Ultimate guide to the Citi travel portal

Editor's Note

The new Citi travel portal launched earlier this year , offering an enhanced user experience, more hotel options and a new feature for booking activities and attractions. Citi Travel with Booking.com is powered by Rocket Travel by Agoda, utilizing the features and booking availability of Booking.com's brands.

In this article, we will explore the functionality of the new Citi travel portal, discuss any potential drawbacks and clarify who can access this booking engine. Additionally, we will provide a step-by-step guide on using the portal to book your desired travel experiences and explain how to pay using your ThankYou points.

What is the Citi travel portal?

There are four main selling points for using Citi Travel with Booking.com.

First, it provides a one-stop shop for travel that you can pay for with your Citi ThankYou points while booking multiple elements of a trip simultaneously. This can be simpler than transferring points to separate airline or hotel partners and booking your trip piece by piece — and you can even use as many or as few points as you want. The downside is that you might achieve less value from your points to gain simplicity.

Second, the portal allows you to use points to pay for travel beyond flights and hotels, such as guided tours and theme park tickets. You can't do this with Citi's list of transfer partners, and you may achieve better value paying for travel with points in Citi's portal than you would by cashing out your points .

Third, certain card benefits require using the Citi travel portal. This is true of hotel benefits built into the Citi Prestige® Card (no longer open to new applicants) and Citi Premier® Card (see rates and fees ). We'll explore those below.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Lastly, if you're paying for travel (and not using points), you may be interested in the bonus points available when using Citi Travel with Booking.com. Competitors like the Chase Ultimate Rewards travel portal , American Express Travel and Capital One Travel offer higher earn rates (depending on which credit cards you have) when booking your travel in the bank's portal rather than directly.

Through June 30, 2024, Citi cardholders can earn bonus points as follows:

- 10 points per dollar on reservations for hotels, rental cars and eligible attractions with the Citi Prestige® Card (no longer open to new applicants) and the Citi Premier® Card

Through December 31, 2025, Citi cardholders can earn bonus points as follows:

- 5 points per dollar on these same bookings with the Citi ThankYou® Preferred Card (no longer open to new applicants) and the Citi Rewards+® Card (see rates and fees )

The information for the Citi ThankYou Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The fact that Citi's portal provides a one-stop shop for your vacation is its main strength. The ability to book hotels, rental cars and even entrance tickets to tourist attractions in one place (and even pay for these with your points) provides great simplicity.

Related: The ultimate guide to Citi ThankYou Rewards

How to use the Citi travel portal

Citi's portal sets itself apart from competitors by being available to anyone with a credit card earning Citi ThankYou points . For comparison, some travel portals reserve their best features for cardholders with expensive premium credit cards . Thus, you can access the portal with the $495-a-year Citi Prestige Card and the no-annual-fee Citi Rewards+ Card .

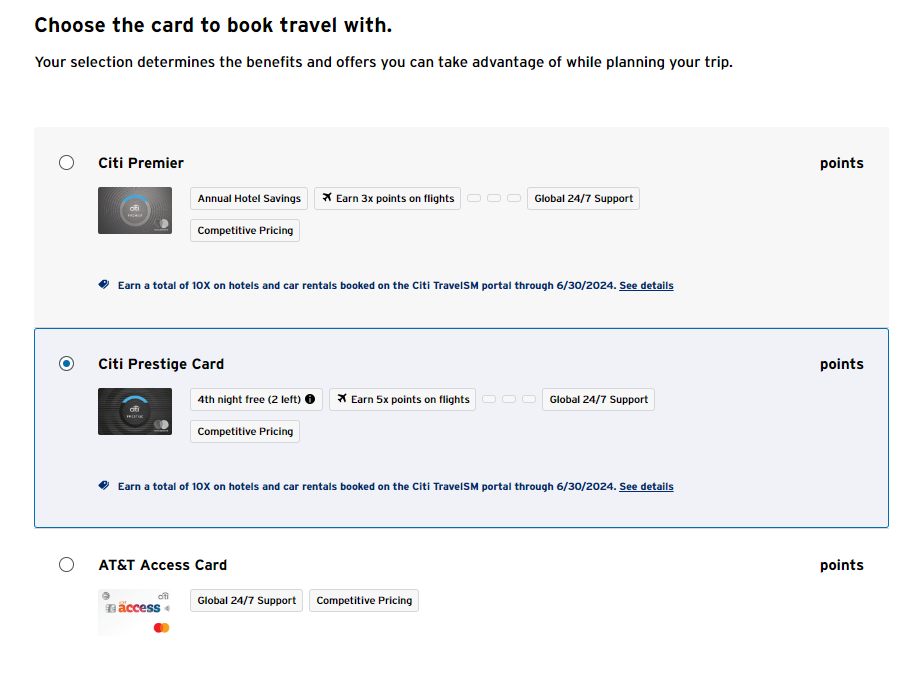

You can access Citi Travel with Booking.com by clicking this link and logging into your Citi account. If you have multiple Citi credit cards, you must select which card you want to use for booking travel.

Once you select a card, you're ready to start booking travel.

How to book flights using the Citi travel portal

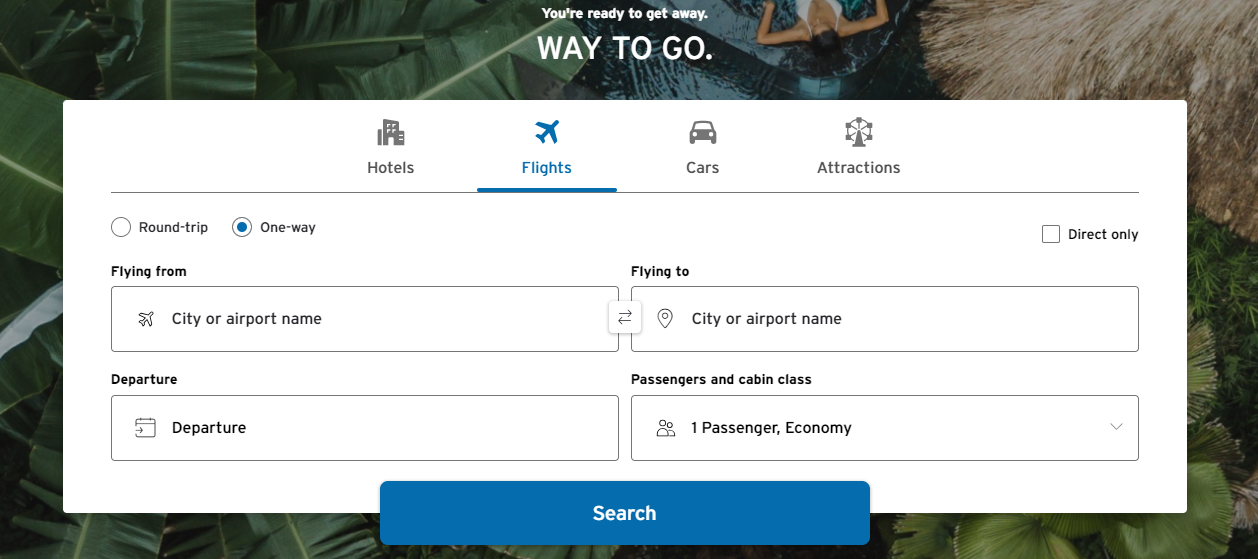

Booking flights in Citi's portal functions similarly to other portals. You'll choose whether this is a one-way or round-trip flight and provide the route, number of passengers, dates and class of travel. Unfortunately, you can't book multi-city itineraries.

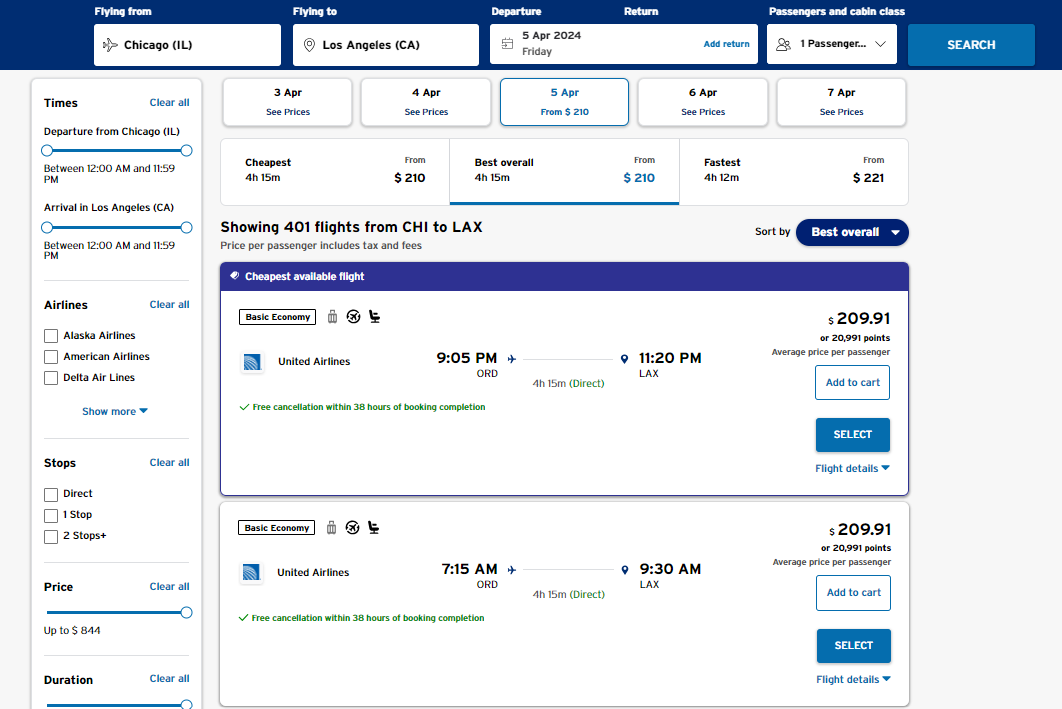

Here's an example search from Chicago to Los Angeles. Note that you can use cities for your search if you don't have a specific airport preference.

The Citi Travel portal offers many filters and sorting options to help you find the most suitable travel options. These filters allow you to refine your search based on price, duration, departure and arrival times, number of connections and even your preferred airline. Furthermore, you can sort the results using these options without losing any filtering choices.

To change the sorting order of the results, click on the "Best overall" drop-down menu on the right side above the price of the first result.

Once you have selected a flight, you will be prompted to provide passenger information, including names, dates of birth, frequent flyer numbers and known traveler numbers for TSA PreCheck and Global Entry (if applicable).

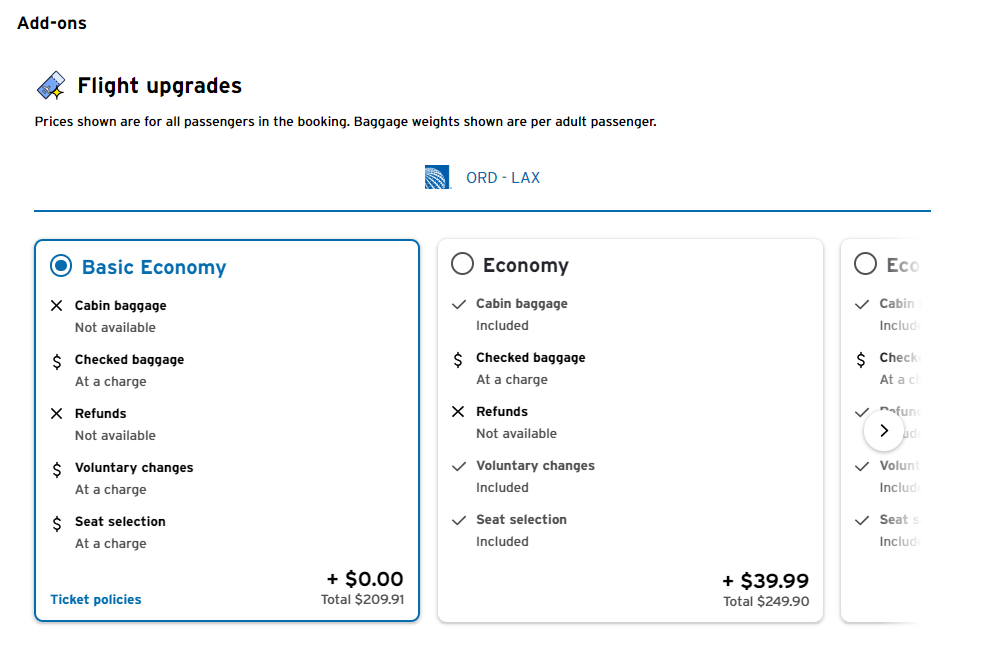

Additionally, before making your payment, you can upgrade to a higher class of travel if it is available. This is the first time you'll see the cost to book a main cabin fare instead of a basic economy fare.

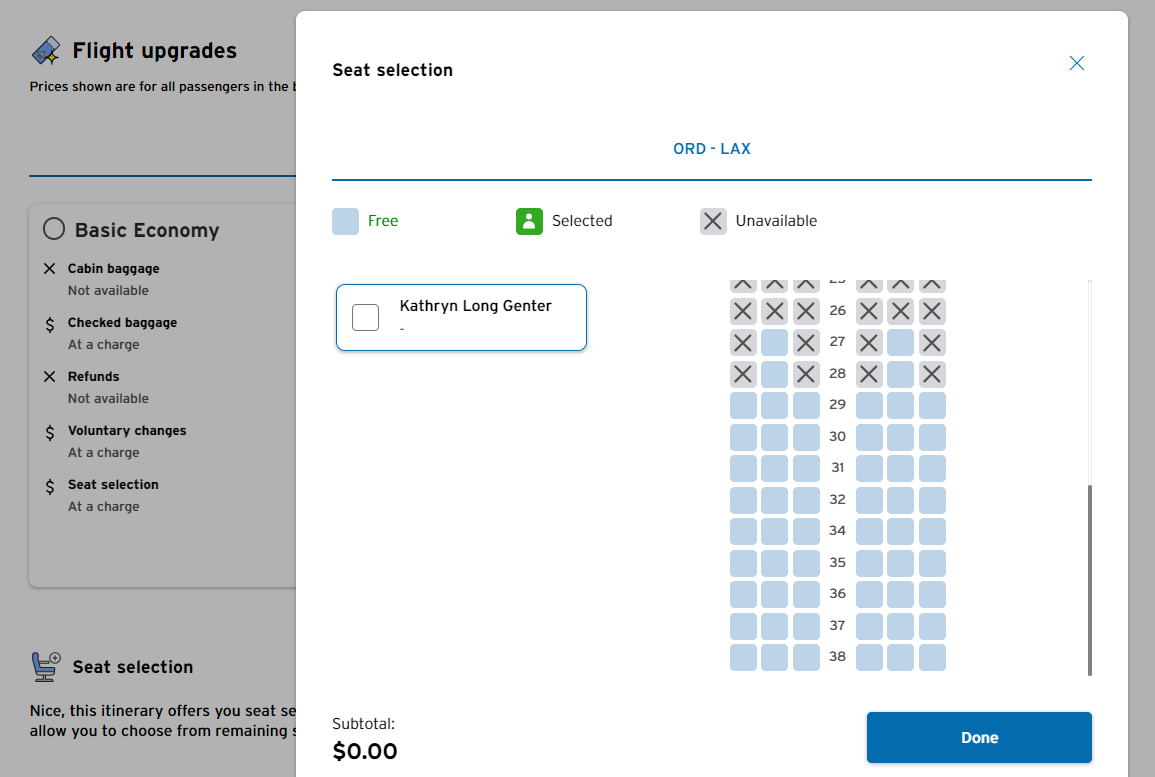

And if your fare class lets you select a seat, you can do so before heading to the payment page.

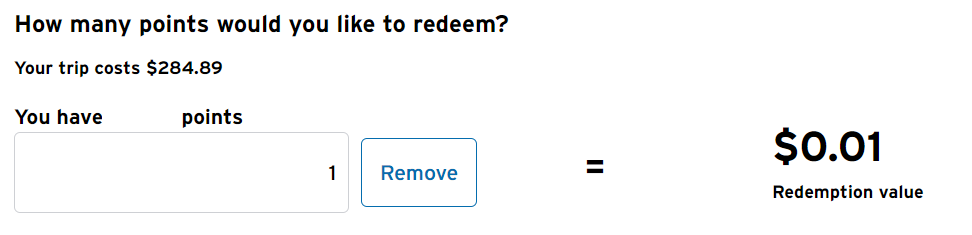

On the final page, you'll choose how you want to pay (with your points, credit card or a mix of the two) and complete your purchase. The redemption rate is an underwhelming 1 cent per point. For context, our valuations peg ThankYou points at 1.8 cents apiece, which you should be able to get by maximizing Citi's transfer partners .

How to book hotels using the Citi travel portal

Booking hotels will feel familiar to those who have used other portals.

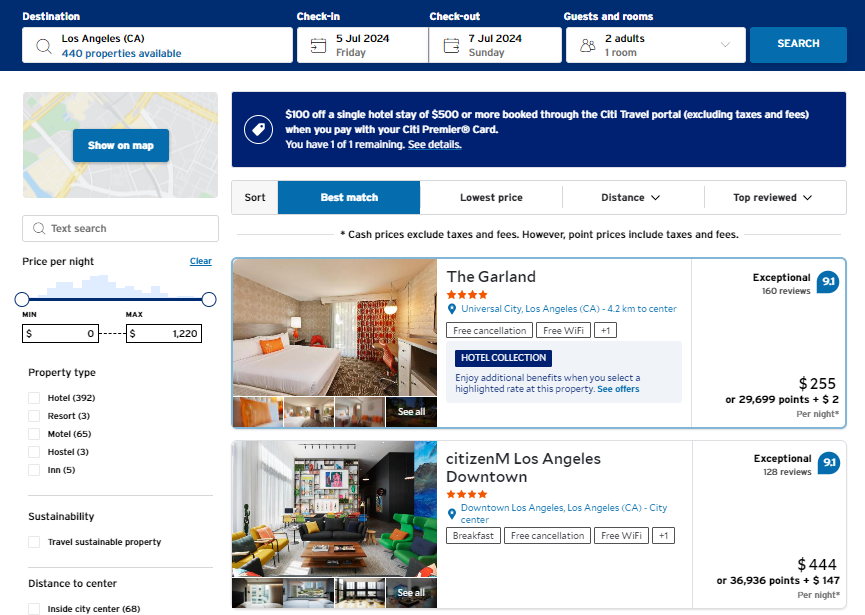

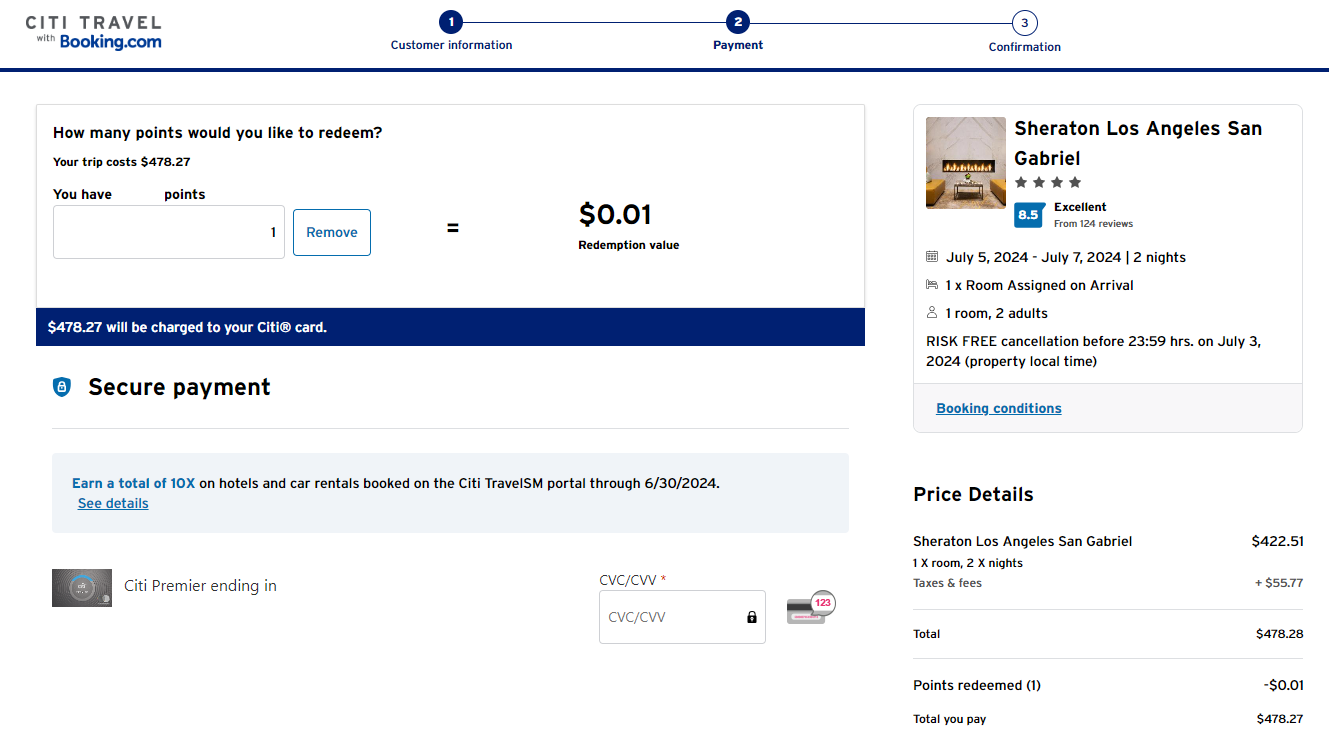

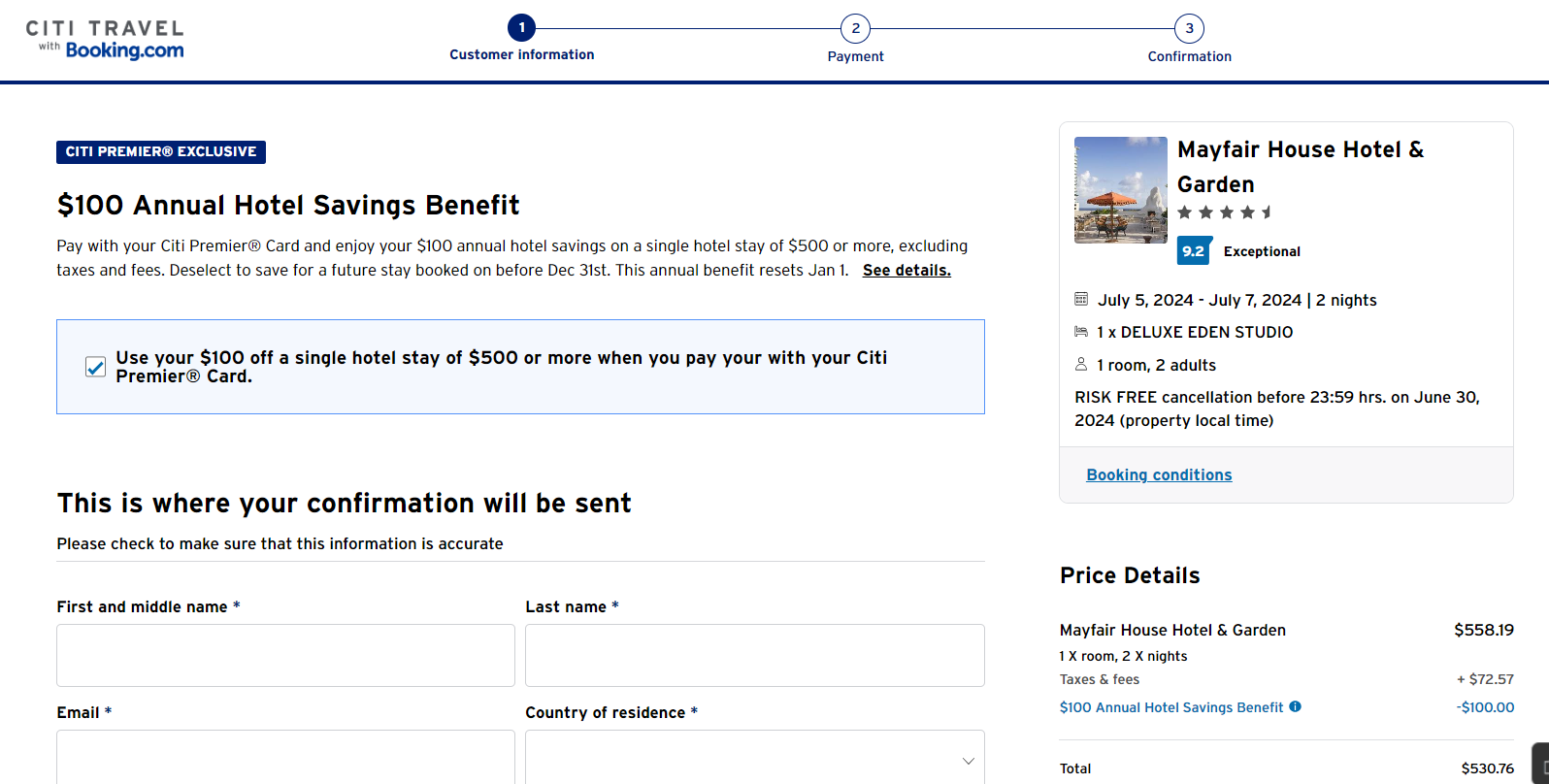

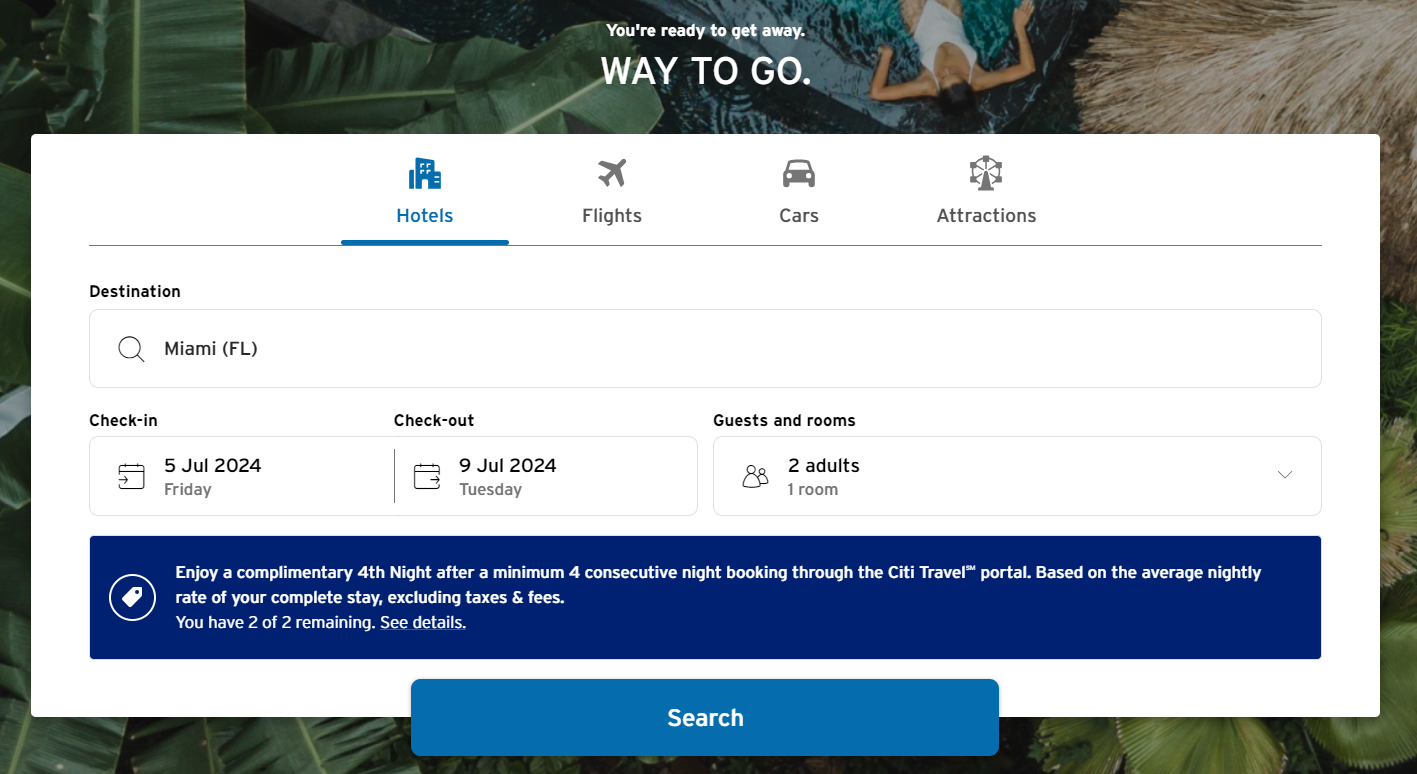

You should choose your Citi Premier or Citi Prestige card before beginning your hotel search if you intend to use those cards' benefits. Premier cardholders can use a $100 hotel credit each calendar year on a booking of $500 or more. In contrast, Prestige cardholders get a fourth night free on hotel bookings in the portal, available up to twice per calendar year.

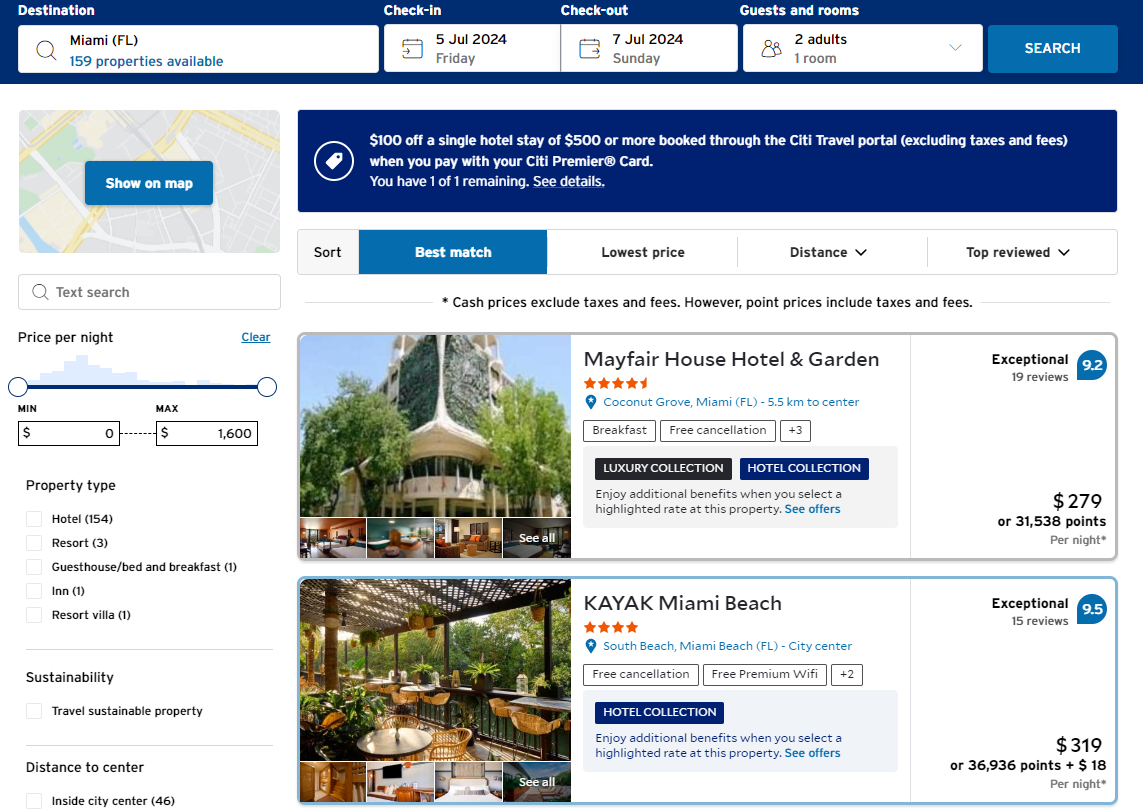

From here, you can add filters to help you reduce your results, such as by price, neighborhood, star rating and nearby attractions.

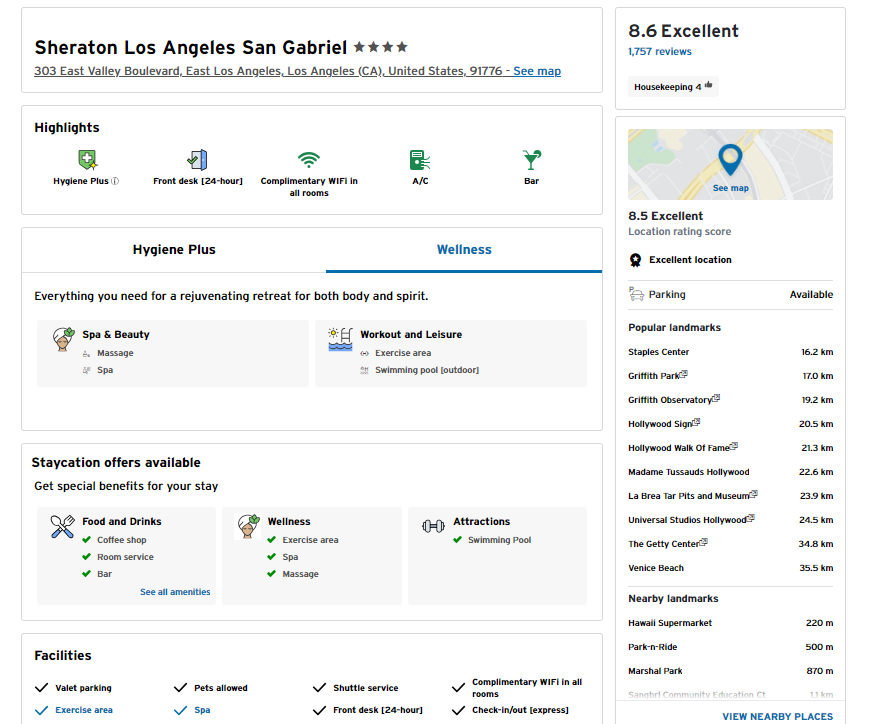

Once you pick a property, you'll see details on its amenities and features.

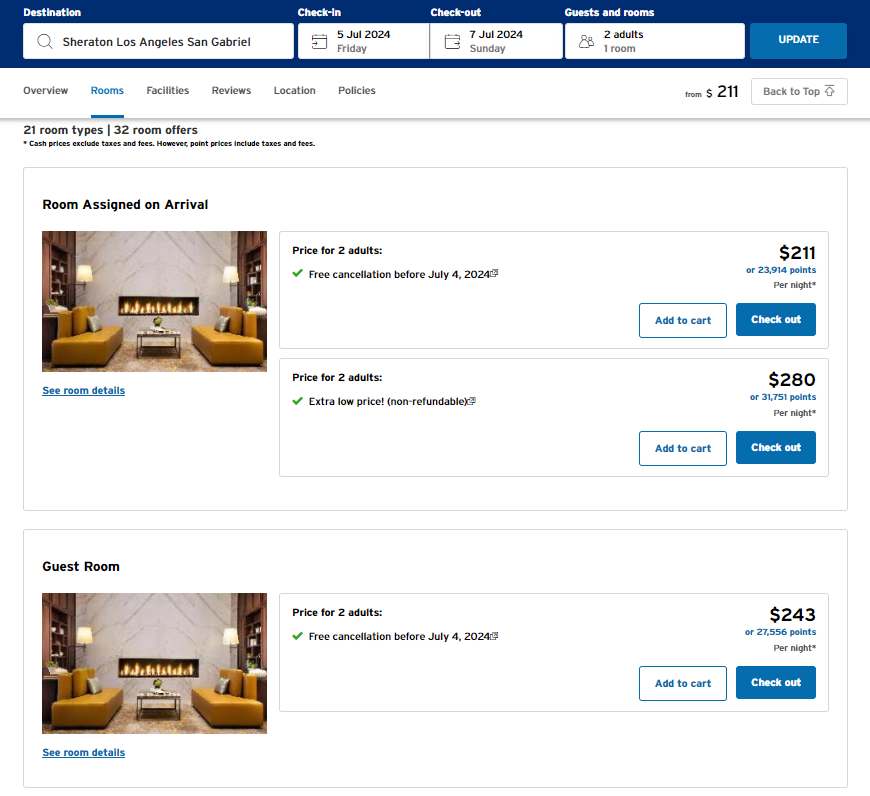

Then, you can select your desired room.

After choosing a room type, you can pay with points at checkout. Again, each point is worth a lackluster 1 cent.

You'll also have the option to view the cancellation policy before paying. Since policies can vary, ensure you know whether it's possible to change or cancel your booking before you make the final payment.

However, if you book a hotel that's part of a major loyalty program — like Hilton Honors or Marriott Bonvoy — through Citi, you likely won't earn points, nor will you enjoy any elite status perks on your reservation.

Hotel Collection and Luxury Collection properties

Alongside its revamped portal, Citi has introduced two new hotel programs, namely the Hotel Collection and the Luxury Collection. These programs offer similar advantages to other luxury hotel programs offered by credit cards .

Reservations through the Hotel and Luxury Collection have no minimum stay requirements. However, access to the Luxury Collection is exclusive to Citi Premier and Citi Prestige cardholders.

You will receive guaranteed benefits such as daily breakfast for two people and complimentary Wi-Fi for Hotel Collection bookings. In addition to these perks, the Luxury Collection offers a $100 on-property credit, which can be used based on the policies of each hotel. Both programs also provide other benefits, such as early check-in, late checkout and room upgrades (specifically for Luxury Collection bookings, subject to availability at check-in).

Unfortunately, you can't filter search results specifically for Hotel and Luxury collections properties. To identify these properties, you must look for a tag or description indicating their inclusion in your search results.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

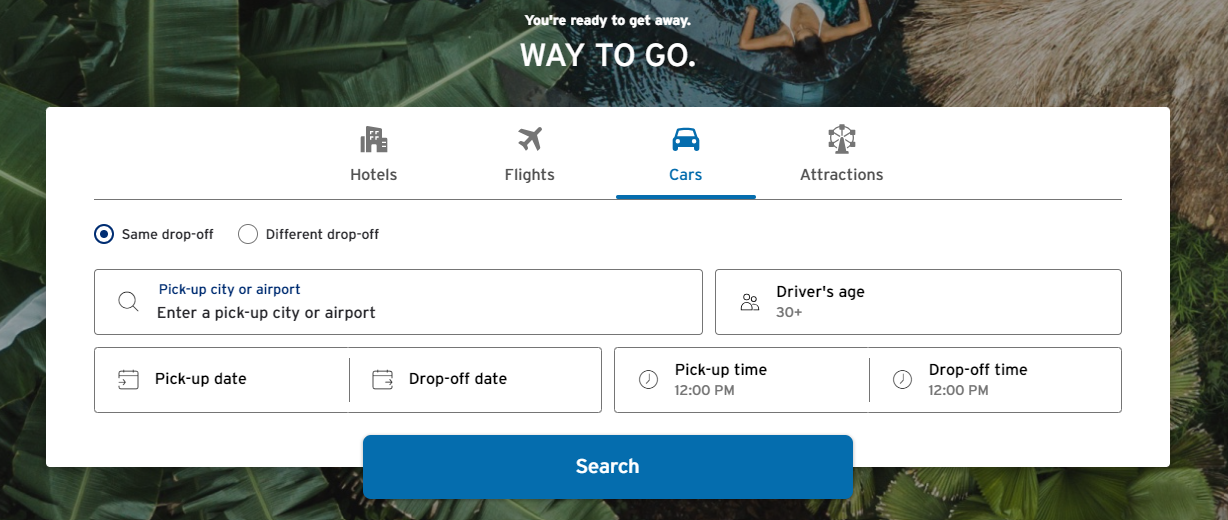

How to book rental cars using the Citi travel portal

Searching for rental cars feels familiar and works quickly.

After providing your location, dates, times and age, click "Search." From the available results, you can use the following filters:

- Vehicle type

- Rental company

- Free cancellation option availability

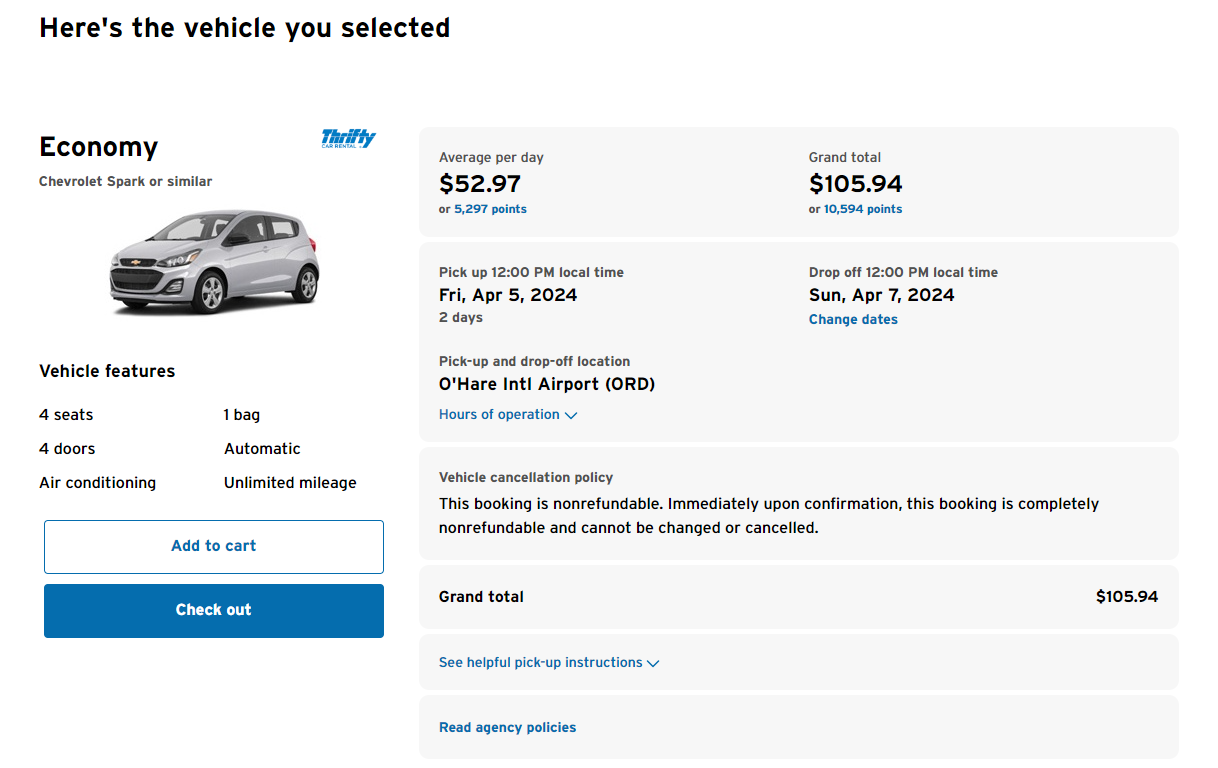

After choosing a car, you can see the full details and cancellation policy on the next page.

As with other items in Citi Travel with Booking.com , you can add your rental car to the shopping cart (if booking multiple travel elements) or go straight to check out to pay and reserve. Again, you can pay with points at a rate of 1 cent apiece.

How to book attractions using the Citi travel portal

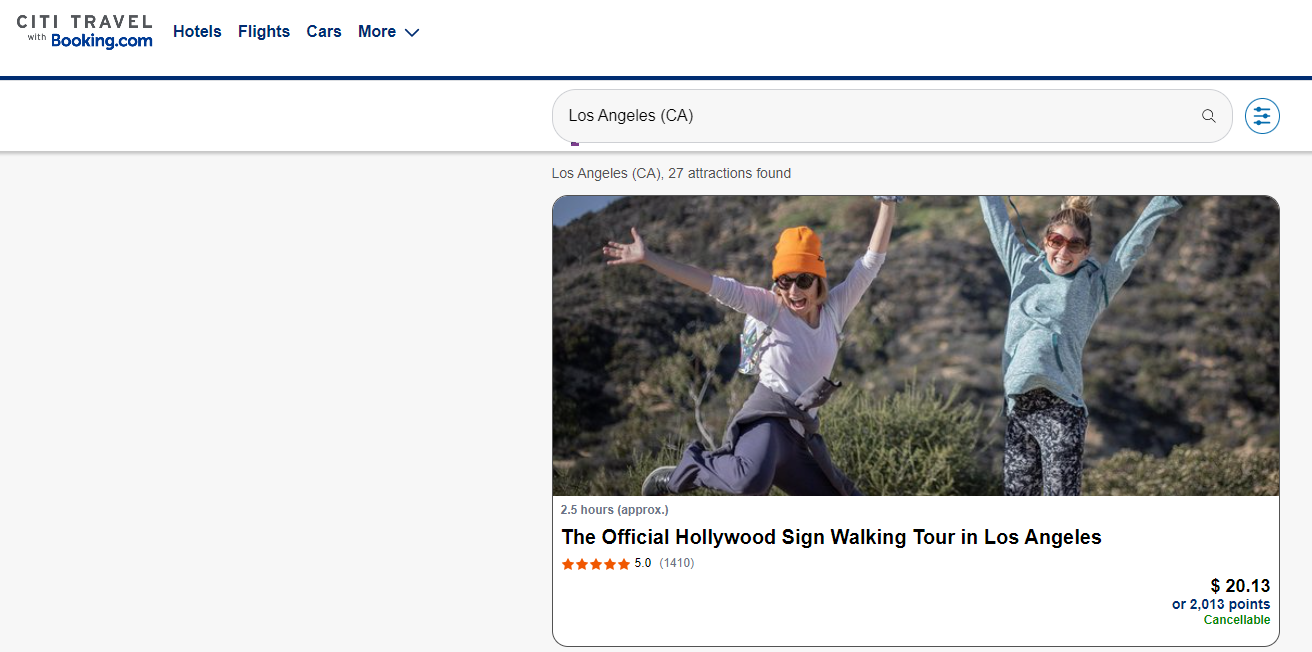

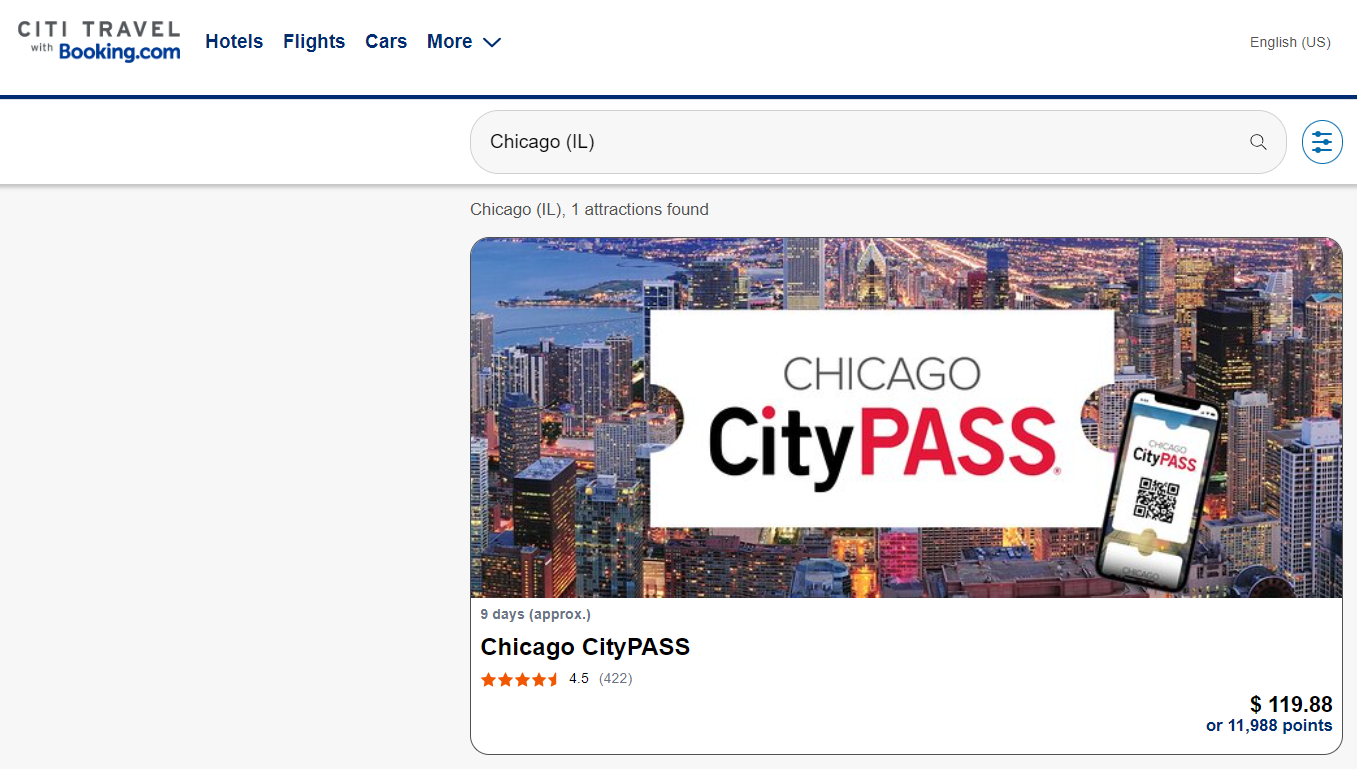

One standout feature of Citi's travel portal is the ability to book attractions along with your hotels, flights and rental cars. This convenient option allows you to make a single transaction for all your travel needs, and you can even use your points to pay for them.

To access this feature, look for the "Attractions" option in the main search bar. However, depending on your location within the portal, you may need to click "More" in the drop-down menu and select "Attractions" from there.

Once you search for a destination, you'll see all available options— from entrance tickets for tourist sights to guided tours. For example, you can book a guided walking tour of the Hollywood Sign.

When you see an activity or tickets you want to purchase, click on the tile. This will take you to a page with details about this offering and cancellation policies.

One noteworthy option is Chicago CityPASS tickets, including access to five popular attractions. Click on "Check availability" in the top right corner to choose your preferred date to find pricing and availability.

As with other elements of Citi's portal, you can pay for attraction bookings using ThankYou points with a value of 1 cent apiece.

More things to consider about the Citi travel portal

Now that you know how to use the Citi travel portal, here's some general guidance to maximize your experience.

As always, we recommend comparing prices. There is no guarantee that Citi Travel with Booking.com will offer the best price for your trip. It's recommended to compare the prices you see on the portal with prices available when booking directly with hotels, airlines, rental car companies or tour providers.

If you plan to pay with points, check if you can get better value by using fewer points with Citi's transfer partners . Transferring points to programs like Wyndham Rewards may let you get more value from your points. Check out our guide to redeeming Citi ThankYou points for high-value redemption ideas.

Also, if you book hotels or car rentals through Citi's travel portal, you may forfeit any elite status earnings and benefits. Many loyalty programs require direct bookings to recognize elite status and provide associated perks. Evaluate whether the benefits you would be giving up are worth it.

Finally, Citi Premier and Citi Prestige cardholders have exclusive benefits within the travel portal. Premier cardholders can enjoy $100 off a hotel stay of $500 or more once a calendar year, while Prestige cardholders can get a fourth night free on hotel stays of four nights or more twice a calendar year. If you're making an eligible hotel reservation, you'll see the option to use your available benefit on the payment screen.

You'll also see the benefit(s) highlighted on the hotel search page if you have one of these cards. This includes information on how many more times your benefit can be used.

If you don't see these benefits, check the top right corner of the portal and ensure your Premier or Prestige card is the active card for your searches.

Bottom line

Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card .

Additionally, if you hold the Citi Premier or Citi Prestige, you can utilize your hotel benefits through the portal.

However, it's important to consider potential tradeoffs. Assess your elite status with hotel or rental car companies and determine if you might get better value by booking your travel through another platform. If convenience is your deciding factor, this user-friendly portal offers many results when planning your upcoming vacation.

Additional reporting by Kyle Olsen.

Introduction to the Citi Travel Portal

Accessing the citi travel portal, citi credit cards that earn thankyou points, what to know about the citi travel portal, citi travel portal: your guide to booking and rewards.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Citi Premier® Card, Citi Prestige® Card, Citi Custom Cash℠ Card, Citi® Double Cash Card, Citi Rewards+® Card. The details for these products have not been reviewed or provided by the issuer.

- If you have a Citi credit card that earns ThankYou points, you can book your travel with them.

- The Citi Travel Portal is like an online travel agency, allowing you to make bookings with ease.

- You can pay with points (worth 1 cent each), your Citi credit card, or a combination of both.

Citi ThankYou Rewards is a flexible points program that allows you to earn points from eligible Citi credit cards and banking products. You can redeem points in a number of ways, including for travel, cash back, or gift cards.

One of the best ways to use points is for travel, either by transferring Citi ThankYou points to airline partners for award flights (only available with certain Citi credit cards), or through an even easier option available to all program members — the Citi Travel portal.

Citi Travel recently got a big overhaul, and it's now partnered with Booking.com and powered by Rocket Travel by Agoda technology. Here's what to know about the new Citi Travel portal and what to expect if you decide to book.

Overview of the Portal

The Citi Travel Portal is an online travel booking platform that works in a similar way to Online Travel Agencies (OTAs) like Orbitz or Expedia. You can search for flights, hotels, rental cars, and attractions based on your destination, travel dates, and other preferences, and you have the option to pay with Citi ThankYou points, your Citi card, or a combination of both.

Benefits of Booking Through the Portal

Although Citi Travel doesn't get as much attention as American Express Travel or the Chase Ultimate Rewards® Travel Portal , it has many of the same benefits:

- You can book travel with no blackout dates

- There's no need to worry about loyalty program award charts or availability

- Your points are worth a flat 1 cent each toward travel, and you can combine them with cash if you don't have enough for a booking

- You'll still earn airline miles and elite-qualifying miles when you book flights, even when you pay entirely with points

- It's possible to pool Citi points from different credit cards (or even share with friends and family who have Citi ThankYou accounts)

A downside to using the Citi Travel Portal is you won't earn points or elite status credit for hotel stays, and you might not have your elite status recognized because it's considered a third-party booking.

If you're looking for the easiest way to cash in Citi points for travel, the Citi ThankYou Travel Portal is a better choice for most people. That said, it's possible to get more than 1 cent per point in value if you skip the Citi Portal and instead transfer your points at a 1:1 ratio to an airline or hotel partner for award travel — but that involves more legwork.

The full range of partners is available if you have the Citi Premier® Card or Citi Prestige® Card (no longer available to new applicants). Otherwise, JetBlue, Choice, and Wyndham are the only airline and hotel options, with a reduced transfer ratio.

How to Log In

To access the Citi Travel Portal, you must be a Citi customer with a ThankYou rewards account. Once you sign in to your Citi account online and click the "View/Redeem" button in the rewards section, you'll land on a screen with several redemption options. Click "Book Travel" in the lower left-hand corner.

Alternatively, you can get to the same screen by signing in with your Citi login details at ThankYou.com .

Once you click "Book Travel," you'll be prompted to select the Citi card account you want to book with if you have multiple Citi cards. Then you'll land on the main Citi Travel search screen.

How to Book Flights with Citi Travel

To search for flights, click the "Flights" tab and enter your departure and destination airport and dates of travel. You'll also have options to select round-trip or one-way flights, class of service, number of passengers, and if you prefer non-stop flights. Then hit "Search."

Next, you'll see a list of flight search results — starting with your outbound flight — which you can sort by price, number of stops, departure time, arrival time, duration, or "best overall" (cheap, short flights). On the left sidebar, there are also filters for the departure and arrival times, airline, number of stops, price range, and total journey duration. To choose a flight, click on the "Select" button, then repeat the process for your return leg if you've searched for a round-trip itinerary.

Once you've selected your flights, you'll be prompted to enter passenger details and will be given options to upgrade your fare (most folks will skip this step). Then, on the final booking screen, you'll have the opportunity to select your payment method — either using your Citi card, ThankYou points, or a combination of both.

How to Book Hotels with Citi Travel

The process of finding a hotel to book through the Citi Travel portal is similar to searching for flights. After selecting the "Hotels" option from the main menu, enter your destination, stay dates, and the number of guests in the search fields.

The results page allows you to sort by property class, price, distance, hotel name, and recommended results. You can filter by price, class, TripAdvisor rating, amenities, nearby landmarks, and even hotels offering deals. One useful feature is the ability to quickly identify properties that have discounted rates by looking for the "Sale" flag in the corner of the hotel listing.

To find out more about the hotel you're interested in, click on the hotel name and you'll be shown different bed options, rate types with cancellation policies, and available packages (breakfast included, for instance) if applicable. Select "Check out" next to the room you want to book. You'll then be asked for guest details (name, address, phone number, and email).

Once you've entered your information, you'll come to the final booking screen where, again, you can choose your method of payment.

How to Rent a Car with Citi Travel

Searching for a car rental through Citi Travel is similarly easy. Once you've clicked "Cars" on the main menu, enter your pick-up location (you can select a different drop-off location if needed), rental dates and times, and the driver's age.

The results list allows you to sort by price, rental company, or car type.

Once you find a car you like, click on its listing to learn more about the rental and enter the driver's name and details.

On the final booking screen, you'll choose your method of payment — again, your Citi card, ThankYou points, or a combination of both.

How to Book Attractions Through Citi Travel

Select the "Attractions" tab on the main search page, and enter the city name where you want to search.

Depending on the destination, you'll get a list of all kinds of activities — from tours and sightseeing tickets to airport transfers and excursions.

When you click on the attraction, you'll get more details about what's included in the activity.

Click "See options" to choose your activity dates, times, and the number of participants.

Once you select "Choose" you'll have the opportunity to enter your traveler details. Then, you'll be brought to the final booking screen where you can select your payment method.

Before you choose between booking through the Citi Portal or transferring points to a partner for an award flight, be sure to compare the number of points required in each case — and verify that an award flight is actually available before you decide on that route.

Earn 10x ThankYou® Points per dollar on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through 6/30/2024. Earn 3x ThankYou® points on restaurant, supermarket, gas station, air travel, and hotel purchases. Earn 1x ThankYou® points on all other purchases.

21.24% - 29.24% Variable

Earn 60,000 bonus ThankYou® points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous bonus categories

- con icon Two crossed lines that form an 'X'. Doesn't offer much in the way of statement credits or other perks

- con icon Two crossed lines that form an 'X'. Citi ThankYou Rewards may not be as convenient as other points for US-based travelers

If you're looking for an all-purpose travel credit card with strong rewards, many ways to use your points, and an annual fee under $100, the Citi Premier should be on your shortlist. Beyond the welcome bonus offer, the Citi Premier® Card offers great 3x earning categories that just about anyone can take advantage of — and the rewards it earns are incredibly flexible.

Citi offers several different cards that earn Citi ThankYou points:

- Citi Premier® Card: Earn 60,000 bonus ThankYou® points after you spend $4,000 in purchases within the first three months of account opening

- Citi Custom Cash℠ Card : Earn $200 cash back, fulfilled as 20,000 ThankYou® Points, after you spend $1,500 on purchases in the first six months of account opening

- Citi® Double Cash Card

- Citi Rewards+® Card : Earn 20,000 bonus points after spending $1,500 in the first three months of account opening

- Citi Prestige® Card: No longer available to new applicants

If you have the Citi Premier® Card, there's an additional incentive to book through the Citi ThankYou portal. Once per calendar year, cardholders can get $100 off a hotel stay of $500 or more (before taxes and fees) when they book through the Citi portal — whether the stay is booked with points, charged to the Citi Premier® Card, or a combination of both.

The Citi Travel Portal is a terrific tool if you're looking for a way to redeem points for flights, hotels, car rentals, and attractions without worrying about blackout dates or fussing with loyalty program award charts. You'll even earn frequent flyer miles and elite credits for flight bookings (but you won't earn hotel points or elite nights on hotel stays, because it's a third-party booking).

Anyone with an eligible Citi ThankYou credit card can redeem their points through the portal at a rate of 1 cent each. Or, if you don't have enough points to cover the entire booking, you can pay with your Citi card in combination with rewards to make up the difference.

Even though using the Citi Travel Portal is easy and convenient, it is usually possible to get more value from your Citi ThankYou points by transferring them to Citi's airline and hotel partners. This method requires jumping through more hoops and searching for award availability, so if you'd rather avoid that inconvenience, the Citi Travel Portal is an ideal booking method.

Citi cardholders can access the travel portal by logging into their online account and navigating to the travel section or directly through the Citi Travel website.

Yes, you can use your Citi points to book flights, hotels, car rentals, and more through the portal. Points can cover all or part of the booking cost.

Typically, bookings made through the portal using your Citi card will earn points according to your card's rewards program.

The portal does not usually charge additional booking fees, but it's always best to review the terms and conditions for any specific charges that may apply.

Yes, you can cancel or modify bookings, but the ability to do so without penalty depends on the specific terms of your booking. Always check the cancellation policy at the time of booking.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Citi Travel With Booking.com Portal: Your Guide To Booking Flights, Hotels, Car Rentals, Theme Parks, & More

Chris Hassan

Social Media & Brand Manager

213 Published Articles

Countries Visited: 24 U.S. States Visited: 26

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3123 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Who Can Use the Citi Travel With Booking.com Portal?

Cards that earn citi thankyou points, why should you use the citi travel with booking.com portal, how to access the citi travel with booking.com portal, how to book a flight through the citi travel with booking.com portal, how to book a hotel through the citi travel with booking.com portal, how to book a rental car through the citi travel with booking.com portal, how to book attractions through the citi travel with booking.com portal, how to book a cruise through the citi travel with booking.com portal, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citi ThankYou Points are an often underappreciated, yet valuable point currency. Often overshadowed by the bigger players like Chase and American Express, Citi offers cardmembers the opportunity to earn and redeem points with some great travel partners.

While transferring points to partners may often yield better value, using points to book travel via Citi’s travel portal can be a convenient option. And the updated Citi Travel with Booking.com portal makes that process even easier and more robust.

In this guide, we will show you exactly what the Citi Travel with Booking.com portal is, who can use it, how to use it, and whether or not you should use it.

Ready? Let’s go!

What Is the Citi Travel with Booking.com Portal?

The Citi Travel with Booking.com portal is a third-party online travel agency (OTA) run by, you guessed it, Booking.com . This portal operates very similarly to other OTAs such as Orbitz and Expedia .

Like other online travel agencies, users have the option to book flights, hotels, rental cars, activities, and more. However, since it’s linked to your Citi account, you can redeem Citi ThankYou Points towards travel at a rate of 1 cent per point.

Unlike other travel portals, like AmexTravel.com , you can only use the Citi Travel with Booking.com portal if you have a Citi credit card that earns ThankYou Points.

Some of our favorite travel cards are issued by Citi. The option to earn flexible points with cards that have some great everyday bonus categories is an excellent way to level up your travel game.

If you want to boost your Citi ThankYou Points balance, here are some of our favorite cards:

Citi Premier ® Card

Frequent flyers will enjoy 3x ThankYou Points at restaurants, gas stations, supermarkets, air travel, and hotels.

The Citi Premier ® Card is an excellent option for anyone looking for an all-around travel rewards credit card. The card helps you earn points fast with great 3x bonus categories such as restaurants, supermarkets, gas stations, airfare, and hotels. Plus, it offers access to airline and hotel transfer partners, doesn’t charge foreign transaction fees, and has a reasonable annual fee!

- 3x points at restaurants, supermarkets, gas stations, airfare, and hotel purchases

- Access to Citi transfer partners

- Annual hotel credit

- No foreign transaction fees

- $95 annual fee

- Earn 60,000 bonus ThankYou ® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou ® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

- Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou ® Points are redeemable for $600 in gift cards redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

Financial Snapshot

- APR: 21.24% - 29.24% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Citi ThankYou Rewards

- Benefits of the Citi Premier

- Authorized User Benefits of the Citi Premier

- Chase Sapphire Preferred Card vs. Citi Premier Card [Detailed Comparison]

- Best Citi Credit Cards

- Best Credit Card Sign Up Bonuses

- Best Travel Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Virtual Credit Cards

Citi Rewards+ ® Card

This no annual fee card rewards cardholders for everyday purchases. Earn bonus points at supermarkets and gas stations, plus your points are rounded up on every purchase.

- Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

- Plus, as a special offer, earn a total of 5 Thank You ® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025.*

- 0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be 18.74% – 28.74%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 2X ThankYou ® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points thereafter. Plus, earn 1X ThankYou ® Points on All Other Purchases.

- The Citi Rewards+ ® Card – the only credit card that automatically rounds up to the nearest 10 points on every purchase – with no cap.

- No Annual Fee

- APR: 0% intro APR on balance transfers and on purchases for 15 months. After that, the variable APR of 18.74% - 28.74%.

- Foreign Transaction Fees: 3% of each purchase transaction in US dollars

- No Annual Fee Cards

- Citi Transfer Partners

Citi Double Cash ® Card

Great card for the average spender with no specific focus category; worry-free cash-back earning on everything!

The Citi Double Cash ® Card has long been one of the top cash-back credit cards on the market, and the card now has the ability to earn Citi ThankYou Points!

This means that cardholders of the Double Cash card will now earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Cash back is earned in the form of ThankYou Points . This means each billing cycle, you will earn 1 ThankYou point per $1 spent on purchases and an additional ThankYou point for every $1 paid on your purchase balance as long as there is a corresponding balance in your Purchase Tracker.

Citi has turned the Double Cash card into a top choice for those who are looking for an everyday, no-fuss credit card.

- Uncapped 2% for every $1 spent (1% when you buy and another 1% when you pay)

- Flexible redemption options

- No annual fee

- No bonus categories

- 3% foreign transaction fees

- Lack of premium travel benefits

- Bonus Offer: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Citi Double Cash ® Card Travel Portal Limited Time Offer: Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions, excluding air travel, when booked through the Citi Travel SM portal on ThankYou.com or by calling 1-800-Thankyou and saying “Travel.” Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024.

- APR: 0% Intro APR for 18 months on balance transfers, then 19.24% - 29.24% Variable

- Foreign Transaction Fees: 3% of the U.S. dollar amount of each purchase

- Cash Back Credit Cards

- Capital One Venture vs Citi Double Cash

- The 8 Best 2% Cash-back Credit Cards [2024]

- Best 0% Interest Credit Cards

- Best Credit Cards for Bills and Utilities

- Best Everyday Credit Cards

Citi Custom Cash ® Card

Earn big on purchases in your top eligible spend category, up to the first $500 each billing cycle, with no annual fee!

The Citi Custom Cash ® Card is inventive when it comes to cash-back credit cards. Instead of earning a set amount of cash-back on predetermined bonus categories, the Citi Custom Cash card earns 5% cash-back on your highest eligible spend category each billing cycle, without an annual fee.

Thanks to that unique perk, you’ll never need to worry about whether you’re using the right card for the right purchase, as your Citi Custom Cash card will always pay you 5% back on whichever category you end up spending the most on each month.

- 5% cash-back (on up to $500 each billing cycle) from your largest purchase category, including restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment

- Multiple redemption options

- No redemption minimums

- Your 5% category is limited to $500 in spend ($25 in cash-back) each month

- Not particularly rewarding for any purchases outside of your top 5% cash-back category

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked via the Citi Travel℠ portal through 6/30/2025.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- Citi will only issue one Citi Custom Cash ® Card account per person.

- APR: 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%.

- Foreign Transaction Fees: 3%

- Citi Custom Cash Card Launches [Earn 5% Back on Your Top Purchases]

While many in the travel community prefer to earn points and then transfer them to partners to book award redemptions, that process can be complicated and confusing to some people.

For a lot of people, booking through an OTA, like the Citi Travel with Booking.com portal, is straightforward and easy — and if that helps you book more travel, then you should absolutely do it.

But there are plenty of other reasons to use the Citi Travel with Booking.com portal as well …

Bonus Points

To kick off the launch of the new portal, Citi is offering up to 10 ThankYou Points per $1 spent on hotels, car rentals, and attractions if you hold a Citi Prestige ® Card or Citi Premier card . If you hold the Citi Rewards+ card , you can earn up to 5 ThankYou Points per $1. This promotion is valid through December 31, 2025.

No Blackout Dates

If there is a seat on the flight you want, you can book it. There are no blackout dates or stress about finding award availability. With the Citi Travel with Booking.com portal, if you see a flight, you can book it.

Earn Airline Miles

One of the nice things about booking flights through an OTA is the fact that you still earn airline miles and elite-qualifying miles despite not booking directly through the airline.

Use Points and Money

If you are a little short on points or don’t want to use them all, you can use a combination of points and money to pay for your travel.

At checkout, simply select how many points you want to redeem and the difference will be calculated for you to pay in cash.

Book Non-chain Hotels

While points are great for booking hotels from the big chains, your options are limited when it comes to independent, boutique hotels.

That is when booking through an OTA like the Citi Travel with Booking.com portal comes in handy. You can use your ThankYou Points to book hotels that otherwise wouldn’t have been possible.

Get a Fourth Night Free

One of the many benefits of the Citi Prestige card (no longer open to new applicants) is that cardholders are eligible for a fourth night free at select hotels.

Simply select a hotel for 4 or more nights and if the hotel is eligible, the price will reflect the discount.

Pool Citi ThankYou Points

If you are short on points or want to boost your balance, Citi allows members to combine ThankYou Points.

This can be done online or by calling the phone number on the back of your Citi credit card.

Luxury Collection and Hotel Collection Benefits

As part of the new travel portal, Citi is gradually introducing 2 new programs for hotel bookings; Luxury Collection and Hotel Collection.

These programs offer unique benefits at select hotels, although the number of hotels is still quite limited. However, you can expect the following if you book:

Luxury Collection Benefits (Citi Premier Card and Citi Prestige Card members):

- $100 experience credit

- Room upgrade, upon availability

- Daily breakfast for 2

- Complimentary Wi-Fi

- Early check-in, upon availability

- Late checkout, upon availability

Hotel Collection Benefits (All eligible cardmembers):

Hot Tip: It’s not all positive — if you book a chain hotel via the Citi Travel with Booking.com portal you are typically ineligible to receive any elite night credits or elite benefits during your stay.

Accessing the Citi Travel with Booking.com portal is pretty straightforward. You can simply visit Citi Travel with Booking.com and log in with your Citi credentials.

From there you will have options to choose Hotels, Flights, Cars, and More . Let’s start with booking flights …

Once you are logged in and click on Flights , you will be directed to the online search tool — which may look familiar if you have used Booking.com before.

Searching for a flight using the Citi Travel with Booking.com portal is pretty straightforward.

Simply select:

- Round-trip or one-way (multi-city is no longer an option)

- Flying from

- Departure date

- Return date (if applicable)

- Cabin class

Once you have started a search, the results will populate and you will have additional options to filter through the flights.

Currently, you can filter flight results by:

- Departure times

- Arrival times

Citi will even break down the results into 3 categories: Cheapest , Fastest , and Best overall — which is a combination of low price and short duration.

By default, the results are shown by price per person, but you can also sort them by:

- Total journey time (fastest first)

- Best overall (cheap, short flights)

- Outbound departure time (earliest first)

- Outbound arrival time (earliest first)

- Stops (fewest stops first)

Once you have found a flight that works for you, click on the blue Select button to proceed with the booking.

If eligible, you will be prompted with options to upgrade your seat, similar to what airline websites offer.

After confirming your selection and adding the passenger information, click the Continue to payment button where your flight details will be shown alongside your Citi ThankYou Points balance.

You then will have the option to use points, pay with your Citi card, or a combination of both. From here, you can use as many (or as few) points as you would like to cover the cost of the flight, and if there is a balance, it will be charged to your Citi card.

After confirming the information, simply click on Complete Purchase and your ticket will be issued. As with most OTAs, there is a 24-hour cancellation window.

Comparing Rates

While it isn’t uncommon for flight prices to fluctuate and be slightly different between online travel agencies and with airlines directly, during our search we found that most prices were the same price on Google Flights as they were through the Citi Travel with Booking.com portal.

While prices are often similar, it is always a good idea to double-check prices on Google Flights.

As an extra data point, American Airlines was charging 11,500 miles for that flight, so that was slightly less than the 12,790 Citi ThankYou Points needed.

Once logged in, click on the Hotel tab to start the booking process through the Citi Travel with Booking.com portal (the default landing page may already be set to hotels).

Searching for a hotel is pretty straightforward and similar to many other OTAs.

- Destination

- Check-in date

- Check-out date

- Number of guests and rooms

If you have a Citi Prestige complimentary 4th night free available, there will be a message displaying that information.

Once you have started a search, the results will populate and you will have additional options to filter through hotel options.

Currently, you can filter hotel results by:

- Price per night

- Property type

- Sustainability

- Distance to center

- Neighborhood

- Star rating

- Payment options

- Guest rating

- Room amenities

- Near popular attractions

- Location rating

- Property facilities

- Room offers

- Beach access

- Location highlights

- Number of bedrooms

- Popular hotel brands

By default, the results are sorted by Best match , but you can sort by lowest price , distance , and top reviewed as well.

Hot Tip: Beware, the prices shown on the first page do not include taxes and fees , so the price may change significantly from one page to another.

Once you have found an option that works for you, click on the hotel to proceed with the booking.

After finding a room that you like, click Add to cart or Check out to be directed to the Review page where you will enter the guest information.

Citi Prestige Card Benefit

On the next page, if you have a Citi Prestige card, you will have the option to apply the Complimentary 4th Night Benefit.

If you don’t have a Citi Prestige card, you can skip ahead.

Citi Premier Card Benefit

If you have a Citi Premier card, you can receive $100 off a single hotel stay of $500 or more.

This $100 credit is available once per calendar year when booking via the Citi Travel with Booking.com portal, and you will have the option to use it or not.

After filling out the guest information, click on Continue to payment.

Finally, on the Payment page, you will have the option to apply your Citi ThankYou Points towards the total at a rate of 1 cent per point. So, for example, using 10,000 points would reduce the total by $100.

Hotels always want guests to book directly with them in order to avoid paying commission fees to online travel agencies, so it’s not uncommon to see prices be different from site to site.

That is why hotels do not provide elite benefits when booking through an OTA, as an extra incentive to book direct.

In the case of the Citi Travel with Booking.com portal, our example was actually cheaper than the price on Expedia as well as directly with the hotel, which is great news for Citi cardholders.

The total for 4 nights via the Citi Travel with Booking.com portal was $1,228, before factoring in any card benefits or points. The price for the same room and dates directly with the Loews Sapphire Falls Resort was $1,266.09 — $38.09 more expensive.

Once you are logged in, click on the Car tab to start booking a car through the Citi Travel with Booking.com portal

If you have searched for a rental car using an online travel agency before, you will notice that the layout is quite similar.

- Same drop-off

- Different drop-off (if applicable)

- Pick-up city or airport

- Drop-off city or airport (if applicable)

- Driver’s age

- Pick-up date

- Drop-off date

- Pick-up time

- Drop-off time

Once you have started a search, the results will be displayed and you will have some additional options to filter through the rental car inventory.

Currently, you can filter rental car results by:

- Vehicle type

- Rental agency

- Cancellation fee

- Price per day

By default, the results are sorted by price — lowest price first.

Additionally, you can see the results on a map, which can be helpful if you are picking up somewhere besides an airport.

Once you have found a price that works for you, select the car to proceed with the booking.

After adding the driver information, you can now use as many (or as few) Citi ThankYou Points as you would like to cover the cost of your rental car.

After confirming all of the information, simply click on Confirm Purchase and your confirmation will be emailed to you. The cancellation policy will vary based on the car and rate you selected.

As a reminder, rental car company-specific credits and benefits will not be available when booking through a third-party travel agency.

Rental car rates are constantly fluctuating, so booking a car with a generous cancellation policy is a good idea in case you find a better price later on.

Comparing prices for this guide was an excellent example of that. In our sample search, Expedia had the same car class from SIXT, but for $22 more for the week. However, Expedia also had several rental car companies that Citi didn’t, many of which were cheaper.

But the good news is, renting via the Citi Travel with Booking.com portal was cheaper than booking directly with SIXT, which was the same price as Expedia, plus you can use points.

One thing to note was the lack of other well-known rental agency options. For example, in Miami, there were many companies that we had never heard of, and the portal was missing big names like Hertz and National. Meanwhile, in Boston, there was only 1 option: Payless. Definitely do your research and don’t rely solely on the Citi search results.

Bottom Line: It is always a good idea to compare OTAs as well as directly with the rental car company when searching for a car. See our guide on finding the best websites for finding cheap car rentals for more tips!

Booking an attraction (think: theme parks) is an awesome feature of the updated Citi Travel with Booking.com portal.

Once you log in, click on the Attractions tab to start the booking process via the portal.

To start, simply type in the city you would like to visit and click Search .

Once the attractions have been populated, you can filter them by:

You can also sort by:

- Lowest price first

- Highest rating first

Once you have found an activity that you like, click on it to bring up more details.

Click on See Options to search for availability and additional ticket options.

If there is availability for your request, click the blue Choose button and then add the number of travelers in your party.

You can now use as many or as few Citi ThankYou Points as you would like to cover the cost of the attraction. If you are short on points, don’t worry, you can add the difference to your Citi card.

After confirming the trip information, simply click Confirm Purchase and your ticket will be emailed to you. As a quick note, many attractions are non-refundable.

Comparing prices on local activities can be difficult because many of them are run by individuals or small companies who may not be on all booking sites.

However, for this example, we chose a 1 day Park-2-Park ticket for Universal Orlando, which sells directly from UniversalOrlando.com for $217.26.

Booking via the Citi Travel with Booking.com portal would be $15 more expensive, per person. That may not be a big deal if you are planning on using your ThankYou Points, but it is something to consider.

Booking a cruise with Citi ThankYou Points was never an easy task, and with the rollout of the new Citi Travel with Booking.com portal, it appears that Citi has decided to move away from that category.

You can still find the occasional river cruise or local boat tour via the attractions search, but weeklong trips to the islands, for instance, are not available at the moment.

Bottom Line: If you are looking to book a cruise, we can show you the best websites to book cruises at the cheapest prices .

Overall, the refreshed Citi Travel with Booking.com portal is a convenient, easy-to-use, and valuable travel tool for those who don’t like to deal with transferring points to partners.

Redeeming Citi ThankYou Points at a rate of 1 cent per point won’t get you the greatest redemptions, but if you would otherwise not use the points, using them (or earning them) to book travel through the portal is a solid deal.

There are some unique perks, like being able to use points at non-chain hotels, but there are drawbacks as well, like not receiving elite night credits and other loyalty perks at some of the chain hotels and rental car companies.

While the cruise section is non-existent, the booking process for flights, hotels, and car rentals is easy and straightforward, and theme parks are now an option — which is always a plus in our book.

If you have some Citi ThankYou Points and are looking for an easy way to redeem them for some upcoming travel, the Citi Travel with Booking.com portal is just a few clicks away.

The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information for the Citi ThankYou ® Preferred Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Does citi have a travel portal.

Yes, Citi has the Citi Travel with Booking.com portal which is an online travel agency (OTA) similar to Expedia and Orbitz.

Can I redeem Citi ThankYou Points for any travel?

Most travel like flights, hotels, rental cars, activities, and even some cruises can be booked via the Citi Travel with Booking.com portal using Citi ThankYou Points.

Is booking through the Citi Travel with Booking.com portal a good deal?

You can often get better value from your points by transferring them to a travel partner, but if there is no award availability or if your desired hotel or airline isn’t a partner, booking via the Citi Travel with Booking.com portal can make sense. Plus, we have found some hotels are even cheaper than booking direct.

How do I use my Citi ThankYou Points?

There are many ways to use Citi ThankYou Points, including buying gift cards, cashing them out, or redeeming them for travel (our preference). Here we will show you how to use them to book travel via the Citi Travel with Booking.com portal.

Can I book Disney World tickets with my Citi points?

No, Disney is not an available attraction, however, you can book Universal tickets with your Citi ThankYou Points.

Was this page helpful?

About Chris Hassan

Chris holds a B.S. in Hospitality and Tourism Management and managed social media for all Marriott properties in South America, making him a perfect fit for UP and its social media channels. He has a passion for making content catered toward family travelers.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![citi bank travel portal Skyscanner: How To Find Flights, Hotels & Car Rentals at the Best Prices [2024]](https://upgradedpoints.com/wp-content/uploads/2019/04/Skyscanner-on-phone.webp?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

Guide to Citi ThankYou travel portal

Carissa Rawson

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 6:47 a.m. UTC Feb. 26, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Gerasimov174, Getty Images

Citi is a Blueprint partner.

Like other card issuers such as American Express , Capital One and Chase , Citi® maintains a travel portal through which cardholders can book hotels, rental cars, flights and activities. Whether or not this is a good idea depends on how you travel.

Let’s take a look at the Citi ThankYou® travel portal, how it works and who can access its booking features.

- The Citi ThankYou travel portal offers flights, hotels, rental cars and activities.

- Eligible cardholders can earn elevated rewards on bookings through Citi travel.

- The Citi ThankYou travel portal provides access to extra hotel benefits via the Luxury Collection and the Hotel Collection.

How to book travel through the Citi travel portal

Booking travel through Citi’s portal is simple. First, you’ll want to navigate to the Citi ThankYou travel portal website . You’ll be prompted to sign in with your online account and choose which Citi card you’ll be using to book your travel. Once signed in, you’ll be directed to the travel portal’s home page.

From here, you can choose what type of travel you’re looking to book, whether that’s a hotel, flight, rental car or activity.

For example, if you were looking to book a hotel through the Citi ThankYou travel portal, you’d simply need to enter your destination, dates of travel and how many people you’re traveling with.

The portal will then pull up a page showing all the results that match your search. You can also check out what properties are available by using an interactive map. The search includes a long list of filters by which you can sort properties, including star rating, neighborhood, cancellation options, bed type, property amenities and hotel brand.

Once you’ve selected the travel you’re looking for, you’ll be taken through the checkout process. This includes providing personal and payment information, like your frequent flyer number for a flight.

Note that you’ll need to use your eligible Citi card to pay for your booking. It’s also during checkout that you can decide whether or not you’d like to redeem your Citi ThankYou points.

Once you’ve completed your booking, you’ll receive a confirmation email. You can also find your upcoming bookings within the travel portal via a drop-down menu in the upper right corner.

Who can use the portal?

The Citi ThankYou travel portal is available to cardholders who have the following Citi cards :

- Citi Premier® Card * The information for the Citi Premier® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Citi Rewards+® Card * The information for the Citi Rewards+® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Citi Double Cash® Card

Citi Custom Cash® Card

- Citi Prestige® Card (no longer open to new applicants).

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome Bonus

Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- No annual fees.

- Easy-to-redeem cash-back rewards.

- Introductory APR period.

- Charges foreign transaction fees.

- There’s a balance transfer fee.

- Limited cash-back reward categories.

Card Details

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

Is the portal worth using?

The Citi ThankYou travel portal isn’t always the best way to book your travel. This is because it doesn’t offer a best-price guarantee, so the pricing you see on the portal may not reflect the lowest available prices.

There may also be an issue if you book hotels or rental cars through the Citi ThankYou travel portal and want to receive any elite status benefits. Generally speaking, hotel and rental car companies exclude third party bookings from elite status perks. This also means you won’t earn any bonus points or elite status credit from your bookings.

However, any flight you book through the Citi ThankYou travel portal will earn miles and will also be eligible for elite status benefits. But, if your plans change, you’ll need to negotiate with Citi travel rather than directly with the airline for your flights.

That being said, Citi heavily rewards those who choose to book within its travel portal. Depending on which card you hold, you can earn up to 10 Citi ThankYou points per $1 spent on eligible bookings through the travel portal (through June 30, 2024).

How to maximize your Citi travel benefits through the portal

Although the Citi ThankYou travel portal may not provide the best prices, there are two key benefits it offers that provide serious benefits. The first is the ability to book certain tickets and attractions through the portal.

This includes tickets to popular amusement parks such as Universal Studios Orlando.

Eligible cardholders can easily redeem their Citi ThankYou points for theme park tickets using this method. Those who hold the Citi Premier Card can also earn 10 points per $1 spent through June 30, 2024.

The second key benefit is that the Citi ThankYou travel portal offers access to the Luxury Collection and the Hotel Collection. Those with a Citi Prestige Card or a Citi Premier Card can book both of these options. The Luxury Collection mimics elite status benefits at high-end hotels and can provide room upgrades, a $100 experience credit, complimentary breakfast, late check-out and more.

The Hotel Collection is available to all cardholders with access to the Citi ThankYou travel portal. Its benefits include daily breakfast, free Wi-Fi, early check-in and late check-out.

Quick guide to Citi ThankYou Rewards

Citi ThankYou Rewards can be earned from a variety of different credit cards, as we noted above. These points can be highly valuable, especially when they’re transferred to Citi’s hotel and airline partners. This is generally considered to be the best way to use your Citi points since you can score outsized value when redeeming your points for reward redemptions.

Other ways to redeem Citi ThankYou points include:

- Online shopping.

- Gift cards.

- The Citi ThankYou travel portal.

- Donations.

- Statement credits.

- Cash.

You’ll always want to do the math before redeeming your points. For example, you’ll receive just one cent in value when redeeming your Citi points via the ThankYou travel portal, while choosing to transfer your points to a partner can yield a much higher value.

Frequently asked questions (FAQs)

Yes, it’s possible to book a flight and use your Citi points to pay. There are a few different ways to do this. The first is to transfer your points over to any of Citi’s airline transfer partners. You can then make an award redemption for a flight.

The second is to book your flight using the Citi ThankYou travel portal and redeeming your Citi points to pay for it. This has the advantage of still earning airline miles on your ticket, but it doesn’t necessarily represent the best value for your points.

The third is to purchase an airline ticket using your card and then redeeming points as a statement credit. This last option typically provides the least value and should only be used in limited circumstances.

Citi ThankYou points can be redeemed in a variety of ways, including transfers, gift cards, statement credits and more. To do so, you’ll want to navigate to Citi’s ThankYou redemption site . Once you’ve signed in to your account, you’ll be able to redeem your points online.

Like many of the best credit cards , Citi has 14 airline transfer partners, including:

- Air France/KLM

- Turkish Airlines

- Qatar Airways

- Virgin Atlantic

- Thai Airways

- Singapore Airlines

- Qantas Airways

- Cathay Pacific

You can also use your Citi ThankYou points via the travel portal to book flights with many different airlines.

While it’s not necessary to tell Citi if you’re traveling internationally, it may be a good idea. Setting up a travel notice lets your bank know that you’ll be out of town. This, in turn, can help avoid your card being declined or flagged for fraud on unfamiliar charges.

If you’re booking travel on Expedia’s website, the only way to redeem your points is as a statement credit. You’ll first want to pay using your Citi card. Then, you can redeem those points against the purchase to wipe it away.

*The information for the Citi Premier® Card and Citi Rewards+® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Ashley Barnett has been writing and editing personal finance articles for the internet since 2008. Before editing for USA TODAY Blueprint, she was the Content Director for an international media company leading the content on their suite of personal finance sites. She lives in Phoenix, AZ where you can find her rereading Harry Potter for the 100th time.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Capital One Quicksilver benefits guide 2024

Credit Cards Lee Huffman

United Airlines credit cards have a secret perk that makes it easier to book awards

Credit Cards Jason Steele

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance