Australia Post Travel Platinum Mastercard®

A prepaid travel card with 11 currencies to load from, giving you confidence when spending overseas.

- About Australia Post Travel Platinum Mastercard

- Fees & limits

- Get started

- Support & FAQs

The ideal prepaid card for overseas travel

Travel smarter with our Australia Post Travel Platinum Mastercard, a reloadable, multi-currency prepaid card that’s accepted wherever Mastercard is, worldwide 1 . Easily swipe or tap in-store, use online and withdraw money from ATMs 2 .

Load up to 11 currencies. Easily switch between USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD, AED and AUD on your travels.

Lock in your exchange rates. Know exactly how much you have to spend online or in-store with locked-in exchange rates 3 .

Travel safely. With no link to your bank account and Mastercard’s Zero Liability 4 protection against fraud and other unauthorised transactions.

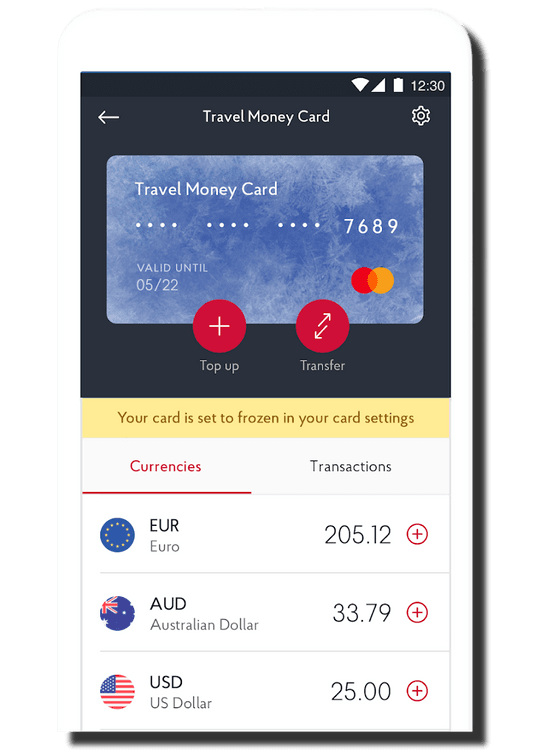

Total control. Manage and load your prepaid travel money card on the go via ‘ My Account ’ or the Australia Post Travel Platinum Mastercard app.

24/7 global assistance. Card lost or stolen? Call for a replacement anytime. You may also be eligible for emergency funds assistance 5 .

Managing your travel money just got easier

Our Australia Post Travel Platinum Mastercard app makes managing your travel money faster and easier. Check your balance, reload in-app, track your spending and switch between currencies.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement (PDF 248kB) and Financial Services Guide (PDF 72kB) before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

View the Target Market Determination (PDF 88kB) for this product.

If you click on links to Australia Post Travel Platinum Mastercard you will be leaving the Australia Post site and be directed to a third-party site to place your order and complete your purchase. Please see the terms and conditions of the third-party site for further details.

1 The ATMs and POS terminals are not owned or operated by Australia Post, the Issuer or Mastercard Prepaid Management Services and Australia Post, the Issuer and Mastercard Prepaid Management Services are not responsible for ensuring that they will accept the Card

2 Some ATM operators may charge their own fees and set their own limits.

3 Lock in your exchange rates means the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

4 Further information relating to Zero Liability card protection can be found at the Mastercard website .

5 T&Cs apply. Customers must contact Customer Service to report lost or stolen cards. Emergency cash can be arranged up to the balance of your Australia Post Everyday Mastercard, subject to availability of funds at the approved agent location.

For a full list of Fees & Limits, refer to the Product Disclosure Statement (PDF 258kB) .

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement (PDF 248kB) and Financial Services Guide (PDF 72kB) before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Travel smarter with our prepaid travel money card

Buy your Australia Post Travel Platinum Mastercard® at a participating Post Office or online .

Register / Activate

Register your prepaid travel money card online.

If you purchased your card online, you’ll need to activate it.

Load your card anytime online through ' My Account ', the Australia Post Travel Platinum Mastercard® app or at any participating Post Office .

Use your card wherever Mastercard is accepted 1 .

1 The ATMs and POS terminals are not owned or operated by Australia Post, the Issuer or Mastercard Prepaid Management Services and Australia Post, the Issuer and Mastercard Prepaid Management Services are not responsible for ensuring that they will accept the Card.

More information

- Product Disclosure Statement (PDF 339kB)

- Financial Services Guide (PDF 72kB)

- Target Market Determination (PDF 88kB)

Can't find an answer below? Call Card Services on 1800 549 718 within Australia or +44 207 649 9404 internationally for help 24/7.

If you have a transaction on your card that doesn't seem right, download the disputed transaction form .

Frequently asked questions

Australia Post acknowledges the Traditional Custodians of the land on which we operate, live and gather as a team. We recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Prepaid Travel Cards for Australians 2024

Here is a list of the 6 best prepaid cards you can take with you on your travels and the positives and negatives for each one:

- Wise - our pick for prepaid cards

Revolut - low fees

- Citibank - good for use at home

- Travelex - no fees for ATM withdrawals

- Australia Post - lock in exchange rates

HSBC - no international transaction fees

With a prepaid travel card you’ll load money - either in AUD or the foreign currency you need - in advance, which you can then use as you travel , for spending and withdrawals. Lots of cards let you top up and manage your account through an app, which means you can always keep up with your money, even when you’re away from home.

Picking the right prepaid card can mean you get more convenient ways to spend and withdraw when you’re abroad - and lower overall costs, too. Let’s look at some of the best prepaid travel cards on offer for Australians , so you can pick your perfect match:

Wise - our pick for prepaid travel card

- Top up for free in AUD using PayID or bank transfer

- No annual fee, hidden transaction fees or exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR), Canada (CAD) and New Zealand (NZD)

- Available in the US, UK, Europe, Australia, Singapore, Japan and New Zealand

Find out more about the Wise card .

With this card:

- It's very easy to set up and order

- Available as a virtual card

- You can receive foreign currency into a multi-currency account linked to the card

- Pay with your Wise card in most places overseas where debit cards are accepted

- You can transfer money to a bank account overseas

It's not all good news though

- There is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- It takes 7-14 days for delivery

Go to Wise or read our review .

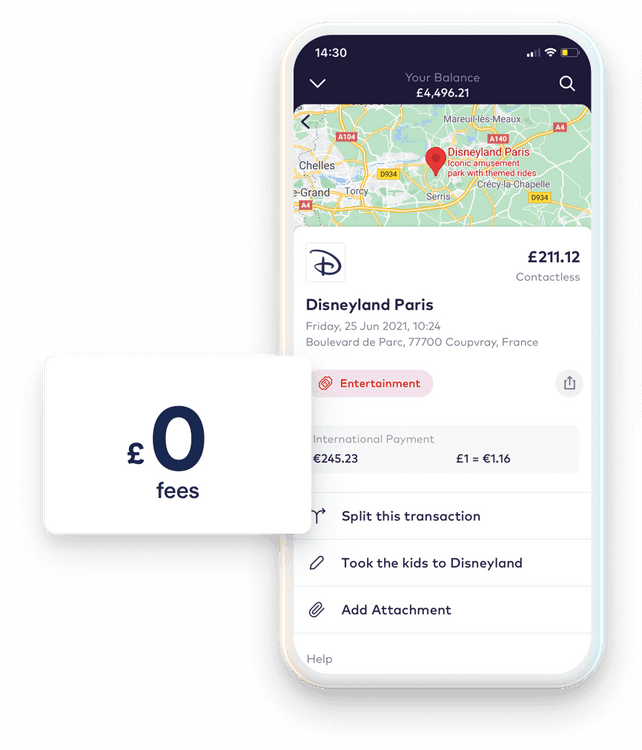

- No hidden fees or exchange rate mark-ups (except on weekends)

- Very easy to use app

- Free to set up account and top up

- You can use it to transfer money to a bank account overseas

Read the full review

- No purchase fee, load fee, reload fee, exchange rate margin or minimum balance requirements

- Unlike other Travel Cards, its free and easy to use the balance of your currency or convert it back to AUD

- The exchange rates are unbeatable. They use the same rate you see on XE or Google with no hidden mark-up

- For the free Standard account, there is a 2% ATM withdrawal fee when you withdraw over $350 during a month

- The premium account costs $10.99 a month, which can really add up if you are not using it often

- Additional fees for using the card on a weekend

- 2% ATM fee once you withdraw more than $350 in any 30 day period

- 3-4 business days before you receive your card

Click here to see the full list of cards and how Revolut compares

Australia Post Prepaid Travel card - lock in exchange rates

- Load up to 11 different major world currencies

- Spend and withdraw easily around the world

- Get access to extras like free wifi when you travel

- Manage your card in online and via an app

- Transfer instantly to another Travel Platinum Mastercard

- Load up to 11 different currencies for easy spending and withdrawals

- Lock in exchange rates so you know what your travel money budget is in advance

- Get extra perks like free wifi when you load 100 AUD or more

- Get fraud protections from Mastercard

- 3.5 AUD international ATM fee, or 2.95% domestic ATM fee

- Exchange rates to add money in a foreign currency or spend a currency you don’t hold are likely to include a markup

- Some fees apply depending on how you top up your account

Travelex - no fees for international ATM withdrawals

- Load up to 10 major currencies at a time

- Spend and withdraw anywhere Mastercard is accepted

- Contactless payments so you can just tap and go

- No Travelex fees for international ATM withdrawals

- Free to spend currencies you hold in your account

- Order online and have it delivered to your home - or collect in store

- Top up and hold up to 10 currencies at a time

- View and manage your account online

- Spend online and in person, and make withdrawals as you travel

- No membership or account fees to pay

- Get exclusive Mastercard discounts and perks

- Inactivity fees apply if you don’t use the card for a year

- Not all major currencies are supported for holding - double check they have the currency or currencies you need

Go to Travelex or read our review .

Citibank Saver Plus - best for use at home

- No international ATM or transaction fees

- Fee-free international money transfers to any account worldwide

- SMS notifications through Citi Alert

With this card you can:

- withdraw money for free at over 3000 ATMs Australia-wide and overseas

- take advantage of no foreign transaction fees, monthly fees, or minimum opening balance

- transfer money to friends and family anywhere in the world for free

- Cash deposits available within 24-48 hours

- Can’t have two cards active at the same time

- $5 account closure

- Hold and exchange 10 currencies: AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, and CNY

- No account opening or annual fees to pay

- No foreign transaction fee and no HSBC ATM fee at home or abroad

- Some cashback earning opportunity on local spending

- Easy online overseas transfers - 8 AUD fee and exchange rate markups apply

- Hold and exchange 10 currencies

- No account opening fee, no ongoing fees

- Get up to 2% cashback on eligible card spend

- No HSBC ATM fee

- No international transaction fee

- 8 AUD fee for sending money overseas

- Cashback on low value transactions made in Australia only

- Limits apply on how you can use CNY within your account

Read our HSBC Everyday Global Account review .

What are Prepaid Travel Cards?

Prepaid travel cards are a good international card alternatives to carrying cash. They look like credit or debit cards, but they function differently.

You're able to load the card with a set amount of money in the currency you need and can use it to make purchases online, in stores and to withdraw money at ATMs.

Most travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

Find out how our 5 best prepaid travel cards for Australians compare in our best and worst travel cards article .

Looking for something different?

Read our guides on:

- The best travel debit cards

- The best travel cards for Europe

- The Wise debit card review

- Best virtual debit cards for Aussies

How does a prepaid travel card work?

Order a prepaid travel card online, through a provider app , or - in some cases - pick one up at a physical location or store. Generally to get your card you’ll need to show or upload some ID documents for verification - this is to keep your account safe and is a legal requirement.

Once you have your card account open , you can load funds . Different cards have their own supported methods for topping up, which usually include bank transfer, PayID, credit and debit card, and which may also allow you to deposit cash in some cases. Once you have funds on your card, you can switch to the currency you need for overseas spending. In some cases you can also leave your funds in AUD and just allow the card to convert for you - but do check that no additional fees will apply in this case.

Prepaid travel cards can then be used to tap and pay , make withdrawals and shop online . You can often also add them to mobile wallets like Apple Pay for convenient spending. Because your card isn’t attached to your everyday account it’s secure, and you can only spend the funds you’ve loaded, which means there’s no chance of accidentally blowing your budget.

Advantages and disadvantages of prepaid cards

Prepaid cards can be a handy addition when you’re abroad, as they are secure and convenient to use for payments and withdrawals. However, they’re not the only option. If you’re not sure about whether a prepaid card is right for you, check out these advantages and disadvantages to help you decide:

Advantages:

- More convenient than carrying cash, with easy access to ATMs to withdraw when you need to

- Not linked to your primary day to day account, which can be more secure and make budgeting easier

- Some accounts let you buy currency in advance to lock in exchange rates when they’re good

- You may be able to access better exchange rates and lower fees compared to using a regular bank card

Disadvantages:

- Some prepaid cards have fairly high fees - including charges when you add money to the account. Read more on how to find the best travel cards with no foreign transaction fees

- Not all prepaid cards support a broad range of currencies - check the currencies you need are covered

- Prepaid cards aren’t always accepted for things like paying security deposits - so it’s safest to have a credit card as well

Who is a prepaid debit card for?

A prepaid debit card is handy for many different customer needs. For example, you may choose a prepaid debit card in the following situations:

- You’re planning travel and want to set your budget in advance with no chance of accidentally overspending

- You want to be able to hold and exchange a selection of foreign currencies all in the same account

- You want to increase security by using a payment card that’s not linked to your main everyday account when you travel

- Some cards also offer other perks like ways to receive foreign currency payments conveniently, or cashback

How can I get a prepaid travel card?

Different prepaid cards have their own order and activation processes. However, to comply with local and international law, providers will usually need to see some ID before you’re able to get a card - this verification step may be available online by uploading images of your paperwork, or in person by visiting a branch.

Here’s an outline of the basic steps you’ll take to get a prepaid travel card:

- Pick the right card for your needs

- Visit the provider’s website or app - or call into a branch if you’d prefer a face to face service

- Complete a travel card order from, which will include your personal information

- Get verified - usually this involves showing or uploading ID like a passport or driving licence

- Add money to your card, which could be in cash, with a bank card, or by bank transfer

- You can now get your card, and manage your account online or in the app

If you’re ordering a card in person you’ll be able to start using it right away. If you’ve ordered online for delivery, you’ll need to wait a few days, to a couple of weeks, depending on the provider you’ve picked, for your card to be available. You might be able to access virtual card details in the meantime, to start spending right away.

How to choose a prepaid debit card

There are many different prepaid debit cards on the Australian market - so picking the best one for you will require a bit of research. Starting with this guide, compare a few different prepaid debit cards based on features and fees. Here are a few pointers to think about:

- Make sure you know about any opening or card delivery fee which will apply once you order your card

- Check how long it’ll take to get your card if you’re ordering online for home delivery

- Make sure the card you pick can hold a broad selection of currencies, so you can use it for more than one trip away

- Check the fees for adding funds, making ATM withdrawals and converting currencies

- Look to see if there are any account close, cash out or dormancy fees that apply once you stop using the card

- Make sure the card is well rated by other users, and from a trustworthy provider

Where can I get a prepaid debit card?

Generally you can order your prepaid debit card online or by downloading your preferred provider’s app. Some cards, like the Auspost card, can also be collected in physical branch locations.

FAQ - 6 Best Prepaid Travel Cards

Are prepaid cards free.

Prepaid cards may be free to order, or you may pay a small one time fee, depending on the provider and card you pick. Once you have your card you may also pay transaction fees such as exchange rate markups when you switch currencies, and ATM withdrawal charges. Read the card’s terms and conditions carefully so you’re aware of the costs involved.

What are the best prepaid debit cards for international travel?

There’s no single best prepaid debit card - it’ll come down to your personal preferences, where you’re travelling, and the type of transaction you need to make. Pick a prepaid card which is easy to use, which supports the currency you need, and which offers a good balance of low fees and good exchange rates.

What is the best reloadable prepaid card?

There’s no single best reloadable prepaid debit card. Use this guide to compare a few options to pick the one that’s right for you, thinking about features, fees and the range of supported currencies you’ll need.

Should I use a Mastercard or Visa for overseas?

Both Visa and Mastercard are very broadly accepted globally. It’s often a good idea to have a prepaid, debit or credit card on each of these networks, so you’ll always have a backup if for some reason one network isn’t available wherever in the world you are.

Are prepaid currency cards worth it?

Picking the right prepaid currency card can help you save money on currency exchange and access low fee international transaction services. You might also get extra perks like easy ways to lock in exchange rates in advance, so you can get a good deal and fix your travel budget before you go away.

Your currency knowledge centre

5 Best Debit Cards for Australians Travelling Overseas

Travel debit cards are a good alternative to carrying cash. They also offer the convenience of a credit card, but work differently. Here is a list of the 5 best travel debit cards you can take with you on your travels and the positives and negatives for each one.

- Read more ⟶

Wise Debit Card Review

The Wise Debit card give customers an easy way to spend their balances in multiple countries. With interbank rates and low fees, this product is available in Australia for both personal and business customers.

8 Travel Traps to Avoid If You're Heading to Europe

To help you avoid spending money unnecessarily, here are some pretty important travel money traps you want to avoid if you travel to Europe.

- United States

- United Kingdom

Travel Money Card Comparison

How to find the best card for your next overseas trip.

In this guide

Travel money card comparison

What is a travel money card, the pros and cons of different options, what are the travel money card fees i should know about, how to find the best travel money card, top travel money tips, australian travel statistics, faqs about prepaid travel money cards.

Travel Money Cards

What you need to know

- The most important features to compare are the foreign transaction fees, exchange rates and usability.

- If you want to withdraw cash, a prepaid travel card or debit card will likely be cheaper than a credit card.

- It is a good idea to have several travel money options in case of loss, damage or theft.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

A travel money card is a prepaid card which you can add multiple foreign currencies onto to use while you're travelling overseas. You can use it to make purchases and withdraw cash from ATMs.

Prepaid travel cards work similarly to debit cards as you can deposit a certain amount of money into the card and only spend what you've got available in the account. However, unlike a standard debit card, a prepaid travel card allows you to lock-in exchange rates before you travel.

You can also avoid some of the fees that you might be subject to if you were to use your normal bank card. Many transaction accounts have international transaction fees or other limitations, so getting a travel money card can save you money there. It can also feel safer to have a travel money card, avoiding the risk of losing your money if something were to happen to your bank card.

ING Orange Everyday Account

There is no universal best travel money card as your options vary from country to country and person to person. In saying that, some of favourable features of travel cards include:

- No additional fees: including ATM fees, reloading fees and card closure fee

- The option to lock in exchange rates before you leave

- The option to add multiple currencies onto the one card

- Digital wallet compatibility so you can add the card to Apple Pay or Google Pay

- Low or no additional cost to convert your left-over money back to AUD

- Security, including card pin

You should also consider exchange rates, conditions, limits and safety.

Here are our top travel money tips:

- Pay for your purchases in the local currency. This will help avoid any currency conversion fees.

- Keep an eye on your transactions . It's always a good idea to regularly check your transaction history to make sure there's no unauthorised transactions - and if there are, you should report them to your bank immediately.

- Always take more than one travel money option. You don't want to be left stranded if you lose your card or it gets stolen. Consider bringing 2 forms of travel cards to avoid being left cashless in a foreign country.

- Keep your travel money in a few different places. Having all your foreign cash and cards in a wallet means you'll have no backup if you lose your wallet. Instead, consider keeping some of your travel money in a separate place. For example, you could keep most of your cash in a hotel safe or a locked part of your luggage.

- Inform your bank. If you're using your regular debit or credit card, let your bank know. You wouldn't want your card to be cancelled due to a 'suspicious transaction' while you're overseas because your bank thinks you're still in Australia.

Australia is a nation of travellers. According to the Australian Bureau of Statistics, there were 8,337,080 resident returns from overseas for the year 2022 - 2023. The most popular reason we travel is for a holiday, and the median trip duration is 15 days.

How do you top up travel money cards?

You can top up your travel money card if you need more money while you're on your trip. Depending on your specific travel money card, you can reload your card online, using BPAY, through your bank's app or via your bank's branch. Look into the card you are topping up because some methods do incur fees e.g. the Qantas Travel Money Card has an instant reload fee of 0.5% while its BPAY and bank transfers are free.

Can you get your money back if you don't spend it all?

You can generally get your money back if you don't end up spending it all while overseas. However, you might encounter fees to get the remaining money back into your regular bank account.

What should I do if my travel money card is lost or stolen?

The first thing you should do upon discovering that your card is missing is call your card provider. Reporting the theft or loss immediately will help protect the funds on your card.

Most of the card companies provide 24/7 customer service emergency numbers. Some even accept reverse charges, so it can be as simple as dialling the operator to connect your collect call. If you dial the number directly, you may be charged for the call.

- CommBank Travel Money Card: +61 2 9999 3283

- Cash Passport Platinum Mastercard: +44 207 649 9404

- Qantas Travel Money Card: +61 1300 825 302

- Travelex Money Card: 1800 303 297

- Revolut: +61 1300 281 208

What are the travel money card exchange rates?

Travel credit cards typically use the Mastercard or Visa network and use the daily exchange rates that the networks provide. You can find out the daily exchange rate by going to the Mastercard or Visa website. Prepaid travel cards allow you to lock in the exchange rate beforehand, so if you find a favourable one you can lock it in and not have to worry about fluctuations while you're away.

What is a cross currency conversion fee?

A cross currency conversion fee is charged when you use your Australian card with Australian dollars to make a purchase in a foreign country. The money is exchanged from Australian dollars into the local currency electronically. You can avoid this fee by choosing to pay in the local currency.

When are inactivity fees charged with prepaid travel cards?

If you have a travel card that charges an inactivity fee (a fee that's charged every month when your account is inactive for a period of time), you will lose any remaining funds on the card, but your account won't go into a negative balance. Once the card has a zero balance, this fee will not be charged.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald.

Read more on this topic

The Wise Travel Money Card supports over 40 currencies, with free loading by bank transfer and an instant, virtual card. Here’s how its other features compare.

Revolut offers virtual and physical Visa cards, support for over 30 currencies and other travel perks – plus 3-month Premium trial with this offer.

Use finder's interactive world map to learn about variations in beer prices globally. Find out where in the world you'd pay a whopping $15.10 for a pint.

Discover the travel money options available for young people and how to prepare for a trip overseas.

Find out which travel cards are the best to use in the 10 most popular holiday destinations for Aussie travellers.

Want to avoid fees and charges when using your card overseas? This guide explains the most common pitfalls when using travel cards.

This guide explains how you can get back any leftover funds from your travel money card after your trip.

Use this guide to understand foreign currency exchange and discover how to get the best deal.

Spend in up to 13 major currencies, lock in exchange rates and manage your account with the CommBank app when you use the Commonwealth Bank Travel Money Card.

Spend in 11 currencies wherever Mastercard is accepted and save on currency conversion fees with the Cash Passport Platinum Mastercard.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

320 Responses

When travelling from Australia to Switzerland is it best to exchange money at Australia Post from AU dollars to Swiss Franc in advance rather that change on arrival in Switzerland.

Hi Marjorie,

If you exchange your money at an airport or at a kiosk once you’ve arrived overseas, you may pay a hefty commission – it’s hard to know what charge in advance. Banks and licensed currency exchange outlets are likely to offer the best rates overseas but again, its hard to know what fees you’ll pay.

AustPost exchange is conveneint but it is not always the cheapest. Today, if you exchange $1000: – At AustPost, you’ll get CHF541.80 – The same transfer with Travelex is CHF550.80 – With Wise, you get CHF572.05

It pays to shop around and compare to find the best value.

Hope this helps!

I want a good all-rounder card, locked in FX, no maintenance charges, ATM fees , no withdrawal fees. What card is best ?

Hi Charles,

The comparison table in this guide includes details of ATM fees, load and re-load fees that can help you compare different options. For example, currently the Wise Travel Money Card and Revolut standard card both offer $0 ATM withdrawal fees for the first $350 per month, with charges for further ATM withdrawals. The Travelex Money Card also offers $0 ATM withdrawal fees.

All of these cards also let you lock in FX rates for supported currencies, but may charge fees when you’re spending in a currency that’s not loaded on the card. So it’s a good idea to consider which currencies you plan to spend, as this could have a big impact on the overall costs and help you choose a card that’s suitable for you. You can also view more details on potential costs for each card on Finder’s review pages. I hope this helps.

I am going to the Uk in 2019. Confusions is supreme. I see there is information about conversation currency fees, however on individual travel card sites they claim 0 fees. If I have a facility with my current domestic bank that charges no fees to transfer money to another facility and I use a travel card that states they have 0 fees for upload and currency conversation fee, am I correct in believing that there will be no cost to me to upload AUD to GBP. I am traveling for about 3 months and with a budget of around AUD 20,000. What cards should I consider compared to using my domestic Credit and Debit cards. I have tried using your search engine for best card for country but it is not uploading.

Thanks for getting in touch.

Sorry to hear about your confusion as to which card you would bring to the UK and apologies as well if you’re having a hard time uploading our page. Nevertheless, to help you narrow down your options, you can refer to our guide on travel money to the UK . From the page, you’d be able to compare your options for pre-paid, debit, and credit cards, and even foreign cash. Just click on the tabs to see the list. Once you have chosen a particular travel card, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can proceed with your application or get in touch with their representatives for further assistance.

With regard to the cost, usually, there’s no cost in loading AUD to the prepaid travel cards. If the currency is supported by the card, say GBP, it’s also free.

I hope this has helped.

Cheers, May

Hello, just wanted to let you know that unless I’m mistaken, the Qantas Cash card has differing information on your website. On one page it says that there is a 1% reload fee and on another that there is 0%. That said, thanks for offering unbiased easy to understand information, much obliged…

Thank you for your inquiry.

There are actually two ways to reload your Qantas Cash Card. The first option is via bank transfer or BPAY which has 0% fee and the second option through Direct Debit that charges 1% of the total amount. As a sample, this is how Direct Debit works:

If you wish to load or reload 200 AUD onto your card using Debit Card Load, you will be charged a fee of 1% of the load amount being AUD 200 x 1% = AUD 2. This means you will be required to pay AUD 202 to complete your Debit Card Load transaction.

Please also note that you may be charged other fees by third parties in relation to the Debit Card reloading transaction like the fees charged by your financial institution.

I hope this information helps.

I am traveling to South Africa and wanted to take a prepaid debit card but do not know who to contact for something like that. I talked to Travelex but they do not deal in South African currency. Any suggestions?

Thank you for contacting Finder .

Our Travel money guide to South Africa will provide you some options that may suit your needs. On the page, is a comparison table for a list of travel debit cards and prepaid travel money cards. You can use the table to help narrow down your options. Once you have selected one, you may proceed by clicking the green “Go to Site” button.

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps.

Cheers, Danielle

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

Best travel money cards in 2024.

Travel money cards are essential when travelling overseas.

They allow you to easily make payments whilst travelling overseas. They make paying easier for shops, restaurants, hotels and ATMs.Travel money cards work in a similar way to ATM cards. They use a pin when you purchase goods or services overseas.

In this guide, we have compared travel money cards to help you make the best selection for your next trip.

Best Travel Money Cards:

- Wise Travel Card Best Exchange Rates

- Revolut Best for Low Fees

- Travelex Money Card Best All Rounder

- Bankwest Breeze Platinum Best Travel Credit Card

- Pelikin Student Traveller Card Best Student Card

- HSBC Everyday Global Travel Card Best Travel Card by Bank

- Qantas Travel Money Card Best Reward Benefits

Wise Travel Card - Great Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is great for frequent travellers as it offers over 40 currencies at the inter-market exchange rate, which is the cheapest rate globally. In addition you can buy goods online from overseas with no transaction fee plus get the best exchange rate. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Our Wise Travel Card Review

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Card is a good all rounder.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as the Wise or Revolut Card abroad , the support network if the card is lost or stolen is very good.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- 0% p.a. on purchases and balance transfers for the first 15 months

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- 55 interest free days

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling overseas.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places around the world.

HSBC Everyday Global Debit Card

- No initial card or closure fees

- No monthly or account fees

- No international ATM fees

- No cross currency conversion fees

- Lock in very competitive exchange rates before travel

- No maximum balance

- Earn 2% cashback

- 10 Currencies can be loaded are AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY (currency restrictions apply to CNY)

- Awarded 5 gold stars by CANSTAR in 2021 for Outstanding Value

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with Visa pay wave, Apple Pay or Google Pay for purchases under $100. With a maximum of $50 cash back per month. In addition you need to deposit $2,000 or more into your Everyday Global Account each calendar month.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Debit Card is a good option to take travelling and to spend money in Australia with no international transaction fees, international ATM fees and monthly fees. In addition there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Finally it is one of the only travel cards that offers Chinese Yuan. To avoid ATM fees you need to find HSBC branches in Australia and only use ATMs overseas with a VISA or VISA Plus logo.

Best Student Card

Pelikin student traveller card.

- Use promo code SMONEY10 for a $10 discount

- Up to 15% off international flights

- A globally accepted virtual student ID card

- 2% cash back on food & drinks, transport and accommodation

- Over 150,000 discounts worldwide

- $30 for 12 months

- 20+ currencies available

- Split bills, pay and get paid instantly

Pelikin is one of the only travel cards in Australia specifically for students. While it has a small annual fee, the range of discounts and offers more than make up for it.

The app is relatively easy to use and card arrives in under a week.

Best Rewards Card

Qantas travel money card.

- No monthly fees, purchase fees and currency conversion fees

- No load fees if you pay by bank transfer or BPay

- Locked in exchange rates: 4%+ margin on exchange rates

- Earn 1.5 Qantas points for every AU$1 spent in foreign currency

- 10 currencies offered USD, GBP, EUR, THB, NZD, SGD, HKD, CAD, JPY, AED

- Free Australia ATM withdrawals

- 0.5% fee debit card reload fee

- ATM fees overseas (USD 1.95; GBP 1.25; EUR 1.50; THB 70; NZD 2.50; SGD 2.50; HKD 15.00; CAD 2.00; JPY 160; AED 6.50)

- Minload of $50 and max of $20,000

- Available to 16 year olds, has a lower age restriction than most credit cards (18 year olds)

Qantas Travel card is a great option to spend foreign currency overseas if you are already a loyal Qantas customer and use your frequent flyer points regularly on flights, accommodation or gifts. The fees are low, the exchange rate is average however the ATM fees are expensive and will easily add up.

Other popular travel money cards

Aside of the Top 5 travel money cards, there are many more options to consider. These include well known brands such as the Commonwealth Bank and Travelex and less known services like Up Bank and Revolut.

Here is a rundown of their best features, fees and available currencies:

- 13 currencies available, including Vietnamese Dong and Chinese Yuan

- No issue fee, load fees, closure and card replacement fees

- Additional card offered

- Can be accessed through Commonwealth Bank app

Commonwealth Bank Travel Money Card

- $3.50 fee at ATMs overseas

- 13 currencies offered USD, GBP, EUR, THB , NZD, SGD, HKD, CAD, JPY, AED, AUD, VND & CNY

- Minload of $1 and max of $100,000

- Available to 14 year olds, has a lower age restriction than most credit cards (18 year olds)

- When you use your card for a purchase or withdrawal in a currency that is not loaded, or when they automatically transfer funds between the currencies on your card to enable the completion of the transaction at the Visa retail exchange rate plus 4%

- To transfer money between currencies or a transaction account, it will be at the bank rate which is normally 4% above the market value

The Commonwealth Bank travel money card is great if you are already a Commonwealth bank customer who banks online and knows exactly how much money in each country you want to spend. However if you need to transfer between currencies or make a purchase in a currency you don't have funds loaded, then you can get an additional expensive charge. Watch how many withdrawals at ATMs you make as well to keep the costs down.

- Exchange rates most competitive for USD, GBP and THB

- No fee on initial card or load (not BPay)

- No fee on reloads via bank transfers

- No monthly or inactivity fees

- Card is valid for 5 years

Travel Money Oz Currency Pass

- 1.1% reloading fee via Travel Money Oz Login or with debit or credit card

- 1% reloading fee for BPay

- $10 closure fee and replacement card fee

- 2.95% on withdrawals from Australian ATMs is expensive

- Roughly $3.50 on withdrawals from overseas ATMs is expensive.

- $3.99 + 5.95% fee on cross currency transactions

- 10 Currencies can be loaded are USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB & AUD

- Exchange rates for SGD and CAD are the least competitive

- Minload of $20 and max of $10,000

- Only 1 card per account

- According to the website they won't take online orders if you are departing within 14 days as the card can take up to 2 weeks for delivery.

The Travel Money Oz travel money card seems to be an outdated version of the Travelex or Australia Post travel card as it does not offer Global Emergency Assistance or Boingo hotspots. However exchange rates and fees are similar to Travelex, so if you are travelling to the US, UK or Thailand, this is a great card to pay for accommodation and things in shops. We would avoid using it at any ATM, to save costs.

- No ATM fees in Australia or internationally

- No minimum monthly deposit

- No account keeping fees

- Can be used in Australia as an EFTPOS card

- Available to 14 year olds and older

Macquarie Travel Card

- $2,000 daily limit for ATM withdrawals

- Simple and easy to work out costs for account

- Exchange rates are MasterCard exchange rates, which are normally 4%+ market rate.

- 90-day theft and damage protection on eligible purchases and stolen wallet protection up to $500

- Can be used in Australia to buy goods overseas and not pay international transaction fees

- Get discounts of up to 10% on eGift cards to use at over 50 leading retailers

The Macquarie Travel Card is a very good option to take overseas for ATM withdrawals as they are all free. In addition in Australia you can buy goods online and not pay an international transaction fee. Furthermore you can use the card like a normal debit card in Australia with no hefty fees or monthly minimum deposits. However the exchange rate is the MasterCard rate which is normally 4%+ above the market rate. Finally we would recommend this card for cash withdrawals at ATMs internationally but not paying for accommodation due to the added margin on the MasterCard exchange rate.

- Cheapest way to send money overseas through a bank

- UI and UX better than traditional banks making it super easy to use

- Competitive savings interest rate

Up Bank Travel Card

- Backed by Bendigo Bank and Adelaide Bank and partnered with Wise so it has financial backing and access to the cheapest exchange rates to send money overseas

- Nifty online tools to help you track spending, budget and save. These include a detailed transaction history often including a company logo, when you paid down to the minute and the suburb where the transaction was made. In addition it has a ‘Regulars feature that detects regular billers and estimate of upcoming bills so you get a heads-up before they are due

- Good savings account interest rates of 1.85% (0.10% base rate plus 1.75% bonus). Bonus interest is easily unlocked after making five successful card or digital wallet purchases each month

The Up Bank Travel Card is aimed at younger markets who are looking to save on bank costs and receive online tools to help them budget and save for their goals. It is also able to be used overseas at any ATM without fees, no international fees and is the cheapest way to send money overseas through a bank due to their partnership with Wise (the largest money transfer company in the world). In addition the exchange rates are Mastercard rates which are normally 4% above interest rates. Finally, while this card is very useful domestically and for ATMs overseas we would not recommend it for big ticket items overseas as it is an expensive card to use.

- No foreign transaction fees

- No fee on initial card, load, unload or inactivity fees

- No cross currency transactions fees

- Lock in exchange rates before you leave

- Exchange rates most competitive for USD, GBP, EUR and CAD and JPY

- No ATM fee at 50,000 Global Alliance ATMs worldwide

- Free additional card

- Flight delay pass

Westpac Travel Money Card

- 11 Currencies can be loaded are USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB, AUD & ZAR

- $2,000 maximum limit on ATM withdrawals overseas within 24 hours

- $50,000 maximum limit on currencies loaded on to travel card

- $3 roughly for ATMs that are not within the Non Westpac Global Alliance

- If you run out of one currency on the card, you can pay with other currencies without the expensive cross currency transaction fee

- No foreign transaction fees, initial card, load, unload or inactivity fees

- According to the Westpac it can take upto 8 business days to receive the travel card

- Secure from fraudulent transactions with Mastercard Zero Liability protection

- 2 cards per account for free

The Westpac Travel Card is a no frills handy travel card with very low fees, no foreign transaction fees, access to some free ATMs worldwide and competitive exchange rates, especially on USD, EUR, GBP, CAD and JPY. In addition it has the South African Rand (ZAR) which is not common in prepaid travel cards. Finally it has access to a flight delay pass in case your flights are delayed and you need to access airport lounges.

- Linked to ANZ Rewards program

- 7 types of insurance for free

- 55 days interest free

- Good security on card purchases

ANZ Travel Adventure Card

- 20.24% interest on purchases and cash advances

- $120 annual fee

- No international transaction fees in person or online

- Offer 7 types of insurance for free

- ANZ Reward points can be used to buy gift cards, swap for Virgin or Singapore airline points or cash into your account.

- Earn 1.5 Reward points per $1 spent on eligible purchases up to $2,000 per statement period

- ATM fees at non ANZ ATMs

- Minimum credit of $6,000

If you utilize rewards points then the ANZ Travel Adventure Card might be suitable for you. Reward points can be used to buy a wide range of gift cards, swap for Virgin or Singapore airline points or cash into your account. In addition no international transaction fees are charged for purchases online or whilst you travel overseas. Finally this card is not recommended for cash withdrawals as the interest rate of 20.24% will eat up any savings.

- No ATM fees

- Can be used in Australia with no additional costs

- No fees for paying via bank transfer or Bpay

- Transfer limits can be set by user

ING Orange Everyday Account Debit Card

- As long as you you deposit at least $1000 and make at least 5 payments each month ING will waive international transaction fees and refund overseas ATM withdrawal fees

- Can be used in all countries

- Works with Apple Pay and Google Pay

- Visa currency conversion rates apply, which are normally 4% above market

The ING Orange Everyday Account Debit Card is a good card for most Australians travelling overseas for ATM access, with no fees. It also allows you to to buy goods online without an international transaction fee.

Furthermore you can use it in Australia for free and there are no fees to get your initial card, for account keeping or to top up your card. A word of caution however, if you travel overseas for longer than 1 month, you still need to deposit at least $1,000 and make at least 5 payments each month to get the rebates.

- Initial card and replacement cards are free

- Increased protection with Mastercard Zero Liability

- Access to cash from your account through the Global Emergency Assistance, if your card is lost or stolen

Australia Post Travel Money Card - Platinum Mastercard

- 1.1% Admin fee for instore loads, including initial load

- $5 fee for reloads via debit bank card

- $10 closure fee

- $3.50 on withdrawals from overseas ATM is expensive

- Currencies that can be loaded are USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD , AED and AUD

- Minload of $100 and max of $100,000

- If your card is lost or stolen you can access cash that is in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer the free wifi and you can look at their number of free hotspots per country on this map

The Australia Post travel money card is a popular option for Australian travellers due to the convenience of stores. However we would recommend the Australia Post travel money card for paying in shops or accommodation as it is costly to withdraw cash from ATMS. As the Australia Post travel money card is fee heavy we recommend not making withdrawals at ATMs or making cross currency transactions to keep additional fees down.

- Up to 11 currencies available

- Manage your account and card online

- 24/7 global assistance

- Access to emergency cash

- Free additional card when ordered at time of purchase

- Can be used at millions of locations worldwide – wherever Mastercard purchase symbol is displayed

Greater Bank Cash Passport Platinum Mastercard

- $5 fee for reloads via debit bank card, FREE reloads via BPAY

- Admin fee of up to the greater of 1.1% of the load/reload amount or $15 for in-store purchases

- Debit card load fee 0.5% of the amount loaded, per Debit Card Load transaction

- Domestic ATM fee 2.95% of value Withdrawn

- International ATM fee USD 2.50, EUR2.50, GBP 2.00,NZD 3.50, THB80.00, CAD 3.50,HKD 18.00, JPY260.00, SGD3.50, AED 10.00, AUD 3.50

- Minimum load of AUD100 and a Maximum of AUD100,000

The Cash Passport is one of the most popular travel cards in the Australian market. With Greater Bank, you can purchase it online and at one of their branches, then download the app or use the website to manage your card. While the card may be useful for international purchases, be mindful when using an ATM both locally or overseas as the fees can add up if you are withdrawing money often.

Learn more about the Cash Passport Platinum Mastercard through Greater Bank .

The best travel card in Australia depends on its use, for ATM withdrawals it is ING Orange , for best exchange rates it is Wise Travel Card, the best credit card is Bankwest Breeze Platinum , for overall best card by a bank its HSBC Global and the best rewards card is the Qantas Travel card .

A travel money card is safer than cash overseas and if you select a Wise travel card , it is the best exchange rate as well. Most places around the world accept MasterCard or Visa, so you should be able to pay for all your purchases by card.

Yes you can use all travel cards in Australia but you might choose not to due to the fees. ING , Macquarie , Up , Citibank are all good examples of travel money cards that do not charge for ATM withdrawals in Australia. However examples of travel money cards that charge $3.50 per Australian ATM withdrawal include Travelex , Australia Post and Travel Money Oz .

Both if you buy your cash from S Money and pay with a Wise card overseas, as they both use the exchange rate you see online and charge very low fees. However if you buy your foriegn currency at the airport, you are paying top prices so using a card is cheaper.

There are many travel money cards that no longer exist but appear in search engine page results. Travel money cards that no longer exist include 7-11 Just Go, NAB Travel Money Card, Travelex Cash Passport, Australia Post Cash Passport, ANZ Travel Card, Westpac Global Currency Card and the Virgin Velocity Global Wallet program.

Learn more about the best debit, credit and prepaid cards for travel

Best Prepaid Cards

Credit Card

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

Using the Post Office Travel Money Card: Pros and Cons

Table of Contents

What is the post office travel money card, pros of the post office travel money card, cons of the post office travel money card, user experiences and reviews, how to get and use the card, best practices for cardholders, alternatives to the post office travel money card.

T he Post Office Travel Money Card is a convenient and secure way for UK residents to manage their finances while traveling abroad. This prepaid card allows travelers to load funds in multiple currencies, offering a practical alternative to carrying cash or using credit cards overseas. It’s particularly popular among those who seek a controlled and budget-friendly travel spending method.

The Post Office Travel Money Card is a prepaid, multi-currency card that can be loaded with up to 23 different currencies. It functions similarly to a debit card but is specifically designed for international travel. The card can be used to make purchases at millions of locations worldwide where MasterCard is accepted and to withdraw money from ATMs.

- Convenience and Ease of Use : The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch.

- Security Features : The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

- Wide Acceptance : Being a MasterCard product, it’s accepted at a vast number of outlets and ATMs worldwide.

- Currency Exchange Rates : Users benefit from competitive exchange rates compared to traditional currency exchange services.

- Budget Control : The prepaid nature allows travelers to manage their spending effectively, avoiding the risk of debt.

- Fees and Charges : Although the card offers free purchases, there are fees for certain transactions, such as ATM withdrawals and inactivity.

- Limitations in Usage : Some countries and establishments may not accept the card, limiting its utility in certain situations.

- Reloading Issues : Adding more funds to the card can be less straightforward, especially in remote areas or during non-business hours.

- Customer Service Concerns : Some users have reported issues with customer service, particularly in resolving card-related problems quickly.

- Comparison with Other Travel Money Options : While the card has many benefits, it may not always be the best option compared to other travel money products, like credit cards with no foreign transaction fees.

Feedback from users generally highlights the convenience and security of the card. However, some have noted the fees and reloading issues as drawbacks. It’s essential to consider both the positive and negative aspects to make an informed decision.

Obtaining the card is a simple process, either online or at a Post Office branch. Users need to load the card with the desired amount and can start using it immediately. For reloading, options include online transfers or visiting a Post Office.

To maximize the benefits of the card:

- Keep track of spending and remaining balance.

- Be aware of the fees for different transactions.

- Have an alternative payment method as a backup.

Other options include other brands of travel money cards, credit cards with no foreign transaction fees, and traditional cash exchange. Each has its pros and cons, depending on individual travel needs and spending habits.

The Post Office Travel Money Card is a valuable tool for travelers seeking a secure and convenient way to manage their funds abroad. While it has several advantages, potential users should also be aware of its limitations and fees.

Q: How does the Post Office Travel Money Card work? A: It’s a prepaid card that you load with currency before traveling. You can use it for purchases and ATM withdrawals anywhere MasterCard is accepted.

Q: Are there any fees associated with the card? A: Yes, there are fees for certain transactions like ATM withdrawals, and there may be inactivity fees if the card is not used for a prolonged period.

Q: How do I load money onto the card? A: You can load money online or at any Post Office branch. The process is simple and can be done in multiple currencies.

Q: What should I do if my card is lost or stolen? A: Contact the Post Office immediately to report the lost or stolen card. They will arrange for a replacement and transfer the balance from the old card.

Q: Can I use the card in any country? A: The card is accepted in most countries worldwide. However, it’s always best to check the specific country’s acceptance before traveling.

Q: How does the card compare to using a regular debit or credit card abroad? A: Unlike regular cards, the Travel Money Card is prepaid, which helps in budget management. However, some regular cards might offer better exchange rates or lower fees, so it’s worth comparing options.

Q: Is the Post Office Travel Money Card a good option for all travelers? A: It depends on individual needs. The card is excellent for those who want a secure, budget-friendly way to carry money abroad. However, for those who travel frequently or to less common destinations, other options might be more suitable.

Related Posts

Expert Tips for Managing Hays Travel Money Effectively

Navigating TUI Travel Money for Better Holiday Finance

John Lewis Travel Money: Convenience and Value Combined

Marks & Spencer Travel Money : Maximizing Value with M&S Travel Money on Your Trips

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

create unique & memorable travel experiences with VOLodge

About volodge.

1325 Derry Rd E Suite 3, 2nd Floor, Mississauga, ON L5S 0A2, Canada

Sign up for the exclusive offers and best deals from us

© 2023 | VOLodge.com | All Rights Reserved

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Post Office Travel Card review

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

Send us an enquiry and we'll get back to you within 48 hours .

email us

Need to speak with us? We're here to help.

Be sure to check out our help centre first.

Send us an email enquiry and we'll get back to you within 48 hours.

- New Zealand - 0800 444 691

- Hong Kong - 800 966 321

- Japan - 00531 780 221

- South Korea - 00798 4434 1279

- Thailand - 001800 442 212

- UK - 0800 056 0572

- USA/Canada - 1 877 465 0085

- Other countries - +44 207 649 9404

- Australia - 1800 098 231

If you find a transaction that does not look correct, please contact card services immediately via phone, who can lodge a dispute on your behalf.

To notify card services of any unauthorized or disputed transactions, simply:

- Complete the dispute claim form located here

- Click here to email us

Please provide as much detail as possible when filling out the dispute claim form, it will help us accurately and quickly work on your behalf to correct the problem. You can use 'my account' to login and establish the details of which transactions you want to dispute.

We will send a response to you within 10 working days of receiving your query.

Remember, you can contact global emergency assistance for PIN reminders or to report lost or stolen cards.

If you have any complaints, please send us an email. For more information, please refer to our complaints procedure.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard® (“Travel Mastercard") in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131 . Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Travel Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. The Target Market Determination for this product can be found here auspost.com.au/travelcard . Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

^Pay no foreign transaction fees on purchases when travelling, when you load your Australia Post Travel Platinum Mastercard with USD or EUR currencies supported by the product, and transact in that same currency.