- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Here are the 5 best cruise insurance plans

Cruise insurance can cover many situations, but you need to shop around to find the best coverage..

A cruise is an ideal vacation for anyone who likes the all-inclusive concept , where you pay one price and have just about everything taken care of, from accommodations to meals and activities. But they also aren't always cheap and a lot of things can go wrong. You could have a flight delay that causes you to miss your departure or be unable to sail because of a sickness. In these situations, cruise insurance can reimburse you for prepaid and non-refundable expenses.

CNBC Select analyzed 19 cruise insurance companies and selected the best plans for various situations. (See our methodology for more information on how we chose the best cruise insurance plans.)

Best cruise insurance

- Best overall: Nationwide Travel Insurance

- Best for affordable coverage : AXA Travel Insurance

- Best for adventure excursions: World Nomads

- Best for pre-existing conditions: Seven Corners Travel Insurance

- Best for cancel-for-any-reason coverage: Travel Guard Travel Insurance

Best overall

Nationwide travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Nationwide's wide coverage for travel insurance allows many different types of travelers to find coverage that fits their needs. Three levels of cruise insurance coverage gives extra options to cruise passengers.

24/7 assistance available

- 10-day review period on cruise insurance policies to make sure the plan meets your needs (not available in NY or WA)

- Most basic cruise plan doesn't offer CFAR coverage

Who’s this for? Nationwide is a top choice for many travelers due to its variety of cruise-specific coverage. The insurer offers three three tiers of cruise insurance, but its standard Universal Cruise Plan should meet many needs.

Standout benefit: Nationwide's cruise-specific plans can cover things like emergency accidents, sicknesses, itinerary changes, mechanical breakdowns and other trip interruptions or on-ship disruptions. The company also offers a 10-day review period on its cruise policies (not available in NY or WA), giving you extra time to look over the policy and ensure it’s a good fit.

[ Jump to more details ]

Best for affordable coverage

Axa assistance usa travel insurance.

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

Who’s this for? Budget-conscious cruisers should consider AXA . In our research, AXA's Silver Plan stood out as the top budget plan for its mix of affordable premiums and essential coverage. CNBC Select also named AXA one of the best overall travel insurance providers .

Standout benefit: AXA's Silver Plan includes the standard coverage you need to protect yourself from delays and cancellations, as well as employment layoff coverage. This benefit reimburses you for prepaid and nonrefundable travel costs if you cancel because of involuntary layoff or you are terminated from your job. You only need to have been at your current employer for one continuous year to qualify, which is generous compared to other plans that require at least three continuous years of employment for this coverage — if it's even included at all.

Best for adventure excursions

World nomads travel insurance.

World Nomads offers travel insurance for all sorts of travelers, from families to solo adventure travelers. Policies are underwritten by Nationwide and offer strong coverage of emergency accident and illness situations, as well as emergency evacuation scenarios.

- Affordable coverage for many travelers

- Coverage for adventure activities like scuba diving, bungee jumping and more

- Lower trip cancellation limits than other travel insurance we reviewed

Who’s this for? World Nomads offers insurance underwritten by Nationwide , geared specifically toward thrill-seekers. The World Nomads Explorer Plan covers over 200 adventure activities and sports. With this plan, you can take part in just about any excursion without fear of negating your coverage .

Standout benefit: The World Nomads Explorer Plan covers baggage and personal items for loss, theft or damage for up to $3,000 and $1,500 per item. Sporting equipment is included in this coverage, so you can bring your golf clubs along on your cruise without worry.

Best for pre-existing conditions

Seven corners travel insurance.

Policies provide missed and delayed tour/cruise connection coverage. Cancel for any reason coverage and pre-existing conditions waiver are also available if you buy your plan within the specified time. ***CFAR and IFAR are subject to certain eligibility criteria and are not available in all states

- High coverage limits available

- Offers group insurance (10+ people)

- Covers Covid-19 illness

- Pre-existing conditions waiver not available for the Economy plan

- Cancel for any reason not available for the Economy plan

Who’s this for? Seven Corners offers a standard Trip Protection Economy plan and a more premium Trip Protection Elite plan. The Seven Corners Trip Protection Elite plan stands out for offering generous coverage limits and an add-on option for cancel for any reason (CFAR) coverage, which both pair well with its pre-existing conditions waiver.

Standout benefit: This plan's pre-existing conditions waiver for medical coverage applies to plans purchased within 20 days of booking and paying your initial trip deposit. That's a generous window compared to some plans which can require you to purchase insurance within seven to 14 days. If you don't purchase your coverage within the waiver window, this plan only considers conditions existing within the previous 60 days, whereas other plans may look back up to 120 days.

Best for cancel for any reason coverage

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Who’s this for? AIG's Travel Guard Preferred plan comes with a wide range of coverages and a variety of useful add-ons for an extra fee such as pet coverage , wedding coverage and cancel for any reason coverage (CFAR).

Standout benefit: The optional CFAR insurance for this plan begins at 12:01 a.m. on the day after you pay for coverage and ends two days before departure (or when the travel is canceled). This benefit reimburses up to 50% of the trip cost (up to $25,000 maximum), which includes reimbursement for:

- 50% of change fees

- 50% of cancellation penalties for unused travel

- 50% of award travel redeposit fees

More on our top cruise insurance plans

Nationwide universal cruise plan.

Nationwide's standard Universal Cruise Plan will be more than sufficient for many cruisers. It offers strong coverage for many different scenarios, but if you're seeking higher levels of coverage or are taking a long cruise, you can opt for the Choice Cruise Plan, or the Luxury Cruise Plan, which offers the highest level of benefits.

Trip cancellation and interruption

The full trip cost (100%) is covered for both cancellations and interruptions. This includes canceling because of a Covid-19 illness .

Covered delays of six hours or more (or at least three hours for missed connections) are eligible for reimbursement of:

- Up to $500 per day

- $500 maximum

Medical coverage and evacuation and repatriation

- $75,000 in emergency accident and sickness coverage

- $250,000 in evacuation and repatriation coverage

- $750 in emergency dental treatment coverage

Pre-existing conditions

No coverage for pre-existing conditions that fall within 60 days of your policy's start date.

Notable perks

All of Nationwide's cruise plans, including the Universal Cruise Plan, include cancel for work reason coverage, meaning you may be covered if you need to cancel because of work-related issues, as well as coverage for extension of the school operating session. The Universal Cruise Plan also provides coverage for delayed and lost baggage, which begins to kick in after delays of eight hours or more, as well as coverage for trip delays of three hours or more for missed connections or other trip delays of six hours or more. You can also get reimbursed if your trip is canceled or interrupted because of terrorism (foreign or domestic) or financial default of the travel provider (14-day waiting period applies). Itinerary changes that cause you to miss a pre-paid excursion are covered by up to $250.

[ Return to summary ]

AXA Silver Plan

AXA offers three insurance plans, with the Silver Plan being the most affordable. The Gold Plan has most of the same types of coverage with higher reimbursement limits. Meanwhile, the Platinum Plan is for anyone who prefers premium benefits, such as cancel-for-any-reason coverage.

The full trip cost (100%) is covered for both cancellations and interruptions. This includes canceling because of a Covid-19 illness.

After a 12-hour delay or more, you're eligible for:

- Up to $100 per day

- Primary medical coverage of $25,000 per (covers Covid-19)

- Evacuation and repatriation coverage of $100,000 per person

No coverage for pre-existing conditions that fall within this policy's 60-day look-back period.

AXA's Silver Plan comes with coverage for delayed and lost baggage, including $200 per person for covered delays of 24 hours or more and $750 per person ($150 per item) for lost baggage and items. You can also get reimbursed if your trip is canceled or interrupted because of terrorism (foreign only) or financial default of the travel provider (10-day waiting period applies). If a hurricane or bad weather causes your travel provider to cease services for at least 48 hours, you can be reimbursed for up to the full trip cancellation/interruption coverage. Notably, you must purchase the coverage before a storm is named.

World Nomads Explorer Plan

The Explorer Plan is World Nomads' premium travel insurance plan and covers a longer list of activities than the Standard Plan. You can review the list of covered activities here and decide if the more affordable Standard Plan works for you.

Covered up to the trip cost with a $10,000 maximum.

Covered delays of six hours or more are eligible for reimbursement of:

- Up to $250 per day

- $3,000 maximum

- $100,000 in emergency accident and sickness coverage

- $500,000 in evacuation and repatriation coverage

No coverage for pre-existing conditions that fall within 90 days of your policy's start date.

This plan includes $35,000 in rental car damage coverage (where it's valid) due to collision, theft or a natural disaster. And an accidental death and dismemberment benefit of $10,000. When your baggage is delayed for more than 12 hours, you can be reimbursed up to $150 a day ($750 maximum) for any necessary personal items you purchase.

Seven Corners Trip Protection Elite

The Seven Corners Trip Protection Elite plan has generous coverage limits for evacuation and repatriation and accident and sickness. Seven Corners Travel Insurance plans also cover Covid-related illnesses.

Trip cancellations are covered for 100% of the trip cost and interruptions are covered for 150% of the trip cost.

Trip delays of six hours or more can qualify for reimbursement of:

- Up to $300 per day

- $1,500 maximum

- $250,000 in emergency accident and sickness coverage

- $1,000,000 in evacuation and repatriation coverage

- $750 in emergency dental coverage

Pre-existing conditions are covered if you purchase coverage within 20 days of making your initial trip deposit. If you don't qualify for the pre-existing conditions waiver, there is no emergency medical coverage for conditions existing within 60 days of your policy's start date.

This plan covers baggage delays of more than 12 hours for up to $600 and covers lost, damaged or stolen bags or personal items for up to $300 per item ($2,500 maximum). It also has missed cruise connection coverage of $150 per day for accommodations and meals ($1,500 maximum).

AIG Travel Guard Preferred

The CFAR coverage is available as an upgrade on Travel Guard's Preferred and Deluxe plans. If you don't need this optional upgrade, you could save money on your premium with Travel Guard's Essential plan.

Trip cancellations are covered for 100% of the trip cost (up to a max of $150,000) and trip interruptions are covered for 150% of the trip cost (up to a max of $225,000).

Trip delays of five hours or more can qualify for reimbursement of:

- Up to $200 per day

- $800 maximum

- $50,000 in emergency medical coverage

- $500 in emergency dental coverage

A pre-existing conditions waiver applies when you purchase coverage within 15 days of the initial trip deposit.

With this plan, you'll have coverage for lost, stolen or damaged baggage or travel documents for up to $1,000. You also receive baggage delay reimbursement for delays of more than 12 hours with a coverage limit of up to $250 per day ($300 maximum). If you miss a connection, you can be reimbursed up to $1,000 for unused prepaid or nonrefundable travel you missed and transportation expenses to rejoin your trip.

When should I buy insurance for a cruise?

It's usually best to purchase cruise insurance shortly after booking. This lets you take advantage of the protections sooner and qualify for certain benefits such as pre-existing condition waivers.

Is there a difference between travel insurance and cruise insurance?

Travel insurance typically covers cruises and other types of travel, whereas cruise insurance is designed to specifically protect you while cruising or getting to your cruise.

Does cruise insurance cover missed ports?

Cruise insurance may cover missed connections, but it's important to read your policy before you purchase it. Each policy has different limits on how much you'll be reimbursed and what exactly you'll be reimbursed for.

Bottom line

Cruise insurance plans protect you in all sorts of situations when something goes wrong while you're cruising. You can be covered for emergency medical expenses, trip delays, trip cancellations or interruptions and more. Shop around and compare providers to find the best cruise insurance policy for you.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every cruise insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best cruise insurance plans.

Our methodology

To determine the best cruise insurance plans, CNBC Select analyzed the offerings of 19 insurance companies and compared them based on various factors. These included the maximum coverage limits, optional coverages, types of coverage, premiums and what the policies cover. We also considered financial strength ratings from AM Best and Better Business Bureau ratings for customer satisfaction.

We based premium costs on a sample cruise with the following details (when applicable):

- 40-year-old male

- Living in New York, New York

- Sailing for seven days in April

- Total trip cost: $2,800

- Destination: Mexico

- Flying to the port of departure

Sample quotes assumed that payments were made on the date of quoting.

Note that the premiums and policy structures advertised for cruise insurance companies are subject to fluctuate in accordance with the company's policies.

Catch up on CNBC Select’s in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

- AIG Travel Guard insurance review: What you need to know Ana Staples

- Here are the 8 best password managers Ryley Amond

Saga travel insurance review

Saga travel insurance review highlights:

- No upper age limit

- Covers most pre-existing medical conditions

- Comprehensive cover as standard with Saga's 5 Star Defaqto Expert Rated Insurance

- Insures against some coronavirus scenarios

Get a Saga travel insurance quote

Who is Saga?

Saga is a British based holiday and insurance specialist for the over 50s. Having started life as a Folkestone based travel company in 1951, Saga now owns its own cruise ships, has a chartered fleet of river cruise ships and offers a wide range of insurance and financial products including car insurance, home and health insurance and equity release.

What does it cover?

Saga provide single trip and annual travel insurance for the over 50s . Their travel insurance is comprehensive, includes cruise insurance as standard and has no upper age limit. It also covers most pre-existing medical conditions and over 40 popular leisure activities.

Here’s how each option works:

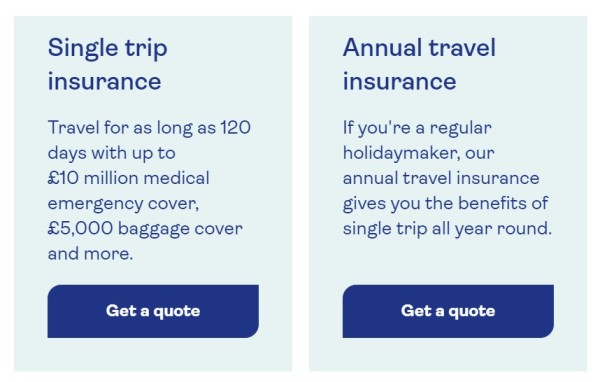

Saga single trip holiday insurance

Single trip travel insurance covers you for a single trip to one or more destinations for up to 120 days. This includes the following services as standard:

- Up to £10,000 cancellation cover

- Up to £10 million emergency medical cover

- Up to £5,000 baggage cover

- Up to £1,500 for a replacement flight

- Up to £1,500 enforced stay cover

- Up to £5,000 substitute accommodation cover

- Up to £10,000 abandonment cover

- 24/7 travel helpline

- Flexibility to add family and friends under 50 years of age

Compare Saga travel insurance

Saga annual travel insurance

Annual travel insurance provides the same benefits as single trip insurance with one big difference. You are covered for multiple trips throughout the year. This includes insurance for up to 120 days per year, with a maximum of up to 45 days per trip and with an option to increase this to 60 or 90 days for some regions.

Depending on the level of cover you choose, Saga travel insurance protects you in the following regions:

- Worldwide excluding USA, Canada, Mexico and all Caribbean islands

Take a look at over 50s travel insurance

Does Saga offer coronavirus travel insurance cover for the over 50s?

Saga travel insurance now includes standard covid-19 cover should you test positive for coronavirus within 14 days of travel. It also provides cover should your holiday be cut short due to coronavirus, plus up to £10,000,000 of emergency medical expenses and repatriation fees to get you back home.

It's worth mentioning that although no cover can be provided if you travel to a country where the FCDO advise against all travel, Saga are willing to offer cover if the FCDO has advised against all but essential travel. If you travel to a country where the FCDO has advised against all but essential travel, for a non-essential reason, you’ll have no cover in place for any policy section if the reason for your claim is related to why the FCDO advice is in place, for example COVID-19. This is subject to there being no other government restrictions in place prohibiting travel. If you travel for essential reasons, then you will have full policy coverage in place.

How much does Saga travel insurance cost?

The cost of Saga travel insurance depends on the traveller’s age, health and the type of cover required.

Am I eligible for Saga travel insurance?

To be eligible as the policy holder for Saga travel insurance you must be at least 50 years of age however there is no upper age limit. You must live in the UK and disclose any pre-existing medical conditions, or your policy could be invalid.

Saga will only look to provide cover for diagnosed medical conditons therefore if you are under investigation or awaiting test results of an undiagnosed condition, no cover will be available.

Is Saga travel insurance any good?

My review of Saga travel insurance is designed to help you compare plans and find the best option for you. I would always recommend that you review all of your options to ensure you’re getting the best deal that suits your budget and needs.

Saga travel insurance has the highest possible Defaqto rating. It also has a Trustpilot score of 4.6 out of 5 for all its insurance products. This means both customers and consumer champions alike rate Saga travel insurance as excellent.

With no upper age limit and cover for most pre-existing medical conditions, Saga offers comprehensive travel insurance as standard. This means it’s simple to arrange yet still offers flexibility to tailor the policy by changing the excess, adding additional travellers and changing the level of cancellation cover.

How to get a Saga travel insurance quote

To get a Saga travel insurance quote, visit their website for more details.

Getting a quote is easy and there is no obligation to proceed.

Travel insurance for over 50s

Frequently asked questions

Who is saga travel insurance underwritten by.

Saga Travel Insurance is underwritten by Astrenska Insurance Limited, which meets our high standards of quality and service.

Does Saga travel insurance cover include repatriation?

Saga travel insurance includes repatriation fees as part of the £10 million emergency medical cover. This includes your repatriation if it is medically necessary and one friend or relative if the doctor thinks it’s appropriate.

Do Saga holidays and Saga Cruises include travel insurance?

All overseas Saga Holidays and Cruises include optional comprehensive travel insurance, subject to a medical screening. However, should you prefer to choose your own travel insurance, a price reduction would be available.

Did you find this information helpful?

We work with

If you have enjoyed visiting our website we would love you to visit and like our Facebook page where you will find our latest news

How this site works

Our aim is to provide you with clear and accurate information to help you research your chosen financial products and services. The material on this site is for general information only and does not constitute any form of advice or recommendation.

If a link has an * by it, it means it is an affiliated link to an insurance company or broker that may result in a payment to the site. Should you use the equity release calculator, speak to an Age Partnership adviser and take out a plan out using their services, we receive a commission, however this will not affect the price you pay.

Also, from time to time you may see advertisements from third party companies who pay us a fee to advertise their services on our site.

None of the above arrangements constitute advice or recommendations, as other products and companies are available. You should always obtain independent, professional advice for your own situation.

The information provided on this site is accurate at the date of publication, occasionally however, things will change before we have had the opportunity to update them, so please do check. Always do your own research and take independent advice.

We do not investigate the solvency of any company mentioned on our website and are not responsible for the content on websites we link to.

Over50choices is an independent company and regulated by the FCA (No.594280) for insurance products only and a member of the Equity Release Council.

Saga travel insurance review: What do you get for your money?

Saga travel insurance is seen by many as the best option for over 50s. On the surface, it appears to offer everything from single trips to annual travel insurance, flights and cruise travel insurance and more. But what exactly does Saga travel insurance cover? Does Saga travel insurance cover pre-existing and long-term medical conditions? How much flexibility is there on premiums?

Saga travel insurance: FAQs

Does saga travel insurance cover issues relating to covid-19.

Thankfully, Saga reacted quickly to the challenges of Covid-19 and the potential for significant additional expenses. Whether you require treatment, other accommodation or repatriation, there is specific cover available .

Do Saga holidays include travel insurance?

All holidays booked directly through Saga include the option of comprehensive travel insurance . However, where you choose to take travel insurance from another third party, this will be reflected in the reduced cost of your Saga holiday.

Can I add others to my Saga holiday insurance?

There is the option to add others to your Saga holiday insurance policy . For example, where you take out a multi-trip policy, not only can you add family and friends of any age, but you don't need to travel together.

While many well-known travel insurance companies today have little history, this is not a criticism anyone can aim at Saga . Saga was founded in 1959 with a simple focus: to cater for over 50s regarding insurance, holidays, financial services and healthcare. The fact that Saga travel insurance is, for many, the first port of call today says everything about the company's reputation. While we are focusing on travel insurance, it's worth noting you can obtain other types of cover such as home and car insurance through Saga.

Let's look at Saga travel insurance , how much it costs, how flexible cover is, and the company's approach to existing medical conditions.

Whether you're looking for single-trip, multi-trip, or specialist cover, or need assurance about pre-existing medical conditions, our panel of travel insurance providers has you covered. Click on your chosen provider below to get started.

- Some restrictions based on age

Do I qualify for Saga holiday insurance?

As we touched on above, Saga is focused on an array of different services for over 50s. Consequently, to qualify for Saga holiday insurance, you should:

- Be at least 50 years of age

- Live in the UK

- Disclose any pre-existing medical conditions

While Saga will not request a medical certificate or direct advice from your doctor, the onus is on customers to be truthful when completing the online or telephone medical questionnaire. If medical information has been withheld, this may invalidate your cover.

Unlike many travel insurance providers, Saga has been able to keep things relatively simple and avoid customers having to overcome numerous hurdles. When it comes to regulatory cover, as a provider of insurance products, Saga travel insurance is covered by the Financial Conduct Authority (FCA).

Different types of Saga travel insurance

Two central travel insurance policies are available with Saga, single trip travel insurance and annual multi-trip travel insurance. Note there is no upper age limit with Saga travel insurance products.

Saga single trip holiday insurance

While the Saga single trip policy only covers you for a single trip, this can include multiple destinations. Cover is valid for one trip a year, up to a maximum of 120 days, which may include an array of leisure activities. Compared to other insurance providers, Saga single trip policies can be a little more expensive. Still, you get what you pay for - as demonstrated by reviews on the Defaqto and Trustpilot websites.

This insurance product offers comprehensive cover that includes:

There is also a 24/7 travel helpline and the ability to add friends and family under 50 to your policy. While the above figures are standard, you can increase and reduce different types of coverage to lower the cost of your Saga insurance premiums.

Saga annual holiday insurance

As you would expect, Saga annual travel insurance policies offer precisely the same cover as the single trip policy. However, you're covered for multiple trips, up to 45 days per trip, for up to 120 days per year.

Worldwide travel insurance

When you begin to dig a little deeper, you become aware of the flexibility available with Saga travel insurance. There are three primary levels of cover:

- Worldwide excluding USA, Canada and the Caribbean

If you are travelling predominately within Europe, European-focused travel insurance is cheaper than the worldwide cover. As we go through the various elements of Saga travel insurance policies, you will become aware of the enhanced degree of flexibility.

As a side note, more relevant with the onset of Covid-19, you would not be covered for countries listed as dangerous on the UK government travel advice website . So it is essential to keep up with the latest news.

Medical conditions

Unlike many travel insurance companies, Saga does not exclude any pre-existing medical conditions when offering comprehensive cover. Consequently, Saga holiday insurance is very popular with over 50s, the company's prime target market. At times, the cost of Saga travel insurance policies can sometimes appear higher than others in the marketplace. However, it is important to compare like for like. Not all travel insurance companies will offer the same level of comprehensive cover for over 50s.

When obtaining your travel insurance quote, you will be asked to complete a simple health screening review online or over the phone. This ensures Saga is aware of any potential medical issues, thereby ensuring your policy remains valid.

Awaiting results of medical tests

Unfortunately, if you are awaiting the results of medical tests, you will not be able to secure cover. However, as soon as you receive the results, you will be free to apply for cover, whatever the condition.

Am I covered for Covid-19 with Saga travel insurance?

Saga travel insurance covers you for the following scenarios:

Cancellation of holiday

In the event of a positive coronavirus test within 14 days of your travel commencing, for either:

- A close relative

- A member of your travelling party

You will receive a payment covering:

- Unused travel expenses

- Accommodation

- Planned excursions

- Prepaid charges

- Other contracted payments

Abandonment

If you are forced to cut your trip short because of a positive test for Covid-19, you will receive payment for expenses as detailed above. The test could relate to you, a family member, someone you are staying with or a member of your travelling party.

Emergency medical expenses/repatriation

We only need to look at additional expenses incurred when receiving Covid-19 related treatment in the UK to appreciate overseas fees and the cost of repatriation. For example, Saga travel insurance includes up to £10 million in medical expenses and repatriation costs should Covid-19 impact you. In addition, the traditional £5,000 health insurance-related cover for UK holidays has been increased to £2 million due to the coronavirus pandemic.

As discussed above, Covid-19 related travel insurance cover will be invalidated if you travel to a country subject to UK government restrictions. Therefore, when taking out your Saga travel insurance, it is essential to discuss your travel plans and how they may or may not be impacted by Covid-19. Take nothing for granted!

Standard features of Saga travel insurance policies

On the surface, Saga travel insurance products may seem a little more expensive than other insurance providers. As ever, the devil is in the detail. It is only when you dig a little deeper that the differences become apparent. We will now expand on the earlier list, which shows the standard features you can expect for single and multi-trip insurance cover:

Alternative accommodation

You can claim up to £5,000 for alternative accommodation and transport costs should any of the following impact you:

- Natural disasters such as earthquakes and hurricanes

- Insolvency of the provider

- An outbreak of food poisoning

- An episode of infectious disease

The fact that this is standard for all Saga travel insurance policies should give you peace of mind.

Transport issues

If your scheduled airline goes out of business before or after departure, an additional £1,500 is available to cover alternative arrangements.

Enforced stay

In the event of an enforced stay, you can claim £100 for each 24-hour delay, up to a maximum of £1,500. This may involve difficulty:

- Reaching your destination

- Returning to pre-booked accommodation

- Returning home

If after 24 hours you're forced to make alternative arrangements, getting to your destination/returning home, you can claim expenses of up to £1,000.

Missed departure

There is also cover available if you miss your departure for any of the following reasons:

- Public transport delays

- Delay to a connecting flight

- Denied access to your flight (overbooked)

- Vehicle breakdown or accident on the way to the departure point

Up to £1,000 is available for extra accommodation or travel costs required to get you to your final destination.

If you are forced to abandon your trip due to unforeseen circumstances, Saga covers you up to £10,000. This can be used to reimburse unused travel and accommodation expenses and other prepaid charges. You are also covered for new flight tickets home.

Saga travel insurance helpline

As part of the comprehensive cover offered by Saga, you'll also have access to the Saga travel assistance helpline 24/7. This worldwide service offers assistance about an array of issues, including:

- Replacement of passports, driver licenses, air tickets and other travel documents

- Tracing luggage if lost or delayed

- Contacting your local embassy/consulate

- Sourcing additional funds from the UK if required

- Guidance and assistance for your family if you are admitted to hospital

- A "phone home" service if you are detained for medical treatment

- Translation/interpretation services if required

It is fair to say that considering the numerous elements of cover provided as standard by Saga travel insurance policies, together with the helpline, this is a comprehensive offering.

How much does Saga travel insurance cost?

One of the benefits of Saga travel insurance is that you can mix and match, and there is excellent flexibility with no upper age limit. For example, a 60-year-old individual looking at a self-catering holiday to Spain would expect to pay around £33 for single trip cover. However, this would increase to just over £60 for Saga's annual holiday insurance cover.

These two premiums are based on:

- An excess of £150

- £10,000 of cancellation cover

- No winter sports

- No additional travellers

There are also other policy elements that you can remove, increase or decrease depending upon your requirements. For example, you may not require any medical cover if you already have overseas medical insurance through another party. If you are uncertain about the level of cover you need, speak to a Saga representative on the telephone. For those who are clear about their requirements, there is an online system where you can get a quote 24/7.

Does Saga travel insurance offer value for money?

If you look at the Trustpilot and Defaqto review websites, you will see that Saga travel insurance for over 50s has received high praise indeed. Whether it is the fact that existing medical conditions are catered for, the vast range of standard cover or the flexibility available, Saga travel insurance is extremely popular. Consequently, it is safe to say that independent third-party feedback from policyholders suggests Saga offers good value for money.

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

SAGA Travel Insurance - 2024 Review

Saga travel insurance.

- Strong Insurance Partner

- Designed for Seniors

- Excellent Coverage

- Not Available To US Residents

Sharing is caring!

SAGA Travel Insurance is offered by SAGA, a UK company that offers products and services to consumers who are 50 years and over. It is reported to have in excess of 2.7 million customers.

As a brand, SAGA is generally very well regarded and strives to offer goods and services which are tailored to its over-50 members.

SAGA Travel Insurance – Website

The SAGA website is well presented with good colors and font size which are clearly legible. The tabs across the home page let the user navigate around the site with ease.

Saga Travel Insurance is just one of the products offered. SAGA also has Saga Car Insurance, Saga Home Insurance as well as additional tabs on its home page for Holidays , Money , Care , Health and Magazine .

The tab to direct customers to Saga Travel Insurance is clear and obvious and sends the customer to a page where they can choose either buy SAGA Travel Insurance Single Trip or a SAGA Travel Insurance Annual Multi-Trip.

SAGA also makes it easy to navigate directly to the policy documentation with just a few clicks on the ‘Single Trip’ on the left column, and following the prompts offered to download the policy document.

Having selected single trip, the quote screen has really simple functionality to progress the quote and the steps to complete your purchase and the progress you are making are shown clearly at the top of the page.

For trip destination, we see a feature we really like. The customer merely starts typing their destination into the search parameter, and the website auto completes their destination, becoming more accurate as they continue to type. It also offers the user the ability to add additional countries to their trip.

The departure date is a calendar drop down box, and once selected, you are immediately offered a click button for some of the most likely vacation durations, including seven nights, ten nights and 14 nights. The final option allows you to select your own dates of travel.

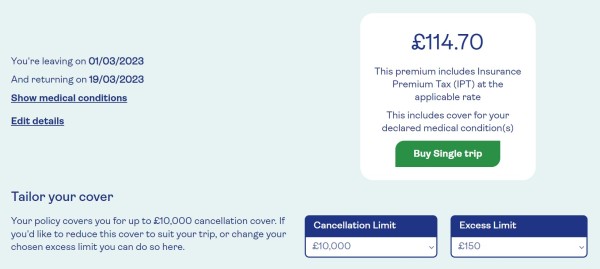

For our trip, our two travelers aged 62 are going to France on March 1, 2023 – March 19, 2023.

After entering all the details of the trip and listing any pre-existing medical conditions (in minute detail) are we taken to the purchase page. However, not until you get to the purchase page does it tell you that you must have your primary home in the UK and that your trip must start and stop in the UK!

Therefore, this insurance won’t work for US travelers going TO the UK or Europe. For US residents traveling overseas, we recommend shopping at a marketplace like CruiseInsurance101 which will provide you with options for travel insurance policies enabling you to choose a policy that will give you the coverage you want for your travel needs.

For UK residents looking for travel insurance from SAGA, let’s look at what their policy provides.

SAGA Travel Insurance – Policy

For UK residents who choose to purchase SAGA insurance, either a single-trip or multi-trip policy is available. The single-trip SAGA travel insurance offers the customer a 14-day free-look period, also known as a cooling-off period.

SAGA Travel Insurance - Coverage

When we turn to the coverage limits, we see the cancellation limit is £10,000. This may be sufficient for many travelers, but there will be some for whom this limit is insufficient for their travel needs and may not provide sufficient coverage for the trip they have booked.

The medical and associated expenses coverage is £10 million. This would seem to provide a substantial level of cover that we would be happy to support. Additional coverage includes £2m of personal liability and £50,000 of legal expenses.

SAGA Travel Insurance – Job Loss (Redundancy)

Cover for loss of job is included, although the wording is quite restrictive. Note that there is no specified minimum period that a person must have worked with their employer. This should not be taken as meaning that no minimum period exists. The policy states that cover is for redundancy and that:

“ you or your travelling companion have been given a notice of redundancy and are receiving payment under the current redundancy payments legislation ”

The UK legislation on redundancy requires an employee to have worked continuously for their employer for two years before they are entitled to receive payments under the redundancy legislation.

This means that although the SAGA Travel Insurance doesn’t specifically state it in so many words, they require a customer to have been continuously employed for two years before being able to gain cover for loss of job under a SAGA travel insurance plan. This is slightly more restrictive than the normal 12 months continuous employment that we like to see in a travel insurance plan.

SAGA Travel Insurance – Medical Care

When we turn to the section of coverage dealing with medical and associated expenses, the first paragraph of the policy immediately looks restrictive.

“What is covered. This section provides insurance for medical and associated costs not covered by the National Health Service or any reciprocal health agreement. This is not private medical insurance.”

The policy speaks in terms of expenses not covered by the National Health Service (NHS) or by a “ reciprocal health agreement” . What this appears to mean is that private hospitals and private associated costs are not covered within the United Kingdom or Europe.

This is on the basis that the NHS covers all medical and associated costs for a UK citizen, and that within Europe, there exist reciprocal arrangements so that each other European country's own health service will be provided to a UK citizen for free, or at a substantial discount, and the UK will act in a similar manner to citizens of other European countries if they need medical assistance whilst in the UK.

It is hard to envision a scenario where a UK citizen traveling in Europe or the UK could ever possibly incur medical and associated costs against their insurance plan. Every medical issue they might have would be covered by the NHS in the UK, or the equivalent within other member states. However, where a traveler is heading further afield than the UK and EU, such as a trip to the USA or Canada, then we see the true benefit of the medical cover coming into play. Imagine being taken ill on a trip to the USA. The costs of medical services, hospital procedures and repatriation back to the UK could quickly mount up.

SAGA Travel Insurance – Pre-existing Conditions

It is possible to cover a pre-existing condition with SAGA Travel Insurance, but any condition must be specified in great detail when buying the travel insurance, and you must continue to inform SAGA if your pre-existing condition changes prior to departure. There is no pre-existing condition waiver.

SAGA Travel Insurance also does not provide the customer with a time-sensitive period to purchase their insurance following initial trip payment to unlock any additional travel insurance benefits – for example, pre-existing condition waiver.

Pre-existing condition waiver is a term used where the normal exclusion that would prevent a traveler with a pre-existing condition getting cover being waived. Typically, with this type of waiver the traveler must be medically fit and stable when the travel policy is bought and needs to buy the travel insurance within a prescribed number of days following the initial trip payment date.

SAGA Travel Insurance – Single Trip Price Comparison

Next let’s turn to the price of the insurance.

Without anything to compare against, our travelers have no idea whether the product and price being offered represents good value and coverage, or whether they may be paying far too much for what may be inferior coverage. Only when we compare and contrast in the travel insurance marketplace will we discover the quality of the plan that SAGA offers.

Interestingly, when filling out the quote, we were not asked about cost of the trip. Having added all of these trip and personal details into the SAGA website, the price offered by SAGA for their single-trip travel insurance was £114.70.

To enable us to compare whether the SAGA travel insurance plan offers good or bad value and cover for money, we ran the same quote criteria through a UK travel insurance comparison website, similar to CruiseInsurance101. The travel insurance comparison site came up with over 60 options of alternative coverage and listed them from cheapest to most expensive. The user then has the ability to sort by various headings, including rating and cover.

SAGA Travel Insurance – Travel Insurance Marketplace

As we have seen time and time again when reviewing single travel insurance products offered by airlines, member organizations and travel agents, the price of coverage available from a travel insurance comparison website was substantially lower for policies that were equal to or higher than that offered by SAGA.

However, to ensure that we are comparing like for like coverage, we filtered the results by the rating, to ensure that we only viewed insurance plans that offered the same 5-star Defaqto (similar to AM Best in the US) rating.

With this filter in place, we were able to see a true comparison of the alternative plans available on the open market versus the single-trip plan offered by the SAGA website and can make a better-informed decision as to the best travel insurance policy for our needs.

This is no surprise to us at CruiseInsurance101. We know that a travel insurance marketplace like the one used in this example is the best way to find great value and coverage for a traveler. That is why we built CruiseInsurance101, to quickly and easily give our customers the ability to compare and contrast multiple insurance plans in one easy-to-use website.

In summary, if you are a SAGA member looking to buy travel insurance, our advice is to use a comparison marketplace where you can compare multiple travel insurance plans from many of the largest providers. This will allow you to compare the product and price offered to you by SAGA and decide which travel insurance plan offers you best value and cover.

For US travelers looking for travel insurance, we encourage you to run a quote at CruiseInsurance101 and compare leading US-based travel insurance companies.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Choosing a plan was quick and easy

Choosing a plan was quick and easy. The questions did not take long at all to answer and a plan was recommended in a short period of time.

Lady Coinbits

My agent, Shanna was awesome. Helped me find the best policy or my needs and explained everything to me.

monica munoz

Excellent customer service.

Spoke to Melanie. Excellent customer service, she was very thorough, answered all my questions, and was very nice.

404 Not found

- Saga Cruises

Saga included insurance

By nosapphire , May 22, 2020 in Saga Cruises

Recommended Posts

BEWARE anyone who has taken Saga included insurance with their booking, and think that you will be covered for Coronavirus because it was added to your booking prior to 3rd April.

When you pay the holiday balance after the 3rd April, your documentation will show that this is a new insurance and you will not be covered for ANYTHING relating to coronavirus.

I have to contact Saga about this, as if this is correct it feels extremely underhand - let me believe that because insurance was added to the booking in May 2019 I was covered, but because the final balance is paid May 2020 it is treated as being taken out after 3rd April.

I'll come back and update after I have spoken (cruise is almost certainly going to be cancelled anyway).

Link to comment

Share on other sites, silversurf1.

I have already checked this. We booked for 5 January 2021 in October 2019 then changed it to July 2021. Our insurance rolls on and covers us for the virus.

Got it recorded on my phone where young lady from Saga assured me of this 100%

we would have cancelled if this wasn’t so.

Slightly different.

We have not rolled over the booking, it is the same booking just the insurance has changed.

It is the inaugural cruise booked back in 2018.

Insurance was added in May 2019. Received documents in May 2019 showing included insurance.

Final balance paid today.

Revised documentation for the cruise now states that the included insurance does NOT cover coronavirus.

Emailed them to ask why an insurance that did cover coronavirus is now saying it does NOT cover coronavirus.

I'd recommend getting Saga to conform yours in writing to be safe.

This is worrying, and I agree it does seem underhand. How on earth can Saga have information on their website which states that insurance purchased prior to April 3 includes Covid cover, and then issue documentation stating that it does not? If correct, it means that anyone who pays the balance of their cruise after April 3 is not covered.

I hope Saga reads these boards and provides clarification.

I've asked the question, should get a reply next week, and I'll come back with their answer.

I am hoping that it is a mistake created by their useless computer system - fingers crossed.

2 hours ago, nosapphire said: I've asked the question, should get a reply next week, and I'll come back with their answer. I am hoping that it is a mistake created by their useless computer system - fingers crossed.

Good luck - their insurance is a bit hit and miss. Last year my wife declared a probably insignificant condition awaiting diagnosis a few days before our cruise, something our GP considered not to be of any concern. Saga promptly cancelled her cover without explanation, while admitting on the phone that many people in the same situation simply don't admit such conditions in order to keep their cover. The travel insurance bundled with our bank account simply doesn't cover conditions awaiting diagnosis rather than refusing any cover at all.

Quick update. I had a reply this morning, which was totally useless as it was so generic.

The impression given was that either they did not know the answer, or they knew the answer but did not want to commit it in writing.

I've asked them for a specific answer to my specific booking.

I have a suspicion that if I push them hard enough I will find out that the insurance is not actually taken out with the underwriters until the final balance is paid.

Which means that nobody relying on Saga's included insurance will be covered for coronavirus.

I'll let you know of progress.

Thanks for posting nosapphire. If Saga can’t sort this out, they’re going to lose a lot of customers.

I now have an email confirming that my specific booking IS covered for Covid-19, ad Saga are working on getting corrected documentation.

Which is good news for anyone who added Saga included insurance to their booking prior to 3rd April 2020, as they will be covered.

Great news nosapphire. Now we just have to hope that our cruises go ahead!

Thank you for this nosapphire. Reassuring.

- 2 weeks later...

Seems very underhand to me. Did not the contract become established on payment of the first amount, you would have lost that if you cancelled the cruise. I think you would have a good legal case that the Insurance was issued

a year ago on first payment. They would have be liable under the policy for any illness nine months ago.

In my opinion, not underhand - just incompetent.

Saga have confirmed by email that the insurance is valid. They have said that they are working on correcting the paperwork (no idea how long that will take them).

The standard of accuracy in the paperwork Saga issue is steadily deteriorating - over the last 2 years we have had to contact them for corrections of various mistakes, including under-calculated advance registration discounts, wrong cabin numbers, missing insurance, dates of birth being mysteriously changed mid-booking, etc. I still have to contact them about a final balance payment date for another cruise which is stated on the paperwork as being due a month too early.

I assume the coumputer system was updated to reflect the fact that new bookings will not be covered for Coronavirus without any consideration of the people who had already booked.

Though - on reflection - maybe it is underhand, and being passed off as incompetence. Sigh.

https://www.worldofcruising.co.uk/travel-insurance-covid-19-medical-cover-cruise-holidays

I received this email today . Those of you commenting on this post may find it interesting.

I note on the saga website that there is a statement that from 1st June, policyholders will be covered under the medical section only, this seems to indicate no cover under the other sections of the policy, Such as cancellation, etc. It still appears to me that policyholders who booked a cruise for late 2020 or 2021 and paid any deposit in say late 2019 would have valid cover and a valid claim under all sections of the policy , since coronavirus was not mentioned or excluded.

so there now at least two classes of covered policy holder.

And probably a third class of policyholder, and claimant following the “coronavirus exclusions” announced in the spring of 2020.

it is an area ripe for discussion by the lawyers.

The recent note on the SAGA website needs to “Precisely” define what the policies state and what the cover is for each traveller.

SAGA cannot retrospectively change the cover.

They have muddied the waters for prior policyholders, in trying to clarify the situation of policyholders in the future.

They have opened a can of worms in their treatment of prior policy holders, the legal profession will have a field day in pursuing claims.

Their website is confusing (nothing unusual there).

Saga optional included travel insurance taken out on or after 3rd April 2020 will cover coronavirus only under the emergency medical section, and only for travel which started on or after 1st June (I assume that is June 2020).

New Saga insurance policies taken out on or after 1st June (again, I assume 2020 as the year is not mentioned) will cover coronavirus only under the emergency medical section, same as above.

For all policies taken out before 6pm on Friday 13th March 2020 - simply tells you who to contact if you need to claim. No mention of coronavirus one way or the other.

No mention of insurance taken between 6pm 13th March 2020 and 3rd April 2020 - maybe nobody booked anything in this period.

Just to muddy the waters, the insurance page, under "get a quote" clarifies that new policies will now offer emergency medical treatment abroad for claims related to coronavirus, then adds that exclusions related to coronavirus for policies dated 13th March onward continue to apply to the rest of the policy.

By the way, I still don't have any corrected paperwork. Although as now the sailing date, and probably the itinerary and price, will have to be changed, maybe it will all get done together.

I wonder when the policy is deemed to be taken out , when you initially book and pay your deposit, when you pay the final tranche of the fare, when you board the vessel or when you claim.

it may all be irrelevant if the Spirit od Discovery is not delivered until 2021.I believe SAGA has said it will be delivered in the next year, a very precise date.

We booked a 2021 cruise on 16th March 2020, with the optional included insurance. We assumed we would be covered for treatment abroad and repatriation to the UK for COVID-19. Not so sure now. What a mess!

It is sure a mess.

I do not think anyone knows, SAGA included.

35 minutes ago, Fred989 said: It is sure a mess. I do not think anyone knows, SAGA included.

Well, I think that post has summed it up accurately enough.

Just to add to the confusion - on the Saga cruises page it simply states that :

QUOTE: If you have purchased the optional Saga Holidays Travel Insurance after 00:01am on Friday 3rd April, 2020, the following applies:

Please be aware this policy will not provide cover for any claims caused by or relating to Coronavirus Disease (COVID-19), or any mutation of unless your trip begins on or after 1st of June, in which case this policy will only provide cover for any claims caused by or relating to Coronavirus Disease (COVID-19), or any mutation of, under the 'Emergency medical associated expenses' section of your policy book. This section provides insurance for emergency medical and associated costs not covered by the National Health Service or any reciprocal health agreement. END QUOTE.

Which is not quite the same as any of the others.

To be honest, I have no idea now whether the email I have confirming that my insurance does cover coronavirus means I am fully covered, or just for emergency medical treatment abroad.

While Saga say that "Saga will assist" in the event of repatriation (because of coronavirus) they do not also say "Saga will pay".

They must be updating things on the website (and hopefully the documentation), as there is no longer a link to the policy book for the included insurance, and the link to the summary is not to the insurance, just to Saga.

Glad the only Saga travel insurance we have is linked with 2 cruises on the Adventure which are almost certain to be no-shows, so the insurance is academic.

I booked acruise back in December 2019 to be taken in May 2020. In March 2020 I ttransferred the booking to a cruise for June 2021. The booking No did not change.

I phoned SAGA this morning for some clarification and was assured that the insurance taken out in December 2019 would roll over to the re-booked cruise.

I am not convinced and will be asking for some written confirmation.

They might insure you , but for what, under what terms and conditions?

your old pre virus insurance would have covered you under all sections for a virus event.

even the new improved recent T&C’s excludes virus events in all but one sections.

All this uncertainty and reduction in original insurance cover is a sign of financial difficulties.Hope not as we enjoyed our Saga cruises to date and UK/UK cruising without Flying is very appealing.

2 hours ago, brimary said: All this uncertainty and reduction in original insurance cover is a sign of financial difficulties.Hope not as we enjoyed our Saga cruises to date and UK/UK cruising without Flying is very appealing.

I do not think the reduction in insurance cover is a particular sign of financial trouble.

The Covid-19 exclusion has been happening across the board from all insurers; Saga themselves do not provide the insurance, their travel insurance is provided by Great Lakes.

The problem is the lack of clarity, with nobody knowing exactly what is or is not covered, and no concise answers being given by Saga, and what this (in my opinion) does show is extremely poor management from Saga.

It does not matter if it is financial difficulty or poor management, either could bring the company down.

The two new build vessels will survive and as are both marked as boutique cruisers, not SAGA, so could be sold on easily to a stronger survivor cruise line.

A market for Cruises from Southampton exists and will be filled by a company who survives the crisis.

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- ANNOUNCEMENT: Set Sail Beyond the Ordinary with Oceania Cruises

- ANNOUNCEMENT: The Widest View in the Whole Wide World

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started 12 hours ago

LauraS · Started Tuesday at 09:24 PM

LauraS · Started Monday at 09:50 PM

LauraS · Started Monday at 05:37 PM

LauraS · Started Monday at 04:09 PM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

- Saga Cruises

Saga included insurance

By silversurf , May 4, 2023 in Saga Cruises

Recommended Posts

Anybody else having a problem with this? Friends, travelling within a month are taking antibiotics for a throat infection. They have been told they can’t be insured within a month of taking them. Another had a small wound on his arm which need dressing every week for a few weeks and been told that they can’t be insured until the dressing is removed for good.

The insurance company seem to pick up on every little thing, so is this included insurance fit for purpose?

After all it is for people over 50 and many considerably older, who often have minor ailments as well as as more serious conditions.

Link to comment

Share on other sites.

Harry Peterson

That’s a very interesting question. I’ve always taken that free insurance claim as likely to exclude a lot of existing conditions, but admittedly without any direct evidence.

Those examples do sound extreme though, unless perhaps in the latter case they have in mind potential claims in respect of reapplied dressings onboard?

twotravellersLondon

31 minutes ago, silversurf said: Anybody else having a problem with this? Friends, travelling within a month are taking antibiotics for a throat infection. They have been told they can’t be insured within a month of taking them. Another had a small wound on his arm which need dressing every week for a few weeks and been told that they can’t be insured until the dressing is removed for good. The insurance company seem to pick up on every little thing, so is this included insurance fit for purpose? After all it is for people over 50 and many considerably older, who often have minor ailments as well as as more serious conditions.

On our last SAGA cruise, just a couple of months ago, there were a small number of people with what looked to be very serious medical conditions... including one who was connected to a mobile device that she pulled along in a small suitcase... so they must have been insured somehow.

47 minutes ago, twotravellersLondon said: On our last SAGA cruise, just a couple of months ago, there were a small number of people with what looked to be very serious medical conditions... including one who was connected to a mobile device that she pulled along in a small suitcase... so they must have been insured somehow.

But perhaps not with Saga, or with an additional premium?

49 minutes ago, Harry Peterson said: But perhaps not with Saga, or with an additional premium?

Perhaps not but our recent personal experience is...

One of us recently had a suspected very serious medical condition... it turned out not to be the case but a far less serious but exhaustive tests spotted rare and little understood condition that may have been there unnoticed for decades.. We spoke to SAGA about the insurance for an upcoming cruise. They were very helpful. One of us now travelled on the all inclusive insurance and the other travels on a different plan which costs an insignificant amount more. We found that SAGAs underwriters were very detailed, very precise and very helpful.

That makes sense... we could have obtained insurance through a specialist charity which specialises in helping folks in that sort of predicament or just given up on cruising and holidays abroad but... with Saga's help the company retained us as customers, retained us as insurance customers and ensured that we would probably book future cruises. There was no hassle and we ensure each trip separately. It only takes 5 minutes.

We can only speak from our own experience of dealing with SAGA insurance about half-a-dozen times in the last few months... but we found that they were very helpful in ensuring that we could travel with them and that they would also ensure us for travelling with other companies and independently.

4 hours ago, silversurf said: Anybody else having a problem with this? Friends, travelling within a month are taking antibiotics for a throat infection. They have been told they can’t be insured within a month of taking them. Another had a small wound on his arm which need dressing every week for a few weeks and been told that they can’t be insured until the dressing is removed for good. The insurance company seem to pick up on every little thing, so is this included insurance fit for purpose? After all it is for people over 50 and many considerably older, who often have minor ailments as well as as more serious conditions.

I wouldn't say we had had a problem because our health incidents were well ahead of a cruise. However, Saga seemed to be saying that one was not covered by insurance for "x" months ("x" depending on the ailment) but would be again if all was well after that period (which it was). This is very different from what happened before when the insurance was still valid except you were no longer covered for the recent health problem. My wife once travelled shortly after she had broken her wrist and the insurance was fine except she was not covered for any complications or anything else that might happen t o her wrist whilst on holiday.

Several complaint today on Facebook pages about the insurance being difficult for minor ailments.

I have booked Saga's icelandic Explorer for 28th July. Unfortunately I was admitted to hospital in March and a new medical condition was diagnosed. It was uncertain if Saga would insure me. I do have other medical conditions which were accepted in the screening process. However Saga have come back to me and are willing to delay payment of the final balance until 9th June when hopefully I will be able to report no further incidents with the newest medical condition for three months and I will then be covered fully on their insurance. I have made tentative enquiries re other insurance companies to be on the safe side but hopefully I stay symptom free to avoid paying in the region on £400 for this one trip with another company! Am very happy with service received from Saga.

Suron (in Bristol)

I've been denied included insurance because month before cruise I lacerated my leg. I bought instead Saga travel insurance with no problem. The two have different underwriters. I buy annual Avanti travel insurance now straightforward no fuss

- 1 month later...

Exiled Brummie

Just been wondering about this, 'Free insurance' must surely have many limitations. My wife and I both have several Pre-Existing long term medical conditions, all controlled by medication so we are are fit and active despite these conditions.

In such circumstances do Saga refuse cover or require an additional premium?

The other issue making us hesitate to look at a Saga cruise is cost compared to many others, not just a few percent either. I know a lot is included but even allowing for this the cost still makes me gulp.

Are Saga really that much better? (compared to say P&O, our last cruise line)

ballroom-cruisers

The way all travel insurers work is that they work out the risk of a particular medical condition and calculate the chance of needing help that costs various amounts. In the case of Saga the insurance is included in the cost of the fare so not really 'free'. If you already have a travel policy with a different insurer (or a Saga annual travel policy) then you don't need to pay for the included insurance. But whichever your insurer is, they will always require you to declare your medical conditions - and they will have had their actuaries calculate whether the likely cost of needing to help a policy holder is a high enough risk that they need to require additional premium. They will do that for each medical condition. Also every insurer will say your policy is invalid if you haven't declared all medical conditions so you have to declare them. They will then tell you whether the particular conditions you have would be included at the standard premium, or if they require you to pay extra to be covered. In general Saga are pretty good and their insurance policies are well thought out. If you have a condition that is low risk of leading to a problem during the period of your voyage then it is likely they will cover you with no additional premium. Clearly some conditions have a significant chance of becoming unwell at the level of needing hospital emergency treatment and possible helicopter evacuation during a few weeks of a voyage, and in that situation there is a strong chance that an insurance company would require an elevated premium, and for some conditions the risk is so high that insurers would not cover them at any cost. Anyone with such a condition would then be subject to major costs if they needed expensive medical care whilst on holiday. Either way the only way to answer the question is to talk to the insurer directly and ask them if they will cover the conditions you have, and at what cost, in the circumstances they are stable and under control with whatever medication is being taken. Usually if you are awaiting test results that complicates the insurance situation, and often the outcome would be needed before the insurer would cover you. It would be much the same whichever insurance company is approached.

Windsurfboy

3 hours ago, Exiled Brummie said: Just been wondering about this, 'Free insurance' must surely have many limitations. My wife and I both have several Pre-Existing long term medical conditions, all controlled by medication so we are are fit and active despite these conditions. In such circumstances do Saga refuse cover or require an additional premium? The other issue making us hesitate to look at a Saga cruise is cost compared to many others, not just a few percent either. I know a lot is included but even allowing for this the cost still makes me gulp. Are Saga really that much better? (compared to say P&O, our last cruise line) Bill D.

Yes Saga are better than P&O and Cunard. In my opinion Saga's food on par with Cunard queens grill if not better. The atmosphere and facilities throughout ship is just on higher level. Worth the money.

On 6/7/2023 at 7:07 PM, Exiled Brummie said: Just been wondering about this, 'Free insurance' must surely have many limitations. My wife and I both have several Pre-Existing long term medical conditions, all controlled by medication so we are are fit and active despite these conditions. In such circumstances do Saga refuse cover or require an additional premium?

Bill, I think (but am not 100% sure) that Saga will either give you the "free" insurance when you declare medical conditions, or will refuse it. I don't think they cover medical conditions for an additional premium, as I've read on here and on social media that people then go to Saga's "paid for" travel insurance, which is completely separate. Other readers may confirm this, or not.

maesteggirl

Yes that's correct. the "free" insurance will not cover my husband but Saga's paid for insurance does!

1 hour ago, Wacktle said: Bill, I think (but am not 100% sure) that Saga will either give you the "free" insurance when you declare medical conditions, or will refuse it. I don't think they cover medical conditions for an additional premium, as I've read on here and on social media that people then go to Saga's "paid for" travel insurance, which is completely separate. Other readers may confirm this, or not.

If you are not eligible for Saga's included insurance because of existing medical conditions I suggest that you obtain quotations from one of the insurers which specialise in extra risks like AllClear or Staysure as well as Saga's own insurance provider. You may well find that they are cheaper.

On 6/7/2023 at 7:07 PM, Exiled Brummie said: Just been wondering about this, 'Free insurance' must surely have many limitations. My wife and I both have several Pre-Existing long term medical conditions, all controlled by medication so we are are fit and active despite these conditions. In such circumstances do Saga refuse cover or require an additional premium? The other issue making us hesitate to look at a Saga cruise is cost compared to many others, not just a few percent either. I know a lot is included but even allowing for this the cost still makes me gulp. Are Saga really that much better? (compared to say P&O, our last cruise line) Bill D.