12 Tourism Trends That Will Shape the Travel Industry in 2022 and Beyond

Table of Content

1. bleisure travel, 2. automation, 3. mobile bookings, 4. personalization, 5. tech-empowered travel, 6. sustainable tourism, 7. active ecotourism, 8. transformative travel, 9. experience tourism, 10. wellness travel, 11. longer trips, 12. staycation.

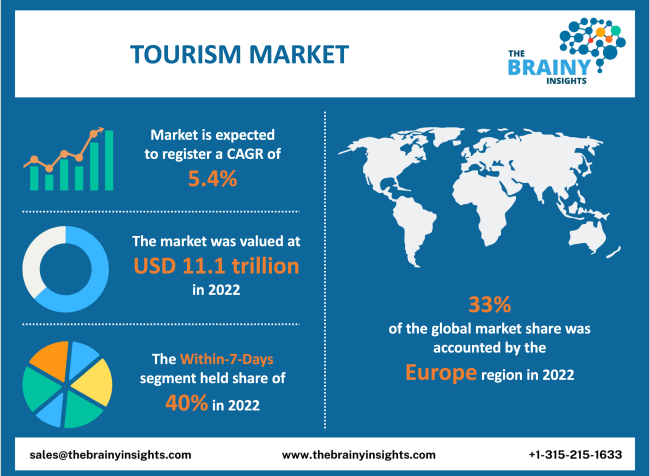

With travelers’ desire for new experiences, the rapid global technological advancements, climate change, and other dynamics, the travel and tourism industry is constantly transforming.

Having experienced an all-time high in the past decade, with 2018 recording the highest international tourist arrival, according to the World Tourism Organization (UNWTO) , the sector is now undeniably faced with big challenges and uncomfortable changes following the COVID-19 pandemic.

All the same, there are still rising tourism trends that can help tour operators , Destination Marketing Organizations (DMOs) , and other industry suppliers to revamp their businesses and experience success as we get into the new normal.

From experiential and transformative travel to automation and Bleisure trips, there are new opportunities companies should focus on.

In this article, we’ll go through the top tourism trends right now and highlight how leisure businesses can stay on top of their game and rebuild tourism for the future.

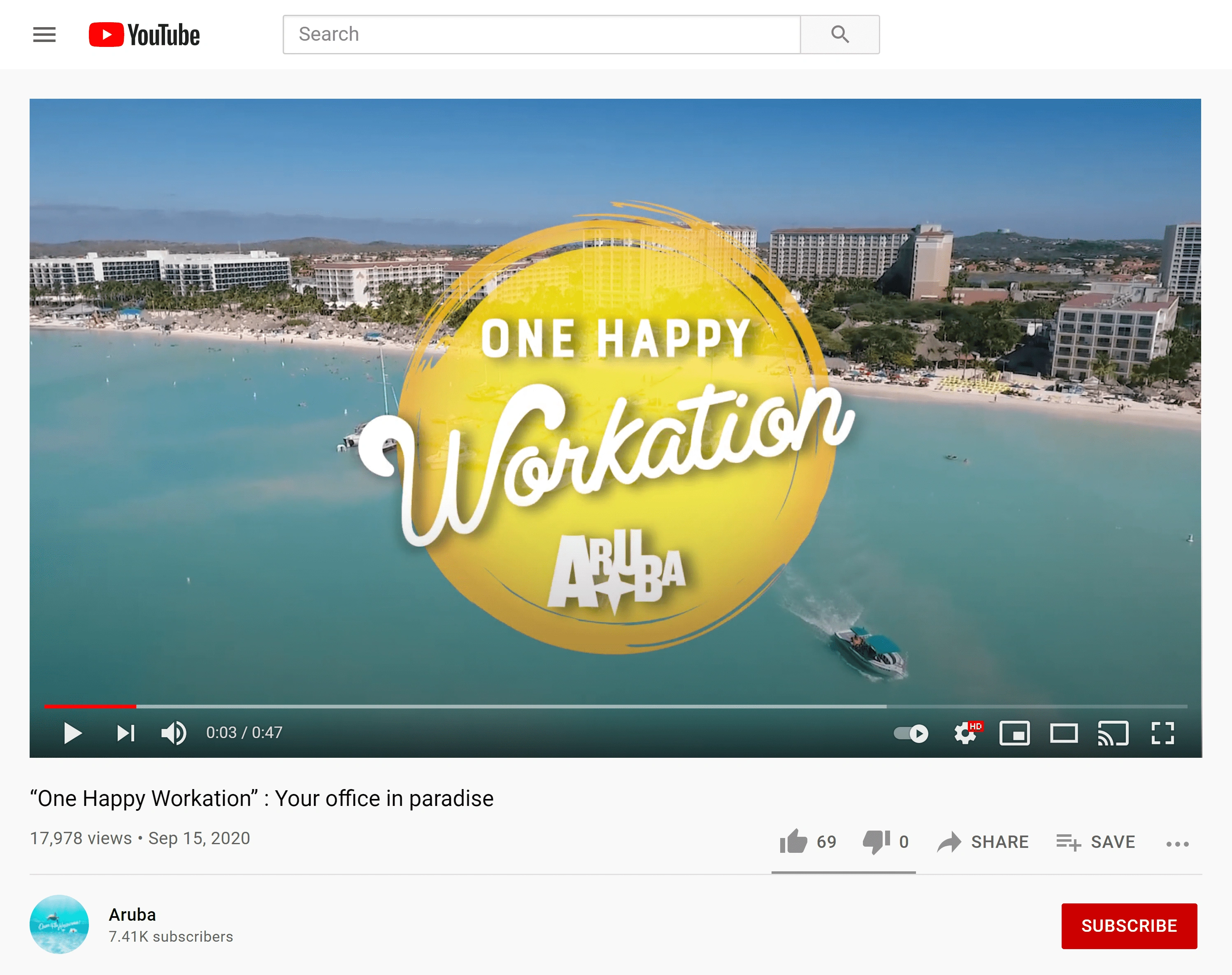

Bleisure travel is a growing tourism trend where people extend their business travel to leisure activities. Experts predict it will continue to grow in the mobile workforce. Although business travel has started to make its comeback in 2021, bleisure is believed to be its future.

A 2018 study revealed that 60% of U.S. business trips incorporated leisure elements, an increase from 43% in 2016.

These business-leisure trips can either be pre-planned, whereby clients schedule their vacation within the same period of a job-related trip. Companies may also offer their workers some tourist experiences during work trips.

On the other hand, this can come as an afterthought. Once the meetings, professional conferences, and other work engagements are over, business travelers may decide to extend their stay and explore their destination.

There is also a growing trend among millennials known as the “digital nomad” phenomenon. This is whereby online workers and freelancers adopt the lifestyle of traveling as they work.

As a tour operator, you can take advantage of this growing trend by creating offers that entice business travelers to extend their stay for leisure. For example, you can sell team retreat packages combined with perks like photos, videos, and transportation.

Having wifi and chargers in buses and accommodation (for multi-day tours) can also entice digital nomads and other travelers looking to stay connected for work.

Gone are the days when booking a trip required clients to make a phone call, speak directly to a service provider, or walk into the supplier’s office for face-to-face negotiation.

Digitization has led to a rise in online bookings. Not only has this made advertising cheaper for travel companies , but also customers are enjoying and increasingly prefer the convenience it offers.

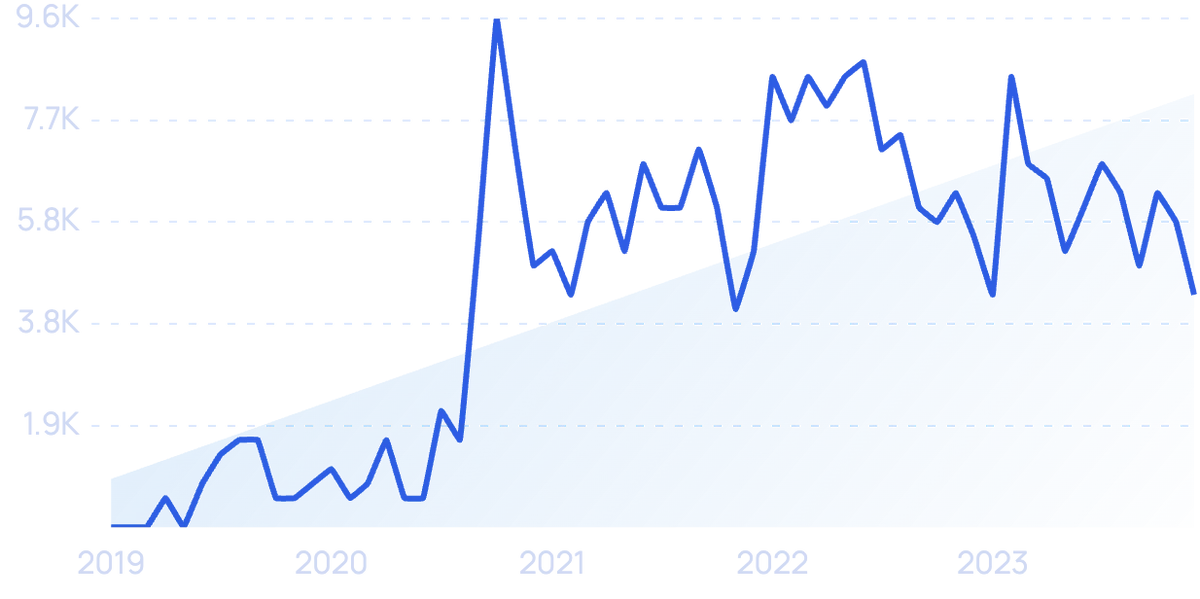

Tour and activities companies have also progressively adopted technology and online booking. In 2019, 71% of operators surveyed were using reservation technology in their businesses, a marked increase from just 25% in 2010. More to that, these companies experienced faster growth plus higher profitability.

Booking systems help tour & activity providers automate their processes and be more effective by adopting cutting-edge technologies. Long gone are the days when you are using spreadsheets, pen and paper to manage your reservations: booking systems do it all automatically, save your time and money. For example, Regiondo booking system has won European travel market by providing seamless reservation experience, flexibility and innovations to businesses of any size.

As we approach the post-COVID period, automation in the sector is bound to continue rising. The increasing digitalization of tourism also generates new business opportunities and promotes the sustainable development of the sector. So as you work on getting back to profitability, take advantage of this tourism trend, and set up the right technology in order to increase your chances of faster recovery.

Another important aspect when it comes to digitization is mobile bookings .

Operators report that 2 in 5 online bookings are made on mobile devices. These smartphone shoppers are also more valuable to your business because of the following reasons:

- They spend 50% more on tours and activities per trip.

- They average 2.9 tours per trip.

- They are twice as likely to leave online reviews .

Source: Arival Travel

According to Think with Google , 57% of travelers believe that companies should personalize their buying experience and base it on their behaviors, personal preferences, and past choices.

Personalization is also important when it comes to the actual tour or activity. By offering flexible experiences that can be tailored to a traveler’s needs, you stand a chance of better satisfying your clients, and that can lead to repeat visits. Your priority should, therefore, be on offering customer-oriented services.

It starts right from the time they see your advert on social media or your website. The messaging should resonate with what the client prefers. Travel and tour suggestions can be offered according to, for instance, what the customer has been browsing on the internet. This is possible to set up using specialized marketing tools and ad platforms like Google and Facebook.

You are better placed by factoring this into your company’s digital marketing strategy. How do you get started? Reach out and speak to your customers to learn about their preferences , characteristics, behavior, and individual needs.

All in all, staying on top of this tourism trend can be the distinction that will make your company stand out from competitors and gain back profitability faster.

We already talked about automation and mobile bookings as some of the future trends in the tourism sector. But existing and emerging technologies will continue to influence travel in many other ways.

A recent Amadeus survey states that technology and innovation seem to be key in building traveler confidence and they will increase willingness to travel in the next 12 months.

Technologies proved to be crucial in the post-pandemic world where international tourists need to present Digital COVID Certificates or fill out travel documentation. What is more, people need instant access to information and help when being abroad.

In the coming year, tech innovations will continue to bring ease to the travel experience. The top five technologies that would increase confidence to travel in the next 12 months are:

- Mobile applications that provide on-trip notifications and alerts (44%)

- Self-service check-in (41%)

- Contactless mobile payments, e.g., Apple Pay (41%)

- Automated and flexible cancellation policies (40%)

- Mobile boarding (40%)

In addition to supporting people throughout their journey, technologies made innovative solutions possible. Virtual tours, experiences, and classes gained significant popularity during the lockdowns, and thanks to tech innovation, many businesses survived the crisis.

The first step for technology-empowered travel experience is a website. However, to make sure your customers can easily find you in the search engines, it is important to care about your SEO metrics. Try our free SEO Grader tool to learn how your website performs and get free recommendations on how you can improve it.

Following the COP 26 UN Climate Change Conference and the launch of The Glasgow Declaration on Climate Action , countries are urged to accelerate climate action in tourism. So encouraging sustainable tourism practices and environmental initiatives is of utmost importance for the resilience of the sector.

The UNWTO Secretary-general has warned that the “climate emergency is a bigger threat than Covid”. As international travelers become aware of this crisis, they come to believe that people need to take action now and make sustainable travel choices in order to save the planet and preserve it for future generations.

More travelers are adopting this mindset hence making their travel decisions with the environment in mind.

But it’s important to note that sustainability is not only about the environment. It’s also about making a positive impact on cultures, economies, and the people at the destinations that clients visit.

In the post-COVID-19 era, sustainability will be a continuous trend in travel and tourism. If you play your part in upholding sustainability, you can earn the trust and loyalty of the generation of travelers who are spearheading this trend.

Active Ecotourism is another trend that has emerged in response to the calls for more sustainable and thoughtful tourism. It encourages combining the passion for travel with direct involvement in conservation and supporting the local environment.

According to a recent Amadeus survey on rebuilding travel, people consider cost-effective sustainable travel a priority.

37% of travelers surveyed think opportunities for travelers to be involved in the preservation of tourist destinations will help the industry to become more sustainable in the long term.

According to Evolve’s 2022 travel forecasts , 58% of people will be more interested in exploring the outdoors and practicing relevant activities including hiking, biking , and kayaking . Mountain/rural escapes and waterfront getaways are expected to be popular vacation experiences in 2022.

Covid-19 has drawn our attention to the negative impact of travel on the global environment and initiated a promise for ‘coming back better’. So the tourism industry will continue this trend by promoting sustainable outdoor travel and ecotourism in the post-pandemic era.

This is a new tourism trend that’s quickly gaining popularity. Transformative travel is about not just traveling for leisure but also aiming to make a difference in both the lives of others and oneself.

Volunteering trips are an example of the experiences that have gained popularity from this trend. Travelers vacation and also set aside time to volunteer at their travel destinations.

When it comes to making a difference in their own lives, clients can opt to go for wellness holidays where they retreat and either join a yoga class, relax at a nature-filled destination, or attend some apprenticeship classes to learn a new skill.

Because of this trend, there is also a notable change in the travelers’ diet. Instead of indulging in unhealthy meals, those who’ve joined the organic food movement prefer places that offer highly nutritious and organic foods.

One of the main aims of transformative travel is to be involved in something that’s significant and adds purpose to the trip. Booking.com shares that 68% of global travelers would consider participating in cultural exchanges to learn a new skill, followed by a volunteering trip (54%) and international work placements (52%).

Based on this trend, tour operators can focus on offering unique and purposeful activities along with their usual products and services.

Experience tourism is on the rise . This trend is about having a once-in-a-lifetime experience or gaining an emotional connection with cultures and nature.

As travelers get tired or bored of cookie-cutter vacations in touristy hot spots, they begin looking for an authentic experience in their travel destination. They can easily go for a brand that will allow them to mingle with the locals and experience the culture of the people.

Harris Group did a study that revealed that 72% of millennials prefer spending more money on unique experiences rather than on material things.

So, if you can offer these experiences, then you’re well on your way to acquiring this increasing breed of clients. One of the most popular experiences is food sampling. Food tourism enables travelers to enjoy different local cuisines, maybe even learn how to cook some of the recipes, and interact with the people’s traditions in the process.

Another way clients want to experience their destinations is by staying with local families rather than in hotels. This gives them a chance to interact even closer with the locals and see their way of life.

These are travelers looking for an enriching experience with the primary purpose of achieving, promoting, or maintaining the best health and sense of well-being and balance in life.

But don’t think wellness travel is limited to resorts and spas. Almost any business can take advantage of this trend.

Think of how you can market your business offers as a way to contribute to wellness tourism by developing and promoting communities and showing how both tourists and locals can benefit.

For example, a helicopter tour, paragliding flight, or whatever fun adventure your company offers, is a chance for personal growth by conquering fears or expanding horizons. Your existing offers may give the chance for people to empower themselves by learning a new skill set which also encourages personal growth.

With international travel returning to some degree, tourists are starting to dream about extended long-distance trips again. While countries are advocating for less air travel, this trend will allow people to travel less but better.

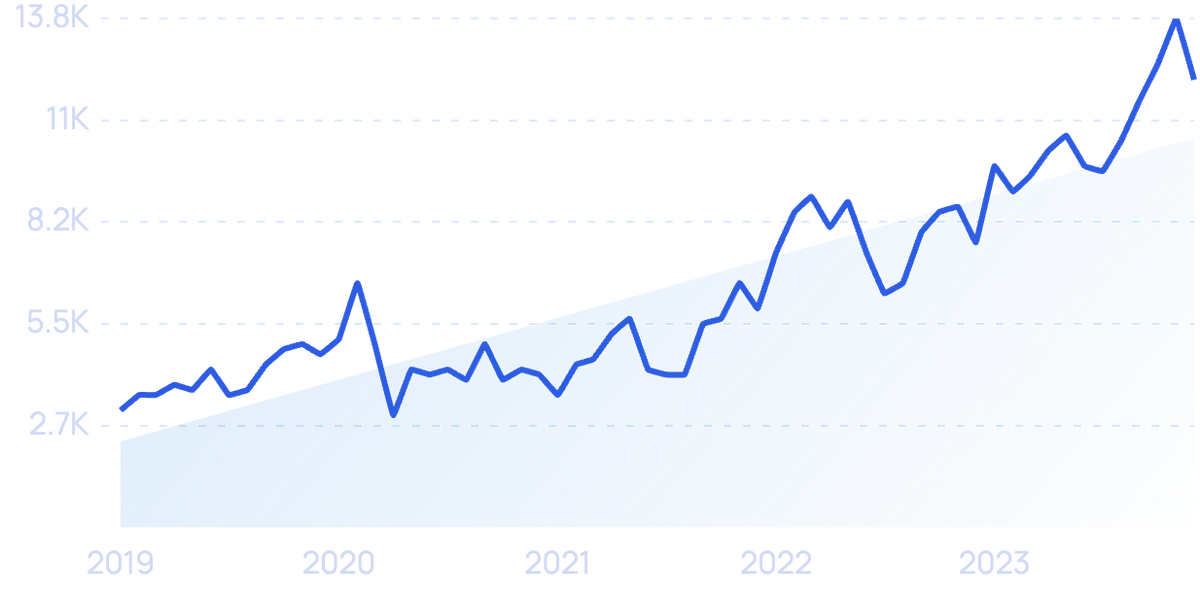

According to Evolve’s 2022 travel forecasts , the average trip will likely be longer in length (5-7 nights in 2022, compared to an average of 3.8 nights in both 2020 and 2021).

Longer trips will be increasing in demand as a result of the many work-from-home opportunities too. A study by Envoy finds that the hybrid work model gives employees more flexibility to get work done when they’re most productive.

So those who work remotely are more likely to plan extended stays in 2022 and beyond.

Staycation is another trend that gained popularity during the pandemic. It represents a holiday spent in one’s home country or home rather than abroad. Often involves day trips for exploring local attractions and activities. This type of vacation is ideal for people who are feeling the need of escaping out of their homes but want to avoid the ongoing Covid-19 regulations.

New research suggests that the trend will continue into 2022 despite the easing of international travel restrictions. This is because tourists want to support their local markets well as feel secure and safe in their holiday environment.

So small tour/activity businesses and accommodation providers can rest assured that there will be a constant stream of visitors during the years to come.

As a tour operator or DMO, it’s best to keep an eye on these tourism trends and begin strategizing. These include:

- The merging of business and leisure travels

- Increasing automation

- Mobile bookings

- Personalization of trips

- Tech-Empowered Travel

- Active ecotourism

- A focus on sustainable tourism

- Transformative travel

- Experience tourism

- Wellness travel

- Longer trips

- Staycations

Have a plan of how to meet the needs of your clients and take advantage of these trends. This can be the much-needed headstart to help you emerge above your competition as you seek to recover from the consequences of the pandemic.

You might also like:

- The Rise of Bleisure Travel and How to Make the Most of it

- Travel Like a Local: How Tour Operators Can Make the Most of This Trend

- Health Tourism in the EU: Facts and Figures

- Virtual Reality in Travel: 9 Applications for Tours, Destinations & Activities

- The Rise of Solo Travel and How to Make the Most of it

- When Numbers Matter: The Travel Statistics You Need to Know About

- The Rise of Experience Tourism and What It Means for the Leisure Industry

Related Articles

- Tips & tricks

- Trends 2024

Stay updated with Regiondo by signing up for our Newsletter

Get a personalized demo or create your free account now

Take your business to the next level with Regiondo - it's free to get started and you don't need a credit card.

- Share full article

Advertisement

Supported by

Travel’s Theme for 2022? ‘Go Big’

With Omicron cases ebbing, the industry is looking for a significant rebound in spring and summer. Here’s what to expect, in the air, at the rental car counter and beyond.

By The New York Times

As governments across the world loosen coronavirus restrictions and shift their approach to accepting Covid-19 as a manageable part of everyday life, the travel industry is growing hopeful that this will be the year that travel comes roaring back.

Travel agents and operators have reported a significant increase in bookings in recent weeks for the upcoming spring and summer seasons. The World Travel & Tourism Council (W.T.T.C.), which represents the global travel and tourism industry, projects that travel and tourism in the United States will reach prepandemic levels in 2022, contributing nearly $2 trillion to the U.S. economy. The council also anticipates outbound travel from the United States will increase; it projects bookings over the Easter holiday period to be up by 130 percent over last year.

“Our latest forecast shows the recovery significantly picking up this year as infection rates subside and travelers continue benefiting from the protection offered by the vaccine and boosters,” said Julia Simpson, the president and chief executive officer of the W.T.T.C. “As travel restrictions ease and consumer confidence returns, we expect a welcome release of pent-up travel and demand.”

While uncertainty remains over the course of the pandemic and government policies on mask mandates and testing requirements for travel, the industry is seeing a strong desire among travelers to take big bucket list trips this year, particularly to far-flung international destinations and European cities.

“Travel is no longer just about ‘going somewhere,’” said Christie Hudson, a senior public relations manager for Expedia. “Coming out of such a long period of constraints and limitations, 2022 will be the year we wring every bit of richness and meaning out of our experiences.”

Here are some of the trends you can expect to see.

Air Travel: Fewer restrictions, but for now the masks stay on

Flying in 2022 looks poised to be much like flying in 2021: reminiscent of prepandemic normal at times, infuriating at others. A primary difference is that there will be more people on planes and in airports — 150 percent as many passengers are expected to fly this year as did last year, according to The International Air Transport Association , which represents nearly 300 airlines.

In terms of where you can fly, you’ll have more options than last year. Destinations that have long been closed to most travelers, including Australia, the Philippines and Bali, have started reopening. Airlines have been gradually adding back old routes and expanding with new ones. In the spring, American Airlines, for example, plans to add six new routes from Boston. JetBlue will soon fly direct from New York City’s John F. Kennedy International Airport to Kansas City and Puerto Vallarta, Mexico, among other locations.

You’ll still need to check the latest entry requirements before flying internationally. There are currently more than 100,000 health and travel restrictions in place, according to Meghan Benton , a research director at the Migration Policy Institute, which tracks them. Though that’s around the same number as a year ago, she noted, there has been a move away from quarantines and outright bans of nonessential visitors toward vaccination and testing requirements. Recently, a growing number of destinations, including Britain, have also reconsidered the merits of entry testing.

That flight for a summer getaway could cost less than it did before the pandemic. Fares are down 18 percent from 2019, according to Airlines for America, which represents seven major airlines. In January, the cost of international airfares purchased hit an all-time low since Hopper, a booking app, began tracking them in 2014. Predicting whether, when and where they will rise is harder than it was before the pandemic, however, as new variants, evolving health threats, travel restrictions and pandemic psychology have upended traditional pricing patterns. Fortunately, most airlines are continuing to waive flight change fees on all but basic economy flights, said Brett Snyder, the founder of Cranky Flier , an airline industry site.

When flying in the United States, everyone will need to wear a mask until at least late March. That’s when the federal mask mandate is set to expire. It has been extended before and could be extended again. Dr. Anthony Fauci, the White House’s chief medical adviser, is among those who have said that masks on planes should be here to stay. Gary Leff, who writes about air travel for View from the Wing, a site focused on air travel, said he agrees with the betting markets , which predict that the mask mandate will go away by the November midterm elections. Regardless, there will be more alcohol in the air. On Feb. 16, Southwest will serve drinks for the first time in two years. — Heather Murphy

Lodging: Hotels fight back, sometimes with robots

This may be the year travelers return to hotels. In a report for the American Hotel & Lodging Association, Oxford Economics, an economic forecasting company, expects total bookings to nearly equal 2019 stays, though a significant source of revenue — more than roughly $48 billion spent before the pandemic on food and drink, meeting spaces and more — will largely remain missing, given the continued slump in business meetings and group events.

Leisure travelers have kept the industry afloat and in certain areas — especially mountain and coastal destinations — vacation business is booming. With record demand, rates rose at escapist resorts like the Chebeague Island Inn in Maine even in the traditional off-season months.

Now, corporate lodging specialists like Level Hotels & Furnished Suites , which has high-rise apartments in four cities including Seattle, are going after leisure travelers, touting amenities like fitness centers. And why not? During the pandemic, many travelers discovered the privacy offered by rental residences. According to AirDNA , which analyzes the short-term rental market, vacation home bookings were up between 30 and 60 percent in small cities and resort destinations compared to 2019, though big-city rentals are down about 25 percent.

Urban hotels hope to compete for digital nomads by adding stylish extended-stay properties, social attractions and better work spaces. Denver’s Catbird hotel offers ergonomic studios with kitchenettes, plus a rooftop bar and rental gear, including scooters, ukuleles and air fryers. The Hoxton chain’s Working From co-working spaces are attached to its hotels in Chicago and London.

Adapting to lean times, many hotels have outsourced operations beyond laundry and landscaping, into food and recreational services. The new app-based service Breeze works with hotels to provide room service either from on-site restaurants or neighboring ones.

The pandemic has also hastened the adoption of automation in hotels — such as keyless check-in, digital staff communication and room delivery by robots — as a cost-effective response to the labor shortage.

“High tech is the new high touch,” said Chekitan Dev, the Singapore Tourism Distinguished Professor of marketing and management at Cornell University’s hotel school.

Hotel sustainability initiatives look to go further than “towel-washing optional” offers.

Hilton plans to introduce what it says is the country’s first net-zero hotel this year with the solar-powered Hotel Marcel New Haven, Tapestry Collection in New Haven, Conn. SCP Hotels , which operates seven hotels around the country, aims to go zero-waste in 2022.

The industry’s focus on leisure travelers may inspire new diversions. A hotel that can no longer afford to employ 50 servers in its events department might use the space to hold a yoga class or a talk by a local designer, according to Vikram Singh, an independent hotel consultant. “These are the experiences people remember more than whether the pillow was soft,” he said. — Elaine Glusac

Rental Cars: Still pricey, and hard to get

This time last year, Jonathan Weinberg, the founder and chief executive of AutoSlash , an online service that makes and tracks discount car rentals, noticed that rental vehicles were unexpectedly scarce and overpriced for the mid-February Presidents’ Day break, an early indication of the post-vaccine travel rebound.

In 2022, it’s looking worse. A Feb. 1 search in Phoenix for the upcoming holiday weekend showed all the major car rental companies were sold out and just two smaller agencies, Sixt and Nu, had cars, starting at $130 a day, more than twice what they might have been prepandemic.

“Even last year, we didn’t see inventory this tight until a week or so out,” Mr. Weinberg said.

It’s possible that consumers have heeded the advice to book cars early after last year’s shortages. But rental agencies still haven’t been able to expand their fleets — thanks largely to slowdowns in automotive manufacturing — and the anticipated return of travel after Omicron suggests more car trouble ahead.

“It doesn’t look like it’s going to improve at all in the next year,” said Mike Taylor, the senior travel analyst at J.D. Power, a market research company, noting that in addition to higher prices, renters may be getting older cars with high mileage.

According to the travel search engine Kayak , rental car rates last summer peaked in July at a national average of $119 a day. Currently, the national average is about $66, or 27 percent higher than last year at this time, and a 41 percent increase over 2019 for the same period. Searches have more than doubled compared to this time last year.

“Road-tripping is a more predictable way of travel these days, where you can avoid crowds and unexpected delays,” said Matt Clarke, the vice president of North American marketing for Kayak, which recently added search results from companies like Kyte , a car rental company that delivers cars to consumers, and Turo , a car-sharing site.

Such alternatives may have benefited from the rental car crunch. In the first nine months of 2021, revenue at Turo grew more than 200 percent, compared to the same period in 2020, according to a recent filing to go public.

“For many travelers, Turo was the least crazy option from a price standpoint,” said Turo’s chief executive Andre Haddad.

For now, car-sharing sites are better bets for finding electric vehicles, although Hertz announced in the fall that it would have 100,000 E. V.s by the end of this year. At Turo, E.V. listings have grown from about 200 in 2014 to more than 27,000 in 2021.

“We’re already seeing activity for March and April, and that is not normal,” said Ryan Hagler, a Maui resident who uses Turo to rent 10 vehicles, including six Teslas, which start around $80 a day. “I’m assuming it’s going to be pretty busy this year.” — Elaine Glusac

Destinations: Cities are back

This March, Virginia Devlin of Chicago is headed to New York City with her daughter, a musical theater student, to celebrate two years’ worth of missed birthday trips. They’ll see Broadway shows and visit Chinatown for dim sum. Tracy Lippes, of Short Hills, N.J., is ready to go to Paris. “I can’t wait to stay in a beautiful hotel, shop, visit museums and eat at great restaurants,” Ms. Lippes said of her March trip. Greg Siskind, an immigration attorney in Memphis, is thrilled to have an in-person conference in London next month, and plans to arrive a few days early to enjoy the city with his adult daughters.

Yes, city travel is back. After more than two years of avoiding urban centers, travelers are eager to return to their favorite metropolis and swan dive into the sights, bites and sounds of a city that is not their own.

“It was a lift to everyone when the U.K. dumped Covid mandates on Jan. 26,” said Henley Vazquez, a co-founder of FORA, a travel agency in New York City . “Bookings are spiking for classic European destinations, particularly Paris and London. Clients want to reconnect with special hotels and restaurants and simply bask in the culture.”

In the United States, Shawna Owen, the president of Huffman Travel , a Chicago-based agency that specializes in luxury and family travel, is planning long weekend trips to New York City. “New York is buzzing again and clients are excited to dine at hot spots and enjoy the city’s dynamism.”

Underscoring the New York-is-back trend, the travel booking site Skyscanner reports that New York City is its top booked domestic destination so far in 2022 and the online travel agency Expedia has had a 13 percent increase in searches for New York City.

As for Europe, Paris and London are the top searched international destinations on Scott’s Cheap Flights , a service that tracks flight deals. Hotel searches on Expedia jumped 62 percent for London and 51 percent for Paris since Jan. 1, and the mobile app Hopper reports that London and Paris clock in as two of the most searched international destinations for spring 2022.

With restrictions easing, Four Seasons Hotels and Resorts reported an 80 percent increase in its bookings in Paris, London and New York from December to Jan. 16.

In London, the luxury travel outfit, Noteworthy , has seen bookings of its private tours to iconic British sites increase 145 percent in February over the same time in 2021. “ The Queen’s Platinum Jubilee has definitely been a tourist draw,” said Nicola Butler, the company’s owner and managing director. — Amy Tara Koch

Resorts: All-inclusives, beyond the beach

A new breed of domestic resort is pioneering an almost all-inclusive model, taking the guesswork out of where to eat and what to do. Why “almost?” These properties don’t include alcoholic beverages in their nightly rate, and, perhaps fittingly, boast enviable wine and spirits collections. A major catalyst for the trend: pandemic-scarred travelers wary of leaving the grounds of a resort once they arrive, according to Erina Pindar, the managing director of SmartFlyer , a luxury travel agency. “The almost all-inclusive is incredibly popular,” she said, “we expect demand to continue to be strong.”

Hotels.com reports that searches for this type of resort have increased significantly compared with the same time frame in 2019. “After the stress of the last few years,” said Mel Dohmen, a Hotels.com spokeswoman, “travelers are looking for stays where they can be doted on.”

“Our clients see these resorts as a hassle-free option,” said Jennifer Doncsecz, president of the travel agency V.I.P. Vacations .

The San Ysidro Ranch in Montecito, Calif., long beloved by luminaries like Winston Churchill and Vivien Leigh, pivoted to an almost-all inclusive model in 2020. In addition to folding the cost of meals into the nightly rate, which starts at $2,495, it did away with extraneous charges like resort fees and parking. “We figured, with all the charges we’ve gotten rid of, what are people going to spend money on? Wine,” said Ian Williams, the Ranch’s general manager. “We’ve had no complaints. This past year has been our busiest ever.”

Given the complications caused by the pandemic, Mr. Williams and his team sought to streamline the travel process. “We want guests to check out and spend their trip home talking about what an amazing vacation they had,” he said, “not some miscellaneous charge on their bill.”

Beachside buffets and watered down margaritas might rule at the traditional all-inclusive; not at the Ranch. “Every guest, if they want the Wagyu for dinner, fine,” said Mr. Williams. “Caviar? Great. Maine lobster? No problem.”

When High Hampton , a Cashiers, N.C., resort that dates back to 1933, remodeled in 2020, it folded breakfast and dinner into its nightly rate, which starts at $595, “because it removes that pressure of where to dine next,” said Scott Greene, the resort’s general manager. (The amber-lit, oak-paneled dining room is always the right answer.)

The same logic has long been in place at Blackberry Farm and Blackberry Mountain , two resorts in Walland, Tenn. Breakfast, lunch and dinner are included in the nightly rate — $845 and up at the Farm, $1,395 and up at the Mountain —- along with all the snacks in the minibar. “We’re exceeding prepandemic occupancy,” said Matt Alexander, Blackberry’s president. SmartFlyer saw a 327-percent increase in revenue from bookings at the two properties in 2021 as compared to 2019. — Sheila Yasmin Marikar

Wellness: Sexual healing

Sexual wellness is one of the fastest growing corners of the global wellness industry, with travel increasingly part of the experience. More hotel brands and relationship therapists are offering couples retreats and beachfront sessions with intimacy coaches and guided anatomical explorations to meet the needs of travelers seeking greater couple satisfaction and personal pleasure.

“People still have stigma around couples therapy and coming to therapy, but nobody ever had a problem going on vacation,” said Marissa Nelson, a sex therapist who runs retreats in Barbados, Hawaii, St. Lucia and Washington, D.C., through her company IntimacyMoons (seven days in St. Lucia starts at $7,500). She also offers virtual sessions; even when retreats were shut down in 2020, she noticed couples were traveling — to Airbnbs or on road trips — before logging on to work with her.

Travel is a powerful tool for unlocking intimacy, said Shlomo Slatkin, a rabbi and certified relationship therapist. His company, The Marriage Restoration Project , focuses on married couples. In the past year, in response to a growing demand to combine therapy and travel, he has introduced his first destination retreats — which cost between $4,000 and $5,000 and take place in Costa Rica, Mexico and Miami.

“Going away is really powerful, because changing the relationship requires a paradigm shift,” he said. “The lockdowns brought out a lot of maintenance issues in relationships that need to be addressed.”

Tara Skubella, a tantric guide, works with both couples and single women. Tantra, a spiritual philosophy with roots in medieval India, includes practices like tantric sex, and Ms. Skubella offers services, including chakra work, which focuses on energy points in the body. Her retreats in Costa Rica and Colorado (starting at $499) have been mostly sold out since 2020, she said.

“It seems very aligned to Covid and breaking out of isolation,” she said. “Society is realizing tantra isn’t only about sex, but about inner connection and healing.”

In March, the hotelier St. Regis will launch a retreat with the sex coach Bibi Brzozka on intimacy, conscious sexuality and emotional awareness at the St. Regis Punta Mita Resort in Mexico ($2,680). In April, Six Senses Ibiza will host Pleasure Principles — Journey of Women’s Sexual Wellness , a six-night stay focusing on female sexual empowerment ($4,500). They are the first sexuality-focused retreats for both brands. — Debra Kamin

Family Travel: Going on the edu-vacation

After two years of quarantines and classroom closures, millions of children across the country have fallen behind in class . And parents, eager for lesson plans that can supplement learning, are now seeking experiences with an educational bent when they travel.

“Previously, families didn’t ask in advance about what educational activities are available at the resorts. Now they do,” said Chitra Stern, founder and chief executive of the family-friendly Martinhal resorts in Portugal. Nearly half of her new bookings, Ms. Stern said, now include questions about on-site educational opportunities for children. Last year, the luxury resorts began partnering with the United Lisbon International School to offer a two-week educational summer camp for its younger guests at Martinhal Lisbon. Courses, which are available for children ages 3 to 17, begin at 440 euros (around $500).

After a pandemic dip, enrollments are on the rise for family-learning itineraries with the tour operator Road Scholar , which produces educational travel programs for all ages. Options for children and their caregivers, which start at $699 per adult and $449 per child, include combining history and geography with spotting grizzlies in the Canadian Rockies , or learning French while taking a scavenger hunt through Paris’s Louvre .

And noting an uptick in children road tripping with their parents, the Colorado Tourism Office last summer launched Schoolcations , a series of free itineraries based on Colorado road trips and designed for grades K-5.

There are also more opportunities to learn back at the hotel. Family Coppola Hideaways — a group of retreats owned by the film director Francis Ford Coppola — now offers the Coppola Curriculum at its properties in Belize and Guatemala. Half-day lessons cost $150 per day for children and include courses in science (like counting bird species) and art (like local textile looming). In Florida, Isla Bella Beach Resort and Oceans Edge Resort & Marina now partner with Marine Science Camp for classes with marine scientists, geared to elementary school children (free for hotel guests). In California, attendance at the Artisans in Residence program at Carmel Valley Ranch — taught in the apiary, organic garden and goat creamery, and starting at $85 for adults and $65 for children — has doubled.

For some, a desire for extra credit also means going for an extra splurge. At the luxury travel agency Black Tomato , bucket-list family travel now accounts for 55 percent of bookings, with the majority of requests falling into what the company defines as BFG travel: Big Family Get-Togethers. So the company has rolled out a family-focused education track, Field Trip , which begins at around $5,800 per person; courses include a physics lesson at the CERN laboratory in Switzerland and a social studies-focused hike through Bhutan’s Gangtey Valley to meet a revered monk.

“Thematically, for 2022 family bookings, it’s all about intrepid adventure mixed with cultural immersion, ecological outdoor experiences, intrepid luxury hotels and even pop-up glamping setups — definitely bucket-list and remote,” said Tom Marchant, Black Tomato’s owner and co-founder. — Debra Kamin

Cruises: Smaller boats and luxury destinations

After two years of devastating losses and a tentative restart last June, the cruise industry has faced a challenging start to 2022, as the highly transmissible Omicron variant of the coronavirus caused cases to surge onboard ships, forcing some cruise lines to cancel voyages and change itineraries.

But demand for future cruises is still high, especially among dedicated cruise fans. A recent survey on cruiser sentiment by the online review site Cruise Critic found that 52 percent of the 6,400 cruisers surveyed were currently looking to book a cruise, with 40 percent hoping to set sail in the next six months.

A 2022 report on the outlook for the industry, published in January by the Cruise Lines International Association, the industry’s trade group, highlighted how major companies are bouncing back from the pandemic despite recent hurdles.

More than 75 percent of CLIA member ships have returned to service, with 100 percent expected to restart operations by August 2022. Additionally, 16 new cruise ships from major lines like Carnival, MSC, Royal Caribbean and Disney will launch in 2022.

One of the biggest cruise trends for 2022 is luxury expedition voyages, appealing to a growing number of travelers throughout the pandemic because they typically sail on smaller ships and steer away from crowded destinations.

“The itineraries vary pretty significantly from those of the larger, more mainstream lines,” said Colleen McDaniel, the editor in chief of Cruise Critic. “Due to their size, luxury ships are able to sail to more remote destinations — so even if you’re sailing in the Caribbean, your ports of call will likely be further removed from the masses, and likely somewhere you might have never been before.”

Smaller river and expedition cruises are also expected to become more popular this year as cruisers seek out big bucket-list destinations and more sustainable ways to travel. Responding to the demand, Hurtigruten, a Norwegian line that specializes in expedition cruises, has added new itineraries to its Galápagos Islands excursions, offering a range of small-ship carbon-neutral expedition sailings that will cover the full span of the remote 19-island archipelago.

“A very positive trend we’ve seen throughout the pandemic is that travelers are increasingly eco-conscious; meaning they do their homework on brands, including cruise ships, to make sure they align with their personal values.” said Daniel Skjeldam, the chief executive of Hurtigruten Group.

The company is also expanding its grand expedition cruise program, offering three unique cruises from the North to South Pole after the success of two similar sold-out sailings scheduled for the fall. The itineraries include destinations like Alaska, Iceland, Greenland, the Northwest Passage sea route, South America and Antarctica.

“After having been isolated for two years, people really want to do something they really can look forward to,” Mr. Skjeldam said. “Something perhaps more active and interesting than their normal prepandemic holiday.” — Ceylan Yeginsu

52 Places for a Changed World

The 2022 list highlights places around the globe where travelers can be part of the solution.

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places for a Changed World for 2022.

An earlier version of this article mischaracterized Kyte, a car rental business. Kyte is a car rental company that delivers cars to consumers; it is not a car-sharing website.

How we handle corrections

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

Size of the museums, historical sites, zoos, and parks market worldwide in 2022, with a forecast for 2023 and 2027 (in billion U.S. dollars)

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Forecast EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Forecast EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Forecast EV/Revenue ratio in the online travel market 2024, by segment

Forecast enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide in 2024, by segment

Forecast EV/EBITDA ratio in the online travel market 2024, by segment

Forecast enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide in 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Report: 2022 year in review.

ANNUAL REPORT January 24, 2023

Two themes dominated the state of the industry in 2022: Pent-up travel demand and ongoing recession fears coupled with economic concerns.

Pent-up demand continued to soar, and travelers’ desire to make up for lost travel experiences helped to largely recover the domestic leisure sector to pre-pandemic levels. The summer and holiday travel periods showed that inflationary concerns and high travel prices did not dissuade travelers but instead shifted behaviors, such as cutting back on travel distance, trip duration and staying with friends and family instead of paid accommodations.

There was also evidence of pent-up demand for business travel—specifically meetings and events—as the sector began rescheduling postponed events which helped to make gains toward 2019 figures. The industry sees potential for growth in this sector, especially as a ‘new normal’ continues to shape travel patterns (i.e. hybrid work, more flexibility, fewer peak months and the blend of business and leisure travel).

However, the recovery has been uneven. Transient business travel and international travel were sluggish throughout 2022. Business travel and international travel are not expected to return to pre-pandemic levels until 2027 and 2025, respectively.

But there is optimism as we head into 2023. U.S. Travel’s latest forecast indicated that despite the ongoing headwinds—economic concerns, recession fears, a strong U.S. dollar, unstable global economies and long U.S. visitor visa wait times—travel industry growth is expected to remain robust as we head into 2023.

- Diversity Inclusion

- Advisory Panel

- Our Audience

- Private Tourism Academies

- Tourism Ambassador Training

- Destination Training

- Tourism Keynote Speakers

- Sponsorship

- Business Class Podcast

- Skill & Knowledge

- Product Training

- Our Technology

- Become An Instructor

- Sponsorship Opportunities

- Product Training & Promotion

- Hire Us To Speak

These Six Tourism Trends Will Rule 2022

At the beginning of every year, tourism forecasters the world over put together expensive reports predicting what the future will bring. I read hundreds of predictions and talk with dozens of industry leaders every year. So, what do these speculators think the next few years hold?

Many of the themes are predictable: automation, artificial intelligence, climate crisis, virtual reality and augmented reality, China’s rising power, cryptocurrencies, Zoom, remote work and people fighting for their rights.

RELATED: 2022 Tourism Trends & Outlook

RELATED: U.S. Travel & Tourism Statistics 2020-2021

What do these 2022 Tourism Trends mean?

Tourism Trends 2022.

Expertise is in demand.

Plenty of group leaders, teachers, and novice travel planners found themselves lacking the expertise, resource and knowledge to handle rapidly changing rules, regulations, policies and restrictions. To avoid this sort of stress and frustration, many of these planners (and the organizations they work for) are now insisting that their trips be planned by professional tour operators and travel agencies.

“People are more willing to pay for ‘expertise’ because they don’t want to be on the hook for everything if the boat sinks.” - Keith Snode, Group Travel Odyssey

Empathy and personalization

At the beginning of the pandemic, we saw so many brands talking about ‘being in this together.’ But your messaging needs to go beyond that pat-on-the-back, we-got-this story. Your potential audiences want to envision how your product or service will make their life easier and better as we ease into resuming normal life. They want something they can believe in. Here are a few tips for creating genuine, authentic empathy in your messaging:

Messaging that focuses on solutions is empowering and positive. It tells customers they can do it, and you can help.

Using plain language in your content makes it more believable and relatable. Be sure you’re not hung up on “marketing speak” and technical jargon.

Choose active words that elicit emotions. Inspire. Imagine. Engage.

Think about creating conversations, not just shouting at your customer. In conversations you know the person’s name, you may be able to reference a specific need or discuss a topic you have in common.

Empathy is about walking a mile (or more…) in your customer’s shoes. Watch how they shop and interact with your products. Learn from them. If you can think like your customer, chances are you’ll create a connection.

RELATED: Finding The Right Speaker For Your Meeting

Work from home policies

Working from home has become an efficient way for businesses to operate and manage overhead. Now that people are working from home, it will never go back to the way it used to be; geographic requirements around talent acquisition will loosen.

Income and economic resources have shifted from city centers to the suburbs & rural areas. This brings added opportunity for those businesses who see this as a target audience.

RELATED FREE COURSE: Work Better/Live Happier - Working From Home Effectively

Price compression

Price Compression is an explanation for market bubbles. It’s a pinch situation. Lower inventories, vendors struggling to recuperate losses, demand spikes, and market uncertainty all converge to drive prices up and options down. Travelers who have very fixed departure dates will feel this more than those who can shift plans to off-peak or shoulder periods.

“We’re seeing so many hotels that remain closed; the other hotels with rooms left to sell can raise their rates. It comes down to basic supply & demand. Demand is there on the domestic front. We’re seeing second tier cities commanding rates that we once only saw in New York City. Add to that - inflation. We’re educating operators to not expect the same rates they saw in 2019. The supply chain is under super-pressure and that honeymoon period is over.” - Robert Miller, TravelAdvocates

Breakdown of traditional education paths

As the pandemic interrupted schooling for millions, new relationships to online learning began to flourish. The weight of student debt and continued class conflict draw people away from the traditional path of college education. We can expect to see a rise in solution-based, on-demand online training, like the courses offered at tourismacademy.org . Training that is more concise, targeted and efficient will lead professional development.

RELATED: Tourism Ambassador Certification

Diversity, Equity, and Inclusion

Many workplaces today focus on DEI instead of D&I. DEI stands for Diversity, equity, and inclusion.

Equity has become just as crucial as D&I in several global companies.

Equity in the workplace refers to fair and impartial processes and outcomes for each individual in the company.

To ensure fair and impartial processes and outcomes, leaders and employers need to be mindful of the challenges, barriers, and advantages at play for everyone at any given point in time.

Equity is the reminder that not everyone starts at the same level playing field, and so swift and vigilant action is paramount to building a fair workplace.

RELATED: The Tourism Academy commitment to Diversity, Equity & Inclusion

In conclusion, the takeaway is simple: travel is evolving. Those who are most nimble and able to adapt quickly will capitalize on market opportunities. Share your thoughts and predictions in the comments below.

Leave a comment

Related articles, tourism academy announces top travel trends for 2023, top 20 tourism keynote topics for inspiring journeys, u.s. travel & tourism statistics 2020-2021.

UN Tourism | Bringing the world closer

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

International Tourism Back to 60% of Pre-Pandemic Levels in January-July 2022

- All Regions

- 26 Sep 2022

International tourism continued to show strong signs of recovery, with arrivals reaching 57% of pre-pandemic levels in the first seven months of 2022.

According to the latest UNWTO World Tourism Barometer , international tourist arrivals almost tripled in January to July 2022 (+172%) compared to the same period of 2021. This means t he sector recovered almost 60% of pre-pandemic levels . The steady recovery reflects strong pent-up demand for international travel as well as the easing or lifting of travel restrictions to date (86 countries had no COVID-19 related restrictions as of 19 September 2022).

UNWTO Secretary-General Zurab Pololikashvili said: “Tourism continues to recover steadily, yet several challenges remain, from geopolitical to economic. The sector is bringing back hope and opportunity for people everywhere. Now is also the time to rethink tourism, where it is going and how it impacts people and planet.”

Now is also the time to rethink tourism, where it is going and how it impacts people and planet

An estimated 474 million tourists travelled internationally over the period, compared to the 175 million in the same months of 2021. An estimated 207 million international arrivals were recorded in June and July 2022 combined, over twice the numbers seen in the same two months last year. These months represent 44% of the total arrivals recorded in the first seven months of 2022. Europe welcomed 309 million of these arrivals, accounting for 65% of the total.

International Tourist Arrivals

Europe and the middle east lead recovery.

Europe and the Middle East showed the fastest recovery in January-July 2022, with arrivals reaching 74% and 76% of 2019 levels respectively. Europe welcomed almost three times as many international arrivals as in the first seven months of 2021 (+190%), with results boosted by strong intra-regional demand and travel from the United States. The region saw particularly robust performance in June (-21% over 2019) and July (-16%), reflecting a busy summer period. Arrivals climbed to about 85% of 2019 levels in July. The lifting of travel restrictions in a large number of destinations also fuelled these results (44 countries in Europe had no COVID-19 related restrictions as of 19 September 2022).

The Middle East saw international arrivals grow almost four times year-on-year in January-July 2022 (+287%). Arrivals exceeded pre-pandemic levels in July (+3%), boosted by the extraordinary results posted by Saudi Arabia (+121%) following the Hajj pilgrimage.

The Americas (+103%) and Africa (+171%) also recorded strong growth in January-July 2022 compared to 2021, reaching 65% and 60% of 2019 levels respectively. Asia and the Pacific (+165%) saw arrivals more than double in the first seven months of 2022, though they remained 86% below 2019 levels, as some borders remained closed to non-essential travel.

Subregions and destinations

Several subregions reached 70% to 85% of their pre-pandemic arrivals in January-July 2022. Southern Mediterranean Europe (-15% over 2019), the Caribbean (-18%) and Central America (-20%) showed the fastest recovery towards 2019 levels. Western Europe (-26%) and Northern Europe (-27%) also posted strong results. In July arrivals came close to pre-pandemic levels in the Caribbean (-5%), Southern and Mediterranean Europe (-6%) and Central America (-8%).

Among destinations reporting data on international arrivals in the first five to seven months of 2022, those exceeding pre-pandemic levels were: the US Virgin Islands (+32% over 2019), Albania (+19%), Saint Maarten (+15%), Ethiopia and Honduras (both +13%), Andorra (+10%), Puerto Rico (+7%), United Arab Emirates and Dominican Republic (both +3%), San Marino and El Salvador (both +1%) and Curaçao (0%).

Among destinations reporting data on international tourism receipts in the first five to seven months of 2022, Serbia (+73%), Sudan (+64%), Romania (+43%), Albania (+32%), North Macedonia (+24%), Pakistan (+18%), Türkiye, Bangladesh and Latvia (all +12%), Mexico and Portugal (both +8%), Kenya (+5%) and Colombia (+2%) all exceeded pre-pandemic levels in January-July 2022.

Tourism spending rises but challenges grow

The ongoing recovery can also be seen in outbound tourism spending from major source markets. Expenditure from France climbed to -12% in January-July 2022 compared to 2019 while spending from Germany rose to -14%. International tourism spending stood at -23% in Italy and -26% in the United States.

Robust performance was also recorded in international passenger air traffic, with a 234% increase in January-July 2022 (45% below 2019 levels) and a recovery of some 70% of pre-pandemic traffic levels in July, according to IATA.

Stronger-than-expected demand has also created important operational and workforce challenges in tourism companies and infrastructure, particularly airports. Additionally, the economic situation, exacerbated by the aggression of the Russian Federation against Ukraine, represents a major downside risk. The combination of increasing interest rates in all major economies, rising energy and food prices and the growing prospects of a global recession as indicated by the World Bank, are major threats to the recovery of international tourism through the remainder of 2022 and 2023. The potential slowdown can be seen in the latest UNWTO Confidence Index, which reflects a more cautious outlook, as well as in booking trends which are showings signs of slower growth.

Tourism Experts Cautiously Confident

On a scale of 0 to 200, the UNWTO Panel of Tourism Experts rated the period May-August 2022 with a score of 125, matching the bullish expectations expressed by the Panel in the May survey for the same 4-month period (124).

Prospects for the remainder of the year are cautiously optimistic. Although above-average performance is expected, tourism experts rated the period September-December 2022 with a score of 111, below the 125 score of the previous four months, showing a downgrade in confidence levels. Almost half of experts (47%) see positive prospects for the period September-December 2022, while 24% expect no particular change and 28% consider it could be worse. Experts also seem confident about 2023, as 65% see better tourism performance than in 2022.

The uncertain economic environment seems to have nonetheless reversed prospects for a return to pre-pandemic levels in the near term. Some 61% of experts now see a potential return of international arrivals to 2019 levels in 2024 or later while those indicating a return to pre-pandemic levels in 2023 has diminished (27%) compared to the May survey (48%). According to experts, the economic environment continues to be the main factor weighing on the recovery of international tourism. Rising inflation and the spike in oil prices results in higher transport and accommodation costs, while putting consumer purchasing power and savings under pressure.

Related links

- Download the News Release in PDF

- World Tourism Barometer (PPT version)

- UNWTO World Tourism Barometer | Volume 20 • Issue 5 • September 2022 | EXCERPT

- Impact of the Russian offensive in Ukraine on international tourism

- UNWTO Tourism Data Dashboard

- World Tourism Day 2022: Rethinking Tourism

Category tags

Related content.

International Tourism to Reach Pre-Pandemic Levels in 2024

International Tourism to End 2023 Close to 90% of Pre-P...

Tourism’s Importance for Growth Highlighted in World Ec...

International Tourism Swiftly Overcoming Pandemic Downturn

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Consumer Trends

A world in motion: shifting consumer travel trends in 2022 and beyond.

- The leading consumer trends report analysing the changing nature of travellers' behaviour and preferences

- Helps businesses understand how consumer travel trends are shifting.

- Supported by Trip.com Group and Deloitte

- Available in English, Chinese, Korean, Japanese

Previous Reports

Trending in Travel: Emerging Consumer Trends

Trending in travel.

Longer Stay, Longer Play

Secondary Destinations

Virus Prevention

Latest Blogs

A longer ‘flexcation’ or off the beaten path - which 2022 travel trends will inspire your next adventure?

Trip.com Group is a leading global travel service provider comprising of Trip.com, Ctrip, Skyscanner, and Qunar with the mission "to pursue the perfect trip for a better world".

Deloitte’s transportation, hospitality & services practice provides market insights to help you grow in a technology-driven and rapidly evolving ecosystem. our insights can help you navigate changing consumer behavior and key market trends such as the future of work, digital supply chain, and sustainability..

- Adventure Tours

- Sightseeing Tours

- Transport and Transfer Tours

- Destination

- Booking Engine

- Back Office Tool

- Channel Manager

- Point of Sales

- Agents and Resellers

- Payment Gateway

- Success Stories

- Books and Guide

- Learning Center

- Help Center

- All Categories

- Travel Trends

- Business Management

- Travel Technology

- Distribution

- TrekkSoft Tips

Tourism market trends in 2022

- Tourism Marketing

After the last couple of years of closed borders followed by strict rules regarding social distancing, face masks, and a limited number of tourists per tour, and places in general, 2022 summer carried big expectations for the tourism industry. Countries are removing covid-related entry requirements for travelers. Without restrictions on the country they're arriving from and vaccination status, tourists have easier entry to their destinations and are retaking vacations. And for this, the tourism industry has prepared for the travel demand.

The expectations for 2022

According to the Top 10 Summer European Destinations review, by Allianz Partners , in 2022, travel to Europe will rise 600% over last year as countries re-open for visitation from the U.S. The review showed, in addition to the eagerness of Americans to travel to Europe, the most popular places on their itineraries. The top cities on the American travel list were London, Paris, Dublin, and Reykjavik. The company published in April 2022 analyzed more than 40.000 flight itineraries in the range of 29th May and 5th September.

How was European summer tourism

Before the pandemic, the travel and tourism industry was experiencing its peak in numbers - including the number of international visitors, how much tourists were spending, days of layover, and more. So the expectation for this year's summer was to get closer and closer to the numbers we had in 2019. Eurostat showed that in July 2022, the number of commercial flights in the European Union countries had reached 85% of pre-covid levels, the same as August 2022 (86% of August 2019 figures). In numbers, how was July 2022:

- The United Kingdom received 1.9 million tourists in July, 88% of those came in July 2019;

- Germany had 1.1 million visitors, representing 88% of visitors in 2019;

- Spain had 9.1 million tourists in July. Which means 92% of the arrivals in July 2019;

- France received more than 1.4 million visitors - 98% compared to 2019.

The most significant number of tourists arriving at these destinations has been from the USA.- they represent 85% of arrivals. The forecast for the tourism market is optimistic, and the numbers show that we're approaching pre-pandemic figures. But, the way people are traveling is the same as before covid?

How tourists are traveling in 2022

Travelers are booking their next destination in short search windows Even though travelers are more confident in booking their vacation ahead of time rather than leaving it to the last minute, there are still numerous people looking at trips in the near term. The Traveler Insights Report 2022 , which analyzed the second quarter of Q2, showed that searches up to the maximum of a 90–days window increased more than 5% globally, and searches in the 61- to 90–day window saw the most significant quarter-over-quarter boost at 15%. It could be a direct result of the uncertainties we face during the pandemic, or it could be a consequence of the agility technology offers when buying a flight ticket or booking an activity. The report also showed that most consumers - 53% - feel comfortable booking travel less than one month in advance.

Tourists want to have a meaningful travel experience Traveling has become more than getting to visit new locations. People are searching for purposeful, life-changing experiences. Part of the provided experience it's in the hands of those who guide the tour; they have the chance to amaze and inspire travelers. To learn how to master the art of guiding, read 10 qualities every good tour guide needs .

Family traveling is back Even though during the pandemic, the total number of families internationally vacationing declined, the Traveler Insights Report 2022 Q2 revealed that international family travel has recovered to pre-covid numbers. Family groups represent the type of group that spends more per night and bookings.

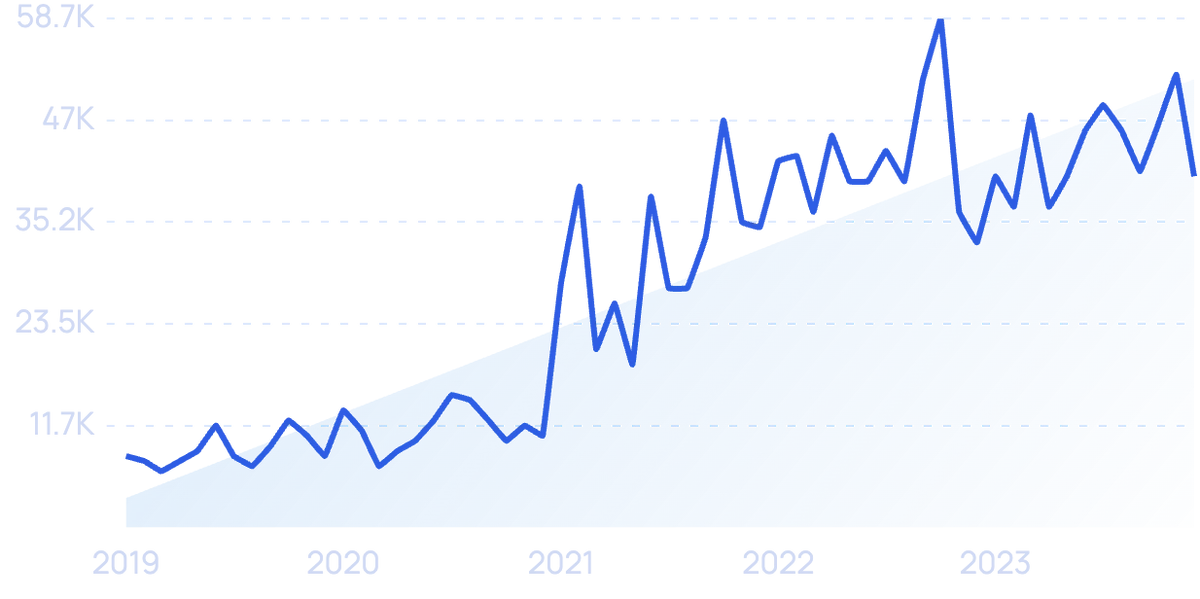

Solo travel is also on the rise

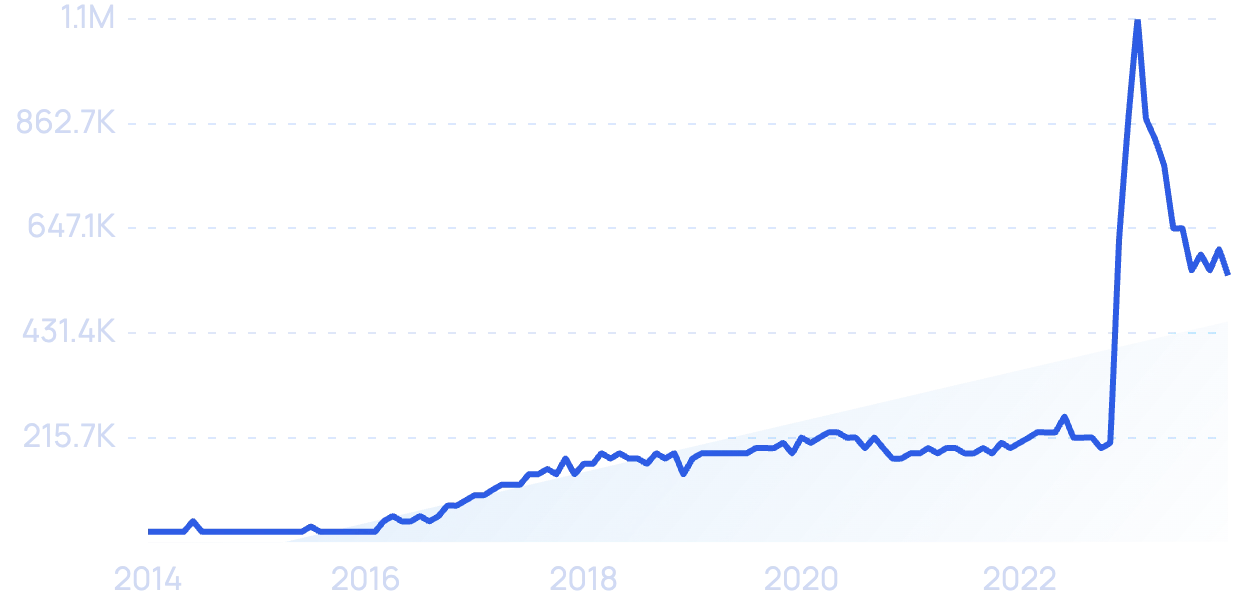

While we see more and more people taking a family vacation, there is also an increase in people traveling on their own. More popular between Millennials and Gen Z, the reason why people are choosing to travel solo are many; some of them need to see the world at their own pace and the feeling of freedom and independence. The online searches for the term 'solo travel' increased by 267% from December 2020 to April 2022 , so it might be only the beginning of a new major type of traveler.

Tourists want to see inclusive travel