- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

7 Rules You Should Know About Deducting Business Travel Expenses

:max_bytes(150000):strip_icc():format(webp)/DanielRathburn-a16946b87e45469aaae5b4998db2397a.jpeg)

- What Is Your "Tax Home"?

Charges on Your Hotel Bill

The 50% rule for meals, the cost of bringing a spouse, friend or employee.

- Using Per Diems To Calculate Employee Travel Costs

Combined Business/Personal Trips

International business travel.

- The Cost of a Cruise (Within Limits)

Frequently Asked Questions (FAQs)

Helde Benser / Getty Images

The IRS has a specific definition for business travel when it comes to determining whether these expenses are tax deductible. The agency says business travel is travel that takes you away from your tax home and is "substantially longer than an ordinary day's work." It requires that you sleep or rest while you're away from home, and that you do so. The travel must be "temporary." This means it can't last a year or more.

Key Takeaways

- You can deduct expenses that take you away from your tax home for a period of time that would require you to spend the night.

- Your tax home is the city or area where your regular place of business is located.

- You’re limited to 50% of the cost of your meals.

- Your trip must be entirely business-related for costs to be deductible, but special rules apply if you travel outside the U.S.

What Is Your "Tax Home"?

Your tax home is a concept set by the IRS to help determine whether a trip is tax deductible. It's defined by the IRS as the entire city or general area where your regular place of business is located. It's not necessarily the area where you live.

Your tax home can be used to determine whether your business travel expenses are deductible after you've determined where it's located. You can probably count your expenses during travel as business deductions if you have to leave your tax home overnight or if you otherwise need time to rest and sleep while you're away.

Check with a tax professional to make sure you're accurately identifying the location of your tax home.

Charges for your room and associated tax are deductible, as are laundry expenses and charges for phone calls or for use of a fax machine. Tips are deductible as well. But additional personal charges, such as gym fees or fees for movies or games aren't deductible.

You can deduct the cost of meals while you're traveling, but entertainment expenses are no longer deductible and you can't deduct "lavish or extravagant" meals.

Meal costs are deductible at 50%. The 50% limit also applies to taxes and tips. You can use either your actual costs or a standard meal allowance to take a meal cost deduction, as long as it doesn't exceed the 50% limit.

The cost of bringing a spouse, child, or anyone else along on a business trip is considered a personal expense and isn't deductible. But you may be able to deduct travel expenses for the individual if:

- The person is an employee

- They have a bona fide business purpose for traveling with you

- They would otherwise be allowed to deduct travel expenses

You may be able to deduct the cost of a companion's travel if you can prove that the other person is employed by the business and is performing substantial business-related tasks while on the trip. This may include taking minutes at meetings or meeting with business clients.

Using Per Diems To Calculate Employee Travel Costs

The term "per diem" means "per day." Per diems are amounts that are considered reasonable for daily meals and miscellaneous expenses while traveling.

Per diem rates are set for U.S. and overseas travel, and the rates differ depending on the area. They're higher in larger U.S. cities than for sections of the country outside larger metropolitan areas. Companies can set their own per diem rates, but most businesses use the rates set by the U.S. government.

Per diem reimbursements aren't taxable unless they're greater than the maximum rate set by the General Service Administration. The excess is taxable to the employee.

If you don't spend all your time on business activities during an international trip, you can only deduct the business portion of getting to and from the destination. You must allocate costs between business and personal activities.

Your trip must be entirely business-related for you to take deductions for travel costs if you remain in the U.S., but some "incidental" personal time is okay. It would be incidental to the main purpose of your trip if you travel to Dallas for business and you spend an evening with family in the area while you're there.

But attempting to turn a personal trip into a business trip won't work unless the trip is substantially for business purposes. The IRS indicates that “the scheduling of incidental business activities during a trip, such as viewing videotapes or attending lectures dealing with general subjects, will not change what is really a vacation into a business trip."

The rules are different if part or all of your trip takes you outside the U.S. Your international travel may be considered business-related if you were outside the U.S. for more than a week and less than 25% of the time was spent on personal activities.

You can deduct the costs of your entire trip if it takes you outside the U.S. and you spend the entire time on business activities, but you must have "substantial control" over the itinerary. An employee traveling with you wouldn't have control over the trip, but you would as the business owner would.

The trip may be considered entirely for business if you spend less than 25% of the time on personal activities if your trip takes you outside the U.S. for more than a week.

You can only deduct the business portion of getting to and from the destination if you don't spend all your time on business activities during an international trip. You must allocate costs between your business and personal activities.

The Cost of a Cruise (Within Limits)

The cost of a cruise may be deductible up to the specified limit determined by the IRS, which is $2,000 per year as of 2022. You must be able to show that the cruise was directly related to a business event, such as a business meeting or board of directors meeting.

The IRS imposes specific additional strict requirements for deducting cruise travel as a business expense.

How do you write off business travel expenses?

Business travel expenses are entered on Schedule C if you're self-employed . The schedule is filed along with your Form 1040 tax return. It lists all your business income, then you can subtract the cost of your business travel and other business deductions you qualify for to arrive at your taxable income.

What are standard business travel expenses?

Standard business travel expenses include lodging, food, transportation costs , shipping of baggage and/or work items, laundry and dry cleaning, communication costs, and tips. But numerous rules apply so check with a tax professional before you claim them.

The Bottom Line

These tax deduction regulations are complicated, and there are many qualifications and exceptions. Consult with your tax and legal professionals before taking actions that could affect your business.

IRS. " Topic No. 511: Business Travel Expenses ."

IRS. " Publication 463 (2021), Travel, Gift, and Car Expenses ."

IRS. " Here’s What Taxpayers Need To Know About Business-Related Travel Deductions ."

Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

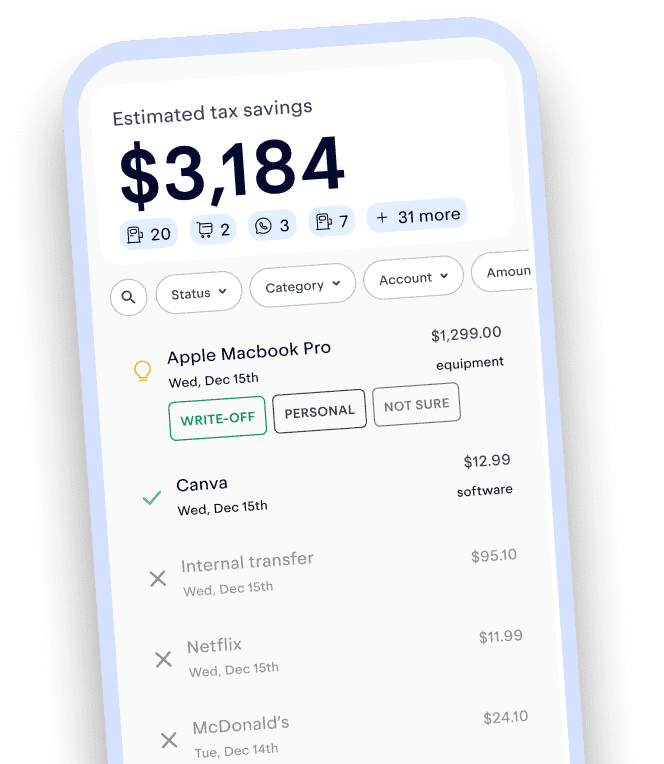

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

5 years ago

Travel and subsistence for directors, what you need to know.

Travel and subsistence costs are one of the most troublesome areas for business owners and company directors.

At PGM we’re here to help, by giving you the run down on travel and subsistence costs.

So what exactly is ‘Travel and Subsistence’?

Travel and subsistence is defined as “ any accommodation, food and drink costs that you incur whilst you are away from your permanent workplace while working for the company”. These expenses are tax deductible when they are incurred wholly and exclusively for the purpose of your business, trade, profession or vocation.

It’s worth noting that food and drink purchased close to your company’s premises does not meet the criteria of ‘work related’.

Claiming your subsistence expenses

Subsistence expenses can only be claimed under the rules for claiming travel. This means that they must be incurred in direct conjunction with being required to travel for work. The hard and fast rule is that an expense must also be ‘reasonable’ . A typical scenario could be claiming lunch on an airport connection or dinner expenses when required to stay overnight at a hotel.

Proximity and timing is important

Expenditure incurred shortly after leaving home, or arriving home is disallowed by HMRC, as this is deemed a personal choice and not seen as a necessity.

Allowable subsistence costs

Subsistence costs incurred while making client or supplier visits, occasional onsite working or travel to and from events and training courses fits the criteria of allowable travel expenses. However inviting your client for a dinner would be treated as client entertaining and that is specifically not tax deductible.

Tracking your travel and subsistence expenses.

Gone are the days of frantically trying to find that receipt, wedged in your work diary or hidden somewhere in your wallet or purse to claim that expense. At PGM we offer bookkeeping and digital record tracking, making your accounts preparation more efficient and therefore making your business more efficient. Save time by recording expenses in real time through your smartphone with our digital solutions.

Just click here to book a free 30 minute business consultation with our team and learn more about the benefits of our cloud accounting solutions.

How to Deduct Travel Expenses (with Examples)

Reviewed by

November 3, 2022

This article is Tax Professional approved

Good news: most of the regular costs of business travel are tax deductible.

Even better news: as long as the trip is primarily for business, you can tack on a few vacation days and still deduct the trip from your taxes (in good conscience).

I am the text that will be copied.

Even though we advise against exploiting this deduction, we do want you to understand how to leverage the process to save on your taxes, and get some R&R while you’re at it.

Follow the steps in this guide to exactly what qualifies as a travel expense, and how to not cross the line.

The travel needs to qualify as a “business trip”

Unfortunately, you can’t just jump on the next plane to the Bahamas and write the trip off as one giant business expense. To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes.

Here’s how to make sure your travel qualifies as a business trip.

1. You need to leave your tax home

Your tax home is the locale where your business is based. Traveling for work isn’t technically a “business trip” until you leave your tax home for longer than a normal work day, with the intention of doing business in another location.

2. Your trip must consist “mostly” of business

The IRS measures your time away in days. For a getaway to qualify as a business trip, you need to spend the majority of your trip doing business.

For example, say you go away for a week (seven days). You spend five days meeting with clients, and a couple of days lounging on the beach. That qualifies as business trip.

But if you spend three days meeting with clients, and four days on the beach? That’s a vacation. Luckily, the days that you travel to and from your location are counted as work days.

3. The trip needs to be an “ordinary and necessary” expense

“Ordinary and necessary ” is a term used by the IRS to designate expenses that are “ordinary” for a business, given the industry it’s in, and “necessary” for the sake of carrying out business activities.

If there are two virtually identical conferences taking place—one in Honolulu, the other in your hometown—you can’t write off an all-expense-paid trip to Hawaii.

Likewise, if you need to rent a car to get around, you’ll have trouble writing off the cost of a Range Rover if a Toyota Camry will get you there just as fast.

What qualifies as “ordinary and necessary” can seem like a gray area at times, and you may be tempted to fudge it. Our advice: err on the side of caution. if the IRS chooses to investigate and discovers you’ve claimed an expense that wasn’t necessary for conducting business, you could face serious penalties .

4. You need to plan the trip in advance

You can’t show up at Universal Studios , hand out business cards to everyone you meet in line for the roller coaster, call it “networking,” and deduct the cost of the trip from your taxes. A business trip needs to be planned in advance.

Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with. Document your plans in writing before you leave. If possible, email a copy to someone so it gets a timestamp. This helps prove that there was professional intent behind your trip.

The rules are different when you travel outside the United States

Business travel rules are slightly relaxed when you travel abroad.

If you travel outside the USA for more than a week (seven consecutive days, not counting the day you depart the United States):

You must spend at least 75% of your time outside of the country conducting business for the entire getaway to qualify as a business trip.

If you travel outside the USA for more than a week, but spend less than 75% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

For example, say you go on an eight-day international trip. If you spend at least six days conducting business, you can deduct the entire cost of the trip as a business expense—because 6 is equivalent to 75% of your time away, which, remember, is the minimum you must spend on business in order for the entire trip to qualify as a deductible business expense.

But if you only spend four days out of the eight-day trip conducting business—or just 50% of your time away—you would only be able to deduct 50% of the cost of your travel expenses, because the trip no longer qualifies as entirely for business.

List of travel expenses

Here are some examples of business travel deductions you can claim:

- Plane, train, and bus tickets between your home and your business destination

- Baggage fees

- Laundry and dry cleaning during your trip

- Rental car costs

- Hotel and Airbnb costs

- 50% of eligible business meals

- 50% of meals while traveling to and from your destination

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that’s a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

The cost of your lodging is tax deductible. You can also potentially deduct the cost of lodging on the days when you’re not conducting business, but it depends on how you schedule your trip. The trick is to wedge “vacation days” in between work days.

Here’s a sample itinerary to explain how this works:

Thursday: Fly to Durham, NC. Friday: Meet with clients. Saturday: Intermediate line dancing lessons. Sunday: Advanced line dancing lessons. Monday: Meet with clients. Tuesday: Fly home.

Thursday and Tuesday are travel days (remember: travel days on business trips count as work days). And Friday and Monday, you’ll be conducting business.

It wouldn’t make sense to fly home for the weekend (your non-work days), only to fly back into Durham for your business meetings on Monday morning.

So, since you’re technically staying in Durham on Saturday and Sunday, between the days when you’ll be conducting business, the total cost of your lodging on the trip is tax deductible, even if you aren’t actually doing any work on the weekend.

It’s not your fault that your client meetings are happening in Durham—the unofficial line dancing capital of America .

Meals and entertainment during your stay

Even on a business trip, you can only deduct a portion of the meal and entertainment expenses that specifically facilitate business. So, if you’re in Louisiana closing a deal over some alligator nuggets, you can write off 50% of the bill.

Just make sure you make a note on the receipt, or in your expense-tracking app , about the nature of the meeting you conducted—who you met with, when, and what you discussed.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket.

Meals and entertainment while you travel

While you are traveling to the destination where you’re doing business, the meals you eat along the way can be deducted by 50% as business expenses.

This could be your chance to sample local delicacies and write them off on your tax return. Just make sure your tastes aren’t too extravagant. Just like any deductible business expense, the meals must remain “ordinary and necessary” for conducting business.

How Bench can help

Surprised at the kinds of expenses that are tax-deductible? Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill. But with messy or incomplete financials, you can miss these tax saving expenses and end up with a bigger bill than necessary.

Enter Bench, America’s largest bookkeeping service. With a Bench subscription, your team of bookkeepers imports every transaction from your bank, credit cards, and merchant processors, accurately categorizing each and reviewing for hidden tax deductions. We provide you with complete and up-to-date bookkeeping, guaranteeing that you won’t miss a single opportunity to save.

Want to talk taxes with a professional? With a premium subscription, you get access to unlimited, on-demand consultations with our tax professionals. They can help you identify deductions, find unexpected opportunities for savings, and ensure you’re paying the smallest possible tax bill. Learn more .

Bringing friends & family on a business trip

Don’t feel like spending the vacation portion of your business trip all alone? While you can’t directly deduct the expense of bringing friends and family on business trips, some costs can be offset indirectly.

Driving to your destination

Have three or four empty seats in your car? Feel free to fill them. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride.

One exception: If you incur extra mileage or “unnecessary” rental costs because you bring your family along for the ride, the expense is no longer deductible because it isn’t “necessary or ordinary.”

For example, let’s say you had to rent an extra large van to bring your children on a business trip. If you wouldn’t have needed to rent the same vehicle to travel alone, the expense of the extra large van no longer qualifies as a business deduction.

Renting a place to stay

Similar to the driving expense, you can only deduct lodging equivalent to what you would use if you were travelling alone.

However, there is some flexibility. If you pay for lodging to accommodate you and your family, you can deduct the portion of lodging costs that is equivalent to what you would pay only for yourself .

For example, let’s say a hotel room for one person costs $100, but a hotel room that can accommodate your family costs $150. You can rent the $150 option and deduct $100 of the cost as a business expense—because $100 is how much you’d be paying if you were staying there alone.

This deduction has the potential to save you a lot of money on accommodation for your family. Just make sure you hold on to receipts and records that state the prices of different rooms, in case you need to justify the expense to the IRS

Heads up. When it comes to AirBnB, the lines get blurry. It’s easy to compare the cost of a hotel room with one bed to a hotel room with two beds. But when you’re comparing significantly different lodgings, with different owners—a pool house versus a condo, for example—it becomes hard to justify deductions. Sticking to “traditional” lodging like hotels and motels may help you avoid scrutiny during an audit. And when in doubt: ask your tax advisor.

So your trip is technically a vacation? You can still claim any business-related expenses

The moment your getaway crosses the line from “business trip” to “vacation” (e.g. you spend more days toasting your buns than closing deals) you can no longer deduct business travel expenses.

Generally, a “vacation” is:

- A trip where you don’t spend the majority of your days doing business

- A business trip you can’t back up with correct documentation

However, you can still deduct regular business-related expenses if you happen to conduct business while you’re on vacay.

For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense . Just make sure you keep the receipt.

Meanwhile, the other “vacation” related expenses that made it possible to meet with this client in person—plane tickets to Portland, vehicle rental so you could drive around the city—cannot be deducted; the trip is still a vacation.

If your business travel is with your own vehicle

There are two ways to deduct business travel expenses when you’re using your own vehicle.

- Actual expenses method

- Standard mileage rate method

Actual expenses is where you total up the actual cost associated with using your vehicle (gas, insurance, new tires, parking fees, parking tickets while visiting a client etc.) and multiply it by the percentage of time you used it for business. If it was 50% for business during the tax year, you’d multiply your total car costs by 50%, and that’d be the amount you deduct.

Standard mileage is where you keep track of the business miles you drove during the tax year, and then you claim the standard mileage rate .

The cost of breaking the rules

Don’t bother trying to claim a business trip unless you have the paperwork to back it up. Use an app like Expensify to track business expenditure (especially when you travel for work) and master the art of small business recordkeeping .

If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit.

Speaking of which, if your business is flagged to be audited, the IRS will make it a goal to notify you by mail as soon as possible after your filing. Usually, this is within two years of the date for which you’ve filed. However, the IRS reserves the right to go as far back as six years.

Tax penalties for disallowed business expense deductions

If you’re caught claiming a deduction you don’t qualify for, which helped you pay substantially less income tax than you should have, you’ll be penalized. In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5,000—whichever amount is higher.

The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax. This is on top of making up the difference.

Ultimately, you’re paying back 120% of what you cheated off the IRS.

If you’re slightly confused at this point, don’t stress. Here’s an example to show you how this works:

Suppose you would normally pay $30,000 income tax. But because of a deduction you claimed, you only pay $29,000 income tax.

If the IRS determines that the deduction you claimed is illegitimate, you’ll have to pay the IRS $1200. That’s $1000 to make up the difference, and $200 for the penalty.

Form 8275 can help you avoid tax penalties

If you think a tax deduction may be challenged by the IRS, there’s a way you can file it while avoiding any chance of being penalized.

File Form 8275 along with your tax return. This form gives you the chance to highlight and explain the deduction in detail.

In the event you’re audited and the deduction you’ve listed on Form 8275 turns out to be illegitimate, you’ll still have to pay the difference to make up for what you should have paid in income tax—but you’ll be saved the 20% penalty.

Unfortunately, filing Form 8275 doesn’t reduce your chances of being audited.

Where to claim travel expenses

If you’re self-employed, you’ll claim travel expenses on Schedule C , which is part of Form 1040.

When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit.

Learn more about how to find, hire, and work with an accountant . And when you’re ready to outsource your bookkeeping, try Bench .

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.

While many travel expenses can be deducted by businesses, those that are deemed unreasonable, lavish, or extravagant, or expenditures for personal purposes, may be excluded.

Types of Travel Expenses

Types of travel expenses can include:

- Personal vehicle expenses

- Taxi or rideshare expenses

- Airfare, train fare, or ferry fees

- Laundry and dry cleaning

- Business meals

- Business calls

- Shipment costs for work-related materials

- Some equipment rentals, such as computers or trailers

The use of a personal vehicle in conjunction with a business trip, including actual mileage, tolls, and parking fees, can be included as a travel expense. The cost of using rental vehicles can also be counted as a travel expense, though only for the business-use portion of the trip. For instance, if in the course of a business trip, you visited a family member or acquaintance, the cost of driving from the hotel to visit them would not qualify for travel expense deductions .

The IRS allows other types of ordinary and necessary expenses to be treated as related to business travel for deduction purposes. Such expenses can include transport to and from a business meal, the hiring of a public stenographer, payment for computer rental fees related to the trip, and the shipment of luggage and display materials used for business presentations.

Travel expenses can also include operating and maintaining a house trailer as part of the business trip.

Can I Deduct My Business Travel Expenses?

Business travel expenses can no longer be deducted by individuals.

If you are self-employed or operate your own business, you can deduct those "ordinary and necessary" business expenses from your return.

If you work for a company and are reimbursed for the costs of your business travel , your employer will deduct those costs at tax time.

Do I Need Receipts for Travel Expenses?

Yes. Whether you're an employee claiming reimbursement from an employer or a business owner claiming a tax deduction, you need to prepare to prove your expenditures. Keep a running log of your expenses and file away the receipts as backup.

What Are Reasonable Travel Expenses?

Reasonable travel expenses, from the viewpoint of an employer or the IRS, would include transportation to and from the business destination, accommodation costs, and meal costs. Certainly, business supplies and equipment necessary to do the job away from home are reasonable. Taxis or Ubers taken during the business trip are reasonable.

Unreasonable is a judgment call. The boss or the IRS might well frown upon a bill for a hotel suite instead of a room, or a sports car rental instead of a sedan.

Individual taxpayers need no longer fret over recordkeeping for unreimbursed travel expenses. They're no longer tax deductible by individuals, at least until 2025 when the provisions in the latest tax reform package are due to expire or be extended.

If you are self-employed or own your own business, you should keep records of your business travel expenses so that you can deduct them properly.

Internal Revenue Service. " Topic No. 511, Business Travel Expenses ."

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 13.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Page 7.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Pages 6-7, 13-14.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 4.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Pages 5, 7.

:max_bytes(150000):strip_icc():format(webp)/TaxHome-3b9f1ac36f6c4e28889c34943d991fc9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What Expenses Can I Claim as a Company Director?

Company directors are entitled to claim certain expenses. This is the case whether you’re the sole director of a limited company, or the managing director of a small business.

In this post we’ll outline some of the expenses you can claim as a company director, along with any limits.

Please note that you should pay for all business expenses from a business bank account . Keep all of your personal expenses separate through paying for them from your personal account.

Be sure to check out our guide to allowable expenses for the self-employed , too.

Allowable Expenses For a Limited Company Director

Director salary.

Your salary as a limited company director is an allowable expense, and so too are your National Insurance contributions.

It’s up to you to decide how much your business pays you. Just make sure that the arrangement you decide on is in line with IR35 regulations. You can read our essential introduction to IR35 .

You can also claim up to 100% tax relief on any contributions you make to your pension scheme – whether it’s for you, as a director, or for your employees.

Business Premises

If you rent external office space, your business can cover the cost of the rent, your utility bill payments, and any other associated expenses.

If you work from a home office, you can either claim:

- Basic allowance – Up to £26 a month if you work at least 25 hours per month from home.

- Apportioned cost – You can claim money back from your business to spend on household bills if you work one day a week from your home office. For this, you’ll have to calculate how much of your bills can be attributed to business use – whether that’s rent, mortgage payments, and utilities. You may ultimately have to provide HMRC with evidence to support your apportioned cost claim. Read our full guide to running a business from home .

Professional Services and Business Expenses

Your business can cover the costs of numerous professional services, including:

- Accounting and bookkeeping.

- Legal costs associated with starting a business.

- Marketing and advertising.

- Website design and hosting.

- Clothing and laundry bills (provided your work requires a protective uniform).

- Telephone and broadband costs.

You can also claim tax relief on some of these services. But check with HMRC for more information about which service costs are allowable expenses.

Other Tax Deductible Expenses

Certain other expenses can be tax-deductible, including:

- Entertainment – though you can’t claim tax relief for the costs of entertaining clients, you can do so for entertaining staff. This only applies to events that you hold every year, which are open to every employee, and which do not cost any more than £150 per head.

- Postage, stationery, and office supplies.

- Employee training and development – so long as the training’s relevant to their current role.

- “Trivial benefits” for employees. Read our full guide to what counts as a trivial benefit .

- Charity donations. Find out what ty pes of donations are tax deductible for limited company directors .

When it comes to cars, there are different rules for allowable expenses depending on whether you’re driving a personal vehicle, or a company-owned vehicle.

You can sometimes claim tax relief for the fuel costs associated driving for work. However, the tax relief is usually only available if you’re travelling “on the job” rather than “to the job”. So you can claim relief if you’re travelling in the performance of your duties, but not for your standard commute.

It’s also possible to apply for tax relief if you purchase a car directly through the business – though you will have to pay tax if you drive this car for private use.

For more details of allowable expenses, limits, and exceptions, check the latest HMRC guidance here .

Other Travel Expenses

Your business can cover the costs of travelling by rail or plane to see a client and HMRC won’t consider it a taxable benefit. HMRC also doesn’t consider hotel accommodation as a taxable benefit if it’s covered by your business – but only if the hotel stay was for business purposes.

You can also apply for tax relief on parking fees and road tolls, while your business can cover the cost of food purchased during business trips.

You can get full tax relief for some forms of insurance. Examples include:

- Public liability insurance.

- Professional indemnity insurance.

- Contents insurance.

- Employer’s liability insurance.

Business insurance provides an essential safety net that will help you keep your company afloat when you’re faced with unexpected situations. Read our full guide to why you need business insurance .

We specialise in providing insurance to small businesses, start-ups and the self-employed. We tailor insurance to meet your needs and protect the specific risks you face as a limited company director.

If you have any questions or would like to discuss your options, please contact our Tapoly team at [email protected], call our helpline on +44(0)207 846 0108 or try our chat on our website.

01865 582064 | [email protected] | Book an appointment

- Search for:

Travel for employees or directors

Are your, or your employees’, travel costs taxable?

Travel costs for employees and directors are always tax deductible for the company. The company includes such costs as an expense in its accounts and only pays tax on the profits which are stated after deducted all such expenses.

However, some travel costs paid for by your company may need to be included on payslips or as a taxable benefit in kind.

These notes apply to directors (including owner managers of companies) and any employees of the company – all referred to as “employees” below. References to “travel expenses” include all travel and associated subsistence and accommodation costs.

Travel expenses that are not taxable on the employee

Travel in performance of duties (ITEPA 2003, s. 337)

Travel in performance of an employee’s employment duties is not taxable. Such journeys include visiting a client’s premises on occasional irregular basis. For an example an IT engineer visiting various sites from their main workplace, as and when the need arises, would be travelling in the performance of duties.

This category does not include regular travel between home and work as this is before and after the performance of duties, rather than during the performance of duties.

Travel between workplaces (of the same employment) is not taxable on the employee or director only if attendance at both workplaces is a requirement of the work. If your company has more than one office and you are required to travel between them in order to carry out your duties then this would not be taxable.

Home is usually not counted as a workplace for this purpose. The only exception is if the nature of duties are such that they have to be carried out home (e.g. home is a bed and breakfast business, a farmhouse for the business of training dogs for the disabled in a home environment – per HMRC guidance).

Travel for necessary attendance at a temporary workplace (ITEPA 2003, s. 338)

Travel to a temporary workplace will not be treated as a taxable benefit for the employee. This is assuming that the employee is required to attend this temporary workplace to fulfil their employment duties (there must be a necessity to attend the temporary work place, not just a preference to do so).

An employee’s expenses of travelling to a customer’s place of business or to a supplier would not be taxable. The employee may travel there directly from home without first going to their normal place of work, or return directly home after the visit.

Note, travel from home or any non-workplace to a permanent workplace or permanent work area is not be covered by this rule even if home is also a workplace. Therefore travel from home to permanent workplace is taxable.

Consequence of travel expenses that are not taxable on the employee

No entries are required on payslips for the above types of travel.

As long as the company is reimbursing actual expenditure then no P11D entries are needed. If payments are made for round sums or an allowance is paid in advance then P11D will be required to show the expenses, which can also be claimed as deduction on P87 or self-assessment tax return.

Travel that is taxable on the employee

All other travel expenses paid by the company, including all travel to a permanent workplaces (except travel between workplaces), all commuting and all private travel are taxable on the employee or director and subject to national insurance.

If the employee pays for the travel and the employer reimburses this, the grossed up amount must be shown on payslips. There is full tax and NI on this amount. No P11D entry is required.

If the employee arranges the travel but the company pays the supplier directly, the amount must be shown as taxable on P11D but subject to national insurance (employees and employers) on payslips.

If the company arranges and pays for the travel then no entries needed on payslips. The amount is taxed by being recorded on P11D and Class 1A (employers only) NI is paid on P11D(b).

Temporary workplaces

Workplaces attended to perform a task of limited duration and the task does not last ( and is never considered likely to last) more than 24 months or most of the period of the employment are temporary workplaces.

An employee may work occasionally at one site for many years but the site may remain a temporary workplace because the visits are occasional. An employee may work full-time at a particular site for a period of up to two years and it can still be treated as a temporary workplace.

If an employee spends many hours per week for more than two years at a particular place, then it can no longer qualify as a temporary workplace. Also if attendance is for the most or all of the period of employment then it cannot be a temporary workplace, even if the duration is less than two years.

Permanent workplaces

Usually your main place of work will be a permanent workplace.

It is possible to have more than one permanent workplace. Permanent workplaces include but are not restricted to:

Any workplace attended to perform a task that is not of limited duration; or

Anywhere that is attended more than 40% or work time, and will be so for more than two years (or most or all of the duration of the employment); or

Any work base at which tasks are allocated; or

Any place attended regularly to perform duties of employment but is not a temporary workplace.

Subsistence

HMRC define subsistence as “the reasonable and necessary cost of a meal/snack incurred by an employee whilst undertaking allowable business travel. The travel must occupy the whole or a substantial part of the working day encompassing the normal meal breaks.”

Obviously this definition is subject to some interpretation, However you should be happy that you could explain to HMRC how the subsistence claims you have made fall within this definition. There is a risk that HMRC could try to reclassify these as staff entertainment which would be taxable of the employees.

The above is general information only. If you are in any doubt about whether you or your employees may be taxable on any of the travel expenses paid by your company, then please contact us regarding specific advice.

- Accounts Payable Software

- Accounts Receivable Software

- Travel & Expense Management

- Payment Automation

- Cash Flow Management

- Account Payable

- Account Receivable

- Travel & Expense

- Finance News

- Press Release

- Get Started

The Complete Guide to Travel and Expense Management (T&E)

Managing travel and expenses for your company can be a complex task, requiring careful attention to detail and adherence to company policies. As your business grows, so does the need for effective travel and expense management. From ensuring compliance with policy guidelines to optimizing costs, there are many factors to consider to make the process smoother for everyone involved.

In this blog post, we will explore the fundamentals of travel and expense management, offering insights into best practices that can help streamline the process. Whether you’re a small business with a handful of travelers or a large corporation with a global workforce, understanding the basics of travel and expense management is essential for maintaining control over your travel costs and ensuring compliance with your company’s policies.

What is Travel and Expense Management?

Travel and Expense Management (T&E) is the process of overseeing and controlling an organization’s spending on business-related travel and expenses. It involves documenting, processing, and monitoring the expenses to ensure they are in line with company policies and tax regulations.

T&E management includes various tasks such as booking travel arrangements, managing expenses, and ensuring compliance with corporate policies and legal requirements. The goal of travel and expense management is to optimize spending, improve efficiency, and maintain transparency in business expenses.

Key components of travel and expense management include:

- Approving travel requests

- Booking travel arrangements (such as flights and hotels)

- Managing corporate credit cards

- Submitting and approving expense claims

- Handling reimbursement

- Auditing expenses for compliance

- Guiding travel policies to employees

T&E management helps organizations save money, time, and resources by providing visibility into spending patterns and ensuring that employees only spend money on necessary expenses during business trips. It plays a crucial role in maintaining accurate financial records and ensuring compliance with tax regulations .

What is the Travel & Expense Policy?

A travel and expense policy is a set of guidelines and rules established by a company to regulate how employees spend company funds on business trips and related expenses.

These policies typically cover various aspects of travel and expenses, including:

- How and where to book travel

- Criteria for approving or rejecting travel itineraries

- Expense reimbursement process

- Guidelines for flights, trains, and class accommodations

- Approved hotels and allowable incidental expenses

- Ground transportation guidelines

- Meal allowances

T&E policies are designed to ensure that employees understand the company’s expectations regarding travel and expenses and to provide clarity and consistency in how these expenses are managed and reimbursed. They help companies control costs, ensure compliance with regulations, and provide employees with clear guidelines for managing expenses while traveling for business.

Why is Travel and Expense Management Important?

Travel and expense management is essential for controlling costs, ensuring compliance, optimizing processes, and enhancing employee satisfaction. Implementing an effective travel and expense management process can lead to significant cost savings and operational efficiencies for businesses of all sizes. Let’s take a look at the importance of T&E management:

- Cost Control: Effective management of travel and expenses helps control costs by ensuring that expenditures are in line with budgets and company policies. It allows businesses to identify areas of overspending and implement measures to reduce unnecessary expenses.

- Compliance: Compliance with company policies and regulatory requirements is crucial. A proper travel and expense management process helps ensure that expenses are incurred for legitimate business purposes and comply with tax regulations , reducing the risk of audits and penalties.

- Visibility and Reporting: A centralized process provides visibility into travel and expense data, allowing businesses to track spending, analyze trends, and generate reports. This visibility helps in making informed decisions and optimizing travel budgets.

- Streamlined Processes: Managing travel and expenses manually can be time-consuming and prone to errors. An automated system streamlines processes, reducing administrative burden, and improving efficiency.

- Policy Enforcement: A robust travel and expense management system helps enforce company policies related to travel and expenses. It ensures that employees adhere to guidelines regarding travel bookings, expense submissions, and reimbursement , promoting accountability and compliance.

- Employee Satisfaction: A well-managed travel and expense process can enhance employee satisfaction by providing a smooth and timely reimbursement process. It also ensures that employees are aware of the company’s travel policies and procedures, reducing confusion and frustration.

What are the Stages of Travel and Expense Management?

Here is a breakdown of the eight different stages of travel and expense management:

1. Developing an Expense Policy

Develop a comprehensive expense policy that covers all aspects of travel and expense management. Specify allowable expenses, limits, and procedures for requesting funds, making authorized transactions, submitting expense reports, and receiving reimbursements. Include clear guidelines for travel-related expenses to ensure consistency and compliance.

2. Streamlining Pre-Travel Processes

Use travel and expense management automation platforms to simplify the pre-travel process. These platforms enable employees to submit travel requests, which are then routed to managers for approval. Managers can quickly review and approve requests, and employees can book their travel directly through the platform, ensuring all bookings are recorded and tracked efficiently.

3. Managing Expense Incurrence

During business trips, employees will incur various expenses, such as meals, transportation, and accommodation. Companies can provide employees with cash advances, and corporate credit cards, or require them to pay out of pocket and submit expense reports for reimbursement. Clear communication and guidelines are essential to ensure employees understand the process and comply with company policies.

4. Efficient Receipt Handling

Managing receipts is a crucial aspect of expense management. Traditionally, employees would need to keep track of paper receipts and submit them along with their expense reports. However, digital solutions offer a more convenient option. Employees can use mobile apps to capture and upload receipts, which are then stored securely in the cloud. Some platforms even offer OCR capabilities, automatically extracting relevant information from receipts and eliminating manual data entry.

5. Standardizing Expense Reporting

Standardize the expense reporting process to ensure consistency and accuracy. Provide employees with easy-to-use tools, such as mobile apps or web-based forms, to submit their expense reports. Include prompts for required information, such as date, amount, and purpose of the expense, to streamline the reporting process and minimize errors.

6. Implementing an Approval Process

Implement a clear and efficient approval process for expense claims. Use expense management software to automate the workflow, allowing managers to review and approve claims quickly. Ensure that all claims are reviewed for compliance with company policies before approval to prevent unauthorized expenses.

7. Ensuring Prompt Reimbursement

Prompt reimbursement of expenses is essential to maintain employee satisfaction. Once expense claims are approved, ensure that reimbursements are processed promptly. Consider using direct deposit or other electronic payment methods to expedite the reimbursement process and reduce administrative burden.

8. Conducting Compliance Audits

Regularly audit expense reports to ensure compliance with company policies and regulations. Look for any anomalies or discrepancies that may indicate fraudulent activity. Conducting regular audits helps maintain the integrity of the expense management process and identifies areas for improvement.

What are the Challenges of Travel and Expense Management?

Managing travel and expenses poses several challenges for organizations, ranging from tracking and controlling costs to ensuring policy compliance. These challenges can impact financial health, employee satisfaction, and operational efficiency. Understanding these challenges is crucial for implementing effective solutions. Here are some common challenges of travel and expense management:

1. Trouble with Policy Compliance

A common challenge in managing travel and expenses is the lack of enforcement of policies. This often occurs due to unclear policies. When policies are ambiguous, employees may spend without regard to guidelines, leading to uncontrolled expenses and budget strain.

As businesses grow, ensuring compliance becomes more challenging. Unauthorized bookings and other policy breaches can occur due to various reasons, such as lack of awareness or attempts at internal fraud.

2. Lack of Data Management

Even with enforced expense reporting within your travel and expense management policy, there’s always a risk of misplacing receipts and losing travel documents. Ensuring comprehensive tracking of every expense can be challenging, especially when employees have to hold onto receipts until they return home to submit them.

3. Limited Visibility into Spends

One of the significant challenges in travel expense management is the lack of visibility into spending. This often occurs due to ineffective tracking of employee expenditures. Without clear visibility, it becomes challenging to control costs effectively.

While some savings might be possible, a comprehensive understanding of spending or potential savings opportunities remains unclear. Delayed submission of expense reports further complicates the situation, as neither managers nor travelers can accurately assess whether expenses align with budgetary constraints.

4. Unclear Expense Policies

Corporate travel and expense management involve many considerations, making it easy to overlook aspects when creating your expense policy. This can create confusion and ambiguity, leading to a lack of clarity for employees.

5. Complicated Expense Workflows

Managing business travel expenses often involves navigating complex workflows. Obtaining approvals from multiple stakeholders can be time-consuming, especially when quick payments are needed. Additionally, the process of filing expense reports after a trip can involve many complex steps.

6. Labor-Intensive Manual Processes and Paperwork

Many businesses use manual processes, such as spreadsheets, to track their expenses. While this may seem efficient initially, it becomes difficult to manage as the business grows. Manually inputting data into spreadsheets is time-consuming and prone to errors.

Without automation, your team will spend a lot of time on manual data entry and paperwork. It includes collecting and storing receipts, as well as entering each transaction from business trips into spreadsheets. These tasks can decrease productivity and lead to inefficiencies.

7. Expense Fraud

Expense fraud can pose a significant threat to your company’s finances, as employees may misuse company funds by submitting false expenses or using them for personal trips. To prevent such fraud, organizations must implement measures to detect and prevent fraudulent activities.

Expense fraud can take various forms, including internal fraud where employees intentionally make unauthorized transactions, or external fraud where criminals steal company funds. Not enforcing travel and expense policies or carefully controlling spending can lead to multiple fraud attempts, some of which may go unnoticed.

8. Difficulty Managing Multi-Currency Expenses

Business travel can involve transactions in different currencies, which can be complex. Managing expenses in foreign currencies requires decisions on when to convert rates, such as at the time of purchase or reimbursement.

9. Challenges with Filing Expense Reports

Filing expense reports manually can be time-consuming and tedious. Employees often find it challenging to keep track of receipts and complete the paperwork accurately and promptly. This manual process can lead to delays in reimbursement and create a frustrating experience for employees.

10. Dealing with Reimbursements

Managing reimbursements for employee travel expenses can be challenging. Without an efficient system in place, employees may experience delays in receiving their reimbursement checks, leading to frustration and dissatisfaction. Delayed reimbursements can also impact employee morale and may create financial burdens for employees who rely on timely reimbursements.

Best Practices for Travel and Expense Management

Effective travel and expense management is crucial for organizations to control costs, ensure policy compliance, and streamline processes. Here are some best practices to improve your travel and expense management:

1. Enhance Spend Visibility

Utilizing automated travel expense software and mobile tracking apps allows companies to gain real-time insights into their spending. These tools provide detailed reports on expenses, highlighting areas where costs can be optimized. By having a 360-degree view of expenses, businesses can make informed decisions, identify trends, and ensure compliance with policies. Additionally, these tools can help detect any unauthorized or non-compliant spending, allowing for prompt action to be taken. Overall, enhanced spending visibility leads to better financial management and cost control.

2. Prioritize Employee Experience

Improving the travel experience for employees can lead to higher compliance with travel policies. Offering self-booking tools and user-friendly interfaces can make the travel booking process more efficient and enjoyable for employees. This can result in higher employee satisfaction and increased productivity. By prioritizing employee experience, companies can create a positive work environment and improve overall employee morale.

3. Offer Convenient Payment Options

Providing corporate credit cards to employees for business expenses can streamline the payment process and eliminate the need for employees to use personal funds. It can reduce the administrative burden associated with expense reimbursement and ensure that employees are not out of pocket for business expenses. Alternatively, engaging a travel management company can simplify the payment process by consolidating all travel expenses into a single invoice, making it easier to track and manage expenses.

4. Embrace Paperless Processes

Digitizing expense filing and reimbursement procedures can significantly reduce the time and effort required to process expenses. By eliminating paperwork, companies can streamline their expense management processes, reduce the risk of errors, and improve efficiency. Additionally, digital processes can provide greater transparency and visibility into expenses, making it easier for companies to track and monitor spending. Overall, embracing paperless processes can lead to cost savings and improved productivity.

5. Optimize Approval Workflows

Designing workflows that facilitate quick approval for essential expenses can expedite the expense approval process. By setting up auto-approval for certain spending categories, companies can reduce the time and effort required to process expenses. This can lead to faster reimbursement for employees and improved cash flow for the company. Additionally, optimizing approval workflows can help prevent delays and bottlenecks in the approval process, ensuring that expenses are approved on time.

6. Utilize Travel Expense Policy Templates

Using pre-designed policy templates simplifies the creation of travel expense policies. These templates are often customizable, allowing companies to tailor them to their specific needs and requirements. By using templates, companies can save time and effort in developing policies from scratch. Additionally, templates ensure that policies are comprehensive and cover all necessary aspects of travel expenses. This helps to reduce the risk of misunderstandings and ensures that employees are aware of and comply with the company’s policies.

7. Implement a Paperless Policy

Integrating the travel and expense policy into digital tools makes it easily accessible to employees. This eliminates the need for physical documents, reducing paper waste and simplifying document management. A paperless policy also allows for real-time updates and changes to the policy, ensuring that employees always have access to the most up-to-date information. Additionally, a digital policy can be easily distributed to employees, ensuring that everyone is aware of and understands the policy.

8. Regularly Update Your Policy

Keeping the travel and expense policy current reflects changes in business needs and employee behaviors. Regular updates ensure that the policy remains relevant and effective in managing expenses. This helps prevent misunderstandings and ensures that employees are aware of any changes to the policy. Regular updates also demonstrate a commitment to compliance and best practices in travel and expense management.

Closing Thoughts

Implementing best practices for travel and expense management is essential for organizations to achieve greater efficiency, compliance, and cost control. By enhancing spend visibility, prioritizing employee experience, offering convenient payment options, embracing paperless processes, and optimizing approval workflows, businesses can streamline their travel and expense processes and drive better outcomes.

At Peakflo, we understand the importance of effective travel and expense management. Our Travel and Expense solution is designed to simplify and streamline the entire process. With Peakflo’s intuitive software, organizations can automate expense tracking, simplify reimbursement processes, and gain real-time insights into spending patterns. By leveraging our solution, businesses can optimize their travel and expense management, reduce administrative burden, and ensure compliance with policies, ultimately driving greater efficiency and cost savings.

Mastering Corporate Travel Policy: Best Practices for Creation and Implementation

The ultimate guide to travel requests: streamlining your business travel process, travel allowance: a guide to enhance employee experience, latest post, barclays capital lost millions due to an excel error, ditching legacy systems: the key to a sustainable finance landscape, split payment: streamlining transactions for marketplaces, future-proofing b2b payments: the payment automation handbook, what is the accounting cycle 8 steps explained.

- Accounts Payable

- Accounts Receivable

- Travel and Expense Management

- B2B Payment Software

- Invoice Management

- Procurement Software

- Product Tour

- Saving Calculator

© 2023 by Peakflo. All rights reserved.

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Business tax

Expenses and benefits for directors and employees - a tax guide: 480

This guidance sets out HMRC's approach to applying legislation on expenses payments and benefits received by directors and employees.

This tax guide explains the tax law relating to expenses payments and benefits received by:

It also explains the tax law relating to the valuation of non-cash benefits received by any taxpayer:

- in connection with termination of employment

- from an employer-financed retirement benefits scheme

For information on these non-cash benefits, read chapter 27 before you look at any other section of the tax guide.

This tax guide is based on the law in force at 6 April 2017 and certain subsequent changes that come into force from 6 April 2018. It has no binding force and does not affect your rights of appeal.

Certain specific aspects of the law affecting securities or share schemes apply from dates later than 6 April 2007. See the website address in chapter 23.10 for more details.

This tax guide also describes the scope of the legislation and the effect of the changes resulting from the Finance Act 1976 and subsequent Finance Acts. Most of the relevant provisions are now in part 3 chapters 2 to 11 Income Tax (Earnings and Pensions) Act 2003 (ITEPA 2003).

Unless otherwise stated the statutory references in this tax guide are to ITEPA 2003.

References to the relevant legislation are shown at the top of each paragraph. If you’re in doubt, consult the wording of the statute on the legislation website .

- 30 December 2019

- 9 March 2021

- 15 April 2021

- 10 May 2021

- 8 March 2024

- 6 April 2020

- 24 November 2022

- 30 March 2020

- 16 June 2022

- 1 April 2020

Related content

Is this page useful.

- Yes this page is useful