We all know "it" happens - have a guardian by your side

WE'VE GOT YOU COVERED!

Guarding your peace of mind.

Travel Insurance for everyone! We provide tailored travel insurance solutions around the unique needs of our individual clients. Our leading edge is our extensive product line offering the most affordable rates to provide you and your family with solid protection. Whether you are traveling outside of your home province or country, visiting Canada or looking for a personalized healthcare plan – we have you covered.

CANADIANS TRAVELING

Whether you’re traveling to another province or outside of Canada, make sure you have insurance should the unexpected happen.

TRAVELING TO CANADA

Planning a visit, moving to Canada or perhaps returning from a long stay abroad? Get the coverage you will need before you arrive.

INDIVIDUAL HEALTH PLANS

Life is unpredictable. Don’t risk becoming overloaded with out-of-pocket medical expenses. Invest in a personalized healthcare plan today.

TRIPS INSURED

CLAIM REIMBURSEMENT

HAPPY CUSTOMERS

Travel Insurance for Everyone.

Ready to get insured? In a few steps you can get a live quote and buy, everything online. Or you can talk to our specialists and they will find you the best coverage at the best rate.

THREE REASONS TO CHOOSE US

Our clients are our #1 priority. Offering world class customer service, we are always here to assist you.

Our solid systems and procedures secure you get the coverage you need no matter your medical conditions.

Our team will find you the best policy at the best rate by accessing most products in the market and exclusive programs.

Happy clients are the best form of advertising. Read more of our stellar reviews here .

Our unique circumstance was such that we couldn’t insure a particular risk while travelling. I looked for an insurance broker. The reviews I read here were favourable. We had a very good experience with Travel Guardian Insurance. They were able to find coverage that met our needs. We would easily do business with them anytime.

I highly recommend this company, my grandma was told she wouldn’t be able to get travel insurance to go to asia, which would have been her last chance to go. travel guardian reviewed her medical history and got the proper supporting documentation and determined they could cover her. because of this company she has been able to go to asia twice to see her family. thanks travel guardian.

Christina M.

I highly recommend Travel Guardian Insurance. I am 85 and have, as expected, some issues. They were dealt with and although the premium was not inexpensive I will now travel, worryfree, knowing that I am completely covered. The representative, I had the pleasure of dealing with was patient, knowledgeable and professional . Thank you

The travel guardian team represents among the highest levels of customer service i have experienced in the industry. information is always accurate, turn around time to questions and quote requests always very fast. staff is always very clear and takes the time to be very detailed with clients to help them make an informed decision quickly, minimising the end to end time to make their process an excellent experience..

Margaret J.

We have been insuring with Travel Guardian for a number of years and been completely satisfied with the responsiveness and level of service provided. Additionally, we have from time to time compared Travel Guardian's prices with other providers and have always found the best price with Travel Guardian.

Need a travel insurance quote or have more questions contact us today..

No matter how much you plan before your vacation or travel, unforeseen circumstances can always dampen a trip. But don't worry — Travel Guardian Insurance is here for all your travel uncertainties with our exclusive range of Travel Insurance Plans.

Travel insurance is aimed to indemnify against potential dangers, emergency circumstances, and financial losses that may occur while travelling. Some of our policies cover missed flight arrangements and misplaced luggage and others cover accidents or acute diseases.

Our Travel Insurance policies will give you the right coverage for your specific needs — such as travel health insurance, baggage insurance and multi-trip benefits to keep you protected throughout your travels.

Travel Guardian Insurance prioritizes customer service. Our travel insurance specialists will guide you through our travel insurance plans and answer any questions you may have. We believe that age should never be a restriction to travelling! Coverage can account for health conditions with individual health plans.

Travel Guardian Insurance also offers travel insurance to young people and families. If your trip gets cancelled, a health issue arises, you have to travel internationally, or you wish to travel out of the province, look no further than Travel Guardian Insurance for affordable travel insurance plans.

Travel Guardian Insurance has been trusted by international travellers since 1991. Beginning in Ontario, we now have five offices across Canada. Our experts will get you the finest insurance at the fairest price!

Why choose Travel Guardian Insurance?

We make it simple to get the finest travel coverage plan for your trip. Finding low-cost, high-quality travel insurance can be challenging. Travel Guardian make the process easy and stress-free! Don't make travel insurance a frustrating process — our travel insurance specialists will guide you through the entire process.

We customize our travel insurance plans according to our client's specific requirements.

Travel Guardian Insurance can help you cover the costs of:

Medical expenses if you are injured while travelling or become sick.

Lost baggage or stolen valuables.

Travel disruption if your trip is cancelled, delayed or interrupted by events beyond your control (such as natural disasters).

Rescheduling expenses if you have to change your travel plans.

What do we offer?

Our competitive advantage is our wide product range, which offers the cheapest travel insurance rates to provide the best travel insurance coverage. We have you covered if you go outside your native province or country, visit Canada, or seek a customized healthcare plan. Our services for travel insurance include:

Canadians Travelling

Travelling to Canada

Individual Health Plans

If you are ready to be insured, you can receive a live quotation and fill everything online in just a few steps. Alternatively, you may talk to our specialists, who can help you find the best coverage at the lowest price.

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

You can adjust all of your cookie settings by navigating the tabs on the left hand side.

You can read more by reviewing our privacy policy .

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics and Facebook Pixel to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

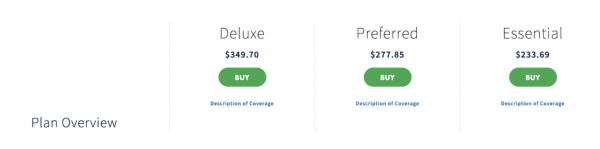

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

HelloSafe » Travel Insurance » Travel Guardian

Is Travel Guardian insurance the best in 2024?

verified information

Information verified by Alexandre Desoutter

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

In a world where unexpected events can disrupt our travel plans, having the right insurance coverage is crucial. One such option to consider in 2024 is Travel Guardian insurance in Canada.

But what are its travel plans? How much does it cost? What are its pros and cons and why should you chose it over another company?

This article answers all your questions and more!

5 key takeaways on Travel Guardian insurance

- Travel Guardian insurance stands out for its array of plans designed to meet the needs of diverse travellers.

- Travel Guardian's insurance is comprehensive and includes medical expenses, trip cancellations, and much more.

- On average, the cost of travel insurance with Travel Guardian insurance is around 5-7% of your total trip cost.

- Travel Guardian does have some exclusions to be aware of, such as losses caused by war, terrorism or hazardous activities.

- We recommend comparing Travel Guardian to its competitors to get the best price/value travel coverage.

Our review of Travel Guardian insurance

Travel Guardian insurance is a Canadian insurance company that specializes in travel insurance. They offer a variety of plans to fit the needs of different travellers, including:

- International travel insurance: This plan covers medical expenses, lost baggage, travel delays and other travel-related incidents while you are travelling outside of Canada.

- Snowbird insurance: This plan is designed for Canadians who spend at least 6 months of the year in another country. It covers medical expenses, emergency evacuation and other travel-related incidents while you are snowbirding.

- Domestic travel insurance: This plan covers medical expenses, lost baggage and travel delays while you are travelling within Canada.

Here are some of the pros and cons of Travel Guard insurance:

Pros of Travel Guardian insurance:

- Wide range of coverage options

- Competitive prices

- Easy to use the website and file a claim.

- Good customer service

Cons of Travel Guardian insurance:

- Can be expensive if you purchase a plan with a lot of coverage

- Some restrictions on its policies, such as pre-existing conditions and certain activities

- The claims process can be slow

The cost of travel insurance from Travel Guardian insurance Ltd. varies depending on the type of plan you choose, the length of your trip and your age and health. The average cost of travel insurance in Canada is $25.35 per trip for a single traveller , making it a great option for travellers.

Before you chose Travel Guardian insurance, do compare its plans to those of other travel companies:

Compare the best travel insurance plans on the market!

What is Travel Guardian insurance's coverage in Canada?

What is covered by travel guardian.

Travel Guardian insurance offers a variety of optional coverages, such as:

- Medical expenses: If you become ill or injured while travelling, Travel Guardian insurance can help pay for your medical expenses, including doctor's visits, hospital stays and prescription drugs.

- Lost or stolen baggage: If your baggage is lost or stolen while travelling, Travel Guardian insurance can help pay for the cost of replacing your belongings.

- Trip cancellation or interruption: If your trip is cancelled or interrupted due to a covered event, such as a medical emergency, natural disaster or terrorist attack, Travel Guardian insurance can help pay for your non-refundable travel expenses.

- Emergency medical transportation: If you become seriously ill or injured while travelling and need to be medically evacuated, Travel Guardian insurance can help pay for the cost of the evacuation.

- Pre-existing medical conditions: If you have a pre-existing medical condition, Travel Guardian insurance can help pay for your medical expenses if you need treatment while travelling.

- Baggage delay: If your baggage is delayed for more than 24 hours, Travel Guardian insurance can help pay for the cost of essential items, such as toiletries and clothing.

- Trip delay: If your trip is delayed due to a covered event, such as a flight cancellation or a natural disaster, Travel Guardian insurance can help pay for the cost of your meals and lodging while you wait for your trip to resume.

- Travel assistance: Travel Guardian insurance also offers a variety of travel assistance services, such as 24/7 emergency assistance, medical referrals and lost passport assistance.

What is not covered by Travel Guardian

Travel Guardian insurance has a number of exclusions, which means that there are certain events or circumstances that are not covered by the policy. Some of the most common exclusions include:

- War and terrorism: Travel Guardian insurance does not cover losses that are caused by war or terrorism.

- Pre-existing medical conditions: If you have a pre-existing medical condition, Travel Guardian insurance may not cover your medical expenses if you need treatment while travelling.

- Hazardous activities: Travel Guardian insurance does not cover losses that are caused by participating in hazardous activities, such as skydiving, bungee jumping or whitewater rafting.

- Deliberate acts: Travel Guardian insurance does not cover losses that are caused by your own deliberate acts, such as drunk driving or drug use.

Also, there are a number of other events or circumstances that may not be covered by Travel Guardian insurance based on the plan or policy you choose.

What are Travel Guardian's insurance plans for visitors?

The specific coverages and exclusions will vary depending on the type of plan you choose and the level of coverage you select. For Canadian residents, travel guardian offers international travel insurance, snowbird insurance, domestic travel insurance and expatriate insurance as we discussed earlier.

But that’s not all, Travel Guardian also offers travel insurance for those travelling to Canada:

How much doest Travel Guardian insurance cost?

The cost of Travel Guardian insurance varies depending on a number of factors, including:

- the type of plan and coverage you choose,

- your chosen destination,

- the length of your trip,

- your age and health ( travel insurance for senior citizens with a pre-existing medical will be more expensive).

In general, Travel Guardian insurance costs about 5-7% of the total cost of your trip.

For example

If your trip costs $1,000, you can expect to pay about $50-70 for travel insurance.

However, here are some tips for getting the best deal on Travel Guardian insurance:

- Shop around and compare different policies: Get quotes from different insurance companies to see which one offers the best coverage and price for your needs.

- Buy early: The earlier you buy your travel insurance, the cheaper it will be.

- Consider a multi-trip policy: If you travel frequently, you may want to consider a multi-trip policy. This type of policy will cover you for multiple trips within a certain period of time, which can save you money.

- Add optional coverages: If you are concerned about certain risks, you may want to add optional coverages to your policy. For example, you can add coverage for trip cancellation or interruption, lost luggage or medical evacuation.

- Consider a travel credit card : Some travel credit cards offer travel insurance as a benefit. This can be a great way to save money on travel insurance, especially if you already have a travel credit card.

Compate Travel Guardian's policy to that of other travel insurers on the market using our free comparison tool below:

Prepare for your trip Compare. Choose. Save.

How to contact Travel Guardian insurance?

Travel Guardian has a presence in many Canadian provinces, including Alberta, BC, and Ontario. You can visit these offices and explore the travel plans in person with an agent. Alternatively:

- You can get a Travel Guardian quote online

- Call the follow Travel Guardian phone number: 1-888-831-9338.

- Or email the company at [email protected] .

Save up to 25% on your travel insurance with our partner soNomad

Get a quote

1-888-550-8302

Sunny has over six years of experience curating engaging content spanning across industries. Specifically in finance, his expertise is insurance reviews and lending and investment topics.

- International edition

- Australia edition

- Europe edition

How to get a good deal on travel insurance

The lowdown on how much cover you need, global health insurance card and Covid-19 factors

Know the basics

Travel insurance is designed to compensate you if your holiday is cancelled or something goes wrong while you are away.

The type of cover you need depends largely on three factors: where you are going, how long you are going for and who you are travelling with. For most standard policies you will be asked if you are travelling within Europe or beyond.

Before you pay for a policy, check to see how the insurer is classifying this. Some European insurance will include certain countries outside the continent, for instance, while worldwide cover can include or exclude travel to the US. Make sure your policy includes the country you are travelling to.

Consider how many trips you plan to make. Annual cover tends to be the best value if you are travelling more than twice in a year. Single trip cover may make more financial sense if you are only planning to head away once or twice. Annual cover is not designed for a gap year – there is usually a limit on the length of each trip. If you plan to travel for more than 30 days at a time you will need to seek out a specialist policy.

If you are travelling with a partner or with your family, you could save money by covering everyone under the same policy. However, if one member of your party needs specialist cover because of existing medical conditions or their age, it might be more cost effective to cover them separately.

You may be turned down for some insurance policies based on your age and existing health conditions but insurers will usually signpost you to a company you can buy from.

Consider the type of holiday you are going on, too. Skiing in the French Alps carries a lot more risk to health than sitting on a beach in Spain for a week. Your policy will need to be comprehensive enough to cover the danger – and may cost more as a result.

Sort out your Ghic

Heading to Europe? Have your European health insurance card (Ehic) or global health insurance card (Ghic) to hand, both of which are free to apply for via the NHS website. These offer you access to medically necessary healthcare for free, or at the cost paid by residents of the country you are in.

If you have an existing Ehic that has not expired, it will be valid, but otherwise you may need a Ghic this time round.

The ‘G’ or global version of this insurance came in after Brexit and is the one you need if you are a UK citizen travelling in Europe. The Ehic is for non-UK citizens who live in the country, or students and some state pensioners living in the EU.

Beware of unofficial sites that charge a fee for you to apply for either of these, as applying directly is free of charge.

Despite having the word global in its name, the Ghic does not offer worldwide cover – it works in the EU and Switzerland – you can check the list of destinations online .

The Ghic is not an alternative or a substitute for an extensive travel insurance policy and does not offer protection against any private medical costs. Some insurers may require you to have a Ghic, so it’s a good idea to read your policy conditions and apply for one.

Work out how much cover you need

This will usually depend on the cost of your holiday and what you think you will be taking with you. The consumer group Which? recommends looking for policies that:

include £5m worth of emergency medical cover and £1m worth of personal liability cover;

will pay out £2,000, or the value of your holiday, in the event of cancellation, curtailment or a missed departure; and

include up to £1,500 for personal belongings and money.

Shop around

Research by Which? found that the most expensive travel insurance was not always the best and that holidaymakers were being quoted wildly different prices for the same level of protection.

“To avoid paying over the odds, shop around for the right policy rather than staying loyal to one provider,” a spokesperson for Which? says.

“A quote from a rival company can act as a bargaining chip with an existing insurer. Comparison websites can also be a useful tool for gauging market prices.”

When looking at prices make sure you are comparing like with like, and pay attention to the excess. This is what you’ll pay towards what your insurer will pay out to you in compensation. Ensure you are able to afford the excess in the event that you do have to claim.

According to the Association of British Insurers, policies that provide more cover and those with lower excesses tend to be more expensive but may be better value in the long run.

Check it’s Covid-proof

The pandemic has been the biggest reason for holiday plans to go wrong over the past two years, so it is wise to check what cover is being offered if Covid-19 strikes.

Look out for: coronavirus medical and repatriation cover to pay out if you are infected when you are away or coronavirus cancellation cover, which will offer a refund if you are unable to travel.

Only the best policies will include cover for cancellations down to changes in Foreign Office advice because of Covid-19 and lockdown rules. If your holiday or flight is cancelled, bear in mind that insurers will only pay out for money you can’t claim back in other ways. Contact your accommodation and transport providers for refunds first before you give them a call.

Don’t duplicate cover

Travel insurance is sometimes included as an extra service on a bank account or credit card. If you already have this kind of policy, check what cover it offers. It may be sufficient protection for your needs – or it may still be more suitable to shop for a standalone deal.

If you are booking through a travel agent, you may also be offered insurance as part of the package. If your agent tries to make you buy from it, however, or increases the cost of your holiday if you turn it down, it is breaking the law. You can contact Citizens Advice for further information on how to make a complaint.

Decline optional extras

Stick to what you need – and uncheck boxes offering anything that doesn’t apply to you. You might not use pet cover as part of your insurance plan, or gadget cover if your mobile phone and laptop are already protected via your home contents insurance. It pays to read up on what you can already claim under your existing insurance policies before you take the plunge and buy a new one.

- Travel insurance

- Money hacks

- Consumer affairs

- Consumer rights

Most viewed

IMAGES

COMMENTS

Guardian's Travel Related Insurance Protection (TRIP) ensures 24-hour access to emergency travel assistance and funds anywhere in the world.

Our Travel Insurance policies will give you the right coverage for your specific needs — such as travel health insurance, baggage insurance and multi-trip benefits to keep you protected throughout your travels. Travel Guardian Insurance prioritizes customer service.

We compared costs, coverage and policy options and found that Travel Insured International and WorldTrips are the best travel insurance companies.

Preferred Travel Insurance Plan: Get the best of both worlds with our popular plan. Enjoy 24/7 travel assistance, excellent travel medical expense coverage, and more for your trip with less worry.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits: Travel Guard Essential - The most basic level of coverage

Compare quotes on our most popular plans. Travel Guard offers over 20 products, ranging from our most popular all-inclusive plans, to rental car and flight insurance plans. Coverages may include: Trip cancellation and delay, lost baggage, medical emergency, international terrorism and any other unforeseen event or accident.

The Travel Guard Deluxe plan is our best travel insurance plan with the most coverages, global travel assistance and access to 24/7 emergency travel assistance services. Get a quote for the new Deluxe Plan

All you need to know about Travel Guardian's insurance: its medical coverage, provincial presence, pros & cons, cost in 2024 + Free quote!

How to get a good deal on travel insurance. The lowdown on how much cover you need, global health insurance card and Covid-19 factors. February 2022.

How to get a good deal on travel insurance. The lowdown on how much cover you need, global health insurance card and Covid-19 factors. Jenn Selby. Mon 4 Apr 2022 02.44 EDT. First published on...