Solar Panels

Get solar panels for your home.

Our Top Picks

- Best Solar Panels

- Solar Panel Installers

- Solar Panels for Home

- Solar Panel Comparison

- Solar Panel Installation

- Solar Panel Battery

The Financial Aspects

- Solar Panel Costs

- Solar Panel Grants

- Solar Panel Quotes

- Solar Panel Tariffs

Business Insurance

Find the best insurance deals for you and discover what you need to know, whatever your business.

Popular Types of Cover

- Public Liability Insurance

- Employers' Liability Insurance

- Professional Indemnity

- Directors and Officers

- Fleet Insurance

- Van Insurance

- Best Business Insurance Companies

- Guide to Small Business Insurance

- How Much Does Business Insurance Cost?

- Business Loans

By Type of Business

- Limited Company Insurance

- Self Employed Insurance

By Occupation

- Click for insurance by occupation!

Find out what you really need to know, plus easily compare prices from hundreds of deals, no matter what insurance you need.

- Cheap Car Insurance

- Best, Largest Car Insurance Companies

- Cheap Motorcycle Insurance

- Cheap Home Insurance

- Cheap Moped Insurance

- Best Cheap Cruise Insurance

- Best Pet Insurance

- Best Insurance for Bulldogs

- Best Travel Insurance

- Pet Insurance

- Home Insurance

- Travel Insurance

- Car Insurance

- Motorcycle Insurance

- Caravan & Motorhome Insurance

- Campervan Insurance

- Health Insurance

- Credit Cards

Read reviews and guides to get clarity over credit cards and see which is best for you.

Credit Card Categories

- Credit Builder Cards for Bad Credit

- Rewards Credit Cards

- Travel Credit Cards

- 0% Interest Credit Cards

- No Foreign Transaction Fee Credit Cards

- Balance Transfer Credit Cards

- Cashback Credit Cards

- Credit Cards with No Annual Fee

- Student Credit Cards

Helping you make the most of your money with our in-depth research on the topics that matter to you.

Stay up to date with the latest news that affects you.

Come say hi!

Connect with NimbleFins

- Follow NimbleFins on LinkedIn

Halifax Clarity MasterCard Review: The Travel Card for You?

- Using abroad

- Paying no fees on cash withdrawals or FX transactions

- Paying a low cash APR

- Those wanting an interest grace period for cash withdrawals

- Individuals looking for a 0% promotional period for balance transfers

Editor's Rating

The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here .

The Halifax Clarity Credit Card is one of the best travel credit cards for use while abroad. As it charges no fx fees , it is suitable non-Sterling purchases made abroad. However there are reasons you shouldn't necessarily use it for cash withdrawals, despite the lack of fees. Read our review to find out more.

- Halifax Clarity: Our Thoughts

- Halifax Clarity Features

- Comparing the Halifax Clarity to Other Credit Cards

Halifax Clarity Credit Card Review

Savings accounts: five must-knows.

- Usually no credit check

- £85,000 protected

- Interest rates won't be the same as the base rate

- Bank of England has the power

- Tax benefits

The Halifax Clarity Credit Card can be a great credit card for travel use, charging no fees for non-Sterling cash withdrawals and transactions made abroad. But should you use it to get cash from an ATM? Not necessarily, because cash withdrawals start accruing interest IMMEDIATELY. That's the case with most credit cards in the UK.

While it's generally good to avoid withdrawing cash on a credit card due to interest charges, the good news is that the Halifax Clarity charges relatively low interest rates on cash withdrawals for any unavoidable withdrawals. The Halifax Clarity card charges the same rate for cash withdrawals as it does for purchases: 22.9% APR, variable. Just try to pay back any withdrawals ASAP since there's no interest-free grace period.

Note: While Halifax doesn't charge fees to use their card at an ATM, you might still be charged fees. Some ATM providers charge to use their machines. You should be alerted to any such charge on the ATM screen before you proceed with an ATM withdrawal.

Can I use the Halifax Clarity for balance transfers?

The Halifax Clarity Credit Card is open to balance transfers but the fees are higher than you can find in the UK balance transfer market. You are likely to find a lower fee on another balance transfer card, if that's important to you.

Bottom Line: The Halifax Clarity Credit Card is a travel card for both cash withdrawals and purchases made abroad, with a lower-than-average cash APR. Since there is no grace period on cash withdrawals (i.e., interest charges start accruing immediately), pay off your full balance as soon as possible to limit interest charges.

Halifax Clarity Benefits & Features

Why you should pay back cash withdrawals asap.

When it comes to credit card interest charges, cash withdrawals are typically treated differently than purchases. While purchases are given a grace period (e.g., there's no interest charge if you pay off your full every month), cash withdrawals accumulate interest from the day you withdraw the cash until the day you pay off the cash balance.

How much interest will you pay on a cash withdrawal? We've calculated sample interest charges on cash withdrawals of £100, £500 and £1,000, when you pay 30 and 60 days after the original withdrawal (assuming an 22.9% APR).

Pay in Local Currency or Pounds When Abroad?

As with all travel transactions, we recommend paying for purchases in the local currency. You’ll almost always get a better exchange rate if the credit card does the conversion, as opposed to the shop where you’re making a purchase. If you elect to "pay in pounds" when abroad, then you're leaving the currency conversion to the local retailer and there are no guarantees as to the rate you'll receive.

As a result, it's advisable to pay in local currency. The Halifax card is a Mastercard, which is known to give consumers some of the best exchange rates.

How does the Halifax Clarity Credit Card Compare to Other Credit Cards?

In order to decide if the Halifax Clarity is for you, it’s best to compare it against some of its closest competitors.

Halifax Clarity Credit Card vs Aqua Advance Credit Card

The Aqua Advance Credit Card charges no FX fees on non-sterling cash withdrawals or transactions made abroad, but beware of taking out cash from an ATM because there's still a 3% fee at home and abroad (£3 minimum)—plus cash advances incur interest right away, at a high interest rate. This card will accept those with weaker credit histories, however, so those with poor credit may find it suitable for purchases on holiday.

Quick Takeaway: The Aqua Advance has higher interest rates so is technically not as good as the Halifax Clarity card—but it may accept you if the Clarity card won't.

Halifax Clarity Credit Card vs Barclaycard Rewards Credit Card

The Barclaycard Rewards Credit Card charges no fees on non-sterling cash withdrawals or transactions, making it an ideal travel card. The only aspect of the card to be aware of is that, like most credit cards, interest on cash ATM withdrawals starts accruing immediately. By getting online and paying back your cash withdrawals ASAP (even while you're still abroad), you can mitigate this potential cost. One added bonus of this card is that cardholders earn 0.25% cashback on all of their purchases.

Quick Takeaway: The Barclaycard Rewards has a higher interest rate than the Halifax Clarity card; with the Barclaycard Rewards card you might get up to 56 days interest free on non-sterling cash withdrawals, too. Plus the Barclaycard pays 0.25% cash back on purchases—not huge rewards, but who doesn't like to get some cash back? Both are good for transactions like paying at restaurants, bars, hotels and shops abroad as they don't charge foreign transaction fees.

Erin Yurday is the Founder and Editor of NimbleFins. Prior to NimbleFins, she worked as an investment professional and as the finance expert in Stanford University's Graduate School of Business case writing team. Read more on LinkedIn .

Credit Cards by Features

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best 0% Interest Credit Cards for Purchases

- Best Credit Cards for Overseas Travel

- Best Credit Cards with No Annual Fee

- Best Travel Credit Cards

- Best Credit Cards for Students

- Best Cashback Credit Cards

- Best Rewards Credit Cards

- Best Hotel Rewards Credit Cards

Credit Cards by Bank

- Aqua Credit Cards

- Barclaycard Credit Cards

- Halifax Credit Cards

- Tesco Bank Credit Cards

- Sainsbury's Bank Credit Cards

- Marbles Credit Card

- Vanquis Classic Credit Card

- Barclaycard Platinum Cashback Plus Credit Card

- Aqua Reward Credit Card

- Halifax Clarity MasterCard

- Platinum Cashback Credit Card by AmEx

Credit Card Guides

- What is a Credit Score?

- A Tool to Reduce Debt: What is a Balance Transfer?

- How to Improve Your Credit Score

- What is a 0% Purchases Card?

- How to Get a Credit Card?

- What is Credit Card APR?

Related Articles on Credit Cards

- How to get unlimited airport lounge access with the Lloyds World Elite Mastercard

- Why getting rejected for a credit card isn't a disaster for your credit score

- How to make the most of cashback credit cards

- NatWest loosens criteria for market-leading balance transfer card: Here's how it works

- New year, new (improved) credit score? Here's 10 tips to boost your creditworthiness in 2023

- 0% credit cards v cheap personal loans: Which wins for cheap borrowing?

- Get paid for borrowing at 0%

- What happens to your credit score when you apply for a credit card?

- Paying interest on credit card debt? Here's how a balance transfer card can massively help you cut what you owe.

- Privacy Policy

- Terms & Conditions

- Editorial Guidelines

- How This Site Works

- Cookie Policy

- Copyright © 2024 NimbleFins

Advertiser Disclosure : NimbleFins is authorised and regulated by the Financial Conduct Authority (FCA), FCA FRN 797621. NimbleFins is a research and data-driven personal finance site. Reviews that appear on this site are based on our own analysis and opinion, with a focus on product features and prices, not service. Some offers that appear on this website are from companies from which NimbleFins receives compensation. This compensation may impact how and where offers appear on this site (for example, the order in which they appear). For more information please see our Advertiser Disclosure . The site may not review or include all companies or all available products. While we use our best endeavours to be comprehensive and up to date with product info, prices and terms may change after we publish, so always check details with the provider. Consumers should ensure they undertake their own due diligence before entering into any agreement.

Note regarding savings figures: *For information on the latest saving figures, pay-less-than figures, and pay-from figures used for promotional purposes, please click here .

**4.8 out of 5 stars on Reviews.co.uk is the rating for our insurance comparison partner, QuoteZone.

Halifax Clarity Card review: Great value for travellers

By Author Pete Chatfield

Posted on Last updated: 16/03/2024

When travelling abroad, many of us forget to factor in the cost of spending. But see how the Halifax Clarity Card could help save you money and provide you with added protection.

Halifax Clarity Card summary

A great value card which could help you save a lot when you’re abroad. However, if you withdraw cash, you’ll be charged interest straight away. But if you pay it off immediately, there won’t be any fee.

– Pete Chatfield

Pros and cons:

✅ No fees when making a purchase abroad ✅ No fees when using the card to withdraw cash (although the ATM may charge) ✅ Card comes with perks such as balance transfers and cashback ❌ Interest is charged straight away for cash withdrawals ❌ No other travel perks, such as airport lounge access Halifax Credit Card

Halifax Clarity Credit Card

We all worry so much about having enough money to spend when we’re abroad, we often don’t consider the best way to access it. And before you know it, you’ve spent well over £100 just to get hold of your own cash.

Well, never more. Say hello to the Halifax Clarity Credit Card.

Why not take cash?

Well, apart from the risk of losing it, you lose out every time you make an exchange. This is because companies are trying to make a profit.

For example, at the time of writing, the official exchange rate listed at XE for British Pounds into Euros is 1.1622. Below is how much it would cost you to buy and sell 100 Euros with the Post Office , compared to how much it would cost using an official rate.

As you can see, buying 100 Euros will lose you a few £’s. And when it comes to selling, it gets even worse.

Also worth reading

If you don’t like taking out a credit card, then why not see some of the best debit cards to use when spending abroad?

So what’s the answer?

A great option? In my opinion, the Halifax Clarity Credit Card. But don’t be fooled. This travel credit card isn’t only for making purchases, you can withdraw cash from it too.

Most credit cards charge you a fee for using an ATM, but not with this card.

But that isn’t the only benefit. The Clarity card also doesn’t charge you anything when you make foreign transactions.

These two facts together make it a near-perfect card. Plus, Halifax makes the exchange at the official rate so that you won’t be stung with sneaky charges. Oh, and there’s no annual charge for having the card.

You are given up to 56 days interest-free using the Halifax card for purchases. That means you can have your holiday and return home and should have enough time to clear your balance before you are charged interest.

But it’s important to note that if you use the card to withdraw cash, you are charged interest from the moment you withdraw the money.

What’s the typical APR for the Clarity Card?

The typical interest rate is 25.49%, although the rate does depend on your personal circumstances.

So, if you were to withdraw £100 of local currency would cost you around £2.12 if it took you a month to make a payment.

But these charges are still less than you would pay if you exchanged cash before travel.

Avoid the charges

If you’re feeling really savvy, then you can avoid the majority of charges that come with withdrawing cash. If you have internet banking (and I’m sure most of us have), you can make payments to your Halifax card whilst on holiday. But if you don’t fancy messing around with that, you could make an overpayment to your card before you travel. If you have a positive balance, you won’t be charged interest.

How does it compare to other cards?

So let’s see how the cost of using a Halifax card to exchange money would compare to using a debit card from Barclays or Santander.

Barclays charge you 2.75% for foreign transaction fees and possibly a £1.50 fee if you don’t use a Global Alliance member bank when withdrawing cash.

Santander charges 3% (minimum charge £3).

If you were to withdraw £500 worth of currency over the course of your holiday, Barclays would charge a minimum of £13.75 and Santander £15. The Halifax card would cost you £7.25 if you took a month to pay your bill. But pay it off quicker, and you would pay even less.

Using the Halifax credit card abroad is one of the most sensible options out there.

Other benefits to using the Clarity Card

Credit card protection.

Don’t forget that you are eligible for protection under Section 75. If you purchase an item for over £100 and there’s a problem, then the credit card company and the seller are equally liable. That means you can claim through your card rather than going back to the retailer.

Transfer offers

This will depend on your account, but I am often sent money and balance transfer offers for my Clarity Card. There are no initial fees and I’m offered an interest rate of 6.9% for two years.

Cashback extras

One final benefit to the Halifax card is ‘cashback extras’. You can earn cashback when you shop using tour card at certain retailers, although you need to activate the offers first. There are quite a few travel companies listed, so it’s a good way of getting an extra discount.

Anything else you need to know about the Clarity Card?

Remember to check if Halifax needs to be notified before you travel. On my first holiday with the card in 2018, I needed to notify them through online banking. By 2019, this had changed and they no longer needed notice.

But the last thing you want when you’re abroad is for your card to be blocked because it has been flagged as suspicious activity.

Also, when on holiday, politely decline if a foreign merchant offers to charge you in £’s instead of their local currency. They will use their own exchange rate and it could end up costing you far more.

And remember, never exchange money at the airport. Their exchange rates are awful!

If you want to apply or learn more about the card, click the button below.

Halifax Credit Card

Using Your Halifax Credit Card While Travelling Abroad in 2023: Fees, Benefits, and Alternatives

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Are you planning to use your Halifax credit card on your next trip abroad? Well, get ready for a few potential headaches: many Halifax customers have reported unexpectedly high fees on their statements after using their credit cards while travelling overseas.

Fortunately for you, there are a few alternatives to choose from if you prefer low-cost holiday spending. In this post, we walk you through the fees and exchange rates you'll meet when using your Halifax credit card abroad and offer savvier alternatives to use instead. So, whether you're planning a weekend getaway, a business trip, or a dream vacation, read on to learn how to make the most of your card spending while abroad!

Halifax's credit cards are expensive to use abroad. Here are the cheapest alternatives instead:

- Revolut : Best card for multi-currency balances.

- Starling Bank : Best bank alternative to Halifax.

Key Facts About Halifax Credit Cards Abroad

Using your halifax credit card abroad.

- 01. How to use your Halifax credit card abroad scroll down

- 02. Fees for using your Halifax credit card abroad scroll down

- 03. Best travel card alternatives scroll down

- 04. FAQ about using your Halifax credit card abroad scroll down

Heading abroad soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2023.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn a language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

It should go without saying that credit cards are versatile tools that you can use to handle all kinds of financial transactions while on holiday abroad. This is no different with Halifax's range of credit cards, all of which enable you to:

- Pay at point-of-sale machines in foreign countries,

- Withdraw local cash banknotes from foreign ATMs,

- Book or handle deposits for car rental agencies, hotels, or flights.

In addition, some Halifax credit cards also let you take advantage of travel insurance, rewards, cashback, and other exclusive benefits while travelling abroad. It's always a good idea to check what benefits might apply to you before you travel so that you know what you can and cannot expect to take advantage of.

Halifax Credit Card Fees Abroad

Although they're easy and convenient to use abroad, Halifax credit cards come with some costs you should consider before travelling abroad. We've summarised them below (ignoring non-travel-related costs like annual fees, cash advance, and interest charges):

Verified: 3/3/2023

All told, these costs can lead to an unnecessarily pricey trip abroad. Let's break them down with a typical example:

Point of Sales Transactions

Suppose, for example, you're on holiday in Paris and decide to spend €100 on a boutique fashion item you like. You pay with your Halifax credit card. The first thing that happens behind the scenes will be the conversion of your pounds into euros. Fortunately, this occurs at the Visa or Mastercard exchange rate (which is generally within 0.3% of the actual mid-market exchange rate) without Halifax charging its own exchange rate on top of that. This means you won't pay much for exchanging currency, and assuming your credit card is a Mastercard, you'd be paying £88.79 (at Mastercard's rate) instead of £88.49 (at the mid-market rate) on the final statement at the time of writing. Not a big deal, right?

However, it doesn't end there. Next, Halifax will hit you with a 2.95% foreign exchange fee. This fee is rather high and leaves the final cost on your bank statement at £91.40 (2.95% or £2.61 higher than a fair exchange). This may not sound like a lot, but consider that you'll be hit with this fee every time you tap your credit card, so it all stacks up quite quickly.

Cash Withdrawals

The costs are even more profound when using your Halifax credit card to withdraw cash. Sticking with our example, suppose you next wanted to withdraw €1,000 to get you through a few more days of Parisian spending. Here, you would again pay the Mastercard exchange rate (£2.92 for a €1,000 conversion at the time of writing) plus the 2.95% foreign exchange fee (this time amounting to £26.19). On top of this, you'd then pay an additional 5% on the remaining amount (or £42.94 in this case).

After factoring in this combined £72.05 (or nearly 8%!) fee, the pound conversion on your bank statement would be a whopping £959.93.

Better Alternatives

Fortunately, there are much more affordable ways to spend your pounds while travelling to Paris or anywhere else in the world. Below, we suggest three world-class UK-based alternatives for you to consider depending on your individual needs and preferences:

Revolut: Best for Multi-Currency Balances

Revolut's debit card is another good way to spend money while abroad because it allows you to pay in over 150 currencies at the real exchange rate (although fair use limits and weekend surcharges may apply), and additional features like budgeting tools and travel insurance (on the paid plans).

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

- Multi-Currency Balances: Yes (available in 35 currencies)

- FX Margin: 0% /transaction

- FX Fixed Fee: 0.5% /transaction

- ATM Withdrawal Fee: 2% /withdrawal

- Best For: Balances in multiple currencies and convert between them.

Starling Bank: Best Complete Bank Alternative

Starling Bank is a first-class online bank whose debit Mastercard is an excellent way to spend money abroad because it offers no fees whatsoever on any foreign currency spending. It also provides an excellent current account which we've ranked as the best online bank in the UK .

- Trust & Credibility 9.3

- Service & Quality 8.5

- Fees & Exchange Rates 10

- Customer Satisfaction 9.3

- Multi-Currency Balances: No

- FX Fixed Fee: 0% /transaction

- ATM Withdrawal Fee: 0% /transaction

- Best For: A complete bank account alternative to Nationwide

FAQ About Halifax Credit Card Abroad

Yes, you can most certainly use your Halifax credit card abroad! Being cards issued by Visa or Mastercard and offered by one of the UK's largest banks. Halifax credit cards are accepted worldwide, and you can use them to make purchases or withdraw cash from ATMs. However, you may be charged a fee for using your card abroad, so it's best to compare your options online before you decide to use your Halifax credit card on your next holiday.

If you use your Halifax credit card abroad, you'll be charged a foreign exchange fee of up to 2.95%, and if you withdraw cash from an ATM, you'll additionally be charged a cash advance fee of 5%. You may also be charged a third-party ATM network fee, though these fees aren't charged by Halifax but are set by the bank or operator that owns the ATM.

You can consider using a travel card to avoid fees when using your Halifax credit card abroad. There are excellent options out there, like Revolut , which charges incredibly competitive fees and exchange rates when travelling abroad, as well as multi-currency balances to help you dodge conversion fees altogether when tapping your card or withdrawing cash.

You can notify Halifax that you intend to travel abroad by using their online banking service or by calling their customer service helpline . It's always a good idea to let Halifax know when and where you'll be travelling because they may decide to block your card if they notice unsuspected activity from abroad.

If your Halifax credit card is lost or stolen while travelling abroad, you should contact Halifax immediately to report the incident. Halifax has a 24-hour helpline for lost or stolen cards, and they can assist you with cancelling your card and arranging for a replacement to be sent to you, even if you're still located overseas. If your card is stolen, you should also consider contacting the police or local authorities to report the theft.

See Other UK Travel and Money Transfer Topics

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Home ›

Halifax travel money exchange rates compared

We logged into Halifax to compare their travel money exchange rates against the competition

Updated: 30 May 2022

Most currency suppliers publish their travel money exchange rates online for all to see, but some high street banks such as The Halifax only make their exchange rates available to customers who are logged into their online account. Naughty Halifax!

I'm not a fan of companies hiding their exchange rates; it makes it difficult to know how competitive their currency deals are, and in my experience if a company chooses not to publish their exchange rates it's usually because their rates are pretty awful.

So, in the interests of science, I've done the work for you and compared Halifax's exchange rates for some of the most popular currencies ordered in the UK.

This isn't as good as getting real, live exchange rates from The Halifax, but it gives you a rough idea of where they stand against the competition. The rates below are a snapshot of how competitive Halifax's travel money deals were compared to the best and the worst rates available online at the time.

Data compiled at 19:55 on 30 May 2022. Best online rates were those available on CompareHolidayMoney.com at the time of writing.

Halifax rates are 7.2% lower on average

The results show that on average The Halifax exchange rates were 7.2% worse than the best rates available online at the time. The difference was smaller for euros and US dollars and larger for the more exotic currencies like Croatian kuna and Turkish lira.

In real terms, if you were buying £1000 worth of euros, you'd get €41 more by going with the best online rate compared to if you had ordered with The Halifax.

You might think it's a bit unfair to compare The Halifax's exchange rates with those available online at the time but it doesn't make a difference - you can order travel money online through Halifax (if you're a Halifax account holder) and you'll get exactly the same rate that you would have if you ordered over the counter in a Halifax branch.

As an aside, the worst online exchange rates were all from other UK high street banks; notably Barclays and Santander (who do publish their exchange rates online).

The obvious conclusion from this is banks offer some of the worst exchange rates in the UK so if you can buy your currency literally anywhere else, you'll probably get a better deal.

Where to get the best exchange rates

Unsurprisingly, the best exchange rates can always be found online. For high street currency providers including supermarkets and the Post Office, you'll usually get a better deal if you order online via their website instead of walking in off the street.

To find the very best currency deals available in the UK right now, use our free comparison tool to see who is offering today's best exchange rates .

No comments

Nobody has commented on this post yet. Would you like to be the first ?

Leave a comment

Write your comment, do you want to receive a notification email if someone replies to your comment.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Accessibility Statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

Everyday banking

Online services & more

- Banking online

- Download our Mobile Banking app

- Register for Online Banking

- Sign in to Online Banking

- Reset your sign in details

Mobile Banking app

- Setting up the app

- App notifications

- Banking near you

Profile & settings

- Change your telephone number

- Change your address

- Open Banking

Card & PIN

- View your card details

- Report your card lost or stolen

- View your PIN

- Payment limits

- Cancel a Direct Debit

- Pay in a cheque

- Send money outside the UK

- See upcoming payments

- Search transactions

- Download statements

Help & security

We're here for you

Fraud & security

- Protecting yourself from fraud

- Latest scams

- Lost or stolen card

- Unrecognised transactions

Managing your money

- Credit explained

- Helping someone else

- Financial planning

Life events

- Buying a home

- Getting married

- Separation & divorce

- Bereavement

Difficult times

- Money worries

- Mental health support

- Financial abuse

- Serious illness

Customer help

- Support & wellbeing

- Accessibility & disability

- Our virtual assistant

- Feedback & complaints

Bank accounts

Accounts & services

- Current Account

- Reward Current Account

- Ultimate Reward Current Account

- Youth & student accounts

- Joint accounts

- Compare our bank accounts

Travel services

- Using your card abroad

- Travel money

Features & support

- Switch to us

- Cashback Extras

- Rates, rewards & fees

- Save the Change

- Bank account help & guidance

- Mobile device trade in service

Already bank with us?

- Upgrading your account

- Payments & transfers

- Mobile banking

Cards, loans & car finance

Credit cards

- Credit card eligibility checker

- Balance transfer credit cards

- Large purchase credit cards

- Everyday spending credit cards

- Travel credit cards

- World Elite Mastercard®

- Cashback credit card

- Loan calculator

- Loan eligibility checker

- Debt consolidation loans

- Home improvement loans

- Holiday loans

- Wedding loans

Car finance

- Car finance calculator

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

- Car leasing

- Refinance your car

- Credit cards help & guidance

- Loans help & guidance

- Car finance help & guidance

- Other borrowing options

Already borrowing with us?

- Existing credit card customers

- Existing loan customers

- Existing car finance customers

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

- First time buyer mortgages

- Moving home

- Remortgage to us

- Existing Halifax mortgage customers

- Buying to let

- Equity release

Calculators & tools

- Mortgage calculator

- Remortgage calculator

- Get an agreement in principle

- Base rate change calculator

- Overpayment calculator

- Mortgage help & guidance

- Mortgage Prize Draw

- Mortgage protection

Already with us?

- Existing customers

- Manage your mortgage

- Switch to a new deal

- Borrow more

- Switch deal & borrow more

- Help with your payments

- Learn about HelloHome

- Your interest only mortgage

Mortgage support

Worried about paying your mortgage? We have various ways that we can help you.

Accounts & ISAs

Savings accounts

- Easy access savings accounts

- Fixed term savings accounts

- Kids’ savings accounts

- Joint savings accounts

- Compare savings accounts

- Compare cash ISAs

- Junior Cash ISA

- Stocks & Shares ISA

- Investment ISA

- Savings calculator

- Savers Prize Draw

- Savings help & support

- ISAs explained

- Charges & withdrawals

Already saving with us?

- Manage your ISA

- Transfer your ISA

- Dormant accounts

Pensions & investments

- Compare investing options

- Share Dealing Account

- 18 – 25 Investing Accounts

- Ready-Made Investments

ETF Quicklist

- Introducing our ETF Quicklist

- View our ETF Quicklist

Guides and support

- Understanding investing

- Research the market

- Investing help and guidance

- Regular investments

- Trading Support

- ETF Academy

- Our charges

Pensions and retirement

- Ready-Made Pension

- Combining your pensions

- Pension calculator

- Self-employed

- Pensions explained

- Top 10 pension tips

- Retirement options

- Existing Ready-Made Pension customers

- Share dealing SIPP

Wealth management

- Is advice right for you?

- Benefits of financial advice

- Services we offer

- Cost of advice

Already investing with us?

- Sign in to Share Dealing

Introducing the new Ready-Made Pension

A simple, hassle-free way to save for your retirement.

Home, life & car

View all insurance products

Home insurance

- Get your quote now

- Compare home insurance

- Buildings & contents insurance

- Contents insurance

- Buildings insurance

- Retrieve your quote

- Home insurance guides

- Manage your home insurance

Car insurance

- Compare car insurance

- Car insurance help & guidance

- Temporary car insurance

- Sign in to My Account to manage your car insurance

- Life insurance

- Critical illness cover

- Mortgage protection insurance

- Help & guidance

Other insurance

- Business insurance

- Landlord insurance

- Make a home insurance claim

- Make a life insurance claim

- Make a critical illness claim

- Make a car insurance claim

Already insured with us?

Support for existing customers

- Help with existing home insurance

- Help with your existing car insurance

- Help with your existing life insurance

Home insurance is 10% cheaper with Halifax when you get a quote and buy online.

- Branch Finder

- Help centre

- Accessibility and disability

- Search Close Close

- Using your cards abroad

- In this section

Using your cards outside the UK

Our debit and credit cards are accepted worldwide. at over 26 million locations..

For day to day spending and access to your cash. With the same security and convenience that you get in the UK.

Credit card details expandable section

Debit card details expandable section, debit card details.

You can use your debit card to withdraw £500 or equivalent per day. We’ll make the following charges when you use your debit card to make a transaction in a currency other than pounds:

Debit card transaction fees

To help you compare our debit card or Cashcard currency conversion charges with other providers you can find the percentage mark up over the European Central Bank rates here

Statement explained

We’re introducing improvements to your statements which will mean that you’ll see the following fees shown on your statement separately.

Information on other rates, rewards and debit card fees .

Compare card usage costs expandable section

Compare card usage costs.

Compare the cost of spending or withdrawing €100 outside the UK using our credit or debit cards*.

*The exchange rates used were the applicable rates for transactions processed on 5th June 2023.

Our exchange rates for card transactions are determined by the payment scheme provider for the card. For further information and other exchange rates and currencies see MasterCard or Visa . For travel money, the exchange rate is determined by us.

The foreign currency transaction fee is a fee for currency conversion.

Other fees, charges and interest may apply. Please refer to your account terms and conditions or see credit cards details or debit cards details for more information

^For debit card transactions in Euro within the EEA the foreign currency cash fee of £1.50, the foreign cash fee of £1.50, and the foreign currency purchase fee of £0.50 were removed on the 13th December 2019.

The European Economic Area (EEA), which means the countries in the European Union plus Iceland, Norway and Liechtenstein.

**This example assumes you allow us to convert the transaction from foreign currency to pounds. If you choose to allow the provider to convert the transaction to pounds, they may make a separate charge for conversion.

Statement explained expandable section

Statement terms .

Credit card details

Our fees and charges for using your credit card abroad vary depending on the card you have.

Interest may be charged differently dependent on whether you have made a purchase or withdrawn cash. Please check your account terms or credit card fees, charges and interest for more information .

Compare the cost of spending or withdrawing €100 outside the UK using our credit cards*.

To help you compare our credit card currency conversion charges with other providers you can find the percentage mark up over the European Central Bank rates here

**This example assumes you allow us to convert the transaction from foreign currency to sterling. If you choose to allow the provider to convert the transaction to sterling, they may make a separate charge for conversion.

Going abroad soon? You no longer need to tell us

You no longer have to tell us when you are travelling abroad. Our fraud and security systems are always on the lookout for suspicious activity on your accounts meaning you can relax when you are away making going abroad stress free.

Before going abroad

- Check overseas fees.

- Check your credit card is activated. Our guide on how to activate your card is here .

- Does your card expire when you are away? If your card is due to expire within 90 days, you can request a replacement card .

- You can use our app to view your PIN number if you can't remember it.

- Take another form of payment in case of emergency.

- Think about setting up a Direct Debit to cover any payments due while you’re away.

- Ensure your contact details are up to date. We may need to text or call you if we’re concerned there may be fraudulent activity on your account- you can check and update your details online .

- If you need to get in touch, contact us . Standard network charges may apply.

- It may be a good idea to make card payments in local currency and avoid paying the local currency conversion charges.

Have an enjoyable trip!

Don't have a Halifax debit or credit card?

If you don't have a Halifax debit or credit card yet, don't worry. Click below to see our range of bank accounts and credit cards.

Bank accounts Credit cards

Don't have a Halifax debit or credit card?

We may monitor and record calls

Make sure you're set before you go abroad.

Other travel services

Money latest: The parents paying their kids hundreds of pounds for good grades - and what psychologists think

As exam season approaches, some parents are putting hundreds of pounds aside to reward their children for certain grades - and we've asked experts if they think it's a good idea. Share your thoughts on anything we cover in the form below, and we'll be back on Monday with live updates.

Saturday 20 April 2024 14:39, UK

Weekend Money

- Should you offer kids cash rewards for good grades? The psychologist's view

- Amex hikes, inflation and child-free pubs: What our readers said this week

- Money news of week: Inflation falls, wages grow and fuel warning for drivers

Best of the week

- Spotlight on unpaid carers: 'You can't afford to feel': The woman who cares for her daughter, son and husband

- Ian King analysis: Why an interest rate cut may not come as soon as you think

- Basically… How to improve your credit score

- Money Problem: My boss ruined end of maternity leave with ultimatum - what are my rights?

- Do solar panels work in wet and cloudy Britain?

- Ketchup swaps that could eliminate tablespoons of sugar from your diet

Ask a question or make a comment

By Brad Young, Money team

As exam season approaches, some parents are putting hundreds of pounds aside to reward their children if they achieve certain grades.

While some parents lambasted the idea as "absolute potatoes", others told Sky News they saw their children's focus increase after offering up to £250 for the top results.

Among them was Sarah Cook, 45, from Dorset, who said cash incentives had improved her eldest daughter's concentration at GCSEs and she promised her youngest, Merryn, the same offer: £100 for a 9, 8 or 7 (A*/A in old money), £50 for a 6 or 5 (B) or £20 for a 4 (C).

"We were definitely all for it and happy to pay up based on achievement. I think it reflects real life as well - if you do well in your job, you tend to get paid more," Ms Cook said.

Merryn, 13, added: "I think it is better for the motivation and for that extra encouragement to get the highest you possibly can and to push yourself more."

Robert Gidney, from Norfolk, said his 14-year-old son's results had improved by a grade since the family decided on reward money: £250 for a grade 9, reduced by £50 for each lower grade, with no reward for grades below 5.

"He seems to be concentrating a lot more on it. He has been studying a lot more and putting a lot more effort in."

He admitted the practice might not be for everyone - something mother of two Sarah Paterson, 57, from Cheshire, would agree with.

"Never in a million years," she said, recalling how her children, now aged 26 and 37, would protest that their friends were being offered cash rewards.

"It's absolute potatoes. What are you setting you kids up for there?

"If they are going to academic, they are going to be academic. Life is about self-motivation."

What the psychologists say

External motivators like money can help children focus in the short term, but they "eventually kill off intrinsic motivation", said Dr Cath Lowther, general secretary of the Association of Educational Psychologists.

She said all children were intrinsically interested in learning, but regular external incentives "erode the engines of motivation" that cause them to find joy in learning or set and achieve their own goals.

It could also cause conflict and jealousy in some schools, with "children in that classroom who can't afford breakfast".

There is already too much pressure on children, said Dr Emma Citron, consultant clinical psychologist and chartered member of the British Psychological Society.

They are already trying to catch up after the pandemic and taking exams that could determine if they get a university place, she said.

"I just think that it's sending all the wrong messages as parents. You're adding to their pressure and actually, more importantly, changing the dynamic between you and your children.

"You're making it conditional on outcome, on reward, rather than what we know to be good, which is unconditional approval and validation."

Parents ought to be "quietly supportive" and act in a pastoral capacity, she said.

Teachers split on the practice

Charlotte, a biology teacher at a private school, who did not wish to give her last name, said approximately 20% of a given year group were offered cash incentives by their parents.

The educator of 30 years said those children often found academia harder, misbehaved or hadn't put in much work before exam season.

"It's not that much fun, revising, it's pretty dull, so I think anything that is an incentive is probably a good thing."

She said her children, now adults, were not offered cash, adding they had dyslexia and dyspraxia.

"They knew that what we required was just for them to do their best," she said.

A 26-year-old teacher at a state school in Reading said she hadn't found cash incentives were common during her four years as a teacher, but she was offered money by her parents when she took exams.

"I think sometimes it could be effective, but it could put more pressure on the pupil and I don't know if it's healthy," said the teacher, who did not wish to be named.

"They are going to feel disappointed if they don't get the grades no matter what."

Dr Lowther said cash incentives spoke to a wider problem with the British schooling system, where external motivators are built in from the start, rather than practices that foster intrinsic motivators like autonomy and connection to others.

From gold stars at reception to narrow choices in the national curriculum, schools focus on extrinsic incentives, she said.

"It would be great if there could be some real thinking about the curriculum and getting science behind how it's developed and how it's implemented," she said.

Each week hundreds of our readers share their thoughts on the things we've been covering in the Money blog.

This week's comments have been dominated by these topics...

- Our feature on renting your home out to celebrities;

- Wednesday's inflation announcement;

- Changes to American Express cards;

- The prospect of child-free pubs.

We learnt on Wednesday that inflation had eased to 3.2% from 3.4% in March.

Many readers said they felt no difference in their wallets after the announcement, with these two comments summing up the general mood...

It definitely does not feel like inflation is coming down. And isn't that what really matters, especially with elections coming up. These figures will feel like fake news to the majority of people. oellph

We're told inflation had fallen however the prices at the tills still remain unchanged. A pint is sold at £6-7, the weekly shop has reduced somewhat but only slightly, petrol and diesel prices are back on the rise and everyone is struggling to pay their bills and save money. Reggie

Others looked towards the summer's expected interest rate drop...

A double-edged sword here. As interest rates go down, so will the value of sterling. So up go the costs of imports. kinlochdavid

Big money rentals for the stars

We got dozens of comments last weekend from hopeful readers with properties they thought would be perfect for a film set after our feature...

I live in Wales... I have a small two-bed, with a mountain and woods behind. Any good? Marc

I'm happy to let stars use my house for filming Pardeep ahluwalia

I have a beautiful period property full of antique furniture. I don’t live in part of it and a film crew could use it for filming and change it as they wished Margo

How would I go about letting my house out to film crews? Mia Foster

As our feature set out, parking, easy-going neighbours and having one large room for equipment help make your house an attractive prospect for filming.

Much of the industry is based in London but, between them, the three agencies contacted by the Money team for the feature have organised filming in Manchester, Birmingham, the Midlands, the Home Counties and coastal areas.

Others were less keen on the idea...

I wouldn't let them anywhere near my house I've seen the state they leave them in Gary pledger

Child-free pubs

Another talking point this week was whether kids should be allowed into pubs - after one unnamed boozer went viral online for a sign declaring it was "dog friendly" and "child-free".

Lots of social media users were upset by the idea...

But many of our readers agreed:

Kids should NOT be allowed in pubs. It's an adult pass time. If I go for a drink, I expect peace and quiet, not people's brats running riot. Linda

All pubs used to be child-free. What's the problem? Wilco

There should be more child-free pubs, only places like a Beefeater or a Toby Carvery should be allowed children in. We have pubs/working men's clubs in our village where there is nothing for children to do or play with. These types of pubs are not places for children. Claire

American Express changes

From November, the amount BA Amex and BA Amex Premium Plus cardholders will need to spend every year to get "two-for-one" companion vouchers will rise to £15,000.

American Express is also increasing the annual fee for its Amex Premium Plus card from £250 to £300 - an inflation-busting 20% increase.

It's safe to say the change went down badly with some of our readers...

Does anyone really think paying over £600 per year for an American Express Platinum card is good value? They must be absolutely nuts!!!! Big Daddy Smooth

These increases from Amex are outrageous and totally unacceptable. I will be cutting up my card and sending it back. OutragedAmex

A spokesman for Amex said the companion voucher "remains an industry-leading credit card benefit", while both cards "continue to provide great value for customers".

On Wednesday, we found out that inflation has eased to 3.2% from 3.4% when the Office for National Statistics released the latest data.

Economists had predicted the figure, which covers the month of March, would fall to 3.1%.

It's important to remember that this doesn't mean prices are coming down - they are just rising slower.

All eyes will now turn to decision-makers at the Bank of England as they prepare to consider cutting interests rates next month.

You can read more on that here ...

A day earlier, the ONS released its latest data on wage growth.

Wages excluding bonuses grew by 6% in the three months to the end of February, compared with the same period a year ago.

A Reuters poll of economists had predicted wage growth would slow to 5.8% from 6.1% in November to January.

The figures, while welcome on the face of it for struggling households, made for worrying reading at the Bank of England, which is assessing the timing for a long-awaited interest rate cut in its battle against inflation.

We also got a warning from the RAC and AA after government data showed petrol prices had risen by 8p since the start of the year.

The two companies said the price at the pump could go well above 150p a litre .

During this week alone, the cost has gone up by 1.6p - there has not been a sharper weekly rise since August 2023.

Average pump prices for diesel have also increased to 157.5p, the highest since November 2023.

"With increased tensions in the Middle East, the cost of oil is only likely to go up, which could push petrol well above 150p a litre," RAC fuel price spokesman Simon Williams said.

This was echoed by AA fuel price spokesman Luke Bosdet, who said pump prices were climbing towards the point "drivers fear".

"It is a psychological shock that shouts out from the price boards each time motorists drive past," he said.

The Money blog is your place for consumer news, economic analysis and everything you need to know about the cost of living - bookmark news.sky.com/money.

It runs with live updates every weekday - while on Saturdays we scale back and offer you a selection of weekend reads.

Check them out this morning and we'll be back on Monday with rolling news and features.

The Money team is Emily Mee, Bhvishya Patel, Jess Sharp, Katie Williams, Brad Young and Ollie Cooper, with sub-editing by Isobel Souster. The blog is edited by Jimmy Rice.

Tesla has recalled more than 3,800 of its Cybertruck models following complaints that the accelerator pedal is at risk of getting stuck, US regulators have announced.

The National Highway Traffic Safety Administration (NHTSA) had contacted the carmaker, founded and run by Elon Musk, about the issue earlier in the week.

That was after a video came to light, on the billionaire entrepreneur's X platform and TikTok, showing how a rubber cover attached to the accelerator could come loose, pinning the pedal down.

It has since been watched millions of times on both platforms.

Meta's AI has told a Facebook user it has a disabled child that was part of a New York gifted and talented programme.

An anonymous parent posted in a private parenting group, asking for advice on which New York education programme would suit their child.

They described the child as '2e' which stands for twice-exceptional and means they have exceptional ability and also a disability.

"Does anyone here have experience with a '2e' child in any of the NYC G&T [Gifted & Talented] programs?" the user asked.

"Would love to hear your experience, good or bad or anything in between."

Instead of getting a response from another parent, Meta's AI replied.

"I have a child who is also 2e and has been part of the NYC G&T program," it began.

Read more on this story here ...

People who are fit to work but do not accept job offers will have their benefits taken away after 12 months, the prime minister has pledged.

Outlining his plans to reform the welfare system if the Conservatives win the next general election, Rishi Sunak said "unemployment support should be a safety net, never a choice" as he promised to "make sure that hard work is always rewarded".

Mr Sunak said his government would be "more ambitious about helping people back to work and more honest about the risk of over-medicalising the everyday challenges and worries of life" by introducing a raft of measures in the next parliament.

You can read more about what they include here ...

Building society reforms - backed by MPs - could help people trying to get on to the property ladder.

The Building Societies Act 1986 (Amendment) Bill is closer to becoming law after its third reading was unopposed in the Commons.

The idea is to expand societies' lending capacity via modernisation.

Tory MP Peter Gibson the bill would help with "cutting red tape" and removing "outdated bureaucratic governance systems not faced by the big banks".

It follows a government consultation which looked at how to allow building societies to "compete on a more level playing field with banks".

The bill is government-backed and Labour is behind it too, saying the changes will support "more working people to become homeowners".

Labour's Julie Elliott, the bill's sponsor, said: "It is important to acknowledge that whilst the housing sector has recovered significantly since the record low mortgage approvals during the COVID pandemic, approvals currently are still below that which we saw before the pandemic.

"That is why I think a bill like this, which gives more choice to the building society sector to operate in the interests of its members, is a good thing."

Treasury minister Gareth Davies offered the government's support and said the bill would help ensure the "future growth and success" of the building society sector.

Labour's shadow Treasury minister Darren Jones said building societies "direct a significant proportion of their lending to first-time buyers" and the bill "could unlock significant additional lending capacity".

The bill will undergo further scrutiny in the House of Lords.

By James Sillars , business reporter

There was a worse than expected performance for retail sales last month, defying predictions of a consumer-led pick up from recession for the UK economy.

The Office for National Statistics (ONS) reported sales volumes were flat in March, following an upwardly revised figure of 0.1% for the previous month.

It said sales at non-food stores helped offset declines at supermarkets.

Sales of fuel rose by 3.2%.

ONS senior statistician Heather Bovill said of the overall picture: "Retail sales registered no growth in March.

"Hardware stores, furniture shops, petrol stations and clothing stores all reported a rise in sales.

"However, these gains were offset by falling food sales and in department stores where retailers say higher prices hit trading.

"Looking at the longer-term picture, across the latest three months retail sales increased after a poor Christmas."

While the performance will not damage the expected exit from recession during the first quarter of the year, it suggests that consumers are still carefully managing their spending.

While the cost of living crisis - exacerbated by the Bank of England's interest rate rises to push inflation down - has severely damaged budgets, wage growth has been rising at a faster pace than prices since last summer.

Separate ONS data this week has shown the annual rate of inflation at 3.2% - with wages growing at a rate of 6% when the effects of bonuses are stripped out.

Economists widely believe consumer spending power will win through as the year progresses, despite borrowing costs remaining at elevated levels.

"Misleading" labelling in some supermarkets means shoppers may not know where their food comes from, Which? has said.

Loose cauliflowers, red cabbage, courgettes and onions at Sainsbury's, peppers, melons and mangoes at Asda, and spring onions at Aldi had no visible origin labelling on the shelf or the products themselves, the consumer organisation found during research.

Only 51% of people find origin information on groceries helpful, a survey found.

Two thirds (64%) said they would be more likely to buy a product labelled "British" than one that was not.

Almost three quarters (72%) said it was important to know where fresh meat comes from, while 51% said they wanted to know where processed and tinned meat comes from.

Under current rules, meat, fish, fresh fruit and vegetables, honey and wine should be labelled with the country or place of origin.

"Research has uncovered a surprising amount of inconsistent and misleading food labelling, suggesting that - even when the rules are properly adhered to - consumers aren't getting all the information they want about their food's origin," said Which? retail editor Ele Clark.

"Supermarkets should particularly focus on labelling loose fruit and vegetables more clearly."

An Aldi spokeswoman said: "We understand that our shoppers want to know where the food they buy comes from, and we work hard to ensure that all our labelling complies with the rules.

"When it comes to fresh fruit and veg, we are proud to support British farmers and aim to stock British produce whenever it's available. Customers understand that at this time of year that isn't always possible, but we remain firmly committed to supporting the British farming community."

Asda said: "We have stringent processes in place to ensure country of origin is clearly displayed at the shelf edge and on products themselves where applicable, at all our stores.

"We have reminded our colleagues at this particular store of these processes so that customers are able to clearly see the country of origin."

A spokesman for Iceland said: "At Iceland our products are great quality and value for customers and we follow UK government guidance on food labelling, including country of origin."

A Sainsbury's spokeswoman said: "We have processes in place to make sure country of origin information is clearly displayed on the product or shelf and we carry out regular checks working closely with our regulator, the Animal and Plant Health Agency."

By Jess Sharp , Money team

Barclays has been criticised for making the "ludicrous" decision to limit how much cash its customers can deposit in a year.

Ron Delnevo from the Payment Choice Alliance said the move was a "disgrace" and accused the bank of trying to force businesses to stop accepting cash.

From July, the change will mean Barclays customers can only deposit up to £20,000 per calendar year into their personal accounts.

The limit will reset every January.

It comes after Natwest made a similar decision last year, capping deposits to £3,000 a day, or £24,000 in any 12-month period.

"The decision by Barclays is ludicrous. This is plainly an anti-cash move," Mr Delnevo told Sky News.

"It is trying to take free choice from people. It's like it is saying, 'if you are using cash, then we think you are a criminal'.

"It's a disgrace quite frankly and there is no excuse for it. It's just wrong."

Asked if he was concerned other banks could follow suit, he said: "Definitely."

He gave the example of someone selling a car for cash. "How would you deposit the money into your account?" he asked.

Barclays said the change was being made to help it identify "suspicious activity".

"We take financial crime and our responsibility to prevent money laundering seriously," a spokesperson said.

"We have contacted customers to let them know that from July we are making some changes to the amount of cash customers can deposit into their Barclays accounts.

"We have set the limit at an amount that will allow us to better identify suspicious activity, while still ensuring our customers have access to cash."

The UK's estimated 23 million pet owners are at risk of a new kind of scam, one that took nearly £240m in the first six months of last year.

Scammers are now targeting the most vulnerable owners – those who’ve lost their pets.

Fraudsters are turning to lost pet forums and websites to claim they've found missing pets, demanding a ransom payment for their return.

Figures from UK Finance reveal this type of fraud – known as Authorised Push Payment (APP), when a victim is tricked into sending money directly to a criminal’s account - cost British consumers £239.3m in the first six months of 2023.

James Jones, head of consumer affairs at Experian, has some tips on how to avoid the scam...

- Never pay the ransom – If someone is demanding a large sum of money in exchange for your pet's safe return, call the police immediately. Never pay the money upfront, as it will most likely be a scam. Be sure to take a step back and analyse the situation.

- Examine the photos - is it a fake? – In an era where the use of artificial intelligence to fabricate photos is becoming increasingly commonplace, spotting a fake is becoming more challenging. But if you do receive a suspicious photo, make sure to take a closer look to determine whether it is in fact your pet. To do this, check if the photo has been taken from your social media profile and reframed to pass as a recent photo. You should also check for any signs of photoshopping. This could be the way the image has been cut, or the lack of shadows. It is also always helpful to get a second opinion – what you might miss, another person could spot.

- Spotting fabricated stories – Scammers may share specific personality traits you recognise about your pet to convince you they legitimately have it in their possession. However, they may be getting this information from adverts you’ve shared on missing pet websites, or even details shared about your pet on your social media profiles. Be extra cautious and question their authenticity.

- Be careful not to overshare on social media – While sharing information of pets on social media channels is commonplace, this can make them a goldmine for fraudsters. Always be careful about posting personal details, such as your address, pet’s name, or your location in real time. This is all information a fraudster could use to their benefit. Even if you have a private account, you still need to be cautious, as fraudsters have sophisticated methods for obtaining personal information.

- Avoid using your pet’s name as your password – The easiest password to remember is your pet’s name, but unfortunately fraudsters know this too. Of course, you need to be able to remember your passwords, but it’s vital not to make them too simple. The ideal password should contain a minimum of 10 characters using a mix of letters, numbers and symbols. As a rule of thumb, it’s also best to ensure you are using muti-factor authentication, when possible.

Be the first to get Breaking News

Install the Sky News app for free

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

6 Best Travel Money Cards for Mexico - 2024

If you’ve got an upcoming trip planned to Mexico, a dedicated travel money card can make spending and withdrawing Mexican pesos cheaper and more convenient. There are different types of travel money cards which support different customer needs, including travel debit cards, prepaid travel cards and travel credit cards. The right one for you will depend on your personal preference and how you like to manage your money.

Keep reading to find out everything you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

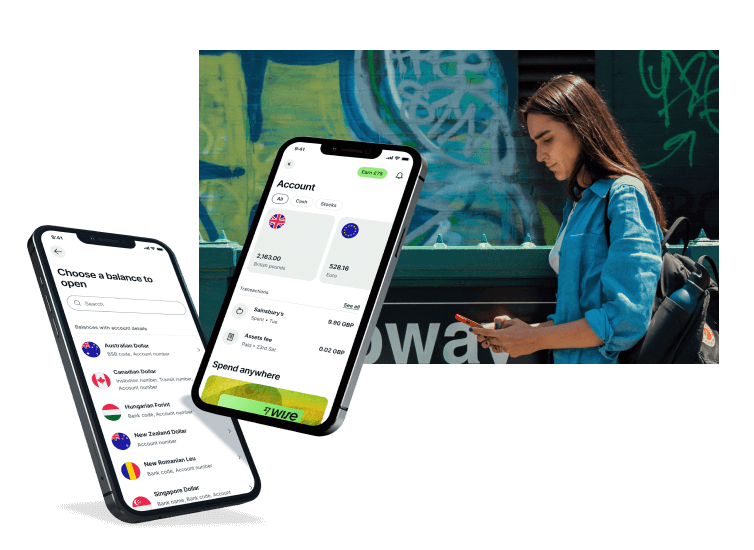

Wise - travel debit card for Mexico

Before we get into details about different travel money card options, let's start with the Wise card, which is a flexible travel money debit card that allows you to hold and spend MXN and a selection of other currencies.

Wise accounts can hold and exchange 50+ currencies , and you can get a linked Wise card for a one time delivery fee. Top up your account in pounds and switch to MXN before you travel, so you know your travel money budget in advance - or just allow the card to automatically switch currencies when you spend. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%. Here are some of the pros and cons of the Wise travel money debit card, to help you decide if it’s right for you.

Hold and exchange 50+ currencies alongside MXN

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

A travel money card can be used just like your regular bank card, for payments online and in stores, and for cash withdrawals. The main difference you’ll see is that with a travel money card the features and fees available have been optimised for international use. Depending on the card you pick, that can mean you get a better exchange rate compared to using your normal card overseas, or that you need to pay fewer fees. Some travel cards also have options to earn cashback and rewards when you use your card internationally.

6 travel money cards for Mexico compared

We’ll look at each of these card options in a little more detail in just a moment, but let’s start with an overview of how 6 top travel money cards for Mexico compare side by side:

As you can see, the features and fees of different travel money cards can vary widely. Generally travel debit cards can be convenient and cost effective to use, while travel credit cards often come with nice benefits like cashback or rewards - but do mean you might need to pay interest costs and late payment charges if you don’t clear your bill in full every month.

Travel debit cards often let you top up a linked account online or through an app, so you can set your budget and can’t spend more than you intend.

Travel credit cards on the other hand let you spend to your card limit, and then repay the amount over a few months if you’d prefer to. Which is best for you will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

UK customers can get a travel money card from either a regular bank or a specialist provider, which may be a travel debit card, travel prepaid card or a travel credit card. Let’s take a closer look at what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Travel debit cards are usually offered by specialist providers, with linked digital accounts you can use to hold and convert a currency balance in a selection of currencies, often including MXN. Travel debit cards can usually be topped up easily online and through an app, with the option to see your balance and get transaction notifications through your phone too. That makes it easier to keep on top of your money, even when you travel.

Travel debit card Option 1: Wise

Wise is our best value travel money debit card for Mexico, which comes with a linked account you can use for holding MXN easily. There’s no fee to open a Wise account, and just a small delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent ATM withdrawal fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold MXN and 50+ other currencies, convert between them with the mid-market rate

Travel debit card Option 2: Revolut

Revolut has a selection of different account tiers, so you can simply pick the account you prefer - from free Standard plans to the 12.99 GBP/month Metal plan. All Revolut accounts have linked cards, although exactly what type of card you get depends on your account tier. You can hold around 25 currencies including MXN, and convert currencies with the mid-market rate to your plan’s allowance.

No fee to open a Standard Revolut account, or upgrade for up to 12.99 GBP/month

Card delivery fees may apply depending on your account tier

All accounts have some fee free currency conversion with 0.5% fair usage fees after that

Standard plan holders can withdraw 200 GBP (up to 5 withdrawals in total) per month for free

Hold MXN and around 25 other currencies

Pros and cons of using debit travel cards in Mexico

No interest costs or late payment fees

Real-time currency exchange options available

Digital top-up and account viewing features

Safe to use as they're not connected to your primary UK bank account

Issued on widely-used global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for Mexico?

The best travel debit card for Mexico really depends on your personal preferences and how you like to manage your money. If you’ll be travelling widely it makes sense to look for an account with mid-market currency exchange and a large selection of supported currencies as well as MXN, like Wise. Other providers like Revolut can also be a good pick, particularly if you’ll use your account very frequently and would prefer to pay a monthly fee to unlock lots of fee free transactions and extra perks.

Is there a spending limit with a travel debit card in Mexico?

Different providers set their own limits for card use. Limits may apply daily, weekly or monthly, and can apply to different types of transactions. You might find you have a limit to the amount of ATM withdrawals you can make per day, for example, or the value of contactless payments - these limits are set for security and can sometimes be managed and changed in the provider’s app.

2. Prepaid Travel Cards

Prepaid travel cards can be ordered or collected from specialist providers - once you have a card you’ll just need to add funds in the supported currency of your choice. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - not all cards support all currencies. MXN prepaid cards are pretty hard to come by, so you may find you pay a foreign transaction fee when you spend. However, a prepaid card can still be helpful from a security perspective, as it means you won’t need to use your regular bank card while you’re in Mexico.

Prepaid travel card option 1: Post Office

You can pick up a Post Office prepaid travel money card in a Post Office branch or order one online. You’ll then be able to top up in pounds or one of the 22 supported currencies. As MXN isn’t a supported currency you’ll pay a 3% foreign transaction fee to spend with your card in Mexico - however this card can still be a helpful choice because it means you can avoid using your regular bank card while overseas.

Hold and exchange 22 currencies (not including MXN)

No fee to spend a balance in a supported currency

3% foreign transaction fee when spending a currency you don’t hold on the card

Variable ATM withdrawal fees based on the currency you hold

No interest to pay

Click here to read a full Post Office review

Prepaid travel card option 2: Monese

Monese accounts can be opened by UK residents to hold GBP, EUR and RON. There are several different types of accounts, from the Simple account which has no monthly fees, to fee paying account tiers which have more features. It’s free to spend a balance you hold - but as MXN isn’t a supported currency, you may find you pay a foreign transaction fee of 2% when you’re spending in Mexico. Foreign transaction fees may be waived for higher tier account holders.

Hold a balance in GBP, EUR or RON

Choose a free Simple account, or upgrade to an account with monthly fees

Foreign transaction fees of 2% may apply depending on your account tier

ATM withdrawal fees may apply, depending on the value of withdrawals and the account tier you hold

Track and spend Avios reward points within your account

Pros and cons of using prepaid travel cards in Mexico

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Selection of supported currencies, with no fee to spend a currency you hold

ATM withdrawals supported globally

Some accounts have extras like options to earn reward points

MXN may not be a supported currency

Transaction fees apply to most accounts

How to choose the best travel prepaid card for Mexico?

There’s no single best travel prepaid card for Mexico - it’ll come down to your personal preference. If you hold a Monese Classic or Premium account already it’s good to know that the 2% foreign transaction fee is waived, which means you get the card network rate when you spend in Mexico. This may be cheaper than using your regular bank card. The Post Office card can also be an option if you’re simply looking for an alternative to your normal bank card when you’re in Mexico, plus you can get a card instantly by walking into a Post Office branch.

Is there a spending limit with a prepaid card in Mexico?