9 Reasons to Purchase TripProtect Travel Insurance through AAA

Updated : March 27, 2024

AAA Travel Editors

Table of contents.

- Life is unpredictable.

- Don’t let sickness stop you.

- Your health insurance has its limits.

- Forgot your medication?

- Lost luggage can leave you in a lurch.

- The plan crumbles.

- Unexpected travel hiccups...

- Your credit card may not cover you.

- Tap into smart travel tools.

- Plan Your Next Trip With AAA

Nobody likes to spend more money, but the truth is that anything can happen when traveling. It’s a good idea to be protected just in case.

Below are some of the most common ways vacations can get sidetracked and how travel insurance can help. Trip delays, interruptions or even cancellations can cause unexpected headaches and expenses, but travel insurance can help make sure you are protected from any adjustments you need to make to overcome these situations. Some plans include cancellation benefits and if you have a covered reason, you can be reimbursed for prepaid nonrefundable expenses — like a covered medical emergency or loss of employment. Allianz Partners, a world leader in travel insurance and assistance services and AAA partner of over 30 years, offers many reasons to protect yourself and your family with travel insurance — helping travelers every year through unanticipated travel delays, bad weather, lost luggage and medical emergencies in foreign countries.

Here are nine reasons why experienced travelers choose Allianz Travel Insurance through AAA:*

1. Life is unpredictable.

Some trips need to be cancelled. With travel insurance, you don’t necessarily have to pay for a trip you are unable to take. Instead, enjoy more confidence knowing you’re a step ahead of unpredictable situations before and during your trip.

2. Don’t let sickness stop you.

From falls to food poisoning, illnesses and injuries can happen anywhere. It’s less scary to be sick or hurt with travel insurance to help you through these troubles with financial benefits and expert assistance services.

3. Your health insurance has its limits.

When you travel outside the U.S., you may be leaving your health insurance at home. Many U.S. plans (including Medicare and Medicaid) don’t cover international travel. Why risk it when a medical evacuation can cost $50,000+?

4. Forgot your medication?

Lost or forgotten medication can set off an alarm when you’re far from home. Let travel assistance help you locate a pharmacy to purchase a replacement. It’s always nerve-wracking when something goes wrong. But when you’re in a foreign country, you don’t want to face any kind of crisis alone.

5. Lost luggage can leave you in a lurch.

Allianz Travel Insurance provides benefits that can help you replace needed items if your bags are delayed, damaged or stolen while you’re traveling. With reimbursement for your trip essentials, you can still suit up for wherever your journey takes you next.

6. The plan crumbles.

If a travel supplier ceases operations, you may not get a refund for the money you fronted for a cruise, flight or tour. Allianz Travel Insurance offers protection in case of covered travel supplier default, so you’re less likely to pay for an experience that’s no longer possible.

7. Unexpected travel hiccups...

Flight delays can add up. Beyond being annoying, prolonged delays can cause you to accrue expenses while you wait—or worse, miss a connection. With travel insurance, a covered travel delay can mean reimbursement for rebooking fees, meals and accommodations.

8. Your credit card may not cover you.

Some travelers opt out of travel insurance, thinking credit card coverage would suffice in a crunch. Truth is, even if you have this free coverage benefit, it won’t likely be as extensive as a separate travel insurance plan.

9. Tap into smart travel tools.

Allianz Partners’ TravelSmart mobile app has recently been updated and rebranded as the Allyz® TravelSmart Mobile App . The Allyz® TravelSmart app has the same great functionality with a new look and FAQ section.

Note, there is no change to the Allianz in-app assistance services embedded in AAA Mobile.

Plan Your Next Trip With AAA

Join the over a million people who are AAA members and start planning your dream vacation today. Dream up the perfect trip with our Trip Canvas research tool and use your membership to get the best discounts on hotels , rental cars and entertainment tickets.

_____________________________________________________________

*Terms, Conditions, and exclusions apply to all plans. Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance (AGA) or its affiliates. AGA compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company.Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected].

More Articles

Travel like an expert with aaa and trip canvas, get ideas from the pros.

As one of the largest travel agencies in North America, we have a wealth of recommendations to share! Browse our articles and videos for inspiration, or dive right in with preplanned AAA Road Trips, cruises and vacation tours.

Build and Research Your Options

Save and organize every aspect of your trip including cruises, hotels, activities, transportation and more. Book hotels confidently using our AAA Diamond Designations and verified reviews.

Book Everything in One Place

From cruises to day tours, buy all parts of your vacation in one transaction, or work with our nationwide network of AAA Travel Agents to secure the trip of your dreams!

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Garden Road Trips Member News AAA's Take Good Question Car Reviews AAA Traveler Worldwise Foodie Finds Minute Escapes

WHAT’S COVERED, COSTS, AND TIPS ON FINDING THE BEST TRAVEL INSURANCE FOR YOUR NEEDS

March 28, 2024 | 5 min read.

Travel insurance can be an overwhelming expense to consider atop an already costly vacation. Admittedly, even as a seasoned travel industry professional with three decades of globe-trotting under my belt, I have a moment of pause each time I’m confronted with this. Ultimately, I almost always purchase some travel insurance coverage, especially when it’s a complex international trip. It’s primarily motivated by my aging parents—heaven forbid anything should happen to them—and wanting a safety net to return home at a moment’s notice without incurring massive out-of-pocket costs. This parental paranoia is just a small piece of the greater solace that travel insurance can provide, says AAA Tour Product Manager Randy Osborne. “Everyone can benefit from travel insurance,” he says. “The unexpected happens. It can provide peace of mind and reduce stress during a traumatic situation, as well as a contact to call when traveling abroad.” Osborne has seen it all. He works directly with AAA Travel Advisors and AAA’s preferred travel insurance provider, Allianz . It’s a vantage point that continually provides him with real-life cautionary travel tales. “I’ve never heard of anyone who needed and used travel insurance regretting having purchased it,” Osborne says. He says the biggest mistake people make is this: “Not getting it at all.” Here are some key things to keep in mind when navigating travel insurance

IT’S A FINANCIAL SAFETY NET FOR YOUR VACATION INVESTMENT There is no “one-size-fits-all” travel insurance plan, says Osborne, since available plans will be based on the trip cost, vacation destination(s) and age of the traveler(s). Most comprehensive travel insurance plans, however, will include varying degrees of coverage for the following:

- Trip Cancellation: This is a predeparture benefit that provides the ability to recoup travel costs if you cannot travel. It’s typically limited to specific reasons covered in the plan. Osborne advises understanding what these covered reasons are upfront when reviewing plan options.

- Trip Interruption: This helps if you need to cut your trip short. Covered reasons typically include an illness or injury during the trip, or a family emergency at home—which, as mentioned earlier, has always been this author’s primary motivator to purchase travel insurance.

- Travel Delays: This helps to cover expenses if your travel is delayed due to a covered reason. Osborne advises understanding what constitutes a “travel delay” within the travel insurance plans you are considering.

- Medical Expenses: This helps to cover unforeseen medical expenses while traveling to destinations where your U.S.-based health insurance may not work. “Frequently, the biggest covered amounts are for medical,” Osborne says.

- Emergency Evacuation Coverage: This typically helps to cover the cost of transportation (plus related medical services and supplies) to a medical facility if you’re seriously injured or ill. The best plans will provide up to $1 million per person for medical evacuation. This can seem high, but evacuation costs can exceed tens of thousands of dollars, especially if you’re traveling to a remote destination.

- Baggage Loss or Delays: This helps to recoup costs for lost luggage, as well as damaged or stolen baggage while you are on your trip.

COMPARE PLANS

In some cases, such as when booking a cruise or a guided group tour vacation, the travel provider may require you to purchase a certain level of travel insurance before you can join the excursion. In these situations, representatives often have options that allow you to bundle travel insurance into the cost of the vacation at the time of booking. Even if this is the case, however, Osborne says it pays to shop around and compare travel insurance plans to see if there is a policy that better suits your needs.

Most travel insurance companies, including Allianz Insurance, have easy-to-use websites that highlight several levels of travel insurance for your trip. These quotes can be used as baselines for building upon or removing elements. Gather a few online quotes, then speak over the phone with a representative to customize.

SEEK PROFESSIONAL GUIDANCE

Allow a AAA Travel Advisor to guide you through the process and identify a travel insurance policy that works for your needs, risk tolerance, and budget. The best part: This service is free.

PURCHASE EARLY FOR THE MOST BENEFITS

You’ll get the best and most comprehensive coverage if you purchase travel insurance within the first 14 days of making a trip deposit. (That clock starts ticking once you put a down payment on any part of the vacation.) The biggest benefits include:

- Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even before you step on that plane, train, or cruise ship. “Often I get calls from travelers who didn’t expect to need insurance and then have a [medical] diagnosis before travel that prevents them from going,” Osborne says.

- Better Trip Cancellation Coverage Options: Many travel insurance companies offer more covered reasons for trip cancellation if you purchase it within 14 days of making an initial trip deposit.

- Pre-Existing Medical Conditions: If you have a pre-existing medical condition, most travel insurance will not cover medical situations due to this condition that arise during your travels— that is, unless you purchase comprehensive travel insurance coverage within the first 14 days of making a trip deposit.

ASSESS MEDICAL COVERAGE CAREFULLY, ESPECIALLY IF YOU HAVE A PRE-EXISTING CONDITION

Most U.S.-based health insurance plans won’t offer medical coverage on non-U.S. soil. Even if you have outstanding health insurance, it may not be very helpful during an international vacation where unexpected medical and health issues arise. This is certainly the case if you’re traveling to more remote areas with limited medical facilities or your vacation includes high-risk excursions and activities. Osborne says it’s important to understand whether travel insurance you’re considering offer primary or secondary medical coverage, and to assess which is best for you.

If you have a pre-existing medical condition or chronic health problems, medical coverage is an especially critical piece of the policy to scrutinize, Osborne says. He recommends consulting a travel insurance specialist so that you are covered accordingly.

UNDERSTAND WHAT IS NOT COVERED IN THE POLICY It’s easy to focus on what’s included when comparing trip insurance plans. Osborne recommends paying close attention to what is excluded from coverage, too.

Case and point: I recently read about a couple who booked a return flight home after their original flight had been cancelled. When the couple filed a claim with their insurance provider to recoup this cost of this new flight, they learned that this specific scenario was not covered under the policy. (The flight was cancelled due to crew not arriving on time, and the airline was able to rebook the couple on a less-desirable flight home, which the couple declined.)

Clearly understanding the exclusions—and this could be achieved with a simple phone call to the insurance provider’s customer service—could have prevented this financial oops. BE

Find An Agent

AAA Travel Advisors can provide vacation planning guidance to make your next trip unforgettable. Find a Travel Advisor

CAREFUL RELYING ON CREDIT CARD TRAVEL INSURANCE Just as you should not rely on your U.S.-based health insurance to cover you while traveling internationally, it’s wise to not make assumptions about a credit card that offers travel insurance as one of its perks. Osborne advises reviewing the credit card’s travel insurance coverage amount; the medical coverage policy; whether all trip purchases need to be made with that credit card; and if approved claims results in a cash refund or a travel credit.

EPIDEMIC AND PANDEMIC COVERAGE IS AVAILABLE The events of 2020 turned travel on its head, and also impacted the travel insurance industry. As a result, travel insurance companies evolved and most now offer epidemic and pandemic coverage options. “Having coverage for quarantine is at the forefront of people’s minds now,” says Osborne, pointing to the out-of-pocket costs that came with many travelers having to quarantine in a vacation destination when Covid-19 was at a peak. BUDGET FOR TRAVEL INSURANCE The average cost of travel insurance is 5% – 6% of your trip costs, according to Forbes Advisors’ analysis of travel insurance rates. If you’re planning an international, bucket-list vacation—and want to protect your investment in the unfortunate event that things go sideways—it’s wise to keep this cost in mind when creating your trip budget. “As much as we don’t want to think about the unexpected, things happen and having the coverage you need when you need it can be a huge benefit,” says Osborne. “If you need it, you will never regret having it.

- facebook share

- link share Copy tooltiptextCopy1

- link share Copy tooltiptextCopy2

3 Surprising Ways to Save Money on a Road Trip

Is It Cheaper To Fly Or Drive For Your Vacation?

6 Car Essentials to Carry in Case of Emergency Roadside Events

Related articles.

What Does Cruise Insurance Cover?

Which Trusted Travel Program is Best For You?

How to Reduce the Chances Your Flight Will Be Canceled

Limited Time Offer!

Please wait....

AAA Magazines

Why buying the right travel insurance is now more important than ever.

By Paul Lasley and Elizabeth Harryman

May 05, 2021

Susan and Jim Ferguson had never bought travel insurance. “I always figured it was a waste of money," Susan says. So when the Lakewood, California, couple booked a trip to Switzerland last year to visit relatives, their AAA travel advisor, Pam Hardin, suggested they buy a travel insurance policy. They initially declined. Ultimately, however, because the cost was not that great, they decided to take Hardin’s advice and pay the additional $59 each for their $620 flights.

It turned out to be a wise move. The day before their trip, Jim, a lighting company sales manager, got sick. “He had a fever, and his doctor told him not to fly,” says Susan, who continued on the trip with her parents. Jim filed a claim with Allianz Travel Insurance, one of many companies selling these products and which partners with AAA to offer travel insurance plans to members. “Within two weeks, we had a check for $620,” Susan says. “I will never fly again without insurance.”

The popularity of travel insurance

The Fergusons are not alone. Even before the onset of the COVID-19 pandemic, travel insurance was gaining in popularity. In 2018, Americans spent nearly $4 billion on travel insurance, a more than 40 percent increase over 2016 (the most recent figures available). By 2020, some countries, such as Ecuador, had begun requiring visitors to show proof of medical travel insurance before entering the country.

Since the pandemic, however, interest in travel insurance has soared. The percentage of consumers buying travel insurance when they book a trip has increased by about 15 percent, says Daniel Durazo, marketing and communications director for Allianz Global Assistance . And travel advisor Hardin notes: “I definitely am seeing across the board more clients inquiring about—as well as purchasing—travel insurance.”

Pandemic coverage in travel insurance policies

Ironically, it was disappointment that thrust travel insurance into the headlines last year, when some travelers tried to cancel their trips because of COVID-19. “Last March, many consumers were shocked that their insurance didn’t cover them,” says Carmen Balber, executive director of Consumer Watchdog , a nonprofit consumer advocacy group. “Pandemics were excluded.”

That’s no longer true in many cases. The anger travel insurance companies faced from consumers over those exclusions has prompted changes in the industry. Many companies, including Allianz, have added epidemic coverage to their insurance products.

Now, if you’re ill with COVID before or during the trip, you’re covered for cancellations, interruptions, and emergency medical care, Durazo says of Allianz. The same applies if you’re individually quarantined by government mandate and have to cancel or interrupt your trip because of that. “Our product enhancements now include coverage for illnesses of COVID-19 or any other epidemic,” he says, noting that there are some caveats. “We’re trying to look forward, and scientists are saying this won’t be the last epidemic we ever deal with.”

You may also like: Ask the Traveler: How do I plan around flight delays?

The benefits of travel insurance

Travel insurance goes far beyond COVID coverage. It typically costs between 5 and 10 percent of your trip cost and can help protect your investment in your vacation or business trip. Here are some other reasons to consider travel insurance:

- If you need to cancel or interrupt your trip. Trip cancellation and trip interruption insurance can reimburse you for your prepaid, nonrefundable expenses if you cancel or interrupt your trip for a covered reason.

- If you need emergency medical care or medical transportation. Medical travel insurance can cover those costs, which can run into many thousands of dollars.

- If your trip is delayed. Travel delay coverage can reimburse you for expenses incurred if you get stuck at the airport and need meals, lodging, or transportation.

- If your bags don’t arrive. Baggage loss or delay coverage can reimburse you if your bags are lost or delayed and you need to buy some clothes or other items for your trip.

What are cancel-for-any-reason policies?

“Cancel for any reason” (CFAR) policies have gained a lot of attention during the pandemic. They allow you to cancel for almost any reason, but they typically cost about 50 percent more than regular travel insurance and reimburse only 50 to 75 percent of your trip cost. (Allianz offers a similar product called Cancel Anytime.)

“CFAR policies are extremely expensive,” says Balber of Consumer Watchdog. “You need to think about how likely it is that you might have to cancel unexpectedly, and gauge how much extra money you’re willing to put out for that unlikely scenario.”

You may also like: Why you need to use a travel agent more than ever now

What to know before buying travel insurance

Before you sign up for any travel insurance policy, do due diligence and educate yourself.

“The biggest problem with travel insurance is that consumers rarely know what they’re purchasing,” says Balber. “The industry is so unstandardized. It’s extremely important to read the fine print. Make sure the insurance covers you for what you’re concerned about.”

Read the policy carefully before you buy it. With Allianz, you have 15 days to review it, and if you find it doesn’t meet your needs, you can either exchange it for a different policy or get a refund, Durazo says.

Here are some things to keep in mind when you’re buying travel insurance:

- Learn the lingo. “Covered reasons” are matters typically covered by travel insurance. Those can include things such as you or your kids getting sick or injured before or during your trip, but always check your particular policy. “Exclusions” are things that are not covered. Acts of war and civil unrest are typically not covered, as well as illegal activity by the customer. (So, if you miss your flight because security found illicit drugs in your carry-on, you’re out of luck.) Perhaps surprisingly, terrorism typically is covered if the terrorist event at your destination occurs within 30 days of your arrival.

- Be aware of timing. It’s best to buy travel insurance when you book your trip—your coverage begins 24 hours after you buy your policy. “You want the longest period of coverage possible,” says Durazo, “and it doesn’t cost extra.” You can get coverage for pre-existing medical conditions, but to get that benefit you typically have to buy the insurance within 14 days of booking your trip. And just as you can’t buy fire insurance for a building that has gone up in flames, you can’t buy coverage for a hurricane after the hurricane has been named.

- Buy from an independent company. Don’t buy the coverage that’s sometimes offered by cruise lines, airlines, or tour operators, to protect yourself in the rare instance that the company goes out of business.

As with any important purchase, you need to do research before buying, but travel insurance can even the playing field in today’s unpredictable travel world.

Paul Lasley and Elizabeth Harryman produce and host two daily radio shows that are broadcast to a million listeners in 167 countries on the American Forces Network and air on their podcast at ontravel.com .

Follow us on Instagram

Follow @AAAAutoClubEnterprises for the latest on what to see and do.

Read more articles

You'll find more of the articles you love to read at AAA Insider .

Travel offers and deals

Hot travel deals

Get the latest offers from AAA Travel’s preferred partners.

Travel with AAA

See how we can help you plan, book, and save on your next vacation.

Entertainment savings

Save big with AAA discounts on tickets to your next adventure.

Travel with confidence

Purchase travel insurance with Allianz Global Assistance.

How AAA Members Can Save Big Money When Traveling

I f you're a frequent traveler, you're no stranger to all the ways you can save money so you can travel more often. From travel credit card perks to airfare booking strategies , you've probably got it all figured out. However, you might be surprised when we say that if you're not a AAA (American Automobile Association) member, you might be missing out on amazing deals.

AAA is a non-profit organization -- technically a federation of motor clubs -- that is dedicated to enhancing its members' travel experiences throughout the U.S.A. It offers a range of benefits that can significantly contribute to cost savings for your trips while also providing peace of mind while on the road.

Perks range from 24/7 roadside assistance to exclusive discounts on car rentals and hotel stays. However, you won't just get perks for road trips -- AAA will also take to the skies with you with deals on airfare and travel abroad with all-inclusive trips to Mexico , the Caribbean , and beyond.

AAA 'S Membership Tiers Offer Great Value For Travelers

Since it was established in 1902, AAA has reliably served travelers across the United States. Now, with a century of experience, it has become a trusted organization best known for its comprehensive travel services.

AAA offers three main membership levels: Classic, Plus, and Premier, all with incredible perks. The Classic membership is the basic tier, but there's nothing simple about it. This tier still provides all the essential services, such as roadside assistance, $60 dollars toward locksmith services, and access to travel resources. However, it also includes discounts on rental cars, identity theft protection, and expedited passport and travel visa services.

The second-tier Plus membership includes all of that but simply in greater amounts. For example, you get 100 miles of towing (whereas Classic provides 7), emergency fuel delivery that is completely free (including the fuel), along with 50% off European travel guides.

The Premier membership offers the highest level of coverage and benefits and includes everything from the Plus and Classic tiers with even greater discounts. Premier members can expect to receive amazing extras like one-day free car rentals and concierge services for those bougie budget-conscious travelers.

Membership costs will vary depending on your zip code and the level chosen. For example, the Classic tier in California costs around $36 per year but in neighboring Arizona goes up to $65. No matter the cost, considering the potential savings and benefits, the value received should make it worth your while.

Get Great Discounts On Travel With AAA

Through its extensive network of partnerships, AAA members can save a trunkload of money. As a member, you will gain access to a wide range of discounted travel options, including all-inclusive resort or cruise packages or piecemeal -- if you like to book things separately -- hotel accommodations, car rentals, and airfare.

For example, when booking hotel accommodations, AAA members often receive discounted rates that can range from 5 to 10% off the regular prices for hotels chains like Hilton, Best Western, and MGM. This means significant savings on popular hotels and resorts located both in the U.S. and worldwide. You'll even earn loyalty points when you book through AAA , which can be applied towards your next membership renewal.

Similarly, when renting a car, AAA members can benefit from discounted rates (up to 35% on electric vehicles ), free upgrades, and additional perks like fuel discounts with their main partner Hertz or budget car rental companies like Thrifty and Dollar. AAA will even waive the additional driver and young renters fees if you're between the ages of 20 to 24.

AAA Offers Members Expert Travel Planning Support

While all the roadside assistance is great for long road trips, what really makes the organization stand out is that it's actually the largest travel agency in the U.S. Their advisors are available to chat with you in-person or virtually. AAA travel agents won't just help you plan an amazing trip but they can also find you the best deals through their exclusive discounts.

If you're thinking about planning a road trip , AAA also offers their own travel app called TripTik. This is an interactive road trip planning tool that can help you plan out stops along your route for gas and rest stops, restaurants, hotels, and attractions. If you need some inspiration, the app also has 600 pre-planned scenic drives including recommended stops.

For those who enjoy the analog versions of things, AAA is one of the few organizations that still offer paper maps to its members for free. However, if you prefer digital, they haven't forgotten you. You can grab AAA's digital TourBooks which provide access to information about destinations across North America and the Caribbean.

Get Everything You Need To Travel In One Place

Now that you know where you want to go, you just have to get there. Luckily, AAA offices can be your one-stop-shop for (almost) all your official documents.

If you know you have air travel planned soon, and you don't have a passport or need to renew it quickly and/or you need a travel visa, head to your nearest AAA office instead of the post office or passport office. With AAA , you can take your passport photos (at a discount for AAA members) and get your passport and visa application expedited through AAA 's connections with RushMyPassport.

If you're planning to drive while abroad, you may also want to consider grabbing an International Driving Permit (IDP). Since a U.S. Driver's License is not accepted in all countries, an IDP is a surefire way to avoid issues. An IDP can also reduce issues with language barriers and it may be required to rent a car. The best part is that with AAA you can get an IDP the same day you apply for only $20, plus additional (but still discounted) fees for the passport photos required for the document.

Lastly, to be prepared for any eventuality that may occur on your trip, you can also purchase automotive and travel insurance through AAA . They partner with Allianz Global Assistance so members can take advantage of insurance policies that cover trip cancellation, trip interruption, and emergency medical coverage.

Read this next: Safety Items You Should Pack For Your Next Road Trip

Six Travel Mistakes to Avoid

No travel medical insurance? Unnecessary luggage and hotel fees? Here are the biggest travel mistakes people make and how you can avoid them.

- Newsletter sign up Newsletter

Even the most seasoned tourists can make travel mistakes when planning a vacation. Some blunders can be minor infractions, but others can cost travelers a lot of money and heartache.

But there are steps you can take to avoid travel mistakes. Here are six slip ups that travelers may make this year, plus tips on how to avoid them.

1. Overlooking travel medical insurance

Christopher Elliott , a consumer advocate and founder of the nonprofit Elliott Advocacy , says many people don’t consider purchasing travel medical insurance . “People often think nothing bad will happen before or on their vacation, but then they get injured overseas and need to go to the hospital, and the next thing they’re looking at is a $10,000 hospital bill.” Indeed, nearly one in four Americans report they’ve experienced a medical issue while traveling abroad, according to a 2023 survey sponsored by GeoBlue, an international health insurance company.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, most U.S. healthcare plans — including employer group plans, Medicare and Affordable Care Act plans — offer limited or no medical coverage outside the U.S.

How to avoid: One solution is to purchase a travel medical insurance policy, a type of insurance that provides coverage for a range of medical emergencies while traveling abroad, from minor injuries to major events like heart attacks and strokes, to medical evacuation and emergency transport in the case of severe emergencies.

The average travel medical insurance plan costs $89, according to Squaremouth , a travel insurance comparison website. Squaremouth advises international travelers to obtain a policy that provides a minimum of $50,000 in emergency medical coverage and at least $100,000 in medical evacuation coverage.

Note: Some travel insurance policies include emergency medical coverage and medical evacuation coverage up to certain limits.

2. Getting hit with unnecessary luggage fees

You may have heard that a number of airlines — including American Airlines , Delta , and JetBlue Airways — recently raised their prices for checked bags. But one thing a lot of travelers aren’t aware of, Elliott says, is that some are now charging customers more if they check a bag at the airport versus paying to check a bag in advance. For instance, JetBlue customers flying within the U.S., Latin America, the Caribbean and Canada can save up to $20 on their first two checked bags ($10 savings per bag) when they add them to their flight reservation at least 24 hours before departure.

How to avoid: Make sure to pay ahead of time for any bags that you plan to check.

3. Incurring hidden hotel fees

Wi-Fi fees, early check-in fees, gym fees—hotels today charge guests no shortage of extra fees and surcharges . It’s a widespread problem: In an April 2023 survey by Consumer Reports , nearly four out of 10 (37%) U.S. adults said they had experienced a hidden or unexpected hotel fee in the previous two years.

How to avoid: Many hotels offer to reduce or, in some cases, waive certain fees to guests who join their loyalty program, which is free in most cases. Also, sometimes simply asking an employee at check-in to waive certain fees could do the trick.

4. Not utilizing a key search feature on Airbnb

Like hotels, Airbnb rental property owners often tack on extra fees, such as cleaning fees, fees for additional guests beyond a certain number, and service fees. These additional costs can add hundreds of dollars to your bill.

How to avoid: Elliott praised Airbnb for introducing a feature in December 2022 that allows guests to view a stay’s total costs, before taxes, when searching for rental properties. But he says there’s a caveat: “If you’re in the U.S., you need to change a setting in order to see the full rate when you search for rentals.”

To enable the feature, click the slider on the upper right of the search page that says, “Display total before taxes.”

5. Paying full price for a rental car

First, the good news: “The rental vehicle shortage has improved,” Elliott says. That’s resulted in a stabilization of rates, with rental car prices recently averaging $42 a day, up only 3% from last year, according to a report from the travel search company Hopper. The bad news? Renting a car is still more expensive than it was before the pandemic, especially for travelers who pay full freight.

How to avoid: There are several ways you can avoid paying full price. Big-box stores such as Costco , BJ’s and Sam’s Club provide their members discounts on certain rental cars. AARP and AAA also offer their members discounted rates. ( AARP members save up to 30% on base rates at Avis and Budget Rent A Car; AAA members save up to 20% on Hertz rentals). In addition, a number of credit card companies offer certain cardholders rental car discounts when they book a vehicle from specific rental car companies.

You may also be able to nab a lower rate by prepaying when you book a reservation. And, some rental car companies offer limited-mileage plans at a lower cost, which could be a good option if you’re planning to take just a short trip.

Tip: See if your credit card offers rental car insurance before you pay for insurance from a rental car company.

6. Encountering sky-high hotel rates because of Taylor Swift’s European tour

When Taylor Swift performs a concert, sometimes tens of thousands of out-of-town fans descend on the city, causing hotel prices to spike. Consider: the median rate for a standard hotel room during an Eras Tour date in Europe this year is projected to jump by 44%, with average hotel room prices in Warsaw surging a staggering 154% during her tour date there, according to a recent study by Lighthouse , a travel and hospitality research company.

How to avoid: The simplest approach for Europe-bound travelers in 2024, Elliott says, is to avoid traveling to a destination during a Taylor Swift tour date in that city. “When Taylor Swift comes to town all of the hotels sell out, and it becomes very difficult to find a reasonably priced hotel,” he says.

Related Content

- 24 Best Travel Websites to Find Deals and Save You Money

- Five Ways to a Cheap Last-Minute Vacation

- Best Travel Rewards Cards May 2024

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Daniel Bortz is a freelance writer based in Arlington, Va. His work has been published by The New York Times, The Washington Post, Consumer Reports, Newsweek, and Money magazine, among others.

Five steps to take if travels go awry and you need to get money back.

By Becca van Sambeck Published 12 May 24

Is your retirement planning full of holes? Unless you fully understand a few key points, you could be setting yourself up for some surprises.

By Jenna Lolly, CFP® Published 12 May 24

Everest, Inc. author Will Cockrell discusses why high-net-worth people flock to climb Mount Everest.

By Alexandra Svokos Published 11 May 24

A new poll shows a vast majority of Americans believe now is a bad time to buy a house, in the worst low in Gallup's history.

By Alexandra Svokos Published 10 May 24

Scammers are targeting college graduates with fake job ads, according to the FTC.

Shop early and honor mothers everywhere with great deals from Walmart, Amazon, Etsy, Applebee's, Pandora and oh, so many more.

By Kathryn Pomroy Published 9 May 24

Celebrate Teacher Appreciation Week through May 10 with deals from Scholastic, Microsoft, AT&T, Verizon and more.

A new Gallup poll shows Americans are still concerned about having enough money for retirement, but there are some changes from last year.

By Alexandra Svokos Last updated 6 May 24

Jobs Report Slower jobs growth and easing wage pressures are good news for rate cuts.

By Dan Burrows Published 3 May 24

Federal Reserve The Federal Reserve struck a dovish pose even as it kept interest rates unchanged for a sixth straight meeting.

By Dan Burrows Published 1 May 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

More From Forbes

Is travel insurance refundable here’s everything you need to know.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Sometimes, travel insurance is refundable. Here's when you can get your money back.

Peter Hoagland always checks to see if his travel insurance is refundable. That's because anything can happen between the time you book your vacation and when you leave — and because travel insurance isn't always refundable.

During the pandemic, he discovered that the hard way. He had to cancel a trip and asked for his money back from the insurance company. It refused.

"Since then, I always read the fine print on the policy," he says.

The refundability of travel insurance has always been an open question. Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions.

Like the pandemic, when refund policies were all over the map. Some insurance companies adhered to their published policies. Others offered a credit that could be reused within a year, which was minimally useful because the pandemic was still happening a year later. Others quietly gave their customers a refund.

Hoagland says he fought for his money. Eventually, he contacted a manager at his travel insurance company.

"That produced a quick result," he says. "I got my money back."

Drake-Kendrick Lamar Feud Timeline: Third Trespassing Incident In A Week Reported At Drake’s Toronto Home

Netflix marvel dud among movies new on streaming service this week, apple’s new chatgpt deal—here’s what it means for iphone security.

But let's face it: Getting a refund for travel insurance can be difficult. There are times when insurance is always refundable because it's required by law. There are times when it's sometimes refundable. And there are times when it's almost never refundable. But even then, there may be a way to recover some — or all — of the value of your policy.

Getting a refund for travel insurance can be a challenge

If you have a travel insurance policy and would like to get a refund, it might be easier said than done, say experts.

"While travel insurance is regulated like auto and home insurance, it’s often less standardized," says Stuart Winchester, CEO of Marble, a digital wallet for your insurance. "So first off, it’s important to check the fine print of your specific policy. Don’t assume it’s like the last one you got."

Even when you have something in writing, a refund can require some serious negotiating skills.

"Getting a refund for travel insurance can be complicated and frustrating," says Peter Hamdy, the managing director of a tour operator in Auckland, New Zealand. He's asked for a refund on policies numerous times and says that despite what travel insurance companies may tell you, there are no hard-and-fast rules when it comes to getting a refund on your policy.

"Some situations can warrant a refund," he says. "It depends on your policy."

What does a typical refundability clause look like? For example, the World Explorer Guardian from Insured Nomads notes that it's refundable only during the 10-day review period from the date of delivery or 15 days from the date of delivery if mailed, provided you have not already departed on your trip and you have not incurred any claimable losses during that time. If you depart on your trip before the expiration of the review period, the review period ends and the policy can't be refunded.

"We go a bit further with our World Explorer Travel Medical plans," notes Andrew Jernigan, CEO of Insured Nomads. "If no claims have been filed then we can refund the unused portion of the policy if you cut your trip short.”

When can you get a refund for travel insurance?

Here are the most common cases where travel insurance can be refunded:

- If you cancel during the "free look" period required by the government. Most states require what's called a "free look" period of anywhere from 10 to 14 days. "During this period, travelers can review the purchase and make sure it fits their needs," explains James Nuttall, general manager of Insubuy . "If it does not, they can cancel it for any reason and get a full refund, no questions asked, so long as you haven’t departed yet.

- If you cancel during the travel insurance company grace period. Many insurance companies also have a grace period for refunds (usually, they are the same as the "free look" although some grace periods can be longer). "If you’re outside your grace period, which typically lasts one to two weeks after signing, you’re contractually obliged to pay your premiums," says David Ciccarelli, CEO of the vacation rental site Lake . "Still, it doesn’t hurt to ask your company for a refund or alternative options if you’re outside your grace window. You might not get a yes, but it could lead to some cost savings or better solutions."

- When someone else cancels your trip. "For instance, if your cruise is canceled due to low river tide, you are not at fault and would typically receive a full refund or credit for a future sailing, thus eliminating the need for the travel insurance policy," explains Rhonda Abedsalam vice president of travel insurance for AXA Assistance US.

- If you die. Typically, the policy would be refunded to your next of kin. Generally, you can also ask for a refund if your travel companion dies before your trip.

Remember, it depends on where you buy your insurance

The refundability of your insurance can depend on where you purchased it. Commercial policies bought from a cruise or tour company are generally canceled and refunded if you cancel the trip far enough in advance of your departure date.

"The travel insurance cancellation provisions are generally tied to the cancellation provisions for the cruise or tour," explains Dan Skilken, president of TripInsurance.com . "After you have paid the last deposits on the cruise and are close enough to departure that they will not provide a refund on the cruise, they generally will also not provide a refund on the travel insurance. But if you cancel early enough to get all or most of your deposit back, you will also get your travel insurance premium refunded."

If you’ve purchased retail travel insurance from a third-party provider or comparison website, you can often get a refund if you can show receipts proving that you received a full refund of all trip deposits and have not had any cancellation penalties or taken any travel credits when you canceled your trip.

That's because retail travel insurance is sold for a specific traveler and for a specific trip. If you have proof of a complete refund and have not received travel credits, then you no longer have what's called an "insurable interest" in the trip. The insurance company must cancel and refund your premium in full, says Skilken.

Insider tip: If the insurance company refuses, just tell them you have proof that you no longer have an insurable interest in the trip. You have to have an insurable interest in a trip to own a travel insurance policy.

Your agent may be able to help you get a refund

You may also be able to lean on the agent who sold you the policy. For example, all policies on Squaremouth come with a money-back guarantee.

"The purpose of this benefit is to give travelers extra time to review their policy documentation to be sure it’s the best policy for their coverage needs," says spokeswoman Jenna Hummer. At Squaremouth, the money-back period typically lasts between 10 and 14 days, which is in line with the mandated "free look" period.

However, I have also seen agents negotiate with travel insurance companies for a more generous refund period in case of extenuating circumstances. There's no guarantee that you'll get it, but it's worth asking — and one reason to work with a third party.

Agents can also help you avoid this problem. Susan Sherren, who runs Couture Trips , a travel agency, notes that American Airlines Vacation Packages offers a predeparture protection insurance plan, which allows cancellation for any reason before the outbound departing flight time. Other restrictions apply, she adds.

"More flexibility will often cost you more," she says. "But having the flexibility is a great way to sleep well at night."

Can't get a refund? Look for other kinds of flexibility from your travel insurance company

Even if your travel insurance company says no to a refund, it doesn't necessarily mean you've lost the value of your policy.

"If a travel supplier changes or cancels your trip, you should be able to change your travel insurance policy to match the new dates of your trip or even cover a new trip, sometimes up to two years into the future," says Daniel Durazo, director of external communications at Allianz Partners USA .

Pro tip: Be sure to change the dates of your travel insurance policy before the departure date of your current itinerary. You can do that online or by calling your agent. Once the policy's effective date has passed, making any changes or initiating a refund or credit becomes much more difficult.

Don't forget to do your due diligence

Bottom line: Travel insurance is refundable under certain circumstances. But knowing when can require research.

"It's important for consumers to carefully read their policy upon receipt to understand the specific terms offered by their insurance provider," says Robert Gallagher, president of the US Travel Insurance Association.

The more you know, the likelier you are to get the refund you want when your plans change.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

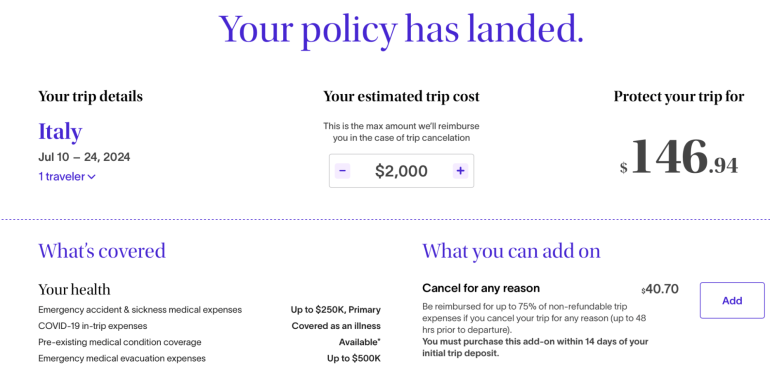

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

IMAGES

COMMENTS

Protect your travel budget with AAA-exclusive TripProtect from our trusted travel insurance partner Allianz Global Assistance and you can have money-saving benefits and 24/7 live assistance. Costly Unplanned Expenses: Travel with peace of mind knowing you have coverage for accidents, illness, medical emergencies, delayed or canceled flights ...

AAA is a federation of independent clubs throughout the United States and Canada. Whether you're traveling internationally or within the United States, AAA members have access to travel insurance which could help with non-refundable costs if you have to cancel your trip.

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis. Before shopping for a policy, check to see what coverage you may already have. Some ...

If you have any medical- or travel-related issues during your trip, call Allianz Global at (866) 884-3556 and mention your AAA travel insurance policy to get help with your problem. AAA Travel ...

With travel insurance, you don't necessarily have to pay for a trip you are unable to take. 2. Nearly 3 million bags were lost, late or damaged by airlines in 2022. Allianz Global Assistance can provide benefits to replace needed items if your bags are delayed, damaged or stolen. 3. Credit card coverage may not provide sufficient coverage for ...

Free Hertz Gold Plus Rewards Membership. Free Best Western Rewards Membership. Discounted Passport Photos. Join AAA. Premier Members Also Receive: Up to $1,500 Trip Interruption and Delay coverage. Up to $500 in Lost Baggage coverage. Up to $300,000 Travel Accident Insurance. Up to $25,000 in Emergency Medical Transportation coverage.

Here are nine reasons why experienced travelers choose Allianz Travel Insurance through AAA:* 1. Life is unpredictable. Some trips need to be cancelled. With travel insurance, you don't necessarily have to pay for a trip you are unable to take. Instead, enjoy more confidence knowing you're a step ahead of unpredictable situations before and ...

Travel insurance. A vacation can be a huge expense and Allianz Travel Insurance plans 7 from AAA can help protect you, your loved ones, and your investment. Travel with confidence knowing you have award-winning 24/7 support and protection from Allianz to help you manage any unforeseen issues that may occur before or during your trip.

The biggest benefits include: Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even before you step on that plane, train, or cruise ship. "Often I get calls from travelers who didn't expect to need insurance and then have a [medical] diagnosis before travel that prevents them from going," Osborne says.

AAA has partnered with Allianz Global Assistance to offer comprehensive travel insurance plans to help you protect your travel investment with coverage for accidents, illness, medical emergencies, canceled flights, lost luggage, missed ports of call, and even options for river cruise high or low water interruptions and more.

Plans include insurance benefits and assistance services. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected]. Keep reading in: Safe Travel Advice, Travel Insurance. Whether you're jetting around the globe or driving cross-country, a dream vacation is a big investment.

Valid for bookings through 5/31/2024 and vehicle pick up through 6/30/2024. Subject to availability, blackout periods and additional restrictions. At the time of rental, present your AAA Membership card for identification. AAA offers roadside assistance, travel, insurance, automotive & banking services. Explore 2024 exclusive savings & discounts.

Here are some other reasons to consider travel insurance: If you need to cancel or interrupt your trip. Trip cancellation and trip interruption insurance can reimburse you for your prepaid, nonrefundable expenses if you cancel or interrupt your trip for a covered reason. If you need emergency medical care or medical transportation.

Travel insurance usually costs anywhere between 3 and 15 percent of price of the trip, with an average deductible of about $200. Services provided by insurance companies typically include 24-hour multilingual phone assistance while traveling. ... Your AAA Travel Counselor can help you select a travel insurance policy that's right for you.

AAA Benefits. With a TripProtect plan* from Allianz Global Assistance, you can relax before and during your trips. Travel Vaccine Coverage: You received immunizations required for entry into your destination and cancel your trip for a covered reason under Trip Cancellation. Lost/Stolen Document Replacement Fees: Costs you incur for the document ...

AAA 'S Membership Tiers Offer Great Value For Travelers. AAA offers three main membership levels: Classic, Plus, and Premier, all with incredible perks. The Classic membership is the basic tier ...

Become a AAA member today and unlock exclusive discounts, free towing, and other benefits. Plus, you'll benefit from 24/7 roadside assistance. Get the best value for your money and start enjoying the perks of membership today!

Here are six slip ups that travelers may make this year, plus tips on how to avoid them. 1. Overlooking travel medical insurance. Christopher Elliott, a consumer advocate and founder of the ...

Save up to 40% on daily, weekly, and weekend car rentals when using promotion coupon #211358 at time of reservation. Book My Hertz Month Offer. Exclusive discounts and benefits for AAA members who rent from Hertz include*: Discounts up to 20% off the base rate on all Hertz rentals. Free AAA additional driver.

Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions ...

Yes. This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis. The plan is comprehensive and includes coverage you don't typically see, such as ...