- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

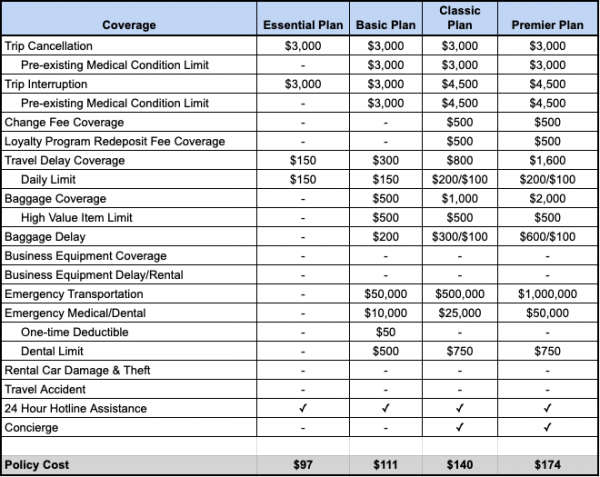

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

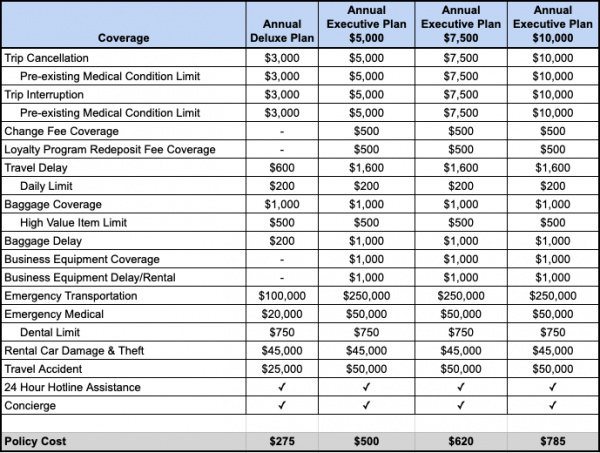

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Member News AAA's Take KeeKee's Corner AAA Traveler Worldwise Foodie Finds Good Question Minute Escapes Car Reviews

WHAT’S COVERED, COSTS, AND TIPS ON FINDING THE BEST TRAVEL INSURANCE FOR YOUR NEEDS

March 28, 2024 | 3 min read.

Travel insurance can be an overwhelming expense to consider atop an already costly vacation. Admittedly, even as a seasoned travel industry professional with three decades of globe-trotting under my belt, I have a moment of pause each time I’m confronted with this. Ultimately, I almost always purchase some travel insurance coverage, especially when it’s a complex international trip. It’s primarily motivated by my aging parents—heaven forbid anything should happen to them—and wanting a safety net to return home at a moment’s notice without incurring massive out-of-pocket costs. This parental paranoia is just a small piece of the greater solace that travel insurance can provide, says AAA Tour Product Manager Randy Osborne. “Everyone can benefit from travel insurance,” he says. “The unexpected happens. It can provide peace of mind and reduce stress during a traumatic situation, as well as a contact to call when traveling abroad.” Osborne has seen it all. He works directly with AAA Travel Advisors and AAA’s preferred travel insurance provider, Allianz . It’s a vantage point that continually provides him with real-life cautionary travel tales. “I’ve never heard of anyone who needed and used travel insurance regretting having purchased it,” Osborne says. He says the biggest mistake people make is this: “Not getting it at all.” Here are some key things to keep in mind when navigating travel insurance

IT’S A FINANCIAL SAFETY NET FOR YOUR VACATION INVESTMENT There is no “one-size-fits-all” travel insurance plan, says Osborne, since available plans will be based on the trip cost, vacation destination(s) and age of the traveler(s). Most comprehensive travel insurance plans, however, will include varying degrees of coverage for the following:

- Trip Cancellation: This is a predeparture benefit that provides the ability to recoup travel costs if you cannot travel. It’s typically limited to specific reasons covered in the plan. Osborne advises understanding what these covered reasons are upfront when reviewing plan options.

- Trip Interruption: This helps if you need to cut your trip short. Covered reasons typically include an illness or injury during the trip, or a family emergency at home—which, as mentioned earlier, has always been this author’s primary motivator to purchase travel insurance.

- Travel Delays: This helps to cover expenses if your travel is delayed due to a covered reason. Osborne advises understanding what constitutes a “travel delay” within the travel insurance plans you are considering.

- Medical Expenses: This helps to cover unforeseen medical expenses while traveling to destinations where your U.S.-based health insurance may not work. “Frequently, the biggest covered amounts are for medical,” Osborne says.

- Emergency Evacuation Coverage: This typically helps to cover the cost of transportation (plus related medical services and supplies) to a medical facility if you’re seriously injured or ill. The best plans will provide up to $1 million per person for medical evacuation. This can seem high, but evacuation costs can exceed tens of thousands of dollars, especially if you’re traveling to a remote destination.

- Baggage Loss or Delays: This helps to recoup costs for lost luggage, as well as damaged or stolen baggage while you are on your trip.

COMPARE PLANS

In some cases, such as when booking a cruise or a guided group tour vacation, the travel provider may require you to purchase a certain level of travel insurance before you can join the excursion. In these situations, representatives often have options that allow you to bundle travel insurance into the cost of the vacation at the time of booking. Even if this is the case, however, Osborne says it pays to shop around and compare travel insurance plans to see if there is a policy that better suits your needs.

Most travel insurance companies, including Allianz Insurance, have easy-to-use websites that highlight several levels of travel insurance for your trip. These quotes can be used as baselines for building upon or removing elements. Gather a few online quotes, then speak over the phone with a representative to customize.

SEEK PROFESSIONAL GUIDANCE

Allow a AAA Travel Advisor to guide you through the process and identify a travel insurance policy that works for your needs, risk tolerance, and budget. The best part: This service is free.

PURCHASE EARLY FOR THE MOST BENEFITS

You’ll get the best and most comprehensive coverage if you purchase travel insurance within the first 14 days of making a trip deposit. (That clock starts ticking once you put a down payment on any part of the vacation.) The biggest benefits include:

- Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even before you step on that plane, train, or cruise ship. “Often I get calls from travelers who didn’t expect to need insurance and then have a [medical] diagnosis before travel that prevents them from going,” Osborne says.

- Better Trip Cancellation Coverage Options: Many travel insurance companies offer more covered reasons for trip cancellation if you purchase it within 14 days of making an initial trip deposit.

- Pre-Existing Medical Conditions: If you have a pre-existing medical condition, most travel insurance will not cover medical situations due to this condition that arise during your travels— that is, unless you purchase comprehensive travel insurance coverage within the first 14 days of making a trip deposit.

ASSESS MEDICAL COVERAGE CAREFULLY, ESPECIALLY IF YOU HAVE A PRE-EXISTING CONDITION

Most U.S.-based health insurance plans won’t offer medical coverage on non-U.S. soil. Even if you have outstanding health insurance, it may not be very helpful during an international vacation where unexpected medical and health issues arise. This is certainly the case if you’re traveling to more remote areas with limited medical facilities or your vacation includes high-risk excursions and activities. Osborne says it’s important to understand whether travel insurance you’re considering offer primary or secondary medical coverage, and to assess which is best for you.

If you have a pre-existing medical condition or chronic health problems, medical coverage is an especially critical piece of the policy to scrutinize, Osborne says. He recommends consulting a travel insurance specialist so that you are covered accordingly.

UNDERSTAND WHAT IS NOT COVERED IN THE POLICY It’s easy to focus on what’s included when comparing trip insurance plans. Osborne recommends paying close attention to what is excluded from coverage, too.

Case and point: I recently read about a couple who booked a return flight home after their original flight had been cancelled. When the couple filed a claim with their insurance provider to recoup this cost of this new flight, they learned that this specific scenario was not covered under the policy. (The flight was cancelled due to crew not arriving on time, and the airline was able to rebook the couple on a less-desirable flight home, which the couple declined.)

Clearly understanding the exclusions—and this could be achieved with a simple phone call to the insurance provider’s customer service—could have prevented this financial oops. BE

Find An Agent

AAA Travel Advisors can provide vacation planning guidance to make your next trip unforgettable. Find a Travel Advisor

CAREFUL RELYING ON CREDIT CARD TRAVEL INSURANCE Just as you should not rely on your U.S.-based health insurance to cover you while traveling internationally, it’s wise to not make assumptions about a credit card that offers travel insurance as one of its perks. Osborne advises reviewing the credit card’s travel insurance coverage amount; the medical coverage policy; whether all trip purchases need to be made with that credit card; and if approved claims results in a cash refund or a travel credit.

EPIDEMIC AND PANDEMIC COVERAGE IS AVAILABLE The events of 2020 turned travel on its head, and also impacted the travel insurance industry. As a result, travel insurance companies evolved and most now offer epidemic and pandemic coverage options. “Having coverage for quarantine is at the forefront of people’s minds now,” says Osborne, pointing to the out-of-pocket costs that came with many travelers having to quarantine in a vacation destination when Covid-19 was at a peak. BUDGET FOR TRAVEL INSURANCE The average cost of travel insurance is 5% – 6% of your trip costs, according to Forbes Advisors’ analysis of travel insurance rates. If you’re planning an international, bucket-list vacation—and want to protect your investment in the unfortunate event that things go sideways—it’s wise to keep this cost in mind when creating your trip budget. “As much as we don’t want to think about the unexpected, things happen and having the coverage you need when you need it can be a huge benefit,” says Osborne. “If you need it, you will never regret having it.

- facebook share

- link share Copy tooltiptextCopy1

- link share Copy tooltiptextCopy2

7 Surprising Gayborhoods for Your Next Pride Month Adventure

The Best And Worst Airports For Flight Connections

Discover the best London Restaurants, London Museums, and London Neighborhoods…in just two days!

Related articles.

What Does Cruise Insurance Cover?

Which Trusted Travel Program is Best For You?

How to Reduce the Chances Your Flight Will Be Canceled

Limited Time Offer!

Please wait....

Allianz Travel Insurance Benefits Cruisers Far Beyond Cancellation Protection

Updated : February 14, 2024

Table of Contents

- Reimbursement for cruises cut short and unplanned travel costs

- Compensation for missed port of call

- Protections for precious cargo

- Valuable benefits for medical mishaps

- Expert travel assistance 24/7

Embarking on a cruise offers a tantalizing escape, promising adventure and relaxation amidst the vast expanse of the open sea. Yet, as any seasoned traveler knows, the journey can sometimes take unexpected turns. From inclement weather disrupting meticulously planned itineraries to unforeseen medical emergencies, a cruise vacation can quickly turn from a dream vacation to a challenging ordeal.

While many travelers prioritize coverage for cruise cancellations, the horizon of protection extends far beyond mere reimbursement for interrupted voyages. Allianz Travel Insurance, in partnership with AAA , unveils a treasure trove of benefits designed to safeguard adventurers against unforeseen circumstances. Below are a few of the many ways protecting your cruise with Allianz insurance can give you peace of mind.

1. Reimbursement for cruises cut short and unplanned travel costs

While reimbursement for covered cruise cancellation is usually the most top-of-mind travel insurance benefit for a majority of cruisers, Allianz Travel Insurance offers much more value beyond that. For example, it can provide benefits in case a cruise gets interrupted for many covered reasons—including family medical emergencies back home and certain inclement weather events that were unnamed at the time the plan was purchased. Since safe cruising can be weather-dependent, this is a valuable benefit to have. It can also be extremely helpful if a traveler’s flight to their cruise embarkment is canceled or delayed, causing them to miss part of their cruise. Even if a traveler has a covered travel delay that doesn’t cause them to miss any cruise time, but does necessitate additional meals or extra accommodations while waiting for departure, travel delay benefits can reimburse them for these types of unplanned costs.

2. Compensation for missed port of call

Travelers who purchase Allianz Travel Insurance through AAA are eligible for compensation if a port of call that was on their original cruise itinerary is missed, due to unforeseen circumstances like unsafe weather conditions. Trip cancellation or interruption benefits can also be used when water levels are too high or too low for a cruise to proceed with its scheduled itinerary.

3. Protections for precious cargo

Insured travelers can also feel more secure knowing they have protection for lost, stolen, damaged or delayed personal belongings—meaning they can be reimbursed for replacement items they need to buy if something happens to their belongings while traveling.

4. Valuable benefits for medical mishaps

Another important reason to protect a cruise with Allianz Travel Insurance is the emergency medical benefit and the emergency medical transportation benefit, which can save travelers thousands if they have a medical emergency—whether traveling domestically or internationally. The emergency medical transportation benefit can pay for a ground or air ambulance to the nearest appropriate medical facility, having a loved one transported to the insured traveler’s bedside and for transportation back home after such an event.

5. Expert travel assistance 24/7

Whether or not a cruiser has an emergency while traveling, Allianz Travel Insurance gives them access to round-the-clock expert travel assistance that can support them through most any travel challenge—like replacing a lost passport or forgotten prescription, providing translation services, following up on medical care and much more.

Start planning your next cruise or vacation with more peace of mind. Ask your AAA travel advisor for details on Allianz Travel Insurance plans available through AAA—even if you’ve already booked.

________________________________________________________________________________________________________________________________________

Terms, conditions, and exclusions apply. Availability of specific benefits and covered reasons described here varies by product and by state. Products may not include all benefits or covered reasons described here. See your plan for details on what your plan includes. Benefits may not cover the full cost of your loss. All benefits are subject to maximum limits of liability, which may in some cases be subject to sublimits and daily maximums. Be sure to review your plan carefully to understand what limits apply to your plan. Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance, TravelSmart, and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through Allianz Global Assistance. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233.

More Articles

Travel like an expert with aaa and trip canvas, get ideas from the pros.

As one of the largest travel agencies in North America, we have a wealth of recommendations to share! Browse our articles and videos for inspiration, or dive right in with preplanned AAA Road Trips, cruises and vacation tours.

Build and Research Your Options

Save and organize every aspect of your trip including cruises, hotels, activities, transportation and more. Book hotels confidently using our AAA Diamond Designations and verified reviews.

Book Everything in One Place

From cruises to day tours, buy all parts of your vacation in one transaction, or work with our nationwide network of AAA Travel Agents to secure the trip of your dreams!

7 Services AAA Offers That You Might Have Not Known About

The American Automobile Association, or AAA, was founded in 1902 when nine of the nation's 50 existing motor vehicle clubs joined forces in Chicago. At the time, there were only about 23,000 cars on the road, but the Journal of Consumer Research says that number has since ballooned to more than 283,000. To keep up with the growth in the domestic auto market, AAA vastly increased its services. Initially, the organization's focus was on lobbying for improvements to roads that had been designed for the horse and buggy, and AAA's efforts helped spur the federal government to provide funds for highways beginning in 1916.

The year before, AAA began offering its members roadside assistance in the event of a breakdown, and that service continues at the core of its operations more than a century later. AAA's 32 nationwide clubs average about a million calls for help each year, along with several other services that can help make your driving experience less stressful.

Maps and TripTik

AAA's first published printed map was of the streets of Staten Island, New York, and was issued in 1905, and a state map of New York was offered in 1911. That same year, the organization issued its first strip map, outlining the route from New York to Jacksonville, Florida. That map was the precursor to AAA's TripTik customized trip planner, which the company established as a trademark in 1932. AAA still provides paper maps to members free of charge and will assemble a spiral-bound TripTik, especially for your intended route, which helps you avoid frustrating map-folding origami challenges when you just want to get to the next roadside attraction.

Mapping and navigation apps for Android smartphones and iPhones are plentiful but put you at the mercy of cell phone signal availability, which can be spotty in rural and mountainous areas. AAA's paper maps may seem primitive in the age of digital everything, but they still are more enjoyable to spread out with on a hotel bed mid-trip than even the largest smartphones or tablets. If you insist on digital maps, AAA has an online map gallery and TripTik planning tool.

Repair shop recommendations

Predicting the cost of auto repairs can be tricky , and determining when a mechanic is taking advantage of you is difficult, too. When your car breaks down, AAA can recommend a shop from its network of more than 8,000 facilities, giving you the assurance that you are in good (albeit greasy) hands until you're back on the road.

AAA members get a 10% discount up to $50 on repairs performed at approved shops, along with a free diagnosis and estimate, which will be provided within one hour if you've been towed to the shop by AAA. Repairs done at an AAA-approved shop are covered by a two-year, 24,000-mile warranty on parts and labor, and if you've performed our array of simple tests for a dead battery and determined that's what you're facing, AAA will come to you to do a more scientific check and replace the battery if necessary.

For more than 50 years, AAA has provided car insurance in 23 states and the District of Columbia via the California State Automobile Association (CSAA), a branch of AAA's Automobile Club of California. The CSAA works with authorized providers in other states and can provide quotes online, over the phone, or at one of its 1,000-plus offices around the country.

You must be an AAA member to buy insurance through the club, but membership entitles you to a discount. You can also get a reduced rate on AAA insurance if you bundle other types of insurance with your auto plan. AAA provides life insurance, policies for homeowners and renters, business and travel insurance, and even coverage for routine health and emergency medical care for pets.

AAA also provides umbrella coverage, which protects you if claims exceed the limits of your base insurance policies. If you're planning a wedding, you can even buy a policy that protects guests if they suffer injuries during your ceremony or reception and helps you recover costs in the event of inclement weather, illness, or a vendor that fails to provide adequate service.

Financial services

AAA has evolved from a strictly auto-focused organization to one that provides a wide range of financial services, most of which have nothing to do with car travel. They do offer auto financing through two partner credit unions, and some buyers will qualify for interest rates as low as 5.5% and won't have to make a payment for the first 90 days of ownership. AAA also teams with College Ave to help secure student loans for its members and offers them a 2% reduction in the principal amount upon graduation and a .25% interest rate discount. AAA also offers several other banking-related services, like credit cards, CDs, and interest-bearing money market accounts.

You can get credit counseling and student loan consolidation services from AAA via Cambridge Credit Counseling if you've overextended your borrowing capabilities, and AAA partners with Vanguard to offer personal investment counseling and TaxAct to help you file your returns on time. If you are one of the 40 million Americans who had their personal information exposed in 2023 through data breaches or system glitches like the one that affected T-Mobile customers in September , AAA provides identity theft protection through ProtectMyID.

Travel services

AAA can also help you make travel plans that don't involve driving. You can book flights, hotels, vacation rentals, tours, cruises, and train tickets through AAA's Club Alliance service. If you plan to travel abroad, you can have new passport photos taken at many AAA locations without an appointment, and discounts with RushMyPassport are available for members if you need a new or renewed passport quickly.

You can also purchase travel insurance from Allianz via AAA, which will protect you in case of a medical emergency or last-minute trip cancellation. AAA also provides exchange services for over 80 different global currencies. You can order online and have it shipped securely to your home or workplace, or visit an AAA office to place your order and pick it up. Many exchanges can be completed in one business day, but AAA advises allowing at least three days when converting currency with them.

Driver education

AAA also provides a range of driver's education and enrichment services, whether you're a new driver preparing for your first driving test or are a more experienced driver seeking to earn a discount on your insurance for completing a safe driving course. AAA's online course can also help you get violation points removed from your license, and three branches of the U.S. military use AAA's driver enrichment program that teaches how to drive safely in hazardous conditions and react to other drivers when they behave in an unpredictable way.

AAA also offers on-the-road training with certified instructors in cars specially equipped for driving lessons. Experienced drivers can sign up for a skills assessment and consultation with one of AAA's instructors. For older drivers, AAA offers its Roadwise program, which teaches seniors how to safely adapt to the challenges of getting older, including minimizing risk factors and improving driving skills. According to AAA's website , this "robust curriculum also addresses the top-5 causes of senior crashes and provides useful tips, proven methods, and practical knowledge for seniors to use while driving."

An AAA membership can also help you save money while going about your daily routine or shopping for gifts. The long list of discounts available to AAA members includes savings on clothing, dining, groceries, meal delivery, electronics and home appliances, office supplies, furniture, and more.

You can easily accumulate enough discounts in a year to cover the cost of an AAA classic membership. However, the yearly membership fee varies by location but ranges from roughly $38 to $164 for a single driver. Just buying an AI-powered Samsung Galaxy S24 Ultra with the 30% AAA member discount will save you nearly $400, enough to enroll your entire family for a year in many places.

Other valuable discounts include the ability to buy Disney's four-park Magic Ticket for as little as $92 per person and price breaks on touring stage productions like "Hamilton," "Les Miserables," and "The Lion King." Sports fans aren't left out either: AAA members can buy tickets to New York Yankees home games for as much as half off, get preferred pricing at many NHL hockey arenas, and even save on tickets for the ongoing March Madness NCAA men's basketball tournament.

Explore Odintsovo

Plan Your Trip to Odintsovo: Best of Odintsovo Tourism

Essential odintsovo.

Odintsovo Is Great For

Eat & drink

- Park Inn by Radisson Odintsovo

- Hotel Mgimo

- Boutique Hotel Zagorodnyy Ochag

- Aparthotel NEP Dubki

- Korchma Taras Bulba

- Church of the Icon of the Mother of God Soothe My Sorrows

- Ruki VVerkh! Bar

- Jungle Kids

- Odintsovo Museum of History and Local Lore

COMMENTS

Contact AGA Service Company at 800-254-8300 or 9950 Mayland Drive, Richmond, VA 23233, or [email protected]. Whether you're traveling internationally or within the United States, AAA members have access to travel insurance which could help with non-refundable costs if you have to cancel your trip.

Find Agent Call 877.721.3977. Terms, conditions, and exclusions apply. Benefits/Coverage may vary by state, and sublimits may apply. Refer to your plan for restrictions and full details. Insurance coverage is underwritten by BCS Insurance Company, rated A- (Excellent) by A.M. Best Co., under BCS Form No. 52.201 or 52.401, or Jefferson Insurance ...

The cost of a travel insurance policy depends on many factors, including the trip length, your state of residence and how much coverage you'd like. Our sample search for a $3,000 two-week trip ...

If you have any medical- or travel-related issues during your trip, call Allianz Global at (866) 884-3556 and mention your AAA travel insurance policy to get help with your problem. AAA Travel ...

Fill out our online form or call us at (800) 222-7448. *Terms, conditions, and exclusions apply. Insurance benefits underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured's state of residence. AGA Service Company is the licensed producer and administrator of these plans.

Here are nine reasons why experienced travelers choose Allianz Travel Insurance through AAA:* 1. Life is unpredictable. Some trips need to be cancelled. With travel insurance, you don't necessarily have to pay for a trip you are unable to take. Instead, enjoy more confidence knowing you're a step ahead of unpredictable situations before and ...

Free Hertz Gold Plus Rewards Membership. Free Best Western Rewards Membership. Discounted Passport Photos. Join AAA. Premier Members Also Receive: Up to $1,500 Trip Interruption and Delay coverage. Up to $500 in Lost Baggage coverage. Up to $300,000 Travel Accident Insurance. Up to $25,000 in Emergency Medical Transportation coverage.

AAA Benefits. With a TripProtect plan* from Allianz Global Assistance, you can relax before and during your trips. Travel Vaccine Coverage: You received immunizations required for entry into your destination and cancel your trip for a covered reason under Trip Cancellation. Lost/Stolen Document Replacement Fees: Costs you incur for the document ...

The biggest benefits include: Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even before you step on that plane, train, or cruise ship. "Often I get calls from travelers who didn't expect to need insurance and then have a [medical] diagnosis before travel that prevents them from going," Osborne says.

Plans include insurance benefits and assistance services. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected]. Keep reading in: Safe Travel Advice, Travel Insurance. Whether you're jetting around the globe or driving cross-country, a dream vacation is a big investment.

Trip Cancellation. As more travelers purchase travel insurance, surveys show that one of the main reasons they do so is in case something comes up and they have to cancel their trip. Illness, accidents, family emergencies, the loss of a job—all can result in forfeiting non-refundable booking fees if you need to change your travel plans at the ...

Travel insurance. A vacation can be a huge expense and Allianz Travel Insurance plans 7 from AAA can help protect you, your loved ones, and your investment. Travel with confidence knowing you have award-winning 24/7 support and protection from Allianz to help you manage any unforeseen issues that may occur before or during your trip.

Learn how travel insurance through AAA can help give you peace of mind while you explore the world. Call your local AAA Office today at 1-800-222-1469. Whether you're jetting around the globe or driving cross-country, a dream vacation is a big investment. Travel insurance can help you protect it.

AAA offers roadside assistance, travel, insurance, automotive & banking services. Explore 2023 exclusive savings & discounts. ... Consider it your one-stop, full-service travel agency, serving AAA Members and non-members. Services include: Personalized counseling and trip planning for cruises, tours and all your travel plans;

1. Reimbursement for cruises cut short and unplanned travel costs. While reimbursement for covered cruise cancellation is usually the most top-of-mind travel insurance benefit for a majority of cruisers, Allianz Travel Insurance offers much more value beyond that. For example, it can provide benefits in case a cruise gets interrupted for many ...

Auto Insurance. Homeowners Insurance. Life Insurance. Renters Insurance. Pet Insurance. All Products. Ready to chat with an agent? Call: 888-406-0599.

You can also purchase travel insurance from Allianz via AAA, which will protect you in case of a medical emergency or last-minute trip cancellation. AAA also provides exchange services for over 80 ...

AAA road trip resources. No one knows road trips better than AAA. For more than 100 years, AAA Travel has been helping members get where they want to go—from weekend getaways to cross-country road trips. Check out our valuable planning tools and resources, member discounts on car rentals, hotel stays, and other travel services.

Prices are per person based on double occupancy. $500 single supplement. Travel insurance is mandatory. Get ready to sip, savor and repeat as we explore some of the best wineries along the Monticello Wine Trail (recently named Wine Region of the Year by Wine Enthusiast) in Charlottesville, Virginia. Explore AAA Vacations®.

Moscow Travel Forum Moscow Photos Moscow Map All Moscow Hotels; Moscow Hotel Deals; Skip to main content. Discover. Trips. Review. USD. Sign in ...

Travel Insurance; Travel Events; AAA Travel Store; travel. main_nav_travel Book a hotel. Destination . Check in: Check out: ... Essential coverage is included free with every AAA membership! Upgrade to Deluxe or Platinum for added features help you protect your identity.

In addition to our standard services, Grand Russia offers tours packages to Moscow and St Petersburg. You cannot resist our Two Hearts of Russia (7 Days &6 Nights), Golden Moscow (4 Days &3 Nights), Sochi (3 Days & 2 Nights), Golden Ring (1 Day & 2 Days), and many more. As a leading travel agency specializing in the tour to Russia and Former ...

Richard and Greg Davies clash with army tanks and head into space in the Russian capital. To watch the full episode click here http://www.channel4.com/progra...

A mix of the charming, modern, and tried and true. See all. Park Inn by Radisson Odintsovo. 217. from $66/night. Boutique Hotel Zagorodnyy Ochag. 9. from $44/night. Hotel Mgimo.