- Airport lounges

- Dining & experiences

- Not a cardmember? Learn more

Explore all the benefits of Sapphire Reserve

Rewards to inspire your next adventure.

The Chase Sapphire Reserve card makes every purchase rewarding. Make your journey memorable with travel perks, private dinners, and VIP access at sought-after events. Explore your complete Guide to Benefits or learn more about your benefits below.

01 Travel

Get closer to your happy place

Earn points as you seek out new destinations. Book a hotel, make the most of airfare, hail rides around town and more.

$300 Travel Credit

Get reimbursed for up to $300 in travel purchases you make with your Sapphire Reserve card 1 each year. Each year, your first $300 in travel purchases will not earn rewards points. 2

Book through The Edit SM

Experience distinct benefits at a curated collection of hotels and resorts when you book through The Edit by Chase Travel SM , an exclusive benefit for Sapphire Reserve cardmembers. 7

10x on hotels through Chase Travel

Earn 10x total points on hotels (excluding The Edit) and car rentals purchased through Chase Travel after the first $300 is spent on travel purchases annually. 1

5x points on flights through Chase Travel

Earn 5x total points on flights purchased travel through Chase Travel after the first $300 is spent on travel purchases annually. 1

3x points on travel

Enjoy the trip even more with bonus points on travel purchases like airfare and hotels. 1

Unlimited points

There is no limit to the number of points you can earn. Points don’t expire as long as your account is open. 1

Enjoy more premium travel rewards

When you travel with Sapphire, plan on benefits ranging from generous statement credits to access to luxury properties worldwide.

Global Entry or TSA PreCheck ® or NEXUS fee credit

Receive a statement credit of up to $100 every four years as reimbursement for the application fee charged to your Sapphire Reserve card. 5

No blackout dates or restrictions

Book travel through Chase Travel and if a seat’s available, it’s yours.

No foreign transaction fees

Pay no foreign transaction fees when you use your card outside the United States. 6 For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Elite hotel benefits at Relais & Châteaux

Enjoy great benefits like a VIP welcome and complimentary breakfast daily at select properties with Relais & Châteaux, a prestigious collection of luxury properties in over 60 countries. Call the Visa Infinite Concierge at 1-877-660-0905 for more details and to book your stay. 8

Special car rental privileges

Enroll in leading car rental rewards programs from National Car Rental, Avis and Silvercar. Log in to Chase Travel to access the special car rental privileges section of your travel benefits page to book with your card. Enjoy enhanced benefits, such as upgrades and car rental discounts, savings on luxury and premium rental car rates, plus promotions and other offers. 9

Ennismore hotel benefits

Your card gets you VIP access to benefits at Delano, Hyde, Mondrian, Morgans Originals and SLS hotels and resorts around the world. Cardmembers can stay a little longer with a complimentary 4th night, receive room upgrades and late check outs, along with priority access to cabana reservations, a $30 food and beverage credit and much more. 10

Free Lyft Pink

Get 2 complimentary years of Lyft Pink All Access when activated by Dec 31, 2024—a value of $199/year. 3 This includes member-exclusive pricing, free Priority Pickup upgrades, discounts on bikeshare and more. Membership auto-renews.

Don't forget as a Sapphire Reserve cardmember you'll still earn 10x total points on Lyft rides through March 2025. 4 That’s 7x points in addition to the 3x points you already earn on travel. That’s 7x points in addition to the 3x points you already earn on travel. Activate Lyft Pink All Access

02 Dining

Indulge in worldwide dining experiences

Whether visiting your local bistro or a restaurant on your bucket list, there are always special dining rewards with Sapphire Reserve.

Private dining series

Sit down for a memorable meal at some of the most sought-after restaurants in the country.

3x points on dining

Earn triple the points at restaurants, including takeout and eligible delivery services with your Sapphire Reserve card. 1 From Sunday brunch to a birthday dinner, meals out mean more rewards.

DoorDash & Caviar benefits

Takeout tastes even better with a complimentary DashPass membership on both DoorDash and Caviar. You’ll pay no delivery fee and lower service fees on eligible orders for a minimum of one year. Activate by Dec. 31, 2024 12 . Plus, as a DashPass member get a $5 monthly DoorDash credit automatically applied at checkout 13 .

Instacart benefits from Sapphire

Skip the trip and have your groceries delivered to your doorstep with 1 year of complimentary Instacart+. 14 In addition, Instacart+ members earn up to $15 in statement credits each month through July 2024. 15 Membership auto-renews. Terms apply.

03 Ultimate Rewards ®

Get the most from your rewards

Enjoy the flexibility of booking airfare, hotels and car rentals through Chase Travel or transfer points to other travel programs.

More value with travel redemption

Your points are worth 50% more when you redeem them for airfare, hotels, car rentals and cruise lines through Chase Travel—our easy-to-use portal that helps you maximize your travel spending. For example, 50,000 points are worth $750 toward travel. 16

Worldwide travel assistance

Whether you need help booking travel or modifying a reservation count on the full-service support of the Chase Travel team.

1:1 point transfer to leading frequent travel programs

Transfer points to participating frequent travel programs at a full 1:1 value—that means 1,000 points equals 1,000 partner miles/points.

No travel restrictions or blackout dates on airline tickets booked through Chase Travel.

1 point per $1 spent on all other purchases

In addition to earning 3 points per dollar on travel and dining at restaurants, you’ll earn 1 point for every dollar you spend on all your other purchases. 1

Flexibility

You can book airfare, hotels and car rentals through Chase Travel using your Sapphire Reserve card, your points or a combination of both—it's up to you.

More ways to get the most from your rewards

Redeem your points for statement credits, gift cards or choose from other flexible ways to make your points work for you.

Shop through Chase ®

Shop online with brands you already love. Earn 1x–15x bonus points at more than 450 popular retailers with Shop through Chase. 16

25% more value with Pay Yourself Back ®

Redeem points for statement credits toward your annual fee and eligible purchases for gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Choose from a selection of over 150 gift cards from some of your favorite retailers and more.

Pay with points

Use your points to pay for all or part of your purchases with popular brands like Apple ® 19 and Amazon.com. 20

04 Lounges

Relax with airport lounge access

With access to Chase Sapphire Lounge by The Club and Priority Pass lounges, each trip becomes an invitation to indulge before you get there.

Enjoy complimentary Priority Pass TM Select membership

Departing for your destination is more relaxing with access to 1,300+ Priority Pass airport lounges in 600+ cities around the world, plus every Sapphire Lounge by The Club, after a one- time enrollment in Priority Pass Select.

Visit Sapphire Lounge by The Club

Relax and refresh at a Sapphire Lounge and enjoy locally inspired menus, a curated selection of beverages, an atmosphere to remember and more. Sapphire Reserve cardmembers, ensure you're enrolled in your complimentary Priority Pass Select membership for lounge access.

The Reserve Suites by Chase

Reserve cardmembers, treat yourself to The Reserve Suites at Sapphire Lounge by The Club at LaGuardia Airport in Terminal B. Enjoy caviar service on arrival, specially curated wine lists by Parcelle, exclusive menus by Jeffrey's Grocery, private bathrooms with spa showers and more. Chase Sapphire Reserve cardmembers can book a suite for a fee up to 72 hours prior to flight departure. Find details on the Chase Mobile ® app in Benefits & Travel. The Reserve Suites are limited and subject to availability.

05 Protection

Travel with peace of mind 22

When you take to the air or hit the road, we make security a priority. Here are some of the protection services built into your Sapphire Reserve card benefits.

Trip Cancellation / Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

Auto Rental Collision Damage Waiver

Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad.

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000.

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year.

Sapphire Reserve Benefits Guide

These are just some of the protection services built into your Sapphire Reserve card benefits. Your Guide to Benefits has more of what you need to know about your travel and purchase protection benefits.

Account security and protection

Your Sapphire Reserve card is equipped with the enhanced account and purchase protection you deserve.

Zero Liability Protection 23

Zero Liability Protection means you won’t be held responsible for unauthorized charges made with your card or account information. If you see an unauthorized charge, simply call the number on the back of your card.

Fraud protection

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

Fraud alerts

We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. 24 Please sign in to chase.com and review your personal details to ensure your mailing address, phone and/or email are up to date.

Return Protection

You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year. 22

Extended Warranty Protection

Extends the time period of the manufacturer's U.S. warranty by an additional year on eligible warranties of 3 years or less. 22

Chip-enabled for enhanced security and wider acceptance

A credit card with an embedded chip provides enhanced security and wider acceptance when you make purchases at chip-enabled card readers in the U.S. and abroad.

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. 22

06 Events

Exclusive access to events and experiences

Sapphire cardmembers enjoy priority ticketing and the best seats in the house for a wide range of events.

Reserved by Sapphire SM

Explore one-of-a-kind experiences from private dinners hosted by award-winning chefs to VIP access at the most sought after events. See where your Sapphire Reserve card can take you.

Events and experiences lounges

Enjoy comfortable seating at Chase Sapphire events in prime locations, complimentary food and drinks, plus a range of amenities, such as a dining concierge, charging stations, Wi-Fi and more.

Early-access tickets

Beat the crowds. Get your tickets to concerts and sporting events before they sell out.

Priority seating

Get up close to the court or the stage. Sapphire Reserve cardmembers can experience events from the best seats in the house.

07 Wellness

Earn 10x total points on Peloton

Work out your way — from HIIT rides to walks and hikes to strength training, and more: Get 10x total points on Peloton equipment and accessory purchases over $150 with a max earn of 50,000 points. Shop Peloton Bikes, Tread, Guide, or Row. Offer ends Mar. 31, 2025. 25

Shop Peloton

08 Services

Personalized assistance for Sapphire cardmembers

Turn to Sapphire for help coordinating travel, restaurant reservations, access to entertainment and more complimentary assistance and referrals.

24/7 access to customer service

Talk to a dedicated specialist whenever you need assistance. Simply call the number on the back of your card.

Visa Infinite Concierge Service 26

Contact Visa Infinite Concierge at 1-877-660-0905 for help with dinner reservations or Broadway, music and sporting event tickets.

Travel and emergency assistance

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

Easily get more from your Sapphire experience

From mobile account access to contactless payment, cardmembers can enjoy many safe and convenient features.

Manage your account with ease

Create an account on chase.com and download the Chase Mobile ® app 27 to check account and points balances, pay bills and more.

Tap-to-pay contactless checkout

Simply tap to pay with your contactless Chase Sapphire card. Just look for the Contactless Symbol at checkout, then tap your contactless card on the checkout terminal. It's fast, easy and secure!

Add an authorized user

Maximize your reward earning potential by adding an authorized user to your account. 28

Go paperless

Get your statement online. Safely access up to 6 years of statements online. It's secure, convenient and reduces clutter.

Convenient ways to pay

Load your card into a digital wallet for a quick and secure way to pay with your mobile device and receive all the benefits and rewards of using your Sapphire Reserve card.

Earn points automatically

Grow your points balance by using your card as the primary payment method for:

- Online checkout Add your card to your favorite shopping apps and online merchants to conveniently build up your points balance.

- Monthly bills Use your card to make auto payments for monthly bills (e.g., cell phone and utility bills). 29

Redeem for travel

Use points toward your next getaway—they’re worth 50% more when you redeem them for travel through Chase Travel.

Pay Yourself Back ®

Your points have more value when you redeem them for statement credits after making eligible purchases on gas, wholesale clubs, and pet supplies & services by June 31, 2024.

Chase Dining SM

Order takeout at popular eateries around town or make reservations at restaurants, wineries and bars across the country.

There's so much for you

More Sapphire Offers

There’s so much more to make yours—top benefits, offers and experiences for Sapphire Reserve cardmembers.

Reserved by Sapphire SM

Your Sapphire Reserve card opens new doors to more flavors, sights and sounds. Explore the extraordinary lineup of experiences—including culinary, sports, music and entertainment.

Refer-A-Friend

Earn up to 75,000 bonus points per year by referring friends to either Chase Sapphire ® card.

Already a Sapphire cardmember?

Sign in to view your account, access exclusive content and take advantage of your Sapphire benefits.

Not a Sapphire cardmember yet?

We’re glad you’re here. Learn more about getting a Sapphire card.

Es posible que esta comunicación contenga información acerca de usted o su cuenta. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

View the details of the Sapphire Reserve benefits offered on this page.

©2024 JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. Member FDIC

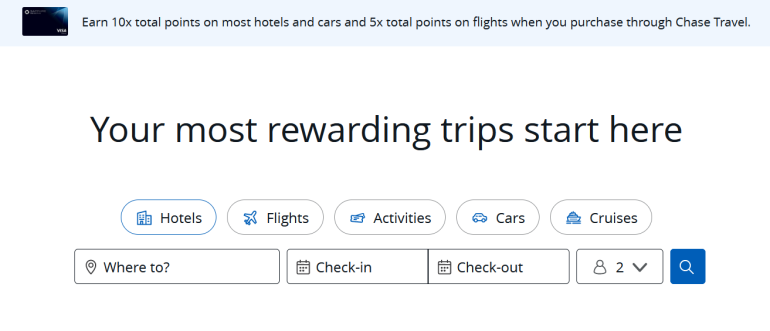

Introducing Chase Travel

Seamlessly book your best trip yet. Choose from coveted hotels and convenient flights, then add car rental and must-do local experiences at the reimagined chasetravel.com .

Start planning

How to book travel (and save points) with Chase Travel

Editor's note : This is a recurring post, regularly updated with the latest information.

Chase Ultimate Rewards is one of the best flexible rewards currencies available, and you can get some incredible value from your Ultimate Rewards points .

Generally, we recommend transferring Chase points to the program's airline and hotel partners for award bookings. However, sometimes redeeming Ultimate Rewards points for paid travel through Chase Travel℠ is more advantageous. This option can save you money, particularly when traditional award space is unavailable, as you can book almost any available flight or hotel through Chase Travel.

Here's what you need to know about Chase Travel.

What is Chase Travel

To maximize your Ultimate Rewards points, it's often best to transfer them to partner programs like United MileagePlus , World of Hyatt or British Airways Executive Club for award reservations. However, it's important to compare the points needed for a direct booking through Chase Travel l to those required for an award booking. Sometimes, booking through the portal can be more advantageous, as the points price is tied to the cash cost of the flight or hotel stay, potentially resulting in lower point requirements.

However, before using Chase Travel, you need to have some Chase points. If you're not already familiar with Chase's most popular cards and welcome offers, here are a few current ones to be aware of.

Ink Business Preferred Credit Card

The Ink Business Preferred Credit Card is a TPG favorite. It currently comes with one of the highest sign-up bonuses from Chase or on any business credit card — 100,000 bonus points after you spend $8,000 on purchases in the first three months of account opening.

Based on our valuations , the bonus points alone are worth $2,000. However, you can redeem these points through Chase Travel for a fixed value of 1.25 cents apiece.

Read more: Ink Business Preferred Credit Card review: A great all-around business card

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is another fantastic addition to your wallet. You'll earn 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The bonus is worth $1,538 based on TPG valuations .

Like the Ink Business Preferred, you'll get a value of 1.25 cents per point when booking directly through Chase Travel with the Sapphire Preferred. You'll also earn 5 points per dollar on paid travel purchased through Chase (excluding the first $50 in hotel purchases that qualify for the card's annual hotel credit ).

Read more: Chase Sapphire Preferred credit card review: 75,000-point bonus for a top travel card

Chase Sapphire Reserve

The Chase Sapphire Preferred Card's bigger brother, the Chase Sapphire Reserve , offers 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, which is worth $1,538 based on TPG valuations.

This card includes additional perks, like a PreCheck or Global Entry credit , Priority Pass lounge access , a $300 annual travel credit and other perks. This card also boosts your portal redemption rate to 1.5 cents per point, giving you 0.25 cents per point in additional purchase power over the Sapphire Preferred. And when you book travel through Chase with the Sapphire Reserve, you'll earn 10 points per dollar on hotels and car rentals and 5 points per dollar on flights (excluding purchases that qualify for the $300 travel credit).

Read more: Chase Sapphire Reserve credit card review: Luxury perks and valuable rewards, plus a 75,000-point bonus

Cash-back cards

Chase also issues a number of cash-back credit cards — including the Chase Freedom Unlimited , Ink Business Cash Credit Card and Ink Business Unlimited Credit Card . The rewards you earn on these cards are worth 1 cent apiece toward travel in Chase Travel. However, Chase allows you to combine your earnings into a single account . This means that you can effectively convert these cash-back rewards into fully transferrable Ultimate Rewards points if you also have the Sapphire Preferred, Sapphire Reserve or Ink Business Preferred.

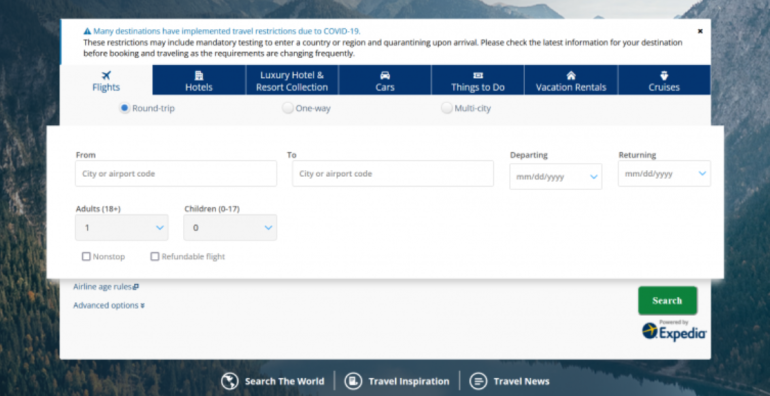

How to use Chase Travel

You can book flights, hotels, car rentals, cruises and other travel through Chase Travel, and it's relatively simple to access. First, you'll need to log in to your Chase account, then navigate to the right side of the page, where you'll see a little box with your total Ultimate Rewards balance.

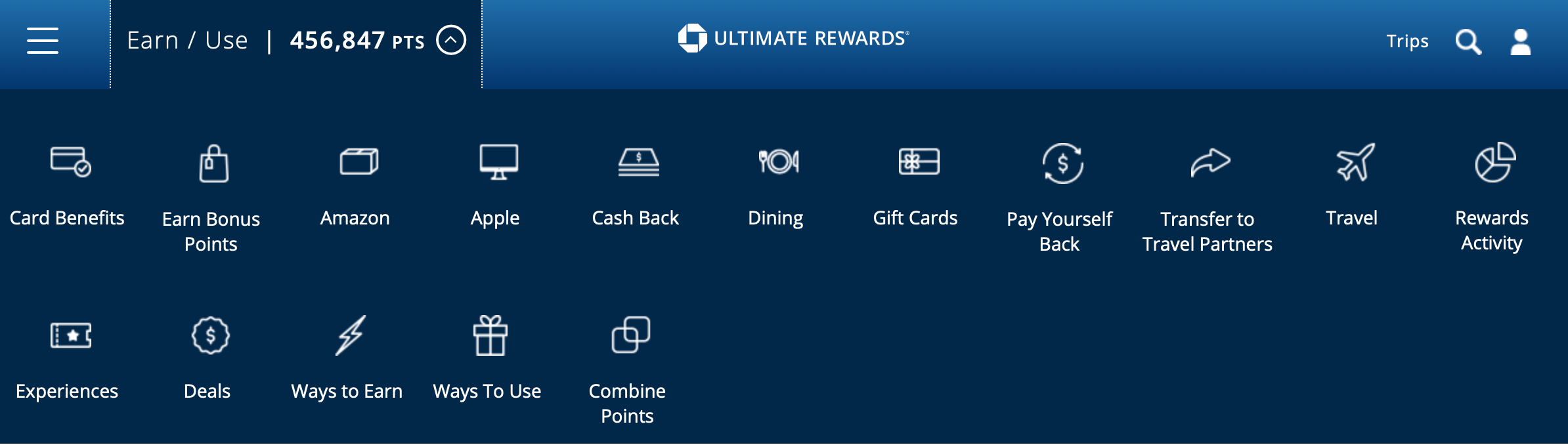

Click that box and it will bring you to the Ultimate Rewards dashboard, which looks like this:

Click "Travel" to access the travel homepage and search for airfare, hotels or vacation rentals.

Remember that when you book hotels through the portal with Ultimate Rewards points, you typically will not earn hotel points and elite credits and may not receive elite status perks because it's considered a third-party booking.

However, flights booked through the portal will typically earn frequent flyer miles and qualify for elite status.

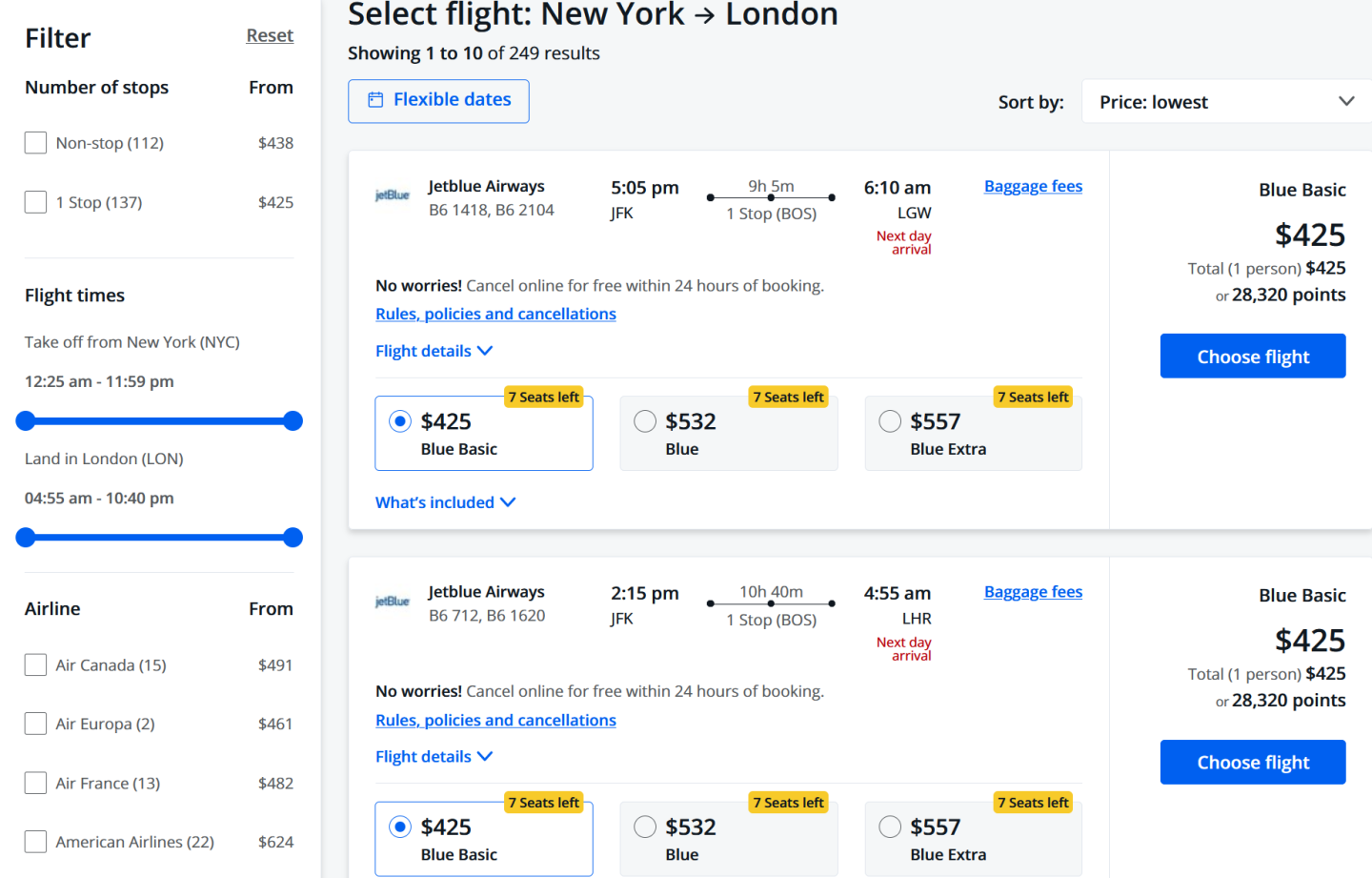

How to book flights using Chase Travel

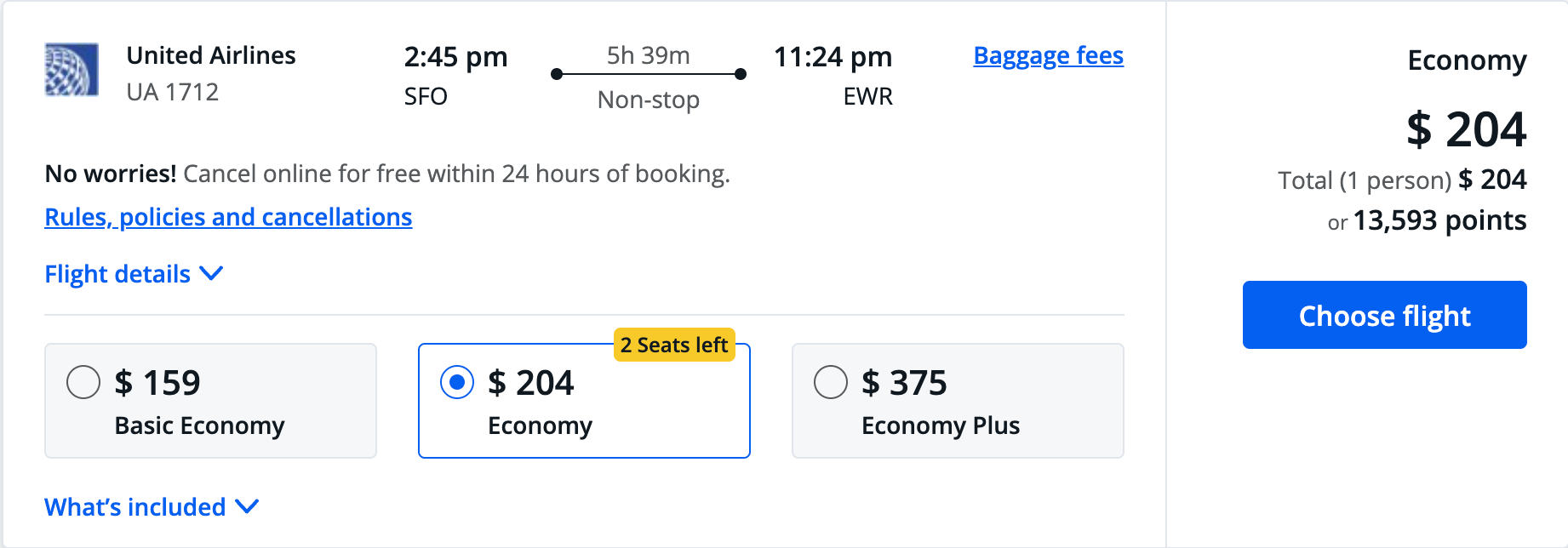

Booking your flights is a straightforward process once you've navigated to the portal's travel page. Type in your arrival and departure airports and travel dates then hit the search button. For this search, I looked for a one-way flight from San Francisco International Airport (SFO) to Newark Liberty International Airport (EWR).

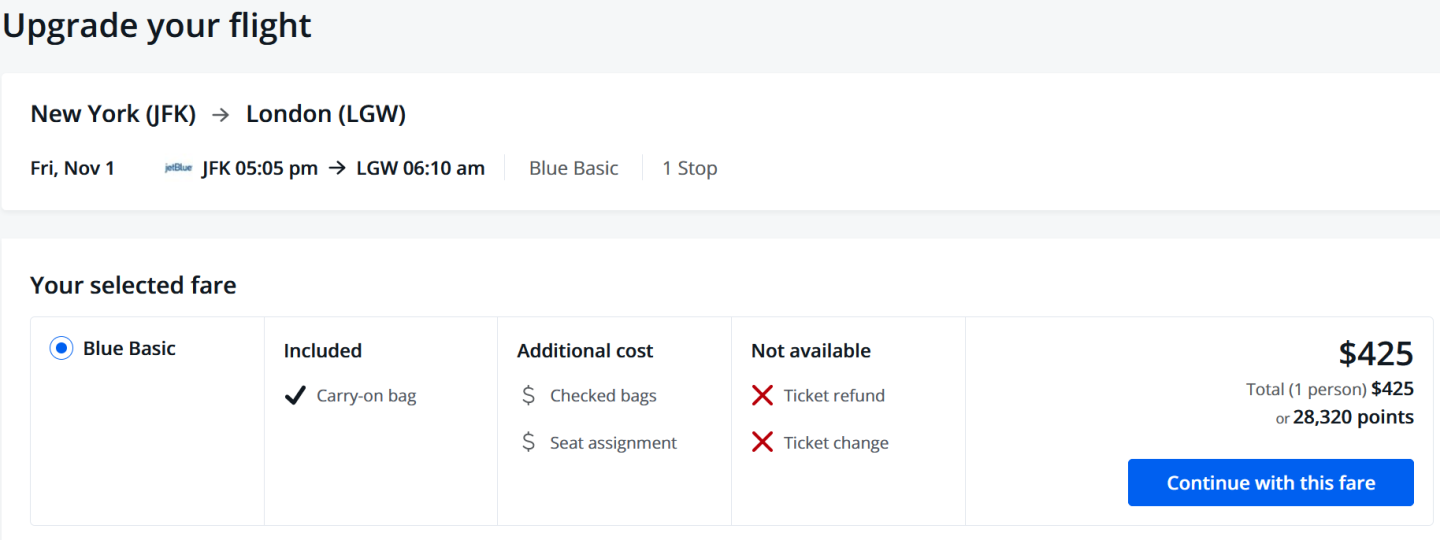

You'll then see the available flight options. When you find a flight you like, select the fare type you want to book and click the blue "Choose flight" button.

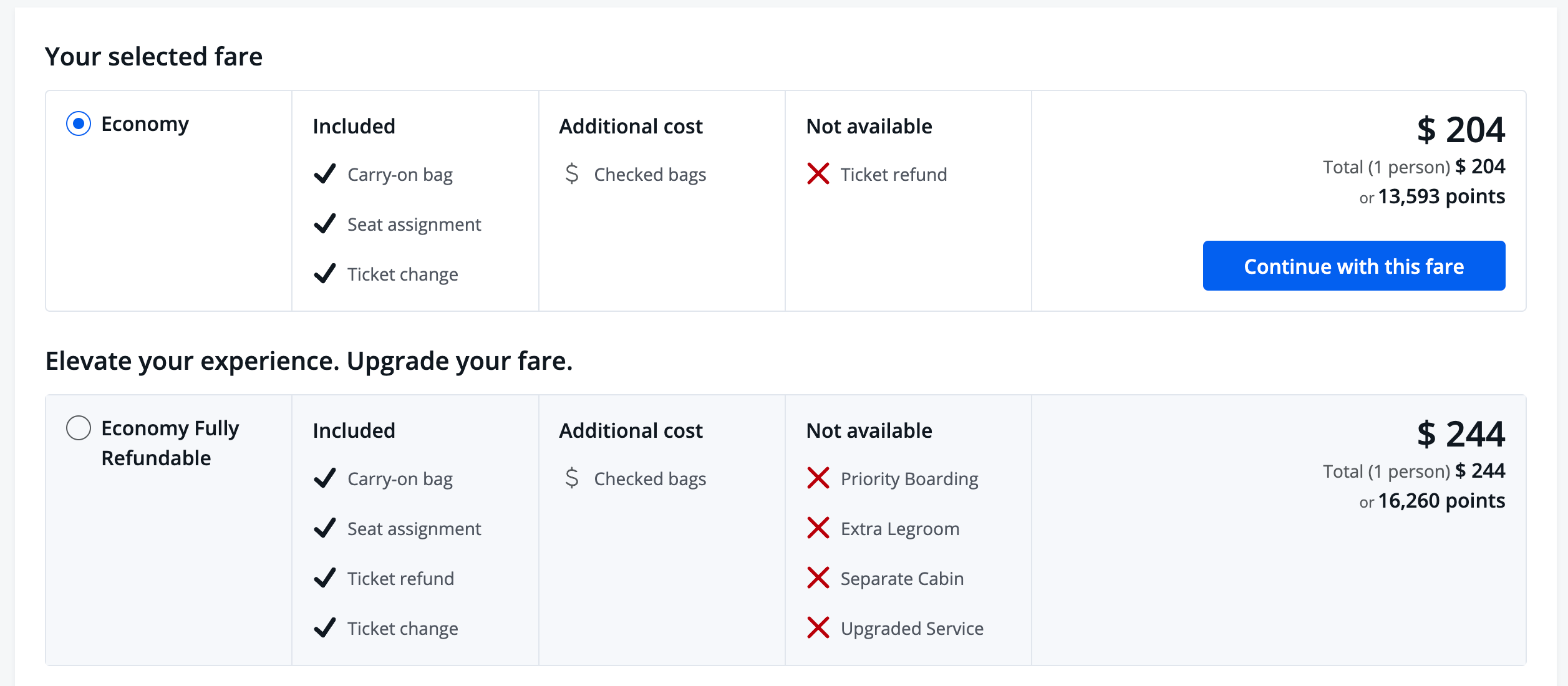

Once you've selected your preferred flights, you'll be taken to the next page to review your flight information and look over any upgrades you'd like to make.

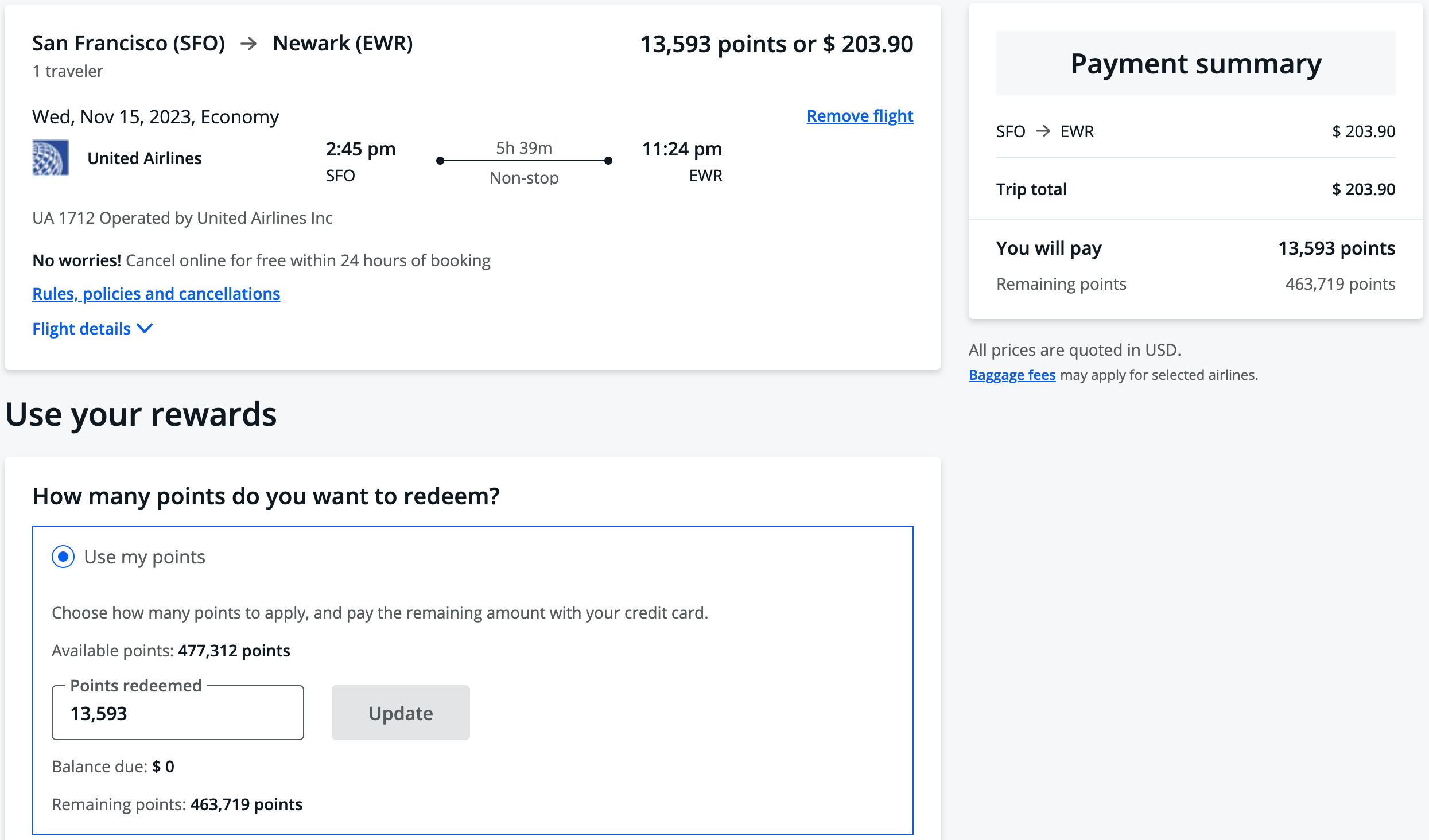

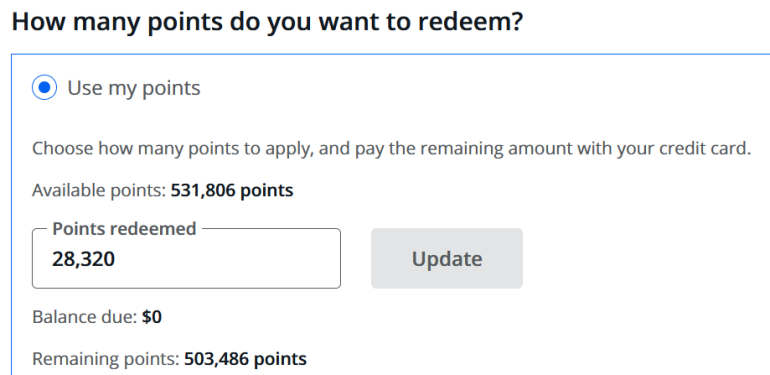

Then, you'll be directed to the checkout page, where you can pay with cash, points or a combination of the two. Again, points linked to a Chase Sapphire Reserve account are worth 1.5 cents each. If you have a Chase Sapphire Preferred Card or Ink Business Preferred Credit Card , points are worth 1.25 cents each.

Finally, you'll be directed to a page where you will enter the traveler's information and finalize your flights.

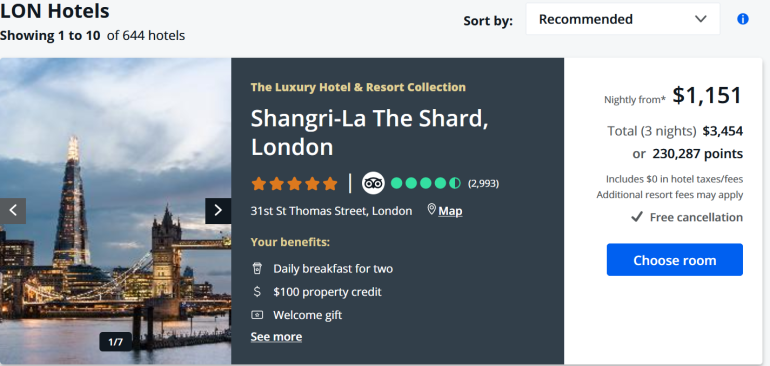

How to book hotels using Chase Travel

Booking hotels is similar to booking flights on the travel portal. This can be advantageous if you're looking at hotels outside of major chains that partner with Ultimate Rewards ( Hyatt , IHG and Marriott ). Regardless of how you book your hotel, compare the award rates required by these hotel loyalty programs to ensure you're getting the best deal.

Also, if you have an eligible card, you can access the Chase Luxury Hotel & Resort Collection , which gives you perks at around 1,000 luxury properties worldwide. Participating cards include the Chase Sapphire Reserve , United Explorer Card , United Club Infinite Card , United Quest Card and United Business Card .

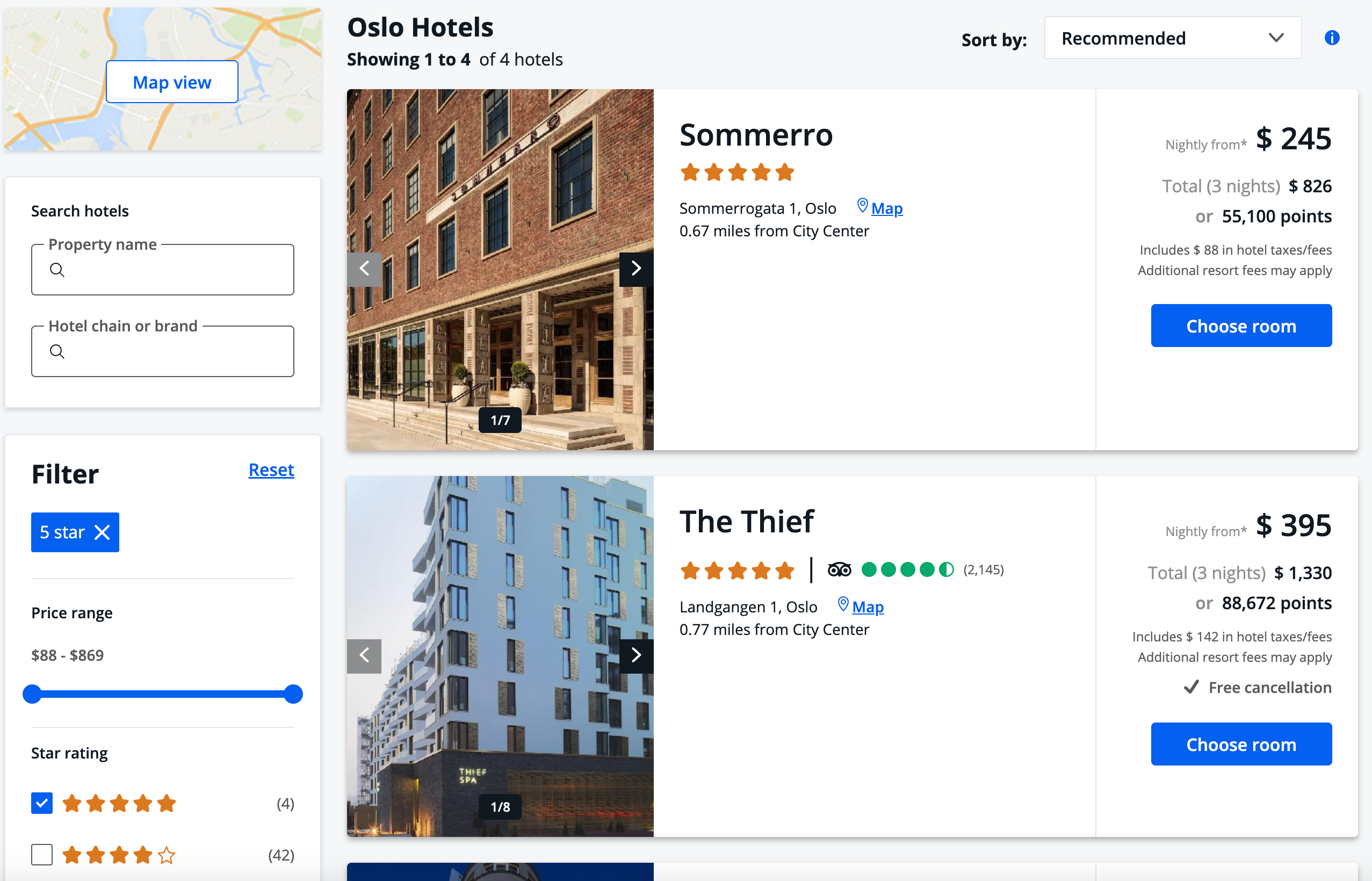

Here's a sample search for hotels in Olso, Norway, which hosts mostly boutique hotels.

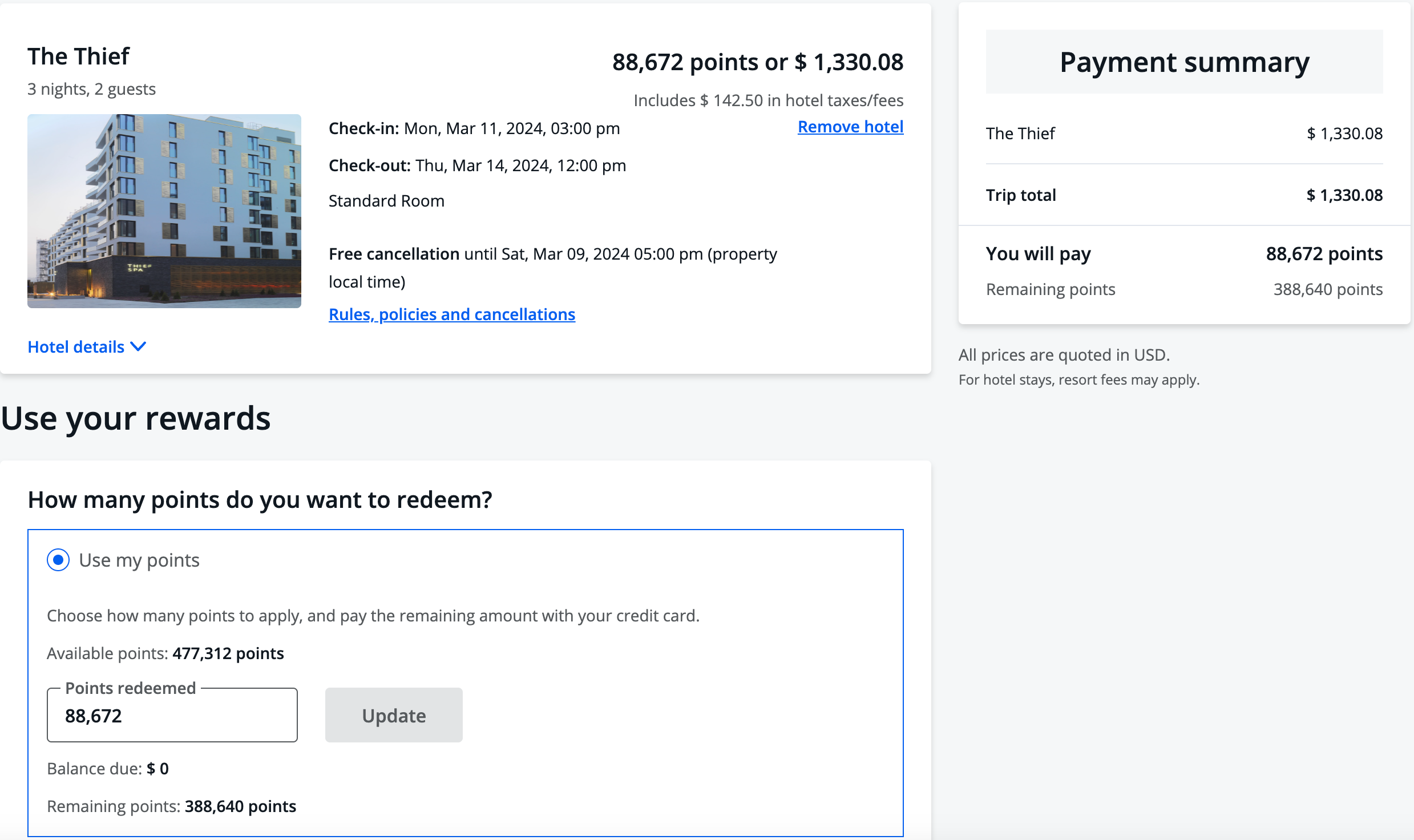

Once you've selected your desired property, room and rate, you can specify how many points you want to use on the checkout page.

Then, run through the on-screen prompts to finalize your booking, and you'll get an email confirmation.

Remember, you'll receive up to $50 in statement credits every year for hotel reservations made through Chase Travel as a Sapphire Preferred cardholder.

Related: The best ways to book hotels through online travel agencies and bank portals

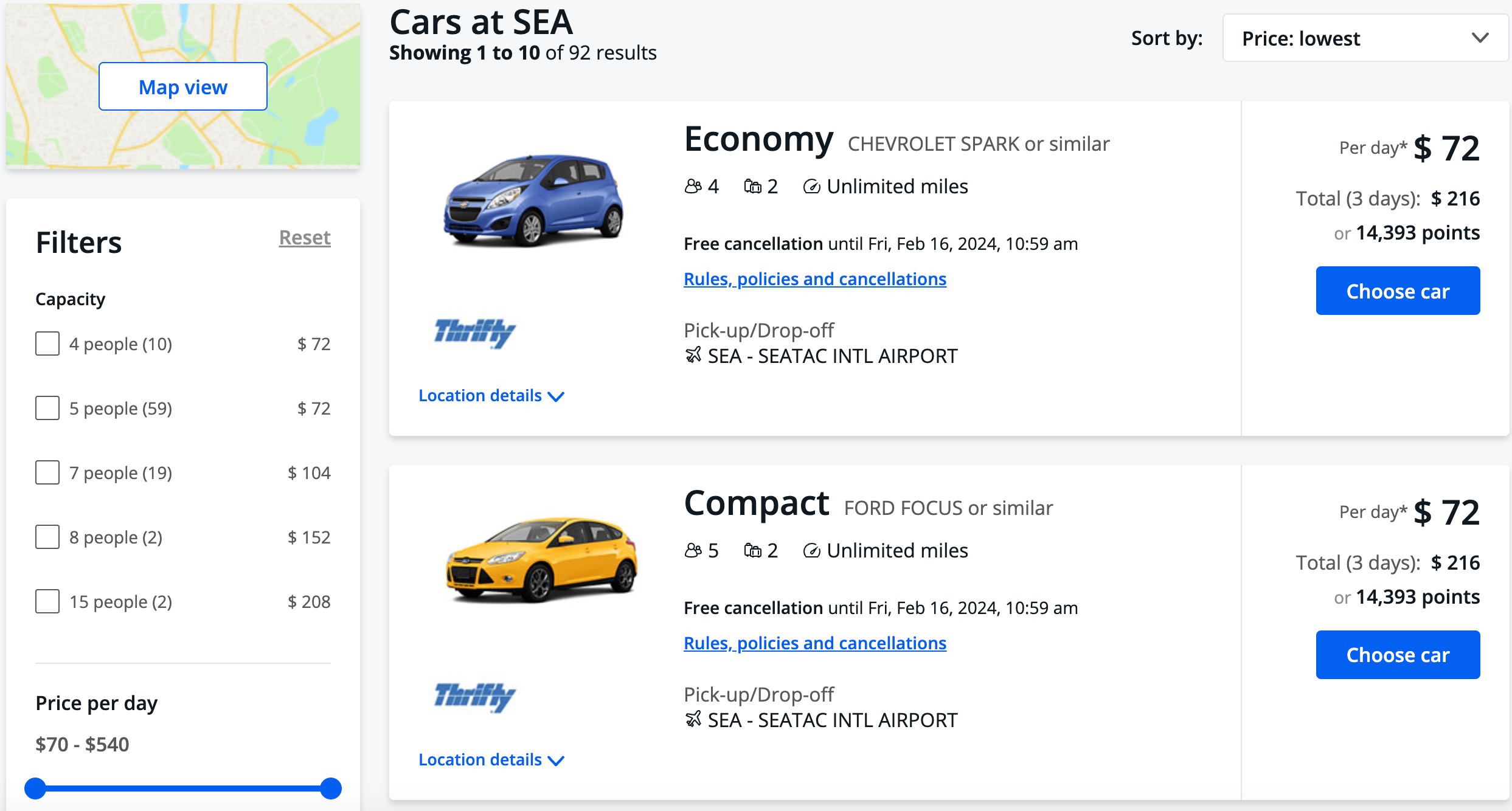

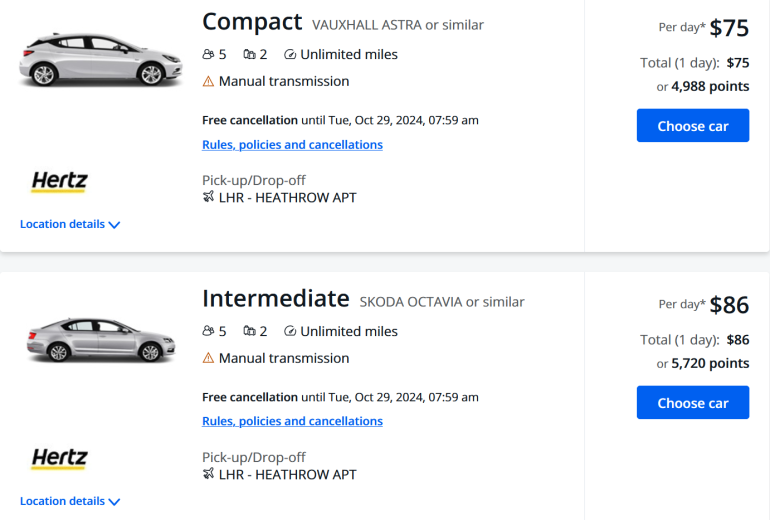

How to book car rentals, cruises and other travel using Chase Travel

Using Chase Travel, you can rent cars, pay with points and still receive the excellent primary car rental insurance offered by the Chase Sapphire Reserve and Chase Sapphire Preferred Card .

The process of renting cars is similar to booking flights and hotels. Navigate to the "Cars" header from the main landing page and type in your itinerary, even if it's a one-way rental. Then, select "Search," and the results page will pop up. Once you choose your car, you'll be prompted to select add-ons.

When you've finished selecting, you'll head to the booking page, where you'll input your personal information and choose how many points you'd like to spend. Remember that to qualify for rental car insurance, you must decline the car rental company's collision damage waiver and ensure that anyone driving the car is on the rental agreement.

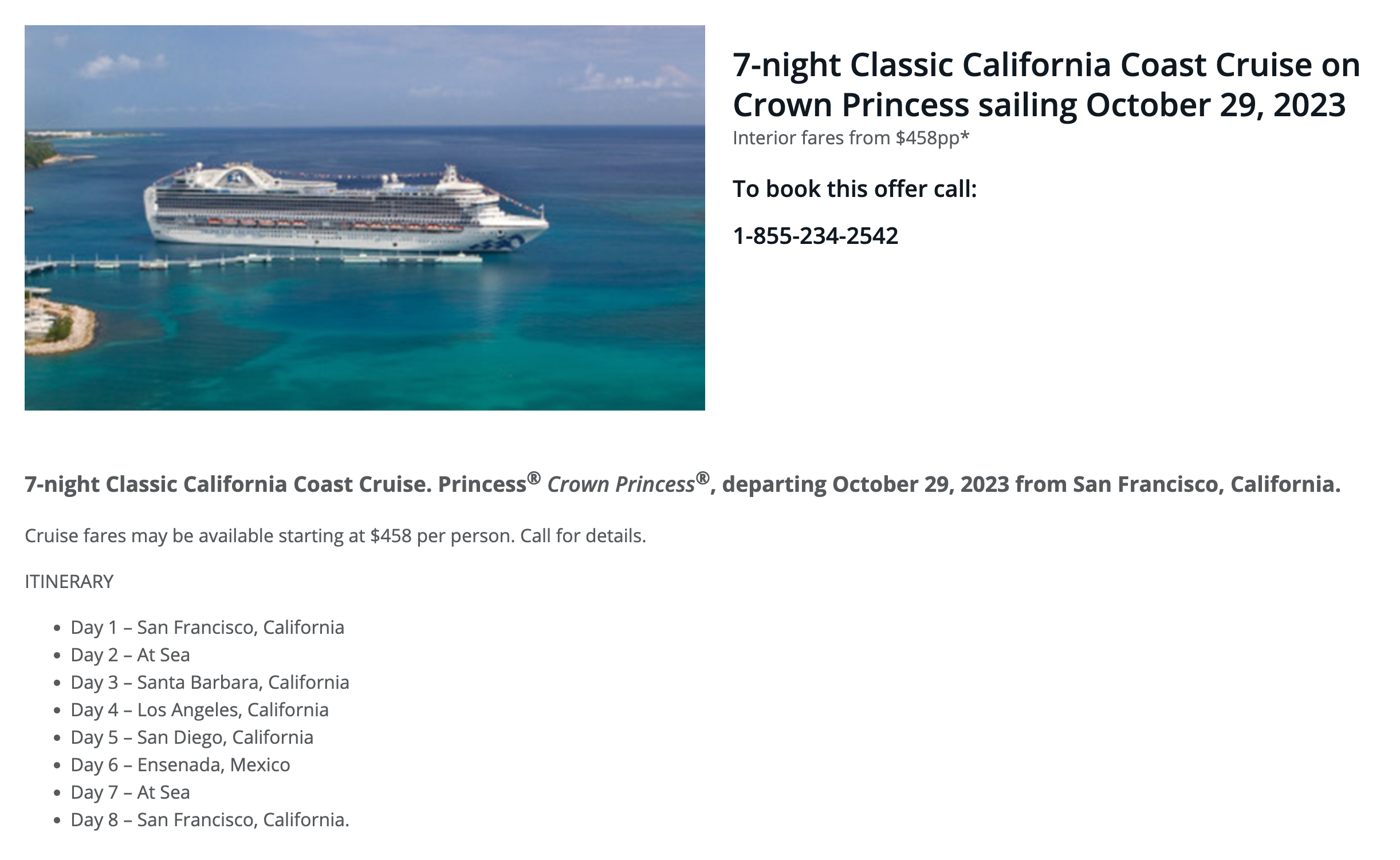

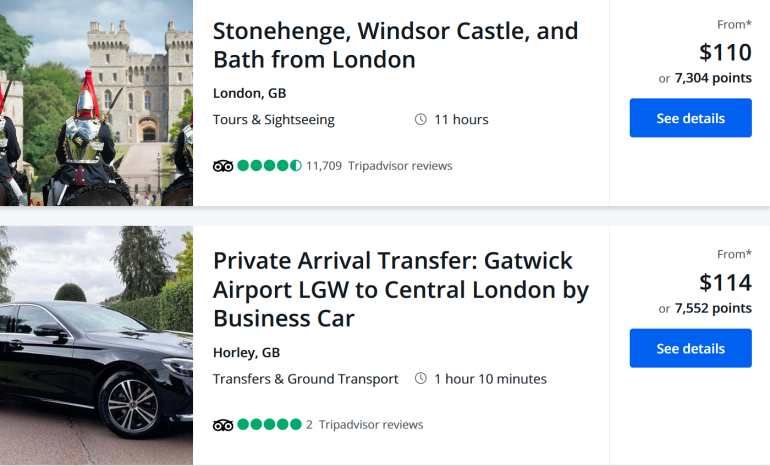

You can also book activities and cruises through Chase. In the case of activities, you can use your points to book some fantastic tours like a Washington, D.C. night monument tour or Singapore heritage food tour at 1.25 or 1.5 cents each. This can be an excellent way to make a vacation free, instead of just your hotels and flights.

Cruises are also available, though you'll have to call to book those.

Related: The top 3 easiest ways to save on rental cars

More things to consider about Chase Travel

Here's some general guidance to maximize your experience with the portal.

We recommend comparing the points needed through Chase Travel with those required for partner transfers, factoring in taxes and fees. If you have or want hotel elite status, avoid booking hotels through the portal. These stays generally won't count toward status or qualify for hotel elite status benefits.

Booking through Chase Travel with cash can earn you extra points, with Ink Business Preferred and Sapphire Preferred cardholders earning 5 points per dollar on all travel and Sapphire Reserve cardholders earning 5 points per dollar on flights and 10 points per dollar on hotels and rental cars. While you might find better rates by booking directly with the travel provider, if your plans are firm and rates are comparable, booking through the portal can be worthwhile for earning extra points.

However, remember that booking through third-party sites may result in issues if you change your plans. Travel providers are more likely to assist you if you've booked directly with them.

Related: Should I book through the Chase portal if I'm not redeeming points?

Bottom line

Chase Travel lets you use your points to book flights, hotels, rental cars, cruises and activities. If award flights aren't available or you find a cheap fare that requires fewer points, booking through the portal can be a good option.

Similarly, for hotels, it can be a good deal if you find a cheap rate or book a boutique property, but keep in mind that you may not earn hotel points or receive elite benefits. Whether booking rental cars, activities or cruises, always compare the options to see if using the portal or transferring to partners for an award is more advantageous.

Additional reporting by Ryan Patterson, Andrew Kunesh and Victoria Walker.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex℠ .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card. c

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

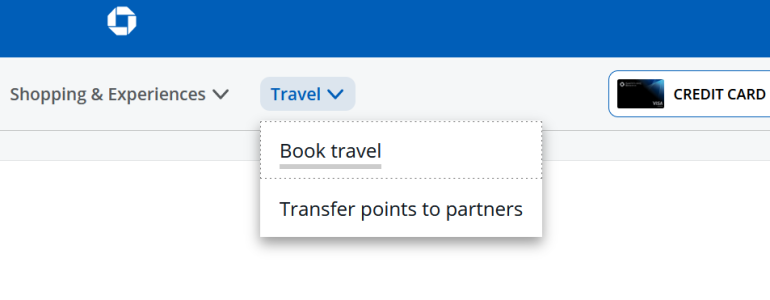

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

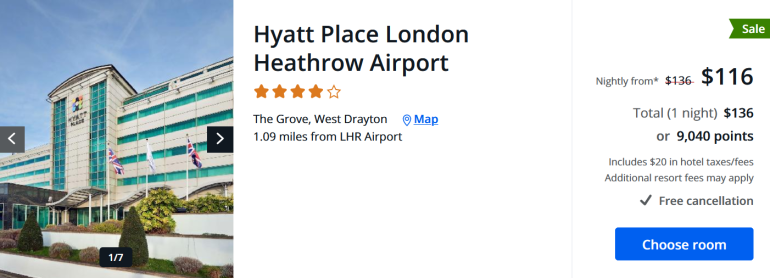

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

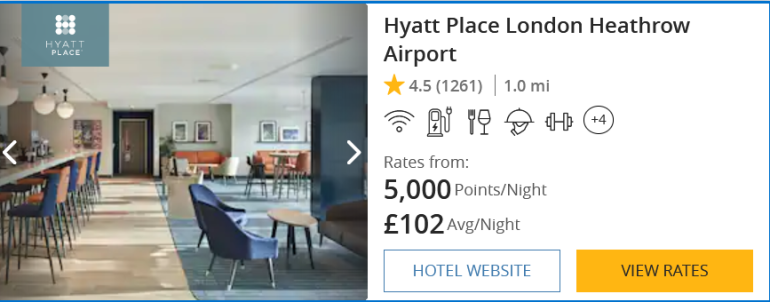

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

One of the booking tabs also leads to the Chase Luxury Hotel & Resort Collection . This subset of high-end hotels delivers bonus perks like free breakfast, a $100 hotel credit and room upgrades, depending on the property and other things.

You can book directly through Chase or redeem points and be eligible. It’s nice to have elite status-style perks at a hotel where you may not have status or that doesn't have a loyalty program.

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Preferred Card

Chase Sapphire Preferred Card Travel Insurance – 10 Frequently Asked Questions [2024]

Content Contributor

66 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

86 Published Articles 487 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3164 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![chase credit card travel services Chase Sapphire Preferred Card Travel Insurance – 10 Frequently Asked Questions [2024]](https://upgradedpoints.com/wp-content/uploads/2022/09/Chase-Sapphire-Preferred-Upgraded-Points-LLC-08-Large.jpg?auto=webp&disable=upscale&width=1200)

Chase Sapphire Preferred Card Overview

Recap of chase sapphire preferred card travel insurance, travel accident insurance, trip cancellation and interruption insurance, 2. does chase sapphire preferred card travel insurance cover cruises, 3. what does the chase sapphire preferred card baggage insurance cover, 4. what does the chase sapphire preferred card medical insurance cover, 5. does the chase sapphire preferred card cover hotel cancellations, 6. does the chase sapphire preferred card cover airbnb cancellations, 7. does chase sapphire preferred card travel insurance cover rental cars in other countries, 8. does the chase sapphire preferred card cover turo or zipcar rentals, 9. how do i file a chase sapphire preferred card travel insurance claim, 10. do i need travel insurance if i have the chase sapphire preferred card, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Chase Sapphire Preferred ® Card remains one of the most popular travel rewards credit cards for numerous reasons. Alongside excellent earning rates and a fair amount of benefits that justify the $95 annual fee, the card also offers numerous shopping and travel insurance benefits.

If you’re like most people, you hear the word “insurance,” and your eyelids start feeling heavy. Let’s be honest: Insurance isn’t thrilling. The terminology can feel confusing, leaving you with many questions about what exactly the travel insurance on your Chase Sapphire Preferred card does and doesn’t cover.

You have questions, and we have answers. Here’s a simple look at your most common questions about travel insurance on the Chase Sapphire Preferred card.

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Chase Ultimate Rewards

Before moving any further, let’s ensure you’re familiar with the long list of travel protections built into the Chase Sapphire Preferred card :

- Auto rental collision damage waiver

- Baggage delay insurance

- Lost luggage reimbursement

- Travel accident insurance

- Trip cancellation and trip interruption insurance

- Trip delay reimbursement

You’ll also enjoy several other cardholder benefits and protections beyond travel insurance :

- Extended warranty protection

- No foreign transaction fees

- Purchase protection

- Roadside dispatch

- Travel and emergency assistance

Some of the benefits seem more obvious than others. And, as with all insurance, there are always specific terms to understand, exclusions to mind, and coverage limits . Let’s clear some of those up.

1. What Flight Insurance Does the Chase Sapphire Preferred Card Have?

When flying, you’ll have 2 types of insurance: travel accident insurance and trip cancellation and interruption insurance. Both types are in effect for trips for which you paid at least a portion of the cost with your Chase Sapphire Preferred card. Let’s look at each benefit.

Travel accident insurance applies to you and your immediate family members if one of you becomes permanently injured or dies while traveling. The cardholder benefit guide lists specific dollar amounts that you can be paid for specific injury types. The coverage is further divided into 2 categories: traveling on a common carrier and 24-hour coverage .

Coverage related to a common carrier covers both injuries and death resulting from your travel on a licensed air, land, or sea transport that regularly carries paying passengers . Think planes and ferries, for example. You’ll also be covered while at an airport, terminal, or station immediately before or after a trip, including courtesy transport to or from these places if provided as part of your trip. If your flight booking includes the airline picking you up from the hotel, this could be covered if all other conditions are met.

The 24-hour coverage applies around the clock and is valid on trips of up to 30 days. If you take a trip longer than this, coverage will end 1 minute after midnight on the 31st day, though it would come back into effect when you are in transportation to the airport for your flight home. If you drive yourself to the airport, coverage should resume once you are inside the airport .

This benefit reimburses you for the money you lose when a trip paid for (in whole or part) with your card is interrupted or canceled. Trip interruption is when you’ve started the trip and must end it early for a covered reason; trip cancellation applies to canceling a trip before it begins. The maximum benefit payout here is $10,000 per person and up to $20,000 per trip. Both the cardholder and immediate family members are covered.

Trip cancellation coverage begins when you make your first deposit toward the trip and ends when you depart on your scheduled departure date. Trip interruption starts on your scheduled departure date and ends on your scheduled return date. However, if these dates or times are adjusted for reasons beyond your or the carrier’s control, the benefit will adjust automatically .

What expenses are reimbursable? They include nonrefundable, prepaid travel expenses by a licensed supplier, such as a travel agency, hotel, shore excursion agency, etc. When canceling for a covered reason, you’re also covered for redeposit fees to get your airline miles back. Unfortunately, this benefit doesn’t cover lost money you paid for tickets to shows or theme parks, tee times at golf courses, museums, or other entrance fees unless they’re part of a tour package.

You’ll be covered for a few more situations with trip interruption coverage only . These include fees for returning a rental car early or to the nearest facility and up to $250 of expenses to transport you for necessary medical treatment. However, that doesn’t include medical transport (such as ambulances or medevac).

What if you paid with Chase Ultimate Rewards points and are due a refund under these benefits? You’ll be reimbursed according to the value on your travel supplier’s confirmation receipt, assuming that’s listed. If there’s no trip value listed on the receipt after you paid with points, you’ll be reimbursed at a value of 1 cent per point.

Covered Reasons

Not every reason for canceling a trip or ending it early is covered under these benefits. Covered reasons include accidental death or injury, a sickness requiring hospitalization, severe weather, a named storm warning, a change in military orders, a subpoena or call to jury duty, your home being burglarized or becoming uninhabitable, your hotel becoming uninhabitable, a public transportation strike that makes you miss 20% of a trip or a scheduled tour departure, and more. Consult the Chase Sapphire Preferred card benefits guide to see if your specific cancellation or interruption reason is covered.

Trip cancellation insurance doesn’t cover everything. For example, changing your mind about a trip is not covered. If your plans are subject to change, you may want to purchase Cancel for Any Reason (CFAR) travel insurance .

This part is a bit confusing, but yes. Chase’s benefits guide for the Chase Sapphire Preferred card states explicitly that cruise lines aren’t included in the definition of a “common carrier.” However, cruise lines are included in the definition of a “travel supplier.”

Why does this matter? Many of the trip cancellation and trip interruption benefits only apply to travel with a common carrier, which doesn’t include cruise lines. However, some benefits do apply to cruises . These include stolen luggage benefits or even canceling a trip if delays mean you’ll miss at least 20% of the trip or that you’ll miss the departure of your cruise ship.

The travel accident and injury benefits also apply while you’re cruising, but it’s worth noting that returning late to your cruise ship, only to find it’s left for the next island without you, isn’t a covered expense. You’ll be on your own for the costs of catching up to your ship.

There are 2 types of baggage protection here: coverage for delayed bags and coverage for lost, stolen, or damaged luggage. Baggage delay insurance covers up to $100 per day for up to 5 days when your bags are delayed by at least 6 hours, covering each additional 24 hours past that until the maximum of 5 days is reached. This benefit applies to you and your immediate family members when you pay for at least part of your trip with your Chase Sapphire Preferred card. You don’t need to be traveling with your immediate family members for them to be covered , as long as at least part of their trip was paid for with your card, which can be a nice perk if you book travel for relatives.

Coverage begins on the scheduled departure date and ends on the scheduled return date, though coverage adjusts automatically if there are changes outside your or the travel provider’s control. There’s also a list of non-covered items, such as medical devices, losses due to war/conflict, electronics, and cash equivalents. In case of baggage delay, you must report it to the travel provid er as soon as possible and keep receipts for necessary expenses you incur ; you’ll submit these for reimbursement afterward.

Lost luggage reimbursement is different; it covers lost, stolen, or damaged luggage during your trip. Both checked and carry-on bags are covered up to a maximum of $3,000 per person per trip. However, there’s a limit of $500 for jewelry, watches, and electronics.

There are some specifics to understand about this coverage, however. First, it doesn’t cover items you leave behind by accident . Second, coverage applies to you and immediate family members (even if you aren’t traveling with them) so long as you paid for at least part of the trip with your Chase Sapphire Preferred card. Coverage is available from the scheduled start to the scheduled end of your trip, but it is automatically adjusted if there are uncontrollable delays to either date.

Coverage applies to common carriers and cruise lines, and you must report the loss, theft, or damage within the timeframe specified by your travel provider. Then, the coverage on your Chase Sapphire Preferred card will cover any difference in the value of your monetary loss (after depreciation of the items) and the payment you receive from the travel provider . Thus, this is secondary coverage. It’s worth noting that documents, furs, tickets, and cash-like items aren’t covered.

Accidents can happen on any trip, from accidentally slipping on the wet deck of a cruise ship to spending nights in a hospital at a far-flung destination. Does your health insurance at home cover you when you head to Florida? What about South America? These are questions worth asking. If your medical coverage won’t be in effect, it’s worth considering medical travel insurance .

The Chase Sapphire Preferred card includes travel accident insurance for you and your immediate family members . It’s in effect if you pay at least part of the airfare for your trip with this card. You’ll receive varying maximum payouts depending on the type of injury (or death) encountered during your trip, and the maximum limit also depends on whether the accident occurs while traveling on a common carrier or at some other point during your trip . The 24-hour benefit provides maximum coverage of $100,000, increasing to $500,000 when traveling on a common carrier.

But how does this work in practice?

If more than 1 person is injured , the benefits administrator will pay no more than 2 times the maximum limit for each type of injury. That sum will be divided among all covered persons eligible for benefits payments.

In case of death , the benefits administrator will give the money to your named beneficiary. If you haven’t named a beneficiary, the order of preference goes from a spouse or domestic partner to children, then parents, siblings, and finally, your estate. If you go missing and haven’t been found after a year, then this will trigger the “loss of life” benefit.

Coverage begins either when you reach the airport, station, or terminal for travel on a common carrier or when you enter courtesy transportation provided to take you to the point at which your trip begins, such as a train station or airport. If you didn’t buy your tickets in advance but are purchasing them when you arrive at the station, coverage begins once you make the payment for travel. Coverage ends after you leave the transportation vessel or exit the courtesy transportation provided afterward.

The 24-hour coverage functions a bit differently. It’s in effect around the clock for up to 30 days, starting from your scheduled departure for air travel. If your trip is longer than 30 days, coverage will pause 1 minute after midnight on the 31st day and resume when you reach the airport for a flight home or are in courtesy transportation to the airport for the flight home.

Obviously, there are exclusions. You aren’t covered if you’re a pilot or crew member on a flight, you get injured while committing a crime, you get injured while skydiving, your injury is self-inflicted, or you’re injured in a war.

Lastly, you may wonder how COVID-19 factors in . The benefits guide says this under covered losses: “Quarantine of you or your traveling companion imposed by a physician or a competent governmental authority having jurisdiction, due to health reasons.”

Thus, your illness could be covered if a doctor or government requires quarantine related to COVID-19. COVID-19 is generally covered under most travel insurance policies in the same way sicknesses are covered. However, not traveling to avoid COVID-19 risks isn’t covered. As the benefits guide says, “Your disinclination to travel, a country closing its borders, or a travel supplier canceling or changing travel arrangements due to an epidemic or pandemic.”

Hotels aren’t treated separately under the Chase Sapphire Preferred card travel insurance terms. If you must cancel or interrupt a trip for a covered reason, then your hotel cancellation fees can be covered. This would include situations like forfeiting a first night’s room cost for canceling your hotel booking at the last minute, assuming you couldn’t arrive for a covered reason, such as a travel delay or a last-minute injury that made you unable to travel.

While you won’t find the word “Airbnb” or even “vacation home” in the benefits guide, you will find a description that covers these types of rentals :

“Provider of Lodging – a hotel, inn, motel, bed and breakfast, or hostel; a Provider of Lodging includes non–commercial time shares, condominiums, or rentals of a private residence; such rental shall require a written contract between You and the property owner or management company, executed in advance of the commencement of the rental period …” Chase Sapphire Preferred card benefits guide.

So long as you’ve reserved your rental in advance and have a written contract — which Airbnb provides at the time of booking, courtesy of your confirmation details — your vacation home rental should count as a type of lodging. The contract must state the cancellation provisions, must not include a rental of more than 60 days, and your booking must be made directly with a licensed website or agent — not with the homeowner directly (unless that person is a licensed agent).

Airbnb is a covered lodging type, meaning your booking should qualify for trip interruption, trip cancellation, and trip delay coverage .

In short, yes. However, there are some exclusions. Since your personal auto insurance policy may not cover you abroad, it’s great to know that paying with your Chase Sapphire Preferred card and declining the rental company’s collision damage waiver can provide protection on your next rental .

You can be covered up to the actual cash value of most rental cars against theft or collision damage. Coverage can include administrative fees, loss-of-use charges, and even towing charges. Coverage applies to rentals up to 31 days and covers you plus any additional drivers listed on the rental contract .

You’ll need to use your card (or your points) to pay for the entire cost of the rental , and most vehicle types are covered by this primary insurance. However, coverage doesn’t apply to exotic or antique cars, high-value vehicles, cargo vehicles, motorcycles, RVs, or vans with seating for more than 9 people (including the driver). Note that Teslas qualify as high-value vehicles, so these aren’t covered .

The benefits guide doesn’t spell out any specific excluded countries . However, Visa typically excludes coverage in Israel, Jamaica, and Northern Ireland, plus you may not be able to use your card to pay for a rental (and thus coverage won’t be in effect) with U.S. Treasury Department monetary embargoes . These destinations include places where your credit cards won’t work, such as Cuba, Sudan, Syria, and North Korea.

Unfortunately, no. Because Turo and Zipcar rentals aren’t considered rentals from a rental car agency, most credit card rental car insurance doesn’t cover them .

To file a claim, you should first gather all of the documents related to your claim . These can include receipts, accident reports, police reports, photos, hospital records, or anything else pertinent to the type of claim you’re making.

Next, you can call the benefits administrator at 866-390-9735 or visit eclaimsline.com to submit online . Different claims have different required timelines. For example, auto claims must be filed within 100 days of the incident. However, you need to file within 90 days for baggage delays or losses, but you’re supposed to contact the benefits administrator within 20 days of these incidents to at least provide notice, even though you have 90 days to finish submitting the claim.

This question will be subjective, and different people will arrive at different conclusions. Travel insurance can be useful for the unexpected, but no 2 trips are equal. The best way to decide whether you need additional insurance beyond what the Chase Sapphire Preferred card offers is to look at what it doesn’t cover.

Will you be skydiving? Do you have significant trip expenses related to Turo rentals or short connections that could cause domino effects if you miss a departure time? Are you renting an RV or going camping — types of travel not covered by the Chase Sapphire Preferred card?

If you have prepaid, nonrefundable expenses that wouldn’t be reimbursed by your credit card’s travel insurance in the event of delays or cancellations, getting a travel insurance policy that covers these could be a good idea and could provide peace of mind. That said, not every travel activity is covered by every travel insurance policy, so you want to make sure you choose a policy that covers your expenses for your particular trip .

If you look at your trip and decide that your flights, hotel plans, and simple plan of just relaxing at the beach will be covered by the Chase Sapphire Preferred card, then purchasing an extra policy probably isn’t necessary.

The Chase Sapphire Preferred card offers numerous protections for purchases and trips. Insurance terms can feel confusing, but hopefully, the explanations of these policies should clarify what is and isn’t covered, as well as policy limits, in a way that helps you know whether the coverages are sufficient for your upcoming travels.

Want to learn more about what else this card offers beyond travel insurance? Consult our full Chase Sapphire Preferred card review .

Frequently Asked Questions

Does the chase sapphire preferred card have trip insurance.

Yes, it has several types of travel protections. Cardholders get rental car insurance, baggage delay insurance, lost and damaged luggage reimbursement, travel accident insurance, trip cancellation and interruption insurance, and trip delay reimbursement.

How to file a claim with the Chase Sapphire Preferred card travel insurance?

You can call the benefits administrator at 866-390-9735 or visit eclaimsline.com to submit online. Each claim type has different required documents and a different required submission timeline, so check your benefits guide for your specific claim type.

Does the Chase Sapphire Preferred card reimburse for travel cancellation?

Yes, you can be reimbursed for monetary losses of up to $10,000 per person and up to $20,000 per trip if you cancel for a covered reason. You’ll need to pay for at least part of your trip with your Chase Sapphire Preferred card, and the cancellation must be for a covered reason, such as death, injury, or being called to active military duty.

What insurance does Chase Sapphire Preferred card cover?

The Chase Sapphire Preferred card has several types of travel protections. Cardholders get rental car insurance, baggage delay insurance, lost and damaged luggage reimbursement, travel accident insurance, trip cancellation and interruption insurance, and trip delay reimbursement. Cardholders also get shopping insurance benefits, such as purchase protection and extended warranty protection, plus other benefits like roadside dispatch and travel and emergency assistance services (though these are pay-per-use benefits).

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- All Cards Opens All Cards category page in the same window.

- Card Finder Opens card finder page in the same window.

Our Most Popular Credit Cards

Our most popular rewards cards.

Chase Sapphire Preferred ® Credit Card

- Earn 60,000 75,000 75,000 not 60,000 bonus points

- Earn 3X on dining and 2X on travel

- $95 Annual Fee

Chase Freedom Unlimited ® Credit Card

- Earn a $200 bonus

- Earn unlimited 1.5% cash back or more on all purchases

- No Annual Fee

Chase Freedom Flex ® Credit Card

- Earn 5% cash back on quarterly bonus categories (spend limits apply, must activate quarterly)

Our Most Popular Travel Cards

Chase Sapphire Reserve ® Credit Card

- Earn 3X on dining and travel purchases

- $550 Annual Fee

Southwest Rapid Rewards ® Plus Credit Card

- Earn 50,000 points

- Receive 3,000 anniversary points each year

- $69 Annual Fee

United SM Explorer Credit Card

- Earn 50,000 bonus miles

- Earn 2x miles on United ® purchases, dining, and hotel stays

- $0 Intro Annual Fee

Our Most Popular Business Cards

Ink Business Cash ® Credit Card

- Earn up to $750 Bonus Cash Back

- Earn 5% Cash back in select business categories

Ink Business Preferred ® Credit Card

- 100,000 bonus points

- Earn 3x points on shipping and other select business categories

IHG ONE REWARDS PREMIER BUSINESS Credit Card

- Earn up to 175,000 bonus points

- Earn up to 26X total points at IHG ®

- $99 Annual Fee

HELP ME CHOOSE

Choosing a credit card can be confusing. chase can help..

What type of card are you looking for?

Just browsing?

See our full range of credit card offerings here.

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Chase's Sapphire Reserve and Preferred, 2 of the best travel credit cards of all time, are offering intro bonuses worth up to $1,125

T he offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

- The Chase Sapphire Preferred and Reserve are two of the best travel rewards credit cards ever.

- Right now, new applicants can earn 75,000 Ultimate Rewards points — up to 50% more than usual.

- 75,000 points are worth up to $1,125 in Chase travel or significantly more through travel partners.

It's time to plan your summer travels — and a new credit card sign-up bonus could earn you more than $1,100 in travel rewards.

For a limited time, new applicants of the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® can earn 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. These points are worth $900 or $1,125 toward travel purchased through Chase, depending on which card you get.

Chase's Sapphire credit cards are specifically designed with travelers and foodies in mind. These sleek metal credit cards come in two flavors: the everyday favorite Chase Sapphire Preferred® Card and premium-tier Chase Sapphire Reserve®.

Chase Sapphire Preferred and Reserve: the main differences

Both cards earn Chase Ultimate Rewards and come with generous travel insurance benefits, no foreign transaction fees, bonus points on dining and travel expenses, and travel credits each year. You can redeem Ultimate Rewards points through Chase Travel℠ , or transfer them to more than a dozen airline and hotel chains for even better deals.

The Chase Sapphire Preferred® Card is Business Insider's top choice for the best travel rewards credit card for value, and the Chase Sapphire Reserve® earns an honorable mention. Chase Ultimate Rewards points are worth 1.8 cents apiece according to Business Insider's valuations, and can be worth significantly more if transferred to Chase's airline and hotel transfer partners .

The Chase Sapphire Reserve® costs $550 each year but comes with many benefits including a $300 travel credit, airport lounge access, monthly DoorDash and Instacart credits, and the best credit card travel insurance you'll find.

Chase Sapphire Reserve® cardholders can redeem Ultimate Rewards points for 1.5 cents apiece through Chase's travel booking portal, so the 75,000-point welcome offer is worth $1,125.

The Chase Sapphire Preferred® Card has a much lower annual fee of $95, with lesser benefits to match. Cardholders get a $50 annual credit toward hotels booked through Chase Travel℠, quarterly DoorDash and Instacart credits, and generous travel insurance benefits.

Chase Sapphire Preferred® Card cardholders can redeem Ultimate Rewards points for 1.25 cents apiece through Chase's travel booking portal, so the 75,000-point welcome offer is worth $900.

Which Reserve card is better for you?

At the end of the day, you can't go wrong with either card. You'll get the most return for your investment by signing up for the Chase Sapphire Preferred® Card, especially during this limited-time promotion, because the sign-up bonus is worth more than 9x what you'll pay in annual fees. But the Chase Sapphire Reserve® offers top-tier travel benefits that can be worth thousands of dollars per year for frequent travelers.

You can't sign up for both cards for double the bonus, however, since cardholders can only have one Chase Sapphire card at a time. You also can't earn the welcome bonus if you've earned a bonus from either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® within the last 48 months.