- Become An Agent

Respect Senior Care Rider: 9152007550 (Missed call)

Help Control COVID-19 New

Get In Touch

Claim Assistance Numbers

Health toll free Number 1800-103-2529

24x7 Roadside Assistance 1800-103-5858

Motor Claim Registration 1800-209-5858

Motor On the Spot 1800-266-6416

Global Travel Helpline +91-124-6174720

Extended Warranty 1800-209-1021

Agri Claims 1800-209-5959

Sales : 1800-209-0144

Service : 1800-209-5858

All transactions, whether they are financial or of any other nature, must be conducted exclusively through our branch offices, our online portals www.bajajallianz.com , our insurance agents or POSPs, or via insurance intermediaries registered with IRDAI who are engaged in solicitation. If you require additional clarification, please write to us at [email protected]

Thank you for visiting our website.

For any assistance please call on 1800-209-0144

Most searched keywords

Two Wheeler Insurance

Health Insurance

Car Insurance

Pet Insurance

- Travel Insurance

Car Insurance Renewal

Family Health Insurance

Car Insurance Calculator

Third Party Car Insurance

Two Wheeler Insurance Third Party

Third Party Insurance for Bike

Two wheeler Insurance Renewal

Travel Ace Plan

Select your Langauge

Let's create a suitable plan for you.

Reference ID should be 11 characters and should start with first 3 characters as alphabets

What’s in it for you?

Accidental & Medical cover

Trip cancelation cover

Trip Extension cover

What is Travel Ace Plan?

Comprehensive Insurance for Carefree Travel, Travel Ace is the perfect travel insurance plan for those travelling internationally. With one flexible plan, you can mitigate a wide range of medical expenses covered, including hospital charges and incidental expenses. Get the medical assistance you need when you need it the most, without worrying about the costs.

The Travel Ace travel insurance will be by your side. The Travel Ace is available in a wide range of plans to suit your inherent needs:

1. Travel Ace Standard - USD 50,000 2. Travel Ace Silver - USD 1,00,000 3. Travel Ace Gold - USD 200,000 4. Travel Ace Platinum - USD 500,000 5. Travel Ace Super Age - USD 50,000 6. Travel Ace Corporate Lite - USD 250,000 7. Travel Ace Corporate Plus - USD 500,000

- Policy Information

- Travel Ace Plan Claim Process

- Frequently Asked Questions

How is the Travel Ace Plan different?

Optional coverage areas.

The Travel Ace covers over 42 optional coverage areas and has 5 different extensions available. It is one of the very few policies not restricted by geographic limitations.

The Medical Coverage Span

Medical expenses for accidents and sickness are separated for higher coverage. The medical coverage can be as high as USD 2 million.

Cover Pre-Existing Diseases

One of the very few travel insurance policies which cover pre-existing diseases and illnesses.

75 Days cover for hospitalization

No additional charges for up to 75 days of hospitalization after the policy expires.

Coverage for cancellation of trips.

Coverage for all forms of cancellation for trips.

No Pre-Policy Check-up

No mandatory pre-policy check-up

Coveres Delayed Luggage

Delayed of checked baggage are also covered while returning to your native country

Discounts On Premiums

People travelling with the insured person can get discounts on the premium as per the following details for a matching plan and same trip duration:

Why Travel Insurance ACE Plan?

Bajaj Allianz is regarded among India's top 10 insurance companies, with a claim reimbursement ratio of over 98%. You can file your claim using any of the given channels convenient to you:

1. cashless travel insurance, 2. reimbursement claim process, 3. documentation for claims.

1. You can file cashless claims for medical expenses exceeding USD 500 and reimbursement claims for the same under USD 500.

2. You can submit all the relevant documents on our platform and initiate the verification process

3. Post successful verification, the hospital and you will receive a payment guarantee notification.

4. If we need more data to verify your claim, you will be requested to do so on time.

1. You can close the entire claim cycle within 10 days with a comprehensive and accurate documentation process.

2. Aggregate all the relevant documents and upload them to BAGIC HAT.

3. Post verification, our team will process your payment within 10 days of approval. You will receive it in your registered bank account via NEFT.

4. Our team will request any necessary but missing documents and provide you with a 45-day window to provide them. You will also receive a reminder every 15 days during this period. If you fail to furnish the necessary documents in this period, your claim request will be closed.

We highly recommend you to use the Caringly Yours app for trip delay delight. The app keeps track of the delay in your flight, does not require any physical documentation, and automatically processes your reimbursement.

To initiate a claims process, please get in touch with our team using any of these numbers:

- 1800-209-0144

- 1800-209-5858

GOT A QUESTION? HERE ARE SOME ANSWERS THAT MIGHT HELP

What is the travel ace plan.

Travel Ace is one of the most comprehensive travel insurance plans covering a wide range of risks - from loss of luggage to medical coverage to even emergency cash assistance. Travel Ace adds an additional layer of security with over 42 coverage areas without any geographic limits and makes your next voyage securer.

How is the Travel Ace Policy Different from Other Travel Insurance Policies?

Travel Ace is different on several grounds:

- 42+ coverage areas and 5 extensions.

- Discount for travelling partners.

- Pre-existing disease and illness inclusion in specific policy variants.

- Separated accident and sickness medical expenses for added coverage.

- No geographic limitations.

- Backed by the seamless Bajaj Allianz experience of discovering, buying, and claiming insurance.

What are the Benefits of Travel Ace?

Travel Ace gives a wide range of benefits such as:

- Comprehensive coverage against medical, travel, and monetary risks on your foreign trip.

- Additional coverage made available with 42+ optional coverages.

- Specific policy variants are designed to suit the needs of the elderly.

Do I Really Need Travel Insurance?

The short answer is – Yes. If you are travelling to Schengen Countries, you will anyway need travel insurance. However, getting travel insurance has benefits beyond being compliant with the laws of the land. It helps you:

- Get the required medical attention without diluting your savings.

- Get access to cash and resources when necessary.

- Get compensated for the loss of baggage and passport when their safety is outside your purview.

- Focus on the agenda of your trip, so you are never worried about the potential medical, travelling, cancellation, or other pertinent risks.

Does the Travel Ace Policy Offer Coverage for COVID-19?

Yes. You can get:

- Up to USD 10,000 worth of coverage if you are hospitalized due to COVID-19 in a foreign country if you are under 70 years of age.

- If you are over 70 years of age, you can get up to USD 3,000 for COVID-19-included hospitalization.

- For home quarantine in a foreign location due to COVID-19, you can get up to USD 3,000 in coverage.

The coverage will be valid only on satisfaction of the terms & conditions mentioned in your insurance agreement.

Can Pre-Existing Diseases Be Covered Under the Travel Ace Plan?

Yes. Certain policy variants cover pre-existing diseases and injuries.

Which Countries Are Covered by the Travel Ace Policy?

All the countries except the ones forbidden by the Government of India for travelling purposes are covered by the Travel Ace plan.

How Long Does It Take to Receive the Policy Document After Buying It?

If you buy the Travel Ace plan on the Bajaj Allianz website or Caringly Yours mobile app, you will get the policy documents instantly as soon as you have made a successful payment.

Is the Travel Ace Plan Applicable for Schengen Countries?

Yes. The Travel Ace Plan is valid for Schengen Countries.

Are There Any Cancellation Charges?

You can terminate the policy any time before the Risk Period begins by providing an application in writing with the necessary documents. After deducting ₹250 as the cancellation fee and applicable taxes, you will receive the premium you have already paid.

Travel Ace at a Glance

The policy's duration depends on whether you are taking single-trip insurance or multi-trip insurance, as well as the room for extensions. The Travel Ace plan is designed to help you make your trip more fulfilling by including your family members. You can add members to the Travel Ace plan and get up to a 10% discount on the premium as far as the travelling tenure and the insurance variant chosen by them is identical to yours. The policy is open to unlimited extensions as far as the net duration for the policy is less than or equal to 360 days.

Corporate Plus

Platinum plan, corporate lite, silver plan, standard plan, travel ace corporate plus (usd 500,000).

1. Age Group Covered: 0 to 70 Years.

2. International Personal Accident Cover of up to (USD) 10,000.

5. Accidental, Death, and Disability cover up to (USD) 6,000.

6. Personal Accident Cover in India of up to ₹ 200,000.

7. Sickness Medical Exigencies of up to (USD) 500,000 (USD 100 Deductible).

8. Accidental Medical Exigencies of up to (USD) 500,000 (USD 100 Deductible).

9. Emergency Dental Care of up to (USD) 500 (USD 25 Deductible).

10. Daily allowance during hospitalization: (USD) 50/day for up to 7 days.

11. Trip & Event Cancellation coverage of up to (USD) 2000.

12. Trip Interruption coverage of up to (USD) 750.

13. Loss of Checked-In Baggage is covered up to ₹ 750. Delay of checked-in baggage is also covered with (USD) 100/10 hrs in a foreign location and ₹1000/10 hrs in India.

14. Personal Liability of up to (USD) 100,000.

15. Coverage for loss of passport and driving license of up to (USD) 400.

16. Golfer’s Hole-in-One coverage for anywhere in the US Golfers’ Association recognized golf courses worth up to 300.

17. Hijack Cover of up to (USD) 3,000.

18. Home Burglary & Robbery Insurance:

a. Up to ₹ 150,000 each for portable equipment other than laptop, laptop, and all other equipment.

19. Standard Fire & Special Perils Cover:

20. Trip Delay Delight of up to (USD) 80/6 hrs

21. Emergency Cash Assistance Service of up to (USD) 1000.

22. Bounced hotel coverage of up to (USD) 500.

23. Trip Extension coverage of up to (USD) 750.

Optional Coverage :

Extended Pet Stay (INR), Lifestyle Modification Benefit, Child Education Benefit, Missed Connection Coverage, Legal Expenses, Loss of Personal Belongings (Mobile, Laptops, and iPads), Car Hire Excess Insurance, Compassionate Visit or Stay, Ticket Overbooking, Display Benefit Cover, Replacement & Rearrangement of Staff, Alternative transport expenses and Waiver of Sub-Limits.

Sub-Limits :

Applicable to people above 50 years of age and seeking OPD or hospitalization.

1. Hospital Room, Emergency Room, and Boarding & Hospitalization: (USD) 1700 per day.

2. ICU: (USD) 2500 per day.

3. Surgical Treatment: (USD) 11,500 and 25% of Surgical Treatment cost for Anaesthetic Services.

4. Consultation Charges of up to (USD) 200 per visit.

5. Diagnostic & Testing charges of up to (USD) 1500.

6. Ambulance Services of up to (USD) 500.

Travel Ace Platinum (USD 500,000)

2. International Personal Accident Cover of up to (USD) 25,000.

3. Lifestyle Modification Benefit of up to (USD) 10,000.

4. Child Education Benefit of up to (USD) 8,000.

5. Accidental, Death, and Disability cover up to (USD) 10,000.

6. Personal Accident Cover in India of up to ₹ 10,00,000.

7. Sickness Medical Exigencies of up to 500,000 (USD 100 Deductible) alongside Pre-Existing Illness coverage of up to 5000 (USD 100 Deductible).

9. Emergency Dental Care of up to (USD) 500 (USD 25 Deductible).

10. Daily allowance during hospitalization: (USD) 100/day for up to 7 days.

11. Trip & Event Cancellation coverage of up to (USD) 5000.

12. Trip Interruption coverage up to (USD) 2000.

13. Loss of Checked-In Baggage is covered up to ₹ 1000. Delay of checked-in baggage is also covered with (USD) 300/6 hrs in a foreign location and ₹3000/6 hrs in India.

14. Personal Liability coverage of up to (USD) 200,000.

15. Coverage for loss of passport and driving license of up to (USD) 500.

16. Golfer’s Hole-in-One coverage for anywhere in the US Golfers’ Association recognized golf courses worth up to (USD) 1000.

17. Hijack Cover of up to (USD) 10,000.

a. Up to ₹ 500,000 for portable equipment other than laptop and ₹ 400,000 for other equipment and up to ₹ 100,000 for laptop.

a. Up to ₹ 500,000 each for portable equipment other than laptop and other equipment and up to ₹ 100,000 for laptop.

20. Trip Delay Delight Platinum of up to (USD) 150/4 hrs.

21. Emergency Cash Assistance Service of up to (USD) 1500.

22. Missed Connection coverage of up to (USD) 300.

23. Bounced hotel coverage of up to (USD) 500.

24. Trip Extension coverage of up to (USD) 1500.

25. Legal Expense coverage of up to (USD) 1000.

26. Weather Guarantee of up to (USD) 500.

27. Extended Pet Stay (INR) covered up to 3,000.

28. Loss of Personal Belongings (Mobile, Laptops, and iPads) coverage of up to (USD) 1500.

29. Car Hire Excess Insurance of up to 50 and Alternative Transport Expenses of up to (USD) 200.

30. Compassionate Visit of up to (USD) 1000.

31. Compassionate Stay of up to (USD) 1000.

32. Return of Minor Child coverage of up to (USD) 1000.

33. Ticket Overbooking coverage of up to (USD) 200.

Sporting Activities, Display Benefit Cover, Replacement & Rearrangement of Staff, Pre-Existing Injury, and Waiver of Sub-Limits.

1. Hospital Room, Emergency Room, and Boarding & Hospitalization: 1700 per day.

2. ICU: (USD) 2500 per day.

3. Surgical Treatment coverage of up to (USD) 11,500 and 25% of Surgical Treatment cost for Anaesthetic Services.

4. Consultation Charges of up to (USD) 200 per visit.

5. Diagnostic & Testing charges of up to (USD) 1500.

6. Ambulance Services of up to (USD) 500.

Travel Ace Corporate Lite ( USD 250,000)

1. Age Group Covered: 0 to 120 Years.

2. International Personal Accident Cover of up to (USD) 10,000.

5. Accidental, Death, and Disability cover of up to (USD) 5,000.

6. Personal Accident Cover in India of up to ₹ 100,000.

7. Sickness Medical Exigencies of up to 250,000 (USD 100 Deductible).

8. Accidental Medical Exigencies of up to (USD) 250,000 (USD 100 Deductible).

10. Daily allowance during hospitalization: (USD) 50/day for up to 7 days.

11. Trip & Event Cancellation coverage of up to (USD) 1000.

12. Trip Interruption coverage of up to (USD) 500.

13. Loss of Checked-In Baggage is covered up to ₹ 500. Delay of checked-in baggage is also covered with (USD) 100/10hrs in a foreign location and ₹ 1000/10hrs in India.

14. Personal Liability of up to (USD) 100,000.

15. Coverage for loss of passport and driving license of up to (USD) 300.

16. Golfer’s Hole-in-One coverage for anywhere in the US Golfers’ Association recognized golf courses worth up to (USD) 300.

17. Hijack Cover of up to (USD) 2,000.

a. Up to ₹ 100,000 each for portable equipment other than laptop, laptop, and all other equipment.

20. Trip Delay Delight of up to (USD) 80/6 hrs.

21. Emergency Cash Assistance Service of up to (USD) 1000.

22. Bounced hotel coverage of up to (USD) 500.

23. Trip Extension coverage of up to (USD) 750.

Extended Pet Stay (INR), Lifestyle Modification Benefit, Child Education Benefit, Missed Connection Coverage, Legal Expenses, Loss of Personal Belongings (Mobile, Laptops, and iPads), Car Hire Excess Insurance, Compassionate Visit or Stay, Ticket Overbooking, Display Benefit Cover, Replacement & Rearrangement of Staff, Alternative transport expenses and Waiver of Sub-Limits.

3. Surgical Treatment: (USD) 11,500 and 25% of Surgical Treatment cost for Anaesthetic Services.

Travel Ace Gold ( USD 200,000)

2. International Personal Accident Cover of up to (USD) 15,000.

3. Lifestyle Modification Benefit of up to (USD) 6,000.

4. Child Education Benefit of up to (USD) 4,000.

5. Accidental, Death, and Disability cover up to (USD) 7,000.

6. Personal Accident Cover in India of up to ₹ 500,000.

7. Sickness Medical Exigencies of up to 200,000 (USD 100 Deductible).

8. Accidental Medical Exigencies of up to (USD) 200,000 (USD 100 Deductible).

10. Daily allowance during hospitalization: (USD) 75/day for up to 7 days.

12. Trip Interruption coverage of up to (USD) 1000.

13. Loss of Checked-In Baggage is covered up to ₹ 750. Delay of checked-in baggage is also covered with (USD) 200/8 hrs in a foreign location and ₹2000/8 hrs in India.

14. Personal Liability of up to (USD) 150,000.

15. Coverage for loss of passport and driving license of up to (USD) 400.

15. Golfer’s Hole-in-One coverage for anywhere in the US Golfers’ Association recognized golf courses worth up to (USD) 500.

16. Hijack Cover of up to (USD) 5,000.

17. Home Burglary & Robbery Insurance:

a. Up to ₹ 200,000 each for portable equipment other than laptop and other equipment and up to ₹ 100,000 for laptop.

18. Standard Fire & Special Perils Cover:

19. Trip Delay Delight of up to (USD) 120/5 hrs.

20. Emergency Cash Assistance Service of up to (USD) 1000.

21. Missed Connection coverage of up to (USD) 300.

22. Bounced hotel coverage of up to (USD) 500.

23. Trip Extension coverage of up to (USD) 1000.

24. Legal Expense coverage of up to (USD) 1000.

25. Weather Guarantee of up to (USD) 200.

26. Extended Pet Stay (INR) covered up to 3,000.

Loss of Personal Belongings (Mobile, Laptops, and iPads), Car Hire Excess Insurance, Compassionate Visit or Stay, Return of Minor Child, Ticket Overbooking, Sporting Activities, Display Benefit Cover, Replacement & Rearrangement of Staff, Alternative transport expenses and Waiver of Sub-Limits.

1. Hospital Room, Emergency Room, and Boarding & Hospitalization: (USD) 1500 per day.

2. ICU: 2500 per day.

3. Surgical Treatment: (USD) 9,000 and 25% of Surgical Treatment cost for Anaesthetic Services.

5. Diagnostic & Testing charges of up to (USD) 1250.

6. Ambulance Services of up to (USD) 400.

Travel Ace Silver ( USD 100,000)

2. International Personal Accident Cover of up to 12,000.

3. Lifestyle Modification Benefit of up to 5,000.

4. Child Education Benefit of up to 3,000.

5. Accidental, Death, and Disability cover up to 6,000.

7. Sickness Medical Exigencies of up to 100,000 (USD 100 Deductible).

8. Accidental Medical Exigencies of up to (USD) 100,000 (USD 100 Deductible).

11. Trip & Event Cancellation coverage of up to (USD) 1500.

12. Trip Interruption coverage of up to (USD) 750.

13. Loss of Checked-In Baggage: ₹ 500. Delay of checked-in baggage is also covered with (USD) 100/10 hrsin a foreign location and ₹ 1000/10 hrs in India.

14. Personal Liability of up to 100,000.

15. Coverage for loss of passport and driving license of up to 300.

17. Hijack Cover of up to 3,000.

a. Up to ₹ 150,000 each for portable equipment other than laptop and other equipment and up to ₹ 100,000 for laptop.

20. Trip Delay Delight of up to (USD) 100/6 hrs.

22. Missed Connection coverage of up to (USD) 300.

23. Bounced hotel coverage of up to (USD) 400.

24. Trip Extension coverage of up to (USD) 750

Legal Expenses, Weather Guarantee, Extended Pet Stay (INR), Loss of Personal Belongings (Mobile, Laptops, and iPads), Car Hire Excess Insurance, Compassionate Visit or Stay, Return of Minor Child, Ticket Overbooking, Sporting Activities, Display Benefit Cover, Replacement & Rearrangement of Staff, Alternative transport expenses and Waiver of Sub-Limits.

Sub-Limits :

1. Hospital Room, Emergency Room, and Boarding & Hospitalization: 1500 per day.

5. Diagnostic & Testing charges of up to (USD) 1250.

6. Ambulance Services of up to (USD) 400.

Travel Ace Super Age (USD 50,000)

1. Age Group Covered: 70+ Years.

2. International Personal Accident Cover of up to 10,000.

3. Accidental, Death, and Disability cover of up to 2,000.

7. Sickness Medical Exigencies of up to 50,000 (USD 100 Deductible).

8. Accidental Medical Exigencies of up to (USD) 50,000 (USD 100 Deductible).

12. Trip Interruption coverage of up to (USD) 500.

13. Loss of Checked-In Baggage is covered up to ₹ 500. Delay of checked-in baggage is also covered with (USD) 200/8hrs in a foreign location and ₹ 2000/8 hrs in India.

14. Personal Liability coverage of up to (USD) 100,000.

15. Coverage for loss of passport and driving license of up to (USD) 250.

16. Hijack Cover of up to (USD) 3,000.

19. Trip Delay Delight of up to (USD) 80/6 hrs.

20. Emergency Cash Assistance Service of up to (USD) 1000.

23. Trip Extension coverage of up to (USD) 1000.

24. Compassionate Visit and Compassionate Stay coverage of up to (USD) 1,000 each.

25. Ticket Overbook coverage of up to (USD) 200.

Legal Expense, Weather Guarantee, Golfer’s Hole-in-One, Loss of Personal Belongings (Mobile, Laptops, and iPads), Car Hire Excess Insurance, Extended pet stay (INR), Alternative transport expenses and Waiver of Sub-Limits.

Applicable to people above 70 years of age and seeking OPD or hospitalization.

1. Hospital Room, Emergency Room, and Boarding & Hospitalization: (USD) 1200 per day.

2. ICU: (USD) 2000 per day.

3. Surgical Treatment: 8,000 and 25% of Surgical Treatment cost for Anaesthetic Services.

4. Consultation Charges of up to (USD) 150 per visit.

5. Diagnostic & Testing charges of up to (USD) 1000.

6. Ambulance Services of up to (USD) 300.

Travel Ace Standard (USD 50,000)

3. Lifestyle Modification Benefit of up to (USD) 3,000

4. Child Education Benefit of up to (USD) 2,000.

11. Trip and Event Cancellation: (USD) 1000

12. Trip Interruption: (USD) 500

13. Loss of Checked-In Baggage: ₹ 500. Delay of checked-in baggage is also covered with (USD) 100/10 hrs in a foreign location and ₹ 1000/10 hrs in India.

14. Personal Liability of up to (USD) 50,000.

15. Coverage for loss of passport and driving license of up to (USD) 300.

a. Up to ₹ 100,000 each for portable equipment other than laptop, laptop, and other equipment.

20. Trip Delay Delight of up to (USD) 80/6 hrs.

21. Emergency Cash Assistance Service of up to (USD) 500.

22. Missed Connection coverage of up to (USD) 250.

Bounced Hotel, Trip Extensions, Legal Expenses, Weather Guarantee, Extended Pet Stay (INR), Loss of Personal Belongings (Mobile, Laptops, and iPads), Car Hire Excess Insurance, Compassionate Visit or Stay, Return of Minor Child, Ticket Overbooking, Sporting Activities, Display Benefit Cover, Replacement & Rearrangement of Staff, alternative transport expenses and Waiver of Sub-Limits.

1 Hospital Room, Emergency Room, and Boarding & Hospitalization: (USD) 1200 per day.

2 ICU: (USD) 2000 per day.

3 Surgical Treatment: (USD) 8,000 and 25% of Surgical Treatment cost for Anaesthetic Services.

4 Consultation Charges of up to (USD) 150 per visit.

5 Diagnostic & Testing charges of up to (USD) 1,000.

6 Ambulance Services of up to (USD) 300.

Important Points to note before buying Travel Ace Insurance?

Legal Expenses

Weather Guarantees

Extended Pet Stay (Covered in INR)

Loss of Personal Belongings such as Mobile, Laptops, and iPads

Car Hire Excess Insurance

Compassionate Visit or Stay

Return of Minor Child

Ticket Overbooking

Sporting Activities

Display Benefit Cover

Replacement and Rearrangement of Staff

Waiver of Sub-Limits Applicable to All Individuals Above 50

Years of Age Seeking OPD/Hospitalization.

Pre-Existing illnesses and injuries are covered only in specific policies. For all policies which do not state explicit inclusion, both pre-existing illnesses and injuries are excluded.

Any incident, injury, or loss because of substance abuse in the form of drugs or alcohol will not be covered.

Any damages resulting from human activities such as nuclear testing/attacks, war, terrorism, or riots will not be covered.

Medical treatment for HIV/AIDS, as well as an alternative treatment, cosmetic treatment, or treatment becoming essential due to self-harm or beyond a licensed doctor's medical advice, will not be covered.

Loss incurred due to unattended luggage or passport will not cover. If the luggage is not dispatched alongside the insured, any damage or loss incurred to the luggage will not be covered.

Adventure sports performed in professional capacity.

Adventure sports activity that is not under the supervision of a trained professional.

Download Travel Ace Insurance Documents

- Policy wordings

- Proposal form

Set Renewal Reminder

Thank you for your interest. We will send you a reminder when your policy is due for renewal.

Summary of Key Coverages

International Personal Accident Cover to help you recover from personal damages incurred during an accident in a foreign location.

Lifestyle Modification Benefits include the additional costs you have to bear to make necessary changes in your lifestyle and assets after an accident or emergency.

Child Education Benefits is the compensation released for your children's welfare if you meet an unfortunate event during the international trip.

Accidental, Death, and Disability compensate for demise or critical damage to bodily functions caused due to an accident during an international trip.

Personal Accidental Cover in India provides compensation to cover all the personal expenses incurred due to an accident in India.

Sickness or Accidental Medical Exigencies cover the cost of medical attention required to post an unforeseeable sickness or accident in a foreign location.

Emergency Dental Care covers the cost of non-cosmetic dental expenses for stopping pain, bleeding, or loss of teeth.

Daily Allowance during Hospitalization covers the non-medical or survival expenses incurred during a stay in the hospital.

Tip & Event Cancellation covers the cost incurred when the trip is cancelled for unforeseeable reasons. Trip Interruption covers only the costs incurred due to an intermittent gap in the journey that was not planned earlier.

Loss or Delay of Checked-In Baggage provides compensation for a fixed set of hours for which the baggage was delayed or lost, post the check-in.

Personal Liability Cover includes any liability on the insured to incur medical or property damage expenses due to inclusion in an overseas accident.

Golfer’s Hole-in-One covers the expenses incurred to play a US Golfer’s Association-recognized golf course under a predetermined limit.

Hijack Cover includes the compensation paid to the insured if the plan she/he/they used to travel is hijacked during the commute.

Home Burglary & Robbery insurance covers replacing portable equipment such as laptops and other equipment stolen when the insured individual is off to the trip.

Standard Fire & Special Perils covers the cost of replacing portable equipment such as laptops and other equipment which are damaged beyond reasonable repair when the insured individual is off to the trip.

Trip Delay Delight provides compensation on a fixed hourly basis if the trip is delayed for any reasons outside the insured individuals’ control.

Emergency Cash Assistance Service provides direct access to cash in a foreign location for emergency purposes.

Missed Connection coverage provides compensation if the insured individual misses a connecting flight for reasons outside her/his/their control.

Coverage for Loss of Passport and Driving License compensate for the loss of passport or driving license of the insured person for no causal error of her/his/their own. Similar coverage in principle is provided under the Loss of Personal Belongings cover for mobiles, laptops, and iPads.

Things to check while Buying a Travel Insurance Plan?

Here are a few things to look into before you choose the variant of the travel ace plan for your next journey:.

Seniors tend to attract a higher premium. Use this to optimize your clubbed insurance plan.

Ideally, avoid travelling to countries with high political or climate risks. Your insurance premium will be higher, and if a man-made event causes damages, your claims might even get rejected.

One-time and long trips will attract higher premiums. If you plan to travel frequently in a given year, consider a multi-trip plan. In terms of the itinerary, the lesser risk you put yourself into, the lesser premium you end up paying on the insurance.

Make a list of requirements you seek. Then, add a few in terms of add-ons. And now compare the insurance carriers who can cover your needs. The sum insured will be the total sum you are insured for.

Check the convenience of the claim settlement process and the claim settlement ratio. Also, make sure you read the entire list of exclusions – the conditions mentioned in your insurance agreement that show the instances under which you will not be eligible for the insured sum.

The Schengen Countries have some unique requirements for travel insurance plans. Read them carefully and see if your insurance plan matches them.

Understand the policies around pre-existing conditions and pre-policy tests conducted before your premium is locked.

Buy multi-trip and group insurance early to minimize the unitary costs of the insurance plan.

How to Find the Premium for your Travel Insurance Plan

You can easily calculate the tentative insurance premium for your Travel Ace plan. Here is how to do it:

Click here and access the Bajaj Allianz Travel Insurance Premium Calculator.

Add your active name, phone number, and email address. Mention your country of residence accurately.

That’s all! You will soon receive a tentative quote for your Travel Ace premium.

The actual cost of the insurance will depend on a broad set of factors such as your age, travel destination, duration of the trip, number of travellers in the plan, and the add-ons you choose.

Steps To Buy Travel Ace Policy Plan?

1. Visit the Bajaj Allianz website, select travel insurance, and then choose the category befitting your needs.

2. Provide your full name and choose from the types of policies available for Leisure, Business Multi-Trip, and Student.

3. Add your Date of Birth, Date of Departure, Date of Return, Destination, and the existing Pin Code.

4. Get the virtual quote and the option to select a plan. Now, you can choose the add-ons you need and make the payment.

5. Post successful payment, you will get the insurance policy documents over email.

1. Download the app and log in with a valid account ID and password.

2. Choose travel insurance and add your name, DOB, journey dates, and existing pin code.

3. Get an instant quote on your phone and select the befitting plan with add-ons.

4. Make a successful payment and receive the insurance documents over email.

Visit the nearest Bajaj Allianz office and get in touch with our dedicated team. They will walk you through the entire process with a designated representative at your service.

Customer Reviews & Ratings

Average Rating:

(Based on 5,340 reviews & ratings)

David Williams

Pretty smooth process. Hassle free process while buying travel insurance

Satwinder Kaur

I like your online service. I am happy with that.

Madanmohan Govindarajulu

Straight forward online travel insurance quote and price. Easy to pay and buy

DEMYSTIFY INSURANCE

Know Everything about Bajaj Allianz's

Domestic Travel Insurance Policy

What is Bajaj Allianz's Missed

Call Facility?

Request CallBack PopUp

Thank You for Your Interest in Bajaj Allianz Insurance Policy, A Customer Support Executive will call you back shortly to assist you through the Process.

Request call back

Request Call Back

I hereby authorize Bajaj Allianz General Insurance Co. Ltd. to call me on the contact number made available by me on the website with a specific request to call back at a convenient time. I further declare that, irrespective of my contact number being registered on National Customer Preference Register (NCPR) under either Fully or Partially Blocked category, any call made or SMS sent in response to my request shall not be construed as an Unsolicited Commercial Communication even though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business. Furthermore, I understand that these calls will be recorded & monitored for quality & training purposes, and may be made available to me if required.

I/We hereby give voluntary consent to BAGIC/Company to share my/our personal information and data provided in this proposal form with its group companies or any other person in connection with the Insurance Policy or otherwise, including for providing products and services of group companies that may be of interest to me/us, to be used in accordance with their respective privacy policies and subject to appropriate measures being in place to safeguard my/our personal information.

You Don't want to miss this

By opting out of WhatsApp communication, you'll lose out on:

- Your personalised quote delivered directly on WhatsApp

- WhatsApp notification on policy information, updates & announcements

Written By: Bajaj Allianz - Updated: 21 st December 2022

Chat with us

Please enter valid quote reference ID

- Would you recommend Bajaj and its services to a friend who is looking to buy insurance? Select Select Definitely Not sure NO. Thank You Please select

- Any comments you have about our service/product/website? Please write your comment

Getting In Touch With Us Is Easy

Customer Login

Partner Login

Employee Login

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

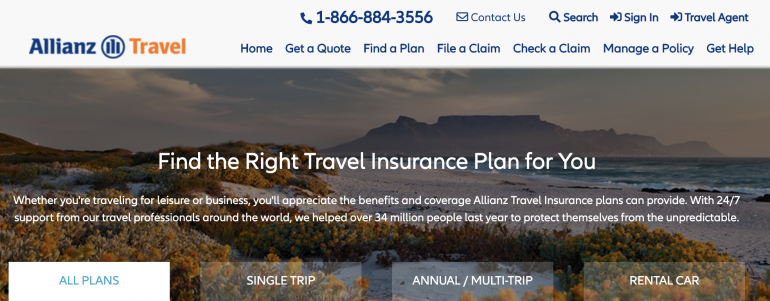

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

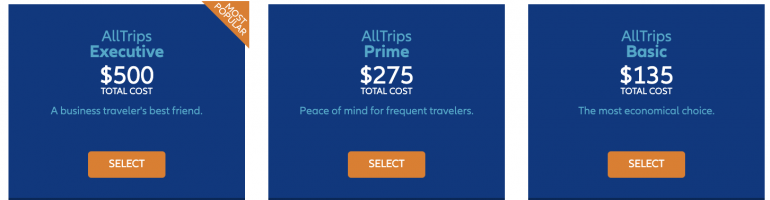

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

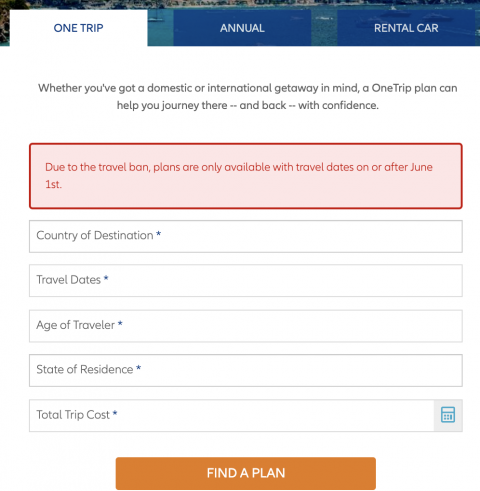

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Bajaj Allianz Insurance Online

- Bajaj Allianz

- Popular Destinations

- Travel insurance for visiting USA

Bajaj Allianz travel insurance USA

Bajaj travel insurance extension/renewal while outside india.

Indian overseas travelers who are stranded outside India due to coronavirus and are unable to travel back want to extend or renew Bajaj Allianz travel insurance online . These travelers can complete the Bajaj Allianz international travel insurance renewal request form online and we will try to get an approval for you.

ONLINE RENEWAL

Bajaj Allianz Travel Insurance Review

Sum insured.

USD 50,000/ 100,000 / 250,000 / 500,000 / 750,000 / 100,000

Tenure Options

180 days( can be extended for further)

Age of Entry

One day to upto 120 years

Bajaj Allianz travel insurance - Useful links

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Travelers who have already traveled from India and do not have insurance can buy Bajaj Allianz travel medical insurance.

Get all the answers to the most frequently asked questions (FAQs) regarding Bajaj Allianz overseas travel health insurance.

In case of Claim or reimbursement of treatment expenses, notify Bajaj Allianz travel health insurance.

Download Bajaj Allianz travel insurance soft copy for overseas travel!

Insurance customers can renew their existing policy online before the exipry date at any time.

Popular tourist destinations in USA

Walt Disney World

Mount Rushmore National Memorial

New York City

Washington, D.C.

USA - General information

North America

United States Dollar

Spring and Autumn

32.57 crores (2017)

American English

New York City, Los Angeles, Chicago, Las Vegas, Washington, D.C., Yellowstone, San Francisco, Jacksonville.

Indian travel insurance for USA by Bajaj Allianz

Indian tourists travelling overseas can get the complete travel insurance quotes using the overseas travel medical insurance premium chart from Bajaj Allianz . Tourists can also complete an online proposal form as well as renew or extend an existing Bajaj Allianz visitor insurance policy using travel health insurance extension form on expiry.

International tourists can buy online either using our Credit Card purchase, Net banking, Mobile wallet or Cheque payment facilities. Bajaj Allianz also satisfies Schengen visa requirements for travel to Europe. Please read through the brochure for complete benefits covered by the plan and its policy wordings which includes the terms and conditions. Click here to get some of the Bajaj Allianz overseas travel insurance reviews . Compare and buy Indian travel health insurance India to USA.

Bajaj Allianz travel insurance USA - Frequently asked questions

You can renew the Bajaj Allianz policy online . Fill the relevant details of the current existing policy and claims information (if any)and submit the form online. Our insurance advisors will then try to get approval based on the filled details.

The policy holder will be updated on the approval or rejection of the renewal request as early as possible (maximum 1 working day). if approved the policy holder will be sent a buy url where he / she can pay online and renew his policy.

Yes you can extend your travel insurance while being abroad. Fill the Bajaj Allianz insurance policy renewal form so that our insurance advisors will help you to renew your policy.

Travel policies can initially be purchased for 6 months and can be renewed for another 6 months provided that the policy holder is in good health, no claims on the existing policy and the policy has not expired. If the policy has expired or has any claims then renewal is based on approval from the insurance head office.

The cost for the USA travel insurance varies depending on the age of the traveler and the duration of coverage required. The older the traveler the higher is the cost. The longer the duration of USA travel insurance required, the greater will be the cost.

You can get buy Bajaj Allianz travel insurance for USA by getting free quotes on our website and then completing the Bajaj Allianz overseas health insurance proposal form and buying the Indian overseas mediclaim policy online.

If you are applying for USA visa, the consular authorities can ask you to have adequate travel insurance for USA. However given the fact that your domestic Indian health insurance provides little coverage in USA, it is important for Indian travelers to buy good Bajaj Allianz travel health insurance for USA.

Bajaj Allianz travel insurance is one of the most popular Indian travel insurance policy since Bajaj Allianz general insurance among the most reputed general insurance companies in India. Bajaj Allianz travel insurance product is considered one of the best Indian travel insurance products available.

Getting travel insurance before you travel outside India is always a good idea. Healthcare outside India, especially in Europe and the US is very expensive. Nobody can predict what will happen while traveling, so it is important to be prepared.

Travel insurance provides coverage for expenses related to hospitalisation, baggage loss assistance, medical emergencies..etc and the cost of travel insurance is very affordable given that it provides coverage in US Dollars while the premium is paid in Indian Rupees.

Bajaj Allianz has an excellent track record of providing good travel insurance plans for international travel. There are multiple plans which provide comprehensive protection at a nominal cost.

Yes you can travel without having travel insurance unless it is mandated by the respective consulates while issuing the travel visa. Many countries like all the Schengen states eg - Austria, Greece, Portugal, Spain, France, Germany, Belgium, Luxembourg and Netherlands insist of travel insurance while issuing the travel visa.

However beyond mandated requirement for the visa, it is prudent to buy travel insurance for XXX from India since healthcare is very expensive outside India, and you do not want to be forced to go to a hospital overseas without any travel insurance .

No, there is no travel insurance without medical coverage included. Always consult your insurance provider before filing a claim, or you risk having your claim denied.

- Competitive price.

- Cashless hospitalization claim settlement in USA.

- No age limit and no paper work

- Travel Companion: This is the most affordable and cheaper plan which the travelers can choose from. Any traveler up to 70 years can buy this plan. This category offers coverage up to $500,000 for travelers under 60 years and $50,000 for 61-70 years.

- Travel Elite - It is a high end plan with more benefits. This category offers coverage up to $500,000 for travelers up to 70 years. For 71 - 85 years you can get cover for $50,000.

- Travel Prime - It is a very popular plan which is recently introduced. This offers more flexible coverage up $1000,000 for travelers up to 70 years and $50,000 for senior citizens 71 - 90+ years.

- Travel Assist Card - This is a special plan which offers pre-existing coverage for a limited amount. This category offers insurance coverage up to $500,000 for travelers under 60 years and $50,000 for 61-70 years.

The Trump administration in the US has recently made it compulsory for all new US immigrant visa applicants to provide proof of proper US health insurance while in the country. This new rule will directly impact new immigrants visa applications of Indian family members of current US citizens. The aim of this mandatory immigrant health insurance is to reduce the burden on the US health care system and finally on US tax payers by uninsured new US immigrants. While this rule is aimed at those applying for US immigrant visas, we are hearing from travelers that even tourist visa applicants are expected to have proper short term visitor insurance. The travel health insurance plans offered here work ideally for tourists to the US. After purchasing these travel insurance plans, customers will receive the travel insurance document by email. Customers can show this travel insurance document as proof of health insurance coverage in the US for applying for the tourist visa. Given the high cost of US healthcare, it is in any case very important for all tourists and new immigrants to buy good health insurance for being in the US.

Travel insurance from Bajaj Allianz

Travel insurance, student insurance, senior insurance, health insurance, schengen insurance, annual insurance, domestic insurance, popular travel destinations.

Travel insurance to Australia

Travel insurance to USA

Travel insurance to UK

Travel insurance to New Zealand

Travel insurance to Thailand

Travel insurance to Singapore

Travel insurance to Malaysia

Travel insurance to Srilanka

Travel insurance to Vietnam

Travel insurance to South Africa

Travel insurance to China

Travel insurance to Mauritius

Travel insurance to Turkey

Travel insurance to Kenya

Travel insurance to Japan

Travel insurance to Dubai

Resourceful Bajaj Allianz travel insurance links

Travelers aged from 6 months to 99 years can buy this plan online without any paper work.

Suitable for travellers who travel frequently for a shorter duration of 45 days multiple times within a year.

Travel Asia Insurance is a special package devised for individuals travelling to Asia for a shorter duration of 30 days.

Bajaj Allianz senior citizen travel insurance can be obtained for $50,000 coverage without giving any medical reports.

Bajaj Allianz offer Europe travel insurance plans which are approved by VFS center.

Compare and buy Bajaj Allianz domestic travel insurance.

Find out more about Bajaj Allianz travel insurance

Travel insurance FAQ's

Answers to FAQ related to Bajaj Allianz travel medical insurance for visitors from India.

Travel insurance reviews

Bajaj Allianz Travel Insurance Review - Customer experiences and testimonials.

Bajaj Allianz travel insurance for popular travel destinations.

Travel insurance premium calculator

Bajaj Allianz travel insurance premium calculator for Indian travelers travelling overseas.

Search Bajaj Allianz travel insurance

Customers testimonials.

I want to add that 'NRIOL' has provided excellent service so far, for the past 3-4 years that we have used it.

Thanks insurance team for quick turnaround and going extra mile on this.

Thanks very much, your prompt response / help is appreciated.

Thank you very much for the excellent guidance in obtaining the renewal of medical insurance policy for my parents.

Thanks a lot for the quick help at this time of the evening.... Appreciate it.

I would like to thank each one of you for supports when I needed most.

Do you need health insurance?

New addition to your family? GET THEN INSURED Find Affordable HEALTH INSURANCE!!

Do you need travel insurance?

Is your family visiting you? GET THEN INSURED Find Affordable TRAVEL INSURANCE!!

Do you need domestic travel insurance?

Get free quotes and buy Indian Domestic travel insurance plans offered by Bajaj Allianz.

Bajaj Allianz Citation

Mr. Anshul Nijhawan, Head Travel Services at Bajaj Allianz says NRIOL and bajaj allianz have been working together for quite sometime now and NRIOL has successfully delivered seamless customer service by making available bajaj allianz travel insurance products to its customers online".

- Call : (080)-41101026

- Contact

- Chat with us

404 Not found

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you are a travel agent or were referred by one, enter the ACCAM number below.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

At Allianz, we continue to show our commitment to sports through our sponsorship with the International Olympic Committee and the International Paralympic Committee. Read More >>

Entry Requirements & COVID-19 Travel Resources

Confused about entry requirements for your destination? Our interactive map shows current travel rules and restrictions for each destination, including info on COVID-19 testing, necessary travel documents and quarantine periods.

Find out how our Epidemic Coverage Endorsement can protect your next trip from certain losses related to COVID-19.

Why do I need travel insurance?

Because sometimes..., you have to cancel a trip last-minute..

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason.

Travel delays leave you stranded.

Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

You get sick or hurt when you're far from home.

Travel insurance can reimburse you for care following a covered medical emergency while traveling. We can even arrange and pay for a medical evacuation if needed.

Fender-benders are unavoidable.

Renting a car means taking on a big financial risk; even a tiny scrape can cost you hundreds. Low-priced rental car insurance lets you drive worry-free.

You need help in a hurry.

Whether you're planning a week-long road trip or a weekend getaway, you never know what might happen. Travel insurance gives you access to our 24-Hour Assistance hotline for expert, personalized support in a crisis.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our Allyz ® TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

TRAVEL RESOURCES

How Travel Insurance Works

How the Cancel Anytime Upgrade Works

What Does Rental Car Insurance Cover?

Is It Too Late to Buy Travel Insurance?

The Comprehensive Guide to Annual Travel Insurance

5 Ways the Allyz ® TravelSmart App Can Help During Winter Travels

Travel Insurance with Emergency Medical Benefits

Destination Guide: Croatia

Travel Insurance & COVID-19: The Epidemic Coverage Endorsement Explained

More Travel Resources »

LATEST COVERAGE ALERTS

The events listed below are considered "known and foreseeable" for travel insurance purposes on the date listed next to the event. Please consult your policy for more information.

More Coverage Alerts »

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

MouthShut.com Would Like to Send You Push Notifications. Notification may includes alerts, activities & updates.

Concern / Feedback Form

Secure your account

Please enter your valid contact number to receive OTP.

Just one step away to protect your account with 2FA.

Add extra security with 2 Factor Authentication

Protect your account by adding an extra layer of security.

OTP Verification

Your 2FA is Activated

Set Email Alert

Alert on more product reviews

Alert on new comments on this reviews

Read All Reviews

Home > Personal Finance > Insurance Companies > Bajaj Allianz Travel Insurance > Worst customer service

Worst customer service. Review on Bajaj Allianz Travel Insurance

Bajaj Allianz Travel Insurance

MouthShut Score

Customer Service:

Claims Settlement:

Range of Plans:

Staff Attitude:

Upload your product photo

Contact Number

The ingenuineness of this review appears doubtful. Justify your opinion.

I feel this review is:

- Question & Answer

The mysterious case of non-refund of the travel insurance amount upon cancellation of policy despite it nearing an entire year since policy purchase.

Strange are the workings of the visa office! They want the tickets to and back from the visiting country, and so also the travel insurance to go along, and not to forget that thick bundle of documents before they even consider your request for a visiting visa. Consulates have their policies and applicants have to adhere to their requirements. No complaints about it! They truly have their country’s interest before them, and they’ll do their best to safeguard their country’s interests.

This grievance is not with regard to any particular country’s consulate, it is with regard to a travel insurance company that benefits when patrons choose to travel.

When you make a visa application, despite being in the dark whether the consulate will approve your visa application, you still need to buy travel insurance as part of the documentation.

This is where our association with Bajaj Allianz began! I purchased travel insurance for my mother who was moving a visa application to visit me. It was at a time when the pandemic was showing signs of waning, and travel between countries was soon picking up. However the pandemic made a stronger comeback, and the consulate changed their travel rules. My mom’s visa was denied.

We promptly approached Bajaj Allianz requesting cancellation of the travel policy and thereby requesting them to refund us the amount that was due to us.

This was not the first time that we have purchased travel insurance and cancelled it. We had purchased travel insurance from HDFC Ergo the previous time around, and we promptly received our refund when the cancellation of the policy was initiated. The refund was completed in the shortest possible time.

Bajaj Allianz is not happy in refunding the cancelled policy amount, we believe. Because that’s what our experience has taught us.

When we purchased the policy, this was their tone - they were the epitome of customer success, or so it appeared:

On Fri, Jan 22, 2021 at 1:34 PM [email protected] wrote:

Call Us 1800-209-5858

We're very excited you're here.

We have issued your policy No. 12-9910-0000528172-00 .

Caringly Yours,

Bajaj Allianz General Insurance

Stay Connected and help us to improve

It was time to cancel the travel insurance, and so we wrote:

Date: Mon, Jan 25, 2021 at 10:07 PM

Subject: Cancellation of Travel: Policy Generated, number:12-9910-0000528172-00

Hello Team,

I would like to cancel the Travel Insurance Policy 12-9910-0000528172-00 issued under name.

VFS office did not accept my Poland VISA application, hence I will not be able to travel

Kindly let me know if any further information is required?

Kind Regards,

This was just the start of a never ending chain of mails that followed. They had even sent us the escalation matrix of personnel we need to contact to address grievances if any, and so forth. If you contact the people on the escalation matrix the silence was simply mind-numbing. We even called their office a couple of times.

We’ve been asked to send bank statements of a certain period to prove that no refund was received. They said the transfer was made. But, our bank statements never reflected that. We did each and everything that was asked of us by Bajaj Allianz’s personnel. Despite this, there was no respite to our grievance, and to date our refund has not been received.

Is this customer support by any standard? If Bajaj Allianz is this hell-bent in not returning us back the cancelled policy amount, what would be the state of a customer who makes a claim for insurance money when stuck in a foreign country and needs money to pay for a hospital expense or something.

If you go by our experience, that person will rot in that country awaiting relief from Bajaj Allianz. We strongly believe that the people at Bajaj Allianz just want to pocket the money while people purchase travel policies, and then forget the rest of their commitments including making a simple refund of a cancelled policy, which is rightfully due to the policy purchaser.

Is it best to keep away from making a purchase of a travel policy from Bajaj Allianz when you travel?

Our experience says, YES! Keep away from these good-for-nothings!

- Flag This Review

- Thank You! We appreciate your effort.

Upload Photos

Upload photo files with .jpg, .png and .gif extensions. Image size per photo cannot exceed 10 MB

Comments on Bajaj Allianz Travel Insurance Review

Service is slow and claiming is not easy. Ticket refund or cancellation is not gonna give money back. Dental medical conditions is not covered in the plan. Not satisfied.

By: YadavDipti | Dec 16, 2021 02:51 PM

View more comments

YOUR RATING ON

Thank you for sharing the requirements with us. We'll contact you shortly.

Free MouthShut app saves money.

An OTP has been sent to your email and mobile number. Please enter OTP to verify the account.

Didn't receive? Resend OTP

An OTP has been sent to your email address. Please Enter OTP to verify your email address

- Compare Plans

TATA AIG vs Bajaj Allianz Travel insurance

Email me the results, best international travel insurance india, unique features of tata aig.

- Joint Venture between Tata Group and AIG, one of the largest General Insurers in the world. Leading Travel Insurer in India known for prompt claims settlement.

- TATA AIG’s Accident & Sickness Sum Insured is per incident/claim and not per trip. Hence it is possible that with TATA AIG Travel Insurance, the customer can have multiple claims, each time the Sum insured is restored back to the maximum benefit limit.

- Policy is available for all entry ages under different plans from the age of 6 months onwards till 70 years of age for all plans except the Senior Citizen plan, which has an entry age of 71 years

- Medical Sublimits under TATA AIG’s Travel Insurance starts from the age of 56 years.

- No Medical Check-up for traveller of any age upto any sum insured. Senior citizens (71-99 years) can also get $50,000 coverage for 180 days without any medical check up.

- TATA AIG’s Travel insurance policies can be renewed for180 days and upto a maximumduration not exceeding 360 days, for travellers below 70 yearsand upto a maximum of 180 days for 70+ travellers

- Pre-existing ailments or medical conditions are covered up to $1500 only incase of life threatening situations.

- Worldwide Travel & Medical Assistance is provided by AIG Travel Assist, who have one of the largest network of hospitals in USA and across the world. They also have 8 alarm centres across the world supporting travellers on medical and non medical needs.

Unique Features of Bajaj Allianz

- One of the largest Travel Insurance companies in India, known for proactive customer service and claims settlements. JV between Bajaj Finance and Allianz Insurance Group of Germany.

- WidestRange of Innovating and Comprehensive Travel Insurance plans to suit travellers requirements and budget.

- Travellers aged between 6 months and 70 years can purchase a Regular Bajaj Travel Insurance plan and Senior Citizens can but the Senior Companion Plan from 71 till the insured reaches the age of 99 years.

- Bajaj Allianz allows travel insurance plan to be purchased for 180 days and renewed for another maximum of 180 days subject to underwriting approval and on a case to case basis.

- Medical Sublimits for Sickness Treatment under Bajaj Allianz travel insurance plans starts from the age of 61 years. There are no sub limits for Accidental Hospitalisation either inpatient or outpatient.

- The Assist Card plan offers coverage of Pre-existing medical conditions for a limited amount depending on the plan opted for.

- No Medical Check up and Entry Age Restriction for Bajaj Travel insurance plans.

- Only Insurance company to offer In House Claims and Assistance which ensures timely and efficient claims management. While their Call Centre is in India, they offer Toll Free Assistance numbers across the world.

Important Points of TATA AIG

- TATA AIG has policy maximum coverage per claim . Therefore it is possible that with TATA AIG, customer can have multiple claims, each for the policy maximum.

- Sublimits for TATA AIG travel starts from the age of 56 years.

- Sum total of coverage days for new policy and / or subsequent renewals cannot exceed 180 days for 70+ travelers

- Senior citizens (71-99 years) can get $50,000 coverage for 180 days without medical checkup.

- Pre-existing ailments or medical conditions are covered up to $1,500 only incase of life threatening situation

- Renewal of Annual Multi Trip policies will now be extended even beyond 70 years of age.

Limitations of TATA AIG

- Accident & Sickness Medical Expense is limited to $10,000 for two wheeled motorized mode of conveyance irrespective of any Plan and age wherever applicable.

- Accidental Death and Dismemberment Benefit is limited to $5,000 for two wheeled motorized mode of conveyance irrespective of any Plan and age wherever applicable.

- Accidental Death and Dismemberment Benefit is limited to 10% of Principal Sum Insured for Insured Person with age 17 years or below.

Compare Other Travel Insurance

India travel insurance blogs and articles.

Tips to find good and adequate international travel health insurance... Click here to read more

Comparison of overseas Healthcare cost and popular tourist destinations... Click here to read more

How to use Indian visitor insurance in case of sudden sickness and accidents... Click here to read more

Indian travel insurance for popular overseas tourist destinations... Click here to read more

India travel insurance useful links

How to buy online.

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Already outside India

Travelers who have already traveled from India and do not have insurance can buy travel medical insurance after approval.

Travel Insurance Online Renewal

Insurance customers can renew their existing policy online before the exipry date at any time.

Insurance Claims

In case of a claim or reimbursement of treatment expenses, notify by contacting them.

Tips on air travel

Travel tips for Indian parents

How are Claims settled?

Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

How does travel insurance work

How to use Indian visitor insurance in case of sudden sickness and accidents

Healthcare cost overseas

Comparison of overseas Healthcare cost and popular tourist destinations

Tips to find best travel insurance

Tips to find good and adequate international travel health insurance

EIndia General Insurance Partners

ONLINE CHAT

What are you looking for?

Provide your contact information

Chat with Us

Insurance Guide

Useful links

- Insurance Categories

- Compare Insurance

- Insurance Claims

- Disclaimer

- Privacy Policy

- Terms & Conditions

- Blog

- Resource Centre

- Insurance FAQs

- About Us

- Contact Us

- SiteMap

Product links

- Health Insurance

- Life Insurance

- Travel Insurance

- Motor Insurance

- Home Insurance

- Personal Accident

Keep in touch

InstantCover Insurance Web Aggregator Private limited 710, 6th B Cross, 16th Main Road, Koramangala 3rd Block, Bangalore - 560 034.

- +91-(80)-41101026

- Send an email

- Call : +91-(80)-41101026

- Contact

- Chat with us