Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

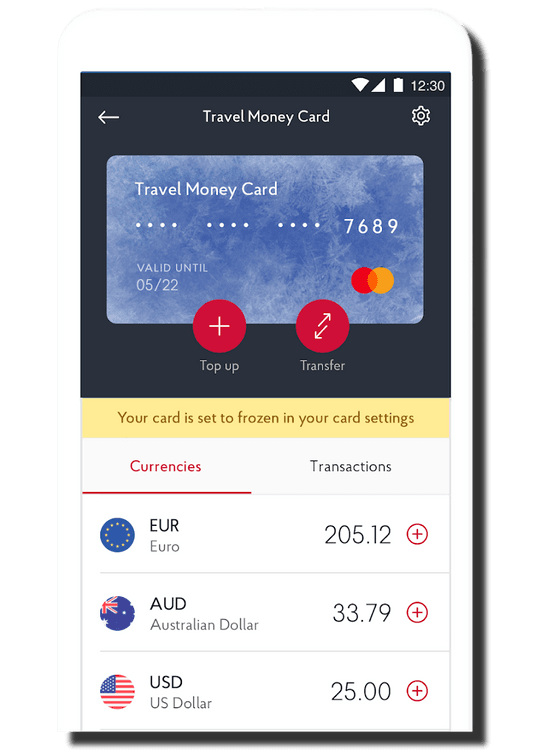

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

Using the Post Office Travel Money Card: Pros and Cons

Table of Contents

What is the post office travel money card, pros of the post office travel money card, cons of the post office travel money card, user experiences and reviews, how to get and use the card, best practices for cardholders, alternatives to the post office travel money card.

T he Post Office Travel Money Card is a convenient and secure way for UK residents to manage their finances while traveling abroad. This prepaid card allows travelers to load funds in multiple currencies, offering a practical alternative to carrying cash or using credit cards overseas. It’s particularly popular among those who seek a controlled and budget-friendly travel spending method.

The Post Office Travel Money Card is a prepaid, multi-currency card that can be loaded with up to 23 different currencies. It functions similarly to a debit card but is specifically designed for international travel. The card can be used to make purchases at millions of locations worldwide where MasterCard is accepted and to withdraw money from ATMs.

- Convenience and Ease of Use : The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch.

- Security Features : The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

- Wide Acceptance : Being a MasterCard product, it’s accepted at a vast number of outlets and ATMs worldwide.

- Currency Exchange Rates : Users benefit from competitive exchange rates compared to traditional currency exchange services.

- Budget Control : The prepaid nature allows travelers to manage their spending effectively, avoiding the risk of debt.

- Fees and Charges : Although the card offers free purchases, there are fees for certain transactions, such as ATM withdrawals and inactivity.

- Limitations in Usage : Some countries and establishments may not accept the card, limiting its utility in certain situations.

- Reloading Issues : Adding more funds to the card can be less straightforward, especially in remote areas or during non-business hours.

- Customer Service Concerns : Some users have reported issues with customer service, particularly in resolving card-related problems quickly.

- Comparison with Other Travel Money Options : While the card has many benefits, it may not always be the best option compared to other travel money products, like credit cards with no foreign transaction fees.

Feedback from users generally highlights the convenience and security of the card. However, some have noted the fees and reloading issues as drawbacks. It’s essential to consider both the positive and negative aspects to make an informed decision.

Obtaining the card is a simple process, either online or at a Post Office branch. Users need to load the card with the desired amount and can start using it immediately. For reloading, options include online transfers or visiting a Post Office.

To maximize the benefits of the card:

- Keep track of spending and remaining balance.

- Be aware of the fees for different transactions.

- Have an alternative payment method as a backup.

Other options include other brands of travel money cards, credit cards with no foreign transaction fees, and traditional cash exchange. Each has its pros and cons, depending on individual travel needs and spending habits.

The Post Office Travel Money Card is a valuable tool for travelers seeking a secure and convenient way to manage their funds abroad. While it has several advantages, potential users should also be aware of its limitations and fees.

Q: How does the Post Office Travel Money Card work? A: It’s a prepaid card that you load with currency before traveling. You can use it for purchases and ATM withdrawals anywhere MasterCard is accepted.

Q: Are there any fees associated with the card? A: Yes, there are fees for certain transactions like ATM withdrawals, and there may be inactivity fees if the card is not used for a prolonged period.

Q: How do I load money onto the card? A: You can load money online or at any Post Office branch. The process is simple and can be done in multiple currencies.

Q: What should I do if my card is lost or stolen? A: Contact the Post Office immediately to report the lost or stolen card. They will arrange for a replacement and transfer the balance from the old card.

Q: Can I use the card in any country? A: The card is accepted in most countries worldwide. However, it’s always best to check the specific country’s acceptance before traveling.

Q: How does the card compare to using a regular debit or credit card abroad? A: Unlike regular cards, the Travel Money Card is prepaid, which helps in budget management. However, some regular cards might offer better exchange rates or lower fees, so it’s worth comparing options.

Q: Is the Post Office Travel Money Card a good option for all travelers? A: It depends on individual needs. The card is excellent for those who want a secure, budget-friendly way to carry money abroad. However, for those who travel frequently or to less common destinations, other options might be more suitable.

Related Posts

Expert Tips for Managing Hays Travel Money Effectively

Navigating TUI Travel Money for Better Holiday Finance

John Lewis Travel Money: Convenience and Value Combined

Marks & Spencer Travel Money : Maximizing Value with M&S Travel Money on Your Trips

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

create unique & memorable travel experiences with VOLodge

About volodge.

1325 Derry Rd E Suite 3, 2nd Floor, Mississauga, ON L5S 0A2, Canada

Sign up for the exclusive offers and best deals from us

© 2023 | VOLodge.com | All Rights Reserved

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Post Office Travel Card review

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

Suggested companies

Post office.

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.9.

Most relevant

It is very useful to have a Travel card with you as you know how much money you have to spend !!

It is very useful to have a Travel money card when on holiday. The staff at the Post Office are very helpful to get it loaded and set up. Also the staff at head office are there for you if you need help

Date of experience : 18 April 2024

Very simple user friendly easy process…

Very simple user friendly easy process to open up new Post Office Money Travel Card account

Date of experience : 16 April 2024

Useless. Card worked ok until it didn't. Stopped working while on holiday. Tried to check balance at local Spanish ATMs but they would not recognise the card. The app wouldn't open and when I tried opening the account via the browser it would not let me in. Eventually I was locked out. Luckily I also had a TUI money card which was easier to set up and works perfectly. Would advise you get card from a travel agent or bank. Do not rely on the Post Office.

Date of experience : 20 April 2024

No fees and easy to use

The Travel Money Card was so easy to use and having the physical card as well as the app meant my husband and I could pay for things from the same account when needed. There are no transaction fees as there are with most bank cards used overseas so would definitely recommend and use next time we go abroad.

Date of experience : 02 March 2024

Updated App won't work - AGAIN!

Here we go again, another update and the new APP DOES NOT WORK. I've been using this app for six years now, and through bumps, things are unbelievably worse now. I've been through the email confirmation in a loop. Called customer services and given all my information except an incorrect post code and they won't sort it out for me. Terrible customer service! Of course where is all my information - on the app - what cannot I access - the app! Solution = photograph your personal documents DL or Passport, send through email (I know!) and they will talk to me about the card.. If only when traveling you could access all this information. This has happened before with an app update - see my Trustpilot review from earlier years.. I think I will just get a new card and start again when I return - brilliant.. what happens to my balance or the card? Customer service have no idea..

Date of experience : 17 April 2024

Reply from Post Office Travel Money Card

Hi Elle, I am sorry to learn that we have been unable to assist you when you contacted Customer Services line. In order to protect customers information we do require each customer to complete verification to be able to discuss the account. Please contact us via email at [email protected] or telephone on 0344 335 0109 and we will be able to assist you with your mobile app.

so far, so good

I am an older person and view apps and phone banking as necessary evils and with great distrust. However it is almost impossible to live without them and some products do help make life easier. This is the premise behind the PO Travel card which allows you to carry foreign currency in the equivalent of a use-abroad deposit account card. While it wasn't entirely pain-free to set up it was bearable with minimal faff, and it worked 100% the small handful of times I tried it in shops abroad. Assuming the remainder of the currency I put in that card does not vanish before I next go abroad I will continue to use it. I'm unsure of the exact advantage it gives over my UK bank account card and using that abroad, perhaps not getting fleeced by fluctuating exchange rates. I was told it is more efficient than just buying a wad of Euros at the Post Office.

Date of experience : 01 April 2024

Used my card for the first time in…

Used my card for the first time in Portugal and found it extremely easy and hassle free, it will be my method of payment when abroad from now on.

Date of experience : 14 March 2024

Travel Money cards - Easy to set-up and use

The Travel Money cards are very easy to set-up and use. It means that you do not have to use your own debit or credit cards when travelling, making it safer for you to pay for things abroad. The website was easy to use and the cards arrived very quickly.

Date of experience : 27 March 2024

Very easy to transfer currencies to…

Very easy to transfer currencies to match your travel plans

Date of experience : 15 March 2024

Very to use and safe to use easy to…

Very to use and safe to use easy to convert money to the currency where your going to visit, you dont have the headache of finding a money exchange shop etc even if you lose your card u can block it etc i would defo recomend to use when going abroad

Date of experience : 01 March 2024

Excellent Service

The lady who dealt with my enquiry was very patient and informative all the way through and nothing was too much trouble for her.

Date of experience : 30 March 2024

Straightforward to set up.

Straightforward to set up the Travel Card: user-friendly interface, easy to understand and easy to use when completed.

Date of experience : 06 April 2024

I wouldn't go on holiday without it!

I've had my Post Office Travel Money Card for years and carry all my holiday spending money on it. Its so easy to use and I've always been able to access cash if I've needed it, from an ATM. The App makes everything easy to manage and I can transfer from my bank whenever I need to because who sticks to budget when they're on holiday?! 😅

Date of experience : 05 March 2024

Thank you so much for your great review and feedback, it really helps us. It's really good to hear that you have been using your Travel Money card for so long with us, so thanks again and we hope that you continue to enjoy it for many more years!

Lessons in travelling

I've found the Post Office travel money card very useful and easy to use on two European trips in the past four months. For a number of reasons my current trip, to Australia, has not been so smooth. I found it impossible to top up on either the app or the website, which proved to be my bank's fault - it declined the transaction, despite having allowed it in the past. The TMC app and website fell short by not explaining at all why things were not working out. And I fell short by switching off my UK phone SIM card to avoid international call rates, which meant that I couldn't receive messages from my bank which would have explained why I couldn't top up. So, faults with me, my bank and (really least of all) the TMC, all now resolved.

Date of experience : 21 March 2024

Useless and customer services can't…

Useless and customer services can't help they just say you have to wait and can't actually do anything to set the card up

Hi there, I am sorry to hear that we have been unable to assist you when you contacted Customer Services. Please contact us via email at [email protected] or telephone on 0344 335 0109 and we will be able to take a further look into your account and give assistance.

Great customer service for Travel Money

Went in to my village Post Office to ask how many Euros I would get for £400, I was asked if I would be using any credit or bank cards whilst on holiday and I said yes, the very pleasant counter person gave me details about the Post Office Travel Money Card and explained the safety benefits of the card rather than taking all cash or using bank/credit cards, they also told me about their Travel APP which I can use to see transactions or top up the card with more currency in the future, I was also told that if I buy over £700 I would get a much better exchange rate. I decided to take the Travel Money Card, I got an exchange rate of just over 1.12 for £700 of Euros on the card rather than a rate of 1.05 had I taken just £400 in Euro notes. Thank you for the great advice and service.

Date of experience : 04 March 2024

Thank you so much for your great review, it really helps us and we hope that you get to enjoy using your Travel Money Card again soon!

Post Office money card account. Problem logging in.

Having activated my new account, my attempts to log in, using my smartphone, are persistently met by your pop-up message "Something went wrong. We're experiencing a systems error. Please try again later." Even your helpline phone receptionist couldn't resolve it (though she was very patient. We tried numerous attempts to uninstall & re-install the app). It still doesn't work. I cannot log in to my account.

Date of experience : 05 April 2024

TMC the best

Great travel money card and app to use on your phone and you benefit with the best exchange rates. You can have multiply currencies and switch between them. The card can be top up online, in branch or via your bank if linked even when on holiday.

Thanks so much for your great review, we're really pleased that you enjoy your Travel Money Card

Used first in 2023 and then raised my…

Used first in 2023 and then raised my concerns (cost of withdrawals and inadequate daily withdrawal limits) but apparently both outside of Post Office control - fair enough. Getting ready for 2024 travel, first found a newer App was required but it's not compatible with my not ancient tablet. Secondly getting verification after loading the new App on my mobile failed as no emails were received (yes I checked in Spam folder etc.) Finally only resolved by linking to an alternative email address. If I wasn't concerned about possibly running out of money abroad I'd have given up on this card by now and dread further problems if I do need to add credit whilst abroad and hope that it shows immediately and emergency withdrawal is possible.

Date of experience : 09 April 2024

Very easy to use app

Very easy to use app. Modern look, information readily available. Great features eg balance check, spend, freeze/unfreeze card. Excellent app.

Thanks for the great review and feedback, it's really useful to us!

Suggested companies

Admiral insurance, insurefor.com, staysure travel insurance.

Post Office Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.3.

Most relevant

Wished Id checked reviews before taking…

Wished Id checked reviews before taking out insurance! Took Policy out 8th March same day holiday was booked. Unfortunatley, my daughter ended up in hospital 29th March with a virus so unable to travel. Post Office sent email refusing claim stating I would have forseen this??? And just realised Post Office filtering what reviews show on their google page. Reviews on Trustpilot not good. Post Office not trustworthy at all...very disappointing. Will be escalating matter to FCA.

Date of experience : 13 April 2024

Unfortunately fell ill abroad

Unfortunately fell ill abroad. Called the claims line who passed me on to claims handler. Sent the documents and within a week or so paid my expenses. Polite and professional help and assistance.

Date of experience : 10 March 2024

Do not use their insurance if you might claim

We used Post Office insurance as they SHOULD be a reputable company. The cost was sensible, but when we wanted to make a claim (a missed port on a cruise) we discovered they are absolute rubbish. Their contact number keeps saying "use online" and when I eventually got to talk to "Kirk" I just got cut off as soon as I said I wanted to make a claim. I logged onto their portal - nowhere to make a claim, you have to register again on a separate site to make a claim, and then enter huge amounts of detail they should already have, before finding "missed port" is not a claim reason on their fixed list of reasons! Awful, obviously specifically aiming to never pay out.

Date of experience : 09 April 2024

Don't get a travel card!

Loaded a new card before going on holiday, installed the app and activated the card. Same card was continuously declined on holiday at ATM's, and retailers. Had to use my visa card which is not good for cash withdrawals. It took countless emails to sort out, and it wasn't until I returned home that I was able to call them and sort it out, and start the process of getting my money returned. Absolutely don't use them, they cannot offer the customer service required, and they had a good deal of my money for way too long. The FCA ought to be aware of their ineptitude as there are very strict regulations in force for handling third party money which the Post office obviously don't observe.

Date of experience : 03 April 2024

Hopeless, don't trust! Since the new app I can't do anything

Since the new app I can't do anything. I've had to freeze the card as strange transactions listed on the account with money I don't have. Customer service blamed it on petrol stations holding fee but the amounts don't correspond at all. The app wouldn't let me top up on several occasions, I de installed, re-installed and now it won't work at all. Don't trust this card or app. Save yourself time and frustration, go elsewhere.

Date of experience : 25 March 2024

Don't do it!

Don't do it. I loaded a travel money card and began to spend. Then they frozen my card with 3k on it. They refused to close my account or let me spend my money. It took 38 emails and over a month before they gave my money back saying they'd acted to protect me. Had I been abroad, I'd have been stranded. I'm so cross that I trusted them with my money. Additionally, they asked for loads of information that you wouldn't need to give to get a mortgage or loan, which I gave them as they had my money. They seem to have accessed other information about my finances, which is very worrying. Please don't trust these crooks.

Date of experience : 09 March 2024

Got Travel money from post office for trip to Iceland, hardley used any as all Icelanders use credit cards' Buy back rate from post office reddicularsly low. Will loose £80 on a £400 transaction. In my opinion daylight robbery.

Date of experience : 26 March 2024

Ordered euros on 13th March was sent…

Ordered euros on 13th March was sent confirmation email that the money will be ready to be picked up the following day after 1pm. Made special trip, and guess what had not been delivered! Totally unreliable , won’t be using post office travel money again

Date of experience : 14 March 2024

Lures you in & spits you out!

It's understandable why people might go with Post Office, trusted name perhaps, coupled with amazing offers (Amazon vouchers after trip confirmation, immediate flight delay payment, promises of flight lounges on delay, hotels if flight delayed, 'live' Dr on their app provided, plus a great price), I could go on and on. I was lured in. (IMO They offer a lot compared to the other insurance companies) But please don't be FOOLED. It's a "child catcher" situation (remember that film?) I give these a big fat ZERO Everything is perfect, until you need to claim. It's their objective NEVER to reimburse your medical expenses. It took me 6 months, and this included a mountain of warnings from a dept collection agency, chasing ME for the treatment fees on behalf of the hospital accountant where l received treatment. If my physical injury wasn't bad enough, the resulting mental trauma after being ghosted by this company almost finished me. This is the thanks I got for an honest insurance application (no previous medical issues) It was only resolved when I requested the Financial ombudsman to step in. And a weak weak apology from Collinson Group. (I was lucky to get that after 100 emails, 70% not replied, the remaining 30% "we wil reply soon" Be aware!!!! Collinson Group underwrite other insurers, so scan your policy wording before committing to your travel insurance.

Date of experience : 18 August 2023

Post Office Car Insurance - money stolen

About 3/4 years after I had taken out car insurance with the Post Office, I started receiving threatening phone calls saying I owed £100. I had paid everything off at the time, there was definitely no remaining debt. So when the caller eventually relented and told me it was Post Office related, I called them. They couldn't tell me what the charge was for, just that it was showing on my account! This was back around 2012 and stupidly I paid the money as I didn't know what else to do and couldn't prove I didn't owe them. Also, I felt intimidated by the phone calls and I was young. Now knowing about the Post Office scandal, I'm even more certain the money was not owed, and I wonder how many other people had similar problems and were robbed.

Date of experience : 01 January 2024

Have had my car insured for last…3months.

Have had my car insured for last months. All seemed well. Wife included as named driver. Both have good record ie no claims or convictions. Wanted a new quote for my wife’s own car so gave details. Mentioned that her car had some malicious damages few months ago. Paid repairs herself so no claim. Post Office insisted the I must pay an extra £121.66 because of the malicious damage. They argued she is a higher risk so my policy is more expensive as she is a named driver. Will avoid this organisation for life after this experience. Maybe the Post Office are facing some big bills?

Date of experience : 25 February 2024

They literally lied to me

Literally lied to me and said if I wanted to complain then I had to go to the ombudsman. Policy States "Cost of replacement passport" Their excuse for not paying up after having my passport stolen. "It mean travel documents to get home" However they also admit you can't get a passport until you are home in the UK. It literally says in black and white that I'm covered, but they say it doesn't mean what it says! Disgusting behaviour

Date of experience : 29 February 2024

Tried getting a quote for contents…

Tried getting a quote for contents insurance and was told they can't give me a quote for home insurance. Absolute morons! Didn't even realize you had a 1-star rating, or I wouldn't have bothered wasting my time. Here's another bad review to add to your collection of time wasters.

Date of experience : 15 February 2024

DO NOT USE POST OFFICE TRAVEL INSURANCE…

DO NOT USE POST OFFICE TRAVEL INSURANCE (Collinson Insurance Services Limited) The other reviews here are true. THEY HAVE NO INTENTION OF PAYING ANY CLAIMS. SHAME ON THE POST OFFICE FOR USING THEM I had a lost money claim go through and they ask every time for different documents to try and make you give up THEY THINK THAT SENDING 2 STATEMENTS FROM 2 DIFFERENT UK HIGH STREET BANKS IS NOT OK AS PROOF OF ADDRESS!! Now they ask for CELL PHONE BILL (note the use of cell rather than mobile) BECAUSE THEY WORK FROM NIGERIA OFFICES!!! the other reviewer did his homework as I did, it's true sadly. My claim is now 3 months old, continually sending more and more documents to try and prove irrelevant things not even pertaining to the claim. PLEASE SEARCH FOR COLLINSON TRAVEL INSURANCE REVIEWS for more information IF YOU ARE TAKING OUT TRAVEL INSURANCE FOR PEACE OF MIND, DON'T USE POST OFFICE TRAVEL INSURANCE

Date of experience : 22 February 2024

One star is too much !

One star is too much !! From day one of claiming for a cancelled holiday a complete nightmare. Took weeks to reply to emails and months to coming to a decision to not pay out. To calling a me liar for circumstances of holiday cancellation out of my control. Don't touch the post office for insurance with a barge pole.

Date of experience : 14 February 2024

£150 on card became £135 on first day

The app would not load on my mobile so I went back to the post office. The clerk authorised it by telephone instead. Still no app. The receipt said £150.28 put on the card. I went to a cash machine to check the balance (not to draw cash) and the balance said £135 and a few pence. So £15 disappears immediately on purchase. Why did I buy this? I have not worked out all the rates and charges but I certainly hope I get better value abroad than UK. I won't be doing this again.

I’m in the process of trying to sort…

I’m in the process of trying to sort out a claim with the post office/ Collinsons (based at Haywards Heath) this is the worst travel insurance provider you could go with. Please do not waste your time, effort and money like I did. This is a genuine experience. Kind regards Tyrone Williams

Date of experience : 24 January 2024

Don't have time for people this stupid

Just another travel insurance company that is happy to take your money until you need to make a claim. Continual delay tactics in the hope you'll eventually go away. Four emails regarding questions that had already been answered, They don't understand how to open a PDF. Post gets lost, then won't accept photographs of documents. Perfectly readable scans of docs provided which they now say are too small. Think you're getting somewhere and they then wait a couple of weeks to request additional documents. Several weeks, no progress, £1200 out of pocket and they have the nerve to ask if 'we'd like to renew our policy with them'

Date of experience : 05 January 2024

Had to cancel cruise.

On doctors advice we had to cancel our cruise the day before we were due to leave. I rang the post office travel insurance with my policy details. I was told exactly what paperwork they would need. I sent these by email. I wasn't expecting much to happen as it was nearing Christmas. I was kept informed of the progress. I was happy to have a positive result in 4 weeks.

Date of experience : 08 December 2023

SCAM do not use Post Office Travel Insurance…

SCAM do not use Post Office Travel Insurance, this is underwritten by Collinson Travel Insurance who run their company from Nigeria. They have no intention of paying any claims, and make it very difficult for you. The claim website has specific drop down sections and if what you want to claim is not there then that’s it. Also after spending hours inputting claim, the errors appear and you lose the lot. They make sure that anything you claim for is not covered under your policy, even a cancelled flight. You cannot contact them on the phone. I lost £400. Really an utter waste of money, post office cannot be trusted either. You have been warned. Martin Lewis has been informed.

Date of experience : 09 February 2024

Is this your company?

Claim your profile to access Trustpilot’s free business tools and connect with customers.

U.k. Post Office Travel Money & Money Transfer Review: What Are the Rates? How Does It Work? Is It the Best Deal?

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Is UK Post Office the best option for sending money abroad? Compare your options to make sure you get the best exchange rate and lowest fees for your transfer.

What Monito Likes About UK Post Office

- Wide availability across the U.K.

- Variety of services including online and local travel money, wire transfers and travel cards

- Post Office Travel Money services are safe, secure and regulated

What Monito Dislikes About UK Post Office

- Exchange rates are more expensive than the base exchange rate or exchange rates from other providers

- Local bureau de change rates can be more expensive still and you can only get quotes on these rates when you visit or contact a Post Office Travel Money location

Compare UK Post Office to Cheaper Money Transfer Alternatives

Our independent review of post office travel money.

The UK Post office provides several convenient travel money services including foreign currency exchange, online ordering, a travel money card and international transfers to foreign bank accounts.

Post Office Travel Money provides services from more than 11,000 locations across the U.K. Post Office locations are often open for long hours, and around 3,000 branches are open every day. The Post Office offers money conversion services into 80 foreign currencies.

Local Bureau de Change Services From Post Office Travel Money

You can buy and sell travel money directly at a Post Office location using the exchange rate for that Post Office location. These local exchange rates will differ from the Post Office online exchange rates and can be more expensive than from a specialist online currency exchange provider. The Post Office does not provide local exchange rates online although you may be able to get a local exchange rate by calling a specific location. There is no minimum order amount when exchanging money in a Post Office branch.

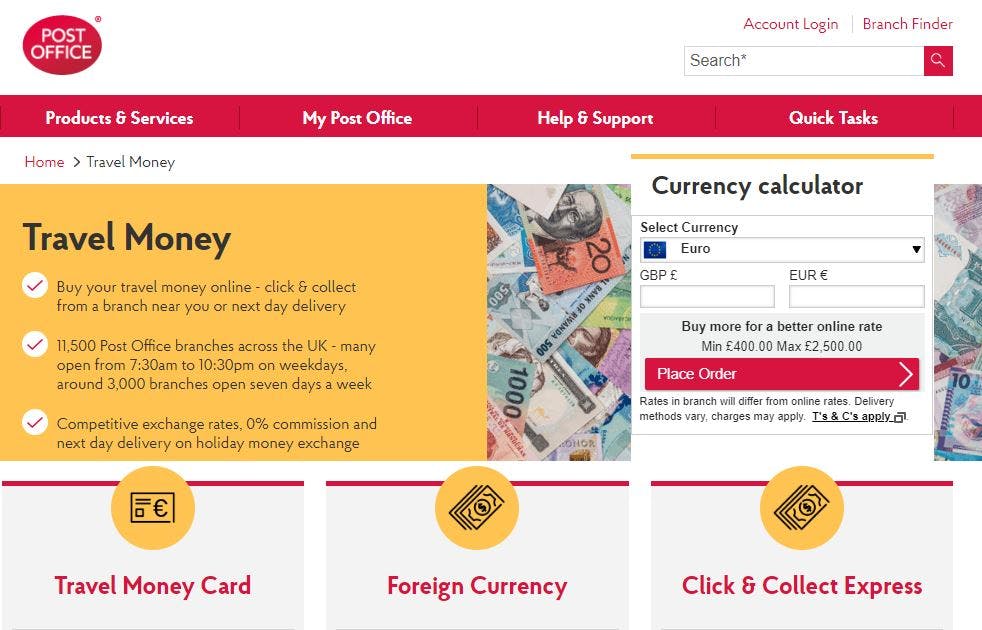

Online Foreign Currency Services From Post Office Travel Money

You can order your foreign currency online and have it delivered to your home or pick it up from a Post Office location. If you order before 3 PM U.K. time, you will get your money on the next working day. You can get better online exchange rates if you convert larger amounts of money—there’s a minimum value of £400 and a maximum value of £2,500. If you order euros or U.S. dollars, the Post Office Click and Collect Express service means you can pick up your currency from a Post Office branch two hours after you place the order.

Bank Account Wire and Money Transfer Services From Post Office Travel Money

You can send money overseas directly to a foreign bank account by using the Post Office International Payments service. Their wire transfer services are provided by Western Union, which means the beneficiary can choose to pick up money at a Western Union agent location in their own country or have the money transferred into their bank account. Please see our Western Union review for examples of exchange rates, fees and other important information.

Post Office Travel Money Money Card

Post Office Travel Money provides a prepaid Mastercard travel card that you can use to spend money overseas. You can load up to 23 currencies onto the card and use it wherever you see the Mastercard logo. You can manage your travel card through the Post Office Travel mobile app and should activate your card before you leave the U.K. The card is Chip and PIN enabled and also allows contactless payments.

The travel card allows you to load money in the following currencies: Euro (EUR), US Dollar (USD), Australian Dollar (AUD), Canadian Dollar (CAD), Croatian Kuna (HRK), New Zealand Dollar (NZD), Polish Zloty (PLN), Pound Sterling (GBP), South African Rand (ZAR), Swiss Franc (CHF), Thai Baht (THB), Turkish Lira (TRY), UAE Dirham (AED), Czech Koruna (CZK), Japanese Yen (JPY), Hungarian Forint (HUF), Norwegian Krone (NOK), Danish Kroner (DKK), Swedish Kronor (SEK), Chinese Yuan (CNY), Hong Kong Dollar (HKD), Saudi Riyal (SAR) and Singapore Dollar (SGD).

UK Post OfficeFees & Exchange Rates

Post Office Travel Money does charge fees for some specific services, like certain activities on their travel card. In most cases, they make their money on the difference between the “base,” interbank* exchange rate and the exchange rate that they charge to you.

*The interbank rate is also known as the mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

Post Office Travel Money Card Fees

Post Office Travel Money charges fees for some services offered through its prepaid money card. The fees we’ve shown below are for cards issued in the U.K. You can find fees for other countries on the Post Office Travel Money website.

- There is a fee of two euros or equivalent to withdraw cash using the card through an ATM or at a physical location

- If your card expires, Post Office Travel Money charges an inactivity fee of £2 per month after 12 months

- A three percent additional charge applies if you use your card to pay in a different currency than the 23 available on the travel card

- If you load U.K pounds onto the card there is a commission of 1.5 percent (min £3, max £50)

Post Office Travel Money Card Limits

Post Office Travel Money does have limits for its prepaid money card.

- You can load between £50 and £5,000 onto the card after you have passed an address verification check

- The maximum amount you can have on your card is £10,000 and you can’t load more than £30,000 in a 12-month period

- The maximum amount you can withdraw in a single transaction is 450 euros or equivalent

Post Office Travel Money Online Fees

If you order online and arrange for the foreign currency to be delivered to your home, there is a delivery fee of £4.99 if you order less than £500, but there is no delivery fee if you order more than that.

The Post Office does state that additional charges may sometimes apply when ordering online, but they do not provide information on how much those charges may be. Here’s what they say on the website, “Any fees relating to commissions, card issuer, or delivery will be displayed during the order process. Please note that your credit card provider may charge a cash advance fee for buying Travel Money. When you place your order you will be given the option to select a preferred delivery date/time. Any additional charges that may be applicable, for example ordering for home delivery on a Saturday, or for home delivery orders under £500, the system will display the fee charged.”

Overseas Money Transfer via Western Union

Post Office Travel Money provides overseas transfers through a partnership with Western Union. Please see our Western Union review .

About Fees Levied by Banks

Certain fees may be levied by banks when you are transferring money to another account. These fees are outside the control of Post Office Travel Money. Circumstances, where banks may charge additional fees, include:

- Wire transfers into or out of sender or beneficiary accounts

- Transfers that are sent via SWIFT or certain other banking protocols

- Beneficiary banks charging a fee to receive a transfer

- Intermediary banks charging fees to process money in transit

These fees could mean that the beneficiary receives less money than stated by Post Office Travel Money due to circumstances beyond Post Office Travel Money’s control. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank.

Post Office Travel Money Exchange Rates for Online Travel Money

Post Office Travel Money offers online currency exchange services and makes money on the difference between the exchange rate they offer to customers and the base exchange rate. For example, the base rate to convert U.K pounds into U.S. dollars is 1.23 dollars per pound. Post Office Travel Money offers an exchange rate of 1.181 USD per pound if you’re exchanging £400. That’s a difference of four percent, or £16.

Note that the more money you exchange, the better the exchange rate. Here are some other examples:

Exchanging 400 U.K. Pounds Into Euros

- Base exchange rate, 400 GBP converts to 449 EUR

- Post Office Travel Money exchange rate, 400 GBP converts to 432 EUR

- The Post Office Travel Money exchange rate is 3.8 percent more expensive, or around 15 GBP in exchange rate fees

Exchanging 900 U.K. Pounds Into South African Rands

- Base exchange rate, 900 GBP converts to 16,922 ZAR

- Post Office Travel Money exchange rate, 900 GBP converts to 16,189 ZAR

- The Post Office Travel Money exchange rate is 4.3 percent more expensive, or around 39 GBP in exchange rate fees

Exchanging 1,400 U.K. Pounds Into Swedish Krona

- Base exchange rate, 1,400 GBP converts to 17,003 SEK

- Post Office Travel Money exchange rate, 1,400 GBP converts to 16,145 SEK

- The Post Office Travel Money exchange rate is 5 percent more expensive, or around 70 GBP in exchange rate fees

Exchanging 2,000 U.K. Pounds Into Australian Dollars

- Base exchange rate, 2,000 GBP converts to 3,669 AUD

- Post Office Travel Money exchange rate, 2,000 GBP converts to 3,539 AUD

- The Post Office Travel Money exchange rate is 3.5 percent more expensive, or around 70 GBP in exchange rate fees

Exchanging 2,500 U.K. Pounds Into U.S. Dollars

- Base exchange rate, 2,500 GBP converts to 3,074 USD

- Post Office Travel Money exchange rate, 2,500 GBP converts to 3,012 USD

- The Post Office Travel Money exchange rate is 2 percent more expensive, or around 50 GBP in exchange rate fees

If you’re purchasing currency online or you want to transfer money to an overseas account, you can get better deals by comparing specialist currency exchange providers . Several money exchange services have overall fees of one percent or lower, even when taking into account differences in exchange rates.

All of the Post Office Travel Money exchange rates quoted in this section are based on their online rates for converting money for home delivery or store pickup. Local bureau de change rates may vary and are more expensive than what we quote here. All rates correct as of early October 2019.

Post Office Travel Money Exchange Rates for In-branch Travel Money

Here’s what the Post Office says about its in-branch exchange rates, “Branch exchange rates depend on several factors, eg., branch location, competition, cost of order, convenience, etc. We will always try and offer the best rate, subject to this criteria. As with many retailers, the cheapest order / distribution method is online, where centralised packing costs can be used. This is why online exchanges are invariably better than branch rates.”

Comparing Post Office Travel Money Rates To Other Providers

You can easily compare many money transfer services directly using our comparison tool . There are several new services that it’s worth comparing directly to Post Office Travel Money.

Modern, Mobile-Only Banks

There are several new, mobile-only banks that are becoming more widely available throughout the U.K. and Europe. Providers like N26 , Monese , Revolut , Monzo or Bunq provide a wide variety of financial services to the modern consumer. All of these modern banks provide international travel cards and international money transfer services, and it’s worth comparing them to Post Office Travel Money.

For example, Monzo provides international money transfers through TransferWise, a very popular and trusted currency exchange provider. If you compare sending 1,000 GBP to a Swedish bank account the recipient would get 12,103 SEK with Monzo / TransferWise compared to 11,546 with Western Union, a difference of around five percent or £50.

Specialist Currency Providers for Other Destinations

You may also be able to get a better deal for money transfers when you’re sending money to certain countries. For example, if you’re sending 500 GBP to Saudi Arabia, the beneficiary would get around 2,289 SAR with Xendpay , compared to 2,158 with Post Office Travel Money, a difference of around 5.3 percent or £26.

How Easy Is It To Send Money With UK Post Office

You can find Post Office Travel Money facilities at most Post Office branches and through their website. Their foreign exchange services are quick and convenient. Their wide availability makes them useful for local currency exchanges, although the fees can be high. International money transfers and travel card services from the Post Office provide a range of additional options if you want to send or spend overseas.

Credibility and Security

You can trust the Post Office to provide a safe and secure exchange of foreign currency. Post Office Travel Money offers currency exchange through First Rate Exchange Services Ltd. First Rate Exchange Services Ltd has a Money Service Business licence No.12133160.

Customer Satisfaction

Unfortunately, the Post Office does not score well for customer satisfaction on Trustpilot, achieving a score of just 1.5 out of 5* across 700 reviews. Ninety percent of the reviews said that they were “poor” or “bad” compared to nine percent of reviews that said they were “excellent” or “great.”

*The scores we show here are for the Post Office overall, not specifically for travel money.

There were not many positive reviews of the Post Office Travel Money service, however, some did praise the Travel Money card with reviews like this, “Really easy opening of the Travel money card at the counter, with great face to face friendly service. Next day activation of the card was smooth and excellent telephone customer care service was friendly and helpful. Giving their names and added extra attention by offering to help with 'anything else we can be of service.'”

Issues raised by reviewers that are specific to Post Office Travel Money include unreasonable conversion rates on the travel money card, poor top-up rates, differences between branch and online exchange rates and difficulties with customer service. Here’s a quote from a review about their in-branch exchange rates, “avoid their travel money service like the plague, purchased currency, then checked after only to find I've been levied over 8%, in the exchange rate, they have totally ripped me off, explained to counter clerk wasn't needing money for 2 weeks, but no mention of a better rate, they’ve ripped me off to the tune of 40 pounds more than I could have paid.”

Post Office Travel Money Mobile Applications

Post Office Travel Money provides a mobile app for both iOS and Android devices. The app allows you to:

- Manage your account

- Top up your travel money card

- Check your balance

- Move money between currencies

- Freeze your card

How Post Office Travel Money Works

Post Office Travel Money services work in slightly different ways, depending on what you want to do.

To request currency online you will need to sign up for an account, provide some identification, let them know the currency you need and provide payment.

To request currency locally you will need to visit a Post Office Travel Money location.

To get a Post Office Travel Money card you can sign up online or visit a Post Office location bringing your passport or a U.K. driving license.

If you want to send money overseas to another bank account you will need to:

- Setup an account through the Post Office partnership with Western Union—they will need your name, address, contact details, bank details, and proof of identification.

- Decide the currencies that you want to exchange money between.

- Book a rate through the website.

- Provide details of the sender and receiver of the funds.

- Pay for the transfer.

- Western Union converts the money and deposits it in the beneficiary’s bank account or they may be able to pick it up at an agent location.