- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How to Find Travel Insurance That Offers COVID Coverage

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Does travel insurance cover COVID?

What is not covered, finding travel insurers covering covid-19, the best covid travel insurance, covid travel insurance, recapped.

Traveling now carries with it more uncertainty than ever before. If you plan on traveling anytime soon, one thing you can do to protect yourself is get a trip insurance policy that includes coronavirus coverage. Previously, many insurers excluded COVID-related claims due to the virus’ status as a foreseen event/pandemic.

But now, some insurers are changing their tune. Here’s what you need to know about how to find travel insurance providers that offer coronavirus-related coverage, as well as what is and isn’t covered.

Coronavirus coverage falls into several categories:

Trip cancellation: You need to cancel a trip prior to departure because you, a covered travel companion or possibly someone you need to care for contracted COVID-19.

Trip delay: Your trip is delayed due to changing COVID-related guidelines.

Travel medical coverage : You (or a covered travel companion) become ill with COVID-19 while traveling abroad and incur health care expenses or require an evacuation.

Of providers that are offering COVID policies, most are covering these expenses.

» Learn more: The majority of Americans plan to travel this year, according to recent NerdWallet study

Countries with Level 4 travel advisories: Some insurers disclose that if a Level 4 Do Not Travel advisory is issued by the U.S. Department of State for a specific country, you will not receive coronavirus-related coverage. With cases surging in various countries unexpectedly, the list of Level 4 countries is constantly changing. Before booking a trip and purchasing a policy, make sure to check that the country does not have a Level 4 advisory.

Fear of getting sick while traveling: Canceling a trip because you’re afraid you’ll get sick does not qualify for coverage under your travel insurance policy. Travel insurance providers have a list of standard reasons that qualify for cancellation, including: car accident, jury duty, terrorist act, military duty and other extenuating circumstances. If you want ultimate flexibility to cancel a trip (no matter the reason), you’ll want to look into the cancel for any reason, or CFAR, supplemental upgrade , which is offered on some travel insurance plans. When you purchase CFAR, you can get up to 75% of your nonrefundable deposit back as long as you cancel at least two days in advance. Not all plans offer CFAR as an option, so research before you purchase if you're interested in this add-on.

COVID-related events not directly related to you: If you planned on going to a conference or a family reunion that was canceled due to COVID-associated concerns, your travel insurer will not reimburse your nonrefundable flight or hotel accommodations.

» Learn more: The best travel insurance companies right now

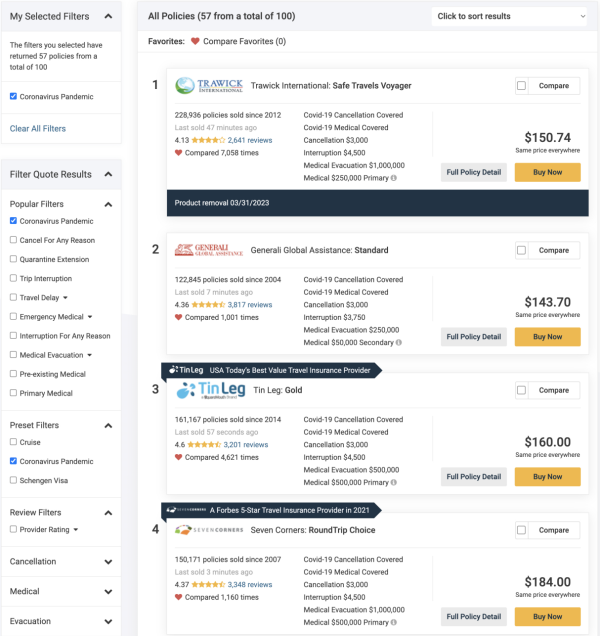

Generally, the policies underwritten by U.S.-based travel insurance providers vary by state, trip information, traveler’s ages and other various details. Travel insurance comparison site Squaremouth (a NerdWallet partner) is one of the very few comparison sites that allows you to filter by policies that offer coronavirus coverage.

To find a policy that specifically covers coronavirus-related losses, input your departure and return dates, your main destination and select “Search for Policies Now.”

In our example, we input the following details: A $3,000 paid-in-full trip to Greece leaving on Oct. 9 and returning on Oct. 18 by a 40-year old U.S. citizen who is a resident of California. The policy will include trip cancellation coverage.

When incorporating the “Coronavirus Pandemic” filter, the results reveal that 57 out of 100 policies include this coverage. You can select additional filters, such as cancel for any reason, if you’re looking for that optional upgrade.

The results can be sorted by price, top sellers, top reviews and insurance providers, offering plenty of ways to easily search for the specific policy you’re looking for.

Each of the top three policies (which is just a sampling of the nearly 60 options) includes coronavirus cancellation and medical coverage, and displays the associated limits. Trip cancellation coverage is $3,000, representing the value of the trip. The price of the policy is clearly stated and ranges from 4.8% to 6.1% of the total trip cost. This range represents very typical travel insurance costs .

» Learn more: Is travel insurance worth it?

A recent NerdWallet analysis determined providers Berkshire Hathaway Travel Protection , IMG and John Hancock Insurance Agency , Inc., among others.

Read the full results of best COVID-19 travel insurance .

Once you narrow your search, you’ll want to review the full policy details to ensure you’re familiar with what exactly is covered and not covered.

If you have specific questions — especially as they relate to the constantly changing travel advisories or whether coronavirus is considered as a foreseen event (which some providers will not cover) — you’ll want to reach out to the insurer. The last thing you want is to purchase travel insurance and later find out it will not cover you in your intended destination.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel Insurance to Cover Your Ski Vacation

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Freephone our UK Team

0800 072 6778

Sales & Service

Monday to Friday: 8:30am to 8pm Saturday: 9am to 5:30pm Sunday: 10am to 5:00pm

Monday to Friday: 9am to 7pm Saturday: 9am to 5:30pm

Travel Insurance

Medical travel insurance, seniors travel insurance, europe travel insurance, worldwide travel insurance, coronavirus travel insurance, skiing travel insurance.

- Unlimited medical emergency expenses¹

- Up to £10K cancellation cover

- 24/7 emergency medical helpline

Covered 27 million+ travellers

Trusted for 20+ years

24/7 emergency helpline

If you’re heading to the slopes, ski holiday travel insurance is as important as a warm coat. Luckily we’ve made getting ski cover as quick and easy as possible.

If you’re aged 65 or under, you can add winter sports travel insurance to any of our policies. Just choose the policy that suits you, whether online or over the phone, and you’ll have the option to add cover for skiing before you buy. We even offer ski insurance off piste!

If you’re planning to go with your family, you should consider a family ski travel insurance policy . We also offer cover for snowboarding travel insurance .

WHAT IS COVERED IN SKI TRAVEL INSURANCE?

If you choose an annual travel insurance policy, adding cover for skiing allows you up to 17 days of snowy fun. On single trip travel insurance , adding ski trip insurance covers you for the whole length of your stay, so you can go skiing for up to 365 days!

Here’s a list of all the ski activities we cover:

- Off-piste skiing (except where considered unsafe by resort management)

- Cross country skiing

- Freestyle skiing*

- Heli-skiing*

- Mono skiing

- Recreational/non-professional ski racing or training*

- Ski acrobatics*

- Ski bob racing*

- Ski/snowboard fun parks*

- Ski stunting*

- Ski touring with a guide

Note: Unfortunately, we’re unable to cover ski flying, ski jumping or ski mountaineering. For the activities marked with an * above, an increased medical excess of £250 will apply, and there will be no cover under the policy’s personal accident or personal liability sections. See our policy wording for more details.

WHAT’S NOT COVERED BY SKI HOLIDAY INSURANCE?

Unfortunately, our cover for ski trips is only available to people 65 and under (when they buy the policy) and is limited to 17 days per year on annual travel insurance policies.

We cover off-piste skiing unless the area has been designated as unsafe by the resort. We are also not able to cover any professional-level ski racing or training.

We will cover all skis, poles, boots & bindings even when they’re left in ski racks (between 10am and 8pm)! Payments for damaged or stolen equipment decrease with the age of the item, and we won’t be able to cover any ski equipment that is left unattended in a public place

SKI INSURANCE WITH COVID COVER

As with all of our travel insurance policies, InsureandGo Ski trip travel insurance covers Covid-19 as standard. This covers you for medical costs and cancellation if you are diagnosed with covid while abroad, subject to certain conditions. Please see the coronavirus travel insurance page for more information about travel insurance that covers coronavirus .

SINGLE TRIP SKI INSURANCE

Our single trip ski insurance can cover you for trips when you’re skiing every day for up to 365 days! Even if you have an annual policy with ski cover, if you’re skiing for more than 17 days, you’ll need a single trip travel insurance policy with ski cover to ensure you’re protected on the slopes.

SKI INSURANCE WITH PRE-EXISTING MEDICAL CONDITIONS

Just like with every other trip, it’s essential to ensure you have adequate travel insurance with medical conditions . We’ll consider cover for any medical conditions which are declared to us, even while you’re on a ski trip. However, please be aware that some conditions, such as osteoporosis , may not be covered while you’re skiing.

SKI TRAVEL INSURANCE FREQUENTLY ASKED QUESTIONS

How much is travel insurance for a ski holiday.

The cost varies from policy to policy and depends on several factors, such as your age, destination and the length of your trip. Please contact us for a quote.

What to look for in ski season travel insurance?

Every provider offers different cover for skiing – there will be variations in the activities covered and the amount they’ll pay out for cancellations and your belongings. You should always check to ensure that your policy meets your specific needs. In general, you should look for ski travel insurance which provides cover for:

- Medical costs while taking part in your chosen skiing activity

- Costs to return you to the UK if medically necessary

- Lost, stolen or damaged ski equipment

- Piste closure and lift passes

- Cancellation or curtailment

Is equipment included in ski travel insurance?

Yes. All InsureandGo policies with ski travel insurance added will cover equipment lost, stolen or damaged as long as it is not left unattended in a public area. If your skis or boots are delayed on your journey to the slopes, we’ll even pay for you to hire replacements until they arrive.

When should I buy travel insurance for a ski trip?

Ideally, you should buy your ski cover as soon as you book your ski trip, to make sure you’re covered if you unexpectedly have to cancel. However, as long as you purchase your policy before you leave the UK, you will be covered to ski.

Are there age limits for ski travel insurance?

Yes. Unfortunately, we can only provide skiing cover for travellers under the age of 66 when purchasing the policy.

- Unlimited emergency medical expenses available on Black level policies.

- Based on 2,050 responses, correct as of 22/01/2024

- Which Ski Resort?

- Saving Money

- Family Skiing

- British Ski Schools

- Luxury Holidays

- Independent v Tour Operator

- Do Something Different

- Group Ski Holidays

Ski Travel Insurance in the Covid-19/Brexit Era

1st October 2020 | Jane Peel, Chief Reporter

Last modified on May 14th, 2021

Getting the right insurance cover for your ski holidays is something most of us take seriously. It’s never been more important than now.

While some of us may be wondering how, or if, we’ll manage to get on the slopes this winter, others are determined not to let coronavirus stop us.

Easier said than done.

UK government advice against ‘all but essential travel’ is, at the time of writing, in place for most of the alpine nations in Europe and North America.

Even some of the ‘safe’ ski countries, such and Norway and Finland, have imposed quarantine requirements for travellers arriving from the UK.

- Quarantine Measures To Ski Countries

A number of UK ski tour operators have issued their own Covid-19 guarantees to reduce the financial risk you take if you book a trip that has to be cancelled or is disrupted by the virus. Check out the terms and conditions carefully before booking.

RELATED STORIES

- Crystal Ski Holidays Answers Your Covid-19 Questions

- Inghams Ski Looks Forward To Next Winter

(Update 21st October: Crystal Ski is now offering its own Covid-19 insurance to include the cost of overseas testing, repatriation, self-isolation and new flights home. It will be included in all holidays this winter and should be used along your usual travel insurance. See the full details here Crystal Ski Holidays Offers Free Covid-19 Insurance).

If you are planning to head to the mountains, it’s advisable to seek out the best travel insurance policy for your needs.

Not least because come 1 st January 2021 when the Brexit transition period is over, and assuming no deals are done between now and then, the chances are that your European Health Insurance Card (EHIC) will no longer be valid.

If that’s the case, then any medical treatment you have in public hospitals or healthcare facilities in countries that are part of the EHIC scheme, will not be free. You – or your insurance company – will have to foot the bill.

So, what do you need to look out for, apart from the obvious of ensuring you have cover for winter sports?

We’ve put together some advice based on our research so far.

Covid-19 – Am I Covered?

Many travel insurance companies have introduced some form of cover for Covid-related claims, but by no means all.

Some will have a general exclusion, which bars any claims relating to the virus. If this is the case, you will not be able to claim for any losses or expenses whatsover that arise from Covid-19.

Some policies will cover only medical expenses if you fall ill with coronavirus while on holiday.

Others will cover you for coronavirus-related medical expenses AND cancellation if you can’t go on your trip or it’s disrupted, though ‘travel disruption’ cover is often an optional add-on you’ll pay extra for.

Even with travel disruption cover, you will need to make sure it doesn’t exclude coronavirus.

You will need to check the small print carefully.

For example, will it pay out only if you catch the virus and have to cancel your holiday?

Or will it also do so if you’re forced to self-isolate because you’ve been in contact with someone with the virus and can’t travel?

Will it pay out if your local area or the area you’re travelling to imposes a lockdown?

The good news is that some insurers have told us they are going to be adding or improving coronavirus cover in time for the ski season with policies expected to be available later this month.

UK Foreign, Commonwealth & Development Office message

“I think the situation can best be described as ‘fluid’ and the insurers I talk to are currently working on policy additions and changes that aim to accommodate snowsports in the new normal , ” Mike Welby, former director of specialist snowsports insurer Dogtag UK, told us.

“As ever, the number one piece of advice is to do your own research based on your own particular circumstances. Then read and understand the policy. Seems obvious but people often don’t do this until they need to make a claim. So if there is anything you don’t understand, email your insurers and ask for the answer in writing.

“An example of this would be: Are you travelling against FCO advice? Currently that would include alpine countries like France, so will your insurer agree it’s OK?

“What if you are displaying symptoms at say Geneva airport and the airline denies boarding – are you covered?

“Suppose your whole household has to isolate because one of you has symptoms but you are well and are supposed to be going on a ski trip with your friends – can you claim for cancelling?”

Mike says that booking with a tour operator that is subject to the Package Travel Regulations won’t always be of help either, since the regulations guarantee you a refund only if the operator has to cancel your holiday, not if you do.

There are exceptions, of course. As mentioned above, a number of ski tour operators have introduced their own Covid guarantees.

Covid-19 Medical Cover/Cancellation Cover Examples

MPI Brokers, which specialises in snowsports insurance, will pay for your emergency medical treatment if you contract the virus abroad.

It is currently not offering Covid-19 cancellation cover. However, we are told this is likely be introduced so watch this space.

Dogtag UK, another snowsports specialist, told PlanetSKI that it will shortly be launching a new ski-specific insurance product that will cover some coronavirus related events.

“We know that planning a winter sports holiday can be stressful at the best of times, and hope that by having this extra level of security our customers will have a more enjoyable experience,” a spokesman told us.

Dogtag Ski is expected to be available later in October and the Covid-19 cover will include:

- Medical expenses and repatriation if you develop Covid-19 abroad

- Travelling home early if medically necessary after developing Covid-19 abroad

- Cancellation if anyone on the policy tests positive up to 14 days before travelling

- Accommodation if you are denied entry at the airport on the way home due to showing virus symptoms, along with the cost of your return trip

AXA says it will cover existing and new customers for emergency medical claims related to coronavirus in countries exempt from the current UK Foreign Office advice against all but essential travel.

Customers will also be covered if they can’t travel because they, someone they are due to travel with, or a close relative contracts coronavirus.

But AXA’s new policies will not protect you if you have to cancel your trip as a result of a lockdown, the Foreign Office advising against travel or any other country’s advice not to travel there.

“For claims such as these, customers should arrange a refund with their tour operator and/or airline,” it says.

One of the UK’s biggest insurers, Aviva, which offers winter sports cover, told PlanetSKI it had stopped selling new travel insurance policies back in March when the global pandemic struck.

It is, however, renewing annual policies for existing customers which will cover the medical costs of contracting the virus abroad.

And if you happen to have Aviva’s Travel Disruption upgrade, you also get:

Up to £5,000 for cancellation or abandonment cover if you cannot travel or continue your trip for one of the following reasons:

- Strike or industrial action

- Severe snowfall

- The Foreign Office advises against travel

- Food poisoning, pandemic or epidemic influenza or catastrophic damage directly affects your pre-booked holiday accommodation

Warnings Against Travel

There are several issues to consider here.

Travel Warning Introduced After Booking/During Your Trip

The simplest one to deal with is if a Foreign Commonwealth and Development Office (FCDO) travel advisory warning against all but essential travel is introduced to your destination after you have booked your holiday and/or taken out your insurance policy.

As long as your policy does not exclude all Covid-19 related claims and you have travel disruption/cancellation cover you should be able to claim for any losses you can’t recover from your tour operator or elsewhere.

Equally, if a travel advisory is imposed while you are abroad, you will continue to benefit from the cover you had at the start of the trip.

Travel Warning In Place At Time of Booking

The FCDO currently advises against all but essential travel to almost every alpine nation.

So are we safe to book a holiday to one of those countries in the hope that the situation will change?

What if it doesn’t and we can’t travel? Will our insurance be invalidated because we knew of the risk at the time of booking/taking out the policy?

Aviva says on its website:

“You aren’t covered for cancelling due to COVID-19 if restrictions were in place when you booked the trip – such as FCO advice, quarantine, self-isolation periods or local lockdowns.”

We contacted Aviva who told us that booking while a travel warning was in place would not invalidate the whole policy.

In other words, if you are prepared to take the risk, you can book now to go skiing in France in February, for example, knowing your insurance will be valid should Covid-19 restrictions be lifted.

“The validity of cover won’t be affected if FCDO advice against travelling has been lifted by the time of travel,” a spokeswoman for the Association of British Insurers told us.

“However, customers should make sure they are aware of current restrictions at the time of booking and whether these are likely to be in place at the time of travel as they are unlikely to receive a refund if FCDO advice does not change.

“When booking any trip it is important to be aware of what the terms of refund are and to book on a credit card where possible.”

And how can our hypothetical skier wanting to go to France in February possibly know whether the travel advisory will be lifted by then?

The only chance of recompense, if it’s not lifted, may well depend on who you have booked your trip with, their terms and conditions and how you have paid.

Travel Warning In Place At Time Of Travel

The FCDO warning system or ‘red list’ is advisory only so, in theory, there is nothing to stop you travelling to a country to which the UK government advises you do not travel.

But will you have any protection if you do so?

We asked the Association of British Insurers for its view of how insurance companies were likely to respond.

Would they consider the whole policy to be invalid or – since the FCDO warning clearly relates only to Covid-19 – just any sections relating to the virus?

“Travelling against FCDO advice is likely to invalidate all of your travel insurance cover,” the ABI’s spokeswoman told us.

Dogtag UK says:

“None of our policies will provide cover if you decide to travel against the advice of the FCO. This would be for ‘all travel’ and ‘all but essential travel’ unless customers have contacted us in advance with their reasons for travel and cover has been agreed by the underwriters.”

Others take a different view.

Michael Pettifer of MPI Brokers told us that travelling against UK government advice was not against the law and MPI would continue to accept non-Covid claims in these circumstances.

So if you’re unfortunate enough to suffer an injury on the slopes or are taken ill with anything other than coronavirus, MPI’s policies will still pay out.

Aviva says that if you travel against FCDO advice, it won’t pay out for any disruption to your holiday, for example if you have to return home early.

However…

“If you book a trip and travel against the advice your travel policy will cover you, so long as you follow the advice of the local authorities, for situations such as:

- Medical expenses for new conditions or accepted conditions you’ve told us about including with COVID-19

- If you’re quarantined abroad, for example following a temperature check.”

Sho uld I Book To Go Skiing and When?

This is the big question we’re being asked more and more at PlanetSKI as the new season approaches.

Anecdotal evidence suggests that many skiers and snowboarders have already decided it’s too much of a risk and have chosen to sit out the 2020-21 season.

For those of us who can’t face the prospect of a winter off the snow, what’s the best approach?

Should I bite the bullet and book now?

“I’m not. I’m going to wait, wait, wait,” one of our contacts who has spent years in the ski industry told us.

“My view is to leave it as long as you can leave it and only book when you are 99% sure it’s going to be OK to travel.

“I’m probably going to drive and book accommodation at the last minute.

“Of course, if you need to go at February half-term, you might need to book Eurotunnel and maybe try to find accommodation that will allow you to cancel right up to the last minute.

“If people are that desperate to go skiing this winter they are going to have to be prepared to take it on the chin.

“This season is going to be really darned tricky.”

That could be the understatement of the year.

For the Spirit of the Mountains – PlanetSKI: Number One for ski news

- Summer in the Mountains

- Holiday Essentials

- New for the 2023/24 Season

- Travel & Holiday

- General News

- Snow & Weather

- Sports News

- Environment

- Resort News

- Gear & Equipment

Editor's Choice

PlanetSKI is Skiing & Sightseeing in Turkey

Alpine Glaciers Predicted to Shrink 50% by 2050

Inghams Is Up For Sale

Dave Ryding: The PlanetSKI Interview

Cost of Day Lift Passes in Europe’s Ski Resorts Outpace Inflation

Esprit Ski to Cease Trading at End of Season

GB Wins Gold & Silver at X Games

A Cautionary Tale About Snow Chains

Andorra’s Other Ski Areas

RIP Ian Baxter

Privacy overview.

- United States

- United Kingdom

Ski travel insurance

You can add on ski cover with most travel insurance policies and get covered for resort cancellations, unused lift passes, covid and more..

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

In this guide

What is ski travel insurance?

What does ski insurance cover, how does ski insurance work, "is off-piste skiing covered, frequently asked questions.

Destinations

What you need to know

- If you are hitting the slopes, ski insurance is a key travel insurance add-on.

- It can refund you for things like trip cancellations, damaged skiing equipment, unused lift passes and costly mountain rescues overseas.

- Ski travel insurance is important both in Australia and abroad. COVID cover is included with some policies.

Ski travel insurance is a type of cover which is specifically designed for people visiting the slopes to ski, snowboard, or take part in any other recreational snow sports.

It usually comes as an optional add-on to a standard travel insurance policy, but provides additional cover that's useful for people who are skiing or snowboarding.

- COVID-19 related travel expenses. Some policies will cover you for cancellation or medical expenses if you get COVID-19 before or while on your trip. You can also get your money back if there's an outbreak at the ski resort you booked. Find out more about ski travel insurance COVID-19 cover below.

- Lost or damaged equipment. Travel insurance can help towards the cost of replacing expensive ski equipment if it's lost, stolen or damaged during your trip. It can even pay for a replacement lift pass if that goes missing too.

- Equipment hire. If your gear is lost or damaged, insurance will cover the cost of rental so you can get back on the slopes as quickly as possible.

- Injury on the slopes. Lots of standard travel insurance policies won't cover medical expenses if you hurt yourself while skiing, but ski insurance will.

- Mountain rescue. Even a relatively small injury can require mountain rescue if you're in a tricky spot. Ski insurance will cover the cost of helicopter rescue, as well as transport to the nearest hospital.

- Unused lift passes. If an injury or even bad weather keeps you off the slopes, ski insurance can reimburse you for your unused lift pass, as well as wasted equipment hire or ski lessons.

Ski travel insurance can help for those breaks to Thredbo or Hotham – or if you're hitting the slopes in Europe or America for a longer trip.

Ski insurance is specifically designed for ski trips and goes beyond what's covered under standard travel cover . It offers financial protection if:

Your ski equipment gets lost, damaged or stolen during your trip. Such equipment is unlikely to be covered under a regular policy.

You break your leg and have to visit a private medical facility for help

Personal liability if you injure someone and they try to sue you

The ski fields close down because of bad weather and you have to change resorts or are forced to cancel

You catch COVID-19 or there's an outbreak at the ski resort you booked. Conditions apply and the country must be deemed safe to travel to by Smartraveller .

Other trip cancellations: for example, if you have to cut short your trip after an injury on the slopes.

Fingers crossed, none of these will happen to you, but this is why travel insurance with COVID coverage is so important when you're on the go, even for a staycation.

Depending on the policy you get, you may or may not be covered for other forms of skiing.

A piste is recognised as a marked run or path down a mountain. Off-piste skiing refers to skiing in the backcountry or on unmarked trails. As there are more risks involved, only a handful of insurance providers will offer off-piste cover .

Note: This information was last updated August 2023

Why you can trust Finder's travel insurance experts

We're experts

We're independent

We're here to help

Am i covered for other snow activities.

Yes. Most insurers will offer cover for recreational skiing and other snow activities such as snowboarding under a ski insurance policy. However, you won't be covered for off-piste, cross-country or backcountry skiing.

Can I get multi-trip ski travel insurance?

You can buy ski travel insurance for one trip if you're heading for a one-off break. But if you're a more frequent skiier then you might want an annual policy .

Am I covered for heli-skiing?

Often, you will need to purchase cover for heli-skiing as an additional benefit. An added premium will apply – if this cover is available to you. Contact your insurer for more information.

Who can apply for ski cover in Australia?

In comparison to other types of travel cover, ski travel insurance is generally only available to people under the age of 65 as senior buyers are considered to carry too great a risk for insurers. Other general requirements for taking out this cover include:

- Must be a resident of Australia

- Policy must be purchased prior to starting journey

- Journey must start and end in Australia

Can I ski if I have a pre-existing medical condition?

Generally, yes. Check to see if your condition is automatically covered in your policy (usually conditions like allergies and asthma are included). If you have a more serious condition, consider AllClear a brand that specialises in travel insurance for the elderly and those with pre-existing medical conditions.

Gary Ross Hunter

Gary Ross Hunter is an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

Everything we know about the Tasmea Limited IPO, plus information on how to buy in.

Cash usage continues to decline, but what happens next?

SPONSORED: Not sure if your current business account is right for your needs? Use our checklist to find out.

These General Terms and Conditions ("General Terms") apply to the game of chance identified as the "Competition" in the schedule of particulars for the Competition that explicitly references the General Terms ("Competition Schedule").

Our experts compared 24 policies, 160+ features and got over 140 quotes to help you find the best pet insurance products of 2024.

Get points from Virgin while you binge on your favourite shows.

SPONSORED: Using a loan matchmaking service can be a great way to get a personal loan that suits your needs – and a better deal on it too!

Finder acknowledges that today ASIC has filed an appeal with the Full Federal Court in relation to proceedings against Finder Wallet regarding its Finder Earn product.

Save $1,800 by switching to a more affordable health fund.

Abuse and violence towards retail workers and service staff has reached disturbing new levels, according to new research by Finder.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Help and Support

- Travel Insurance

Adventurous Sports Insurance

Throwing yourself onto a bike or into the sea be sure you're covered., do i need adventurous sports insurance.

There's a degree of risk to most sports, but particularly the adventurous ones.

Having the right cover in place before you go on holiday means you can try exciting and adventurous sports without worrying about what might happen if something goes wrong.

Admiral Travel Insurance covers a wide range of sports, but let’s take a look at which ones you’re covered for as standard and which you’ll need to pay a bit extra for.

Covid-19 - what our travel insurance covers

Our travel insurance now covers you for certain events related to Coronavirus (COVID-19), provided you have proof of a positive Covid-19 test and your cover is active at the time of the event.

What we cover

We provide cover for some costs related to Covid-19: please see Section 1 'emergency medical costs and repatriation' and Section 2 'cancelling or cutting short your trip' in your policy book for full details on what's covered.

We'll cover you if:

- you were diagnosed with Covid-19 before your trip was due to start

- a close relative died or became seriously ill as a result of Covid-19 before your trip was due to start

- you weren't allowed to board your pre-booked outbound travel due to symptoms of Covid-19

- an insured person or a close relative died during the trip because of Covid-19

- you couldn't take part in an excursion due to you self-isolating after getting Covid-19

What we don’t cover

You won't be covered if:

- you had reason to believe your trip may be cancelled, postponed or cut short when you booked it, purchased your policy or started your trip

- any government or public authority imposes travel restrictions or quarantine on a community, location, or vessel because of Covid-19 (this includes, but is not limited to, local lockdowns, entry requirements, being denied entry and airspace closures)

- you have to quarantine after arriving in the UK or abroad

- the Foreign Commonwealth & Development Office (FCDO) change their advice to avoid ‘all travel’ or ‘all but essential travel’ to your destination because of Covid-19

For more information about how Coronavirus (COVID-19) affects your travel cover, see our FAQ page . And remember to check the policy booklet carefully before you buy to make sure our cover meets your needs.

What's covered under standard travel insurance?

Many of the sports you might want to do on holiday are covered by our standard holiday insurance.

These activities don’t require an extra payment on top of your standard travel insurance – and you’ll be covered for personal accident and legal liability too:

Banana boating

Body/boogie boarding

Canoeing (up to grade two rivers)

Fishing Kayaking (up to grade two rivers)

Parasailing (over water)

River tubing

Sailboarding

Scuba diving up to 30m*

Sea kayaking

Snorkelling

Wake boarding

Windsurfing

Yachting (inside territorial waters)

Water skiing

White/black water rafting (up to grade four rivers)

*For unqualified scuba divers, the diving depth is limited to 30m. (See policy wording for more conditions around scuba diving cover).

Raquet ball

Table tennis

Tennis Volleyball

Beach games

Cycling (except for racing, BMX, mountain biking, and cycling on extreme terrain)

Fell walking

Hiking (up to 4,000m altitude)

Hot air ballooning

Ice skating

Orienteering

Paintballing

Pony trekking

Safari (guided)

Rollerblading/inline skating

Sand boarding

Skateboarding

Trekking (up to 4,000m altitude)

Paddle boarding

Jogging/Running (excluding marathons)

Pony trekking (any equine 58 inches or less at the wither)

Extreme sports travel insurance: how to get covered for hazardous activities

If you couldn’t see your chosen activity on the list above, don't panic. Adrenaline junkies out there can still try that once-in-a-lifetime bucket list activity – you’ll just need to pay a little extra to be covered.

When buying travel insurance through Admiral, you’ll get the option to add extra cover for a specific hazardous activity. Just select the sport or activity you’ll be taking part in and pay the extra cost to get cover.

Bear in mind all hazardous sports and activities on our list exclude cover for personal accident and legal liability:

Assault course

Bungee jumping (maximum three jumps)

Canoeing (rivers over grade 2)

Canyon swinging

Coasteering

Gorge walking

Horse riding

Kayaking (rivers over grade two)

Kite surfing (over land)

Sand yachting

Scuba diving to depths between 30m and 50m (requires qualification)

Sea canoeing

Shark diving

White/black water rafting (rivers over grade four)

Yachting (outside territorial waters)

Trekking (up to 4500m altitude)

Hiking (up to 4500m altitude)

Motorcycling over 125cc (Europe only)

Sky diving (max 3 jumps)

Paragliding

If you'd like to be insured for a sport that’s not listed, contact our team to find out if we can arrange cover for you.

What level of cover do I need?

Now you know what activities are covered as standard and which require an extra payment, you need to choose the right cover for your trip. We break travel down into three zones:

- Worldwide excluding USA, Canada, Caribbean and Mexico

See the full list of benefits in the policy summary booklet .

Winter sports insurance: make sure you're covered

If you're taking to the slopes to go skiing or snowboarding, you'll need to add our winter sports insurance to your standard cover.

As well as covering you in case of accidents or injury on the slopes, winter sports insurance means you'll get compensation if your equipment is lost, stolen or damaged. It also covers you if your trip is affected by severe weather, like avalanches.

Without the upgrade, your trip won't be covered at all but adding it means you'll get all the standard protection included in our single trip and annual policies as well as cover for the sport you'll be taking part in.

Limitations and exclusions

As is always the case with insurance, there are certain limitations and exceptions that could invalidate your cover.

For Admiral's winter sports insurance, we don’t cover travellers over 75 years old for trips within Europe and over 70 years old for trips outside of Europe.

Reckless behaviour

You won't be covered if you're injured as a result of your own reckless behaviour. This includes:

- Deliberately injuring yourself

- Being under the influence of drugs, solvents or excessive amounts of alcohol

- Not following the safety precautions while taking part in an activity

For a full list of exceptions, see the General Exclusions section in our policy documents .

What if I have a pre-existing condition?

A pre-existing condition is a short or long term illness or injury you have or have had before you buy travel insurance. This includes having symptoms, tests, diagnosis or medical treatment for a condition.

You can declare your pre-existing conditions during the quote process to see if we can offer cover. If you’re unsure what needs to be declared or if you're unable to find your condition on the medical conditions list, please contact us on 0333 234 9913 .

Your pre-existing conditions won’t be covered unless you’ve:

- Declared them all on your policy

- Received written confirmation that we’ll cover your medical condition

- Paid any additional premium in full

Policy terms and conditions apply. Please note, if you’ve had a positive diagnosis of Covid-19 and been prescribed medication, received treatment, or had a consultation with a doctor or hospital specialist for any medical condition in the past two years, this needs to be declared on your policy.

If you don’t tell us about your pre-existing conditions or give us incorrect information, your policy may be invalid, and we may refuse all or part of any claim you submit.

For a quote with us, click the green button above.

The MoneyHelper directory

If you require cover for more serious medical conditions, MoneyHelper may be able to help you find specialist travel insurance through their medical directory.

If you wish to get in touch with them you can call them on 0800 138 7777 or find them online . (Monday to Friday 8:00-18:00, closed on Saturday, Sunday and bank holidays.)

Getting the most out of your trip

Going anywhere nice.

Off to one of the destinations below? Take a look at our guides for some hints and tips on what you need to remember.

Travel insurance that suits you

Whether you're travelling solo, with your family, or with a little one on the way, read our guides to make sure our cover is right for you.

Family Travel Insurance

Student travel insurance, travelling while pregnant, travel insurance over 65, travelling with medical conditions, travel insurance upgrades.

Whether you want the adrenaline rush of a skiing holiday, or fancy taking to the seas on a cruise, you'll need to add extra cover to your policy.

Cruise Travel Insurance

Ski travel insurance, gadget travel insurance, single trip insurance, annual trip insurance.

Telephone Hours

Opening Hours

- Mon-Fri: 8:30am - 8pm

- Sat: 9am - 5:30pm

- Sun: 10am - 5pm

- Mon-Fri: 9:00am - 8:00pm

- Sat: 9:00am - 5:30pm

- Sun: 10:00am - 5:00pm

Winter Sports Travel Insurance

Winter sports should be fun for everyone, even if you have a pre-existing medical condition. If you wish to enjoy sports such a skiing or snowboarding on your trip, it's important that you get specialist winter sports travel insurance. Our individually tailored policies cover cancellations and medical expenses.

Page contents

Why do you need travel insurance that covers winter sports, what is covered by winter sports travel insurance, what activities does winter sports travel insurance cover, age limits for winter sports cover, winter sports insurance with pre-existing medical conditions, why more than 3 million people have chosen allclear.

Winter sports travel insurance covers you should you wish to enjoy adventurous sports such a skiing or snowboarding and still want peace of mind whilst on holiday. This type of insurance covers you for medical emergencies, even those related to Covid, which is vital to prevent unexpected medical bills and give you the support you need if you have any medical problems while you are away.

If you’re planning a winter holiday and want full peace of mind, you’ll need to make sure you have Travel Insurance with ski cover in place. Few things ruin a holiday faster than an injury and a costly trip to the hospital. If you need emergency medical treatment and don’t have insurance, bills could be incredibly expensive.

Here’s what to look for when you’re buying Travel Insurance for your winter sports holiday.

Winter sports and other snow-based activities increase the risk of injury and require a lot of specialised equipment and unique venues compared to standard holidays on the beach. All this needs to be factored into your insurance policy.

ABTA research shows that over 3.5 million Brits who have been on a winter sports holiday have never taken out Travel Insurance. The same research found that ABTA Members had reported more than 200 significant injuries caused by collisions and falls on the slopes amongst British holidaymakers in the 2018 ski season.

Proper, high-quality cover for winter sports will help you avoid costly medical bills if you have an accident during your activity, lose or damage your equipment. Without a valid Travel Insurance policy, you could be left out of pocket.

Some insurance providers will offer cover through a dedicated policy or with a special add-on. When applying for a quote with AllClear, add ‘Winter Sports’ in the ‘Extras’ section after you have selected your preferred policy and your quote will adjust accordingly.

Benefits of AllClear Cover

Winter sports equipment – protects the cost of repairing or replacing your equipment up to £500, if yours were to be stolen, lost or damaged during your holiday. We’ll also help with the costs of hiring replacement equipment up to £10 a day. We take into account the age of your items when working out a claim.

Piste closure – we’ll contribute to the cost if you need to travel to another resort to ski or you can’t ski at all because of piste closures caused by a lack of snow.

Ski pack – cover for up to £400 of unused parts of a ski pack you bought before travelling if you’re unable to take part in winter sports because of illness or injury sustained while travelling. You’ll need to be medically certified as being unfit for your activity by a doctor at the resort.

Delayed ski equipment – up to £150 towards hiring replacement equipment if your own equipment is certified by your carrier to have been misplaced for more than 12 hours on the outward journey of your trip.

As above, the sports or activities covered will vary by your insurer. So, you need to check your policy documents carefully and make sure it’s appropriate for your plans.

With an AllClear add-on, the following activities are included:

Inner tubing (in snow)

Skiing (including, off-piste, mono, heli, dry and cross country)

Snowboarding

Snowmobiling

Snowshoeing

Sphereing/Zorbing

Tobogganing

If your activity is not included, call us for free on: 0808 281 0561 as we may be able to add a specific activity to your policy.

It’s important to remember that there may be limitations or other requirements. For example, if you want to ski off-piste, you’ll need to be accompanied by a qualified instructor or guide. This information will be detailed in your policy documents.

Simple 3 step quote process

1. call us or click a quote button on our site, 2. complete our simple medical screening process, 3. get your quotes.

You’ll be given the option to include Winter Sports on most of our policies. A number of our providers will insure you up to and 65 years of age.

If you’re planning to hit the slopes, you must declare any medical conditions when applying for a quote.

Any injuries caused by an existing condition when participating in an activity could mean you aren’t covered if you haven’t declared it. Plus, if you fall ill while travelling because of an existing condition and you haven’t declared it, you’ll have to pay for your time in hospital. In addition to this, you won’t be covered for anything lost on your ski pack.

We can cover over 1300 different medical conditions, and we’re experts in Medical Travel Insurance since the year 2000. If you declare all your conditions, your insurer agrees to cover them, and the activity is included in your policy, you’ll be covered for the costs of your treatment and other expenses.

We compare cover from up to 61 insurance providers, and 98% of customers have rated us ‘Good’ or better at being helpful and friendly. [1]

“AllClear Gold is simply the best travel cover I have found.”

Even 2 years after having been declared to be in remission from cancer i found many companies would not insure me to go skiing, but with allclear it was a breeze – and best of all it wasn’t expensive. i’ve been using allclear for over 8 years and would never look anywhere else now. when i had a skiing accident 3 years ago they were fantastic and provided me with an excellent service getting me home safely, organising assistance at the airport etc. highly recommend their services ”, sarah harbord – trustpilot, read allclear trustpilot reviews.

We hope you found this information helpful and you enjoy your time on the slopes!

If you’d like to start a quote, click the quote now button below.

[1] From 450 responses.

Written by: Russell Wallace | Travel Insurance Expert Last Updated: 24 November 2023

[1] Based on Trustpilot reviews of all companies in the Travel Insurance Company category that have over 30,000 reviews as of January 2023.

Policy Wordings

Modern Slavery Statement

MaPS Travel Insurance Directory

Earn rewards by sharing with friends

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

What Does Travel Insurance Cover?

Why do i need travel insurance.

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Travel Insurance Ski

Hitting the slopes? Compare travel insurance offers with ski cover with Savvy today.

Fact checked

Compare Travel Insurance Quotes in 30 Seconds

- 100% free to use. No obligation.

Whether you’re heading to the Swiss Alps or Falls Creek for your next ski holiday, it’s important to have the right insurance to offer you cover for a range of unexpected circumstances which can occur while you’re hitting the slopes. Before you pack away your poles and goggles, you can compare travel insurance options with Savvy.

We're partnered with some of the top travel insurance providers in Australia to enable you to compare a range of high-quality offers before you buy your policy. Get the process started with us today by completing a free, no-obligation quote.

What is ski travel insurance and how does it work?

Ski travel insurance is designed for those wanting to partake in a range of winter sports while on a domestic or international snow holiday. Because this type of recreational activity comes with a greater risk of injury, many insurers will require you to buy extra coverage instead of already having it rolled into your basic or comprehensive coverage.

The benefit of these policies is that they’re specifically designed for winter thrill seekers. Some of the areas in which these policies may be able to offer cover (subject to the terms and conditions of your policy and any other qualification criteria in place with your insurer) include:

- Loss of or damage to your ski equipment

- Injuries sustained on the slopes (international insurance only)

- Travel disruptions and unexpected cancellations for reasons such as a family emergency or another medical reason

- Damage to your rental car due to bad weather

- The hire of replacement ski equipment if yours is stolen

- Piste closure due to bad weather

- Theft of valuable items, such as mobile phone or camera

Some providers can offer ski and snowboarding travel insurance to travellers up to the age of 69. What’s covered will differ from policy to policy and will depend on your insurer's terms and conditions, but a wide range of winter sports activities can be included, such as:

- Off-piste skiing with an instructor

- Back-country skiing in a remote location

- Heliskiing or snowboarding

- Sledding, tobogganing and snowmobile riding

- Ice skating or non-competitive ice hockey

- Snowshoeing

However, it's important to know what won't be covered under a skiing or winter sports insurance policy. Some of the activities which may be excluded include:

- Partaking in professional skiing or snow sports

- Snowboard acrobatics, freestyle skiing or racing, including training

- Cat, glacier, backcountry or heli-skiing without an instructor

- Skiing outside of the designated routes

- Bobsleighing or parascending

- Skiing outside the regular snow seasons

How do I compare ski travel insurance policies?

Before you settle on a ski policy for your next winter holiday, it’s always handy to compare travel insurance products. Some of the factors you should be assessing when comparing with Savvy include:

Inclusions and exclusions

Aside from the bonus extras attached to your ski travel insurance policy, it’s worth comparing offers to help you weigh up which provider offers you the most coverage at the best price. As such, it's important to find out and compare the terms and conditions outlined by your insurer and in their PDS so you can have a better idea of what is and isn't covered under your policy.

Basic or comprehensive

Travel insurance comes with two primary options: basic and comprehensive. Weigh up your needs as a traveller to help you determine which type of cover is better suited to your upcoming ski trip. Basic travel insurance is generally cheaper and typically only offers coverage for medical expenses and personal liability. Comprehensive insurance can be pricier but typically includes a greater number of benefits and higher claim limits.

Features of your policy

Outside of the standard policy features, insurers may offer bonus extras such as round-the-clock assistance and the ability to extend your insurance policy. For instance, some providers will allow you to contact them 24/7 if you suffer a medical emergency overseas. They may also allow you to extend your policy if you’re stuck overseas due to unforeseen circumstances such as illness or a natural disaster, though whether cover is granted will be at the discretion of your insurer and subject to the event meeting their criteria.

Consider the limits

Insurance companies agree to cover costs up to a certain amount in circumstances which are deemed claimable. Comparing different policies can help you determine which offers provide you with the most suitable claim limits. For example, basic coverage may only cover you up to $7,500 for lost luggage or valuables, while comprehensive coverage may allow you to claim up to $15,000 should the circumstances be covered by your lender.

Winter activities covered

If you’re travelling to Japan to indulge in some snow sports around the mountainous Niseko, ensure you have the right coverage for the activities you want to partake in. If you have a particular snow sport you want covered, it may be important for you to find a policy which can cover you where required.

What factors can impact the cost of my ski travel insurance?

Insurers charge a premium when you take out your policy, which is dependent on several factors. Some of the common factors that can impact the cost of your insurance premium include:

The older you are, the more your travel insurance is likely to cost. Insurers see it as an important variable when assessing the price of your policy because the likelihood of injury and death increases with age. As such, those over the age of 60 tend to pay considerably more in their insurance premiums. Although you can be covered up to the age of 69 by some insurers, whether your policy is

Your destination

Where you choose to spend your holiday can impact the price of your insurance premium. If you’re travelling to a country with expensive health care, you could be paying more upfront for your policy. For example, travelling to the United States to hit the slopes would likely incur a higher premium because the cost of healthcare is exorbitant compared to our system.

How long you’re abroad

Simply put, the longer your trip, the more you’ll pay for your insurance policy. Taking out travel insurance over a longer period means there’s a greater space of time where things can go awry, such as losing your belongings or having an accident.

Your excess

Any time you have to make a claim, you’ll need to pay an excess. Opting to pay a greater gap will drop the price of your premium simply because you’re offering to stump up more of your own money if you have to claim against your insurance.

Any pre-existing conditions

Some insurers have a list of pre-existing conditions which they can cover in either their basic or comprehensive policies (subject to meeting other qualification criteria). For example, some of these companies may offer cover for conditions such as asthma, graves’ disease, sleep apnoea or glaucoma automatically in certain situations. However, there are other, more serious conditions which may be excluded, such as cancer or heart conditions, so it's important to compare offers thoroughly if it's important to find one which offers cover where you need it.

Your level of cover

Consider the type of trip you’re taking and the coverage you’ll need on it, as this will help you narrow down the type of insurance best suited to your needs. Basic coverage is generally cheaper than comprehensive insurance, but typically offers fewer benefits and lower claim limits.

How many people are being insured

Some travel insurance companies may allow you to include up to 25 travellers on the same policy (provided they meet the terms and conditions set by your insurer). As such, it may be cheaper in some cases to take out a group policy than purchasing individual insurance for each member of your group. However, it's important to determine what is and isn't covered under your policy before you buy.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

Your step-by-step guide to purchasing ski travel insurance

Fill out a quick quote with savvy.

You can start by completing our quick, no-obligation quote form, which includes:

- Your destination/s (such as if you're travelling to India )

- Whether you're purchasing a single-trip or annual-trip policy

- The start and end date of your trip

- Whether you're buying for yourself, as a duo or family

- The ages of all the travellers

- Whether you need additional cover for skiing or a cruise

Compare travel insurance policies with Savvy

Once you've filled our this form, you'll be taken to a list of available quotes provided by our partners. This will enable you to compare different offers based on their price, coverage, inclusions and more.

Review the terms and conditions

Brush up on the PDS documents provided by different insurers to give you a greater understanding of what is and isn't covered under the policy. It's important to do this before you purchase your policy, as it's always better to have a clear understanding of the terms of your agreement.

Purchase your policy

If you’re happy with your quote and have settled on one to purchase, you can select your chosen policy and complete the purchase online via your insurer's site. After you've bought your plan, you'll receive confirmation of your agreement soon after and your coverage will generally kick in within a few days (depending on your insurer).

Common ski travel insurance questions

Some insurers exclude expenses relating to epidemics or pandemics as part of their policies, but many today are offering travel insurance which covers certain COVID-19-related expenses . However, your coverage will depend on the terms and conditions of your agreement. While circumstances such as cancellation or medical expenses due to contracting the virus may be covered, not all events will be. For instance, some insurers will implement a period of 72 hours after your policy is purchased where any claimable events won't be covered. It's important to compare a range of offers to determine what you can be covered for before you purchase your policy.

There are some travel insurance companies which won’t cover you for a ski trip taken during the off-season of your intended destination. However, it's important to compare different policies to find out when and where you can be covered for skiing.

You can generally add your child to your family policy for free, as long as they are under the age of 20 and aren’t working full-time (though these criteria may differ between insurers). Adding a snowsports pack to your family policy will generally mean the coverage can apply to all the individuals listed, but you should check with your insurer if you're unsure.

You can be covered in the event you have a serious medical or family emergency and have to cancel your holiday at the last minute (which will also be subject to your insurer's other qualification criteria). Depending on the level of travel insurance you’ve purchased, you may be able to get a refund on the deposits you’ve paid.

If you’re planning on taking part in other activities such as riding mopeds, scooters or motorcycles, you’ll typically need to take out additional coverage. Winter sports coverage generally only addresses snow-related activities, while other packs (such as adventure packs) are designed to cover other risky activities such as motorcycle riding, rock climbing or abseiling.

Helpful travel insurance guides

How to Get a Travel Insurance Quote

Find out how to complete a travel insurance quote and the process involved in Savvy's handy guide. Compare Travel Insurance...

Asking yourself why you need travel insurance for your holiday? Compare with Savvy and understand the benefits. Compare Travel Insurance...

How Late Can You Buy Travel Insurance?

Find out how close to your departure you can purchase your policy with Savvy. Compare Travel Insurance Quotes in 30...

Travel Insurance Broker

Find out how a broker may be able to help you and compare travel insurance options with Savvy. Compare Travel...

Cheap Domestic Travel Insurance

Compare with Savvy and find a cheap travel insurance deal for your next domestic holiday. Compare Travel Insurance Quotes in...

Benefits of Travel Insurance

Understand more about the benefits of travel insurance by comparing your options with Savvy. Compare Travel Insurance Quotes in 30...

Cheap Travel Insurance For Seniors

Compare travel insurance for seniors with Savvy to help you find the cheapest. Compare Travel Insurance Quotes in 30 Seconds...

Travel Insurance for Heart Conditions

Looking for travel insurance that covers heart conditions? Compare with Savvy to help you get the cover you need today....