Travel, Tourism & Hospitality

Tourism and hotel industry in Singapore - statistics & facts

Singapore as a must-visit tourist destination, recovering from the covid-19 pandemic and its impact on tourism, key insights.

Detailed statistics

Tourism direct contribution as share of GDP Singapore 1995-2029

Tourism receipts Singapore 2013-2022

Hotel room revenue in Singapore 2013-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Number of international visitor arrivals in Singapore 2013-2022

Related topics

Recommended.

- Tourism in Malaysia

- Travel and tourism in Indonesia

- Tourism industry in Thailand

- Tourism industry in Vietnam

- Tourism industry in the Philippines

Recommended statistics

- Premium Statistic International tourist arrivals in Asia 2020, by country

- Premium Statistic Tourism sector GDP share in Asia 2020, by country

- Premium Statistic Per capita international tourism expenditure in Asia 2020, by country

- Basic Statistic Value of international tourism spending APAC 2022, by country

International tourist arrivals in Asia 2020, by country

Ranking of the international tourist arrivals in Asia by country 2020 (in millions)

Tourism sector GDP share in Asia 2020, by country

Ranking of the tourism sector GDP share in Asia by country 2020

Per capita international tourism expenditure in Asia 2020, by country

Ranking of the international tourism expenditure per capita in Asia by country 2020 (in U.S. dollars)

Value of international tourism spending APAC 2022, by country

Value of international tourism expenditure in the Asia-Pacific region in 2022, by country or territory (in billion U.S. dollars)

Economic impact

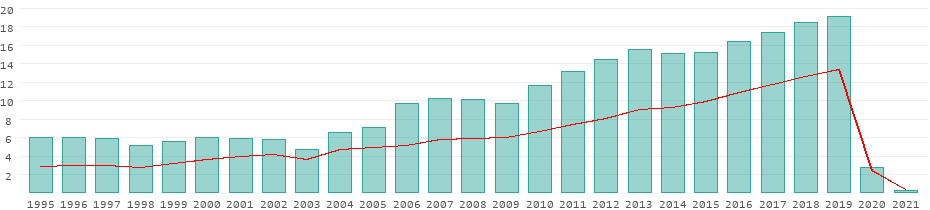

- Premium Statistic Tourism direct contribution as share of GDP Singapore 1995-2029

- Premium Statistic Number of people employed in accommodation and food services Singapore 2013-2022

- Premium Statistic Tourism receipts Singapore 2013-2022

- Premium Statistic Tourism receipts of Singapore 2022, by country

- Premium Statistic Tourism receipts per capita Singapore 2013-2022

- Premium Statistic Distribution of tourism receipts in Singapore 2022, by main components

Direct contribution of the tourism industry as a share of the gross domestic product in Singapore from 1995 to 2019 with forecasts until 2029

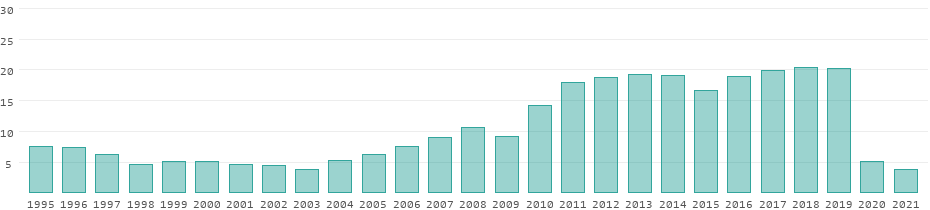

Number of people employed in accommodation and food services Singapore 2013-2022

Number of people employed in the accommodation and food services sector in Singapore from June 2013 to June 2022 (in 1,000s)

Tourism receipts in Singapore from 2013 to 2022 (in billion Singapore dollars)

Tourism receipts of Singapore 2022, by country

Tourism receipts in Singapore in 2022, by country (in billion Singapore dollars)

Tourism receipts per capita Singapore 2013-2022

Per capita tourism receipts in Singapore from 2013 to 2022 (in Singapore dollars)

Distribution of tourism receipts in Singapore 2022, by main components

Share of tourism receipts in Singapore 2022, by main components

Visitor arrivals

- Premium Statistic Number of international visitor arrivals in Singapore 2013-2022

- Premium Statistic Number of international visitor arrivals Singapore 2022, by leading markets

- Premium Statistic International visitor arrival numbers Singapore 2022, by mode of arrival

- Premium Statistic Average length of stay of inbound arrivals Singapore 2013-2022

- Premium Statistic Frequency of visits to Singapore 2019

Number of international visitor arrivals in Singapore from 2013 to 2022 (in millions)

Number of international visitor arrivals Singapore 2022, by leading markets

Number of international visitor arrivals to Singapore in 2022, by leading markets (in 1,000s)

International visitor arrival numbers Singapore 2022, by mode of arrival

International visitor arrival numbers in Singapore in 2022, by mode of arrival (in 1,000s)

Average length of stay of inbound arrivals Singapore 2013-2022

Average length of stay of inbound arrivals in Singapore from 2013 to 2022 (by number of nights)

Frequency of visits to Singapore 2019

Frequency of visits to Singapore in 2019

Hotel industry

- Premium Statistic Number of hotels and similar establishments Singapore 2011-2020

- Premium Statistic Number of rooms in hotels and similar establishments Singapore 2011-2020

- Premium Statistic Hotel room revenue in Singapore 2013-2022

- Premium Statistic Standard average room rate in Singapore 2013-2022

- Premium Statistic Revenue per available hotel room (RevPar) in Singapore 2013-2022

- Premium Statistic Standard average occupancy rate (AOR) in Singapore 2013-2022

- Premium Statistic Accommodation choices of visitors to Singapore 2019

Number of hotels and similar establishments Singapore 2011-2020

Number of hotels and similar establishments in Singapore from 2011 to 2020

Number of rooms in hotels and similar establishments Singapore 2011-2020

Number of rooms in hotels and similar establishments in Singapore from 2011 to 2020 (in 1,000s)

Revenue from hotel rooms in Singapore from 2013 to 2022 (in billion Singapore dollars)

Standard average room rate in Singapore 2013-2022

Standard average room rate in Singapore from 2013 to 2022 (in Singapore dollars)

Revenue per available hotel room (RevPar) in Singapore 2013-2022

Revenue per available hotel room (RevPar) in Singapore from 2013 to 2022 (in Singapore dollars)

Standard average occupancy rate (AOR) in Singapore 2013-2022

Standard average occupancy rate (AOR) in Singapore from 2013 to 2022

Accommodation choices of visitors to Singapore 2019

Accommodation choices of visitors to Singapore in 2019

Tourism activities

- Premium Statistic Main purpose of international visits to Singapore 2019

- Premium Statistic Distribution of international visits to tourist attractions Singapore 2019

- Premium Statistic Distribution of international visits to free tourist attractions Singapore 2019

- Premium Statistic Most popular shopping items purchased by international tourists in Singapore 2019

Main purpose of international visits to Singapore 2019

Main purpose of international visits to Singapore in 2019

Distribution of international visits to tourist attractions Singapore 2019

Share of international tourists who visited the top tourist attractions in Singapore in 2019

Distribution of international visits to free tourist attractions Singapore 2019

Share of international tourists visiting the leading free tourist attractions in Singapore in 2019

Most popular shopping items purchased by international tourists in Singapore 2019

Share of international tourists in Singapore who purchased the following items during their stay there in 2019

Impact of the COVID-19 pandemic

- Premium Statistic YoY change in monthly international visitor arrivals in Singapore 2020-2023

- Premium Statistic Tourism receipts Singapore Q1 2019-Q2 2023

- Premium Statistic Quarterly hotel room revenue Singapore Q1 2019-Q1 2023

YoY change in monthly international visitor arrivals in Singapore 2020-2023

Year-on-year change in monthly international visitor arrivals to Singapore from February 2020 to June 2023

Tourism receipts Singapore Q1 2019-Q2 2023

Tourism receipts in Singapore from 1st quarter 2019 to 2nd quarter of 2023 (in billion Singapore dollars)

Quarterly hotel room revenue Singapore Q1 2019-Q1 2023

Quarterly hotel room revenue in Singapore from 1st quarter 2019 to 1st quarter 2023 (in million Singapore dollars)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Tourism Statistics

What's new on Stan?

1. Access Hotel industry performance dashboard (for hotels only);

2. Participate in Tourism Transformation Index to understand your state of transformation, assess your strengths, and identify areas of opportunity;

3. View updated Tourism Statistics.

View Tourism Statistics

Draw insights from tourism data to make business decisions. Gain an overview of key Visitor Arrivals data presented in visualisations, including top source markets, overnight visitors, and the average length of stay.

STB Data College

Within STB's Learn-Test-Build framework, Data College allows companies to learn how others have accomplished their transformation plans, what their pitfalls have been, and what actions have been critical for success.

Data College also complements the Tourism Transformation Index (TXI), where companies may view short e-primer videos to better understand the knowledge/ competency gaps within their company.

Tourism Transformation Index

Take a self-diagnostic tool to understand your current state of transformation, assess your strengths, and identify areas of opportunity. Receive recommendations on next steps to take in your digital transformation journey.

TXI Assessment

Tourism Transformation Index (TXI) is a self-assessment tool to measure digital transformation for tourism organisations.

Private Space

A secured personal space for you to conduct data exploration and analytics on your company data.

Data Marketplace

A platform for industry users to share and consume Singapore tourism-related data.

A co-creation space equipped with predictive tools, for industry collaboration on data analytics projects.

New to Stan? Download the Stan User Guides .

If you wish to be updated about new Stan features and upcoming events, indicate your interest.

Explore the archives

Government agencies communicate via .gov.sg websites (e.g. go.gov.sg/open) . Trusted websites

Obtain latest news and data; View dates of upcoming data releases; Sign up for alerts on key releases; Check out the newsletter.

- Latest Data

- Latest News

- Visualising Data

- Advance Release Calendar

- Statistics Singapore Newsletter

- Sign Up for Alerts

- Really Simple Syndication (RSS)

Find Data Search for data by themes or A-Z

- Search by Theme

- Multi-Dimensional Data Cubes

- Search by A-Z

- SingStat Table Builder

- Data for Businesses

- Students' Corner

- eBook of Statistics

- Singapore in Figures

- Sustainable Development Goals

- International Statistics

- Concepts, Methods and Applications

- Publications

Our Services, Tools & Surveys

View our suite of services and tools.

- SingStat Mobile App

- Statistical Enquiries

- Benchmark My Business Performance

- SSOC Search

- Population Query

- SingStat Data Services

- Anonymised Microdata Access Programme (AMAP)

- Household Expenditure Survey 2022/23

- Business Survey

- Price Survey

- Public Sector Surveys

- Sampling Service for Household Surveys

- Census of Population 2020

- Online Payment

Learn more about the statistical standards, classifications, concepts and methods adopted by Singapore Department of Statistics, as well as other international classifications.

- Data Dissemination Standard

- Standards and Classifications

- International Classifications

- Vision and Mission

- Guiding Principles

- Singapore Statistical System

- Statistics Act

- DOS's Approach to Data Stewardship and Governance

- Build Your Career @ DOS

- Career Opportunity

- Internship @ DOS

Discover the new and improved features of the enhanced SingStat Mobile App . Download the app for fast, free and easy access to key official statistics.

- Household Sector Balance Sheet

- International Accounts

- Labour, Employment, Wages & Productivity

- National Accounts

- Prices and Price Indices

- Public Finance & Public Sector

- Agriculture, Animal Production and Fisheries

- Building, Real Estate, Construction and Housing

- Corporate Sector

- Energy and Utilities

- Finance and Insurance

- Formation and Cessation of Business Entities

- Food Establishments

- InfoComm and Media

- Manufacturing

- Research and Development

- Foreign Affiliates Statistics

- Merchandise Trade

- Trade In Services

- Education and Literacy

- Community Services

- Culture and Recreation

- Environment

- Public Safety

International Visitor Arrivals

The Singapore Tourism Board publishes monthly statistics on international visitor arrivals. Data on international visitor arrivals are compiled from immigration movement records completed by all visitors arriving in Singapore at the points of entry.

Please click on the topic to view the available data tables.

Data are preliminary when first released. 1 Refers to % change in latest period over the same period in the previous year. 2 Refers to % change in the previous period over the same period in the previous year. 3 Data under the column for '% change (y-o-y)' refer to percentage point change. 4 Refers to room-nights available for occupancy. Excludes rooms closed for renovations and staff use as declared by the hotels in the statutory forms.

Title : International Visitor Arrivals By Inbound Tourism Markets, Monthly

Definitions

Other references.

Tourism in Singapore

Development of the tourism sector in singapore from 1995 to 2021.

Revenues from tourism

All data for Singapore in detail

- Board Of Directors

- Organisation Chart

- Achieving Quality Tourism

- Legislation

- Corporate Governance

- Invest in Tourism

- ASEAN Economic Community

- Media Releases

- Corporate Publications

- Newsletters

- Statistics & Market Insights Overview

- Tourism Statistics

- Industries Overview

- Arts & Entertainment

- Attractions

- Dining & Retail

- Integrated Resorts

- Meetings, Incentives, Conventions & Exhibitions

- Tourist Guides

- Travel Agents

- Assistance and Licensing Overview

- Tourism Sustainability Programme (TSP)

- Singapore Visitor Centre (SVC) Network Partnership

- Grants Overview

- Licensing Overview

- Tax Incentives Overview

- Other Assistance & Resources Overview

- SG Stories Content Fund Season 2

- Marketing Partnership Programme

- SingapoReimagine Marketing Programme

- Singapore On-screen Fund

- Hotel Licensing Regulations

- Data College

- Trade Events and Activities

- Trade Events Overview

- SingapoReimagine Global Conversations

- SingapoRediscovers Vouchers

- Made With Passion

- Joint Promotion Opportunities

- Procurement Opportunities for STB's Overseas Regional Offices

- Product And Industry Updates

- Rental of F1 Pit Building

- Singapore Tourism Accelerator

- Sponsorship Opportunities

- STB Marketing College

- Tourism Innovation Challenge

- Harnessing Technology to Emerge Stronger Post COVID-19

- Tourism Transformation Index (TXI)

- New Tourism Development in Jurong Lake District

- International Trade Events

- Singapore Familiarization Trips

- EVA-Ready Programme

- Tourism Industry Conference

- Expo 2025 Sponsorship and Partnership Opportunities

- Students & Fresh Graduates

- Professionals

- Attractions Operator

- Business/Leisure Event Organiser

- Media Professional

- Tourist Guide

- Travel Agent

Singapore’s tourism sector recovers strongly in 2022, visitor numbers expected to double in 2023

International arrivals exceed forecast to hit 6.3 million, tourism receipts reach an estimated $14 billion amid growing demand

Singapore, 17 January 2023 – Singapore’s international visitor arrivals (IVA) reached 6.3 million in 2022 (~33 per cent of 2019 IVA), exceeding STB’s forecast of between 4 and 6 million visitors. Tourism receipts (TR) are estimated to reach $13.8 to $14.3 billion[1] (~50 per cent to 52 per cent of 2019 TR). Barring unexpected circumstances, tourism activity is now expected to recover to pre-pandemic levels by 2024.

Mr Keith Tan, Chief Executive, Singapore Tourism Board (STB), said: “Our 2022 tourism performance underscores Singapore’s appeal as a leading business and leisure destination for post-pandemic travellers. To sustain our growth in 2023 and beyond, we will expand our partnerships, build up a rich year-round calendar of events, ramp up investment in new and refreshed products and experiences, and continue to support industry efforts to build the capabilities they need to meet consumer demands.”

2022 Tourism Performance

Visitor arrivals were driven by strong demand from Singapore’s key source markets, led by Indonesia (1.1 million), India (686,000) and Malaysia (591,000).

TR reached $8.96 billion between January to September 2022. The top TR generating markets were Indonesia, India and Australia, which contributed $1.1 billion, $704 million, and $633 million respectively in TR (excluding Sightseeing, Entertainment and Gaming)[2].

Visitors are also spending more time in Singapore compared to before the pandemic. For the last three quarters of the year (April-December 2022) when Singapore no longer required quarantine for fully-vaccinated travellers, the average length of stay was approximately 4.81 days[3]. This is a significant increase compared to 3.36 days for the same period in 2019.

Key Industry Performance

MICE and Leisure Events

The resumption of MICE[4] events picked up pace in 2022, following the easing of border restrictions and safe management measures.

Marquee international events returned to Singapore, including Food and Hotel Asia – Food & Beverage and Food and Hotel Asia – HoReCa, which took place as two dedicated trade shows for the first time, ITB Asia, and Singapore Fintech Festival, which attracted a record turnout from over 115 countries. STB also secured new events like FIND: Design Fair Asia as well as Global Health Security Conference 2022 and the 14th World Stroke Congress, which reinforced Singapore's leadership in key industry clusters.

Singapore’s calendar of leisure and sporting events also recovered strongly. The Formula 1 Singapore Airlines Singapore Grand Prix 2022 – held after a two-year hiatus – drew a record attendance of 302,000; the Tour de France Prudential Singapore Criterium also made its Southeast Asian debut. Regular crowd-pleasers such as the Singapore Food Festival, Christmas Wonderland, Christmas on A Great Street at Orchard Road, the Marina Bay Singapore Countdown and ZoukOut Singapore were all organised successfully and drew visitors from around the world.

Hotels Industry Performance

Singapore’s hotel industry also posted an encouraging year due to stronger demand for leisure and business travel. From April to December 2022[5], the Average Occupancy Rate (AOR) was 79.1 per cent, compared to 87.3 per cent recorded in the same period in 2019. Average room rates during this period increased by 17 per cent to $260, while Revenue per Available Room (RevPAR) increased by 6.2 per cent to $206.

Singapore welcomed a total of 465 new keys in 2022 with the opening of new hotels like the Citadines Connect City and Garden Pod @ Gardens By The Bay Centre. New brands like Hotel Telegraph (formerly known as SO Singapore), Pullman Singapore Orchard (formerly known as Grand Park Orchard), voco Orchard Singapore (formerly known as Hilton Singapore at 581 Orchard Road) and Vibe Hotel Singapore Orchard (formerly known as Elizabeth Hotel) were also introduced. These investments underscored the private sector’s confidence in Singapore’s tourism prospects.

Cruise Industry Performance

Singapore’s position as a regional cruise hub strengthened in 2022 with more than 230 ship calls. Passenger throughput was 1.2 million, which is about two-thirds of pre-pandemic levels in 2019. The return of cruising was supported by the year-round deployment of Resorts World Cruises’ Genting Dream and Royal Caribbean International’s Quantum/Spectrum of the Seas . Following the resumption of sailings with ports of call in July, two new cruise lines made Singapore their seasonal homeport[6]:

· STB’s new three-year partnership with Silversea Cruises will see its ships homeport seasonally in Singapore till the 2024/2025 season, with Silver Muse kicking off the first sailing from Singapore in December 2022.

· TUI Cruises' Mein Schiff 5 also returned to Southeast Asia in December 2022, starting their three-year seasonal homeport from Singapore and taking passengers to ports in Southeast Asia.

Singapore also welcomed the return of transit and turnaround sailings[7] from Cunard, Seabourn Cruises, Viking Cruises, Oceania Cruises and Regent Seven Seas Cruises in 2022.

2022 Highlights

Branded Collaborations and Strategic Partnerships

To keep Singapore top-of-mind and rebuild demand, STB scaled up its SingapoReimagine campaign across 17 markets. It also increased Singapore’s appeal to consumers through innovative partnerships.

For example, STB collaborated with media and entertainment companies such as Warner Bros. Discovery and Studio Dragon, as well as celebrities Billie Eilish, Charlie Puth and Jackson Wang to inspire travel to Singapore through authentic and creative storytelling. STB also forged strategic partnerships with industry leaders such as Singapore Airlines, Scoot, CapitaLand, Expedia, Klook and Visa to promote Singapore, exchange insights and enhance the visitor experience.

Enhanced Destination Attractiveness

Singapore welcomed new and enhanced experiences, including the Children’s Museum Singapore; Avatar: The Experience at Gardens by the Bay; Sentosa’s Night Luge, Scentopia, Wings of Time and Central Beach Bazaar; a new gallery at ArtScience Museum’s Future World: “ Exploring New Frontiers” ; A Minion’s Perspective Experience at Resorts World Sentosa; Mr Bucket Chocolaterie at Dempsey; and the Singapore Night Safari’s new amphitheatre and refreshed Creatures of the Night show. The Changi Bay Park Connector and the Rifle Range Nature Park were also opened, strengthening Singapore’s attractiveness as a City in Nature.

Singapore’s tour operators continued to introduce new and innovative tours, including the Seadog Kayak Sailing Tour by Kayak Fishing Fever, Letters From Blakang Mati by Woopa Travel as well as Hawker Fare: Little India Street Food Tour.

Becoming an Urban Wellness Haven and a Top Sustainable Destination

To meet increasing demand for holistic wellness offerings, STB organised the inaugural Wellness Festival Singapore (WFS) in June 2022, which featured over 130 wellness activities and experiences over 10 days. STB also inked a partnership with global wellness platform ClassPass, onboarding more than 90 new wellness businesses across 167 locations.

To make wellness a key component of Singapore’s tourism offerings, STB launched an Expression-of-Interest (EOI) in November to develop a wellness attraction on the southern coast of Singapore.

STB also made strides to help the tourism sector become more sustainable. A destination sustainability strategy for the tourism sector was developed in 2022 in line with the Singapore Green Plan 2030 and our ambition to become a sustainable urban destination. Industry-specific roadmaps were developed for hotels[8] and the MICE ecosystem[9], while the Tourism Sustainability Programme[10] was launched to support tourism businesses in all stages of their sustainability journey.

2023 Outlook

STB expects the tourism sector to continue its growth momentum this year, on the back of increasing flight connectivity and capacity, and China’s gradual reopening. International visitor arrivals are expected to reach around 12 to 14 million visitors, bringing in approximately $18 to 21 billion in tourism receipts – around two-thirds to three-quarters of the levels in 2019.

In the meantime, STB will continue efforts to increase Singapore’s destination attractiveness. STB will support the development of new and refreshed offerings in 2023, such as Bird Paradise @ Mandai Wildlife Reserve, and new experiences in Orchard Road such as the Trifecta integrated sports facility.

To support tourism recovery, STB will front load $110 million of the $500 million set aside for Singapore’s tourism recovery to ramp up business and leisure events over these two years.

STB will continue to attract more high-quality MICE events, such as the Herbalife APAC Extravaganza 2023 and the 25th World Congress of Dermatology 2023. On the leisure events front, 2023 has already kicked off strongly with Art SG, Southeast Asia’s largest ever art fair as part of the Singapore Art Week, and Sail GP, which made its Asian debut last week. New events like the Olympic Esports Week and Professional Triathletes Organisation Asian Open will also take place in Singapore for the first time.

To increase Singapore’s mindshare, STB will ramp up the SingapoReimagine campaign in all our key markets through creative activations, content and partnerships. This will be augmented by the SingapoReimagine Marketing Programme (SMP)[11] to help local tourism and lifestyle businesses promote Singapore while also raising their marketing capabilities.

To support the pace of recovery, STB will continue to help the tourism sector ramp up hiring. As of September 2022, the total tourism workforce is around 65,000 – about 78 per cent of 2019 levels. STB will continue to support manpower needs through the Tourism Careers Hub, which has placed more than 500 workers in the tourism sector since its launch in 2022 by providing career coaching, skills upgrading and job matching. STB will also continue to support digital transformation for the industry through Tcube[12], which has already helped more than 1,000 local tourism companies through its various programmes.

Please refer to Annex for International Visitor Arrivals (IVA) and Tourism Receipts (TR) from 2019-2022.

Please download the STB Year-in-Review presentation deck from this link.

[1] These are preliminary estimates for 2022. The final figure will be available in 2Q 2023.

[2] In line with previous practices, STB excludes Sightseeing, Entertainment & Gaming in the country analysis due to commercial sensitivities.

[3] Figures are updated as at 17 Jan 2023.

[4] Meetings, Incentives, Conventions and Exhibitions (MICE)

[5] Figures for the hotel industry are updated as at 17 Jan 2023.

[6] A homeport refers to the port at which a cruise ship is based, and is where a cruise itinerary begins and ends. Year-round homeports are perennial, while seasonal homeports last only for a few months, typically during the summer.

[7] A transit sailing indicates that Singapore is a port of call in an itinerary that begins and ends at another port. A turnaround sailing is one that begins at another port of call but ends its itinerary in Singapore.

[8] The Hotel Sustainability Roadmap was jointly launched by STB and Singapore Hotel Association (SHA) in March 2022.

[9] The MICE Sustainability Roadmap was jointly launched by STB and Singapore Association of Convention & Exhibition Organisers & Suppliers (SACEOS) in December 2022.

[10] The Tourism Sustainability Programme was developed to strengthen the tourism sector's foundation in sustainability.

[11] The SingapoReimagine Marketing Programme is a S$8 million programme, which was launched in September 2022, to supports local businesses across tourism and lifestyle industries to promote Singapore and recapture international demand.

[12] Tcube, or the Tourism Technology Transformation Cube, is a hybrid innovation space that brings STB’s digital initiatives, resources and thought-leadership content onto a single platform to support our sector’s digital transformation. For more information, visit https://go.gov.sg/tcube

About the Singapore Tourism Board

The Singapore Tourism Board (STB) is the lead development agency for tourism, one of Singapore’s key economic sectors. Together with industry partners and the community, we shape a dynamic Singapore tourism landscape. We bring the Passion Made Possible brand to life by differentiating Singapore as a vibrant destination that inspires people to share and deepen their passions.

More: www.stb.gov.sg or www.visitsingapore.com | Follow us: facebook.com/STBsingapore or linkedin.com/company/singapore-tourism- v.sg/tcube

About the Organisation

What industry does your organization fall within, what best describes the key intent of the project that your organisation is seeking funding for, is your organisation a singapore-registered legal entity, is your organisation an association, is the project able to achieve one or more of the following outcome.

- Increase no. of sailings to/from Singapore

- Increase no. of foreign cruise passengers to Singapore through sailings to/from Singapore

- Increase no. of pre/post nights for cruise passengers sailing to/from Singapore

- Increase capability of industry players via cruise-specific industry training programmes

- Strengthen the potential/ attractiveness of cruising in Singapore and/or Southeast Asia

Is the project able to achieve one or more of the following?

- Improve visitor satisfaction (especially foreign visitors)

- Increase footfall

- Increase revenue

- Significant branding and PR value

Is the project able to attract foreign visitors and contribute to foreign visitors' spend?

Who will be the main target audience of your project, is your project innovative and/or a new event in singapore with tourism potential, what best describes your project, does the event have proven track records in singapore or overseas, and/or growth in tourism value such as growing foreign visitorship, and/or enhancement of precinct vibrancy etc, does the project have a clear tourism focus (e.g. tourism-related trainings, tourism companies taking on capability development initiatives or technology companies creating technology products and services for the tourism businesses), what best describes your market feasibility study project.

Based on your selection, the following STB grant/s may be applicable for your project:

Please note that projects that have commenced prior to Singapore Tourism Board's offer may not be eligible for grant support. Examples where projects are deemed as having commenced include:

- Applicant has started work on the project e.g. tender has been called.

- Applicant has made payment(s) to any supplier, vendor or third party.

- Applicant has signed a contractual agreement with any supplier, vendor or third party.

IMAGES

VIDEO

COMMENTS

2 All Tourism Receipts estimates are correct as at April 2020. TOURISM RECEIPTS BY MAJOR COMPONENTS, TOP 10 MARKETS TOURISM RECEIPTS* :S$21.7 BILLION (2.9% VS JAN-DEC 2018) JANUARY TO DECEMBER 2019 PERFORMANCE TOURISM RECEIPTS BY MAJOR COMPONENTS2 TOURISM RECEIPTS: S$27.7 BILLION (+2.8% VS JAN-DEC 2018) VA % Change vs 2018 TR % Change vs 2018 ...

The hotel tiering system is a reference system developed by the Singapore Tourism Board (STB) to categorise the different hotels in Singapore into tiers based on a combination of factors that include average room rates, location and product characteristics. Figures for the hotel industry are preliminary estimates, based on returns as at 26 Jun ...

Most of the data series in this publication are compiled by the Singapore Department of Statistics. A number of key indicators are obtained or computed by the Department based on basic data provided by departments and research and statistics units in various ministries and statutory boards. Subject Matter. Sources of Data.

2 All Tourism Receipts estimates are correct as at April 2019. TOURISM RECEIPTS BY MAJOR COMPONENTS, TOP 10 MARKETS TOURISM RECEIPTS* :S$21.1 BILLION (-0.5% VS JAN-DEC 2017) JANUARY TO DECEMBER 2018 PERFORMANCE TOURISM RECEIPTS BY MAJOR COMPONENTS2 TOURISM RECEIPTS: S$26.9 BILLION (+0.5% VS JAN-DEC 2017) VA % Change vs 2017 TR % Change vs 2017 ...

Annual Cruise Statistics. Data up to Year 2022. Download. (Excel Document, 67 KB) View visualisations and/or download data files on Singapore tourism statistics: Monthly Visitor Arrivals, Monthly Hotel Statistics, Annual Tourism Receipts and Annual Cruise Statistics.

2017 2018 2019 Tourism Receipts in S$ Billions (B) S$26.8B S$27.1B1 S$27.3B - S$27.9B 1% increase vs 2017 1 - 3% increase vs 2018 * Growth in other TR Components was mainly from airfare revenue, with more visitors arriving via local-based carriers. S$1,946M S$4,055M S$4,347M S$5,758M S$4,472M

Statistics on the tourism sector and hotel industry are compiled by the Singapore Tourism Board. Data are preliminary when first released. 1 Refers to % change in latest period over the same period in the previous year. 2 Refers to % change in the previous period over the same period in the previous year. 3 Data under the column for '% change ...

The "Yearbook of Statistics Singapore 2019" is the fifty‐second edition of an annual flagship publication by the Singapore Department of Statistics (DOS). ... Tourism 204 Finance 211 Public Finance 239 Prices 257 Education and Literacy 280 Health 203 Hawkers and Food Establishments 320 Community Services 324 Culture and Recreation 336

Tourism receipts in Singapore from 1st quarter 2019 to 2nd quarter of 2023 (in billion Singapore dollars) Premium Statistic Quarterly hotel room revenue Singapore Q1 2019-Q1 2023

Make data driven decisions today with Stan! Stan is a data analytics platform to view visualisations and perform analysis on tourism-related data, aggregated from STB and the industry, to derive actionable insights about Singapore's visitors. New to Stan? Download the Stan User Guides.

Singapore's tourism revenue has shown solid growth. In 2019 (estimate), as the number of tourists reached a record high, tourism revenue also increased by 2.6% from the previous year to about S $ 27.6 billion (about 2.095 trillion yen). However, there are concerns.The tourism revenue has grown for four consecutive years, but the growth

Record Title: Singapore Tourism Board's Annual Report 2019/2020 and Audited Financial Statements 2019/2020. Record Date: 26/10/2020. Presented By: Ministry of Trade and Industry.

The Annual Report on Tourism Statistics contains detailed statistics of visitor arrivals to Singapore, tourism receipts and hotels. This report also contains other information on inbound passenger carrier flights, cruise and Singapore outbound statistics. ... @2019 Government of Singapore. Last Updated 21 April 2020.

Budget Direct 2019 Singapore Tourism Statistics - Read online for free. Singapore's location in the centre of South-East Asia, its well-developed tourism industry, its mix of cultures, its safety, and its efficient airport make it an attractive travel destination. Being a compact city-state, Singapore visitors stay for a relatively short duration, but its status as a transport hub means the ...

Compendium of Tourism Statistics, Data 2015 - 2019, 2021 Edition. Published: February 2021 Pages: 854. eISBN: 978-92-844-2249-4. Abstract: Understanding, for each country, where its inbound tourism is generated is essential for analysing international tourism flows and devising marketing strategies, such as those related to the positioning of ...

As such, international tourism can generate a tourism trade surplus when receipts exceed expenditure, or a deficit (vice versa) in the travel balance of countries. In 2019, the United States of America had the world's largest travel surplus with USD 62 billion, resulting from tourism receipts of USD 214 billion and expenditure of USD 152 billion.

As noted above, the number of foreign visitors reached a record high in 2019, but fell sharply in 2020, hit by the Covid outbreak. The number of visitors for the full year was down 85.7% from the previous year to 2.74 million. The following year, 2021 also fell, contracting by 88.0% to 330,000. In the ranking of visitor numbers by country (2021 ...

This quarterly report provides a summary of key statistics on tourism receipts, international visitor arrivals and gazetted hotels. ... 2020: 2.7 MILLION (-85.7% VS 2019), VISITOR DAYS: 11.8 MILLION DAYS (-81.7%) ... The hotel tiering system is a reference system developed by the Singapore Tourism Board (STB)

The Singapore Tourism Board publishes monthly statistics on international visitor arrivals. Data on international visitor arrivals are compiled from immigration movement records completed by all visitors arriving in Singapore at the points of entry. Data. Please click on the topic to view the available data tables. View Latest Data:

Singapore is one of the few countries where tourism arrivals outnumber the population. There are more than three times as many tourist arrivals than the country's population. 2018 was a record year with 18.5 million arrivals generating S$27.10 billion in tourism receipts. Growth year over year was 6.2% and 1.0% respectively.

In 2020, tourist receipts plummeted due to the COVID-19 pandemic. Of the $20.31 billion billion (2019), only $5.18 billion billion remained. This is a 75 percent decrease in Singapore. In purely mathematical terms, each of the tourists who arrived in 2021 spent an average of 10,836 dollars.

Singapore Tourism Board International Visitor Arrivals Statistics Published Date: 08 Oct 2019 Statistical Tables 1.1 All Mode of Arrival 1.2 Air 1.3 Sea 1.4 Land 2 Visitor Days Explanatory Notes CONTENTS Monthly International Visitor Arrivals by Inbound Tourism Markets and Mode of Arrival, January - December 2019.

ベトナムは、2019年水準を上回る直行便数の回復、インセンティブツアーの催行等の影響も あり、訪日外客数は67,400人(対2019年同月比140.8%※)であった。 ホーチミン~成田間の増便などもあり、日本への直行便数は2019年同月を上回っている。

International arrivals exceed forecast to hit 6.3 million, tourism receipts reach an estimated $14 billion amid growing demand. Singapore, 17 January 2023 - Singapore's international visitor arrivals (IVA) reached 6.3 million in 2022 (~33 per cent of 2019 IVA), exceeding STB's forecast of between 4 and 6 million visitors.Tourism receipts (TR) are estimated to reach $13.8 to $14.3 billion ...