What is a Specialist Tour Operator?

A specialized tour operator provides unique and niche travel experiences. You can think of food tours, cooking classes, wine tastings, and hiking tours. Any tour provider that offers services in a niche is a specialized tour operator.

In recent years, there has been a rising interest in specialized tourism. For example, 2021 data shows that 68% of travelers are shifting towards sustainable tourism. Also, the Global Wellness Institute reports that 64% of travelers want wellness vacations. In addition to these, food tourism is constantly growing. In the U.S. alone, 95% are looking for 'some kind of unique food experience', and the numbers are growing globally.

In this blog, we'll learn more about specialized tour operations. If you are a travel agent or tour provider looking for a fresh marketing approach in 2024, this is for you. Below are 5 ideas on how to curate specialized travel experiences that meet travelers' demands.

1. Niche Expertise

Specialist tour operators have in-depth knowledge and expertise in specific travel niches or themes, such as adventure travel, wildlife safaris, cultural immersions, or culinary tours.

Did you know that some specialist tour operators specialize in niche markets like "dark tourism," offering tours to historically significant but often somber places such as battlefields, prisons, or disaster sites?

Tips for tour operators:

- Know Your Stuff : Really get to know everything about the special travel area you're focusing on, like history and interesting facts.

- Tell Great Stories : Make your tours interesting by telling cool stories. Work with local people who know a lot about the place to make it more real.

- Listen and Change : Pay attention to what your travelers like and don't like. Use their feedback to make your tours even better.

2. Customized Experiences

They often have travel agency to offer customized or tailor-made itineraries to cater to the unique interests and preferences of their target audience, allowing travelers to personalize their journeys.

Many specialist tour operators provide travelers with the opportunity to design their own itineraries, offering a level of personalization that can include specific activities, accommodations, travel arrangements, or even dietary preferences.

- Offer Tailor-Made Options : Give your travelers the chance to create their own itinerary. This could mean letting them pick specific activities, choose their own accommodation, or even request special meals.

- Ask for Preferences : Before the trip, ask your travelers about their interests, what they want to see and do, and any special needs they might have. Use this info to make their experience more personal.

- Flexible Scheduling : Allow some flexibility in your itinerary. This way, travelers can spend more time on the activities they enjoy most or explore additional sites that catch their interest during the tour.

3. Destination Specialization

Some specialist tour operators concentrate on specific destinations or regions, becoming experts in those areas and offering comprehensive experiences within them.

Other specialist tour operators focus exclusively on regions with unique natural wonders, like the Galápagos Islands, where they specialize in eco-friendly and sustainable travel experiences.

- Be a Local Expert : Learn everything about the specific region or destination you focus on, including its culture, history, and natural wonders. This knowledge will help you create in-depth, engaging tours.

- Highlight Unique Features : Showcase what makes your destination special, like unique natural attractions or cultural experiences. For example, if you specialize in the Galápagos Islands, emphasize eco-friendly tours that highlight the unique wildlife and ecosystems.

- Sustainable Practices : If your destination is known for its natural beauty, like the Galápagos, prioritize sustainable and eco-friendly travel practices to preserve the environment. This is not only good for the planet but also appeals to eco-conscious travelers.

4. Exclusive Access

They may provide package tours with exclusive access to attractions, accommodations, or activities that are not readily available to mass-market tour operators, enhancing the uniqueness of the tours.

Specialist tour operators might arrange exclusive access to archaeological sites before or after regular opening hours, allowing travelers to explore these historic treasures without the crowds.

- Arrange Special Visits : Work to get special access to popular sites, like arranging visits to archaeological sites outside of normal hours. This lets travelers enjoy these places without the usual crowds.

- Unique Experiences : Offer activities or experiences that aren't usually available to the general public. This could be anything from a private tour with a local expert to exclusive access to certain areas.

- Build Relationships : Develop good relationships with local attractions and accommodation providers. This can help you arrange special access or unique experiences for your travelers.

5. Passionate Guides

Specialist tour operators often employ passionate and knowledgeable tour guides who are experts in the niche or destination, ensuring travelers receive a high level of expertise and engagement during their journeys.

In the world of birdwatching tours, specialist operators often employ ornithologist guides who are not only experts in bird identification but also passionate advocates for bird conservation, enriching travelers' experiences with their deep knowledge and enthusiasm.

- Hire Expert Guides : Look for guides who are not just knowledgeable but also passionate about the niche. For example, in birdwatching tours, hire ornithologists who are experts in bird species and conservation.

- Train for Engagement : Ensure your guides are trained not only in factual knowledge but also in engaging storytelling and interaction with travelers. This enhances the overall experience.

- Focus on Special Interests : Match guides with specific interests or expertise to relevant tours. A guide's enthusiasm for their specialty, like bird conservation, can greatly enrich a traveler's experience.

Key Takeaways

As we wrap up our exploration of specialized tour operators, it's clear that this niche-focused approach in the tourism industry is not just a trend, but a growing sector meeting diverse traveler demands.

From the increasing interest in sustainable tourism and responsible travel, to the rise of wellness vacations and unique culinary experiences, the opportunities for specialized tour operators are vast and varied.

To stand out in this competitive market, here are three key actionable tips that you, as tour and activity providers, can implement:

- Embrace Your Niche : Whether it's eco-tourism, culinary experiences, or wellness retreats, dive deep into your niche. Know your audience and tailor your offerings to their specific interests and needs.

- Prioritize Authentic Experiences : Travelers are seeking genuine, immersive experiences. Collaborate with local communities and experts to offer authentic and unique tours that cannot be found elsewhere.

- Leverage Technology and Innovation : Utilize the latest technology, like AI for personalized itinerary planning or virtual reality previews of tours, to enhance the customer experience and streamline operations.

By focusing on these areas and continually adapting to the evolving desires of travelers, you can create memorable and distinctive experiences that not only meet but exceed the expectations of your clientele. Remember, in the world of specialized tourism, it's all about delivering uniqueness, authenticity, and quality.

Our Happy Specialized Tour Operators

TicketingHub has worked with specialized tour and activity providers for years now. Some of them are now renowned for their food tours, city tours, and special events. Read our case studies below and see what helped them succeed in this rising market.

- The Secret Food Tours

- Egypt's Sound and Light Show

- Belfast City Tours

People Also Ask:

1. why is online booking software helpful for specialist tour operators.

An online booking software is a game-changer for specialist tour operators. This type of software streamlines the booking process, making it easier for travelers to secure their spots on specialized tours.

For the operator, it simplifies managing reservations, tracks customer preferences, and automates tasks like sending confirmations and reminders.

Online booking systems offer efficiency and personalized service, particularly for specialist operators who deal with customized and niche travel packages. It saves money and time, both for the tour operator and the traveler, enhancing the overall experience.

2. What is a specialist tour operator?

Specialist tour operators are tour operators in the travel industry who focuses on offering specialized and niche travel experiences. Unlike mass market tour operators who cater to broad, general travel demands, specialist tour operators offer in-depth expertise in specific areas.

These can range from eco-tourism, adventure travel, cultural tours, to specific country or regional focuses. They provide tailored package holidays and tours that cater to specific interests and often offer more personalized service than other tour operators.

3. What is a specialized tour?

A specialized tour is a travel package designed to cater to specific interests or themes. Unlike general tour packages offered by many travel agencies, specialized tours delve deep into a particular area, offering unique experiences such as eco-tourism adventures, culinary tours in specific countries, or in-depth exploration of national parks.

These tours are usually crafted by specialist tour operators who possess deep knowledge and passion for the niche, ensuring an enriching and authentic experience for the traveler.

4. What are the main three types of tour operators?

The three main types of tour operators in the travel industry are inbound tour operators, outbound tour operators, and domestic tour operators.

- Inbound Tour Operators : These operators specialize in arranging tours and travel packages for travelers coming into a country. They work closely with hotels, airlines, and ground operators to provide a comprehensive travel experience in the destination country.

- Outbound Tour Operators : These receptive tour operators organize trips for travelers stepping out of their home country to visit other destinations worldwide. They often work with airlines, hotels, and travel operators in different countries to arrange all travel components.

- Domestic Tour Operators : They organize tours for domestic travelers within their own country. They specialize in knowing the best local spots and experiences that appeal to domestic travelers, including hotels, transport, and leisure travel activities.

Each type of tour operator plays a crucial role in the tourism ecosystem, catering to different segments of holidaymakers and travelers. It offers varied services like transport, accommodation, and travel packages.

5. What types of niche travel experiences do specialist tour operators offer?

Specialist tour operators offer a wide range of niche experiences, including wildlife safaris, cultural immersions, adventure travel, culinary tours, and more. They cater to specific interests and passions, providing travelers with unique and customized journeys.

6. Are specialist tour operators more expensive than regular tour companies?

Specialist tours can cost widely depending on niche and customization. While some specialist tours may have a premium price due to exclusive access or unique experiences, others can be competitively priced. It's essential to compare options and assess the value of all arrangements and experiences offered.

Get the latest news and stay in touch with the industry secrets.

By clicking "Subscribe", you agree to our Privacy Policy and the data we do collect.

Online Travel Booking Tool: How Magic Link is Solving the Rebooking Problem

.webp)

FareHarbor vs Rezdy vs TicketingHub: Honest Tour Booking Software Comparison Guide

Why Online Reputation Management Is Important for Tour Operators

How to Craft a Perfect Tourism FAQs Page for Your Tours

Keep Reading

Discover the role of specialized tour operators. From wellness to food tours, gain insights in how they create authentic travel experiences.

How Can Tour Operators Contribute to Sustainable Tourism?

Explore how tour operators contribute to sustainable tourism, with eco-friendly strategies and community support tips.

The mass tourism industry EXPLAINED

Disclaimer: Some posts on Tourism Teacher may contain affiliate links. If you appreciate this content, you can show your support by making a purchase through these links or by buying me a coffee . Thank you for your support!

Mass tourism is a prominent part of the tourism industry. Associated with the traditional package holiday, well-known holiday resorts and famous tourist attractions, many areas both benefit and suffer at the hands of mass tourism. But what exactly is mass tourism and how does it impact the wider tourism industry?

In this article I will explain what mass tourism is, with some useful definitions. I will then outline the characteristics of mass tourism, the evolution of mass tourism and the positive and negative impacts of mass tourism. Lastly, I will provide some examples off destinations that are known for their mass tourism industries.

What is mass tourism?

Mass tourism definitions, extreme concentration of tourists, saturation of a destination, organised groups, accessibility, media and promotion, the stage of consolidation, psychocentric tourists, how did mass tourism evolve, enclave tourism, beach holidays, theme parks, major tourist attractions, mountain climbing, positive impacts of mass tourism, negative impacts of mass tourism, how can we manage mass tourism in a sustainable way, mass tourism destinations, mass tourism: conclusion, further reading.

Well, the clue is in the title!

Mass tourism is essentially tourism that involves ‘the masses’.

So, what is a mass? Well, this is not exactly clear. But lets just say its usually a lot- like thousands or tens of thousands or more.

Mass tourism can occur in a variety of tourism situations. It could be a coastal resort, such as Benidorm. It could be an area that is home to a major tourist attractions, such as the Great Wall of China . It could be a picturesque village or remote island.

Wherever mass tourism occurs, it relies on the same concept- there are large amounts of tourists , often filling or exceeding capacity, in a given location at one time.

For decades, mass tourism has been a widely used term in tourism literature as well as in wider society. Yet, to this day there has never been a clearly agreed definition and content.

According to Poon (1993), mass tourism refers to the movement of a large number of organised tourists to popular holiday destinations for recreational purposes. It is a phenomenon which is characterised by the use of standardised package products and mass consumption. Conceptually, this type of tourism features standardized leisure products and experiences packaged for mass tourists.

Hilallali (2003) describes mass tourism as ‘an offspring of industrialisation and democracy, good student of consumption and globalisation .

As noted by Dehoorne et Theng in 2015, Mass tourism is the epitome of aggressively large-scale sold standardized packages stands in stark opposition to elite or luxury tourism.

Naumov and Green (2016) state that mass tourism refers to the movement of a large number of organised tourists to popular holiday destinations for recreational purposes.

Whilst these definitions are useful, I personally feel that they are all missing some important detail. These definitions quite rightly acknowledge the fact that organised packaged tourism products are significant facilitators of mass tourism. But they fail to acknowledge the growing dynamic independent tourist.

In today’s world, consumers are more independent than ever. We can find a cheaper deal online ourselves than what the travel agent is offering. We can plan our own itinerary using the information presented by travel blogs. We don’t need a guide when we can download the information we need on our phones. But just because we are not part of a mass organised group, does not mean that we are not mass tourists.

Thousands of tourists flock to Santorini’s picturesque white streets each July. Thousands of people line the streets of Shanghai to get a look at the light show on the Bund each evening. People struggle to get a photo without the crowds of tourists behind them at the Pyramids of Giza in Egypt. Are all of these people on an organised package holiday? I very much doubt it.

In reality, most attempts to define the concept of mass tourism are indeed outdated, failing to take into account post-modern tourist motivations and behaviours. In light of this, I have developed my own definition of mass tourism below…

Mass tourism can be defined as ‘extreme concentrations of tourists in any one place, resulting in saturation of the place’. Mass tourism cannot be characterised by specific numbers or values, because every destination has different carrying capacities. Rather, mass tourism occurs when there are too many tourists for a destination to comfortably accommodate.

Characteristics of mass tourism

OK, so now we have defined mass tourism, what are the identifying characteristics? The most notable characteristics of mass tourism include: extreme concentrations of tourists; the saturation of a destination, travel in organised groups, good accessibility to a destination, media influence, the stage of consolidation and tourists who are described as psychocentric.

I will explain what each of these means below.

The most obviously characteristic of mass tourism is that there are a lot of tourists. What is a lot, I hear you say? Well, I can’t quite answer that question-sorry.

Each type of tourist destination is different. Some places are big, others are small. In fact, what is a destination? Well, this isn’t entirely clear either.

In the context of mass tourism, a destination could be a city, a holiday resort or the area surrounding a popular tourist attraction. The size of the destination doesn’t actually matter though. The important fact is that there are more tourists that come to the area at a given time than the destination can comfortably cope with.

OK, so here comes another subjective term- what does ‘comfortably cope’ mean? Well, what I mean by this, is that if the tourism has adverse effects as a result of the visitor numbers, it is no longer ‘comfortably coping’. This could include environmental degradation, gentrification or adverse social impacts, for example.

So the major characteristic associated with mass tourism is that there are too many tourists in a given area, big or small.

Having too many tourists leads to saturation of a tourist destination.

If a tourist destination is saturated, there are likely to be more tourists than members of the local community. Revenue from tourism-related activities is likely to dominate the economy. Many of the negative economic , environmental and social impacts of tourism are notable.

Mass tourism is generally associated with the concept of overtourism . Overtourism refers to the issue of having too many visitors in a given time in a given place, which impacts negatively on the tourist experience, the host community and environment.

Overtourism is a growing problem that can only be resolved by adopting principles of sustainable tourism management.

Mass tourism is associated with organised and packaged tourism.

Whilst not all mass tourists are package tourists, there is definitely a linear relationship between the two.

By default, group organised holidays bring large amounts of tourists to a destination at the same time. Whether this by via a coach tour, a day trip or through a tour operator, travel in organised groups brings large amounts of tourists together in one place at one time.

Group tourism is usually organised in a place because it has some particular value to the tourist. For example, there are many tours to visit the famous Abu Simbel attraction in Aswan, Egypt. Likewise, Sharm el Sheikh is a popular destination for package holidays and enclave tourism .

Mass tourism is directly associated with good accessibility.

The advent of the low cost airline largely fuelled the growth of the mass tourism industry. Airlines such as easyJet and Wizz Air put new tourist destinations on the map and helped to transport more tourists to existing tourist destinations than areas could [can] comfortable cope with.

Cheap flights has meant that many areas have become saturated with tourism. Cheap flights means that more people can afford to go on holiday, more often.

But accessibility isn’t just about price. The past two decades have seen the number of available flights increase exponentially. This has meant that destinations are more accessible to tourists.

Likewise, many destinations have become more accessible because they have developed their transport infrastructure. New airports, new roadways and improved rail infrastructure has meant that more tourists can reach more destinations around the world than ever before.

If we don’t know about a place then we don’t go to a place.

The media has placed a significant role in the growth of tourism to particular areas. From episodes of Karl Pilkington’s Idiot Abroad to Travel Man, starring Richard Ayoade , to Leonardo Dicaprio’s famous film, The Beach , there are plenty of places that have made their way to fame through the media.

One of the most notable developments in the promotion of tourist destinations is the development of social media. Have you ever heard of Insta tourism ? Yep- it’s a an actual type of tourism !

Social media platforms have raised awareness of many tourist destinations around the world that had previously featured only deep in our guidebooks.

In particular, Instagram’s geotagging function enables social media influencers to display the exact location of where their photographs were taken. This has resulted in tourists flocking to areas around the world that had previously experienced little or no tourism.

Butler, in his Tourism Area Life Cycle model , outlines the way in which a destination grows and evolves. In his model, there is a clear point at which tourist numbers are at their highest. This is the time when tourism is fully developed and is starting to the negative experience impacts associated with overtourism .

When tourism reaches the stage of consolidation in a destination, it is likely that it is also experiencing the concept of mass tourism.

Similarly to Butler, Plog looked at tourist motivations, mapping them to particular times during a destination’s development in his model of allocentricity and psychocentricity .

Plog demonstrated in his typological assessment, that when a tourist is classified as a psychometric tourist, they are likely to pertain to mass tourism as their primary choice of holiday type.

Psychocentric tourists typically travel in organised groups. Their holidays are typically organised for them by their travel agent . These travellers seek the familiar. They are happy in the knowledge that their holiday resort will provide them with their home comforts. These tourists enjoy holiday resorts and all inclusive packages . They are components of enclave tourism , meaning that they are likely to stay put in their hotel for the majority of the duration of their holiday. These are often repeat tourists, who choose to visit the same destination year-on-year.

The history of tourism is a long one and mass tourism plays a key role in the growth and development of the tourism industry .

The origins of mass tourism can be traced back to 1851, when Thomas Cook led his first organised group of tourists to the Great Exhibition in London. While his business model did change and adapt over the years, the concept remained the same- organised group travel.

Over time, more and more people were able to travel. After World War ii, people began to have more disposable income and new legislation was brought in to ensure that workers had paid holidays each year.

At the same time, destinations became more developed. They developed their transport infrastructure, promoted their destination for tourism and built the facilities and amenities that tourists required.

Mass tourism notably developed in Western societies since the 1950s. This was the result of a period of strong economic growth. Mass tourism was first seen in Western Europe, North America and Japan as these countries had strong economies and thus the general public were wealthier overall.

Globalisation has also fuelled the mass tourism industry. People can find the familiar on their travels. There are less surprises than there once was. We can research our trip on the Internet and watch travel shows to familiarise ourselves before we travel.

The mass tourism industry really started to boom with the advent of the low cost carrier . The average UK outbound tourist went from having one two week holiday per year to taking a big holiday and a couple of short breaks. People who couldn’t afford to go on holiday before, were now being brought into the market.

Types of mass tourism

Although many people associate mass tourism predominantly with the traditional package holiday model, there are in fact many different types of mass tourism.

Examples of enclave tourism destinations : Sharm el Sheikh, Egypt ; Kusadasi, Turkey; Costa Blanca, Spain.

Mass tourism is commonly associated with enclave tourism .

Enclave tourism is essentially tourism that takes place in a space that is segregated from the community outside. It is in its own ‘bubble’, so to speak.

Enclave tourism implies a conscious decision to segregate tourists from the general population . This is usually in the context of an all-inclusive environment such as a cruise ship, hotel or resort complex.

Enclaves are enclosed and self-contained physically, socially, and economically. This means that tourists have hardly any reasons to leave the enclave.

Examples of mass tourism beach destinations: Benidorm, Spain; Phuket, Thailand; Kuta, Bali .

There are many beach areas where the destinations have become overdeveloped. These are most commonly located in Western Europe, although they are found all around the world. It is these overdeveloped beach areas that are most commonly associated with mass tourism.

Mass tourism beach holidays have traditionally been the bread and butter for travel agents . Up until this day, high street travel agents are filled with holidays brochures boasting photo after photo of beautiful beaches and swimming pools.

With the lack of British sunshine and seemingly endless rainy days, it is no surprise that Brits, amongst other nationalities, seek warmer climes. Thomas Cook’s products were among the first to provide British holiday makers with the typical sun, sea and sand experience, but there have since been many more players enter the market.

Examples of mass ski destinations: Andorra, Italy ; Chamonix, France; Breckonridge, USA.

There are many ski resorts that have developed to such a stage that they can now be classified as mass tourism destinations.

Popular throughout the winter months, many tourists flock to ski destinations for their holiday. This is especially popular in the Alps in Europe and the Rockies in the USA and Canada.

Ski holidays are also often sold as a packaged product by travel agents, composing of flights, transfers, accommodation and ski rental/lessons.

Examples of mass tourism in theme parks: Universal Studios Florida , USA; Alton Towers, UK; Disney Shanghai, China.

Theme parks attract large amounts of tourists.

Disney Land, Paris attracts around 15 million tourists each year, Disney Land in Tokyo has approximately 18 million visitors and Magic Kingdom at Walt Disney Florida has more than 20 million tourists each year! Wow, that’s a lot!

People who visit theme parks also often provide a tourism boost for local areas too. People may choose to eat at nearby restaurants or stay in nearby hotels.

Mass tourism events: Hogmonay, Edinburgh, UK; Rio Carnival, Brazil; San Fermin , Spain.

Mass tourism occurs when large numbers of people undertake tourism-related activities in the same place at the same time. This is often the case with major events.

From the Olympics to the Day of the Dead Festival in Mexico, events attract tourists all over the world.

Mass tourism caused from events can out a strain on locals areas, which may not be equipped to deal with the influx of visitors.

Examples of major tourist attractions attracting the masses: The Eiffel Tower, France ; The Pyramids of Giza, Egypt; The Great Wall, China.

Many tourists will travel to an area to visit a particular tourist attraction. Whether this is a museum in Paris, a war memorial in Washington or an underground cave in Jeju , South Korea, tourist attractions are often the main appeal of a tourist destination .

Major tourist attractions can attract masses of tourists, who then spend time in the surrounding area, thus making the area a mass tourism destination.

Examples of mass tourism cruise areas: The Caribbean; the Mediterranean.

Cruise tourism is one of the most popular types of tourism .

Cruises come in all shapes and sizes and the smaller ones are obviously not examples of mass tourism. However, some cruise ships are so big that they are the size of a small city!

The largest cruise ships in the world have a capacity of more than 5000 tourists. These tourists will disembark en mass when the ship docks at various locations, causing an influx of tourists to said destinations over a short period of time.

Examples of mountain climbing where tourist numbers exceed capacity: Mount Everest; Mount Kilimanjaro.

Mass tourism when climbing a mountain? Surely not? Well actually- yes.

OK so you are not getting thousands of tourists like you might on a cruise ship or in a beach resort, but like I explained earlier, mass tourism is not about specific numbers- it is when the numbers exceed capacity.

Sadly, there have been many stories in recent years of capacity issues when climbing mountains. The most notable is on Mount Everest, where tourists have dies as a result of queuing at high altitude.

Whilst mass tourism is most commonly discussed because of its negative impacts, there are actually some positive impacts of mass tourism too.

Mass tourism makes money. That’s the number one motivator for all destinations who allow areas to evolve into mass tourism destinations (not sure what I mean? Take a look at Butler’s Tourism Area Life Cycle model ). After all, money is what makes the world go round, right?

Mass tourism brings lots of tourists. Lots of tourists spend lots of money. This supports economic growth in the local area and enables the destination to spend or reinvest the money that is made in a way that is appropriate for that particular area. Some destinations may build more hotels. Other may make financial investments. Some may spend more money on public health services or education.

However they choose to spend their money, it is money which is the motivation for tourism development.

Mass tourism creates many jobs. This also helps to boost the local economy as well as supporting livelihoods. Jobs can be directly related to tourism (i.e. a hotel waiter or a holiday representative) or they can be indirectly related to tourism (i.e. the fisherman who supplies fish to the hotels).

You can read more about the positive economic impacts of tourism here .

Mass tourism has gained a pretty bad reputation in recent years. If you Google the term ‘mass tourism’ you will be largely greeted with articles that discuss the negative impacts on the environment and society.

Mass tourism creates intense environmental pressures due to the fact that such activity involves a large number of tourists in small areas. The environmental impacts of tourism include aspects such as littering, erosion, displacement of animals, damage to flora and fauna and reduction in air quality, to name but a few.

Mass tourism can also cause significant social impacts . Gentrification, increases in crime, loss of culture and authenticity and cultural ignorance are just some of the ways that large amount of tourists in a given area can negatively effect the local society.

The other major problem is economic leakage . Whilst mass tourism creates significant revenue, not all of this money remains in the destination. In fact, because mass tourism is closely associated with all inclusive holidays and enclave tourism, it experiences more economic leakage than other areas of the tourism industry.

Economic leakage is when the money raised leaks out of the area. This is largely due to multinational chains operating within the tourism system .

If you eat McDonalds, most of your money goes back to America.

If you buy a can of Coke, most of your money goes back to America.

If you stay in a Hilton Hotel, most of your money goes back to America.

Get the picture?

The key to managing mass tourism in a sustainable way is to minimise visitor numbers. OK, so that sounds counterintuitive, right? Wrong.

Yes, mass tourism is great because it brings in lots of money. BUT the problem is that it is not sustainable. Destinations cannot continue to exceed their capacity indefinitely.

As I explained above, there are generally more negative impacts associated with mass tourism than there are positive. But that doesn’t mean that mass tourism doesn’t have to stop altogether. There are many methods to manage tourism destinations in a more sustainable manner.

One way to manage mass tourism better is to provide incentives to help distribute tourists evenly throughout the year and to avoid the peaks and troughs that come with seasonality. Instead of having the majority of tourists arrive in July and August, for example, a destination could put caps on visitor numbers during this time and instead offer discounted rates at other times of the year.

A destination could temporarily close to allow for some of the environmental damage caused by mass tourism to be repaired. This has been done at Maya Bay in Thailand and on the island of Borocay in the Philippines in recent years, with positive outcomes.

Another way to manage mass tourism in a more sustainable way is to introduce smart tourism techniques. These can help to better manage tourist flows, monitor tourist activity and accurately analyse tourist patterns and behaviours. This allows tourism stakeholders to more easily and more accurately implement sustainable tourism principles where possible.

Ultimately, however, sustainable tourism and mass tourism are contradictory terms. Mass tourism is generally viewed as the antithesis of sustainability, due to the large amount of negative impacts that are widely known and documented. That isn’t to say that sustainable mass tourism is impossible, it just requires some very careful tourism planning and management.

There are many destinations around the world that are classed at mass tourism destinations. Some are resorts, others are major tourist attractions. Some destinations have suffered at the hands of the mass tourism industry for many years and others are new to the scene. In some cases, Governments have [are] implementing changes to better manage tourism or to remove themselves from the mass tourism market.

As much as I would love to discuss each of the mass tourism destinations below, this article is already almost 4000 words long, and I don’t want to bore you! Instead, I will provide a list of mass tourism destinations and if you are interested, you can research these more yourself!

Mass tourism destinations include:

- Eifell Tower

- Val-d’Isere

- Côte d’Azur

- Mont St Michael

- San Sebastian

- Vatican City

- Coloseum, Rome

- Cinque Terre

- Neuschwanstein, Germany

- Hallstatt, Austria

- Oktoberfest, Munich

- Stonehenge, UK

- Lake Lucerne, Switzerland

- Great Wall of China

- The Bund, Shanghai

- Terracotta Warriors, Xian

- Islands of Thailand

- Mount Everest

- Great Barrier Reef

- Macchu Picchu

- Manuel Antonio, Costa Rica

- The Caribbean islands

- Several US National Parks

- Pyramids of Giza, Cairo

Mass tourism is big business, quite literally. Mass tourism isn’t new, but our awareness of many of the negative impacts that it causes is relatively new. It is only in recent years that we have really started to understand the impacts of our actions and think in a more sustainable way.

As you can see, there are many mass tourism destinations all over the world. Are these destinations and the practices that they are adopting sustainable? Probably not.

It is imperative that we plan and manage our tourism industries in order to keep them alive. To learn more about how we can do this and about the importance of the mass tourism industry, I suggest that you consult the texts below.

- Overtourism – This book examines the evolution of the phenomenon and explores the genesis of overtourism and the system dynamics underlining it.

- Overtourism: Tourism Management and Solutions – Questioning the causes of this phenomenon, such as increased prosperity and mobility, technological development, issues of security and stigma for certain parts of the world and so on, this book supposes that better visitor management strategies and distribution of tourists can offset the negative impacts of ‘overtourism’.

- The Challenge of Overtourism – Working paper outlining the concept by Harold Goodwin.

- How to be a highly Sustainable Tourist: A Guidebook for the Conscientious Traveller – a great guide with tips on how to travel sustainably

- The Intrepid Traveler: The ultimate guide to responsible, ecological, and personal-growth travel and tourism – Leading travel expert Adam Rogers draws upon 40 years of experience exploring more than 130 countries in every region on Earth to share the smartest ways to travel in this tip-filled guide

- Outdoor Recreation: Environmental Impacts and Management – an academic text discussing the sustainability of outdoor pursuits

- Sustainable and Responsible Tourism: Trends, Practices and Cases – Sustainable tourism case studies from around the world

- Responsible Tourism: Using tourism for sustainable development – a textbook addressing the concept of sustainability in terms in development

Liked this article? Click to share!

Tourism in Emerging Economies pp 45–73 Cite as

Mass Tourism

- Wei-Ta Fang 2

- First Online: 03 January 2020

1028 Accesses

Mass Tourism plays a very essential role in the development of the tourism industry after the World War II (Jayawardena 2002 ). Due to that, the trend and popularity has helped in the up grading the mass tourism cross to domestic products. The destinations have involved in motivating tourist to come in large numbers to various destinations . It has led to the expansions of the destinations in various aspects, based on the following factors: (1) economically, (2) environmentally, and (3) social-culturally. Mass tourism has been recognized as one of the major sources of foreign revenues, employment opportunities for the local peoples, and economic growth for many developing and least developed countries .

This is a preview of subscription content, log in via an institution .

Buying options

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Claver-Cortés E, Molina-Azorı´n JF, Pereira-Moliner J (2007) Competitiveness in mass tourism. Ann Tour Res 34:727–745

Google Scholar

DECSBF (2015) Barbados breaks a 25 year record for tourist arrivals. Business focus Retrieved 31 March 2019

Jayawardena C (2002) Mastering caribbean tourism. Int J Contemp Hosp Manag 14:88–93

Article Google Scholar

Manzo GG (2019) Travel & tourism economic impact 2019. World Travel & Tourism Council, London, UK

Schmalbruch S (2017) The 10 most-visited cities in the US this year. Insider Retrieved 31 March 2019

Singh S, Timothy DJ, Dowling RK (2003) Tourism in destination communities. Oxford University Press, Oxford, UK

Book Google Scholar

Vainikka V (2013) Rethinking mass tourism. Tour Stud 13:268–286

Download references

Author information

Authors and affiliations.

Graduate Institute of Environmental Education, National Taiwan Normal University, Taipei, Taiwan

Wei-Ta Fang

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Wei-Ta Fang .

Rights and permissions

Reprints and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter.

Fang, WT. (2020). Mass Tourism. In: Tourism in Emerging Economies. Springer, Singapore. https://doi.org/10.1007/978-981-15-2463-9_3

Download citation

DOI : https://doi.org/10.1007/978-981-15-2463-9_3

Published : 03 January 2020

Publisher Name : Springer, Singapore

Print ISBN : 978-981-15-2462-2

Online ISBN : 978-981-15-2463-9

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

AITO – The Specialist Travel Association

Trends in specialist travel revealed in the aito travel insights report 2020, brexit, what brexit 80% of travellers’ holiday plans not affected by the uk’s departure from the eu, value for money comes fourth amongst six factors when considering booking a holiday, customer reviews have doubled in importance for travellers since 2019.

British travellers aren’t holding off on their holiday plans as Brexit advances, with 80% claiming it has had no effect on them whatsoever, according to a recent survey by AITO , The Specialist Travel Association. Of the 20% whose holiday plans have been hindered or changes in some way by Brexit, 73% of them are less likely to book a holiday to Europe in 2020, with concerns over access to EU countries and potential long airport queues.

The AITO Travel Insights Report 2020, compiled in association with leading travel data insight agency SPIKE , has – for the 5th year in succession – delved into the travel habits of the specialist traveller, who largely falls into the 50+ market (80%, with an average age of 61), usually travels as a couple (57.4%) and tends to take two or more holidays a year (36%).

The 2020 specialist traveller has been hit by the latest ‘Waitrose effect’ (in the latest Which? Supermarket Satisfaction Survey , the supermarket came top in every category but price) and considers value for money fourth on the list when booking a holiday, below (1) knowledge and expertise, (2) a holiday company offering a preferred specialism, and (3) having a previous good experience with the tour operator. There is a remarkable thirst for specialist expertise and a willingness to pay more for an experience to make it memorable.

Verifiable customer reviews are more influential than ever before, nearly doubling in importance – from 19.9% in 2019 to 39% – in 2020. However, travellers are wary of fake review sites and untrustworthy platforms and it is imperative for the industry to ensure that feedback submitted is submitted by genuine customers. AITO’s own review system on AITO.com, for example, has measures in place to ensure that reviews are solely from authentic sources.

The AITO Travel Insights Report 2020 revealed the following Top 10 specialist interests as:

1. Exploring culture, arts and history 2. Walking and trekking 3. Wildlife 4. Safaris 5. Gastronomy and wine 6. Skiing and winter sports 7. Photography 8. Archaeology 9. Gardens 10. Wellness and spa

While cultural holidays top the list, wellness & spa holidays have edged their way into the Top 10 list in 2020, along with skiing & winter sports and photography, demonstrating a desire for holidays with purpose, whether it be wellbeing, fitness or learning a new skill.

AITO’s Executive Director, Martyn Sumners says: “This report and the research behind it proves how vital it is for our specialist holidays companies to utilise their vast expertise and knowledge to help consumers navigate the world of travel bookings and to make their experiences memorable and meaningful.

“Specialist travel is hugely different from the mass-market holiday sector, and we need to keep refining our research to help our members to understand the needs of the discerning customer and to provide them with an experience like no other.”

NOTES TO EDITORS

Some 40 companies participated in the research – a mix of AITO tour operators and AITO Agents – and 26,000 customers responded to the detailed survey.

AITO , The Specialist Travel Association, is a group of unique and specialist travel companies, which collectively provide an unrivalled range of holidays. When booking with an AITO member, you are assured of the finest personal service, expert knowledge, and a holiday that is fully financially protected. All AITO members are fully bonded and comply with AITO’s Quality Charter and Sustainable Tourism goals. Their joint aim is to offer the best possible holiday, allied with excellent customer service.

For more information on AITO’s 120-plus specialist holiday companies with an unrivalled collection of holiday ideas covering every corner of the world, visit www.aito.com .

About SPIKE

SPIKE is the leading data insight and customer experience specialist in travel. Founded in 2009 by Roy Barker and Jon Walton, SPIKE aims to deliver commercial value by using powerful data analysis techniques, Net Promoter Scores, and the latest technology to help businesses benchmark, monitor and improve their customer experience.

Press: For more information on AITO or AITO Specialist Travel Agents, or for high-res photos, please contact Jackie Franklin or Charlotte Griffiths at Travel PR on 020 8891 4440 or email [email protected] or [email protected] .

AITO’S Travel Insights Report 2024 reveals interesting trends in specialist travel

Aito travel writer of the year awards, aito travel writer of the year awards 2023 now open for entries.

Travel PR are a joy to work with. They understand their clients and media contacts well, and are always super-responsive when needed. I always take notice when they contact me as they never waste my time with anything irrelevant. All in all, a great team who have my trust and respect. Lyn Hughes, Wanderlust

Travel PR, established 27 years ago, is a leading specialist PR and communications agency specialising in the travel, hotel and lifestyle markets. Want to create a PR strategy for your brand?

Privacy Overview

Why you’re better off booking with an AITO member

- AITO ensures that all specialist members are professional, so you don't have to do the research.

- All package holidays sold by AITO members have financial protection, allowing you to travel with full confidence.

- AITO members promote an ethical and sustainable approach to travel, to help maintain their travel destinations.

- All AITO members sign up to our Quality Charter, ensuring high standards of practice.

- AITO is the best place to find authentic, original holidays from quality specialist travel companies.

- View the 2024 AITO Guide to Specialist Travel

- Find Your Local AITO Specialist Travel Agent

- Become a Member - Join the Association

AITO has over 40 years’ experience in upholding travel industry standards at the highest level. Its members are unique, specialist UK travel companies, who provide an unrivalled range of holidays to every corner of the world. Click here to read more about AITO.

AITO monitors the quality of our members and their holidays. This website features over 12,000 impartial reviews from verified customers of AITO companies. Click here so you can judge for yourself.

Featured Holidays

An expert-led cultural tour along the Lycian Way

Join this walking tour in Turkey

An immaculately kept, family-run hotel -customer favourite

https://www.capeverde.co.uk/hotel-morabeza

Exploring Crete

A spectacular expert-led tour of the legendary island of Crete

Join this Gastronomic Gulet Cruise in Turkey!

Explore Turkey's turquoise coast & discover its fantastic cuisine

A Gastronomic tour of Sicily. Discover its fabulous cuisine.

Join this fabulous expert-led culinary & cultural tour of Sicily.

Barefoot Luxury - River Lodges in Gambia

https://www.gambia.co.uk/mandina-lodges

All inclusive 4 Grade wintersun

https://www.gambia.co.uk/sunbeach-hotel

A beautifully designed hotel on the Island of Sal

https://www.capeverde.co.uk/hilton-cabo-verde-sal-resort?bt=packa

Golf in Wallonia Belgium

Explore Mons former EU Capital of Culture

Luxury Boutique Ngala Lodge with renowned restaurant

Once you've stayed at Ngala, you wont settle for anything else

Essential Bhutan Experience

Bespoke Immersives holidays in Bhutan with ETG

Explore Rudyard Kipling's India

Bespoke Immersive holidays in India with ETG

Arguably the most striking beachfront hotel in The Gambia, C

https://www.gambia.co.uk/coco-ocean-resort-spa

The best of Mons & Waterloo

Visit Wallonia Southern Belgium

Discover the wonders of ancient Macedonia in Greece

Join this expert-led archaeological & cultural tour of Macedonia

Sri Lankan Family Adventure

Bespoke Immersive holidays in Sri Lanka from ETG

Special Offers

Escape to The Gambia with this fabulous late deal

Beachfront hotel on Cape Point Holiday

Great saving Wintersun

https://www.gambia.co.uk/holiday-beach-club

Late deal 7 nights from £659

https://www.gambia.co.uk/kombo-beach-hotel

popular hotel situated in the resort of Kolol

https://www.gambia.co.uk/senegambia-beach-hotel

Adult only All inclusive Winter Sun

https://www.gambia.co.uk/tamala-beach-resort

Discover the Dodecanese islands aboard an elegant gulet

Expert-led gulet cruise in the Greek islands

Exploring Sicily

A spectacular expert-led tour of the legendary island of Sicily

Gulet cruise in Croatia with AITO Tour Operator of the Year

Expert-led gulet cruise in Croatia

Gulet Cruising to Ephesus - Almost Full

An expert-led archaeological and historical adventure in Turkey

Expert-led gulet cruise in the Greek Islands

Join this trip with award-winning Peter Sommer Travels

Last cabins available on Greek Islands gulet cruise

Join this expert-led trip with AITO's Tour Operator of the Year

Holiday Reviews

Byron was an excellent birding guide with detailed local knowledge and found us so much. Andy also helped a great deal. ... read more

Naturetrek specialises in tours focusing on wildlife and birds. Terrain can be difficult so the trips are graded - so you ... read more

naturetrek. 3rd holiday with them now. they keep you well informed and provide excellent wildlife holidays read more

The Difference Between Tour Operators & Travel Agents

Quite a common question for anyone not working in the travel industry is about the difference between a tour ...

Where's Zugspitze?

A lesser-known mountain adventure is the subject of Ramble Worldwide's latest blog post as they take us on ...

Discover India's Forgotten Corner

Rajasthan and Kerala tend to monopolise the attention of most first-time travellers to India – and with good ...

If You Haven’t Heard of São Tomé and Príncipe, It’s About Time

The team at Archipelago Choice take you through the deep, rich culture of São Tomé and Príncipe. Just off ...

Tips for Your First Trip to Vietnam

Are you thinking of going to Vietnam? If so, here are a few top tips, and FAQ's, answered. How do I get a ...

5 Reasons To Ski in Scandinavia

If you’re still unsure of the recent hype, the team at Scandinavian Travel would like to share their top ...

Please enter your username and password to logon to the member pages

By clicking the box above, you agree that a cookie will be placed in your browser to retain your login details Forgotten password?

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

Multi-Day Tour Operators 2021: Reshaping Supply Chains and Distribution

Executive summary, definition and core products, the tour operator value chain, digital marketing to become primary sales channel, rise of online booking platforms, the ongoing shake-up of supply chain roles, the new era of modernization and professionalization, covid-19 is driving new types of tours, the pandemic also accelerated many existing trip trends, collaboration and transparency across the industry, bankruptcies are coming, what will the new multi-day tour landscape look like as covid fades, related reports, report overview.

Perhaps no sector has been as badly hit by the pandemic as tour operators, given their intrinsic connection to cross-border travel as well as human interaction. Based on our research and discussions with over a dozen executives we see an industry on the precipice of major changes.

This report will focus on the global multi-day tour operator sector with a heavy emphasis on itinerary-based guided tours. We will also briefly touch upon packaged tour sales. Multi-day tours are one of the last truly offline spaces of the travel industry. But that isolation cannot last. This report will cover the structure of this complex and fragmented industry. We see an ecommerce revolution occurring in the next five years that will reshape the way the industry supplies and distributes its products.

We will also discuss the impact of COVID-19 on the industry and how we see the types of tours offered, and the operators themselves, evolving as a result.

What You'll Learn From This Report

- How the complex supply chain of the multi-day tour industry works and the different kinds of businesses and tours that exist within it.

- How digitalization is disrupting the industry and where the biggest new opportunities exists

- How tour operators have responded to the pandemic

- What we think the new multi-day tour landscape will look like as COVID-19 fades

Executives Interviewed

- Matt Berna, Managing Director, North America for Intrepid Travel

- Murray Decker, Chief Executive Officer of Tour Amigo

- Gavin Delaney, CEO and Co-Founder of TravelStride

- Tom Hale, Founder and President of Backroads

- Travis Pittman, CEO and Co-Founder of TourRadar

- Catherine Prather, President of the National Tour Association

- Massimo Prioreschi, CEO of MT Sobek

- James Thornton, Chief Executive Officer of Intrepid Travel

- Gavin Tollman, President of The Travel Corporation

- Enrique Velasco Jr., Chief Commercial Officer of Coltur Peru

- With special thanks to Jared Alster and Tom Buckley, Co-Founders of Dune7 for their background contributions to this report

From our vantage point today it’s easy to take for granted that people across the world would use their leisure time to travel. But tourism — traveling for the pure enjoyment of it rather than for trade or religion — is a relatively recent development in the grand scheme of things. Most date the birth of modern mass tourism to Thomas Cook’s first package tour in 1841.

But naturally a lot has changed since then. Today’s tour operators need to be constantly evolving to keep up with the changing face of modern travel, as Thomas Cook itself discovered the hard way — and that was before a global pandemic hit!

This report will focus on the global multi-day tour operator sector with a heavy emphasis on itinerary-based guided tours. We will also briefly touch upon packaged tour sales. Though smaller than the hotel or airline industry, anyone seeking to understand leisure travel overlooks tour operators at their own risk. Pre-COVID, 12% of U.S. leisure travelers booked a package tour and in the United Kingdom, 47% of household travel spending was on packages. In Southeast Asia, 60%+ of trips were packaged or semi-guided tours.

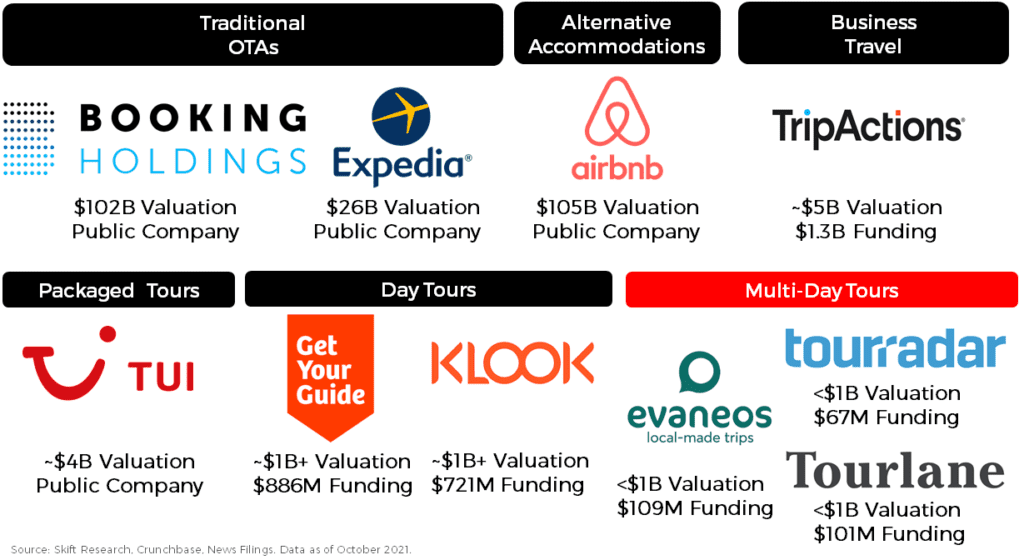

Perhaps no sector has been as badly hit by the COVID-19 pandemic as tour operators, given their intrinsic connection to cross-border travel and human interaction. Many operators are still seeing revenues down 80%+ even as other sectors like hotels and airlines are moving to a recovery. The pandemic changed the kind of tours that people want, driving them to seek the outdoors, small groups, and domestic trips.

Based on our research and discussions with over a dozen executives, we see an industry on the precipice of major changes. It is one of the last truly offline spaces of the travel industry, but that isolation cannot last. There is a need for new modern tools and digital distribution, which presents a massive opportunity for new tech startups in the space. We see an ecommerce revolution occurring in the next five years, similar to what short-term rentals experienced following the success of Airbnb. This disruption will be compounded by the profound damage inflicted by the pandemic

In a sense, we already have a bit of a roadmap based on the past trajectory of other travel businesses that moved offline to online. We expect to see the emergence of a few major online booking sites and a new class of intermediary tech vendors to handle online bookings, channel distribution, and inventory management. Eventually this will lead to conflicts over direct distribution, repeat guests, and rate parity.

We also believe that the pandemic will spur a winnowing of the ‘middle class’ of tour operators. A wave of bankruptcies and mergers is likely to come leading to consolidation in a handful of large players on one side and on the other side a long-tail of specialist operators that can niche down into their own unique offerings.

The Tour Operator Landscape

The multi-day tour industry is a big tent that incorporates a wide range of operators, suppliers, and distributors. Plus, at times it seems like every company in the space is running a slightly different business model.

Our first step towards untangling this web of interconnected tour companies is to put a basic definition in place.

Tour Operator : A tour operator is any company that sells two or more trip components together. At its most simple this could be a flight, hotel, or cruise sold together as a package. More complex tour operators bring together transportation and accommodation with local meals, activities, and guides.

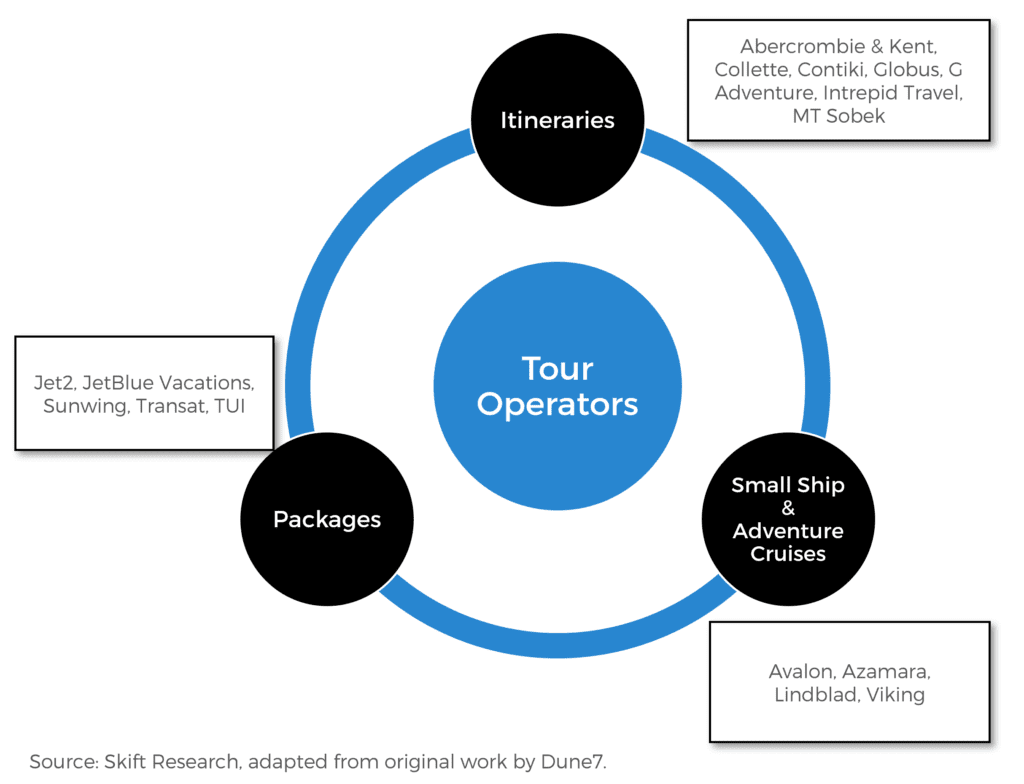

There are three core products sold by tour operators: packaged travel, itinerary-based tours, and small ship & adventure cruises.

Small Ship, Adventure, and River Cruising

Small expedition ships and river cruises are often included as within the tour operator space. The same travel agents that sell land-based multi-tours frequently also offer specialized cruises. Major booking sites like TourRadar have a prominent and well-stocked river cruise section.

This space was traditionally dominated by specialists, like Azamara, Lindblad Expeditions, orViking River Cruises and they are some of the fastest growing businesses in the entire cruising sector. Arguably these smaller companies have as much, if not more, in common with a land-based tour operator than they do with the mega-ships of Carnival or Royal Caribbean. And to that point, we are now starting to see traditionally land-locked operators go to sea, with, for instance, Intrepid Travel now offers polar cruises and TUI owns several cruise ships.

Small ships do meet our definition of a tour operator as they bring together transportation, accommodation, activities and food into one package. Though in fact, if you stop and think about it, so does the entire cruise industry, regardless of ship size. In order to prevent this report becoming too big we will set aside all cruising — big and small — as its own topic to be covered in future research. The rest of this report will be focused on land-based multi-day tours.

Packaged Travel

Packaged travel offers the distilled essence of our original tour operator definition. These trips bring together two or more components of travel supply, usually a flight and a hotel, and offer the combination together as a single new product to the consumer. The main selling propositions for this kind of product is typically value for money, convenience, or unique supply. Packages are also very commonly sold as an upsell for travel suppliers.

Given that there is no itinerary design included, this type of product is most popular among those looking to ‘fly and flop.’ These guests are typically looking to spend their leisure time off in a hot location with a cold beverage. And they want to access that vacation as easily and cheaply as possible.

One of the main reasons why package tours can offer better pricing to a traveler than assembling the separate components of the trip themselves is because, from the point of view of a travel supplier, packagers operate as an opaque selling channel.

Take hotels as an example: in a package the customer is quoted a single price for the entire bundle – flight + hotel + car – so the traveler can’t pinpoint how much they are paying per room night. This means that hotels can offer discounted rates without violating rate parity and undercutting first-party pricing. Tour operators tend to move high volumes so hotels are incentivized to offer bulk pricing for their business. Bed banks and global distribution systems often act as intermediaries providing wholesale supply to tour packagers.

Convenience is another main driver of packaged tour sales. There is a large segment of consumers, especially in Europe, that don’t want the stress and confusion of booking all of their own travel arrangements. While those of us that have the most severe cases of the ‘travel bug’ may have turned booking travel into a hobby (perhaps many of you reading this), we can admit that this is possibly not the most fun part of a trip for an average vacationer.

Another reason why a traveler might pick a packaged tour operator is because they can offer exclusive supply. Perhaps there is a resort that the operator owns and therefore the only way to visit it is by booking via a package. One of the best examples of this is TUI owns or operates over 400 hotels to ensure it can control the guest experience and provide access to rooms in supply-constrained markets like Cape Verde. It also owns nearly a dozen cruise ships and several charter airlines. Jet2 also follows a similar model with its own in-house airline that complements its vacation packages as it can offer uniquely convenient airlift for its guests only.

Dynamic Packaging

One of the most exciting developments in the packaged tour space is dynamic packaging. This is a relatively new development in the packaged tour space driven by the growth of tech connectivity in the industry. The concept is that, rather than operators or agents manually pulling rates and building bundles by hand, algorithms automatically create package deals live during the guests’ shopping experience.

The next step for this market is the development of open platforms that plug into suppliers’ booking engines and allow dynamic packaging ‘as a service.’ For example Hotelbeds offers dynamic packaging via an API that could allow for this. Third-party platforms for bundling opens up a whole new world of plug-and-play upselling capabilities for travel suppliers that might not have traditionally considered a packaged tour product, although it also brings with it the potential for rate parity issues.

Airlines have long used packaged tours as an upsell to drive revenue and margin on the flight products they were already selling. These bundled upsells often accounted for a small slice of revenue. JetBlue in a 2018 investor day disclosed that its attach rate for JetBlue Vacation was just 1.5% of transactions. However these small percentages can add up to big dollars, like at LatAm which sold $22 million worth of tour packages in 2020, still less than 1% of group revenues. But the package revenue shares can go quite high, even at a traditional mainline carrier. Japan Airlines Group (JAL) — certainly not a discount packager like Jet2 — sold $485 million of packaged tours in 2021, accounting for ~10% of group revenue, according to IdeaWorks .

Most airlines, if they sell tours at all, operate closer to Jetblue with the business driving a low single-digit share of group revenues. But JAL and other exceptions prove just how high the numbers could potentially get. Many airlines see today’s low package numbers as a mere starting point from which to build significant ancillary revenue streams to complement their unbundled retail strategies. Dynamic packaging has made this far more feasible and now airlines of all types from AirAsia, Allegiant, and EasyJet to Emirates and American Airlines are selling tour packages.

In the past, standing up a packaged tour offering at an airline would require a lot of time-consuming negotiations with hotel and car rental suppliers and even after all of that work, supply might still be limited. Airlines are in the core business of selling flights and not negotiating hotel wholesale rate contracts. With dynamic packaging airlines have the ability to tap into B2B platforms that can build bundles around their routes with relatively low lift. Bedbanks, like Hotelbeds , GDSs, like Amadeus , and tech vendors, like Switchfly all now offer dynamic packaging tools. This means that in today’s fast evolving landscape, airlines can add new routes and immediately be selling dynamic packages around that destination on launch.

The development of dynamic packaging further blurs the line between a tour operator, like a TUI, and an online agent, like Expedia. If JetBlue (supplier), TUI (operator), and Expedia (OTA) can all sell the same flight plus hotel package, what is fundamentally the difference between these three companies?

We believe that online travel agencies like Expedia and Booking will be some of the biggest beneficiaries of the move towards dynamic packaging and the above blurring of industry lines. In a dynamic world, having the most possible permutations of trip choices is a key differentiator. And the OTAs sit in a sweet spot where they have strong pre-existing direct customer relationships while also having millions of hotel, flight, and car listings across the globe already live in their databases. When guests shop for a flight, the OTA can then offer them the upsell to add on a hotel room or car booking, all for one packaged rate. The discounted package price is calculated automatically on the fly based on the unique combination of travel choices selected by the shopper. The discount can come from specific wholesale rates pushed by the suppliers to the OTA or the booking site might just choose to algorithmically reduce its commission margin to encourage an upsell to a higher ticket purchase. They can also resell their inventory and technology as white-label dynamic packaging tools to other agents, hotels, and airlines. Both Booking Holdings and Expedia as well as smaller OTA players like lastminute.com have all been running experiments around the best way to sell tour packages. Expect to see more developments in this space.

Itinerary-Based Tours

Itinerary-based tours are, arguably, the heart of the tour operator industry. These tours go beyond simply bundling component travel products, adding on top of that core package a layer of local expertise and itinerary design. These tour operators will be the focus of the rest of this report.

Price is not often the main selling point here. Rather, the convenience of not having to plan, the assistance of a guide, or the uniqueness of an itinerary is the main selling point. There is quite a lot of variety within products offered in this space.

There are three main variables that we can use to define the main types of itinerary-based tour products:

- Fixed-Date Departures vs. Custom: Fixed date tours are offered with a pre-scheduled departure date and a set itinerary. Travelers buy these pre-built itineraries off the shelf. In contrast, custom tours are built to suit each individual guest with a unique schedule and departure date.

- Guided vs. Self-Guided: Though the classic image of a tour includes a guide leading a group, this does not always have to be the case. Self-guided tours are growing in popularity. In this case, the traveler buys a travel package that can include local connections, activities, meals, and suggested sights, but no in-person guide to contextualize the destination.

- Group vs. Individual: This has more to do with the buying behavior of the guest than the actual itinerary on offer. In group travel, the entire tour is booked up by a single organization, perhaps a school group, work retreat, or a large family. On the other hand, individuals traveling book a single slot as part of a larger overall planned departure that combines many other individuals or a small group of travelers that don’t know each other.

We can mix and match these different variables, offering for instance a guided group fixed date tour or an individual self-guided custom tour.

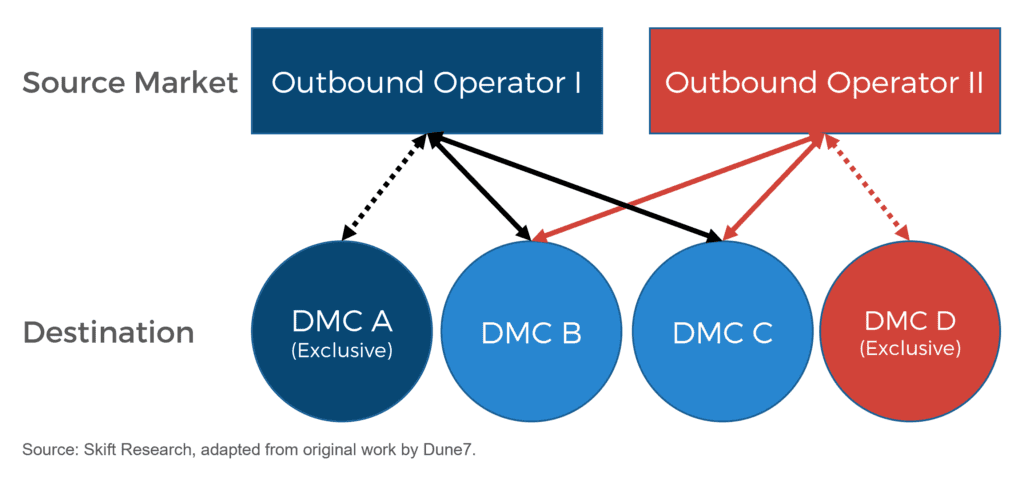

In addition to the main products on offer, there are two primary layers of operators in the itinerary-based space. One is based on the source market that the travelers buying the tour are departing from, and the other based on the destination market that the tour is taking place in.

- Outbound Tour Operators: These tour operators service international travelers. They typically focus on a single origin market but often service multiple overseas destinations. Outbounds specialize in the market that travelers purchasing a tour are departing from and can provide native language marketing, sales, and customer support. They also have the cultural context to understand what kind of itineraries may appeal in their home market. Outbound businesses may operate their own in-destination trips or outsource the local logistics to a destination management company. An example would be a UK based tour company that offers British travelers a variety of trips across Asia and continental Europe.

- Destination Management Companies: Also known as inbound tour operators or receiving tour operators. These operators receive inbound international travelers. They typically focus on a single destination market but often service travelers from multiple overseas origins. By specializing in a single destination, they have the local know-how and logistics to ‘make the trains run on time.’ They can sometimes use their local connections to source unique experiences. DMCs usually contract with an outbound tour operator but increasingly may sell direct to the overseas consumer. An example would be a local Peruvian tour operator that specializes in running Machu Picchu treks for guests coming from many different outbound operators and nations.

The line between outbound and inbound operators has always been blurry and it is only getting hazier. The core distinction we will be making when referring to outbound operators vs. DMCs is the difference between retail-specialists focused on the source market and logistic-specialists focused on the destination.

These terms originate from the cross-border market but, especially as local tourism boomed during the pandemic, have a place in domestic markets as well. While they may not technically be ‘outbound’ operators when within the same country, there can still often be a separation between the retail tour operators and their domestic DMC partners or subsidiaries (though one could even argue New York City might as well be an outbound foreign market from the perspective of a Utah river guide).

Illustrative Example of the difference and connections between Outbound Tour Operators and Destination Management Companies.

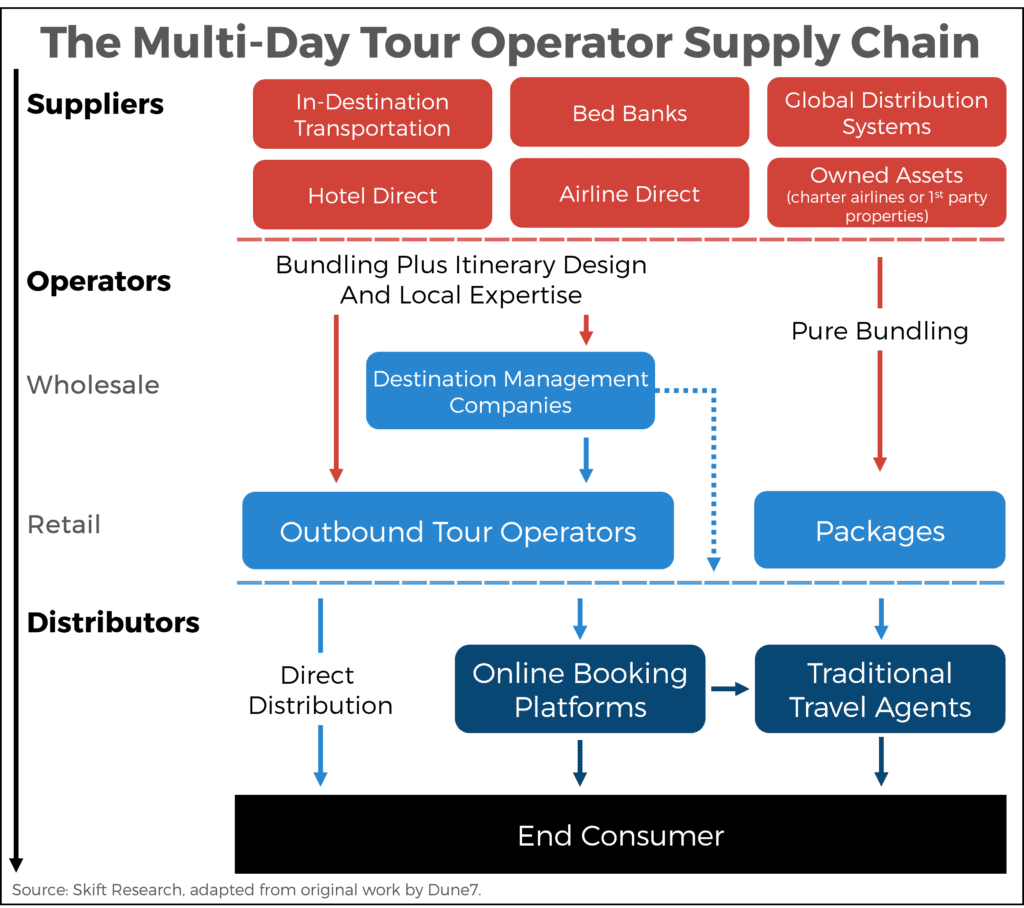

With the baseline definitions and products understood, let’s examine the lifecycle of how a tour is created and comes to market in the land-based tour operator space.

Our model of the tour operator chain has three layers of value add. It starts with the supply of core travel products like hotels, flights, trains, and cars. These ‘raw materials’ of the tour might come from direct contracting with an airline or via a reseller like a bed bank. Some fully integrated tour operators even own their own charter airline or resort properties.

The next layer is the tour operator itself. “The tour operator is the manufacturer,” says Catherine Prather, President of the National Tour Association. Unlike a hotel or airline that is fundamentally anchored to a physical asset, tour operators sell a value-added travel service not tied to a single tangible product. By that we mean that tour companies ‘assemble’ unique trips by taking building blocks from other travel suppliers and adding an additional layer of intangible value-add. That value-add might be local expertise, cheap bundled pricing, or peace of mind. This transforms the raw materials into a more valuable new product which they can resell into the marketplace.

We distinguish here between tour packagers that are doing pure bundling and itinerary-based tours where an additional layer of in-destination curation and expertise is used in the ‘manufacturing’ process. A company like TUI is still a multi-day tour operator at this tier. It ‘manufactures’ its own tour products and retails them through first-party channels and also re-sells through agents and other distribution channels. But the tour products it offers are mainly a bundling of different supply components. In contrast, a G Adventures both bundles the supply components and adds an additional design component by planning daily activities and arranging for local guides.

There is also the opportunity in this layer for wholesalers and retailers. Specialist DMCs often design local tours that can be resold to larger retail travel agencies that can tap into their local market of outbound travelers.

The final layer is that of distribution. There are three primary channels. First is the direct channel driven by in-house sales and marketing efforts. Then there are the two major intermediaries in the space, online booking sites, which operate on both commission and advertising models, and travel agents. It should be noted that tours are one of the last great bastions of traditional travel agents (along with business travel). A very significant volume of tour products is distributed by the large travel consortia and even, in some countries, by brick-and-mortar retailers. This is because tours are one of the most complex travel products, a result of the above ‘manufacturing’ process, making a human intermediary much more valuable.

A hotel room might have a handful of core attributes (star rating, price, location, room type) and several more secondary ones (Wi-Fi, pool, view, floor height). But even the most basic tour can have dozens or more key attributes (departure date, size of group, length of trip, itinerary variations, level of physical activity, type of accommodation, age of participants, etc.). This creates difficulty to code for tours in the back end, as well as for consumers to shop and compare multi-day tours. This has made it doubly hard for online booking sites to take off in the space; however, these challenges are slowly but surely being overcome and digital platforms are growing in prominence as distributors of tours.

We understand that we have tried to simplify a very complex space and so there may be many nits to pick with this diagram. But we think that these core mental models of three main tour products (packages, itineraries, and cruises) sold via layers of value (supply, operation, and distribution) is a useful way to help decipher the tangle of different operators in this industry.

A lot of the confusion in the space seems to stem from the many different permutations of how vertically integrated an organization chooses to be and what permutation of products they choose to sell. But by building this mental model of the industry we can better see past the superficial differences of each specific company. A lot of the variation we see across tour companies is often reflective of different choices about what parts of the value chain to vertically integrate and what products to sell. But within each specific part of the value chain in isolation, business models are often more similar than they may first appear.

For example, tour operators that run their own in-destination programs vs. ones that outsource to a DMC are not two fundamentally different types of tour companies but are instead making different decisions about how vertically integrated they want their organizations to be. Or a travel agent that sells tour packages is best thought of as vertical integration between the ‘manufacturing’ stage of packaging process and a distribution channel, rather than as a wholly separate kind of company from a tour operator with a large first-party salesforce.