Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Most Americans have traveled abroad, although differences among demographic groups are large

Americans are gradually returning to international travel, though international travel restrictions remain in place in many countries.

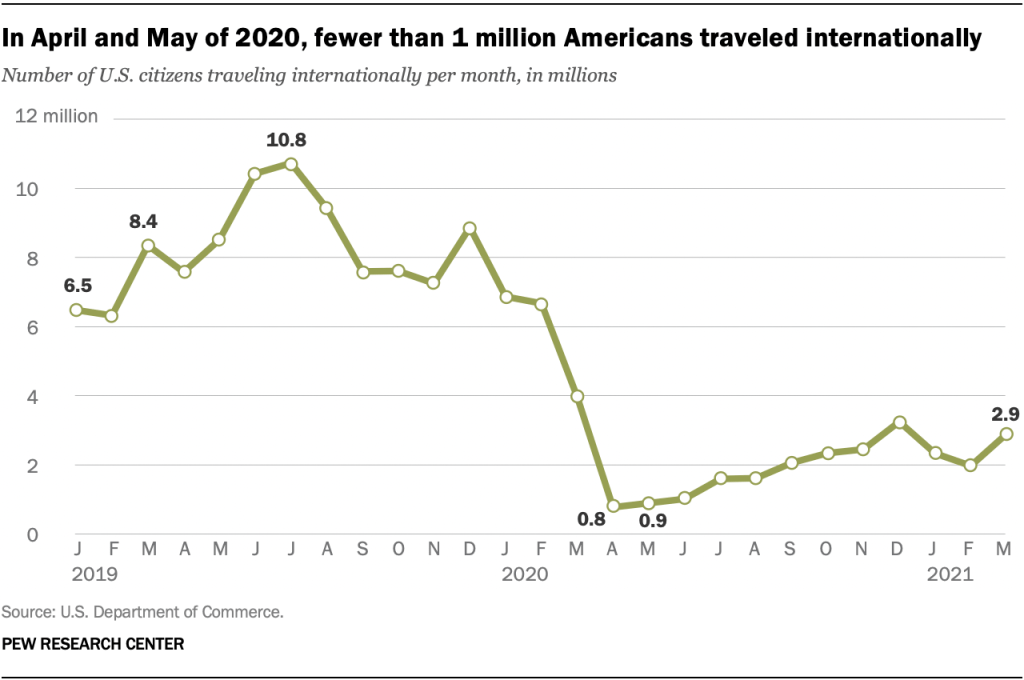

In March 2021 – the most recent month for which data is available – around 3 million American citizens traveled outside of the country. This is shy of the nearly 4 million U.S. citizens who traveled abroad in March 2020 as the coronavirus pandemic unfolded and far below the roughly 8 million who did so in March 2019, according to U.S. Department of Commerce data . But it represents a significant uptick over the low point in the late spring of 2020, when only around 1 million Americans or fewer left the United States. Still, international travel by Americans remains far below pre-pandemic levels.

To provide context for the impact of the COVID-19 pandemic on international travel, this post looks at the habits of Americans when it comes to who most frequently goes abroad, as well as those groups in the U.S. who have been less likely to do so. To do this, we analyzed I-92 data from the International Air Travel Statistics Program at the U.S. Department of Commerce. This data includes all flights in and out of the U.S. and reports the total volume of air traffic as well as the number of U.S. citizens traveling.

The post also uses findings from a Pew Research Center survey conducted June 14-27, 2021. The survey sampled 10,606 adults who are part of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for the report, along with responses, and its methodology .

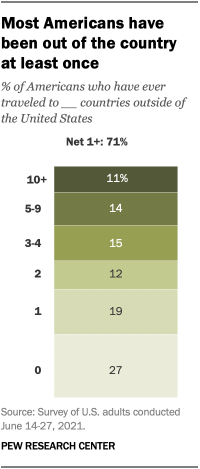

Whether before or during the pandemic, international travel is something a 71% majority of U.S. adults have done at some point in their lives, according to a June Pew Research Center survey. By contrast, around a quarter (27%) have not traveled abroad.

Still, the degree to which Americans have traveled around the globe varies widely: 19% have been to only one foreign country, 12% to two countries, 15% to three or four countries, and 14% to five to nine countries. Only 11% of Americans have been to 10 or more countries.

Who travels – and how much – also differs substantially across demographic groups. Income plays a decided role: Almost half (48%) of those earning less than $30,000 a year have not left the country, compared with 28% of those who earn between $30,000 and $79,999 a year and 10% of those earning $80,000 or more. These highest earners are also significantly more likely to have visited multiple countries.

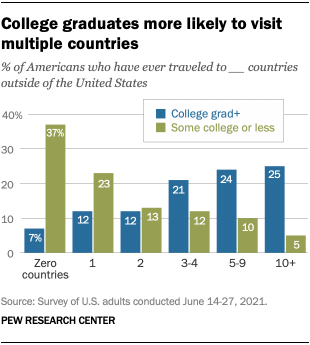

Americans with lower levels of education are much less likely to have traveled widely than those with more schooling. For example, 37% of those with just some college education or less have not left the country, compared with only 7% of those who have graduated college. College graduates are also more likely to have been to multiple countries: A quarter have been to 10 or more countries.

Women (32%) are more likely than men (22%) to have never traveled outside the country. Men, for their part, are much more likely than women to have been to five or more countries (30% vs. 22%). Still, men and women are equally likely to have been to only one country.

Black Americans are much less likely to have ever traveled abroad (49%) than White (75%) or Hispanic Americans (73%). White adults are also more likely to have been to five or more countries (30%) than Black (13%) or Hispanic (15%) adults.

When it comes to party affiliation, there are no significant differences in the share of Republicans and Democrats who have traveled internationally or in the number of countries they have visited.

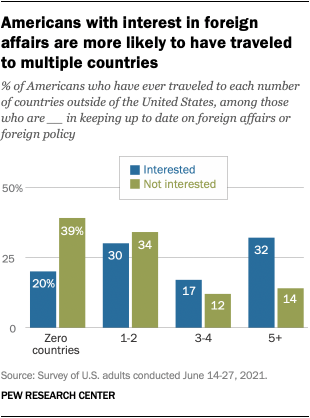

The 64% of Americans who say they are at least somewhat interested in keeping up to date on foreign affairs or foreign policy are much more likely to have traveled abroad at some point in their lives than those who say they have limited or no interest. They are also more likely to have been to many countries. For example, 32% of those who are interested in foreign affairs or foreign policy have been to at least five foreign countries, compared with 14% who are less focused on keeping up to date on foreign affairs.

Note: Here are the questions used for the report, along with responses, and its methodology .

- COVID-19 & the Economy

- Global Image of Countries

Laura Silver is an associate director focusing on global attitudes at Pew Research Center .

Wealth Surged in the Pandemic, but Debt Endures for Poorer Black and Hispanic Families

Key facts about the wealth of immigrant households during the covid-19 pandemic, 10 facts about u.s. renters during the pandemic, after dropping in 2020, teen summer employment may be poised to continue its slow comeback, in the u.s. and around the world, inflation is high and getting higher, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

UN Tourism | Bringing the world closer

The first global dashboard for tourism insights.

- UN Tourism Tourism Dashboard

- Language Services

- Publications

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

UN Tourism Data Dashboard

The UN Tourism Data Dashboard – provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality and accommodation (data on number of rooms, guest and nights)

Two special modules present data on the impact of COVID 19 on tourism as well as a Policy Tracker on Measures to Support Tourism

The UN Tourism/IATA Destination Tracker

UN Tourism Recovery Tracker

- International tourist arrivals and receipts and export revenues

- International tourism expenditure and departures

- Seasonality

- Tourism Flows

- Accommodation

- Tourism GDP and Employment

- Domestic Tourism

International Tourism and COVID-19

- The pandemic generated a loss of 2.6 billion international arrivals in 2020, 2021 and 2022 combined

- Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels.

- The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period.

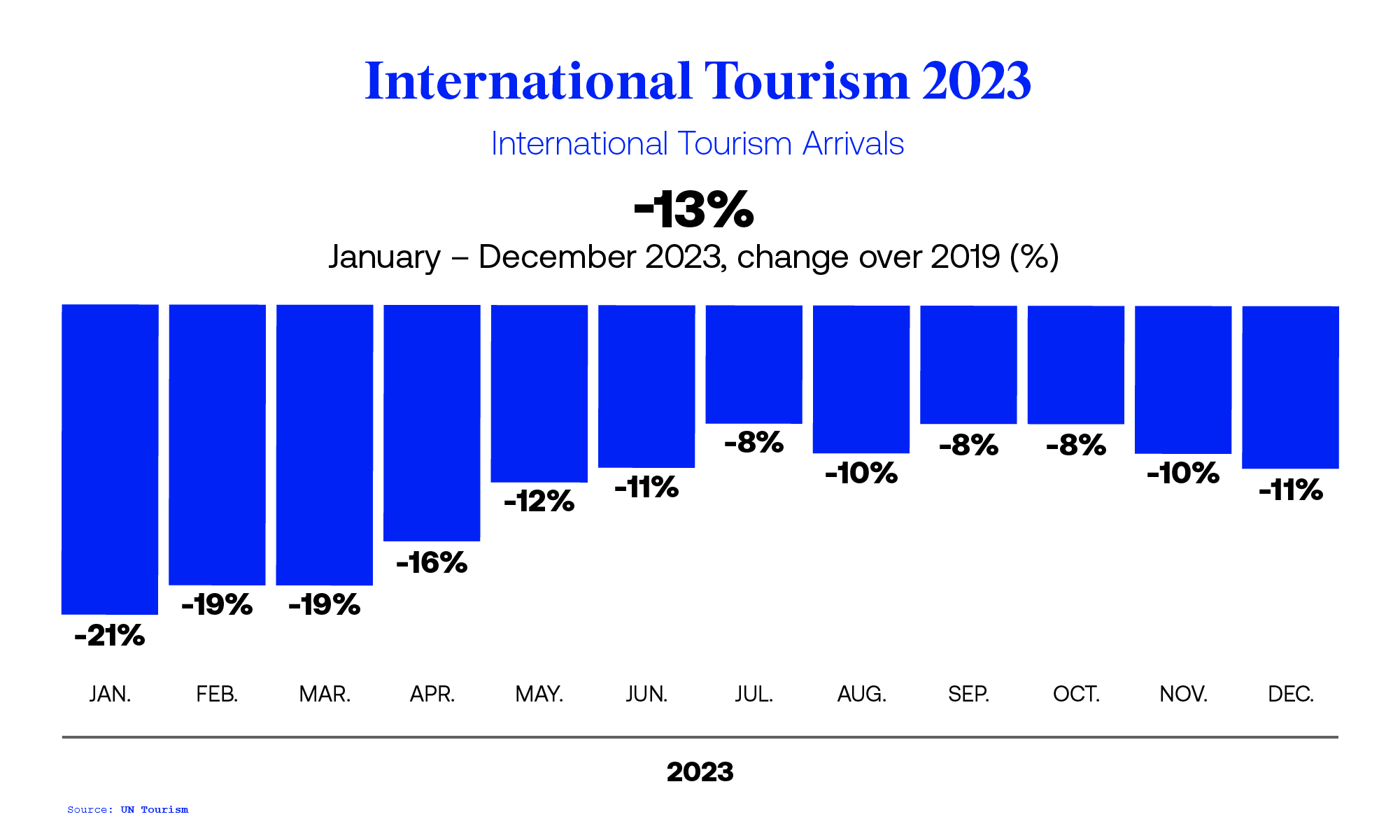

- International tourist arrivals reached 88% of pre-pandemic levels in January-December 2023

COVID-19: Measures to Support Travel and Tourism

International tourism, number of arrivals

All Countries and Economies

Country Most Recent Year Most Recent Value

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

NTTO Releases International Travel Statistics for 2023

- International Visitor Arrivals of 66.5 million Increased 31% from 2022.

- Overseas Visitation to Four States/Territories Exceeded Visitation in 2019.

International Visitor Arrivals to the United States in 2023

Total international visitor arrivals 1 of 66.5 million in 2023 increased 15.7 million (+31%) from 50.8 million in 2022 to a level 84% of the 79.4 million arrivals in 2019.

Annual international arrivals from 2000 to 2023 covering all countries and world regions are available on NTTO’s ADIS/I-94 Visitor Arrivals program page or can be downloaded here .

NTTO’s latest forecast expects international visitor arrivals to surpass pre-pandemic 2019 levels in 2025 with 85.2 million.

Major Characteristics of Overseas Visitors to the United States from the Survey of International Air Travelers (SIAT)

New York was the most-visited state by overseas travelers in 2023, up from #2 in 2022, followed by Florida and California.

New York City was the most-visited city by overseas travelers in 2023, followed by Miami and Los Angeles.

2023 overseas visitation to the following U.S. states/territories surpassed visitation in 2019: Puerto Rico (+85%), Tennessee (+15%), Texas (+7%) and Georgia (+5%).

These and other characteristics of international visitors to the United States can be analyzed in reports on the SIAT Results Inbound page or can be viewed in the SIAT Inbound Survey Monitor data visualization tool .

U.S. Citizen Departures from the United States in 2023

Total U.S. citizen departures 2 of 98.5 million in 2023 increased 17.6 million (+22%) from 80.8 million in 2022 to a level 99% of the 99.7 million arrivals in 2019.

Annual international arrivals from 2000 to 2023 covering all countries and world regions are available on NTTO’s APIS/I-92 Visitor Departures Program page or can be directly downloaded here .

Travel Trade Statistics

Spending by international visitors to the United States (travel exports) totaled $213.1 billion in 2023, an increase of $47.6 billion (+29%) from $165.5 billion in 2022 to a level 89% of travel exports in 2019. Travel exports accounted for 7.0% of total U.S. exports of goods and services in 2023, up from 5.5% in 2022. Travel exports supported 1.6 million U.S. jobs in 2023 3 .

Spending by U.S. residents abroad (travel imports) totaled $215.4 billion in 2023, an increase of $53.5 billion (+33%) from $161.9 billion in 2022 to a level 17% above travel imports in 2019.

Travel yielded a $2.3 billion trade deficit in 2023.

NTTO Releases New Data Visualization Tool

NTTO is releasing a Country Profile Monitor, which includes annual visitation, traveler characteristics and economic impact of travel to the United States for 71 countries.

Click here to see this new tool!

1 ADIS/I-94 (with stays of 1-night or more in the United States and visiting under certain visa types)

2 apis/ “i-92” (arrivals + departures), 3 direct and indirect jobs.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

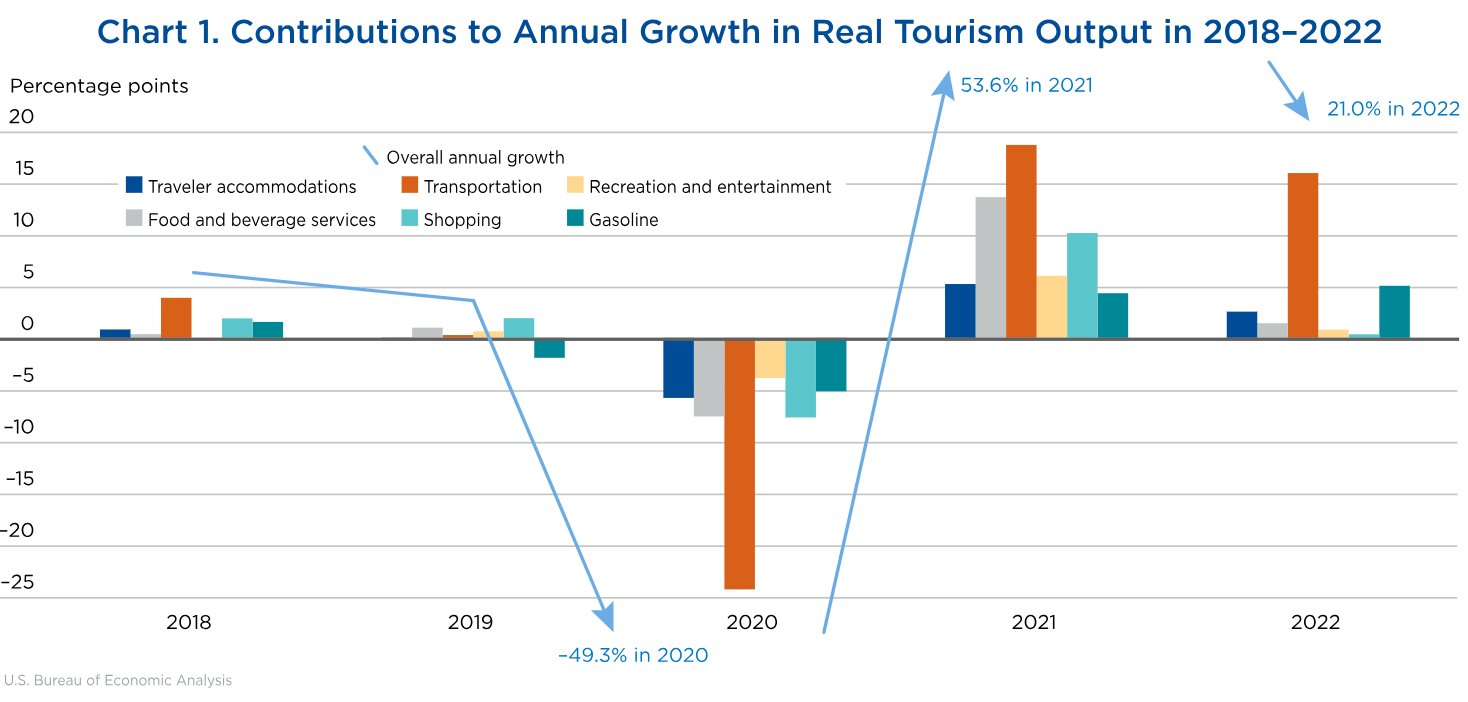

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

COVID-19: International and Domestic Travel

Research and data: Edouard Mathieu, Hannah Ritchie, Lucas Rodés-Guirao, Cameron Appel, Daniel Gavrilov, Charlie Giattino, Joe Hasell, Bobbie Macdonald, Saloni Dattani, Diana Beltekian, Esteban Ortiz-Ospina, and Max Roser

- Coronavirus

- Data explorer

- Hospitalizations

- Vaccinations

- Mortality risk

- Excess mortality

- Policy responses

Public transport

This interactive chart maps government policies on public transport closures.

Restrictions on internal movement

This interactive chart maps government policies on restrictions on internal movement/travel between regions and cities.

International travel controls

This interactive chart maps government policies on restrictions on international travel controls.

Learn more about the data source, the Oxford Coronavirus Government Response Tracker

The research we provide on policy responses is sourced from the Oxford Coronavirus Government Response Tracker (OxCGRT). 1

The tracker presents data collected from public sources by a team of over one hundred Oxford University students and staff from every part of the world.

OxCGRT collects publicly available information on 17 indicators of government responses, spanning containment and closure policies (such as school closures and restrictions in movement); economic policies; and health system policies (such as testing regimes). Further details on how these metrics are measured and collected is available in the project’s working paper .

The data presented here is taken directly from the OxCGRT project; Our World in Data do not track policy responses ourselves, and do not make additions to the tracker dataset.

These charts are regularly updated based on the latest version of the response tracker.

OxCGRT is an ongoing collation project of live data. If you see any inaccuracies in the underlying data, or for specific feedback on the analysis or another aspect of the project please contact OxCGRT team . See the tracker’s notes and guidance on data quality.

Explore other policy responses to COVID-19

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Stats and Summaries

- Travel Statistics

Traveler and Conveyance Statistics

The Office of Field Operations (OFO) is the law enforcement component within CBP responsible for carrying out CBP's complex and demanding border security mission at all ports of entry (POE), including managing the lawful access of people to the United States by securing and expediting international travel. The statistics posted here represent the conveyances and travelers arriving to the United States via aircraft, on foot (pedestrians), passenger vehicles, and trucks.

Inbound Traveler and Conveyance Data at Air and Land Ports of Entry

This dataset does not represent all conveyances and travelers processed by CBP and does not indicate admissibility. Previously published statistics may be revised.

To access the data used to build this dashboard, please visit the CBP Data Portal .

Data is extracted from live CBP systems and data sources. Statistical information is subject to change due to corrections, system changes, changes in data definition, additional information, or data pending final review. Final statistics are available at the conclusion of each fiscal year.

Note: Internet Explorer has problems displaying the following charts. Please use another web browser (Chrome, Safari, Firefox, Edge) to view. When using a mobile device, the charts are best displayed in landscape mode.

Related Resources

Cbp travel programs.

- Global Entry

- Mobile Passport Control

- NEXUS

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » International Travel Statistics: Facts and Trends for 2024

International Travel Statistics: Facts and Trends for 2024

Every year, millions of tourists jet off to different parts of the planet in search of new experiences and lands unseen. Global tourism is a humongous industry – we’re talking trillions of dollars, millions of jobs, and thousands of attractions in every country around the world!

With international travel being such a Big Deal , there’s lots of interesting stuff to look into. So, that’s exactly what our mission here is today!

What are the most visited countries in the world? What nationalities travel the most? All the questions you never even knew you needed answers for – they’re all here.

I’ve dug up some cool travel and world tourism statistics. We’ll be looking at the most popular travel destinations around the world, international air traffic, travel styles, and more.

In addition, I wanted to find out some more stuff about the future trends of international travel statistics. No spoilers, but one of the biggest current directions of the international tourism market might start with the prefix “eco”.

So, without further ado, let’s find out what we can find out!

The Broke Backpacker is supported by you . Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more .

A Quick Look at International Travel Statistics

Top statistics about international travel, what’s coming – future trends in international travel, international travel – with more destinations to come.

Look, I get it – maybe numbers and figures are just not your thing. That’s fine!

Do hang out for a bit, though. For folks like you, or just people who like spoilers, I’ve compiled a little list of the main facts. Here are some highlights of international travel statistics:

- International tourism makes up 10% of the global GDP

- The country with the most international tourists is China

- The most visited countries are France, Spain, and the US

- 4 out of 5 international tourists travel within their own region

- Bangkok is the world’s most internationally visited city

- 70% of all passenger flights fly to Europe, Asia, or the Pacific

- Eco is in: 83% of travellers consider sustainability important

- 84% of millenials would travel abroad to volunteer

- 61% of travellers say that the pandemic has made them want to travel more sustainably

Maybe that little list has awakened your appetite for facts… Or maybe you just enjoy reading statistics on travelling in your free time. In that case, follow me as we dive deeper into the world of international tourism statistics!

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Global travel and tourism make up a whopping 10% of the global GDP, and every 10th job worldwide is directly or indirectly tied to the industry [4a]. (Some travellers even end up in travel jobs themselves!)

In 2018, there were about 1.4 billion international arrivals (although this is not clearly comparable to the actual number of travellers – many international tourists would be travelling multiple times) [5]. That figure was already an increase from the previous year, so the real number would have definitely been even higher by 2020 when the pandemic hit.

For a funzies comparison: in 1950, there were 25 million international arrivals and 435 million in 1990. [5]

Some nationals are also more diligent travellers than others. In 2017, the Chinese were the biggest group of tourists abroad with 143 million trips. They were followed by Germany (92m), the US (87.8m) and the UK (74.2m). [5]

So, international travel has been experiencing a massive boom in the last decades as methods of travelling and information have become more widely available, cheaper, and safer. And there really isn’t a reason why it might be slowing down in the upcoming years – vice versa actually.

Now, let’s take a peek at some features of international travel statistics.

Who Travels Where?

There’s something to see in every country and region of the world. But which countries are the fan favourites? Which are the best-loved, most-travelled, super-favourite countries of all time? Here are some fun leisure travel statistics.

The list probably doesn’t come as a huge surprise. Here were the top 10 most visited countries in the world in 2019: [1]

- France – 90.0 million international visitors

- Spain – 83.7 million

- United States – 79.3 million

- China – 65.7 million

- Italy – 64.5 million

- Turkey – 51.2 million

- Mexico – 45.0 million

- Thailand – 39.8 million

- Germany – 39.6 million

- United Kingdom – 39.4 million

These countries have long been on top of travellers’ favourite destinations, and continue to be so. No wonder: they’re all chock-full of things to see – including some of the most famous attractions in the world – and have amazing infrastructure already set up to cater to tourist’s needs.

Plus, according to UNWTO, most travellers – four out of five – travel within their own region. [5] Considering that the standard of living in Europe is generally high (so people have more money for travelling).

And travelling around Europe is easy, especially on an EU passport. It’s no wonder that Europe and Europeans lead these international tourism statistics.

But as even the more obscure parts of the world become more accessible, there will be some interesting, emerging destinations.

Skyscanner’s data shows the biggest growth for bookings in different country categories: among popular countries, Argentina and Austria have seen the most increased bookings. In medium-visited places, it’s Azerbaijan and Uzbekistan. And in the least visited destinations, the biggest growth has been for St Maarten and Congo. [6]

Cities vs. Countryside

According to WTTC, about 44% of international tourist arrivals are aimed at cities. They looked at 73 top city destinations around the world and found that these cities’ tourism dollars contribute about 25% of the GDP of the tourism industry.

Moreover, almost half – 45% – of the money spent towards tourism in these cities came from international travellers. [4a] So, the effect of international travel on popular cities is HUGE.

In 2018, the top five most visited cities in the world were:

- Bangkok, Thailand (22.8 million international tourists)

- Paris, France (19.1 m)

- London, UK (19.09 m)

- Dubai, United Arab Emirates (15.9 m)

- Singapore, Singapore (14.7 m)

This is not a super surprising order. Almost all of these cities are located in countries that were listed as the most visited in the last section.

However, as popular as city travel is, it seems that international visitors are now heading more and more to other destinations too. Travelling in the countryside, camping and hiking are gaining popularity as people are looking for ways to get into nature and avoid other travellers, especially post-pandemic.

Airbnb also notes this new trend and says that travellers are now headed towards more rural destinations than before. Tourists are more scattered. No more do people only congregate to the most popular places on the planet.

This kind of mindset shift is also thanks to widespread news about over-tourism . The tourists of today are more mindful of their impact than before and make conscious decisions to avoid places that suffer from over-tourism. [11]

More on sustainable travel later, though…

Up in the Air: International Air Travel Statistics

Let’s talk about international air travel statistics. For many travellers, finding a cheap flight is the easiest way to jetset off to an international holiday.

Just to note, I’ve mostly dug up data from 2019 here. They have still published reports during the pandemic but obviously it isn’t very representative of the “normal” airline industry.

For example, pandemic-time searches showed that people were booking less international trips, shorter (distance) trips for longer times, and favoured airlines with very high health and safety ratings. Lots of the data is muddled by people travelling to visit family and friends rather than for leisure.

In 2019, there were about 4,500 million international passengers in airline traffic. This number has been on a steady rise for years, even after events like 9/11 or the financial crisis. [8]

The most popular destinations in international flight traffic are clearly Europe and Asia/Pacific. In 2019, air traffic to these two destinations made up about 70% of all international passenger flights.

A total of 856 million international passengers flew to Europe – a huge number, considering the total number of international arrivals to ALL the other continents was 994 million. The Asia/Pacific area was a good second with 496 million passengers. Africa had the least international arrivals: 74 million. [8]

The rise of budget airlines has definitely helped a lot more people get out there, travelling internationally. Travellers are also taking advantage of different price options for flights. On long-distance flights, more tourists booked Premium Economy fares than First, Business, and Economy class.

However, on shorter flights, while Economy is still the most popular option, searches for first-class tickets have risen. [6] This is probably due to travellers wanting to be comfortable on their flight – but over-the-top comfort is not necessary.

On shorter flights, more people might be booking first-class because it is still relatively affordable since flight prices, in general, would be lower. [6] My guess as to why Premium Economy and similar are also gaining popularity is due to airlines’ luggage fees – especially budget airlines charge pretty large fees for extra baggage.

So, international travel is definitely going to keep growing and growing. People will keep travelling – there’s no surprise there. But what else is there to be expected in the international travel market?

More Sustainable Than Before

With growing concerns about climate change and the general state of woke-ness of the world in 2024, eco-travel is IN, in a big way! Statistics on travelling show that travellers appreciate being able to traipse the world while leaving a positive impact by supporting sustainable travel.

There’s clearly a demand for eco-friendly accommodation options. In a Condor Ferries survey, over half (58%) of the respondents said that they chose their hotels depending on if they gave back to the community and helped the planet.

Similarly, a whole 70% of travellers said they’d be more likely to book accommodation if they knew it was eco-friendly. [2]

Similarly, when Booking.com asked its customers about sustainability, 83% of travellers thought that sustainability is essential. Almost half of them thought that, even now, there aren’t enough sustainable travel options.

3 out of 4 accommodation providers say that they have environmentally friendly practices in place. But only 1 in 3 out of them are actively marketing this info to potential customers. [3]

Unfortunately, though, only 7% of global travellers said they’d be willing to pay $10-$15 extra per night for environmentally friendly accommodation. [2]

So, even though it seems that travellers are more than willing to support eco-friendly travel, they’re not ready to foot the bill that comes with it. Eco is THE keyword for holiday accommodation now.

In the future, tourism operators are gonna have to figure out how to either provide eco-experiences for a lower price or make the environmentally friendly, more expensive service so attractive that people won’t mind paying the difference.

Or maybe the time for change is now – two-thirds of global travellers say that COVID-19 has made them want to travel more sustainably . Half have started new environmentally friendly habits at home. [3]

Giving Back to the Community – Travellers First

Voluntourism , ergo travelling abroad to volunteer somewhere, has become an increasingly interesting option, especially for the young travellers of today. Travellers are more aware of their impact on the destination – as well as the emissions their international travels cause

They are more eager to give back than before. In a 2015 survey, 84% of millennials, 68% of Gen X-ers, and 51% of Baby Boomers said that they would travel internationally to volunteer. [9]

In general, the tourists of today want more authentic, local experiences. This is all part of sustainable travel: tourists that are looking to travel on a more local level more easily become aware of grassroots issues in the destination. Tourists don’t want just experiences: they want to make connections. [9]

Post-Covid Travel: A Question Mark

World tourism statistics 2020 look pretty grim.

When the pandemic hit, the international travel industry took a massive smack in the face. Airline passenger traffic was cut in half. [8] In 2020, the tourism industry lost about $4.5 trillion USD, and about 62 million tourism-related jobs were lost. [1]

The travel industry was, without a doubt, one of the sectors that was hit the hardest by COVID-19. But we’re climbing back, babey! Experts expect the travel industry to keep growing in the next few years. The pandemic might have slowed down international travel but I think it’s FAR from over.

Quite opposite – I think that once people are able to travel freely again, there’ll be an absolute boom in travel. People are sick of staying in their homes and feeling anxious about the state of the world. Many are looking forward to hitting the road and experiencing something new – now even more than ever.

Tourists will probably continue to be a bit cautious for some time, though. Many travellers who would’ve booked international trips before might opt for touring the homeland. About half of global travellers surveyed in 2021 were planning for a domestic holiday in the “next 12 months” [4b].

Not only for safety and money reasons: many people will want to support the tourism operators in their home countries after everything they’ve suffered through. Plus, in a booking.com survey, 61% said that ‘the pandemic has made them want to travel more sustainably in the future’. [3] Plus, being green is easier when you travel locally.

So, there you have it. International travel statistics – with a few survey-backed ideas of what might be to come!

Despite everything, I don’t think it would ever be possible for international travel to just completely stop. People have, and will always, be fascinated by foreign cultures and new experiences. Many are feverishly waiting to get back to the life of travel.

The pandemic has made travellers more aware of their impact on the world. As I’ve already mentioned, travellers think sustainable travel is more important than before , and not only for environment-related reasons.

More people are concerned about the effect of their travels on the local community. Three-quarters want to have an “authentic” travel experience that puts them close to the local life and they think that revenue from tourism should be spread evenly in society [3].

These kinds of ideas combined with the fact that many travellers want to avoid crowded destinations might open the road to even more offbeat destinations. In fact, it’s very likely: statistics on travelling show that over 2 out of 3 people said they wanted to travel off the beaten path on their next trip – 69% (nice). [3]

For international travel to continue and all these new destinations to emerge, a few things are needed. Travel and visa restrictions must be lenient; safety, both COVID-wise and in the general area, must be stable; and the countries must have good travel connections.

It will be interesting to see what’s next for international travel!

[1] World Population Review

[2] Condor Ferries

[3] Booking.com

[4] WTTC 4a: , 4b:

[5] The Guardian

[6] Skyscanner

[7] UNWTO: 7a, Sustainable Travel

[9] Responsible Travel

[10] Statista

[11] Airbnb

Elina Mattila

Share or save this post

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Number of international tourist arrivals worldwide 1950-2023

The number of international tourist arrivals worldwide increased in 2023 compared to the previous year. That said, it remained still below the figure reported in 2019, before the impact of the COVID-19 pandemic. After declining with the onset of the health crisis to roughly 407 million, the lowest figure recorded since 1989, global inbound tourist arrivals showed strong signs of recovery in the following years, totaling just under 1.3 billion in 2023.

Europe is the most popular destination for international tourism

Since 2005, Europe has been the global region attracting the highest number of international tourists . While inbound tourist arrivals in Europe rose significantly in 2023 over the previous year, they did not catch up yet with pre-pandemic levels. Within this region, Southern and Mediterranean Europe was the most popular area for international tourism , recording around 265 million arrivals in 2022.

How big is the global travel and tourism market?

According to Statista Mobility Market Insights, the global travel and tourism market's revenue - including hotels, package holidays, vacation rentals, and camping - amounted to nearly 860 million U.S. dollars in 2023, recovering from the impact of COVID-19. When breaking down travel and tourism's revenue worldwide by sales channels , it emerges that the online channel generated over two-third of the global transactions' value that year.

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

1950 to 2023

Data prior to 2011 were previously published by the source.

Other statistics on the topic Tourism worldwide

Accommodation

- Leading hotel companies worldwide 2023, by number of properties

Parks & Outdoors

- Most visited amusement and theme parks worldwide 2019-2022

- Market value of selected airlines worldwide 2023

- Total contribution of travel and tourism to GDP worldwide 2019-2033

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Tourism worldwide "

- Travel and tourism: share of global GDP 2019-2033

- Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Global leisure travel spend 2019-2022

- Global business travel spending 2001-2022

- Number of international tourist arrivals worldwide 2005-2023, by region

- Travel and tourism employment worldwide 2019-2033

- Global hotel and resort industry market size worldwide 2013-2023

- Most valuable hotel brands worldwide 2023, by brand value

- Hotel openings worldwide 2021-2024

- Hotel room openings worldwide 2021-2024

- Countries with the most hotel construction projects in the pipeline worldwide 2022

- Airports with the most international air passenger traffic worldwide 2022

- Global passenger rail users forecast 2017-2027

- Daily ridership of bus rapid transit systems worldwide by region 2023

- Number of users of car rentals worldwide 2019-2028

- Number of users in selected countries in the Car Rentals market in 2023

- Carbon footprint of international tourism transport worldwide 2005-2030, by type

- Leading museums by highest attendance worldwide 2019-2022

- Monuments on the UNESCO world heritage list 2023, by type

- Selected countries with the most Michelin-starred restaurants worldwide 2023

- Online travel market size worldwide 2017-2028

- Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Market cap of leading online travel companies worldwide 2023

- Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Global travelers who believe in the importance of green travel 2023

- Sustainable initiatives travelers would adopt worldwide 2022, by region

- Airbnb revenue worldwide 2017-2023

- Airbnb nights and experiences booked worldwide 2017-2023

- Technologies global hotels plan to implement in the next three years 2022

- Hotel technologies global consumers think would improve their future stay 2022

- Travel and tourism revenue worldwide 2019-2028, by segment

- Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Inbound tourism visitor growth worldwide 2020-2025, by region

- Outbound tourism visitor growth worldwide 2020-2025, by region

Other statistics that may interest you Tourism worldwide

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Further related statistics

- Premium Statistic Estimated impact of the coronavirus on tourist arrivals in Italy 2020, by region

- Premium Statistic Arrivals of foreign tourists staying overnight in China 2009-2019

- Premium Statistic Arrivals of foreign tourists in China in 2015, by reason for traveling

- Premium Statistic Arrivals of overnight foreign tourists in China 2019, by region

- Premium Statistic Arrivals of foreign tourists in China in 2009-2019, by origin

- Premium Statistic Tourist arrivals from the United States of America in China 1995-2018

- Basic Statistic Number of overseas arrivals to the U.S. 2019-2026

- Premium Statistic Impact of the coronavirus on total tourist arrivals in Italy 2020-2024, by scenario

- Premium Statistic International tourism expenditure in Italy 2010-2021, by type

- Premium Statistic Inbound tourism volume in Trinidad & Tobago 2021, by purpose

- Premium Statistic Number of foreign visitor arrivals in Indonesia 2023, by port of entry

- Premium Statistic Number of international visitor arrivals from the Netherlands to Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals from South Korea to Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals from the UK to Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals from Taiwan to Indonesia 2014-2023

- Premium Statistic Change in international tourist arrivals worldwide 2020-2021, by sub-region

Further Content: You might find this interesting as well

- Estimated impact of the coronavirus on tourist arrivals in Italy 2020, by region

- Arrivals of foreign tourists staying overnight in China 2009-2019

- Arrivals of foreign tourists in China in 2015, by reason for traveling

- Arrivals of overnight foreign tourists in China 2019, by region

- Arrivals of foreign tourists in China in 2009-2019, by origin

- Tourist arrivals from the United States of America in China 1995-2018

- Number of overseas arrivals to the U.S. 2019-2026

- Impact of the coronavirus on total tourist arrivals in Italy 2020-2024, by scenario

- International tourism expenditure in Italy 2010-2021, by type

- Inbound tourism volume in Trinidad & Tobago 2021, by purpose

- Number of foreign visitor arrivals in Indonesia 2023, by port of entry

- Number of international visitor arrivals from the Netherlands to Indonesia 2014-2023

- Number of international visitor arrivals from South Korea to Indonesia 2014-2023

- Number of international visitor arrivals from the UK to Indonesia 2014-2023

- Number of international visitor arrivals from Taiwan to Indonesia 2014-2023

- Change in international tourist arrivals worldwide 2020-2021, by sub-region

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

The latest travel data.

MONTHLY INSIGHTS March 04, 2024

U.S. Travel has temporarily paused our monthly data newsletter, however, the latest travel data is still available via the U.S. Travel Insights Dashboard . This dashboard is updated each month (member login required).

The U.S. Travel Insights Dashboard , developed in collaboration with Tourism Economics, is supported by more than 20 data sources. The dashboard is the most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry, tracking industry performance, travel volumes and predictive indicators of recovery including air and lodging forecasts, DMO website traffic, convention and group trends, travel spending and losses, traveler sentiment, among others to measure the health of the industry.

Key Highlights January 2024:

- Travel appetite started the year on a softer note, but overall growth continued. Air passenger growth remained positive, up 6% versus the prior year but lower than the double-digit growth seen through 2023. Foreign visits remained strong, up 24% YoY.

- Hotel room demand continued a trend of slight contraction falling 1% versus the prior year, while short-term rental demand grew 1%, a lower rate than 2023.

- A particular bright spot was that group room demand within the top 25 markets displayed solid growth of 9% relative to the prior year.

- The outlook for the economy remains fairly optimistic due to the strength of the labor market, looser financial conditions and healthy household and nonfinancial corporate balance sheets. This has filtered through to slightly higher consumer sentiment in February.

- Sentiment is also growing for upcoming leisure travel in 2024. The share of travelers reporting having travel plans within the next six months increased to 93% in January from 92% in December, according to Longwoods International’s monthly survey.

- Travel price inflation (TPI) fell slightly in January as a result of falling transportation prices. Sticky services inflation should see relief from decelerating wage growth. However, upside risks stem from rising healthcare costs, supply chain disruptions and slowing labor supply. Source: U.S. Travel Association and Tourism Economics

Member Price:

Non-Member Price: Become a member to access.

ADDITIONAL RESEARCH

Travel Price Index

Travel Forecast

Quarterly Consumer Insights

Additional monthly insights are available through the full U.S. Travel Monthly Data Report, exclusive to members. Please inquire with membership if you are interested in learning about becoming a member of U.S. Travel Association.

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Overseas Travel and Tourism - Table of contents

Tool to locate the datasets of Overseas Travel and Tourism estimates.

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey .

Overseas Arrivals and Departures, Australia

Statistics on international travel arriving in and departing from Australia.

- Next Release 14/05/2024 Overseas Arrivals and Departures, Australia, March 2024

- Next Release 12/06/2024 Overseas Arrivals and Departures, Australia, April 2024

- Next Release 12/07/2024 Overseas Arrivals and Departures, Australia, May 2024

- View all releases

- Overseas Arrivals and Departures, Australia Reference Period January 2024

- Overseas Arrivals and Departures, Australia Reference Period December 2023

- Overseas Arrivals and Departures, Australia Reference Period November 2023

Key statistics

In February 2024:

- Short-term visitor arrivals: 857,950 – an annual increase of 257,240 trips

- Short-term resident returns: 775,630 – an annual increase of 136,060 trips

- Total arrivals: 1,786,650 – an annual increase of 411,140

- Total departures: 1,491,730 – an annual increase of 423,320

These statistics report on the number of international border crossings rather than the number of people. Most data in this release are rounded to the nearest 10. As a result, sums of components may not add exactly to totals.

Overseas Migration Statistics

This release presents statistics on all overseas arrivals and departures, which is not the same as overseas migration statistics.

If you are looking for ABS statistics on overseas migration, please refer to:

- Overseas Migration ;

- National, state and territory population .

Arrivals and departures

- Download table as CSV

- Download table as XLSX

- Download graph as PNG image

- Download graph as JPG image

- Download graph as SVG Vector image

- Provisional data for the most recent month has not had the full quality assurance methods applied as is done for the earlier months. Provisional data will be revised in the next issue of this publication.

- Provisional data for the most recent month has not had the full quality assurance methods applied as is done for the earlier months. Provisional estimates will be revised in the next issue of this publication.

- Category of travel data is not available from provisional estimates.

- Permanent arrivals (settlers) comprise: travellers who hold permanent visas, New Zealand citizens who indicate on their passenger card an intention to migrate permanently, and those who are otherwise identified as eligible to settle.

- Australian resident includes Australian citizens, permanent visa holders residing in Australia, and any New Zealand citizens who can be identified as a resident.

- An overseas visitor is any traveller arriving to, or departing from, Australia who is not an Australian resident.

Note: Long-term are travellers who have been away or in Australia for 12 months or more. Short-term are travellers who have been away or in Australia for less than 12 months.

Visitor arrivals - short-term

Compares international visitor arrivals each month by source country and change at the state and territory level. Analysis in this section is undertaken on short-term trips (less than 1 year).

For visitor arrivals to Australia:

- A total of 857,950 short-term trips were recorded, an increase of 257,240 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 7.5% lower than the pre-COVID level in February 2019.

- China was the largest source country, accounting for 18% of all visitor arrivals.

Countries where visitors came from

The three leading source countries where visitors came from were:

- China (149,770 trips)

- New Zealand (105,970)

- The USA (82,790).

- Top 10 source countries based on month ending February 2024.

- Excludes SARs and Taiwan.

State or territory of stay

All travellers are asked their intended address in Australia upon arrival. For February 2024, the highest number of visitor arrivals for short-term trips was observed for New South Wales (352,320), whilst the Northern Territory recorded the fewest (3,380).

2.3 Short-term visitor arrivals, state or territory of stay - February 2024

This map presents the number of short-term visitor arrivals in Australia in February 2024, by their state of intended stay.

- New South Wales (352,320) - Victoria (238,270) - Queensland (139,620) - South Australia (24,390) - Western Australia (78,250) - Tasmania (9,990) - Northern Territory (3,380) - Australian Capital Territory (11,620).

- Includes Other Territories.

Visitor arrivals - state and territory

Compares international visitor arrivals each month by source country for each state and territory. Analyses in this section are undertaken on short-term trips (less than 1 year) unless otherwise stated.

New South Wales

For visitor arrivals to New South Wales:

- There were 352,320 short-term visitor arrivals, an increase of 105,300 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 1.4% lower than pre-COVID levels in February 2019.

The three leading source countries for New South Wales were:

- China (67,160 trips)

- The USA (46,700)

- New Zealand (38,250).

Long-term visitor arrivals

For visitors arriving in New South Wales for a long-term trip (1 year or more):

- There were 40,110 arrivals, an increase of 4,150 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 25.8% higher than pre-COVID levels in February 2019.

For visitor arrivals to Victoria:

- There were 238,270 short-term visitor arrivals, an increase of 83,700 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 8% lower than pre-COVID levels in February 2019.

The three leading source countries for Victoria were:

- China (50,240 trips)

- New Zealand (32,610)

- The USA (17,150).

For visitors arriving in Victoria for a long-term trip (1 year or more):

- There were 40,550 arrivals, an increase of 4,640 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 22.9% higher than pre-COVID levels in February 2019.

For visitor arrivals to Queensland:

- There were 139,620 short-term visitor arrivals, an increase of 39,580 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 15.5% lower than pre-COVID levels in February 2019.

The three leading source countries for Queensland were:

- New Zealand (25,180 trips)

- China (16,990)

- Japan (16,940).

For visitors arriving in Queensland for a long-term trip (1 year or more):

- There were 16,100 arrivals, an increase of 1,350 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 29% higher than pre-COVID levels in February 2019.

South Australia

For visitor arrivals to South Australia:

- There were 24,390 short-term visitor arrivals, an increase of 3,470 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 19.4% lower than pre-COVID levels in February 2019.

The three leading source countries for South Australia were:

- China (3,600 trips)

- The UK (2,750)

- The USA (2,180).

For visitors arriving in South Australia for a long-term trip (1 year or more):

- There were 7,340 arrivals, an increase of 190 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 47% higher than pre-COVID levels in February 2019.

Western Australia

For visitor arrivals to Western Australia:

- There were 78,250 short-term visitor arrivals, an increase of 20,650 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 5.1% lower than pre-COVID levels in February 2019.

The three leading source countries for Western Australia were:

- The UK (14,130 trips)

- China (6,860)

- Singapore (6,750).

a. Top 10 source countries based on month ending February 2024. b. Excludes SARs and Taiwan.

For visitors arriving in Western Australia for a long-term trip (1 year or more):

- There were 14,000 arrivals, an increase of 1,850 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 76.8% higher than pre-COVID levels in February 2019.

For visitor arrivals to Tasmania:

- There were 9,990 short-term visitor arrivals, an increase of 1,810 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 24.7% lower than pre-COVID levels in February 2019.

The three leading source countries for Tasmania were:

- New Zealand (1,630 trips)

- The USA (1,260)

- China (940).

For visitors arriving in Tasmania for a long-term trip (1 year or more):

- There were 1,150 arrivals, a decrease of 80 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 13.7% lower than pre-COVID levels in February 2019.

Northern Territory

For visitor arrivals to the Northern Territory:

- There were 3,380 short-term visitor arrivals, an increase of 550 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 33.8% lower than pre-COVID levels in February 2019.

The three leading source countries for the Northern Territory were:

- The USA (760 trips)

- India (220)

- Indonesia (200).

For visitors arriving in the Northern Territory for a long-term trip (1 year or more):

- There were 980 arrivals, an increase of 70 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 58.3% higher than pre-COVID levels in February 2019.

Australian Capital Territory

For visitor arrivals to the Australian Capital Territory:

- There were 11,620 short-term visitor arrivals, an increase of 2,150 compared with the corresponding month of the previous year.

The three leading source countries for the Australian Capital Territory were:

- China (3,790 trips)

- The USA (1,200)

- India (780).

For visitors arriving in the Australian Capital Territory for a long-term trip (1 year or more):

- There were 2,960 arrivals, an increase of 200 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 3.5% higher than pre-COVID levels in February 2019.

Visitor arrivals - short-term - calendar year 2023

Compares annual international travel arrivals over time by source country, state and territory, age and sex, main reason for journey and median duration of trip. All analysis in this section is done on short-term trips (less than 1 year).

For the most recent analysis by financial year, see the June 2023 issue of Overseas Arrivals and Departures, Australia .

For visitors arriving in Australia in 2023:

- There were 7,187,430 visitor arrivals, nearly double the previous year

- New Zealand was the largest source country, accounting for 18% of visitors

- The most popular reason for travel was 'holiday' (40%)

- The median duration of stay in Australia was 14 days, down from 18 days in 2022.

Annual visitor arrivals

The COVID-19 pandemic resulted in a substantial decline in travel movements due to international border restrictions from March 2020. These restrictions were progressively lifted from 1 November 2021, and by 21 February 2022 Australian borders were reopened to most travellers.

There were 7,187,430 visitor arrivals in 2023. This is an increase of nearly double on the previous year, up from 3,694,380.

Visitor arrivals have increased since international border restrictions were removed in November 2021, but remain lower than pre-COVID levels back in 2019. The number of arrivals in December 2022 was 60% of the same period in 2019, and by December 2023 had increased to 81% of the 2019 level. The total number of visitor arrivals in 2023 was 76% of the number recorded in 2019.

Visitor arrivals to Australia have generally been increasing over recent decades, with a continuous increase in the ten-year period ending 2019. However, due to the impact of COVID-19, a substantial decline was observed from February 2020 onwards. Since November 2021, visitor arrivals have been increasing as border restrictions were progressively lifted.

Peaks were seen during the:

- Brisbane Expo in 1988

- Sydney Olympics in 2000

- Easing of COVID-19 border restrictions from late 2021.

Decreases were observed during the:

- Asian financial crisis in 1998

- September 11 attacks in the USA in 2001

- Severe Acute Respiratory Syndrome (SARS) outbreak in 2003

- Global Financial Crisis (GFC) in 2008

- Global COVID-19 pandemic starting in 2020.

- 2001 Sept 11 attacks

- Asian financial crisis

The top five source countries for 2023 were New Zealand, the USA, the UK, China and India.

- Short-term visitor arrivals for all top 5 source countries were higher than the previous year

- New Zealand remained the largest source country for visitor arrivals with 1,272,140 visits

- Arrivals from the USA were the second highest with 659,750 visits

Ten years ago, in 2013, the top five source countries were New Zealand, China, the UK, the USA and Singapore.

- Top 5 source countries based on year ending December 2023.

Visitor arrivals have increased significantly since the easing of travel restrictions in November 2021, but visitor numbers from different countries have recovered at varied rates.

South Korea was the only one of the top 10 source countries in 2023 to exceed pre-COVID levels, reaching 103% of 2019 arrivals. China had the lowest rate of recovery, reaching 37% of 2019 arrivals.

- Top 10 source countries based on year ending December 2023.

All travellers are asked their intended address in Australia upon arrival.

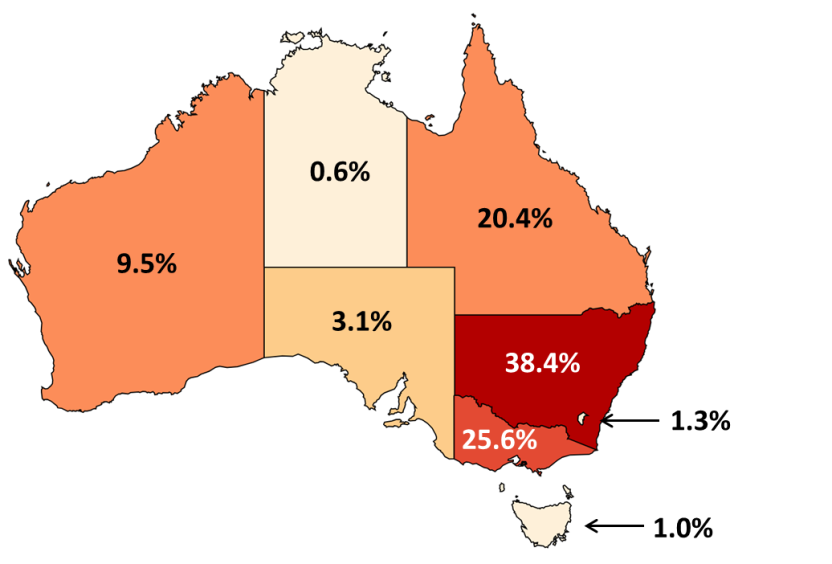

11.7 Short-term visitor arrivals, state/territory of stay — 2023

This map presents the proportion of short-term visitor arrivals in Australia in 2023, by their intended state or territory of stay:

- NSW (38.4% of all short-term visitors)

- Vic. (25.6%)

- Qld (20.4%)

- Tas. (1.0%)

- ACT (1.3%).

Ten years ago, in 2013, Victoria had a smaller proportion of visitor arrivals (22.3%) than Queensland (23.5%) and the Northern Territory had a larger proportion (1.2%) than the Australian Capital Territory (1.0%) and Tasmania (0.7%).

All states and territories expect the Northern Territory recorded an overall increase in international visitors in the years prior to 2020. While most states recorded steady annual growth, the Northern Territory and South Australia experienced fluctuations in visitor numbers. All states and territories observed a considerable drop in visitor numbers during the COVID-19 pandemic.

Since the easing of travel restrictions in November 2021, visitor arrivals have increased in all states and territories, but have increased towards pre-COVID levels at different rates. In 2023, visitor arrivals to ACT reached 86% of 2019 movements, the highest of any state or territory. Visitor arrivals to the Northern Territory were the lowest, with movements in 2023 reaching 60% of 2019 levels.

The mix of source countries at the state and territory level was different to that at the national level. In 2023:

- New Zealand was the largest source country for visitors to NSW, Vic., Qld, SA and Tas.

- The UK was the largest source country for WA

- The USA was the largest source country of visitors to the NT

- China was the largest source country of visitors to the ACT.

Ten years earlier, in 2013, it was similar, the only difference was that the UK was the leading source country for visitors to SA, and New Zealand was the leading source country for visitors to ACT.

Age and sex

There were more visits to Australia by females than males in 2023 (3,456,860 males compared with 3,730,570 females). In 2013, however, there were more male short-term visitor arrivals than female (3,317,100 males and 3,164,600 females).

In 2023, the median age for male visitors was 41 years, while the median age for female visitors was 42 years. When broken down into five-year age groups, the largest group of visitor arrivals was those aged between 25 and 29 years. New Zealand was the largest source country for this age group, and ‘holiday’ was the most frequently stated reason for journey (42%). In 2013, the median age for male visitors was 40, and the median age for female visitors was 39.

Main reason for journey

Visitors are asked the main reason for their journey upon arrival in Australia.

In 2023, the most frequently stated reasons were:

- ‘Holiday’ (40%)

- ‘Visiting friends/relatives’ (37%)

- ‘Business’ (6.2%).

- As a percentage of all short-term visitor arrivals.

In the pre-COVID period, ‘holiday’ was the most frequently reported reason for journey for visitor arrivals (47% in 2019), but international travel restrictions due to COVID-19 caused a change in travel behaviour. Since the easing of these restrictions, the number of visitors to Australia has increased for all reasons, and ‘holiday’ has returned to the most common (40% in 2023).

Female visitors were more likely than males to record their main reason for journey as 'holiday' or 'visiting friends/relatives'. Male visitors were more likely to record 'business' or 'employment' than female visitors.

- Visiting friends/relatives

Duration of stay

Visitors are asked their intended duration in Australia upon arrival.

During 2023, the median duration of stay in Australia was 14 days. This is a decrease compared to 2022, when the median trip duration was 18 days. In 2019, prior to the pandemic, the median duration of short-term visitor trips was 10 days, but median duration of stay increased during the pandemic.

The median duration varied between the states and territories and between the numerous source countries.

- Top 10 source countries have been calculated at the Australia level.

- Excludes SARs and Taiwan.

In 2023 the median duration by state or territory was:

- Highest in NT at 21 days

- Lowest for NSW and Qld at 12 days.

Visitors from India recorded a median duration of stay of 61 days, which was the longest of the top 10 countries. This was down from 86 days the year before.

Visitors from Japan recorded for a comparatively shorter stay, with a median duration of 7 days. This was down from 10 days the year before.

The median duration of stay of short-term visitors to Australia also varied by their reported reason for journey. Those travelling for:

- ‘Education’ stayed the longest (152 days)

- ‘Employment’ (147 days)

- ‘Visiting friends/relatives’ (20 days)

- ‘Holiday’ (10 days)

- ‘Convention/conference’ and ‘business’ stayed the shortest (7 days).

Arrivals - international students

Compares international student arrivals each month by visa type.

- In February 2024 there were 175,950 international student arrivals to Australia, an increase of 33,370 students compared with the corresponding month of the previous year.

- The number of student arrivals in February 2024 was 4.3% lower than the pre-COVID levels in February 2019.

- International student visa holders whether it be for a short-term (less than 1 year) or long-term (1 year or more) duration. This is not the same as when a traveller self reports 'education' as their main reason for journey.

- English Language Intensive Courses for Overseas Students.

Resident returns - short-term

Compares international resident returns each month by destination country and change at the state and territory level. Analysis in this section is undertaken on short-term trips (less than 1 year).

For residents returning from overseas:

- A total of 775,630 short-term trips were recorded, an increase of 136,060 compared with the corresponding month of the previous year.

- The number of trips for February 2024 was 4.0% higher than the pre-COVID level in February 2019.

- New Zealand was the most popular destination country, accounting for 14% of all resident returns.

Destination countries

The three leading destination countries residents returned from were:

- New Zealand (105,970 trips)

- Indonesia (95,610)

- Japan (72,210).

State or territory of residence

All travellers are asked their intended address in Australia upon arrival. For February 2024, the highest number of resident returns from short-term trips was observed for New South Wales (258,540), whilst the Northern Territory recorded the fewest (5,260).

13.3 Short-term resident returns, state or territory of residence - February 2024

Description: This map presents the number of short-term resident returns in Australia in February 2024, by their state of intended residence.

- New South Wales (258,540) - Victoria (213,310) - Queensland (144,380) - South Australia (32,390) - Western Australia (102,930) - Tasmania (5,720) - Northern Territory (5,260) - Australian Capital Territory (12,940).

Resident returns - short-term - calendar year 2023

For Australian residents returning to Australia in 2023:

- There were 9,975,230 resident returns from overseas, an increase of over 4.7 million on the previous year

- Indonesia was the leading destination country for Australians travelling overseas, accounting for 1,368,050 trips

- The most popular reason for travel was 'holiday' (57%)

- The median trip duration was 15 days.

Annual resident returns

The COVID-19 pandemic resulted in a substantial decline in travel movements due to the introduction of international border restrictions in March 2020. These restrictions were eased progressively from 1 November 2021, resulting in increased travel in 2022 and 2023.

9,975,230 residents returned from overseas trips in 2023. This was an increase of over 4.7 million on the previous year, when 5,225,640 trips were taken.

The number of resident returns in 2023 remained lower than pre-COVID but increased across the year, and by December 2023 had reached 99% of the corresponding period in 2019. The total number of residents returning from overseas in 2023 was 88% of 2019 (pre-COVID) volumes.

The number of Australian residents travelling overseas has largely been increasing over recent decades, with the general trend interrupted by various historical events such as the:

- Early 1990s recession in Australia

- September 11 terrorist attacks in 2001

- Bali bombings in 2002

- Global COVID-19 pandemic starting in 2020.

A substantial decline was observed in late March 2020 due to the impact of COVID-19. Travel by Australian residents has been increasing over the past two years after border restrictions were gradually removed from November 2021.

- 2002 Bali bombings

- Early 1990s recession

The top five destination countries in 2023 were Indonesia, New Zealand, the USA, the UK and Japan.

- Short-term resident returns for all top 5 destination countries continued to increase after the removal of international travel restrictions

- Indonesia was the leading destination country with 1,368,050 trips, most of whom recorded 'holiday' as their reason for travel (86%)

- Residents returning from New Zealand increased to 1,263,540, up from 707,990 in 2022

- The USA was the only country in the top 5 where travel volumes remained lower than 10 years ago (667,080 trips, down from 972,020 in 2013).

Ten years ago, in 2013, the top five countries were New Zealand, the USA, Indonesia, Thailand and the UK.

- Top 5 destination countries based on year ending December 2023.

The number of Australian residents travelling overseas has increased significantly since the easing of travel restrictions in November 2021, but the number of residents visiting various countries has increased at different rates.

India was the highest of the top ten destination countries when compared to pre-COVID levels, with trips taken in 2023 exceeding the 2019 level by 15%. The number of Australians visiting Fiji also exceeded the 2019 level by 12%. The USA had the lowest rate of recovery of the top 10 countries, reaching 63% of the 2019 volume.

- Top 10 destination countries based on year ending December 2023.

All travellers are asked their intended address in Australia upon arrival.

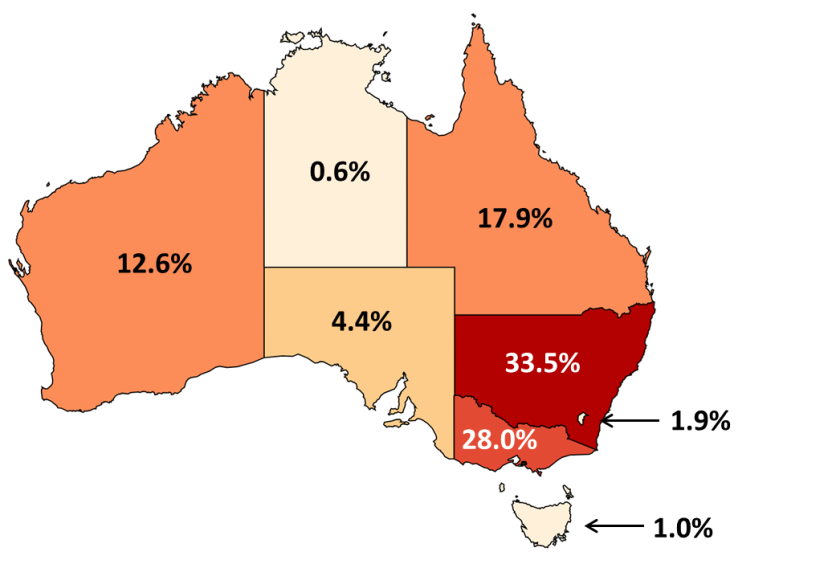

14.7 Short-term resident returns, state/territory of residence — 2023

This map presents the proportion of short-term resident returns in Australia in 2022-23, by their intended state or territory of residence:

- NSW (33.5% of all short-term resident returns)

- Vic. (28.0%)

- Qld (17.9%)

- ACT (1.9%).

Ten years ago, in 2013, the Northern Territory had a higher proportion of resident returns (1.2%) than Tasmania (1.0%). Victoria’s proportion has increased (up from 24.8%) and Western Australia’s has decreased (down from 15.3%).

Most states and territories recorded growth in the number of residents taking overseas trips in the years prior to 2020. Western Australia remained steady from 2014 until the impact of the pandemic, while the Northern Territory fluctuated across the decade. There was a considerable drop for all states and territories from March 2020 due to the COVID-19 pandemic.

The easing of travel restrictions from November 2021 has resulted in an increase of international travel from residents of all states, but travel has increased towards pre-COVID levels at different rates. When compared to 2019, overseas trips were the highest for Victorian residents, with resident returns in 2023 reaching 90% of 2019 levels, and lowest for Northern Territory residents, with 2023 movements reaching 66% of 2019 levels.

The top destination country varied between states and territories:

- New Zealand was the most popular destination for residents from NSW, Qld, Tas. and ACT.

- Indonesia was the top destination for Vic., SA, WA and the NT.

Ten years earlier, in 2013, the difference was that New Zealand was the leading destination for residents of Vic., and the USA was the top country for those living in NSW, SA, and the ACT.