of Delta tickets purchased partially with a gift card being reimbursed by American Express. This is because, when the purchase processes, it adds an “additional collection” to the transaction instead of listing an airline route, like most airfare purchases.

This means that American Express sees the transaction as if it were some sort of add-on or other inflight expense. However, this is not officially supported, and American Express may choose not to honor your incidental credit for this purchase.

Airfare of $99 or Below on Certain Airlines

We’ve seen reports of below-$99 fares on Delta, Southwest, and JetBlue being reimbursed by the incidental fee credit. But again, this is very much something you would try at your own risk, as the purchase will code as airfare.

Spirit Saver$ Club Memberships

Spirit Airlines has a members-only discount club called Spirit Saver$ Club. It provides access to discounted tickets and includes other perks but has an annual fee.

We’ve seen reports of Spirit Saver$ Club memberships being reimbursed by American Express. Definitely keep this in mind if you’re a frequent flyer on this ultra-low-cost carrier, as it can save you a nice sum of money as you travel throughout the year.

$5.60 TSA Passenger Security Fee on Award Tickets

Our team has had the $5.60 TSA passenger security fee reimbursed on multiple award tickets in the past.

Purchases That Do Not Trigger the Airline Incidental Credit

Now that you have a full list of things that do (or might) trigger the airline incidental fee credit, here’s a quick look at the things that don’t trigger this credit.

Award Taxes and Fees

Aside from the $5.60 TSA security fee mentioned above, our team has not had luck having other award fees reimbursed. This is likely because these purchases code as airfare when posted to your American Express card.

Airline Gift Card Purchases

Airline gift card purchases were a longtime favorite for redeeming the airline incidental fee credit. However, as of this summer, our team has had no luck getting these reimbursed.

Class of Service Upgrades

Cabin upgrades are not eligible for reimbursement .

Inflight Wi-Fi

As mentioned, inflight Wi-Fi generally does not trigger the incidental fee credit, as a third party like Gogo or Panasonic usually bills it. However, we’ve seen reports of United Airlines Wi-Fi purchases being reimbursed because United does bill Wi-Fi purchases on its own or if you purchase the service through the airline before your flight.

While American Express states that it will reimburse eligible charges within 4 weeks, some charges don’t make it through the system. If you’re not reimbursed for an eligible charge, you can call the number on the back of your card or use the American Express live chat service to request reimbursement.

While the Amex Platinum card’s airline incidental fee credit is limited compared to travel credits offered by other premium credit cards, it still provides a ton of value. It has gotten hard to use the credits, but there are still ways to get the total value.

When you use the methods listed above, you’ll save money and have a better travel experience with extra checked bags, lounge access, and more. Better yet, the airline incidental credit can help offset the hefty annual fee of the Amex Platinum card.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Frequently Asked Questions

What is the american express airline fee credit.

The American Express airline incidental fee credit allows you to receive up to $200 in statement credits per calendar year when incidental fees are charged to your account. You must select a qualifying airline before you can use the airline incidental credit.

Do authorized users get additional airline incidental fee credits?

No, the airline incidental fee credits are up to $200 per account per calendar year.

Can I use my airline incidental credit toward airfare?

Generally speaking, no. The terms and conditions prohibit this, and it has not worked in practice for a majority of Amex Platinum cardholders. However, there are reports of fares of $99 or below triggering the credit when you book on certain airlines.

Can I cash out my incidental fee credit if I don't use it?

No, you must use the entirety of the incidental fee credit before the end of a calendar year. Otherwise, the credit expires.

When does the airline incidental credit renew?

You receive $200 per year in incidental fee credit. The credit renews on January 1 of the new calendar year.

Will I earn points on purchases reimbursed by the incidental fee credit?

Yes, you will still earn points on reimbursed purchases.

Was this page helpful?

About Andrew Kunesh

Andrew was born and raised in the Chicago suburbs and now splits his time between Chicago and New York City.

He’s a lifelong traveler and took his first solo trip to San Francisco at the age of 16. Fast forward a few years, and Andrew now travels just over 100,000 miles a year, with over 25 countries, 10 business class products, and 2 airline statuses (United and Alaska) under his belt. Andrew formerly worked for The Points Guy and is now Senior Money Editor at CNN Underscored.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Credit Card Content

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Reviews

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![platinum united travel bank The Amex EveryDay Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2016/10/The-Amex-Everyday-Credit-Card-from-American-Express.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

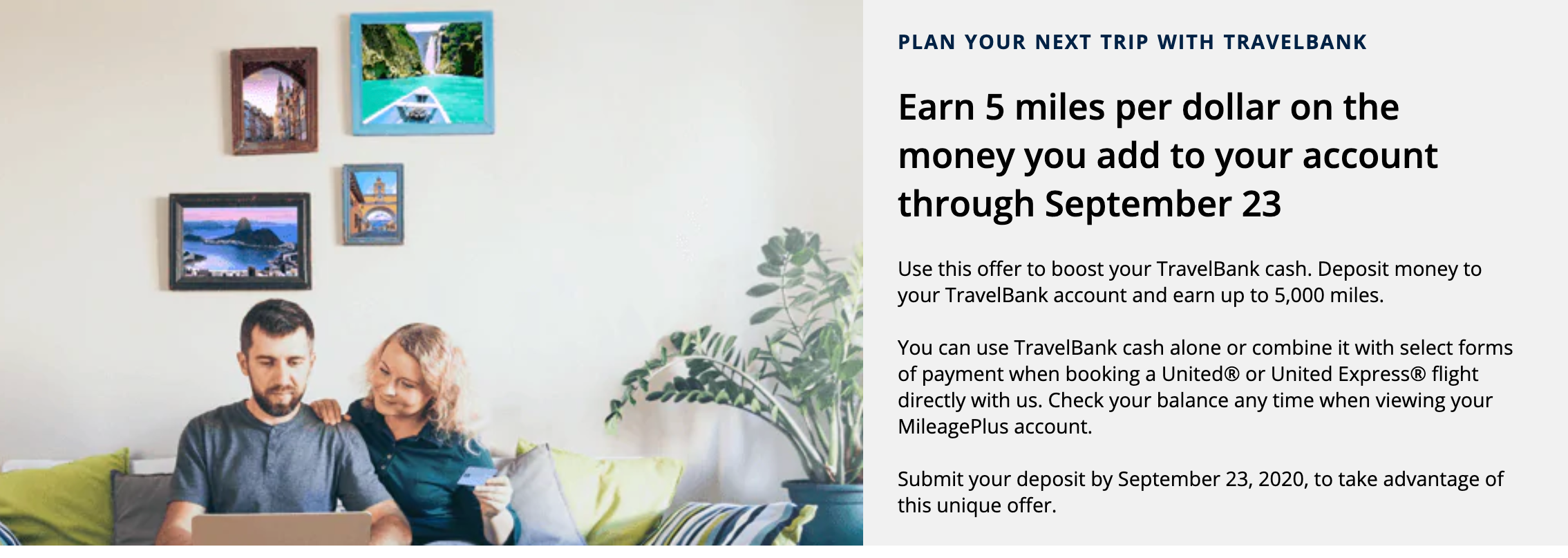

Why you may want to buy future United flight credits to earn a 5x miles bonus

Airlines are doing some interesting things to raise cash, while many would-be travelers are still on the ground. And while many of these sales and offers won't be a great deal for travelers who aren't sure when they'll fly next, there are exceptions to every rule. Sometimes these offers can make sense in the right situation.

United has brought back the opportunity to deposit future flight credits into a TravelBank account. The airline has offered this type of account at various times in the past. Now, it's incentivizing travelers to put money in by Sept. 23 by awarding five bonus United miles per dollar spent as a special offer. You are limited to $1,000 (5,000 bonus miles) per promotion, per MileagePlus account.

For more TPG news and deals delivered each morning to your inbox, sign up for our free daily newsletter .

Once you have funds in your account, they're available for use on United flights for five years. You can make deposits in the following denominations: $50, $100, $250 or $750.

In my tests, United TravelBank funds are available for immediate use -- which is different than some other airline gift cards that have a waiting period before you can use them. However, there are some potential downsides to consider before taking advantage of this offer.

Related: What it's like to fly in the U.S. right now

First, you can't stack TravelBank funds and credit from a previously canceled flight in the same transaction. You also can't use the funds on flights that aren't operated by United or United Express. Additionally, if you want built-in travel protections that may come from purchasing the trip with your credit card , you won't have those if you are using TravelBank funds to pay for the ticket. (Though you could likely still use a purchased trip insurance plan to cover your trip if you do go that route.)

I bought a little bit of United TravelBank credit to earn a bonus 5x redeemable United miles per dollar because I fly United frequently enough that I know it'll go to good use well before its five-year expiration date. I also paid with a credit card that has some unused 2020 airline fee credits ... just in case that happens to kick in.

Related: Guide to the United MileagePlus program

It won't make sense for everyone to stock up on United TravelBank credit to earn 5x miles on the purchase, but in my case, I was happy to buy a little bit of United credit -- and earn bonus miles in the process -- that I know I'll use in the coming months and years.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

United TravelBank Card: Closed to Applications, Replaced by United Gateway

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

The card was suited to those who didn't travel much, but who flew United when they did travel. But it did not offer flexibility or traditional airline-card perks.

Rewards rate

Bonus offer

$150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Ongoing APR

APR: 15.99%-22.99% Variable APR

Cash Advance APR: 24.99%, Variable

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Foreign transaction fee

- Earn 2% in TravelBank cash per $1 spent on tickets purchased from United.

- Earn 1.5% in TravelBank cash per $1 spent on all other purchases

- No foreign transaction fees

- Enjoy 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United®-operated flights when you pay with your United TravelBank Card.

- TravelBank cash is easy to use. $1 in TravelBank cash = $1 when used toward the purchase of a United ticket.

- Your TravelBank cash accumulates in your United TravelBank account on United.com.

- $0 Annual fee

High rewards rate

No annual fee

No foreign transaction fee

» This card is no longer available.

The United℠ TravelBank Card is no longer accepting applications. United Airlines and Chase have introduced a new credit card with no annual fee, the United Gateway℠ Card , which effectively takes the place of the TravelBank Card. Read our review of the United Gateway℠ Card , or explore other United Airlines credit card options . Below is our review of the United℠ TravelBank Card from when the card was still on the market.

If you fly United Airlines, the United℠ TravelBank Card might be tempting because of its annual fee of $0 . But it ultimately might not be worthwhile for most United flyers because of all that it lacks as an airline card.

The card has its own rewards currency that you can use to book free United flights. And its rewards rate is decent for both United spending and all other spending. It’s kind of like a cash-back card, where you can spend the cash only at United.

But you won't get free checked bags or early boarding like you do with many airline cards. And you won’t earn United MileagePlus miles, the airline’s frequent-flyer miles that have a chance at returning huge value.

If you want a card like this one, just get a true cash-back card . Then, you can spend your cash rewards on anything, not just United flights. Otherwise, ante up for a United card with an annual fee that comes with useful airline perks. There’s a good option in the United℠ Explorer Card .

» MORE: How to choose an airline credit card

United℠ TravelBank Card : Basics

Card type: Airline .

Annual fee: $0 .

2% in TravelBank cash per $1 spent on tickets purchased from United.

1.5% in TravelBank cash per $1 spent on all other purchases.

Sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Foreign transaction fee: None.

Interest rate: The ongoing APR is 15.99%-22.99% Variable APR .

Noteworthy perks:

25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with your card.

No foreign transaction fees.

Trip cancellation/interruption insurance.

Rental car insurance.

Purchase protection.

» MORE: Benefits of United Airlines credit cards

Simple rewards earning

With a typical airline card, you earn frequent flyer miles or points with every purchase. You then redeem those rewards for free flights or seat upgrades. But frequent flyer programs can be exceedingly complicated. The number of miles you’ll need for a particular flight depends on an array of factors. On top of that, the flight you want might not have award seats available. And your preferred travel dates might be “blacked out” — that is, reserved for paying customers.

The United℠ TravelBank Card eliminates the whole idea of miles. Instead, you earn “TravelBank cash,” which is redeemable for travel with United on a simple dollar-for-dollar basis.

The card earns 2% back on United purchases and 1.5% back on everything else. A $500 United flight, for example, would earn $10 in TravelBank cash. A $500 purchase elsewhere would earn $7.50.

Simple rewards redemption

When booking a flight with United, you can pay some or all of the fare with your accumulated TravelBank cash rewards. Consider a ticket that costs $400. If you had at least $400 in TravelBank cash, you could use it to pay the entire fare. If you had only $50 in rewards accumulated, you could apply it to the fare and reduce the cost to $350.

Some travel credit cards have annual fees measured in hundreds of dollars, while the typical airline card often charges a fee of close to $100 per year. This card has an annual fee of $0 .

Sign-up bonus

For a simple credit card with an annual fee of $0 , it’s a pleasant surprise to have a sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

» MORE: NerdWallet's best airline cards

The United℠ TravelBank Card is light on flash compared with most travel cards, but it comes with minor perks:

In-flight discount: 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with the card.

No foreign transaction fees: Travel cards generally don’t charge a fee — 3% is common — for making purchases abroad. This United card doesn’t, either. And it uses the Visa network, which is widely accepted abroad.

Travel-related insurances: Trip cancellation/interruption insurance and secondary rental car insurance are nice-to-haves on an airline card.

Purchase protection: Covers new purchases made with the card for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

How it compares with other United cards

The United℠ TravelBank Card is one of three co-branded consumer United Airlines credit cards. Its siblings pack more perks.

Here’s how they compare on key features:

Business owners, even those with side gigs, might consider the United℠ Business Card .

» MORE: Full review of the United℠ Business Card

No checked bags or early boarding

At $35 per bag each way when you don't prepay, fees for first checked bags add up in a hurry, especially when you’re traveling with others on your itinerary. That’s why typical airline cards are so valuable. But this card has no checked-bag-fee waivers, so you’ll have to pay. And you won’t get boosted toward the front of the boarding line, because the card lacks a priority boarding perk. That could hurt you when looking for overhead bin space.

» MORE: Airline credit cards that offer free checked bags

The logical solution is the United℠ Explorer Card . It offers:

2 MileagePlus miles per dollar spent on purchases from United.

2 miles per dollar spent on restaurant purchases and hotel stays.

1 mile per dollar spent on all other purchases.

First checked bag free for you and a companion on your reservation, if you use the card to purchase your ticket.

Two United Club one-time use passes per year.

Global Entry/TSA Precheck statement credit every four years.

25% off in-flight purchases.

Sign-up bonus: Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

It has an annual fee of $0 intro for the first year, then $95 .

» MORE: Full review of the United℠ Explorer Card

You won’t earn United MileagePlus miles with this card. That keeps things simple, but you also lose the potential to reap outsize value by scoring a great awards seat — like a business-class international fare worth thousands of dollars — for relatively little spending.

Fewer benefits

Some airline cards give you perks at the airport. They might reimburse you the application cost of Global Entry or TSA Precheck to get through security lines quicker, or get you free or discounted passes to an airport lounge.

This card offers none of those.

» MORE: Cards that offer airport lounge access

Limited reward redemptions

Redeeming rewards is relatively simple, but you’re still locked into United Airlines. That's limiting compared with general travel credit cards , which allow you to apply rewards to a wide range of travel-related expenses.

An option for those looking to avoid an annual fee is the Bank of America® Travel Rewards credit card .

1.5 points per dollar spent.

3 points per dollar spent on eligible travel booked through the Bank of America® Travel Center.

A value of 1 cent per point when redeemed for travel credit and a little over half a cent per point for cash.

A sign-up bonus.

The Bank of America® Travel Rewards credit card isn't tied to an airline or hotel chain. Book travel any way you want, with no restrictions and no blackout dates, and then use points to wipe out the cost on your statement. Bank of America® also has one of the broadest definitions of "travel" of any major issuers. You can use points to get credit for airfare, hotel stays, cruises, car rentals, campgrounds, art galleries, amusement parks, carnivals, circuses, aquariums and zoos.

» MORE: Full review of the Bank of America® Travel Rewards credit card

The United℠ TravelBank Card offers a simpler way to earn free flights on United Airlines for casual flyers committed to that airline. But honestly, you’re better off with a cash-back credit card .

If you spread your flying among a number of carriers or want more flexibility, consider a general travel credit card . United loyalists are likely to get more value from the United℠ Explorer Card .

Information related to the United℠ TravelBank Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

This card earns bonus rewards in multiple categories, including dining and travel. You can transfer points on a 1:1 basis to about a dozen hotel and airline programs, including United, or you can use them to book travel through Chase at 1.25 cents per point. However, you won't get any airline-specific perks. Annual fee: $95 .

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

U.S. Bank Business Platinum review 2024: It’s got one job – an intro APR for purchases and balance transfers

Julie Sherrier

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:47 a.m. UTC May 14, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

sommart, Getty Images

If your business is looking for a $0 annual fee card with a long introductory APR period on purchases and balance transfers purchases and balance transfers, then the U.S. Bank Business Platinum Card * The information for the U.S. Bank Business Platinum Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. fits the bill.

Just know that besides the intro APR offer, this card doesn’t earn rewards or offer much else in terms of benefits. We’ll cover what you need to know in our U.S. Bank Business Platinum card review.

U.S. Bank Business Platinum basics

- Annual fee: $0.

- Welcome bonus: None.

- Rewards: None.

- APR: 0% intro APR on purchases and balance transfers for 18 billing cycles, followed by a variable APR of 17.24% to 26.24%. A balance transfer fee of either 3% of each transfer or $5 minimum, whichever is greater, applies.

- Recommended credit score: Good to excellent.

- Other benefits: ExtendPay, free employee cards.

U.S. Bank Business Platinum review

The U.S. Bank Business Platinum Card is designed specifically for businesses seeking a lengthy intro APR period for purchases and/or balance transfers. This card offers no rewards, charges a foreign transaction fee, has no welcome bonus or other noteworthy benefits, so the only reason you’d apply is to use the card for its lengthy intro APR .

If you want to save on interest charges for over a year, then the U.S. Bank Business Platinum can help you do that. Just know that there are other business credit cards that offer both a rewards program as well as intro APR promotions, but the U.S. Bank Business Platinum offers one of the longest no-interest periods among competing business cards in this category you’ll find.

- Long intro APR : Save on interest charges for over a year for both purchases and balance transfers.

- ExtendPay Plan : Once the intro APR promotion expires, you may be able to finance purchases through a fixed payment program for a monthly fee not to exceed 1.6% of the purchase amount.

- No annual fee: It won’t cost your business anything for card ownership.

- No rewards : The U.S. Bank Business Platinum does not earn cash back, points or miles on your purchases.

- Foreign transaction fee : If you’re traveling abroad, you’ll want to leave this card at home as it charges a fee of 3% of each foreign transaction, which is added to any purchases you make outside the country.

- Limited travel benefits : This card does not come with travel protections or travel credits other than secondary car rental protection and roadside dispatch.

U.S. Bank Business Platinum APR

The U.S. Bank Business Platinum offers one of the longest introductory offers of any business card. You’ll get a 0% intro APR on purchases and balance transfers for 18 billing cycles, followed by a variable APR of 17.24% to 26.24%. A balance transfer fee of either 3% of each transfer or $5 minimum, whichever is greater, applies. Note that you cannot transfer a balance from one U.S. Bank card to another.

U.S. Bank Business Platinum drawbacks

If your business is looking to earn cash back, miles or points on your purchases, the U.S. Bank Business Platinum won’t help you do that. It doesn’t offer much in the way of benefits, travel protections or travel credits either.

The only aspect of this card that makes it stand apart from other business cards is its lengthy 18-month intro APR on purchases and balance transfers. Just know that there are consumer cards offering even longer intro APRs than the U.S. Bank Business Platinum, such as the Wells Fargo Reflect® Card * The information for the Wells Fargo Reflect® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. which offers 0% intro APR for 21 months from account opening on purchases and on qualifying balance transfers made within the first 120 days, afterwards a 18.24%, 24.74%, or 29.99% variable APR applies. There’s a balance transfer fee of 5% with a $5 minimum.

How the U.S. Bank Business Platinum compares to other business balance transfer cards

When choosing which business balance transfer card is best for your enterprise, here are a few competing cards to also consider.

U.S. Bank Business Platinum vs. U.S. Bank Triple Cash Rewards Visa® Business Card * The information for the U.S. Bank Triple Cash Rewards Visa® Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

A more robust U.S. Bank business card that also offers an intro APR on purchases and balance transfers — 0% intro APR on purchases and balance transfers for 15 billing cycles, followed by a variable APR of 19.24% to 28.24% (balance transfers must be completed within 30 days to qualify for the intro rate). A balance transfer fee of either 3% of each transfer or $5 minimum, whichever is greater, applies — is the U.S. Bank Triple Cash Rewards Visa® Business Card * The information for the U.S. Bank Triple Cash Rewards Visa® Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. .

For a $0 annual fee, cardholders can earn 5% cash back on prepaid hotels and car rentals booked directly in the Travel Rewards Center, 3% cash back at gas and EV charging stations, office supply stores, cellphone service providers and restaurants and 1% cash back on all other eligible purchases.

Plus, there is a welcome bonus of $500 in cash back after spending $4,500 on purchases in the first 150 days of account opening.

U.S. Bank Business Platinum vs. State Farm® Business Cash Rewards Visa Signature® Card * The information for the State Farm® Business Cash Rewards Visa Signature® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

The State Farm® Business Cash Rewards Visa Signature® Card * The information for the State Farm® Business Cash Rewards Visa Signature® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is also issued by U.S. Bank and has a 0% intro APR for the first 12 billing cycles on purchases and on balance transfers made within 60 days from account opening. After that, a 19.24% to 28.24% variable APR applies. A balance transfer fee of either 3% of the amount of each transfer or $5 minimum, whichever is greater, applies.

Where this card shines is that it offers 3% cash back on insurance premium payments (up to $4,000 spent annually), 3% cash back at gas stations and electric vehicle charging stations, cell phone service providers, office supply stores and on dining and 1% cash back on all other eligible purchases. That makes it a better choice long-term than the U.S. Bank Business Platinum.

U.S. Bank Business Platinum vs. PNC Visa® Business Credit Card * The information for the PNC Visa® Business Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

The PNC Business Visa has an intro APR as well, but just for balance transfers, offering 0% intro APR for the first 13 billing cycles following account opening when the balance is transferred within the first 90 days following account opening. Then a variable APR of 15.24% to 25.24% applies on both purchases and balance transfers. There's a balance transfer fee of $5 or 3% of the amount of each balance transfer, whichever is greater. While there is no annual fee or rewards program with this card, there is the possibility of qualifying for the lower end of the ongoing APR range once the intro balance transfer APR expires. If your business tends to carry a balance, this might make it a better choice for you. But if you’re looking for an offer on purchases, the U.S. Bank Business Platinum has one of the longest ones out there.

U.S. Bank Business Platinum is right for you if:

- You want a long intro APR on purchases and balance transfers. If your primary objective is to get a reprieve on interest charges for more than a year for either purchases or a balance transfer, the U.S. Bank Business Platinum offers 18 months of no interest.

- You don’t want to pay an annual fee. Along with saving money on interest charges for 18 months, you also won’t be assessed an annual fee for carrying this card.

- Simplicity is key for you with a new card. If you already have another rewards card for your business or are just not interested in a credit card rewards program, but you do want a card to help you finance a large purchase or transfer a balance to, then know that the U.S. Bank Business Platinum offers one of the longest intro APR periods among its competitors.

Frequently asked questions (FAQs)

Your credit limit will depend on multiple factors, including your income, business revenue, credit standing, outstanding debts and more.

According to U.S. Bank, to qualify for a credit limit above $25,000, you will have to submit the last two years’ worth of financial statements as well as an accountant-prepared balance sheet and yearly income statements for the past two years or two years of company tax returns.

You will need a good to excellent credit score in order to qualify for the U.S. Bank Business Platinum Card. According to FICO, that means your credit score should range between 670 to 850.

Your minimum payment will be the greater of $40 or 1% of your balance, excluding any fixed payment program balances, plus any interest charges and fees. If your balance exceeds the credit limit, you will also be responsible for paying the overage.

No. In order to qualify for the U.S. Bank Business Platinum Card, you’ll need to meet the credit requirements (having a credit score in the 670 to 850 range) as well as have a business.