Oyster Fares Central

Journey History and Queries

Journey history has improved beyond all recognition since the early days of the Oyster system. As long as your Oyster or zip card is registered to a TfL account you can view details of journeys and topups for the last eight weeks. This is available through the TfL website and also using the TfL Oyster app. More details for Oyster follow, but first an overview of the history for contactless.

Contactless Journey History (and how to query a journey)

Unlike Oyster, contactless journey history remains accessible for a year. This is because it provides the detail justifying debits on your bank or credit card account. There are two views available. One is Payment History which displays the journeys making up a particular debit. This won’t change if extra information arrives, like a late touch or a confirmation of a missed touch. Instead, the new information will make up a new entry for the day any adjustment was processed and sent to your bank. The other is Journey History which displays the journeys made during each day. This will change if late information becomes available. On both displays you have the ability to query a particular journey, though it’s not obvious at first. TfL have kindly provided some screenshots to explain how to do this.

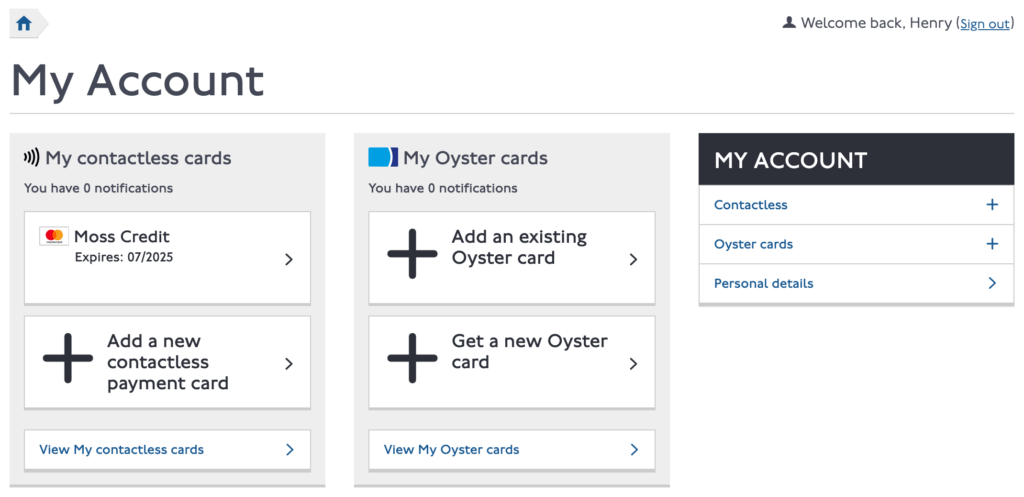

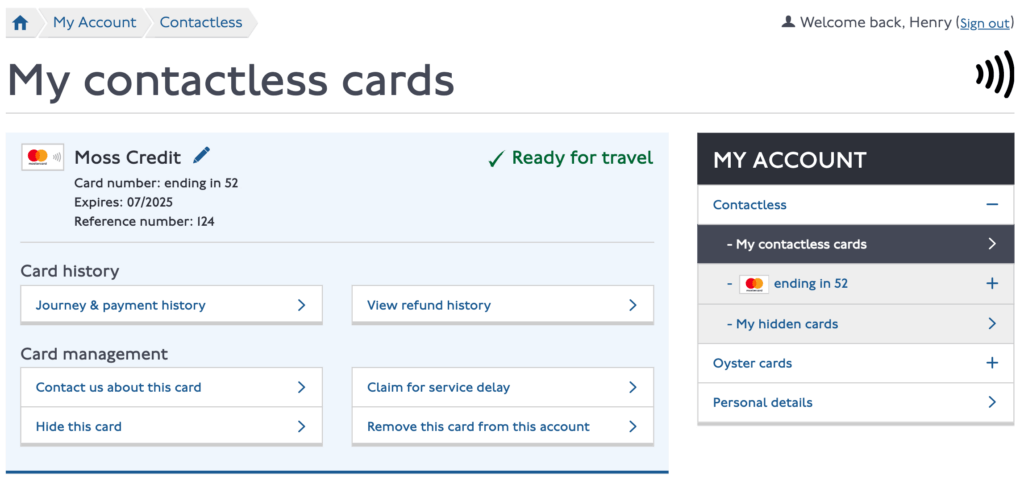

The first screen shows the overview for the selected card. Note that identifying information has been hidden. You need to click the button highlighted in red. There is a button to contact TfL about the card, but this won’t pass the details of a specific journey.

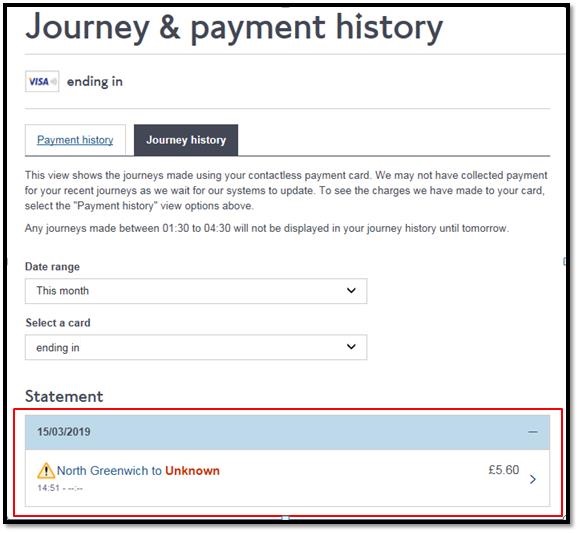

Next you come through to the journey statement. Note the tabs to switch between payment and journey view. For any journey you can click on the detail line as shown in red below. Don’t click on the date heading as that just hides the individual journeys for that day.

This brings you through to more detail about the journey, including all touches (yellow and pink readers). Crucially underneath the detail is a button to bring up a form to contact TfL about that specific journey. Again it’s highlighted in red.

The form confirms the journey and gives you a text box to make any comments. You can use this to add information about a missing touch (if the normal form doesn’t work) or to explain why you think the charge is wrong. Most importantly, do NOT enter your payment card details in the box. TfL already have them if they are needed.

Oyster Journey History

Oyster journey history looks similar to the contactless views above, although there is only one view. When you select journey history from the overview you have a drop down menu to choose the period to display. The default is the last seven days, with options for the previous 8 weeks ending on a Sunday or a custom selection. The history is displayed below the drop down. As well as journeys you will also see topups and any refunds picked up. For rail journeys you can click on the ‘+’ sign to expand and show all touches that make up the journey. An example view is below, noting that the prices relate to a zip 16+ Oyster card.

Oyster statement sent by email

There is also a facility to have weekly or monthly Oyster statements sent automatically by email. Sadly this doesn’t exist for contactless. In the right hand menu select “Card preferences” and you can choose the frequency between weekly, monthly or never. You can also choose to receive CSV or PDF formats, or both.

34 thoughts on “Journey History and Queries”

Hi Mike, Is there still an option to receive a Oyster print out at tube stations? Thanks Kim

Sadly not. I believe it can still be done at the National Rail stations which perform Oyster transactions in the ticket office.

My Oyster card always says “You have 0 incomplete journey(s) eligible for refund.”, even if I do have an incomplete journey.

Is this feature for Contactless only – and if so, why does it display that message in the Oyster card page?

No, it’s for Oyster. Not all incomplete journeys are eligible for a refund without contacting the helpdesk.

Can anyone tell me how soon my Oystercard journey history will appear? I used my card today but my outward journey failed to register the touch in and I was charged maximum fair.

Hi Veronica,

It will appear tomorrow morning. If you made identical outward and return journeys there is a chance that they may auto complete the missing touch and queue a refund automatically. Otherwise you can let them know tomorrow.

Last Friday afternoon, I travelled using my Oyster PAYG (with a Gold Card added) from Orpington NR to Charing Cross NR, took a bus (the bus journey triggering the expected auto top up) and later the same day went on the Tube from South Kensington to Embankment and then immediately on to Charing Cross NR to return to Orpington NR. My online Oyster journey history is fine, showing all the expected touches and fares, but for the return journey my Oyster app journey history shows only the South Kensington, Embankment and Orpington touches (skipping the touch at Charing Cross NR) and shows a fare of £1.60 rather than the correct £3.70. The app shows a total daily spend of £5.80 and the online version shows the (correct) daily spend of £7.90 – the £2.10 discrepancy is the difference between the fare shown on the app and what I have been correctly charged. Bizarrely, my PAYG balance as shown online and in the app are both correct and reflect that the correct fare has been charged. Any idea why the two versions are out of step?

I’ve no idea. I’d be interested to know what the helpdesk say. Both Oyster online and the app should be accessing the same online database, as far as I know.

Hello again Mike

I reported the problem of the mismatch between journey histories to the helpdesk and their reply is set out below (it goes on a bit!). I didn’t to resort to the solution the helpdesk suggested – the app history magically updated itself over the last couple of days to bring it into line with the Oyster Online history, without me doing anything.

“Thank you for your web form submission of 24 June regarding the mismatching information between your Transport for London (TfL) account and the TfL App.

I apologise for any confusion and inconvenience resulting from these circumstances and appreciate you taking the time to bring them to our attention.

The TfL App is essentially an extension of your online TfL account, rather than a wholly independent system with a separate set of records. Under normal circumstances, once your online TfL account is updated to reflect the latest travel records, these are then pushed to the TfL App as well for you to have remote access.

On occasion, data may only partially be pushed to the TfL App resulting in the inconsistencies you’ve witnessed. This is usually automatically corrected by our system within a couple of days as soon as the next update is pushed through and the older data replaced.

As you’ve clearly seen directly though, the mismatching information does not necessarily mean that an overcharge/undercharge has in fact occurred. Should this occur anew, it is recommended to fully sign out of the TfL App, restart your smartphone and then sign back in. This should trigger our App to retrieve the records once more overwriting any older one.

If for whatever reason your records are still not being displayed properly on, please respond to this email at your earliest convenience to advise us of this. It would also be of great help if you could provide the following information:

The make and model of smartphone you’re using

The operating system currently installed on it – including the version number (found under your smartphone’s settings)

The version of the TfL App you’re using

Screenshots (if possible) of your travel records as displayed on your smartphone

We’ll then proceed to investigate in more depth to determine why information is not being displayed consistently across the two sets of records”.

Thanks for the update, very interesting.

Hello Mike,

Here is a good one:

Last week I travelled from Queens Road Peckham (overground service) to Goldhawk Road vía Whitechapel (Hammersmith line) making sure I touched on the pink card reader when interchanging. I used my contactless card for this journey.

I travelled from zone 2 to zone 2 crossing zone 1 using TfL services, so I thought I would be charged £2.40/2.90 for this journey.

I have been charged £4.

If I search this journey on the fare finder I got the same fare of £4. But if for example, I try to finish my journey at the previous station which is in the same zone 2 (Shepherd’s Bush Market) I got the usual fare between zone1-2 which is £2.40/2.90.

How is this possible?

I’d contact the helpdesk and ask them to explain. The £4 fare assumes you start by taking a Southern train to London Bridge. This incurs the mixed mode premium hence the high fare. They seem to think you wouldn’t go the long way round to Goldhawk Road.

Hi I took a journey on 2nd July from London City Airport to Paddington and as I had plenty of time I took a very convoluted route. I used Apple Pay and went as follows: – DLR to Bank – Northern to Moorgate – Circle to Farringdon – Thameslink to Blackfriars – Circle to Paddington There are 2 things I don’t understand: – Although I touched in and out everywhere, it shows as an automatically completed journey on my TFL account with the following comment: o To offset any travel disruption you may have experienced, we’ve charged you the minimum fare for this journey. Normally this would have resulted in a higher fare being charged. – The charge was £4:30. Should it not be £2:80? My TFL account shows: 13:08 London City Airport (yellow reader) 13:45 Moorgate (yellow) 13:46 Moorgate (yellow) 13:58 Blackfriars (National Rail) (yellow) 14:00 Blackfriars (London Underground) (pink – although this was at the entrance to the tube and was actually yellow!) 14:30 Paddington (London Underground) (yellow) Do you think this is correct or perhaps I just broke the system?!

I think you might have hit a problem with the temporary arrangements at Moorgate. It’s certainly had trouble working out what journey you were making. You’ve been charged as if you’d gone via Woolwich Arsenal. I think it might have tried to charge you two journeys, hence the comment about a higher fare. You could try contacting the helpdesk via the link at the bottom of the page listing all the touches.

Last Saturday (29th June) I tapped in at Chiswick & caught a train to Waterloo. Due to a trespasser on the track at Putney we were held at Barnes Bridge for 90 minutes. When I eventually tapped out at Waterloo I got 2 £5.60 penalty fares. My journey history shows the system is assuming I failed to tap out from my journey from Chiswick and then failed to tap in on a journey to Waterloo. Understandable given the times I tapped in and out, but my Oster account says I have no incomplete journeys eligible for refund so I can’t apply for a refund on-line & I only have a PAYG mobile so it would cost more than the penalty fare to call them. I won’t be at a tube station until next Thursday, so I assume I can get one of the tube staff to refund both penalties then? I did get a Delay Repay refund from SWT so that’s something.

The tube staff may be able to process the refund, but I’m not 100% sure. The helpdesk is a standard rate number these days so it would take quite a while to rack up the value of two maximum charges minus the correct fare. Or could you borrow a phone with included minutes from someone?

Thanks, but the last time I called them cost me all my credit just whilst I was waiting for someone to answer. I’ll try at a tube station and see how it goes. Why does it not show that I have any eligible incomplete journeys when my journey history shows a journey that I didn’t tap out from & one I didn’t tap in for – as they see it.

I don’t know, but I imagine it’s to do with the fact that with two incomplete journeys you may be looking at combining them into one, and that may have been defined as beyond the scope of the online form.

Hi Mike, I intend to travel from New Malden to Central London on Thursday. As I need to make several stops on the way (Covent Garden, Waterloo, Clerkenwell, Liverpool Street, St Pancras to name a few), would the overall cost of my journey be capped at £10.10 irregardless of whether I use the train for the whole of my journey, or the bus for part of it.

Yes, buses count towards the daily cap.

A couple of weeks ago I used my Oyster card, touched in at Denmark Hill, out at Blackfriars to continue home on Thameslink with my paper ticket. At Blackfriars I checked the display as the exit barrier opened, it recorded the right fare and balance. But a couple of days later I got my Oyster journey history statement which showed an unresolved journey. It is very worrying that these displays don’t show the actual balance. My wife was doing the same journey, used a different barrier at Blackfriars, and it also showed the right balance but failed to contact the Oyster central database so she also had to claim for a refund. We had to this by phone because, for some reason, the online system did not allow us to use this facility.

There was obviously a fault in the barriers at Blackfriars. We have now got refunds, but TfL blame GTR for the problem and vice-versa. I shall refer this to London TravelWatch if I don’t get someone to explain the fault and take responsibility. From now on I shall check by Oyster balance every day that I use it, and recommend everyone else to do the same. It is a most untrustworthy system. The idea of using a bank card for contactless payment horrifies me.

Sorry to hear about your issues. From what you’ve described there seems to have been a communications problem between Blackfriars NR and the central Oyster system. These do happen occasionally. I’m somewhat surprised that it hadn’t rectified itself by two days later as Blackfriars is a very busy station and it must have been causing lots of issues. The fault seems clearly to be the responsibility of GTR, although I’m not sure I’d go so far as to blame them. I have however alerted people in both GTR and TfL to see whether the blame ping-pong is appropriate.

Checking your travel history daily is a very good suggestion anyway, and one that I’d always recommend. I don’t agree that the system is untrustworthy, but when the occasional issue occurs it is important for the problem to be owned and resolved.

Hi. Is there any way to obtain your Oyster card travel history beyond 8 weeks at all? I would need it for employment reimbursement for the tax year beginning April 2019. thanks, Karolina

Hi Karolina,

I’m afraid there is not. Going forward you can set up monthly emails on your TfL account, or if contactless is an option (full adult fares only) the history then stays online for a year. This is because it is justification for debits from your bank or card account.

Unsure whether this is a problem linked to the 60+ Oyster which I have but over the last few months a journey starting after midnight in this case after midnight on the 31st October is shown as occurring on the 1st December. Although this is not a problem on a 60+ Oyster if the same thing is happening on a normal oyster it could cause charging problems. I copy the details from my latest weekly read out.

Date / Time

Journey / Action

Sunday, 01 December 2019 £0.00 daily total 00:20 Bus journey, route U5 £0.00 £0.00

Sunday, 03 November 2019 £0.00 daily total 23:59 Bus journey, route U5 £0.00 £0.00 22:09 Bus journey, route U5 £0.00 £0.00

Saturday, 02 November 2019 £0.00 daily total 00:39 Bus journey, route 350 £0.00 £0.00 21:43 Bus journey, route 350 £0.00 £0.00 14:16 – 14:46 Paddington [National Rail] to West Drayton [National Rail] £0.00 £0.00

13:21 – 13:55 Chancery Lane to Paddington (Bakerloo, Circle/District and H&C) £0.00 £0.00

13:12 Bus journey, route 17 £0.00 £0.00 12:16 Bus journey, route 63 £0.00 £0.00 11:21 – 12:07 Elstree and Borehamwood [National Rail] to Farringdon £0.00 £0.00

09:15 – 10:15 Paddington (Bakerloo, Circle/District and H&C) to Elstree and Borehamwood [National Rail] £0.00 £0.00

08:47 – 09:14 West Drayton [National Rail] to Paddington [National Rail] £0.00 £0.00

Friday, 01 November 2019 £0.00 daily total 01:29 Bus journey, route N222 £0.00 £0.00 00:08 Bus journey, route 222 £0.00 £0.00 Thursday, 31 October 2019 £0.00 daily total 21:54 Bus journey, route 222 £0.00 £0.00

Hi Malcolm,

It didn’t happen on 1st November, have there been other occurrances and is it always 1st December? I’ll pass the details over to TfL anyway.

It has certainly been happening all this year all involve bus journeys. On the months missing it is because the return journey was made prior to midnight examples are

Out 31st December 21:43 return showing as 31st January 00:38 Out 31st March 21:34 return showing as 1st May 00:13 Out 30th April 20:34 return showing as 30th May 00:20 Out 31st May 22:00 return showing as 1st July 00:59 Out 31st August 21:19 return showing 1st October 00:40

Still happening on journeys after midnight

Monday, 30 December 2019 £0.00 daily total 00:37 Bus journey, route 350 £0.00 £0.00

Saturday, 30 November 2019 £0.00 daily total 21:16 Bus journey, route 350 £0.00 £0.00

Thanks for this, I’ll pass it over. I can actually see a pattern here, it’s when the journey is made after midnight on the 1st day of a new month.

Please can you provide details of the bus route involved in your other late night journeys.

is it possible to get a printout of the cost when I used oyster to travel on the 18th Sept 2019?

Sorry, that’s too far away. Oyster travel data is anonymised after 8 weeks in line with the agreed fair use of data.

The bus routes involved will be either 222, 350, U1, U3 or U5 to return home. So either operated by Metroline West or Abelio West London.

Thanks Malcolm,

The info has been passed on to the team investigating.

Leave a comment Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

You are in the Personal site

It looks like your browser needs an upgrade

Download a new version now to continue using our online services

Will I be able to check my journey history?

If you have an online Transport for London (TfL) account, you can view up to 12 months of journey and payment history. If you haven't already, you can set up an account at contactless.tfl.gov.uk .

Other popular questions about contactless payments

How secure is Apple Pay?

What is the maximum Apple Pay transaction amount?

How do I return goods I've purchased using Apple Pay?

Contactless Mobile

What is the maximum Contactless Mobile transaction amount?

Why was my Contactless Mobile transaction unsuccessful?

I have my device in a case, will this affect my use of Contactless Mobile?

General Information

Do I have a daily limit for contactless payments?

Can I turn off the contactless functionality on my card?

I carry both my contactless debit/credit card and my Barclaycard in my wallet, which one will be debited if I tap my wallet on a reader?

TFL Network

How will Transport for London (TfL) travel charges be shown on my card statements?

What should I do if I think I've been charged the wrong amount or if I accidentally touch my contactless Barclays debit card or Barclaycard on a card reader?

What should I do if my Barclays Debit card or Barclaycard is lost or stolen?

Recommended

About us | Advertise with us | Contact us

TfL mobile app now displays journey history and payments on the go

- Odnoklassniki

- Facebook Messenger

- LiveJournal

Posted: 21 June 2018 | Intelligent Transport | No comments yet

Customers using contactless payment cards across London can now conveniently view their journey history and check or top-up payments on the go…

Customers using contactless payment cards in London can now view their journey history on the go following the latest update to the free Transport for London (TfL) Oyster and contactless app .

Half of all Tube and rail pay-as-you-go journeys in London are made using contactless payment cards or mobile devices. More than 17 million pay-as-you-go journeys a week are made across public transport services; providing value for money, flexibility and convenience.

The success of contactless payment in London is leading more cities to introduce the technology as a convenient method of paying for travel.

Shashi Verma, Chief Technology Officer at Transport for London, said: “We’re delighted that so many Londoners have already downloaded our app, making it easier to check journey history and top-up on the go. This latest update follows feedback from customers and is part of our work to make travelling in London simple and convenient for everyone.”

TfL has updated the free app – available to download from the Google Play Store and Apple App Store – to enable customers to view their journey and payment history and see if they have any ‘incomplete’ journeys. Customers can use their smartphone to quickly add pay-as-you-go credit or season tickets to their Oyster card.

Since the app launched in September 2017, more than 800,000 downloads have been made.

Customers can add their contactless payment card to an online account, personalise cards or devices and hide features that are not required. New features on the app illustrate updated maps and design changes to improve the customer experience.

Chief Executive of London Chamber of Commerce and Industry, Colin Stanbridge, said: “We support any improvements to make London’s public transport network easier, cheaper and more attractive to use: in doing so, benefitting commuters, tourists and the economy as a whole. Using contactless cards to travel has made great strides in this area and this update to the app would appear to take these changes a stage further.”

TfL is now working to introduce further improvements to make all the functions of the app available to customers using concessionary cards such as Zip and Student photocards. Future changes are expected to make it easier in requesting refunds.

Related topics Passenger Experience , Ticketing & Payments

Related cities London , United Kingdom

Related organisations Transport for London (TfL)

Related people Colin Stanbridge , Shashi Verma

Revolutionising mobility: Exploring the future of microtransit

City of Stirling begins trial of Trackless Tram in Australian first

By Intelligent Transport

London’s trial for off-peak Friday fares on public transport to launch on 8 March 2024

Flix’s second ESG report highlights environmental benefits of collective travel

Dubai RTA experiences 8% growth in taxi ridership

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

© Russell Publishing Limited , 2010-2024. All rights reserved. Terms & Conditions | Privacy Policy | Cookie Policy

Website design and development by e-Motive Media Limited .

Privacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorised as "Necessary" are stored on your browser as they are as essential for the working of basic functionalities of the website. For our other types of cookies "Advertising & Targeting", "Analytics" and "Performance", these help us analyse and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these different types of cookies. But opting out of some of these cookies may have an effect on your browsing experience. You can adjust the available sliders to 'Enabled' or 'Disabled', then click 'Save and Accept'. View our Cookie Policy page.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Performance cookies are includes cookies that deliver enhanced functionalities of the website, such as caching. These cookies do not store any personal information.

Analytics cookies collect information about your use of the content, and in combination with previously collected information, are used to measure, understand, and report on your usage of this website.

Advertising and targeting cookies help us provide our visitors with relevant ads and marketing campaigns.

- Search forums

- Our booking engine at tickets.railforums.co.uk (powered by TrainSplit) helps support the running of the forum with every ticket purchase! Find out more and ask any questions/give us feedback in this thread !

- Fares, Ticketing & Routeing

- Fares Advice & Policy

Chase Bank - Debit Card - No Journey history for TFL

- Thread starter Railguy1

- Start date 27 Dec 2022

- 27 Dec 2022

I have not been able to see my journey history when using my debit card from Chase for contactless journeys on the TFL website. Does anyone know how I can resolve this issue?

RailUK Forums

The PAN (card number) Chase give you in the app is different to the PAN on the contactless interface on your card. Suggest using something like Cardpeek to read the PAN on the physical card, which you can then enter into the TfL website.

Established Member

crablab said: The PAN (card number) Chase give you in the app is different to the PAN on the contactless interface on your card. Suggest using something like Cardpeek to read the PAN on the physical card, which you can then enter into the TfL website. Click to expand...

Adding your card to TfL? Click to expand...

Tap here for the details you need. Click to expand...

- 29 Dec 2022

Interesting. I have a Chase card and avoid using it for tap on, tap off in Arriva Yorkshire for precisely this reason. Is it just TfL that Chase allows this for, or will it work with other providers?

mikeg said: Interesting. I have a Chase card and avoid using it for tap on, tap off in Arriva Yorkshire for precisely this reason. Is it just TfL that Chase allows this for, or will it work with other providers? Click to expand...

Benjwri said: so if you’re ever in London you can get the number in this way, or you could try contacting their customer services. Click to expand...

crablab said: Suggest using something like Cardpeek to read the PAN on the physical card Click to expand...

mikeg said: Interesting. I have a Chase card and avoid using it for tap on, tap off in Arriva Yorkshire for precisely this reason Click to expand...

- 30 Dec 2022

Presumably you either clicked 'Add to Apple Pay' or entered the PAN from the Chase app, when you added the card to Apple Pay? And so Apple Pay will have tokenised that (which is shown in the app) PAN.

In the chase app you need to find the actual card details, rather than the 'fake' ones. There is an option for this, tap on "returning items or collecting tickets" or words to that effect .

Thanks, I found the correct details in the app. It required removing the card from the TFL website and then re-adding it again with the right details - the journeys were then visible.

- 17 Jan 2023

bubieyehyeh

I encounter a annoying issue with my chase card this evening. I was collecting a ToD ticket I had bought from southern's website where I paid with paypal (using my chase card), so would be any card collect, as I have done several times. However tonight after swiping chase card and typing in code (as done before) at a TVM (at a GTR station) it came up with a message that I could not use that card to collect my tickets. I tried it another machine at the same station, and got the same, I then tried a different card and it worked. I bought a ticket from one of the machines this morning using my chase card. So they havent blocked use of chase card for purchases, just it seems for collection. It seems only to be GTR since I collected a ToD this morning from a london overground machine this morning using the chase card. However it makes no sense for GTR to reject using a chase card to collect a ToD paid on paypal.

Veteran Member

bubieyehyeh said: I encounter a annoying issue with my chase card this evening. I was collecting a ToD ticket I had bought from southern's website where I paid with paypal (using my chase card), so would be any card collect, as I have done several times. However tonight after swiping chase card and typing in code (as done before) at a TVM (at a GTR station) it came up with a message that I could not use that card to collect my tickets. I tried it another machine at the same station, and got the same, I then tried a different card and it worked. I bought a ticket from one of the machines this morning using my chase card. So they havent blocked use of chase card for purchases, just it seems for collection. It seems only to be GTR since I collected a ToD this morning from a london overground machine this morning using the chase card. However it makes no sense for GTR to reject using a chase card to collect a ToD paid on paypal. Click to expand...

Haywain said: Has the Chase card got a magnetic strip on the back of it? Click to expand...

Starmill said: Mine certainly appears to. Although it's not in a very good condition despite light use. Perhaps @bubieyehyeh 's card is getting worn out? Click to expand...

Haywain said: Not sure why I asked that, to be honest. If the mag stripe was a problem the machine wouldn't have allowed the collection reference to be keyed in. I can't think of a reason for what happened there but I'm not sure it would be possible to block a card or range of cards from being used for 'any card' collection. Click to expand...

- 18 Jan 2023

I have had no problem collecting tickets (bought with LNER vouchers so any card collection) using my Chase card, though sometimes the ticket machine fails to read the card's chip and gives an error.

I believe the chase card does have a mag stripe. I was able to collect a paypal anycard ToD using it on a overground TVM this morning.

Reimbursements

How to Get a Receipt for Contactless TfL Travel

The London transport system is regarded as one of the best urban transport systems in the world. It may not be perfect, but Londoners have it pretty good all things considered. It’s possible to traverse the city with nothing more than a contactless card, which is just about the easiest way to pay as a passenger. Unfortunately, this can make things a little tricky when it comes to getting a valid digital receipt for travel expenses. Luckily it’s possible to get a TfL receipt sent directly to your TfL account.

In this guide, we’ll explain how to get expense receipts for your contactless journeys around London. We’ll also explain some of the other services TfL offers to make your life easier when it comes to managing travel payments.

Using contactless payment for London travel

Whether you’re using underground trains, overground trains or buses, you can pay quickly and easily anywhere in London using contactless payment. When contactless payment was first introduced, customers were limited to Oyster cards. Oyster cards were a game changer which allowed commuters to travel around the city on the TfL network with minimal hassle. But they have one main drawback in the sense that they can’t be used anywhere else.

Since 2014, public transport passengers in London have been able to use their contactless bank cards, as well as cards stored in digital wallets, alongside the standard Oyster card. In fact, the number of passengers using contactless debit or credit cards now outnumbers those using oyster cards.

Reimbursements with Moss: More freedom for your team

Tax rules for employer-provided Oyster cards

HMRC treats Oyster cards that are provided to employees by their employers in effectively the same way as individual travel tickets for business trips. This is because Oyster cards use a top-up system, and are usually the most cost effective and flexible way for individuals to travel on the TfL network.

If the amount of money provided by the employer is not enough to cover necessary business trip costs, the employee can claim a tax deduction on the additional costs they’ve paid out of pocket. You can find more information about the tax rules surrounding Oyster cards on the gov.uk website .

How to get a receipt for contactless TfL travel

Contactless payment for TfL is no doubt hugely popular with passengers. It makes it easier and more convenient to travel around the capital, particularly if you’re in a rush. But there’s one common area of confusion—obtaining a valid receipt for individual TfL journeys.

Firstly, it can be hard to distinguish individual work-related journeys if you have a monthly or yearly subscription. To claim a tax rebate for business travel, you need to be able to supply detailed records of each and every item you’re claiming.

When you mix business travel and personal travel on the same card or payment method, it can be difficult to isolate specific journeys. You can find out more about the rules and regulations surrounding travel expenses in our travel expenses guide .

Secondly, many employers will not accept transaction statements from banking apps as valid proof of a journey when claiming expenses. This is because transactions on banking apps lack most of the additional data that employers need to verify a payment was made for a specific journey.

Instead you’ll need to get a TfL payment receipt, which you can obtain online with a TfL contactless and Oyster account. We’ll explain how to do this below.

Getting a TfL contactless and Oyster account

Having a TfL contactless and Oyster account allows you to perform various actions online, like viewing your purchase history or obtaining refunds for unused credit.

Unless you buy an Oyster card in person at a London underground or overground station, you’ll be asked to set up a TfL contactless and Oyster account when you purchase your Oyster card. Once you’ve opened an account, you’ll be able to add credit to your Oyster card whenever you need.

Alternatively, you can create a TfL contactless and Oyster account without buying an Oyster card. Instead you can simply add a normal contactless debit or credit card to your account and access your transaction records this way.

How to get receipts from your contactless and Oyster account

Go to the TfL website at tfl.gov.uk , and then tap ‘Top up Oyster’ to log in. Tap ‘Sign in’ and enter your details. This will take you to the account overview page where you can select your contactless payment cards or Oyster cards.

If you’ve been using a contactless payment card, select the card you want to view on the left hand side of the screen. (This applies to cards you’ve used physically, as well as cards you’ve used through a digital wallet like Apple Wallet ).

Select ‘Journey & payment history’ and you’ll be able to filter and view all of TfL your journeys and payments. You can then download a PDF or CSV file of the receipts for journeys you made during the period you’ve selected. You can also view your transactions if you have an Oyster card linked to your account by selecting ‘Oyster cards’ under the ‘My Account’ menu on the right hand side of your account home screen.

Getting receipts and payment history on the Oyster app

Instead of logging in to your contactless and Oyster account in your browser, you can access all the essential account functionality in the TfL Oyster and contactless app. The app displays all of the contactless payment cards you’ve added to your account.

You can select which card you want to use, and then simply tap on the contactless card reader with your phone whenever you want to pass through a barrier at the station. Your can access your payment and journey history for each card directly from the app, and there’s a handy map of the TfL network in case you get lost in the depths of the tube.

How to update your first generation Oyster card

Unfortunately you won’t be able to access any of the functionality of the Oyster app if you have a first generation Oyster card. First generation Oyster cards are not compatible with the app. However, because they were phased out in 2010, this shouldn’t be an issue for the vast majority of users.

If you’re unsure whether you have a first or a second generation oyster card, simply check the back of the card and look for a ‘D’ in the bottom left hand corner. If your card doesn’t have a ‘D’, it’s a first generation Oyster card. You’ll need to exchange it for a new second generation card to use the app.

Don’t worry about losing any credit you had remaining on your old Oyster card. When you buy a new one and register it on your contactless and Oyster account, you’ll be able to transfer the remaining balance. You’ll also get your deposit back as credit on your account.

Paying for TfL travel with cash

Since 2012 London buses have been contactless payment only. But you can still buy overground and underground tickets with cash at ticket offices and certain ticket machines. While this makes it easier to get a receipt (you’ll receive a paper receipt as normal when you pay), you actually end up paying more for your fare than you would if you used contactless payment.

Getting TfL receipts as a London road user

Using public transport isn’t the only time you pay when travelling around London. If you’re a road user, you’ll be familiar with the Congestion Charge and Ultra Low Emissions Zone (ULEZ) charge. These charges were introduced to ease traffic congestion and emissions in the centre of the city, and they’re unavoidable if you have to drive within a certain area.

In most cases, these charges are not tax-deductible because they don’t meet HMRC’s requirements for employee expenses. However, many employers will reimburse you for additional charges you incur on business trips and other work-related travel. If this is the case, your employer will ask you to provide proof of payment of the charge before they reimburse the expense.

Reimburse with Moss: Give freedom to your team

To get your receipts, payment history and other information, you’ll need to log in to your London road user charging account. The process is very similar to the contactless and Oyster account as mentioned above.

Go to the TfL website at tfl.gov.uk , and then tap ‘Congestion Charge’ and ‘Sign in’. Unlike paying with an Oyster card, you have to set up a London road user charging account to pay the congestion charge or ULEZ charge.

Once you’ve logged in, go to ‘My account’ on the top right of the page. Scroll down and click on ‘Payment history’ on the left side of the screen. Here you’ll be able to search your past payments and download a summary of your receipts on a month-by-month basis as a PDF or CSV file.

Receipts and travel expenses with Moss

Moss’s spend management platform simplifies the employee expense and reimbursement process with a range of different tools for employers and employees. When it comes to managing and storing receipts, travel-related or not, Moss can save you time and effort. Employees can scan their expenses receipts directly into the Moss app, and managers can review and approve expenses on the go. There’s no need to deal with paper receipts or invoices because Moss digitises the entire process.

Employers can provide each employee or department with their own Moss corporate credit card . This can be specifically for travel, general expenses, or any other business related spend. Moss virtual credit cards can be set with custom cash limits, and controlled directly from the Moss app for full visibility over every pound that’s spent. Team members can store their Moss cards in Apple Wallet and spend directly from their phone using Apple Pay.

Then there’s Moss insights , which displays a range of detailed cashflow data. With aggregated data from across all of your linked accounts, you can ensure you’re always on top of outgoing costs and aware of potential expense cost savings.

Yes, you can get receipts for contactless journeys on TfL using a contactless card or an Oyster card. To do so you need to set up a contactless and Oyster account. This allows you view all of your past journeys and payments that you’ve made to TfL.

To set up a contactless and Oyster account, visit the tfl.gov.uk website, click ‘Top up Oyster’ and follow the instructions on screen.

An Oyster card is a contactless card that passengers can use on the TfL transport network. Users can top up their Oyster card at ticket machines around London, or link it to a bank card using a contactless and Oyster account.

Yes. To do so you’ll need to set up a London road user charging account, which you can do on the TfL website .

Yes. Contactless payment is cheaper than buying individual tickets with cash because contactless travel has a fixed cap per day.

- Latest Posts

Our digital content is for information purposes only and does not constitute legal or tax advice. All content is compiled with the utmost care. However, they do not replace binding advice and are not guaranteed to be correct or complete. We do not assume any liability. For individual advice, please consult a lawyer or tax advisor.

Related Posts

Data Protection | Imprint | Terms & Conditions | Cookie Consent

This card is issued by Transact Payments Limited pursuant to licence by Mastercard International Incorporated. Transact Payments Limited is authorised and regulated by the Gibraltar Financial Services Commission. Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

See your contactless journeys and payment history on Metrolink

You can now see your journeys, check charges and get statements online for the payment cards you use to travel contactless on Metrolink.

You can look up journeys for the past 12 months and download statements that include:

- the total charges for each day and week you travelled

- a breakdown of the journeys you made, including the stop name, date and time

- details of additional charges for contactless penalty fares (after a ticket inspection)

If you have any questions about your charges, please complete the contact form. Just click on the link within your journey statement, to start a query.

To get started, you will need:

- the long number from the contactless payment card you used when travelling

- the long number from the payment card linked to your mobile wallet on the smartphone, smartwatch or other device you used when travelling

See full terms and conditions for accessing your journey history online. Use of this service confirms acceptance of these terms and conditions.

Touch. Screen.

Don't touch your phone while driving. It's a dangerous, criminal offence.

Say yellow to the Bee Network

Buses in Oldham, Rochdale and parts of Bury, Salford and north Manchester joined the Bee Network on 24 March.

New sponsor: Starling Bank Bikes

We’re delighted to welcome Starling Bank on board as the new sponsors of our bike hire scheme.

Manchester City Matchday Buses

We've teamed up with Manchester City to launch a large-scale bus trial helping fans from across Greater Manchester and nearby areas to travel to and from the Etihad Stadium on a matchday.

Rate your journey

We want to hear your views to help us deliver a better Bee Network for Greater Manchester.

Planned engineering works on Metrolink

Visit our dedicated webpage to find out how the works could affect your journeys.

- News and media

- Commercial opportunities

- Procurement

- Privacy policy

- Accessibility statement

- Modern slavery statement

- Help and contact us

- Where to find us

- Safe and secure travel

Giltbyte Helpdesk

How can we help you today, how can i provide a receipt when using contactless on the london underground print.

Modified on: Sat, 26 Oct, 2019 at 10:07 PM

Introduction

It is a common belief that when you use a contactless payment method on the London Underground that you can't get a receipt to confirm the journey and amount being claimed. That's not entirely true. You can create a Contactless and Oyster account on the Transport for London (TfL) website so you can get a statement of the journeys travelled and the cost involved.

This article goes through how you can obtain a copy of the statement to attach to your claim for reimbursement of your underground journeys in EASY.

Where you have not got an Oyster account and you use an Oyster Card, a contactless debit/credit card or mobile payment to to pay as you go, you will not have access to a TfL receipt for your journey. In this situation, you should contact your employer's system support team who will advise you of your organisation's policy and how you may claim for your journeys, or what alternative evidence you may need to provide to support your expense claim.

Go to the Oyster page on the TfL website using the https://oyster.tfl.gov.uk/oyster/entry.do and enter your username and password.

Then click on the Submit button

My Contactless Account

Under the My Account menu click on the + to the right of the Contactless option

No click on the My contactless cards option

Contactless Card

Select the contactless card that you require a statement for.

Journey & Payment History

Click on the link

Choose the period of your claim

Select the period that your claim relates to - this will display a breakdown of the journeys and the cost of the journey.

Download PDF

Scroll down and click on the Download PDF Format button

Downloaded PDF

Did you find it helpful? Yes No

Related Articles

Comparing the Wells Fargo Autograph Journey: How does it stack up against other premium travel cards?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit card trends

- • Maximizing rewards

- • Credit cards

- • Rewards credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

The release of the new Wells Fargo Autograph Journey card in March may seem like a good option with competitive rewards rates, but how does it stack up to some of the best travel credit cards on the market today? And does it deserve a place in your wallet?

In this article, we’ll examine the cards’ welcome offers, rewards, benefits and travel partners to assess their overall value. Let’s see how the Autograph Journey measures up to these four competitors:

- Chase Sapphire Preferred® Card

- Citi Premier® Card

- Capital One Venture X Rewards Credit Card

- The Platinum Card® from American Express

Welcome offers

The Wells Fargo Autograph Journey SM Card has a competitive welcome offer of 60,000 bonus points when you spend $4,000 in the first three months. According to Bankrate’s valuations , Wells Fargo Rewards are worth about 1.0 cents per point, giving the welcome offer a value of $600. After completing the spending requirement, you could have anywhere from 64,000 to 80,000 points, depending on which categories you utilize to meet the spending requirement. That’s a return of 16 percent on the low end to 20 percent on the high end, though you’ll likely fall somewhere in the middle.

How the Autograph Journey stacks up

The welcome offer on the Autograph Journey matches up with the regular offers from the Chase Sapphire Preferred and the Citi Premier exactly. All three give the same bonus, for an identical spending requirement and timeframe, with the same annual fee. However, both Chase Ultimate Rewards and Citi ThankYou Points are worth more, at about 2.0 cents and 1.6 cents per point, respectively, when transferred to a high-value travel partner. This gives the edge to both, with Chase being the most valuable at $1,200 and Citi at $960.

Looking around, the Capital One Venture X offers more miles for the same amount of spending requirement and timeframe. With this card, you’ll get 75,000 miles, but also pay a higher $395 annual fee. Capital One miles are also more valuable at about 1.7 cents per point, making its welcome offer worth $1,275.

The Platinum Card® from American Express offers the most points of any of these offers — at 80,000 Membership Rewards points — but it also requires the highest spending at $8,000, although you’ll get twice as long to meet that amount (six months). It also has the highest annual fee of these cards at $695. Since Membership Rewards points are valued at about 2.0 cents cents per point, this offer has a value of $1,600.

Our decision: Not as good as the competition

The Wells Fargo Autograph Journey offers the lowest overall value of any of these welcome offers, due to the lower value of the Wells Fargo Rewards it earns.

When deciding between these cards, consider:

- Whether you can meet the spending requirement

- What you want the points for

- The return on your spending

Based on these criteria, the best overall value comes from the Venture X since your return on spending will likely be a higher percentage — even though the Amex Platinum offers the most points and the highest value.

Rewards and benefits

Outside of its welcome bonus, the Wells Fargo Autograph Journey comes with excellent earning rates in numerous categories focusing on travel. Specifically, you’ll earn 5X points at hotels, 4X points on airlines and 3X points on other travel and restaurants. All other purchases earn 1X points.

You’ll also get a $50 annual statement credit with a $50 minimum airline purchase — utilizing this credit offsets more than half of the $95 annual fee. Additional benefits include:

- Trip protection coverage

- Auto rental collision coverage

- Emergency/roadside assistance

- Cell phone protection

- My Wells Fargo deals

- Visa Signature benefits

As it is, the card earns solidly enough to function as a standalone card, offering excellent protection and benefits. However, let’s compare this more closely with its competitors to assess its actual value.

Wells Fargo Autograph Journey vs. Chase Sapphire Preferred®

Both of these cards come with a $95 fee. For travel purchases, the Autograph Journey gets 5X on hotels, 4X on airfare, and 3X on other travel, while the Sapphire Preferred only earns 2X on travel (but can earn 5X if you go through the Chase Travel portal or use Lyft). Chase points also get a 25 percent boost when booking travel through Chase Travel. While both cards earn 3X on dining, the Sapphire Preferred also earns 3X for streaming and online grocery purchases.

Whereas the Autograph Journey has a $50 air credit, the Sapphire Preferred has a $50 hotel credit instead. You’ll also get a points boost on your account anniversary equal to 10 percent of your spending from the prior year. Chase has more extensive transfer partners, including four of Wells Fargo’s airline partners. There are also more Chase cards available that can combine points with the Sapphire Preferred via the Chase trifecta , giving it an even further advantage.

You might choose the Autograph Journey if your travel spending aligns better with Wells Fargo’s bonus categories. However, for most people, the Sapphire Preferred will be the more flexible option.

Wells Fargo Autograph Journey vs. Citi Premier®

These cards also have the same annual fee — and once again, the Autograph Journey earns slightly better on hotel and air purchases. While the Citi Premier has limited-time earnings of 10X on hotel and car rentals through the Citi Travel portal through June 30, 2024, it earns 3X in the following categories:

- Restaurants

- Supermarkets

- Gas stations

By covering a more comprehensive range of everyday expenses, Citi Premier gets the edge for earning rewards.

The Citi Premier also offers an annual $100 hotel credit on a stay of $500 or more when booked through the Citi Travel portal — more than double the Autograph Journey’s air credit. While Citi overlaps on a few of Wells Fargo’s transfer partners, it also offers a more extensive list than Wells Fargo. Citi also has the Citi trifecta that allows you to combine points from multiple cards.

As a result, the Citi Premier generally offers more value overall, unless your spending is primarily travel-focused.

Wells Fargo Autograph Journey vs. Capital One Venture X

The Capital One Venture X comes with a higher annual fee than the Autograph Journey, coming in at $395 instead of $95. Still, this higher fee can be easily offset with the card’s $300 annual travel credit on the Capital One travel portal and the 10,000 bonus miles you’ll earn on your account anniversary (worth $100).

The main difference between the two is that the Venture X earns a flat rate of 2X miles on all purchases. If you book through the portal, you’ll get 5X on airfare and 10X on hotels and car rentals. If you book travel directly, the Autograph Journey is likely a better choice, but the Venture X still has the potential for higher returns. Non-bonus spending will do better on the Venture X, for example, but you’ll earn more with dining purchases on the Autograph Journey.

Overall, Capital One miles have a higher value and more transfer partners while overlapping most of Wells Fargo’s partners. You’ll also get more benefits and perks like extensive airport lounge access . Even with the higher annual fee, the Venture X is a clear favorite almost across the board.

Wells Fargo Autograph Journey vs. The Platinum Card® from American Express

These two cards approach travel from opposite positions. While the Autograph Journey has a manageable annual fee and earns solid reward rates, the Amex Platinum has one of the highest annual fees out there and mediocre earning rates outside of its 5X rate on airfare and hotels purchased through Amex Travel. Beyond travel purchases, the Autograph Journey is superior for spending.

Where the Amex Platinum shines above the rest is its laundry list of perks and benefits . For as high as the $695 annual fee is, you can still come out ahead if you take advantage of all the credits offered, including:

- $200 annual airline incidental credit with your selected airline

- $200 Uber credit ($15 each month, $35 in December)

- $100 Saks Fifth Avenue credit ($50 semi-annually)

- $200 annual credit with Amex Fine Hotels & Resorts

- $240 entertainment credit ($20 monthly)

- $189 annual CLEAR membership credit

- $300 Equinox/SoulCycle annual credit

- Walmart+ reimbursement ($12.95 monthly cost)

- Global Entry or TSA PreCheck credit once every four years

- *Enrollment required for select benefits

Maximizing these credits more than compensates for the card’s annual fee, covering everything from travel and shopping to lifestyle purchases. In addition, you’ll get extensive airport lounge access, excellent travel protections, a superior list of transfer partners and complimentary elite status with Hilton, Marriott and several car rental companies. Here, the overall value offered by the Amex Platinum’s perks and credits far exceed any other card — if you can fully utilize them.

Our decision: Perks fall short but rewards measure up

These comparisons point to a glaring weakness of the Autograph Journey — its perks and benefits. Each main competitor card offers more value in credits, benefits and point value. Even the higher annual fee cards make up for that difference with superior returns in the benefits category. If you’re looking at this card specifically to handle your travel needs, you may want to consider one of the other cards, all of which give better returns.

However, the card holds up well with its reward-earning rates, particularly in the travel and dining categories. The rates for hotels and airfare purchases are strong and don’t require you to shop through a travel portal. This distinction can be helpful, as many hotel chains and airlines will deny your elite benefits when you book through a third party like this. With plenty of bonus categories, the Autograph Journey should be able to cover much of your everyday spending.

Airline and hotel transfer partners

Each card has its own set of airline and hotel transfer partners — multiple cards can cover some programs, while others may be unique to a single card. We’ve compiled a list of all the partners to help you decide which card is best for you. All transfer ratios are 1:1 unless otherwise noted.

Our decision: The Autograph Journey doesn’t measure up

As you can see, the Autograph Journey has the smallest number of transfer partners — each of which is covered by at least two competitors. Further, considering that the Autograph Journey comes with the lowest overall point value, the card’s competitors are likely to be a better choice if you’re looking for a specific transfer partner, given their wider selection and better value.

You could certainly use the Autograph Journey’s welcome offer to supplement the point balance in one of its partners, but in most cases, you shouldn’t use it as the primary method to accrue those points unless you’re spending in its top categories.

The bottom line

While introducing a travel card with transfer partners is a big milestone for Wells Fargo, the Autograph Journey unfortunately doesn’t quite rise to the level of its competition. While the reward rates are decent, the lower value of Wells Fargo points keeps it a step behind the competition. Given that, this card is best suited for people who may already have a solid portfolio of credit cards and are looking for a new program to supplement their points balances. But if you’re looking for your first premium travel card, you’ll likely get more value from one of the other cards in this space.

Related Articles

Bank of America Travel Rewards card vs. Chase Sapphire Preferred

Wells Fargo Autograph benefits guide

New Wells Fargo Autograph Card launches, offering rewards on everyday spending for no fee

Why I love the Wells Fargo Platinum card

IMAGES

VIDEO

COMMENTS

7 day contactless journey and payment history. Access up to 7 days history without an account.

Customers using contactless payment cards in London can now view their journey history on the go following the latest update to the free TfL Oyster and contactless app. Half of all Tube and rail 'pay as you go' journeys in London are now regularly made using contactless payment cards or mobile devices. More than 17 million 'pay as you go ...

However, if the card has been irregularly used, there may some older data on the card itself, according to TFL: We retain data about the individual journeys made using your Oyster card for eight weeks after the card is used. After eight weeks, the journey data in the ticketing system is disassociated from your card (ie anonymised).

Why use the app? Top up your pay as you go credit and get notifications when it gets low. Check your journey history. See if you have incomplete journeys. Buy adult rate Travelcards and Bus & Tram Passes valid between seven days and 12 months. Get notifications before your Travelcard and Bus & Tram Pass expires.

Manage your Oyster and contactless cards, view your journey history, apply for refunds and discounts, and more with your TfL account. Sign in or create an account online in minutes.

Important - if you have an account and register a card, TFL won't show any journeys before the card was registered. If you then try to check the last 7 days as an unregistered customer, your request will be declined with reason the card is already registered and to login to view history.

Journey History and Queries. Journey history has improved beyond all recognition since the early days of the Oyster system. As long as your Oyster or zip card is registered to a TfL account you can view details of journeys and topups for the last eight weeks. This is available through the TfL website and also using the TfL Oyster app.

If you have an online Transport for London (TfL) account you can view up to 12 months of journey and payment history. If you have an online Transport for London (TfL) account you can view up to 12 months of journey and payment history. ... I carry both my contactless debit/credit card and my Barclaycard in my wallet, which one will be debited ...

Customers using contactless payment cards in London can now view their journey history on the go following the latest update to the free Transport for London (TfL) Oyster and contactless app. Half of all Tube and rail pay-as-you-go journeys in London are made using contactless payment cards or mobile devices. More than 17 million pay-as-you-go ...

The Oyster card is a payment method for public transport in London (and certain areas around it) in England, United Kingdom.A standard Oyster card is a blue credit-card-sized stored-value contactless smart card. It is promoted by Transport for London (TfL) and can be used on travel modes across London including London Buses, London Underground, the Docklands Light Railway (DLR), London ...

To add a contactless payment card to your TfL online account you will need to provide your contactless payment card number, the expiry date, the card security code and the card's billing address. You can view your journey history and apply for an incomplete journey refund. You can complete up to 3 incomplete journeys in a calendar month.

We are improving the way your online ticketing account works between 20:00 on Tuesday 14 May and 06:00 on Wednesday 15 May. If you use an Oyster card, you will not be able to access your online account during this time. You will still be able to top up and manage your Oyster card via the Oyster and Contactless app, Ticket Stops or ticket ...

Using contactless or an Oyster card to pay as you go for your travel is easy and flexible. You can add money to an Oyster card or use contactless (card or device) straight away. You only pay for the journeys you make and it's cheaper than buying a paper single or return ticket (train companies may offer special deals on some journeys).

Using a mobile payment to pay as you go is the same as using a contactless card. You can make mobile payments with devices such as phones, watches, key fobs, stickers or wristbands. You can use different mobile payments to travel on our transport services: If you use a mobile payment associated with a non-UK bank card, your card may not work or ...

UK. The PAN (card number) Chase give you in the app is different to the PAN on the contactless interface on your card. Suggest using something like Cardpeek to read the PAN on the physical card, which you can then enter into the TfL website. 27 Dec 2022. #3.

To get your receipts, payment history and other information, you'll need to log in to your London road user charging account. The process is very similar to the contactless and Oyster account as mentioned above. Go to the TfL website at tfl.gov.uk, and then tap 'Congestion Charge' and 'Sign in'.

Just click on the link within your journey statement, to start a query. To get started, you will need: the long number from the contactless payment card you used when travelling; or. the long number from the payment card linked to your mobile wallet on the smartphone, smartwatch or other device you used when travelling

Introduction. It is a common belief that when you use a contactless payment method on the London Underground that you can't get a receipt to confirm the journey and amount being claimed. That's not entirely true. You can create a Contactless and Oyster account on the Transport for London (TfL) website so you can get a statement of the journeys ...

TFL Overcharged Debit Card: A Guide. January 8, 2024 by London Local. In London, England, the majority of the city's transportation infrastructure is managed by TfL which stands for Transport for London. TfL oversees the operation of the London Overground, Docklands Light Railway, London Underground, buses, and trams in the city.

Register your Oyster card or debit card online and you'll be able to track your journey history and check if you've been charged for any incomplete journeys. What does TfL say? A TfL spokesperson said: "As we have made clear since the introduction of contactless payments on our transport network in December 2012, you must touch in and out with ...

Discover how the new Wells Fargo Autograph Journey card compares to top travel cards in terms of welcome offers, rewards, benefits and transfer partners.