How virtual tourism can rebuild travel for a post-pandemic world

The Faroe Islands is just one destination using new technologies to create a virtual tourism experience Image: Knud Erik Vinding/Pixabay

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Anu Pillai

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

- The COVID-19 pandemic has upended the travel and tourism industries;

- Businesses in this sector must build infrastructure and practices that allow people to travel safely in a post-pandemic world and support local communities that benefit from tourism;

- Augmented, virtual and mixed reality technologies can offer alternative ways to travel the world and an exciting new model for the industry.

The tourism industry has hit a nadir owing to the COVID-19 pandemic. It will continue to feel the effects for at least the first three quarters of 2021 – according to a recent UN report , tourist arrivals globally in January 2021 were down 87% when compared to January 2020.

Travel will prevail over post-pandemic anxiety, making it incumbent on the aviation and tourism industry to build safer infrastructure and practices that take care of travellers’ well being.

Have you read?

International tourism is set to plunge by 80% this year – but some regions could recover more quickly, how global tourism can become more sustainable, inclusive and resilient, virtual reality adds to tourism through touch, smell and real people’s experiences.

After a year thwarted by the pandemic and with the future not looking too upbeat for the industry at this juncture, tourism business owners should look at alternative modes of interaction for holidaymakers that can also aid the people and economies who depend on tourism.

The COVID-19 pandemic has noticeably hastened the testing and rollout of forward-looking technologies. Technology has not only enabled citizens globally to interact with loved ones, but also helped industries such as healthcare, information technology, education and many more to work remotely.

In the last few decades, technology has helped travel and tourism industries increase their reach through travel booking websites, videos, blogs and travel photography. Digital tools and content are a vital source of information for vacationists organizing their next holiday or creating a destination wish list. Whilst remote or virtual tourism has been a futuristic theme within industry forums for some time, the world today, shaped by the COVID-19 pandemic, might now be ready to accept it.

A human-centric design that draws insights from cognitive behaviour, social psychology, neuroscience and behavioural economics applied with cutting edge technologies such as augmented, virtual or mixed reality (AR, VR, MR) could be a game-changer. AR, VR and MR can enable a seamless, uninterrupted interactive experience for viewers from their own private space. The design principles will create a frictionless digital user experience and construct a positive perception of a tourist destination.

There have been previous attempts to achieve this feat: if you are an aqua sightseer, you might be aware of a documentary exploring the Great Barrier Reef . Through an interactive website, one can view the clear, tranquil currents of the Pacific Ocean and the biodiversity of the reef, and experience the sounds of a healthy coral reef. Another much-discussed VR experience is Mission 828 which allows you to take a virtual parachute jump from the world’s tallest building, Burj Khalifa in Dubai. The Official Tourist Board of the Faroe Islands has also crafted a virtual experience to entice post-pandemic visitors from across the world.

Imagine a human-centric designed, interactive space online that makes a destination accessible and so real for a sightseer with sound captured by electro-acoustics researchers. You could view holiday sites in a video or through self-navigation using voice or joystick controls, interact with people using video-calling platforms, travel through the streets of said location, eavesdrop on local music and much more. This could be stitched together in a single platform individually or in silos on the internet and further enhanced by setting up physical experience tourism centres locally. Such a setup would allow tourist guides, artisans, craftspeople, hoteliers and transport business to create their own digital and virtual offerings and interact with possible customers.

Here’s how it might look: a vacationer starts their experience from the time their flight commences. The plane descends to the destination runway and pictures of the vicinity from the aircraft window pane are captured. The airport signage welcomes passengers and directs them to a pre-booked taxi. The vacationer gets to choose their first destination and travels through the streets in a chauffeur-driven car whose interactions en route become part of their cherished memories. On arrival, a tourist guide walks you through the destination all controlled with just a tap on your gadget. During the sightseeing, you hear random people speaking, posing for photographs and more. You take a photo to post on social media, go shopping and negotiate with a local vendor to purchase an artwork and get it delivered to your door. You learn how a local dish is prepared and get familiar with local customs.

A virtual platform could even provide an opportunity for people to explore areas that are affected by or fighting terrorism. For example, imagine seeing the diverse wildlife and snow leopard of the Gurez Valley, in the union territory of Jammu and Kashmir, India. It doesn’t stop there: if thought through, one could experience travelling to the South Pole, space and beyond. It could also serve as a learning portal for students to understand geographies, culture, art and history.

With technology improving lives globally, virtual tourism could reignite the tourism industry and its people and help build a more sustainable economic model. As a human-centric platform, it can establish local tourist guides, artisans and others as global citizens in the tourism industry.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Travel and Tourism .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How Japan is attracting digital nomads to shape local economies and innovation

Naoko Tochibayashi and Naoko Kutty

March 28, 2024

Turning tourism into development: Mitigating risks and leveraging heritage assets

Abeer Al Akel and Maimunah Mohd Sharif

February 15, 2024

Buses are key to fuelling Indian women's economic success. Here's why

Priya Singh

February 8, 2024

These are the world’s most powerful passports to have in 2024

Thea de Gallier

January 31, 2024

These are the world’s 9 most powerful passports in 2024

South Korea is launching a special visa for K-pop lovers

Digital Platforms and the Future of Tourism

Successful woman backpacker use digital tablet taking photo on mountain peak cliff. © lzf/Shutterstock

STORY HIGHLIGHTS

- The tourism industry is vital to the growth of the majority of developing economies, with the potential to create millions of jobs and promote entrepreneurship and innovation.

- Digital technologies have the potential to give small tourism businesses in emerging destinations direct access to a global market of travel consumers for the first time, vastly expanding their prospects.

- To celebrate World Tourism Day, the World Bank Group, together with partners, are exploring how digital advances can be used to benefit sustainable tourism for development.

Tourism is one of the fastest growing and most important economic sectors in the world providing benefits to both host communities and destination areas. In 2017, international tourist arrivals reached a new record high at over 1.3 billion according to the latest UNWTO Tourism Highlights . The sector has now seen uninterrupted growth in arrivals for eight straight years. It also represents 10.4% of GDP and in 2017 the tourism industry supported 313 million jobs or 1 in 10 jobs globally.

Tourism also provides better opportunities for women’s participation in the workforce, women’s entrepreneurship, and women’s leadership than other sectors of the economy.

That is why the World Bank Group continues to be committed to invest funds, knowledge and expertise to support tourism for development.

- As a part of the World Bank Growth & Competitiveness Project in the Gambia, a hospitality training center trained 1,235 students and helped increase arrivals by tourists from non-traditional markets by 71% between 2011 and 2015.

- In Peru, an IFC Advisory project financed by SECO (Swiss State Secretariat for Economic Affairs – Economic Cooperation and Development) helped streamline procedures for obtaining licenses and permits to start and operate tourism businesses in Cusco. The reforms eliminated 150 unnecessary processes and shaved three years off the business registration process, making it easier for both local and foreign investors to operate in Cusco.

- A World Bank Group report on the 20 Reasons Sustainable Tourism Counts for Development explains how sustainable tourism counts not just for travelers, but for tourism destinations and local residents.

- The World Bank Group developed the Abraham Path project to bring together fragmented communities along the path in the West Bank through many interventions like training and capacity, which were aimed at generating tourism revenue and jobs, and improving economic opportunities for women. The project has generated 137 jobs, 57% going to women.

Digital technologies and platforms are disrupting the way the tourism sector operates from end to end. Many low-income economies can potentially benefit from this digital transformation and others are at risk of being left behind if they fail to embrace this moment.

The World Bank Group recently published two reports on the significance of this disruption on tourism and how countries can harness it for the benefit of all. According to the report, Tourism and the Sharing Economy , the annual growth rate for the global P2P accommodation is estimated at 31 percent between 2013 and 2025, six times the growth rate of traditional bed and breakfasts and hostels.

In addition, the second report, The Voice of Travelers , produced in collaboration with TripAdvisor explains how peer reviews and other forms of user-generated content (UGC), facilitated by digital platforms, have become the most important sources of travel information globally—more important than tourism boards and traditional outlets. This joint report is part of an MoU that was signed by the World Bank Group and TripAdvisor to promote the development of the tourism sector that highlights some of the key digital trends impacting the sector to countries and private sector partners.

This year, World Tourism Day is shining a light on “Tourism and the Digital Transformation” — as its theme. The UNWTO is calling on governments and the global community, to “support digital technologies that can transform the way we travel, reduce the ecological burden of tourism and bring the benefits of tourism to all.”

They also can provide new opportunities for women and rural entrepreneurs to improve their market access and financial inclusion. However, many developing destinations have limited knowledge on how to take advantage of digital platforms and mitigate risks. Either constrained by the lack of understanding or knowhow and resources, these economies are not able to leverage digital tools to grow their tourism.

Responding to the global call to promote innovations in tourism through technology, the World Bank Group, will host a day-long event just prior to WTD2018 focusing on Digital Platforms and the Future of Tourism .

- Watch the Event Live on September 26th at 9:00 am

- Tourism and the Sharing Economy

- The Voice of Travelers

The best virtual tours to explore the world from home

Oct 8, 2020 • 5 min read

The Sistine Chapel is just one wonder offering a virtual museum tour ©Rajesh Gathwala/500px

We live in an age of unprecedented access to digital technology – and with it, brand new ways of exploring the world around us.

While it's not quite the same as seeing, say, the Mona Lisa or Christ the Redeemer in person, some of the world’s most popular and remote destinations have created libraries of online images and video, as well as 360 degree virtual tours that let you virtually explore museums, galleries, world wonders and even national parks.

Here a just a few of the best digital tours that let you wander the world from wherever you may be social distancing.

See the seven wonders of the world

If there’s anything capable of whetting your appetite for world travel, it is the new seven wonders of the world: the Great Wall of China , the ancient city of Petra , the Taj Mahal , the Colosseum , Machu Picchu , Christ the Redeemer , and Chichen Itza . Thankfully there are impressive virtual tours of each from The New York Times , AirPano , Google , and Panoramas .

With modern technology, you can even see the last standing wonder of the ancient world— The Pyramids of Giza . There are a few other wonders that might not make it into to the top seven but are still worth a digital peek, like the Alhambra , Seville's La Giralda , and even Easter Island.

Best virtual museum tours

In recent years, Google has partnered with over 2,5000 art museums to upload high-resolution versions of millions of pieces of art. Highlights include New York’s MoMA , DC’s National Gallery of Art , Chicago’s Art Institute , the Casa Battl ó, and Amsterdam’s Van Gogh Museum to name a few.

In addition, The Louvre offers a virtual tour , as do The Vatican Museums , many of the Smithsonian Museums , the Russian Museum , the top-rated British Museum , the Minneapolis Museum of Russian Art , and the Palace Museum in Beijing.

You may not be able to kiss the Blarney Stone right now, but you can tour the Blarney Castle from afar. You can also visit the Museum of Flight, the Museum of Science, the Museum of Natural History, the National Women's History Museum and Boston's History of Science Museum .

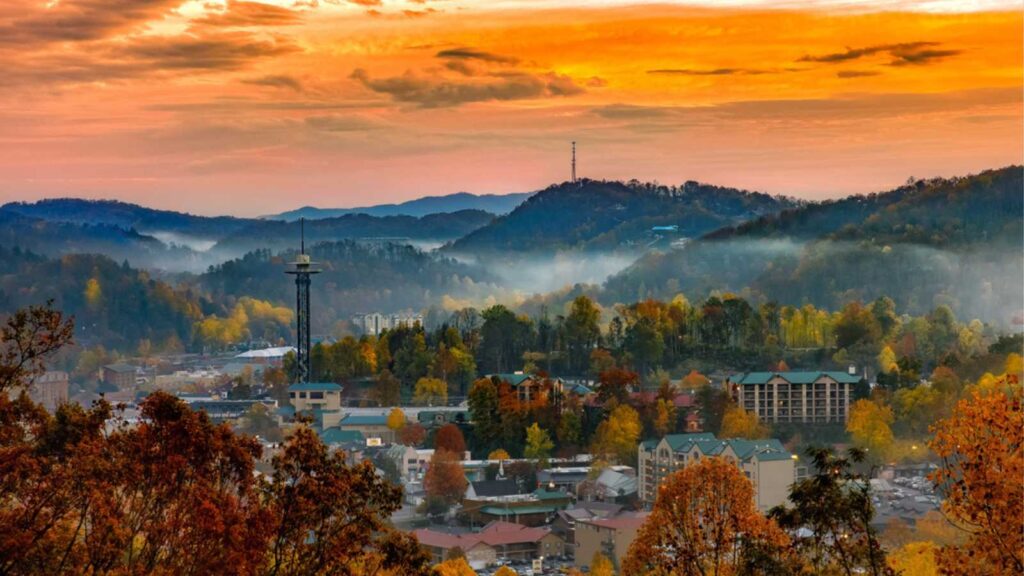

While museums are often an inherently visual experience, there's a lot to be learned from archives of past lectures and tours like the ones preserved online by Nashville's Frist Museum , the Hunter Museum of American Art in Chattanooga, Tennessee, the Smithsonian American Art Museum, the Frick , and others.

You might also like: Broadway might be closed, but here’s how to stream the best performances from your home

Explore national parks

While travel to National Parks is best avoided for the time being, you don't need to miss out on the scenery. Virtual Yosemite is absolutely stunning and one of the best, replete with audio. Both Yellowstone National Park and Mount Rushmore offer virtual tours as well.

Google has similar 360 degree audio-visual tours of five select national parks, including Kenai Fjords, Hawai'i Volcanos , Carlsbad Caverns, Bryce Canyon , and Dry Tortugas, as well as 31 more on Google Earth . You can also get an up-close look at almost 4,000 pieces of artwork, artifacts, and other treasures related to the history and culture of the national parks, and view online exhibits .

Digital safaris

Wildlife is a big draw for travelers, whether it's sighting some of the Big Five in Africa, glimpsing whales in North America, or introducing your children to new animals in person on a family safari . But if you're forays into the bush are grounded for now, many zoos and aquariums have created digital access to their habitats.

You can easily watch several live webcams of some of the nation’s greatest zoos and aquariums, including the San Diego Zoo , Houston Zoo , Zoo Atlanta , the Tennessee Aquarium , and the Georgia Aquarium . Additionally you can see Canadian farm animals doing their thing , or you could watch Stella the Dog jump endlessly into huge piles of Maine leaves.

You may also like: These nine wildlife web cams offer access to your favorite animals

Virtual hiking

Thanks to panoramic video, you can get a really good idea of what a hike looks like well before you arrive at the trailhead. For example, you can experience all of the following top-rated hikes right now from your computer or tablet: Bryce Canyon , Grand Canyon , GR20 , Inca Trail , and the death-defying Angel's Landing . For even more great hikes, simply YouTube one of Lonely Planet’s top 10 treks or any other hike that suits your fancy. Bonus points if you follow along during a workout to enhance the realism.

Famous landmarks

You can visit many wonders of nature, including the Amazon Rainforest , Iguazu Falls , the Komodo Islands , or Table Mountain , using virtual tours. Or you can explore the Statue of Liberty , the Sahara Desert , Niagara Falls , or even a guided tour of the Eiffel Tower . For even more virtual tours, search your bucket list of adventures with AirPano , Google Earth , or YouTube .

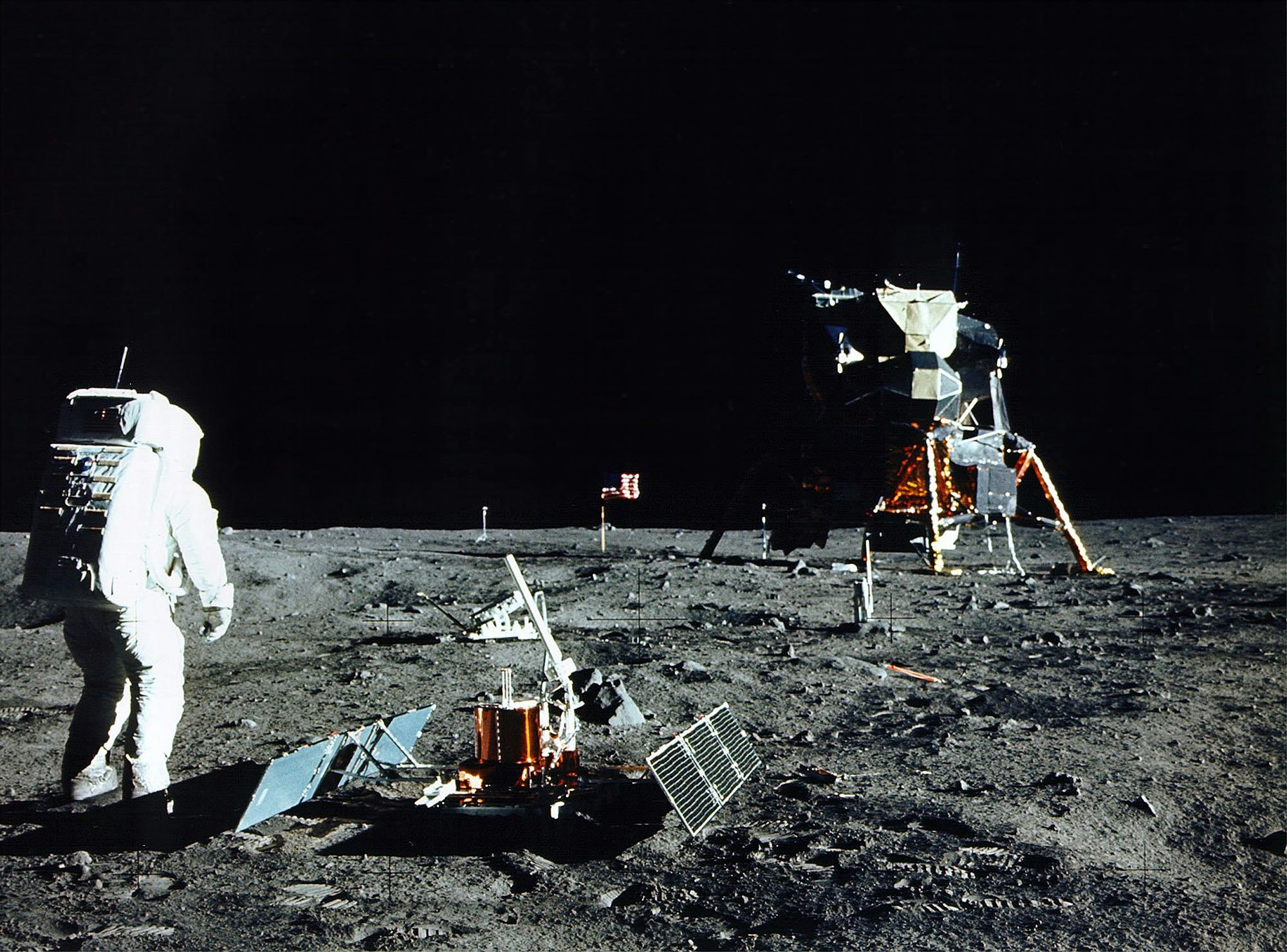

Travel to outer space

The moon hasn't made it to Lonely Planet's Best In Travel list (yet!), and even without self-isolation and shelter-in-place measures for COVID-19, many of us may never travel to space. But thanks to technology, now is as good of a time as any to do so virtually. Before blasting off, considering touring some of NASA’s offices first. Then relive the last lunar missions and moon walks in stunning HD. Or take a virtual tour of Mars with the help of Google.

You might also like:

Listen to the sounds of forests around the world Cook your way around the world with these travel-inspired kitchen essentials Rome watchlist: films to see before your trip

The novel coronavirus (Covid-19) is now a global pandemic. Find out what this means for travelers .

This article was originally published March 2020 and was last updated October 2020.

This article was first published March 2020 and updated October 2020

Explore related stories

National Parks

Jun 14, 2022 • 8 min read

Here are 8 national parks where you can learn more about the history of the Native American peoples first-hand.

Mar 15, 2024 • 10 min read

Mar 1, 2024 • 6 min read

Feb 27, 2024 • 6 min read

Jan 24, 2024 • 7 min read

Dec 27, 2023 • 8 min read

Dec 3, 2023 • 6 min read

Nov 2, 2023 • 5 min read

Oct 7, 2023 • 14 min read

Aug 15, 2023 • 6 min read

12 Best Apps & Websites for Booking Travel Online

by Elizabeth Gorga - Last updated on January 8, 2022

- Travel Apps

If there’s anything better than traveling, it’s the build up. Daydreaming of the perfect destination, scrolling through unique places to stay, and browsing travel guides for the best hole-in-the-wall restaurants and local must-sees are all opportunities to start wanderlusting before you’ve even packed your bags.

Be honest—how many Airbnb Stays do you have bookmarked?

True, it can be overwhelming to map out the nitty gritty flights, connections, accommodation, and pit stops when there are endless options available, but having something exciting to look forward to is one of the keys to happiness after all.

Lucky for you, there are countless apps and websites to help you with booking travel online, so you don’t have to feel overwhelmed when planning the travel adventure of your dreams.

Whether you’re an Apple or Android fan, you’ll have the time of your life in the lead up to your trip with the best travel booking apps and trip planners around!

What to look for in the best travel booking apps

You’re scrolling the app store wondering, what is the best trip planner app? There are hundreds of apps out there—how do you choose? The struggle is real. The truth is, many of them will be more useless than helpful. So how do you weed out the junk that’s clogging up your phone?

The best travel booking apps have these essential features.

1. They’re available offline.

If you’re traveling overseas, there’s no guarantee that you’ll have easy access to WiFi. Unless you have an international phone plan, a local SIM card, or don’t mind roaming charges, limited WiFi can be a killer if you want to access your travel apps in-country. The best travel booking apps have an offline version, so you can access them anywhere, anytime.

2. They include a booking service.

If you’re looking for the best travel booking app, it will definitely have a booking service included. Whether you’re looking for accommodation options or are wanting to book tickets and tours, the ability to book from the app makes everything easier. Let’s call it your one-stop-shop.

3. They have reviews.

The best way to find authentic experiences is to look for recommendations from other people, whether they’re locals or tourists who have stumbled upon hidden gems. Reviews can really make or break your travel plans. The best travel booking apps will definitely have you covered with experienced travelers’ tips and recommendations.

4. They have a translation function.

When you’re traveling between countries, it can be helpful to have a translation function on your travel apps, so you don’t have to switch between apps to get what you’re looking for. With a translation option, you can move about without language barriers, making travel easy even if you don’t speak the native tongue.

5. They have social media integration.

As simple as it sounds, the time it takes to sign up and register for a new app can be a deciding factor for many. In a world where we want information at our fingertips, it can be a turn off when it takes too much time to create a profile before you can use an app.

The best travel booking apps allow you to link your social media accounts—not only for easy access, but so you can share the highlights of your trip directly to your social accounts!

6. They have a travel planner feature.

We want more than just a place to book a bed for the night. We want an app to help us organize our itineraries, bookmark our favorite travel destinations, create schedules, and make travel easy. If you’re wondering what the best trip planner app is, you’ll know you’ve found it when you can plan your travel all in one place.

READ MORE: How to Plan a Trip When You’re Short on Time—And Cash

What is the best trip planner app 6 top contenders.

Searching for the best travel booking apps around? Here are the top apps to download before your next big trip.

1. LikeALocal

- Why it’s the best: If you’re into hole-in-the-wall restaurants and hidden spots that only the most seasoned travelers frequent, LikeALocal is the best travel booking app for you. With guides, tips, and tricks, all the content is created by true locals who have lived in the destination for years.

- The app allows you to browse destination guides, book tours, and even connect with residents through their Q&A feature—and it’s all available 100% offline.

- Why it’s the best: There’s no better way to settle into a new destination than staying in a local’s home. Airbnb is rising as one of the best travel booking apps for accommodation, offering an excellent in-between for hostels and hotels.

- Whether you want to book individual rooms or entire houses from local residents, there are options to suit most budgets. Through the app, you can easily communicate with your host, making it easy to check-in, out, and get the best tips on local hot spots.

- Available for iOS and Android.

3. HotelTonight

- Why it’s the best: While some travelers plan out every detail before leaving home, others live for spontaneity. Luckily, there’s an app for that, too. HotelTonight helps you find last-minute deals on nearby hotels, making it perfect for spur of the moment holidays or road trips with unplanned stops along the way.

- It’s easy to use, with filter options to help you find the right place to suit your needs, and booking a room for the night is just one click away.

- Why it’s the best: Are you a travel junkie? Love multi-destination travel? If you answered ‘ yes’ and you’re still wondering what the best trip planner app is, look no further than TripIt. All you have to do is forward your travel confirmation details to [email protected], and the app creates a master document for all of your travels so you can stay organized!

- You can access it any time, WiFi or dead zone. Upgrade to their paid version to receive real-time flight alerts, a currency converter, socket requirements for your destination, tipping advice, alternative routes for canceled flights, and even track your reward points.

5. Skyscanner

- Why it’s the best: If you’re looking for flights, Skyscanner is where it’s at! The app gives you access to flights from over 1,200 different sources so you can find the best options out there, whether you’re looking for the cheapest options, the fastest routes, or the most affordable days to fly.

- If you’re in the daydreaming stages and open to new possibilities, Skyscanner also has an “anywhere” option to help you find affordable flights you never knew were possible. You can even set up alerts for price dips to find the best airfare rates around.

- Available for IOS.

6. PackPoint

- Why it’s the best: For some travelers, packing can be the biggest headache when preparing for a trip. PackPoint will keep you organized and do the hard work for you. The app creates a custom packing list based on your gender, travel destination, dates and duration of travel, and the type of trip you’re planning. It even checks the weather for you!

- You can add or remove items to make it more personal and check them off as you go, making the packing experience quick and easy.

6 best travel booking websites

Prefer to sit down in front of a computer to do some brainstorming for your next trip? Then you’re probably wondering what the best travel booking website is. Here’s a round-up of the best places for booking travel online.

1. Tripadvisor

No trip is complete without a visit to Tripadvisor. Whether you’re looking for tours, hotels, transportation, restaurants, or just a little travel inspo, Tripadvisor is one of the best websites for browsing and booking travel online.

You can read reviews, save your favorites, get organized using the map features, and book travel all in one place. This site is a must when planning your next trip.

2. Intrepid

Adventure junkies love Intrepid. With small group tours to more than 100 countries, Intrepid is one of the top tour companies for solo travelers who want an adrenaline rush and connection to like-minded people. While most tours attract young travelers under 30, there is no age limit for tours through Intrepid.

Search for unique, niche experiences, from cycling the Middle East to trekking the world’s tallest mountains. With great deals all year round, you can score discounts of up to 50% and reserve your next tour for as low as $1.

3. Hostelworld

Who doesn’t love a good hostel? Backpackers on a budget can find some of the most affordable accommodation options through Hostelworld. Search for your destination, filter by price range or ratings, and find accommodation descriptions, reviews, and booking policies for hostels in over 170 countries worldwide.

The full-screen interactive map makes it easy to see if the hostel is near where you want to be—whether that’s down the street from night clubs or nature.

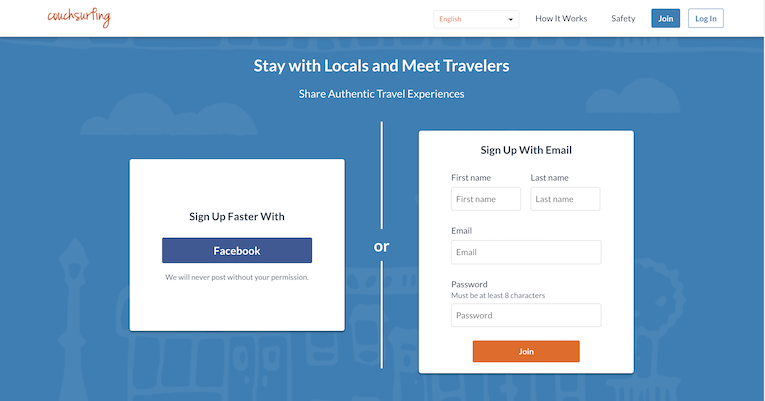

4. Couchsurfing

If you want a truly unique travel experience at the absolute lowest cost, why not try couch surfing? Through Couchsurfing, you can connect to locals and stay in their homes for free, saving you money and giving you access to true local experiences.

If you don’t feel comfortable staying in someone’s home, Couchsurfing also has a Hangouts feature for you to use to meet and socialize with other travelers—perfect for solo travelers!

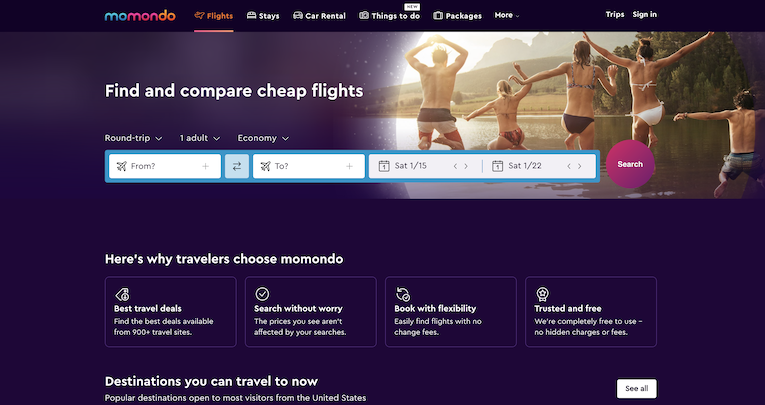

If you’re booking travel online, Momondo is worth a browse. This flight search engine is unique to other sites, showing prices of smaller airlines and travel companies that are often overlooked by other popular search engines.

With Momondo, you can find the best times to fly using their monthly matrix, featuring the best prices and routes, no matter where you want to go. Check out the flight insights page for trends and analytics, which will give you insight into how far in advance you need to book your flights to save the most money.

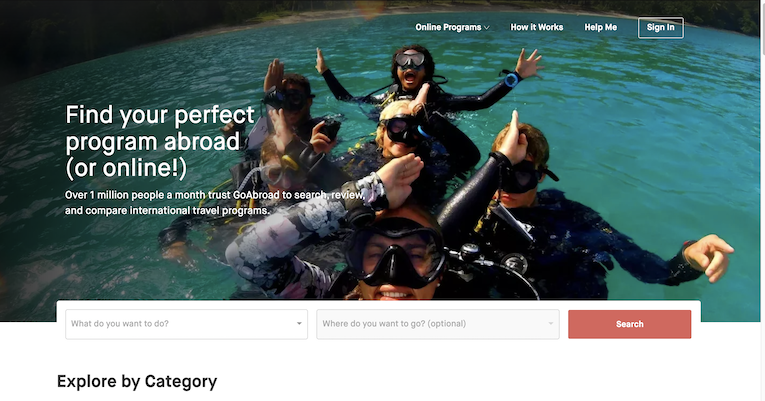

6. GoAbroad

Last, but certainly not least on the list of best sites for booking travel online, is the one and only GoAbroad (that’s us!). Find your perfect program for meaningful travel abroad, with over 15,000 programs, destinations worldwide, scholarships, and insider tips.

If you want to travel abroad with purpose, GoAbroad can undoubtedly help you discover the program to help you smash your goals and make your wildest dreams come true! You can browse our Travel Resource Hub right now to get a jump start on your travel planning.

Booking travel online is fast and easy!

If you’ve been bitten by the travel bug, there’s really no excuse not to start planning your next getaway. Check out the best travel booking apps and websites to stay organized, score great deals, and quench your wanderlust. Booking travel online has never been easier! You’re just a click away from your next big adventure abroad.

Talk to Our Online Advisor & Get Matched with 5 Travel Programs for FREE

Do you have questions about planning your next trip? Talk to us on Twitter , Instagram , or Facebook !

Want to Get Matched with Programs?

Use MyGoAbroad to Save & Compare Programs!

Related articles, global respectful disruption summit: why it’s worth it & what to expect, how to practice cultural sensitivity during meaningful travel, how to make travel meaningful in 2024, announcing goabroad’s top rated providers of 2023, what solo travel teaches you, 11 undeniable benefits of solo travel, popular searches, study abroad programs in italy, study abroad programs in spain, marine biology study abroad programs, study environmental studies abroad, fall study abroad 2024, spring study abroad programs, recommended programs.

2565 reviews

International TEFL Academy

1675 reviews

International Volunteer HQ [IVHQ]

1894 reviews

MAXIMO NIVEL

555 reviews

Intern Abroad HQ

For Travelers

Travel resources, for partners.

© Copyright 1998 - 2024 GoAbroad.com ®

- Study Abroad

- Volunteer Abroad

- Intern Abroad

- Teach Abroad

- TEFL Courses

- Degrees Abroad

- High School Abroad

- Language Schools

- Adventure Travel

- Jobs Abroad

- Online Study Abroad

- Online Volunteer Programs

- Online Internships

- Online Language Courses

- Online Teaching Jobs

- Online Jobs

- Online TEFL Courses

- Online Degree Programs

- Course Catalog

Welcome to the Tourism Online Academy

The Tourism Online Academy is an online learning platform that will provide self-paced, 100% online courses that mainly focus on concepts, areas of interest and fundamental principles related to the tourism sector, addressing the challenges it faces such as globalization, digital revolution, travel marketing and sustainability, among others. These flexible courses allow participants to reconcile academic, professional and other personal commitments.

IE University and the World Tourism Organization of the United Nations have partnered to launch the Online Tourism Academy with the support of different partners – and we are expecting many more to join this initiative in the future.

This high-quality learning experience is available for everyone and caters to those who are looking to improve or supplement their current skillset in order to adapt to this fast-growing and evolving sector. Through these first programs, participants will acquire managerial skills in digital marketing, finance, strategy, operations, innovation and digital transformation.

Choose your course

Introduction to Tourism – Industry Management

This Massive Open Online Course (MOOC) is suitable for managers and high potential individuals seeking to update their knowledge in tourism industry management and its integration into the Tourism, Hospitality and Destination Management industries. This is achieved through the 100% online training course that includes multimedia content, short videos with professors and experts, readings, exercises and activities and many other learning materials within specific modules. You can enroll and study the content for free and only pay € 49 if you want to do the assignments and receive a certificate of completion.

Institution:

INTRODUCTION TO INTERNATIONAL TOURISM AND TRAVEL LAW

You can study the content for free and only pay € 49 if you want to do the assignments and receive a certificate of completion.

مقدمة في إدارة قطاع السياحة (Introduction to Tourism – Industry Management)

This Massive Open Online Course (MOOC in Arabic) is suitable for managers and high potential individuals seeking to update their knowledge in tourism industry management and its integration into the Tourism, Hospitality and Destination Management industries. This is achieved through the 100% online training course that includes multimedia content, short videos with professors and experts, readings, exercises and activities and many other learning materials within specific modules. You can enroll and study the content for free and only pay € 49 if you want to do the assignments and receive a certificate of completion.

How to Become a Restaurateur

This MOOC (Massive Open Online Course) completion certificate is suitable for professionals and individuals seeking to learn how to open their food & beverage concept and create unique selling points that will distinguish your business from the competition. Training with world-leading hospitality experts at the Swiss Education Group (SEG), you will be able to create profitable menus, structure and organize a kitchen, and build a brilliant concept brand.

Artificial Intelligence (AI) in Hospitality: Challenges & Business Opportunities

On this course, you’ll discover how Artificial Intelligence (AI) has the potential to change – and challenge – the hospitality industry. Understand how to grasp the opportunities it presents, including lowering costs, improving customer satisfaction, and innovating front office and housekeeping. You’ll identify how to distinguish between terms such as artificial intelligence, machine learning, and deep learning. You’ll get a comprehensive overview of the legal and ethical considerations of AI and consider customers’ expectations of how digitalisation could change the hotels of the future.

Mastering Wine Tasting

Learn to taste wines like a pro! Cultivate an analytic mindset while tasting and develop a rich vocabulary to describe wines & advocate your preferences easily. Discover viticulture, oenology, grape varieties, and soil relevance. Delve into biodynamic, organic, and natural wines, wine dinners, tastings, and heritage. From reading a wine label to storing techniques, this short course will give you the knowledge to master any wine tasting.

Branding + Innovation: “Brandinnovation”

En el mundo se están produciendo muchos cambios simultáneamente. Uno de los más importantes es que el branding ya no se considera un gasto y comienza a valorarse como una inversión. Este es uno de los cambios más significativos que tendrá un mayor impacto en la industria turística en los próximos años. El activo más importante y probablemente el único activo de una empresa que incrementa su valor con el tiempo: la marca. En otras palabras, el activo más valioso de una empresa empieza a ser su buen nombre, su marca y su reputación. Una marca con un fuerte propósito no solo ayuda al bien general de la sociedad, sino que también ayuda a los empleados y a los clientes a saber qué representan y en qué creen. Este Mooc es esencial para ampliar su conocimiento sobre la construcción de marca en el sector turístico para crear valor, generar confianza y destacar en un mercado altamente competitivo.

Retos de la Industria del Turismo

Este MOOC (Massive Open Online Course) está dirigido a personas que deseen profundizar sus conocimientos en los próximos retos y tendencias de la industria del turismo. El curso es 100% online y tiene por objetivo presentar una aproximación a los desafíos del siglo XXI en la industria turística, para lo cual, se han seleccionado cinco temas que permitirán aprender y/o mejorar el desempeño de la industria turística local y global. Las cinco temáticas son: sostenibilidad turística, hospitalidad y servicio al cliente, diseño de productos y experiencias memorables, principales tendencias del turismo como experiencia de ocio y turismo de negocios.

MARKETING MUSEUMS AND VISITOR ATTRACTIONS

This Massive Open Online Course (MOOC) is suitable for professionals and individuals seeking to learn introductory concepts and expand their knowledge on marketing for museums and visitor attractions. This 100% online and self-paced training course includes multimedia content, short videos with professors, and readings in each module. You can study the content for free and only pay € 49 if you want to complete a short quiz at the end of each module and receive a certificate of completion. You must earn 60% or higher to earn your certificate.

Sustainable Destination Management

This MOOC (Massive Open Online Course) is suitable for future-oriented, young but also well-experienced professionals who would like to get acquainted with key topics of nowadays tourism – Destination Management and Sustainability. Attendees will understand both topics including the link between them to recognize the need for a united application of the two management dimensions. This 100% online course consists of 4 modules. Each of it encompasses brief informative videos, a great choice of interviews with international tourism experts, relevant short readings, and supportive web links, research exercises and online videos for a long-lasting learning effect.

Introducción a la Hotelería y el Turismo

Este MOOC (Massive Open Online Course) está dirigido tanto a profesionales como a personas que desean conocer las principales características del fenómeno turístico. En este curso online analizaremos y profundizaremos sobre estas características. Los conceptos de turismo y hospitalidad nos permitirán abordar la relevancia que tienen en la economía, la cultura y el medioambiente a nivel mundial. Debes alcanzar un 60% o más para obtener el certificado.

Brief Introduction to Chinese Tourism

This MOOC (Massive Open Online Course) completion certificate is suitable for tourism professionals and individuals seeking to learn introductory knowledge on China and Chinese tourism. This 100% online course consist of four modules which summarize some of the most important aspect to take into account in order to work with Chinese tourists.

Innovation and Technology Management in Tourism and Hospitality

Gain an in-depth understanding of the strategic applications of ICT (information and communication technologies) innovations in the hospitality and tourism industry. Learners will learn about the roles of ICT infrastructures and tools in shaping business environment, business models, marketing practices, revenue strategies, and customer services. We will also discuss the dynamics that is generated in the development of ICTs and its impact on hospitality and tourism organizations. The 100% online course consist of 8 weeks’ content and different assessments. You must earn 60% or higher to earn your certificate.

Innovación turística

Este MOOC (Massive Open Online Course) está dirigido a todo aquel que desee conocer los aspectos generales de la Innovación Turística. No requiere saberes previos ni pertenecer a una disciplina especial. Este curso 100% online consta de contenidos presentados en texto y videos y cuestionarios que se encuentra al final de cada módulo; los cuales tienen como propósito verificar la comprensión de los temas. Se debe aprobar un 80% o más para obtener el certificado correspondiente.

Strategic Communication for Tourism

This Massive Open Online Course (MOOC) aims to present foundational understanding of strategic communication for tourism, including topics from stakeholder management to branding. Ensure the communication strategies of your destination organization or company are generating positive impact in line with your objectives. It is suitable for managers, professionals and individuals seeking to gain practical understanding for immediate application of new techniques. This 100% online free course is full of multimedia content, including videos with instructors, interviews with experts, reading suggestions and quizzes. You may also pay 49€ + Iva and get your certificate.

Negotiations in Tourism

This MOOC (Massive Open Online Course) completion certificate is designed for hotel managers, sales managers, professionals, academics, students, politicians seeking to provide them with an in-depth understanding of negotiation strategies and techniques in the tourism industry, which can be applied to various roles within the industry. To earn your certificate, you must score 60% or higher on the 4 course quizzes.

Fundamentals of Tourism – Industry Management

This Online Certified Program is aimed at professionals, managers and anyone else seeking to deepen their learning or update their knowledge in tourism sector management and its integration into tourism, hospitality and destination management. This is achieved through a 100% online training course which includes short videos with professors, readings, exercises, interactive learning materials and assignments in five modules (Digital Marketing, Finance, Strategy, Operations and Innovation & Digital Transformation).

Customer Experience Design: Differentiation Strategies for Brand Positioning

If customer value creation is the most important and crucial part of brand positioning today, then a lazer sharp focus on ultra-personalized services and experiences will drive business differentiation and customer engagement. Discover in this Online Certificate Program how the most successful companies in the world found their elements of differentiation and the key to sustainable business success.

El revenue management: origen y evolución hasta las últimas tendencias

Actualmente, el sector turístico está experimentando una transformación en la comercialización y comunicación de los servicios y productos turísticos. Es por este motivo que la gestión de establecimientos turísticos se hace más compleja y requiere de profesionales bien formados para responder a las expectativas del cliente obteniendo, a la vez, la máxima rentabilidad.

Técnicas básicas de cocina

Las técnicas básicas de cocina son esenciales cuando hablamos de gastronomía. Su aprendizaje es importante y atemporal, por eso hemos diseñado este curso que proporciona los conocimientos y ayuda a desarrollar las habilidades fundamentales en las técnicas, las tecnologías y los productos necesarios para la elaboración de especialidades culinarias. El programa se divide en módulos que permiten ir consolidando progresivamente cada una de las técnicas con una metodología eminentemente práctica.

تقنيات الطبخ الأساسية

تعتبر تقنيات الطبخ الأساسية ضرورية عندما نتحدث عن فن الطهي. تعلمها مهم وصالحة لكل زمان، ولهذا السبب صممنا هذه الدورة التي توفر المعرفة وتساعد على تطوير المهارات الأساسية في التقنيات والتكنولوجيا والمنتجات اللازمة لتحضير تخصصات الطهي.

Maximising Spa Profitability

Learn how to achieve the best results in spa and wellness centers. Discover ways to ensure your spa or wellness center is financially successful with this course taught by experts in the spa and wellness industry. Understand the methods and tools you can use to increase sales, reduce costs and maximize profits in spas and wellness centers. This course is for spa and hospitality professionals responsible for, or involved in, the finances or operations of spa real estate or spa investments.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

Digital Strategies for U.S. Travel and Tourism

Maximize your digital outreach strategy by learning about preferred platforms for researching, booking, and promoting travel and tourism destinations.

Comparing online travel review platforms as destination image information agents

- Original Research

- Open access

- Published: 22 April 2021

- Volume 23 , pages 159–187, ( 2021 )

Cite this article

You have full access to this open access article

- Xinxin Guo ORCID: orcid.org/0000-0002-7904-3040 1 ,

- Juho Pesonen 1 &

- Raija Komppula 1

5719 Accesses

13 Citations

Explore all metrics

Online travel reviews have been extensively used as an important data source in tourism research. Typically, data for online travel review research is collected only from one platform. However, drawing definite conclusions based on single platform analyses may thus produce biases and lead to erroneous conclusions and decisions. Therefore, this research verifies whether or not there are discrepancies and commonalities between different travel review platforms. In this study, five native Chinese travel review platforms were selected: Ctrip; Qyer; Mafengwo; Tuniu; and Qunar. Using a mixed content analysis method, the destination image of Finland was extracted from 10,197 travel reviews in Simplified Chinese as the destination image is a popular topic in online review research. Results show Finland’s destination image representation varies between Chinese travel review platforms. This discrepancy is especially prominent in the dimension of functional and mixed functional-psychological destination attributes. Significant theoretical contributions and managerial implications for the analysis of online travel reviews and destination image research are discussed.

Similar content being viewed by others

Social media influencer marketing: foundations, trends, and ways forward

Yatish Joshi, Weng Marc Lim, … Satish Kumar

Customer engagement in social media: a framework and meta-analysis

Fernando de Oliveira Santini, Wagner Junior Ladeira, … Barry J. Babin

The influence of social media eWOM information on purchase intention

Choi-Meng Leong, Alexa Min-Wei Loi & Steve Woon

Avoid common mistakes on your manuscript.

1 Introduction

Today, online travel reviews (OTRs) have a huge influence on the tourist decision-making process, because they are often used when tourists compare various options and make travel-related decisions. OTRs are also an indicator of a destination’s post-visit destination image (DI) because tourists write reviews of their experiences based on the image they have after the trip (González-Rodríguez et al. 2016 ; Park et al. 2007 ). OTRs are therefore gaining increasing attention in tourism research and destination marketing. Meanwhile, DI is increasingly analyzed using online textual data instead of other data collection methods such as interviews (Lu and Stepchenkova 2015 ). New analysis methods based on big data allow us to gain in-depth knowledge from this vast social media data ocean (Fazzolari and Petrocchi 2018 ).

Earlier studies involving OTRs have relied on a single data source (Xiang et al. 2017 ). In using a single data source for OTR research, researchers ignore platform-specific biases such as differences in platform design, user base, platform-specific behavior, and storage strategy (Pfeffer 2014 ). Using a single platform is also a potential source of sampling bias that potentially complicates the interpretation of the research findings (Tufekci 2014 ). This study aims to explore whether or not platform-specific biases in OTRs should be accounted for in tourism research and practice, and if so how. Moreover, earlier studies have mainly used statistical analyses, natural language processing techniques, or algorithms to explore the length of the review, frequently words, topics, and review sentiment (Xiang et al. 2017 ; Zhang and Cole 2016 ), or have analyzed the functional features of different websites (Pai et al. 2014 ).

Additionally, research on OTR platforms in tourism studies is still based largely on the Western context (Xiang et al. 2017 ). With the rapid growth of Chinese outbound tourists in recent years, scholars are increasingly focusing on China and other Asian countries. The exploration of Chinese social media platforms has become an important research venue (Sotiriadis and Sotiriadis 2017 ). However, cultural and language barriers mean research on Chinese OTR platforms is rarely published in English. Data from OTR platforms may, therefore, provide a new approach to destination image research among Chinese tourists.

To address these gaps in the previous research, this study makes an in-depth comparison of various native Chinese OTR platforms to identify their potential differences and universal attributes. The differences are analyzed by comparing the DI between platforms as the DI concept is an important topic in OTR analysis (Marine-Roig and Ferrer-Rosell 2018 ). Additionally, the aim was to explore the reasons for discrepancies and commonalities in the representation of the DI. An instrumental case study approach (Mills et al. 2013 ) was used in this study as we are interested in the differences of online platforms in representing DI instead of the case itself. Since the research team is familiar with Finland and tourism in the country, it was chosen as the case destination. Finland is also a relatively new destination for Chinese tourists, but growing fast before COVID-19 pandemic. This development aspect makes Finland an interesting case to study the phenomenon. However, we acknowledge that the context is secondary for this research compared to the phenomenon itself and the destination could have been virtually any another destination. The data was collected from five Chinese OTR platforms and analyzed using a mixed content analysis approach focusing on data referring to Finland as a tourist destination. A qualitative content analysis was used to formulate a DI coding manual (for use in the analysis) from part of the samples. A quantitative content analysis was then conducted to objectively extract Finland’s DI from the other OTRs’ data, based on the coding manual.

The structure of the paper is as follows: Chapter 2 presents previous social media studies of OTR platforms. Chapter 3 introduces the theoretical background of the DI framework. The methodology and results are presented in Chapters 4 and 5. A theoretical discussion and practical implications based on the results are presented in Chapter 6. The final chapter includes a conclusion, a discussion of the study’s limitations, and suggestions for future study.

2 Social media analytics on online travel review platforms

In 2018, the number of Chinese outbound tourists exceeded 149 million (iResearch 2019 ). The increasing outbound travel has also led to the increasing use of online travel review platforms in China. With the development of information technologies, China’s tourism information services now cover the pre-travel, on-travel, and post-travel processes (Pan et al. 2019 ). OTR platforms are especially prominent: 51.4% of outbound tourists obtain travel recommendations and information from Chinese OTR platforms (iResearch 2019 ). Besides, 71.6% of Chinese outbound tourists share travel experiences on Chinese social media, and 39.9% of tourists share travel experiences on OTR platforms (iResearch 2019 ). All the evidence indicates that OTR platforms are very important in any attempt to understand outbound Chinese tourists.

There is a vast amount of online information on OTR platforms, commonly known as “big data”. When researchers conduct DI studies based on shared online travel experiences, OTRs are regarded as a form of electronic word-of-mouth communication (eWOM) (Marine-Roig 2017 ). Although online reviews may be seen as unsolicited and unbiased online information that reflects the realistic tourist perception of the destination (Marine-Roig 2017 ), the OTR content given by different tourist segments has different focuses (Van der Zee and Bertocchi 2018 ). Nowadays, the application of OTRs in tourism research has received increasing attention, and researchers usually collect data from a single Western OTR platform, especially TripAdvisor, Yelp, or Expedia (Xiang et al. 2017 ).

Many researchers have adopted a single OTR platform approach in tourism studies (Xiang et al. 2017 ). The platform-specific biases of different OTR platforms mean that multi-platform data sources may be more valid in researching tourism phenomena. These biases are not only reflected in the platform design itself (Pai et al. 2014 ), but in the posting behavior of tourists and managers (Pfeffer 2014 ). The research already demonstrates that the major Western OTR platforms differ regarding the cost of reviewing (Chevalier et al. 2018 ; Zhuang et al. 2018 ), the review content posting behavior in terms of the number of reviews, the review length, customer preference, and sentiment, for example (Proserpio and Zervas 2017 ; Wang and Chaudhry 2018 ; Xiang et al. 2017 ).

Researchers are thus well aware of the differences between major Western OTR platforms. However, although we often use OTR platforms for destination image analytics (Marine-Roig and Ferrer-Rosell 2018 ), how the OTR platform itself affects DI analytics remains unknown. It is imperative to understand how the DI differs between different platforms or whether there is a difference at all. We, therefore, compare Chinese OTR platforms and analyze the results of online DI analytics from major Chinese OTR platforms.

3 The framework of the destination image

The usual definition of DI is the sum of a person’s beliefs, ideas and impressions of a destination (Crompton 1979 ). It is formed in a process in which personal, sociocultural, and information technology factors (Beerli and Martin 2004 ; Josiassen et al. 2015 ; Kislali et al. 2016 ; San Martín and Del Bosque 2008 ), as well as stimulus factors (e.g., information sources, previous experience of the destination) affect the formation of the image (Gartner 1993 ). According to Gartner ( 1993 ), destination information can be regarded as a continuum of various image formation agents, ranging from traditional forms of the induced agent to autonomous and organic image agents. “Induced agents” refers to the information provided by commercial destination actors representing the supply-side view of DI as the projected image (Mak 2017 ). “Autonomous image agents” refers to information sources which are not under the control of the destination organizations, referring to news, movies, and documentaries, for example (Gartner 1993 ). “Organic image agents” refers to information sources based on a visit to the area (Gartner 1993 ).

With the development of information technology, induced and organic image formation agents are not necessarily mutually exclusive but may complement each other (Selby and Morgan 1996 ). One view is that the Internet can be seen as an induced information agent in the image formation process (Beerli and Martin 2004 ). The opposing view is that the previous point is outdated in the modern online environment, and the different online travel platforms (such as official tourism websites, travel blog platforms, or travel review platforms) on the Internet can be classified as induced, autonomous, or organic information agents (Llodrà-Riera et al. 2015 ). Online destination information can, therefore, be regarded as an agent of induced or organic image formation, both of which play a significant role in the image formation process (Llodrà-Riera et al. 2015 ). Besides, when tourists obtain destination information from different online travel platforms, there may be a discrepancy between the destination images based on official tourism website content (induced), travel blog platform content (autonomous), and travel review platform content (organic) (Mak 2017 ; Marine-Roig and Ferrer-Rosell 2018 ). Perceptions of official tourism website content (induced) and travel blog platform content (autonomous) differ less from each other (Marine-Roig and Ferrer-Rosell 2018 ).

Due to the OTRs’ source credibility and information quality, travel review platforms as organic information agents are more unbiased and trustworthy than the induced information agents of official tourism websites (Filieri et al. 2015 ). The assessment of DI formation based on OTR data is, therefore, becoming increasingly popular. In particular, understanding DI based on different OTR platform content may assist in exploring whether there is a DI discrepancy between different organic information agents. Mak ( 2017 ) used the term online destination image to depict “the online representation of the collective beliefs, knowledge, ideas, feelings and overall impressions of a destination.”

There are two main approaches to defining DI construction. One considers DI as a multidimensional construct with two main components: the cognitive image and the affective image of destinations (Baloglu and McCleary 1999 ). These two images respectively represent a tourist’s knowledge of the destination and their emotions based on their destination knowledge (Baloglu and McCleary 1999 ; Gartner 1993 ). The other most-cited construction is considering DI as a person’s overall evaluation of the destination, which includes attribute-based and holistic components (Echtner and Ritchie 1991 , 1993 ). Each component can be further subdivided into functional-psychological; or common-unique characteristics (Echtner and Ritchie 1991 , 1993 ). The attribute-holistic continuum illustrates whether the representation of DI is from the perspective of an individual attribute or a holistic aggregate. The functional-psychological continuum refers to functional (directly observable or measurable) or psychological (less tangible, difficult to measure) attributes. The common-unique continuum also refers to common characteristics, attributes, and impressions according to which destinations are commonly compared, or it refers to unique or destination-specific features (Echtner and Ritchie 1991 , 1993 ). By introducing a three-dimensional DI framework, Echtner and Ritchie ( 1993 ) developed a 35-item destination attribute scale, ranging from more functional attributes (including tourist sites/activities, national parks, and historic sites) and mixed destination attributes (including crowdedness, cleanliness, and political stability) to more psychological destination attributes (including hospitality, place atmosphere, and reputation).

Subsequently, some studies have proposed various scales to determine the destination attributes and measure the DI (Beerli and Martin 2004 ; Choi et al. 2007 ; Enright and Newton 2005 ; Gallarza et al. 2002 ; Marine-Roig 2017 ; Rodrigues et al. 2015 ; Vinyals-Mirabent 2019 ). In this study, we have combined Echtner and Ritchie’s ( 1993 ) functional-psychological attribute scales and Beerli and Martín’s ( 2004 ) attribute classification as an adapted framework (see Appendix 1 ) for data analysis. Echtner and Ritchie’s ( 1993 ) study placed 35-item destination attributes into a functional-psychological scale, which does not cover all the universal attributes in the destination. Therefore, another often cited destination attribute study by Beerli and Martín ( 2004 ) was applied for the adapted framework. Beerli and Martín’s ( 2004 ) study classified destination attributes into nine dimensions, but they did not distinguish the functional or psychological features of these attributes. For this reason we developed an adapted attribute framework which combines the advantages of Echtner and Ritchie’s ( 1993 ) and Beerli and Martín’s ( 2004 ) studies.

In order to build the adapted attribute framework, the first step was to place Echtner and Ritchie’s ( 1993 ) 35 identified destination attributes into Beerli and Martín’s ( 2004 ) destination attribute classifications. Then, according to the functional-psychological definition of the attribute given in Echtner and Ritchie’s ( 1993 ) study, the functional and psychological feature of the attribute classification were determined. For example, tourist sites, tourist activities, sports activities, national parks, and tourist entertainment were regarded as functional destination attributes in Echtner and Ritchie’s study ( 1993 ). In Beerli and Martín’s ( 2004 ) study, these attributes were classified as a tourism leisure dimension. Therefore, the tourism leisure dimension was considered a functional attribute after some research group discussion. Moreover, in the tourism leisure dimension, architecture and buildings, which were not covered in Echtner and Ritchie’s ( 1993 ) study but were identified in Beerli and Martín’s ( 2004 ) study, were also considered as a functional destination attribute. The adapted DI framework comprehensively illustrates the destination attributes from continuous functional to psychological characteristics in nine dimensions. The tourism leisure and recreation, natural resources, and tourism infrastructure dimensions are more related to the functional level. On the other hand, the dimensions of culture, history, art, general infrastructure, and natural environment belong to the mixed functional-psychological level. The abstract psychological attributes include politics and economics, the social environment, and the atmosphere of the place in question.

As socio-demographic and sociocultural factors (Beerli and Martin 2004 ; Josiassen et al. 2015 ; Kislali et al. 2016 ; San Martín and Del Bosque 2008 ) play an important role in the image formation process. It can be assumed that tourists with different cultural backgrounds may perceive the same destination attribute differently (Nakayama and Wan 2019 ). As most of the academic research on destination image analytics has been conducted Using western platforms, a short review of the literature focusing on Chinese tourists’ perceived images of Western destinations may highlight the dimensions of the image the Chinese tourists’ highlight. Chinese tourists retain different preferences for domestic and Western destinations (Li and Stepchenkova 2012 ; Wang and Hsu 2010 ). In domestic travel, the service quality attribute is the most important factor in shaping the DI (Wang and Hsu 2010 ). However, most Chinese tourists visiting Western countries share travel experiences concerning natural resources and local cultures (Huang and Gross 2010 ; Li and Stepchenkova 2012 ; Sun et al., 2015 ). Chinese tourists are also willing to discuss political and economic issues affecting Western destinations (Li and Stepchenkova 2012 ). To confirm judgements about Western destinations, Chinese outbound tourists tend to compare differences between a Western destination’s social systems and China’s (Huang and Gross 2010 ). Additionally, Chinese cultural norms play an important role in the process of perception formation and the interpretation of Western destinations (Sun et al. 2015 ). These cultural norms include the desire for harmony and respect for the authorities. The different cultural backgrounds of Chinese and Western tourists mean there may be significant differences in perceptions of the same destination (Tang et al. 2009 ). According to Kim and Morrison ( 2005 ), Chinese outbound tourists are more likely to change their perception of destinations in a short period than Western tourists.

4 Methodology

Adopting the mixed qualitative and quantitative content analysis approach, this study compared the representation of the image of Finland in different Chinese OTRs, to interpret the commonalities and discrepancies between various platforms. China has become one of the largest source markets in international tourism (UNWTO 2018 ), and this growth has also been witnessed in Finland. Between 2011 and 2018, the number of Chinese tourists visiting Finland increased by 323% (Statistics Finland 2019 ). In 2012, the Finnish national tourism office (VisitFinland) and the Finnish airline company Finnair established digital marketing strategies on Weibo, in China. Although the data reveals that the Nordic countries have great potential in the Chinese market, gaps and deficiencies remain in DI research in the Nordic countries (Andersen et al. 2018 ). Today, China has the largest market of Internet users, accounting for 21% of the worldwide total (Meeker 2019 ). With an increasing number of Chinese tourists sharing travel experiences online, the massive amount of information they generate provides researchers with a way of studying the DI of a European destination from the perspective of Chinese tourists. Even though the study uses Finland and China as examples, the results can be generalized to other market combinations.

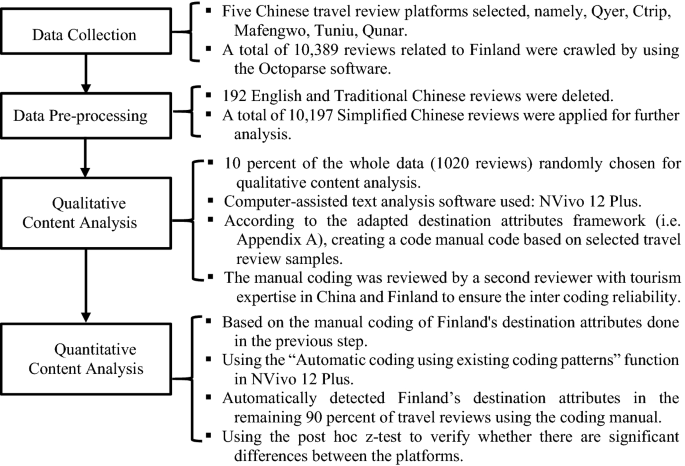

In China, travel websites with review functions can be classified in two main categories: travel vertical platforms, such as Mafengwo, Qyer; and online tour agents (OTA), such as Ctrip, Tuniu, and Qunar (Graff and Parulis-Cook 2019 , p. 53). Vertical travel websites rely heavily on user-created content, and provide tourists with generated travel information and related travel-specific services (Graff and Parulis-Cook 2019 ; Kizmaz 2018 ). Chinese OTA websites provide many travel-related services including visa arrangements, tax refunds, and financial services, as well as travel information. Many Chinese OTA websites now also have a review function for users to share their comments about destinations. Before entering the detailed introduction of the research method, a flowchart (Fig. 1 ) summarizing the key information of the research process is shown below.

The flowchart of the research process

The flowchart shows the four main parts of the research process, namely data collection, data pre-processing, qualitative content analysis, and quantitative content analysis. The following chapters will introduce each of these steps in detail.

4.1 Data collection and pre-processing

Baidu is the largest online search engine in China. Its information center ( http://site.baidu.com/ ) displays 23 popular Chinese tourism websites. Manually typing “芬兰” (Finland) into the search engine of each tourism information website resulted in six websites with Chinese OTRs for Finland. These OTRs were on Qyer, Ctrip, Mafengwo, Tuniu, Qunar, and Maotuying (the Chinese version of TripAdvisor). On Maotuying, the OTRs in Chinese are translated from other languages. This platform was therefore excluded from the study. Table 1 displays background information about these five platforms. Figure 2 shows the format of the OTRs on different platforms. OTRs are basically comprised of four components: linguistic features; semantic features; sentiment; and reviewer information (Xiang et al. 2017 ). The differences in travel platform design mean that not all these features can be found on each platform (Xiang et al. 2017 ). For example, except for Tuniu, tourists can attach photos to OTRs on the other four platforms. On Qyer, Mafengwo, Tuniu, and Qunar tourists can comment on others’ OTRs. However, all the platforms contain basic review features (textual review content, ratings, and the release time) and reviewer’s information (nickname, profile photo).

The format of the OTRs on Qyer, Ctrip, Mafengwo, Tuniu, and Qunar

In Fig. 2 , the red box indicates the content of the OTRs. The black circle indicates the reply function.

Data collection was conducted using a web crawler, Octoparse, which was used to extract the required data information from the hypertext markup language on the travel review webpages. In this study, we collected only the textual review content, release date, and reviewer’s nickname. The collection process took place between early October and the end of December 2018. A total of 10,389 OTRs related to Finland were crawled by the setting crawling process. The textual OTR content includes descriptions of attractions, hotels, restaurants, entertainment activities, and others. Furthermore, only Simplified Chinese OTRs were considered in this study. After deleting 192 English and Traditional Chinese OTRs, a total of 10,197 Simplified Chinese OTRs were applied for further analysis. As Table 2 shows, Qyer had the largest number (3570) of OTRs, followed by Ctrip and Qunar. Mafengwo and Tuniu had a nearly equal number of OTRs and are the smallest platforms.

4.2 Data analysis

The content analysis approach is commonly adopted to analyze textual messages (Stepchenkova and Mills 2010 ). It can be used to compress many words into categories based on explicit coding rules (Harwood and Garry 2004 ). Most of the existing literature used either the qualitative or quantitative content analyses to study the perceived destination from OTRs, and the quantitative approach seems to be the mainstream choice (Marine-Roig and Ferrer-Rosell 2018 ; Qi et al. 2018 ; Zhang and Cole 2016 ). Applying the computerized quantitative content analysis approach to OTR-based image studies includes two basic steps, data pre-processing and attribute identification (Marine-Roig and Clavé 2016 ; Xiang et al. 2017 ). Data pre-processing generally involves some operations, including tokenization (means breaking the review text into words, phrases, or other meaningful elements), and removing stop words (e.g. a, the, so, or other words do not contribute to the meanings of the text) (Xiang et al. 2017 ). Attribute identification in a quantitative content analysis aims to detect the frequency, density and weight of keywords or key phrases in the content by computer program, and then aggregate keywords or key phrases into destination attribute categories (Marine-Roig and Clavé 2016 ). Because a quantitative content analysis often focuses on searching for keywords, adopting a quantitative computerized approach alone often results in ignoring valuable contextual information embedded in the OTR data (Stepchenkova et al. 2009 ; Zhang and Cole 2016 ).

In contrast to the quantitative content analysis approach, the qualitative content analysis approach is the subjective interpretation of textual content, and used to manually extract the DI from a small number of tourists’ narrative descriptions (Sun et al. 2015 ; Tegegne et al. 2018 ). Using the qualitative content analysis approach could extract the valuable contextual information embedded in the textual content. The systematic classification process of encoding the destination attributes and identifying attribute categories is the core of the qualitative content analysis approach in DI studies (Lian and Yu 2017 ). In addition, inter-coder reliability must be carefully considered, which means that different coders need to produce the same encoding results in the same way (Lian and Yu 2017 ). Although a qualitative content analysis focuses on valuable contextual information embedded in the text content, manual coding is quite time-consuming to apply for large-scale text analysis. In order to solve the two problems of extracting valuable information embedded in review content, and processing large amounts of OTR data, thus, a novel approach combining both qualitative and quantitative methods was applied in this study.

The qualitative content analysis in this study was conducted first to identify Finland’s destination attributes and build up a coding manual. In this process, the coding of the destination attributes and categorization followed the adapted attribute framework from previous studies (see Appendix 1 ). Basically, the adapted attribute framework ensured the validity of encoding destination attributes and identifying attribute categories. Therefore, two coders randomly chose 10% of the travel reviews to formulate a coding manual of Finland’s destination attributes. All data coding was conducted on Chinese-language texts using the computer-assisted text analysis software NVivo 12 Plus. The data reached a saturation point when adding additional OTRs failed to reveal novel aspects or issues (Papathanassis and Knolle 2011 ). The coding manual was built by using the following steps: (a) an OTR was read carefully and destination attribute were identified based on the context of review content, (b) the identified attribute was verified in the adapted attribute framework, (c) the code was confirmed if the identified attribute existed in the framework, (d) if the identified attribute did not exist in the framework, the coders discussed and decided on the attribute code and its classification. Furthermore, in order to ensure the reliability of the coding manual, a second reviewer with tourism expertise in China and Finland was asked to review the codes.

In the process of formulating the coding manual, several operations were performed on the selected reviews. First, the coders made efforts to unify the spelling of the names of attractions on different review platforms. For example, the description of Kamppi Chapel and the Silent Church pointed to the same attraction, which was coded as “Kamppi Chapel” under the destination attribute code “churches”. Second, universal terms of destination attributes were applied in the cases that Chinese tourists mentioned general infrastructure without giving a specific name. For instance, Chinese tourists gave descriptions of Finland’s libraries without referring to a certain place, thus the general terms “libraries” were applied to these descriptions.

Based on the coding manual from the qualitative content analysis, a computerized quantitative content analysis was applied to the remaining data by using the “automatic coding using existing coding patterns” function in NVivo 12 Plus. The premise of using pattern-based auto-coding is that the coder needs to manually code part of the material. When using the identified codes for automatic coding, NVivo compares each text part (e.g., a sentence or paragraph) with the review content already coded into the destination attribute. If the content of the text paragraph is similar in wording to the content already coded for the destination attribute, the text paragraph will be coded for that identified attribute. In doing so, the quantitative content analysis results can then reveal Finland’s image on the various Chinese OTR platforms. This study further used the post hoc z test to verify whether the differences between Finland’s image on different platforms are significant. The chi-square post hoc z-test using adjusted residuals is applied to detect differences between groups data (Zhang et al. 2017 ). The premises of using the z-test are that the variance is known and the sample size is large enough (sample size ≥), as is in this case (Table 4 ). The test shows the cells in the chi-square table that have significantly lower or higher adjusted residuals on the 95% confidence interval.

5 Results of the destination image analysis

5.1 qualitative analysis results for finland’s destination image categories.