- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What to Know About Pet Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Traveling with your pet can be so rewarding; but it can also be a huge hassle. Between ever-changing airline policies regarding emotional support animals , to needing to shell out a few hundred dollars for a round-trip flight for your furry friend, traveling can get complicated (and costly) fast.

And that’s if everything goes according to plan. If your pet gets sick or injured while traveling, things can get really hairy. So it pays to make sure your pet is covered with insurance.

Here's what to know about pet travel insurance.

Pet travel insurance vs. pet health insurance

First things first, is pet travel insurance different from pet health insurance? In short, yes. Pet health insurance covers your furry companion’s healthcare needs, whereas pet travel insurance is offered by businesses hired to relocate your pet and only applies to what happens between the beginning and end of a trip.

Pet health insurance covers needs like vet visits, surgery, injuries and dental work. Like your own health insurance, you will pay a monthly or annual premium and can expect deductibles of varying amounts depending on your level of coverage.

Pet travel insurance, on the other hand, only covers your pet during a set period of time. This is usually from point to point and when your pet is traveling unaccompanied, like when you are hiring a service to relocate your pet. The most important distinction is only businesses can buy pet travel insurance, not the pet owner.

“Pet flight insurance” doesn’t exist.

Fortunately, many pet health insurance policies may cover some travel cancellation and health care costs for your pet if your trip gets interrupted because your pet gets sick or injured. To find out if that’s the case, be sure to read your individual policy for details.

» Learn more: How to make traveling with your pet affordable

Pets aren’t covered under most normal travel insurance and trip cancellation policies

Travel insurance and trip cancellation insurance is a handy thing to have when the unexpected happens, as it can help reimburse travel costs if you have to cancel a trip or call it short due to an emergency. Unfortunately, travel insurance and trip cancellation coverage don’t typically cover pets, only human travelers.

In fact, trip cancellation insurance rarely considers pet emergencies, deaths or overbooked pet reservations on an airline as valid reasons for cancellation — though there may be exceptions made in the case of registered service animals.

That said, if you still want the option to cancel travel plans and get reimbursed for your investment in the case of a pet emergency, there may be a way: You can select a travel insurance policy with “ Cancel For Any Reason ” coverage, which would include pet emergencies.

» Learn more: The most pet-friendly airlines

Some pet insurance only covers your pet in the U.S.

While there are some pet health insurance companies that offer cat and dog travel insurance coverage in the form of health care treatment when you’re away from home, not all provide coverage in all places. Some may only cover health issues and care within the U.S. and Canada, while others may reimburse you for services abroad, too (though they may be limited to certain countries).

So before you pick a plan, make sure to read the fine print to know if your pet is covered wherever you plan on traveling together, especially if you’re headed overseas.

» Learn more: How to fly with a dog

Pets may require additional info to fly

Do pets need insurance to fly? Generally no, though depending on the airline, you may be required to bring other information and documentation with you when you travel with an animal. Check with your specific airline before booking to ensure you’re following protocol and you don’t miss your flight for lack of appropriate paperwork.

If you’re traveling internationally with your pet and your destination country allows four-legged visitors (not all do), you’ll need an international health certificate and will be required to adhere to any specific requirements set forth by that country.

You can check the Animal and Plant Health Inspection Service site from the U.S. Department of Agriculture for regulations by country.

» Learn more: The best airline credit cards right now

Pet travel insurance considerations, recapped

Traveling with a pet can be complicated and costly, but pet insurance can bring peace of mind whether you’re road tripping across the country or flying around the world.

Just make sure before you head off on your adventure to check and make sure that your pet’s health insurance policy covers veterinary treatment where you’re headed, find out whether your travel insurance offers coverage for trip cancellation or interruptions insurance because of sick pets, and consider getting a “Cancel For Any Reason” policy so you can change your plans for any and all pet-related reasons.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Pet Travel Insurance: Everything You Need To Know

Traveling with pets by your side can be great, but it does make planning trips a bit more complicated. Between finding pet-friendly locations , choosing the best method of transportation, and packing all your essential pet supplies, there’s a lot to think about every step of the way — including your pet’s safety, first and foremost .

Best U.S. Cities For Dogs In 2022

So many things can go wrong when traveling, that you might find yourself in need of unexpected veterinary care. In these cases, insurance coverage can be a literal life-saver, but can you use pet insurance anywhere ? Or do you need pet travel insurance ? And what’s the difference, anyway?

Keep reading to learn how pet insurance works when traveling , or use the links below to jump to the answers you’re looking for:

What is pet travel insurance?

Can you use pet insurance anywhere, how does pet insurance work when traveling.

- Does pet insurance cover travel cancellations for sick pets?

How much is pet insurance for a flight?

Key takeaways.

Pet travel insurance covers the loss, injury, or death of your pet during a trip from Point A to Point B. Otherwise known as pet transport or pet taxi insurance, these policies provide liability coverage to companies that offer transportation, shipping, and delivery services for pet traveling without their owners.

If you are sending a pet by land, air, or sea, there are certain health risks that make pet travel insurance well worth your consideration. Ground transportation is more favorable for pet travel safety than traveling as air cargo, but the common issues that occur in either setting include:

- Motion sickness

- Increased stress levels

- Unexpected injuries

- Heat stroke

- Hypothermia

When making transportation arrangements for your pet, ensure that your carrier company is licensed and provides a minimum amount of pet travel insurance — typically from $100 to $500 per pet . Or, if you’re entrusting your pet directly to an airline, know that they all have different pet policies. The results of one legal case found that some may limit their liability to that of checked baggage , currently set at $3,330 for domestic flights.

Note that these hypothetical figures represent the maximum amount you’d receive for a pet injury or death mid-travel. Travel insurance doesn’t cover sick pets or natural illnesses that may occur in transit. Nor do they these policies cover ongoing health problems caused by an incident mid-transport that develop later on.

For coverage that’s comprehensive and long-lasting, you’d need a traditional pet insurance plan .

How Does Pet Insurance Work?

It depends on the provider. While all pet insurance companies allow you to use any licensed veterinarian, emergency hospital, or specialist in the United States, restrictions on where you can use pet insurance vary at the international level. Here are some examples from top providers:

- Trupanion , Figo , and Pets Best Insurance cover pets in the US, Puerto Rico, and Canada

- Fetch , Healthy Paws , and Pet Partners cover pets in the US and Canada

- Embrace Pet Insurance provides pet insurance for traveling pets if they reside in the US for at least 51% of the year

- Nationwide covers pets worldwide.

- Bivvy , Companion Protect, and MetLife Pet Insurance cover pets in the US only

For pets traveling abroad, covered vet fees may differ depending on the length of stay in the foreign country.

If your pet insurance covers travel, then you can get reimbursed for veterinary bills while you’re away from home, so long as the service does not relate to a pre-existing condition . Unless your provider offers Vet Direct Pay, the policy will work the same overseas or out-of-state:

- Pay for veterinary care out-of-pocket

- File a claim for covered services

- Get paid out at the policy’s reimbursement rate (pending you’ve met your deductible and haven’t hit your annual limit)

Some providers, like ASPCA Pet Insurance , offer additional travel benefits for pets that may include:

- Lost or stolen pet passport or health certificate coverage

- Quarantine kennel fee coverage

- Advertising and reward coverage in case your pet gets stolen or lost.

- Access to 24/7 pet help hotline

Many insurance companies offer supplementary pet wellness plans that could help reimburse expenses incurred to get a pet passport , including the cost of a vet exam , microchipping, and required vaccinations for dogs and cats.

Does pet insurance cover travel cancellations due to sick pets?

Some pet insurance companies, such as Pet Plan and Trupanion, reimburse travel cancellations due to sick pets . The cancellation coverage often pays for your travel expenses in case you have to abruptly cancel your trip or cut it short because you had to take your pet to the emergency room .

Only businesses can buy insurance for travelling pets, so if you want to get pet insurance for a flight , you’d have to enroll in a traditional pet insurance policy and pay the price of a monthly premium . The cost of pet insurance averages $49.51 for dogs and $28.48 for cats, but this number could go up or down depending on where you live and the coverage you choose.

Many people get pet travel insurance prior to their cat or dog flying unattended, then cancel the policy upon safe arrival. If you plan on only getting pet insurance for a flight, you’d need to research the cancellation policy to see whether you’d incur any fees or receive a prorated refund for the monthly premium.

However, if you travel with your four-legged companion often, you may want to keep your pet insurance for flights in the future . By canceling and re-enrolling for each flight, you risk the any pre-existing condition your pet may develop being excluded from your next policy. If anything related to that health issue were to happen while traveling — such as the stress of flying worsening a pet’s heart condition — it would be ineligible for insurance coverage.

Keep in mind that you’ll likely need a pet health certificate issued within 10 days of your trip for pets flying abroad, which will require a visit to your vet. If you want to be reimbursed for exam fees and services your pet may need for international travel, be sure to enroll well in advance, since the policy won’t go into effect until after the mandatory waiting period has passed.

If you’re looking for pet insurance coverage that will provide protection for your pet while you’re home or away, Pawlicy Advisor makes it easy to read the fine print, compare plans, and find the features that matter the most for your preferences. Click on the button below to get started today.

- Pet travel insurance covers expenses relating to issues or accidents when pets are traveling. The benefits of this type of insurance typically extend only from airport to airport. If you are looking for ongoing coverage, you should consider traditional pet health insurance.

- Some pet insurance providers also cover pets traveling both domestically and internationally. Most insurance companies allow pet parents to use any licensed veterinarian throughout the US, but some of them also provide coverage when your pet is traveling abroad.

- It’s easy to get overwhelmed when you are shopping for pet insurance, but Pawlicy Advisor can help keep you organized when comparing different options and make sure you choose the best plan for your pet and your budget.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

About Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

How To Compare Plans

Determine If Pet Insurance Is Worth It

Determine If Wellness Plans Are Worth It

Vet Visit Costs

New Puppy Checklist

Comparison Charts

ASPCA vs. Pets Best

Pets Best vs. Embrace

Embrace vs. Pumpkin

Pumpkin vs. MetLife

More Comparison Charts

Find Your State

Pennsylvania

More States

Dog Insurance

German Shepherd

English Bulldog

French Bulldog

More Breeds

.css-3sl4ml{color:#E26C33;-webkit-text-decoration:none;text-decoration:none;}.css-3sl4ml:hover{color:#E26C33;-webkit-text-decoration:underline;text-decoration:underline;} Kari Steere .css-aqd080{font-size:16px;font-weight:bold;}@media screen and (min-width: 992px){.css-aqd080{font-size:21px;}} Licensed Insurance Producer - Pawlicy Advisor

Kari Steere is a licensed P&C insurance agent in all 50 states and has focused entirely on pet insurance since 2019. As an animal lover with a rescued Terrier named Barry, when she's not helping pet owners find the perfect plan on Pawlicy Advisor , she runs a ranch in Oregon and rehabilitates any animals that come across her path.

More on Pet Insurance

How To Compare Pet Insurance Plans

Is Pet Insurance Worth It? Here's A Vet's Perspective

How to Get the Best Pet Insurance Plan, No Matter the Provider

How Soon Does Pet Insurance Take Effect?

Average Pet Insurance Cost in 2022 by Breed, Age, & State

Pet Insurance for More Than One Pet: Multi-Pet Discounts And Strategies

When Is Pet Insurance A Great Decision?

How Pet Insurance Works: Your Essential Guide

5 Reasons Why Outdoor Cats NEED Pet Insurance

Fascinating Pet Insurance Statistics 2019-2020

More on veterinary costs.

How Much Does a Vet Visit Cost? Here's Everything You Need To Know

Budgeting For Pet Dental Costs: Vet Bills, Insurance & More

Dog Cataract Surgery Costs and How to Save

Dog Teeth Cleaning Costs: Best Ways To Save On Dental Care

Dog X-ray Costs and How to Save

How Much Does it Cost to Spay or Neuter a Dog?

How Much Does It Cost to Microchip a Dog?

How Much Does It Cost to Treat Parvo?

- Images home

- Editorial home

- Editorial video

- Premium collections

- Entertainment

- Premium images

- AI generated images

- Curated collections

- Animals/Wildlife

- Backgrounds/Textures

- Beauty/Fashion

- Buildings/Landmarks

- Business/Finance

- Celebrities

- Food and Drink

- Healthcare/Medical

- Illustrations/Clip-Art

- Miscellaneous

- Parks/Outdoor

- Signs/Symbols

- Sports/Recreation

- Transportation

- All categories

- Shutterstock Select

- Shutterstock Elements

- Health Care

- Sound effects

PremiumBeat

- PixelSquid 3D objects

- Templates Home

- Instagram all

- Highlight covers

- Facebook all

- Carousel ads

- Cover photos

- Event covers

- Youtube all

- Channel Art

- Etsy big banner

- Etsy mini banner

- Etsy shop icon

- Pinterest all

- Pinterest pins

- Twitter All

- Twitter Banner

- Infographics

- Zoom backgrounds

- Announcements

- Certificates

- Gift Certificates

- Real Estate Flyer

- Travel Brochures

- Anniversary

- Baby Shower

- Mother's Day

- Thanksgiving

- All Invitations

- Party invitations

- Wedding invitations

- Book Covers

- About Creative Flow

- Start a design

AI image generator

- Photo editor

- Background remover

- Collage maker

- Resize image

- Color palettes

Color palette generator

- Image converter

- Creative AI

- Design tips

- Custom plans

- Request quote

- Shutterstock Studios

- Data licensing

You currently have 0 credits

See all plans

Image plans

With access to 400M+ photos, vectors, illustrations, and more. Includes AI generated images!

Video plans

A library of 28 million high quality video clips. Choose between packs and subscription.

Music plans

Download tracks one at a time, or get a subscription with unlimited downloads.

Editorial plans

Instant access to over 50 million images and videos for news, sports, and entertainment.

Includes templates, design tools, AI-powered recommendations, and much more.

Travel Insurance Logos vectors

7,994 travel insurance logos vectors, graphics and graphic art are available royalty-free..

Our company

Press/Media

Investor relations

Shutterstock Blog

Popular searches

Stock Photos and Videos

Stock photos

Stock videos

Stock vectors

Editorial images

Featured photo collections

Sell your content

Affiliate/Reseller

International reseller

Live assignments

Rights and clearance

Website Terms of Use

Terms of Service

Privacy policy

Modern Slavery Statement

Cookie Preferences

Shutterstock.AI

AI style types

Shutterstock mobile app

Android app

© 2003-2024 Shutterstock, Inc.

Pennies, Places, and Paws

Saving pennies to go places and spoil your paws

Travel Insurance for Dogs

As an Amazon Associate, I earn from qualifying purchases. We may receive a commission for purchases made through these links. This site also contains affiliate links to products besides Amazon and we may also receive a commission for purchases made through those links too (at no additional cost to you).

Adding Travel Insurance for Pets

Travel Insurance is becoming increasingly popular (and necessary) as more and more people see the need to plan for the unknowns that can pop up before and during vacation. There are so many companies and plans to choose from depending on where you are going, the length of time you’ll be gone, what activities you have planned, and who you will be going with.

As a dog and ferret mom, I am SOOO excited to see that some companies have finally begun to offer travel insurance for dogs and other pets! Being able to add on bundles that cover travel insurance for our animals is a game-changer for pet owners and I hope to see more and more options available.

Since travel insurance for pets (and travel insurance in general) is a relatively new subject for many of us, I’ve brought in an expert to help unravel some of the mysteries around these newer insurance options. In our site’s first guest post, Chelsea from Travel Insurance Master will be breaking down why we should all at least consider getting travel insurance for future trips AND give us some details about a great add-on pet bundle option for pet parents.

For more help planning a dog-friendly vacation, take a look at our Tips for Taking Your Dog on Vacation .

*For full disclosure, I am an affiliate for Travel Insurance Master and may earn a small commission on any purchases through our links*

Travel Insurance for You and Your Pet

By Chelsea from Travel Insurance Master

Your travel budget must include a lot – from your own itinerary to your furry friends’ staycation at home or adventure alongside you. Travel insurance may be the last thing you want to worry about or include in your budget, but it’s an important part of every trip! The relatively small cost you’ll put towards insurance can prove to be an invaluable purchase that will protect yourself and your pet too!

Why and When Should I Get Travel Insurance?

If the last few years have proven anything, it’s the importance of protecting your trip against the unexpected. On any trip that takes you 100 miles or more from home, including domestic trips, and road trips too, travel insurance is a smart purchase. You’ll be happy to learn the cost is even lower when you are not traveling internationally! If you do plan on leaving the States though, you will want to ensure you protect your investment of time and money too.

Travel Insurance Master

Travel Insurance Master partners with the top travel insurance providers to bring a large variety of plans and benefits to one website. In just three steps, you’ll be able to request a quote and find your recommended plan and best value for your next trip, as well as view side-by-side comparisons.

Types of Travel Insurance

There are two main types of travel insurance to choose from. Comprehensive Plans or plans with trip cancelation and travel medical options are the most popular plan type.

Trip Cancellation

Trip Cancellation gives you the ability to cancel your trip before it starts for 100% of your otherwise non-refundable prepaid trip costs. The covered reasons for Trip Cancellation are covered in your plan’s certificate and are most commonly due to sudden illness or injury preventing you from taking a trip.

If you request a quote and purchase a plan early, usually within 1-21 days of the initial trip deposit, you may be able to purchase the Cancel for Any Reason (CFAR) benefit with your plan as well. Although these plans usually cost the most, they give you the most flexibility. CFAR plans allow you to do just that, cancel for any reason whatsoever usually up to 2 days prior to departure for up to 75% reimbursement of your trip cost, or your prepaid and non-refundable expenses.

Travel Medical Coverage

Travel medical coverage is an invaluable resource while you travel domestically or internationally. Many travelers do not realize that their regular health insurance may only provide very limited or no coverage at all outside their home country. If there’s little time before your trip and you do not think there is a chance of trip cancellation, you can filter by No Trip Cancellation on TravelinsuranceMaster.com and find a Travel Medical Plan at a fraction of the price of a Comprehensive Plan. Some of these Travel Medical Plans even provide coverage for trip interruption and delays, baggage protection, and more.

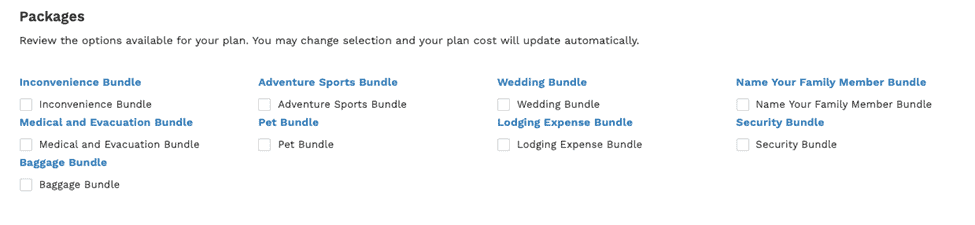

AIG Pet Bundle: Dog Travel Insurance

One of their providers, AIG Travel Guard offers a Pet Bundle option with some of their plans. It adds a variety of benefits for your furry friend, including an additional Trip Cancellation & Trip Interruption benefit due to a critical condition or death of a domestic dog or cat.

Dog Travel Insurance: Pet Care

This Pet Bundle also includes Pet Care for up to $100 per day, to a maximum of $500. This benefit applies if you have placed your pet in a kennel for the duration of the trip, or you have pre-arranged in-home care for your pet for the duration of the trip. The insurance company will pay a benefit to reimburse you up to the maximum limit to cover the necessary additional kennel fees, or additional in-home care fees, if you are delayed past your scheduled return date for at least 12 hours while en route to your Return Destination, due to any of the reasons listed under Trip Cancellation, Trip Interruption, or Trip Delay. See your plan for covered reasons and details.

Dog Travel Insurance: Vet Care

As the owner of a furry friend, you know that medical expenses can be costly for them too! The Pet or Service Animal Travel Medical Expense Benefit is part of the Pet Bundle offered with some AIG Plans on Travel InsuranceMaster.com . The Pet Bundle adds the Pet or Service Animal Medical Expense Benefit up to $2,500, with a deductible of $100. Covered expenses can include medically necessary services of a physician, animal emergency clinic charges, and X-rays.

Be sure to review your plan certificate for details and exclusions. It’s important to note that among other exclusions, routine care, care or treatment which is not medically necessary, and pre-existing conditions are not covered. If the medical expense is covered, your plan may pay a benefit to reimburse you for the Reasonable and Customary Charges, up to the maximum limit shown in the Schedule or Declarations Page (and after satisfaction of the Deductible) if, while on a trip, your pet or service animal traveling with you suffers a sickness or an injury that requires them to be treated by a Physician. Initial treatment by a physician must occur during the trip.

Ready to start planning?

Whether your furry friend is traveling with you or staying home, you will want to protect your trip at TravelInsuranceMaster.com . It’s never too early to start shopping for travel insurance either. As soon as you put down your initial trip deposit, even if you have not paid for your trip in full yet, you can still request a quote and purchase travel insurance.

With Travel Insurance Master, all you’ll need to do is input your trip and traveler details in just easy 3 steps, and you’ll quickly find your recommended plan. Filter by the benefits most important to you on the left-hand side and compare plans from the leading providers.

For the Pet Bundle, look for select AIG plans, click Buy Plan and add the Pet Bundle from the Packages section of the purchase page where available. The plan cost will automatically update and then you can complete your purchase! You’ll receive your plan straight to your email, so you can get back to planning and ultimately enjoying your next adventure with your friends or family – pets included!

Pin For Later:

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.

Budget-friendly animal and wildlife enthusiast that currently owns three dogs and two ferrets that loves to travel (with and without the pups) and enjoys spoiling all of her animals!

Similar Posts

North Dakota Roadside Attractions

Be prepared with a list of North Dakota roadside attractions for your road trip. These are great opportunities to break up the monotony of your road trip and add some fun photos to your vacation.

Gettysburg Beyond the Battle Museum

The Beyond the Battle Museum helps visitors understand the role of the town throughout history, with a focus on the Civil War. Don’t miss their top 4-D exhibit!

Easy and Fun Feeding Enrichment Ideas for Your Pet

Whether your pet is furry, scaly, or feathery, use our ideas for feeding enrichment to help fight boredom, improve digestion, encourage natural behaviors, and more!

No Fridge Camping Food Ideas

Need some no fridge camping food ideas for your next trip? Here’s some food and meal ideas so you don’t have to worry about running out of ice for your cooler!

Visiting Flight 93 Memorial

The events of 9/11 forever changed the course of the United States. Visit the crash site of the Flight 93 and learn the important role they played on that tragic day.

How to Save Money on Gas

Learn how to save money on gas so you can still meet your budget and go on that next vacation! Did you know that there are 3 main ways you can save on fuel?

Insurance for Visiting the USA, or Immigrating to the USA

Dogtag international, our best comprehensive travel insurance for usa plan for going over 100 miles from home, why we like it:.

DogTag is probably the best comprehensive travel insurance for USA plan we have for U.S. travelers age 65 or younger traveling within the USA (at least 100 miles from home), and those traveling within their own nation (at least 100 miles from home).

It has affordable fixed rates for trips 10 days to 90 days long and includes trip cancellation benefits of $2,500 up to $10,000 in case you have to pay non-refundable deposits up front.

It covers 100% of most medical benefits and $0 deductible.

Note: Cannot accept policies from addresses in Canada, The US Virgin Islands, Australia, Switzerland, Iran, or Syria at this time.

It also covers most adventure sports/extreme sports – See a list of adventure sports on this page >>

- Up to age 65 and trips of 10 days to 90 days

- Our best policy for US traveling within the USA

- Complete coverage away from home (over 100 miles or more)

- Includes a trip cancellation benefit of $2,500-$10,000

This DogTag travel insurance for the USA policy is the best comprehensive travel insurance for USA that includes trip cancellation, travel insurance protection within your home nation, even adventure sports travel insurance coverage for participating in extreme and adventure sports, with four levels of coverage. Covers most countries with zero deductible and up to $100,000USD in coverage as well as $1,000,000USD in medical/emergency evacuation!

Travel must be over 100 miles from home to be covered. For example:

- Covers a Russian in Russia over 100 miles from home as well as in Poland and Austria

- Covers an American from Tennessee traveling to Texas

- Covers an Indonesian traveling to Bali, as well as coverage in Singapore or Australia

- Cannot accept policies from addresses in Canada, The US Virgin Islands, Australia, Switzerland, Iran, or Syria at this time.

One of the best comprehensive travel insurance for USA plans we offer – with four options. From Trawick whom we have done business with for many years.

- Basic premium is $189 for up to 29 days (For all ages, including children). Up to $465 for 30 days-180 days.

- $100,000 medical coverage per person per Period of Coverage

- Includes trip cancellation benefits up to $10,000 for those who must pay non-refundable deposits

- $0 deductible

- $1,000,000 for Medical/Emergency Evacuation

- Up to age 65

- Loss of sports equipment $3000 ($300 per article), Search and rescue up to $10,000, more… (See sample certificate for more) (Note: This Loss benefit should not take the place of personal property insurance as specialized equipment can be expensive to replace.)

DogTag “Basic”

Just the necessities. Our Basic level includes our worldwide 24/7 Emergency Assistance Services as well as $1000 for Trip Cancellation and Interruption. $25,000 coverage for both Accident and Sickness as well as baggage and many other essential benefits while you travel.

DOGTAG BASIC – Benefit Per Person (If U.S. resident – View Certificate specific to your state )

Trip Cancellation* $1,000

Trip Interruption* $1,000

Trip Delay (12 hours) $500 maximum ($100/day)

Emergency Accident Medical Expense $25,000

Emergency Sickness Medical Expense $25,000

Emergency Dental $100

Medical Evacuation / Repatriation $250,000

Hospital of Choice Not Covered

Return of Mortal Remains $10,000

Transportation of Dependent Children $10,000

Transportation to Join You $10,000

Search & Rescue Not Covered

Non-Medical Emergency Evacuation Not Covered

Baggage/Personal Effects $1,000 Max; $100 per Article; $250 for Valuables

Baggage Delay $250

Sports Equipment Rental Not Covered

24-Hour AD&D $5,000 of Principal Sum

Sports Exclusion Hazardous sports are excluded

Emergency Travel Assistance Services Included

Emergency Travel Assistance and Concierge Services Not applicable

DogTag “Sport”

For the more active crowd, the Sport Plan features everything in the Basic plan plus we have included Hazardous Sports Coverage which includes coverage for skydiving; hang-gliding; parachuting; mountaineering; bungee cord jumping; scuba diving (if accompanied by a dive master or if the depth is equal or less than 50 feet); spelunking or caving;

This plan features $2500 for Trip Cancellation and Interruption and $50,000 coverage for accidents and $25,000 for sickness. $2,000 for baggage. Also included is a Search and Rescue benefit of $5000 and Evacuation in case of a natural disaster at your location up to $50,000.

DOGTAG SPORT – Benefit Per Person (If U.S. resident – View Certificate specific to your state )

Trip Cancellation* $2,500

Trip Interruption* $2,500

Trip Delay (12 hours) $750 maximum ($150/day)

Emergency Accident Medical Expense $50,000

Emergency Dental $250

Medical Evacuation / Repatriation $500,000

Hospital of Choice Not Coverered

Return of Mortal Remains $25,000

Transportation of Dependent Children $25,000

Search & Rescue $5,000

Non-Medical Emergency Evacuation $50,000

Baggage/Personal Effects $2,000 Max; $250 per Article; $500 for Valuables

Baggage Delay $500

Sports Equipment Rental $3,000

24-Hour AD&D $10,000 of Principal Sum

Sports Exclusion Hazardous sports are included, Extreme sports are excluded ( See list or call)

DogTag “Extreme”

For our most adventurous customers. The Extreme Level offers all the benefits of both Basic and Sport level coverage plus coverage for over 400 named sports! There’s more! $5000 for trip cancellation. $100,000 for accident coverage, $3,000 for baggage. Search and rescue up to $10,000 and Sports Equipment Rental protection up to $3,000.

DOGTAG EXTREME – Benefit Per Person (If U.S. resident – View Certificate specific to your state )

Trip Cancellation* $5.000

Trip Interruption* $5,000

Trip Delay (12 hours) $1000 maximum ($200/day)

Emergency Accident Medical Expense $100,000

Emergency Dental $500

Medical Evacuation / Repatriation $1,000,000

Hospital of Choice Included

Return of Mortal Remains $50,000

Transportation of Dependent Children $50,000

Transportation to Join You $50,000

Search & Rescue $10,000

Non-Medical Emergency Evacuation $100,000

Baggage/Personal Effects $3,000 Max; $300 per Article; $500 for Valuables

Baggage Delay $750

Sports Equipment Rental $5,000

24-Hour AD&D $25,000 of Principal Sum

Sports Exclusion All sports exclusions are removed ( See list or call)

Emergency Travel Assistance and Concierge Services Included

DogTag “Extreme PLUS”

Our highest level of coverage available. All the benefits of Basic, Sport and the Extreme level plans with an increased Trip Cancellation / Interruption benefit of $10,000.

Trip Cancellation* $10.000

Trip Interruption* $10,000

- Does not cover travel to Iran or Syria.

- Does not cover those over 65 years of age.

- As an adventure sport, motocross is covered, but not as a professional

Compare plans and benefits

Dogtag schedule of benefits.

Coverages are per person per Period of Coverage unless stated otherwise.

Additional information

International Plan Documents – DogTag Basic

International Plan Documents – DogTag Sport

International Plan Documents – DogTag Extreme

International Plan Documents – DogTag Extreme PLUS

See Plan Documents and Examples of Sample Certificate For Your State – For U.S Travelers

Here at Good Neighbor Insurance it is very important for us to connect with you.

As an international service provider, we want to be sure that you are taken care of while you, your family, and your friends are traveling or residing around the world. It is our honor to serve you!

travel insurance

Download 10000 free Travel insurance Icons in All design styles.

- User documentation

- Travel insurance plans

Tin Leg Travel Insurance Cost

Compare tin leg travel insurance.

- Why You Should Trust Us

Tin Leg Travel Insurance: An In-Depth Review

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Before finalizing your travel plans, look into various insurance policies to safeguard yourself against potential risks. Travel insurance is an invaluable resource that can protect you from many unforeseen issues, but not all companies provide the same level of coverage. And some companies' policies may cost more than others.

That's where Tin Leg Travel Insurance comes in. Created by travel agency Squaremouth, Tin Leg Travel Insurance offers eight different plans with varying coverage levels and benefits, with the option to add Cancel for Any Reason (CFAR) coverage to select plans. Keep reading to see if Tin Leg Travel Insurance is the right travel insurance for you.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy coverage includes most pre-existing health conditions

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical and evacuation amounts for peace of mind

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. COVID coverage included by default on all insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers a wide range of plans for various budgets and travel needs

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans offer CFAR, “cancel for work reasons,” financial default, and unemployment coverage

- con icon Two crossed lines that form an 'X'. Limited add-on coverage options

- con icon Two crossed lines that form an 'X'. Baggage loss and delay coverage is low compared to competitors

Tin Leg travel insurance offers eight travel insurance plans to meet the unique needs of travelers.

- Tin Leg was founded in 2014 by the travel insurance industry experts at Squaremouth. Designed to meet the most common needs of travelers, these policies offer comprehensive Trip Cancellation and Trip Interruption benefits, and a range of Emergency Medical and Medical Evacuation limits.

Overview of Tin Leg Travel Insurance

Tin Leg Travel Insurance is a travel insurance provider founded in 2014 by travel insurance aggregator SquareMouth. With eight different plans, Tin Leg Travel Insurance is one of the providers listed in our guide on the best travel insurance companies , specifically for travelers with pre-existing conditions. We chose Tin Leg Travel Insurance because seven of its eight plans offer pre-existing condition waivers, with a 15-day purchase window and no extra cost.

That said, Tin Leg Travel Insurance has other coverages that are noteworthy. Its coverage limits for emergency evacuation go up to $1 million, which is great particularly if you have nautical travel plans as water-to-land rescues can be costly.

Additionally, sports equipment loss is included with seven of Tin Leg Travel Insurance's eight plans. However, you will need to call for more information on adventure sports, as Tin Leg Travel Insurance doesn't guarantee coverage.

Tin Leg's Travel Insurance Plans

Tin Leg Travel Insurance travel insurance offers eight travel insurance plans: Economy, Basic, Standard, Luxury, Adventure, Silver, Platinum, and Gold. Each plan offers varying levels of protection that correspond to the premium costs.

Here's a look at what you'll get with each plan. We've split the eight plans into two tables to make things easier to follow.

Here's how the Adventure, Silver, Platinu, and Gold plans compare:

Additional Coverage Options

Tin Leg Travel Insurance travel insurance offers additional coverage options, but they're only available on specific plans.

You can add rental car damage coverage to the Luxury plan for an additional fee. And both the Gold and Silver plans allow you to add on CFAR (cancel for any reason) coverage . With CFAR coverage travel insurance, you can cancel for any reason not listed in the base policy and be reimbursed — in the case of Tin Leg Travel Insurance, for 75% of your trip costs.

How to Purchase and Manage Your Tin Leg Policy

Travel insurance coverage varies greatly, and the amount you pay reflects the range of protection . However, since travel insurance protects your financial investment, it's typically worth spending a few extra dollars for higher coverage maximums, especially for medical insurance and evacuation expenses.

Getting a quote from Tin Leg Travel Insurance travel insurance is an easy process. You can do so from their website or an insurance aggregator like SquareMouth. You should be prepared to provide the following information:

- Number of travelers

- Age of traveler(s)

- Duration of trip

- Whether you want trip cancellation coverage

- Date of booking

- If you have any trip payments left to make

- One country you're traveling to

- Country of residence/citizenship

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate Tin Leg Travel Insurance's coverage costs.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Tin Leg Travel Insurance travel insurance quotes:

Premiums for Tin Leg Travel Insurance plans are between 1.8% and 3.9% of the trip's cost, well below the average cost of travel insurance . It's also relatively cheap compared to many of its competitors

Tin Leg Travel Insurance provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

Once again, premiums for Tin Leg Travel Insurance plans are between 3.4% and 5.2%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following Tin Leg Travel Insurance quotes:

Premiums for Tin Leg Travel Insurance plans are between 6.9% and 9.4%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to File a Claim with Tin Leg Travel Insurance

One exceptionally nice aspect of Tin Leg Travel Insurance is that you can report a claim online or over the phone. You can contact Tin Leg Travel Insurance's claims department at 844-240-1233 or by email at [email protected] . It's available on weekdays between 8 a.m. and 4 p.m. ET.

You'll be asked to fill out a claims form that asks about your trip details and the issue you faced. Tin Leg Travel Insurance will then ask you to file supporting documents related to your claim. If you're filing a claim because you canceled a flight due to an illness, they'll likely require medical documentation that supports this claim.

Tin Leg Customer Service and Support Experience

Tin Leg Travel Insurance is well reviewed, receiving an average of 4.6 stars out of five on SquareMouth across nearly 3,800 reviews. Reviews on its Better Business Bureau are consistent with its SquareMouth score, also averaging 4.6 stars across over 110 reviews, admittedly a limited sample size. Additionally, Tin Leg Travel Insurance is not certified with the BBB.

While most customers reported a smooth and speedy claims service, some noted that communication from Tin Leg Travel Insurance during the process can be spotty. Additionally, customers complained about their claims being denied due to requirements they were unaware of when purchasing coverage. One customer wrote about how they had to cancel a trip because of work, but hadn't been working at their company long enough to qualify for trip cancellation coverage.

See how Tin Leg Travel Insurance travel insurance stacks up against the competition.

Tin Leg Travel Insurance vs. AIG Travel Guard

To compare Tin Leg Travel Insurance travel insurance to Travel Guard , we'll consider the coverage limits from their highest-rated, Gold and Travel Guard Deluxe plans, respectively.

With AIG Travel Guard's Deluxe plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $100,000

- Coverage for baggage loss, theft, or damage up to $2,500

- Travel delay coverage of up to $1,000

Comparing those coverages with Tin Leg Travel Insurance's Gold plan, you'll see that AIG's coverages are better than Tin Leg Travel Insurance's in all areas except one – emergency medical. While AIG offers emergency medical coverage of $100,000, Tin Leg Travel Insurance's coverage limit is $500,000 (in primary coverage).

If the medical coverage piece is what's most important to you, Tin Leg Travel Insurance would be the right choice in this scenario. That said, having $100,000 in emergency medical coverage is nothing to scoff at, so it may come down to comparing premium costs.

Remember that the premium costs will depend on the traveler's age, trip destination, and trip cost. So you'll need to compare these two insurers using your trip-specific information to get a solid idea of the costs associated with each plan.

Read our AIG Travel Guard insurance review here.

Tin Leg Travel Insurance vs. Allianz Travel Insurance

Both Allianz Travel Insurance and Tin Leg Travel Insurance travel insurance offer a variety of travel insurance plans designed for different types of travelers with varying types and degrees of coverage.

In this comparison, we'll look at Allianz Travel Insurance's most popular single-trip plan, the OneTrip Prime plan, compared to Tin Leg Travel Insurance's Basic plan.

With Allianz Travel Insurance's most popular single-trip OneTrip Prime plan, you'll get:

- Up to $100,000 in trip cancellation coverage

- Up to $150,000 in trip interruption coverage

- $50,000 in emergency medical coverage

- Up to $1,000 in coverage for baggage loss, theft, or damage

- Up to $800 in travel delay coverage

In looking at Tin Leg Travel Insurance's basic plan, you'll find that these two policies offer the same $50,000 coverage limit for emergency medical. Still, Allianz Travel Insurance's plan exceeds Tin Leg Travel Insurance's in the other coverage limits. That said, you'll have to quote both of these policies using your personal trip information to make an informed decision, especially if cost is the most important factor to you.

Read our Allianz travel insurance review here.

Tin Leg Travel Insurance vs. Credit Card Travel Insurance

Do you have a travel credit card? If so, consider the type of insurance coverage it may (or may not) offer. Some basic coverages, like primary rental car insurance, are provided through your credit card's travel protection . And if you don't need medical coverage or don't have a lot of non-refundable trip expenses, the coverage offered by your credit card could suffice.

That said, don't forget that credit card coverage is sometimes considered secondary coverage. That means you'll have to file a claim with any other applicable insurer before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Tin Leg Travel Insurance FAQs

All policies except Economy cover pre-existing medical conditions as long as you purchase your policy within 15 days of trip deposit.

You have 14 days after you purchase your policy to refund your Tin Leg Travel Insurance policy, as long as you haven't left for your trip.

All Tin Leg Travel Insurance travel insurance policies include 24/7 emergency assistance services.

Tin Leg Travel Insurance claims can be submitted online or over the phone at 844-240-1233 during business hours. You'll need to provide details about your trip and the problem that arose during your trip. The claims process is quick, according to customer reviews, but be sure to review your policy for guideline related to claims.

Yes, all tiers of Tin Leg Travel Insurance travel insurance offer cancellation coverage if you or a non-traveling loved one contracts COVID-19, though you will need to provide a positive test to receive reimbursement.

Why You Should Trust Us: How We Reviewed Tin Leg

To review Tin Leg Travel Insurance travel insurance, we looked at several different factors. These included premium costs, coverage categories, and claim limits. In addition, we compared the policies and premiums available through Tin Leg Travel Insurance to those from the best travel insurance providers to see how they stack up — and also considered any additional add-on coverages available and the ease of getting a quote and filing a claim.

In the end, the best policy for you will be the one that provides the coverage you need and limits you're comfortable with while also staying within budget.

Read more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

We’re sorry, but Freepik doesn’t work properly without JavaScript enabled. FAQ Contact

- Notifications

- Go back Remove

- No notifications to show yet You’ll see useful information here soon. Stay tuned!

- Downloads 0/60 What is this?

- My collections

- My subscription

Find out what’s new on Freepik and get notified about the latest content updates and feature releases.

- Seguros logo

- Travel ticket logo

Travel Insurance Logo Vectors

- Add to collection

- Save to Pinterest

- tourism logo

- travel logo

- traveling logo

- company logo

- modern logo

- business logo

- logo templates

- aviation logo

- airline logo

- airplane logo

- air transport

- business pack

- protection logo

- safety logo

- protect logo

- travel stickers

- world travel

- travel stamp

- flight logo

- travel globe

- travel illustration

- tourism traveling

- travel agency

- logo design

- brand design

- ticket logo

- silhouette logo

- logo illustration

- castle logo

- paper airplane

- holiday travel

- travel design

- airport logo

sign up and keep track of your travel insurance events

Travel Protection for Pets and Service Animals: Help Protect Your Furry Friends

Key Takeaway

Generali’s travel protection plans apply to your pets and service animals in these ways:

- Travel Delay coverage : If you experience a travel delay, you can be reimbursed for pet kennel fees. To qualify you must be delayed at least 6 hours with our Premium Plan, 8 hours for Preferred, and 10 hours for our Standard Plan.

- Trip Cancellation and Trip Interruption coverages can reimburse your insured trip costs if your service animal becomes sick, injured or dies and prevents you from traveling.

- Pet return : Arranges for the return of your pet to your home if your pet is traveling with you and you are unable to take care of your pet due to a medical emergency.

- Need help finding pet-related services? Our concierge services can help you find veterinarians and pet sitters while you are away from home.

Your pet is like a member of the family, so it only makes sense to have them join you on your travels. When they do, it’s especially important to plan well, since not everywhere is pet friendly. As part of the planning, consider how a travel protection plan can help with the pets you bring on a trip.

With Generali Global Assistance’s plans, your pets or service animals can benefit from certain coverages and services. See how >>

Travel Insurance, Assistance Services and Pets

Traveling with pets has become more and more common over the years. Most pet owners (78%) have traveled with a dog and 19% of cat owners have brought their tiny companion on a trip. The number of people traveling with pets is on the rise, up 18% in the last decade.

81% of travelers reported having only positive experiences vacationing with their pet, but taking a pet on a trip can be stressful, too. Having a travel protection plan and the assistance team behind it can help relieve that stress.

Getting a travel protection plan from Generali Global Assistance gives you access to certain coverages and services that could help when traveling with pets. Especially if you're planning a trip around destinations that cater to your dog or cat, consider how a travel protection plan might help on your trip.

Also read: Top 10 Dog-Friendly Vacations Around the World

Also read: Surprising Travel Insurance Coverages and Features

Travel Delay Coverage

Travel Delay coverage can provide reimbursement for certain reasonable out-of-pocket expenses if you are delayed on your trip, including extra pet kennel fees. Other things that can be covered include hotel accommodations, meals, local transportation and more.

Depending on your travel insurance plan, there are requirements that must be met to qualify. For our plans, the delay must be 10 hours or more (Standard), 8 hours or more (Preferred) or 6 hours or more (Premium). The delay must also result from one of the listed covered reasons mentioned in the Plan documents .

Concierge and Assistance Services

Need help finding pet-related services? Our Concierge Services can help you find veterinarians and pet sitters during or even before your trip.

Has the concierge at a hotel ever helped you find your way around a city you’re visiting, giving great suggestions and helping you make reservations? Wouldn’t it be great to have that kind of service in your back pocket, ready to use, wherever you are during your trip, or even before it begins? All travel protection plans from Generali Global Assistance include Travel Concierge Services that can do that very thing.

How can our Concierge Services help you?

Part of the 24/7 Travel Assistance Services also applies to your pets. Not only will you be taken care of in case of a medical emergency , but we will arrange for the return of your pet to your home if your pet is traveling with you and you are unable to take care of your pet due to a medical emergency. This is a service included with our plans, not a coverage, so you won’t be reimbursed for the costs, but we’ll help make all the arrangements.

Watch: 14 Tips for Traveling with Dogs and Cats

Should You Purchase Pet Travel Protection?

Pet travel protection is great to buy for you and your pet or service animal when the two of you are taking a trip together. While Generali doesn’t offer specific pet travel protection, our plans apply to your pets in a variety ways:

- Travel Delay coverage : If you experience a travel delay resulting from a covered event, you may be reimbursed for pet kennel fees. To qualify you must be delayed at least 6 hours with our Premium Plan, 8 hours for Preferred, and 10 hours for our Standard Plan.

- Trip Cancellation and Trip Interruption coverages may reimburse your insured trip costs if your service animal becomes sick, injured or dies and prevents you from traveling or interrupts your trip.

- Need help finding pet-related services? Our Concierge Services can help you find veterinarians and pet sitters while you are away from home.

Is Pet Coverage Necessary for Domestic Travel?

It’s not necessary, but it’s beneficial. Traveling nowadays can be challenging, so travel insurance that benefits you and your pets puts you in a position to expect (and prepare for) the unexpected. It can also help you feel more at ease knowing the two of you have the extra coverage no matter where your travel plans take you.

Do You Need Travel Protection if You Have Health Insurance for Your Pet?

Maybe. Pet health insurance and pet travel insurance are two different things. While the former covers medical circumstances like surgery, the latter helps in situations like if your trip gets delayed and you need to pay extra kennel fees or locate a last-minute pet-sitter while you’re on the road.

Travel Insurance and Service Animals

Your service animal can benefit from the same travel insurance and assistance services as non-service animal pets, plus they are counted the same as a family member or other traveling companion would be when it comes to the coverages that many travelers care about most -- reimbursing you for trip costs when you need to cancel or interrupt your trip for a covered reason.

First, let’s define what counts as a “service animal” according to our Plan documents :

Service animal means any guide dog, signal dog, or other animal individually trained to work or perform tasks for the benefit of an individual with a disability, including, but not limited to, guiding persons with impaired vision, alerting persons with impaired hearing to intruders or sounds, providing animal protection or rescue work, pulling a wheelchair, or fetching dropped items.

Now, let’s get into the coverage details:

Trip Cancellation

Trip Cancellation is a coverage included with our plan that’s designed to make you "whole" again by reimbursing you up to 100% of your insured trip cost for unused, non-refundable, pre-paid travel expenses, and certain additional expenses in some cases, if you’re prevented from taking your trip due to a covered event that is not subject to an exclusion.

One of those covered events is the sickness, injury or death of you, a family member, your traveling companion or your service animal . If the animal is sick or injured while coverage is in effect, coverage requires the in-person treatment by a veterinarian and the written opinion of the veterinarian that the condition will prevent your travel, or you need to care for your service animal.

Our policies state that you need to be treated by a physician in order to qualify for travel insurance coverage related to illness or injury. If a service animal is the patient, a veterinarian meets the definition of physician. Definition: PHYSICIAN means a person licensed as a medical doctor by the jurisdiction in which he/she is resident to practice the healing arts. They must be practicing within the scope of their license for the service or treatment given and may not be you, a Traveling Companion , or a Family Member of yours.

Trip Interruption

Trip Interruption coverage is similar to Trip Cancellation in that it’s designed to help you recoup pre-paid, unused, non-refundable travel costs, and certain additional expenses in some cases, if you’re prevented from taking your trip due to a covered event -- including the sickness, injury or death of your service animal, that is not subject to an exclusion. While Trip Cancellation can help if you must cancel your trip altogether, Trip Interruption can help if you’re still taking your trip but aren’t able to use all your pre-paid, non-refundable arrangements.

Trip Interruption coverage goes into effect as soon as you’re scheduled to depart on your trip. It can reimburse you for unused, non-refundable, pre-paid travel arrangements. Trip Interruption can also reimburse for out-of-pocket transportation expenses to get you caught back up to your trip as planned, or to get you back home if you must end your trip early.

Who wants to leave their furry friends at home when going on vacation? It stresses them out and stresses us out. Having to arrange, trust and pay for pet sitters, or board cats or dogs in a kennel is no fun. It might take a little extra planning and work to take them on a trip, but people do it all the time and their trip is more fun as a result.

Make sure you consider the animals traveling with you when you’re choosing travel protection for your trip. All of our plans include these features for pets and service animals, so it’s easy for you to get a quote and choose which plan fits your trip best , without worrying about which one covers pets or service animals.

Travel Resources

*Some exclusions apply. See plan documents for details.

Average Customer Rating:

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

Overseas travel

Thinking about taking your pet abroad, overseas travel cover for cats and dogs, what's included in our overseas travel cover.

Our Overseas Travel cover can provide you and your pets with the insurance you need to help make sure that your holiday goes swimmingly. With our extended Overseas Travel cover, the same great benefits that you already receive in the UK will automatically join you over in Europe, the Republic of Ireland, the Isle of Man and the Channel Islands. Please note that if you have chosen our Dog Liability Insurance option, then this cover only applies in the UK.

We know that you want to sit back and relax while you're on holiday, but sometimes this can be hard if you're worrying about your dog being bitten by ticks or missing your flight home. So that's why we also offer additional benefits as part of our overseas cover that can help, including:

Loss of pet travel documents

We can replace your pet’s pet travel document should it become damage or lost. If your pet can’t travel or you lose the travel documents while you’re away, then we can cover the cost of a replacement. Loss must be reported to your vet within 24 hours.

Quarantine costs

If your pet’s microchip fails, we will cover the kennelling and costs incurred in getting new pet travel documents for your pet. If your pet has to go into quarantine due to illness, where you have complied with all the required regulations of the Pet Travel Scheme, we will cover the kennelling.

What is not covered:

- Any amount exceeding £2,000 during the period of insurance.

- Any costs incurred if the microchip was not checked and found to be functioning properly within 14 days of your departure on a journey.

- Any costs arising in respect of any condition of which you were aware before the start of the journey.

- Any costs resulting from a pre-existing medical condition.

Emergency expenses

We can offer up to £1,500 to cover travel and accommodation fees should you miss your departure because your pet requires emergency treatment. Pre-existing conditions or treatments that your pet doesn’t need aren't covered.

How much can I be covered for, when I'm abroad?

While you and your pet are abroad, our Overseas Travel cover can provide you with the protection you need to safeguard against things that may go wrong while you're on holiday. Our cover includes:

- Emergency expenses: Up to £1,500 per period of insurance to cover the loss of pet travel documents while you're away and up to five days of travel and accommodation costs should your pet either go missing, require emergency vet treatment, or you miss your return flight to the UK because of the loss of pet travel documents.

- Quarantine costs: Up to £2,000 per period of insurance to cover the cost of kennelling and boarding fees if you need to stay on to get new pet travel documents due to a failed microchip or if your pet has contracted an illness despite you complying to Pet Travel Scheme rules.

Overseas Travel cover can be added to your pet's insurance at any time during your period of insurance. So, if you started your policy at the beginning of the year and are planning a holiday now, you can extend your cover to bring along your pet.

If you have multiple pets insured with us however, all of those pets will need to be on the same policy, which will need to be extended to include Overseas Travel insurance. If you have also included our Public Liability cover for dogs , be aware that Public Liability cover only applies in the UK.

How long will my pet be covered for?

Got a long break in the sun but are worried about when the cover for your pets is going to expire? With our insurance, you shouldn't have to worry! You can travel within Europe with your pet as many times as you like a year, as long as your trip away lasts no longer than 60 days each time. We aren't ones to tell you that you shouldn't have a holiday, so you can take as many trips as you like within the year and we can keep your pet covered.

How will Brexit affect travelling with my pet?

With effect from 1st January 2021 there are new procedures that you will need to follow when travelling overseas with your pet under the European Union’s Pet Travel Scheme.

Living in England, Scotland or Wales

If you and your pet live in England, Scotland or Wales (Great Britain), the following changes apply for each trip to a country within the Pet Travel Scheme or Northern Ireland:

- You must have your dog or cat microchipped

- Vaccinate your dog or cat against rabies, and your pet must be at least 12 weeks old before it can be vaccinated

- Wait 21 days after the primary vaccination before travel

- Visit your vet to get an AHC for your pet, no more than 10 days before travel to the EU

- As long as you keep your pet’s rabies vaccinations up to date, you will not need to get repeat vaccinations for repeat trips to the EU or Northern Ireland.

Getting an animal health certificate (AHC)

You must take your pet to your vet no more than 10 days before travel to get an AHC. The AHC needs to be signed by an official vet. Check with your vet that they can issue AHCs for pets.

You must take proof of:

- your pet’s microchipping date

- your pet’s vaccination history

Your pet’s AHC will be valid for:

- 10 days after the date of issue for entry into the EU or Northern Ireland

- onward travel within the EU or Northern Ireland for four months after the date of issue

- re-entry to Great Britain four months after the date of issue

Travelling to Finland, Island of Ireland, Norway or Malta

If you’re travelling with your dog directly to Finland, Island of Ireland, Norway or Malta, it must have treatment against tapeworm (Echinococcus multilocularis). Your dog will need to receive treatment one to five days before arriving in any of these countries. Your vet must enter full details on the AHC following treatment. You will not be able to travel with your pet if you have not completed these steps.

Arriving in the European Union

When arriving in the EU you must use a designated traveller’s point of entry to check compliance with all regulations. Details can be found here .

Living in Northern Ireland

If you live in Northern Ireland the EU pet travel documents are no longer valid, however as an interim measure you can contact your vet to update the pet travel documents to allow travel. DARERA are in the process of obtaining a new style UK (NI) pet travel documents. Further details for pet owners living in Northern Ireland can be found here .

Additional questions

Please do contact your vet if you have any queries relating to any future travel you have planned. You can also view the guidance from the Government here .

Frequently asked questions about our overseas travel insurance

Want to find out more about our overseas travel insurance.

Got a question about our travel cover? Or want to know more about cats and dogs in general? We’ve answered a few questions for you here!

- Pet insurance

If you’ve got more than one dog, then why not look at multi-pet insurance?

Instead of having each of your dogs on different pet policies, with our multi-pet insurance, you can save any hassle and take advantage of our multi-pet discount. You can cover up to five dogs on one policy. We are unable to insure dogs that are used for breeding purposes and pre-existing illnesses and conditions are not covered.

If you own more than one cat, then you could look into including all of your cats on one insurance policy.

Multi-pet insurance means that you don’t need to have all of your cats on different policies. Instead, you can cover up to five cats on one policy, saving you plenty of hassle and money at the same time!

We are unable to insure cats that are used for breeding purposes and pre-existing illnesses and conditions are not covered.

If you’ve got dogs and cats at home, then why not look at multi-pet insurance?

Instead of having each of your dogs and cats on different pet policies, with our multi-pet insurance you can save any hassle and take advantage of our multi-pet discount. You can cover up to five pets on one policy. We are unable to insure dogs and cats that are used for breeding purposes and pre-existing illnesses and conditions are not covered.

Insurance for your cat or dog can start as soon as possible! Our cover starts for cats and dogs aged eight weeks and over. We cannot cover claims arising within the first 14 days of your insurance starting and pre-existing illnesses and conditions are not covered.

Yes! Our pet insurance includes older dogs. If you're looking to get insurance for your long-time companion, or whether you've recently taken in an older dog, then we can provide you and your dog with cover.

What about dogs over eight years of age?

Much like us, as dogs get older their health and behaviour may have changed since they were a young pup. This might mean that they need more frequent trips to the vet. Their treatment can even be complicated by their old age and therefore potentially more expensive.

If you've got a dog over eight years of age and you're making a claim for their vet fees, then the excess that you must pay is:

- The first £150

- Plus 20% of the remaining cost of treatment

The excess applies to each condition claimed for annually.

Yes! With our pet insurance we can cover older cats. If you're looking to get insurance for your feline friend, or whether you've recently adopted an older cat, then we can provide you with cover.

What about cats over eight years of age?

If you've got a cat over eight years of age and you're making a claim for their vet fees, then the excess that you must pay for each condition annually is:

Having insurance for your dog means that you can be covered against the cost of potentially very expensive trips to the vet.

You get to choose either Accident Only cover or cover for Accident and Illness for your dog. We offer three levels of vet fee cover, which means that you can be covered for up to £3,000, £6,000 or £12,000 per year.

If your claim has been successful, then we can pay the agreed amount, less any excess, either:

- Straight into your bank account so you aren't left out of pocket, or;

- To your vet if this is more convenient for you and your vet.

All vet fee claims are handled in the UK by Covea Insurance. While your claim is being dealt with, you can receive regular updates on its progress via email or text message.

Public Liability insurance for your dog, sometimes referred to as Third Party Liability insurance, can provide up to £2million per event if your dog injures someone or damages property and you are held liable.

If you're out for a walk with your dog and they were to knock somebody over, then we can keep you covered if you’ve chosen our Public Liability option. Heading out for a dog walk shouldn’t end in hefty compensation costs, which is why we offer dog owners Public Liability protection for claims of property damage or injury from a third party.

Cover only applies in the UK.

Some dog breeds cannot be covered by our Third Party Liability option, see " Are there any breeds of dog that you are unable to insure? " For assistance dogs to qualify for Third Party Liability cover, they must have been trained by a member of, and within the guidance of, the organisation of Assistance Dogs UK .

Yes! Our Accident Only cover still offers you the same great choice of annual vet fee cover options for £3,000, £6,000 or £12,000.

Dogs can suffer injuries when you least expect it. Whether they've hurt themselves while out for a walk, or if playtime has ended in a trip to the vets.

Our Accident Only policy provides you with an uncomplicated level of cover for your dog which aims to protect you against potentially expensive trips to the vet to treat your dog for an injury.

Vet fees arising from illnesses that your dog may be suffering from are not covered and the excess you will be required to pay for treatment for injury depends on the age of your pet. Unfortunately, we can't cover any pre-existing conditions; nor claims for injury within the first 48 hours of your cover starting.

Yes, we are able to cover working dogs. This would include a dog that is being used for shooting, hunting, or working with livestock. Also a dog that performs tasks to assist a human companion, including therapy dogs.

Unfortunately, for all of our policies, we cannot provide any vet fees or liability cover for any animal registered under the Dangerous Dogs Act 1991 and/or the Dogs (Muzzling) regulations (Northern Ireland) 1991 or any amendments; or (whether pedigree, cross breed, mixed breed or known or classed as the names listed) an Abruzzese Mastiff, African Crested Dog, African Wild Dog, Alangu Mastiff, American Bulldog, American Bully, American Bully XL, American Indian Dog, American Mancon, American Mastiff, American Pit Bull Terrier, American Rottweiler, American Staffordshire Bull Terrier, American Staffordshire Terrier, Argentine Dogo, Argentinian Mastiff, Australian Dingo, Bandogge, Bandogge Mastiff, Blue Bull Terrier, Boerboel, Bole, Brazilian Mastiff, Bully, Bully Kutta, Canadian Inuit Dog, Canary Dog, Canary Mastiff, Cane Corso, Cão de Fila de São Miguel, Cão Fila, Chinese Shar Pei, Czechoslovakian Wolfdog, Dingo, Dogo Argentino, Dogue Brasileiro, East Siberian Laika, Fila Brasileiro, Gull Dong, Husky Wolf Hybrid, Inuit Dog American, Irish Staffordshire, Irish Staffordshire Blue Bull Terrier, Irish Staffordshire Bull Terrier, Irish Wolfhound, Italian Mastiff, Japanese Mastiff, Japanese Tosa, Johnson American Bulldog, Korean Jindo, Korean Mastiff, Laika, Libyan Desert Dog, Neapolitan Mastiff, Northern Inuit Dog, Pakistani Bull Dog, Perro de Presa Canario, Pit Bull Mastiff, Pit Bull Terrier, Pocket Bully, Presa Canario, Racing Greyhound, Sarloos Wolfhound, Shar Pei, South African Boerboel, South African Mastiff, Tamaskan Dog, Tibetan Mastiff, Tosa, Tosa Inu, Utonagan Dog, Wolf Hybrid and Wolfdog.

No, we cannot cover pets that are used for guarding.

Yes, we are able to cover a crossbreed dog.

Yes. You must be a UK resident and domiciled in the UK.

You can choose to pay in full by credit or debit card. Alternatively, you can take advantage of our interest free monthly payment option and simply spread the payments out, without any additional cost.

Your pet must be eight weeks old at the start date of cover. There is no maximum pet age to apply for this insurance, but there are age limits on cover sections.