Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

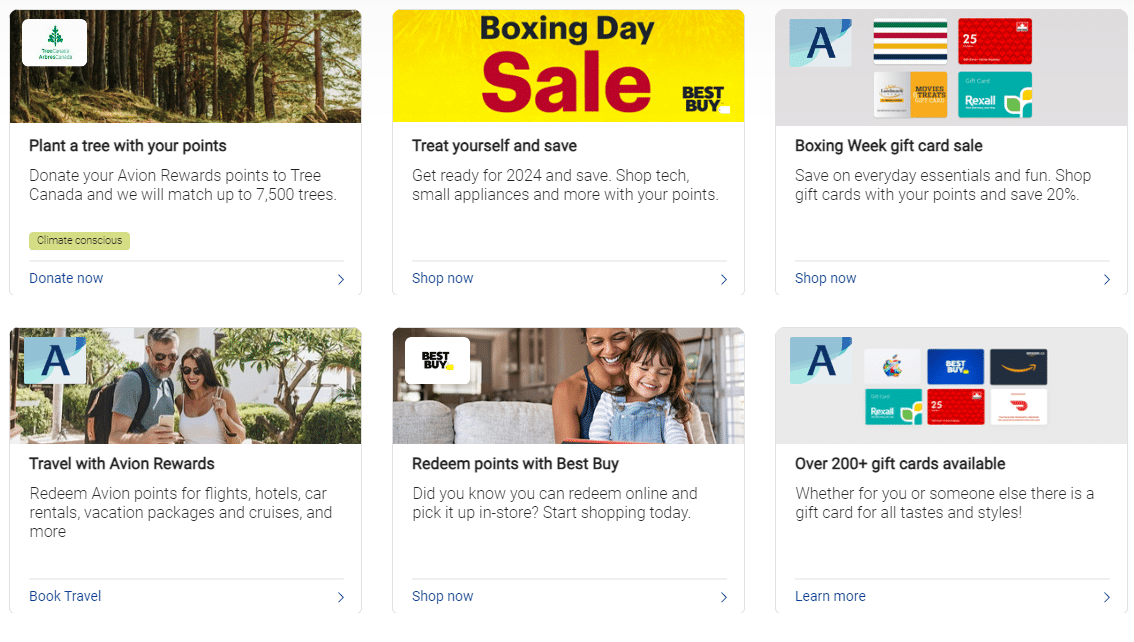

Redeem your points for gift cards, merchandise, travel and more

All Avion Rewards members can use points to...

Use points to...

Redeem top brands

Use your points for a huge selection of merchandise and gift cards from top brands like Apple, Best Buy and more 1 .

Take that dream vacation

Use your points to book travel, including hotels, flights and package deals.

Donate to charity

Redeem your points wherever they matter most by donating to a charity of your choice.

Avion Premium and Elite members can also use points to...

Make payments online.

Use your points for Interac transfers, credit cards and bill payments and leave more in your wallet.

Save for the future

Use your points to contribute to investments such as mortgages and lines of credit.

See all membership levels and benefits

Join now to get all your personalized offers

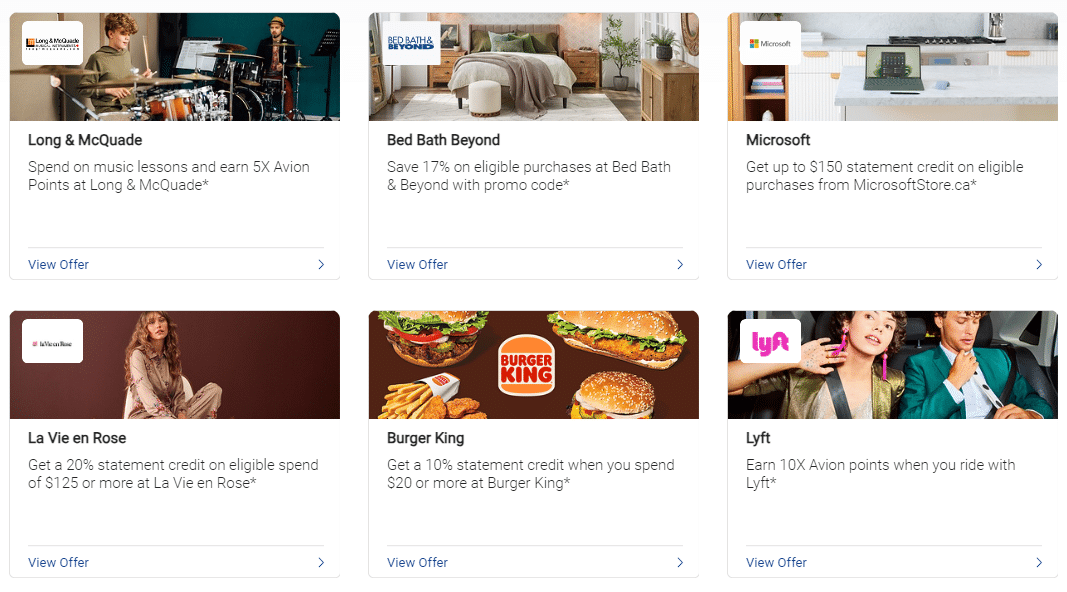

Here are just a few examples of offers you’ll find to help you earn and save.

Avion Elite members can travel more for less

Avion Elite members can use fixed points pricing to book deals to top destinations – any airline, any flight, any time.

Do it all with points in the Avion Rewards app

The Avion Rewards app lets you access your account quickly and easily. Use your points for gift cards, merchandise, travel and more. Shop, earn, save and redeem – all in the app.

Download the app

View Legal Disclaimers Hide Legal Disclaimers

RBC Avion : How to Use Your RBC Avion Points for Travel Rewards

RBC Avion Rewards Credit Cards

There are several RBC Avion credit cards part of the Avion Rewards program . One of the best is the RBC Avion Visa Infinite Card .

It has excellent insurance, including one for mobile devices, which is rare. In addition, as a welcome offer, it offers a lot of points with little effort.

Other cards that earn Avion Points are:

- RBC Avion Visa Infinite Card

- RBC ION+ Visa Card

- RBC ION Visa Card

- RBC ® Avion ® Visa Infinite Privilege* Card

- RBC Avion Visa Platinum

- RBC Avion Visa Infinite Business Card

- RBC Avion Visa Business Card

With this exceptional offer for the RBC Avion Visa Infinite Card, you can earn up to 55,000 Avion points:

- 35,000 Avion points on approval

- 20,000 Avion bonus points when you spend $5,000 in your first 6 months

This offer expires on April 30, 2024, and will not be renewed. Take advantage of it before it’s too late !

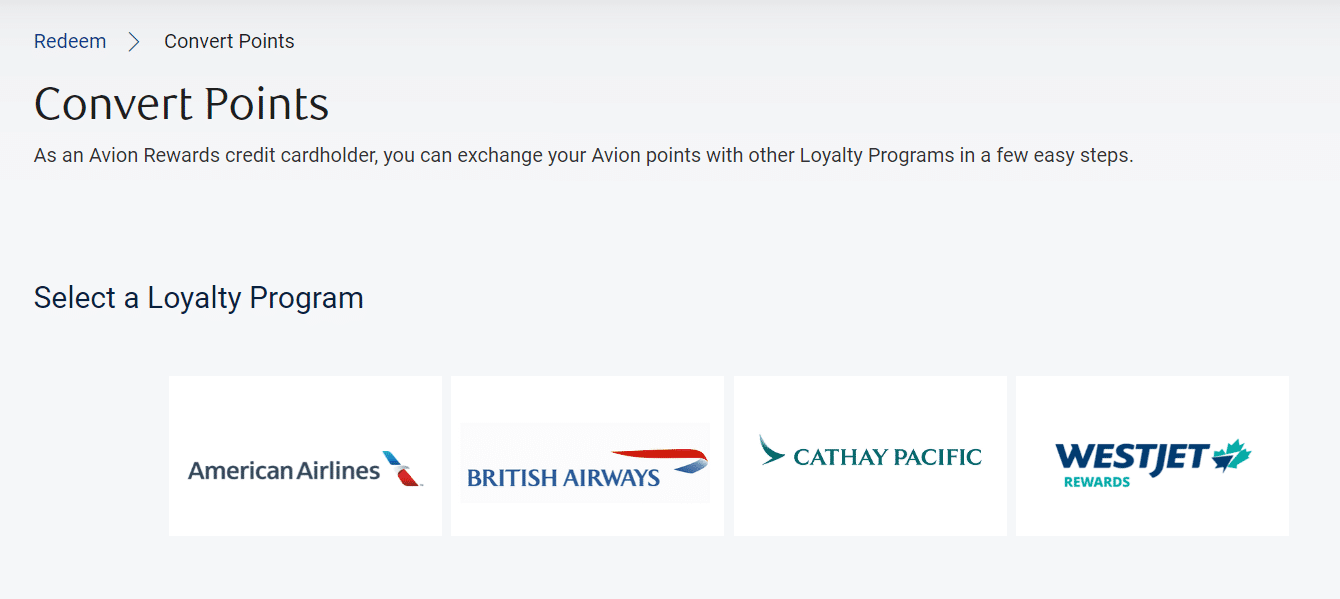

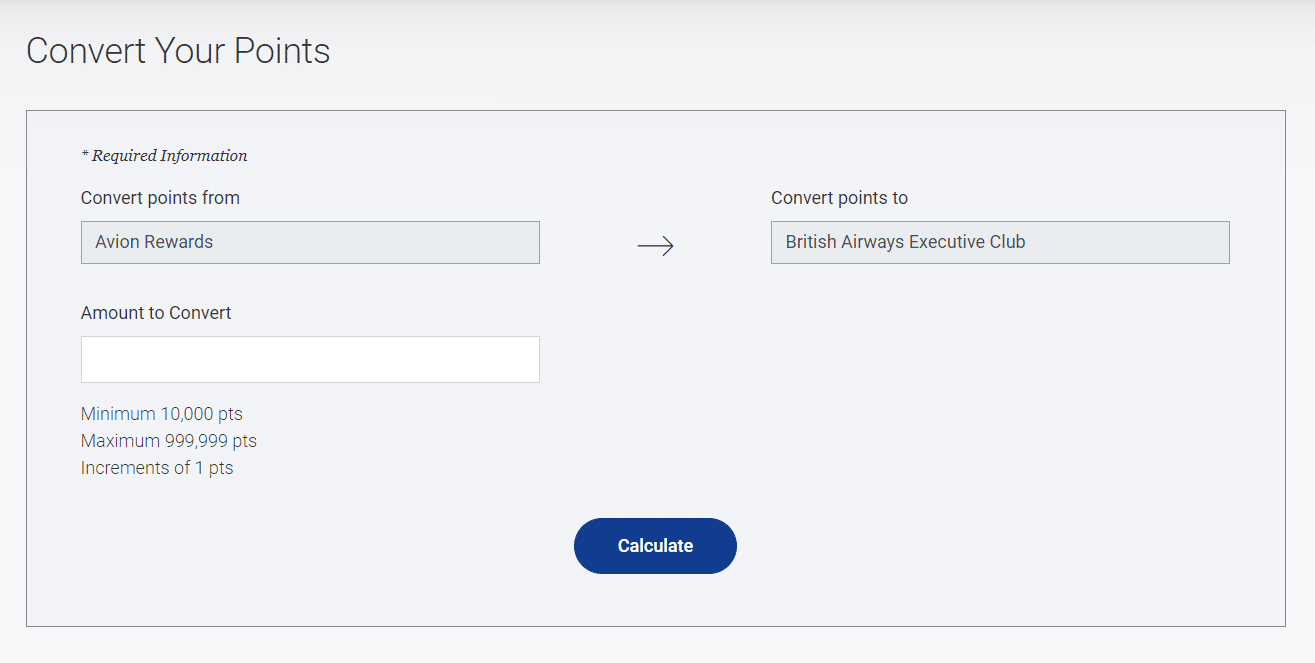

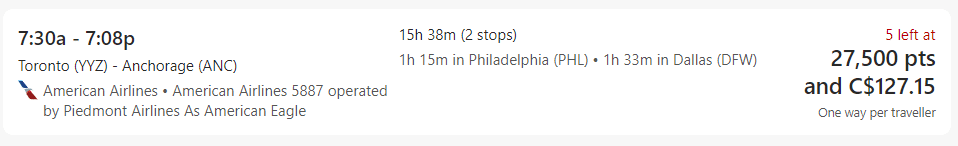

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

For example, with the current welcome offer, you can get 55,000 British Airways Avios Points or 550 WestJet Dollars .

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

And you’ll benefit from a wide range of insurance coverage: Trip Cancellation and Interruption Insurance, Out-of-Province/Country Emergency Medical Insurance, Rental Vehicle Collision/Loss Damage Insurance, Mobile Device Insurance.

How to Use Your Avion Points for Travel Rewards

Use the fixed fare chart for airline tickets.

One way to use your Avion points for travel is with the purchase of an airline ticket. This is the best way to get the most value out of the RBC Avion Rewards program . This is described in detail in this article .

Depending on the destination, 15,000 to 100,000 Avion points are required per ticket.

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight:

On average this equals about 2 cents per Avion point .

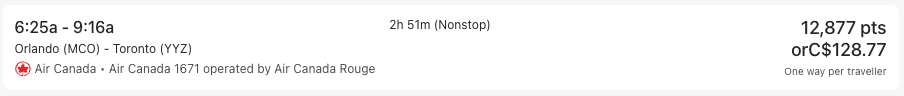

Use the Flexible Fare Chart for Airfare

The Flexible Fare Plan uses 100 Avion points for a $1 discount on your airfare. The transaction must be made directly on the Avion Rewards website, using the flight search tool.

For example, with the flat rate fare, 35,000 points will get you a round-trip ticket anywhere in Canada and the U.S., up to a value of $750.

If you choose to purchase that same $750 ticket with the flexible fare structure , you will need 75,000 points. So using the flexible fee schedule would be more of a disadvantage in this case. It’s up to you to make your calculations, depending on the number of points you have banked.

Redeem Avion Points for Any Trip

For even more flexibility, book your hotel, car rental, cruise or airline tickets as you wish on the Avion Rewards site to have your account credited.

Avion credit cardholders can redeem 100 Avion points to deduct $1 from this travel expense. For example, for a night at the hotel that cost $200, 20,000 points are required to bring the balance down to zero.

For ION and ION+ credit card holders, it’s different. They redeem their points using a conversion rate of 172 points = $1.

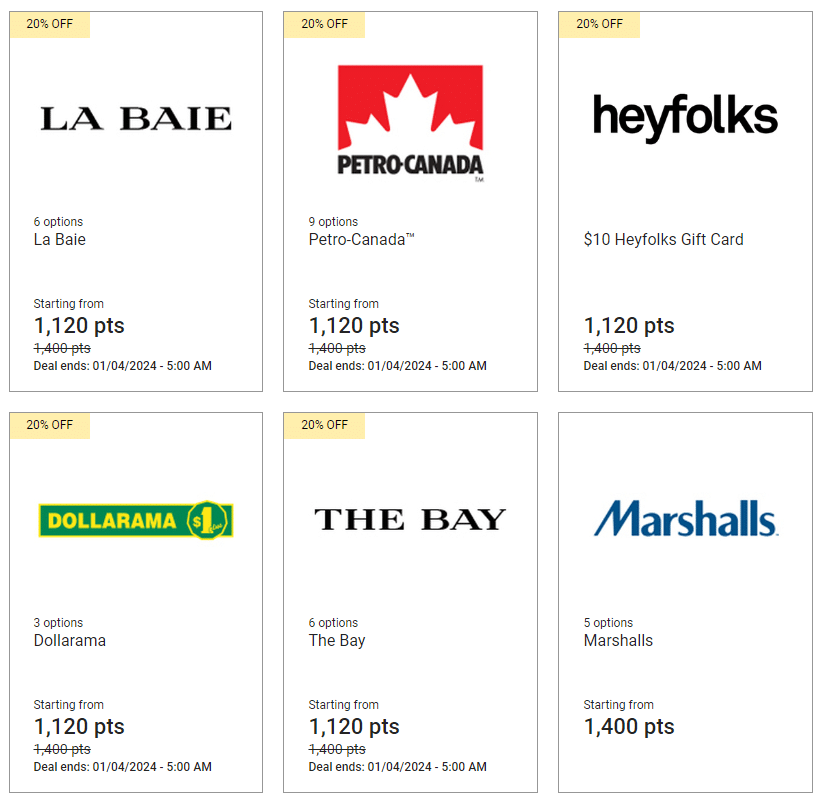

Buy Gift Cards

There are approximately 250 gift cards to purchase with Avion points. About ten of these geared towards travel. For example, buying a gift card for future stays at Fairmont or Best Western hotels. Or Tim Hortons, for roadtrips !

Generally, the cost is 1 cent per Avion point, so 5,000 points for a $50 gift card .

Uber is different, with 7,000 points for $50.

Transfer to Other Airline Loyalty Programs

Did you know that it is possible to transfer your Avion points to other airline loyalty programs? We explain how in our tutorial on this subject:

Another way of exchanging RBC points in the event of technical problems

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results.

During that time, call Avion Rewards Customer Service at 1-800-769-2512.

- Get an authorization number to book the flight you want;

- Book your own flight directly on the desired airline’s website;

- Send an e-mail to [email protected] with your authorization number obtained earlier from Customer Service, your name, the number of tickets reserved, proof of ticket purchase and itinerary details.

Avion Rewards will then deduct the required points from your RBC Rewards points account to credit the cost of your airline tickets, according to their fare structure.

Frequently asked questions about the Avion Rewards program

How many avion points are needed for a free airline ticket.

Depending on the destination, 15,000 to 100,000 Avion points are required.

Can I buy a ticket for another person?

Yes , make sure that the person’s personal information is written down perfectly at the time of booking.

What is the definition of a basic Avion Rewards account?

These are the people enrolled in the Value Program , who earn Avion Rewards points.

Where can I redeem my Avion Rewards points for travel?

Go to the site Avion Rewards or click on the Avion Rewards icon in your RBC Direct Banking session. Then go to the Travel section.

All posts by Caroline Tremblay

Suggested Reading

Avion Rewards

About this app

Data safety.

App support

More by royal bank of canada.

Similar apps

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest news

- Stock market

- Premium news

- Biden economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal loans

- Student loans

- Car insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

"leave limits behind" with avion rewards: expanded program features available to all canadians, regardless of where they bank.

All members can now earn and redeem Avion points, get cash back, access exclusive experiences and more

TORONTO , March 11, 2024 /CNW/ - Avion Rewards , Canada's largest proprietary loyalty program, has launched expanded benefits for its newest membership level, Avion Select, free for all Canadians to join regardless of where they bank. Avion Select members can experience a wide breadth of program features, including up to 40% cash back deals, offers from over 2,400 retailers and brands, the ability to earn Avion points and redeem for virtually anything and much more.

"Accessing value and savings has never been more important for Canadians, and by enabling all of our members to shop, save, earn and redeem, we've created a more inclusive program that offers them limitless choice, freedom and flexibility," said Niranjan Vivekanandan, senior vice president and head, Loyalty & Merchant Solutions, RBC. "By transforming Avion Rewards and expanding the scale and breadth of our program, we're able to deliver an end-to-end loyalty experience that brings everyday value to millions of more Canadians while also increasing reach and access for our retail partners."

Avion Select members can join Avion Rewards and access the following unique features:

Earn points that can be used for virtually anything. Earn cash back and points that can be used for virtually anything, including gift cards, merchandise, travel and more. By linking their payment card, members will earn cash that they can transfer to any Canadian bank account once they've reached savings worth $15 .

Get unique value and savings of up to 40% from over 2,400 retailers and brands. Avion Rewards members can save and access value on everyday purchases from partners including Metro, Petro-Canada, WestJet, DoorDash, Rexall and McDonald's Canada . Members will also benefit from the program's innovative and award-winning shopping companion, Avion Rewards ShopPlus, which eliminates the need to hunt for deals by presenting offers from top brands and more retailers than any other savings platform in Canada.

Access exclusive experiences. Being an Avion Rewards member also means exclusive access to exciting events and contest opportunities, including the chance to win tickets to Taylor Swift | The Eras Tour . As the Official Financial Services Partner and an Official Ticket Access Partner of Taylor Swift | The Eras Tour in Canada, RBC and Avion Rewards are giving away hundreds of tickets leading up to the Canadian leg of the tour.

Access to Avion Rewards Travel. Avion Rewards is one of the largest travel platforms in Canada and members benefit from the program's market-leading "any airline, any flight, any time" travel offering, with no blackout periods or seat restrictions. Avion Select members will now have access to this leading e-travel portal as well as the flexibility to book travel with points, credit cards or both.

To showcase the full breadth of the program and its differentiated benefits, Avion Rewards has just launched " Leave Limits Behind ", a bold new marketing campaign that will run nationally across mainstream media, including TV, digital and social. The campaign highlights the flexibility and choice that is central to Avion Rewards, which millions of members have grown to love and is now available for all Canadians to access and experience.

"With our Leave Limits Behind campaign, we're highlighting the limits that consumers often face with traditional rewards programs, while with Avion Rewards, they can get it all – cash back, points and savings – all in one program," said Carolyn Hynds , vice president, marketing, Avion Rewards. "Through our new campaign, we're bringing this insight to life in a fun and playful way and we're excited for more Canadians to see what Avion Rewards has to offer."

Canadians who hold an eligible RBC product will continue to enjoy even more benefits through the program's two additional tiers: Avion Premium and Avion Elite.

To become an Avion Rewards member, Canadians can simply sign up using their email address. For more information visit avionrewards.com or download the Avion Rewards mobile app .

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 94,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada's biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada , the U.S. and 27 other countries. Learn more at rbc.com .

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact .

About Avion Rewards

Avion Rewards is an award-winning internationally recognized loyalty and consumer engagement platform that provides Canadians with the flexibility to shop, save, earn and redeem for everyday merchandise, aspirational rewards and experiences. Its exclusive shopping companion, Avion Rewards ShopPlus, enables members to access offers seamlessly, saving them time and money right where they shop online. Additionally, as one of the largest travel providers in Canada , Avion Rewards makes it possible for members to benefit from the program's market-leading "any airline, any flight, any time" travel offering, as well as its flagship Avion credit cards and concierge service. Learn more at avionrewards.com .

SOURCE RBC Royal Bank

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/11/c9614.html

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.

RBC Avion points are an incredibly useful, transferrable reward currency for Canadians.

Its diverse suite of transfer partners and ease of earning make it a great program to include as part of your points-earning endeavours.

Before we go further, it’s important to distinguish between the different tiers of RBC Avion Rewards. There are subtypes of Avion points: Avion Select, Avion Premium, and Avion Elite.

Avion Elite is the highest Avion Rewards tier, and has the most redemption flexibility. Both Avion Elite and Avion Premium points are earned through RBC credit cards, and can be transferred from one account to the other, if you hold a credit card that earns Avion Elite points.

Comparatively, Avion Select points are a recent addition to the RBC Avion program, and these aren’t nearly as valuable as the other two tiers.

Avion Select points are earned through applicable shopping activity, and can’t be combined with Avion Elite or Avion Premium points.

In this guide, we’ll be focusing on Avion Elite points, while exploring the possibilities of earning Avion Premium points for the sole purpose of converting the Premium points into Elite points.

Earning RBC Avion Points

The main way to earn RBC Avion points is through RBC credit cards. You can rack up Avion points through credit card welcome bonuses and through everyday spending.

Credit cards will earn either Avion Elite points or Avion Premium points.

The credit cards that earn Avion Elite points include all from the RBC Avion lineup.

Meanwhile, the cards that earn Avion Premium points are from the RBC ION lineup.

As long as you have at least one of the RBC Avion cards from the first list, you’ll be able to freely transfer Avion Premium points earned from the ION cards in the second list to your Avion Elite rewards account.

Transferring Avion points from Premium points to Elite points will give you a lot more redemption options.

Credit Card Welcome Bonuses

The best way to earn RBC Avion points is through welcome bonuses.

Welcome bonuses fluctuate depending on the current promotion. However, you can usually expect an RBC Avion card to come with a welcome bonus of 15,000–35,000 Avion points, with the bonus sometimes getting as high as 55,000 Avion points if you’re able to meet the associated spending requirements.

Despite having similar welcome bonuses, the Avion cards do all have slight differences in the benefits they offer, their earning rates, and their annual fees.

The RBC® Avion Visa Platinum†, RBC® Avion Visa Infinite†, and RBC® Avion Visa Business all have an annual fee of $120 (all figures in CAD).

Meanwhile, the RBC® Avion Visa Infinite† Business has an annual fee of $175, and lastly, the RBC® Avion Visa Infinite Privilege† card has the highest annual fee at $399.

With the higher annual fees, you can usually expect to also see additional benefits, such as higher earning rates and access to airport lounges.

By comparison, the RBC ION cards seriously lag behind in terms of welcome bonuses offered, often ranging from 3,500–7,000 Avion Premium points.

However, the ION cards do have minimal annual fees, with the RBC® ION Visa having no annual fee, and the RBC® ION+ Visa charging a fee of only $4 per month.

Credit Card Spending

In addition to earning the welcome bonus, you’re also able to earn Avion points on your day-to-day purchases.

The RBC Avion-branded credit cards come with the following earning rates on daily spending:

RBC® Avion Visa Infinite†

- 1.25 Avion points per dollar spent on all travel purchases (flights, hotels, car rentals, etc.)

- 1 Avion point per dollar spent on all other qualifying purchases

RBC® Avion Visa Platinum†

- 1 Avion point per dollar spent on all qualifying purchases

RBC® Avion Visa Infinite Privilege†

- 1.25 Avion points per dollar spent on all qualifying purchases

RBC® Avion Visa Business

RBC® Avion Visa Infinite† Business

The RBC ION cards, earning Avion Premium points instead of Avion Elite points, have better earning rates than the cards above, despite fetching little to no annual fees.

Although the ION cards earn less valuable Avion Premium points, you can easily transfer the Avion Premium points earned through ION cards to Avion Elite points at a rate of 1:1, if you hold one of the Avion cards listed above.

The two cards through which you can earn Avion Premium points have the following earning rates:

RBC® ION Visa

- 1.5 Avion points per dollar spent on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

RBC® ION+ Visa

- 3 Avion points per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

- 1 Avion point per dollar spent spent on all other qualifying purchases

Avion Rewards

A relatively recent addition to the RBC Avion program is Avion Rewards, which is open for RBC clients and non-clients alike.

Since all points transactions are made under its platform, those with an Avion or ION card product have automatically been registered to Avion Rewards, while those with other RBC products may use their existing RBC credentials to enroll.

Under Avion Rewards, you may benefit from two types of offers: “save & earn” offers, and “shop now” offers.

The former lets you earn Avion points, discounts, and cash back when you use your eligible RBC card at participating online and in-store establishments. Meanwhile, the latter lets you earn cash back on online purchases, akin to the Aeroplan eStore and Rakuten.

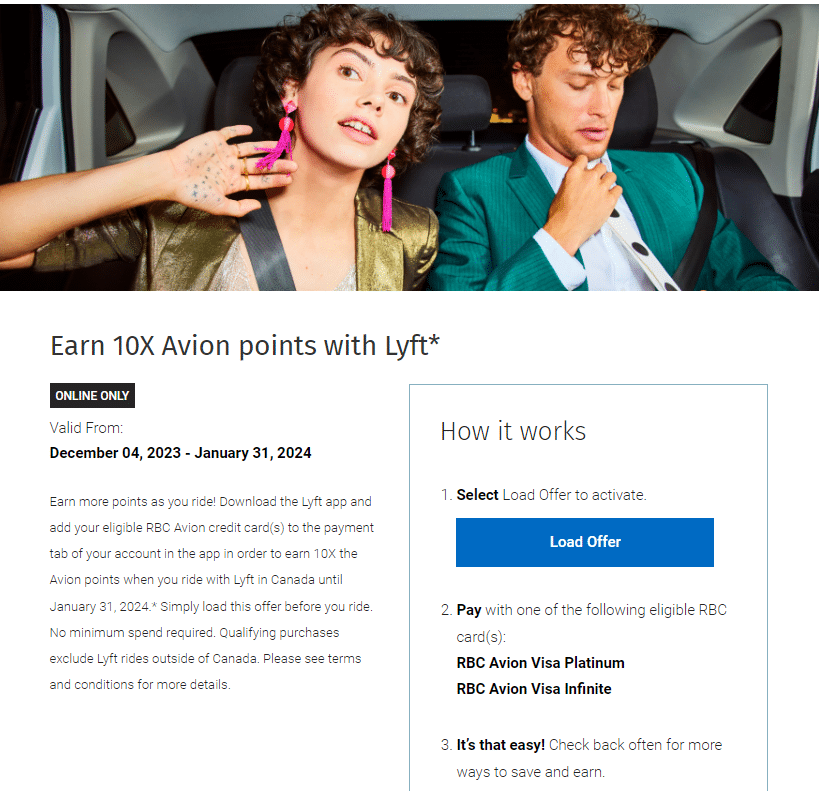

Examples of save & earn Avion points offers are as follows:

- Earn 1,000 Avion points when you spend $300 or more at participating Marriott Bonvoy hotels in Canada

- Earn 10x Avion points on Lyft rides

- Earn 2x Avion points on eligible Apple purchases

For save & earn offers, you must opt into each offer by logging into your Avion Rewards account.

Redeeming RBC Avion Points

The best feature of the RBC Avion program is the flexible nature of Avion points.

Avion Elite points can be transferred to airline loyalty programs, redeemed through RBC’s Air Travel Redemption Schedule , or cashed out through gift cards or statement credits.

Comparatively, Avion Premium points aren’t quite as valuable on their own.

Avion Premium points can only be transferred to WestJet Rewards , or they can be cashed out for statement credits and gift cards. Notably, Avion Premium points cannot be transferred to any other airline loyalty program and can’t be used to book travel through RBC’s Air Travel Redemption Schedule.

Given this, the best use of RBC Avion Premium points is simply to transfer them to RBC Avion Elite points, which you can easily do as long as you have a Avion credit card.

Even if you don’t currently have an Avion credit card, it’s still best to save your Avion Premium points, and make plans to get an Avion credit card in the future.

For this reason, we’ll look exclusively at the redemption options for RBC Avion Elite points.

Transferring to Partner Programs

You can transfer your RBC Avion Elite points at a 1:1 ratio to British Airways Executive Club (Avios) and Cathay Pacific Asia Miles, and to WestJet Rewards at a rate of 1 Avion point = $0.01 in WestJet Dollars (WSD).

You can also transfer Avion Elite points to American Airlines AAdvantage at a rate of 10 Avion points = 7 AAdvantage miles.

British Airways Executive Club is great for short-haul journeys, as well as long-haul trips in economy class.

One amazing sweet spot is transferring British Airways Avios to Qatar Airways Avios at a 1:1 ratio. From there, you can book Qatar Airways QSuites one-way from North America to Doha for only 70,000 Qatar Airways Avios.

It’s also worth noting that RBC regularly offers transfer bonus promotions from Avion to British Airways Executive Club. Historically, the most common promotional offer is a 30% bonus on point transfers.

Lastly, keep in mind that there are a few restrictions on the ability to transfer points to these partners. In particular, for British Airways Avios, American AAdvantage, and Cathay Pacific Asia Miles, you need to transfer a minimum of 10,000 Avion points at a time. However, there is no such restriction for transfers to WestJet Rewards.

RBC Air Travel Redemption Schedule

If you’re not interested in transferring your Avion points to an airline loyalty program, you can still get great value by redeeming points through the RBC Air Travel Redemption Schedule.

While you won’t be able to get outsized value for your points, you’ll still get more value through this avenue than if you redeemed Avion points for a statement credit or for gift cards.

Through the Air Travel Redemption Schedule, you’ll be able to redeem Avion Elite points at a fixed rate for the base fare of any flight booked through the Avion Rewards portal, powered by Expedia.

Each redemption option allows you to use the specified number of points towards a listed maximum base fare.

It’s important to note that you’ll be responsible to pay for any base fare amount that’s over the maximum base fare listed in each category, as well as for the taxes and additional fees.

If you wish to redeem Avion points for the additional costs, you can choose to do so, albeit at the lower redemption rate of 1 cent per Avion point.

When using RBC’s Air Travel Redemption Schedule to book a flight, you’ll get a value of up to 2.3 cents per Avion point, depending on the origin and destination of your trip and the cost of the base fare.

The maximum value of 2.3 cents per Avion point can be found in the “Quick Getaway” category when you redeem 15,000 Avion points for the maximum return-trip base fare of $350.

In all the other categories, the maximum value you’ll be able to extract is 2 cents per Avion point, when booking a round-trip for the maximum base fare amount.

As an example, if you were to redeem 100,000 Avion points for a round-trip flight from Toronto to Lima with a base fare cost of $1,700, you would receive a value of 1.7 cents per point.

Notably, with the Air Travel Redemption Schedule, the number of Avion points required for a redemption in each category doesn’t fluctuate with the cost of the base fare.

Using the above example of the round-trip flight between Toronto and Lima, even if the base fare was only $900, you would still need to redeem 100,000 Avion Elite points.

Based on this, to extract maximum value from your Avion points when using the Air Travel Redemption Schedule, you’ll want to aim to redeem for base fares that are as close to the category’s maximum base fare as possible.

For this reason, the fixed-rate redemption chart can be particularly valuable for bookings during busy times of year, such as holiday seasons, when travel costs are elevated.

This is because the fixed-rate nature of the Air Travel Redemption Chart allows you to book these more expensive dates of travel for the same number of points as a cheaper date of travel (assuming the base fare remains below the maximum threshold for the category).

Travel Credit

Another option for redeeming your Avion Elite points is for fixed-rate travel statement credits through the Avion Rewards platfo.

By booking through this avenue, most cardholders will receive a fixed rate of 1 cent per point, and if you hold the RBC® Avion Visa Infinite Privilege† or the RBC® Avion Visa Infinite† Business , you’ll have access to a fixed rate of 2 cents per point if you’re booking a business class or First Class flight.

When compared to the Air Travel Redemption Schedule , this may seem like a similar or even slightly worse valuation; however, it can actually prove to be better in certain scenarios.

As we mentioned above, when redeeming Avion points through the Air Travel Redemption Schedule, you are required to redeem the set number of points regardless of the cost of the base fare, as long as it’s under the maximum amount.

Looking at the “Explore North America” category from the Air Travel Redemption Schedule, this means that even if the base fare ends up being less than the $750 maximum listed, you’ll still have to pay the full 35,000 Avion points.

Taking a deeper dive, based on the redemption rate of 1 Avion point = 1 cent, the 35,000 Avion points required for this booking is equal to $350.

This means that if you’re looking at redemptions using the Air Travel Redemption Schedule and you find a base fare within this category for less than $350, you’ll be better off booking the flight on your own and then redeeming your Avion points for a travel credit.

Other ways to Redeem Avion Points

Beyond what’s already been mentioned, RBC provides a number of additional options for redeeming Avion points through the Avion Rewards platform. However, these options are not particularly valuable.

For example, you can use points to send e-transfers, pay bills, add to your existing investments, make a mortgage payment, or even pay off your credit card.

For most of these financial redemption options, you’ll get a value of 0.83 cents per point, and if you want to pay your credit card directly, the value is only 0.58 cents per point.

You can access better value than this by redeeming Avion points for gift cards, with some options offering value as high as 1 cent per point (and occasionally higher during promotions), but the best value can still found by transferring Avion Elite points to partner airline loyalty programs.

One additional option is to redeem Avion points for merchandise, but similarly to the other non-travel redemption options, this doesn’t offer nearly as much value for your Avion points.

RBC Avion is an important rewards program that can help unlock some amazing sweet spots through transfers to partnered airline loyalty programs, such as British Airways Executive Club and Cathay Pacific Asia Miles.

Thanks to its unique set of transfer partners, the relative ease of accumulating points via RBC’s Avion- and ION-branded credit cards, and the frequency of transfer promotions, Avion points are extremely useful to collect as a way to supplement the other major Canadian points programs.

19 Comments

Can you tell me how is the Avion Visa Infinite Card better than say.. the RBC British Airways Visa Infinite? RBC Avion Visa Infinite – earn 1.25 points on travel, 1 point everywhere else – transfer points to Cathay/American Airlines/WestJet/British Airway RBC British Airways Visa Infinite -earn 3 points when buying British Airway tickets, 2 points on Dining/Grocery, 1 point everything else

Yes. The Visa Infinite appears to have better flexibility on paper, but since all of those airlines are part of the one-world alliance, you automatically have access to all those airlines anyways, does that “flexibility” even still matter? With the BA card you are very likely to earn much more points? The BA card does cost $45 more annualy, but as it earn more points I think that’s justifiable? not to mention the BA card also gives a free companion voucher every year?

Hi Jon, there a pros and cons to each card mentioned. As you said, one advantage of the Avion family of cards is the ability to transfer to more than one partner program. While British Airways, Cathay Pacific, and American Airlines are all One World airlines, each program has unique sweet spots that can be utilized. There are also occasional transfer bonuses when transferring Avion points to partner programs. You mentioned the British Airways card having a free companion voucher, however this voucher in only awarded after spending $30,000 in a calendar year. An underrated strategy with Avion cards is pairing an RBC ION+ card with an Avion, and taking advantage of the 3x earn rates in popular categories offered by the ION+. An Avion/ION+ combination would have annual feels of $168 ($120 + $48), just about equal to the British Airways Visa Infinite’s $165 annual fee. One other advantage to the Avion/ION+ cards is that you can apply for the Avion Platinum card if you do not meet the $60,000 income threshold of a Visa Infinite product.

I tried Transferring Avion Points to Qatar Airlines and it did not work. Apparently, Qatar Airlines requires to have at least 1000 points balance in order to transfer or purchase additional points 🙁 However, I had a great experience with British Airways – a great value for the tickets!

You can’t transfer directly from RBC Avions to Qatar Avios, only RBC Avions to BA Avios. And if your BA Avios is connected to QR Avios, then you can freely move the Avios between the 2 airlines program

i’ve held the RBC infinite priveledge card for over a year now and finally used it for a redemption at 2cpp (flight for myself & family from Tokyo to Manila this december 2023). I’m so impressed by the discount on the tickets I got via the points redemption that I’m eager to earn more avion points. I wish I could transfer points from my wife’s regular Visa infinite (RBC) avion to mine which gets 2cpp but as far as I can tell this isn’t allowed.

Hi Ricky, Does RBC qualify you back for a welcome bonus if you already received one ?

Generally yes

You never know! 😉

I sometime find booking though airlines is cheaper than using the RBC reward travel orbitz. Does RBC offer price matching?

Can I use my avion points to up grade at the AIRPORT the day of departure.

There’s no easy way to do this. Your best bet would be to bid-upgrade with cash.

can transfer my westjet dollars to avion

Can you redeem Avion points for statement credit.

I’m short 2000 points for a flight . Can you buy points?

Hi, Just wondering if you know when the next RBC avion to westjet dollar promotion is?

I don’t believe this conversion bonus is ever coming back.

Hi Ricky, any idea if there’ll be another transfer bonus to Avios this year?

With it being mid-November already, it’s looking doubtful.

Hi, Can you use RBC Infinite Avion points to redeem PREMIUM Economy class of Air Canada. e.g. 100,000 points from Canada to Middle East. Or does RBC only allow to redeem Economy class?

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

A beginner's guide to travel credit cards

Key takeaways

- Travel reward programs allow you to earn points or miles when you make purchases with certain credit cards.

- Once you hit a specific spending threshold, points can be redeemed for flights, hotel stays, and other travel-related perks.

- The point-to-dollar exchange rate varies widely with each program and could add up to big savings, but program fees could offset the benefits in some cases.

- Rewards cards that aren't tied to a specific company often let you transfer points to a participating travel partner like a hotel or airline.

Using credit to book travel can unlock cheaper, even free ways to see the world if you play your cards right. Travel credit cards also may offer airport lounge access or rewards you can redeem for travel-related perks like hotel or flight upgrades. There's a reason why 41% of Americans already use a travel rewards credit card, according to a 2023 NerdWallet survey. 1 But choosing one can be daunting. Here's how travel rewards work and how to navigate the options.

Feed your brain. Fund your future.

How do travel rewards work?

Travel reward programs function on a simple premise: You earn points or miles by spending on a designated credit card. Depending on the specific card, transactions such as booking flights or hotel stays through partner companies can earn you these points. Some cards even offer points on everyday purchases, like groceries or gas, or for every dollar spent. You could even earn bonus incentives by signing up (these are called introductory offers) or by passing a spending threshold on certain types of purchases.

Once you've accumulated enough points, you can then spend them on benefits within your travel rewards programs, such as flights, hotel stays, upgrades, and more, depending on the program. And these points can add up to some serious savings. Although it's tricky to assign a specific dollar value to points (more on that later), a 2023 survey found that the average travel card holder had a balance of over 50,000 points. 2

If these rewards would act as a coupon for your current spending habits, a travel rewards credit card could be a good financial move if you'd save more than the annual fees and pay off your balance each month. But if one of these credit cards would encourage you to spend more than you would without it, then a travel rewards program may end up costing you more money than it saves.

Travel rewards and credit card features to consider

Every travel rewards program is unique, but here are some common features to consider when trying to score travel rewards with a credit card.

Annual fees

An annual fee is the cost of owning a travel rewards credit card and reaping the benefits that come with it. Not all travel rewards credit cards have annual fees, but those that do can range from less than $50 to more than $500. 3 While these fees may sound like a drawback, they often correlate with enhanced benefits and rewards potentially including lucrative sign-up bonuses, complimentary travel insurance, and airport lounge access, to name a few.

Before committing to a card with an annual fee, it's important to do a cost-benefit analysis first. Weigh the value of the benefits against the annual fee and decide whether the card would save you money, based on your spending habits and travel aspirations. Also, keep an eye out for waived annual fees in the intro period enabling you to test-drive the card's features without an immediate financial commitment. An introductory bonus offer may cover a card's annual fee for one year, for example, which could be a good trial run to see if the card's perks are worth it.

Initial spend/sign-up bonuses

Sign-up bonuses are an incentive to join a credit card travel rewards program. These bonuses typically come in the form of points or miles awarded to your account—commonly in bulk, at one time—after meeting a minimum spending requirement in a specific timeframe. It gives you a head start on accumulating rewards and can help justify an annual fee (if there is one). Like many promotions, rewards for new cardholders can change at any time, so keep in mind that an offer you see today could be different tomorrow.

And while the allure of a boatload of points may seem irresistible, read the fine print so you know up front whether the required spending aligns with your budget and financial habits. Ultimately, sign-up bonuses (and travel rewards in general) are designed to encourage you to spend more on a given card. This gamification of spending may seem exciting, but it can also foster bad financial habits if you aren't careful. A good guideline to help keep spending in check is to never put more on a credit card than what you can pay off when the bill comes. If the card offers a reward for signing up, consider the long-term value beyond that initial bonus.

Cash-conversion rate for points

Once you've narrowed down your travel rewards program options, get a rough estimate of the cash conversion rate for points or miles. Some programs allow you to directly convert your points to cash and pay down your credit card bill, in which case, the point-to-dollar ratio shouldn't be too hard to figure out. But many don't, only allowing you to spend those points or miles to book travel.

The value of your points or their redemption value aren't always a one-for-one exchange. Online calculators are one way to check whether a specific rewards deal is a good one.

Although it varies from card to card, points may have more lucrative redemption values for some rewards over others. For instance, booking travel through the card issuer's portal might mean 100,000 points gets you a $100 flight—but booking that same flight on another platform might cost 150,000 points. If this sounds confusing that's because it is, and each program has its own incredibly nuanced points exchange program. Online communities for travel rewards points could be another resource for decoding the points value for your specific program and getting info about how other travelers have used their points.

Foreign transaction fees

A foreign transaction fee is an extra charge added to transactions that aren't in US dollars. This includes charges on the ground in another country and purchases online from retailers that work in different currencies. Although these fees vary from card to card, they usually range from 1% to 3% of the transaction. 4

If all your travel is domestic or in countries that use US dollars, you won't have to worry about these fees. But if you plan to travel internationally, you might want to look for a card that waives foreign transaction fees. This will ensure that you're not charged extra for that croissant in Paris or for those souvenirs in Tokyo.

General travel vs. specific travel company rewards

Some travel rewards programs are tied to a specific airline or hotel, while others reward you for spending no matter who you book with. If you always book with a specific airline, stay at one brand of hotel, or use a specific rental car company, you could get more value for your points—or earn more points—if you use that company's travel rewards credit card.

Transfer point programs

Many general travel rewards credit cards let you transfer their points to loyalty programs at different hotels and airlines, which you can then redeem for hotel stays and flights. These exchange programs tend to have a higher redemption value than programs offering cash back and, by most estimates, are the best way to maximize the benefits of a travel rewards credit card. Keep in mind that credit card companies have different exchange rates for each hotel and airline partner, so you'll have to determine on a case-by-case basis whether an exchange program is worthwhile for your specific card.

Airport perks

Airport lounge access is a popular perk for travel rewards credit card holders, especially those who travel often. Some programs will also cover the cost of programs that make getting through airport security easier. Consider the annual fees associated with each card and whether these perks would cost less if you paid for them with cash—and without paying for the card.

Consider general cash-back cards

Making the most of a travel rewards program can be a lot of work. Not to mention, travel rewards points can't always be easily redeemed unless you plan to travel. If you're looking for a less fussy and more liquid way to earn rewards for your credit card spending, consider a general cash-back card. Typically, these credit cards give you a percentage of your total spending back in cash without having to calculate exchange rates or redemption values.

One to consider: the Fidelity® Rewards Visa Signature® Credit Card, which can earn you unlimited 2% cash back on everyday spending. 5 That cash back can be deposited into any eligible Fidelity account, 6 giving your money more chances to grow.

Spend and earn at the same time

Spending on your Fidelity ® Rewards Visa Signature ® Card can put money in your Fidelity account.

More to explore

How to save money on travel, 10 credit card security tips, subscribe to fidelity smart money ℠, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. 1. erin el issa, "how the 41% of americans with a travel credit card can boost rewards," nerdwallet, march 28, 2023. 2. erin el issa, "how the 41% of americans with a travel credit card can boost rewards." 3. beverly harzog, "best travel rewards credit cards of 2024," u.s. news and world report, april 9, 2024. 4. lyle daly, "what happens if a credit card's sign-up bonus increases after you get the card," the accent: motely fool, november 14, 2024 5. you will earn 2 points per dollar in eligible net purchases (net purchases are purchases minus credits and returns) that you charge. account must be open and in good standing to earn and redeem rewards and benefits. upon approval, refer to your program rules for additional information. subject to applicable law, you may not redeem reward points, and you will immediately lose all of your reward points, if your account is closed to future transactions (including, but not limited to, due to program misuse, failure to pay, bankruptcy, or death). reward points will not expire as long as your account remains open. certain transactions are not eligible for reward points, including advances (as defined in the agreement, including wire transfers, travelers checks, money orders, foreign cash transactions, betting transactions, lottery tickets and atm disbursements), convenience checks, balance transfers, unauthorized or fraudulent charges, overdraft advances, interest charges, fees, credit insurance charges, transactions to fund certain prepaid card products, u.s. mint purchases, or transactions to purchase cash convertible items. the 2% cash back rewards value applies only to points redeemed for a deposit into an eligible fidelity ® account. the redemption value is different if you choose to redeem your points for other rewards such as travel options, merchandise, gift cards, and/or statement credit. other restrictions apply. full details appear in the program rules new card customers receive with their card. establishment or ownership of a fidelity ® account or other relationship with fidelity investments ® is not required to obtain a card or to be eligible to use points to obtain any rewards offered under the program other than fidelity rewards. 6. eligible accounts include most nonretirement registrations as well as traditional ira, roth ira, rollover ira, sep ira, fidelity charitable ® giving account ® , fidelity hsa ® , and fidelity ® -managed 529 college savings plan accounts. the ability to contribute to an ira or 529 college savings plan account is subject to irs rules and specific program policies, including those on eligibility and annual and maximum contribution limits. full details appear in the program guidelines new card customers receive with their card. contributions to fidelity charitable ® are generally eligible for a federal income tax charitable deduction. please consult with your tax advisor. the list of eligible registration types may change without notice at fidelity’s sole discretion. for more information about whether a particular registration is eligible, please call 1-800-fidelity (800-343-3548). the third parties mentioned herein and fidelity investments are independent entities and are not legally affiliated. the views expressed are as of the date indicated and may change based on market or other conditions. unless otherwise noted, the opinions provided are those of the speaker or author, as applicable, and not necessarily those of fidelity investments. the third-party contributors are not employed by fidelity but are compensated for their services. the fidelity investments and pyramid design logo is a registered service mark of fmr llc. the third-party trademarks and service marks appearing herein are the property of their respective owners. fidelity brokerage services llc, member nyse, sipc , 900 salem street, smithfield, ri 02917 © 2024 fmr llc. all rights reserved. 1141513.1.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

IMAGES

COMMENTS

Avion Rewards is a loyalty program that lets you redeem points for travel on any airline, with exclusive pricing and benefits for Avion Elite members. You can also convert points to other programs, or use them for car rentals, packages and things to do.

Join Avion Rewards and enjoy the benefits of redeeming your points for travel, shopping, cash back and more. Sign in now to start.

Find out how to manage, change or cancel your Avion Rewards Travel bookings, use airline credits, and access travel insurance. Learn about the latest changes and policies for CWT Vacations, RBC Avion Visa, and RBC COVID-19 support.

Avion Elite members can travel more for less. Avion Elite members can use fixed points pricing to book deals to top destinations - any airline, any flight, any time. Explore travel. Do it all with points in the Avion Rewards app. The Avion Rewards app lets you access your account quickly and easily. Use your points for gift cards, merchandise ...

Avion Rewards is Canada's largest bank-owned loyalty program that offers cash back, points and savings on purchases. Join for free and access exclusive travel, merchandise, gift card and charity options with your points.

RBC Avion Visa Infinite Privilege - A Luxury Travel Credit Card. Get 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months 1. Apply by April 30, 2024. Get 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months 1.

The Avion Rewards app is the easiest way to manage your activity and the best way to ensure you don't leave points and savings behind. Explore and load offers, redeem points, shop the web, get cash back deals and more. Download the app.

Do it all with points in the Avion Rewards app. The Avion Rewards app lets you access your account quickly and easily. Use your points for bill payments, credit card payments, Interac e-transfers and more. Shop, earn, save and redeem - all in the app. Scan to download. Scan to download.

Earn Avion Rewards points on debit and credit purchases. Redeem them for flights, hotels, tech, financial rewards, and much more.

How to Book an Airline Ticket with RBC Avion Rewards Points. With 35,000 Avion points, I could afford a plane ticket to Canada or the United States. From your RBC Online Banking profile, click on the blue Avion Rewards button. Then, on the Trips page, click on Book a Trip. Avion Rewards acts like a travel agency.

Get 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months 1. Apply by April 30, 2024. Earn 1 Avion point for every dollar you spend 2. Choose any airline, any flight, any time. There are no blackout dates or advance booking restrictions, even during peak periods.

within 12 months after the termination of the Avion Rewards program or after you voluntarily close your RBC Royal Bank credit card account. 2 You will earn 1.25 Avion points for every dollar spent when you use your RBC Avion Visa Infinite card to pay for travel-related purchases made at merchants classified by Visa's "Merchant Category Code ...

One way to use your Avion points for travel is with the purchase of an airline ticket. This is the best way to get the most value out of the RBC Avion Rewards program.This is described in detail in this article.. Depending on the destination, 15,000 to 100,000 Avion points are required per ticket. RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket.

Avion Rewards members who are eligible to redeem for travel have the flexibility to book any flight on any airline at any time. MANAGE YOUR POINTS Combine your points across your Avion Rewards accounts and use them where you need them most. Get the flexibility you need when you convert your Avion points to another loyalty program.

Access to Avion Rewards Travel. Avion Rewards is one of the largest travel platforms in Canada and members benefit from the program's market-leading "any airline, any flight, any time" travel ...

There are subtypes of Avion points: Avion Select, Avion Premium, and Avion Elite. Avion Elite is the highest Avion Rewards tier, and has the most redemption flexibility. Both Avion Elite and Avion Premium points are earned through RBC credit cards, and can be transferred from one account to the other, if you hold a credit card that earns Avion ...

Romana King. You can redeem Avion points for travel, items, gift cards and more. Here's how it works: Sign in to Avion Rewards to book flights and other travel-related rewards such as hotels, cruises, car rentals and vacation packages. It's easy to book your travel on this site in the same way you would on a regular travel site.

Explore travel. Pay with points. Use your points 2 to shop Apple, Best Buy, gift cards, home decor, sports gear and more. Browse now. Do more with points. From bills to investments to charitable giving, use your points 2 for what matters most. ... Avion Rewards ShopPlus is available for desktop and mobile iOS users - and it's free! ...

Rewards: Earn 1 Avion point for every dollar you spend, plus 25% more points on travel-related purchases. Interest rates: 20.99% on purchases and 22.99% on cash advances. Minimum income requirement: A minimum annual personal income of $60,000 or household income of $100,000.

Since I travel often, I'm a big fan of using credit cards to earn rewards. For some travelers, an airline credit card is the best option. For some travelers, an airline credit card is the best option.

Travel credit cards also may offer airport lounge access or rewards you can redeem for travel-related perks like hotel or flight upgrades. There's a reason why 41% of Americans already use a travel rewards credit card, according to a 2023 NerdWallet survey. 1 But choosing one can be daunting.

The US Food and Drug Administration said Tuesday that it had detected viral particles of H5N1 avian influenza in milk purchased at grocery stores, but the agency says it still believes that the ...