- About Dunedin

- Accommodation

- Entry requirements

- Fees and scholarships

- Key dates for applications

- Prepare to enrol

- Connect with us

- International students

- Postgraduate

- PHD programme

- Summer school

Are you looking for...

- Health Sciences First Year

- University of Otago, Christchurch

- University of Otago, Wellington

- Departments and schools

- Subjects and papers

- Qualifications

- Continuing education

- Distance learning

- Student exchange

- Academic integrity

- Scholarships

- Student grievances

- University communications

- Entrance requirements

- Planning your degree

- Terminology

- Diploma for graduates

- Graduate research

- Research Masters

- Student Learning Development

- Academic Key Dates

- Course Advice

- Services and Support

- DVC's welcome

- Our people at Research and Enterprise

- Research collaboration

- Research strengths

- Research highlights

- Research consultation with Māori

- Pacific Research Protocol

- About Performance-Based Research Fund

- Facilities and special collections

- Applying for research funding

- Funding opportunities

- Graduate Research School

- Library services for research

- Research masters'

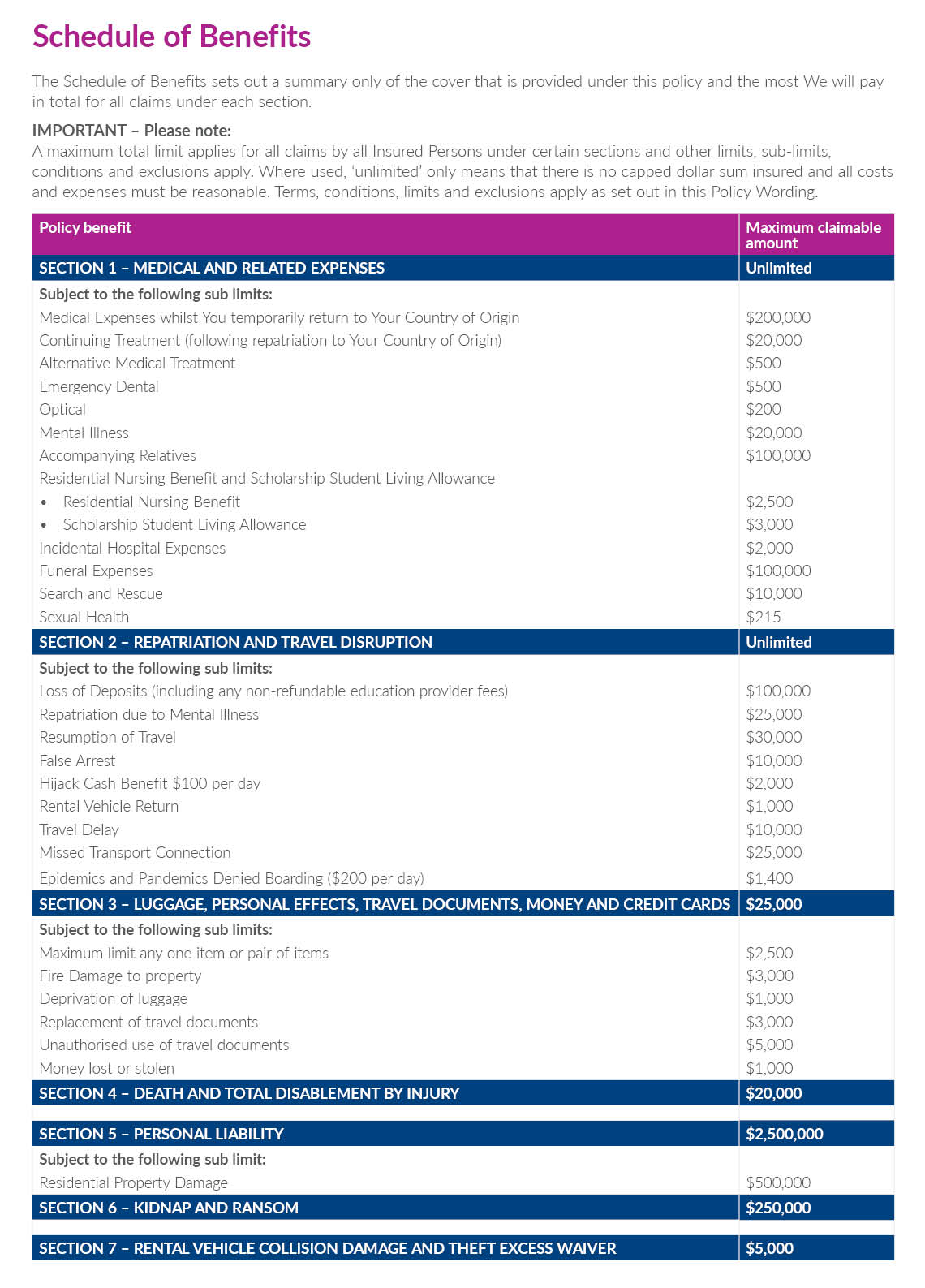

University of Otago International Student Medical and Travel Insurance

- Post author: Botswana

- Post published: January 18, 2019

- Post category: University of Otago / University of Otago Admissions

Medical and Travel Insurance

You will be charged for the insurance policy Studentsafe Inbound University unless you have been advised by the University of Otago that your alternative insurance policy is compliant. Applying for insurance cover is easy; accept your offer of place in eVision then complete the insurance declaration under ‘Information required for 2018 study’ during the Course Enrolment process. Alternative polices need to be submitted for assessment six weeks before the semester starts. You can pay your insurance premium when you arrive on campus, your invoice will become available on the ‘My Account’ page of your eVision portal. There is no application form to complete unless: you have a pre-existing condition; you are over 60 years old; you wish to have a family member(s) included on your policy. You do not need to provide evidence of your insurance policy with your student visa application, however, you are required to declare in your application that you will arrange and hold insurance which the University of Otago considers acceptable.

Insurance for international students

The New Zealand Government’s Code of Practice for Pastoral Care of International Students requires all international students to have appropriate medical and travel insurance during their period of study.

It is the University of Otago’s responsibility under the Code to ensure all enrolled international students have compliant medical and travel insurance.

Our recommended insurance

Studentsafe Inbound University is our recommended insurance policy. This is a comprehensive insurance policy designed and supported by all the universities in New Zealand.

All international students will be charged for this insurance policy unless you have had confirmation from the University of Otago that your alternative insurance policy is compliant.

How do I apply?

Once you have accepted your offer of place the Course Enrolment steps in eVision will become available. You will need to select what insurance policy type you would like (individual, couple, or family) during the ‘Information required for 2018’ step. Once this is completed an insurance record will be created.

An invoice for your insurance will be added to your ‘My Account’ in eVision. Depending on when you start studying at Otago, this may take several weeks to show on your account.

There is no application form to complete unless you have a pre-existing condition, you are over 60 years of age, and/or you wish to include your partner and/or children in your policy.

Your cover under Studentsafe Inbound University will start 31 days before classes begin so you’re you are covered for your journey to New Zealand if your travel plans correspond with this timeframe. You do not have to pay for your insurance until you get here and finalise your enrolment. If you want to you can choose to pay for your insurance at the same time you pay your fees before you arrive.

How much does it cost?

The 2018 academic year premiums for international student health and travel insurance are as follows:

Individual options: Summer School only: NZ$104.00 One Semester: NZ$310.00 One Year: NZ$620.00

Couple options: Student plus partner OR student plus one child: Summer School only: NZ$207.00 One Semester: NZ$620.00 One Year: NZ$1,240.00

Family Options: Student plus two or more family members Summer School only: NZ$259.00 One Semester: NZ$775.00 One Year: NZ$1,550.00

If your family is coming with you to New Zealand read this information on family cover requirements .

What you are covered for and what you are not covered for?

It is your responsibility as a student to understand and become familiar with the insurance policy terms and conditions. All Policy documentation and forms are available at the International Office.

Below are some examples of what you are not covered for:

*If you have paid the annual premium the insurer will pay for one sexual health consultation per calendar year. In addition they will pay up to NZ$45 for any prescription required following the consultation. The consultation must be through the University of Otago Student Health Services. You will have to pay for the consultation and prescription then make a claim to be reimbursed. The claim must be made within 31 days of the consultation.

Pre-existing conditions

You are not covered for pre-existing conditions under the Studentsafe Inbound University policy. Cover can be arranged in certain circumstances.

If you have a pre-existing condition or have had a medical procedure in the past, we recommend you submit a Medical Risk Assessment Form before you travel or start your programme and send it to [email protected]

If the insurer accepts your cover, an additional premium may be charged. Please ensure you understand the conditions of acceptance.

What is a pre-existing condition?

Any medical or physical condition:

- which you were aware of, or ought to have been aware of

- for which advice, care, treatment, medication or medical attention had been sought, given or recommended

- which has been diagnosed as a medical condition, or a sickness or which are indicative of a sickness

- which is of such a nature to require, or which potentially may require medical attention

- which is of such a nature as would have caused a prudent, reasonable person to seek medical attention prior to the start of cover under this policy

- procedure or surgery in the past even if you are no longer affected by this condition

What happens if the cover is declined or I don’t apply for cover of my pre-existing condition?

- We strongly recommend you arrange insurance from your home country that will cover you for any treatment you receive in New Zealand for your pre-existing condition; or

- You need to understand you will have to pay for all treatment you receive in New Zealand for your pre-existing condition.

While your condition might currently be stable and/or you might not be receiving medical care at home, this could change quickly in New Zealand, especially in a new environment.

It’s important that you understand that medical treatment in New Zealand for international students, including PhD Students , is expensive and not subsidised . For example, an appointment with a Doctor (GP) at Student Health is currently (NZD) $75 and prescription costs are in addition to this. One night in hospital is in excess of (NZD) $1,000.

Can I bring medicines into New Zealand?

In certain cases yes but restrictions apply. More information is available from Medsafe .

Alternative insurance policies

The following alternative insurance policies have been assessed and are compliant for studying at the University of Otago:

- Southern Cross International Student

- Uni-Care NZ Student Plan

- Orbit Protect Prime

If you choose one of these policies you will need to:

- organise your cover before you arrive in New Zealand;

- ensure it covers you for the whole period of enrolment, including travel to and from New Zealand;

- email a copy of your policy certificate to the insurance administrator before the semester begins.

If your alternative insurance policy is not listed above you must apply to have your cover assessed at least six weeks before the semester starts. If you submit your application later than this you will be liable to pay for Studentsafe Inbound University.

How to get an alternative policy assessed Please check that your policy meets the minimum cover requirements outlined in the insurance checklist document before you submit it for approval. To get your alternative policy assessed you will need to email the full policy wording and schedule of benefits in English to the insurance administrator at least six weeks before the semester starts. You are advised not to purchase an alternative policy until the University has notified you that it is Code compliant. The policy will then be sent to our independent broker for assessment. If your policy: is approved – we will let you know and request you to email the certificate of insurance to the insurance administrator before the semester begins; is not approved – the decision is final and you will be required to take out the Studentsafe Inbound University insurance policy or one of the compliant New Zealand based policies.

How do I make a claim?

If you need to make a claim, download a claim form and complete it in full. We recommend you scan and email your completed claim form together with your receipts and supporting information to [email protected] . Alternatively you can post the claim to Studentsafe, PO Box 33313, Auckland 0740, we recommend you keep a copy of what you send for your own records.

In support of your claim you need to provide as much information as possible such as doctor’s notes and receipts. For lost, stolen or damaged items the claim needs to be supported by evidence of ownership, such as receipts, bank statements, photos of the items. If these are not available the insurer will consider the claim at their discretion.

Understand when a claim excess and/or depreciation will apply by reading the Studentsafe Inbound University insurance policy wording .

More information on claims

Student Health Services

Student Health Services is a team of health professionals on campus including doctors, nurses and counsellors committed to your overall well-being during your life as a student. For more information about the full range of services and costs please refer to Student Health .

If you need to see a doctor for a condition that is not covered by your insurance policy, you will need to pay the Student Health for your appointment and any associated pharmacy / laboratory costs.

Prescriptions If you are prescribed medication from a Doctor at Student Health for a condition that is covered under your policy, the following pharmacies in Dunedin offer Direct Billing, meaning you will not have to pay for the prescription:

- Knox Pharmacy, on the corner of George and Frederick Street

- Urgent Pharmacy, 95 Hanover Street

- Dunedin North Pharmacy, 15 St David Street

- Albany Street Pharmacy, 27 Albany Street

If you take the prescription to any other pharmacy or have a prescription from any other medical centre, you will be required to pay for the medication and submit a claim form to be reimbursed.

Insurance for your family

You can also insure your family under your Studentsafe Inbound University policy if they will be coming to New Zealand with you. A couple policy includes the student plus a partner or one child. A family policy includes the student plus two or more family members.

If you wish to purchase the couple or family option, please select the relevant policy during course enrolment in eVision, then complete a family member application form and email it to the insurance administrator .

Your family are unable to go to Student Health. Once you are settled in Dunedin, it is best you register your family with a medical centre near to your home, workplace or children’s schools. If you haven’t yet registered them with a medical centre you can take your family to Dunedin Urgent Doctors between the hours of 8am and 10pm. In an emergency call 111.

When your family visit the Doctor they will need to pay for the consultation and any medication prescribed. To be reimbursed for these costs a claim form needs to be completed and submitted.

Cover for your children If your children are enrolled as international students at a New Zealand school, they’ll need to have insurance. Studentsafe Inbound University family insurance is an easy and affordable way of making sure you and your children have appropriate cover.

PhD Students

When you begin your PhD you will be charged for insurance from the month that you start until 31 December that year. Once you arrive on campus your insurance record is created, then an invoice will be added to your account. The following year you will be charged an insurance premium for 12 months from 1 January until 31 December.

Important Note : If you choose to cancel your insurance policy while you are on deferral or overseas research and then resume your insurance cover when you return, it will be considered a new policy. This means that any medical conditions you received treatment for under the original policy will then be considered pre-existing condition and will not be covered under the new policy.

If you return to your country of origin to undertake study or research for a period not exceeding 180 days, your Studentsafe Inbound University policy provides you with limited cover during this period as long as you are intending on returning to New Zealand to continue your studies. If you are required to attend a conference or undertake overseas research in another country your Studentsafe Inbound University will not provide you with sufficient cover. There is an insurance package Studentsafe Outbound which is designed specifically for students who are required to study offshore for part of their studies which you may wish to consider purchasing.

Please contact the insurance administrator for advice before you travel.

Further information

You can contact Studentsafe on 0800 486 004 or read the answers to FAQ’s .

The University of Otago insurance administrator is also available for help you with any questions you may have. Office opening hours are Monday to Friday between 10.00am and 4.00pm.

International Office University of Otago Archway West Building 90 Union Place East Dunedin 9016 Tel: 64 3 479 8582 Fax: 64 3 479 8367

Disclaimer information

The University of Otago strongly recommends students read the Studentsafe policy wording carefully. Take particular note of exclusions. It is the student’s responsibility to become familiar with the level of cover and the refund conditions offered by the insurance.

- The University of Otago takes no responsibility for misunderstandings over insurance contents and conditions or for medical and travel costs not covered by insurance or for the activities of the insurance companies involved.

See Also: University of Otago Admissions

Related posts:.

You Might Also Like

University of otagouni schedule, university of otago admission from an overseas secondary school, university of otago international students.

- https://twitter.com/OPSAotago

- https://www.facebook.com/OtagoPolytechnicStudentsAssociation

- https://www.instagram.com/opsa.org.nz

Student Insurance

Domestic students.

- Select Language

- Travel Alerts

- Studentsafe

- Workersafe/Seasonsafe

- Explorersafe

Studentsafe Inbound University

Studentsafe inbound learners, studentsafe inbound young learners, studentsafe domestic, studentsafe outbound.

- Explorersafe Outbound

- Explorersafe Inbound

- Workersafe Outbound

- Workersafe Inbound

- Seasonsafe Inbound

Policy Finder

What policies are you eligible for.

Answer our simple questions to get started

The Studentsafe Outbound policy provides travel insurance cover to New Zealand residents, citizens and student visa holders who are leaving New Zealand temporarily for study.

The Studentsafe Inbound University policy provides travel insurance cover for international students studying at a University in New Zealand.

Our Studentsafe Inbound Learners policies are designed for international students studying at a New Zealand tertiary institution that is not a university.

Our Studentsafe Inbound Young Learners policies are designed for students attending a New Zealand primary school, intermediate or high school.

Studentsafe Domestic is a travel insurance policy designed for New Zealand residents or citizens living and studying away from home within New Zealand.

Congratulations! You’ve made the decision to study overseas.

Studying abroad, or even within New Zealand if you are a New Zealander, is an exciting adventure. But like all adventures, this comes with some level of risk. That’s why it’s important to make sure you have your medical and travel insurance under control. If you are coming to New Zealand, you’ll also need medical cover to qualify for an international student visa. Use the Policy Finder to narrow your policy search, or click on each policy to learn more about the policy and to get a quote.

Studying in New Zealand: Luckily if you’re an international student who’s been accepted to study at a New Zealand University, your Studentsafe Inbound University policy is offered as part of your enrolment process. If you are not an international student or you are studying at a different educational provider, we can still provide you with a policy.

Studying outside of New Zealand: If you are currently residing in New Zealand and wishing to study overseas, you might be interested in our Studentsafe Outbound policy.

Covid-19 Benefits Guide

Scams and scammers, taking care of your sexual health.

If you’re reading this article, you’ve already made a sensible choice. If you’re in a new relationship, or thinking about starting to date, it’s important to think about how you can ensure that you and your partner stay safe when you’re having a little extra ‘fun’.

So read on to learn more about what steps you should be taking to keep safe. The consequences can range from irritating to life-threatening – and that isn’t a gamble anyone should take.

STI protection

The best ways to escape the kiwi winter, escape the kiwi winter – discovering the pacific and australia.

Unless you’re really into skiing, winter in New Zealand isn’t really the most exciting time of year. It’s not cold enough for there to be pretty snow falling in the cities, but it’s still cold enough that you don’t want to spend time outside unless you have to. Instead of snow, we mostly get rain and wind. It’s certainly not terrible – but it does give you a good excuse to go somewhere sunny if you have the time and budge

Reverse Culture Shock

Your responsibilities, flatting on a budget, keeping safe and healthy, how to make friends, finding a place to call home, insurancesafenz newsletter.

Subscribe to our free email newsletter and stay connected with useful tips and information on studying, travelling and working overseas.

Need more information?

Find answers to your important questions

Need to contact us?

24/7 claims emergency assistance.

Worldwide +64 9 488 1638

Claims, Sales and General Enquiries

Phone: +64 9 488 1638 Toll Free: 0800 486 004

The Studentsafe Inbound University policy provides travel insurance cover for International students studying at a University in New Zealand. All international students studying in New Zealand are required, by the ' Code of Practice for the Pastoral Care of International Students ', to have medical, travel and other insurance cover for the duration of their study.

If you are an international student whose enrolment at a New Zealand university has been accepted, you could be eligible to be covered under this policy.

Policy Eligibility

You are eligible for the Studentsafe Inbound University Policy if you are;

- A non-New Zealand citizen or resident, who studies at a New Zealand University and temporarily resides in New Zealand.

Family members can also be covered under the Studentsafe Inbound University policy. A Family Application Form will need to be completed and an additional premium for the family or couple will be payable to the University. Acceptance is subject to Allianz Partners approval.

Click here to download a Family Application Form.

If you have purchased a policy prior to 1 January 2021 and you are looking for your Policy Wording or have any queries please contact us on 0800 486 004.

Record of cover

We will send you a Record of Cover electronically when your student records are sent to us by the University. The Record of Cover will include specific information about your policy including your period of cover. We recommend that you store this in a safe place. You can also contact us to request this information earlier.

Policy Claims Excess

The Studentsafe Inbound University policy includes an excess of $200 for baggage and portable computers or sporting equipment. Terms, conditions, limits and exclusions apply. Please refer to the Policy Wording for detailed terms of cover.

Pre-existing Medical Conditions

The Studentsafe Inbound University policy does not automatically cover Pre-existing Medical Condition. A Pre-existing Medical Condition is a medical or physical condition that you had before you enrolled in the plan and can extend to Pre-existing Medical Condition(s) you were aware of but did not seek treatment for. Cover can be arranged in certain circumstances by completing a medical assessment form. An additional premium will be charged if we agree to provide cover.

Click here to download a Medical Assessment form.

Specified High Value Items

For any baggage items that are worth more than the policy item limit of $2,500 you can extend the cover and specify the item on your policy. An additional premium will be charged to specify an item and you should insure it for the indemnity or current value of the item.

Click here to download a Specified High Value Items Form

Campus Health Centre List

If you are a Studentsafe Inbound University policyholder and you attend your Campus Health Centre, you may be eligible to have your consultation fees paid by us without paying the centre or completing a claim form .

- University of Auckland

- University of Waikato

- Auckland University of Technology (AUT)

- Massey University - Albany

- Massey University -Palmerston North

- Massey University - Wellington

- Victoria University of Wellington

- University of Canterbury

- Lincoln University

- University of Otago

Find out more about Studentsafe Inbound University for the following universities:

- Massey University

Making a claim

To learn more about how to make a claim, visit the claims page on this website.

Answer our simple questions to get started.

01 what is the reason for your travel, 02 what country will you be travelling to, 03 where will your travel start from, 04 where will you study in new zealand, travelling from, travelling to, travel start date, travel end date, number of adults, number of dependant children, age of adults, month .

InsurancesafeNZ travel insurance is issued and managed by AWP Services New Zealand Limited trading as Allianz Partners and underwritten by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia), ("Hollard"). You should consider the Policy Wording before making any decisions about this travel insurance policy. Terms, conditions, limits, sub-limits and exclusions apply.

The Hollard Insurance Company Pty Limited – Financial Strength Rating and Overseas Policyholder Preference Disclosure Notice

The Hollard Insurance Company Pty Ltd has a financial strength rating of A (Strong) issued by Standard and Poor's. The Standard & Poor's rating scale is:

The rating may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. The rating scale above is in summary form. A full description of this rating scale can be obtained from www.standardandpoors.com .

An overseas policyholder preference applies. Under Australian law, if The Hollard Insurance Company Pty Ltd is wound up, its assets in Australia must be applied to its Australian liabilities before they can be applied to overseas liabilities. To this extent, New Zealand policyholders may not be able to rely on The Hollard Insurance Company Pty Ltd’s Australian assets to satisfy New Zealand liabilities.

Allianz Partners website

- MyAucklandUni

- Student Services Online

- Class search

- Student email

- Change my password

- MyCDES+ (job board)

- Course outlines

- Learning essentials

- Libraries and Learning Services

- Forms, policies and guidelines

- New students

- Enrol in courses

- Campus card

- Postgraduate students

- Summer school

- AskAuckland

- Student Hubs

- Student IT Hub

- Student Health and Counselling

- Harassment, bullying, sexual assault and other violence

- Complaints and incidents

- Career Development and Employability Services (CDES)

- Ratonga Hauātanga Tauira | Student Disability Services (SDS)

- Rainbow support

- Covid-19 information for our community

- Emergency information

- Report concerns, incidents and hazards

- Health and safety topics

- Staff email

- Staff intranet

- ResearchHub

- PeopleSoft HR

- Forms register

- Careers at the University

- Education Office

- Early childhood centres

- University Calendar

- Opportunities

- Update your details

- Make a donation

- Publications

- Photo galleries

- Video and audio

- Career services

- Virtual Book Club

- Library services

- Alumni benefits

- Office contact details

- Alumni and friends on social media

- No events scheduled for today You have no more events scheduled for today

- Next event:

- Show {0} earlier events Show {0} earlier event

- Event_Time Event_Name Event_Description

- My Library Account

- Change Password

- Edit Profile

- My GPA Grade Point Average About your GPA GPA not available Why can't I see my GPA?

- My Progress

- Points Required Completed points My Progress Progress not available All done!

- Student hubs

- Health and counselling

- All support

- Health, safety and well-being

Breadcrumbs List.

- Ngā tauira | Students

- Student support

- Personal support

- International student support

- You are currently on: Health and travel insurance page. Open sub navigation overlay.

Health and travel insurance

Insurance at the University of Auckland

Studentsafe university policy, family insurance, insurance waivers, making an insurance claim.

- Pre-existing medical conditions

- Change in circumstances

Travelling overseas

All international students must have health and travel insurance while studying in New Zealand. These guidelines apply to international students only.

Find out detailed information on the University's insurance policy for international students.

You may be eligible for an insurance waiver if you already have an alternative insurance policy.

Follow these simple steps to lodge a Studentsafe Inbound insurance claim.

Learn more about adding your family to your Studentsafe Inbound University insurance policy.

Changes in circumstance

What to do if your circumstances change during the period of your insurance.

Find out more about getting insurance cover for travel outside New Zealand during your studies.

Jump to section...

This dialog can be closed by pressing Escape close button .

- Services A-Z

- Knowledge Base

- KA-10001456

Insurance for international students

Compliance with the New Zealand Government's Education Pastoral Care of Tertiary and International Learners Code of Practice 2021 mandates that all international students at the University of Otago possess appropriate travel and medical insurance throughout their studies.

Upon enrolment, you will be automatically included in the Studentsafe Inbound University insurance policy. Ensure you read the policy carefully for details.

For enquiries and assistance, email: [email protected]

The policy does not cover pre-existing conditions, but arrangements can be made under certain circumstances. If you require cover for pre-existing conditions, submit a Medical Risk Assessment Form to: [email protected] before travelling or starting your programme.

The policy becomes effective 31 days before classes commence, providing coverage for the journey to New Zealand within this timeframe. Check the policy for end dates.

You can arrange your own insurance policy if you prefer. You must organise coverage before arriving in New Zealand, ensuring it covers the entire enrolment period, including travel. Email a copy of the policy certificate to: [email protected] at least six weeks before the semester begins.

Late applications may result in liability for payment of Studentsafe Inbound University.

Further information

- InsurancesafeNZ — policy information

- International — Medical and Travel Insurance

Related Articles (3)

The AskOtago team can help you find what you’re after.

When should I arrange my travel insurance?

You should organise your international travel insurance as soon as you have booked your air tickets.

This will ensure that you are covered for any unexpected events that mat affect your travel arrangements prior to travel.

TOP FIVE FAQs

- What is the University's Bank Account and Swift Code Details?

- How do I book international air travel?

- How can I arrange travel insurance?

- How do I find an Account Code within Finance One?

COMMENTS

University travel insurance is required. In booking this insurance, please be advised that: While travel insurance currently covers medical costs arising from COVID 19, non-medical disruption insurance only covers up to $200 per day with a maximum of $1,400 total (ie. If the traveller is delayed or required to isolate due to COVID 19 at some ...

Information about medical and travel insurance, student health services and alternative insurance policies for international students at the University of Otago. ... It is the student's responsibility to become familiar with the level of cover and the refund conditions offered by the insurance. The University of Otago takes no responsibility ...

Selected Cover for Epidemic and Pandemic Diseases Corporate Premier Travel Insurance - University Collective, 15 March 2022. These FAQs relate to selected cover for epidemic and pandemic diseases under Corporate Premier Travel Insurance. Terms, conditions, limits, sub-limits and exclusions apply and these are set out in the Policy Wording ...

University of Otago Dentistry or Medicine students travelling overseas for placements are expected to arrange their own travel insurance. The recommended insurance package Studentsafe Outbound is designed specifically for students who are studying offshore for part of their course. Further information. Studentsafe Outbound

University Medical and travel insurance cover for international students studying at a University in New Zealand 2017 Edition www.insurancesafenz.com Studentsafe Inbound University Member Card Policy number: AGA-OTAGO-2017 University: University of Otago www.insurancesafenz.com Claims Assistance Phone Number Within New Zealand: 0800 486 004 or ...

group insurance plan to cover international students' medical and travel requirements and the Studentsafe Inbound University Policy, is designed to meet this need. Your Cover International students enrolled at University of Otago are automatically covered by the Studentsafe Inbound University policy wording during their study.

Studentsafe Inbound University insurance has been designed with the Student in mind and provides a number of unique benefits including: Automatic travel insurance cover for travel between New Zealand and your Country of Origin Free access to the University Medical Centre for covered medical conditions Automatic Cover before Enrolment

The University of Otago insurance administrator is also available for help you with any questions you may have. Office opening hours are Monday to Friday between 10.00am and 4.00pm. International Office University of Otago Archway West Building 90 Union Place East Dunedin 9016 Tel: 64 3 479 8582 Fax: 64 3 479 8367 Disclaimer information

Travel insurance can be arranged using our online application. By simply working through the required information you can arrange your travel insurance. ... University of Otago, Christchurch University of Otago, Wellington Aka Ōtākou Learning and Teaching. Learning and teaching Departments and schools ...

Studentsafe Domestic is a travel insurance policy designed for New Zealand residents or citizens living and studying away from home within New Zealand. Congratulations! You've made the decision to study overseas. Studying abroad, or even within New Zealand if you are a New Zealander, is an exciting adventure. But like all adventures, this ...

Benefits of membership - Southern Cross Health Insurance. For further information, please contact: Jill Chronican. Mob +64 21 190 4828. Email [email protected]. University of Otago Southern Cross work scheme - monthly direct debit (PDF) University of Otago Southern Cross work scheme - fortnightly direct debit (PDF)

Otago Polytechnic can now offer our domestic students access to a tailored insurance program through insurancesafeNZ. Studentsafe Domestic is a travel insurance policy designed for New Zealand residents or citizens living and studying away from home within New Zealand. Our aim is to minimise stress related to living away from home with a policy ...

The University of Otago, one of the oldest and most prestigious universities in the southern hemisphere, is located in Dunedin, on New Zealand's South Island. ... Visa/required documentsVisa ($25), NZ Insurance ($450) $475: Travel clinic/immunizations * $0: Housing deposit: $500: Total Estimated Cost Incurred Prior to Departure: $3,625:

University Medical and travel insurance cover for international students studying at a University in New Zealand 2018 Edition www.insurancesafenz.com SFUB.1 0118 Brought to you by: Studentsafe Inbound University Member Card Policy number: AGA-OTAGO-2018 University: University of Otago Website: www.insurancesafenz.com Claims Assistance Phone Number

Studentsafe Domestic is a travel insurance policy designed for New Zealand residents or citizens living and studying away from home within New Zealand. Congratulations! You've made the decision to study overseas. Studying abroad, or even within New Zealand if you are a New Zealander, is an exciting adventure. But like all adventures, this ...

Health and travel insurance. Insurance at the University of Auckland. Studentsafe University policy. Family insurance. Insurance waivers. Making an insurance claim. Pre-existing medical conditions. Change in circumstances. Travelling overseas.

Upon enrolment, you will be automatically included in the Studentsafe Inbound University insurance policy. Ensure you read the policy carefully for details. For enquiries and assistance, email [email protected]. The policy does not cover pre-existing conditions, but arrangements can be made under certain circumstances.

University of Otago, Christchurch University of Otago, Wellington Aka Ōtākou Learning and Teaching. Learning and teaching Departments and schools ... You should organise your international travel insurance as soon as you have booked your air tickets.