Travel protection for student groups.

Supporting youth journeys all the way.

Protect your investment and plan for the unexpected with a group-discounted travel insurance + protection package specially designed to support student journeys close to home and far away. Our group plans are offered through Travel Insured International.

ELIGIBLE TRAVELERS RESIDE IN THE UNITED STATES – VIEW PLANS FOR CANADIAN TEENS AND WORLDWIDE TEENS

Due to regulatory considerations, "Cancel for Any Reason" is only available to New York State residents who purchase an Individual Plan within 21 days of their first trip payment.

NOTE: If you are signed up for a trip that includes Israel travel and you are a resident of NY State who wishes to purchase "cancel for any reason" coverage, solutions are available via Travel Guard (not via the link above).

The "Cancel for Any Reason" add-on benefit is currently not available for Israel travel

Coverages may vary and not all coverage is available in all jurisdictions. Review more details of coverage and refer to the full plan document for a complete description of coverage.

- Up to the lesser of the Trip Cost paid or the limit of coverage on your confirmation of coverage. Subject to the maximum benefit amount of $15,000 ( individual plans available for trip costs exceeding $15,000). Trip Cancellation and Trip Interruption coverage only applies if trip is cancelled/interrupted by a covered peril.

- Cancel for any reason coverage (CFAR) is up to 75% of the nonrefundable trip cost (subject to $15,000 maximum). CFAR is optional and available if purchased within 14 days of your initial trip payment and if you insure the full non-refundable cost of the trip. Trip cancellation must be 48 hours or more prior to scheduled departure. NOTE: CFAR is not available to New York State residents as a group plan, but it is available as an individual plan for New York State residents when purchased within 21 days of your initial trip payment.

- If $0 Trip Cost is displayed for Trip Cancellation on your confirmation of coverage, a maximum of $500 return air ticket is covered under Trip Interruption.

- Pre-existing conditions may be covered under the Accident & Medical Expense benefit if purchased within 14 days of your initial trip payment, if you insure the full non-refundable cost of the trip, and if you are not disabled from travel at the time you pay the plan cost. Losses due to, arising, or resulting from pre-existing conditions are normally excluded from coverage. However, such losses are covered on the same basis as losses due to, arising, or resulting from all other sicknesses and injuries if you qualify for the Pre-Existing Medical Condition Exclusion Waiver.

The cost of your plan is a function of your total non-refundable travel costs – including the cost of your program and any connecting travel (e.g. flights). Not sure about your final travel costs? Purchase your plan now with the no-hassle option to modify your coverage amounts later.

- Scholarships for which you may be financially responsible to the donor in the event you cancel may be counted towards the cost of your travel.

- For travel over 30 days, a $5/day surcharge applies Maximum trip length is up to 60 days for all states, except Hawaii. For Hawaii residents, a maximum trip length of 30 days applies.

- The rates above do not apply to residents of Pennsylvania, California, Hawaii, and Virginia. Obtain a quote to view these rates.

- If your travel costs will exceed $15,000, you can obtain similar coverage via an individual travel protection plan .

Yes, these plans provide coverage for travel within the United States and abroad.

Group Student Deluxe plans are available to travelers up to age 35, and up to 20% of the travelers in the group who purchase a Student Deluxe plan may be above the age of 35. Travelers must also reside in the United States, regardless of citizenship status. Not a USA resident? Review plan options for Canadian teens and worldwide teens .

Include all travel costs, including your group travel program, your connecting travel, and any personal travel outside of the group program.

You can purchase a plan now based on your anticipated or estimated total travel costs. If your final travel costs end up being different than what you expected, contact [email protected] to update your plan coverage costs, and be sure to reference your group name, plan code, and policy confirmation number in your message.

The group Student Deluxe plan may be purchased until the day before your travels begin. However, your medical benefit will only include coverage for pre-existing conditions if the plan is purchased within 14 days of your initial trip payment date (including travel costs purchased privately). Similarly, if you are including the Cancel for Any Reason supplement, the plan must be purchased within 14 days of your initial trip payment date.

Yes, you can round up to the highest value in your applicable trip cost bracket to give yourself a coverage cushion in case you add on additional travel expenses prior to your trip. However, any claimed benefits will be calculated based on actual documented trip costs.

Student Deluxe group rates are valid for travel costs that do not exceed $15,000. If your travel costs will exceed this threshold, you can obtain similar coverage via an individual travel protection plan .

NOTE: With individual plans, the Cancel for Any Reason benefit and the Pre-Existing Medical Conditions Exclusion Waiver is only available if the plan is purchased within 21 days of the first trip payment.

No, all direct program and travel costs that you paid for must be covered*. Exceptions may be reviewed on a case-by-case basis by contacting [email protected] .

*If you received a grant or scholarship, its value may be counted towards your total covered travel costs at your discretion. We encourage you to include the value of a grant or scholarship in your covered costs if you will be held financially responsible for the repayment of the grant or scholarship in the event you are unable to participate in the program.

Yes. Due to state-level regulatory considerations, Student Deluxe with Cancel for Any Reason (CFAR) is not available to travelers who reside in New York State. However, if you live in New York State and want to secure CFAR benefits, you can purchase an individual travel protection plan provided you do so within 21 days of your initial trip payment.

If your travel dates exceed the arrival and departure dates posted on the purchase form, your coverage can be extended for up to 10 total days beyond your officially registered group travel dates. Contact [email protected] to extend your coverage dates, and be sure to reference your group name and plan code in your message. If your travel dates extension exceeds 10 days, you can obtain similar coverage via an individual travel protection plan .

In some cases, the travel dates posted on the purchase form will exceed the actual dates of the group travel program to provide a cushion for those travelers arriving early or extending their travels. If your travel dates exceed the arrival and departure dates posted on the purchase form, contact [email protected] to extend your coverage dates. Be sure to reference your group name and plan code in your message.

The rate table is based on a maximum of 30 travel days. If you will be traveling for more than 30 days, a $6 per day supplement will apply. A maximum of 60 travel days applies (30 days is the maximum for Hawaiian residents).

You may cancel your plan within 14 days of the effective date of your coverage for a full refund of your plan cost provided there has been no incurred loss, your scheduled trip has not departed, and you have not filed a claim under the plan.

Should your group travel program be entirely canceled by the organizer, in most cases your premium will be considered refundable provided there has been no incurred loss, you have not departed on your trip, and you have not filed a claim under the plan

If you received a grant or scholarship, its value may be counted towards your total covered travel costs at your discretion. We encourage you to include the value of a grant or scholarship in your covered costs if you will be held financially responsible for the repayment of the grant or scholarship in the event you are unable to participate in the program.

Certificates and discounts applied (in part or in full) towards the cost of your travel arrangements are not considered payments in this context and are not eligible for coverage.

Frequent flyer and/or rewards points applied (in part or in full) towards the cost of your travel arrangements are not considered payments or deposits in this context.

Yes, you may still purchase a plan based on entering a $0 trip cost, and the plan will entitle you to all benefits apart from trip cancellation and trip interruption. If you will be held financially responsible to the outside sources for the cost of your trip in the event you are unable to participate in the program, consider covering those costs.

Yes, provided that no more than 20% of the travelers in the group purchasing a plan exceed the age of 35. Chaperones whose travel costs are covered by the program may still purchase a plan based on entering a $0 trip cost. A $0 trip cost plan will entitle the traveler to all benefits apart from trip cancellation and trip interruption.

To upgrade your Student Travel Protection Plan to include Cancel for Any Reason coverage, contact [email protected] and be sure to reference your group name, plan code, and policy confirmation number in your message. Cancel for Any Reason coverage is only available if you are within 14 days of making your initial trip payment.

No, the plans provide global coverage and are merely registered using one primary destination of travel.

Yes, we also offer individual plans , available for all ages.

We can help. There are many benefits associated with offering group travel insurance:

- Providing a better value for your travelers

- Ability to identify who in your group has purchased a plan

- Possibility to make a bulk claim, if applicable

Student Deluxe plans can be included in the cost of your travel program or can be offered individually to members of your group. Contact us to learn more.

Choose your group travel program from the option(s) below.

ELIGIBLE TRAVELERS RESIDE IN THE USA VIEW ALTERNATE PLANS FOR CANADIAN TEENS OR WORLDWIDE TEENS

Upon selecting a plan, you will be redirected to the Travel Insured International website to complete your purchase. By checking this box I acknowledge that all offers are subject to the issuer’s conditions and exclusion clauses, which have been made available to me for review in the full plan documents .

- Plans are fully refundable within 14 days from the date of purchase.

- The Student Travel Protection Plan may be booked up to a full day prior to departure. The Cancel for Any Reason supplement must be booked within 14 days of your initial trip payment.

Review our FAQs for answers to common questions, and contact us for any additional guidance!

Teen Travel Insurance is a project of Tlalim Tours Inc. 5185 Macarthur Blvd., NW #640 | Washington, DC 20016

Licensed by the National Association of Insurance Commissioners

© 2022 Tlalim Tours, Inc. | Privacy Policy

Website Development by Web Symphonies

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Studying abroad? Here are the best international student travel insurance companies

Travel insurance can not only save students money when studying abroad, but many schools also require it..

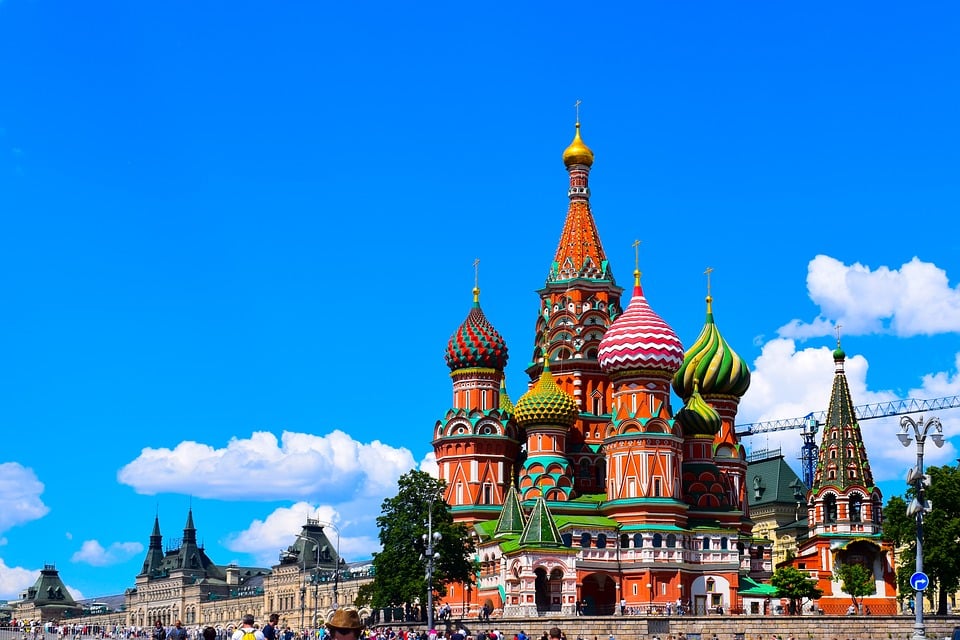

Studying abroad is a valuable educational and cultural experience and could give you an advantage in the job market after graduation. Buying travel insurance is a way to protect yourself financially while studying abroad.

Many international programs require travel insurance , and some offer it through a predetermined provider. But if you're on the hunt for a comprehensive travel insurance plan on your own, CNBC Select has made it a little easier. We compared dozens of top travel insurance companies for students and narrowed down the five best options that stood out for their strong coverage and affordability . (See our methodology for more information.)

Best student travel insurance

- Best overall: AXA Assistance USA Travel Insurance

- Best for medical expenses: USI Affinity Travel Insurance

- Best for trip interruptions: Travel Guard Travel Insurance

- Best for customizable coverage: Allianz Travel Insurance

- Best for students on a budget: Berkshire Hathaway Travel Protection

Best overall

Axa assistance usa travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

24/7 assistance available

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

AXA Assistance USA 's most basic plan, the Silver Plan, includes all of the essentials a student will likely need while studying abroad: coverage for emergency medical expenses (up to $25,000 for accident or sickness and up to $100,000 for evacuation), baggage loss (up to $750) trip interruption and trip cancellation.

It's budget-friendly as well and is one of the most affordable yet comprehensive travel insurance plans on the market. If you're interested in higher coverage limits, AXA offers two more premium plans, one of which includes a cancel for any reason (CFAR) option.

[ Jump to more details ]

Best for medical expenses

Usi affinity travel insurance.

USI Affinity has travel medical policies in addition to trip cancellation policies. Travel medical plans include an option for frequent travelers to cover multiple trips. Trip cancellation options include coverage for road trips and group travel.

- Wide variety of plans for both trip cancellation coverage and travel medical insurance

- CFAR only covers up to 70% of non-refundable trip costs

USI Affinity is a good choice for students primarily concerned about potential medical expenses abroad. The company offers only one trip cancellation plan but offers a wide variety of travel medical plans tailored to specific situations.

Best for trip interruptions

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Students who are concerned about trip interruptions should consider Travel Guard , which offers last-minute coverage. There are three base packages available online, with more options available through a representative. Its most basic plan includes typical coverage for travel medical expenses (up to $15,000 in medical expenses and $150,000 for evacuation), but robust coverage for trip cancellation, trip interruption, baggage theft as well as per-day compensation for trip delays.

Best for customizable coverage

Allianz travel insurance.

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Allianz offers a whopping 10 different travel insurance policies. While many premium insurers offer cancel for any reason coverage that can cover up to 75% of prepaid, non-refundable trip costs, Allianz's Cancel Anytime upgrade can reimburse up to 80% of your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents. If you're planning to be adventurous during your study abroad experience, Allianz has a variety of add-ons to cover rental cars, hazardous sports and more.

Best for students on a budget

Berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

- Wide variety of policies available

- Strong financial strength rating by AM Best

- Cancel for any reason only provides reimbursement for up to 50% of non-refundable trip payments

Berkshire Hathaway Travel Protection is a strong choice for students on a tight budget looking for strong coverage. Its most basic plan (the ExactCare Value plan) earned one of the cheapest quotes reviewed by CNBC Select and includes moderate-limit coverage for everything a student might need while studying internationally.

More on our top travel insurance for studying abroad

AXA's travel insurance offers medical coverage for emergencies and accidents while traveling for up to $250,000. It offers three different plans for travelers starting as low as $16 according to its website.

CFAR coverage available

24/7 assistance?

[ Return to summary ]

USI Affinity offers a number of travel plans, including travel medical plans for those traveling outside of the U.S. Its InterMedical Insurance plan has three levels of medical coverage available ranging from $50,000 to $150,000, and starts at $1.35 per day, according to the company's website.

Travel Guard Travel Insurance

Travel Guard's travel insurance could be a fit for students studying abroad with three levels of coverage. Its travel medical expense coverage can go up to $100,000 with the brand's deluxe plan.

Allianz offers several types of travel insurance for students, including its OneTrip Emergency Medical Plan with up to $50,000 in emergency medical benefits and $250,000 in evacuation benefits. Its OneTrip Prime and Premier plans offer cancellation and trip interruption benefits on top of emergency medical benefits up to $50,000.

Berkshire Hathaway Travel Insurance

Berkshire Hathaway Travel Protection offers several travel insurance plans that could be a fit for student travelers, including its ExactCare Value and ExactCare plans, offering both trip cancellation and interruption coverage in addition to medical coverage.

What does travel insurance cover for studying abroad?

Medical expenses and emergency evacuation.

Stan Sandberg, a co-founder of the online marketplace TravelInsurance.com , said medical coverage is the most important area of coverage for students studying abroad.

Most travel insurance plans, regardless of whether they are designed for students, cover medical expenses incurred abroad. Medical expense coverage can help to cover injuries or illnesses you may incur while abroad. Emergency evacuation coverage generally includes transportation to the nearest adequate facility or transportation home.

Travel medical coverage can exclude some situations that are relevant for students studying abroad — namely, intoxication. "If the individual is either beyond a certain intoxication level or under the influence of illegal substances, those things are very often excluded from coverage," Sandberg said. "So, a student traveling to a country that doesn't have a drinking age, for instance, that would be something to keep in mind."

Because of cultural alienation and homesickness, studying abroad can be an emotionally difficult time for many students. If you are shopping for student travel insurance, you should consider searching for a plan that covers mental health services. Read your travel policy carefully to understand the coverage offered and any requirements for coverage.

If medical expenses are the only cost you wish to insure, then you might instead consider an international health plan, which Sandberg recommends for students on a budget .

Trip cancellation and interruption

If your circumstances change at the last minute, you'll be grateful to have a travel insurance plan with trip cancellation coverage, which will reimburse you for your non-refundable trip costs, like flights and hotels , for covered events.

This coverage will not, however, cover any non-refundable costs of your study abroad program, such as tuition, room and board, which are likely to be much more expensive than the flights to and from. So to Sandberg, this coverage is slightly less important for students.

Travel assistance

It's possible that studying abroad will be a student's first time out of the country. Traveling internationally , especially in areas with a language barrier, can be confusing. Many travel insurance plans, and all five policies we chose as our top picks , offer a 24/7 helpline to assist you along your journey.

Lost or stolen baggage

Along with travel assistance, baggage loss and baggage delay coverage are examples of post-departure benefits. Study abroad programs typically last an entire semester or a summer, so you'll likely pack a lot of luggage.

If you're traveling with valuables, you should consider searching for a plan that includes baggage insurance. Sandberg recommends reading the fine print, though, as many plans exclude electronic items in luggage and items above a certain value.

And of course, make sure any policy is worth your money and aligns with your coverage goals before purchasing it. Many travel insurance policies offer free look periods that include time to read over the policy and cancel coverage with a refund.

What is travel insurance for studying abroad?

For students and adults alike, travel insurance is a flexible type of coverage designed to protect you when you're far from home. By purchasing a policy, you can prevent financial hardship related to international medical expenses or travel mishaps like interruptions, delays and lost luggage. Some premium travel insurance plans offer cancel for any reason (CFAR) coverage, which allows you to recoup some of your expenses should you cancel your trip for any reason.

Is travel insurance worth it for studying abroad?

Travel insurance is a wise investment for travelers who will be abroad for a while, including students studying abroad. Most domestic medical plans do not cover international hospital bills, so in case of an emergency, having travel insurance with medical expense coverage could be crucial.

How much does travel insurance cost for students studying abroad?

Travel insurance costs vary depending on the length of the trip, the age of the travelers and the extent of the coverage. You can expect to pay around 4% to 10% of your trip's total cost, according to travel insurance comparison site InsureMyTrip . Keep in mind though that your trip's "total cost" does not include the cost of your study abroad program itself. Most travel insurance companies are only interested in the cost of flights and non-program lodging like hotels. The best way to estimate the cost of insuring your trip is to get quotes from multiple companies.

What is international health insurance?

International health insurance is a health coverage plan that covers your medical expenses anywhere in the world. An international health insurance plan provides very similar medical coverage to that provided by a travel insurance plan.

Do I need travel insurance if my credit card has it already?

Some of the best travel credit cards on the market provide some travel protection. For example, the Chase Sapphire Reserve® card offers trip cancellation and interruption insurance up to $10,000 per covered person up to $20,000 per trip, travel accident insurance, emergency evacuation insurance and coverage for baggage delays and loss. Ask your issuer if your card has any travel protection benefits. If not, or if the coverage is minimal, you should consider purchasing travel insurance from a third party.

Bottom line

Not only is it a smart idea to purchase travel insurance to study abroad, but it is also required by a lot of international programs. With travel insurance, students can worry less about the unexpected and make the most of their experience abroad. If your academic program does not have a pre-existing partnership with a certain provider, then consider using one of these top travel insurance companies for students.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best cheap travel insurance.

Our methodology

To determine the best travel insurance companies for students studying abroad, CNBC Select analyzed dozens of U.S. travel insurance companies that come with a wide variety of policies and offer coverage for a number of situations.

When narrowing down the best travel insurance companies, we focused on the coverage available, including the number of plans available, 24/7 assistance availability and cancel for any reason (CFAR) coverage availability. We also considered financial strength ratings from AM Best and Better Business Bureau ratings for customer satisfaction.

To consider costs, we gathered quotes from the top travel insurance companies for four sample trips, which included:

1. A semester-long (January 15 to June 15) study-abroad trip to the United Kingdom:

- $3,000 per person (flights to and from JFK and non-program hotels)

- New York residents

- Traveler aged 20

2. A summer (June 15-August 15) study-abroad trip to Italy:

- $2,000 per person (flights to and from JFK and non-program hotels)

Sample quotes assumed that payments were made on the date of quoting.

Note that the premiums and policy structures advertised for travel insurance companies are subject to fluctuate in accordance with the company's policies.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money . And follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- This 5-month term CD offers 9.5% APY, but with a catch — here's how to get your hands on it Andreina Rodriguez

- How Quicken Simplifi can help you get a grip on your spending Elizabeth Gravier

- IRA vs CD — what's the difference and which one should you pick? Andreina Rodriguez

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Student Travel Insurance Benefits

Study-abroad and student travel programs are an incredible opportunity for young people to experience the wide world. But as any chaperone can tell you, there's always one student who misses the plane, loses their passport or ends up in the hospital after eating bad pineapple. What will you do if it's your son or daughter?

Three Things You Need To Know Before Buying Student Travel Insurance

School travel coordinators will do their best to help, but what you really need is a student travel insurance policy that includes emergency medical services coverage and trip cancellation coverage . Whether your student is embarking on domestic travel or a long international vacation , you need to get student travel insurance first. Here are the three reasons why.

1. Student travelers take more risks.

Sometimes, the thrill of studying abroad erases young travelers' good judgment. They may leave their bag on the beach while snorkeling, only to find someone has stolen their passport. Or they may sprain an ankle while learning to dance the Merengue. It's all part of the adventure - and it's okay, as long as they have student travel insurance.

Look for a student policy that includes things like medical coverage, trip interruption coverage, emergency medical evacuation coverage, 24/7 travel assistance services and more.

2. In an emergency, student travel insurance may provide valuable guidance.

For student travelers who have never left home before, traveling overseas can be scary because they don't know what to do in an emergency. That's when a student travel insurance policy with access to a 24-hour hotline can help. No matter where students are in the world, a multilingual specialist can offer guidance for all kinds of problems, from tracking down lost baggage to getting emergency medical care.

3. Student travel insurance gives you peace of mind.

It's hard enough to wave goodbye to your daughter before she boards an international flight for the first time. Do you really want to be worrying about her every minute she's overseas? A student travel insurance policy lets you know she's covered in case the unexpected happens. Look for a policy that offers coverage for illness, accidents, lost baggage, missed flights, theft or other international emergencies. Make sure you review your insurance plan carefully before you buy, because not all plans offer the same coverage.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Trip Insurance

Travel for teens requires all participants to purchase a travel protection plan..

Each year, at least one family typically loses the money they’ve invested in their child’s program because he/she was unable to travel at the last minute due to medical/family emergencies or other unforeseeable situations. Travel insurance is required on all of our programs. You may choose your own plan or the Travel for Teens travel protection plan offered through Travel Insured International. Travel For Teens has partnered with Travel Insured International (TII) to offer the Travel For Teens Protection Plan, which can help give you some peace of mind that your investment is protected against many unexpected events. Your plan can be purchased directly through us and is included on your invoice. The cost of your plan is calculated based on the total non-refundable cost of your trip, including all non-refundable airfare you may have purchased through Travel For Teens that appears on your invoice.

Protection Plan Options and Prices

The Travel for Teens Protection Plan includes many benefits, such as Trip Cancellation coverage, which reimburses non-refundable trip expenses if you cancel your trip with Travel For Teens due to a covered reason, such as Sickness. The plan also includes missed connection, trip interruption, and travel delay coverages. In addition, you have the option to add on the Cancel For Any Reason (CFAR) benefit for an additional cost. The Travel For Teens Protection plan allows cancellation and reimbursement for covered reasons per the plan details, while the optional Cancel For Any Reason (CFAR) benefit allows for cancellation and reimbursement for any non-covered reasons per the plan details.

Download Pricing Details above as a PDF

Download Full Plan Details

If you would like to purchase a plan, use any of the three options below! You can make payment by credit card with no additional fee.

- Calculate the tier that your teen’s tuition falls into and make a payment . We will add the plan and send you an updated statement

- Email [email protected] with the plan you want, and we will send you an updated statement with a link to make payment

- Schedule a quick call at a time that is convenient for you and we can discuss the pricing for your plan.

NY RESIDENTS

Please note, NY residents cannot add CFAR coverage to this plan. However, residents of NY can purchase an individual plan with a non-insurance CFAR waiver from TII. Visit this link for a direct quote. Parents who purchase this plan may increase the level of coverage once the plan is purchased to cover additional costs such as airfare or a more expensive trip.

Trip Protection Plans for International Residents

Canadian Residence

If your permanent residence is in Canada, you have options but you must purchase the insurance directly from the insurance provider. Travel For Teens partners with TripMate.

Use this link to get a quote, review policy benefits, and buy your travel insurance policy directly from TripMate.

Note: For the Standard Plan Policy or Premium (w/ Cancel For Any Reason) Plan Policy, the policy must be purchased for the traveler within 21 days of the initial deposit and before the final payment has been made to TFT. Travel For Teens cannot sell this policy directly to Canadian residents.

International Residence

For those living outside the USA and Canada, you have options but you must purchase the insurance directly on your own. TFT can only sell insurance policies within the United States. We suggest that families who reside outside of the United States or Canada contact a local Travel Agent for guidance on a suitable policy for their traveler.

If you purchased a policy from Travel For Teens in the calendar year 2023, please reference this page for the policy details.

Have Questions About Our Programs? Our Client Service Team Will Take Your Call!

Stay informed about 2024!

Sign up for our special travel newsletter and be notified about exclusive discounts, new trips, and other announcements. Stay in the know.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

11 Best Travel Insurance Companies in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If the past few years have shown us anything, it’s that travelers need to be prepared for the unexpected — from a pandemic to flight troubles to the crowded airport terminals so many of us have encountered.

Whether you’re looking for an international travel insurance plan, emergency medical care or a policy that includes extreme sports, these are the best travel insurance providers to get you covered.

How we found the best travel insurance

We looked at quotes from various companies for a 10-day trip to Mexico in September 2024. The traveler was a 55-year-old woman from Florida who spent $3,000 total on the trip, including airfare.

On average, the price of each company’s most basic coverage plan was $126.53. The costs displayed below do not include optional add-ons, such as Cancel For Any Reason coverage or pre-existing medical condition coverage.

Read our full analysis about the average cost of travel insurance so you can budget better for your next trip.

However, depending on the plan, you may be able to customize at an added cost.

As we continue to evaluate more travel insurance companies and receive fresh market data, this collection of best travel insurance companies is likely to change. See our full methodology for more details.

Best insurance companies

Types of travel insurance

What does travel insurance cover, what’s not covered, how much does it cost, do i need travel insurance, how to choose the best travel insurance policy, what are the top travel destinations in 2024, more resources for travel insurance shoppers, top credit cards with travel insurance, methodology, best travel insurance overall: berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection

- ExactCare Value (basic) plan is among the least expensive we surveyed.

- Speciality plans available for road trips, luxury travel, adventure activities, flights and cruises.

- Company may reimburse claimants faster than average, including possible same-day compensation.

- Multiple "Trip Delay" coverage types might make claims confusing.

- Cheapest plan only includes fixed amounts for its coverage.

Under the direction of chair and CEO Warren Buffett, Berkshire Hathaway Travel Protection has been around since 2014. Its plans provide numerous opportunities for travelers to customize coverage to their needs.

At $135 for our sample trip, the ExactCare Value (basic) plan from Berkshire Hathaway Travel Protection offers protection roughly $10 above the average price.

Want something cheaper? Air travelers looking for inexpensive, less comprehensive protections might opt for a basic AirCare plan that includes fixed amounts for its coverage .

Read our full review of Berkshire Hathaway .

What else makes Berkshire Hathaway Travel Protection great:

Pre-existing medical condition exclusion waivers available at no extra cost.

Plans available for travelers going on a cruise, participating in extreme sports or taking a luxury trip.

ExactCare Value (basic) plan was among the least expensive we surveyed.

Best for emergency medical coverage: Allianz Global Assistance

Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Global Assistance is a reputable travel insurance company offering plans for over 25 years. Customers can choose from a variety of single and annual policies to fit their needs. On top of comprehensive coverage, some travelers might opt for the more affordable OneTrip Cancellation Plus, which is geared toward domestic travelers looking for trip protections but don’t need post-departure benefits like emergency medical or baggage lost.

For our test trip, Allianz Global Assistance’s basic coverage cost $149, about $22 above average.

What else makes Allianz Global Assistance great:

Annual and single-trip plans.

Plans are available for international and domestic trips.

Stand-alone and add-on rental car damage product available.

Read our full review of Allianz Global Assistance .

Best for travelers with pre-existing medical conditions: Travel Guard by AIG

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

Travel Guard by AIG offers a variety of plans and coverages to fit travelers’ needs. On top of more standard trip protections like trip cancellation, interruption, baggage and medical coverage, the Cancel For Any Reason upgrade is available on certain Travel Guard plans, which allows you to cancel a trip for any reason and get 50% of your nonrefundable deposit back as long as the trip is canceled at least two days before the scheduled departure date.

At $107 for our sample trip, the Essential plan was below average, saving roughly $20.

What else makes Travel Guard by AIG great:

Three comprehensive plans and a Pack N' Go plan for last-minute travelers who don't need cancellation benefits.

Flight protection, car rental, and medical evacuation coverage, as well as annual plans available.

Pre-existing medical conditions exclusion waiver available on all plan levels, as long as it's purchased within 15 days.

Read our full review of Travel Guard by AIG .

Best for those who pack expensive equipment: Travel Insured International

Travel Insured International

- Higher-level plan include optional add-ons for event tickets and for electronic equipment

- Rental car protection add-on for just $8 per day, even on lower-level plan.

- Many of the customizations are only available on the higher-tier plan.

- Coverage cost comes in above average in our latest analysis.

Travel Insured International offers several customization options. For instance, those going to see a show may want to add on event ticket registration fee protection. Traveling with expensive gear?Consider adding on coverage for electronic equipment for up to $2,000 in coverage.

Be sure to check which policies are available in your state. You will need to input your destination, residence, trip dates and the number of travelers to get a quote and see coverages.

What else makes Travel Insured International great:

Comprehensive plans include medical expense reimbursement accidents, sickness, evacuation and pre-existing conditions, depending on the plan.

Flight plans include coverage for missed and canceled flights and lost or stolen baggage.

Read our full review of Travel Insured International .

Best for adventurous travelers: World Nomads

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

Many travel insurance plans contain exclusions for adventure sports activities. If you plan to ski, bungee jump, windsurf or parasail, this might be a plan to consider.

Note that the Standard plan ($72 for our sample trip), while the most affordable, provides less coverage than other plans. But it can be a good choice for travelers who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain more adventurous activities.

What else makes World Nomads great:

Comprehensive international travel insurance plans.

Coverage available for adventure activities, such as trekking, mountain biking and scuba diving.

Read our full review of World Nomads .

Best for medical coverage: Travelex Insurance Services

Travelex Insurance Services

- Top-tier plan doesn’t break the bank and provides more customization opportunities.

- Offers a plan specifically for domestic travel.

- Sells a post-departure medical coverage plan.

- Fewer customization opportunities on the Basic plan.

- Though perhaps a plus for domestic travelers, keep in mind the Travel America plan only covers domestic trips.

For starters, basic coverage from Travelex Insurance Services came in at $125, almost exactly average for our sample trip.

Travelex’s plans focus heavily on providing protections that are personalized to your travel style and trip type.

While the company does offer comprehensive plans that include medical benefits, you can also choose between cheaper plans that don’t provide cancellation coverage but do offer protections during your travels.

Read our full review of Travelex Insurance Services .

What else makes Travelex Insurance Services great:

Three comprehensive plans available, two of which cover international trips.

Offers a post-departure plan geared exclusively toward disruptions after you leave home.

Two flight insurance plans available.

Best if you have travel credit card coverage: Seven Corners

Seven Corners

- Annual, medical-only and backpacker plans are available.

- Cancel For Any Reason upgrade is available for the cheapest plan.

- Cheapest plan also features a much less costly Interruption for Any Reason add-on.

- Offers only one annual policy option.

Each Seven Corners plan offers several optional add-ons. Among the more unique is a Trip Interruption for Any Reason, which allows you to interrupt a trip 48 hours after the scheduled departure date (for any reason) and receive a refund of up to 75% of your unused nonrefundable deposits.

The basic coverage plan for our trip to Mexico costs $124 — right around the average.

What else makes Seven Corners great:

Comprehensive plans for U.S. residents and foreigners, including travelers visiting the U.S.

Cheap add-ons for rental car damage, sporting equipment rental or trip interruption for any reason.

Read our full review of Seven Corners .

Best for long-term travelers: IMG

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

While some travel insurance companies offer just a handful of plans, with IMG, you’ll really have your pick. Though this requires a bit more research, it allows you to search for coverage that fits your travel needs.

However, travelers will want to be aware that IMG’s iTravelInsured Travel Lite is expensive. Coming in at $149.85, it’s the costliest plan on our list.

Read our full review of IMG .

What else makes IMG great:

More affordable than average.

Many plans to choose from to fit your needs.

Best for travelers with unpredictable work demands: Tin Leg

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Tin Leg’s Basic plan came in at $134 for our sample trip, adding about $8 onto the average basic policy cost. Note that you’ll pay a lot more if you shop for the most comprehensive coverage, and there are eight plans to choose from for trips abroad.

The multitude of plans can help you find coverage that fits your needs, but with so many to choose from, deciding can be daunting.

The only real way to figure out your ideal plan is to compare them all, look at the plan details and decide which features and coverage suit you and your travel style best.

Read our full Tin Leg review .

Best for booking travel with points and miles: TravelSafe

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

- Multi-trip or year-long plans aren’t available.

Selecting your travel insurance plan with TravelSafe is a fairly straightforward process. The company’s website also makes it easy to visualize how optional add-on elements influence the total cost, displaying the final price as soon as you click the coverage.

However, at $136, the Basic plan was among the more expensive for our trip to Mexico.

What else makes TravelSafe great:

Rental car damage coverage add-on is available on both plans.

Cancel For Any Reason coverage available on the TravelSafe Classic plan.

Read our full TravelSafe review .

Best for group travel insurance: HTH Insurance

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH offers single-trip and multitrip medical insurance coverage as well as trip protection plans.

At around $125, the Trip Protector Economy policy is at the average mark for plans we reviewed.

You can choose to insure group trips for educators, crew, religious missionaries and corporate travelers.

What else makes HTH Insurance great:

Medical-only coverage and trip protection coverage.

Lots of options for group travelers.

Read our full review of HTH Insurance .

As you shop for travel insurance, you’ll find many of the same coverage categories across numerous plans.

Trip cancellation

This covers the prepaid costs you make for your trip in cases when you need to cancel for a covered reason. This coverage helps you recoup upfront costs paid for flights and nonrefundable hotel reservations.

Trip interruption

Trip interruption benefits generally involve disruptions after you depart. It helps reimburse costs incurred for flight delays, cancellations and plenty of other covered disruptions you might encounter during your travels.

This coverage can cover the costs for you to return home or reimburse unexpected expenses like an extra hotel stay, meals and ground transportation.

Trip delay coverage helps cover unexpected costs when your trip is delayed. This is another coverage that helps offset the costs of flight trouble or other travel disruptions.

Note that many policies have a total amount a traveler can claim, with caps on per diem benefits, too.

Cancel For Any Reason

Cancel For Any Reason coverage allows you to recoup some of the upfront costs you paid for a trip even if you’re canceling for a reason not otherwise covered by your standard travel insurance policy.

Typically, adding this protection to your plan costs extra.

Baggage delay

This coverage helps cover the costs of essential items you might need when your luggage is delayed. Think toiletries, clothing and other immediate items you might need if your luggage didn’t make it on your flight.

Many travel insurance plans with baggage delay protection will specify how long (six, 12, 24 hours, etc.) your luggage must be delayed before you can make a claim.

Lost baggage

Used for travelers whose luggage is lost or stolen, this helps recoup the lost value of the items in your bag.

You’ll want to make sure you closely follow the correct procedures for your plan. Many plans include a maximum total amount you can claim under this coverage and a per-item cap.

Travel medical insurance

This covers out-of-pocket medical costs when travelers run into an emergency.

Because many travelers’ health insurance plans don’t cover medical care overseas, travel medical insurance can help offset out-of-pocket health care costs.

In addition to emergency medical coverage, many plans have medical evacuation or repatriation coverage for costs incurred when you must be taken to a hospital or return to your home country because of a medical situation.

Most travel insurance plans cover many trip protections that can help you be prepared for unexpected travel disruptions and expenses.

These coverages are generally aimed at protecting the money you put into your trip, expenses you incur because of travel trouble and costs incurred if you have a medical emergency overseas.

On top of core coverages like trip cancellation and interruption and travel medical coverage, some plans offer add-on options like waivers for pre-existing conditions, rental car collision damage waivers or adventure sports riders. These usually cost extra or must be added within a specified timeframe.

Typical travel insurance policies offer coverage for many unforeseen events, but as you research to select a plan, consider your needs. Though every plan differs, there are some commonly excluded coverages.

For instance, you typically can’t get coverage for a named storm if you bought the coverage after the storm was named. In other words, if you have a trip to the Caribbean booked for Sept. 25 and on Sept. 20 a hurricane develops and is named, you generally won’t be able to buy a travel insurance plan Sept. 21 in hopes of getting your money back.

Many plans also don’t cover activities performed under the influence of drugs or alcohol or any extreme sports. If the latter applies to you, you might want to consider a plan with specific coverages for adventure-seekers.

For numerous plans, a few other situations don’t qualify as an acceptable reason to cancel and make a claim, such as fear of travel, medical tourism or pregnancies (unless you booked a trip and bought insurance before you became pregnant or there are complications with the pregnancy). This is where a Cancel For Any Reason add-on to your coverage can be helpful.

You can also run into trouble if you give up on a trip too soon: a minor (or even multihour) flight delay likely isn’t sufficient to cancel your entire trip and get reimbursed through your plan. Be sure to review what requirements your specific plan has when it comes to canceling a trip, claiming trip interruption, etc.

Travel insurance costs vary widely. The final price of your plan will fluctuate based on your age, length of trip and destination.

It will also depend on how much coverage you need, whether you add on specialized policies (like Cancel For Any Reason or pre-existing conditions coverage), whether you plan to participate in extreme sports and other factors.

In our examples above, for instance, the 35-year-old traveler taking a $2,000 trip to Italy would have spent an average $76 for a basic plan to get coverage for things like trip cancellation and interruption, baggage protection, etc. That’s a little less than 4% of the total trip cost — lower than average.

If there were multiple members in a traveling party or if they were going on, say, a rock-climbing or bungee-jumping excursion, the costs would go up.

On average, travel insurance comes to about 5% to 10% of the trip cost. However, considering many of the plans reimburse up to 100% of the trip cost (or more) for disruptions like trip cancellation or interruption, it can be a worthwhile expense if something goes wrong.

It depends. Consider the following factors that might affect your decision: You’re young and healthy, all your bookings are refundable or cancelable without a penalty, your flights are nonstop, you’re not checking bags and a credit card you carry offers some travel protections . In that case, travel insurance might not be necessary.

On the other hand, if you prepaid a large chunk of money for a nonrefundable African safari, you’re going on a Caribbean cruise in the middle of a hurricane season or you’re going somewhere where the cost of health care is high, it’s not a bad idea to buy a travel insurance plan. Here’s how to find the best travel insurance coverage for you.

If you’re thinking of booking a trip and not planning to buy travel insurance, you may want to consider at least booking refundable airfare and not prepaying for hotel, rental car and activity reservations. That way, if something goes wrong, you can cancel without losing any money.

Selecting the best travel insurance policy comes down to your needs, concerns, preferences and budget.

As you book, take a few minutes to consider what most concerns you. Is it getting stranded because of flight trouble? Having the ability to cancel for any reason you see fit without losing money? Getting sick or injured right before departure and needing to postpone the trip? Injuring yourself or falling ill while overseas?

Ultimately, you want a plan that protects you, your money and the large investment in your trip — but doesn’t cost too much, either.

Medical coverage. If your priority is having adequate medical coverage abroad, you might want to look for plans with high limits for medical emergencies and medical evacuation.

Complex travel itinerary. If your itinerary has lots of flight connections, prepaid hotels and deposits for activities you can’t get back, prioritizing a plan with the best coverage for trip cancellations or interruptions may land at the top of your list.

Travel uncertainty. If you’re on the fence about a trip and have nonrefundable reservations, you may want to select a plan with a Cancel For Any Reason coverage option, which can help you recoup about 50% to 75% of the costs. This helps provide peace of mind, placing the decision on whether to travel entirely in your hands.

Car rentals. If you’re renting a car, a collision damage waiver is often worth looking into.

The following destinations are the top insured destinations in 2024, according to Squaremouth (a NerdWallet partner).

The Bahamas.

Costa Rica.

Antarctica.

In 2022, travelers spent about 25.53% more on trips than they did before the pandemic.

As of December, NerdWallet analysis determined travel prices are 10% higher than pre-pandemic. Each statistic makes a strong case for protecting your travel investment as you plan your next trip.

Bookmark these resources to help you make smart money moves as you shop for travel insurance.

What is travel insurance?

CFAR explained.

Is travel insurance worth getting?

10 credit cards that provide travel insurance.

Here is the list of travel cards offered by Chase that include various forms of travel insurance.

Having one of these in your wallet is a good start to protecting your travel investments and preventing expensive accidents; however, savvy travelers check card terms closely and sometimes supplement with a third-party policy, like from one of the companies above, to better protect themselves.

on Chase's website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 12 hours.

• Car rentals: Theft and collision damage for most cars in the U.S. and abroad.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

We used the following factors to choose insurance providers to highlight:

Breadth of coverage: We looked at how many plans each company offered plus the range of their standard plans.

Depth of coverage: We considered two data points to get a sense of how much each company pays out for common travel issues — the maximum caps for trip cancellation and trip interruption claims.

Cost: By looking at the costs for basic coverage across multiple companies, we determined an average cost for shoppers to benchmark plan prices against.

Customizability: While standard plans can cover a lot of ground, sometimes you need something a little more personal.

Customer satisfaction. Using data from Squaremouth when available, and Google Reviews as a backup, we can give kudos to companies with better track records from their clients.

No, it doesn’t necessarily get more expensive the longer you wait to purchase. However, as you put off buying insurance, you may lose access to potential plans and coverage options.

In general, buying travel insurance within a few days to two weeks of prepaying or making an initial deposit for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

But, generally, many plans do allow you to buy coverage quite close to your departure date.

To get the most out of your travel insurance plan, buy it soon after making your initial prepayment or deposit to ensure you have access to the biggest menu of plans possible.

Select a plan that’s comprehensive enough to cover the travel scenarios you’re most concerned about or likely to encounter but not too expensive or laden with protections you’d never likely need.

Whatever your coverage, thoroughly review the plan so you understand what’s covered and what’s not, plus how to adhere to the plan’s rules for making a claim.

Travelers frequently use phrases like “trip insurance” and “travel insurance,” as well as “trip protection,” interchangeably, but they do mean different things, according to Stan Sandberg, founder of insurance comparison site TravelInsurance.com.

Trip insurance, or trip protection, generally refers to predeparture (or preevent) coverage if you need to cancel. You may see these plans sold by airlines, online travel agencies or even ticketed event sellers.

“You could refer to it as the portion that protects the investment in the trip,” Sandberg says.

A travel insurance plan typically includes that — plus more comprehensive benefits to protect you during your trip, from medical coverage to trip delay and lost baggage protections, and many more elements, depending on the plan.

Though travel insurance is typically not required for international trips, your personal circumstances will play a key role in whether it’s a good investment.

For instance, young, healthy travelers with few prepaid trip expenses embarking on a relatively risk-free trip may not see a need to buy a plan.

Older travelers with complicated itineraries who are visiting destinations where they could potentially fall ill or get injured — or who could encounter bad weather or some other disrupting factor along the way — may want to buy coverage.

Consider a few key questions:

How well would your health insurance plan cover you if you needed to visit a hospital overseas?

How much did you prepay for a hotel or rental car?

How much money would you be out if weather or some other flight issue derailed your itinerary?

Could you afford an unexpected night in a city where you have a connecting flight?

Do you already have a credit card that provides some travel protections?

Your answers to these questions can help you decide whether you need travel insurance for your international trip.

In general, buying travel insurance

within a few days to two weeks of prepaying or making an initial deposit

for your trip is your best bet. Assuming you’re not booking last-minute, this will provide you with access to the widest possible range of coverage options. It also helps prevent any medical conditions or storms that pop up between booking and buying a plan from ending up as excluded situations, which won’t be covered by your plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Youth Travel Insurance

Travelance’s youth travel insurance has been designed exclusively for the young traveller who requires medical and non-medical travel insurance bundled into one convenient package.

Coverage is available to persons under 30 years of age at the time of purchase, travelling up to 365 days, bundling medical and non-medical coverages. We offer separate rates for USA and non-USA travel to provide you with flexible insurance.

Rates start as low as $32 for a 3 day trip.

What is the difference between the USA & non-USA Plans?

- The USA plans are for persons travelling to the USA during their trip

- The non-USA plans are for individuals travelling outside the USA

- The non-USA plans allow a stopover in the USA for 48 hours or less

Product Highlights

Youth premier plan.

- USA and non-USA rates available

- Trip cancellation and interruption benefits

- Trip delay up to $1,500

- Emergency medical up to $1,000,000

- Emergency medical evacuation/return home up to $1,000,000

- Baggage and personal effects: passport, travel visa, and travel tickets loss up to $800

- Airflight accident up to $25,000

- 24/7 travel assistance

Click to review the policy.

This is a brief description of coverage. Please see policy wording for benefits, definitions, exclusions, limitations, terms and conditions.

Underwritten by Old Republic Insurance Company of Canada.

Now included at no additional cost - COVID-19 Quarantine Coverage Benefits Rider (at destination). Click here to learn more.

All products.

- Visitors to Canada Emergency Medical Insurance

- Student Accident Plan

Quick Links

- Get a Quote

- Our Underwriter

How to Quote or Purchase a TRIPs Plan from our Website

Our products.

- Visitors to Canada Insurance

Phone: 1-855-566-8555

Email: [email protected]

126 Catharine St. N., Hamilton, ON L8R 1J4 Canada

Follow Us On

AMF Information

Distributing Firm’s Name: Travelance Incorporated 126 Catharine St. N., Hamilton, ON L8R 1J4 Canada 1-855-566-8555 or [email protected] Client Number: 601870 Licensed Sectors: Insurance of Persons

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

The Best Student Travel Insurance Companies of 2024

Companies like Faye, Travelex and Seven Corners can provide affordable options for student travel insurance if you’re planning to travel or study abroad.

with our partner, travelinsurance.com

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

If you’re a college student planning an international excursion, you may decide to protect your investment with travel insurance. Travel insurance compensates you if you need to cancel your trip for a covered reason, get injured abroad, or lose your luggage or other personal belongings while traveling.

Our top recommended travel insurance provider for college students is Travelex , thanks to its budget-friendly policies and quick applications.

Compare Student Travel Insurance Companies

Our top picks for student travel insurance are Travelex, Faye and Nationwide, which offer a blend of affordability and a range of coverage options.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors