The Man Who Turned Credit-Card Points Into an Empire

Brian Kelly, The Points Guy, has created an empire dedicated to maximizing credit-card rewards and airline miles. What are they worth in a global pandemic — and why are they worth anything at all?

Brian Kelly, the Points Guy, at J.F.K. Terminal 4 before departing on a trip to Croatia. Credit... Jonno Rattman for The New York Times

Supported by

- Share full article

By Jamie Lauren Keiles

- Published Jan. 5, 2021 Updated June 15, 2023

Listen to This Article

They came to Dubrovnik by cruise ship or Ryanair — members of a new hypermobile class of tourist, who traveled for cheap and didn’t stay long. They’d seen its walled Old Town on “Game of Thrones,” and they wanted to be there themselves, so they went. Venice, Barcelona, certain beaches in Thailand — these places had all faced their own “overtouristing” problems, but even by this standard, Dubrovnik was extreme. On busy days, tourists could outnumber permanent Old Town residents about 6 to 1. With a main thoroughfare less than a thousand feet long, this pressure on the city’s charm was overwhelming. By 2017, tourism had so overburdened the Old Town that UNESCO was threatening to revoke its World Heritage status. Mayor Mato Frankovic set out to save his city by sabotage, capping passage through the gates at 4,000 daily visitors and functionally banning new restaurants. Nevertheless, the tourists kept coming.

But then, around March 2020, they stopped. After the Diamond Princess debacle, no more cruise ships appeared in the port. Airplanes were grounded, then took flight again — ending an age of quick and easy travel and ushering in a new, slower one. Pandemic travel was arduous and impeded by knotty, sometimes contradictory governmental guidelines. To travel under these conditions required an unhinged urge to take flight and a bureaucrat’s eye for parsing fine print. Brian Kelly, the founder of a website called The Points Guy, had both — plus a few million unused frequent-flier miles. This was how, on Saturday, Aug. 7, he found himself heading from New York to Dubrovnik, to see the walled city with nobody there.

His trip began at 2 p.m. the day before, with an express nasal swab at NYU Langone Medical Center. Travelers arriving in Croatia were at that time required to present a negative coronavirus test no more than 48 hours old. Between test-processing time and travel time, the tight window posed a logistical challenge. But Kelly, as the face of the world’s most popular credit-card rewards blog, had plenty of experience interpreting strict guidelines. For 10 years, readers had come to his site for help turning terms of service into free trips. In this way, the pandemic was another day at work. That afternoon, he posted footage of his nasal swab to Instagram. Nine hours later, he shared his results: negative.

The following evening, he arrived at J.F.K. ready to board a Virgin Atlantic flight to London. The business-class ticket cost him 57,500 miles, plus $724 cash. He eased his way through the TSA PreCheck line and signed into the Delta Sky Club lounge. (The airline, he knew, had a partnership with Virgin.) A bartender announced the evening special: 10,000 points for a bottle of Dom Pérignon. On that day, The Points Guy — which publishes monthly cash valuations of the top 45 rewards currencies — had Delta miles trading at 1.1 cent each. Kelly did a quick calculation in his head: The deal was worth about $110. The same bottle of Dom at a restaurant might go for $250, or more. He ordered the Champagne.

The flight boarded at 10 p.m. Kelly counted just 12 passengers in the 44-seat business-class cabin. Everyone was wearing a mask, and some fell asleep wearing two (face and eye). “Flying during Covid is kind of like flying private,” Kelly told me later. “I had my own A350 plane.” The transfer at Heathrow went smoothly. The flight touched down in Croatia just in time. Kelly presented his negative test results.

Dubrovnik that day was near-empty and majestic, saved by disease from the lure of its own beauty. Kelly met up with his friend Mauricio, a furloughed fashion merchandiser from Miami, and they made plans to meet up with more friends and all rent a boat to hop around the nearby islands. The idea was that by the time they docked again, they’d all have been in Europe for two weeks, freeing them up to travel on to other places. This was a sort of loophole in the strict E.U. travel restrictions. Kelly knew that international travel was not, at the moment, feasible for the average Points Guy reader, but he had the points, the Covid status and the time to allow his readers to travel vicariously through him. He had no idea when the world might reopen. For now, he was content to enjoy the solitude.

“No cruise ships, no mass tourists,” he says.

Just the reigning king of cheap travel, enjoying a momentary upside to its downfall.

The seeds of cheap travel were planted in the 1970s, as U.S. airline deregulation drove down the cost (and luxuriousness) of flying. The boom would not begin for another two decades, when self-book travel websites curtailed travel agents’ power, removing considerable friction from the market and allowing the consumer to take flight more casually. In 2018, according to the United Nations, global tourist arrivals reached a record annual high of 1.4 billion — a 56-fold increase since the end of World War II. This boom, like all booms, had its clear-cut losers (locals, the environment) and winners (home-sharing platforms, crowdsourced review sites, wanderlusting influencers).

Somewhere in this mix is The Points Guy, and its domain is the set of novel currencies issued by airlines and credit cards. Points are ersatz money that you earn by spending real money, a form of currency hidden inside of another. And “loyalty programs,” as the broader sector is known, are businesses inside businesses. On an ordinary, nonpandemic weekday, an American might encounter half a dozen opportunities to accrue loyalty points, from morning coffee (Starbucks Rewards) to daily commute (Exxon Mobil Rewards+) to lunch break (Chipotle Rewards) to after-work errands (CVS ExtraCare points) to date night (Regal cinema’s Crown Club). The degree to which loyalty programs actually increase customer loyalty varies widely from program to program. Good programs dangle a deliberate carrot, forging customer loyalty and heightening what behavioral economists call “switching costs.” They exploit perceived thrift and a fantasy of status to make users want to earn, and thereby spend.

Within the loyalty-program space, travel and credit-card rewards are by far the most successful and well known. As one oft-cited, almost-certainly imaginary airline executive once put it, “People are willing to pay anything for a free ticket.” Travel rewards pose a compelling incentive — a shortcut to the playgrounds of the globalized elite. (Or, if not that, at least a chance to sit in the part of the airplane where cocktails are free.) And yet, as rewards programs have multiplied, the earned point has grown increasingly complex and fungible: A Chase Ultimate Rewards point, worth about 2 cents as I write, can also be converted to a British Airways mile, which in turn can be transferred to Iberia Plus, or cashed out for a ticket on Cathay Pacific, or used to book a rental car with Hertz. The Points Guy helps readers navigate this web.

Since 2010, The Points Guy has published over 30,000 blog posts: hotel, airline and cruise-ship reviews, next to wonkish analyses of rewards-program fine print. (Some typical headlines: “Why the Amex Gold Is the Perfect ‘In Between’ Credit Card”; “How to Get to Puerto Rico on Miles and Points”; “Why I Canceled Bora Bora Again.”) Kelly is only the face of the site; the “guy” is now voiced by a 30-person team of credit-card experts, aviation reporters and expats from legacy travel media. Older travel publications sell a daydream: crisp ocean vistas, street side cafes, European hamlets with more steeples than people. The Points Guy sells that daydream as a promise, upholding a sworn oath to help you “maximize your travel.”

This is not a false promise, at least not on an individual basis. Almost anyone with a decent credit score can get a free vacation by following the protocol outlined in the “T.P.G. Beginner’s Guide.” First, forget your debit card. Your debit card has “no point — pun intended.” It takes without giving and spends without earning. “Wouldn’t you rather know that all the money you spend is like an investment toward your next trip?”

If the answer is yes, your next step is credit. Since the chuh-CHUNK days of the Diners Club card, the credit-card industry has evolved from a substitute for checks into a passport to total convenience. The latest credit cards, known on the market as “premium cards,” charge an annual fee for access to deluxe amenities: airline lounges, free TSA PreCheck, travel reimbursements and, most crucial, points. Convertible, transferable — practically alchemical — points turn diapers and caramel macchiatos into premium status, and first-class upgrades, and over-water villas at the Conrad Maldives. Points accrue passively, without apparent work, taunting the labor theory of value by simply appearing on your monthly credit-card statement.

On The Points Guy Instagram feed, there is proof of all the ways that household-budget straw might be spun into travel gold: Honeymooners hold hands in lie-flat seats. Retirees see the Taj Mahal at last. A cancer survivor with a new lease on life strikes a pose at the world’s tallest indoor waterfall. Two dads with two kids take a family selfie, en route to a free getaway in Cancún. Three shades dominate the color palate: vitreous ocean blue, white sand and cleanable-seat-back-headrest navy. Here, the legroom goes on forever. All the rooms are suites, all the pools are infinite and anyone can live like a billionaire, so long as you play your credit cards right.

Don’t have a premium credit card yet? The Points Guy is happy to sign you up for one. This is, in fact, the site’s main source of revenue. Wander the labyrinth of guides and reviews, and soon you’ll encounter your first sign-up bonus: 60,000 for Chase Sapphire Preferred; 100,000 points for a Capital One Venture. Why should running money through this essentially arbitrary chain of transactions produce value? Does it? The Points Guy is barely concerned with such questions. With one new card, a free trip can be yours. Just enter your address and your mother’s maiden name.

The Points Guy is headquartered in New York City, in a midrise office building just north of Union Square. I went there to visit on Feb. 10, a month or so before the pandemic would devastate the U.S. travel industry. Stepping off the elevator, I felt no sense of impending collapse. The office floor whirred with bullish momentum. Inside a glass-walled conference room, a blogger pecked out posts from a converted airline seat, salvaged from a defunct Concorde turbojet.

Kelly’s office was spacious and clean, appearing mostly ceremonial. In 2012, The Points Guy was purchased by Bankrate, a consumer-finance company, which in turn was acquired by Red Ventures — a portfolio of service-y sites, including Lonely Planet, CreditCards.com, Safety.com, Reviews.com and HigherEducation.com. Kelly stayed on through both acquisitions, retaining the title of chief executive and remaining the figurehead of the brand. In a typical year, he spends about four months traveling, splitting the rest of his time between two homes in the West Village and Bucks County, Pa., where he grew up. Still, when you go on vacation for a living, the line between personal and professional life can be hard to draw. (A March 2020 Business Insider article highlighted this lack of boundaries, reporting that Kelly had made passes at freelancers and snorted cocaine in front of colleagues on a business trip to the Nobu Hotel Las Vegas. Kelly and Red Ventures denied any wrongdoing.)

A bank of shelves, behind a large and empty desk, showcased evidence of Kelly’s airport-lounge lifestyle: an unopened box of Veuve Clicquot; a scale model of a Singapore Airlines jet; two copies of “Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together ... Finally.” (The author was a guest on his podcast.) In the corner of the room, on a gray sectional sofa, Kelly, in dark-wash jeans and Gucci boots, reclined into a stockpile of novelty throw pillows. One was inspired by air-traffic-control lingo (Alpha, Bravo, Charlie, etc.). Another showed a dozen smiling Celine Dions. A third, in brassy, boldface type, asked, “DO I LOOK LIKE I FLY ECONOMY?” At 6 feet 7 inches tall, he did not. He spoke with a frank insiderishness that made me feel as if I shouldn’t, either.

On TSA PreCheck: “I haven’t waited more than five minutes in years.”

On the Concorde: “I’d rather be in a lie-flat bed for six hours than a cramped seat for three. Whose time is that valuable?”

On the diminishing thrills of success: “The joy of a 50,000-point sign-up bonus is lost when now our corporate cards earn up to two million points a month.”

Kelly found points and miles as a child. One morning in 1996, his father, a health care consultant, came to him and said: “Hey, I have all these frequent-flier miles. If you can figure out how to use them, we’ll go somewhere.” Kelly, age 13 — “closeted, gay, fabulous,” by his own description — called the US Airways customer-service line, asked a few questions in his best adult voice, then hung up and told his parents, “OK, we’re going to the Cayman Islands!” (He’d first heard about the Caribbean hideaway in John Grisham’s best-selling thriller “The Firm.”) A few months later, the family of six was wheels-up on a zero-dollar flight to paradise. Thus, a devotion to miles was born.

In college, at the University of Pittsburgh, Kelly earned US Airways Gold status flying to and from student-government conferences on the university’s dime. After graduation, he moved to New York and eventually wound up in human resources at Morgan Stanley, recruiting at college job fairs (and racking up airline miles in the process). The year after he started, the economy collapsed — a failure of too-imaginative financial widgets. Morgan Stanley downsized. Kelly found himself on the firing squad, waiting outside conference-room doors to escort the casualties down to the lobby. This was thankless, demoralizing work. The lifers sometimes cried. Kelly went home feeling drained. Miles and points became an escape — rewarding on some higher plane of human need. He learned the fine print of his corporate Amex card and earned a water-cooler reputation as “the points guy.” In spring 2010, he unveiled a simple website, where visitors could pay him for help booking vacations.

This first version of The Points Guy went online just as several economic trends converged. As the economy began to improve, credit-card companies were looking for ways to regain the customers they lost during the downturn. Chase had just poached a top executive from American Express — the reigning rewards charge card at the time — and had just introduced Chase Ultimate Rewards, a new, flexible points currency designed to draw millennials into the premium-card market. Kelly added a blog to his site in June 2010, just as many other miles hobbyists were launching credit-card blogs of their own. But only Kelly was lucky enough to come across a way to turn this passion into money. In February 2011, a distant friend who had come across the site reached out and asked Kelly to meet him for dinner.

“I thought he was asking me out on a date,” Kelly says. “He was like, ‘Let’s meet up, I can help you with your blog,’ and I was like, ‘OK, that’s like the lamest excuse.’”

The two sat down for a pinot grigio near the Morgan Stanley office in Times Square. The friend, it turned out, was an account manager at LinkShare (now Rakuten), which specialized in affiliate marketing — an online sales tactic in which a company pays a commission to bloggers for selling its product. If you wrote a blog post that got the top Google ranking for, say, “best nonstick skillet,” and put in an affiliate link to the product, you could earn money for every customer you brought in. This was a relatively novel concept in 2011. To Kelly, it seemed spammy, but what did he have to lose besides time? The friend signed him up as a Chase affiliate, and Kelly put up a blog post about the Chase United card. That first month, Kelly says, he earned $5,000 in affiliate payouts. The following month, he earned $20,000. The month after that, he earned $130,000. “I don’t like talking about numbers,” Kelly says. “But basically, it just picked up from there.”

At the time we sat down in his office, The Points Guy had reached a peak of about 12 million monthly unique readers. Up on the wall, a flat-screen TV reeled off a feed of metrics from the site. The blog, by then, had published 16 posts about what we then called the novel coronavirus, covering rerouted cruise ships and suspended flights from China weeks before most mainstream publications. Still, the outbreak remained a curiosity; none of the posts were cracking the Top 10.

The main thing on Kelly’s horizon that day was a new Points Guy app, which he hoped would be released by June, after months of delays. The app, he explained, was designed to synthesize the terms of different loyalty programs, helping people choose which transactions to put on which credit card. Beyond sign-up bonuses and regular spending, a major way to rack up points is by playing the so-called category bonuses — e.g. “5x points on dining” — which vary among cards and change all the time. Hardcore earners keep track of these rules in Excel spreadsheets, or by sticking Post-it Notes to their cards. The Points Guy app would make the chaos systematic, opening the hobby up to more casual earners.

“Mastercard now has Lyft credits. Amex has off Uber. Chase now has Lyft, too” Kelly said, trailing off. “It is dizzying — the amount of constantly changing promotions and targets.”

More dizzying than racking up points is figuring out how to spend efficiently. Most casual credit-card users think of rewards as a freebie. The Points Guy thinks in terms of cold, hard cash, and wants you to get the most freebies for your money. Beyond publishing points-to-cents valuations, the site also posts step-by-step instructions for transferring points among the currencies themselves. Most airlines and credit cards have transfer partners, and those transfer partners have their own partners. By converting points among the different programs, a traveler can arbitrage his way to better deals. This convoluted system formed incidentally, over many years, as airlines and credit cards formed ad hoc agreements. Kelly, who told me he has 25 credit cards and employs a full-time staff member to manage his and his company’s rewards, admitted he still messes up the calculus. “I’ll post on Instagram, ‘I’m using Alaska Airlines to fly American Airlines to fly to London first class,’ and people will be like: ‘Dumdum! Didn’t you realize if you transfer Amex to Etihad it’s less miles?’”

Kelly is a middleman’s middleman — an intermediary in an industry that exists to turn intermediation into profit. There are three major players in the travel-rewards game: credit cards (banks), airlines and consumers. Points, the set of novel currencies minted by airlines, transform their vague-but-strong mutual interests into something fungible. This web of partnerships can become tangled, but generally speaking, the system works like this:

Airlines issue their own frequent-flier miles, but they don’t always go directly to consumers. Just as often, the currency is sold in blocks to banks. With points in hand, a bank can then issue a “co-branded” credit card, like the Chase Southwest Rapid Rewards card, and use the incentives to attract high-value customers. In another version of this arrangement, a bank issues its own currency, like Chase Ultimate Rewards. These points can be redeemed for just about anything. The bank converts its own points into real dollars when buying the desired reward from a third-party vendor.

Points function, in most ways, as real currencies do. When airlines devalue their points — as United did recently during the pandemic to counter the glut of unspent miles — it can cause a minor shock wave, nerfing one card or supercharging another. But because travel remains such a high-value prize, what industry wonks call an “aspirational reward,” the minor fluctuations have not yet destabilized the market. With points in the mix, all three players generally win: Airlines make money selling rewards; consumers enjoy the indulgence of free travel; banks recruit new customers, who more than justify the upfront cost of acquisition.

It’s a common misconception that premium credit cards earn money mainly through interest payments and annual fees. Their meat and potatoes are interchange fees, the surcharges levied on merchants per transaction. When you pay with your credit card in a store, the owner pays the bank a percentage of your total. For certain credit cards, this fee is low — maybe 1 to 2 percent. For premium cards, like Chase Sapphire or American Express, the fees can be higher, depending on the merchant, to cover the cost of a card’s amenities. (This is partly why restaurants, which operate on thin margins, sometimes exclude American Express from the list of cards they accept.) In places outside the United States, interchange fees are generally capped, which can make rewards far less rewarding. In this way, points and miles are an all-American pastime. Only here was the margin wide enough for the coupon scheme to flourish into the kind of game The Points Guy’s readers play.

You might rightly begin the history of points with Diners Club, the first credit card, which came into use in 1950 and, through issuing monthly statements, inadvertently established a way to track and analyze consumer spending. Credit cards would eventually become an indispensable tool for administering travel-rewards programs, but it was deregulation in the 1970s that did more to establish points currencies themselves. From the Nixon administration on, think-tank types on both sides of the aisle began to advocate for regulatory reforms that decreased federal involvement in America’s largest industries. Energy was partially deregulated in 1973. Railroads began in 1976. In 1978, Jimmy Carter signed the Airline Deregulation Act, which undid federal aeronautics controls in place since 1938.

Before airline deregulation, flight maps and ticket prices were set centrally by the Civil Aeronautics Board. Because this prevented airlines from competing on price, they were forced to offer fliers deluxe amenities: full meals in coach, conversation-pit seating, attractive stewardesses in Oleg Cassini suits. Under the Airline Deregulation Act, carriers were free to determine their own prices, which could theoretically increase profits, but also introduced a new quandary: What would prevent the airline market from simply becoming a race to the bottom? Frequent-flier programs emerged as a way to reward customers for staying loyal. Certainly, the business traveler would spend a little more of his boss’s money if it meant getting something extra for himself.

“Using incentives was hardly new,” says Bob Crandall, American Airlines’ C.E.O. at the time. Supermarkets gave out S&H Green Stamps, luring customers with prizes like free toasters. In the airline industry, experiments like United’s “100,000 Mile Club” had already demonstrated some success, but the big impediment to administering such programs was keeping track of customers. (Who could say whether the John Smith who flew New York to London was the same John Smith who flew Houston to Detroit?) On this front, American had a technological advantage — a new computerized reservation system. “So we started doing some research about what kind of rewards people would like,” Crandall says. The answer, somewhat obvious in hindsight, was travel.

“The only thing people want more than cash, as an incentive, is travel,” says Hal Brierley, a consultant who helped design American’s first program. AAdvantage, as it came to be called, debuted in May of 1981 with a wave of pre-enrollment mailers directed at the airline’s top customers. From the beginning, the program was tiered, with the top prize being a free round-trip ticket. “If you flew 50,000 miles in one year,” Brierley says, “you got a first-class trip to wherever we flew, which at the time meant ‘Go to Hawaii.’ Even a business guy wants a beach in Hawaii!”

With haste, other airlines unveiled their own mileage programs. (“I credit United for having responded to the program literally over the weekend,” Brierley says.) These early miles, unlike modern points, were measures of actual distance: miles flown from A to B. Program enrollees received monthly statements, tracking their progress toward the reward. At this early stage, a free trip cost an airline almost nothing to give away. Airline seats were perishable; planes take off, full or not. By turning this so-called distressed inventory into an asset, airlines retained their most loyal customers, who more than paid them back in repeat business.

Within a few years, an estimated 75 percent of all business travelers had joined at least one frequent-flier program. The programs were free; there was no risk in joining. Consumer expectations were low, and most still saw the miles as a kind of funny money. Business sections, throughout the early ’80s, devoted column space to explaining terms of service — and complaining about blackout dates and mileage thresholds. One reporter deemed frequent-flier programs “as confusing and as complicated as Rubik’s Cube.” Another critic, the former senator Eugene J. McCarthy, took to The New York Times to complain:

I was rarely able to take advantage of the special reduced fares, given if one scheduled three months in advance, or agreed to go on Tuesday and return on Sunday, before noon; or to complete one’s round trip within the Octave of the Feast of All Saints, or of the birth of Clare Booth Luce; or buy a ticket before the spring equinox and use it before the summer solstice or, failing in that, only after the September equinox and before the winter solstice, flying west before noon and east after sundown.

The gimmick reputation of early mileage programs proved to be a hindrance, but soon a set of early adopters came to see the programs for what they were worth — or rather, what they could be worth.

In 1981, when AAdvantage was introduced, Randy Petersen was 30 and working in the corporate offices of Chess King, a groovy young-men’s mall retailer founded on the market-research proposition that teen males loved auto-racing and chess. Flying from grand opening to grand opening to reposition racks of nylon parachute pants, Petersen accrued a free trip to Hawaii, booked a room at the Sheraton Waikiki and ate dinner at the luau every single night. When he returned to the Chess King offices in New York, his co-workers gathered around his desk with questions about taking free trips of their own. Seeing latent demand in their barrage of inquiries, Petersen put in his two weeks’ notice. By 1986, he had struck out on his own as the publisher, editor and only employee of the world’s first frequent-flier magazine.

The first issue of InsideFlyer looked, in Petersen’s words, like a “bad ransom note.” Typewritten commentary on airline programs mixed with photocopied offers clipped from monthly statement mailers. Its first readers were road-warrior types — guys in wrinkled suits with Hartmann luggage — who traveled enough to earn a free trip now and then, but didn’t go out of their way to earn further. This all changed in 1988, with the debut of Delta Triple Mileage, one of the first industry experiments in driving consumers to actually fly more than they might otherwise. The promotion, which delivered on the promise of its name, shortened the free-ticket accrual time from a period of years to a period of months. A free trip to Hawaii, which cost about 30,000 miles, used to be an ambitious goal. Now, it could be earned in one-third of the distance — just two round trips from LAX to J.F.K.

For the average business traveler, Delta Triple Mileage increased the immediate value of belonging to a loyalty program. For mileage obsessives like Petersen, taking miles off the gold standard of concrete distance transformed program membership from a static, passive interest to a game that could be played. Triple Mileage gave rise to a frequent-flying frenzy, one that could be amped up even further by learning and exploiting airline-route particulars. Back then, routes were more limited, and travelers often completed the last leg of a trip with a short flight from a hub airport to a smaller regional one. To make accounting for these brief jaunts less annoying, Delta decided to compensate all flights with a minimum of 1,000 rewards miles, even when the actual distance was shorter. Under Triple Mileage, the minimum, well, tripled. And quickly, InsideFlyer readers realized that by stacking these short flights they could mint their own free trips. Flying back and forth between two short-leg cities, a rewards ticket to Hawaii could be earned in just eight continuous hours of flying. “One of the most popular ones was Dallas to Austin,” Petersen says. “People would do that eight, nine, 10 times in a day.”

In time, other airlines introduced their own “multiples” promotions, and around them, a mileage community was born. InsideFlyer eventually spawned its own online replacement — a message board called FlyerTalk — where mileage prodigies, including Brian Kelly, would come to hear the lore of their mileage ancestors. Most stories from this Wild West time have proved impossible to fact-check in hindsight. Back in the ’80s, before the T.S.A. and security theater, “the number of people that used to fly under other people’s names strictly to earn frequent-flier miles was extraordinary,” Petersen says. According to his memory, one high school basketball coach enlisted a whole team to fly under his name. “Back and forth all weekend,” he says. “Between Dallas and Austin, just so he could earn bonus miles. That’s how you push the envelope. You get greedy.”

One of the greatest points-and-miles hustles of the pre-broadband age was something called the LatinPass Run. In the lead-up to the new millennium, a small handful of Latin American airlines formed a consortium called LatinPass. For a while, it was doing OK, but then the big global airlines came in and started eating up all of the business travelers. LatinPass needed a competitive edge, so it turned to Bobby Booth, an airline marketer out of Miami.

Booth’s idea was to incentivize travel with the smaller carriers by creating a million-mile prize for flying at least one international segment on each of the LatinPass member airlines in one year. There were a bunch of exceptions and fine print, stuff involving rental cars, hotels and partner airlines, all of which amounted to a brain teaser for Petersen. In 2000, he worked out a plan for how you could do it and published an article in InsideFlyer saying, “I’m going to do it all in one weekend. Any volunteers?” Three people joined the first LatinPass Run. One was a Silicon Valley investor. One was a loan officer down in Dallas. The third was an off-duty I.R.S. agent. The foursome met up in Miami on a Friday and flew 24 hours a day — up, down, connect; up, down, connect. They got into Lima, slept on the concrete floor of the airport for two hours and then caught the first flight out to Nicaragua. There was unrest in the country at the time, Petersen recalls. “You’d look at all the soldiers all around with the machine guns, and think: We’ve been here. This qualifies. I’m not getting off. No, no, I’ll sit here for two hours while you refuel.”

In the end, the whole run cost about $1,100 per person. The million miles, via transfer partners, were worth at least three first-class international round trips. Petersen published the details of the run, and after that, LatinPass really took off. “You’d pull into Lima last flight of the day,” he says, “and you’d look over and see a couple of other Americans in the back, because we were all in coach, and you’d kind of nod your head a little bit, like ‘I know what you’re doing.’”

In the end, about 250 people earned the million-mile bonus — more than the few dozen the program had forecast. (One was the famous “Pudding Guy,” immortalized by Adam Sandler in “Punch Drunk Love.”)

“They ended up folding that venture just a few years later,” Petersen says. “Just because they couldn’t handle all the redemptions.”

LatinPass was an inflection point in loyalty-program history, marking a moment when airlines began to give more thought to the delicate math required to maintain a strong points currency. By 2005, the global pool of frequent-flier miles was accruing 10 times as fast as the open seats that made the whole system possible. That year, The Economist estimated the value of these unredeemed miles as more than the value of all the $1 bills in circulation. Consumers had embraced the frequent-flier program, but now airlines found themselves facing pressures to give away seats that would otherwise be sold. In time, more and more programs would begin selling points to banks. By turning their loyalty programs into income streams, the airlines could afford to give away more free seats. In fact, according to Evert de Boer, managing partner of an airline loyalty consulting firm, seats purchased with airline points can generate more revenue than seats purchased with cash.

Today the business of selling points is more stable and more reliably profitable than the business of actually flying people places. “Over time, airline performance is very volatile,” de Boer says. “Something happens — say, the price of oil goes up, or a competitor comes in, dumping capacity — and it constantly goes up and down, up and down, up and down ... ” Points, by contrast, are relatively calm. Recently, in the midst of the pandemic, American Airlines used the program as collateral to secure a $7.5 billion CARES Act loan. Delta did the same with SkyMiles to get $9 billon from private lenders. As in other parts of the American economy, airlines are finding ways to become financial-service providers. “There have been transactions in the past where the loyalty program was acquired or sold at a total value exceeding that of the airline,” de Boer says. “It’s the tail wagging the dog.”

Earlier this year, on March 8, I traveled to Washington, D.C., to attend Frequent Traveler University, a travel-hacker seminar series held several times a year around the world, most often in airport-hotel conference rooms. This iteration took place at the Walter E. Washington Convention Center as part of a Travel and Adventure Show that, unfortunately, coincided with the first wave of Covid travel panic. In the main hall of the convention center, two scuba instructors floated idly in an unattended demonstration pool.

I arrived at the F.T.U. conference room just in time for introductory remarks by Stefan Krasowski, a blogger who had leveraged the Delta and United mileage programs to visit every U.N. member country before his 40th birthday. Krasowski, like much of the room, was male, white, not overtly subcultural-looking. He warmed up the crowd with some lighthearted cracks about how “travel hacking” had affected his marriage. His wife, he said, had recently instituted a “one-free-hotel-lounge-meal-per-day rule.” The room laughed along in recognition.

In the mileage community, almost every relationship has one obsessive and one tolerant enabler, generally known as “Player 2.” Marriage unlocks a higher level of the game by uniting two incomes, two credit scores and two Social Security numbers. Several obsessives I spoke with joked that getting access to a spouse’s credit card was one of the best days of his or her life. Krasowski told the room that one of the most common questions he gets was, “What can I do about spouses that are interested in the spending, but not the earning?” He and his wife had begun taking an annual “spousal harmony trip.” She lays out the parameters, and he has to deliver: “Fourth of July weekend, Australia. Business class, single connection preferred, Korean Air.”

My first seminar of the day was called “Awards Worth MS-ing for.” MS, or manufactured spending, was popularized through FlyerTalk. The technique has since established itself as the foremost earnings tactic of hard-core milers. The seminar was hosted by Nick Reyes, a self-declared “rabid” points and miles collector, with an open-collar shirt and a neatly trimmed goatee. He approached the lectern, took off his fedora and rubbed some sanitizer on his hands. As someone struggled to set up the projector, he stalled for time by telling the crowd that he’d named his first son Conrad, after the Hilton luxury hotel chain. (He had already collected several complimentary Conrad-branded stuffed animals from his previous stays.)

“If you were to name your child after a hotel brand, which would you pick?” he asked.

The crowd tossed off suggestions: Regis (in homage to the St. Regis hotel chain), and Bonvoy (after the recently-merged Starwood-Marriott-Ritz-Carlton rewards program).

Soon the PowerPoint presentation was up and running. Manufactured spending, Reyes explained, is a tactic in which you buy a cash equivalent using a credit card, earn credit-card rewards points for the purchase and use the cash value to pay off the bill. A simple example might entail using your Visa credit card to buy a Mastercard prepaid gift card and then repaying the bill through an online bill-pay app (perhaps even using the gift card itself). This is a tidy way to print points, but rarely are MS schemes so obvious. Bill-pay apps, gift cards and other cash abstractions tend to come along with all kinds of piddly fees. In order for an MS scheme to turn a profit, the earning must exceed the cost of manufacture.

One of the earliest MS schemes, at this point a foundational legend of the points-and-miles community, was the dollar-coin bonanza. In 2005, in an attempt to overcome the struggling Sacagawea dollar — and to piggyback off the recent state-quarter craze — Congress passed the Presidential $1 Coin Act, introducing a new series of coins. The first, featuring George Washington’s face, went into circulation around Presidents’ Day 2007. For the next few years, by congressional mandate, a new president was minted every season — Adams, Jefferson, Madison and so on.

Nearly every venue of American consumer life is set up to dissuade the use of coins, and so the new series was a failure. In order to get the currency into circulation, the U.S. Mint started a new direct-ship program, allowing consumers to buy the coins online and have them mailed out free of charge. Before long the Mint started to notice strange buying patterns, as travel hackers discovered the program, used their credit cards to buy millions of coins, and delivered the packages straight from their mailboxes to the bank. This hustle generated an untold number of mileage millionaires, and even more big-fish tales for the points-and-miles community. Here’s one: At the first Frequent Traveler University in 2010, held at a Sheraton near La Guardia Airport, attendees broke for lunch together at a nearby Chinese restaurant, only to discover that the business was cash only. When the bill finally arrived, the waitress was surprised to discover a table piled high with golden coins. (Eventually, the Mint halted the bonanza by disallowing credit-card orders altogether.)

In my second talk of the day, called simply “Manufactured Spending,” a software engineer named Mike Graziano ran through a list of other bygone MS tactics, like paying yourself through the Amazon Pay portal or prepaying a Visa Buxx debit card. In the course of my reporting, I heard of others too: paying yourself through a Square credit-card reader; overpaying your taxes with a credit card and waiting for the I.R.S. to refund you; issuing short-term microloans to the developing world using a website called Kiva. One travel hacker I spoke with divided MS schemes into two categories: pajama spend, which you could do from your computer, and real-world spend, which took in-person work. Manufactured spending was getting harder, as credit-card algorithms became smarter at catching hackers. Increasingly, the profitable schemes involved arduous real-world effort, like driving between Walmart locations to buy money orders at a discount. Some hackers I read about online build these pit stops into their real-job commutes, as a kind of second shift. Others, a small percentage, make travel-hacking (and other arcane arbitrage schemes) a full-time occupation — reselling their points in secret online markets, against the credit-card terms of service.

Staying ahead as a manufactured spender means staying alert, and attuning yourself to particular ways that abstract financial innovations can be layered. “There are new financial products popping up every day,” Graziano assured the crowd. “Bill-pay apps are Silicon Valley-backed companies. Generally they are moving very quickly, and we are not on their radar when they put these products out. When you see that, do not hesitate.”

Legally speaking, travel hacking is not a crime, though it does lead to conflict with vendors and credit-card companies, many of which have instituted rules against MS schemes. A bank or airline has a lot of leeway to decide what abides by its program’s rules and what does not. Even if a travel-hacking scheme does not outright violate the terms of service, a company can simply decide the technique transgresses the spirit of its program. In cases like these, your rewards balances might be seized. Card issuers even institute long-term bans.

Every travel hacker I spoke with had a different relation to the morality of the hobby. Credit cards and airlines are not sympathetic victims, and this fact could be used to justify almost any ethical position. Some drew the line at exploiting credit unions. Others stopped at misrepresenting their own identities, or reselling points online for cash. Pretty much every player at this level disliked Brian Kelly and The Points Guy for one reason or another, including, but not limited to: being a sellout, beating them to the punch, getting in bed with the credit-card companies, advocating for suboptimal deals, masquerading as a consumer advocate, taking credit for a community he did not create and giving a face to a subculture that would rather remain anonymous.

Kelly admits these travel hackers are not his target audience. “I don’t want to have to go around to 10 different Targets to buy different gift cards to get points,” he says. “People called me a sellout in the beginning, like, ‘Oh, you’re just doing this for the masses.’ And yeah — I am. That’s the point.” He didn’t start The Points Guy to keep his deals a secret. “That was a business decision early on, and that’s why I think we’ve been able to grow it. We are very open about the fact that we have to make money. I have 100 employees. I can’t pay their salaries in Amex points.”

I left Washington on March 8 and arrived back home in New York City just in time to watch it shut down. That Thursday, Broadway went dark, and a prohibition on gatherings of more than 500 people was announced. In the following weeks, the schools were closed; the city’s daily Covid deaths reached a peak of more than 800, by some counts. The Points Guy, with its fluency in bureaucratic jargon, pivoted almost exclusively to parsing the daily-changing crisis plans. (Some sample headlines: “Everything You Need to Know About the U.S. European Travel Ban”; “Here’s How to Figure Out if You Qualify for a Flight Refund”; “How to Cancel an Airbnb if Your Reservation Is Affected by Coronavirus.”)

Over the months that followed, I checked in with Kelly periodically as he bounced around the world, from Palm Springs, Calif., to Antigua to Mexico City — getting massages, dining out at restaurants, updating his Instagram story throughout. When we last spoke, in November, he had just returned from two weeks in French Polynesia, where he stayed at the Conrad Bora Bora Nui and swam with humpback whales. Now back home in Pennsylvania, he was once again looking forward to the release of the Points Guy app, which had been kicked down the road to mid-2021. “I’m still confident it will change the way people think about points,” he said.

While writing this article, my own perspective on miles and points certainly changed. Through day-to-day spending — and expenses, which were later reimbursed by The New York Times — my rewards balances began to grow. At press time, I have: 3,815 in AAdvantage, 4,735 in Delta SkyMiles, 5,600 in Marriott Bonvoy, 44,485 in Southwest Rapid Rewards and 65,482 in Chase Ultimate Rewards. I hoped to end this story in a faraway place, relaxing on my own plot-concluding free vacation, but who knows when this might be possible? The more I sit home daydreaming about travel, the more skeptical I feel about the sorts of trips that points and miles tend to produce.

As corporate partnerships have grown increasingly enmeshed, rewards have come to form a worldwide hamster tube, connecting Sky Club lounges to Ritz-Carlton lobbies to Wolfgang Puck Expresses to Uber Black cars. This elite global habitat — part of our world, but also apart from it — is suggestive of our stratified economy at large, one that stays aloft through financial novelties and unfettered access to cheap money. A major reason points-and-miles trips exist is because airlines turn a more stable profit by minting their own currencies than by selling actual airline seats. The flight seems almost ancillary to the financial transaction it enables — a trend across the whole economy, where the selling of goods or services serves to enable the collection of data, the absorption of venture capital funds or the levying of hidden transaction fees. In this scheme, posting to social media, or collecting points and miles, or ordering a taxi or a gyro on your phone, is merely a gesture to keep the whole process in motion. The real moneymaking happens behind the scenes, driven by a series of exchanges where value seems conjured from nothing at all.

But of course, value always comes from somewhere. If you trace the thread back on any one of these businesses, it’s always the same deal: The poor underwrite the fantasies of the middle class, who in turn underwrite the realities of the rich. When credit cards charge high interchange fees, they pass the cost of loyalty programs on to merchants, who in turn pass it back to customers by building the fees into their sticker prices. Those who pay with credit can earn it back in points. Those who pay with debit or cash wind up subsidizing someone else’s free vacation. According to a 2010 policy paper by economists at the Federal Reserve Bank of Boston, the average cash-using household paid $149 over the course of a year to card-using households, while each card-using household received $1,133 from cash users, partially in the form of rewards. It remains a regressive transfer to this day.

Almost a year into the pandemic, we’ve seen travel plummet to practically premodern lows. According to the United Nations’ World Tourism Barometer, international tourist arrivals dropped 93 percent year-over-year last June, the beginning of the summer tourism season. The ripple effect was quick and vast, manifesting itself in idiosyncratic ways: Carbon emissions dipped; the Mona Lisa sat alone for four full months, probably her longest solitude since she was painted. In famously overtouristed Venice, reduced canal traffic and the disappearance of tourist “wastewater” output contributed to what one study called “unprecedented water transparency.” The decline in export revenue from international tourism has been, according to one estimate, eight times more severe than the loss the sector experienced following the global financial crisis. Hundreds of millions of people are out of work. The United Nations predicts travel will begin to rebound as early as the third quarter of 2021. McKinsey says we might return to pre-Covid levels by 2023. “Rebound,” to me, is a strange way of describing whatever the next tourist wave might look like. In any case, I’ll keep holding on to my points.

Jamie Lauren Keiles is a contributing writer for the magazine.

Advertisement

Airfare shouldn’t spike again this summer, but don’t expect steep discounts either

After a volatile few years for airfare, prices this summer should be a bit more steady thanks to stabilizing supply and demand, experts say.

In fact, whether you're planning to fly within the U.S. or internationally, you may have better luck finding a good deal than you did a year or two ago.

At the same time, those hoping for smaller crowds at airports and tourist hot spots may be waiting awhile, as all signs point to another busy summer travel season — both at U.S. airports and overseas.

Want more airline-specific news? Sign up for TPG's free biweekly Aviation newsletter .

'Roller coaster' may be subsiding

Domestic airfare has been on something of a roller coaster ever since the start of the coronavirus pandemic more than four years ago.

In 2020 and early 2021, fares dropped as airports emptied out, with travelers staying home. Then, prices surged as demand, fuel costs and overall inflation did the same in 2022. At the same time, demand from travelers exceeded the supply — of flights and seats — airlines could offer.

But if you found yourself booking a trip late last year to North America's most popular leisure destinations like Orlando, Las Vegas or Cancun, Mexico, you may have found a bargain.

In fact, airlines added so many flights to those cities and some others — too many, in the eyes of some industry analysts — that competition drove fares down , prompting some carriers (like Frontier Airlines and Spirit Airlines) to pivot in recent months, shifting planes to other parts of the country in search of higher profits.

Will flights be cheaper this summer?

When it comes to the domestic airfare picture this summer, how does a little stability sound?

"We expect summer 2024 to be similar to last year in terms of demand and pricing," Hayley Berg, lead economist at booking app Hopper, told TPG.

Domestic airfare

Average domestic, round-trip airfare for June currently sits at roughly $303, Hopper noted in its most recent consumer travel index published last week. Average round-trip routes are trending lower for July ($282) and August ($267).

In keeping with recent months' trends, you may be able to score an even cheaper deal if you're headed to Walt Disney World or South Beach in Miami Beach, Florida, or if you're planning to take advantage of Marriott Bonvoy's growing presence along the Las Vegas Strip.

"Current airfare as of this week to Orlando, Miami, Las Vegas and most other top domestic destinations remains lower than at this time last year, and in 2022," Berg said.

Don't expect summer 2024 fares to drop significantly, either

At the same time, ultra-cheap fares to Orlando or Las Vegas are of little help if you're planning a trip to, say, Chicago or Seattle.

To that end, when taking the whole country into account, experts don't expect overall fares to drop much more, either — at least not significantly. Again, the expectation is that fares will generally stay fairly consistent from last summer, although that can certainly vary from one destination to another.

Part of that stability comes from airline capacity.

Numerous airlines are growing their flight schedules, but at a much slower pace than they did in the first years after the height of the pandemic.

Collectively, airlines this June, July and August will offer a modest 6% more seats on domestic flights versus last summer, according to data from aviation analytics firm Cirium.

For perspective, domestic seats grew about 15% from 2021 to 2023.

"We shouldn't expect a significant reduction in [fares] this summer as airlines both manage capacity and also have to work their way through issues of aircraft availability in some cases," said John Grant, analyst at travel data firm OAG.

To his point, some airlines would love to add more flights but can't. Aircraft delivery delays, engine problems and air traffic control shortages could limit more significant growth.

That could prevent the overall supply and demand equation from tilting too much further in customers' favor. After all, consumers benefit when supply (flights and seats, in the case of air travel) solidly exceeds demand.

Also a factor in capping stronger growth: Hundreds of regional jets remain parked amid a still-festering pilot shortage that's continued to limit flights at many of the nation's smallest airports.

Broader trends encouraging for consumers

Still, bigger-picture signs do point in an encouraging direction for consumers with respect to airfare.

Adjusted for inflation, the cost of airfare is as low as it's been in recent memory, Scott Keyes, founder and cheap flight expert at Going.com , pointed out in a post last week on the social platform X.

"By historical standards, we are living in the golden age of cheap flights," Keyes wrote, citing March Federal Reserve data, noting that inflation-adjusted airfare is around 33% cheaper than it was a decade ago.

How expensive will summer 2024 international flights be?

There's also promising news for travelers hoping to plan an overseas trip for this summer.

Round-trip airfare to several of the most popular European destinations has dropped since last year , according to data from FCM and Corporate Traveler, the flagship business travel divisions of Flight Centre Travel Group, shared exclusively with TPG.

The first three months of 2024 featured round-trip price drops of roughly 12% to the United Kingdom and France versus last year. Fares to Spain were also down 9%, while those to Italy were down nearly 4%. Not to mention, there was a 6.5% drop for transpacific flights to Japan.

As usual, prices over the summer will surely be more expensive than the lower-demand winter months. However, the overall trends this year point in a positive direction for consumers, Berg said — particularly after a couple of expensive summers for international flying.

"For travelers priced out of Europe in 2023, you may be in luck for a 2024 trip," Berg said. "Prices to Europe are down [roughly] 10% compared to this time last year already."

Collectively, seats to Europe on the "Big Three" U.S. carriers — American Airlines, Delta Air Lines and United Airlines — this June, July and August will be up roughly 13% from 2019, Cirium data shows — though the vast majority of that growth is aboard two airlines: Delta and, most significantly, United.

Another busy summer expected

Wherever you're flying, all signs point to another busy summer at U.S. airports.

So far in 2024, Transportation Security Administration checkpoints have seen passenger traffic up about 6% from this time last year, according to data analyzed by TPG.

On March 28, the Thursday leading into Easter weekend, the TSA recorded its 10th busiest day of all time. That follows all-time single-day passenger traffic records broken on two occasions last year.

Meanwhile, U.S. Customs and Border Protection received an unprecedented crush of Global Entry applications in February, a top program official told TPG this month — far exceeding the record rate of applications witnessed in 2023.

Airlines have similarly noted the intense desire to travel witnessed since 2022 hasn't waned in 2024.

"Everything we see from a bookings perspective is solid now," American Airlines CEO Robert Isom said at an industry conference in March. "I do think that this is a trend that we will continue to see long into the future."

"Consumer demand is robust and premium trends remain strong," Delta president Glen Hauenstein echoed on the carrier's first-quarter earnings call last week.

Finding the cheapest summer 2024 airfare

Here are some things to consider if you're planning to book a flight this summer.

Search using Google Flights, but book directly with the airline

Unless you're in hot pursuit of elite status on a particular airline, using Google Flights to search fares across a broad list of airlines will help you find the cheapest fares. And don't limit yourself: search as many airlines, airports and dates as your schedule and travel preferences allow.

Then, your best bet is typically to go and book the trip directly with your airline of choice.

Tip: Don't forget to check Southwest.

Southwest Airlines itineraries don't populate in Google Flights, so you'll need to check that carrier's website separately.

Though our guide to finding the cheapest airfare gets more specific on how early you should book domestic and international flights, your best bet is, generally, to book as early as possible.

That's especially true if you're booking an international trip.

Tip: Cancel and rebook if you find a better deal.

Remember, the larger carriers' main cabin fares typically allow you to cancel a flight and, at a minimum, retain the difference in airline credit. That means that if you book early and later realize the price dropped, you can often cancel your trip and rebook at the lower price point.

This is also true (even more so, in fact) for award flights booked using airline miles . Most loyalty programs will redeposit your miles and refund taxes and fees if you need to cancel, which can help you get a better redemption if the points price drops after you book.

Travel in shoulder season

If your schedule allows you to travel close to, but not in, the peak summer months, do it.

"For the best deals, plan to travel in May or September when prices will be lowest for bucket list trips," Berg said.

Tip: Be ready to plan a fall trip, too.

Last year, we saw numerous airfare deals pop up toward the end of summer, and those prices lasted through the autumn months.

Enroll in Global Entry now (but wait for the kids)

Global Entry application fees are set to jump from $100 to $120 for a five-year membership in October.

So, if you're an adult applicant, now is the time to apply before the price increases. Keep in mind that several travel credit cards have historically come with perks that include reimbursing the cardholder's $100 application fee. Citi just announced two of its cards will fully reimburse the higher $120 fee as of October.

One bit of good news is that kids of Global Entry members or applicants can join for free as of Oct. 1. Because of this, it may be best to hold off on enrolling your kids who are younger than 18 until fall.

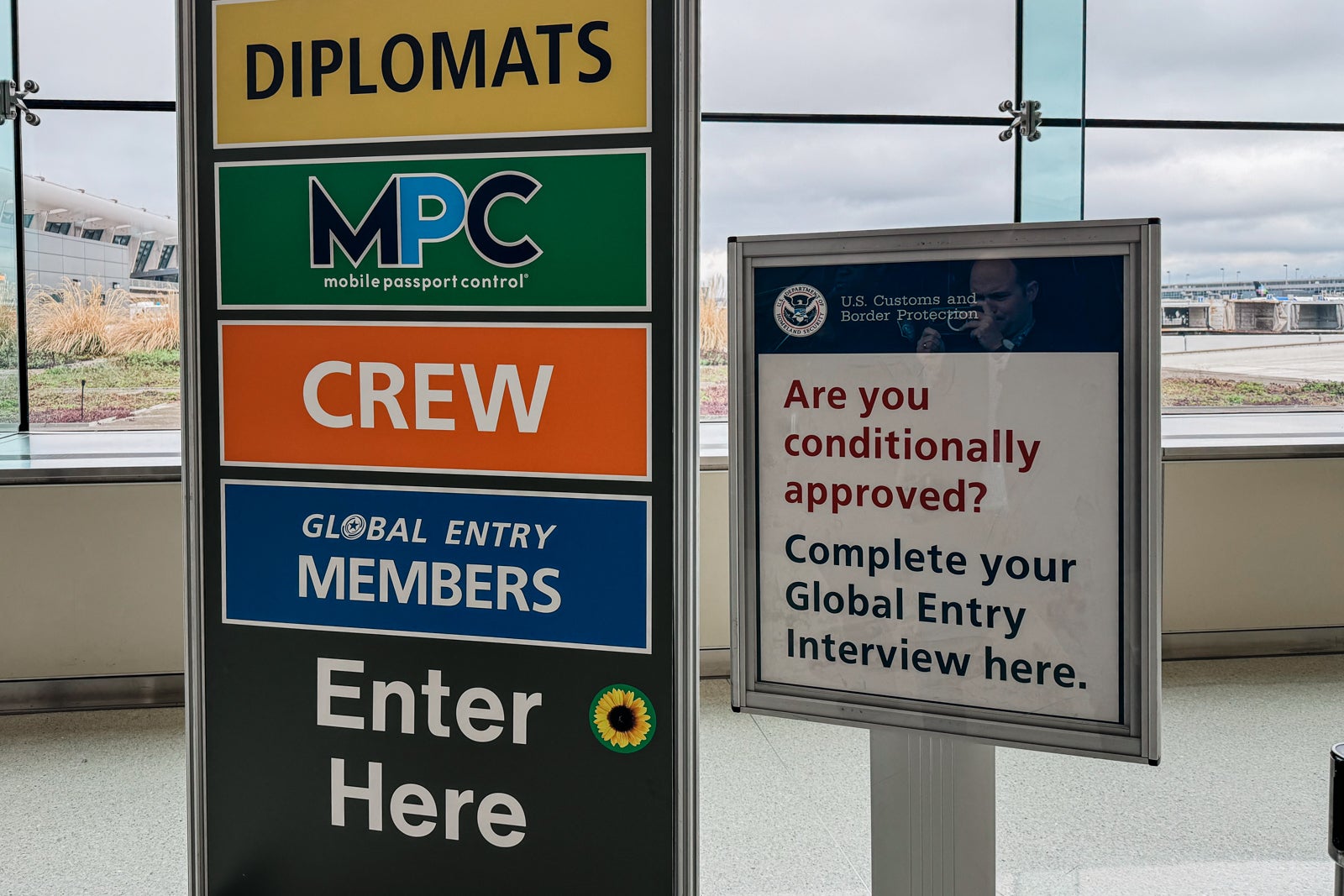

Tip: Use Mobile Passport Control for non-members.

If you're not a frequent international traveler or are holding off on enrolling kids for Global Entry, CBP has a free time-saving option for non-Global Entry members you'll want to consider.

The Mobile Passport Control app makes it possible to handle a good portion of your customs requirements on your smartphone before deplaning so you can head to a shorter line at passport control.

The app has been around for years but is used by far too few travelers, said Marc Calixte, CBP's area port director for the area port of Washington, D.C.

"It's not Global Entry," he said, "but it's pretty close. And it's free."

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

This Is The Cheapest Day of the Week To Fly Business Class

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

Whether you’re flying for work or leisure, it’s always nice to score a good deal on airfare. This is especially true when you’re flying business class which, according to The Points Guy , can cost twice as much as premium economy — if not more.

But how exactly can you save money while still enjoying the perks of flying business class? Unless you’re on a strict schedule, one option is to fly on days that, historically, cost less than others.

While your mileage may vary, these are the best and worst days to fly business class if you’re trying to keep costs reasonable — and how to get even better deals .

Midweek Is Usually the Cheapest

If your schedule allows, you’re likely to save the most money on airfare by flying during the middle of the week. This is especially the case when flying internationally.

“In my personal experience, I’ve noticed that mid-week business class fares tend to be lower, especially on Tuesdays and Wednesdays,” said Stephanie Rytting, a travel expert, renowned travel author and the founder of France Adventurer .

Thursdays could also be cheaper since fewer people are traveling that day and airlines sometimes have lower prices to encourage more customers to buy airfare.

Saturdays Could Be Even Cheaper for Domestic Flights

If you’re flying domestically, you could find the lowest business class prices on Saturdays.

“Midweek seems to be the sweet spot, though there is one potential hidden gem — Saturdays on domestic routes within North America,” said Andy Medearis, a travel expert and founder of Deals Points . “Now, you’d think Saturday would be a weekend premium, but based on my analysis, it often slots in just behind Tuesday to Thursday in terms of average price. The airlines seem to have a separate categorization for ‘not quite weekend’ travel. Worth keeping in mind!”

Avoid Mondays and Fridays

Certain days of the week tend to be cheaper than others to fly, but the opposite also holds true. In particular, avoid flying business class at the start and end of the work week.

“I’ve noticed that Fridays are usually the most expensive days for business class,” said Rytting. “As the week ends, there is more competition for seats from people who want to start their weekends early or go on short trips. Because of this higher demand, airlines can raise prices every Friday.”

According to Rytting, airfare is often 10% to 20% higher on Fridays than it is for the same trip during the middle of the week. The price shift could be even higher than that, however.

“We all know the standard advice is to avoid Mondays and Fridays like the plague, as that’s when business travel peaks and airlines gouge prices accordingly,” said Medearis. “But it’s even worse than most folks realize — I’ve tracked over a dozen routes for months at a time and consistently found prices 30% or more higher at the start and end of the standard work week. Yikes!”

Sundays Also Tend To Be Expensive

If you’re flying back home on a Sunday, prepare to spend more on airfare. That’s because many other people have the same idea and are traveling on that day, too.

“Everyone wants to travel on their days off work, so demand skyrockets while availability plummets,” said Lucia Polla, a travel expert and the founder of Viva La Vita . “Fridays and Sundays, in particular, tend to have outrageous business-class prices. I once saw a Sunday flight that was nearly double the Tuesday fare for the same route!”

Ways To Save Money on Business Class Flights

Even if you’re flying on a day that’s usually more expensive, you could still save money and get a good flight. Here are some pro strategies.

- Use rewards programs. Many airlines have rewards programs that let you earn miles whenever you fly. If you’re a frequent flyer, take advantage of these programs to get cheaper or even free flights. “I’ve scored countless premium cabin upgrades and deep discounts by cashing in points at the right time,” said Polla. “Sign up, pick one airline and rack up those miles!”

- Be flexible and keep an eye on travel patterns. “You can find good times to book cheap business class by keeping an eye on normal travel patterns and times when demand drops,” said Rytting. “Making small changes to your schedule can often save you a lot of money while still meeting your work needs and giving you more freedom on the road.”

- Book early. Buying your plane tickets early — even months ahead of time — could help you score the lowest prices.

- Fly through a regional airport. “Most of the time, more people go through bigger commercial airports with more airlines and connections,” said Rytting. “But smaller regional airports that aren’t too far away can also have good flight and fare options because they serve the local area.”

- Set up price tracking. “The single best strategy I’ve developed is to set up automated price tracking on Google Flights for a wide range of travel periods when you have flexibility — say an entire month rather than just a week,” said Medearis. “Then, try to pounce within 24 hours if the rare lightning deal comes through — I’ve seen business fares 60% below usual price that way.”

- Fly during the shoulder season. “Aim for shoulder seasons when fewer leisure travelers are competing for seats,” said Polla. “Some of my best business-class deals have been snagged simply by dodging the peak crowds around major holidays.”

More From GOBankingRates

- Should You Buy Groceries at the Dollar Store?

- 5 Japanese Cars To Stay Away From Buying

- 16 Best Places To Retire in the US That Feel Like Europe

- 3 Things You Must Do When Your Savings Reach $50,000

Share This Article:

- How To Save Money Fast

- How To Save $10,000 in 3 Months

- How To Save $10,000 in a Year

Best Ways To Save Your Money

- Best Ways To Save Money

- Best Clever Ways To Save Money

- Best Ideas To Save Money Each Month

- Best Frugal Living Tips To Help You Save Money

- Best Tips and Tricks for Saving Money

- Best Money-Saving Challenges

- Best Budgeting Apps

Related Content

Dave Ramsey: 7 Vacation Splurges That are a Waste of Money

April 14, 2024

Uncategorized

4 Best International Airlines for First and Business Class

6 Unexpected Money Tips for Traveling Abroad

April 12, 2024

5 Vacation Destinations That Middle-Class Families Can't Afford Anymore

April 13, 2024

8 Beach Vacation Destinations the Middle Class Can Actually Afford

April 10, 2024

Want To Sail the World? Here's How Much It Costs

April 09, 2024

5 Travel Hacks That Will Save You Money If You Travel Frequently for Work

10 Best US Vacation Destinations for Retirees on a Budget

April 08, 2024

10 Luxury Wellness Retreats That Only the Rich Can Afford

April 05, 2024

How You Can Get $2,000 For Getting Bumped From Your Flight

4 Best Domestic Airlines for First and Business Class

I'm a Travel Agent: 3 Times I Always Travel To Save Money

April 04, 2024

Rachel Cruze Shares Her 12 Cheapest Places To Travel in 2024

6 Key Signs You Can't Afford To Travel This Year

8 Affordable World Capitals for a Budget-Friendly Vacation

Don't Buy Airline Tickets on This Day of the Week

April 03, 2024

Sign Up For Our Free Newsletter!

Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy . You can click on the 'unsubscribe' link in the email at anytime.

Thank you for signing up!

BEFORE YOU GO

See today's best banking offers.

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here .

5 cool things you can take off a plane

There are some cool things you can swipe off planes and some you cannot.

(Disclaimer: The author of this article may or may not be in possession of a gel pillow she slept on during her first United Polaris flight in 2016.)

These days, water, soft drinks and tiny bags of sweet or salty snacks are the only free amenities routinely distributed to domestic economy-class flyers. Meanwhile, premium-class flyers often get more service and "stuff."

But if you play your cards right, ask nicely and stay alert, you can often leave the plane guilt-free with airline swag, no matter what cabin you fly in.

Delta's 'secret' airplane trading cards

According to Delta Air Lines, "when they're not busy preparing for flight, or flying our customers to their next adventure," the airline's pilots are happy to pass out a collectible trading card featuring one of the airplanes in its fleet to "any customer that asks nicely."

Created by Delta employees, the series — which is refreshed about every five years — includes cards that each feature one of the aircraft types for mainline and Delta Connection flights. The current set was redesigned in 2022 by Delta's "Window Seat" visual design team and included input from flight operations employees and a vote by pilots, according to Delta.

The carrier says there are 11 card types in the current collection and six total Delta collections since the beginning of the program, which has been active for more than 20 years.

Airplane wings

Experienced flyers may have forgotten the excitement of their first flight. However, kids or adults stepping onto a plane for the first time can have an even more memorable experience by receiving a small wing pin with the airline's insignia from a pilot or flight attendant.

Delta and Alaska Airlines are among the carriers that still have airplane wings for kids and first-time flyers. Most are plastic, but the wings Alaska Airlines hands out are metal.

"Keep in mind, only about 20 are provisioned for an aircraft that may fly several legs, so we apologize if we run short," the airline told TPG in an email.

Southwest Airlines does not hand out wings on its own, but it does stock entertainment kits with wings in them for traveling children or others upon request.

"It's got fidget spinners, wings, activity books, little crowns, mini playing cards" and other items, according to an airline spokesperson. "So just ask."

KLM's little Delft houses

It is a given that premium-, business- and first-class passengers get more perks, but long-haul business-class passengers on KLM get to take home one of the more unusual and collectible items: a miniature Delft house.

The little blue-and-white houses are in the shape of historic, notable buildings in the Netherlands or abroad and are filled with Bols Genever, a Dutch liquor made with corn, rye and wheat.

KLM commissions a new little house each year and releases it in October to coincide with the anniversary of KLM's founding in 1919. This year's house — the 104th in the series — portrays Valkenburg Station, the oldest existing railway station in the Netherlands.

Business-class travelers flying on KLM's long-haul international flights may choose from an assortment of houses from the carts flight attendants roll down the aisle when the plane is getting ready to land.

Salt and pepper shakers

You cannot (or should not) swipe the plates, stemware, utensils or coffee mugs from your meals in business- and first-class cabins. However, airlines know that many passengers pocket salt and pepper shakers. Some airlines have fun with that.

Virgin Atlantic's salt and pepper shakers say "pinched from Virgin Atlantic" on their feet.

And the little see-through airplane filled with salt and pepper on Condor (remove the propeller for pepper) says "aeroplane souvenir" on the underside.

Amenity kits

Long-haul premium passengers are often gifted pajamas and other sleepy-time amenities, but the swag airlines really want premium passengers to take home are the amenity kits, which can get very swanky.

United Airlines' new Polaris amenity kits are filled with products from the Therabody wellness brand. Emirates has a collection of Bulgari amenity kits for first- and business-class passengers packed with a wide variety of upscale products, including an engraved Bulgari mirror.

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

IMAGES

COMMENTS

Istanbul in May 2018. CLINT HENDERSON/THE POINTS GUY. Turkey's international borders are open for travelers from a number of countries, including the U.S., according to the U.S. Embassy in Turkey. As of June 1, Turkey has dropped all COVID-19-related entry requirements, so proof of vaccination or a negative COVID-19 test is no longer required.

The Points Guy founder Brian Kelly canceled an early June 2020 trip to Antigua but eventually was able to reschedule. ... Additionally, all incoming travelers (residents excluded) must provide proof of international travel insurance. Luckily, credit card travel insurance satisfies this requirement. Travelers could use a card like the Chase ...

If you want a travel credit card that doesn't have a lot of bells and whistles and no annual fee, this is one to consider. The sign-up bonus is 25,000 points after spending $1,000 on the card in the first 90 days, worth a $250 statement credit toward travel purchases You earn 1.5 points per dollar spent every time you swipe this card.

Maximize your travel with hands-on travel advice, guides, reviews, deal alerts, and more from The Points Guy. ... The best ways to get from Midway International Airport to downtown Chicago. April 16, 2024 / 4 min read. News ... The Points Guy believes that credit cards can transform lives, helping you leverage everyday spending for cash back or ...

A JetBlue aircraft taxis during peak Fourth of July 2023 travel at John F. Kennedy International Airport (JFK). SEAN CUDAHY/THE POINTS GUY Don't expect summer 2024 fares to drop significantly, either. At the same time, ultra-cheap fares to Orlando or Las Vegas are of little help if you're planning a trip to, say, Chicago or Seattle.

The leading lobbying group for the U.S. travel industry this week claimed inefficient policies like long tourist visa wait times and friction points like lagging security screening technology are causing the United States to lose its competitive edge when it comes to attracting international visitors — not high prices on airfare and hotel rates.. A study out this week from the U.S. Travel ...

All Travel Tips Stories. Airline stopover flights: A complete guide to maximizing your flight itinerary. Guides. 11h ago. 2024 Daily Getaways sale: Save on hotel points and stays, theme park entry, vacation packages and more. Deals. 2d ago.

ERIC ROSEN/THE POINTS GUY. The New York-to-London corridor is one of the most competitive and profitable international aviation routes, with dozens of nonstop flights daily. Here are some options to redeem your points and miles to travel from New York to London. American Airlines. Economy: 22,500 Alaska Airlines MileagePlan miles plus $19

(Photo by Zach Honig/The Points Guy) A second option for travel is Ellume's COVID-19 home test, which you can find on the Target, Walmart and Kroger websites, among other places. After you purchase the test, you must pay $20 for a video observation through Azova to take the proctored test — similar to the BinaxNow process.

AT&T international day pass: Pay an extra $10 per 24 hours for unlimited high-speed data, talk and text in more than 210 destinations. You'll only be charged for days (as determined by your local U.S. time zone) you use data, make or receive a call or send a text message while in a destination covered by the international day pass.

The three major alliances are SkyTeam, Star Alliance and Oneworld. Transferring points from one airline to another in an alliance lets you use them to get where you want to go, even if the airline you originally earned the points or miles with doesn't fly to your destination. More on Airline Alliances.

Brian Kelly, The Points Guy, talks about why the U.S. government should drop its COVID-19 testing requirement for returning international travelers.

Brian Kelly, the founder of a website called The Points Guy, had both — plus a few million unused frequent-flier miles. This was how, on Saturday, Aug. 7, he found himself heading from New York ...

The Sapphire Preferred recently announced new travel benefits. 1. Chase Sapphire Preferred. Current Sign-up Bonus: Earn 50,000 points after you spend $4,000 in the first 3 months. You will earn another 5,000 bonus points when you add an additional cardholder and make a purchase within the first 3 months.

Here's the full list of the top 10 busiest airports in the world for 2023. Rank. Airport. 2023 passengers. 2022 ranking. 2019 ranking. 1. Hartsfield-Jackson Atlanta International Airport (ATL) 104,653,451.

Hours of operation: The L runs nearly 24 hours a day — from 3:30 a.m. to 1:05 a.m. Monday through Friday, from 4 a.m. to 1:05 a.m. on Saturdays, and from 4:30 a.m. to 1:05 a.m. on Sundays and holidays. Alternate overnight service is available via the N62 Archer bus. Transit time: Getting downtown via the Orange Line will take roughly 20 to 25 ...