Best cash back credit cards for travel

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Rewards credit cards

- • Credit card comparisons

- • Travel credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- If you travel two or more times per year, or if you plan to travel more in the future, you might find a lot of value in a travel credit card

- If you don't travel frequently, you might find more value in strategically using a cash back credit card to cover travel-related purchases

- Many cash back cards offer travel-related perks like bonus rewards on travel purchases, no foreign transaction fees, access to the issuer's travel portal and limited-time offers on select travel purchases

Once you’ve got the travel itch, you know it’s time to plan your next getaway. But if you only travel occasionally, a travel credit card might not be the right fit for you. Sure, travel cards often come with incredible welcome bonuses, higher rewards rates, annual statement credits, airport lounge access and other major perks, but they also tend to come with high annual fees, which can be hard to recoup if you don’t use enough card benefits each year.

In that case, it might make more sense to use a cash back credit card to help fund your next vacation. Many cash back cards offer rewards on both everyday spending and travel spending, and you can redeem your rewards for statement credits to cover travel-related expenses. Plus, some cash back cards also come with access to an issuer’s travel portal, no foreign transaction fees and other travel benefits.

Below, we’ll go over some of the best cash back credit cards for travel, along with some tips and considerations.

Chase Freedom Flex: Best for rotating bonus categories

The Chase Freedom Flex℠ * offers 5 percent cash back on activated, rotating bonus category purchases each quarter (on up to $1,500, then 1 percent back). These bonus categories change each quarter, but the annual calendar often includes gas stations or other travel-related categories.

This card also earns 5 percent cash back on Chase Ultimate Rewards travel purchases; 5 percent cash back on Lyft rides (through March 31, 2025); 3 percent cash back on dining and drugstore purchases; and 1 percent cash back on all other purchases. This card also comes with no annual fee, trip cancellation and interruption insurance , travel and emergency assistance services and the ability to redeem rewards for travel through Chase.

Blue Cash Preferred Card from American Express: Best for higher rewards on everyday spending

With the Blue Cash Preferred® Card from American Express , you’ll earn 6 percent cash back on U.S. supermarket purchases (on up to $6,000 per year, then 1 percent back); 6 percent cash back on select U.S. streaming subscriptions; 3 percent cash back on transit and at U.S. gas station; and 1 percent cash back on everything else. Also, note that you’ll get a $0 intro annual fee for the first year, after which an annual fee of $95 applies.

With this card, you can save up your cash back earnings and redeem them for a statement credit to cover travel purchases like hotels or flights. Plus, this card also comes with access to Amex Offers , allowing you to earn more rewards on qualifying purchases with select brands (including travel brands like hotels), along with access to the American Express Travel portal .

Citi Double Cash Card: Best for flat cash back

If you’d prefer a simpler rewards strategy, the Citi Double Cash ® Card is one of the best flat-rate cards on the market. This card comes with no annual fee, and you’ll earn up to 2 percent cash back on all purchases — 1 percent back as you make purchases and 1 percent back as you pay for purchases. That’s $20 in rewards for every $1,000 you spend on your card. Over time, you can earn enough rewards to cover a flight or hotel (in the form of a statement credit to your account).

This card also allows you to redeem your rewards for travel through the Citi travel portal , though it’s important to note that you won’t be able to transfer your rewards to Citi travel partners since this card only earns basic Citi ThankYou points .

Capital One SavorOne Cash Rewards Credit Card: Best for entertainment and international travel

The Capital One SavorOne Cash Rewards Credit Card is, by far, one of the best cash back credit cards for international travel. It comes with no annual fee and no foreign transaction fees, along with impressive rewards rates on entertainment and select travel purchases. You’ll earn 10 percent cash back on Uber and Uber Eats purchases (through Nov. 14, 2024); 8 percent cash back on Capital One Entertainment purchases; 5 percent cash back on hotels and rental cars booked through Capital One Travel; 3 percent cash back on dining, entertainment, popular streaming subscriptions and grocery store purchases (excluding superstores like Walmart and Target); and 1 percent cash back on all other purchases.

This card also comes with travel-related benefits like travel accident insurance, 24-hour travel assistance services and complimentary concierge services, which can help you with any travel, dining and entertainment plans. Plus, cash back rewards can be redeemed for Capital One Travel reservations (not including taxes and fees).

How to use cash back credit cards for travel

Look for cards that offer cash back on everyday expenses and travel.

Numerous cash back cards offer rewards on both everyday expenses and travel purchases, so look for a card with bonus categories that fit well with your everyday and travel spending. And don’t forget: If you have a cash back card that offers rewards on dining and gas, for example, you’ll still earn rewards on dining and gas purchases when you travel. However, with some cards, you’ll only earn rewards on U.S. category purchases, so be sure to check the fine print of your credit card agreement for any terms or limitations.

Redeem cash back as a statement credit to cover travel expenses

With a cash back credit card, you can redeem your cash back to cover a wide variety of travel-related expenses. For instance, you could save up your rewards until you reach $100 to $200 in cash back. Then, you could redeem your rewards for a statement credit to cover hotel bookings, flights, rideshares, dining out or any other travel-related expenses you have.

Check your issuer’s limited-time offers program for travel deals

Most credit cards come with access to an issuer’s limited-time offers program, which allows you to earn more rewards when you make eligible purchases with participating merchants. For example, you might find offers on hotel bookings with a specific chain (such as 10 percent back on a booking or $100 off a booking when you spend $300 or more) or offers for purchases made with travel-booking sites or rideshare companies.

See if you have access to your issuer’s travel portal

In order to stay competitive, many cash back credit cards now offer access to issuer travel portals . These portals may offer exclusive deals on travel or other benefits. For example, some cash back cards offer boosted rewards rates for select purchases made through a travel portal, while others allow you to redeem your rewards for travel purchases through the travel portal.

If you travel abroad, look for a card with no foreign transaction fees

Many cash back credit cards include a foreign transaction fee (usually 3 percent) on any purchases you make outside of the United States. If you travel abroad frequently, it would be worth getting a card with no foreign transaction fee so you don’t cancel out the rewards you’ll earn with your card. For instance, all Discover and Capital One credit cards come with no foreign transaction fees.

Is a cash back card for travel right for you?

While you can use the rewards you earn from a cash back credit card to help fund your vacation, make sure that you’re truly better off with a cash back card rather than a points or miles credit card .

For instance, if you travel two or more times per year, or if you plan to travel more frequently in the near future, it would be worth looking at some of the top travel credit cards available. Travel credit cards frequently come with perks like high welcome bonuses, travel protections, annual statement credits for travel-related purchases or airport lounge access. Just make sure that you’re able to recoup the cost of membership through card spending or benefits if you pick a card with an annual fee.

If you’re just starting to travel more frequently — or if you’re not sure if a travel card is right for you — there are a number of entry-level travel cards with low annual fees or no annual fees . That way, you can test out the travel card space to see if it’s right for you before committing to a card with a higher annual fee.

The bottom line

If you don’t travel that frequently, getting a travel credit card doesn’t make sense. Instead, you might find more value in strategically using a cash back credit card to cover travel-related purchases. With the right cash back card , you might even get some travel-related card perks such as bonus rewards on travel purchases, no foreign transaction fees, access to the issuer’s travel portal and limited-time offers on select travel purchases.

*The information about the Chase Freedom Flex℠ has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Why you should have a 2% cash back card

How to choose a cash back credit card

Best Cash Back Credit Cards of 2024

The Best Cash-Back Travel Rewards Cards

By Eric Rosen

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers. We don't review or include all companies, or all available products. Moreover, the editorial content on this page was not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are entirely those of Condé Nast Traveler's editorial team.

UPDATE: Welcome offers for the cards listed below may be out of date. Confirm the current welcome offers on each card issuer's site.

Travel rewards credit cards come in many forms: Some are co-branded with a specific airline or hotel chain , while others accrue points that can be transferred to travel partners through the issuer’s own loyalty program , like Chase Ultimate Rewards. And then there's a third type: One that earns fixed-rate points that can be redeemed for cash back on travel and other purchases.

That third type is especially useful for consumers who don’t have the time or inclination to search for airline and hotel awards, and just want to earn a solid return on their spending. What’s more, fixed-value cash-back points are more versatile than airline miles and hotel points—you can use them on a wider range of travel expenses than standard travel rewards cards, like car rentals, train tickets, and campground fees.

Here are the top nine rewards credit cards for earning cash back towards travel, and why each is especially useful.

Capital One Venture Rewards Credit Card

Earning and cash-back value: The Venture Rewards card earns two miles per dollar on every purchase, but five miles per dollar on hotels and rental cars booked through Capital One Travel. Each mile can be redeemed for statement credits toward travel purchases such as airline or train tickets, hotel rooms, car rentals, taxis and cruises, or retail gift cards at a rate of one cent apiece, so your return on spending is a sterling two percent.

Annual fee: $95

Sign-up bonus: 50,000 bonus miles (worth $500) when you spend $3,000 on purchases in the first three months.

Why it’s worth considering: In addition to redeeming miles for cash back, cardholders can also transfer their miles at a rate of two Capital One miles to 1-1.5 airline miles to 15 airline partners such as Air Canada, JetBlue, and Singapore Airlines. Capital One waives foreign transaction fees and will reimburse you for a TSA PreCheck or Global Entry application once every four years. Beware, though: While travel and gift card redemption rates are one cent per mile, if you redeem miles for statement credits toward other purchases, such as a restaurant bill or a grocery tab, you only get a half-cent in value.

Capital One VentureOne Rewards Credit Card

Earning and cash-back value: Cardholders earn 1.25 miles per dollar on all purchases and 10 miles per dollar on Hotels.com bookings through January 2020. Miles can be redeemed at one cent apiece toward travel and gift cards.

Annual fee: $0

Sign-up bonus: 20,000 bonus miles (worth $200) when you spend $1,000 on purchases in the first three months.

Why it’s worth considering: If you're looking for a CapitalOne card, the VentureOne is a great no-fee alternative to the Venture. It still has a solid rate of return and waives foreign transaction fees. Stick to travel and gift-card redemptions since you only get half the value by redeeming for other purchases.

Chase Freedom Unlimited

Earning and cash-back value: Cardholders earn 1.5 points per dollar on all purchases, plus five points per dollar on travel purchased through the Chase Ultimate Rewards portal and three points per dollar on drugstore purchases and dining. Points can then be redeemed at a rate of one cent apiece for travel or any other purchase.

Why it’s worth considering: A potential first-year return on spending of 3% for a card with no annual fee is reason enough to apply. And if you have the Chase Sapphire Preferred or the Chase Sapphire Reserve too, you can combine your cash-back points with the ones you earn with them. That means the ability to transfer your points to the Ultimate Rewards program’s airline and hotel partners like Southwest and United, or get a better rate of return on your cash-back redemptions for travel bookings made through the Chase travel site (1.25 cents per point with the Preferred and 1.5 cents with the Reserve).

Learn more about applying for the Chase Freedom Unlimited here .

Barclaycard Arrival Plus World Elite Mastercard

Earning and cash-back value: This card earns two miles per dollar on all purchases. Miles can be redeemed for a broad array of travel expenses, including airline tickets and hotel stays, but also taxes and fees on tickets, incidental charges like room service, as well as purchases like cruises, train fares , and car rentals. The redemption rate is one cent per mile but you get a 5% mileage refund, so your return on spending is more like 2.1%.

Annual fee: $89, waived the first year.

Sign-up bonus: Usually 50,000 miles (worth $500) after spending $3,000 in the first 90 days. However, it was recently as high as 70,000 miles after spending $5,000 in the first 90 days.

Why it’s worth considering: the Barclaycard Arrival Plus is a top choice for international travel since it waives foreign transaction fees and has Chip + PIN capability, making it more compatible with machines in other countries. Its World Elite Mastercard benefits include a $10 credit for every five Lyft rides taken each calendar month, and $5 off Postmates orders of $25 or more.

Learn more about applying for the Barclaycard Arrival Plus World Elite Mastercard here .

Bank of America Premium Rewards Credit Card

Earning and cash-back value: This card earns two points per dollar on travel purchases and 1.5 points per dollar on everything else. Depending on how much you have in deposits with Bank of America and Merrill Lynch through their Preferred Rewards banking tiers, you can boost your earnings 25% to 75%. ( Read more about the terms on Bank of America's website, here. ) Points can then be redeemed for cash back as a statement credit, for gift cards or purchases through the Bank of America Travel Center, or as a deposit to a Bank of America account—all at a rate of one cent apiece. That means your rate of return could be as high as 3.5%, depending on your purchases and deposits.

Caitlin Morton

Stacey Lastoe

Meaghan Kenny

Sign-up bonus: 50,000 bonus points (worth $500) after you make at least $3,000 in purchases in the first 90 days.

Why it’s worth considering: In addition to waived foreign transaction fees, cardholders can enjoy $100 in statement credits for airline incidentals like checked bags or upgrades each year, and a reimbursement of up to $100 for either Global Entry or TSA PreCheck applications once every four years.

Learn more about applying for the Bank of America Premium Rewards Credit Card here .

SunTrust Travel Rewards Credit Card

Earning and cash-back value: This card’s earning structure includes unlimited 3% cash back on travel purchases, 2% back on dining, and 1% on everything else.

Sign-up bonus: $250 statement credit after making $3,000 in qualifying purchases in the first three months.

Why it’s worth considering: Waived foreign transaction fees, a Global Entry or TSA PreCheck application reimbursement every five years, and the ease of redeeming points for simple cash back are all reasons to get the SunTrust Travel Rewards card.

Learn more about applying for the SunTrust Travel Rewards Credit Card here .

Citi Rewards+

Earning and cash-back value: Cardholders earn two points per dollar at supermarkets and gas stations for the first $6,000 per year, and one point per dollar on everything else. Plus, your earnings are rounded up to the nearest 10 points on each purchase—so if you spend a dollar, you still earn 10 points. Those points are worth one cent apiece when redeemed for gift cards, cash back, or travel booked through ThankYou.com. Plus, you get 10% of your points back on the first 100,000 you redeem each year.

Sign-up bonus: Earn 15,000 points (worth $150) after spending $1,000 in the first three months.

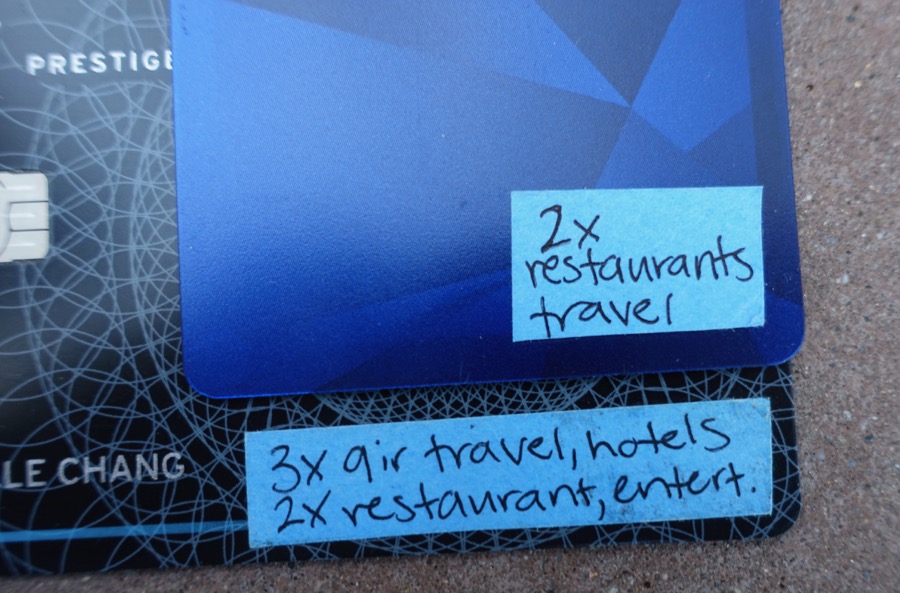

Why we love it: Depending where you spend money, the Citi Rewards card can be a top earner thanks not only to its category bonuses, but also that rounding-up feature. If you have a more premium Citi card that earns ThankYou points , like the Prestige, you can also transfer the points you earn with this one to the program’s 15 airline partners, including Air France/KLM, JetBlue, and Virgin Atlantic.

Learn more about applying for the Citi Rewards+ Card here .

Discover it Miles

Earning and cash-back value: Earn an unlimited 1.5 miles per dollar on all purchases, which can be redeemed for one cent apiece for travel or for cash as a direct deposit to your bank account. Your final return on spending: 1.5%.

Sign-up bonus: Discover will match the miles you earn at the end of your first year, which effectively gives you a 3% return on spending for your first year.

Why it’s worth considering: No annual fee, a great rate of return, and a simple earning/redeeming formula that applies to all purchases—not just travel—make the Discover it Miles card a no-brainer. Discover typically isn't accepted as broadly as Visa and Mastercard, though.

Learn more about applying for the Discover it Miles Card here .

U.S. Bank Altitude Reserve Visa Infinite Card

Earning and cash-back value: Earn three points per dollar on travel and mobile wallet purchases, and one point per dollar on everything else. Cardholders can redeem points for 1.5 cents apiece on airfare, hotels, and car rentals (or lower values for other purchases). If used mostly for travel, your rate of return is a considerable 4.5%.

Annual fee: $400

Sign-up bonus: Earn 50,000 points (worth $750 toward travel) after spending $4,500 in the first 90 days.

Why it’s worth considering: The annual fee is high, but in return, cardholders enjoy $325 in travel statement credits annually, 12 complimentary Gogo in-flight Wi-Fi passes each year, a 12-month Priority Pass Select membership for airport lounge access , reimbursement for a Global Entry or TSA PreCheck application every four years, and waived foreign transaction fees.

Learn more about applying for the U.S. Bank Altitude Reserve Visa Infinite Card here .

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers.

This story was originally published in July 2019. It has since been updated with new information.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

15 Best Travel Credit Cards of April 2024

ALSO CONSIDER: Best credit cards of 2024 || Best rewards credit cards || Best airline credit cards || Best hotel credit cards

A travel rewards credit card brings your next trip a little closer every time you use it. Each purchase earns points or miles that you can redeem for travel expenses. If you're loyal to a specific airline or hotel chain, consider getting one of that company's branded credit cards. Otherwise, check out the general-purpose travel cards on this page, which give you flexible rewards that you can use without the restrictions and blackout dates of branded cards.

Some of our selections for the best travel credit cards can be applied for through NerdWallet, and some cannot. Below, you'll find application links for the credit cards from our partners that are available through NerdWallet, followed by the full list of our picks.

250+ credit cards reviewed and rated by our team of experts

80+ years of combined experience covering credit cards and personal finance

100+ categories of best credit card selections ( See our top picks )

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of April 2024

Chase Sapphire Preferred® Card : Best for Flexibility + point transfers + big sign-up bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate travel rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

Chase Freedom Flex℠ : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers — bonus rewards + big sign-up offer

Citi Premier® Card : Best for Triple points on multiple categories

Bank of America® Travel Rewards credit card : Best for Flat-rate rewards + no annual fee, and for balance transfers

Chase Sapphire Reserve® : Best for Bonus travel rewards + high-end perks

World of Hyatt Credit Card : Best for Hotel credit card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments + no annual fee

United℠ Explorer Card : Best for Airline card

Best Travel Credit Cards From Our Partners

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Flexibility + point transfers + big sign-up bonus

Flat-rate travel rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers — bonus rewards + big sign-up offer, triple points on multiple categories, flat-rate rewards + no annual fee, and for balance transfers, bonus travel rewards + high-end perks, hotel credit card, travel rewards for rent payments + no annual fee, airline card, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Bank of America® Travel Rewards credit card

Our pick for: Flat-rate rewards + no annual fee, and for balance transfers

One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. Bank of America® has an expansive definition of "travel," too, giving you additional flexibility in how you use your rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus travel rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Flexibility + point transfers + big sign-up bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Premier® Card

Our pick for: Triple points in multiple categories

The Citi Premier® Card earns bonus points on airfare, hotels, supermarkets, dining and gas stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

Chase Freedom Flex℠

The Chase Freedom Flex℠ offers bonus cash back in quarterly categories that you activate, as well as on travel booked through Chase, at restaurants and at drugstores. Category activation can be a hassle, but if your spending matches the categories — and for a lot of people, it will — you can rack up hundreds of dollars a year. There's a fantastic bonus offer for new cardholders and an intro APR offer, too. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: United Airlines + best domestic airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Hotel credit card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Small business — bonus categories + big sign-up offer

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

Are you in Canada?

See NerdWallet's best travel cards for Canada.

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.

Seize every opportunity to pick up the tab, especially if your travel credit card pays bonus rewards on dining; your friends can pay you back while you collect rewards.

Redeem rewards for travel instead of gift cards, merchandise or (in most cases) cash back to get the best value.

Join the loyalty program associated with a co-branded card — a frequent-flyer or frequent-guest program.

Shop for essentials in your card’s online bonus mall or through its exclusive offers, if available, to get extra rewards.

OTHER CARDS TO CONSIDER

It’s worth considering whether a travel credit card is even right for you in the first place. A NerdWallet study found that cash-back credit cards often earn more money — even for many travelers.

If you carry a balance from month to month, the higher interest rates typically charged by rewards cards can cancel out any rewards earned. If you have a good credit score, you're better off with a low-interest credit card that can save you money on interest.

A good travel credit card shouldn't charge foreign transaction fees, but there are good non-travel cards that also don't charge them. See our best cards with no foreign transaction fee .

If you value transparency and flexibility in your rewards, you can't go wrong with a cash-back card — and you can still use the rewards for travel, if you want.

Finally, if you're still not sure what's right for you, take a look at our best rewards credit cards for options beyond travel and cash back.

NerdWallet's Sam Kemmis contributed to this article.

To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of The Platinum Card® from American Express , see this page .

Last updated on April 4 , 2024

Methodology

NerdWallet's Credit Cards team selects the best travel rewards credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of travelers. Factors in our evaluation include each card's annual fee, foreign transaction fees, rewards earnings rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, and cardholder perks such as automatic statement credits and airport lounge access. Learn how NerdWallet rates credit cards.

Frequently asked questions

Travel credit cards earn points (sometimes called miles) each time you buy something. The standard earning rate is 1 to 2 points per dollar spent, and many cards give you extra points for certain purchases, particularly travel expenses. The value of a point depends on the card that earned it and how you redeem it, but a good rule of thumb is to assume each point is worth an average of about 1 cent.

Your points accumulate in a rewards account, where you can use them to pay for travel. Most cards let you book travel directly using a portal similar to those at online travel agencies or on airline and hotel websites, but instead of paying cash, you pay with your points. Depending on the card, you may also have the option of booking travel any way you want, paying for it with the card and then cashing in your points for a credit against those expenses.

Points and miles are just different names for the same thing: the currency used in a travel rewards program. Some travel credit cards call them points, some call them miles.

Airline frequent flyer programs have long used the term “miles” to refer to the rewards you earn for flying. That’s because at one time, you really did earn rewards according to how many miles you flew — the longer the flight, the more miles you earned. Nowadays, most domestic airlines give out “miles” based on how much you spend, not how far you fly, so they’re really just points. (There are a few exceptions, though, notably Alaska Airlines.)

Especially when it comes to redeeming your rewards, there’s no difference between points and miles. The number of points or miles you need is based mostly on the cost of what you’re redeeming them for. It takes more than 500 miles (value about: $5) to get a free 500-mile flight!

The value of a point or mile depends on the card you earned it with and how you redeem it. A common rule of thumb is to assume that each point or mile is worth an average of 1 cent, although you can certainly get a much higher (or lower) redemption value. See our travel loyalty roundup page for NerdWallet’s current valuations for airline miles and hotel points.

Travel credit cards fall into two main categories: co-branded and general-purpose.

• Co-branded travel cards carry the name of an airline or hotel chain. The rewards you earn on the card can typically be redeemed only with that brand (or maybe its partners). Co-branded cards limit your flexibility, but because they are issued in partnership with an airline or hotel, they can give you special perks, like free checked bags or room upgrades.

• General-purpose travel cards are issued by a credit card company and are not directly tied to any particular airline or hotel. They earn points in the issuer's own program, such as American Express Membership Rewards, Chase Ultimate Rewards® or Citi ThankYou. These points are a lot more flexible, as you can use them to pay for a range of travel expenses, including flights on any airline or stays at any hotel. However, they don’t offer the airline- or hotel-specific perks of co-branded cards.

Travel cards — like rewards cards in general — typically require good to excellent credit for approval. Good credit is generally defined as a credit score of 690 or better. However, credit scores alone do not guarantee approval. Every issuer has its own criteria for evaluating applications.

About the author

Sara Rathner

UponArriving

How Much Cash Can You Travel With? (TSA & International Rules) [2023]

So you have a load of cash and you want to transport it across the country or perhaps even internationally. But exactly how much cash are you allowed to travel with?

In this article, I will break down everything you need to know about traveling with cash including important rules and limitations when flying.

I’ll also cover a number of key considerations you will want to think about before taking your cash with you when going through TSA or even traveling internationally.

Table of Contents

How much cash can you travel with?

There are no limits on the amount of cash you can travel with but there are some major considerations you need to think about when doing so.

If you are traveling domestically, your primary concern is avoiding forfeiture of your cash.

If you are traveling internationally, forfeiture is a concern but you should also be focused on remembering to declare the value of your currency and monetary instruments totaling above $10,000. Keep reading to find out more.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Legal risks of traveling with cash

TSA is concerned about dangerous threats such as explosives and not with enforcing laws and penal codes. (This is why they do not check for arrest warrants .)

Your cash money does not present a dangerous threat and so there should be no legitimate concern about it harming other passengers on the plane.

However, in the past there have been reports of TSA agents initiating the process for seizing cash from passengers under the suspicion that it is money gained from an illegal activity or money that is intended to be used on illegal activity.

Think drugs, weapons, and organized crime activities.

The seizing of cash can be accomplished under a number of different statutes including 21 U.S. Code § 881(a)(6) which governs forfeitures.

It states that you have no property right for:

(6) All moneys, negotiable instruments, securities, or other things of value furnished or intended to be furnished by any person in exchange for a controlled substance or listed chemical in violation of this subchapter, all proceeds traceable to such an exchange, and all moneys, negotiable instruments, and securities used or intended to be used to facilitate any violation of this subchapter.

It’s possible that if a TSA agent spots a lot of cash on you or in your bag (especially a lot of smaller bills like $20 bills) they could refer you to authorities (i.e., DEA) for some type of questioning.

The authorities may check to see if you are on some type of watchlist but even if you are not they may still deem that your cash is subject to civil forfeiture, which means that it will all be taken from you.

This can happen even if you have not been charged or convicted of any crime.

Some dogs that patrol airports have a nose for cash and a lot of cash has come into contact with illegal narcotics.

In fact, a study by Yuegang Zuo of the University of Massachusetts Dartmouth in 2009 found that about 90 percent of banknotes contain traces of cocaine . Traces of other drugs have also been found on cash like codeine, amphetamines and methamphetamines .

That means that “false positives” could be triggered, which could potentially be used as further evidence about your illegal activity (reportedly dogs don’t usually sniff out these faint traces).

If your money is seized you should have the opportunity to petition the process and to retrieve your funds.

It’s an odd legal proceeding where your cash is literally the defendant: “United States of America v. $50,000 in United States currency.”

That’s important because it means that the legal burden of proof is at the civil level which only requires it to be more likely than not that you were up to no good.

This petition process may not be very fun, could last a long time, and could be very costly. For example, you will likely need to hire an attorney which might cost you as much money as you have at stake.

Your success rate could also be very low.

In March 2017, the Justice Department’s Office of Inspector General reported that over the course of 10 years, the DEA only returned money in 8% of cases.

And if you do get your money back, if you owe taxes or judgments, those will likely have to be paid out first.

For these reasons, I would try to limit the cash I take through TSA security to maybe just a couple of thousand dollars (If that).

Personally, the most cash I ever carry on me is a couple of hundred bucks.

This may be problematic for people who want to gamble at their destination or who are looking to do things like purchase a car with cash but you should make alternative arrangements to receive your cash at your destination if possible.

Tips for traveling domestically with cash

If you are thinking about traveling through TSA with cash my advice would be the following:

Keep the amount as small as possible

First, avoid bringing more than $2,000 in cash if possible. That should be well below the level considered to be suspicious, as the lowest amount I saw subject to forfeiture was $6,000.

Also, try to avoid $20 bills since those are customarily used in drug deals.

Notify a TSA agent

If you do bring cash consider notifying a TSA agent when you enter the line and see if you can get some type of private or secondary screening.

If you have TSA Pre-Check , an agent might consider you to be less likely to be engaged in criminal activity but that is not a guarantee.

But note that cash has been seized in cases where people notified a TSA agent themselves so this is not a full proof method.

And it goes without saying but do not attempt to conceal the cash on your body such as strapping it to your chest because the full body scanners will find this quite easily.

Avoid checked baggage

You might be thinking about putting the cash in your checked baggage but that is not a good idea.

For one, if the cash was detected you will not be there to explain the situation and you may be caught off guard later when you are brought in for questioning by the DEA.

Second, if your cash is detected it’s possible that an unethical TSA agent could simply decide to take your cash.

And finally, if your luggage is lost you will not be able to retrieve that cash and cash is almost always an exception to baggage insurance policies.

Bring documentation

If you are traveling with a lot of cash because you want to purchase a vehicle or take care of some other transaction make sure that you have all of the supporting documentation already with you in case you are brought in for questioning.

Presenting anything less than an airtight explanation for transporting cash can mean instant forfeiture.

Avoid transporting suspicious items

It is a good idea to avoid transporting other items such as marijuana along with your cash since that will only reinforce the image that you are up to some type of criminal drug activity.

This is even the case if the state you are flying out of has legalized marijuana.

Consider your criminal history

And finally, if you have any type of criminal history — especially cases related to drug infractions — the odds of you encountering an issue with forfeiture go up.

That’s because it will be that much easier for them to make a case against you. Remember, we are talking about a civil court burden of proof — not criminal court.

So you should really reconsider bringing a lot of cash if that applies to you.

The International cash limit of $10,000 and the need to declare

US Customs and Border Protection is clear that you can transport “any amount of currency or other monetary instruments into or out of the United States.”

The caveat is that if the amount of currency exceeds $10,000 or it’s for an equivalent then you will need to file a FinCEN Form 105 (“Report of International Transportation of Currency or Monetary Instruments”) with U.S. Customs and Border Protection.

This is a pretty simple form to fill out and basically just requires you to input the following information:

- Contact information including passport number

- Export/import information

- Shipping information if applicable

- Details of the currency or monetary instrument

You can file this form electronically at FinCEN Form 105 CMIR, U.S. Customs and Border Protection (dhs.gov) but you can also file it in paper form.

In addition, if you are entering the United States you must declare if you are carrying currency or any other monetary instruments if they total over $10,000.

You can make this declaration on your Customs Declaration Form (CBP Form 6059B) and then file a FinCEN Form 105.