The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

UN Tourism | Bringing the world closer

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism on Track for Full Recovery as New Data Shows Strong Start to 2023

- All Regions

International tourism is well on its way to returning to pre-pandemic levels, with twice as many people travelling during the first quarter of 2023 than in the same period of 2022.

New Data from UNWTO: What We've Learned

The second UNWTO World Tourism Barometer of the year shows that the sector's swift recovery has continued into 2023. It shows that:

- Overall, international arrivals reached 80% of pre-pandemic levels in the first quarter of 2023

- An estimated 235 million tourists travelled internationally in the first three months, more than double the same period of 2022.

- Tourism has continued to show its resilience. Revised data for 2022 shows over 960 million tourists travelling internationally last year, meaning two-thirds (66%) of pre-pandemic numbers were recovered.

Recovery by Region in Q1 2023:

- The Middle East saw the strongest performance as the only region exceeding 2019 arrivals (+15%) and the first to recover pre-pandemic numbers in a full quarter.

- Europe reached 90% of pre-pandemic levels, driven by strong intra-regional demand.

- Africa reached 88% and the Americas about 85% of 2019 levels

- Asia and the Pacific accelerated its recovery with 54% of pre-pandemic levels, but this upward trend is set to accelerate now that most destinations, particularly China , have re-opened.

In many places, we are close to or even above pre-pandemic levels of arrivals

The UNWTO data also analyses recovery by sub-region and by destination: Southern Mediterranean Europe and North Africa have also recovered pre-pandemic levels in Q1 2023, while Western Europe, Northern Europe, Central America and the Caribbean all came close to reaching those levels.

What it Means:

UNWTO Secretary-General Zurab Pololikashvili says: "The start of the year has shown again tourism's unique ability to bounce back. In many places, we are close to or even above pre-pandemic levels of arrivals. However, we must remain alert to challenges ranging from geopolitical insecurity, staffing shortages, and the potential impact of the cost-of-living crisis on tourism, and we must ensure tourism's return delivers on its responsibilities as a solution to the climate emergency and as a driver of inclusive development."

International tourism receipts grew back to hit the USD1 trillion mark in 2022, growing 50% in real terms compared to 2021, driven by the important rebound in international travel. International visitor spending reached 64% of pre-pandemic levels (-36% compared to 2019, measured in real terms). By regions, Europe enjoyed the best results in 2022 with nearly USD 550 billion in tourism receipts (EUR 520 billion), or 87% of pre-pandemic levels. Africa recovered 75% of its pre-pandemic receipts, the Middle East 70% and the Americas 68%. Due to prolonged border shutdowns, Asian destinations earned about 28%.

International tourism receipts: Percentage of 2019 levels recovered in 2022(%) *

International tourist arrivals: percentage of 2019 levels recovered in q1 2023 (%)*, looking ahead: what's in store.

The Q1 2023 results are in line with UNWTO's forward-looking scenarios for the year which project international arrivals to recover 80% to 95% of pre-pandemic levels. UNWTO's Panel of Experts expressed their confidence in a strong peak season (May-August) in the Northern Hemisphere, reflected in the latest UNWTO Confidence Index which indicates performance for the period is on track to be even better than 2022.

However, tourism's recovery also faces some challenges . According to the UNWTO Panel of Experts, the economic situation remains the main factor weighing on the effective recovery of international tourism in 2023, with high inflation and rising oil prices translating into higher transport and accommodations costs. As a result, tourists are expected to increasingly seek value for money and travel closer to home. Uncertainty derived from the Russian aggression against Ukraine and other mounting geopolitical tensions, also continue to represent downside risks.

International Tourist Arrivals, World and Regions

Related links.

- Download the News Release in PDF

- UNWTO World Tourism Barometer - EXCERPT Volume 21 • Issue 2 • May 2023

- World Tourism Barometer (PPT version)

- The UNWTO Tourism Data Dashboard

- UNWTO World Tourism Barometer

Category tags

Related content.

International Tourism to Reach Pre-Pandemic Levels in 2024

International Tourism to End 2023 Close to 90% of Pre-P...

Tourism’s Importance for Growth Highlighted in World Ec...

International Tourism Swiftly Overcoming Pandemic Downturn

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Travel forecast.

FORECAST January 17, 2024

Driven by Tourism Economics' travel forecasting model, the latest U.S. Travel Forecast projects the following:

International travel to the U.S. is growing quickly but is still far from a full pre-pandemic recovery.

An expected global macroeconomic slowdown, a strong dollar, and lengthy visa wait times could inhibit future growth, with volume reaching 98% of 2019 levels in 2024 (up from 84% recovered in 2023) and achieving a full recovery in 2025. Spending levels, when adjusted for inflation, are not expected to recover until 2026.

Other countries with whom the U.S. directly competes have recovered their pre-pandemic visitation rates more quickly, and some countries—such as France and Spain—have even increased their share of the global travel market. Meanwhile, U.S. global market share is declining.

Business travel is still expected to grow in 2024, albeit at a slower rate.

Volume in the sector is expected to end the year at 95% of 2019 levels—up from 89% recovered in 2023. Slowing economic growth will hinder domestic business travel’s recovery, with a full comeback in volume not expected until 2026. Domestic business travel spending is not expected to recover to pre-pandemic levels within the range of the forecast.

Domestic leisure growth decelerated through three quarters of 2023 as consumer spending slowed amid higher borrowing costs, tighter credit conditions and the restart of student loan repayments.

The sector achieved a full recovery to pre-pandemic levels in 2022.

To complement the travel forecast table, U.S. Travel has released an accompanying slide deck , which provides context for the latest projections. This document, which appears on the right under "downloads," is available exclusively to U.S. Travel members.

Member Price: $0

Non-Member Price: Become a member to access.

Global Tourism - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Global Tourism

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Global Tourism industry is , which means the top four companies generate of industry revenue.

The average concentration in the sector in Global is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Global Tourism industry?

What's driving the Global Tourism industry outlook?

What influences volatility in the Global Tourism industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Global Tourism industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Global Tourism industry's products and services performing?

What are innovations in the Global Tourism industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Global Tourism industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Global Tourism industry?

What are the export trends in the Global Tourism industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Global Tourism industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Global Tourism industry?

Barriers to Entry

What challenges do potential entrants in the Global Tourism industry?

Substitutes

What are substitutes in the Global Tourism industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Global Tourism industry

What power do buyers and suppliers have over the Global Tourism industry?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Global Tourism industry?

Regulation and Policy

What regulations impact the Global Tourism industry?

What assistance is available to the Global Tourism industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Global Tourism industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the global tourism industry.

The market size of the Global Tourism industry is measured at in .

How fast is the Global Tourism market projected to grow in the future?

Over the next five years, the Global Tourism market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Global Tourism from up to .

What factors are influencing the Global Tourism industry market trends?

Key drivers of the Global Tourism market include .

What are the main product lines for the Global Tourism market?

The Global Tourism market offers products and services including .

Which companies are the largest players in the Global Tourism industry?

Top companies in the Global Tourism industry, based on the revenue generated within the industry, includes .

How many people are employed in the Global Tourism industry?

The Global Tourism industry has employees in Global in .

How concentrated is the Global Tourism market in Global?

Market share concentration is for the Global Tourism industry, with the top four companies generating of market revenue in Global in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

Tourism outlook: A new spring in its step?

Global tourism receipts were well below the pre-pandemic level in 2021 as travel restrictions and uncertainty persisted, and changing consumer behavior dented economic recovery. But now, in the spring of 2022, some two years since COVID-19 forced governments to impose lockdowns and severe travel restrictions, there are plenty of signs of optimism for the future of tourism. This is true even with potential macroeconomic and geopolitical headwinds.

STR has evaluated consumer views and behaviors throughout the pandemic, and our latest survey, conducted in February 2022, canvassed opinion from a global audience to gauge sentiment and the outlook on travel.

Omicron hangover is there, but the future is bright

High COVID case rates and consumer wariness are two key factors which have likely influenced negative sentiment for travel in the short-term as net propensity remained in negative territory in our last survey.

Echoing a trend seen throughout the pandemic, international travel was again much less appealing than domestic travel with a backdrop of uncertainty and caution.

Meanwhile, the response to a post-pandemic travel outlook was markedly different. Net propensity to travel was +32% for domestic and international travel, which was an improvement from July and November 2021 findings. This demonstrates optimism for the industry and underscores a strong consumer appetite to travel in the future. Furthermore, parity in the views regarding domestic and international tourism signaled a boost for international travel as those trips have generally been considered less appealing than domestic travel during COVID-19—even when the pandemic is over.

The fate of travel could be in the hands of governments

COVID-19 as a barrier to travel continued to decline in significance although consumers overall maintain a cautious attitude toward the virus.

Among those who had not booked or undertaken travel recently, 42% said that COVID-19 was a major reason for not doing so compared with 56% in November 2021 and 67% in July 2021.

The sense that concerns about the virus are diminishing was echoed when consumers were asked to consider potential COVID-19 barriers to travel in the next 12 months. Comfort barriers, which include concerns regarding infection, and financial barriers, were of a lesser significance than government barriers. These findings suggest that the decisions of governments may pose the greatest risk to tourism recovery and not the views and behaviors of consumers.

City breaks gaining popularity

Assessing attitudes on city breaks could be one approach to monitor tourism recovery. Prior to the pandemic, it was estimated that almost half of all international tourists each year visited urban destinations . However, the pandemic has led to an aversion toward these destinations as consumers have sought increased space and minimized their interactions with others.

Now there are signs now that urban destinations are gaining in popularity, although these destinations continue to be less appealing overall than those with natural landscapes. Net interest in city breaks was -3%, while other urban locations came in at +19%. These responses in February 2022 were significant improvements from November 2021 results. Improving hotel performance data, in the U.S. for example, also aligns with improvement in the major metro areas as well.

Biophilia is a well-documented trend of the pandemic as consumers have wanted to interact more with nature and the outdoors. Data shows that interest in these types of trips may have peaked with net interest at +31% in February 2022 versus +32% and +33% in November and July 2021, respectively.

Increasing importance of other global factors

The emergence of the Omicron variant slowed recovery in Q4 2021 and Q1 2022 as restrictions were reimposed in some countries and higher infection rates invariably led to an increase in travel cancellations and uncertainty. However, by the end of Q1 2022, COVID-19 restrictions have largely been relaxed globally. This marked a significant shift in government response to the virus and hints that we’ve entered a new phase of the pandemic with increased tolerance of COVID-19. It remains to be seen though how other global factors, such as the squeeze on household income and the war in Ukraine , will influence consumer behavior and, ultimately, the recovery path for tourism in the coming weeks and months.

Welcome to STR

Please select your region below to continue.

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

- Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Tourism Market

Tourism Market: Global Industry Analysis and Opportunity Assessment 2022 - 2032

Market Insights on Tourism covering sales outlook, demand forecast and up-to-date key trends

- Report Preview

- Request ToC

- Request Methodology

Tourism Market Overview

Valued at US$ 10.5 Trillion in 2022, the global tourism market is expected to develop at a CAGR of 5% over the next ten years. By the end of this forecast year in 2032, analysts anticipate the tourism market size would be worth US$ 17.1 Trillion.

Countries such as the United States, France, and other European countries are traditionally famous tourist destinations across the world with an established tourism market. However, in recent years, several lesser-known Asian and African countries have come to the fore as destinations of appeal to foreign tourists. As a result, global tourism service providers are realigning their offerings to capitalize on the potential economic benefits of this shift.

The emergence of new trends such as adventure tourism, art tourism, and so on is projected to boost the global tourism market growth. Rock climbing, mountaineering, excavating, kayaking, and other pursuits are examples of adventure tourism significantly contributing to the tourism market share in recent years. Secondly, the adoption of tourism websites plays a significant role in the management and monetization of all types of tourism. The expanding tendency of social networking sites is also projected to give a promising possibility for tourism market advancement.

In accordance with a travel market analysis report, cultural and pilgrimage tourism are the sectors with the highest exponential growth in Asia, Africa, and South America, while adventure and ecological tourism are the fastest-growing sectors in North America and Europe. Unfortunately, outbreaks of diseases such as Ebola, SARS, and COVID in certain countries, along with geopolitical tensions, are having a significant impact on global tourism market opportunities.

During the years of the Covid-19 pandemic, the global tourism market dealt a near-fatal blow, and the market players' income declined due to severe lockdown circumstances and the suspension of transportation options. However, after the lifting of the lockdown, the tourism business recommenced in 2022 and is expected to return to its previous growth rate in the next one to two years.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Govt. Initiatives to Bode Well for the Market

Health tourism produces significant cash in emerging nations, allowing them to expand their healthcare operations. As a response, public bodies have increased their engagement through travel and tourism websites in support of healthcare services. For instance, in February 2018, the administration of Thailand announced the requirements for granting smart visas for professionals or entrepreneurs willing to engage in launching new enterprises, which could assist global health tourism service providers in expanding their operations in Thailand.

As per the previous tourism market report, Thailand was ranked as the most popular medical tourist attraction in 2019. Thailand's prominence as one of Asia's most popular dental tourism destinations has contributed to its overall market development.

Increasing per capita income is driving the growth of global tourism market leading to continuous growth in international tourism. Over the last five years, tourism market in emerging economies, especially countries in South America and Asia have driven the global tourism market. Compared to a decade ago, global tourism market has undergone a lot of changes. Emerging economies now account for more market share as compared to developed economies. As per International Travel Association (ITA), the number of international tourists arrivals in the U.S.is expected to grow from 69.8 million in 2013 to 83.8 million by 2018.

Government bodies and organizations such as World Tourism Organization UNWTO are promoting tourism in order to attract diverse tourists across the globe. These initiatives are leading to the growth of global tourism market. Adventure tourism is new concept in tourism market driving the overall tourism market. Further, medical tourism is also a new trend observed in global tourism market. Significant price difference of medical procedures between different countries is driving the trend of medical tourism across the world. Global sports and game events is another driving factor for the global tourism market. People travel to enjoy sports events such as FIFA World Cup 2014, London Olympics 2012 and ICC World Cup 2011. However, disease outbreaks such as Ebola in specific countries affect the global tourism up to large extent. Ebola outbreak in West Africa affected the tourism market in African region.

The global tourism market is segmented on the basis of type, industry products, activities involved and geography. On the basis of type, international tourism and domestic/local tourism are the two major types of tourism market. Along with it, on the basis of purpose of travel or tourism the market for global tourism is segmented into adventure tourism, leisure business travel, conference or seminar travel, business tourism, visiting relatives and friends. The companies providing tourism services offer various products and services to their customer. Thus, the industry products included in the global tourism industry are traveler accommodations, travel arrangement and reservations, air transportation, other local transport such as car rental , food and beverage establishments, recreation and entertainment, gasoline and other retail activities. Further, the industry activities considered within the global tourism market include traveler accommodation services, providing hospitality services to international tourists, airline operation, automotive rental, travel agent and tour arrangement services. Countries such as U.S., Germany and France are popular destinations for global tourism; but in recent years other less well known countries from Asia and Africa have emerged as destinations of interest for international travelers. Thus, tourism service providers are realigning their services in order to reap the economic benefits from this trend

The global tourism market has a low level of concentration as there are large numbers of international and local players in tourism market. The market for global tourism is highly fragmented in nature. Aban Offshore Ltd., Accor Group, Crown Ltd., Balkan Holidays Ltd., Fred Harvey Company and G Adventures are some of the players in global tourism market.

This research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically-supported and industry-validated market data and projections with a suitable set of assumptions and methodology. It provides analysis and information by categories such as market segments, regions, product type and distribution channels.

The report covers exhaustive analysis on

- Market Segments

- Market Dynamics

- Market Size

- Supply & Demand

- Current Trends/Issues/Challenges

- Competition & Companies involved

- Value Chain

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Regional analysis includes

- North America

- Latin America

- Western Europe

- Eastern Europe

- Middle East and Africa

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Recommendations

Travel and Tourism

Wildlife Tourism Market

Published : March 2024

Medical Tourism Market

Published : November 2023

Turkey Medical Tourism Market

Published : July 2023

Tourism Security Market

Published : February 2023

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2017-2021.

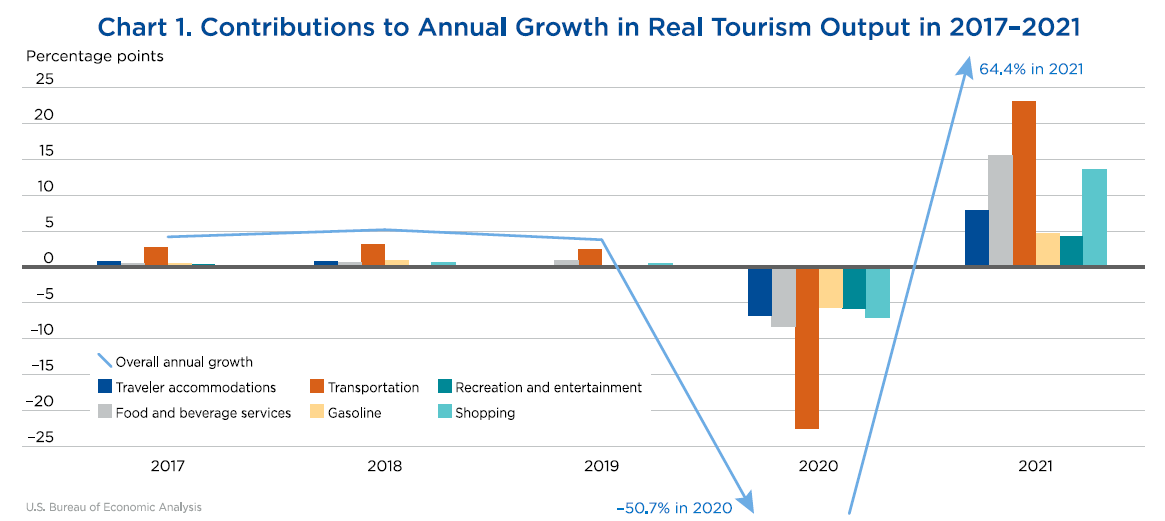

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 64.4 percent in 2021 after decreasing 50.7 percent in 2020, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2017–2021 By Sarah Osborne - Survey of Current Business February 2023

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data Sheets A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

More From Forbes

Travel trends 2024 report (part 1): authenticity and the rise in ai.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

In this series of articles, I talk to a wide range of travel experts, insiders and luxury brands to find out more about the future of travel for next year and beyond. Today, I look at two growing trends: the search for authentic travel and how technology can elevate travel experiences.

TREND 1: DEEP AND MEANINGFUL TRAVEL

Connecting with local communities, learning about local cultures and harnessing authentic experiences are all key for travelers.

An intrepid Travel trip to Karijini National Park, Western Australia.

In Intrepid Travel ’s recent ‘ A Sustainable Future for Travel ’ Report–which was published in collaboration with foresight agency, The Future Laboratory–‘People-Positive’ travel is pegged as the successor to sustainable travel. Going forward, regenerative travel will focus on travel being social-led instead of product-led, says the report, with people-positive travel focusing on forging deeper human connections, as well as considering the environmental and social impact. Inclusivity will also be key, with travel companies like Intrepid focusing on social change through connection. One area has seen Intrepid investing in recruiting more female leaders in locations such as Morocco and India, doubling the number of female leaders in recent years, and introducing 100 new Indigenous-focused trips in 2023. Focusing on local communities will also be key, helping prevent ‘tourism leakage’, when money flows out of the destinations.

Meeting local communities is key to Intrepid Travel's experiences.

“One of the problems with tourism at the moment is that it is the opposite of regenerative,” explains Darrell Wade, co-founder and chairman of Intrepid Travel. “It's extractive–and this cannot continue for much longer.”

Best High-Yield Savings Accounts Of September 2023

Best 5% interest savings accounts of september 2023.

A typical Polynesian barbecue at the Conrad Bora Bora Nui.

Meanwhile, Hilton ’s 2024 Trends Report finds the makeup of the modern traveller is evolving. It identifies an emerging theme of travelers prioritising experiences (85%), with many looking forward to exploring the unknown (81%), trying the local cuisine (64%) and learning about local customs and traditions (48%) when on holiday. And people are saving the pennies to make it happen, with more than half (52%) reducing spending in other areas to prioritise travel. Hilton’s global trends report found over half (56%) of people in Britain plan to spend more on travel in 2024 than in 2023. Some are going further to immerse themselves into local traditions, with 25% looking for locally-sourced food while away.

A Sri Lankan cookery class, with Cartology.

Cartology Travel , a bespoke, luxury travel agency, describes its focus as curating unique experiences around the world by working with select local partners to ensure memorable stays. The company agrees that the search for authentic travel experiences has been a growing trend over the past few years. “Clients are keen to meet and connect with local people and delve into new experiences,” says co-founder Justin Huxter.“This could be learning more about conservation alongside researchers in South Africa or a cooking class in Sri Lanka, in the home of a villager, which focuses on traditional recipes handed down through the generations.”

The Yukon River, Canada. Travel deeper with Audley Travel.

Clients are asking for more 'unique' experiences when they travel, says Audley Travel . The specialist in tailor-made travel says its North America specialists are responding with suggestions of experiences such as guided kayak and camping trips to see whales and wolves; or exploring lesser travelled regions, such as Saskatchewan and the Yukon. This trend is also being recognised by Audley’s partners in destinations. While arranging tailormade trips has always been at the heart of Audley’s operations, the country specialists report that an increasing number of partners are also customising the excursions and experiences that they offer for individual clients.

Original Travel has identified 'watercultralists' as a specifc upcoming trend.

Original Travel is also reporting a similar trend for travellers wanting to ‘deep-dive’ into a destination. In fact, it has created 10 new itineraries to satisfy the demand from what they are calling ‘waterculturalists’: divers who want to deepen their understanding of the seas and the life and cultures they support. Just as horticulturalists are students of the land and plantlife, ‘waterculturalists’ want to better understand the seas they explore, educate themselves on issues which need addressing and get involved in ways to protect and cultivate the waters and the cultures which depend on them–and it’s becoming a vital part to many more dive trips than ever before. The new and innovative projects include: building reef highways in Fiji; planting coral in the Philippines; restoring coral in French Polynesia; diving with Bubu fisherman in Indonesia and observing local traditional fishing practices from a unique perspective underwater; and joining a safari dive in Tanzania, where you will be equipped with an earpiece to listen to the dive guide as they take you on a tour of coral gardens.

TREND 2: AI AND TRAVEL

How advances in technology and artificial intelligence can aid the hospitality sector and secure the future of the planet.

Timbers Resorts , a boutique hospitality developer and operator, says that AI can play an important role in hospitality. CMO, Heidi Nowak, says: “In the luxury travel sector we stress there is no substitute for personalized service when it comes to providing a truly meaningful experience for guests. However, AI can and does play an effective role both for guests and staff. We discovered that the optimal approach in utilizing this technology is for tasks that require less of a human touch, such as expediting requests for fresh linens or addressing various housekeeping requests.”

Timbers Resorts, Kaua'i, Hawaii.

She continues: “Through AI, guests can share their needs via text which can be sent from anywhere and at any time throughout their stay. So if there is a request for fresh glassware or towels, they can make that ask while they’re working on their swing on the golf course or spending a day on the slopes and can expect the delivery to occur before their return. We strongly believe technology could never replace the personal connection creating lasting memories with every guest's stay. We recommend AI for routine tasks where efficiency is the top priority.”

Wearable Carbon Tracker.

Intrepid Travel ’s aforementioned ‘A Sustainable Future for Travel’ Report also touches upon artificial intelligence. The report says: “A genuine concern for the state of the planet and its people manifests as holding the travel industry accountable. These are Travel Transformers, who not only want to mitigate any further harm but plan to drive positive change through travel. They won’t let the travel industry get away with greenwashing, and they want tangible results. By 2040, it will be unusual to see members of Generation Alpha without a carbon footprint tracker on their smartphones. Every Uber ride, plane journey and trip to the supermarket will be logged in their devices, noting their carbon footprint in real time.”

Tehnology can only assist the travel of the future, says Intrepid Travel.

The report also forecasts how technology can aid regenerative travel: “Tracking travel metrics in real time will create an era of live traceability and accountability within the travel industry. 2040’s travelers will hold themselves accountable, leaning into technology to measure and optimize their behaviours in line with environmental values and targets. By 2028, the global travel technology market is predicted to reach £11.2bn, up from £7.3bn in 2022. This booming category will give Travel Transformers and other cohorts the means to log their daily emissions and track their travel metrics in real time to help them reduce their footprints. Noteworthy strides have already been made in shaping this landscape. Ariel, a sustainability platform, is recognised for its accuracy in gauging carbon footprints and subsequently offsetting emissions for individuals and businesses. Other platforms, such as Klima, Earth Hero and Joro, calculate travel and everyday footprints travel, aiding people to achieve decarbonisation goals.”

“In 2020, Intrepid Travel adopted science-based targets, which set out a path to reduce emissions in accordance with the Paris Climate Agreement. The World Economic Forum’s Mission Possible Platform aims to achieve net-zero carbon emissions by mid-century from a group of traditionally ‘hard-to-abate’ sectors, including aviation.”

- Editorial Standards

- Reprints & Permissions

- New Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Travel and tourism to break records, bring over $11 trillion in 2024: report

The global travel and tourism industry is expected to be at an 'all-time high' this year.

Air travel demand is incredibly strong: TSA Administrator David Pekoske

TSA Administrator David Pekoske discusses air travel demand, flight disruptions, his experience going through TSA and firearm detections at checkpoints.

Travel and tourism is expected to be a boon for the global economy this year.

Countries around the world will see travel and tourism produce $11.1 trillion in 2024, according to a report released Thursday by the World Travel & Tourism Council.

The group said the forecasted global economic contribution would mark an "all-time high" from the roughly $10 trillion the industry brought in pre-pandemic 2019.

Countries around the world will see travel and tourism produce $11.1 trillion in 2024, according to a report. ( / iStock)

The coronavirus hit many industries hard, with travel and tourism in particular seeing negative impacts from the lockdowns and restrictions instituted in the early days of the pandemic.

CLICK HERE TO READ MORE ON FOX BUSINESS

This year, both international and domestic tourists are expected to splash out during their travels.

The report, which involved a partnership with Oxford Economics, projected a record $5.4 trillion in spending would come from domestic travelers. That would set a record, according to the WTTC.

Meanwhile, international tourists will reportedly contribute $1.89 trillion.

The report projected a record $5.4 trillion in spending from domestic travelers. (Jeffrey Greenberg/Universal Images Group via Getty Images / Getty Images)

And the WTTC had an even rosier outlook for a decade from now, when it predicted global tourism and travel will be responsible for nearly $16 trillion and 449 million jobs.

ECLIPSE TOURISM EXPECTED TO BRING BIG BUCKS TO AREAS IN PATH OF TOTALITY

The travel and tourism industry’s performance in 2023 provided momentum for this year, the group said.

In 2023, it produced $9.9 trillion around the world .

"This isn’t just about breaking records, we’re no longer talking about a recovery – this is a story of the sector back at its best after a difficult few years, providing a significant economic boost to countries around the world and supporting millions of jobs," WTTC CEO Julia Simpson said in a Thursday statement. "There’s a risk however, we need the U.S. and Chinese governments to support their national Travel & Tourism sectors."

Passengers walk past a flight status board in Terminal C at Orlando International Airport, Jan. 11, 2023, after the FAA grounded all U.S. flights, reportedly due to an FAA computer system failure. (Joe Burbank/Orlando Sentinel/Tribune News Service via / Getty Images)

The head of the WTTC warned the U.S . and China could "continue to suffer whilst other countries are seeing international visitors return much faster" if they don’t.

CRUISE LINES SAILING INTO 2024 SEEING STRONG DEMAND, AAA SAYS

The group pegged 2023’s U.S. international visitor spending at "more than a quarter below the peak of 2019" and China’s "almost 60% down."

In August, the WTTC issued a prediction that the U.S. travel and tourism industry would provide $2.2 trillion in 2023. It was responsible for $2 trillion the year prior to that.

Ask Skift: What Are Summer Travel Trends for 2024?

Rashaad Jorden , Skift

April 12th, 2024 at 9:35 AM EDT

As a monster summer travel season is a rapidly approaching, here are some trends worth noting as the industry continues its recovery from the pandemic.

Rashaad Jorden

Travel brands are busy preparing for the upcoming summer season, and travel demand is xpected to surpass pre-pandemic levels . What are the major trends for this summer?

We put the question to our artificial intelligence chatbot Ask Skift , which used information from our past news coverage and research, and we did additional reporting as well.

Ask Skift said:

Based on recent articles from Skift, several travel trends are emerging for summer 2024.

First, many travelers are keeping an open mind when it comes to their summer trips. In fact, 51% of visitors to a certain website and app are still undecided on a destination or departure date as of March 2024.

In terms of specific travel behaviors, there’s a growing trend of digital nomadism, where people are traveling while working, spurred on by the rise of remote work. This trend is not only popular among solo travelers but across different traveler segments as well. There’s also a noticeable increase in travelers seeking social connections during their travels. For instance, about 66% of Hostelworld’s guests travel solo to meet people to hang out with .

Personalized experiences are becoming more in-demand , with more travelers hiring private drivers and guides to design their unique tours, showing a growing demand for more independent travel experiences.

In terms of accommodation, hotels remain the top choice, but vacation rentals are also gaining in popularity . Direct bookings, especially for hotels and flights, maintain an upward trend. It’s also worth noting that international tourism is predicted to rise by 15% in 2024 , exceeding 2019 levels by 2%, suggesting a strong recovery for the travel industry.

Ask Skift Is the AI Chatbot for the Travel Industry

Go deeper into the business of travel with Skift’s new AI chatbot.

What else you need to know:

One trend to look out for this summer is the rise of “ coolcations ,” which are summer vacations in colder and more moderate destinations. Condé Nast Traveler listed coolcationing as one of 2024’s biggest travel trends , with a growing number of travelers looking to avoid scorching heat .

A survey by luxury travel network Virtuoso found 75% of travelers are seeking destinations with more moderate weather, according to its Vice of President of Sustainability Javier Arrendondo. In addition, 46% of Virtuoso advisors said climate change was causing their clients to travel differently.

As for where travelers might head to this summer, a survey by Skyscanner found 53% of those based in Europe, the Middle East and Africa said they’re choosing Europe as a summer holiday destination this year. That’s a 4% percent jump from 2023. Meanwhile, roughly 12% of EMEA travelers are looking to visit Southeast Asia this summer, a 1% increase from last year.

Skyscanner attributed that shift in part to a 4% decline in interest among EMEA travelers in visiting North America this summer, which the travel metasearch site said was likely caused by the strength of the U.S. dollar.

The strength of the U.S. dollar is also driving more Americans to plan travel to destinations where their money will go further. Tour operator Intrepid Travel said its North American bookings to Southeast Asia for this year are up 15% from 2023, according to the company’s President of the Americas Matt Berna.

As for travelers based in the Asia-Pacific region, more of them are looking to visit destinations closer to home this summer. Skyscanner found roughly 10% fewer APAC travelers are looking to book trips to Europe, while it saw 4% and 1% increases in those looking to visit North Asia and Southeast Asia this summer, respectively.

Finally, this summer is poised to see a further boom in the rise of ‘ destination dupes ,’ in which travelers opt to visit a less crowded or less expensive location with a vibe similar to that of a more popular destination.

“We’ve seen some more ‘alternate’ destinations starting to grow in popularity, like Balkans in Europe with lesser-known destinations like Albania becoming a popular alternate to Croatia,” said Berna, adding that bookings made to Italy and France for the first quarter of 2024 dropped 25% from the previous year.

“We anticipate more people this summer looking to avoid those bucket list trips this year to escape the crowds, as well as find better deals.”

Latest News

The daily newsletter.

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ask skift , climate change , skyscanner , summer , summer travel

Photo credit: This summer will continue to see more scenes like this. Phil Shirley / Flickr

- Share full article

Aurora Tourism in Iceland: You Can Seek, but You May Not Find

The country markets itself as a destination to see the northern lights — especially this year, which is a peak time for solar activity. But they can be elusive, as one writer recently found.

In Reykjavík, Iceland, aurora borealis tourism is a booming business. Hopeful tourists board buses to head out into the night in search of the northern lights. Credit... Sigga Ella for The New York Times

Supported by

By Amelia Nierenberg

Amelia Nierenberg spent four nights searching for the northern lights in Iceland.

- March 25, 2024

From the outside, it may seem like the northern lights dance across Iceland’s skies each night. On Icelandair ads, planes fly across shimmering curtains in the sky. On social media, travelers gaze at the green bands above them . The lights are even on some recycling bins in Reykjavík, the capital: “Keep Iceland Clean.”

In the past decade or so, an aurora borealis industrial complex has boomed in Iceland. Many rent a car and go out on their own, but there are northern lights big bus tours and northern lights minibus tours and northern lights Super Jeep tours . There are private guides and boat cruises . There’s an observatory base camp . There’s even a museum .

But the lights can be elusive.

“Tourists sometimes expect, like, ‘At what time do you turn them on?’” said Björn Saevar Einarsson, a forecaster at Iceland’s meteorological office , chuckling. “Like we have a switch in the back room.”

This year, the letdowns are especially intense.

The northern lights, which are also called the aurora borealis, are most visible when there are solar flares, which are big eruptions on the sun that send charged particles toward Earth. This year, the sun is approaching the peak of its 11-year cycle of activity , which some assume means that the displays could peak, too.

But the enhanced solar activity doesn’t necessarily mean the northern lights will be brighter or more frequent, scientists wearily explain. Instead, they mostly mean that the lights can be seen farther south than usual: In recent months, they have been visible in Arizona , Missouri and southern England .

That doesn’t mean much for Iceland.

In fact, Icelanders and scientists said, this winter is nothing special. Sometimes, the lights are there. Sometimes, they aren’t. Just like always.

Hunting the lights

But nothing special, with the northern lights, is still very special. And so tourists keep coming .

Last month, I joined the fray. For four nights, I looked for telltale sky shimmers in and around Reykjavík.

I booked my tickets riding high — this was the best year yet, right? But as I learned more, and as my flight neared, my hopes ebbed. Scientists and tour leaders gently told me that the skies were cloudy and the solar activity seemed quiet.

“Just to let you know the forecast doesn’t look too good” Inga Dís Richter, the chief commercial officer at Icelandia , a tourism agency, wrote in an email two days before I planned to take a minibus trip with Reykjavik Excursions , one of its tour operators.

“But,” she added, “this can change.”

To find the lights, guides and travelers often rely on aurora forecasts, which overlay cloud cover and solar activity. They check them constantly, like a bride with an outdoor wedding in mid-April.

Some of the forecasts are free, like the aurora forecast run by Iceland’s meteorological office or Iceland at Night , which includes space weather. (Some are not — Aurora Forecast , which costs $12.99 a year, sends alerts.) Many people also turn to Facebook pages , where enthusiasts hungrily swap sightings.

Luck, though, is everything.

“There’s only one thing less predictable with the northern lights, and that’s the Arctic weather,” said John Mason, a global expert on the northern lights. “An aurora forecast is barely worth the paper that it’s written on.”

The guides work hard to explain the science, and set expectations. Most companies offer a free rebooking option if the lights do not show.

On my first night of aurora stalking, despite Ms. Richter’s warnings, I joined an expectant group on the Reykjavík Excursions minibus. For $88, I got a seat on the 19-person bus, which left the city’s central bus station at 9:30 p.m.

Over the next three to four hours, we would drive through the Icelandic night together. I’d either see something astonishing with these strangers — the sky, banded with light — or shiver with them shoulder-to-shoulder, awkward in the cold.

As we pulled onto the road, Gudjon Gunnarsson, the guide, set the mood early. “We are going hunting for the lights,” he said, emphasizing the word “hunting,” “similar to going out fishing in a lake.”

He drove for about 45 minutes, letting Reykjavík’s glow fade behind us. The city has about 140,000 people, and no real skyscrapers, so there’s limited light pollution. Although the northern lights can appear over the city, it’s best to see them in total darkness.

Then he paused and consulted with another guide.

“It is too cloudy here,” he told his flock. “So we will keep driving.”

But as we kept driving, clouds turned to a dense fog, so thick that the moon all but disappeared.

Mr. Gunnarsson turned off the main highway about an hour after we left Reykjavík. He parked in a parking lot. Or maybe it was a side street? The darkness was so deep that I could only make out the moonlight on the ocean, and only then after my eyes adjusted.

We disembarked and stood dutifully beside him, staring up at the sky. Then, one woman pointed toward Reykjavík. Were those the lights? (No. That was light pollution.)

Christof Reinhard, 65, who owns a medical laser company and was visiting with his family from Paris, mused that our search was a little bit like a safari. Sure, the desert is amazing, but it’s much better with lions. Or, maybe, was this more like a whale watch?

“Instead of a boat,” he said, “you have a bus.”

Mr. Gunnarsson watched the group stomp their feet and bend into the wind. Fifteen minutes. Then, half an hour. The clouds hung thick above. “There’s nothing happening here, as you can see,” he finally said to relieved chuckles. “It’s one of those nights where you just have to give up.”

Tourists can get mad, Mr. Gunnarsson and other guides said. It’s rare, but it does happen.

“It’s the trip that has our worst reviews,” said Eric Larimer, the digital marketing manager for Gray Line Iceland , a day tour and airport transport company.

A wake-up call for the aurora

For some, the joy is in the search, even if there is no find. A few focus on astronomy, often opting to stay at Hotel Rangá , which is just off the main ring road (Route 1) near Iceland’s south coast.

The hotel looks unassuming — low-slung and wooden — but it’s one of the most famous in Iceland. (The Kardashians stayed there . So did the Real Housewives of Orange County .) A standard room costs more than $300, depending on the season.

But Rangá doesn’t just cater to celebrities. It also draws astronomy buffs, enticed by its “aurora wake-up call” service and its observatory, which has state-of-the-art telescopes.

“One thing is to sell them,” said Fridrik Pálsson, the hotel’s owner, speaking of the northern lights. “Another thing is to deliver them.”

About 20 years ago, before the northern lights industry took off, he delegated the night security guard to monitor the sky. The guard pokes his head out every few minutes to look for the telltale flicker. If he sees the lights, he alerts the guests.

The service aims to address one of the main issues with hunting for the northern lights: They are usually only visible on winter nights, when it is very cold, very windy and very late.

“To be a good northern lights observer, you need the constitution of an insomniac polar bear,” Dr. Mason said.

My room phone, alas, stayed silent. But I did dream about the lights — great Wonka colors swirling, strangely, behind the Chrysler Building.

Mr. Pálsson built the observatory, too. Even if the lights didn’t show up, he figured, the stars are still magnificent — and, for city dwellers, also rare. The hotel contracts astronomers to work the telescopes and explain the stars to guests.On my second night in Iceland, as twilight slipped below happy-hour skies, I crunched across the snow to the observatory with Saevar Helgi Bragason, an Icelandic science communicator who leads the astronomy program.

He bent into a toddler-size telescope, focusing it on the moon’s craters. They looked clearer than the hotel, just a short walk away. It was too early for the lights, he said. And that evening seemed too cloudy (on Earth) and too quiet (on the sun).

Mr. Bragason joked that the lights can get in his way — they create a mist over the stars he really wants to see. But tourists often come specifically to see them. And sometimes, he said, as they wait impatiently, they can miss the real wonder.

“You’re left with these beautiful skies above you,” he said. “Basically, literally, another universe opens up.”

Creating a lights season

Hotel Rangá was a pioneer in Iceland’s northern lights tourism industry: About two decades ago, people came to Iceland for the long summer days, and left as daylight slipped farther south.

“I found it rather stupid in the beginning,” admitted Mr. Pálsson, the owner of Rangá, speaking of northern lights tourism.

But spreading tourism throughout the year made sense. Partly, that was an environmental concern. The tourists would crowd the country’s extraordinary natural sites over just a few months. It was also economic. When the visitors left Iceland, tourism jobs would ebb with the sunlight.

So the northern lights, which are reliably visible from September to March, became the backbone of the country’s winter branding, said Sveinn Birkir Björnsson, the marketing and communications director at Business Iceland , which promotes the country.