- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

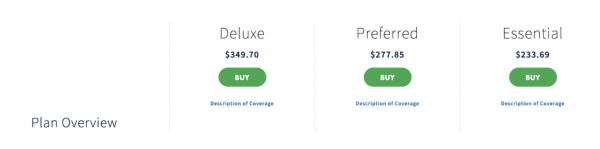

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- TATA AIG Travel

TATA AIG Travel Insurance

Get best quotes for TATA AIG

- Including USA and Canada

- Excluding USA and Canada

- Schengen Countries

TATA AIG Overseas Travel Insurance

TATA AIG’s Travel insurance program covers the insured from any unforeseen emergency while traveling abroad or within India, on Business or for Leisure. The plans are ideal for travelers going to any country across the world including the USA , Canada , Europe , South East Asia or Australia . The travelers can also remain covered throughout their travel to any destination in India on any mode of transport.

This Travel insurance policy covers treatment for Covid19 while overseas.

TATA AIG Travel Insurance review

TATA AIG travel insurance coverage for Covid19

The TATA AIG travel insurance provides coverage for Covid19 related medical expenses. COVID19 related expensed are covered up to the sum insured according to the plan chosen. Covid expenses are covered for plans both with and without Sub Limits up to the eligible policy maximum.

- Expenses related to Covid testing are not covered till a positive Covid test report requires further medical expenses.

- Institutional and home quarantine expenses are not covered.

- Expenses incurred by travelers for Covid19 testing as part of government regulation are not covered.

Unique Features of Tata AIG travel insurance for overseas travel

- Available up to 99 years

- Offers coverage for pre-existing conditions

- Offers coverage without sublimits

- TATA AIG travel insurance covers Coronavirus under Hospitalization Medical Expenses.

How to buy a Travel Policy online?

There is a simple online application for travelers to complete and enroll to purchase TATA AIG’s travel insurance.

- Once the online application is filled completely, travelers can use a credit / debit card /other modes or cheque to make the payment of premium for their policy.

- Travelers can purchase this travel insurance online from anywhere in the world.

- Many of our customers are in the USA , Canada , UK , Europe and Australia and buy this insurance online for family members traveling overseas from India.

- It must be noted that policies can be purchased for only those travelers, traveling out from India.

- A confirmation email will be sent to the travel insurance customer immediately after the completion of purchase process and paying the requisite premium.

- Those who are paying via cheque can forward the same to the mailing address of Eindiainsurance office specified on the application.

- Please note that the payment has to be received prior to commencement of travel.

Key features of TATA AIG travel insurance

- Tata AIG has been the undisputed market leader in the travel insurance market in India since inception in 2001 and till date enjoys amongst the highest market share in India in Retail Travel Insurance.

- Today they issue the highest number of International Retail Travel insurance policies and settle the maximum number of International Travel insurance claims as well.

- American International Group, Inc. (AIG) has Business Operations in 130 countries across all General Insurance lines of business including Travel Insurance. This global presence is a big advantage while managing the Travel Insurance business worldwide.

- Tata AIG's Medical Assistance Company is Europe Assistance

- Travel Guard is the worldwide Travel Insurance business was almost $1.05 billion across 80 countries including India. Clearly one of the leaders and the most preferred company for the longest time in the World Market for Travel Insurance.

- Travel Guard is one of the most popular travel insurance plan currently in the Indian market, which is comprehensive in terms of benefits and backed up by efficient and transparent claims servicing.

TATA AIG overseas insurance, TATA AIG international health insurance

Travel Guard

- Asia Travel Guard

- Student Guard

- Domestic Travel Guard

TATA AIG Travel Guard insurance for overseas travel

Travel Guard is a product specifically for International Travelers who are traveling on business or leisure to any destination across the world. This is the largest selling plan for Tata AIG and it is the most comprehensive in terms of Benefit Coverage and Sum Insured options.

Tata AIG currently offers seven variants of their International Travel Insurance product - five variants of Single Trip plans offering different Accident & Sickness (A&S) with Sum insureds like Silver Plan – US$50,000, Silver Plus Plan - US$100,000, Gold Plan - US$250,000 and Platinum Plan - US$500,000 and a recently introduced Senior Plan with a coverage of UDS $50,000. Apart from the Single Trip plans, they offer two variants of Annual Multi Trip Plans with different A&S coverage - Gold Plan - US$250,000 and Platinum Plan - US$500,000.

- Policy is available for all entry ages under different plans from the age of 6 months onwards till 70 years of age for all plans except the Senior Citizen plan, which has an entry age of 71 years.

Tata AIG travel insurance eligibility

- Travel insurance is available for the maximum of 180 days under the Single Trip Plans.

- Traveller should hold either an Indian citizen with an Indian passport, PIO Card (Persons of Indian Origin Card) or OCI Card (Overseas Citizen of India Card)

- Traveller should be traveling out from India and be available in India while purchasing the TATA AIG Policy

Benefits of TATA AIG Travel Guard insurance

- Hospital Room and Board and Hospital miscellaneous: Max $1,500 per day upto 30 days whichever is less.

- Intensive Care Unit: Max $3,000 per day upto 7 days whichever is less.

- Surgical Treatment: Max $10,000

- Anesthetist Services: Upto 25% of Surgical Treatment

- Physician's Visit: Max $75 per Day upto 10 visits

- Diagnostic and Pre-Admission Testing: Max $500

- Ambulance Services: Max $400

Features of Tata AIG Travel Insurance

- Coverage of Medical Expenses Travel Guard takes care of your medical expenses due to Accident and Sickness while traveling so that you can concentrate on enjoying the holiday without any stress.

- Checked Baggage Loss Compensation for the loss of checked in baggage in the custody of the common carrier.

- Baggage delay Compensation for reasonable expenses incurred for purchase of emergency personal effects due to delay in arrival of checked in baggage, whilst overseas.

- Loss of Passport Compensation for expenses incurred directly in obtaining a duplicate or new passport abroad.

- Personal Liability Compensation for damages to be paid to a third party, resulting from death, bodily injury or damage to property; caused involuntarily by the insured.

- Hijacking In an unfortunate event of your common carrier in which you are travelling; being hijacked, this product will pay a distress allowance to you.

- In-hospital Indemnity The Policy pays a Daily benefit for each day you are an inpatient in a hospital due to injury or sickness.

- Trip Delay Reimbursement of additional expenses occurred due to trip delay (only if the trip has been delayed for more than 12 hours).

- Automatic-extension of the policy Travel Guard allows you to extend your policy upto a period of 7 days from the policy expiry date in the unfortunate event of Delay by the scheduled airline, which is beyond the control of the insured.

- Personal Accident Travel Guard gives you worldwide coverage against Accidental Death and Dismemberment following an accident during your trip.

- Sickness Dental Relief The policy pays for immediate Dental Treatment occurring due to sudden acute pain during the course of an overseas Insured Journey. Dental benefits will be provided for Medically Necessary filling of the tooth or surgical treatment, services, or supplies.

- Other Benefits Tata AIG’s Plans also cover some other benefits like Trip Cancellation / Curtailment, Repatriation of Remain and Medical Evacuation, Bounced Hotel / Airline Booking and Missed Connection / Departure

TATA AIG Asia Travel Guard Insurance for travel within Asia

Asia Travel Guard is Tata AIG’ s product designed for travellers within the continent of Asia but excludes Japan & Korea. There are two variants of the plan namely Silver and Gold with differential Sum Insureds for Emergency Accident & Sickness (A&S). The Silver plan has an A&S coverage of $50,000 while the Gold Plan has A&S coverage of $200,000.

Eligibility of Asia Travel Guard

- Policy is available for all entry ages under different plans from the age of 6 months onwards till 70 years of age.

- Hospital room and board and hospital miscellaneous: Max $1,500 per day upto 30 days whichever is less.

- Intensive care unit: Max $3,000 per day upto 7 days whichever is less.

- Surgical treatment: Max $10,000

- Anesthetist services: Upto 25% of Surgical Treatment

- Physician's visit: Max $75 per Day upto 10 visits

- Diagnostic and pre-admission testing: Max $500

- Ambulance services: Max $400

Coverage benefits of TATA AIG medical insurance

- Personal accident - 24-hr personal accident cover upto US$ 15,000.

- Medical expenses Cover - Reimbursement of medical expenses due to accident and sickness.

- Emergency medical evacuation and repatriation - In the event of a medical emergency, Tata AIG will arrange for the evacuation and transportation to move an ill or injured traveller to a location where appropriate medical care is available. Policy provides for repatriation of remains in case of unfortunate death of the insured during the trip.

- Checked baggage loss - Compensation for the loss of checked in baggage.

- Loss of passport - Compensation for expenses incurred in obtaining a duplicate or new passport.

- Checked baggage delay - Compensation for reasonable expenses incurred for purchase of emergency personal effects due to delay in arrival checked in baggage, whilst overseas.

- Personal liability - Compensation for damages to be paid to a third party, resulting from death, bodily injury or damage to property; caused involuntarily by the insured.

- Afghanistan, Armenia, Azerbaijan, Bahrain, Bangladesh, Bhutan, Brunei, Burma (Myanmar), Cambodia, China, Hongkong, Indonesia, Iran, Iraq, Israel, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Laos, Lebanon, Malaysia, Maldives, Mongolia, Nepal, Oman, Pakistan, Philippines, Qatar, Saudi Arabia, Singapore, Sri Lanka, Syria, Taiwan, Tajikistan, Thailand, Turkey, Turkmenistan, UAE, Uzbekistan, Vietnam, Yemen.

TATA AIG student medical insurance

Studying abroad is a crucial opportunity for students. You can explore new lands, new cultures and new lifestyles during your spare time while abroad for studies. But you also should be aware that along with the opportunity there can be risk of accident or loss of sponsorship. TATA AIG StudentGuard insurance is designed for people who are travelling abroad to pursue their studies.

TATA AIG Domestic Travel Guard Insurance for Travel within India

Domestic Travel Guard completes the product offerings under Travel for Tata AIG. It is a plan suited for insuring a domestic travel journey on business or leisure. Domestic Travel is perhaps the most underpenetrated market in the India insurance space because most persons believe that there is no need for insurance while traveling within India. Tata AIG’s Domestic Guard covers travel outside the home city/location on any mode of transport ie. Air, Road, Rail etc.

Tata AIG’s Domestic Travel Guard has only one plan but there is an option for the insured to purchase multiple units (maximum upto 5 units) of this basic plan. Domestic Travel Guard Insurance also offers many unique benefits such as family transportation cover in case of emergencies, lost ticket reimbursements, missed departure compensations, personal liability coverage and personal accident insurance. So the next time you are traveling, ensure that you leave behind your worries and enjoy every moment of the trip.

- **We will pay the excess of what will be re-inbursed / paid by any other agency / authority.

- #Max units for Core benefits 5. The number of units for Add-on-benefits cannot exceed units for core benefits.

Features of TATA AIG international health insurance

- Missed Departure - In the event of missing the departure of your booked journey, the cost of your actual ticket(air / rail) will be reimbursed subject to certification by the concerned authority.

- Accommodation charges due to trip delay - In the event of the trip delay, the extra accommodation expenses incurred will be reimbursed.

- Lost ticket reimbursement - In case of a ticket loss due to which one cannot continue the journey the actual cost of the ticket will be reimbursed.

- Emergency medical evacuation - In the event of a medical emergency, the arrangements for the evacuation and transportation of the insured for appropriate & quality medical care, shall be covered.

- Repatriation of Remains – Coverage is provided up to the amount stated in the Policy Schedule for covered expenses reasonably incurred to return the insured’s mortal remains body to Your usual residence in India if You die during a Trip. Covered expenses include, but are not limited to, expenses for: (a) embalming;(b) cremation;(c) coffins; and (d) transportation.

- Replacement Of Staff (Business Trip) – the insurer shall pay upto the sum insured in respect of reasonable additional travel and accommodation expenses necessarily incurred under the circumstances in - 1. Sending out a replacement for an Insured Person; and returning the replacement following the completion of the duties necessarily undertaken. Alternately, returning the original person, back to the usual town in India or seding out the original Insured Person to complete a tour of duty following recovery from disability

- Family Transportation - If the insured is hospitalized for a long period of time following a covered hospitalization, the insurer will pay subject to SI for the the cost of round-trip economy airfare to bring one of Your Immediate Family Members chosen by You to and from Your bedside or pay the reimbursement of the hotel room charge due to convalescence after Your Hospital discharge

- 24 x 7 Assistance - Tata AIG’s assistance team will be available round the clock for any assistance or referral services like : Medical evacuation, Medical Assistance, Legal Assistance, Lost Luggage Support, Lost Travel Document Support, Assistance in emergency message transmission, Assistance in hotel accommodation, Arrangement of Bail Bond etc

How are Tata AIG’s overseas travel insurance claims administered/managed?

The Assistance Company, Europe Assistance offers claims support and assistance to the Traveller abroad, across the world. They have 8 alarm centres across the world and Tata AIG’s overseas portfolio is managed from Houston, US and Kuala Lumpur, Malaysia…Some of their services include:

- Pre-departure services- information about foreign locations, passport / visa requirements, immunization requirements etc

- Emergency Travel Agency- provides with 24 hour travel agency service for airline and hotel reservations.

- Medical Assistance- Assistance company will recommend or assist in securing the availability of services of Local Physicians, Admissions in Hospital and arranging other medical services. Assistance service including monitoring the patient and determining the next course of action is also carried out by them.

- Medical Evacuation & Repatriation- In the event of medical emergency, the assistance services will arrange for evacuation and transportation based on the medical evaluation of your condition. Travel Guard also provides for repatriation of remains in case of unfortunate death of the insured while overseas.

- Lost travel documents assistance

- Emergency Message transmission services

- Embassy referral services

- Claims procedures Information services

What are the exclusions under Tata AIG’s travel policies? Some of the key exclusions are listed below:

- Pre-existing Condition or any complication arising from it (unless specifically covered under certain plans that are purchased by the insured)

- Services, supplies, or treatment, including any period of Hospital confinement, which were not recommended or approved, and certified as Medically Necessary by a Physician

- Routine physicals or other examinations where there are no objective indications or impairment in normal health, and laboratory diagnostic or X-ray examinations except in the course of a disability established by the prior call or attendance of a Physician (an example could be a person visiting the hospital to check their blood pressure or their cholesterol levels, just for their information)

- Elective, cosmetic, or plastic surgery, except as a result of an Injury caused by a covered Accident

- Suicide, attempted suicide (whether sane or insane) or intentionally self inflicted Injury or Illness, or sexually transmitted conditions, mental or nervous disorder, anxiety, stress or depression, Acquired Immune Deficiency Syndrome (AIDS), Human Immune deficiency Virus (HIV) infection

- Being under the influence of drugs, alcohol, or other intoxicants or hallucinogens unless properly prescribed by a Physician and taken as prescribed

- Any loss arising out of War, civil war, invasion, insurrection, revolution, act of foreign enemy, hostilities (whether War be declared or not), rebellion, mutiny, use of military power or usurpation of government or military power, Terrorism

- Congenital anomalies or any complications or conditions arising therefrom

- Participation in winter sports, skydiving/parachuting, hang gliding, bungee jumping, scuba diving, mountain climbing (where ropes or guides are customarily used), riding or driving in races or rallies using a motorized vehicle or bicycle, caving or pot-holing, hunting or equestrian activities, skin diving or other underwater activity, rafting or canoeing involving white water rapids, yachting or boating outside coastal waters (2 miles), participation in any Professional Sports, any bodily contact sport or potentially dangerous sport for which You are untrained (please note that on our eIndiaInsurance website, we offer some insurance plans that cover Adventure sports…so if the insured is likely to participate in any of these activities, it’s best to buy a plan that covers Adventure Sports)

- Pregnancy and all related conditions, including services and supplies related to the diagnosis or treatment of infertility or other problems related to inability to conceive a child; birth control, including surgical procedures and devices

Why buy TATA AIG?

There are many advantages of buying TATA AIG’s insurance plans online. Some of the advantages are listed below:

- Tata AIG has been the undisputed market leader in the travel insurance market in India since inception in 2001 and till date enjoys amongst the highest market share in India.

- Tata AIG is a JV with AIG ($55 billion turnover) holding 24% share and balance 76% with Tata Group ($100 billion turnover Industrial conglomerate).

- TATA AIG satisfies all statutory regulations of IRDA in India.

- American International Group, Inc. (AIG) has Business Operations in 130 countries across the following Property, Casualty lines of business apart from Travel. This global presence is a big advantage while managing the Travel business worldwide.

- Europe Assistance have the largest network of hospitals in USA, which is managed through their Houston alarm centre. The Rest of the World Assistance servicing is done through the alarm centre in Kuala Lumpur. At any given time the TATA AIG’s insureds will have access to faster medical assistance services at more number of specialty hospitals

- AIG Travel Inc. is the worldwide Travel Insurance business was almost $1.05 billion across 80 countries including India. Clearly one of the leaders and the most preferred company for the longest time in the World Market for Travel Insurance.

Does Tata AIG Travel Insurance policies cover Covid19?

The outbreak of COVID-19 curbed international travel for a while. Currently, Indian citizens are able to travel on Vande Bharat flights or approved carriers to countries with which we have a travel bubble. Most countries will require you to have an international travel insurance policy that covers the cost of COVID-19 medical care. With TATA AIG, you don’t have to worry since all their international travel insurance plans help you deal with the medical costs associated with COVID-19 if you happen to test positive while you’re abroad.

What does Tata AIG Travel Insurance cover related to Covid19?

Tata AIG policies cover the following Covid related medical and non medical exigencies:

Tata AIG travel insurance Covid19 FAQs

If i am diagnosed with covid-19, who do i need to contact to seek assistance.

- For America’s policies, you can either call us at +1-833-440-1575 (Toll-free within the US and Canada) or write to us at [email protected]

- For other policies, you can either call us at +91 – 022 68227600 (Call back facility available) or write to us at [email protected]

Will I Require Any Special Documents While Filing a Claim for COVID-19?

No, you need not submit any special documents while filing a claim under COVID-19 cover. You just need to submit your report stating that you have tested positive for COVID-19 along with other documents for expenses being claimed.

If I Am Tested Positive for COVID-19, And am Instructed to maintain a Home Isolation, Will My Medical Expenses Be Covered?

No, medical expenses incurred during home isolation are not covered. However, if you are hospitalized, your medical expenses will be covered.

I travelled to a destination with Tata AIG travel insurance covering COVID-19 and get diagnosed with COVID-19 during the trip and am hospitalized for treatment. But, during the days of my hospitalization, the policy expires. In this case, will my post-policy expiry medical charges be claimable?

In such a case, Post your policy Expiry, your medical charges will be claimable till the date of discharge or upto 60 days, whichever is lesser, provided you are hospitalized during the policy period.

Tata AIG travel medical insurance frequently asked questions

What is travel insurance policy.

Travel insurance provides insurance coverage during ones travel overseas. You can also get domestic travel insurance for travel within India, Travel insurance provides coverage more than just for the duration of your travel itself. The scheme covers medical expenses incurred for any in-patient& outpatient treatment throughout your journey.

What is the ‘Policy Period’?

The duration of the Policy from the start date till the expiry date of the policy is called as ‘Policy Period’. You can benefit the coverage as specified only during the duration of ‘Policy Period’.

What is the percentage of the claim payable and whether it will be taxed?

The standard deductible under the Accident & Sickness Reimbursement is $100 irrespective of the value of the claim. The same is not taxable.

Can I get a comprehensive policy without any medical restrictions for my parents who are 60+ years and traveling overseas?

Yes, Tata AIG offers Travel Guard plans without sublimit restrictions, which you can opt for your parents who are 60+ and travelling overseas.

What are the sub-limits prescribed by the policy?

The sublimits are applicable to the Age Category of 56-79. Please refer the benefits under all Plans as in the Travel brochure of Insurance Company.

Are there any restrictions on the hospital where the treatment should be taken?

There is no restriction on the hospital where treatment should be taken. The treatment can be taken in any hospital in the world outside India. However, the only restriction is that the hospital should be a registered hospital under the local jurisdiction. It is however advisable in pre planned hospitalization, the Insured informs the Assistance Company whom may choose the direct them to a Network Hospital in the same locality.

Is the sum insured mentioned under each category applicable to all members traveling on the policy and is there any restriction on number of claims?

The sum insured as mentioned in the policy schedule is for each traveling member. For eg. If there are 3 family members traveling under a single Gold Plan policy, each of the them will be covered for a SI of $250,000 under the Accident & Sickness benefit. Also this limit of $00,000 is per accident which means that the limit gets topped up once a claim is settled. For eg. If Individual A has had an accident and had filed a claim for $10,000, in the event of another sickness claims he/she will be eligible for $200,000 in full and the same will not be reduced by the $10,000 already claimed under the first claim. However the deductible of $100 will be applicable for a single claim/incident. There is no restriction on the number of claims per person in the policy period.

Is a newborn child covered from day one under the Travel Policy?

A newborn child will be covered after 6 months of birth.

What is the Age Limits to buy TATA AIG travel insurance?

Persons between 6 months up to 70 years can buy TATA AIG travel insurance. For those who are above the age of 70 (i.e. 71-79) can buy Senior Citizen plan.

How do you define a trip?

Trip - means any Insured Journey during the Insured Period which starts and finishes in India and involves a destination(s) outside India; which lasts or is expected to last for: « up to 180 » Days or less if covered under Single Trip Insurance; or « up to 30/ 45 » Days or less per Trip, if covered under Annual Multi Trip Insurance.

What are the key benefits of TATA AIG travel health insurance?

What are the plan types in tata aig travel insurance.

Tata AIG essentially offers two types of travel insurance plans…one for single trip and another for multi trip (frequent travellers going abroad more than 3-4 trips in a year). Under the Single trip plans Tata AIG offers Travel Guard for individuals traveling to any part of the world…They also offer plans specific for Asia, and for Domestic travel within India. They also have an insurance plan specifically for students going abroad for their higher studies. Under the Multitrip they offer a comprehensive Annual Multitrip plan covering frequent travellers which has worldwide coverage.

What do you mean by deductible? How much is the deductible in TATA AIG travel insurance plans?

In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments. The policy deductible is applicable for each instance of sickness/ailment. For continuous treatments relating to the same sickness, the deductible will only be applicable once. The insured is required to quote the Claim reference number when contacting the assistance company while undergoing follow up / re-revisit treatments. The deductible will need to be paid in each instance of a new/ different ailment / sickness. The deductible under the Accident & Sickness is normally USD $100 under all Tata AIG plans.

Is TATA AIG travel insurance a cashless travel health insurance?

Yes, Tata AIG offers Cashless Travel/Health Insurance overseas for inpatient hospitalisation, subject to the treatment being covered under the policy. The Assistance TPA/Insurance company will pay up to 100% of the claim to the medical facility above the deductible amount (mentioned on the policy certificate), upto the maximum Sum Insured availed and subject to the policy terms and conditions. This will be done either by placing a Guarantee of Payment (GOP) or making a payment directly to the hospital. This is subject to eligibility of the insured for coverage. Let us look at a couple of examples… Example 1 - if the insured is admitted to the hospital for treatment for a covered illness and the hospital estimates the expenses to be $700, then Tata AIG will pay the hospital $600 and the insured will pay the $100 which is the deductible under the policy. Example 2 – if the insured is admitted to the hospital for treatment for a covered illness and the hospital estimates the expenses to be $70,000, and the total Sum Insured under the policy is $50,000, then Tata AIG will pay the hospital $49,900 and the insured will need to pay the remaining $20,100 which is the deductible under the policy. (Insurer will pay max sum insured of $50,000 minus deductible of $100).

Does TATA AIG travel health insurance cover outpatient medical expenses?

Yes, Tata AIG’s travel insurance plans do cover outpatient medical expenses upto the sum insured opted for by the traveller. However the difference between inpatient and outpatient treatment is that in the case of outpatient (OPD) treatment, the travelling insured needs to settle the hospital bills directly by making a payment to the facility and then get a refund from the insurance company after submitting the invoices to the claims team. This reimbursement process could take upto 7 working days after submitting all the relevant documents.

I am traveling to UK and Schengen countries? Which plan should I buy which will cover both the countries?

Tata AIG’s best selling plan is Travel Guard. Under Travel Guard, they offer an “Excluding Americas” plan which covers travellers who are going to any other country in the world except North and South America. This plan will cover you for your travel to both the Schengen countries and UK. Given the cost of healthcare in these countries it is advisable to go ahead with the Gold or Platinum plan.

What is the maximum coverage that TATA AIG travel health insurance offers for a traveler with pre-existing disease?

A pre existing condition means any condition, ailment or injury or related condition(s) for which the insured had signs or symptoms, and / or were diagnosed, and / or received medical advice/ treatment, within 48 months prior to commencement of the first Policy issued by the Insurer. This means that if the insured is traveling abroad with a pre existing condition and avails of any treatment abroad, Tata AIG will not be liable for paying the claim. Tata AIG however offers a limited coverage for medical arising due to pre existing conditions, when the situation is Life threatening in nature upto $1,500. A Life threatening condition is an unforeseen medical emergency, which puts the life of the insured at extreme risk. In such event, measures solely designed to relieve acute pain, provided to the Insured by the Physician for Disease/accident arising out of a pre-existing condition would be reimbursed upto a limit specified in the policy terms and conditions. The treatment for these emergency measures would be paid till the insured becomes medically stable or is relieved from acute pain. All further medical cost to improve or maintain medically stable state or to prevent the onset of acute pain would have borne by the Insured.

Can TATA AIG travel insurance be renewed online?

Technically Travel Insurance doesn’t fall under the category of insurance policies which have a renewal date. Two types of plans (Student Insurance and Annual Multi Trip plans) have a renewal date or what can be termed as an extension date. Hence once must apply for a renewal/extension on eindiainsurance and post approval from the insurance company, the extension / renewal policy can be purchased on the same website .

What is the maximum duration TATA AIG travel health insurance be purchased?

Tata AIG’s travel insurance plans for business and leisure travellers can be purchased for a maximum duration of 180 days at a time. As a special case, the traveller can seek an extension beyond this duration, but that is subject to approval from the Tata AIG team. However the Tata AIG Student plans have a maximum duration of 365 days at a time.

How do I claim if I want to use the policy for medical expenses?

There are two types of claims that an insured can file under a Travel Insurance policy. The first is a Cashless/Direct Settlement claim which is typically for Inpatient treatment for Accident & Sickness Medical expense claims. So if the insured is admitted to the hospital, the family should reach out to the Assistance TPA (their contact details are on the insurance certificate) and inform the about the hospitalisation. The Assistance Company will make coordinate with the hospital and insurance company to make a payment directly with the hospital. The other type of claims are Reimbursement claims where the upfront expenses are incurred by the insured and then a reimbursement is sought from the Insurance company. Reimbursement claim are usually for Outpatient Medical Expense claims and for Non Medical claims like Passport Loss, Baggage Delay/Loss, Trip Delay, Missed Connection, Personal Accident etc. Here the insured is required to retain bills, receipts, documents pertaining to the expenses incurred and then submit the same to the insurance company on their return to India. The documents are submitted along with a claim form which narrates the type of loss incurred and other information including bank details, policy details etc. All insurance companies reimburse these claims against the documents submitted in a standard outer timeframe of 7 working days subject to policy terms and conditions.

What is the difference between with medical sub limits and without medical sub limits plan? Can you explain the term "no medical sub limits"?

Tata AIG currently has sublimits under its Travel insurance policies as per the table below…this means that if there is an insured who has opted for an insurance policy with a sum insured of $50,000, in case of a surgery, the insurance company’s exposure/claims payment will be restricted to $10,000 (see table below for Surgical Treatment). Similarly there is a restriction on the room rent, ICU charges etc.

- ince the coverage does not have a restriction like a sublimit, the premium for Non Sublimit plans will be higher than the sublimit plans for a similar coverage.

- It is important to note that Tata AIG plans have a medical sublimit in place only for Sickness Medical expenses and this means that for any Accident related expenses, the maximum Sum insured is available to the insured for treatment.

NEED HELP? Contact our customer service team We are here to help you!

- Call : 080-41101026

Get quotes for Tata AIG travel insurance!

Review and compare the best travel insurance.

India travel insurance blogs and articles

Tips to find good and adequate international travel health insurance Know more

Comparison of overseas Healthcare cost and popular tourist destinations. Know more

How to use Indian visitor insurance in case of sudden sickness and accidents. Know more

Tata AIG travel insurance useful links

How to buy online.

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Already outside India

Travelers who have already traveled from India and do not have insurance can buy Tata AIG travel medical insurance after approval.

Tata AIG Travel Insurance Online Renewal

TATA AIG health insurance renewal customers can renew existing policy online before the exipry date at any time.

Tata AIG Travel Insurance Claims & Customer care

In case of a claim or reimbursement of treatment expenses, notify Tata AIG by contacting them.

Tata AIG Travel Insurance Policy Wordings

Kindly refer the Travel Policy Insurance Wordings for complete coverage details along with terms and conditions.

How are Claims settled?

Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

Resourceful Indian travel insurance links

Travel Insurance Benefits

Premium Calculator

India travel insurance FAQ

Search for tata aig travel insurance.

Compare TATA AIG Travel Insurance with other popular companies

- TATA AIG vs Reliance Travel

- TATA AIG vs Cholamandalam Travel

- TATA AIG vs Bajaj Allianz Travel

- TATA AIG vs Religare Travel

TATA AIG Travel Insurance links

Travel Asia

Senior Citizen

Pre Existing

Schengen Visa

Annual Multitrip

Domestic Travel

Parents Insurance

Chat with Us

Insurance Guide

Useful links

- Insurance Categories

- Compare Insurance

- Insurance Claims

- Disclaimer

- Privacy Policy

- Terms & Conditions

- Blog

- Resource Centre

- Insurance FAQs

- About Us

- Contact Us

- SiteMap

Product links

- Health Insurance

- Life Insurance

- Travel Insurance

- Motor Insurance

- Home Insurance

- Personal Accident

Keep in touch

InstantCover Insurance Web Aggregator Private limited 710, 6th B Cross, 16th Main Road, Koramangala 3rd Block, Bangalore - 560 034.

- 080-41101026

- Send an email

- Contact

- Chat with us

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

AIG Travel Guard insurance review: What you need to know

Whether you need an annual plan or a policy for a last-minute trip, travel guard can deliver..

Travel Guard is one of CNBC Select 's picks for best travel insurance , thanks to its wide range of customizable policies. But are any of them right for you? Below, we review the provider and its offers and how they compare to the competition to help you choose the right travel insurance for your next trip.

Travel Guard review

Other insurance offered, how it compares, bottom line, travel guard® travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Travel Guard® is a global travel insurance provider specializing in plans for leisure and business travelers. Its online travel insurance packages include five options, from basic and last-minute trip coverage to more comprehensive plans. This allows travelers to pick a plan that best matches their situation.

For example, budget-minded travelers might go for the Essential Plan which offers basic protections, such as trip cancellation, interruption and delay insurance, coverage for lost, damaged and delayed baggage, and medical, evacuation and death coverage.

On the other hand, the Deluxe Plan — the most comprehensive option — adds such extras as missed connection coverage, security evacuation, travel inconvenience benefits and more. It also boosts high limits for essential coverages.

Last-minute travelers can opt for the Pack N' Go Plan which only includes certain post-departure coverages. Or, if you travel often, the Annual Plan can cover your trips throughout the year.

Finally, Travel Guard offers "offline" travel insurance packages, meaning you'll have to call if you're looking for a specialty plan.

Coverage types

Depending on the plan, here are the types of protection Travel Guard can include in your package:

- Trip cancellations

- Trip interruption

- Baggage coverage

- Baggage delay

- Travel medical expenses

- Travel inconvenience benefits (reimbursement for such situations as runway delays, cruise diversion and other unforeseen situations)

- Medical evacuation

- Trip Saver (reimbursement for meals, hotels and transportation if you need to begin your trip sooner due to weather or airline changes)

- Trip exchange (reimbursement in case you have to cancel your trip and book a new one due to covered unforeseen circumstances)

- Security evacuation (due to a riot or civil disorder)

- Flight guard (coverage for accidental death or dismemberment that occurs when traveling by plane)

- Pre-existing medical conditions exclusion waiver

You can also customize your plan with add-ons, such as car rental insurance and "cancel for any reason" coverage .

Travel Guard landed on our list of the best travel insurance companies thanks to its variety of coverage. With plenty of options to choose from, both online and offline, it's easy to build a policy that meets your needs.

Travel Guard also features 24-hour concierge services that you can use to book a new flight in case of an emergency or delay.

The provider's website also offers informational resources — here, you can check travel news, read safety tips and find general travel advice. Additionally, the website lets you modify your plan, file a claim and check its status, or apply for a voucher or refund.

As of writing, Travel Guard doesn't offer any discounts. That's common for travel insurance — you're more likely to find deals when shopping for other types of insurance, such as home and auto insurance .

Travel Guard is a portfolio of travel insurance and travel-related services offered by AIG Travel, a member of American International Group (AIG). AIG also offers life insurance and a variety of business insurance products.

Travel Guard makes it easy to get a travel insurance policy customized to your needs. But before you purchase coverage, it's always a good idea to shop around.

For example, if you're going on a cruise, you might want to look at Nationwide Travel Insurance . The provider advertises cruise-specific insurance with three plan options available. This type of coverage is designed with issues unique to cruises in mind — from ship-based breakdowns to missed pre-pard excursions.

If you're planning a more active trip filled with rock climbing or sky diving, Berkshire Hathaway offers the AdrenalineCare® plan which features coverage for unforeseen costs that result from participating in extreme sports on your trip, as well as reimbursement for sporting equipment delay. Pre-existing conditions are covered under this plan (if you meet qualifying conditions).

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

As you can see, offerings vary by provider. It can be helpful to compare multiple companies and the plans they offer to find what works best for you. It's even better if you gather several quotes to ensure you're getting a good price for your policy.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Travel Guard offers plenty of ways to customize your policy, making it a solid choice for travel insurance. You can also access additional options by giving Travel Guard a call. However, make sure to check out other travel insurance companies too — comparison shopping is essential when picking any type of financial product.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

- 3 best Chase balance transfer credit cards of 2024 Jason Stauffer

IMAGES

VIDEO

COMMENTS

Affordable international coverage: Our international travel health insurance plans provide coverage against medical emergencies and more for a premium of as much as ₹40.82 per day. Quick and easy policy purchase: You can easily buy a Tata AIG travel medical insurance plan online in a few easy steps. Avoid the hassle of a medical check-up or ...

To apply for travel insurance for a Schengen visa, you must know the basic Schengen visa travel insurance requirements: The travel insurance for Schengen visa coverage value must be a minimum of 30,000 euros. However, Tata AIG provides a coverage amount up to approximate 4,31,000 euros at premium prices as less as ₹40.82 per day.

Explore FAQs on travel insurance coverage and medical treatments. Get answers before you buy your policy for a worry-free journey. ... Tata AIG travel insurance only includes the coverages mentioned in your insurance certificate. For more information, you may refer to the set of exclusions as mentioned in the policy wording. ...

Cons. The Travel Guard Deluxe plan has generous coverage but a high average cost compared to other top-rated policies. Medical expense coverage of $100,000 is on the low side, but might be ...

From medical emergencies to any other personal liability, an annual travel insurance policy will cover it all. At Tata AIG, we have some of the best-suited annual multi-trip insurance policies for you. Eligibility Criteria. The eligibility criteria to opt for multi-trip travel insurance varies from one insurer to another.

Tata AIG Aarogya Sanjeevani Policy. This policy is a standard health plan that covers the basic health-related expenses. The sum insured ranges from INR 1 lakh to INR 5 lakh. TATA AIG Aarogya ...

A medical emergency during your trip, for example, can be costly. With proper travel insurance, you have no reason to worry about ballooning expenses and can take on the challenges as they come your way. ... Get yourself insured with Tata AIG travel insurance and safeguard your journey in advance. Top features of Tata AIG Travel Insurance ...

The TATA AIG Travel Guard insurance policy is available as a single-trip and multi-trip policy for international travel. Robust coverage for accidental death and dismemberment, medical expenses ...

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan. Like the Preferred, you'll get 100% coverage for trip cancellation and 150% of the cost of your insured trip ...

The Tata AIG travel insurance is the best with good number of benefits like the premiums are low and the returns are high. The policy coverage is high and the claims are even better. The luggage and the accidental cases are inbuilt recoverable in the policy. Good future investment, Good work.

In the event of any service-related queries on cancellation/refund, endorsement and claim reimbursement, customers should contact TATA - AIG General Insurance through the below-mentioned option: Toll-Free: 1800-266-7780. Tolled: 022-66939500. For detailed policy wordings of International travel, please refer to the link. Stay insured!

For America's policies, you can either call us at +1-833-440-1575 (Toll-free within the US and Canada) or write to us at [email protected]. For other policies, you can either call us at +91 - 022 68227600 (Call back facility available) or write to us at [email protected].

AIG Travel Guard insurance review: What you need to know Whether you need an annual plan or a policy for a last-minute trip, Travel Guard can deliver. Published Mon, Apr 22 2024

Who can purchase travel insurance? Residents of India buying flight tickets directly from Air India can also purchase our travel insurance. The coverage is provided under a group travel insurance policy underwritten by Tata AIG General Insurance Company Limited (Tata AIG). Please make sure that your trip starts from India.

Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders).

At Faye Travel Insurance, an AI-powered app helps customers file claims for flight cancellations, baggage delays, and medical emergencies. The app speeds up the claims process, ensuring travelers ...

A vast majority of travelers visiting New York City for business or leisure usually buy visitors medical insurance. A visitors medical insurance plan in New York City can protect you from the disturbingly high costs of medical aid. It also helps you connect with the best medical facilities and can help fund the costs of treatment that you may ...

Travel Advisories . The U.S. Department of State urges travelers to avoid travel to Russia because of COVID-19 and to "exercise increased caution due to terrorism, harassment, and the arbitrary enforcement of local laws."; Anyone exploring more of Russia should avoid "The North Caucasus, including Chechnya and Mount Elbrus, due to terrorism, kidnapping, and risk of civil unrest."

These include 1. Urban polyclinics with specialists in different areas that offer general medical care. 2. Ambulatory and hospitals that provide a full range of services, including emergency care. 3. Emergency stations opened 24 hours a day, can be visited in a case of a non-life-threatening injury.

Tata AIG offers travel insurance to passengers of Air India India to Canada: Follow Vienna Convention, allow our diplomats to perform duties Live: Voting under way in MP, Chhattisgarh