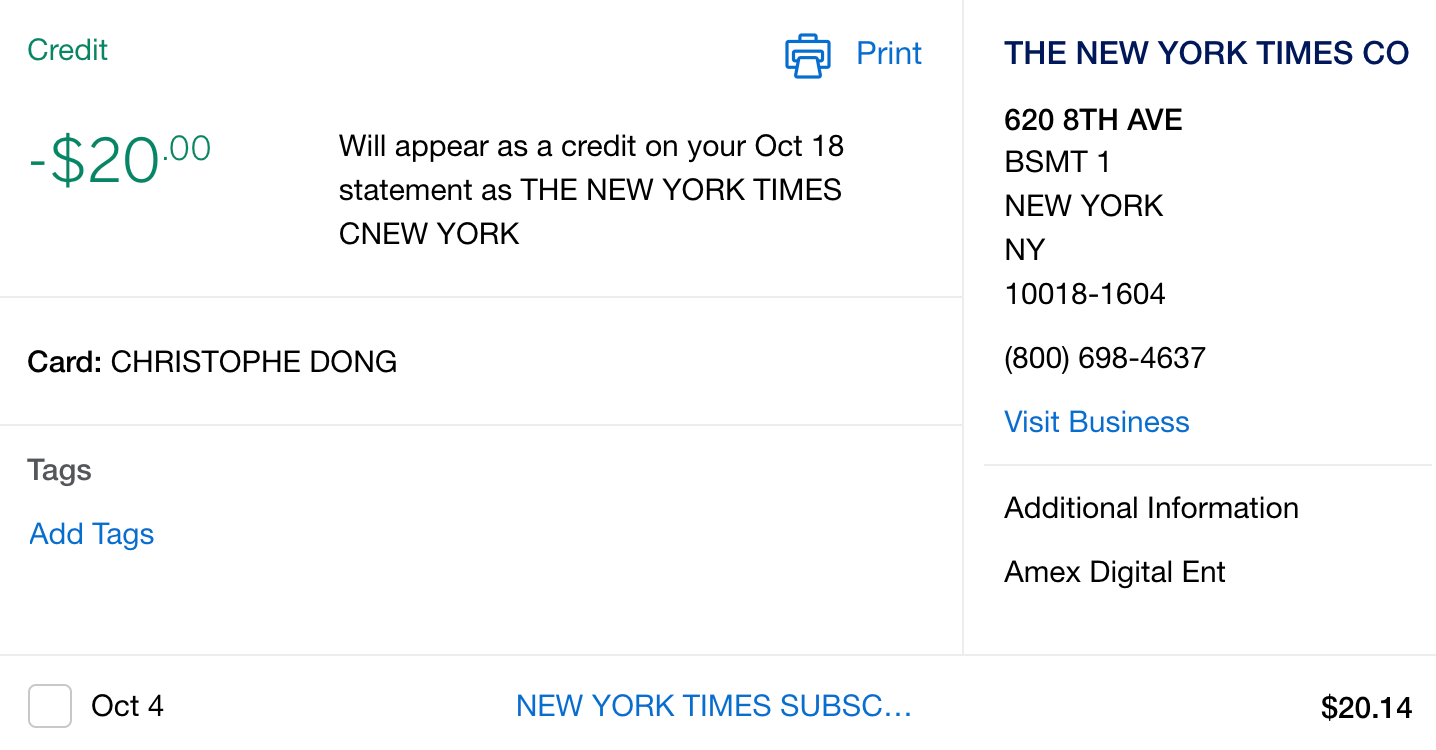

How I discovered the joy of the Sunday paper — thanks to this Amex Platinum credit

Update: Some offers mentioned below are no longer available. View the current offers here .

In the years before the pandemic, I had a preflight tradition.

If I had access to an airport lounge, before leaving to board my flight, I would grab a copy of a newspaper to peruse while in the air. Or, if an airline offered newspapers on board, I would almost always take one.

In our era of digital devices, it may seem counterintuitive. But I loved the feeling of being disconnected while up in the air -- all the while flipping pages of the day's top headlines.

For more TPG credit card news and travel tips delivered each morning to your inbox, sign up for our free daily newsletter .

Whenever I did this, I would also distinctly recall a childhood memory, that of my parents as they read the Chinese newspaper at the kitchen table on a weekend morning. The paper they read was in a text that felt familiar yet foreign at the same time.

That's all to say now as a 20-something adult, I savor the opportunity to read something that's printed, to feel the weight of a crisp piece of paper between my fingers. And there's a certain personal nostalgia it brings of a bygone era where life felt a bit more carefree.

So when I discovered that the recently-launched " digital entertainment credit " on The Platinum Card® from American Express also applied to physical, print copies of The New York Times, I eagerly signed up.

In the past, I wrote about how the Platinum's digital entertainment credit -- applicable toward only four services -- could use a revamp to be more useful for the average consumer. While I still think this credit is far too limiting , it actually has served my needs as an existing Times subscriber.

Here is what the up to $240 annual credit applies towards for the Times:

Eligible purchases for The New York Times include any subscriptions (including digital or print news, NYT Cooking, and New York Times Games) made directly through www.nytimes.com/subscription.

I recently swapped my digital subscription to a print and digital subscription. These days, I get the paper delivered to my New York City apartment every Saturday and Sunday. Now, when I'm at home, I look forward to waking up early, grabbing the paper while sipping my favorite latte from a neighborhood cafe.

Related: It's a 'lifestyle' card now: A closer look at the Amex Platinum's 6 new benefits launched in 2021

In our current COVID-19 era, newspapers at airport lounges (and onboard cabins on international flights) feel like a relic of the past. Who knows if they will actually return to the airport setting, or if QR codes and endless scrolling will forever replace the satisfying turn of a printed page.

But for now, using my Platinum credit, I at least have something that restores my print fascination. No, it's not exactly like reading the paper at 30,000 feet, all the while occasionally glancing out the window at the world below.

Getting the New York Times home delivery allows my mind to still disconnect in a way that reading online never could do. That's how I discovered -- or really, rediscovered -- the joy of the Sunday paper.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

8 New Credit Card Benefits We’d Love to See for 2022

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The travel world as we knew it won’t be back for some time and credit card issuers had to zig and zag their way through the pandemic to bring value to customers in the new normal. We saw things like the addition of Peloton partnerships, travel credits used at grocery stores, discounted streaming services and even credit statements for Dell products.

Why stop there? As travel hopes to slowly rebound, credit card companies would be smart to continue to find new ways to improve the value of their travel cards .

With that said, as NerdWallet travel writers, here are new credit card perks we’d like to see come to fruition in 2022:

Travel credit card reward ideas

1. vacation rental benefits.

When will credit cards crack the vacation rental puzzle? Granted, Airbnb owes much of its success to shaking up the established travel world, including eschewing traditional models like rewards and credit card partnerships, but it’s time someone figured out how to bridge this gap.

As a digital nomad, I generally spend far more on vacation rentals than traditional hotel rooms, yet my credit cards do very little beyond earning a few points. Even a category spending bonus from one of my cards would shake up this paradigm.

2. Wellness perks

Who knows when I’ll be able to really “travel” like I did pre-pandemic, but when that time comes, I’m going to want a massage. I find it strange that so few travel credit cards offer perks for spas, fitness classes and other wellness activities.

Some cards did offer meditation app subscriptions in recent years, which was a welcome and interesting benefit, but this felt more like a way to promote these apps than a true wellness-inspired offering.

3. Smarter offers

Nobody knows more about my preferences than my credit cards, which track nearly every dollar I spend. So when Chase pops into my inbox with an offer like, “Save 20% at the Olive Garden,” I’m appalled.

Don’t you know I’m a snob, Chase?

Frankly, I wish credit card issuers would get a little smarter with that wealth of data they have collected on me, and stop sending me offers and promotions that couldn’t possibly interest me.

» Learn more: The best airline credit cards right now

4. Uber and Uber Eats purchases

Several higher end American Express cards offer annual credits for Uber rides or Uber Eats, and I have long considered getting one of them. However, these credits apply only to U.S. purchases, which has always been confusing to me because Uber and Uber Eats are available worldwide.

As a result of the exclusion of international purchases, the annual credits (which can be worth hundreds of dollars) aren’t as useful to me because I spend a lot of time outside the U.S.

5. Grocery store bonuses on AmEx cards

American Express grocery/supermarket bonus categories are also currently restricted to U.S. purchases. These supermarket bonus points (4 to 10 points per dollar) are not available to expats, leaving them to earn the standard 1 point per dollar spent.

If AmEx would include global Uber and supermarket purchases, it would make their cards significantly more appealing.

» Learn more: The best cards for groceries right now

6. A staycation credit

Wouldn’t it be nice if credit card companies found a way to encourage us to spend money on travel without going much beyond our cities? With air travel down for the foreseeable future, it would be interesting if airline incidental credits transitioned into a staycation credit: say, $100 credit toward a hotel within 100 miles of your address.

That would give hotels much-needed business while avoiding out-of-state travel. For consumers, it would be a chance to experience the fancy hotel downtown that you’ve always been curious about but haven't since your own bed is just a couple of miles away. Sure, actually executing this kind of credit would be a logistical nightmare, but I’m just the idea person.

7. Rollover travel statement credits

For credit cards that offer airline incidental or hotel resort credits, I’d like to see them roll over to the next year, so people don’t feel pressured to travel until it’s safe. I see this as a win for credit card companies too, as you’d have to continue holding (and paying annual fees on) your card to allow you to maintain those rolled over credits.

Even a simple one-year rollover would go a long way to helping travelers.

8. An outdoors statement credit

One of the great trends of recent years has been an increase in getting outdoors and experiencing nature. Many national parks, state parks and campgrounds charge entrance fees, so it would be delightful for credit cards to offer a statement credit covering those.

So many cards offer TSA PreCheck or Global Entry benefits that weren't really necessary in 2020 or 2021, which presents an opportunity to swap those out. Perhaps an $80 outdoors credit would be apt. That’s the cost of an America the Beautiful Pass, which covers entrance fees for a year at federal recreation sites including national parks.

» Learn more: The best hotel credit cards right now

The bottom line

There’s no shortage of ideas for what the next batch of new credit card perks and benefits could entail. How credit card issuers adapt in 2022 could have a significant effect on what cards customers sign up for, keep or cancel.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

The 5 best travel credit cards for 2024 — including the new fine print

TSA Pre-Check fees are waived for Chase Sapphire Reserve cardholders.

Sorting through the cards in your wallet should be an annual chore. You want to double down on the most rewarding perks — which can change from year to year — while omitting other cards that have drifted into mediocrity. It’s a tedious process that can significantly boost your points and miles balances and pave the way for free and upgraded travel.

Let us do the heavy lifting for you. Changes to major credit cards offerings that happen in the yearend cycle are now inked in place, and we’ve been busy sifting the fine print so you don’t have to.

There are a few caveats: Sign-up bonuses come and go, and it is always wise to scour the internet for the best offer. Don’t assume that you need to go with the most prominent, highest-fee cards for hefty rewards. These days, some options with lower annual fees pack a solid punch, too.

Here are the best travel credit cards on the market right now, plus more affordable alternatives well worth considering.

Best overall

American express platinum card.

Annual fee: $695

The quick sell: Even with patchy acceptance of Amex cards abroad, the Platinum card continues to reign supreme for its excellent airport lounge access and instant VIP status at hotels. You can milk its pricey fee for some $1,800 in value before you redeem a single point.

New fine print for 2024: Effective February 2025, cardholders can access Delta Sky Clubs only 10 times a year; previously, there were no such limits. Meanwhile, a new partnership offers cardholders free access to Points.me, a clever tool that makes it easy to compare points-redemption options across a wide variety of airline and hotel programs.

The perks: Access to 40+ Centurion airport lounges is always a draw, though now you’ll have to pay $50 to bring a guest unless you spend more than $75,000 on your card annually. Cardholders also benefit from partnerships with other lounge networks, including Priority Pass (which offers no-cost access to its 1,300+ locations), Plaza Premium, Escape, Lufthansa and Delta Sky Club (when flying Delta). For now, Sky Club use is unlimited; in 2025, it will be restricted to 10 visits per year.

A rendering of plans for the new American Express Centurion Lounge at Newark Airport.

The card comes with a slew of valuable credits. These include $200 for such incidental airline fees as seat assignments and bag surcharges, $200 toward hotel reservations made via Fine Hotels + Resorts program, and monthly credits for Uber and media subscriptions (including Disney+, SiriusXM and the New York Times). You can also score a $155 Walmart+ credit and $100 for Saks Fifth Avenue — not to mention instant gold status with both Marriott Bonvoy and Hilton Honors loyalty programs.

Points (1 point equals 1 cent) can be redeemed like cash via the Membership Rewards portal or transferred to such airline and hotel loyalty programs as Air France/KLM, Delta and Virgin Atlantic. You get five times the points when booking travel via American Express or its Fine Hotels + Resorts program, which confers free breakfasts, room upgrades and late checkout at such hotels as the Hotel Plaza Athénée Paris or the Four Seasons Bali at Jimbaran Bay.

Cheaper alternatives: The Blue Business Plus Card from American Express offers unrivaled points-earning potential among no-annual-fee cards — two points per dollar. If you value airport lounge access, the $395-annual fee Capital One Venture X card is a better deal that offers similar earnings, plus access to Priority Pass, Plaza Premium and a growing number of Capital One lounges.

Best return on points

Chase sapphire reserve.

Annual Fee: $550

The quick sell: This card provides the most value when it comes to redeeming points for free travel. Its built-in credits are great, too.

New fine print for 2024: Here, it’s business as usual.

The perks: Chase Ultimate Rewards points can be redeemed like cash or transferred to airline and hotel partners. You’ll get 10 of those per dollar spent on hotels, rental cars and dining booked through Chase, and 5 points per dollar on flights. You also get 10 points per dollar on Lyft rides and 3 points per dollar on other travel and dining purchases made outside Chase’s ecosystem. All other purchases earn 1 point per $1.

These points come with mega value: One point is akin to 1.5 cents, making a $1,400 flight in premium economy from New York to Paris and back roughly 90,000 points.

As with Amex, you can quickly earn back the annual fee. A $300 annual credit wipes away travel charges, and you get $100 toward TSA PreCheck or Global Entry applications, plus free Priority Pass membership. Book via Chase’s own Luxury Hotel & Resort Collection program, and you’ll get perks like free breakfast and room upgrades, too. Then come such smaller benefits as a $5 monthly credit to DoorDash (plus free DashPass membership) and the free bike rentals, discounts and priority pickups that come with Lyft Pink All Access membership.

Cheaper alternative: The Chase Sapphire Preferred offers excellent points earning and solid redemption values — 1 point for 1.25 cents — but nixes Priority Pass and some other perks in exchange for a lower $95 annual fee.

Best for Star Alliance travelers

United club infinite card.

Annual Fee: $525

The quick sell: Why pay the $650 annual fee to join the United Club as a member when you can get access—for $125 via this card — along with greater access to United MileagePlus award-redemption availability just for holding the card?

New fine print for 2024: You can now earn 10,000 status-qualifying points by swiping this card — up from 8,000 last year. That’s enough to earn Premier Gold status all on its own.

The perks: United’s miles may have lost value over the years, particularly since the airline ditched award charts and raised prices on partners, but it’s the most transparent of the three biggest US carriers. (For one thing, it still shows award availability for most partners on its website and app.) With this card, MileagePlus earnings pile up fast, thanks to 4 miles per dollar on United purchases, 2 miles on dining and other travel and 1 mile on everything else. The path to elite status—measured via Premier Qualifying Points or PQPs — accelerates, thanks to 25 PQPs awarded per $500 spent (up to 10,000 PQPs a year), making most loyalty tiers (including Platinum) relatively attainable, even for non-business travelers.

This is not just about earning potential. You’ll get upgraded on eligible domestic and Caribbean award tickets just for holding the card, and if you redeem miles for a saver economy ticket, you’ll get 10% off in rebate form. Hotel benefits come via a partnership with IHG Hotels & Resorts: Cardholders get a $75 credit to apply toward on-site expenses whenever they stay at these properties, plus automatic Platinum Elite status with IHG One Rewards. (The latter gets guaranteed late checkouts, bonus points and free room upgrades.) When it comes to lounges, unlimited access is included, not just to United Clubs but to those of many Star Alliance partners as well.

Other benefits include a TSA PreCheck or Global Entry credit, two complimentary checked bags per flight, 25% discounts on in-flight purchases and standard travel insurance.

Cheaper alternative: The $95 annual fee for the United Explorer Card nets many of the most important perks, such as upgrades on United award tickets; two miles per dollar spent on United flights, dining and hotels; and two United Club passes.

Best for Delta loyalists

Delta skymiles reserve credit card.

Annual Fee: $650

The quick sell: SkyMiles has seen Zimbabwe-like currency devaluation entailing inflated redemption prices and scant partner availability. That makes this card — which isn’t a great option by most conventional measures — especially valuable to Delta loyalists. It offers an unparalleled three miles per dollar on Delta purchases (or one mile for every other purchase), and holding it bumps you up the upgrade list if you also have Medallion status.

New fine print for 2024: Pay attention to that annual fee; it costs $100 more than it did last year. But new travel credits offset that price hike, and your annual companion certificate can now be used on international flights to Mexico, Central America and the Caribbean.

The perks: In a bid to convert users toward booking hotels on Delta Stays, its own nascent platform, the airline is extending a $200 annual accommodations credit to cardholders. That’s in addition to $20 monthly Resy credits, $10 monthly ride-sharing credits and top Hertz elite status. But lounge access will soon be cut back. Starting on Feb. 1, 2025, cardholders will be limited to 15 day passes per year, rather than four free passes per trip on an otherwise unlimited basis. Additional visits will cost $50 unless you spend $75,000 per calendar year to unlock unlimited access.

The Delta Air Lines SkyLounge at LaGuardia Airport.

Also noteworthy, a free status-qualifying “boost” for cardholders nets you $2,500 Medallion Qualifying Dollars (MQD) at the beginning of the year — getting you halfway to silver under the airline’s new qualification scheme. (You’ll also get 1 MQD for each $10 spent on the card; you’d earn Diamond status with some $280,000 in annual spending at that rate.)

That’s not to mention the more standard travel benefits: free checked bags, a 20% discount on in-flight purchases, a 15% mileage discount on award flights, priority boarding, travel insurance coverage and a credit for either Global Entry or TSA PreCheck.

Cheaper alternative: If lounge access is not important, the Delta SkyMiles Platinum Card offers a happy medium with a lower $350 fee yet fewer benefits. These include a $150 Delta Stays credit, $10 per month for both Resy and ride-sharing services, mid-tier Hertz status, and the same expanded companion certificate perks. In addition to the $2,500 MQD bonus each year, the card earns 1 MQD per $20 spent, plus further basic travel benefits.

Best for American Airlines flyers

Citi/aadvantage executive world elite mastercard.

Annual fee: $595

The quick sell: While American now lets you buy status with credit card spending on everyday purchases with any of its co-branded credit cards, only this one adds complimentary Admirals Club lounge membership. This ordinarily costs $850 — more than this card’s annual fee.

New fine print for 2024: The accrual period for AAdvantage points now stretches from March through February rather than from January through December.

The perks: Airport lounge access is where you extract value from this card; you’ll maximize it by adding up to three authorized users to your account. Setting this up comes with a $175 fee, but it extends your Admirals Club access to those users — and gives them the ability to bring two guests into the lounge as well. It’s great for family members you trust and travel with; lounge membership for four individuals could otherwise cost $3,400.

The Intercontinental Paris Le Grand hotel, one of many IHG properties that extend benefits to United Club Infinite cardholders.

Moreover, handy credits include $10 per month to use with Lyft and Grubhub, $120 toward Avis or Budget car rentals annually, and 20,000 bonus points when you spend some $90,000 on eligible purchases.

Cheaper alternative: While the unique ability to exchange points for AAdvantage miles with the no-annual-fee Bilt Mastercard will end on June 30, 2024, a new partnership with Alaska Mileage Plan makes this option appealing to Oneworld flyers at large.

Bilt has quickly shaken up the industry by offering one point on everything, including rent and mortgage payments (typically not payable with other credit cards). This can help college-age consumers and young adults build credit while earning points.

Monthly promotions can help you earn and spend those points more efficiently, and the card has points-transfer partnerships with more than a dozen loyalty programs, including World of Hyatt and Air France-KLM Flying Blue.

- Latest Issue

- Arts & Entertainment

- Banking & Finance

- Latest Commentary

- Letters to the Editor

- Health Care

- Politics & Policy

- Restaurants

- Sports & Recreation

- Transportation

- Latest News

- Commercial Real Estate

- Residential Real Estate

- Deals of the Day

- Who Owns the Block

- Real Estate Families of New York

- Health Pulse

- Top Earners

- Who's News

- On Politics

- Crain's Forum

- Chasing Giants

- Economic Outlook

- 20 in Their 20s

- 40 Under 40

- Best Places to Work

- Diversity & Inclusion Awards

- Hall of Fame

- Women of Influence

- 2023 Empire Whole Health Heroes Awards (sponsored)

- 2023 New York ORBIE Awards (sponsored)

- Nominations

- Data Center

- Highest-Paid CEOs

- Highest-Paid Hospital Execs & Doctors

- Largest Private Companies

- Largest Public Companies

- Largest Residential Sales

Travel Credit Card Advice

Read up on the latest travel credit card advice from the team at Bankrate. We'll help you navigate all of the travel rewards programs out there and help you pick out a card (or several) that can help you reach your travel goals.

Our Latest Travel Advice

The Platinum Card from American Express vs. The Business Platinum Card from American Express

Which card is better — the Amex Platinum or Amex Business Platinum?

Best credit cards for Uber and Lyft

The right credit card can help you to save money on ridesharing.

Amex Gold benefits guide

Learn about the Amex Gold Card benefits you’ll receive if you sign up for this card.

Your guide to Hawaiian Airlines Dining Rewards

Dining for miles will have you dining in style with Hawaiian Airlines.

Capital One Venture vs. Bank of America Travel Rewards credit card

Considering the Capital One Venture vs. Bank of America Travel Rewards card?

Best credit cards for airport lounge access

Find out the best travel credit cards for airport lounge access.

Why I love the United Explorer Card

Chase’s United Explorer Card offers rewards for travel that include baggage, a luxurious lounge, and so much more. Read to find out our take on the card, and find out if it may be right for you.

Should I get a travel credit card that earns points, miles or both?

The right travel credit card ultimately depends on the type of traveler you are.

When 1.5% cash back is better than 2%

1.5 percent may provide more value once you unpack the entire rewards structure.

Is the Capital One Venture Card worth it?

Capital One Venture Rewards is worth it if you take advantage of all it has to offer.

Discover rewards program guide

Discover offers a broad range of credit cards that let you rack up rewards for cash back, travel and more.

Your guide to gas rewards programs

Revamp your rewards by combining the gas loyalty program of your choice with one of the best credit cards for gas.

Why I love the Chase Freedom Unlimited

Learn why the Chase Freedom Unlimited is a great first credit card option.

Premium credit card comparison: Chase Sapphire Reserve vs. Capital One Venture X vs. Amex Platinum

These three travel cards offer similar benefits and rewards, but which is best for you?

Do I still need a travel agent?

Hire a travel agent or book your own trip? Get the facts before your next vacation.

Why I love the Capital One Venture Rewards Card

The Capital One Venture Rewards card offers numerous travel perks and rewards.

Why I charged a cruise on my credit card

A 0 percent intro card can help you fund large purchases, even a vacation.

TSA PreCheck vs. Clear: Which is better?

In this guide, we’ll weigh their pros and cons to help you decide which one might work better for you, or if you should get both.

Traveler’s guide to the best frequent flyer programs

The major airlines offer frequent flyer programs, but some are better than others.

Best gas credit cards for bad credit

You may find most rewards cards for bad credit are ones geared to specific purchases, such as gas.

Please read our updated Privacy Notice and Terms of Use , effective on December 19, 2019.

The statements expressed in this story are the author’s or sources’ alone, and the content is not endorsed by any entity. Every offer is independently selected by our editors and the products listed do not reflect all companies’ offerings. Credit cards you apply for through our links may earn us a commission; this may impact the presentation of offers.

The Best Credit Cards, According to People Who Know Everything About Credit Cards

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

It’s confusing business, calculating all those annual fees and interest rates and rewards points in order to find the credit card that’s best for you, whether your specific lifestyle involves a lot of travel or ride-share services or even just — if we’re talking about the current moment — streaming Netflix. And while there’s a lot of personal-finance-focused content out there these days to help you wade through your options, we at the Strategist have decided to come at the subject in our own way. That is, by talking to a lot of people about the credit cards they use and why they use them.

For the list that follows, we consulted plenty of professionals, including money managers and finance authors, but we also turned to less expected sources who happen to be obsessive (and exceptionally informed) about the world of credit cards. The more traditional of our dozen or so experts include credit-card journalists Eric Rosenberg , Jason Steele , and Holly Johnson ; personal finance experts Trae Bodge and Tiffany Aliche ; and financial planner Nick Holeman . Beyond this core group, we spoke to editors on the masthead at Condé Nast Traveler , analysts at places like Goldman Sachs and Barclays, and even a couple of 20-something buddies who have such passion for their respective favorite credit cards, they agreed to let us moderate them in a high-intensity debate about which is better. The recommendations that emerged include those for frequent flyers, Amazon shoppers, and restaurantgoers — or takeout-orderers, given the current moment. (But then again, in the time of a pandemic, a very straightforward cash-back card may well be your best bet.) Read on to decide for yourself; as always, we’ve broken the recommendations and advice into sections, so if you want to jump to something specific, you can by clicking any of the below links. Note: Prices shown reflect annual fees charged by each card; for cards that don’t charge annual fees, no price is listed.

The best credit card for a pandemic | The second-best credit cards for a pandemic | What’s the deal with APR, or interest rates? | The best credit card for travelers | The best credit card for casual travelers who want to get into rewards | Is there a best airline credit card? | Two more good credit cards for travelers, according to Condé Nast Traveler editors | Why are rewards-points systems so confusing (and are there ways to make them less so)? | The only retailer-affiliated credit card worth having | The best credit card for entrepreneurs | The best credit card for college students | And a debate about travel-points-focused credit cards vs. cash-back credit cards

The best credit card for a pandemic

It should not come as a shock that our present moment isn’t the best time to sign up for a card that rewards you for getting on a plane or dining out. While some cards that employ a points system, like both Chase Sapphire® cards and the American Express® Gold Card, also allow you to turn those points into cash, you tend to get more value putting those cards’ points toward things like flights and hotels. Because of that, the most useful credit card to sign up for right now is probably a very simple cash-back card, which, as Rosenberg puts it, “is like getting free money back on the money you spend” — pretty much wherever you spend it — because it allows you to pay off purchases on your statement or balance.

According to Steele, an ideal credit card to sign up for right now is the American Express Blue Cash Preferred card, which offers 6 percent cash back at U.S. supermarkets on up to $6,000 in purchases per year, as well as on certain U.S. streaming services, including Netflix. (You also get 3 percent cash back on transit and U.S. gas station purchases, and one percent cash back on everything else.) “It covers urbanites and suburbanites equally,” Steele says, given that what counts as transit includes trains, taxicabs, ride-share services, and subways. You’ll have to pay a $95 annual fee, “but if you do the math,” Steele notes, “it’s pretty hard to imagine you not earning hundreds of dollars in cash back on that card just with the supermarket benefit alone.” (However, new applicants will have their first annual fee waived.) Tonya Rapley, the author and founder of MyFabFinance , also says the Blue Cash Preferred is the best pandemic card option, because it takes advantage of everyday spending while also allowing you to use points earned to reduce your monthly bill. “A lot of us aren’t doing the things that traditional credit cards reward,” she explains. “That will be really helpful because that way if you don’t have the cash, you can still use the benefits that you reap with that card to pay down your balance.” View card rates and fees here .

The second-best credit cards for a pandemic

One downside to the American Express Blue Cash Preferred card, according to Rapley, is that it can be harder to get approved for depending on your credit standing. But the experts recommend a couple of credit cards that are easier to get and have similar benefits. Rosenberg told us he also likes the Capital One Savor credit card for the same reasons he likes the Blue Cash Preferred card. “It also has an annual fee of $95,” he notes, “but has really good bonuses for a bunch of categories,” including groceries — with the Savor you’ll get 2 percent cash back at grocery stores, and one percent back on most other purchases. (Its best bonuses, though, are on dining and entertainment — 4 percent cash back — which will be nice for whenever you start dining and entertaining out again.)

Rapley says another good alternative to the Blue Cash Preferred card could be the Freedom Unlimited card from Chase, which she says tends to be a little more lenient with issuing credit. The Freedom Unlimited earns 1.5 percent cash back on every purchase, and also offers a $200 cash-back bonus if you spend $500 within the first three months of opening an account. There’s no annual fee, and no minimum required to redeem for cash back. Personal finance expert Trae Bodge also likes this card for a pandemic because it has a zero percent intro annual percentage rate — or APR — on purchases for 15 months (after that, a variable APR of 14.99–23.74 percent will apply). Bodge says this generous intro APR will (hopefully) allow you to bypass paying interest on your balance during what is, for most, a financially uncertain period. When it comes to cards that offer 0 percent intro APR, though, Rapley says to be mindful of what happens when you come out of that introductory period. “Some cards will charge you the back interest, so you end up paying the interest on the purchases from that 15-month period if you have not already paid off” the balance by the time the period ends, she warns.

What’s the deal with APR, or interest rates?

Most of the experts we spoke to say that interest rates — or the fees charged on a balance you can’t fully pay off — should be a nonissue, because, according to them, you should really avoid carrying a credit-card balance at all. If you’re worried you won’t be able to pay off a monthly balance, some of the experts say that you’ll be better off with a debit card instead. But Bodge admits this ideal-world scenario isn’t always the reality: “That’s easy enough for us financial experts to say, because we’re going to be more financially responsible than the average person.” Personal finance expert Tiffany Aliche agrees: She says that saying to never carry a credit-card balance is like “telling kids the best way not to get pregnant is abstinence. Of course it is the ideal situation, but there are going to be people with credit-card debt.”

That’s why Aliche and Bodge say you should always be mindful of any card’s interest rate when you sign up for one. In terms of what cards have the so-called best interest rates, Aliche says she’d start by looking for a card with no annual fee, “but it’s really going to be you with your credit score that’s going to determine the interest rate for your card. If you have a score of 750 or above, that’s considered a perfect credit score and you’re going to be able to command a better APR.” Bodge adds that, ideally, you want to look for a card with an APR under 15 percent when comparing available options based on your credit score. (Most of the cards on this list, except for one, come with variable APRs based on credit score, with the lowest amounts generally hovering around 15 or 16 percent.) Aliche, along with Talaat and Tai McNeely, the husband-wife duo behind His & Her Money , say that you can get your credit score for free on websites such as Credit Karma or Experian. Once you know it, they suggest visiting MagnifyMoney , a website that helps you find the credit card that will offer you the best interest rate based on the credit score you provide.

The best credit card for travelers

By and large, the Chase Sapphire Reserve was the credit card recommended most often by our experts — eight of them say they have it in their own wallets — especially for people who love to travel. The card comes with benefits like a $300 annual travel credit, access to more than 1,000 airport lounges through Priority Pass, and the ability to transfer airline miles to hotel points. The catch is the Reserve is far from free, with a steep annual fee of $550. But, as Rosenberg emphasizes, this is offset by that annual travel credit, which, if you spend that much a year on travel anyway (and that includes hotels and airport parking), effectively reduces the yearly fee to just $250. Plus there’s the trip cancellation/interruption insurance: When you get stuck somewhere due to, say, a weather delay, Rosenberg notes that airlines aren’t required to do anything other than to help you find the next flight, which could even be the next day — and in that case, you’ll have to pay for your own hotel room. “But if you have a Sapphire card, that interruption insurance will kick in and you can get them to pay for your hotel room so you don’t have to pay out of pocket.”

With the Reserve, you get three points per dollar on travel and dining worldwide and one point per dollar for everything else, as well as money towards DoorDash (through March 2022), and a Lyft Pink membership (through December 2021). Meredith Carey, an associate editor at Condé Nast Traveler and a co-host of the Women Who Travel podcast, says she uses her Reserve for pretty much everything she buys, which means her points add up fast. With her day-to-day purchases alone, she can usually get three or four economy flights a year out of the card, she estimates. The Reserve offers an enticing sign-up bonus of 50,000 bonus points, provided you spend $4,000 on purchases in the first three months of getting the card. But as financial planning expert Nick Holeman warns, one of the biggest ways people lose money with credit cards is by spending more than they otherwise would in order to meet that minimum to get the bonus. That’s why, says Holeman, you should time when you apply for a new credit card around a large purchase that you were already planning on making, which is what he and his wife did with their honeymoon. Bodge says it’s worth noting that meeting the minimum required to reap the Reserve sign-up bonus is something that most people would have a hard time doing in their everyday course of spending. “If you can put your rent on the card, that makes a big difference. But not everywhere you live will let you pay your rent on a card. I can’t pay my mortgage with my card,” she adds.

The best credit card for casual travelers who want to get into rewards

If the Reserve’s $550 annual fee seems like too big of an obligation, several experts say you might want to opt for Chase’s starter Sapphire card, the Chase Sapphire Preferred. The experts call this card the best option for someone who wants to learn how travel rewards like points and miles work, because the Preferred has an annual fee of just $95 and still earns double the points on travel and restaurant expenses, plus one point per dollar on everything else. Rapley says it’s a great option for someone who can’t necessarily qualify for the Reserve but still wants access to the Chase portal, which she says is her favorite booking tool given how easy it makes the redemption process. The simplicity of the Chase portal, she says, makes it “literally like a central booking station to redeem your points instead of having to use them across the board.” The Preferred’s sign-up bonus is 60,000 points after spending $4,000 on purchases in the first three months. One investment banking associate we spoke to told us that both of his roommates started with the Preferred card out of college, before upgrading to the Reserve after two years.

Like the Reserve, the Preferred card also offers that travel cancellation/interruption insurance — which applies to car rentals, too. Ashlea Halpern, the editor-at-large for AFAR Media, says one of the most valuable things to know when you go to rent a car is to skip the rental agency’s coverage and charge the entire rental transaction to your card, which then is your insurance, providing reimbursement up to the actual cash value of the car for collision and theft. (Multiple experts we spoke to, including Halpern, said that Chase has exceptional customer service when it comes to dealing with car rentals.) Rosenberg adds that a rental company’s insurance usually costs about $10–20 a day, so if you use the card as your auto insurance on a ten-day trip, you just saved $100. “That right there in one trip paid for the whole annual fee,” he says.

Is there a best airline credit card?

On the one hand, if there’s an airline you really love and are loyal to — say, United — there are merits to signing up for their card (which, in United’s case, would be the United Explorer Card , which has a $95 annual fee and “comes with a free checked-bag benefit,” according to Rosenberg). But as Halpern points out, an airline could tweak their miles program at any time, and “if you put all of your eggs in one basket and the airline devalues it on a whim, you’re screwed.” Steele says airlines are notorious for lowering the value of their rewards miles and “moving the goal post in a very frustrating way for people who have been using the credit card and saving their miles.”

If you are worried about airlines devaluing points, Steele says you can mitigate this risk by going with a card like the Chase Sapphire Reserve or Preferred because you can use their points across several airlines. “Just because someone says it’s the best airline card doesn’t mean it’s the best for your lifestyle,” says Rapley, noting that a card specific to an airline that doesn’t fly where you’re located or have a nearby hub is essentially useless. “Make sure it’s an airline that you know you would be able to utilize frequently to take advantage of those perks.”

Two more good credit cards for travelers, according to Condé Nast Traveler editors

When planning her wedding last year, Stephanie Wu, the articles director at Condé Nast Traveler , signed up for the American Express Platinum Card knowing that she would be spending enough to get the welcome bonus of 100,000 points for spending $6,000 in the first six months of opening the account. As for why Wu went with the Platinum in the first place, she says her main reason was the “unbeatable” five points per dollar on airline-ticket purchases (all other expenses earn one point per dollar). “Between my bachelorette trip, honeymoon, and other weddings I was attending, I knew I’d be on a lot of planes,” says Wu. A few other perks came in handy during her trips, too, like the access to Delta Sky Clubs. “With the Platinum card, you can enter Delta Sky Clubs whenever you fly Delta, no matter what class you’re flying. While AmEx’s own Centurion Lounges are arguably nicer than most Sky Clubs, I found that they often weren’t in the right cities or terminals for my travels — but a Delta Sky Club always was.” These perks do come at a cost, though: The Platinum card charges an annual fee of $695, and is the only card mentioned that doesn’t technically have a regular APR; instead, for anyone who does not pay their balance in full each month, American Express offers the ability to pay off select charges of $100 or more on this card over time, but any monthly balance carried will be subject to a variable APR of 15.99–22.99 percent. View card rates and fees here .

While she now uses a Sapphire Reserve card, Carey also told us how much she loved the more general Bank of America Travel Rewards card that she used for years before making the switch. “The points game is not for everyone,” she says, “since calculating the best way to earn and spend points can sometimes feel like a full time job.” Instead of awarding points you can use to book future travel, this card’s points can be used to pay off any travel-related purchases you’ve charged to it within 12 months (making it more like a cash-back card specifically for travel). As Carey puts it, the card “allows you to reap travel benefits” when you buy your usual groceries, dinners out, clothes — whatever — with it: “All the while, you’re racking up points that you can then use to retroactively pay off travel costs and knock, say, a flight to London or your $33-weekly MTA pass off your previous statement.” Additional perks include no annual fee, points that never expire, and no foreign transaction fees (we should note that none of the cards on this list that are specifically recommended for travel charge foreign transaction fees).

Why are rewards-points systems so confusing (and are there ways to make them less so)?

A main point of confusion with points, according to Holeman, is that they often are not as simple as one point equalling one dollar, as this exchange rate can depend on what you are using the points toward. “If you redeem your Chase points for cash back, you might get $0.01 of value per point; if you redeem your Chase points for travel, then you can get 50 percent more value for each point,” he explains. Steele adds: “The more valuable systems tend to be more complicated.” When it comes to getting the best bang for your points on travel, Halpern suggests utilizing a booking service that can help you find the best way to transfer your points to miles if you’re using a credit card whose points aren’t dedicated to a specific airline (one of Halpern’s favorites is Juicy Miles ).

The only retailer-affiliated credit card worth having

While the general consensus among our experts is that you should probably skip most retailer-affiliated credit cards, the Amazon Rewards Visa Signature Card is an exception. Rosenberg says this is the only retailer-affiliated card he has himself, the reason being the five points per dollar that Amazon Prime members get on all Amazon and Whole Foods purchases. “If you shop at either of those regularly, getting a rate of 5 percent (or five points per dollar) is about the most you’re going to get on any card wherever you spend,” he says, adding that the card has no annual fee. You also earn two points per dollar on purchases at restaurants, gas stations, and drugstores, and one point per dollar on everything else — all of which can be used to pay down your balance. Bodge agrees, describing this as “a really stellar card” both in terms of the offered rewards as well as the simplicity of the benefits. “It’s very clear what you’re getting,” she says. “For me, I need to find a card that’s easy to use with good points on offer for the things that matter to me,” noting that being an avid Amazon and Whole Foods shopper makes her confident that she’ll reap the perks without having to think too much about it. “Any card with no annual fee that has this level of benefits is, I think, one to strongly consider.”

Holeman says the one time to be wary about signing up for a retailer-affiliated credit card, though, is if it’s your first one. For credit-score reasons, he says you want to hold onto the first cards that you get for life “because they help build your credit score over time.” While you “might shop at, say, Old Navy right now,” he continues, “ten years from now, are you still going to want that card? If not, you might be tempted — especially if it has a fee — to close it.” Either way, you’re stuck in a bad situation. “You’re either paying a fee to keep a credit card open that you don’t use and get value from, or you close it to save the fee and take a hit to your credit score.” But Holeman feels differently about the Amazon card, calling a “pretty low-risk” card with a valuable rewards system. “I like it because Amazon is inherently pretty flexible. It’s not like you can only buy one kind of thing — you can buy anything on Amazon,” he says. “And Amazon is probably not going anywhere anytime soon.”

The best credit card for entrepreneurs

The McNeely team cautions that the best card for a business really depends on what kind of expenses you’re dealing with. But for entrepreneurs just setting up shop and looking to market themselves to potential clients, they suggest the Chase Ink Business Preferred card, which they use for their own business. “For an entrepreneur who spends a good portion of their marketing budget on online advertisements, the Chase Ink Business Preferred is going to make the most sense,” says Talaat McNeely, because it offers triple the points on advertising purchases made on social-media sites and search engines. Rapley also uses this card for her business, for the same reason: The reward categories are areas where her business would be spending either way. “I’m able to get points for the Facebook ads that we run — something we’re already going to do in our business, but now we’re getting perks for it,” she explains. Tai McNeely adds that “the nice thing about Chase points is that you can actually merge or transfer the points to redeem them for something of a larger ticket,” including cash back, business travel through the Chase portal, and even to pay for things on Amazon.

The Chase Ink card has a $95 annual fee, but you get 100,000 bonus points if you spend $15,000 on purchases in the first three months after signing up. In addition to points awarded for social-media and search-engine advertising, this card offers triple the points on charges for shipping, internet/cable/phone service, and travel, plus one point per dollar spent on everything else. (Though there is a $150,000 annual cap on charges that earn triple the points; once you spend more than that, those charges only earn one point per dollar.) A note that because this is a business card, you will need to provide extra documentation about your business in order to sign up.

The best credit card for college students

In Steele’s opinion, the biggest deciding factor for college students choosing a credit card should be convenience. That’s why he’ll recommend they get a card from a bank that they already have an account with, which makes it really simple to make a payment. “It’s just one login, payment is instant, and they can keep all their reminders and balances in one place,” he says. But if you’re looking for one that also offers some rewards, three experts named the Discover it Student Cash Back card as a great credit card for college students (The minimum age to apply for your own card, by the way, is 18 years old; and to apply for this one, you will need to show proof of education). It has no annual fee, offers five points for every dollar spent on rotating categories (such as Uber or Walgreens purchases), and one point for every dollar spent on everything else — the points, again, can be used as cash to pay off your balance. According to Aliche, “Cash back is probably the most important reward for a student to start to earn, and the rotating categories give you a little bit of everything.” Credit-card writer Holly Johnson adds that this card gives bonuses for good grades, offering college students a $20 statement credit each year their GPA is 3.0 or higher. Johnson says that “the best card for a student would be one you could grow with, or that has programs you can throw on it,” which is why she likes the Discover it program: “They’ve done a lot of work in the past to ensure that their cards are less predatory when it comes to students, as well as making it easy for students to understand.”

Johnson, Rapley, and Steele all told us college students should really only consider credit cards with no annual fees — with Rapley going so far as to declare students should “absolutely not” apply for cards with annual fees. In fact, she doesn’t necessarily think a student should have a credit card at all unless they have a way to pay it off. “Do you have a job where you can pay it off? If not, it can be a challenge,” she warns. Instead, she says students might be better off being an authorized user on their parents’ or guardians’ card, rather than having their own. Authorized users still get the benefit of building their credit history — plus, they’ll have someone monitoring their expenses, which Rapley notes to be especially useful for someone dipping their toes into the credit-card world. “It’s easy for debt to quickly get out of hand — and a kid might not recognize that until it’s already happened,” she says.

And a debate about travel-points-focused credit cards versus cash-back credit cards

Buddies Jack and Scott, who are both in their mid-20s and work in New York City (Jack in private equity, Scott in sports business development), each love their preferred credit card deeply, for different reasons. Jack swears by the Citi Double Cash card for its cash-back benefits, while Scott stans the Chase Sapphire Reserve card for its travel perks.

Jack: The Citi Double Cash card is one of the simplest but most reliable and most powerful credit cards on the market. You get 2 percent cash back on every single purchase, no categories, no frills — one percent when you make the purchase, and one percent when you pay it off. And there are no annual fees.

Scott : Your pitch is so short because there are just no benefits to your card besides it being 2 percent cash back. With the Sapphire Reserve, it literally would take me an hour to go through every perk that I get. Also, an important bit of color: Jack, you don’t have this card and you can’t get it, or something … right? Your credit score isn’t working out?

Jack: No. I don’t have it because I have the Chase Sapphire Preferred and I got it within four years, so I can’t get the sign-up bonus — you can’t get a bonus for both of the Sapphire cards. The sign-up bonus is a huge part of the value with the Reserve or Preferred, but that’s a one time thing. I got the bonus for the Preferred and it was great, but now I’m just paying an annual fee and not getting a ton of value, which is what, a few years down the line, you’ll be doing with the Reserve. The Citi Double Cash is free from day one and you’re getting two percent back on everything. With your card, you’ve talked about everything you get back on travel and dining — but what percentage of your monthly expenses are on travel and dining?

Scott: Fair. The Reserve is not the card for everyone. However, I think a good number of people could use the sign-up bonus in travel credit. You could redeem it for flights, hotels. So if you’re going to take a road trip and just want to stay in nice hotels, or you’re going to actually fly somewhere — say, to see some family across the country or whatever it may be. All that you have to do is sign up for that card and then in the first three years, it all nets out to be a free card —

Jack: Assuming you can spend $4,000 dollars in the first three months.

Scott: Correct. If you can’t spend $4,000 in the first three months, I would not suggest the Reserve card.

Jack: Has that been easy for you? You’ve made it there no problem?

Scott: No problem at all. The coronavirus has made it a little tricky, simply because my spending has gone down. But still no problem. I’ll easily hit it.

Jack: I don’t mean to paint you as an elitist, but $4,000 in three months is not necessarily an easy task, especially for people whose housing costs — which you can’t pay by credit card — are the largest portion of their spending. But with the Citi Double Cash, no matter who you are, where you are, or what you spend your money on, you will get great value from it.

Scott: I’d say the Reserve is more of a premium experience. But you can’t really compare a cash-back card to a travel card; ultimately, they aren’t one-to-one. My point is that the Chase Sapphire Reserve is the best travel card on the market, bar none. You have a good, but not the best, cash-back card, in my opinion.

Jack: People are spending money every single month at their grocery stores, on home goods, they’re spending on all of these things. That’s what makes my pitch for the Citi card so easy: You pay it off every month and you get 2 percent cash back on everything you spend. If you spent $10,000 over five months, you get $200 back. It’s that simple. And people want to be able to pay off a balance with that cash, instead of redeeming your Chase points in the Chase interface where you’re limited on what you can actually redeem them on.

Scott: Your argument to me can’t be that people are lazy and incapable of understanding the Sapphire’s perks. It’s like Christmas morning when you go through the redemption website — there are new things everyday. Did I tell you that Lyft charges earn you ten times the points back?

Jack: That’s great, but most people don’t rely on rideshare to get from point A to point B.

Scott: But what we’re debating is what’s the better card — what has the most value? With the Chase Sapphire Reserve, I will be more than doubling you on points awarded for dining, travel — the important categories, to some. Yes, there are lots of people that wouldn’t actually get the full value out of the Chase Sapphire Reserve card. And they shouldn’t get that card; they should go for a great cash-back card — which is not yours, yours would be maybe two or three on the list, definitely behind the Capital One Savor card.

The Strategist is designed to surface the most useful, expert recommendations for things to buy across the vast e-commerce landscape. Some of our latest conquests include the best acne treatments , rolling luggage , pillows for side sleepers , natural anxiety remedies , and bath towels . We update links when possible, but note that deals can expire and all prices are subject to change.

- the strategist

- recommended by experts

- credit cards

Deal of the Day

Micro sales, greatest hits, most viewed stories.

- The 11 Very Best Shampoos

- The Strategist’s Two-Day (Actually Good) Sale Is Over — Here’s What You Missed

- What Ariana Madix Can’t Live Without

- This $17 ‘Concrete’ Planter Is So Great I Bought 8 of Them

- The 17 Very Best Work Bags for Women

- Best Credit Cards

- Balance Transfer

- No Annual Fee

On this page

- Our top picks

- Travel credit card details

- How travel cards work

Types of travel cards

- Pros and cons

- How to make the most of a travel card

- Alternatives to travel cards

- Our methodology

- Frequently asked questions

The Best Travel Credit Cards of April 2024

April 5, 2024

How we Choose

Whether you’re an occasional traveler looking to save on your next vacation or a frequent traveler looking for premium travel perks, there’s a travel rewards card for you. We’ll break down our top picks for the best travel rewards credit cards.

Best travel credit cards of April 2024

- Chase Sapphire Preferred® Card : Best welcome bonus

- Capital One Venture Rewards Credit Card : Best for flat-rate rewards

- The Platinum Card® from American Express : Best for luxury travel

- American Express® Gold Card : Best for foodies

- Capital One VentureOne Rewards Credit Card : Best first travel card

- Bank of America® Travel Rewards credit card : Best for occasional travelers

- Citi Premier® Card : Best for everyday spending

- Capital One Venture X Rewards Credit Card : Best for annual credits

- Chase Freedom Unlimited® : Best for pairing with Chase cards

- Credit One Bank Wander® Card : Best for fair credit

- Discover it® Miles : Best for no annual fee

- Wells Fargo Autograph℠ Card : Best for gas and transit

- Southwest Rapid Rewards® Plus Credit Card : Best for budget flyers

- Bank of America® Premium Rewards® credit card : Best for travel credits

- Chase Sapphire Reserve® : Best for point value

- United Quest℠ Card : Best for United MileagePlus members

Additional Options:

- Marriott Bonvoy Boundless® Credit Card: Best hotel credit card

- American Airlines AAdvantage® MileUp®: Best no-annual-fee airline card

Chase Sapphire Preferred® Card

Rewards rate

At a glance, overall rating, why we like this card.

This card has one of the highest sign-up bonuses you’ll find with a mid-level travel card. Plus, it offers generous rewards for your travel and dining purchases and additional benefits like a 25% boost in points value when you redeem your rewards through the Chase Travel℠ portal.

- You'll find more benefits with this card than with other mid-level travel cards, including an anniversary boost and a hotel credit.

- Instead of the typical 1-cent–per-point value you might find on rival travel cards, you can enjoy 25% more value when you book travel through Chase Travel℠.

- Bonus categories are limited to travel and dining, so you have little flexibility in how you earn rewards.

- The card lacks attractive travel perks like airport lounge access or security precheck credits.

Bottom Line

If you are hoping to fast-track your way to your next trip, the Chase Sapphire Preferred offers ample opportunities to earn rewards, along with a generous sign-up bonus.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Rates & Fees

Capital one venture rewards credit card.

The Capital One Venture Rewards Credit Card offers a great flat rate of 2X miles for all purchases and gives you ultimate flexibility for redemption, including for travel purchases booked outside of the Capital One portal non-travel rewards, such as gift cards (though you may get a lower value). You can also enjoy additional benefits, like an up to $100 credit toward Global Entry or TSA PreCheck®, that can help offset the $95 annual fee.

- Simple earning structure and flexible redemption options

- Generous sign-up bonus

- Lack of large domestic travel transfer partners

- Low redemption value unless using select airlines

The Capital One Venture Card is a top-notch travel card that offers simplicity and valuable perks without the pricey annual fees associated with many premium cards in this category or skimping on rewards.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

The Platinum Card® from American Express

See if you’re pre-approved for this card using our CardMatch tool .

This popular premium card from American Express comes fully-loaded with travel benefits, including luxury lounge access, Hilton Honors gold status (enrollment required), no foreign transaction fees and an impressive list of travel benefits that will help offset the $695 annual fee.

This card currently touts a generous welcome offer: You can earn 80,000 points if you spend $8,000 in your first six months of card membership, which we estimate to be worth around $800 when you book through AmexTravel (where points are worth around 1 cent each).

- Extensive list of travel credits and premium perks

- Ability to transfer points to a host of airline partners, including Delta Airlines

- Limited amount of bonus categories

- Expensive annual fee

For frequent travelers or those looking to make their dream vacation a reality, the Amex Platinum checks every box and provides generous travel credits to offset its high annual fee.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

American Express® Gold Card

The Amex Gold card offers an industry-leading 4X points at restaurants (including U.S. takeout and delivery) and U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1 point per dollar) as well as 3X points on flights booked directly with airlines or amextravel.com.

It also features dining benefits, such as an up to $120 in yearly statement credits on select restaurants, including Grubhub and The Cheesecake Factory, and up to $120 in Uber cash annually. In addition to the foodie-friendly rewards rate, this card offers a valuable introductory offer and travel perks like baggage and car rental insurance when you book with your Gold card.

- If you spend a lot on food and dining, its industry-leading rewards rate on restaurant and U.S. supermarket purchases is hard to beat.

- Like the Amex Green card, you can transfer points to multiple air travel partners, including Delta Airlines, and hotel partners, like Hilton Honors.

- Its annual fee is pricier than what’s on some travel credit cards.

- You must redeem travel rewards through amextravel.com.

The Amex Gold is one of the best cards on the market with its generous rewards rate and lucrative introductory offer. If food and travel account for a large portion of your spending, this card’s value more than covers the $250 annual fee.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Capital One VentureOne Rewards Credit Card

This card is ideal as a first travel card because you don’t have to strategize to offset an annual fee every year, but can still enjoy terrific travel benefits. You can redeem for various travel purchases like hotels, rental cars and flights either through Capital One’s travel portal or other travel websites. Plus, you can transfer your rewards to partner loyalty programs — adding more flexibility in your travel.

- No need to offset the cost of an annual fee

- Low minimum spend for sign-up bonus

- Lower rewards rate and less perks than cards with an annual fee

- Reduced value of your miles when you use the rewards for non-travel redemption options, such as statement credits or gift cards

This card offers a straightforward earning structure and an attainable sign-up bonus, allowing cardholders to rack up miles while not worrying about an annual fee.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

Bank of America® Travel Rewards credit card

The Bank of America Travel Rewards credit card is a great choice for infrequent travelers who want ultimate flexibility when it comes to earning and redeeming rewards. Cardholders can redeem points for statement credit to pay toward travel expenses, like flights, hotels, vacation packages, cruises, rental cars or baggage fees. Additionally, you can redeem for dining purchases.

You can also take advantage of its sign-up bonus — 25,000 online bonus points if you spend $1,000 in your first 90 days, redeemable for a $250 statement toward travel and dining made on your credit card within the last 12 months, including on third-party sites like Expedia or Travelocity.

- Ultraflexible redemption policy that can cover some purchases outside travel

- Can redeem rewards as a statement credit months after the initial travel or dining purchase

- Rewards rate for travel purchases not as lucrative as others in this category

- Not the most valuable sign-up offer

Despite the fact that cardholders won’t be able to weigh spending toward a particular category to maximize their points, this card is a great fit for occasional travelers who still want to earn rewards but without having to pay an annual fee.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Citi Premier® Card

If you can’t decide between a travel or general rewards credit card, the Citi Premier offers the best of both worlds with a rewards rate of 3X points for every $1 spent on air travel, hotels, restaurants, gas stations and supermarkets, as well as one point per dollar spent on all other purchases. Plus, for a limited time, earn a total of 10X points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel portal through June 30, 2024.

The Citi Premier card is currently offering a valuable sign-up bonus of 60,000 points for spending $4,000 in the first three months in addition to its flexible redemption options and exclusive side benefits.

- Annual hotel credit when booked through thankyou.com or 1-800-THANKYOU

- Earn bonus rewards for select travel and everyday purchases

- Domestic airline transfer partner limited to JetBlue

- No travel insurance, which is typical for travel cards in this tier

The Citi Premier card is a smart choice for frequent travelers who want to use a single rewards card for the bulk of their everyday spending and offers premium perks for a reasonable annual fee.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening. Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

- Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels