Expedia Rewards is now One Key™

Vacation payment plans - book now, pay later.

- Things to do

I only need accommodations for part of my trip

Better together

Save up to $580 when you book a flight and hotel together*

Find the right fit

With over 300,000 hotels worldwide, it's easy to create a perfect package

Plan, book, and manage your trip all in one place

Vacation payment plans

Jet off on your dream 2024 getaway with vacation payment plans by Expedia Affirm. From relaxing beach escapes to European city breaks, your next adventure is more affordable than you think thanks to Expedia’s book now, pay later vacations. Instead of paying the entire trip cost up front, pay-later travel deal lets you make monthly payments towards your adventure whether it’s in 2024 or 2025. Expedia Affirm gives you the option to spread the cost over 3, 6, or 12 months, with no hidden fees. This means you can bag the best travel deals with monthly vacation payment plans.

Wondering where to take your kids for a summer break in the sun? Choose from a vast array of family vacation packages with payment plans. Your kids could soon be swimming with dolphins in Cancun or riding rollercoasters in Florida’s theme parks. If it’s a romantic retreat you’re seeking, whisk your partner away to an adults-only resort by the beach. You’ll encounter a plethora of all-inclusive vacations with payment plans to hot destinations, including the Caribbean and the Maldives. Play around with the easy-to-use search wizard to view a wide range of book now, pay later vacations. Simply select “Monthly payments” at checkout to book your pay-later travel deal.

Worried your 2024 plans may change? No problem. Expedia Affirm lets you cancel or modify your booking at no extra cost. You’ll encounter epic vacation payment plans with flexible booking conditions for a vast array of accommodation, car rental, and travel packages. Read on for ideas and inspiration, with everything from romantic weekend getaways to all-inclusive vacations with payment plans.

Book now, pay later vacations

1. choose your dream expedia vacation.

Take your pick from hundreds of book now, pay later vacation packages. Need inspiration for 2024? Scroll down and you’ll encounter plenty of ideas for relaxing vacations with payment plans, including short getaways and international adventures. If you’ve got somewhere in mind, tap your dates and destination into the search wizard to compare the best pay-later travel deals.

2. Select the plan that works for you

Ready to snatch up one of Expedia’s book now, pay later vacations? Then click “Monthly payments” at checkout, “Continue to Affirm”, and enter a few pieces of information. It’ll give you an instant, real-time decision and display the vacation payment plans available. Pick the one that suits you best and you’re all set – your dream escape is booked.

3. Make simple and easy payments

Once you’ve reserved one of Expedia’s book now, pay later vacation packages, create your account to set up monthly payments. You can do so through the Affirm website or by downloading the app. Whichever option you choose, you can set up automatic payments in a few quick and easy steps.

Why book now, pay later with Expedia?

Whether it’s catching a tan in the Caribbean or soaking up the culture in Europe, you can now jet off on the adventure you’ve been dreaming of for years. With a vast array of destinations and vacation types available, Expedia Affirm makes travel more affordable than ever. Here are just some of the benefits of booking Expedia’s buy now, pay later vacations.

waiting until pay day to score the best discounts.

Frequently asked questions about payment plans to book now, pay later on Expedia

Can i pay monthly for my vacation with expedia.

Yes, you can pay monthly for your vacation with Expedia Affirm vacation payment plans. Simply choose your dream travel package and select “Monthly payments” at checkout. You’ll have the option to spread the cost over 3, 6, or 12 months, giving you financial flexibility when planning your dream getaway. These pay-later travel deals include all-inclusive escapes, family breaks, weekend getaways, and more. Thanks to Expedia’s vacation payment plans, you can now jet off on the adventure you’ve been dreaming of for years.

How to use Affirm on Expedia and where can I find this payment option?

To take advantage of Affirm’s vacation payment plans, choose your travel package and select “Monthly payments” at checkout. Click “Continue to Affirm”, enter your details, and you’ll get an instant, real-time decision. It’ll then display the final cost for spreading the cost over 3, 6, or 12 months. Choose the plan that’s right for you and you’re all set. You can then log in to Affirm or download the app to set up automatic payments.

How do I use Afterpay on Expedia?

Affirm is Expedia’s trusted partner for pay-later travel. Book with Expedia Affirm to spread the cost over 3, 6, or 12 monthly payments with simple interest and no hidden fees. You can even set up automatic payments on Affirm’s website or through the app. Expedia’s vacation payment plans are available on a vast array of packages, accommodation, and car rentals.

Is there a credit check when paying with a payment plan?

Yes, there is a credit check to see if you qualify for Expedia Affirm’s vacation payment plans. The good news is this pre-check will have no impact on your credit score. It’s quick and easy to perform, and you’ll get a real-time decision instantly. All you need to do is enter a few brief details to do the check.

Can I book all-inclusive vacations with payment plans?

With Expedia Affirm, you can book a vast array of all-inclusive vacations with payment plans. Choose to split the total cost of your escape into 3, 6, or 12 monthly installments. If you’re open to ideas and need inspiration, check out Expedia’s all-inclusive vacation packages to view some of the most popular deals. If you know where you’d like to jet off to, tap your dates and destination into the search wizard. Select the “All-inclusive” filter under “Meal plans available” to view hundreds of the best vacations with payment installments. Whether you’re craving white-sand beaches in the Bahamas or the tropical shores of Hawaii, your next getaway is more affordable than you think.

Can I book family vacation packages with payment plans?

You can book a wide range of family vacation packages with payment plans thanks to Expedia Affirm. Once you’ve found your perfect 2024 escape, click the “Monthly payment” tab at checkout and follow the quick and easy steps. You’ll have the option to pay in 3, 6, or 12 monthly installments with simple interest and no hidden fees. Take a peek at Expedia’s family vacations for ideas and inspiration. If you’ve got somewhere in mind already, enter your dates and destination into the search wizard to view hundreds of the best pay-later travel deals. From Florida’s exhilarating theme parks to the Dominican Republic’s fun-filled kid-friendly resorts, your family adventure is just a few clicks away.

What are the benefits of vacation payment plans?

Expedia’s book now, pay later vacations mean you can jet off on the dream trip you wouldn’t otherwise be able to afford in 2024. From romantic sunsets on Jamaica’s beaches to the elegant streets of Paris, the world is more accessible with Expedia Affirm. You’ll have the option to pay in 3, 6, or 12 monthly installments, and you’ll see the total cost up front. There are no hidden fees or late payment fees either, so you can rest assured that what you see is what you pay. Automatic payments are easy to set up and make for a hassle-free booking. Many of Expedia’s vacation packages even allow you to modify or cancel your trip at no extra cost, giving you peace of mind in case your 2024 plans change. As you no longer have to pay up front, you can nab the best travel deals before they’re gone – no need to save up or wait until payday.

How can I find great deals on vacation packages with payment plans?

If you’re keen to score the best deals on book now, pay later vacations in 2024, it’s a good idea to be flexible with your dates. You may find cheaper vacations on different days. For travel during peak season dates, be sure to book early to nab the best prices and your first choice of hotels – accommodation can fill up during busier months. If you plan to get away in low season, you may score a great deal for a last-minute escape. Another way to score great travel discounts is to take advantage of special offers, discounts, and promotions.

Are there any additional fees or interest charges for pay monthly vacations?

You’ll be pleased to know there are no hidden fees with Expedia Affirm’s monthly payment vacation plans. What you see is what you’ll pay. Before you confirm, you’ll be able to view the total cost of your book now, pay later vacation package. While most credit cards charge compound interest that’s complicated to work out, with Affirm you’ll pay simple interest on your monthly installments. Best of all, there are no late payment fees or just-because fees. Expedia Affirm’s simple and transparent pricing make booking your dream 2024 escape a breeze.

Save with our bundle deals!

Car, Stay, Flight... book everything you need for your perfect weekend getaway with Expedia and save!

Vacation rental

Apartments, Villas, Cabins... we have everything you need!

Car Rentals

Hit the road with one of our car rental deals

Explore other types of vacation packages

All Inclusive Vacations

Beach Vacations

Kid Friendly Vacations

Golf Vacations

Luxury Vacations

Romantic Vacations

Ski Vacations

Adventure Vacations

Gay & Lesbian Vacations

Where to go when

- More Vacation Ideas

- Getaway Ideas

- Vacation Deals & Tips

- Top Vacation Destinations

- Best Travel Destinations by Month

- New Year's vacation deals

- Christmas vacation deals

- Spring travel deals

- Spring break vacation deals

- National Park Vacation Deals

- Northern Lights Vacations

- Memorial Day Weekend Getaways

- Fourth of July Weekend Getaways

- Labor Day Weekend Getaways

- MLK Day Weekend Getaways

- Thanksgiving Getaways

- Weekend Getaways

- 1 Day Getaways

- 2 Day Getaways

- 3 Day Getaways

- 4 Day Getaways

- 5 Day Getaways

- 6 Day Getaways

- One Week Getaways

- 8 Day Getaways

- Las Vegas Getaway

- Vacation Rental Deals

- Vacations under $1000

- Vacations under $500

- Last Minute Vacation Deals

- Last Minute Hotel Deals

- Travel Deals + Vacation Ideas

- Plan a vacation

- Deposit and Vacation Payment Plans

- London Vacations

- Paris Vacations

- Cabo San Lucas Vacations

- Playa Del Carmen Vacations

- New York Vacations

- New Orleans Vacations

- Punta Cana Vacations

- Montego Bay Vacations

- Puerto Vallarta Vacations

- Honolulu Vacations

- Orlando Vacations

- Miami Vacations

- Cancun Vacations

- Los Angeles Vacations

- Fort Lauderdale Vacations

- January Vacations

- February Vacations

- March Vacations

- April Vacations

- May Vacations

- June Vacations

- July Vacations

- August Vacations

- September Vacations

- October Vacations

- November Vacations

- December Vacations

Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

$250 down, pay later

Reserve your vacation for as little as $250 down.

United Vacations allows you to reserve your vacation from just $250 per person and pay the rest later. United Vacations offers you the flexibility to apply multiple payments over time, or even pay using multiple credit cards. The final payment is due at least 45 days prior to departure. The amount of your deposit includes a portion of your flights, your hotel stay and the full cost of any vacation add-ons, such as show tickets, excursions or travel protection.

How do I put as little as $250 down and pay later?

If you are booking your vacation more than six weeks in advance, the deposit option will appear during the booking process on step three of checkout. At this point, you can even schedule automatic final payments or set up email reminders. The actual deposit amount required varies based on the destination and hotel accommodations selected.

Scheduling automatic final payment

Select a final payment date more than 45 days before your departure date and your credit card will automatically be charged on that date. If you've entered multiple credit cards for your initial deposit, select the corresponding number in the Payment # field (a "1" in this box will charge the first credit card listed, a "2" will charge the second credit card listed, and so on).

Scheduling an email reminder

It's easy to set up an email reminder that will notify you when payment is due on your vacation. This makes it especially easy when you are making multiple payments toward the full vacation price. Just follow the instructions during step three of checkout to schedule your email reminder.

The actual deposit amount required varies based on the destination and hotel accommodations selected. Destinations outside of North America require a $350 per person deposit. Some special holiday/convention periods (or other exceptions) may apply where full payment is required at time of booking. Vacation cancellations/revisions are subject to penalties outlined in the Terms and Conditions . If you prefer, you may pay for some or your entire final vacation amount due before the final payment date (you can do this either by logging in to the account you created at time of booking or by calling us at the phone number above).

Have questions?

Call us at 1-888-854-3899 . You can also find answers to most of your questions by reviewing our Frequently Asked Questions .

The 10 Best Payment Plans for Vacations

Vacations are a time to have fun, sit back, and relax. It’s a great way to let off steam that comes with the monotony of life. The only possible drawback I can think of? The meticulous planning and finances.

The good thing is, there’s an alternative. The “Book Now Pay Later” vacation payment plans option is increasingly becoming popular and for good reason!

Imagine this scenario: You need a vacation badly. You’re burnt out from working and the distinction between your work and private life has disappeared, but you don’t have enough in savings to fund your vacay. Should you wave that badly needed vacation goodbye?

Not quite. This is where payment plans come into play. Payment plan offers range from interest-free policies to low down payments and easy monthly installments.

Even if you can’t afford a vacation right now, you can still take the leap. Your dream of exploring the City of Light? Vacationing in the Maldives? Payment plans put them all within reach.

The benefits of using payment plans for vacation packages abound. With so many options in the tour and travel market, it can get a little overwhelming. Don’t fear, this article has you covered.

Top Vacation Payment Plans

1. expedia .

With their Uplift payment program , you can book a trip today and set easy monthly instalments that fit your budget. You don’t have to pay an arm and a leg every month. These monthly payments can be tailored to your budget allowing you to travel before your loan is paid off in its entirety. Southwest are a particularly good choice if you are looking for all-inclusive vacations with hundreds of resorts to choose from.

- They have customizable monthly payments.

- They offer an easy application process.

- There are no charges in the monthly payments, no late fees, and no prepayment penalties.

- Large range of all-inclusive vacations and resorts (including Mexico and Caribbean)

- Canceled flights are refunded as Southwest Airlines air credit which can be limiting.

- Canceled land travel, tours, and accommodations are refunded in the form of travel credit from Southwest Vacations.

3. Funjet (Best for All-Inclusive Packages)

Funjet has a great payment plan if you want to travel and save money at the same time. With a simple downpayment, you can secure the best deals at great rates.

You’ll have to make your vacation reservation six weeks in advance with deposit options available at checkout. You can schedule a final payment or make multiple payments at zero interest.

- Cancel any time for any reason. There are no pesky rebooking fees.

- Reserve a vacation for as little as $50.

- Reservations are subject to change.

- Deposit options are not available if you’re traveling during a holiday.

4. Luxury Escapes

Luxury Escapes’ Latitude Financing Payment plan offers a 12-month interest-free period. You’ll pay monthly installments, but after the 12-month promotional period, you’ll be charged a pretty hefty 24.99% interest rate.

Luxury Escapes offers flexible booking dates. That means you can book a limited-time deal for a certain property now and rebook it for a different date later.

- They have a seven-day refund guarantee.

- There are no hidden costs.

- If your preferred date is unavailable, you can’t get a refund. Make sure to read the terms and conditions carefully.

5. Contiki

A small layaway deposit of $99 will lock in your travel dates. Contiki accepts Visa, Mastercard, and American Express. They can accommodate all types of installment plans : weekly, monthly, two payments of 50% each – you name it, you got it. You just have to make the entire payment 45 days before departure. That’s it.

- There are no interest charges and no fees.

- They offer flexible payment plans.

- The Freedom Guarantee ensures you can reschedule travel dates, swap the tour type, or choose a different region to travel in altogether. You can avoid cancellation fees with this feature.

- Cancellation fees as high as 50% if cancellation is done within one to seven days before departure and 100% if done on the day of departure.

6. United Vacations (Best for Layaway Vacation Packages)

With United Vacations, you can finance your trip through Uplift . United have a layaway vacation option which allows you to lay down an initial $250 deposit and pay the rest at least 45 days before the departure date. The best part? You can use multiple credit cards to fund your trip.

- If you get the vacation protection package, you won’t have to deal with cancellation fees. You have the flexibility to change or cancel the plan as needed.

- You can book your entire trip through United Vacations from hotels, flights, car rentals to resorts, airport transfers, and excursion experiences.

- Airfare is non-refundable. If your flight was canceled, they’ll give you credit you can use within a year as long as your tickets were booked through American Airlines. If not, policies vary from carrier to carrier.

7. JetBlue Vacations

JetBlue’s annual percentage rate ranges from a huge 10.99% to 25.99% for a loan term of 12 to 18 months. Their partnership with MarcusPay enables them to offer top-tier package getaways.

If you want lower rates and longer terms, you’ll need to have excellent credit scores. Additionally, rates are generally higher for longer-term loans.

- They don’t require a deposit upfront.

- If you find the same package for a cheaper price within 24 hours of booking, they’ll match it and refund the difference.

- JetBlue Vacation charges a $200 cancellation fee per person plus additional penalties charged by the hotels.

8. G Adventures

Deposits for layaway vacations start at $250. If you’re unsure about a specific tour but don’t want to let the opportunity pass you by, they have a “holding an option” tool that lets you reserve a spot for 48 hours without paying a pretty penny.

The best part? If you ever have to cancel a trip, change it, or push it back, you’re not forced to use it within a year or two. It’s good for life. You can pay the full balance close to your departure date.

- They have small groups per trip. This helps you form a closer connection to the places and people you visit on your travels.

- They offer lifetime deposits.

- “Optional” activities cost you an additional fee if you decide to purchase. If you don’t want to factor in any additional costs to your budget, you can pass on these.

- Depending on the trip, guides can be a hit or miss.

9. Intrepid Travel

Intrepid Travel provides exemplary flexibility in changing travel plans. There are no change fees as long as you notify them about the changes at least 21 days in advance. You have the flexibility to choose an entirely new trip or pick new travel dates.

You only need to secure your trip with a deposit and you can pay the rest in installments whenever you like. Just make sure you’ve paid for the trip in full at least 21 days before you’re scheduled to depart.

- There are no interest and rebooking fees.

- You can hold your trip for up to 5 days without paying a deposit.

- If you’re traveling solo, you’ll have to pay a mandatory single supplement fee for certain trip types.

10. Priceline

Priceline.com comes through with terrific ways to save on travel. As long as you know how to look for deals, you’ll hit pay dirt.

Check out Priceline’s Express Deal which can save you anywhere between 10% to 40% off flights. The catch? You don’t know what time your flights will depart. It can be a red-eye for all you know.

- Priceline offers significantly lower prices.

- You can place bids for a lower price. If you get it, it’s a win. If you don’t, you lose nothing.

- Once the fee is charged, you don’t get a refund if you change your mind.

- You can’t reserve a room for more than 2 people.

Most popular destinations for vacation payment plans

If you are looking for inspiration for your next vacation then we’ve chosen 5 of the most popular destinations which are available to finance with installments.

Bonus Trip – Disney World Payment Plan

If you’re looking for family vacation payment plans then one of the best is the Disney World payment plan , we’ve written about it before and it’s a great choice if you have kids. Family vacations can be expensive and instalments are a great way to spread the cost. With Disney you can book your vacation and choose how often you want to pay. The payment plans are extremely flexible allowing you to look forward to your next family vacation without the stress of a huge amount leaving your bank account.

Wrapping It All Up

Payment plans for vacations are probably the best thing for people who don’t mind taking a chance and are flexible in their travel itineraries. With plans offering 0% interest rates and easy installments, who wouldn’t want to travel the world?

Before you settle on a payment plan, read the fine print. There are multiple “book now, pay later” options available on the market, but some have better deals than others. Always explore your options and take your time in making a decision. Most, if not all travel plans, are non-refundable. Click wisely.

Can you use Afterpay for vacations?

Yes. You can currently use Afterypay for hotels and accommodations via the website Agoda.com. Agoda is a reputable travel company and is part of the Priceline group.

Can you use Affirm for travel?

Yes. There are multiple travel companies which accept Affirm at checkout. These companies currently include Expedia, Priceline, Delta Vacations and CheapOair.

Can you finance vacations with Klarna?

Yes. It is possible to book vacations with Klarna using their ‘Pay in 4’ option which allows you to split your vacation payments into 4 payments using the Klarna app.

Related Posts

Can you buy a gift card with Afterpay?

Pay later apps like Klarna

Buy Now Pay Later Gift Cards

Pay Monthly Cruises

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Vacation deposit and payment plans.

- Things to do

I only need accommodations for part of my trip

What are the benefits of vacation payment plans?

Paying for your vacation in instalments can help you spread the costs and also gives you the option to plan a vacation you wouldn’t otherwise be able to afford. By booking in advance and choosing a trip payment plan you’ll give yourself plenty of time to pay for the vacation of your dreams. It can also come in handy when paying for a group booking, giving you extra time to round up money from other members of your party.

Can I book now and pay later with Expedia?

With Expedia you can filter your vacation search results by payment type, to see what options are on offer. If you know you need to spread the costs, go straight to our latest book now, pay later deals . With this option you can reserve your accommodation ahead of time, and cancel or modify your booking with no extra fees, should your plans change.

How can I find great deals on vacation packages?

To grab the best deal on your next vacation, book your accommodation, flight, and car rental as an Expedia bundle . Search the latest deals to see what’s on offer and then choose to pay monthly for your vacation on checkout.

Does Expedia have a flexible cancellation policy?

Find free cancellation and pay later options by filtering your search results by payment type, so you can rest assured that your vacation is fully flexible. Cancellation policies differ between vacation packages, so it’s always best to check at the time of booking.

Why should I book a vacation payment plan with Expedia?

At Expedia we give you easy access to a huge selection of the best vacation packages. You can then use our advanced filter options to build your ideal vacation and book it in just a few clicks. With access to loads of book now, pay later deals, as well as vacations with payment instalments , we can help you secure the vacation of your dreams.

Save with our bundle deals!

Car, Stay, Flight... book everything you need for your perfect weekend getaway with Expedia and save!

Vacation rental

Apartments, Villas, Cabins... we have everything you need!

Car Rentals

Hit the road with one of our car rental deals

Explore other types of vacation packages

We'll Be Right Back!

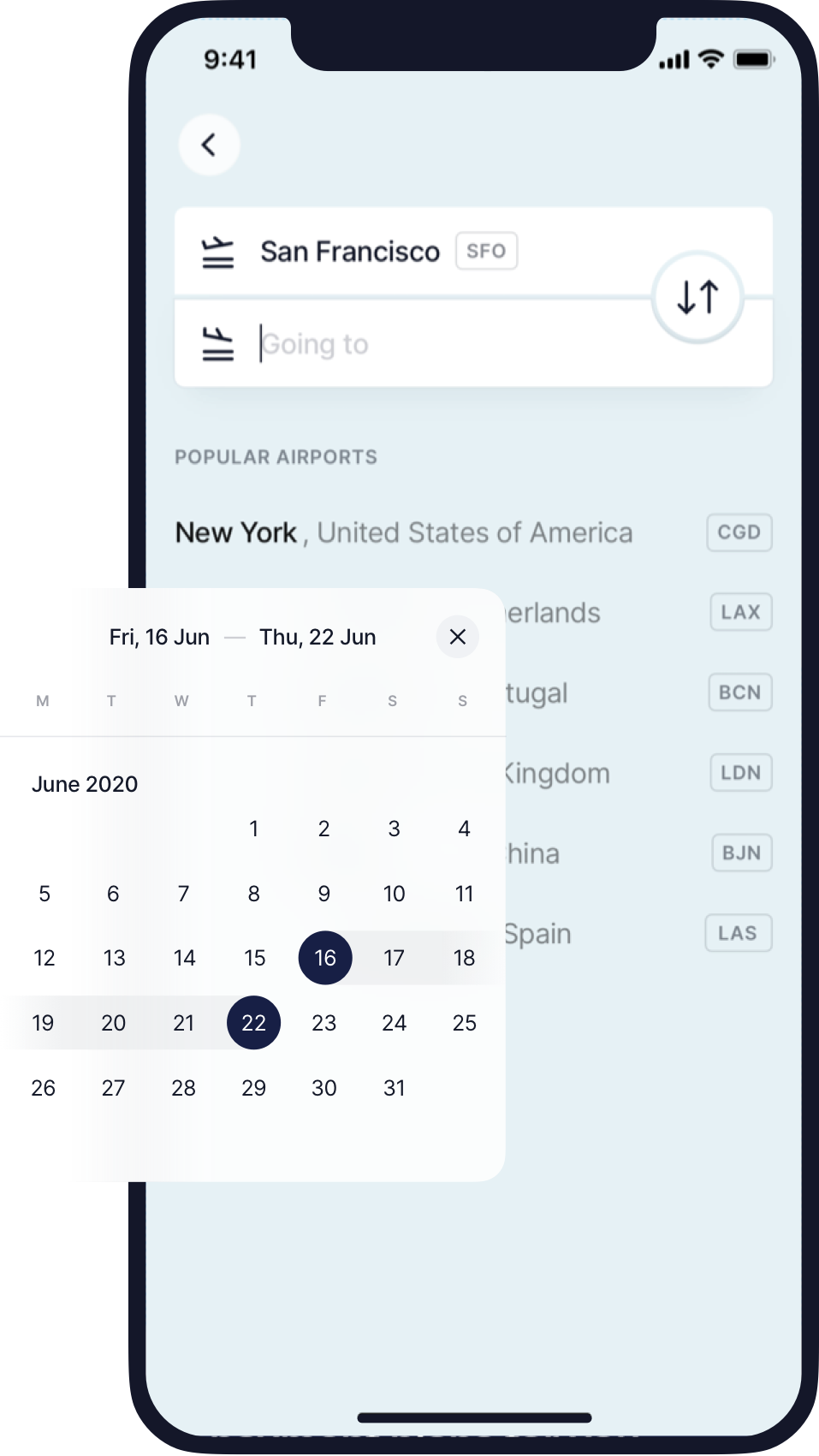

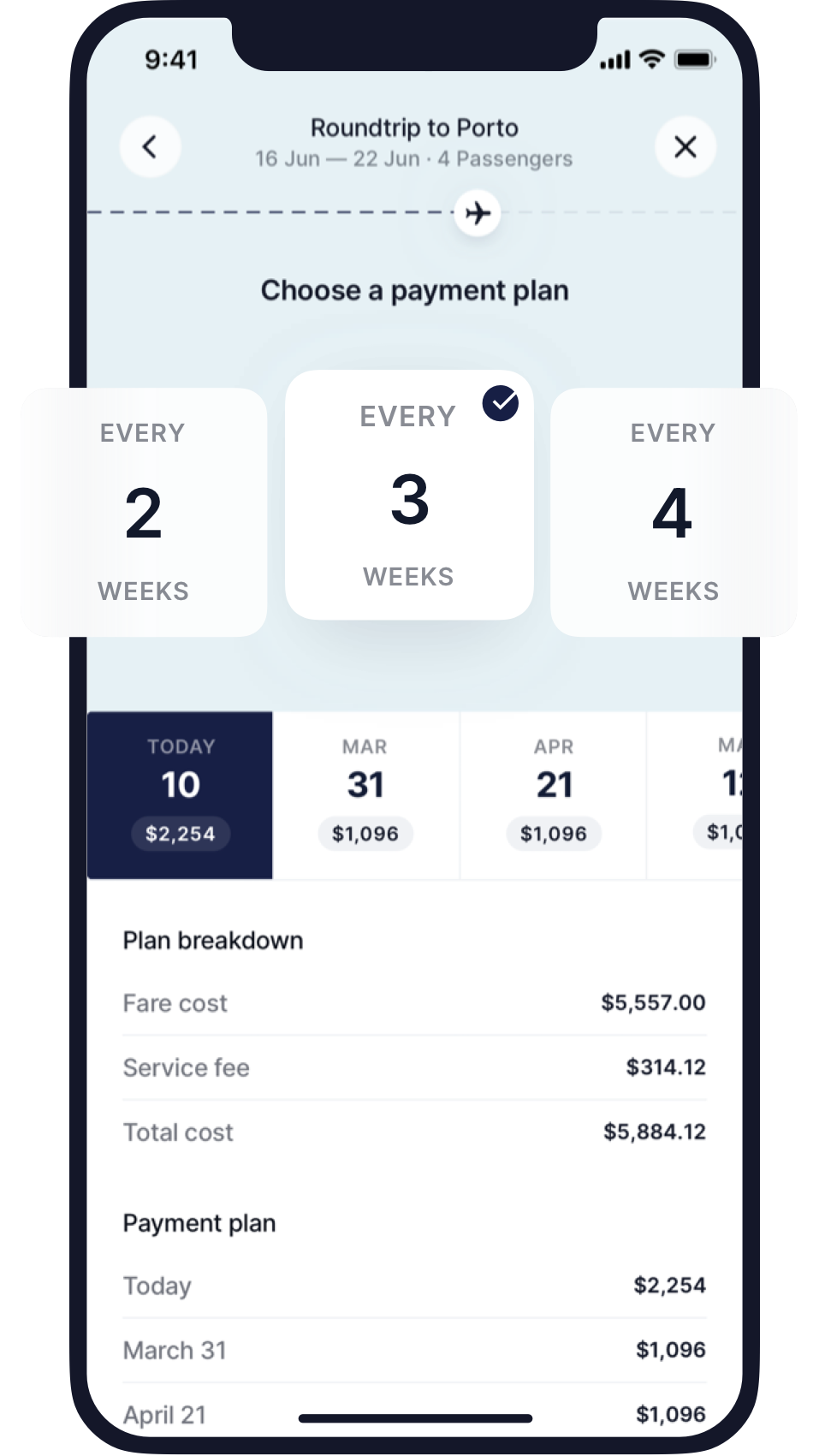

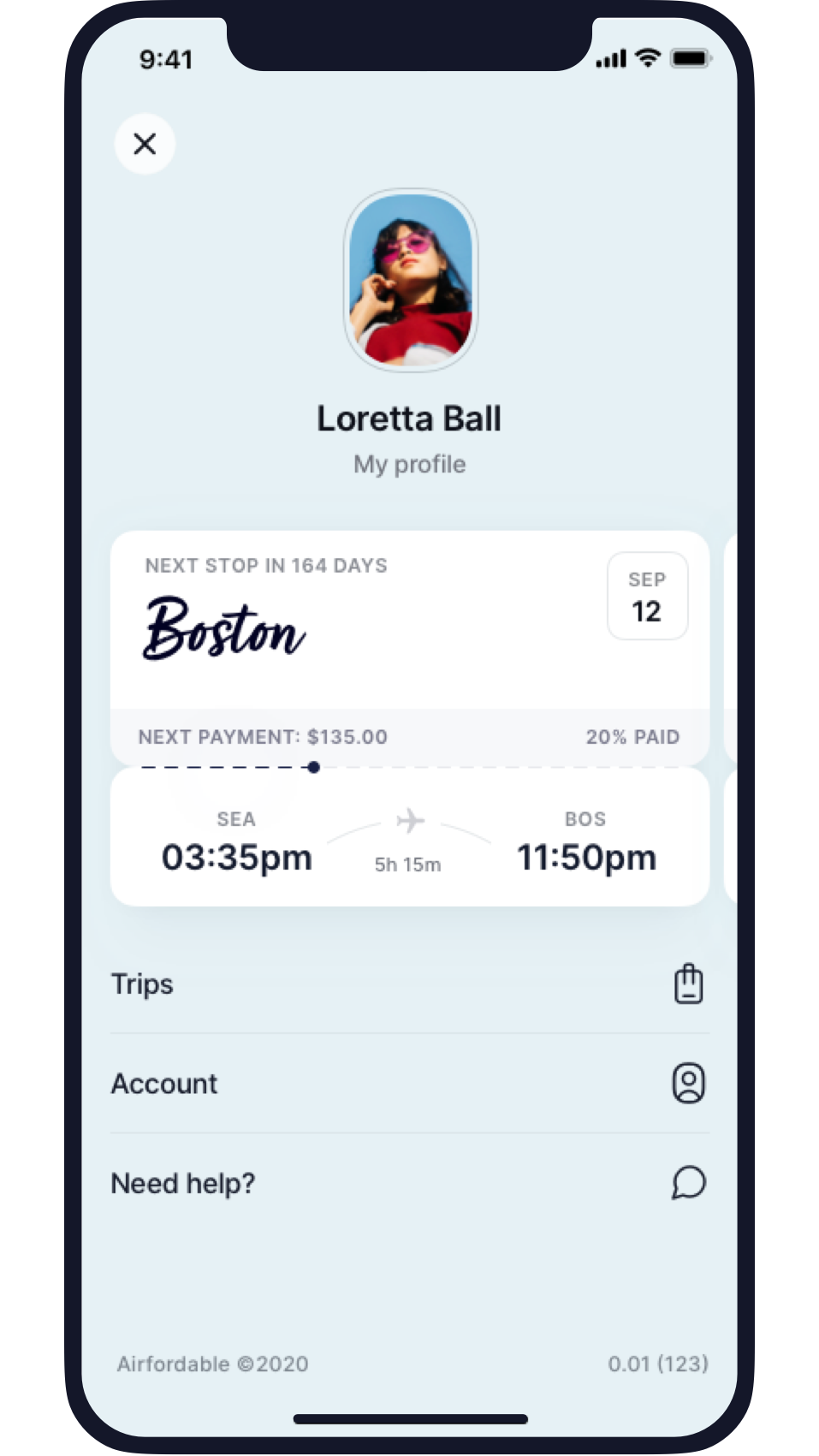

NEW: Book your hotel with Airfordable! 🏨 Download our app to get started now.

Get Started!

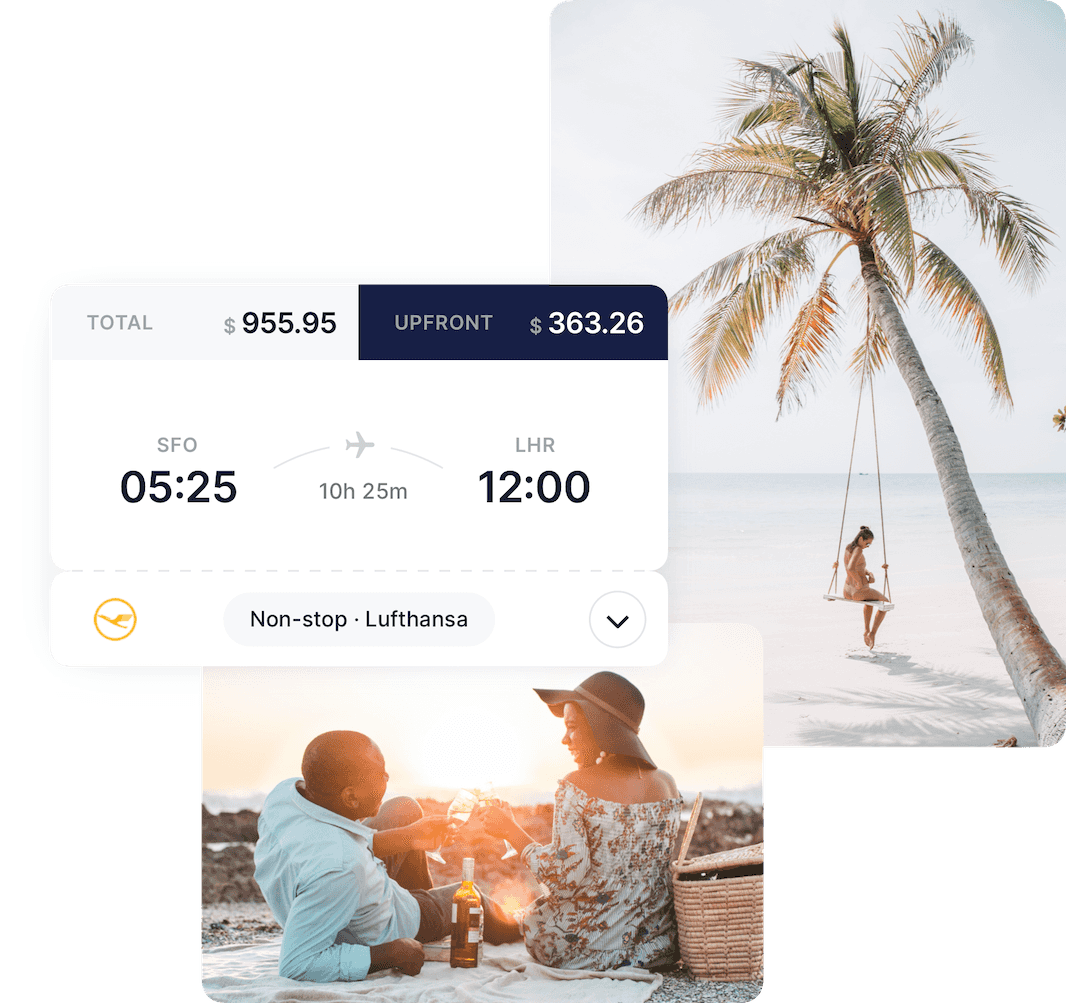

Your flight for only a fraction upfront

Get an estimate.

How much is your ticket?

Your upfront payment now is

And the rest in installments

No credit check, no interest

Just a transparent one-time service fee

Flexible payment plan

Choose the plan that works for you

Lock in your fare now

Don't miss out on a great deal

24/7 customer support

Focus on the fun of travel - not the stress

Scan to download

Accessible. Flexible. Easy. And done!

Fraction upfront

Book your flight for a fraction now, pay the rest later

Payment options

Pick what works best for your wallet

Progress tracking

Track all your payments and trips in one place

Discover the Airfordable difference

Planning your trip doesn’t need to feel like a chore. We put in the work so you don’t have to!

Book your favorite airlines

Complete control over your payment schedule

Manage multiple trips

Airfordable is the way to go!

Trusted by 500,000+ satisfied travelers, each with their unique stories and incredible adventures to share. Read real Airfordable traveler reviews.

What makes us different

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Price protection

When you book with us, you can secure your airfare well in advance when prices are cheaper. Protect yourself from the notorious airline price hikes no one likes.

Amazing community

Our travelers are a diverse group looking for creative ways to travel and budget. Airfordable is the bond that brings them together.

In good hands

The Airfordable team's sole mission is to help you travel more, but in an easy and financially responsible way. We're here for you.

Flexible and guaranteed

Pay only a fraction upfront for your flights. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle. Just accessible travel for your needs.

Safe and secure

Every interaction with Airfordable uses bank-level security and encryption. Your sensitive data is safe with us.

Great support at your fingertips

Dealing with airlines can be a hassle. Our team does the legwork for you, so you can focus on the fun — not the stress.

Available 24/7

We're always here to help you, day or night, with any support you need to book your perfect trip.

Reach us by email

Have a question, comment, or review? Our team can always be reached by email at [email protected].

Talk to support

Our in-app chat will send you directly to a member of our team for the one-on-one support you need.

Approved by the press

“Airfordable's value comes at the intersection of volatile ticket prices.... By locking in a ticket price up front, users can benefit by securing a better price on airfare while demand stays low and the date of departure is still far away.”

“A service like Airfordable could mean the difference between someone being able to take a trip or not – turning it into a priceless service.”

“The best part about Airfordable is that your ticket is paid off before your trip, so you don’t have to deal with debt once you return home. For someone who doesn’t want to miss out on a trip to see family and friends, a vacation or a life milestone, this can be a really great service.”

“Airfare is usually cheaper when you buy further in advance, but what if you haven't planned for a trip, or saved up the cash yet? One new solution is Airfordable.”

Travel now. Pay over time.*

Through Uplift, you can book your trip today and make easy monthly payments that fit nicely within your budget. It's a fast and easy way to turn your ideal vacation into reality. Plus, you can travel before your loan is paid off.

With Uplift Pay Monthly you get:

Great rates

Affordable plans

Pay off your vacation with convenient monthly payments. To keep things simple, Uplift can automatically process your payments and notify you with a convenient email and text.

Quick and easy application

Simply select Pay Monthly at checkout, complete a short application, and you’ll receive a quick decision.

No surprises

Make the same fixed payment each month with no late fees and no prepayment penalties.

Questions? Visit the Uplift FAQ page .

*Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use . Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Expedia Payment Plans: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is a ‘buy now, pay later’ loan?

How do expedia payment plans work, downsides of using an expedia payment plan, should you book travel using an expedia payment plan, expedia payment plans recapped.

There’s no doubt that travel can be expensive. Between flights, hotels, rental cars and more, booking and paying for a trip all at once can seem daunting if you haven’t saved for it. That’s why payment plans — the option to pay in installments over time instead of all at once — can be so enticing. Are they a good idea?

Online travel agencies like Expedia are popular services for travelers. But does Expedia let you buy now and pay later? It does.

Here, we break down what Expedia payment plans are and what’s important to know before you sign up for one on this third-party site.

Buy now, pay later (BNPL) services are offered by many travel brands and companies these days as booking payment plan vacations becomes more common. They are payment options that offer travelers a way to book travel now, but pay for it over a specified period of time in regular installments.

It’s similar to a credit card, but these loans may have lower interest rates and they typically offer automatic deductions from your debit card or bank account.

There are several companies that offer these sorts of loans across the web, but Expedia partners with Affirm to offer the service to their customers.

» Learn more: Should you use Buy Now, Pay Later services for travel?

Expedia makes it easy to book your travel and pay using a trip payment plan. All you have to do is select the flights, accommodations, car rentals or even cruises that you’d like to book, then select “Monthly Payments” during the checkout process.

You’ll be prompted to log in to Affirm or create an account if you haven’t already. On-screen prompts will then lead you through the process, which includes a soft credit check to make sure you’re eligible for what is essentially a loan. This check won’t affect your credit score.

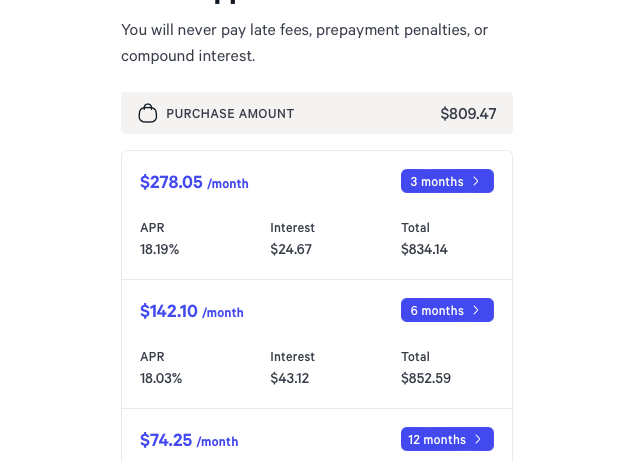

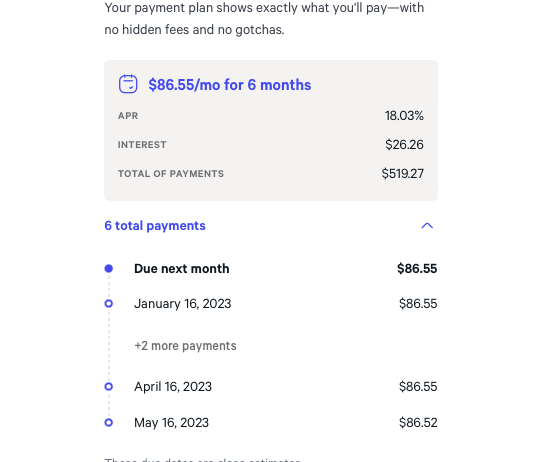

You’ll then see a list of payment options if you’re approved. In our search for a flight and rental car for a week-long trip to San Francisco that costs $809.47, we had the option to pay in three-, six- or 12-month installments. The monthly payment, interest amount, APR rate and total cost is displayed for each option so you know how much extra you’ll be paying on top of the base price of your travel.

Select an option that suits you, then choose whether to have automatic payments deducted from your account via a debit card or bank account. You’ll then complete checkout and pay over time, starting with your first payment the following month.

» Learn more : How to book travel on Expedia

Expedia makes it easy to book travel now and pay for it later, but it’s not necessarily a good idea for everyone.

There’s the loan’s interest to deal with, which you wouldn’t have to pay if you pay for your travel in full, assuming you pay your credit card balance and avoid interest charges. On the upside, Affirm states in their terms and conditions that they don’t charge late payment fees or penalty fees if your payment is returned or doesn’t go through (say, from lack of funds in your bank account). You won’t likely get the same treatment from your bank.

That said, if you are more than 120 days late on a payment, Affirm may send you to collections, which may impact your credit score.

If you or the airline have to cancel or postpone your travel plans, refunds can get tricky. Expedia will refund the base cost of your travel, but you will still be on the hook for any interest that has already accrued.

» Learn more : What factors affect your credit scores?

Does Expedia do payment plans? Yes — but that doesn’t mean it’s a good option for everyone or every situation.

For starters, depending on the interest rate of the credit cards you already have, you may be paying as much, or more, interest with Affirm. Even if Affirm offers a slightly lower rate, it’s likely not worth the headaches of having to deal with multiple entities (airlines, Expedia and Affirm) if your travel plans change or are canceled.

There are times when using an Expedia payment plan could come in handy, of course. For example, if you’re unable to pay for a last-minute ticket in full, and your available credit cards have much higher interest rates than Affirm, a payment plan might save you money.

But if you’re a points and miles collector, the biggest downside is that you won’t be earning any additional benefits like you do when paying with a travel rewards credit card. That means you’re potentially leaving hundreds or thousands of points and miles on the table that could eventually go toward award flights or hotel stays.

There is also the option of no- and low-APR rewards cards available .

» Learn more: How travel credit cards work

When booking travel on Expedia, the available payment plans offered through Affirm may sound like an enticing option. The BNPL service may be smart way to break up a purchase, especially if you get a low-interest offer and know you can make your payments on time.

On the other hand, refunds and cancellations can be complicated if travel plans change, and you won’t earn points and miles like you would when paying with a travel rewards credit card.

So before you utilize the service, read the fine print, weigh your options and choose wisely.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Update your browser

Be sure you have the most current version of your browser for the best experience on AAVacations.com. Browser requirements Opens in a new window

- Skip to global navigation

- Skip to content

- Skip to footer

Vacation package deals

Plan your getaway

- Save up to $125 on your European vacation Book by April 15

- Sign up for email offers Opens in a new window

- aa.com Opens in a new window

- Destinations

- AAdvantage®

- AAdvantage® login

AAdvantage login

Logout Exclusive AAdvantage® experiences Verify AAdvantage® Number(s)

Enjoy now. Pay over time.

Spread the cost of your trip over low monthly payments.

Experience Buyer's Joy Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized installments while keeping yourself on a budget.

Low monthly payments Budget-friendly loan options

Easy application Quick decision

Surprise-free No late fees or prepayment penalties

Easy AutoPay No payment dates to remember

- Select Uplift at checkout Add purchases to your cart just like you normally would. When you are ready to check out, choose Uplift as your form of payment.

- Quick & easy Provide a few pieces of information and receive a quick decision.

- Enjoy now Enjoy your trip now and pay for it over time with low monthly installments.

Find vacations

Frequently Asked Questions

- What is Uplift?

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you're ready to check out, just select "Uplift" as your payment method, complete a short application and receive quick decision. Choose the terms of your payment plan, finish checking out and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

- How do I apply for installment payments through Uplift?

Shop for your items and add them to your cart just like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a U.S. resident, your Social Security Number. If you're approved, finish checking out and you're done.

- How are my loan term offers determined?

We look at a number of factors, including your credit information, purchase details and more.

- How do I make installment payments?

You can make a payment anytime at pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button.

We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com, click on the Accounts page and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime at pay.uplift.com.

Make installment payments Opens in a new window

- I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

- What is your Privacy Policy and Terms of Use?

Privacy Policy Opens in a new window

Terms of Use Opens in a new window

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $300 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders.

Uplift lenders Opens in a new window

Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Airport lookup

Our system is having trouble.

Please try again or come back later.

Please tell us where the airport is located.

Your session expired

Any confirmed reservations have been saved, but you'll need to restart any searches in progress

Pay your way

Super-simple travel payment plans so you can choose when and how to pay for your trip.

Pay monthly or bi-weekly

Automatic payments with no interest and certainly no drama.

- Put $150 down*

- Your card or bank account is automatically charged once or twice per month

- Finish paying 30 days before your trip

* If you book your trip less than 100 days before departure, the minimum deposit will be $750. Trips booked less than 60 days before departure must be paid in full.

Pay at your own pace

No fixed schedule. Pay over time, on your own terms.

- Put $450 down*

- Pay off the balance on your own schedule

- Finish paying 99 days before your trip

* Plus a $50 service fee to cover the costs associated with processing these payments.

Pay in full

Everything up front, nothing to worry about later.

- Pay for your trip in its entirety

- Relax some more

Pay with affirm

Travel now, pay later.

- Check your eligibility during checkout

- Pay over 6, 12, or 18 months. For example, on a $1,500 purchase, you may pay $135.39 for 12 months with a 15% APR.

- Go on your trip, even if you’re still paying for it

.css-1m22qs9{-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;background:none;border:0;color:inherit;display:grid;font-size:17px;font-weight:700;line-height:1.2;grid-template-columns:1fr auto;margin:0;padding:16px;text-align:left;width:100%;}.css-1m22qs9 path{stroke:#191919;} What happens if I choose monthly or bi-weekly and I miss a payment? .css-xxs3zl{-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;}@media print{.css-xxs3zl{display:none;}}

If you miss one payment, the amount will be distributed evenly over your remaining payments. However, if you miss two consecutive payments, you will be withdrawn from the plan altogether. Note: there is a $35 decline fee each time you miss a payment.

Can I make a payment outside of my payment plan?

Yes, you can do this anytime from your online account under the payments tab. An additional payment does not take the place of any upcoming automatic payments. Your new balance will be distributed evenly over the remaining payments.

How do I use a Future Travel Voucher?

Future Travel Vouchers issued in 2020 or 2021 can be applied to any travel booked prior to 12/31/2022, for departures before 9/30/2024. Just book a trip like you usually would and then start a chat on our website to apply the voucher to your order.

What if I switch trips or move my trip to a later date?

All completed payments will be applied to your new trip and any remaining balance will be redistributed evenly over your new time frame.

What payment methods do you accept?

You can pay using a credit/debit card (Visa, MasterCard) or by using a checking account.

Is Affirm a loan?

Technically speaking, yes. Our financing partner, Affirm, will lend you the money to pay for your trip, and you’ll pay them back over time.

Does Affirm perform a credit check?

Affirm only performs a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. Checking your eligibility will not affect your credit score.

Can I pay for my trip in pennies?

Please don’t.

If I refer a friend, do I get a discount on my trip?

Actually, yes. We have group and referral discounts to make it even easier to afford your trip. Learn more about these discounts here.

What if I have more questions?

You’re in luck! We’re available via phone, email, live chat, and messenger pigeon. You can reach us here.

Where Can I Book a Trip and Make Payments? Your Ultimate Guide

Are you dreaming of a much-needed vacation but struggling to pay for it all upfront? Fortunately, many travel booking platforms, airlines, and cruise lines offer payment plans and installment options to make it easier to budget and book your next adventure . In this blog post, we’ll explore where you can book a trip and make payments, so you can start planning your dream getaway today. From popular travel booking platforms like Expedia and Booking.com to airlines such as Delta and United, and cruise lines like Royal Caribbean and Carnival, we’ve got you covered. So, pack your bags, and let’s dive into the world of travel booking and payment plans.

Popular Travel Booking Platforms

When booking a trip, there are plenty of options available, but it can be overwhelming to choose the right platform. Here are some of the most popular travel booking platforms to consider:

- Expedia: Expedia is one of the largest online travel booking platforms, offering a wide range of flights, hotels, rental cars, and vacation packages. Expedia allows you to pay for your trip upfront or in installments using Affirm or PayPal Credit.

- Booking.com: Booking.com is another popular travel booking platform, known for its extensive range of accommodation options. With Booking.com, you can pay for your trip upfront or in installments using Affirm or PayPal Credit.

- TripAdvisor: TripAdvisor is a popular travel platform that allows users to research and book travel experiences, including flights, hotels, and vacation rentals. You can pay for your trip upfront or in installments using Affirm or PayPal Credit.

Airlines Offering Payment Plans

Booking a flight can be one of the most expensive parts of a vacation, but many airlines offer payment plans to help make it more affordable. Here are some airlines that offer payment plans:

- Delta Airlines: Delta Airlines offers a payment plan called Fly Now Pay Later, which allows you to book a flight and pay for it in installments. You’ll need to apply for a loan through Affirm and make monthly payments.

- United Airlines: United Airlines offers a payment plan called United TravelBank. It allows you to earn TravelBank cash with each purchase and use it to pay for flights and other travel expenses.

- American Airlines: American Airlines offers a payment plan called Fly Now Payment Plan, which allows you to book a flight and pay for it in installments. You’ll need to apply for a loan through Affirm and make monthly payments.

Cruise Lines Offering Payment Plans

Cruising is a popular vacation option, but it can be expensive upfront. Fortunately, many cruise lines offer payment plans to make it easier to budget for your vacation. Here are some cruise lines that offer payment plans:

- Royal Caribbean: Royal Caribbean offers a payment plan called CruisePay, which allows you to pay for your cruise in installments. You’ll need to make a deposit upfront, and then you can make payments leading up to your cruise departure.

- Norwegian Cruise Line: Norwegian Cruise Line offers a payment plan called Pay Later, which allows you to reserve your cruise and pay for it in installments. You’ll need to make a deposit upfront, and then you can make payments leading up to your cruise departure.

- Carnival Cruise Line: Carnival Cruise Line offers a payment plan called EasyPay, which allows you to pay for your cruise in installments. You can choose to make payments with a credit card or debit card, and Carnival will automatically charge your account on the due date.

- MSC Cruises: MSC Cruises offers a payment plan called MSC Book Now Pay Later, which allows you to reserve your cruise and pay for it in installments. You’ll need to make a deposit upfront, and then you can make payments leading up to your cruise departure.

Vacation Package Providers

If you’re looking for an all-in-one solution for your vacation, vacation package providers may be the way to go. These providers offer a bundled package that typically includes flights, accommodations, and activities. Here are some popular vacation package providers:

- Expedia: In addition to being a popular travel booking platform, Expedia also offers vacation packages. With Expedia, you can choose from a variety of packages that include flights, accommodations, and activities. You can pay for your vacation package upfront or in installments using Affirm or PayPal Credit.

- Travelocity: Travelocity is another popular vacation package provider, offering packages that include flights, accommodations, and activities. You can pay for your vacation package upfront or in installments using Affirm or PayPal Credit.

- Apple Vacations: Apple Vacations specializes in all-inclusive vacation packages to popular destinations such as Mexico and the Caribbean. You can pay for your vacation package upfront or in installments with a credit card or check.

- Funjet Vacations: Funjet Vacations offers all-inclusive vacation packages to destinations such as Mexico and the Caribbean. You can pay for your vacation package upfront or in installments with a credit card.

Travel Credit Cards

If you’re a frequent traveler, travel credit cards can be a great way to earn rewards and save money on your trips. Here are some popular travel credit cards:

Chase Sapphire Preferred: The Chase Sapphire Preferred is a popular travel credit card that offers rewards for travel and dining purchases. You can use your rewards to book travel through Chase’s travel portal, and you can also transfer your points to airline and hotel loyalty programs.

Capital One Venture Rewards: The Capital One Venture Rewards card offers rewards on all purchases, which can be redeemed for travel expenses. You can use your rewards to book travel through Capital One’s travel portal or transfer them to airline and hotel loyalty programs.

American Express Platinum: The American Express Platinum card offers a range of travel benefits, including airport lounge access and statement credits for travel expenses. You can also earn rewards for travel and other purchases, which can be redeemed for travel expenses or transferred to airline and hotel loyalty programs.

Online Payment Services for Travel

In addition to travel booking platforms and travel credit cards, there are also online payment services that can help you pay for your trip. Here are some popular online payment services for travel:

- PayPal: PayPal is a popular online payment service that is accepted by many travel booking platforms and airlines. You can link your PayPal account to your bank account or credit card and use it to pay for your trip.

- Venmo: Venmo is a mobile payment app that allows you to send and receive money from friends and family. Some travel booking platforms and vacation rental websites accept Venmo as a payment method.

- Square Cash: Square Cash is another mobile payment app that allows you to send and receive money. Some travel booking platforms and vacation rental websites accept Square Cash as a payment method.

Tips for Booking a Trip and Making Payments

Booking a trip and making payments can be overwhelming, but with these tips, you can make the process much smoother:

- Plan ahead: Start planning your trip well in advance so you have time to research and compare prices.

- Use a travel booking platform: Consider using a travel booking platform like Expedia or Travelocity to find the best deals on flights, accommodations, and activities.

- Check for payment plans: Look for airlines, cruise lines, and vacation package providers that offer payment plans so you can pay for your trip in installments.

- Use a travel credit card: If you’re a frequent traveler, consider using a travel credit card to earn rewards and save money on your trip.

- Consider online payment services: Online payment services like PayPal, Venmo, and Square Cash can make it easy to pay for your trip from anywhere.

By following these tips, you can book your dream trip and make payments without stress.

Frequently Asked Questions

- Can I book a trip and make payments on any travel website? A: No, not all travel websites offer payment plans. However, there are many popular travel booking platforms, airlines, cruise lines, vacation package providers, and online payment services that offer payment plans for travel.

- What are some popular travel booking platforms that offer payment plans? A: Some popular travel booking platforms that offer payment plans include Expedia, Travelocity, and CheapOair. These platforms allow you to search for flights, hotels, and activities and offer payment plans that allow you to pay for your trip in installments.

- Which airlines offer payment plans for travel? A: Many airlines offer payment plans for travel, including Delta, United Airlines, and American Airlines. These payment plans allow you to book your flight and pay for it in installments over time.

- Can I use a travel credit card to make payments for my trip? A: Yes, using a travel credit card can be a great way to make payments for your trip. Many travel credit cards offer rewards and perks such as airline miles or hotel points, which can help you save money on future trips.

- Are there any online payment services that can be used for travel? A: Yes, there are several online payment services that can be used for travel, such as PayPal, Venmo, and Square Cash. These services allow you to make payments from anywhere with just a few clicks.

- How can I ensure that I am getting the best deal on my trip? A: To ensure that you are getting the best deal on your trip, it is important to compare prices across multiple travel websites and providers. You can also sign up for price alerts or use a price tracking tool to monitor prices and get notifications when prices drop.

- What happens if I am unable to make payments on my trip? A: If you are unable to make payments on your trip, you may risk losing your reservation or being charged additional fees. It is important to read the terms and conditions of any payment plan or reservation carefully to understand the consequences of missed or late payments.

- Can I cancel or change my reservation if I have made payments on my trip? A: Yes, in most cases you can cancel or change your reservation if you have made payments on your trip. However, there may be cancellation fees or penalties, depending on the terms and conditions of your reservation.

- What should I do if I encounter any issues with booking or making payments for my trip? A: If you encounter any issues with booking or making payments for your trip, it is important to contact the travel website or provider as soon as possible. Many providers have customer service teams that can assist with any issues or concerns you may have.

In today’s world, it’s never been easier to book a trip and make payments. Whether you’re planning a romantic getaway or a family vacation, there are plenty of options available to help make your dream vacation a reality. From popular travel booking platforms to airlines and cruise lines offering payment plans, you’re sure to find a payment option that suits your budget and travel style. So, what are you waiting for? Start planning your next adventure today and make your travel dreams come true.

Flexible Payment Options

Paying for your getaway is simple with Apple Vacations. We offer flexible payment options to help you plan the perfect vacation without the stress of budgeting or having to pay upfront. Take a look at the choices available or give us a call at (800) 517-2000 to learn more about how you can finance your trip.

Vacation Now, Pay Over Time with Uplift

When you book with us, you’ll have the option to spread the cost of your vacation over low monthly payments . Enjoy flexible payments, no late fees and no pre-payment penalties and you can even travel before your installments are paid off. It’s a fast and easy way to turn your dream vacation into a reality.

*Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use . Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Make a Deposit

Our deposit program allows you to save your spot on the sand without having to pay in full the same day. Please review our deposit requirements as charges and payment schedules vary per package type.

If you've received an Apple Vacations gift card, you can treat yourself to a beachy getaway to Mexico, the Caribbean, Costa Rica, Panama or Hawaii at any time! Redeem your gift card today or give a special someone in your life the gift of sand and sunshine.

A guide to using buy now, pay later for travel

PayPal Editorial Staff

January 5, 2024

Planning a vacation? Buy now, pay later (BNPL) may be offered as a payment option when booking flights, hotels, or other travel accommodations.

Discover how BNPL options work for travel, from potential pros and cons to responsible practices and strategies if considering using it.

What is buy now, pay later for travel?

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares.

If BNPL is an available payment option for an airline, hotel, or travel retailer, individuals can opt for a payment plan at checkout. Normally, they would select the BNPL provider and apply in the checkout, but some providers may redirect applicants to their website to create an account and apply. Typically, applicants receive a near-instant decision, which may mean those looking to use buy now, pay later for travel can book their travel or vacation without a significant delay.

Depending on the BNPL provider , there may be interest fees and other charges, though some providers may offer plans with no interest. Be sure to review any terms before applying.

While application and approval requirements may vary depending on provider, here’s a breakdown of the general eligibility requirements and approval process:

- Meet the eligibility requirements: These can vary based on the provider. People typically need to be at least 18 years old and provide personal details like their social security number and home address. Some BNPL providers may also assess income, payment history, and credit score.

- Agree to the terms: Individuals must agree to the terms and conditions of a BNPL plan, including an installment schedule and any associated fees or interest charges.

- Receive a decision and book travel: People usually receive a BNPL approval decision in seconds. If approved, they can book their travel using BNPL as their payment method.

Potential benefits of using buy now, pay later for travel

Before using buy now, pay later for a trip, consider the potential advantages:

- Flexibility: BNPL may offer flexibility to spread the cost of a trip over time, allowing travelers to manage their budget and avoid a significant upfront expense.

- Interest-free options: Some BNPL services may provide interest-free payment plans. For example, PayPal’s Pay in 4 allows people to split eligible purchases into four interest-free, bi-weekly installments. 1

- Accessibility: Buy now, pay later may help make travel accessible to those with limited credit histories or low credit scores.

Potential downsides of using buy now, pay later for travel

There are some potential disadvantages to using buy now, pay later for travel expenses. Some examples include:

- Interest and fees: Some BNPL providers may charge interest or fees if travelers miss payments or choose longer repayment terms, potentially increasing the overall cost of their trip.

- Overspending: While BNPL offers flexibility, it can also lead to overspending if travelers don't carefully budget for their installment payments. It also may tempt some to book more expensive trips than they can comfortably afford.

- Credit impact: Although certain buy now, pay later providers may not conduct hard credit checks initially, missed payments or defaults may negatively impact credit scores in the long run.

- Limited booking options: Not all travel providers or agencies accept BNPL as a payment option.

Using buy now, pay later for travel responsibly

Here are some factors to consider when signing up for a BNPL plan for travel:

- Budget and plan: Establish a personal budget for travel plans that includes not only the upfront trip cost but also the future installment payments to ensure the overall expense remains manageable and within budget.

- Read the fine print: Carefully read and understand the terms and conditions. Pay close attention to any interest rates, fees for missed payments, and the total cost of a trip when opting for BNPL.

- Responsible spending: Avoid the temptation to overspend just because BNPL offers flexibility. It’s important to only buy on credit responsibly .

- Ensure timely payments : Commit to making payments on schedule to avoid late fees or interest charges. Setting up automatic payments can help prevent missed deadlines.

Using BNPL for travel may offer convenience and flexibility for those looking to travel or book a vacation, but it should be done with careful consideration. Be sure to consider any fees or interest that may apply and keep track of when payments need to be made.

Learn about PayPal Pay Later .

BNPL for travel FAQ

What is buy now, pay later.

Buy now, pay later is a type of short-term financing method that allows people to split a purchase into several smaller installments over weeks or months. Some BNPL plans may be interest free, while others may include interest and fees.

Can buy now, pay later be used for flights?

Buy now, pay later can often be used for flights. Many airlines and travel booking platforms offer BNPL as a payment option at checkout. Travelers should budget and plan their payments accordingly before committing to a payment plan.

Can I book a vacation with buy now, pay later?

Individuals may be able to book a vacation using buy now, pay later. BNPL options are increasingly available for vacation planning, including flights, accommodations, and activities. Travelers can opt for BNPL at checkout and split the total cost into smaller installments. However, be sure to budget carefully and be aware of any potential interest or fees.

Was this content helpful?

We use cookies to improve your experience on our site. May we use marketing cookies to show you personalized ads? Manage all cookies

- Visit Family Vacation Critic on Facebook!

- Visit Family Vacation Critic on Twitter!

- Visit Family Vacation Critic on Instagram!

- 1 Subscribe to stay up to date!

- Budget-Friendly Travel

5 Payment Plan Family Vacation Options

May 4, 2017

See recent posts by Amanda Norcross

Yes, payment plan family vacations exist! And not necessarily in layaway form. Some hotels, for example, only require a small deposit upon booking, leaving you plenty of time to save up. Other places, such as Disney World, offer bona fide payment plans. Here, we look at our favorite payment plan options for family vacations.

1. Disney

Disney World; Disneyland; Aulani, A Disney Resort ; Adventures by Disney; and even Disney Cruise Line offer the Disney Vacation Account . The program essentially acts as your own Disney vacation advisor, prompting you to estimate your trip budget with a series of questions and creating a customized plan for payments based on your answers. You can easily track your savings progress until you have enough and are ready to officially book. The program is completely free!

2. Beaches Resorts

Beaches Resorts (and adults-only Sandals Resorts ) offer the Luxury Layaway Installment Payment Plan, allowing guests to split up their vacation payments. Payment plans can range from three months to two years in length. Beaches has three resorts in the Caribbean: Beaches Turks and Caicos , Beaches Negril and Beaches Ocho Rios .

3. eLayaway

How cool is this? eLayaway.com allows you to save money for gift certificates that can be used on airfare, cruises, Marriott hotels and even Disney vacations. (It also offers layaway programs for tons of retailers). eLayaway takes an allotted amount (determined by you) out of your bank account and before you know it, you’re on a beach in the Caribbean with your family.

4. Sears Vacations

The same company who brought you holiday shopping layaways also offers vacation layaways! Families can save up to 50 percent on vacations to popular destinations such as Chicago, Las Vegas and Orlando, and pay as low as $49 per month for those trips. There’s no cost to pay in installments with Sears Vacations , where you can book both hotels and cruises.

5. Travel Agent

Working with a travel agent is a surefire way to get a payment plan family vacation. Your travel agent will work with your budget and desires to craft a vacation itinerary that makes sense for your family. While you’ll likely be required to dole out a small down-payment upon booking, you won’t need to pay your final balance until closer to the trip. Plus, you’ll have the option to make payments along the way.

What to Pack for Your Next Trip

Girls caribbean vacation day outfit for summer, shop the look.

Tie Dye Circle Top

Tie-Waist Shorts

Men’s/Dad’s Caribbean Vacation Day Outfit for Summer

Collar Linen Shirt

Tapered Pants

Aviator Sunglasses

Apollo Sandal

Women’s/mom’s caribbean vacation day outfit for summer.

Martinique Dress

Lagoon Earrings

Wedge Sandals

Boys caribbean vacation day outfit for summer.

Fun Short-Sleeved Shirt

Canvas Shorts

Shark Tooth Necklace

Our team of parents and travel experts chooses each product and service we recommend. Anything you purchase through links on our site may earn us a commission.

Related Articles

13 Best Budget-Friendly Family Resorts for 2021

10 Best Cheap Florida Family Vacations 2021

13 Cheap Family Weekend Getaways 2021

10 Best Bang-for-Your-Buck Bahamas Family Resorts

Your personal family vacation planning starts now.

Get expert advice, handpicked recommendations, and tips for your family all year round!

Get family travel & tips from our experts

By proceeding, you agree to our Privacy Policy and Terms of Use .

Thanks for signing up!

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT