Insurance Asia website works best with Javascript enabled. Please enable your javascript and reload the page.

- Sections Co-Written / Partner Insurance

- Events Insurance Asia Forum - Jakarta - May 14, 2024 Insurance Asia Forum - Kuala Lumpur - June 25, 2024 Insurance Asia Summit - September 4, 2024 Insurance Asia Forum - Manila - October 1, 2024

- Advertising Advertising Digital Events

NTUC Income launches new travel cover that protects by the hour

Premiums start at S$1.80 for a six-hour coverage.

NTUC Income has launched a new travel insurance product, FlexiTravel Hourly Insurance, that enables travellers to buy insurance by the hour with premiums starting at S$1.80 for the first six hours.

Currently, FlexiTravel Hourly Insurance is only available for those who are travelling to Bintan, Batam and Malaysia.

The new product is targeting Singaporeans who do short impromptu regional trips like driving to Malaysia for a few hours to golf, shop, eat, or visit attractions such as Legoland for a day with family.

According to vice president and head of personal lines at NTUC Income, Annie Chua, travellers often find it expensive or a hassle to purchase travel insurance for such short trips as they are perceived to be less risky and many often end up travelling uninsured.

FlexiTravel Hourly Insurance is designed to give control to customers while protecting them on short trips. It charges a minimum of S$1.80 for six hours of protection, with the option for travellers to add on coverage at a rate of S$0.30 for every additional hour, capped at a maximum charge of S$3 per day.

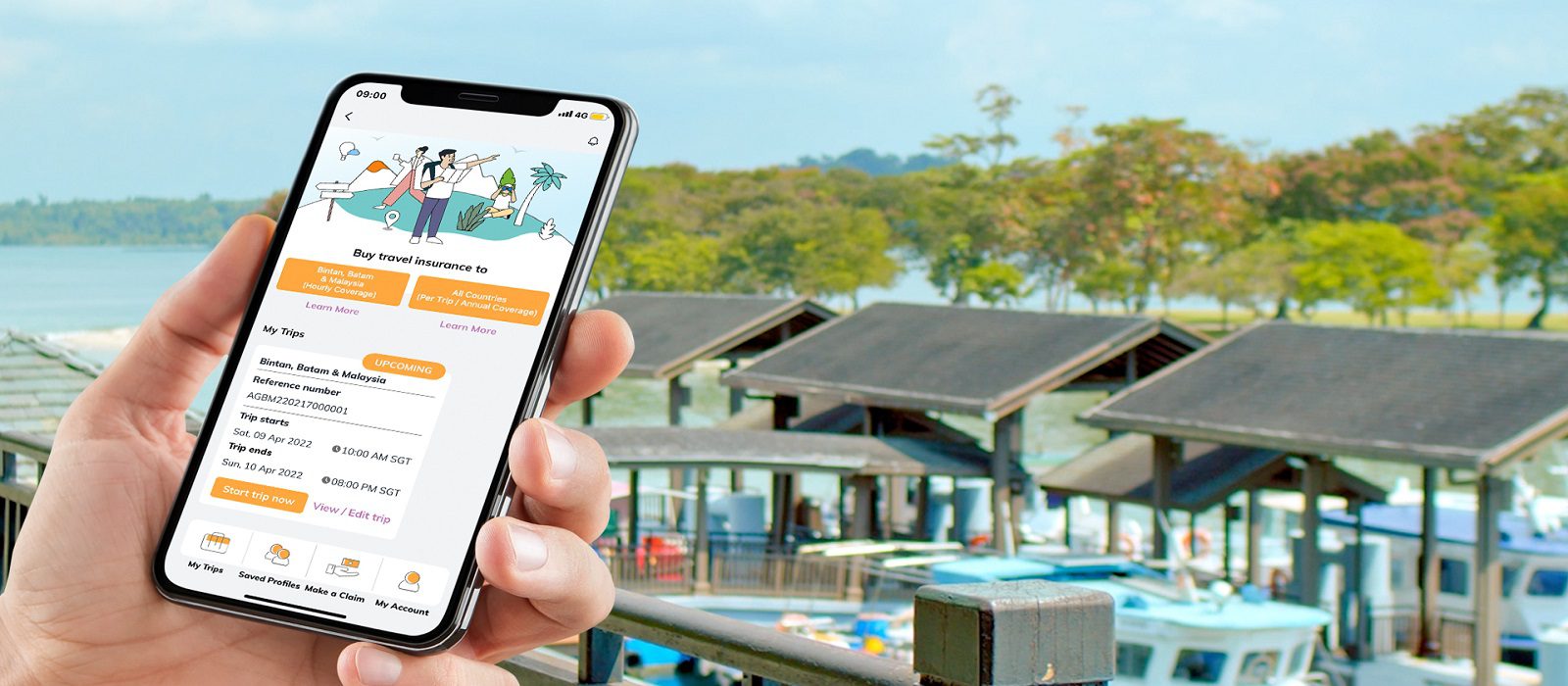

Accessible via the ‘My Income’ mobile app, travellers can easily activate and stop their FlexiTravel Hourly Insurance coverage anytime at their fingertips. With its geolocation feature, FlexiTravel Hourly Insurance is set to make travelling to Bintan, Batam and Malaysia not just spontaneous but safe as the app is designed to push notifications to travellers and remind them to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival in Singapore.

Alternatively, travellers can update their travel details manually on the app to terminate or extend their travel insurance plan accordingly without the need to turn on the geolocation feature.

“The recent relaxation of travel-related measures has injected fresh enthusiasm among Singaporeans over the possibility of travelling again. The launch of FlexiTravel Hourly Insurance is timely in catering to the evolving needs of travellers, such as short trips to nearby destinations and travelling amidst the pandemic, so they can now travel with peace of mind as they stay protected by the hour as needed,” Chua said.

You may also like:

Prudential’s health app can now scan people’s faces for stress

Malaysia general insurance industry to reach $5.5b in 2026

DBS, Manulife Singapore launch insurance starter plan ProtectFirst

Follow the links for more news on

Credit insurance drives BRI's premium increase: Fitch Ratings

Towngas, FSE Nova commit to expanded insurance cooperation

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you dight and create an advertising campaign, in print and digital, on this website and in print magazine.

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Low penetration rates challenge Indonesian insurance

Synthetic data to power 40% of insurance AI by 2027

Etiqa introduces tailored pet insurance in singapore.

Non-contributory plans propel market growth in group life insurance

Resource center, swiss re customer story, the financial services world of the future, re-wiring financial services operations for a bold future, financial services: the smarter way to workflow, the innovation paradox in property and casualty insurance, transform and modernise with an effective hybrid cloud strategy, insurance asia digital conference, print issue.

Insurance Asia Awards

Insurance asia forum - jakarta - may 14, 2024, insurance asia forum - kuala lumpur - june 25, 2024, insurance asia summit - september 4, 2024, insurance asia forum - manila - october 1, 2024, partner sites.

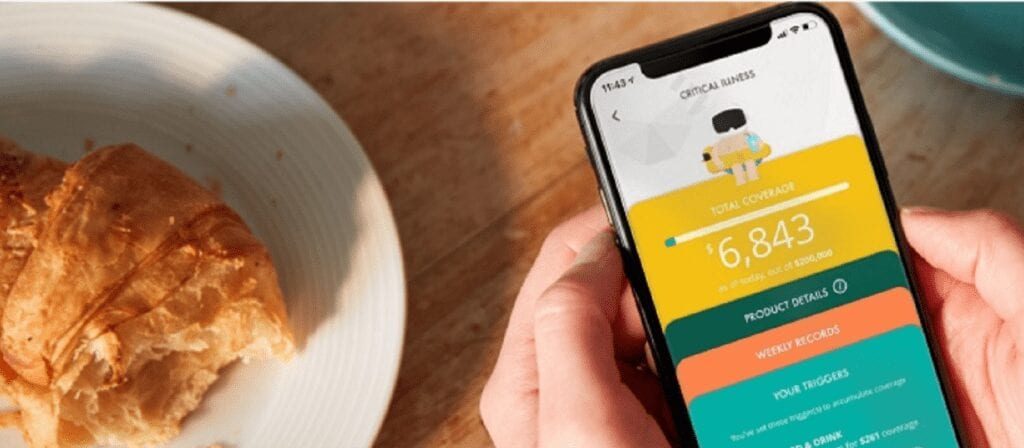

Critical illness coverage penetration challenges: Understanding Singaporean Struggles and Solutions

Renewables push faces climate hurdles post-cop28.

NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums

- NTUC Travel Insurance: Summary

- NTUC Travel Insurance Coverage

- NTUC Travel Insurance Pre-Existing Conditions

- NTUC Travel Insurance COVID-19 Coverage

- NTUC Travel Insurance: Extreme Sports

- NTUC vs MSIG vs Etiqa Travel Insurance

- NTUC vs FWD Travel Insurance

- NTUC Travel Insurance vs Other Travel Insurers

- NTUC Travel Insurance Promo

- NTUC Travel Insurance Claim

- Should I buy NTUC Travel Insurance?

1. NTUC Travel Insurance Summary

- NTUC Travel Insurance Standard

- NTUC Income Enhanced PreX (covers pre-existing medical conditions)

- Classic/ Basic PreX

- Deluxe/ Superior PreX

- Preferred/ Prestige PreX (most expensive)

- ASEAN : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam

- Asia : Australia, China (no Mongolia, Tibet), Hong Kong, India, Japan, Korea, Macau, New Zealand, Sri Lanka, Taiwan, ASEAN

- Worldwide : All countries

2. NTUC Travel Insurance Coverage

3. ntuc travel insurance pre-existing conditions, ntuc enhanced prex travel insurance premiums and coverage:, 4. ntuc travel insurance covid-19 coverage, ntuc travel insurance's covid-19 coverage and benefits:, 5. ntuc travel insurance: extreme sports, 6. ntuc vs msig vs etiqa travel insurance, 7. ntuc vs fwd travel insurance, 8. ntuc travel insurance vs other travel insurers, 9. ntuc travel insurance promo, 10. ntuc travel insurance claim.

- Trip cancellation

- Trip shortening

- Travel delay

- Baggage delay

- Loss and damage of baggage or personal belongings

11. Conclusion: Should I buy NTUC Travel Insurance?

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

NTUC Income launches FlexiTravel short trip travel insurance product

Singaporean insurance cooperative ntuc income has launched a new travel insurance product for short trips which enables travellers to purchase insurance by the hour.

Premiums for the new product, known as FlexiTravel Hourly Insurance, start at S$1.80 for the first six hours, with additional hours of coverage being charged at a rate of $0.30 per hour, capped at a maximum charge of $3 per day.

The policy is currently only available to travellers visiting Malaysia and the Indonesian Bintan and Batam, and is targeted at Singaporeans planning short, impromptu regional trips such as driving to Malaysia for a few hours.

The policy is purchasable via NTUC Income’s My Income app, enabling travellers to easily activate or stop their coverage when it is no longer required. In addition, the app’s geolocation functionality enables users to receive notifications reminding them to activate the plan when it detects that they are entering or leaving Singapore. Travellers can also update their travel details via the app to terminate or extend the plan manually.

The policy is intended to make it easier for Singaporeans who feel it is expensive or a hassle to purchase travel insurance for such short trips.

Vice President and Head of Personal Lines at NTUC Income Annie Chua, said:Top of FormBottom of Form “The recent relaxation of travel-related measures has injected fresh enthusiasm among Singaporeans over the possibility of travelling again. The launch of FlexiTravel Hourly Insurance is timely in catering to the evolving needs of travellers, such as short trips to nearby destinations and travelling amidst the pandemic, so they can now travel with peace of mind as they stay protected by the hour as needed.”

A recent survey by MSIG and Ancileo, also found that three in five Singaporeans plan to travel abroad in 2022 , with the vast majority also interested in purchasing travel insurance for their trip.

Switch language:

NTUC Income launches new travel insurance to protect customers by the hour

- Share on Linkedin

- Share on Facebook

NTUC Income has launched a new offering in Singapore that allows customers to get travel insurance by the hour.

The new product, called FlexiTravel Hourly Insurance, aims to offer cover to travellers going on a short or impromptu regional trip by land or sea that last for a few hours to a full weekend.

Go deeper with GlobalData

How Customers Purchase Income Protection Insurance?

Premium insights.

The gold standard of business intelligence.

Find out more

Currently, FlexiTravel Hourly Insurance is available only for customers who are travelling to Bintan, Batam and Malaysia.

The travel insurance plan charges a minimum of S$1.8 for six hours of cover, with the ability to get additional coverage at S$0.3 per hour, which is capped at S$3 per day.

Income’s travel insurance offering can be accessed and toggled on/off via the ‘My Income’ app.

The FlexiTravel Hourly Insurance also uses geolocation data to remind customers to activate or terminate their insurance cover depending on where they are.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

According to a survey conducted by NTUC Income, most travellers are concerned about getting help in events such as catching Covid, accidents and losing their belongings.

Despite these concerns, majority of the respondents of the survey found purchasing travel insurance for such short trips expensive or cumbersome.

NTUC Income vice president and head of personal lines said Annie Chua: “With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain points so they can continue enjoying their short trips while staying protected.”

According to the insurer, “FlexiTravel Hourly Insurance also provides COVID-19 benefits such as medical expenses incurred overseas and emergency medical evacuation if required.”

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

UNEP announces new global insurance coalition for net zero

Vitality launches automated underwriting tool, sapiens launches updated version of reinsurance solution , bms re appoints new us coo to scale operations , sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

- Health x Wellness

The Gen XY Lifestyle

- Insights + interviews

- Gen XY News

- Gen XY Updates

NTUC Income launches FlexiTravel Hourly Insurance

Flexitravel hourly insurance is singapore’s first travel insurance that protects travellers by the hour, with premiums starting from as low as sgd 1.80 for 6 hours of coverage.

FlexiTravel Hourly Insurance is a newly launched travel insurance plan that provides travel protection by the hour. Available only for travellers headed to Bintan, Batam and Malaysia, the insurance plan provides a flexible and affordable way for them to insure themselves.

Travellers that are looking to do a short or impromptu trip – by land or sea – that ranges from a few hours to a full weekend can benefit from using this travel insurance plan and coverage.

How does FlexiTravel Hourly Insurance work?

FlexiTravel Hourly Insurance charges a minimum of SGD 1.80 for six hours of protection.

Travellers can add on coverage at a rate of SGD0.30 for every additional hour, capped at a maximum charge of SGD 3 per day. Policyholders who need to extend their trip while overseas can easily extend their coverage up to 7 days.

The insurance plan is accessible via the ‘My Income’ mobile app. Activating and stopping the coverage is also done through the mobile app.

An interesting feature that taps on the app’s geolocation function are the push notifications sent through the app to remind travellers to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival in Singapore. There is also a manual function to update their travel details and terminate the coverage.

Based on a recent survey we conducted, we found travellers to be most concerned about seeking assistance when mishaps occur such as catching COVID or getting injured while overseas and needing medical treatment, as well as losing their personal belongings. However, despite these concerns, majority of the respondents still find purchasing travel insurance for such short trips expensive or cumbersome. With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain point so they can continue enjoying their short trips while staying protected. Annie Chua, Vice President and Head of Personal Lines, NTUC Income

What are some of the benefits designed for trips to Bintan, Batam and Malaysia?

FlexiTravel Hourly Insurance benefits are specially designed to cover the common needs and concerns of short-term travellers to Bintan, Batam and Malaysia by land or sea.

According to Income, here are examples of some key benefits of FlexiTravel Hourly Insurance:

- Golfer’s cover, including stolen golf equipment from locked car and subsequent rental of golf equipment

- Reimbursement for unused entertainment ticket purchased for your trip

- Loss of baggage and personal belongings due to robbery or snatch theft and fraudulent use of bank card while overseas

- Relief for additional transport expenses due to snatch theft, robbery, or road accident

FlexiTravel Hourly Insurance provides COVID-19 benefits such as medical expenses incurred overseas and emergency medical evacuation if required.

Access to FlexiTravel Hourly Insurance

Interested travellers can find more information about FlexiTravel Hourly Insurance on the Income website . They can also download the ‘My Income’ mobile app from the App Store or Google Play.

For first time FlexiTravel Hourly Insurance customers, Income is offering complimentary first-trip coverage for the first 1000 customers until 26 July 2022. Travellers that qualify can register via the “My Income” mobile app and key in the promo code “1STTRIPONUS” to enjoy complimentary travel insurance.

Images credit to Income

You may also like...

Word from our advertisers, recent post, singapore’s silent sleep epidemic: a wake-up call.

According to the 2024 Global Sleep Survey from ResMed, Singapore is in the grip of a silent sleep...

Great Eastern Leads the Charge in Pre-Planning for Singaporeans

In a pioneering move, Great Eastern has partnered with the government to promote the importance of pre-planning among...

Sleepless in Singapore: OSIM Wellness Survey 2023 reveals a sleep crisis

A good night’s sleep is more of a dream than a reality for many Singaporeans, according to this...

Free Cervical Cancer screening for women by the 365 Cancer Prevention Society

In a bid to combat cervical cancer, the 365 Cancer Prevention Society (365CPS) has launched a free screening...

5 things that make Singapore a family-friendly destination

When planning a family holiday, the destination matters. You want to make sure that the country you are...

- About the Active Age

- Working with the Active Age

- Code of Conduct at the Active Age

- Privacy Policy

- Terms of Service

The Active Age is an online magazine that shares content about trends, insights, features, products and services that revolve around the Generation XY lifestyle.

Copyright © 2019 The Active Age

Latest Posts

Prism+ expands into home appliances with own line of refrigerators.

Advertisement

Recent searches, trending searches.

Now Available: Hourly Travel Insurance From $1.80 For 6 Hours For JB Day Trips Or Bintan Or Batam Weekend Getaways

It’s much cheaper than conventional travel insurance. So what’s the catch?

The days of impromptu JB jaunts or spontaneous Bintan weekend getaways are finally back.

But if we’ve learnt anything from the pandemic, it’s that travel insurance is a must-buy for overseas trips, whether you’re going for a long European vacay or a day trip to Legoland in JB. For the latter, there’s now a travel insurance policy that lets you buy travel protection on an hourly basis.

NTUC Income has just launched FlexiTravel Hourly Insurance for travellers to Bintan, Batam and Malaysia which not only costs a fraction of the price of conventional travel insurance policies, it comes with Covid-19 coverage as well.

How much does it cost?

The minimum charge is $1.80 for six hours of protection, while additional coverage costs $0.30 per hour, and this is capped at a maximum charge of $3 for 24-hour coverage. In other words, for a short weekend getaway, you could be paying $6 for two days with this plan, compared to $32 for Income’s classic travel insurance plan.

Of course, with such a big difference in pricing, the benefits are largely different from regular travel insurance plans as well. The newly-launched pay-by-hour travel insurance is designed to cover short-term trips via land or sea up to a maximum of seven days. In comparison, conventional travel insurance policies have more comprehensive coverage that includes flights, and offer travel protection for up to 180 days.

The key benefits of the FlexiTravel Hourly Insurance include loss of baggage and personal belongings due to robbery or snatch theft, fraudulent use of bank card while overseas, relief for additional transport expenses due to snatch theft, robbery or road accidents, and reimbursement for unused entertainment tickets purchased for your trip.

Folks heading out for nearby golfing day trips will also be pleased to know that it also includes golfer’s cover (including stolen golf equipment from a locked car and subsequent rental of golf equipment).

Covid-19 coverage benefits include medical expenses incurred overseas and emergency medical evacuation if required.

Income FlexiTravel Hourly Insurance key benefits

To be eligible for the FlexiTravel Hourly Insurance, you have to be living or working in Singapore and have a valid Singapore identification document. You also need to be starting and ending your trip in Singapore, and have bought the policy before leaving Singapore.

The travel insurance plans are accessible via the My Income mobile app, and plans are purchased based on date and time of travel. The app has a geolocation feature which detects when you’re departing or arriving in Singapore, and will send push notifications to remind you to activate or terminate the plan according to your location. However, if you don’t want to turn on the geolocation feature, this can be done manually on the app as well.

More info here . Photos: NTUC Income

Related Stories

You Can Now Fly Direct From Seletar Airport To Redang Island; All-In Resort & Flight Packages Available

These Travel Insurance Policies Come With Covid-19 Coverage — Absolutely Essential If You're Planning A VTL Trip

Travel Insurance: To Buy Or Not To Buy?

Home Matters

Best Pancake & Waffle Makers From $32 — From Multi-Functional To Cute Hello Kitty Ones

These Handbags & Pouches Are Actually Free Gifts With Japanese Magazines; Prices From $15

The New Sony Headphones Are A Cheaper Version Of The Holy Grail XM5 – And Is For The Bass Lovers

Subscribe to the 8days weekly e-newsletter to receive the latest entertainment, celebrity, food and lifestyle news!

Terms & Conditions!

I consent to the use of my personal data by Mediacorp and the Mediacorp group of companies (collectively “Mediacorp”) to send me notices, information, promotions and updates including marketing and advertising materials in relation to Mediacorp’s goods and services and those of third party organisations selected by Mediacorp, and for research and analysis, including surveys and polls.

Want More? Check These Out

How To Travel With Just A Carry-On Luggage — Packing Tips & Travel Essentials You Need

When Can You Catch Cherry Blossoms In Japan In 2024? The First Sakura Forecast Of The Year Is Here

Tried & Tested: Travel Essentials That Are Worth Buying — And The Ones That Aren’t

You May Also Like

This browser is no longer supported.

We know it's a hassle to switch browsers but we want your experience with 8 Days to be fast, secure and the best it can possibly be.

To continue, upgrade to a supported browser.

Upgraded but still having issues? Contact us

International Cooperative and Mutual Insurance Federation

NTUC Income launches FlexiTravel Hourly Insurance, Singapore’s first travel insurance that protects travellers by the hour

ICMIF member NTUC Income (Income) has launched FlexiTravel Hourly Insurance , Singapore’s first travel insurance that enables travellers to purchase travel protection as needed by the hour. Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves for short or impromptu regional trips by land or sea that range from a few hours to a full weekend.

Spontaneous weekend getaways to destinations such as Bintan, Batam and Malaysia have always been popular with Singaporeans. Some examples of favourite activities include driving to Malaysia for a few hours of golf, grocery shopping and dinner, visiting attractions like Legoland with the family for a day or taking a ferry to Bintan for a weekend vacation. However, travellers often find it expensive or a hassle to purchase travel insurance for such short trips as they are perceived to be less risky and many often travel uninsured.

Designed to give control to customers while protecting them on short trips, FlexiTravel Hourly Insurance charges a minimum of SGD 1.80 for six hours of protection, with the option for travellers to add on coverage at a rate of SGD 0.30 for every additional hour, capped at a maximum charge of SGD 3 per day.

Accessible via the ‘My Income’ mobile app, travellers can easily activate and stop their FlexiTravel Hourly Insurance coverage anytime at their fingertips. With its geolocation feature, Income says FlexiTravel Hourly Insurance is set to make travelling to Bintan, Batam and Malaysia not just spontaneous but safe as the app is designed to push notifications to travellers and remind them to activate their FlexiTravel Hourly Insurance plan when it detects that they are departing Singapore, and to terminate their plan upon arrival back in Singapore. Alternatively, travellers can update their travel details manually on the app to terminate or extend their travel insurance plan accordingly without the need to turn on the geolocation feature.

Annie Chua, Vice President and Head of Personal Lines, NTUC Income, said, “Travelling always involves a certain level of risk, be it short or long trips as unforeseen circumstances can occur any time. Based on a recent survey we conducted, we found travellers to be most concerned about seeking assistance when mishaps occur such as catching COVID or getting injured while overseas and needing medical treatment, as well as losing their personal belongings. However, despite these concerns, majority of the respondents still find purchasing travel insurance for such short trips expensive or cumbersome. With this in mind, we designed FlexiTravel Hourly Insurance to offer a pay-by-the-hour proposition to solve travellers’ pain point so they can continue enjoying their short trips while staying protected.”

Latest news

A4S publishes guidance for the insurance industry to help achieve a net-zero insurable economy

Thrivent launches community-focused, multi-year partnership with Minnesota Twins baseball team

New Global Mutual Market Share research from ICMIF reveals the mutual share of the total insurance market is at an eight-year high

For member-only strategic content on the cooperative/mutual insurance sector, ICMIF members have exclusive access to a range of online resources through the ICMIF Knowledge Hub .

Related content

News article.

NTUC Income launches Pinfare to safeguard travellers against airfare fluctuations

Read More »

New insurtech partnership to provide on-demand insurance in Canada

NTUC Income launches SNACK, Singapore’s first bite-sized, stackable insurance

Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- Income Travel Insurance: Is It a Good Deal?

- Covers pre-existing conditions

- Provides COVID-19 hospitalisation and evacuation coverage for certain countries

- Expensive, especially annual plans

- Low personal accident and medical benefits

Like many other insurers, NTUC Income offers three levels of travel insurance policies to cater to the tastes and budgets of all kinds of consumers. Ultimately, its plans tend to be priced quite close to the industry average and feature a medium degree of coverage in most areas with two main weak points. While Income's plans are priced fairly given the level of coverage provided, deal-seekers will not be particularly wowed. However, Income's travel insurance policies stand out because they are one of the only insurers in Singapore that cover pre-existing medical conditions.

Table of Contents

- Income Enhanced Travel Insurance: What You Need to Know

- Income Enhanced PreX Travel Insurance

Sports Coverage

Claims & contact information.

- Income Coverage & Benefits

NTUC Income Travel Insurance: What You Need to Know

NTUC Income's travel insurance plans are best for travellers who aren't price sensitive and want coverage for their pre-existing conditions. You can choose from 3 tiers of plans for both the Enhanced and Enhanced PreX plans: Classic, Deluxe and Preferred for the standard plans and PreX Basic, PreX Superior & PreX Prestige for the pre-ex coverage plans. We found that Income's single trip plans generally cost 15-30% below average compared to its competition, while its annual plans cost between average to 20% above average. For those prices, the coverage is more competitive when it comes to travel inconvenience benefits (cancellations, delays, luggage loss), but sinks to below average overseas medical and personal accident coverage.

NTUC Income offers the standard array of travel insurance benefits, ranging from medical and personal accident to trip inconvenience benefits like trip cancellation, postponement, delays and baggage loss. While most of the benefit limits are slightly below average, Income does boast above average limits for medical coverage in Singapore, trip delay and baggage loss coverage. However, these plans may fail to impress some types of travellers. For instance, Income's Basic plan provides average levels of coverage but won't impress budget travellers since its possible to find cheaper basic plans. The premium tier plan (Preferred) boasts above average coverage for a small amount of benefits, but won't stand out to travellers who equate premium-level plans with market beating coverage.

Income's annual policies cost above average for all 3 plans, so it won't be the best option for frequent travellers who are hoping to save on an annual travel insurance plan. However, as Income is the only insurer that is currently providing COVID-19 medical and hospitalisation coverage as long as you take the mandatory PCR test and test negative pre-departure and won't be travelling to a high-risk nation, it is the best option for travel during the COVID-19 period. Overall, Income's travel insurance plans are just enough for the average traveller and can provide sufficient additional coverage if that traveller needs coverage for pre-existing coverage. Otherwise, Income's Enhanced travel insurance plans may not sway budget travellers or travellers who like high levels of coverage.

Notable Exclusions

NTUC Income only covers pre-existing conditions if you purchase their Enhanced PreX plans. Besides that, the exclusions are pretty standard, including no cover for travelling for medical conditions, items lost or damaged while unattended, travelling to participate in professional or compensated sports, being a victim of war, riots, or rebellion and travelling against the advice of the Singapore Government.

NTUC Income Enhanced PreX Plans Travel Insurance

If you are not limited by budget and just want a plan that will give you ample protection for your pre-existing coverage, Income will be a good choice. However, budget travellers with pre-existing conditions may find Income to be an expensive option. We found that Income's PreX travel insurance plans cost around 3 times as much as Income's standard plans, making them quite expensive considering that Income isn't competitively priced to begin with. As one of the 3 insurers who provides extensive coverage for your pre-existing coverage, it settles somewhere in the middle, with MSIG's plans costing 10-22% less but Etiqa's Tiq plans costing around 15% more.

Besides the pricing, you should also consider the extent of Income's pre-existing coverage benefits. Its PreX plans also combine medical and emergency evacuation coverage under one limit, which brings down the value of these plans considerably (for instance, MSIG's PreX and Tiq's PreX plans have separate limits for medical and emergency evacuation, resulting in more coverage than Income). On the other hand, Income does let you claim for trip inconvenience (cancellations and postponement) due to your pre-existing conditions if you buy its Superior or Prestige plans, which can be a useful benefit for people who book their trips far in advance and have somewhat risky conditions. You should just be aware of the 50% copay you'll be responsible for should you use those benefits.

Income includes medical coverage for adventure and sports including skiing, scuba-diving, white water rafting and motorcycling. There's no golf coverage and no cover for extreme sports such as bungee jumping, skydiving and mountaineering.

Income lets you submit your claim online or via post. Both options require you to submit the proper documentation, which they list when you indicate the type of claim you want to submit. You should read the policy wording before buying the policy so you are aware of what you can and can't claim for.

Summary of NTUC Income Travel Insurance Benefits & Coverage

With so many options for travel insurance plans in Singapore, it's no wonder that picking the right one for your next business trip or holiday can seem like a daunting task. Below, we've compiled a summary of NTUC Income's premiums and coverage and how it compares to the industry average. If you'd like to learn more about how Income compares to other insurers, you can read our top picks for the best travel insurance plans in Singapore.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

- Dating | Relationships

- Family | Parenting | Kids

- Health | Wellness

- Home & Decor

- Personal Care

- Personal Growth & Development

- Technology | Media

- New Zealand

- South Korea

- Switzerland

- United Arab Emirates

- United Kingdom

- Bar / Pub / Club

- Convenience Foods

- Fine Dining

- Food Trucks

- Hawker Centre Fare

- International

- Malay / Muslim / Halal

- Middle Eastern

- South African

- Street Food

- Vegan / Vegetarian

- Baking & Roasting

- Bento / Lunchbox

- Dessert & Sweet Treats

- Drinks & Beverages

- Fish & Seafood

- Keto & Low Carb

- Miscellaneous

- Poultry & Meat

- Rice, Pasta & Noodles

- Salad & Vegetables

- Sandwich & Bread

- Snacks & Finger Foods

- Soups & Stews

Comprehensive Review of NTUC Travel Insurance: Coverage, Benefits, and More

NTUC Travel Insurance is a product offered by NTUC Income, a leading insurance provider in Singapore. Established in 1970, NTUC Income is dedicated to offering affordable, comprehensive, and accessible insurance coverage to individuals and families. Their travel insurance plans are tailored to safeguard travelers against a wide range of unexpected circumstances, ensuring peace of mind during their journeys.

Primary features and highlights

Primary features and highlights refer to the key characteristics and notable aspects of a subject. These are often the distinguishing factors and unique attributes that set it apart. Speaking of which, an NTUC travel insurance review typically focuses on these primary features and highlights, offering insights into how it stands out in the competitive insurance market. They can refer to an event’s main activities, a product’s exceptional features, or a service’s outstanding components.

In-Depth Review of NTUC Travel Insurance Coverage

Medical and accident coverage.

Medical and accident coverage is a type of insurance policy that helps cover medical expenses resulting from sudden illnesses or accidents. It offers financial assistance towards hospitalization costs, doctor’s fees, medication, and related health care services following an unexpected event.

Travel inconvenience benefits

Travel inconvenience benefits offer compensation for unexpected challenges encountered during a journey. These include flight delays, lost luggage, emergency accommodation needs, and medical emergencies. Such benefits alleviate stress, offering travelers peace of mind and financial security.

Baggage and personal effects protection

Baggage and personal effects protection is an important feature in travel insurance policies. It covers loss, theft, or damage to personal items during your transit or stay. This ensures secure travel experiences, granting peace of mind to travelers while on their journeys.

Extra coverage – Adventure Sports, Golf Equipment, etc.

Extra coverage options for adventure sports and golf equipment provide specialized protection for enthusiasts. These coverages ensure your gear is protected from theft or damage, and in the case of adventure sports, it covers potential accidents or injuries as well.

Overview of COVID-19 Coverage under NTUC Travel Insurance

NTUC Travel Insurance now includes coverage for COVID-19-related incidents for customers. This includes medical and hospitalization expenses incurred overseas due to infection. Additionally, cancellation and trip postponement benefits related to the virus are also part of the coverage.

Detailed benefits of NTUC Travel Insurance

Extended coverage options.

Extended coverage options provide additional insurance protection beyond standard policies. These options may cover unforeseen circumstances such as natural disasters, vandalism, or unexpected health issues. They may cost more, but offer increased peace of mind.

High claims limit

A high claims limit refers to the maximum amount an insurance company is willing to pay for a claim. It’s beneficial for policyholders as it provides extensive coverage, safeguarding against substantial financial losses caused by accidents, illnesses, or damages.

Access to 24/7 emergency assistance

With around-the-clock availability, 24/7 emergency assistance provides immediate help during urgent situations. Access to this service ensures safety at all times, regardless of when an emergency occurs. Thus, it promotes peace of mind and guarantees immediate response in crisis events.

Special benefits for family plans

Family plans offer special benefits such as discounted rates, shared data, and free add-ons for multiple lines. These plans may also include parental controls, unlimited talk and text, and exclusive family features enhancing connectivity and savings.

Option of pre-existing medical coverage

Pre-existing medical coverage is an insurance option that covers prior health conditions. It is vital for individuals with ongoing health issues as it ensures they receive necessary care and medication regardless of their health status at the onset of the policy.

Variety of Add-ons

Add-ons refer to optional features or enhancements that can be added to improve a basic product or service. They enhance functionality or offer customization options to suit the user’s unique needs, increasing product versatility and overall user experience.

Pricing and plan options

Pricing and plan options are vital considerations for any product or service. They provide flexibility and choice to customers, allowing them to select an option that best fits their budget and needs. Proper pricing strategies can significantly enhance market competitiveness.

Overview of different plans

Various plans encompass different objectives and strategies. They include business plans, marketing strategies, project timelines, and financial plans. These documents guide decision-making processes, outlining goals, expected outcomes, timeframes, and necessary resources for achieving predetermined objectives.

Cost comparison with other travel insurance

Comparing the cost with other travel insurance policies is crucial while purchasing travel insurance. The coverage, benefits, and exclusions differ among the policies, so comparing helps in choosing the best out of all financially feasible options.

Claims Procedures for NTUC Travel Insurance

General procedure for filing a claim.

The general procedure for filing a claim typically involves notifying the relevant authority or insurance company about the incident. Detailed documentation must then be gathered, supporting your claim. Afterward, a claim form must be filled and submitted, typically accompanied by the gathered documentation.

Typical claim processing time

Typical claim processing time varies across different industries. For insurance claims, it generally takes 30 days from filing the claim to receiving a payout. However, complex claims can require extended periods, sometimes up to 60 days or longer.

Common reasons for claim rejection

Claim rejections often result from errors in billing information, missing documentation, or procedural missteps. Insufficient evidence of medical necessity and delayed claims submissions are common reasons. In some instances, services may not be covered by an individual’s insurance policy.

NTUC Travel Insurance Customer Service

NTUC Travel Insurance Customer Service provides exceptional assistance to policyholders. They offer prompt responses and resolve issues efficaciously. Their well-trained staff are adept at answering queries and guiding customers through the intricacies of their travel coverages. This reinforces the trust and satisfaction of their clients.

Analysis of customer service quality

Analyzing customer service quality involves understanding customer interactions, expectations, and satisfaction levels. It includes measuring response times, query resolution efficiency, communication skills, and service delivery standards. Such analysis guides improvements, fostering loyalty, and ensuring customer retention.

Overview of customer feedback and reviews

Customer feedback and reviews are crucial tools in understanding customer satisfaction and their perception of a product or service. These insights help businesses improve their offerings, resolve issues, enhance customer experience, and foster brand loyalty. It shapes future strategic decisions and influences business growth.

The Upsides and Downsides of NTUC Travel Insurance

NTUC Travel Insurance offers comprehensive coverage spanning medical expenses, travel inconveniences, and personal accidents. It includes unique benefits such as overseas study interruption and safety measures against novel viruses. It’s customizable, offering varied plans to cater to unique travel needs.

While NTUC Travel Insurance boasts numerous advantages, there are some downsides to consider. One drawback is the potential for higher premiums compared to basic travel insurance plans offered by other providers. Despite its comprehensive coverage, the cost may be prohibitive for budget-conscious travelers. Additionally, while NTUC Travel Insurance offers customization options, the process of selecting and tailoring a plan to individual needs may be complex or time-consuming for some customers. Another disadvantage is that certain exclusions or limitations within the policy may not be immediately apparent, requiring careful scrutiny of the terms and conditions to fully understand the extent of coverage.

1. What is the best travel insurance?

The best travel insurance varies based on individual needs; however, NTUC Income is widely recognized for its comprehensive coverage. It covers medical emergencies, trip cancellations, and lost baggage, and offers 24/7 worldwide assistance, suitable for both leisure and adventurous travelers.

2. Does NTUC insurance cover in Malaysia?

NTUC Income’s travel insurance does cover trips to Malaysia and it includes coverage for medical expenses, trip cancellation, personal accident, and other travel inconveniences. It provides comprehensive coverage, offering peace of mind for travelers to the neighboring country.

3. What does travel insurance not cover?

Travel insurance typically does not cover incidents related to pre-existing medical conditions, extreme sports injuries, losses due to civil unrest, or cancellations due to personal reasons. It also often excludes coverage for pandemic-related disruptions or expenses.

4. When should I buy travel insurance?

You should consider buying travel insurance as soon as you book your trip. It will cover unforeseen circumstances such as trip cancellation, medical emergencies, or travel disruptions due to weather conditions, ensuring you’re financially protected.

Disclosure: This article is sponsored. The views expressed herein are solely those of the author. The content presented is for informational purposes and may not necessarily represent the viewpoints or opinions of Spring Tomorrow.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Reddit (Opens in new window)

Tags: advertorial sponsored post sponsored review

Leave a Comment Cancel reply

Subscribe to our newsletter to receive the latest updates in your inbox

Enter Email Address

Trending Posts

- Bangkok Airport Rail Link - Getting from Central Bangkok to Suvarnabhumi Airport

- AEON Tebrau City Food Court - Better than before!

- Moo Ping Recipe | Thai Grilled Pork Skewers

- Heng Hua Restaurant (兴化美食) @ Yishun Street 72

- 50年 Taste of Tradition - Best Portuguese Egg Tarts in Singapore

- Pratunam food street - Bangkok's most authentic and best street food experience

- Long Covid: Understanding the Long-Term Effects of COVID-19

- One Day in Tamsui: What to See, Do and Eat in Taipei's Seaside District

- Bopiliao Historical Block and The Red House

- Taking The Train From Taipei To Hualien And Savouring The Railway Bentos

SINGAPORE - Insurer NTUC Income is expanding its operations to Indonesia, Vietnam and Malaysia through strategic partnerships with leading insurance companies in these countries.

The partnerships will be built on the insurance-as-a-service model, in which insurers deliver personalised insurance products to the customer in a simplified way while taking into account when and how they require them.

NTUC Income said on Thursday (Oct 28) that it will work with PT Central Asia Financial (Jagadiri) in Indonesia, Post and Telecommunication Joint Stock Insurance Corporation (PTI) in Vietnam and VSure Tech Sdn. Bhd (VSure) in Malaysia.

These three companies will launch NTUC Income's rain insurance plan Droplet across cities including Jakarta, Hanoi, Ho Chi Minh City and Kuala Lumpur.

Droplet offers insurance to consumers who book a ride via ride-hailing platforms such as Grab. It provides a payout when prices on these platforms surge due to rain.

Citing research by German data company Statista, NTUC Income said that in 2020, the total market value of ride hailing in South-east Asia was estimated to be US$11 billion (S$14.82 billion), with Indonesia topping the list (S$6.73 billion), followed by Singapore (S$2.69 billion), Vietnam (S$2.16 billion) and Malaysia (S$1.48 billion).

"This tremendous demand for ride-hailing services among South-east Asians has given rise to the need for 'rainsurance' like Droplet to protect consumers financially against price surges on these platforms, particularly during the monsoon season," NTUC Income's chief executive Andrew Yeo said. said.

It also noted the strong demand for digital consumption in South-east Asia, citing a report by Facebook and Bain and Company. Since the start of the pandemic, according to the report, an additional 70 million people in the region have become digital consumers and have been making online purchases.

Malaysia's Vsure's chief executive Eddy Wong said of Droplet: "Malaysians are no strangers to rain, and we believe protection against ride hailing pricing surge during rainy days is a great example of insurance reimagined to be palatable for the consumers and their modern lifestyles of today."

Droplet serves as a way to educate underserved Malaysian communities about the importance of staying protected, he added.

Mr Yeo said the overseas venture is a natural next step in the company's strategic growth plan.

"The market potential of countries like Indonesia, Malaysia and Vietnam is huge, given their relatively young populations and high mobile penetration rates.

"Considering their large geographical distribution areas, I believe that these markets are especially primed for new digital insurance propositions that are enabled by technology."

He added that the company aims to draw inspiration from its partners and regional consumers, and will look into co-creating digital insurance offerings that will ultimately benefit Singaporeans.

"We will continue to keep our focus on empowering better financial well-being among Singaporeans through sharper innovations and personalised experiences."

Join ST's Telegram channel and get the latest breaking news delivered to you.

Read 3 articles and stand to win rewards

Spin the wheel now

IMAGES

COMMENTS

With FlexiTravel Hourly [1] Insurance, it's always Happy Hour in Malaysia, Bintan and Batam! Enjoy the flexibility to shorten your trip coverage if you return to Singapore early. [2] Stay covered against medical expenses incurred overseas due to COVID-19, food poisoning, accidental injury and more. Coverage for loss of baggage and personal ...

27 April 2022 SINGAPORE, 27 April 2022 - NTUC Income (Income) today launched FlexiTravel Hourly Insurance, Singapore's first travel insurance that enables travellers to purchase travel protection as needed by the hour.Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves ...

Included. Best Travel Insurance for Pre-Existing Conditions. NTUC Income's PreX plans offer S$150,000 to S$300,000 to cover medical expenses and emergency evacuation. But as we've pointed out, the downside is that the limits for both are shared.

NTUC Income has launched a new travel insurance product, FlexiTravel Hourly Insurance, that enables travellers to buy insurance by the hour with premiums starting at S$1.80 for the first six hours. Currently, FlexiTravel Hourly Insurance is only available for those who are travelling to Bintan, Batam and Malaysia.

FlexiTravel Hourly Insurance is accessible through the My Income app and costs a minimum of SG$1.80 for six hours of protection. Customers have the option to add on coverage for SG$0.30 per ...

Take COVID-19 overseas medical coverage for example, NTUC offers $150,000 while MSIG' basic plan offers $75,000. Then, there's overseas COVID-19 quarantine cash allowance, which NTUC gives $100 ...

Singaporean insurance cooperative NTUC Income has launched a new travel insurance product for short trips which enables travellers to purchase insurance by the hour Premiums for the new product, known as FlexiTravel Hourly Insurance, start at S$1.80 for the first six hours, with additional hours of coverage being charged at a rate of $0.30 per ...

The travel insurance plan charges a minimum of S$1.8 for six hours of cover, with the ability to get additional coverage at S$0.3 per hour, which is capped at S$3 per day. Income's travel insurance offering can be accessed and toggled on/off via the 'My Income' app.

For first time FlexiTravel Hourly Insurance customers, Income is offering complimentary first-trip coverage for the first 1000 customers until 26 July 2022. Travellers that qualify can register via the "My Income" mobile app and key in the promo code "1STTRIPONUS" to enjoy complimentary travel insurance. Images credit to Income.

For the latter, there's now a travel insurance policy that lets you buy travel protection on an hourly basis. NTUC Income has just launched FlexiTravel Hourly Insurance for travellers to Bintan, Batam and Malaysia which not only costs a fraction of the price of conventional travel insurance policies, it comes with Covid-19 coverage as well.

ICMIF member NTUC Income (Income) has launched FlexiTravel Hourly Insurance, Singapore's first travel insurance that enables travellers to purchase travel protection as needed by the hour.Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves for short or impromptu regional ...

PROMO: Get 40% off single-trip policies. Like many other insurers, NTUC Income offers three levels of travel insurance policies to cater to the tastes and budgets of all kinds of consumers. Ultimately, its plans tend to be priced quite close to the industry average and feature a medium degree of coverage in most areas with two main weak points.

2. Does NTUC insurance cover in Malaysia? NTUC Income's travel insurance does cover trips to Malaysia and it includes coverage for medical expenses, trip cancellation, personal accident, and other travel inconveniences. It provides comprehensive coverage, offering peace of mind for travelers to the neighboring country. 3.

Nov 26, 2020, 11:58 AM. (THE BUSINESS TIMES) - NTUC Income customers who buy its travel insurance will now receive Covid-19 coverage as well, for medical-related expenses while overseas. Outbound ...

SINGAPORE — Trust Bank, the digital banking service backed by Standard Chartered and FairPrice Group, announced that its users will now be able to directly purchase travel insurance by Income Insurance from its app.. The latest offering will enable users to get near-instant travel insurance quotations and coverage, as well as being a complementary feature of the bank's zero foreign exchange ...

One great advantage of NTUC Income's travel insurance is the high trip cancellation coverage ranging from $5,000 to $15,000. Other travel insurance providers might not be so generous. For instance, is offering $2,000 to $15,000, while offers $2,500 to $15,000. Great Eastern logo. Great Eastern TravelSmart Premier Classic.

FlexiTravel Hourly Insurance. While most travel insurances ask you to pick from a one-time coverage or an annual one, this particular insurance from NTUC gives you hourly travel insurance coverage to Malaysia, Bintan and Batam. You can book this insurance to enter Malaysia with the My Income App. The insurance coverage includes:

Up to $50,000 overseas hospital allowance for inpatient hospitalisation due to COVID-19 per individual. Hurry! Apply promo code 'TRAVEL45' during checkout and get 45% discount when you sign up for any Per-trip plans! Income Insurance offers Life, Health, Travel, Motor, Savings and Investment, and other financial planning solutions, for your ...

Citing research by German data company Statista, NTUC Income said that in 2020, the total market value of ride hailing in South-east Asia was estimated to be US$11 billion (S$14.82 billion), with ...

For Travel Insurance activated from 26 Nov 2020 to 14 Oct 2021 - The COVID-19 high risk countries listed below are excluded from COVID-19 Coverage. If you have purchased your policy/included the COVID-19 Coverage in your policy: The following countries are classified as COVID-19 high risk countries: From 26 Sep 2021 to 14 Oct 2021.