- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

5 Best Travel Cards for Dubai

Getting an international travel card before you travel to Dubai can make it cheaper and more convenient when you spend in United Arab Emirates Dirham. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to AED for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to Dubai, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for Dubai:

Let's kick off our roundup of the best travel cards for Dubai with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Dubai.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Dubai. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Dubai or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in AED, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in AED when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Dubai, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Dubai with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to AED instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in Dubai and globally. Monzo accounts are designed for holding USD only - but you can spend in AED and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Dubai. While these cards don’t usually let you hold a balance in AED, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Dubai or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Dubai. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Dubai

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Dubai include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in AED can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Dubai

The best travel debit card for Dubai really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in AED.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Dubai. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Dubai in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Dubai - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Dubai

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Dubai card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use AED?

If you have AED, you should be able to use it in a few countries. You may decide to keep your travel card topped up with a balance for this trip to Dubai or for the next time you’re headed somewhere which uses AED.

What should you be aware of when travelling to Dubai

You’re sure to have a great time in Dubai - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Dubai before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to AED before you travel to Dubai if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to AED in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Dubai to make an ATM withdrawal in AED if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Dubai

Ultimately the best travel card for your trip to Dubai will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Dubai

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Dubai.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / AED rate to calculate how much United Arab Emirates Dirham you would receive when exchanging / spending $4,000 USD. The card provider offering the most AED is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

- Latest News

- Emergencies

- Ask the Law

- GN Fun Drive

- Visa+Immigration

- Phone+Internet

- Reader Queries

- Safety+Security

- Banking & Insurance

- Dubai Airshow

- Corporate Tax

- Top Destinations

- Corporate News

- Electronics

- Home and Kitchen

- Consumables

- Saving and Investment

Budget Living

- Expert Columns

- Community Tips

- Cryptocurrency

- Cooking and Cuisines

- Guide to Cooking

- Art & People

- Friday Partner

- Daily Crossword

- Word Search

- Philippines

- Australia-New Zealand

- Corrections

- From the Editors

- Special Reports

- Pregnancy & Baby

- Learning & Play

- Child Health

- For Mums & Dads

- UAE Success Stories

- Live the Luxury

- Culture and History

- Staying Connected

- Entertainment

- Live Scores

- Point Table

- Top Scorers

- Photos & Videos

- Course Reviews

- Learn to Play

- South Indian

- Arab Celebs

- Health+Fitness

- Gitex Global 2023

- Best Of Bollywood

- Special Features

- Investing in the Future

- Know Plan Go

- Gratuity Calculator

- Notifications

- Prayer Times

Planning an overseas trip? Prepaid travel credit or debit card is one of the cheapest way to spend

Travel cards allow you to make use of exchange rates, but check what your card charges you

Dubai: Although most credit and debit cards let you spend abroad, they will charge you whenever you do so – and even if your card provider gives great rates, it usually adds foreign currency costs.

On top of this, many debit cards charge a flat fee each and every time you spend overseas, regardless of the amount. Withdrawing cash usually attracts fees and unavoidable interest on credit cards.

- Got hit with a credit charge when travelling abroad? Know these two overseas card fees

UAE prepaid travel cards to your financial advantage

In such predicaments you can take advantage of prepaid or reloadable travel cards. These cards don't charge these fees, so you get the same rate the bank does when it processes your transaction.

This is usually a couple of days after using the card, so you won't know the exact rate you're getting at the time. If you're worried about currency swings, a prepaid travel card can also help you lock in a rate.

“People who do not have savings accounts, or who use them very little, used to be the main users of prepaid cards,” explained Richa Dev, a Dubai-based independent travel consultant. “But prepaid-card usage is now common due to increased adoption among those consumers who do have bank accounts.”

People who do not have savings accounts, or who use them very little, used to be the main users of prepaid cards - Richa Dev

An illustration on costs with a travel card on a trip to London

On an overseas trip from the UAE to London, let’s say you spend the equivalent of $1,000, which is about Dh4,000, at a prominent retail outlet.

Assuming five $100 (approx. Dh400) cash withdrawals and 20 transactions of $25 (approx. Dh100) each on the cards, based on the calculated average of five travel cards, here’s how much this can cost in British pounds (GBP) after you have converted UAE dirhams or US dollars in the Emirates:

• Travel credit or debit card repaid in full: £818 (Dh3,370)

• Cash via cheapest money exchange via pick up in London: £821 (Dh3,382)

• Cash from an outlet on London’s high street: £829 (Dh3,415)

• Using a debit card with a spending charge: £872 (Dh3,592)

• Exchanging cash at airport: £949 (Dh3,909)

How do prepaid cards fare versus credit and debit cards?

Although prepaid cards look similar to debit and credit cards, they all function differently. With a credit card, you borrow money you must pay back, with interest if you do not pay the balance by the due date. To get one you have to have good credit, and using one responsibly will continue to improve your credit rating. This in turn can help you down the line to get better rates on car loans, mortgages, etc. But using a credit card irresponsibly can lead to overspending, late payments and, ultimately, damaged credit.

On the other hand, a debit card is issued by your bank and linked to your savings account. The money is yours and there are no interest charges, but there can be penalty fees for overdrafts. As with your chequebook, you'll want to keep track of your balance.

With prepaid cards, you spend money that has previously been loaded onto them; they aren't connected to savings accounts. They work like debit cards, but you do not need a bank account (or good credit) to get one.

You can purchase the card in a certain amount, but you can add additional money to it at any time. When the balance is gone, your card stops working unless you add more money to it.

A perk includes a prepaid card being easy to get and one that you can buy almost anywhere - Sophie Cortez

What hidden fees should you watch out for with prepaid cards?

All prepaid cards are different and may charge varying fees, from a charge for each time you use the card to make a purchase to a fee for using it to withdraw cash from an ATM.

“These fees can add up quickly, eating away at the balance of money you've loaded onto the card. It's important to read the fine print to find the best deal. Look for information on the card, inside the card package or at the card issuer's website,” added Dev.

“Some activities your card provider might charge for and a range of their associated fees include - card purchase and/or activation fee of $0-$30 (Dh110), card reload fee of $0-$5 (Dh20), monthly service fee of $0-$9.95 (Dh40), purchase transaction fee of $0.49-$2 (Dh8), ATM withdrawal fee $1-$3 (Dh10), inactivity fee of $2-$5.95 (Dh25) per month.”

Dev added that some other fees include balance inquiry fees of $0.49-$2 (Dh8), fee for a paper statement of $0-$5.95-plus (Dh25), lost card replacement fee of over $10 (Dh40), card cancellation fee of around $10, overdraft charge of $15 (Dh55).

Other possible seemingly insignificant fee-incurring actions include bill payment, additional card, inactivity, to stop a payment, when a payment is declined, card-to-card transfer and a foreign transaction.

Key perks to using a prepaid card

The advantages and disadvantages of prepaid-card use varies widely by card. Following are some issues to consider when purchasing a prepaid card; not all cards have all the pros nor all the cons listed below.

“Some perks include a prepaid card being easy to get and one that you can buy almost anywhere. It is also easy to use and you can use them pretty much everywhere – with the added advantage of it being comparatively safer,” said Sophia Sanchez, a travel itinerary planner at a UAE-based European tour operator.

“If you lose cash, it's limited. If your credit card is stolen, the thief could rack up substantial charges. If you lose your debit card, a thief could drain your account. But if you lose a prepaid card, your loss is limited to the amount on the card. Also, some prepaid cards offer protections against loss or theft.”

Cortez also added that when it comes to prepaid cards, there is no credit check to get those cards. This is a plus for those with not-so-great credit histories. It is also an effective budgeting tool. You can load your monthly grocery budget, for example, on a prepaid card.

“Additionally, when using a prepaid card, you're spending a specific amount of money you've loaded onto it, so there is no chance of incurring debt with it,” Sanchez explained.

Key risks to using a prepaid card

Apart from the above-mentioned hidden fees, another key drawback is that money stored on prepaid cards does not accrue interest.

“Additionally, prepaid cards may not be safer than credit cards given that all the amounts on a credit card is protected from theft given that it is not your own hard-earned money,” added Sanchez.

“Prepaid cards also do not provide credit-history boost. Prepaid-card activity is not reported to the major credit-reporting agencies, so it doesn't affect your credit score. As such, it will not help build your credit.”

Verdict: Are prepaid cards better when travelling?

Since prepaid cards are associated with major card networks — Visa, Mastercard, American Express and Discover — they can be used anywhere debit cards can: to buy groceries, fill up on gas and even pay bills online. One downside of prepaid cards is hidden fees.

Prepaid cards are accepted where most debit and credit cards are, so they're an easy option to utilise when you're traveling. So even if you're planning a vacation within the country, these prepaid debit cards are the best options to choose from.

When travelling overseas, prepaid travel cards make it easy to get cash in the local currency without the risk of using your own debit card, costly credit card cash withdrawals or the hassle of traveller’s cheques.

In general, however, it's more convenient and secure to have a traditional debit card than a prepaid card. But if you're unable to open a bank account or are on a strict budget, prepaid cards may be more accessible.

Bottomline? A prepaid travel card doesn’t come without downsides, but if you want an easy way to access cash in your destination’s currency – and want a quick way to pay merchants once you arrive at your international destination – the ease of using them might make your trip a less stressful one.

More From YourMoney-Budget-Living

Does credit shield help you against credit card fraud?

UAE remittance fee hike: Will residents go digital?

‘I paid off my loan and my credit score dropped’: Why?

Send more for less: Weak rupee, peso - get April gains

Tax savings for NRIs with health insurance in India

Indian expats get tax notices on big deals: Next steps?

Don’t postpone your gold shopping: Here’s why

Bankman-Fried to appeal 25-year sentence

Get Breaking News Alerts From Gulf News

We’ll send you latest news updates through the day. You can manage them any time by clicking on the notification icon.

Choose from our selection of multi-currency prepaid cards for all your travel and shopping needs

TRAVELEZ PLUS CLASSIC

Presenting the Travelez Plus Classic card tailored to customers who are looking for a safer alternative to cash. The reloadable prepaid Visa card is ideal for customers who would like to enjoy shopping online or at any POS in the UAE bundled with a wide range of offers.

The card is a secure and convenient way to manage your funds and is accepted at almost all shopping outlets and online store and can be used to withdraw cash from ATMs, wherever Visa is accepted. Get yours today! Click here for steps to activate your card. Click here for Terms and Conditions.

Load any amount from AED 100 to AED 36,700.

Option to personalize the card with your name on it.

Accepted at POS, online and ATMs worldwide, wherever Visa is accepted.

Dedicated website and mobile app to track all your transactions

Enjoy seasonal rewards and offers from Visa.

Request a card (all fields are mandatory)

Your Email:

Mobile Number:

Nationality:

Type of card required

Fill in the details below to complete the application.

Best Debit Card in UAE: A Comprehensive List and Comparison

Table of Contents

Debit cards have become an essential part of everyday life in the UAE. They allow individuals to make purchases, withdraw cash, and pay bills with ease. However, with so many options available, it can be challenging to determine which debit card is the best fit for your needs.

To help with this decision, this article will provide a comprehensive list and comparison of the best debit cards currently available in the UAE. The list will include information on fees, rewards, benefits, and any other relevant features that make each card unique. By the end of this article, readers will have a better understanding of the different debit cards available and be able to make an informed decision on which one to choose.

Whether you’re looking for a card with low fees, cashback rewards, or exclusive benefits, this article will provide all the necessary information to help make the right choice. With the UAE’s banking industry constantly evolving, it’s essential to stay up-to-date with the latest debit card options available to ensure that you’re getting the most out of your money.

Overview of Debit Cards in UAE

Debit cards have become an essential part of daily life, providing a convenient and secure way to access your money. In the UAE, there are many banks and financial institutions that offer a range of debit cards with different features and benefits.

One of the most significant advantages of using a debit card is that it allows you to make purchases and withdraw cash from ATMs without carrying cash. Additionally, debit cards are accepted worldwide, making them an ideal travel companion.

When it comes to choosing the best debit card in the UAE, there are several factors to consider. These include the fees and charges, rewards and benefits, ATM network, and security features.

Most banks in the UAE offer basic debit cards that come with no annual fees and allow you to withdraw cash from their ATMs free of charge. However, if you want to enjoy additional benefits such as cashback, discounts, and loyalty points, you may need to opt for a premium debit card that comes with an annual fee.

It is also essential to consider the ATM network of the bank before choosing a debit card. Some banks have a vast network of ATMs, while others have limited coverage. Therefore, it is advisable to select a debit card that offers maximum access to ATMs to avoid paying additional fees for using other banks’ ATMs.

Finally, security is a crucial factor when it comes to choosing a debit card. Most banks in the UAE offer advanced security features such as chip and pin technology, two-factor authentication, and SMS notifications for every transaction.

In summary, choosing the best debit card in the UAE depends on your personal preferences and requirements. By comparing the features and benefits of different debit cards, you can select the one that best suits your needs and provides the most value for your money.

Best Debit Cards in UAE

When it comes to choosing a debit card in the UAE, there are several options available in the market. Here are some of the top debit cards in the UAE that offer great benefits and features to their users.

ADIB Etihad Visa Debit Card

The ADIB Etihad Visa Debit Card is a popular choice among UAE residents. This card offers a range of benefits including cashback on purchases, discounts on dining and entertainment, and access to exclusive airport lounges. Additionally, the card allows users to earn Etihad Guest Miles on their purchases, which can be redeemed for flights, hotel stays, and other rewards.

Emirates NBD Liv. Account Debit Card

The Emirates NBD Liv. Account Debit Card is another popular option in the UAE. This card offers cashback on purchases, discounts on dining and entertainment, and access to exclusive offers and events. Additionally, the Liv. app offers a range of features such as budgeting tools, savings goals, and bill payment reminders.

HSBC Advance Debit Card

The HSBC Advance Debit Card is a great option for those who want to earn rewards on their spending. This card offers cashback on purchases, discounts on dining and entertainment, and access to exclusive offers and events. Additionally, the card allows users to earn HSBC Rewards points on their purchases, which can be redeemed for a range of rewards such as flights, hotel stays, and gift cards.

Mashreq Neo Smart Debit Card

The Mashreq Neo Smart Debit Card is a popular choice for those who want to manage their finances on-the-go. This card offers a range of features such as instant notifications, spending tracking, and budgeting tools. Additionally, the card offers cashback on purchases and discounts on dining and entertainment.

RAKBANK Red MasterCard Debit Card

The RAKBANK Red MasterCard Debit Card is a great option for those who want to earn cashback on their spending. This card offers cashback on all purchases, as well as discounts on dining and entertainment. Additionally, the card offers a range of other benefits such as free movie tickets and access to exclusive offers and events.

Overall, there are several great debit card options available in the UAE that offer a range of benefits and features to their users. It is important to compare the different options and choose the one that best suits your needs and spending habits.

How to Apply for a Debit Card in UAE

Applying for a debit card in UAE is a simple process that can be done online or in-person at a bank branch. Here are the steps to follow:

- Choose a bank: Research the different banks in UAE and compare their debit card features and fees. Choose the bank that best fits your needs.

- Check eligibility: Ensure that you meet the bank’s eligibility criteria for a debit card. This may include minimum age, minimum income, or residency status.

- Gather required documents: Prepare the necessary documents, which may include a valid Emirates ID, passport, and proof of income or residency.

- Fill out the application form: Complete the debit card application form, either online or in-person. Provide accurate information and double-check for any errors.

- Submit the application: Submit the application form along with the required documents to the bank. If applying online, follow the instructions for uploading the documents.

- Wait for approval: The bank will review your application and documents and notify you of the status. If approved, your debit card will be issued and sent to you.

It is important to note that some banks may charge a fee for issuing a debit card or for certain transactions. Be sure to read the terms and conditions carefully before applying for a debit card in UAE.

Criteria for Evaluating Debit Cards

When evaluating the best debit cards in UAE, there are several criteria that should be considered. These include fees and charges, ATM network and accessibility, rewards and benefits, security features, and customer service.

Fees and Charges

One of the most important factors to consider when choosing a debit card is the fees and charges associated with it. These can include annual fees, transaction fees, foreign exchange fees, and ATM withdrawal fees. It is important to compare the fees and charges of different debit cards to find one that offers the best value for money.

ATM Network and Accessibility

Another important factor to consider is the ATM network and accessibility of the debit card. The best debit cards in UAE should have a wide network of ATMs that are easily accessible. This can help users avoid high ATM withdrawal fees and ensure that they can access their money whenever they need it.

Rewards and Benefits

Many debit cards in UAE offer rewards and benefits such as cashback, discounts, and loyalty points. These rewards and benefits can be a great way to save money and get more value from your debit card. When evaluating debit cards, it is important to consider the rewards and benefits offered and how they can benefit you.

Security Features

Security is a top priority when it comes to debit cards. The best debit cards in UAE should have advanced security features such as chip and PIN technology, two-factor authentication, and fraud protection. These features can help protect users from fraud and ensure that their money is safe.

Customer Service

Finally, it is important to consider the quality of customer service offered by the debit card provider. This can include factors such as the availability of customer support, the responsiveness of customer service representatives, and the ease of resolving issues. Good customer service can be crucial in ensuring a smooth and hassle-free experience with your debit card.

Comparison of Debit Cards

Fee structures comparison.

When it comes to fee structures, some debit cards in UAE charge annual fees, while others do not. Some also charge transaction fees for using the card abroad or withdrawing cash from ATMs. Therefore, it is essential to compare the fee structures of different debit cards before choosing one.

For example, the Emirates NBD Liv. card does not charge an annual fee, and it offers free ATM withdrawals in the UAE and abroad. On the other hand, the ADCB Lulu card charges an annual fee of AED 100 and a transaction fee of AED 2.5 for using the card abroad.

Rewards and Perks Comparison

Debit cards in UAE also offer various rewards and perks, such as cashback, discounts, and loyalty points. Some cards offer higher rewards for specific categories, such as dining, travel, or shopping.

For instance, the CBD Now card offers up to 10% cashback on dining and entertainment, while the Mashreq Neo card offers up to 5% cashback on groceries and utility bills.

Security and Fraud Protection Comparison

Security and fraud protection are crucial factors to consider when choosing a debit card. Some cards offer advanced security features, such as biometric authentication, while others provide fraud protection and zero-liability policies.

For example, the Emirates Islamic Flex card uses biometric authentication to verify transactions, while the Dubai First Royale card offers a zero-liability policy for unauthorized transactions.

Customer Support Comparison

Lastly, customer support is another critical factor to consider when choosing a debit card. Some banks offer 24/7 customer support, while others have limited hours of operation. It is also essential to check if the bank provides online support or a mobile app for managing the card.

For instance, the ENBD Go4it Gold card offers 24/7 customer support and a mobile app for managing the card, while the RAKBANK Titanium card provides limited customer support hours and no mobile app.

In summary, when comparing debit cards in UAE, it is crucial to consider the fee structures, rewards and perks, security and fraud protection, and customer support to make an informed decision.

Choosing the Right Debit Card for Your Needs

When it comes to choosing the right debit card in the UAE, it’s important to consider your individual needs and preferences. Here are a few factors to consider before making a decision:

One of the most important factors to consider is the fees and charges associated with the card. Some cards may have annual fees, transaction fees, or ATM withdrawal fees. It’s important to compare these fees and choose a card that suits your budget and spending habits.

Many debit cards in the UAE offer rewards and benefits such as cashback, discounts, and loyalty points. Consider which benefits are most important to you and choose a card that offers them.

Security is a top priority when it comes to banking and financial transactions. Look for a debit card that offers advanced security features such as chip-and-PIN technology and fraud protection.

Accessibility

Consider the availability and accessibility of ATMs and bank branches. Choose a card that offers convenient access to ATMs and branches in your area.

Brand Reputation

Finally, consider the reputation of the bank or financial institution offering the debit card. Look for a bank with a strong reputation for customer service and reliability.

By considering these factors, you can choose the right debit card for your needs and enjoy the benefits of convenient and secure banking in the UAE.

Free Debit Card UAE

When it comes to choosing a debit card in the UAE, one of the most important factors to consider is the fees associated with it. Fortunately, there are several free debit cards available in the UAE that offer a range of benefits.

One of the most popular free debit cards in the UAE is the Emirates NBD Visa Debit Card. This card comes with no annual fees and offers a range of benefits, including cashback rewards, discounts at select merchants, and free access to airport lounges.

Another great option is the ADCB Simply Life Cashback Debit Card. This card also comes with no annual fees and offers cashback rewards on all purchases, as well as discounts at select merchants.

For those who prefer a digital-only option, the Liv. Debit Card from Emirates NBD is a great choice. This card can be managed entirely through the Liv. app and comes with no annual fees, as well as cashback rewards on all purchases.

Overall, there are several great free debit card options in the UAE that offer a range of benefits and features. By comparing the different options available, consumers can find the best card to suit their needs and budget.

After careful analysis and comparison of the top debit cards available in the UAE, it is clear that each card has its own unique features and benefits. The Emirates NBD Visa Debit Card offers a wide range of rewards and discounts, making it an excellent choice for those who frequently shop at partner merchants. The Dubai Islamic Bank Debit Card offers a unique profit-sharing feature, making it a great option for those looking to earn extra income on their savings.

The Mashreq Neo Debit Card and the ADCB SimplyLife Debit Card both offer cashback rewards on everyday purchases, making them ideal for those who want to earn rewards on their daily spending. The Abu Dhabi Commercial Bank Visa Debit Card offers a range of travel benefits, including free airport lounge access and travel insurance, making it a great option for frequent travellers.

Overall, when choosing the best debit card in the UAE, it is important to consider your individual needs and preferences. Whether you are looking for rewards, cashback, or travel benefits, there is a debit card available to suit your needs.

Related Posts

Abu Dhabi Traffic Department Contact Number: How to Reach Them Easily

Adib Call Center Number: How to Contact Adib Customer Service Easily

Ajman Driving License Renewal and fees 2024

Bank Working Days in UAE and Working Hours

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

5 Best Travel Cards for Dubai

Getting an international travel card before you travel to Dubai can make it cheaper and more convenient when you spend in United Arab Emirates Dirham . You'll be able to easily top up your card in GBP before you leave the UK, to convert seamlessly to AED for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the UK heading to Dubai, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for Dubai:

Let's kick off our roundup of the best travel cards for Dubai with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the UK:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Dubai.

Starling Bank travel card

If you’re interested in a card from a licensed bank in the UK you might like the Starling Bank personal GBP account which comes with a travel card you can use in Dubai and anywhere else in the world, to spend with the network exchange rate and no extra fee.

You’ll hold a balance in GBP - but whenever you need to spend in AED or other foreign currencies, the card converts instantly for you for convenience. There are no monthly fees and no Starling ATM fees. Converting from your GBP balance to your EUR balance has a 0.4% fee.

Starling Bank features

Starling bank travel card pros and cons.

- No foreign transaction fee

- No need to convert your money from GBP to get the best available rate - the card does it for you

- No Starling ATM fees

- Broad range of additional services and add on products available

- Fully licensed UK bank

- You can open a GBP and EUR balance but USD balances are for businesses only

- ATM operators might apply their own fees to your withdrawals

How to apply for a Starling Bank card

Here’s how to apply for a Starling Bank account and order a travel card in the UK:

Visit the Starling bank website

Click Apply now

Complete your personal and contact information following the prompts

Get verified and confirm your shipping address for your card

Complete the details needed, confirm and your card will be posted to you

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Dubai. Wise accounts can hold 40+ currencies, so you can top up in GBP easily from your bank or using your card. Whenever you travel, to Dubai or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

With the Wise money card you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in AED, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in AED when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 7 GBP delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 2 - 6 days to arrive (you can use your virtual card right away)

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the UK:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 7 GBP fee, confirm your mailing address, and your card will be on the way, and should arrive in 2 - 6 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Dubai, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 30+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 30+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the UK and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Post Office travel card

If you want a travel card you can collect in person instantly, and then use to spend when you visit Dubai, you might be interested in the Post Office travel card. You’ll be able to get your card by popping into a Post Office branch - online ordering is also available. Remember to take your ID document when you go to pick up your card, for verification.

You’ll be able to pay in GBP to top up your card, and then convert to any of the 22 supported currencies. It’s then free to spend if you have the currency you need on your card, although a 3% fee applies if you use your card to spend or make a withdrawal in a currency you’ve not topped up yet. Double check the latest details online to see if AED is supported for holding a balance - and what the associated fees will be for currency conversion and withdrawals, as these vary by currency.

Post Office features

Post office travel card pros and cons.

- 22 supported currencies

- Collect your card in person at a Post Office if you need it in a hurry

- Manage your card through the Post Office app

- Use your card for this trip - and hold in to it for the next time you travel

- Reliable service, with a card that's accepted globally

- 3% fee to spend a currency you don't hold

- 4.1% exchange rate markup on average when loading supported currencies

- ATM fees apply which vary by currency

- Low daily ATM limits at the equivalent of 300 GBP

How to apply for a Post Office card

Get your Post Office travel card before you leave the UK, simply by calling into your local Post Office. It’s also possible to order your card online, although in this case you’ll need to wait a couple of days for it to arrive by post, and activate it once you have your card in your hand.

Travelex travel card

Get your Travelex card for spending in Dubai either in person at a store, or by ordering online. 15 currencies are supported for holding a balance - but it’s useful to know that you need to convert to the currency you need for your trip in advance to avoid extra fees.

You can pay in GBP and load a balance in the currency of your choice, to spend and withdraw with no further Travelex fee - or you’ll pay 5.75% to convert at the point of payment. Check the up to date list of supported currencies on the Travelex website to ensure that AED is available for holding a balance.

Travelex features

Travelex travel card pros and cons.

- Hold 15 currencies

- No Travelex ATM fees

- Free wifi for card holders

- Mastercard privileges for card holders

- 24/7 support if your card is lost or stolen

- 5.75% fee to spend a currency you don't hold

- Inactivity fees if you don't use your card frequently

- 4.2% exchange rate markup on average when loading supported currencies

How to apply for a Travelex card

To apply for a Travelex account and order a travel card in the UK before you leave for your trip, you can pop into a Travelex store with your ID document. It’s also possible to order your card online, although in this case you’ll need to wait a couple of days for it to arrive by post, and activate it once you have your card in your hand.

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your British Pound everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Dubai or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app, although you can also often add money in person by visiting a branch - we've picked out the Post Office and the Travelex travel card as popular prepaid cards with a branch network in the UK, for example.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Dubai. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday GBP account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Dubai

We've picked out 5 great travel cards available in the UK - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Dubai include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in AED can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences. If you're looking for a low cost card with the mid-market rate, which you can use in 150+ countries, the Wise card may be a good fit. If you'd prefer to pay a monthly fee to get higher no-fee transaction limits, take a look at Wise. And if you need to get a card in a hurry, check out a travel card from a provider with a physical branch network, like the Post Office card or the Travelex travel money card.

What makes a good travel card for Dubai

The best travel debit card for Dubai really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in AED.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Dubai. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Dubai in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Dubai - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Dubai

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Dubai card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use AED?

If you have AED, you should be able to use it in a few countries. You may decide to keep your travel card topped up with a balance for this trip to Dubai or for the next time you’re headed somewhere which uses AED.

What should you be aware of when travelling to Dubai

You’re sure to have a great time in Dubai - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Dubai before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change GBP to AED before you travel to Dubai if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in GBP and either exchange to AED in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Dubai to make an ATM withdrawal in AED if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the UK so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Dubai

Ultimately the best travel card for your trip to Dubai will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Dubai

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like Wise - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise and Revolut.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Dubai.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their GBP / AED rate to calculate how much United Arab Emirates Dirham you would receive when exchanging / spending £3,000 GBP. The card provider offering the most AED is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

The current account for your travel money.

Great escapes, meet your match. Spend and withdraw cash with your Starling current account anywhere, for free.

T h e c u r r e n t a c c o u n t f o r y o u r t r a v e l m o n e y

Great escapes, meet your match. Spend and withdraw cash with your Starling current account anywhere, with no fees from us.

Why Starling’s current account is great for travel

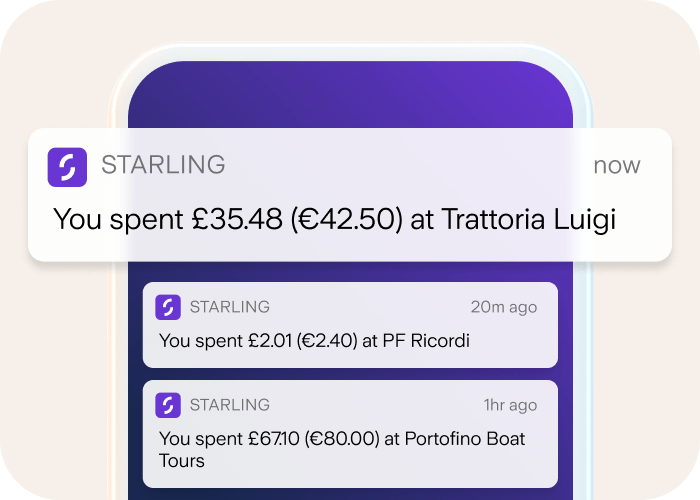

Instant alerts when you spend.

In real time. And in both currencies.

Spend fee-lessly.

Pay on card or withdraw cash abroad anywhere, with no fees from us.

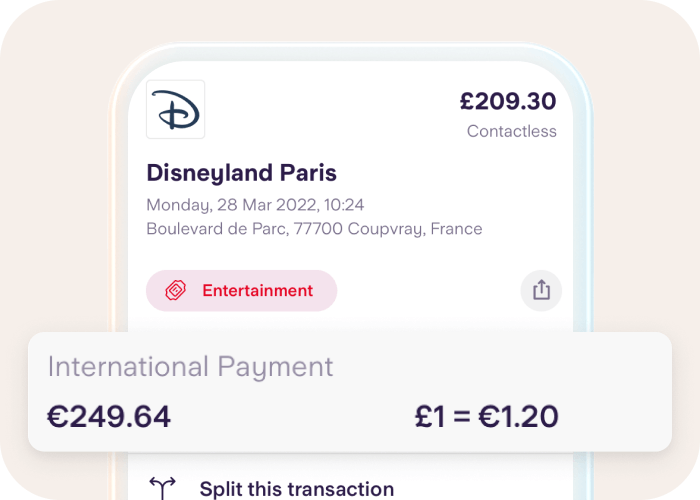

Great rates.

We pass Mastercard’s real exchange rate onto you, and don’t add anything on top. So you’ll get more for your money - whatever currency it’s in.

Holiday spending. But better.

Benefits of travelling with Starling’s current account

Friendly human help. If you’re awake, so are we. Get support in-app 24/7.

Lost your card? Lock it in the app , or order a new one to be sent out to you, wherever you are.

Settle payments. Paid together? Pay friends and family - or get paid back - with Nearby Payments and Split the Bill .

Flight next week? Start spending from your digital wallet straight away.

How far can £100 take you?

Use our travel tool to see how far £100 can take you in the world’s top tourist destinations.

- Try the tool

How does Starling’s current account stack up against other banks when it comes to travel?

Provider 1:

Please select a provider below

Provider 2:

Data correct as of 8 April 2024.

Not just for travel

Get more from your money with Starling’s simple, award-winning current account. With features such as instant notifications, Spending Insights and Saving Spaces, money management has never been easier. Apply in minutes from your phone.

- Find out more

Use Starling for your travel money. Apply for a current account today and enjoy app-based banking at its best.

Currency calculator.

Need to convert GBP to USD or EUR? Use our currency converter to calculate the exchange rate. We won’t charge you for spending overseas – but do bear in mind that some ATM providers may charge their own fee.

Calculating rate...

Frequently asked questions

Do i need to let you know that i’m going abroad, what’s your exchange rate, will i be charged for using my debit card abroad, how do i work out the exchange rate i’m going to get, read our blog posts on travelling with starling, how to avoid card charges abroad.

13th June 2023

Making the most of your holiday money

5th May 2023

Converting a campervan to travel the world

16th March 2023

Please wait while your request is being verified...

- Prepaid Cards

Top 10 Personal Loans

Rakbank Personal Loan

Emirates NBD Personal Loan

Dubai Islamic Bank Personal Loan

ADIB Personal Loan

FAB Personal Loan

Popular Credit Cards

Rakbank Credit Card

Emirates NBD Credit Card

Citi Credit Card

FAB Credit Card

Top Home Loans

HSBC Home Loan

Rakbank Home Loan

Dubai Islamic Bank Home Loan

ADIB Home Loan

FAB Home Loan

Popular Car Loans

HSBC Car Loan

Standard Chartered Car Loan

Emirates NBD Car Loan

ADIB Car Loan

Ajman Bank Car Loan

Top Business Loans

United Arab Bank Business Loan

Rakbank Business Loan

CBD Business Loan

Union National Bank Business Loan

Dubai First Business Loan

Popular Life Insurances

Oman Insurance Company Life Insurance

Zurich Insurance Life Insurance

AIG Insurance Company Life Insurance

AXA Gulf Life Insurance

MetLife Life Insurance

Monthly Salary

Prepaid cards in uae.

Credit Bureau Consent, Welcome Offer & General Terms & Conditions

I hereby acknowledge and agree to allow Citibank to share my details with any UAE credit bureau and make enquiries about me with any UAE credit bureau at its sole and absolute discretion. I agree to the Terms and Conditions listed below. Citibank Terms and Conditions apply, are subject to change without prior notice and are available upon request. For the current Terms and Conditions, please visit our website www.citibank.ae. All offers are made available on a best-effort basis and at the sole discretion of Citibank, N.A. Citibank, N.A. makes no warranties and assumes no liability or responsibility with respect to the products and services provided by partners/other entities. By inquiring about our services, offers or products, you will be authorizing our representatives to approach you on your contact details including your telephone/mobile number for any product or service offered by Citibank. The applicant agrees to be bound by Citibank’s General Terms and Conditions available on the website www.citibank.ae. The applicant hereby represents and warrants that the information provided herein is true, accurate, and complete and that he/she agrees to remain responsible for and to indemnify Citibank, N.A. from and against any losses, claims and/or liabilities incurred by Citibank NA as a result of having relied on such information. Citibank, N.A. is not required to verify the information provided by the applicant and neither is the bank obliged to provide the applicant with any loans or credit facilities based on the provided information. The products and services mentioned on this website are not offered to individuals resident in the European Union, European Economic Area, Switzerland, Guernsey, Jersey, Monaco, San Marino, Vatican, The Isle of Man or the UK. This page is not, and should not be construed as, an offer, invitation or solicitation to buy or sell any of the products and services mentioned herein to such individuals.

Provide the following details to get a quick response

No of years in the current job:

(4.0/5)

16 People rated this page

Compare Prepaid Cards in UAE

List of prepaid cards in uae.

FAB Abu Dhabi Pay Hayyak Card

Maximum Limit

Validity of Card

- The card is easy to issue prepaid card with or without registration or any bank account

- The cards validity is five years from the date of issue

- The starting loading amount is limited to a maximum amount of AED 3,500 and this can be used on Abu Dhabi Pay govt transactions only.

- The merchant payments and other reloads will be enabled after the full KYC is done and this will provide a maximum limit of AED 50,000

- The card will offer easy loading of funds and reloading of funds. You can keep track of your spendings.

- The Abu Dhabi Pay Hayyak Card can be loaded or reloaded through the following.

- FAB Cash Deposit Machines (CDMs)

- The FAB Mobile app and Online Banking for retail

- FAB iBanking and Nafura for corporate

- The payit mobile app (available soon)

- Distribution channels and government counters (available soon)

- UAE Funds Transfer System (UAEFTS)

- No card issuance cost, loading or reloading fees

- Hayyak Cards are available at Magnati offices and government counters.

- If cardholder full KYC is not done then maximum card balance is AED 3,500

- For all the KYC completed cardholders the maximum card balance is AED 50,000

- The card can be loaded or reloaded and the below are the various options available.

- FAB Cash Deposit Machines (CDMs): Free

- Distribution channels and government counters: Free(available soon)

- The FAB Mobile app and Online Banking: Free

- FAB iBanking and Nafura: Free

- The payit mobile app: Free (available soon)

- UAEFTS: Free

- For all the cardholders without KYC the maximum load amount is AED 3,500 on one time basis

- For KYC completed users the maximum load amount is AED 50,000

- Any kind of reload is not allowed for cardholders who have not completed their KYC

- For KYC completed users the max reload per day and transaction at FABs CDM is AED 50,000 and the maximum reload is unlimited

- The balance amount may be refunded on FAB ATMs if there is cash withdrawal provided to them.

- You can also place a request at Magnati offices to get your refund of balance on your Abu Dhabi Hayyak Card, the incomplete refund requests are not processed.

- For KYC users Withdrawal allowance per transaction is AED 10,000

- For KYC users Withdrawal allowance per day is AED 50,000

- For KYC users Withdrawal allowance per month is unlimited

- The cash withdrawal facility is provided at any FAB and Non FAB ATMs, the withdrawal facility is available only for the KYC completed customers.

- Cash withdrawal at FAB ATMs is free of charge

- AED 2 is charged for cash withdrawals at Non-FAB ATMs

- For all the International withdrawals AED 15 or 2.5 percent is charged whichever is greater

View details on bank page

FAB Government Black Corporate Card

- The cost of the card is AED 25 which will be deducted from the first load

- The Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required

- The card has five years validity

- The Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required

- The Maximum card balance is AED 10,000,000

- The card can be used for government transactions

- The Government Black Corporate Card can be loaded or reloaded through: FAB Cash Deposit Machines (CDMs)

- FAB iBanking corporate

- Distribution channels and MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

- The loading and reloading fees is as follows:

- FAB Cash Deposit Machines (CDMs): AED 5

- MBME Kiosks: AED 5

- Distribution channels and iBanking: AED 5

- The UAE Funds Transfer System (UAEFTS): AED 5

- The maximum card balance is AED 10,000,000

- The maximum load amount is AED 10,000,000

- Maximum reload amount per transaction at FAB CDMs is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is unlimited

- The Cards can be purchased and applied for through the following channels

- - Magnati offices

- - FAB’s website (www.bankfab.com)

- - FAB iBanking (will be available soon)

- Cash withdrawals are not permitted for corporate cards.

- This card is available to all UAE-registered companies.

FAB Abu Dhabi Pay Excellence Corporate Card

- There are No card issuance costs and no loading or reloading fees

- The card can only be used for Abu Dhabi Government transactions by corporates

- Card is valid for five years from the date of issue

- Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account is required The card offers easy loading and reloading of funds to help you keep track of your spending.

- The Card can be loaded or reloaded through the following ways

- FAB iBanking and Nafura

- The card loading and reloading can be done through the following channels.

- Distribution channels and government counters: Free (available soon)

- UAE Funds Transfer System (UAEFTS): Free

- The Maximum load amount is AED 10,000,000

- The Maximum reload amount per transaction at FAB CDM is AED 75,000

- The Maximum reload amount per month at FAB CDMs is AED unlimited

- The card can be purchased/applied for through:

- Magnati offices

- FAB’s website (www.bankfab.com)

- FAB iBanking (available soon)