Virgin Voyages Help & Support for Pre-Voyage Policies

- Help & Support

- / Before You Sail

- / Pre-Voyage Policies

Pre-Voyage Policies

Other topics related to "pre-voyage policies".

- Port Information

- Travel Requirements

- Voyage Protection

Need help getting the As to your Qs?

Hit the big, red button below and reach out to our sailor services crew..

- Skip to main content

- Skip to header right navigation

- Skip to site footer

milepro | travel like a pro!

travel smarter....travel like a pro!

Virgin Atlantic Delays & Cancellations: How to Get Compensated

If your flight is cancelled or significantly delayed here are the rules you need to know regarding rebooking & reimbursement with Virgin Atlantic

European Regulation EU 261

Eu 261 compensation, controllable vs. non-controllable delays & cancellations, eu 261 definition of a “delay”, virgin atlantic’s policy for controllable flight delays:, how to check virgin atlantic flight status, virgin atlantic flight cancellations: what to do if your flight is cancelled, virgin atlantic flight delay & cancellation compensation, how to file a flight delay compensation claim.

Were you impacted by a Virgin Atlantic flight cancellation or delay of more than 3 hours? If so, you need to understand Virgin Atlantic’s policy for handling these situations. You could be eligible for a €600 reimbursement per passenger!

Flight delays and cancellations are an unfortunate part of traveling and while any unexpected schedule changes can be very frustrating, don’t let them discourage you from traveling. Just make sure you know the rules and your rights when one of these situations occurs, especially if you are traveling to/from or within Europe.

If you are flying Virgin Atlantic, and your flight gets canceled or significantly delayed, here are the key things to know about Virgin Atlantic’s flight delay and cancellation policy, as well as the protections you have from European Regulation EU 261.

Everyone who takes a flight to/from or within Europe needs to understand Regulation US 261.

EU 261 regulation was passed in 2004 to protect airline passengers against severe flight disruptions. The legislation states that long delays, cancellations, missed connections and flight re-bookings cause great inconvenience to airline passengers, and as such, affected passengers should be compensated.

If you are on a flight to/from/within the European Union (“EU”) , regulation EU 261 applies in the following situations:

- Your flight is within the EU and operated by an EU or non-EU airline.

- Your flight arrives in the EU from outside the EU and is operated by an EU airline.

- Your flight departs from the EU to a non-EU country operated by an EU or a non-EU airline.

EU Regulation 261 will not apply if your flight arrives in the EU and is operated by a non-EU airline. It applies to all EU-based airlines but only applies to U.S. airlines when a U.S. airline is leaving the European Union.

Furthermore, even though Iceland, Norway, and Switzerland are not part of the EU, flights to and from those countries are covered under EU 261.

With EU 261, you are entitled to compensation from the airline in the following cases:

- Delays: If your flight arrives at its destination 3 or more hours late.

- Cancellations: If you have been informed of a flight cancellation less than 14 days before the departure date.

- Overbooking: If the airline overbooked your flight and you are denied boarding due to lack of seat availability.

- Missed Connections Due to Delay: If you arrive at your final destination 3 or more hours late due to a missed connecting flight.

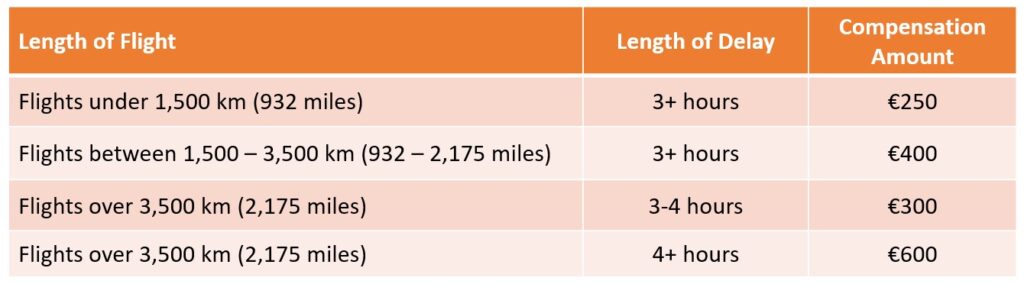

The amount of compensation you are eligible for will vary depending on the length of the delay and flight distance.

Now, let’s see how it applies to a Virgin Atlantic canceled or delayed flight.

Virgin Atlantic Flight Delays: What to do if your Flight is Delayed?

If your flight is delayed and you are looking for compensation, you will need to determine if the cause of the delay was within the airline’s control. A controllable flight delay (or cancellation) is a delay or cancellation that has been caused by the airline and qualifies for reimbursement under EU 261.

- Controllable Delays are caused by things the airline has control over such as maintenance and mechanical issues, lack of available equipment, cabin cleaning, flight crew schedules, fueling, baggage loading, etc.

- Non-Controllable Delays or delays due to “Extraordinary Circumstances” are caused by things that are outside of the airline’s control such as weather, air traffic congestion, air space closure, terrorism, political instability, emergency diversion, etc.

Another important definition to consider is the definition of a delay under EU 261. A delay is not determined by the time you leave your departure gate. It is calculated based on the time you arrive at the gate of your destination. This gives the airlines some opportunity to make up for the lost time in the air.

If your flight is significantly delayed for a controllable reason, Virgin Atlantic will do the following:

- Rebook you on another Virgin Atlantic flight at no extra cost.

- Provide you with a meal voucher.

- Provide complimentary hotel accommodations and ground transportation (if impacted by an overnight delay).

- Provide two free phone calls

For further details, here is a link to the Virgin Atlantic Passenger Rights .

You can check the status of any Virgin Atlantic flight via the Flight Status and Notification section of the Virgin Atlantic website. Here you can search by flight number; if you don’t have the flight number, you can search by the route.

If your flight is canceled, you will have the same protections in place you will for a significant delay.

However, you are not entitled to compensation if any of the following three situations occur:

- You are informed of the cancellation at least 14 days before your departure date

- You are informed of the cancellation between 14 days and 7 days before departure and your departing flight leaves no more than two hours before the original departure time and/or you arrive no more than four hours after the planned arrival time

- You are informed of the cancellation less than seven days before departure and your departing flight leaves no more than one hour before the original departure time and/or you arrive no more than two hours after the planned arrival time.

As stated earlier, if your flight was delayed by 3 hours or more (on arrival) you may be able to get compensation from Virgin Atlantic. To file a claim and see if you are eligible, go to the Virgin Atlantic Flight Delay Compensation page and fill out the form.

If your Virgin Atlantic flight is delayed or canceled, you could be owed up to €600 per person in compensation from Virgin Atlantic, in addition to a refund of the ticket cost.

If this sounds confusing and you need some help understanding your rights and your potential refund amount, AirHelp is a company that specializes in helping you get the compensation you are entitled to.

It’s always best to first check with the airline directly, but if they are not helpful, you can use a claim company like AirHelp to help resolve the claim. Check out their compensation per airline page so you can find out what you’re owed.

Flight delays and cancellations are inevitable, you can’t totally avoid them, but there are things you can do to reduce your chances of experiencing them. And if you do encounter a significant delay or cancellation, it’s always good to know the rules and the rights provided to you by both the airline and the government. Hopefully, this article helps!

Tim is a business road warrior and avid leisure traveler who has flown over two million miles in the air and spent well over a thousand nights in hotels. He enjoys sharing tips, tricks, and hacks to help readers get the most out of their travel experience and learn how to “travel like a pro”!

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

- Fly with Virgin Atlantic

- Travel news

- Covid-19 travel advice hub

- DRAFT Combined flexible booking policy

We're flexible with your travel plans

We understand that the ever-changing travel restrictions can make planning your trip difficult and appreciate the need for flexibility.

You don’t need to worry — We’ve got you covered.

On this page

Our flexible ‘no change fees’ booking policy gives you the freedom to book your trip now with Virgin Atlantic or Virgin Holidays and change it later if you need to - all without any of those pesky admin charges.

When you book a flight or a holiday that starts before 30 April 2022, you’re free to change your travel dates as much as you like. You can even choose a different destination or make one name change (if you’d like someone else to benefit from your ticket).

You'll just need to make sure you travel before 30 April 2023 and make any changes before the date you were originally due to travel.

This policy applies to bookings made and flights cancelled on or after 3rd March 2021. If you booked before this and want to make a change, check our earlier policies .

Your new travel arrangements are subject to availability and there may be a fare difference to pay if you change your dates and the new fare is higher There may also be additional charges under our standard terms and conditions.

When you're ready to rebook, we're here for you

If you booked directly with us, you can use our Rebook my flights form . We'll check availability for your chosen destination and dates, and if there's no fare difference to pay, we’ll update your booking and email your new eTicket. If we need to speak to you about anything, we'll get in touch via WhatsApp or SMS within 7 days to complete the process.

Not ready to rebook?

If you haven’t yet decided on new travel dates, we’ll keep your ticket open as credit until you’re ready. Your new travel dates can be any time up to 30 April 2023 and the same flexible booking policy applies.

You’ll need to use the full value of your open ticket. If your new ticket price is lower, we can’t refund the difference.

If you’ve changed your mind, that’s okay — you can postpone your holiday, giving you more time to plan.

The best way to change your holiday dates or pick a different destination is to get in touch with our Customer Service team at Virgin Holidays, available 7 days a week to help.

Received a digital voucher?

If you received a voucher, you have until 30 September 2021 to spend it on a new holiday.

Find your voucher in Manage my booking , make a note of the unique code and head over to our website www.virginholidays.co.uk to start planning your next getaway - Once you’ve decided where and when you want to go, simply apply your voucher code at the checkout.

Payment flexibility

Don’t worry if you’ve missed a payment or just need a little more time to pay; we have options available to help you.

- Customers travelling before 31 August 2021 have a reduced balance due date and can pay their balance 6 weeks prior to departure rather than 12 weeks before.

- If you’re struggling to pay, you can delay any additional payments by amending your booking to travel at a later date.

- If your holiday is more than 6 months away, you may wish to set up a Direct Debit to spread the cost.

If your booking with Virgin Holidays is unaffected and you choose to cancel, we understand.

Please bear in mind, if your holiday is still planned to go ahead, our standard cancellation terms and conditions apply and your refund may be less than the amount you’ve paid. Please contact us to discuss this option. Our Customer Service team at Virgin Holidays are available 7 days a week to help.

If you booked before 3 rd March, check our earlier policies here.

Our flexible booking policy was updated on 3 March 2021. If you booked before this, check our earlier policies below.

Earlier flexible booking policies where flights are still operating

Our flexible booking policy (replaced by new policy 3 March 2021)

We understand that the ever-changing travel restrictions can make planning your trip difficult, so we’ve got you covered. This policy is to allow for more flexibility if your plans change.

When you book to travel any time up to 30 April 2022, you can make unlimited date changes and one name change free of charge (if you’d like someone else to benefit from your ticket). You'll just need to use your ticket by 30 April 2023.

We'll also waive any difference in the fare if your travel is completed by 31 May 2021.

It’s important that you make any changes before the date you were originally due to travel.

This policy applies to bookings made on or after 6 February 2021, and to flights which are cancelled from 6 February 2021.

If you booked before 6 February 2021 and would like to make a change, check our previous flexible booking policy at the bottom of this page.

If you booked with Virgin Holidays , or through another website or travel agent, please contact them directly for your options.

Other useful information

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Trip Cancellation Insurance Explained

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is trip cancellation insurance?

Covered reasons for trip cancellation, what is not covered by trip cancellation insurance, cancel for any reason trip insurance, is trip cancellation insurance expensive, different ways to get trip cancellation insurance, which insurance coverage is best for me.

When booking travel, particularly expensive trips consisting of nonrefundable reservations, it makes sense to consider trip cancellation insurance since it can protect your deposit if your plans do not materialize due to unforeseen events. However, not every reason for canceling a trip will qualify for coverage, so you’ll want to familiarize yourself with the basics of trip cancellation insurance.

Trip cancellation coverage can be purchased as part of a comprehensive travel insurance policy , or you can receive it for free when you hold certain premium credit cards. The benefit is designed to protect prepaid, nonrefundable reservations, including flights, hotel reservations and other bookings if the trip is canceled due to an extraordinary circumstance. Each policy will state exactly which events are considered valid reasons for cancellations.

With COVID-19 still affecting travel plans, you’ll want to pay close attention to which reasons for cancellation due to the pandemic are valid. For example, wanting to cancel a trip you booked a while ago because your destination now has rising COVID-19 numbers and you’re afraid to travel is not likely a valid reason.

If you want to be able to cancel a trip for truly any reason, consider the Cancel For Any Reason supplemental upgrade when purchasing your insurance policy. CFAR will allow you to get up to 75% of your trip investment back as long as the trip is cancelled at least two days before departure.

» Learn more: Does my travel insurance cover the coronavirus?

Imagine you’ve booked a two-week vacation to Italy costing $5,000 ($1,000 flight, $3,500 hotel and $500 excursions), all of which is nonrefundable. Then, a week before your departure date, you fall and break your leg.

So, what does trip cancellation insurance cover?

If you have trip cancellation insurance, you’ll be able to get your entire prepaid, nonrefundable trip cost back (as long as the entire amount was insured), since injuries that necessitate medical treatment and prevent you from taking your trip qualify as a covered reason.

Other covered reasons include death of your traveling companion, inclement weather that results in disrupted service, jury duty, terrorist incident, job termination and other extraordinary events.

Although this is not an entire list of all the covered reasons, generally the cancellation must be due to unforeseen circumstances to qualify for a reimbursement. Review the fine print of your policy for the details of exactly which reasons are covered. When seeking reimbursement, you’ll need to submit claims to the insurance provider to substantiate your claim.

Although a wide range of reasons allow you to receive your prepaid, nonrefundable travel expenses back in the event of a trip cancellation, there are important exclusions to know about.

Trip cancellation insurance will not cover losses arising from self-harm, foreseeable events, acts of war, taking part in activities considered dangerous (e.g., skydiving, bungee jumping, endurance races, etc.), a felony, childbirth, dental treatment and more.

» Learn more: How to find the best travel insurance

So what if you want the flexibility to cancel your trip for reasons other than those covered by your policy? For that, you're going to need the CFAR insurance mentioned above.

CFAR is often available as an add-on to travel insurance policies, and while it can come in handy if you want to cancel your trip just because, you're not likely to get all your money back.

Most CFAR policies will only reimburse 75% of your nonrefundable travel expenditures.

» Learn more: Best travel insurance with Cancel For Any Reason Coverage

The price of trip cancellation insurance can vary based on the traveler’s age, destination, length of trip, cost of trip and insurance company.

Using the same $5,000, two-week trip to Italy as mentioned above, a search of policies on SquareMouth (a NerdWallet partner) ranged from $115 to $470, representing 2.3% to 9.4% of the total trip cost.

» Learn more: How much is travel insurance?

All policies provide 100% coverage of the trip cost, however the more expensive plans usually have higher limits on benefits like medical evacuation.

If you’re only looking for trip cancellation coverage and no other protections, a policy equating to 2.3% of the total trip expenses seems reasonable.

On your travel credit card

Trip cancellation coverage can be included as part of a comprehensive travel insurance plan or offered as a benefit on premium travel credit cards.

For example, the Chase Sapphire Reserve® will reimburse you or your immediate family members up to $10,000 per trip. The Business Platinum Card® from American Express and many other American Express cards also offer up to $10,000 in trip cancellation coverage. Terms apply.

These premium cards also offer other insurance benefits like trip interruption coverage, emergency assistance services, trip delay and more.

If you travel often and typically purchase trip cancellation coverage, consider applying for one of the cards that offer complimentary travel insurance . Not only will you get trip insurance benefits, but you will also get other travel perks and statement credits that can partly offset the annual fee.

Supplement by purchasing policies out-of-pocket

If the coverage limits offered on the cards aren’t sufficient or you’re looking for more protections (e.g., coverage for emergency medical expenses), you’d be better off with a travel insurance . Although you’d incur an additional cost for purchasing a comprehensive plan, you’d have many more benefits not commonly found in the insurance policies offered by the credit cards.

A comprehensive trip cancellation policy is likely to cover canceled flights so long as the flight or flights are nonrefundable and are a part of the total, prepaid expenses covered by your policy. Insurance provided by travel cards typically includes trip delay or cancellation coverage so long as you used that card to pay for your flight reservations.

If you're forced to cancel your trip due to extraordinary circumstances beyond your control, travel insurance will provide coverage for some or all of your nonrefundable travel expenditures, depending on your policy. Covered events will vary, so be sure to review the terms of any plan you intend to purchase.

Trip cancellation insurance is available for purchase from a wide range of companies and is often included as a benefit on travel credit cards. Under certain circumstances, it provides coverage for prepaid travel expenses in the event that you cannot complete your trip as planned.

A comprehensive trip cancellation policy is likely to cover canceled flights so long as the flight or flights are nonrefundable and are a part of the total, prepaid expenses covered by your policy.

Insurance provided by travel cards

typically includes trip delay or cancellation coverage so long as you used that card to pay for your flight reservations.

If you’re going on a trip consisting of costly flights, hotel reservations and excursions and would like to protect your prepaid, nonrefundable deposit but do not need any other coverage, a minimally priced trip cancellation insurance policy is a good choice.

If you have a premium travel credit card , check if you already have trip cancellation insurance as a benefit before you purchase a policy.

However, if you’re looking for additional coverage like travel medical insurance , and/or a basic plan doesn’t have adequate limits, consider a comprehensive travel insurance policy from providers such as AAA , Allianz , and AIG . Read NerdWallet's full analysis of the best travel insurance companies here .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Virgin Atlantic Offers Free COVID-19 Insurance to All Passengers

Anyone who flies from now through March 2021 will be automatically covered

:max_bytes(150000):strip_icc():format(webp)/StefanieWaldek-38071ba574ea46c2ac94e15fa18dc581.jpg)

When the COVID-19 first hit the scene and wreaked havoc on the travel industry, travelers were shocked to find out that most insurance plans didn’t cover epidemics , losing them all the money spent on trips that ended up being canceled. Even now, many policies don’t cover COVID-19, meaning if you did hit the road today, then you contracted the coronavirus on your travels, you might be on the hook for all of your medical bills. Understandably, this financial risk has made people nervous about traveling again, even if destinations are relatively safely opened back up for tourism.

In an industry first, however, Virgin Atlantic is automatically giving all passengers flying on the airline between now and March 31, 2021, free COVID-19 insurance through Allianz Assistance. The offer stands not only for passengers who have already booked their flights but also for anyone who makes a new booking for a flight departing between those dates.

The policy offers up to 500,000 pounds (approximately $654,000) for medical treatment outside of your home country, including repatriation to your home country if deemed necessary by medical professionals, up to 3,000 pounds (approximately $4,000) for quarantine accommodations and refreshments outside your home country, up to 1,500 pounds (roughly $2,000) for accommodations and transportation in your home country. In essence, you’d pretty much be off the hook for any COVID-19 expenses you might run into on a trip, including at least some of the cost of a quarantine facility if you test positive once you land.

Now, the insurance policy does have a fair bit of fine print. First of all, the insurance only covers COVID-19, so if you happen to break your foot while surfing, you won’t be covered by Virgin Atlantic’s plan. Second, it only applies to passengers who are ticketed through Virgin Atlantic, not through any of its codeshare partners. For instance, if you book a flight from New York to London through Delta, but Virgin Atlantic operates the flight, you will not be covered. However, if you book a flight through Virgin Atlantic, but Delta operates it, you will be covered.

“Whether it’s to visit friends and relatives or take a well-deserved break, we believe this complimentary cover will provide some added reassurance for our customers as they start to plan trips further afield,” Juha Jarvinen, Chief Commercial Officer at Virgin Atlantic said in a statement. “It applies in parallel to existing travel insurance policies which may now exclude COVID-19, and provides comprehensive cover for coronavirus, recognizing the needs of our customers as we restart services.”

While low fares and flexible cancellation policies have been used by airlines to woo passengers back onboard, Virgin Atlantic’s new insurance policy might just be enough to convince some holdouts to book a flight. Before you run off to buy a ticket, check out the full details of the insurance policy here , and be sure to read the fine print carefully.

Virgin Atlantic. " Free Covid-19 Insurance Cover For All Bookings ." August 24, 2020.

Etihad Gives All Passengers Free COVID-19 Insurance

Hotels Across the World are Being Repurposed to Help Fight the Pandemic

How to Get Your Miles Back After Canceling an Award Flight

What to Ask Before Renting a Vacation Home

Flight Insurance That Protects Against Delays and Cancellations

Everything International Travelers Need to Know About Planning a Trip to the US

The CDC Won't Require COVID-19 Testing for U.S. Domestic Travel. Here's Why

CDC Releases New COVID-19 Testing Guidelines for Cruise Ships

Is Thailand Ready to Reopen Its Borders to Tourists?

What Travelers Should Know About the Delta Variant

8 Air Travel Rights You Didn’t Know You Have

What to Expect If You’re Going on a Cruise This Winter

What It’s Like to Fly Halfway Around the World During the Pandemic

Best Online Travel Agencies

What Documents Do I Need for Mexico Travel?

Southwest Just Dropped a Buy One, Get One Free Deal—But You Need to Act Fast

- Media centre

- Press releases

Free Covid-19 insurance cover for all bookings

Virgin Atlantic provides complimentary COVID-19 global insurance cover for all bookings

- To support customers and provide additional peace of mind, Virgin Atlantic has introduced Virgin Atlantic COVID-19 Cover, which will apply to all existing and new bookings, travelling from 24 August 2020 up until 31 March 2021.

- The insurance policy with Allianz Assistance offers comprehensive cover in the event that a Virgin Atlantic customer or travel companion becomes ill with COVID-19 while on a trip.

- Emergency medical costs, associated expenses such as transport and accommodation and repatriation up to £500,000 are included, as well as costs if a customer is denied boarding or held in quarantine.

Virgin Atlantic customers can book with confidence this year with the introduction of free COVID-19 insurance cover on all new and existing bookings.

The policy, which applies automatically to all flights booked with Virgin Atlantic, is designed to complement existing travel insurance and provide additional peace of mind for upcoming trips, whether customers are already booked or plotting a getaway.

In the event that they or anyone else on their booking becomes ill with COVID-19 while travelling, Virgin Atlantic COVID-19 Cover ensures related costs are covered, no matter how long the trip is or even if they’re visiting another destination on the same overseas trip. The insurance policy is fulfilled by Allianz Assistance and covers emergency medical and associated expenses while abroad totalling £500,000 per customer – the highest value of policy offered by any airline to date, with no excess payment required.

The policy also covers expenses incurred up to £3,000 if a customer is denied boarding, at either departure or in destination, or has to quarantine due to positive or suspected COVID-19 during a trip.

Customers booked to travel from 24 August 2020 up to and including 31 March 2021 will automatically receive the new COVID-19 Cover and Virgin Atlantic Holidays customers will also benefit, where the flights on their holiday booking are with Virgin Atlantic. Providing the customer is travelling on a Virgin Atlantic ticket, if the flight is operated by a partner airline or a Joint Venture carrier - Delta Air Lines or Air France-KLM - the cover will also apply. Tickets can be booked via virginatlantic.com, by phone or through a travel agent, including reward tickets on Virgin Atlantic flights.

Juha Jarvinen, Chief Commercial Officer at Virgin Atlantic said:

“Our priority is always the health and safety of our people and customers and this industry-leading Virgin Atlantic COVID-19 Cover ensures customers can continue to fly safe and fly well with us.

“Following our return to the skies to much-loved destinations like Barbados, we’re planning more services in the autumn, as travel restrictions continue to ease, including London Heathrow to Montego Bay, Antigua, Lagos and Tel Aviv. Whether it’s to visit friends and relatives or take a well-deserved break, we believe this complimentary cover will provide some added reassurance for our customers as they start to plan trips further afield. It applies in parallel to existing travel insurance policies which may now exclude COVID-19, and provides comprehensive cover for coronavirus, recognising the needs of our customers as we restart services.”

Virgin Atlantic COVID-19 Cover joins the airline’s flexible booking policy to give as much choice as possible to customers as they make their future travel plans. Customers booking with the airline have the option to make two date changes to their flights, with rebooking available up until 30 September 2022. These date changes have the associated change fee waived, though potential fare differences may be incurred if the new travel dates are after 30 November 2020.

Key features of the COVID-19 Cover include:

- 24-hour emergency medical assistance

- £500,000 of emergency medical expenses if you are taken ill due to Coronavirus during your journey, including treatment, transport and accommodation costs

- Additional costs should a customer be denied boarding due to suspected or actual COVID-19, or if they are held in quarantine, including accommodation, transport charges, refreshments, booking amendment fees and other travel expenses

- Repatriation home, including private air ambulance where necessary

- No excess payable

- Cover for the whole trip, with no upper limit on the length of customer’s time away

- Cover for all passengers with no restrictions on age, travel class or length of journey

- Terms and conditions apply.

The cover starts from the point of booking and ends when the customer returns home or to a hospital or nursing home in their home country. One-way trips are also included, with the insurance cover valid until the end of the journey, which is defined as 12 hours after the arrival of the customer’s final flight.

For a full breakdown of Virgin Atlantic COVID-19 Cover and more information on the policy visit the Virgin Atlantic website: https://flywith.virginatlantic.com/gb/en/news/coronavirus/free-global-cover-for-COVID-19.html

As part of its multi-layered approach to public health measures, and for customer convenience, peace of mind and confidence, Virgin Atlantic will direct customers towards a list of recommended companies that offer COVID-19 'PCR Antigen' testing, where it’s required to travel. This list will be constantly reviewed by the Medical, Health and Safety teams to ensure the highest standards. Information about the testing requirements for destinations that Virgin Atlantic currently flies to can be found on the website: https://flywith.virginatlantic.com/gb/en/news/coronavirus/travel-restrictions.html

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Flight Cancellation Insurance: Your Questions Answered

How does flight cancellation insurance help when the airline cancels your flight—and you end up canceling your whole trip?

Let’s say you find yourself in the same situation I was in, when the airline cancels your flight and messes up your travel plans. In this scenario, you have to decide if you’ll accept the rescheduled flight, or if you’ll cancel the trip altogether.

If you opt not to rebook after a canceled flight, then the airline should refund your money. “A consumer is entitled to a refund if the airline canceled a flight, regardless of the reason, and the consumer chooses not to travel,” says the Department of Transportation . This applies even if you purchased a non-refundable ticket. However, airlines often will issue that refund in the form of a travel credit or voucher, instead of cash.

What about other pre-paid travel expenses, such as an Airbnb rental or museum tickets you’d already purchased? That’s where travel insurance comes in. If your airline can’t get you to your planned destination for at least 24 consecutive hours from the originally scheduled arrival time because of a natural disaster, severe weather; an FAA or foreign equivalent mandate; or a strike, then your trip cancellation benefits kick in. That means you can cancel your trip and file a claim for your pre-paid, nonrefundable trip costs.

If your trip has already begun, and you miss at least 50% of the length of your trip due to a travel carrier delay (e.g. a canceled flight), then your trip interruption benefits can reimburse those pre-paid, nonrefundable trip costs.

How does flight cancellation insurance help when the airline cancels your flight—and your trip is delayed?

In this scenario, the airline cancels your flight and rebooks you on a different one. You’ll still reach your destination, but later than you planned. Then, travel delay benefits become your best friend.

Did your canceled flight causes a covered travel delay, as defined in your plan? Then your trip delay benefits can reimburse you for meals, a hotel stay, transportation and other eligible expenses during the delay (up to the maximum limit for your plan). You also can be reimbursed for the portion of the trip that you miss. Voilá: your unexpected layover has turned into a mini-vacation, with your key expenses paid.

If your plan includes SmartBenefits® , you can opt to receive a fixed inconvenience payment of $100 per insured person, per day , for a covered delay. You don’t need to provide any receipts — just proof of the delay.

How does flight cancellation insurance help when the airline cancels your flight—and the rescheduled flight won’t work for you?

Your brother’s getting married abroad in Mexico on Saturday, at a gorgeous resort in San José del Cabo . Unfortunately, the demands of your job mean you can’t fly until Friday. And wouldn’t you know it? A storm cancels your flight, and the best the airline can do is put you on a plane leaving late the next evening.

That’s not going to work. You can’t miss the ceremony—you’re the best man! Can flight cancellation insurance help?

Yes. If your travel carrier can’t get you to your destination for at least 24 hours from your originally scheduled arrival time due to a covered reason (such as severe weather), your travel insurance trip interruption benefits can reimburse you for alternate transportation , less available refunds, if you can get to your original destination another way. So if you discover that another airline has an available seat on a flight leaving Friday night, go ahead and book it so you can make it to the wedding on time.

What if you need help figuring out your alternate transportation plans? Contact 24-hour assistance . While we can’t book travel on your behalf, we’ll do our best to help research the options and assist you with finding a new flight.

How does flight cancellation insurance help when you make the decision to cancel your flight?

Your trip cancellation benefits can reimburse you for a canceled flight and other pre-paid, nonrefundable trip expenses—but only when you cancel for a covered reason .

Covered reasons are specific situations and events that, when they occur, mean you may be eligible to make a claim. It’s important to know that most travel insurance plans do not cover flight cancellation for any reason.

Your plan documents will list all the covered reasons for trip cancellation, such as:

- You or a traveling companion becomes seriously ill or injured, or develops a medical condition

- A family member who is not traveling with you becomes seriously ill or injured, or develops a medical condition

- A traveling companion or family member dies

- You need to attend the birth of a family member’s child

- Your primary residence is uninhabitable

- Your destination is uninhabitable

Flight cancellation insurance can’t reimburse you if you cover for a non-covered reason, such as:

- You oversleep and miss your flight

- You change your mind at the last minute and decide not to go

- Your dog gets sick

- You leave your passport at home, and the airline won’t let you board

Have questions about what can and can’t be covered? Contact us! We’re always here to help.

Is flight cancellation insurance worth it?

With airline cancellations and delays on the rise, it’s always smart to defend yourself with travel protection you can trust. When you get flight insurance as part of a complete travel insurance plan, you can travel without worrying about all the things that could go wrong. If cost is an issue, consider an affordable travel insurance plan such as OneTrip Basic or OneTrip Cancellation Plus .

Find the right travel insurance for your next trip.

Related Articles

- How To Deal With Travel Anxiety

- The Simple Guide to Airline Passenger Rights

- 5 Reasons Your Trip Cancellation Insurance Won't Cover You

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Virgin Money and Virgin Red offer exclusive Travel Insurance rewards for Virgin Red members

We know taking travel insurance out can be one of the least exciting ‘To Dos’ when planning for a trip, but that's all about to change with Virgin Red and Virgin Money . Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Annual Multi-trip Travel Insurance

If you’ve got a few trips coming up, Virgin Money’s annual multi-trip travel insurance will give you the peace of mind you need to truly relax.

What could be more relaxing than that? 3,500 Virgin Points that's what, from your friends at Virgin Red.

With Virgin Money’s Annual Multi-Trip insurance , you can choose up to 94 days’ worldwide cover per trip, with everything you care about covered – from your gadgets to your health.

Added benefits

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you’re diagnosed with Covid-19.*

Gadget cover as standard, plus optional extras - from Enhanced Gadget and Enhanced Covid Cover – to cover for winter sports, car hire excess, and more (fees apply).

On hand to help, 24 hours a day, 365 days a year - help is just a phone call away with Virgin Money’s worldwide medical emergency assistance helpline.

Your policy at your fingertips - looking after your policy is now a breeze, thanks to Virgin Money’s handy new online portal – from downloading docs to making a claim, all in one place.

*Please check your policy wording for full details and any exclusions.

The Virgin Money travel insurance has three levels of cover : Red, Silver and Gold, so you can choose which suits you and your needs best.

Managing your travel insurance is a breeze. Simply register online then unwind knowing you can do anything from updating your personal details, to making a claim, all in one place.

The fun part - spending your points

Virgin Red members are rewarded for everyday spending, and with everything from the biggest brands in retail, travel and entertainment to smaller treats or exciting new start-ups, there are so many different rewards which anyone would enjoy. Members can also use Virgin Points for good by supporting a number of different charities or helping develop technology to remove carbon from the atmosphere.

What will you put your points towards? Your next flight, getaway or holiday? Navigating the world of Virgin Wines? Or another Virgin Red treat, experience or exclusive? Enjoy deciding.

Buy your travel insurance today with Virgin Red and Virgin Money and earn 3,500 Virgin Points.

Terms and conditions

Who can take up this offer?

Virgin Red Members who are 18+ and resident in the UK.

How do you take up this offer?

It’s important that you follow these steps to make sure you are eligible for this offer. If you don’t, you might not get your points... and we don’t want that!

Buy a Virgin Money Annual Multi Trip Policy (the Policy) via the offer in the Virgin Red app or Virgin Red website.

You’ll see the offer listed in the “Earn Points” section of the Virgin Red app and website.

Just click on “Get Points” when you want to go ahead. This will link you to the offer page on the Virgin Money website.

From there, click on ‘Get a quote’ and fill in your policy requirements to receive a quote.

Make sure you choose the Annual Multi-trip Policy. The Policy start date must be within 45 days of buying the Policy.

When you’re happy to go ahead, pay for the Policy. o You will receive a confirmation email from Virgin Money.

You need to hold the Policy for at least 45 days to be eligible for the Offer before points are credited to your Virgin Red account. If you or Virgin Money cancel the Policy before 45 days, you won’t be eligible for points.

This offer can’t be used in conjunction with any other offer. Points are only offered in year one of the policy.

What is the offer?

If you meet the offer conditions, we’ll give you a Virgin Red promo code. You can redeem this code with our friends at Virgin Red to get 3,500 Virgin Points.

We’ll send you an e-mail with your promo code within 28 days of you meeting the offer conditions. We’ll send your code to the e-mail you gave when you bought the Policy. The email will provide instructions on how to redeem the code within the Virgin Red app or website.

Your Virgin Red promo code can be used until 30 April 2023. Make sure to redeem your code before then.

Only one Virgin Red promo code will be generated per eligible Policy.

After you’ve redeemed your Virgin Red promo code, the points are added to your Virgin Red account. There is no specific expiry date for using the points. You’ll be free to use them in line with Virgin Red’s programme terms. You can find the terms here [ http://policies.red.virgin.com/terms ].

We thought we should highlight a few key things from Virgin Red’s terms:

the points don’t have a cash value and they can’t be swapped for cash;

the available offers can change from time to time; and

the points cost for each offer can change too.

Although we’ll be working closely with our friends at Virgin Red on this promotion, we aren't responsible for their terms, their marketing, or any of the offers available through their app. Just contact Virgin Red or the relevant offer provider if you have any questions about these topics.

When can you take up the offer?

The offer will be available on an ongoing basis until we withdraw it. We can withdraw the offer without giving you any advance notice, but we’ll try to give some notice if we can.

The offer is subject to availability. This means we will definitely withdraw it when we’ve used up our stock of Virgin Red promo codes.

You don’t need to worry if we withdraw the offer when you’re part way through meeting the offer conditions. As long as you've bought the Policy before we withdraw the offer, you can still qualify. You’ll just need to continue to meet the rest of the conditions.

What else do you need to know?

You can only benefit from this offer once.

We’ll use your personal information to help us run the offer.

English law applies to the offer.

Standard Virgin Money Travel Insurance Policy conditions apply.

If something goes wrong, we’ll try to fix it. If we can’t because it’s something we can’t control, or it’s not our fault, then we may have to change the offer. This includes suspending the offer or ending it early. We can make such changes without giving you notice. However, we’ll try our best to avoid making changes. And we’ll try to minimise any disappointment to you when we make changes.

Who is the promoter?

We are Clydesdale Bank PLC trading as Virgin Money.

Our company number is SC001111.

Our registered office is 30 St Vincent Place, Glasgow, G1 2HL.

Virgin Red and Virgin Money give new customers 20,000 reasons to switch

Unlock Virgin Red: How to earn Virgin Points with a Virgin Money M Plus Account or Club M Account

Who wants to be a virgin points millionaire.

- Share full article

Advertisement

Supported by

Automatic Refunds and No More Hidden Fees: D.O.T. Sets New Rules for Airlines

The Transportation Department issued new requirements on refunds when flights are canceled or delayed and on revealing “junk” fees before booking. Here’s what passengers can expect.

By Christine Chung

The Transportation Department on Wednesday announced new rules taking aim at two of the most difficult and annoying issues in air travel: obtaining refunds and encountering surprise fees late in the booking process.

“Passengers deserve to know upfront what costs they are facing and should get their money back when an airline owes them — without having to ask,” said U.S. Transportation Secretary Pete Buttigieg in a statement, adding that the changes would not only save passengers “time and money,” but also prevent headaches.

The department’s new rules, Mr. Buttigieg said, will hold airlines to clear and consistent standards when they cancel, delay or substantially change flights, and require automatic refunds to be issued within weeks. They will also require them to reveal all fees before a ticket is purchased.

Airlines for America , a trade group representing the country’s largest air carriers, said in a statement that its airlines “abide by and frequently exceed” D.O.T. consumer protection regulations.

Passenger advocates welcomed the new steps.

Tomasz Pawliszyn, the chief executive of AirHelp, a Berlin-based company that assists passengers with airline claims, called it a “massive step forward and huge improvement in consumer rights and protection” that brings the United States closer to global standards in passenger rights.

Here’s what we know about the D.O.T.’s new rules, which will begin to go into effect in October.

There’s now one definition for a “significant” delay.

Until now, airlines have been allowed to set their own definition for a “significant” delay and compensation has varied by carrier . Now, according to the D.O.T., there will be one standard: when departure or arrival is delayed by three hours for domestic flights and six hours for international flights.

Passengers will get prompt refunds for cancellations or significant changes for flights and delayed bags, for any reason.

When things go wrong, getting compensation from an airline has often required establishing a cumbersome paper trail or spending untold hours on the phone. Under the new rules, refunds will be automatic, without passengers having to request them. Refunds will be made in full, excepting the value of any transportation already used. Airlines and ticket agents must provide refunds in the original form of payment, whether by cash, credit card or airline miles. Refunds are due within seven days for credit card purchases and within 20 days for other payments.

Passengers with other flight disruptions, such as being downgraded to a lower service class, are also entitled to refunds.

The list of significant changes for which passengers can get their money back also includes: departure or arrival from an airport different from the one booked; connections at different airports or flights on planes that are less accessible to a person with a disability; an increase in the number of scheduled connections. Also, passengers who pay for services like Wi-Fi or seat selection that are then unavailable will be refunded any fees.

Airlines must give travel vouchers or credits to ticketed passengers unable to fly because of government restrictions or a doctor’s orders.

The vouchers or credits will be transferable and can be used for at least five years after the date they were issued.

Fees for checked baggage and modifying a reservation must be disclosed upfront.

Airlines and ticket agents are now required to display any extra fees for things like checking bags or seat selection clearly and individually before a ticket purchase. They will also need to outline the airline’s policies on baggage, cancellations and changing flights before a customer purchases a ticket.

The rules, which apply to all flights on domestic airlines and flights to and from the United States operated by foreign airlines, have varying start dates.

For example, automatic refunds must be instituted by the airlines within six months. But carriers have a year before they’re required to issue travel vouchers and credits for passengers advised by a medical professional not to fly.

Follow New York Times Travel on Instagram and sign up for our weekly Travel Dispatch newsletter to get expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places to Go in 2024 .

Christine Chung is a Times reporter covering airlines and consumer travel. More about Christine Chung

Open Up Your World

Considering a trip, or just some armchair traveling here are some ideas..

52 Places: Why do we travel? For food, culture, adventure, natural beauty? Our 2024 list has all those elements, and more .

Mumbai: Spend 36 hours in this fast-changing Indian city by exploring ancient caves, catching a concert in a former textile mill and feasting on mangoes.

Kyoto: The Japanese city’s dry gardens offer spots for quiet contemplation in an increasingly overtouristed destination.

Iceland: The country markets itself as a destination to see the northern lights. But they can be elusive, as one writer recently found .

Texas: Canoeing the Rio Grande near Big Bend National Park can be magical. But as the river dries, it’s getting harder to find where a boat will actually float .

- Help centre

- Travel news

- Travel alerts

Flexibility for customers due to French Air Traffic Controllers Strike

Last updated 24 th April 2024

General Guidance

- This policy is to allow customers more flexibility in addition to original fares rules.

- Customers must advise of changes to their travel plans ahead of their travel date, or no-show policy will apply as per fare rules.

- Fare difference must include all taxes/charges.

Booking cancellations, refunds and downgrades are subject to the original fare rules, unless permitted by this policy – whichever is the most flexible.

1. If your flights are still operating – more information

- Itineraries must be rebooked on VS/VS* tickets.

- Tickets must be reissued before departure.

- Rebook in the same booking class in the same cabin. If the same booking class is not available, please check fare rules for applicable booking classes in the same cabin.

- If no alternative VS flight available, rebook onto other VS/VS* services [e.g. from EDI to MAN/LHR] in the same booking class and flight dates. If the same booking class is not available, please check fare rules for applicable booking classes in the same cabin. Changing return travel date to maintain travel duration is allowed. Changes fees and fare difference charges are waived.

- Fare difference charges applies for any travel rebookings outside of travel dates covered.

- OSI comment needs to be added to PNR for trade bookings.

IMAGES

COMMENTS

Accidents Happen. Get Travel Insurance Protection. Worldwide Coverage. Compare Plans. Consumer Voice Provides Best & Most Updated Reviews to Help You Make an Informed Decision!

Selecting Allianz Travel Insurance at checkout is the easiest way to protect your investment, giving you more freedom to embrace your entire travel experience. If you've already booked your flights, you can still find a plan to protect your trip. Provides reimbursement for your prepaid, non-refundable travel expenses if your trip is cancelled ...

When can I add Voyage Protection to my booking? Voyage Protection can be purchased at any time before the final payment is made on a booking. Is Voyage Protection refundable? All payments for Voyage Protection are final (non-refundable) after the 10-day grace period if the booking was made more than 120 days before the voyage.

Our cancellation policy was created to provide a better experience for our Sailors. Here's everything you need to know: If you're booking more than 120 days prior to the start of the voyage, you have a 7-day grace period to request a full refund on your deposit and any other payments made. Refunds will be issued to your original form of payment.

The options available to you may differ slightly depending on when you made your flight booking, and the type of ticket you have. The ability to make unlimited date changes without admin fees applies to Virgin Atlantic bookings made between 3 rd March 2021 and 23 rd June 2022. If you booked before this and would like to make a change, check out ...

Cover yourself, your family and any other travel companions with our comprehensive travel insurance policy. Our travel insurance is available exclusively to UK residents with up to £15,000,000 cover for medical expenses and up to £5,000 per person for cancellations. Get insured. If you are a British national travelling to a country where the ...

Make a claim on your insurance for flights that have been cancelled. If you need a letter for your insurance company confirming your flight was delayed or cancelled, or a proof of travel, please complete the below webform. Make sure to be clear in the comment box what you're looking for. We'll then send the letter to you as soon as we can.

Airline staff shortages combined with a surge of vacationers are contributing to hundreds of flight cancellations on many days. The percentage of flight cancellations this year (3.9%) is more than ...

The steps necessary to cancel a flight with travel insurance vary by travel insurance company, but many have the same basic process for submitting a claim. 1. Cancel your flight with the airline ...

Virgin Atlantic Flight Delay & Cancellation Compensation. As stated earlier, if your flight was delayed by 3 hours or more (on arrival) you may be able to get compensation from Virgin Atlantic. To file a claim and see if you are eligible, go to the Virgin Atlantic Flight Delay Compensation page and fill out the form.

This policy applies to bookings made and flights cancelled on or after 3rd March 2021. If you booked before this and want to make a change, check our earlier policies. Your new travel arrangements are subject to availability and there may be a fare difference to pay if you change your dates and the new fare is higher There may also be additional charges under our standard terms and conditions.

If you purchase a basic travel insurance policy that includes trip cancellation coverage, you can expect to pay between 5% and 10% of your trip costs. For instance, if you buy a $10,000, nine-day ...

The price of trip cancellation insurance can vary based on the traveler's age, destination, length of trip, cost of trip and insurance company. Using the same $5,000, two-week trip to Italy as ...

In an industry first, however, Virgin Atlantic is automatically giving all passengers flying on the airline between now and March 31, 2021, free COVID-19 insurance through Allianz Assistance. The offer stands not only for passengers who have already booked their flights but also for anyone who makes a new booking for a flight departing between ...

Offering the lowest fare available. 2. Notifying customers of known delays, cancellations and diversions. 3. Delivering baggage on time. 4. Allowing reservations to be held or cancelled without penalty for 24 hours. 5. Provide prompt refunds where due.

Virgin Atlantic customers can book with confidence this year with the introduction of free COVID-19 insurance cover on all new and existing bookings. The policy, which applies automatically to all flights booked with Virgin Atlantic, is designed to complement existing travel insurance and provide additional peace of mind for upcoming trips ...

Virgin Voyages offers contemporary cruising experiences, but minimal travel insurance. Their policy is deficient in critical areas such as Trip Cancellation, Medical Insurance, Medical Evacuation and covering Pre-existing Conditions. It also lacks a Cancel For Any Reason option. Overall we rate it a 5 out of 10.

Cancellation and medical expenses are covered by us, as standard, if you're diagnosed with Covid-19.* Choose the travel insurance policy you want. ... Virgin Money Travel Insurance is promoted by CYB Intermediaries Ltd, registered at Jubilee House, Gosforth, NE3 4PL (Company No: 04056283) who is authorised and regulated by the Financial ...

A travel insurance policy with benefits for air travel issues, such as flight and baggage delays and missed connections. When you buy an airline ticket, flight insurance is usually offered as an ...

23 August 2020. Virgin Atlantic customers can book with confidence this year thanks to the introduction of free COVID-19 insurance on all new and existing bookings. The policy, which applies automatically to all flights booked with Virgin Atlantic, is designed to complement existing travel insurance and provide additional peace of mind for ...

Please contact us via Live Chat by logging in to your account and then clicking on the "Chat with us" button or email us at [email protected] to cancel your policy. We will give you a full refund if you cancel within the 14 days of the receipt of your documentation and you have not started a trip or made or intend to make a claim.

Your destination is uninhabitable. Flight cancellation insurance can't reimburse you if you cover for a non-covered reason, such as: You oversleep and miss your flight. You change your mind at the last minute and decide not to go. Your dog gets sick. You leave your passport at home, and the airline won't let you board.

Virgin Money. by Katie Fiddaman. 1 June 2022. We know taking travel insurance out can be one of the least exciting 'To Dos' when planning for a trip, but that's all about to change with Virgin Red and Virgin Money. Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

New travel insurance policies are no longer issued, effective 25 March 2020. Please note: Some words may have specific meanings - refer to "Our definitions" in the Product Disclosure Statement (PDS) prior to reading through these FAQs. The answers given are only a brief summary - you must read the PDS for complete details of what is ...

The department's new rules, Mr. Buttigieg said, will hold airlines to clear and consistent standards when they cancel, delay or substantially change flights, and require automatic refunds to be ...

1. If your flights are still operating. Affected Cities. From/To/Through. France. Bookings from. Any. Bookings until. 24 Apr 2024. Impacted travel date(s) 25 Apr 2024. New travel must be completed by. 02 May 2024. Change fees. Waived; for date and flight changes. Fare difference. Waived; must be the same point of origin/destination and cabin as ...