- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize the AmEx Platinum Hotel Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As the COVID-19 pandemic rocked the world in 2020, many credit card issuers rolled out new temporary benefits to help boost value to cardholders.

American Express was no exception, and offered a particularly generous perk: a $200 hotel credit for some holders of The Platinum Card® from American Express . They also extended the amount of time that new cardholders had to meet the minimum spending requirements by three months, then went on to add a bevvy of new incentives , like limited-time bonus rewards, streaming credits, wireless credits and a host of juicy AmEx offers .

Since I’m a travel enthusiast and credit card junkie (admittedly), I found myself flush with newfound perks and growing balances of bonus points from everyday shopping. The problem was, like many people, I wasn’t really traveling.

Here’s how I was able to make use of — and maximize — the $200 travel credit.

» Learn more: How credit card issuers are responding to COVID-19

About the $200 American Express travel credit

Some cardholders of The Platinum Card® from American Express who renewed their card became eligible for a credit up to $200 for travel booked through American Express Travel. Terms apply.

I didn’t give the credit much thought at first. Due to COVID-19 considerations, I had canceled all of my travel for the foreseeable future. Even when I do travel frequently in “normal” times, I rarely book through American Express. I generally prefer to transfer my Membership Rewards points to travel partners to get outsize value.

Still, $200 is a generous credit that I didn’t want to waste. And when my family was starting to go stir-crazy after months of quasi-lockdown, I set out to plan a safe “staycation” using the bonus AmEx travel credit.

How the booking portal, American Express Travel, works

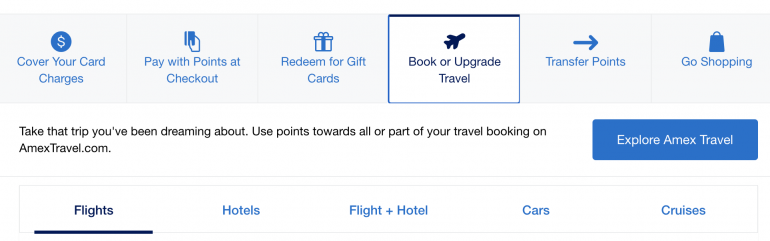

American Express Travel is a booking portal available to cardholders to book flights, hotels, cruises, tours and flight + hotel package deals. When you log into your AmEx account, just click into your Rewards page and you can find the AmEx Travel portal.

When you make a booking through American Express Travel, you can choose to pay with either your Membership Rewards points or with cash.

If you hold The Platinum Card® from American Express or The Business Platinum Card® from American Express , you’ll earn 5x points when you use your card to charge travel in the AmEx travel. All other Membership Rewards-earning cards will earn 2x points on AmEx travel bookings. Terms apply.

If you choose to pay with points, they’ll be worth 1 cent each. This isn’t a great redemption value, since you can easily get more value for your points by transferring to AmEx’s travel partners . But when you consider that you will earn airline miles (and sometimes hotel points) when you book your trip through AmEx travel, the value jumps up a bit. That’s because the airline or hotel sees this as a “cash” booking rather than an “award” booking, even when you’re using your Membership Rewards.

» Learn more: Best American Express credit cards

How I got out-sized value from my travel credit

Since my family was staying grounded during the pandemic, we decided to take a “staycation” in a nearby hotel. And since we had missed most of our planned travel in 2020, we decided to use the $200 credit toward a splurge for luxury.

When I started hunting for hotel options in the American Express Travel portal, the first several hotels that appeared in my search were designated as being part of the Fine Hotels & Resorts program.

Available only to cardholders of The Platinum Card® from American Express , The Business Platinum Card® from American Express and the Centurion Card from American Express, the FHR program offers extra benefits, including:

Early check-in.

4 p.m. checkout.

Room upgrade (based on availability).

Daily breakfast for two.

$100 property credit (varies by hotel, but dining and spa credits are common).

Since my $200 AmEx credit would cover anything booked through AmEx Travel — including a hotel in the FHR program — I knew I could pack even more value when I combined the benefits.

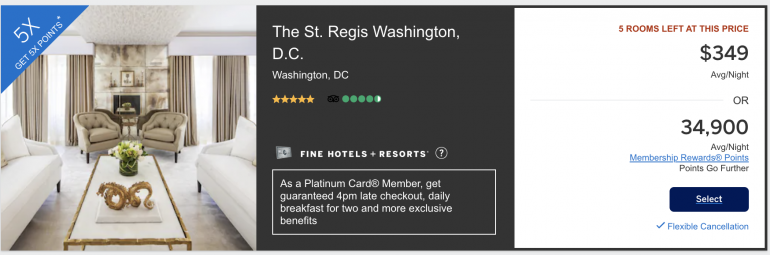

We decided on a “staycation” night at the luxurious St. Regis close to where we live.

When booked through AmEx travel, the room was going for $349 a night. To be clear, booking a hotel through FHR doesn't always give you the lowest rate. If booked directly, a room at this same hotel could have cost $308 for that same night.

But the added benefits from booking through FHR can usually outweigh the added cost.

Here’s how my AmEx travel booking broke down. The room rate was $349, but by booking a FHR property through AmEx travel I got:

The Platinum Card® from American Express credit: $200.

Property credit: $100.

Breakfast credit: $60.

My family got the red-carpet treatment at the St. Regis. We were able to check in early at 11 a.m. to kick off our staycation, and we were upgraded to a larger room with a prime view.

The $100 property credit at this hotel was good for a food and beverage credit, so we used it to splurge on a fancy, socially-distanced tea party, to the sheer delight of our two young kids.

Photo courtesy of Erin Hurd

In the morning, we were informed that we would be given $60 in breakfast credits from our booking. Even at St. Regis prices, that credit was enough for all four of us to enjoy a light breakfast.

At checkout, we had a few incidental charges, including valet parking, that we needed to pay for out of pocket. Since St. Regis is a Marriott brand, I used my Marriott Bonvoy Brilliant® American Express® Card for those charges. The card comes with up to $300 in credits for eligible purchases at Marriott hotels. In September, the $300 Marriott credit will be replaced with a new benefit of up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide. Terms apply.

The bottom line

This staycation was certainly not free, since I pay a hefty $695 annual fee to hold The Platinum Card® from American Express . But by booking a room through American Express’ Fine Hotels & Resorts program, I was able to get even more value from the extra $200 travel credit. Terms apply.

Though earning hotel points can sometimes be hit-or-miss with FHR bookings, I was pleasantly surprised a few days after checkout to see that I had earned Marriott Bonvoy points and an elite night credit on this booking.

If you have The Platinum Card® from American Express and are eligible, make sure you remember to use your extra $200 AmEx travel credit whenever you’re ready to travel again. The credit is good for travel through the end of 2021. Check your AmEx account to see if you have the offer, or contact customer service through online chat or over the phone to confirm your eligibility.

To view rates and fees of The Platinum Card® from American Express, see this page .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

My Points Life

Travel Smarter & Better

How To Use & Maximize $200 Hotel Credit With American Express Platinum Card For Fine Hotels & Resorts

One of the new benefits of the American Express Platinum Card is the annual $200 hotel statement credits on prepaid Fine Hotels & Resorts or The Hotel Collection bookings made through the Amex Travel website.

In this post, I will explain how the Amex Platinum $200 Hotel Credit benefit works and answer some commonly asked questions about using the credit. Finally, I’ll provide some ideas on maximizing the credit, specifically for Amex Fine Hotels & Resorts (FHR).

Table of Contents

How Does Amex Platinum $200 Hotel Credit Work?

If you are used to Amex Offers , Amex Saks Fifth Avenue Statement Credits , or Amex Walmart+ Membership Statement Credits benefits on the Platinum Card, the Amex Platinum $200 hotel credit works pretty much the same.

- When using your Platinum Card to book the Amex Fine Hotels + Resorts or The Hotel Collection through Amex Travel, you can receive up to $200 back in statement credits .

- You do not have to spend $200 at once in one transaction, and you receive the statement credit each time you spend in combined eligible hotel bookings on your Platinum Card.

- The benefit goes by the calendar year from January 1 through December 31 each year.

- The bookings must be “prepaid,” referred to as “Pay Now” on the American Express Platinum Travel site.

- Enrollment for this benefit is not required .

Is the Amex Platinum $200 hotel credit benefit based on the calendar or Card membership year?

The benefit goes by the calendar year, so be sure to use it before December 31 each year. The Amex Platinum $200 hotel credit benefit resets on January 1 each year.

Do you need to spend $200 in one transaction to get the Platinum Hotel credit?

No. You receive “up to” $200 back in statement credits.

Each time you spend on an eligible Amex FHR booking made through Amex Travel , you will receive a statement credit for that amount. If the amount is less than $200, you will have unused credit for the future eligible booking until the benefit’s end date, December 31 of that year.

Is there a minimum night required to get Fine Hotels & Resorts benefits?

No. Unlike The Hotel Collection , there is no minimum number of nights required to receive the Amex Fine Hotels and Resorts statement credit. In addition, you can get all the FHR benefits mentioned above on a one-night stay .

Can multiple Platinum Cards be used for back-to-back stays to get additional Fine Hotels & Resorts benefits?

Understandably, you may have multiple Amex Platinum Cards in your household, and you want to maximize the $200 hotel statement credits to get multiple FHR perks on consecutive night stays at an FRH hotel.

One real-world example is if there are two of you, each with an American Express Platinum Card. You want to book a one-night stay at an FHR property, and each receives all the Amex FHR perks, including the $100 on-property credit per night, plus a $200 hotel statement credit for each Amex account for a luxurious two-night stay somewhere in the world.

Unfortunately, while each of you can book a 1-night stay at the same FHR property for consecutive night stays and gets the Amex $200 hotel statement credit for each Platinum account, Amex has updated the terms regarding back-to-back stays ineligible for multiple FHR benefits :

Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits.

Maximizing Amex Platinum Card $200 Hotel Statement Credits

Use the $200 hotel credit and enjoy amex fine hotels & resorts elite benefits..

When you book each Fine Hotels & Resorts property stay through the Amex Travel site, you receive exclusive benefits in addition to your Amex Platinum $200 hotel statement credit.

These benefits are typically available to hotel rewards program members with elite status . However, by booking with the Amex Fine Hotels and Resorts program, you can enjoy all these perks without having any elite level with the hotel:

- Noon check-in, when available

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Guaranteed 4 pm late check-out

- Complimentary Wi-Fi

- Special amenities unique to each property include on-property credits valued at least $100 for spa or food and beverage.

Use the $200 Hotel Credit and Earn 5x Points on Travel With American Express Platinum Card.

Remember that as an American Express Platinum Card member, you get 5x American Express Membership Rewards (MR) points per $1 spent on all prepaid hotel bookings, including the Fine Hotels & Resorts on Amex Travel .

Check Amex Offers For Fine Hotels and Resorts

From time to time, American Express may have an offer for Fine Hotels and Resorts bookings that you can add that offer to your American Express Platinum Card .

For example, there used to be the following Amex Offer on Fine Hotels + Resorts that has expired now:

- Get a one-time $150 statement credit by using your enrolled Card to spend a minimum of $800 in one or more transactions on prepaid hotel bookings with Fine Hotels + Resorts and The Hotel Collection properties with American Express Travel by xx date.

I do not know when the Fine Hotels + Resorts Amex Offer returns, so check your Amex account regularly, especially if you have any upcoming FHR bookings. Alternatively, subscribe to our blog posts below to be notified when that offer returns.

Recommended Post:

- Full List of Amex Offers

Check American Express Fine Hotels and Resorts Promotions and Special Offers

The Amex Fine Hotels and Resorts program has dedicated promotions and offers pages that you can check for exclusive benefits with each participating property. In addition to the elite benefits you receive with Fine Hotels and Resorts bookings, you can also receive a complimentary night, additional property credit, etc., that vary by each Fine Hotels and Resorts property.

- Direct Link to the Amex Fine Hotel + Resorts Offers by Property .

Use Up the $200 Hotel Credit Before Closing Your Platinum Card

If you decide to close your American Express Platinum Card , consider using up your Card’s $200 hotel credit before making that final decision.

Technically, you were still the card member when you used that Amex Platinum $200 hotel credit benefit. American Express will not claw back that credit once used for an eligible transaction. The good news is that this benefit requires the transaction to be prepaid , so you do not have to wait until your check-out date to receive the statement credits, which is an ideal way to maximize that credit by saving on the Card’s annual fee because this credit is a calendar year’s benefit.

What I mean by that, for example:

- You applied for the American Express Platinum Card in July 2024 and can enjoy all its benefits, including the $200 hotel credit, until the end of December 2024.

- Starting January 1, 2025, the $200 hotel credit benefit resets.

- You have until July 2025 to spend that $200 hotel credit again before your Card’s annual fee is charged and posted to your account.

- If you decide to close your Platinum Card, you will already have a total of $400 hotel statement credits.

Can I Use the $200 Hotel Credit For Future Reservations Next Calendar Year?

Yes. Moreover, you can now change the date on an Amex Fine Hotels & Resorts booking. See below.

Changing the Date on Amex Fine Hotels & Resorts For Future Reservations Next Calendar Year

American Express travel platform allows you to change the date on Amex Fine Hotels & Resorts bookings. The process can all be done online by viewing your reservation and clicking the blue Change Dates button. You do not have to cancel and rebook if the price drops or you want to change the stay date for the next calendar year to use the $200 hotel credit for this calendar year plus another $200 hotel credit for the next calendar year .

However, you need to know one crucial piece of information regarding Amex FHR booking. If you cancel the 2024 “modified” reservation in 2025 and are still in the free cancellation window, Amex will refund you, but they will also claw back the $200 hotel credit issued to you in 2024 .

The bottom line is, subject to the hotel’s cancellation policy on your booking’s terms:

- If you cancel an FHR booking in the next calendar year using the previous year’s hotel credit and receive a refund, Amex will claw back the hotel credit issued to you in the previous year, and you will lose the $200 hotel credit for that year.

- If you cancel an FHR booking in the current year that you made the reservation and receive a refund, Amex will claw back the hotel credit but will reissue the credit for any future eligible FHR bookings through the end of that year.

I’ll talk more below on cancellation and refunds with the Amex $200 Hotel Credit.

Can I Use the $200 Hotel Credit For Someone Else?

Yes. American Express Travel platform now allows you to modify the guest name information before finalizing a booking.

What are the Amex Fine Hotels & Resorts like?

If you are new to Amex Fine Hotels & Resorts (FHR), they are worldwide luxury properties hand-picked by American Express. You can expect those properties to be “the world’s most luxurious hotels and resorts,” as American Express describes.

Luxury comes with high costs, so the $200 hotel credit can help. Moreover, by booking Fine Hotels & Resorts through the Amex Travel site, you will also receive on-property benefits ranging from complimentary daily breakfast, room upgrades, and hotel credits that vary based on the property and availability.

Amex Fine Hotels and Resorts Directory List

If you go straight to the Amex Travel site and start searching, the site will display all hotels and resorts, but you can filter through which property falls under the Amex Fine Hotels and Resorts program. But there’s another easy way to find the Amex Fine Hotels and Resorts list based on the destination:

- Direct Link to the Amex Fine Hotels and Resorts Directory

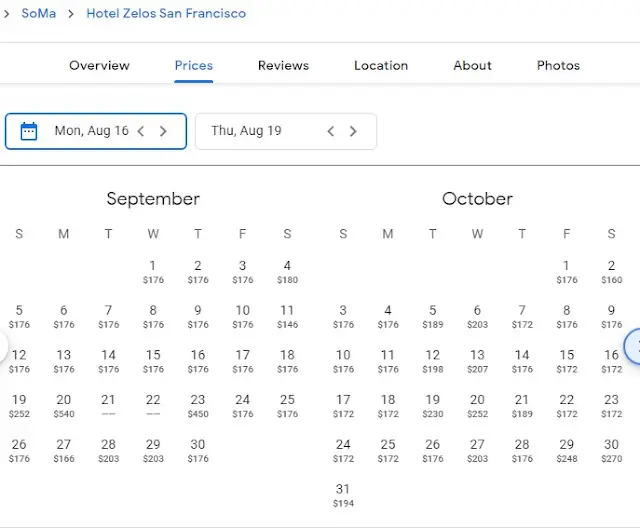

How to Find the Cheapest Fine Hotels and Resorts Properties to Use Amex Platinum $200 Hotel Credit?

“Cheap” and “Luxury” don’t go together often. However, if you are flexible in your dates and you don’t really care which property you’re staying at, here’s a tip for finding a cheap Amex Fine Hotels and Resorts property:

Perform the following steps using the computer desktop’s web browser:

- Go to the Amex Fine Hotels and Resorts Directory

- Enter the destination that you are interested in. Do not click on Explore Benefits

- A list of Fine Hotels + Resorts properties is displayed.

- Go through the list and find the property you may be interested in.

- Next, go to Google Hotels

- Enter the hotel name that you saw from the list above.

- Click the View Prices button on the next page, and Google will launch a new page.

- Click on the “ Check in” field to bring up a calendar, and go through each date on that calendar to find the lowest rate for that particular property. See the screenshot below.

- Once you find the date you want, go to the Platinum travel site to start searching, compare the rates you found, and book! See the step-by-step guide below: How to Use Amex Platinum $200 Hotel Credit?

How to Use Amex Platinum $200 Hotel Credit?

Using the Amex Platinum $200 hotel credit benefit is relatively straightforward, and the challenging part is to find an FHR property that offers a reasonable rate. If you have not, you should read the above section: How to Find the Cheapest Fine Hotels and Resorts Properties to Use Amex Platinum $200 Hotel Credit?

- Please note that the above Link will only show Fine Hotels and Resorts properties. You must go directly to the Amex Travel site to see The Hotel Collection and others.

- Click the “ Log In” button at the top of the page to log into your Amex account.

- Enter the hotel name or destination you are interested in and other search parameters.

- If you want to see The Hotel Collection and others, search on the Amex Travel site instead.

- Go through the list and select the property that you are interested in.

- Find the room type you want, and view the cancellation policy if flexibility is important to you. Then click the Book button.

- If the property offers payment options between Pay Now or Pay at Hotel, you must choose Pay Now for the Amex Platinum $200 hotel credit to work.

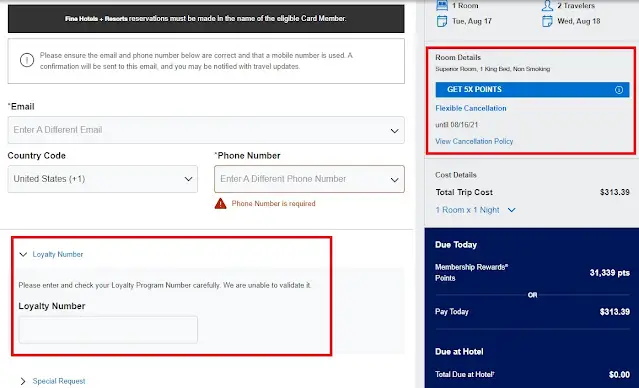

- On the next page, fill in your information, including your hotel’s loyalty number, if you want to earn loyalty benefits at that specific hotel. See this section for more details.

- The Pay + Points option is also available, but you must use your Platinum Card to pay for the cash portion to receive the credit. Also, ensure you get good values from your American Express Membership Rewards (MR) points this way.

- Finally, if everything looks good, you can complete your booking by clicking the Book My Room button.

- The charge will appear pending in your Platinum Card account right away. Once the eligible charge is posted to your account, you will receive Amex Platinum hotel credits (up to $200) within a few days. The reimbursement process is automatic, so asking Amex for that is unnecessary.

American Express Travel Platinum Service Phone Number

Alternatively, suppose you do not want to book Amex Fine Hotels and Resorts online. You can call the Amex Travel Platinum Service at 1-800-297-2977 to assist with reservation-related requests.

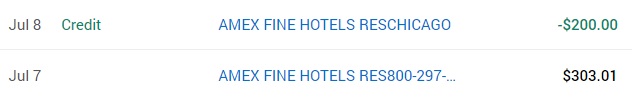

How long does it take to receive Amex’s $200 hotel statement credit?

The time it takes American Express to issue the $200 hotel statement credits is pretty much the same as the time it takes to issue the other Amex statement credits you are already used to, such as the Amex Airline Fee Statement Credit , Amex Saks Fifth Avenue Statement Credits , and Amex Walmart+ Membership Statement Credits benefits on the Platinum card.

Once the eligible purchase is posted to your Amex account, Amex will issue the hotel statement credit to your account in 2 to 7 days. In my case, it only took one day! See the screenshot below.

Amex Fine Hotels and Resorts Cancellation Policy

To get the Amex Platinum $200 hotel credit each year, you must book a Fine Hotels and Resorts or The Hotel Collection with Amex Travel . You must also use your American Express Platinum Card to pay for that reservation at the time of booking, known as Pay Now .

This prepayment type means that you pay upfront for the hotel’s reservation, and it does not mean that you cannot change or cancel the reservation to get a refund. All bookings are still subject to the cancellation policy set by each property, and the terms are clearly stated on your booking before you pay and book.

Can I Change the Amex Fine Hotels and Resorts Date?

Yes. See the above section: Changing the Date on Amex Fine Hotels & Resorts For Future Reservations Next Calendar Year .

Will Amex Claw Back the Hotel Credit For Refunds Due to Cancellation?

Amex Fine Hotels & Resorts (FHR) bookings can be canceled and refunded according to the cancellation policy in the hotel’s booking terms.

If your booking is eligible for a refund due to cancellation, Amex will issue you the refund. However, Amex will also take back the hotel credit issued to you. You can rebook, and Amex will reissue the hotel credit for your future eligible FHR booking accordingly. The process is all done automatically by American Express.

Alternatively, if you only want to change the dates or the room type, you can change the reservation instead of canceling and rebooking.

Does Amex Fine Hotels and Resorts Earn Hotel Points & Elite Night Credits?

There are quite a few popular hotels and resorts under the Fine Hotels & Resorts collection that have rewards programs, such as MARRIOTT , HYATT , and HILTON, to name a few.

Generally speaking, hotel bookings made through Amex Travel are considered third-party bookings. Those bookings typically do not earn any hotel points or elite night credits because hotels require that you book directly with them. The good news is booking Amex Fine Hotels & Resorts does qualify for hotel loyalty programs such as earning points, earning elite night credits, and enjoying elite perks.

When you make an FHR booking on Amex Travel , there’s an entry field where you can provide your loyalty number before finalizing your booking. See the screenshot below.

Suppose you want to be sure whether your booking with Amex FHR will qualify for your desired hotel loyalty program. In that case, I recommend that you make a prepaid FHR reservation that offers a refundable cancellation policy. After your booking, you can contact the property directly and ask if your stay will be eligible to earn points and elite night credits. You can cancel the reservation without penalty if the property refuses to recognize your loyalty benefits.

Recommended Posts:

- [Confirmed] Amex Fine Hotels and Resorts (FHR) Booking Earns Elite Points and Elite Nights

- My Experience Not Earning Marriott Bonvoy Points For The Ritz-Carlton Tysons Corner Booking With Amex Fine Hotels and Resorts

- Does Amex Fine Hotels and Resorts (FHR) Booking Earn World of Hyatt Points and Elite Nights?

If you found this article useful, please share it:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to email a link to a friend (Opens in new window)

2 thoughts on “ How To Use & Maximize $200 Hotel Credit With American Express Platinum Card For Fine Hotels & Resorts ”

Thanks for writing such a comprehensive article! Do you know if I can book a stay using my $200 platinum hotel credit for my son or do I need to be there?

Hi Martha, unfortunately you will need to be there to check in to receive the FHR benefits per the terms. While in practice you may ask the property for the second guest check-in; however, I do not think it's worth the risk ruining your son's stay, so I do not recommend it.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

How to use Amex's The Hotel Collection to snag extra perks on hotel stays

Update: Some offers mentioned below are no longer available. View the current offers here .

One of the lesser-known perks on select American Express cards is access to The Hotel Collection . This program offers room upgrades and hotel credits for dining, spa and resort activities when you stay for two or more nights at select hotels.

To use this benefit, you need to have an eligible card and book a participating hotel through American Express Travel . But using the Amex Hotel Collection to book your next hotel stay may also save you money and improve your experience.

In this post, I'll take a closer look at The Hotel Collection and compare it to the better-known Amex Fine Hotels & Resorts (FHR) program to help you understand what to expect and how to take full advantage of the benefits.

Get the latest points, miles and travel news by signing up for TPG's free daily newsletter .

How The Hotel Collection works

Only cardholders of the following American Express cards can book hotel stays through The Hotel Collection:

- American Express® Gold Card

- American Express® Business Gold Card

- The Platinum Card® from American Express (requires a minimum two-night stay)

- The Business Platinum Card® from American Express

- The Centurion Card (invite-only, both business and personal versions are eligible)

If you have one of the above cards, then you'll have access to the following benefits when you book through The Hotel Collection (terms apply):

- A room upgrade at check-in when available

- Up to a $100 hotel credit to spend on qualifying dining, spa and resort activities

- 2x Membership Rewards points when you use your Gold card for prepaid bookings

- 5x Membership Rewards points when you use your Platinum card for prepaid bookings

- The ability to use Pay with Points on prepaid bookings

However, you'll only get these perks when you book a stay at an eligible property through American Express Travel . And there's a minimum stay requirement of two nights for Hotel Collection stays. Finally, back-to-back stays within 24 hours at the same property are considered one stay and won't get multiple $100 hotel credits.

Related: Should you use points or cash to book hotels?

What to know about The Hotel Collection

Before you book a stay through Amex's Hotel Collection, there are several aspects to keep in mind.

Pay with Points

You will see the option to Pay with Points when you book a stay with Amex's Hotel Collection. However, you'll only receive 0.7 cents of value per point redeemed, which is less than half of TPG's valuation of Membership Rewards points , at 2 cents each.

Especially since Platinum and Business Platinum cardholders earn 5x points for prepaid reservations made through American Express Travel, this is a case where it's better to pay for your stay and save your points for higher-value redemption options.

Related: Here are 9 of our favorite ways to use Amex Membership Rewards points

When you search, beware that Amex displays only the base rate (which excludes taxes and fees). For example, I saw a nightly rate of $89 for a sample two-night stay in November at the MGM Grand Las Vegas. But, the actual cost is $145 per night after all taxes and mandatory hotel fees .

The fine print for the Hotel Collection notes that hotels can add additional government taxes and fees as well as hotel-imposed taxes, fees and deposits when the hotel charges your card. So, you may need to call the hotel and ask about its policies to ensure you're aware of the total cost of your stay.

Related: 4 Las Vegas hotels raised resort fees — here's how to avoid them

Elite earning and perks

Additionally, most hotel loyalty programs won't give elite earnings and benefits if you don't book direct . And, although you may get elite earnings and benefits when you book some hotels through the Amex Fine Hotels & Resorts program , you typically won't when you book through The Hotel Collection. As such, if you have hotel elite status with one or more brands, you may find it best to only book through The Hotel Collection with properties outside your primary loyalty program(s).

Related: Booking direct: How much value does Marriott status provide?

Properties in The Hotel Collection

The Amex Hotel Collection includes a range of both popular brands and smaller boutique properties. Here's what I found when searching for Hotel Collection properties in three popular tourist destinations. Note, the pricing and availability are as of publishing and may be different when you search.

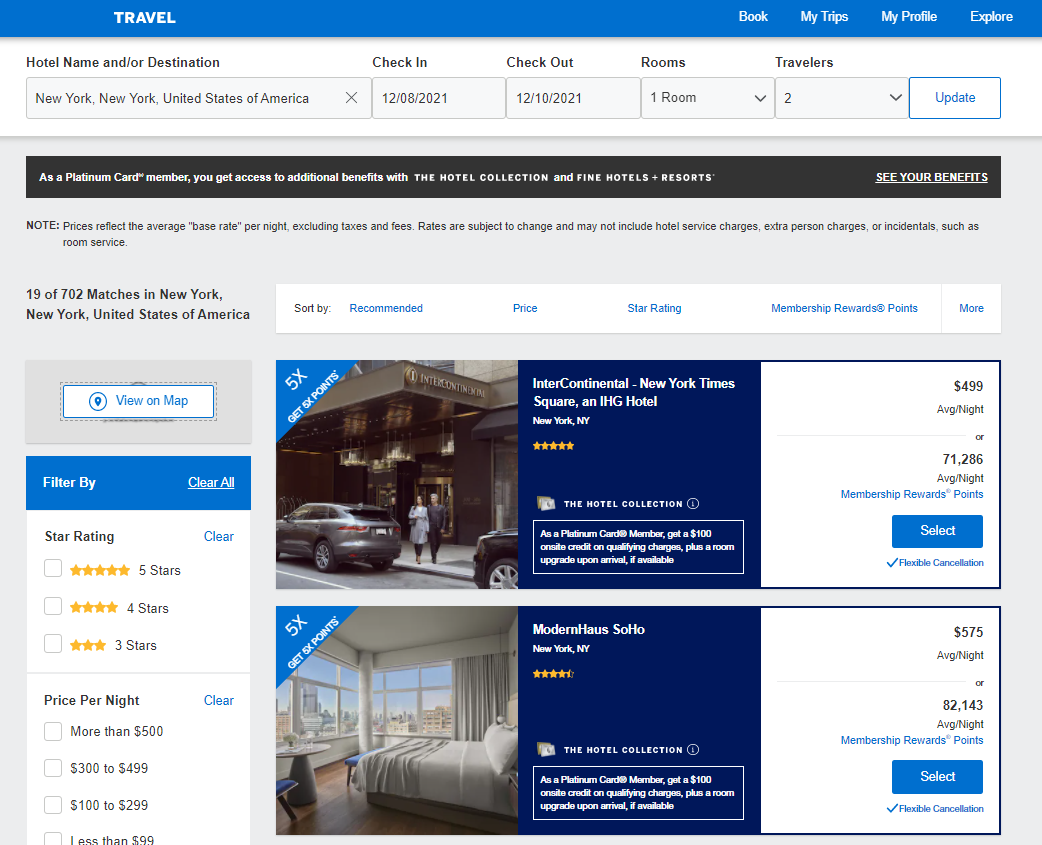

I picked a date this winter and performed a search for properties available in New York City . My search returned 19 Hotel Collection properties.

The least expensive Hotel Collection property for my dates was the Ink 48 Hotel at $389 per night before taxes and fees. Meanwhile, the most costly Hotel Collection property for my dates was the JW Marriott Essex House New York at $929 per night before taxes and fees.

Related: 8 easy New York City escapes you can get to in three hours or less

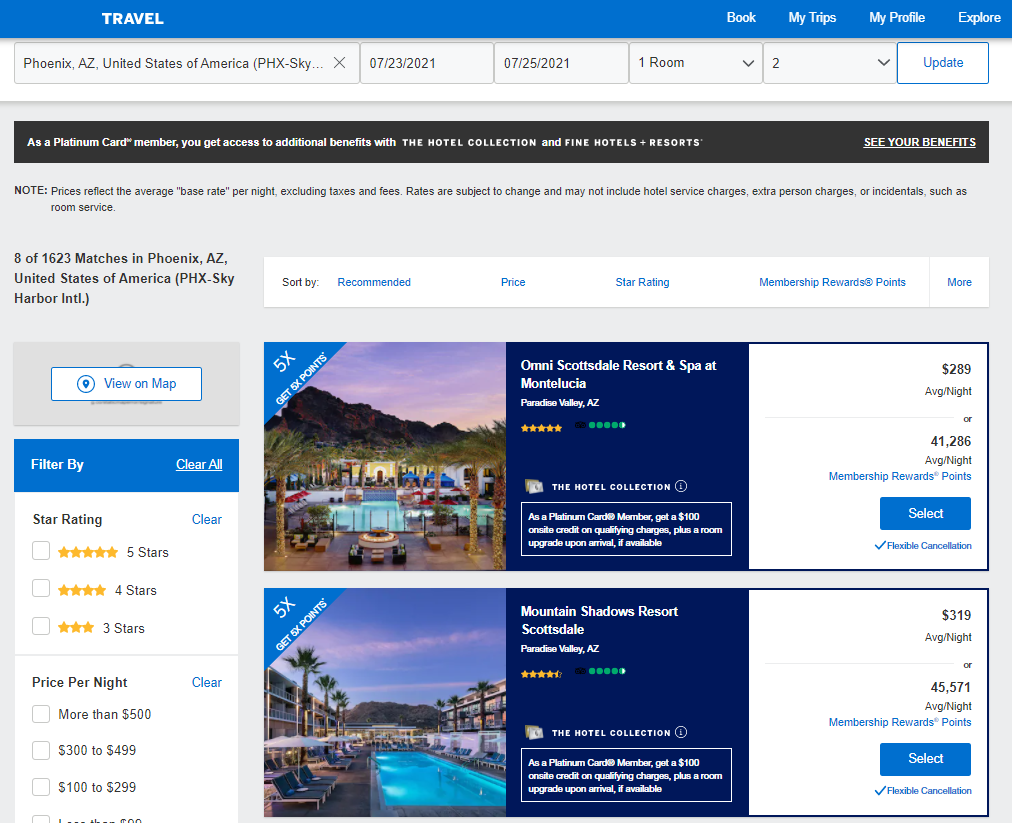

On the other end of the price spectrum is Phoenix in the summer, which stands out for having some of the lowest prices for hotels featured by these types of programs. I got eight Hotel Collection results when I searched for a weekend in July.

The least expensive Hotel Collection property in Phoenix for the weekend I searched was the Tempe Mission Palms, a Destination by Hyatt Hotel , for $169 per night before taxes and fees. Meanwhile, the most expensive property for the weekend I searched was the Mountain Shadows Resort Scottsdale for $319 per night before taxes and fees.

Related: Road-tripping from Phoenix? Here are six destinations to set your sights on

Rome, Italy

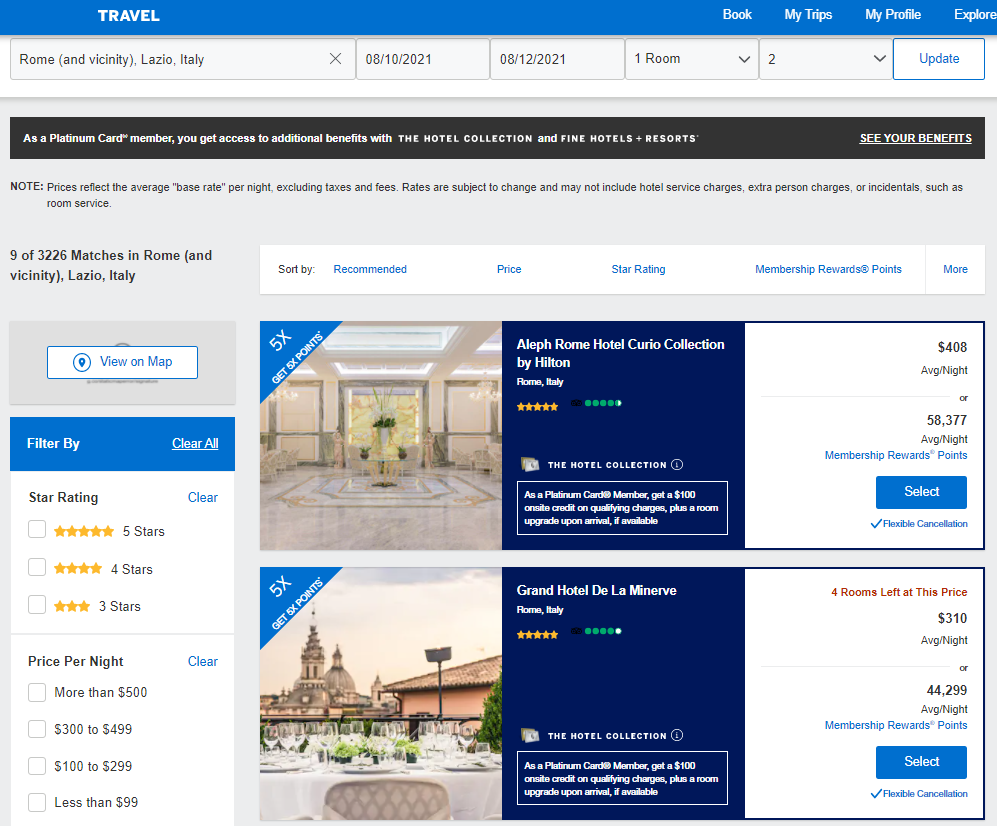

If you're looking to travel internationally, there are plenty of Hotel Collection properties abroad. For example, a search for a stay in Rome, Italy , returned nine Hotel Collection properties.

In Rome, Italy, the least expensive Hotel Collection property was the NH Collection Roma Giustiniano, for $163 per night before taxes and fees. Meanwhile, the Sofitel Rome Villa Borghese was the most expensive property for $438 per night before taxes and fees.

Related: Italy is reopening: 11 things I learned as a tourist there this week

The Hotel Collection vs. Fine Hotels & Resorts

The Amex Fine Hotels & Resorts (FHR) program offers more valuable benefits. But, the FHR program is only available to Amex Platinum and Centurion cardholders. Booking through the Amex Fine Hotels & Resorts program can get you the following elite-like perks:

- Noon check-in when available

- Room upgrade when available at check-in

- Daily breakfast for two

- Free in-room Wi-Fi

- Guaranteed 4:00 p.m. late checkout

- $100 experience credit

Related: How American Express Fine Hotels & Resorts can land you elite-like benefits at top hotels

While I expected to find significant overlap in the properties offered by The Hotel Collection and the Fine Hotels & Resorts program, I found none. A comparison of the two programs reveals that each has its strengths and weaknesses.

But, in general, Amex Fine Hotels & Resorts program properties tend to be more expensive than The Hotel Collection properties. And the benefits you'll get on FHR stays, including complimentary breakfast, early check-in and guaranteed late checkout, are superior. Thus, the real benefit of The Hotel Collection appears to be access to extra perks at high-end (rather than ultra-high-end) hotels.

Related: When to book through Amex Fine Hotels & Resorts vs. Chase Luxury Hotel and Resort Collection

How to best use The Hotel Collection

Food, beverage and other services at hotels can be costly. So, most travelers won't have trouble using the $100 credit. But, the real sweet spot of this program is for business travelers whose company already reimburses their room and meals. After all, these hotel guests can put the $100 credit toward drinks, pay-per-view movies and spa services that would not be allowed by most company expense policies.

The benefits of the Fine Hotels & Resorts program — such as early check-in, late checkout and complimentary breakfast — are geared toward leisure travelers who can afford expensive properties. And booking through the Fine Hotels & Resorts program can be particularly useful when you don't have elite status with a particular brand.

Amex offers both programs to Platinum and Centurion cardholders, which indicates that The Hotel Collection and Fine Hotels & Resorts programs each offer distinct benefits. In short, The Hotel Collection is a valuable perk of the Amex Gold and Business Gold Card -- not just a watered-down version of FHR.

Additional reporting by Chris Dong and Katie Genter.

Activate your Amex Platinum benefits

- Airline incidental fee credit

- Airport lounge membership

- Saks Fifth Avenue credit

- Digital entertainment credit

- Walmart+ subscription credit

- Paramount+ subscription credit

- Hotel elite status

- Hotel credits

- CLEAR® credits

- Equinox credits

- Rental car elite status

- Global Entry or TSA PreCheck credit

- ShopRunner membership

Activate these 14 Amex Platinum card benefits so you can get hundreds of dollars in perks

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

- The Platinum Card® from American Express offers a ton of value from its welcome bonus and benefits.

- The annual fee is high, but the card pays for itself if you maximize its rewards and benefits.

- Some of these perks and credits require activation before you can use them — they aren't automatic.

- Read Insider's guide to the best travel rewards credit cards .

The Platinum Card® from American Express has one of the highest annual fees of any publicly available consumer card —$695 — but the perks of the card can more than outweigh the annual cost. For many frequent travelers, the Amex Platinum Card is a must-have, but even if you're sticking closer to home, you can still get hundreds of dollars in value from its benefits if you enroll.

What's more, there's currently a great welcome offer on the card that is incredibly rewarding even if you're not traveling right now. You'll earn 80,000 Membership Rewards® points after you spend $8,000 on purchases on your new card in your first six months of card membership. That's worth around $1,440 in travel, based on Insider's points and miles valuations .

With a full six months to meet the minimum spending requirement , it should be easy for most people to unlock the welcome bonus.

Limited time offer: Earn 10X Membership Rewards® Points at restaurants worldwide for three months, on up to $25,000 in purchases when eligible card member refers a friend and the friend applies by May 22, 2024 and gets the card (terms apply). Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (on up to $500,000 per calendar year) and on prepaid hotels booked with American Express Travel. Earn 1X Points on other purchases.

See Pay Over Time APR

Earn 80,000 Membership Rewards® points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Long list of travel benefits, including airport lounge access and complimentary elite status with Hilton and Marriott (enrollment required)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual statement credits with Saks and Uber

- con icon Two crossed lines that form an 'X'. Bonus categories leave something to be desired

- con icon Two crossed lines that form an 'X'. One of the highest annual fees among premium travel cards

If you want as many premium travel perks as possible, The Platinum Card® from American Express could be the right card for you. The annual fee is high, but you get a long list of benefits such as airport lounge access, travel statement credits, complimentary hotel elite status, and more.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Some of the Amex Platinum's best benefits need to be activated before you can use them. To make sure you don't miss out, here's what you should do as soon as you get your card so that you can make the most of it.

Choose an airline for the Amex Platinum incidental fee credit

One of the biggest perks of the Amex Platinum Card is a yearly airline incidental fee credit . Each calendar year, you can choose one airline on which you can get up to $200 in fees reimbursed as a statement credit when you use your card for the purchase**.

While the fee credit isn't meant to include airfare, it covers extras like checked bags, flight-change fees, inflight food and drinks, fees for traveling with a pet, lounge day passes (for lounges you don't already have access to), and sometimes things like seat assignments and extra legroom upgrade fees.

The best part of the airline credit is that because you get it each calendar year (instead of cardmember year), you can get it twice before you pay your second annual fee. For example:

- If you opened the card in March, you could earn the full $200 credit before the calendar year ends

- Once the credit resets on January 1, you can get it again

This means you can get up to $400 in value from this credit in a single cardmember year.

To designate your airline, you can either call the number on the back of your card or log in to your online account. If you're not sure which airline to choose because you don't have travel plans yet, you can make the selection when you're ready; otherwise, once you've made your choice, you can change it each January either online or by phone.

Add your Amex Platinum card to your Uber account

The Amex Platinum Card offers cardholders up to $200 in Uber Cash credits** each calendar year. If you don't take Uber rides, don't worry — you can still use the credit toward Uber Eats food delivery and takeout.

The Amex Uber credit is broken into monthly chunks. At the start of each month, you'll get $15 of credits added to your Uber account, with a $20 bonus each December (for a total of $35). Additionally, your account will be upgraded to Uber VIP status, which comes with a few perks, like the option to only request rides from top-rated drivers.

To get the credit, just add your new Amex Platinum Card to your Uber account as a payment method. You don't actually have to use the card to pay; as long as you have it stored in your account you'll get the credits and VIP status.

Enroll in Priority Pass lounge membership

The Amex Platinum Card offers the most comprehensive airport lounge access of any card on the market. But you won't automatically have access to all lounges.

The card comes with Priority Pass Select membership, which you must first enroll in. It gives you unlimited access to more than 1,300 airport lounges worldwide, and even allows you to bring along two guests for free.

This membership tier is better than any membership you can buy. The highest tier available for purchase costs $429, and doesn't allow for free guests.

Enroll your Amex Platinum for up to $100 each year in Saks credits

The Amex Platinum Saks credit is split into two chunks: You'll get up to $50 in statement credits between January and June, and another $50 from July to December when you use your card at Saks Fifth Avenue**.

This perk also requires activation. To do so, sign in to your Amex account, click on the "Benefits" tab, and scroll down to find the credit listed. Click "Enroll," and you're all set going forward — you don't need to re-enroll to get the credit each time.

While items from Saks can be expensive, there are plenty of lower-priced items available, especially during sales and online shopping season . It's a perfect opportunity to splurge on a luxurious treat you might not otherwise consider.

Enroll your card for up to $240 in digital entertainment credit

Another newer perk on the Amex Platinum Card is up to $240 annually in digital entertainment credits**, handed out in chunks of up to $20 per month. You need to enroll before you can use this perk by calling the number on the back of your card or activating the benefits through your online Amex account.

Eligible digital subscription services (and current pricing) include:

- Hulu — $7.99 per month for the standard version, $17.99 for ad-free plan, $76.99 for Hulu + Live TV and ES[M+ with adds, $89.99 for Hulu + Live TV and Disney+ with no ads and ESPN+ with adds, $14.99 for Hulu bundled with Disney+ and ESPN+, $24.99 for Hulu with no ads bundled with Disney+ and ESPN+, $81.99 per month for Hulu with no ads + Live TV bundled with Disney+ and ESPN+

- Disney+ — $7.99 per month, $13.99 per month for Disney+ Premium (no ads), $14.99 per month bundled with Hulu and ESPN+, $24.99 per month bundled with Hulu (no ads) and ESPN+

- ESPN+ — $10.99 per month

- Peacock — $5.99 per month for Premium

- The New York Times — $4 every four weeks for six weeks (then $25 every four weeks)

- The Wall Street Journal — $2 every four weeks for one year, then $9.75 per week

Once you've activated the benefit, be sure to use your Amex Platinum Card to pay your monthly bill to receive the credit.

Enroll in Walmart+

The Amex Platinum Card reimburses you for Walmart's subscription service, Walmart Plus, in the form of a statement credit** ($12.95 plus applicable sales tax each month). To be clear, this credit is only beneficial for a Walmart+ monthly membership — not an annual one.

Walmart+ comes with things like:

- Free delivery

- Free shipping (with no minimums)

- Gas discounts

- Pharmacy discounts

Enroll in Paramount+

Another benefit of Walmart+ is free Paramount Plus Essential subscription**. While this version costs a mere $4.99 per month (and is ad-supported), it's still an easy way to save $50+ each year if you would normally pay for the Paramount streaming service, anyway. Paramount comes with access to programs from Nickelodeon, Comedy Central, MTV, CBS, and more.

Within your Walmart+ account, you'll see the option to subscribe to Paramount Plus for free.

Sign up for Marriott Bonvoy and Hilton Honors Gold elite status

Getting complimentary Marriott and Hilton hotel elite status from the Amex Platinum Card is an excellent perk that offers real value, especially if you don't stay at one chain often enough to qualify for the mid-tier Gold level status.

Before you enroll, make sure you've signed up for loyalty accounts with each of the hotel brands. Then, either call the number on the back of your Amex Platinum Card, or log in to your Amex online account. Enter your Marriott and Hilton account numbers to request Gold status — it typically takes a day or two for it to show up in your accounts.

Elite status perks vary between brands and each individual hotel, but typically include things like early check-in and late checkout, a better chance at room upgrades, bonus points on stays, and, in Hilton's case, free breakfast (or a dining credit) — which can add up to hundreds in savings if you're a frequent guest.

Note that you can also get complimentary Hilton status with the best Hilton credit cards , and Marriott elite status with some Marriott credit cards . Depending on which card you have, the elite status you get from one of these cards can be much more valuable than what you'll get from the Amex Platinum Card.

Check out Fine Hotels & Resorts and The Hotel Collection for your $200 credit

The Amex Platinum Card offers up to $200 in annual credit toward prepaid Hotel Collection (minimum two-night stay) and Fine Hotels & Resorts bookings made through Amex Travel .

There are about 1,800 properties between Amex Fine Hotels & Resorts and The Hotel Collection, although this curated list changes each year as new properties are added and dropped.

There's no enrollment required to get up to $200 back on your bookings each year — just use your card to prepay for your hotel stay. You'll get exclusive perks at the hotel, which can include room upgrades, early check-in, late checkout, complimentary breakfast, and an on-property credit to use on dining or spa services.

Sign Up for CLEAR Plus and use up to $189 in credit

CLEAR Plus is an expedited airport security program, similar to TSA PreCheck, but it's also available for fast-track access at select stadiums.

The CLEAR Plus credit on the Amex Platinum Card will reimburse you for the $189 annual membership fee — just use your card to pay when you sign up. Keep in mind that CLEAR Plus isn't available at as many airports as TSA PreCheck, and you'll still have to remove items like your laptop and shoes before getting screened.

Activate up to $300 in Equinox credits

The Amex Platinum Card has added up to $300 per year in credit towards any gym membership with Equinox, including digital subscriptions for fitness classes through the Equinox+ app. To receive the credit, you'll have to activate through Amex first, then use your card to pay your monthly membership charge.

This could be a valuable benefit if you live in a city with Equinox locations, or if you're a fan of the fitness app. Just keep in mind that Equinox memberships are not cheap. For example, with a 12-month commitment, you'd pay $240 per month for membership at the Rockefeller Center location, and $275 per month if you want access to all US clubs.

Enroll your Amex Platinum for rental car elite benefits

In addition to hotel status, you can get elite status with several car rental agencies. When you get your Amex Platinum Card, log in online and request Avis Preferred, Hertz President's Circle Status, and National Car Rental Emerald Club Executive status — you'll just need to create accounts with those providers first.

Benefits include things like car upgrades, guaranteed availability, and waived fees for additional drivers.

Use your Amex Platinum to apply for Global Entry or TSA PreCheck

If you don't have Global Entry and TSA PreCheck, you're missing out on one of the most valuable, time-saving tools frequent travelers swear by.

TSA PreCheck is a program that offers expedited security screening at airports. Instead of having to take off their shoes and light jacket, unpack laptops, tablets, and liquids from their hand luggage, and go through slow full-body scanners that create a bottleneck at the security checkpoint, PreCheck members can just put their bags through the x-ray machine, empty their pockets, and walk through a metal detector. It's a faster, easier process, and typically leads to shorter and quicker lines.

You can pay an application fee for PreCheck, or you can pay extra to apply for Global Entry, which, if you're approved, includes PreCheck. Global Entry lets you use self-service kiosks at passport control and customs when you return from abroad, skipping the long, snaking lines that typically form in the border control halls.

The Platinum Card offers a statement credit to cover either program's application fee, $100 statement credit every 4 years for a Global Entry application fee or up to $85 statement credit every 4.5 years for TSA PreCheck®. To get the credit, fill out the application online and pay with your card. If you already have Global Entry or TSA PreCheck, you can use the credit to cover the cost of the application for someone else.

Sign up for ShopRunner to get free two-day shipping

ShopRunner is like Amazon Prime for other retailers. With a ShopRunner account, you can get free two-day shipping and free returns from hundreds of participating online stores.

The Amex Platinum Card comes with a free ShopRunner membership (which normally costs $79 per year). To sign up, visit ShopRunner's American Express website, enter your email and card number, and follow the prompts.

Bottom line

The Platinum Card® from American Express comes with potentially thousands of dollars in statement credits and benefits each year. Some of them must be activated, however — and others require that you at least use the Amex Platinum Card to trigger the credits.

If you don't know all the discounts that come with this card, you could unwittingly waste many hundreds of dollars in value each year. Use the above checklist as soon as you receive your Amex Platinum Card to ensure you're maximizing its benefits.

For rates and fees of The Platinum Card® from American Express, please click here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

The Amex Platinum Card – How To Use the Annual $200 Prepaid Hotel Credit

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3136 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1172 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Amex Platinum Card – Snapshot

What is the amex platinum card’s prepaid hotel credit, 1. midtown shangri-la, hangzhou (china), 2. the ritz-carlton, tianjin (china), 3. shangri-la sydney (australia), 4. mr. c coconut grove (florida), 5. taj campton place (san francisco, california), 6. the beekman, a thompson hotel (new york), 7. sofitel mexico city reforma (mexico), 8. condado vanderbilt hotel (puerto rico), 1. conrad bali (indonesia), 2. hôtel des arts saigon – mgallery collection or pan pacific hanoi (vietnam), 3. sofitel wellington (new zealand), 4. grand hyatt são paulo (brazil), 5. delano las vegas (nevada), purchases that do not trigger the prepaid hotel credit, what if my purchase isn’t automatically reimbursed, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you can maximize your card’s benefits, the value proposition of The Platinum Card ® from American Express has never been greater.

Our guide will walk you through all the nuances of the up to $200 prepaid hotel credit and inspire you with high-value ways to use it. We hope that you’ll walk away knowing how to utilize this credit efficiently.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

The prepaid hotel credit on the Amex Platinum card is a benefit that takes the form of a statement credit on prepaid Fine Hotels + Resorts or The Hotel Collection bookings, which requires a minimum 2-night stay through AmexTravel.com .

Don’t be scared of the “prepaid” language, though, because almost all these bookings are cancellable and refundable!

Typically, when you book a stay through AmexTravel.com, you can opt to pay for your booking in 2 ways:

- Prepaid (can earn 5x points)

- Pay at the hotel ( cannot earn 5x points)

So, if you’re interested in maximizing your points, you’ll want to book a prepaid booking anyway — rest assured that these reservations are refundable.

In total, you can receive up to $200 in these statement credits every calendar year . It may take up to 90 days for the credit to be posted to your account, though this has actually been within a week in practice.

The 8 Best Ways To Use Your Prepaid Hotel Credit at Fine Hotels + Resorts

American Express’s signature set of luxury hotels is Fine Hotels + Resorts — think of globally-known luxury brands like Four Seasons and lavish boutique brands like Aman .

Whenever you book a Fine Hotels + Resorts stay, you’ll enjoy:

- Room upgrade upon arrival, when available

- Daily breakfast for 2 people

- Noon check-in, when available

- Guaranteed 4 p.m. late checkout

- Complimentary Wi-Fi

- Unique property amenities, such as a spa or food and beverage credit valued at a minimum of $100

There’s no minimum stay requirement, which means you can enjoy all these benefits on 1-night stays!

Let’s explore our favorite ways to use your $200 prepaid hotel credit at Fine Hotels + Resorts properties.

One of the newest, sleek city hotels you can book is the Midtown Shangri-La, Hangzhou in China .

This riverfront, 5-star hotel is situated along the Guxin River, just 3 miles from Zhejiang Art Museum and 2 miles from West Lake.

Each of the 414 rooms and suites starts at 462 square feet and offers luxury amenities such as floor-to-ceiling windows , modern decor, a king bed appointed with soft bedding, a work desk, a sitting area with a couch, a balcony, a flat-screen TV, a set of coffee and tea facilities, a minibar, and more.

The spacious bathroom welcomes you with a separate shower, a deluxe soaking tub , posh Shangri-La bathrobes and towels, and designer toiletries.

You’ll find 3 restaurants, a cocktail lounge, and a lobby lounge for food and beverage options.

Plus, the property has a gym, spa, indoor pool, whirlpool, steam room, boutique, and an abundance of event space.

If you book a 1-night stay during the weekday, you could potentially net a free stay using your $200 prepaid hotel credit, as rates are typically below $200 per night!

Booking a night at The Ritz-Carlton probably was outside your realm of realistic ways to use a $200 prepaid hotel credit, considering how some properties command over $1,000 per night!

But thrifty luxury travelers rejoice — The Ritz-Carlton Tianjin is a posh property in China just 5 minutes from the metro station and 3 miles from the Tianjin Museum .

This opulent property has rooms measuring at least 538 square feet. Each room has a king bed with incredibly soft Frette bedding, a work desk, a private balcony overlooking the garden or courtyard, coffee and tea facilities, and more.

There’s a full marble bathroom with twin vanities, a separate tub and rainfall shower, a powder room, a toilet with a bidet , and a lighted make-up mirror.

This property has 3 restaurants, a cocktail lobby lounge serving afternoon tea, a full-service spa, a fitness center, an indoor pool, a Club Lounge , and a meeting space.

By booking a weekday stay within 1 month of the stay, you might be able to find room rates at around the $200 per night cutoff, including taxes and fees!

Shangri-La Sydney is a high-rise luxury property just a 5-minute walk from the Museum of Contemporary Art Australia , a 7-minute walk from Circular Quay train station, and half a mile from the famous Sydney Opera House .

The superb location isn’t the only thing going for it — each of the spacious and comfortable rooms starts at 430 square feet in size with amazing views of Darling Harbour and comes with signature bedding, a sitting area, a full-size executive desk , a flat-screen TV, coffee and tea, a minibar, and a pillow menu.

The marble bathroom has a separate soaking bathtub, shower, and Shangri-La toiletries and bathrobes.

Once you leave your room, you can recharge at the restaurant, coffee shop, or cocktail lounge with sweeping city views. Enjoy the indoor pool, gym, spa, or Jacuzzi to rejuvenate!

This property represents a fantastic balance between 5-star luxury and reasonable pricing — you can enjoy all of the Fine Hotels + Resorts benefits available and pay around $250 for a 1-night weekday stay!

Mr. C Coconut Grove often has room rates of around $200, including taxes and fees. This is a steal, considering how pricey these Miami can get.

Often, Mr. C properties are the cheapest Fine Hotels + Resorts properties in the vicinity, so value-focused travelers will have a blast at any of these 3 properties!

If you’ve ever looked for a Fine Hotels + Resorts property in San Francisco, you’ve probably seen a particular property come up as one of the most affordable options: Taj Campton Place (a member of Taj Hotels).

This property is primely located in San Francisco’s Union Square neighborhood and is actually a prominent landmark.

Offering classical Indian luxury, this elegant luxury hotel is just outside the Financial District and is a half-block from Union Square and a 5-minute walk from Montgomery Street BART station.

Each of the classy rooms starts at 250 square feet large and has a California king bed, a work desk, premium bedding, an iHome docking station, a pillow menu, a well-stocked minibar, turndown service, an LED TV, and a Nespresso machine.

The limestone bathrooms contain a single vanity, a walk-in shower or a shower/tub combo, a bath menu, bath salts, plush bathrobes, slippers, and more.

You’ll enjoy a 2-Michelin-starred restaurant , a bar and bistro, and private dining options here.

This property has an open-air fitness center and a 24/7 business center, too.

Although it’s increasingly rare to find Fine Hotels + Resorts room rates less than $175 per night in an expensive city like San Francisco, you might discover 1-night stays with a Sunday or Friday check-in booked as far out as 1 month in advance for that price.

Hot Tip: If you prefer to avoid booking a cash rate, check out the best San Francisco hotels to book with points for maximum value.

If you’re thinking of checking out New York , you’ve probably come to terms with the fact that you’ll probably be shelling out a handsome amount to book your hotels here.

And while it’s true that a $200 prepaid hotel credit isn’t enough for a Fine Hotels + Resorts stay (rooms average around $380 per night), you’d be remiss in discarding the possibility entirely because The Beekman, a Thompson Hotel , is competitively priced!

Located in the Downtown Financial District area of Lower Manhattan, this 5-star hotel is a 3-minute walk from Fulton Street subway station and a 14-minute walk from Brooklyn Bridge. It is surrounded by other attractions like the 9/11 Memorial , One World Trade Center, and more.

Each of the rooms at this property boasts high ceilings, curated art, aged oak floors, 285 square feet of space, eclectic furnishings, a minibar, a cocktail table, a flat-screen TV, a courtesy luxury house car available upon request , and more.

The bathroom is tiled with Carrara marble and is appointed with an oversized rain shower, D.S. & Durga bath amenities , an oversized walk-in rain shower, a single vanity, and more.

Here, you’ll also find eateries run by famous chefs, a wood-paneled cocktail lounge, a chic bar, and an awe-inspiring 9-story atrium !

Although this property tends to be the cheapest Fine Hotels + Resorts property in New York, you’ll enjoy nothing but the finest 5-star luxuries here.

Experience quintessential French luxury in Mexico City’s Reforma district, a historic destination that immerses you into French and Mexican poshness.

Sofitel Mexico City Reforma features views of the Angel of Independence monument and is a 9-minute walk from Insurgentes metro station and a little more than a mile from Chapultepec Castle .

Here, you’ll live the French way with floor-to-ceiling windows, a king bed or 2 double beds, a work desk, at least 410 square feet of space , an LED TV, urban Mexico City views, a Nespresso machine, and much more.

The marble bathroom features plenty of counter space, bathrobes, L’Occitane amenities, and a walk-in shower.

You’ll find 5 dining options here, plus a gym, a sauna, meeting rooms, and pet-friendly policies!

We found the cheapest Fine Hotels + Resorts room rate was around $250 per night, excluding taxes and fees, for a weekday stay.

Still, using the prepaid hotel credit, this property is your best bet for a value-packed Mexico City stay!

Hot Tip: Save money on your hotel stay and your flight — see the best ways to fly to Mexico with points and miles (step-by-step) .

Our last inclusion in the Fine Hotels + Resorts section is Puerto Rico’s best-value property, the Condado Vanderbilt Hotel .

Make no mistake — this time-tested luxury resort has amazingly consistent reviews, a spectacular Condado Beach location , and is a crown jewel for value luxury.

Each of the standard guestrooms has at least 350 square feet of real estate with either 2 queen beds or 1 king bed with Rivolta Carmignani linens, a sitting area with 3 chairs, a desk, a flat-screen TV, an in-room French press coffee maker with Puerto Rican coffee and tea, and a minifridge.

The sleek bathroom has marble tiling, a shower-tub combination, a single vanity, bathrobes, bamboo towels, and C.O. Bigelow amenities.

Notably, 9 dining options include a cigar lounge, a cocktail bar, an oceanfront restaurant, a fine dining spot, and more. You’ll also find a chic spa, 4 pools , a gym, and a meeting space.

The cheapest Fine Hotels + Resorts rate we could find is $258 before taxes and fees. Considering all the other perks you’ll enjoy with Fine Hotels + Resorts, this is an excellent opportunity to use your prepaid hotel credit.

Bottom Line: You can use your $200 prepaid hotel benefit on 1-night stays at Fine Hotels + Resorts locations, while The Hotel Collection properties require a 2-night stay.

The 5 Best Ways To Use Your Prepaid Hotel Credit at The Hotel Collection

The Hotel Collection is the “little sister” of Fine Hotels + Resorts.

A different set of hotels fall under The Hotel Collection, and these are almost always upscale or luxury hotels, compared to the opulent properties a notch higher at Fine Hotels + Resorts.

Although The Hotel Collection requires a stay of at least 2 nights , these properties are almost always more affordable, so getting an entire short stay paid for using your $200 prepaid hotel credit is possible.

To make things better, all bookings at The Hotel Collection afford you with:

- $100 credit to spend on qualifying dining, spa, and resort activities

- Room upgrade at check-in, if available

Let’s get into some neat ways to get some fantastic value at The Hotel Collection with your $200 prepaid hotel credit!

One of the most spectacular ways to use your prepaid hotel credit is on luxury properties in affordable leisure destinations.

One of these destinations is Bali — specifically, the Conrad Bali is a fantastic 5-star resort that will have you dreaming about a stay here.

Conrad Bali has 368 rooms and suites in the Nusa Dua area. Every room is at least 484 square feet large. It is outfitted with garden views, a private balcony/terrace , blackout curtains, a pillow menu, a desk, a separate sitting area, a minibar, a flat-screen TV, and coffee and tea facilities.

You’ll find a granite bathroom with a single vanity, walk-in shower, separate bathtub, Shanghai Tang amenities , and a water closet.

The amenities here are fantastic, including 3 restaurants, a pool bar, a lobby lounge, sprawling lagoon pools , beachside cabanas , a spa, a gym, and more.

But the most incredible part is the price tag — you can easily find rates available for $158 per night (excluding taxes)!