An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Card/Account Holders and Approving Officials Travel Training

Lesson 1: Travel Program Overview

What is the gsa smartpay® program.

Established in 1998, the GSA SmartPay program is the world’s largest government charge card and commercial payment solutions program, providing services to more than 250 federal agencies/organizations and Native American tribal governments with 6.5 million total accounts. GSA SmartPay payment solutions enable authorized government employees to make purchases on behalf of the federal government in support of their agency’s mission. The GSA SmartPay program includes the following business lines:

- GSA SmartPay Purchase.

- GSA SmartPay Travel.

- GSA SmartPay Fleet.

- GSA SmartPay Tax Advantage Travel.

- GSA SmartPay Integrated.

Through the Master Contract with multiple banks, the GSA SmartPay program enables agencies/organizations across the federal government to obtain payment solutions to support mission needs. The Master Contract, administered by GSA, is a fixed price, indefinite delivery, indefinite quantity (IDIQ) contract. The maximum base period for the initial order is four years with three, three-year options.

Agencies/organizations issue a task order under the GSA SmartPay 3 Master Contract to one of the GSA SmartPay contractor banks – Citibank or U.S. Bank. Then, the awarded bank provides payment solutions to the agency.

Through the task order, your agency/organization program coordinator (A/OPC) sets up accounts for the card/account holders, manages the accounts using the bank’s Electronic Access System (EAS), and resolves issues or questions by working directly with a bank representative.

Specific to travel, the GSA SmartPay program provides card/account holders with a means to pay for all travel and travel-related expenses. Additionally, the GSA SmartPay program is the primary mechanism used to purchase airline, rail, and bus tickets at significantly reduced fares under the GSA City Pair Program (CPP) .

What are the benefits to using the GSA SmartPay Master Contract for obtaining payment services?

The GSA SmartPay program has continued to grow through increased adoption as agencies/organizations realize benefits afforded under the program.

Utilizing the GSA SmartPay Master Contract means:

- A faster contract acquisition process and reduced risk of protest, as compared with a full and open competitive procurement.

- Favorable negotiating platform and contract terms.

- Awards to contractor banks based on a competitive bidding process.

- Established relationships with contractor banks.

- A broad range of flexible products and services for agencies/organizations as well as the flexibility to add products and services.

- Ongoing support for your agency/organization.

What are some of the overall benefits to using the GSA SmartPay program?

Agency refunds.

Agencies have the opportunity to earn refunds based on the dollar volume of transactions and the speed of payment.

Safety and Transparency

The GSA SmartPay program provides secure solutions for efficient payment transactions. Customers also have access to tools that provide increased transparency to spend and performance data.

Electronic Access to Data

Through the GSA SmartPay contractor bank’s electronic access system (EAS), account managers and card/account holders have immediate access to complete transaction-level data, helping to mitigate fraud, waste and abuse.

Worldwide Acceptance

Through the use of commercial payment infrastructure, customers are able to use GSA SmartPay solutions anywhere in the world where merchants accept cards.

Identification for Discount Programs

GSA SmartPay solutions provide automatic point-of-sale recognition for many GSA discount programs, including Federal Strategic Sourcing Initiative (FSSI), the GSA City Pair Program (CPP) and more.

Other Benefits

GSA SmartPay payment solutions provide other less tangible benefits including travel insurance and eliminating the need for imprest funds or petty cash at the agency.

Why does the U.S. Government have a travel payment solutions program?

The Travel and Transportation Reform Act of 1998 (Public Law 105-264) [PDF, 9 pages] mandates that federal government card/account holders use the travel card/account for official government travel expenses. Additionally, the Federal Travel Regulation (FTR) mandates use of the travel card/account in almost all cases (see FTR Subpart H §301-70.700 for exemptions ). The travel card/account allows individual card/account holders to pay for travel expenses and receive cash advances. In many instances, use of the travel/card account eliminated the need for agencies to issue travel cash advances. Government card/account usage provides streamlined, best-practice processes that are consistent with private industry standards.

What are some types of GSA SmartPay Travel cards/accounts?

Individually billed accounts (ibas).

- Most common travel card/account.

- Issued to an employee designated by the agency/organization in the employee’s name.

- Used to pay for official travel and travel-related expenses.

- Only issued to federal employees or employees of tribes or tribal organizations.

- May be used for local travel only if authorized by written policy of the agency/organization.

- Agencies/organizations reimburse employees only for authorized and allowable expenses.

- Card/account holders are directly responsible for all purchases charged to the IBA account.

- Payment may be made directly by the card/account holder, agency/organization or in the form of a split disbursement in accordance with agency/organization policy.

Centrally Billed Accounts (CBAs)

- Established by the bank at the request of the agency/organization to pay for official travel charges and official travel-related expenses.

- Generally used to purchase common carrier transportation tickets for employee official travel through third-party arrangements, such as the GSA E-Gov Travel Service (ETS) for civilian agencies, the Defense Travel System (DTS) for the Department of Defense or permissible equivalent travel system.

- Agencies/organizations may also make purchases through their Travel Management Centers (TMCs), commercial travel offices and through other government contracts.

- Agency is directly billed and is liable for making the payment.

- Payment is made directly to the bank by the government.

Tax Advantage Travel Accounts

- Used to pay for travel and travel-related expenses.

- Combines IBA and CBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses.

- Charges for rental cars and lodging will be automatically billed to a CBA for payment, taking advantage of the government’s CBA tax exemption status for those types of accounts.

- Charges for other travel-related purchases, such as meals and incidentals, are billed to the IBA portion of the account and will still incur tax. The individual traveler will still be liable for payment to the bank for those charges.

How do I recognize GSA SmartPay Travel cards/accounts?

Typically, travel cards have one of these designs:

Please note that card designs may vary.

GSA SmartPay Travel cards/accounts use the following prefixes:

For the travel business line only, the sixth digit will identify whether the account is a CBA or IBA.

Why is it important to understand your travel card/account type?

Tax exemption and liability differ depending on the travel card/account type.

Tax exemption considerations

- All GSA SmartPay CBAs should be exempt from state taxes.

- Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states.

- Card/account holders should review and understand the state tax policy for the state where you will be traveling to and should make sure to have all necessary forms before traveling.

Liability considerations

Iba accounts.

- Liability for charges on the IBA rests with the individual card/account holder, not with the agency/organization.

- If the card/account holder fails to pay his/her account on a timely basis, the bank may suspend or cancel the account and assess late charges and fees.

- If the bank cancels an account due to delinquency, the bank may report that information to credit bureaus and the information will appear on the card/account holder’s personal credit report.

- The bank can pursue debt collection to obtain repayment of the charges.

- The agency/organization is never responsible or legally liable for the account.

CBA Accounts

- Liability for charges on the CBA rests with the agency/organization, not with the individual card/account holder.

- Because the account is a combination of both CBA and IBA, the liability will be determined by the type of purchase.

- If it is a CBA purchase, the liability rests with the government.

- If it is an IBA purchase, the liability rests with the card/account holder.

How would someone check tax exemption status?

Here is a typical example of how to check tax exemption status:

- Jo is planning an official government trip to the GSA SmartPay Training Forum in Orlando, Florida.

- During the planning stages for the trip, she checks the GSA SmartPay website to find out more information about tax exemption in Florida.

- Jo learns that IBA travel cards/accounts are tax exempt in Florida. In addition, while no form is required, Florida does allow hotels to require a “Certificate of Exemption”. She also saved the Florida Department of Revenue’s phone number in case any questions came up during her trip.

- Jo confirms that she has a GSA SmartPay IBA travel card/account – the first four digits are “4486” and the 6th digit is a “4”.

- Jo books the hotel room and follows up with a call to verify that the hotel is compliant with the state’s tax exemption policy. If not, she’s given herself plenty of time to find another hotel that does comply.

training.smartpay.gsa.gov

An official website of the General Services Administration

Do you want to install app?

Add a shortcut to your home screen: Share button at the bottom of the browser. Scroll left (if needed) to find the Add to Home Screen button.

Travel Bank Credits

Got some JetBlue travel credits? It’s easy to view your current balance, expiration dates and transaction history—and use your credits for a new booking. Just create/log in to your travel credit or TrueBlue account to get started.

- Travel Bank 101

What can travel credits be used for?

How to access and link travel credits, how to use travel credits, using multiple travel bank accounts, helpful videos, how to use jetblue vacations credits, terms and conditions travel bank 101.

Your JetBlue Travel Bank is an online account (or bank) where you can access and manage any JetBlue travel credits you’ve received. Think of it like a payment wallet that you can choose to use on jetblue.com or the JetBlue app.

- Your Travel Bank account is created automatically the first time you’re issued a travel credit, and your login info is sent to you in two separate welcome emails.

- The link in the password creation email expires after 48 hours. If you haven’t received or can’t locate these emails, you can request your login ID and/or reset your password with our online login look-up form.

- You’ll need to use your login ID and password every time you want to view or use your Travel Bank account.

Travel credits can be used to book a reservation for anyone you’d like. The name on the account doesn't need to match the name of the traveler.

JetBlue travel credits can be applied to:

- Airfare and taxes on JetBlue-operated flights booked through jetblue.com.

- The air portion of a JetBlue Vacations package.

- Blue Basic fares booked or exchanged on or after Mar 18 2024 cannot be changed but may be cancelled.

Travel credits cannot be applied to:

- Checked bags

- Same-day switches

- Taxes for Move to Mint certificates (Mosaic 3 and Mosaic 4)

- Seat selection for Blue Basic or other seat fees

- Even More® Space

- Core (preferred) seats

- Priority security

- Unaccompanied minor fee

- Service fees (including phone and GDS bookings and changes), etc.

- Bookings on partner airlines

- Non-air portion of a JetBlue Vacations package

- Online travel sites other than jetblue.com or the JetBlue app

Access Travel Bank without a TrueBlue account

- For your security, the first email contains your login ID, and the second email contains your password.

- Create your Travel Bank password.

- Save your Travel Bank account details somewhere safe for future use.

- You now have full access to Travel Bank.

Access Travel Bank with a linked TrueBlue account

- Log in to your TrueBlue account.

- Click your initials or picture in the top right corner. Your total travel credit amount will be displayed in the dropdown menu.

- If you would like to review your Travel Bank statement, select Travel Bank Credit from the dropdown menu. You should be automatically logged into your Travel Bank account to view your Travel Bank statement.

- Any travel credits issued to you should be visible when you log in to your TrueBlue account. If you don’t see them, your TrueBlue account and your Travel Bank account might not be linked.

- Expired travel credits will not display in your TrueBlue dropdown.

Not receiving Travel Bank emails? Contact us

How to use travel credits while booking:

- If you have a TrueBlue account linked to your Travel Bank account, log in before you begin to book your trip. You also have the option to sign in during the booking process.

- If your Travel Bank is not linked to your TrueBlue account, or you are not logged in, you will have the option to log into your Travel Bank account on the payment screen while booking.

Need to use travel credits in Manage Trips?

- If you don’t have a Travel Bank account, select create a new account in Manage Trips.

- If you have an existing Travel Bank account that is not attached to a TrueBlue account, log into your Travel Bank account on the Manage Trips payment page.

- If you have an existing Travel Bank account that is attached to your TrueBlue account, log into your TrueBlue account and your Travel Bank Credits will auto-populate.

Where is my travel credit?

Credit expirations and open tickets.

Locate Travel Bank Info with TrueBlue

Find Your Travel Bank Credentials

Reset Your Travel Bank Password

How to Use Your Travel Bank Credit

If you’ve received a JetBlue Vacations credit, it’s important to know how it’s different than a JetBlue travel credit. While both can be used to book your next JetBlue adventure, here are the key differences:

- Can be applied toward any portion of a JetBlue Vacations package.

- Can't be viewed or managed in your Travel Bank account.

- Can’t be applied online—it must be redeemed by calling JetBlue Vacations at 1-844-JB-VACAY (1-844-528-2229). Provide them with your confirmation code and the last four digits of the credit card used on the original JetBlue Vacations reservation.

- Can be applied toward JetBlue-operated flights or the flight portion of a JetBlue Vacations package.

- Can be viewed or managed in your Travel Bank account.

- Can be applied online by choosing Travel Bank on the Payment screen.

Was this page helpful?

Get To Know Us

- Our Company

- Partner Airlines

- Travel Agents

- Sponsorships

- Web Accessibility

- Contract of Carriage

- Canada Accessibility Plan

- Tarmac Delay Plan

- Customer Service Plan

- Human Trafficking

- Optional Services and Fees

JetBlue In Action

- JetBlue for Good

- Sustainability

- Diversity, Equity & Inclusion

Stay Connected

- Download the JetBlue mobile app

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

A traveler’s guide to the Chase Travel portal

Tamara Aydinyan

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:23 p.m. UTC Nov. 28, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

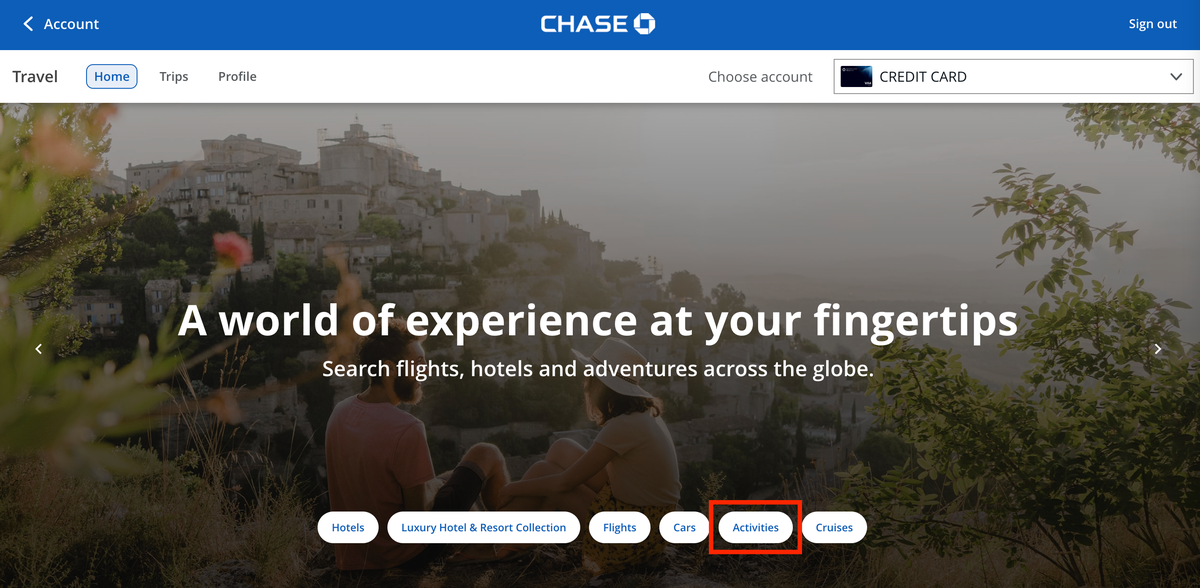

For qualifying Chase cardholders, the easy-to-use Chase Travel℠ portal offers a flexible and convenient way to book hotels, flights, rental cars, cruises and more using points or a combination of points and cash.

What is the Chase travel portal?

A favorite among frequent travelers for its versatility and redemption options, Chase Ultimate Rewards® (UR) is one of the major transferable credit card rewards points programs and UR points are Chase’s flexible rewards currency.

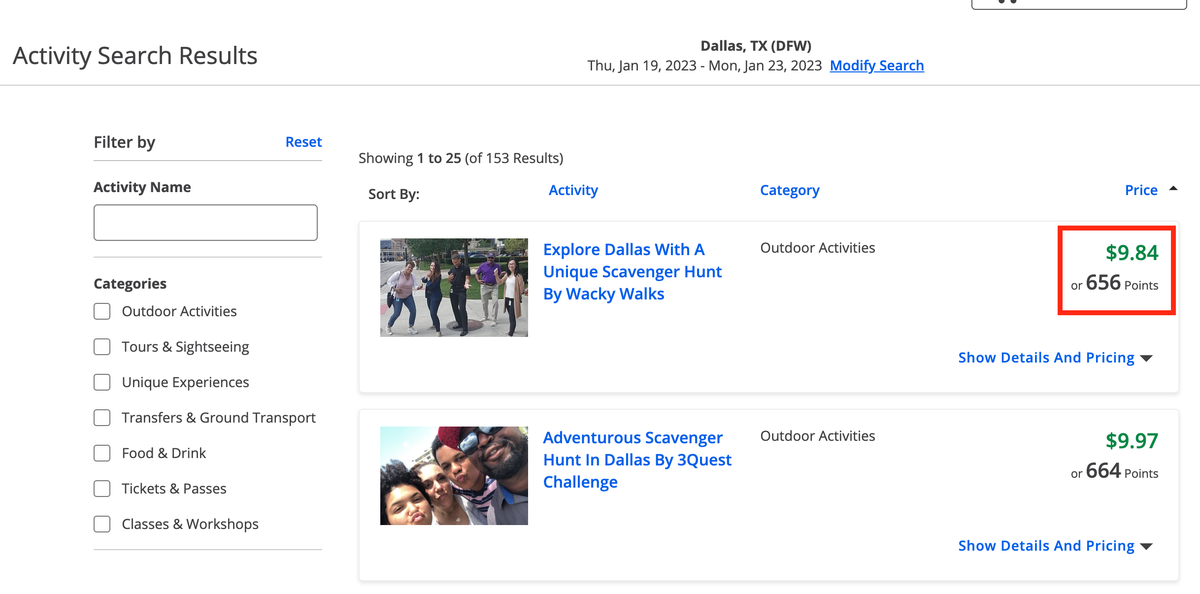

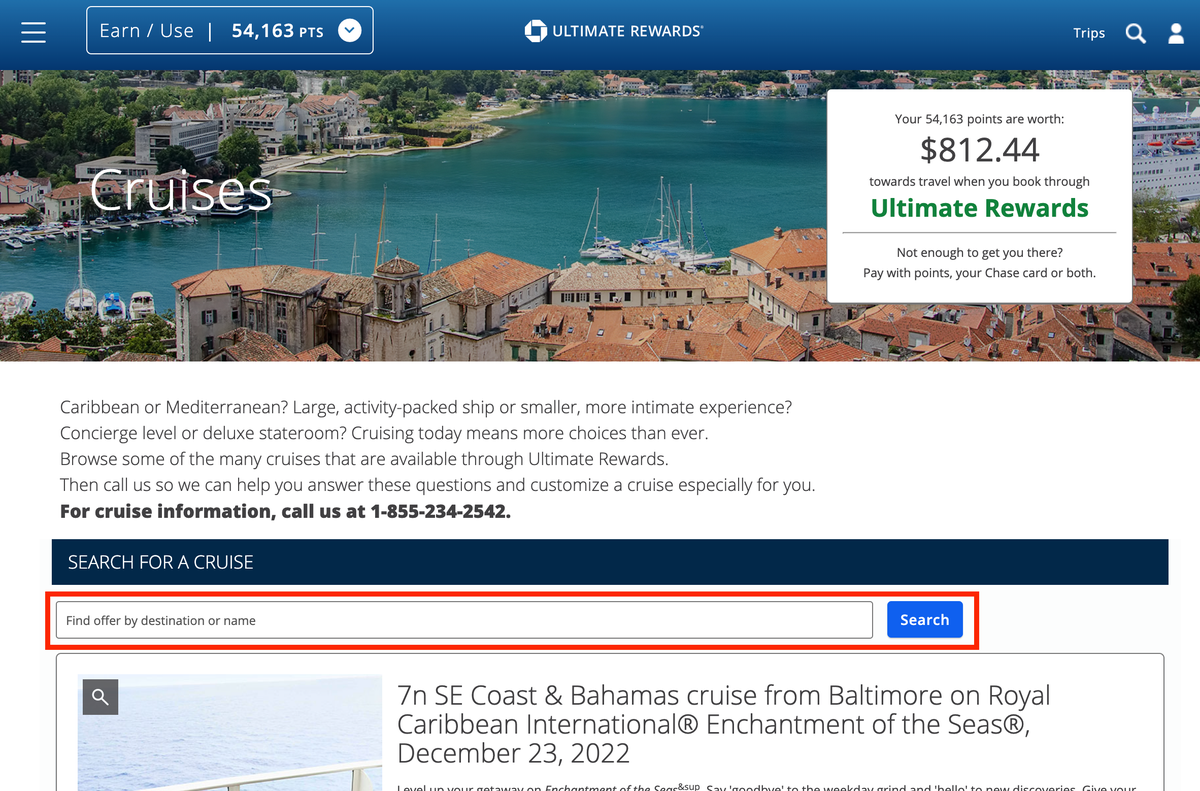

The Chase travel portal works much like an online travel agency (OTA) similar to Orbitz or Priceline where you can book hotels, flights, cars, activities and cruises. But unlike a traditional OTA, with the Chase travel portal you can book travel with your Chase card’s rewards points, cash or a combination of the two.

Who can use the portal?

A handful of exclusively Chase-issued credit cards grant cardholders access to the Chase travel portal, but how you can utilize the portal and the value you can receive is card-specific.

The following credit cards are the only cards that earn Chase Ultimate Rewards points outright:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

But if you or a household member own at least one of the cards above, the rewards on the following cash-back credit cards can be combined with any of the cards listed above and used as Chase Ultimate Rewards points:

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

And while the points earned cannot be combined with any of the UR-earning cards, the following pay-in-full card does have access to the Chase travel portal:

- Ink Business Premier℠ Credit Card * The information for the Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Is the portal worth using?

It’s often said that having the right travel credit card is important, but knowing how to redeem your miles and points can be as paramount as which card you use to earn them. However, not everybody has the patience or interest to learn the intricacies of different rewards programs to maximize the value of every mile and point.

So while transferring UR points to individual loyalty programs is still one of the best ways to get the most cents per point at a 1:1 basis, for those who value simplicity, the Chase travel portal offers a straightforward way to book travel, earn and redeem points and still receive a great deal. Best of all, you won’t be limited by any loyalty program or award space availability.

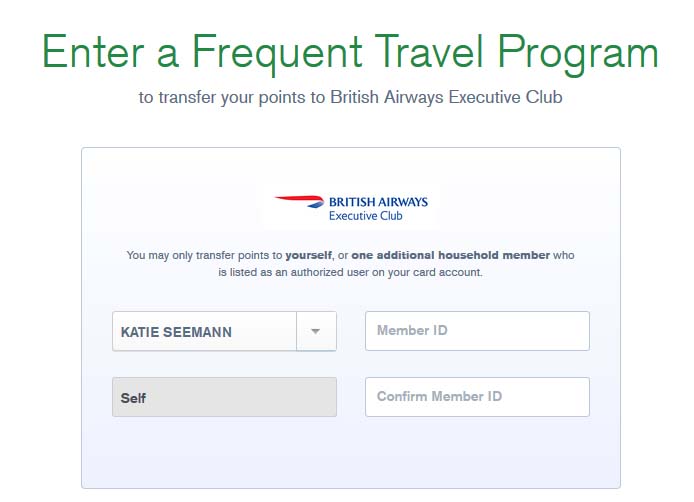

When transferring points, the minimum you can transfer is 1,000 points to the following UR travel partners with either the Chase Sapphire Reserve, Chase Sapphire Preferred or the Ink Business Preferred cards:

Regardless of how you’re using the Chase travel portal, it’s worth considering the pros and cons.

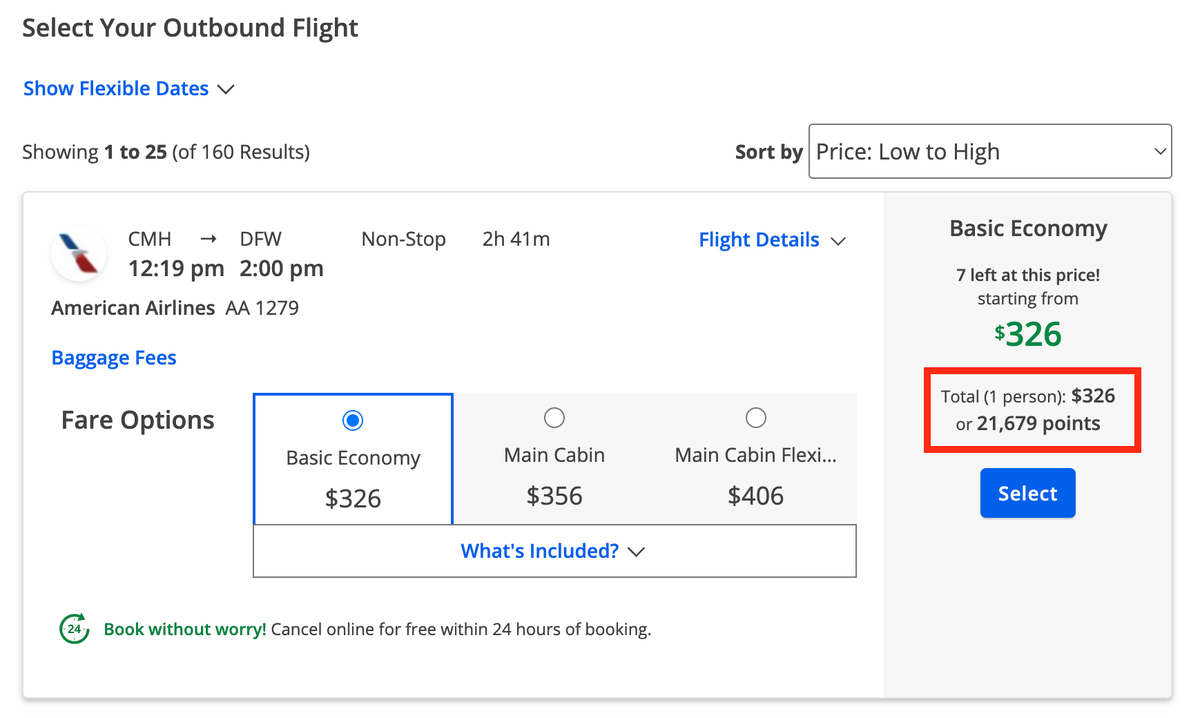

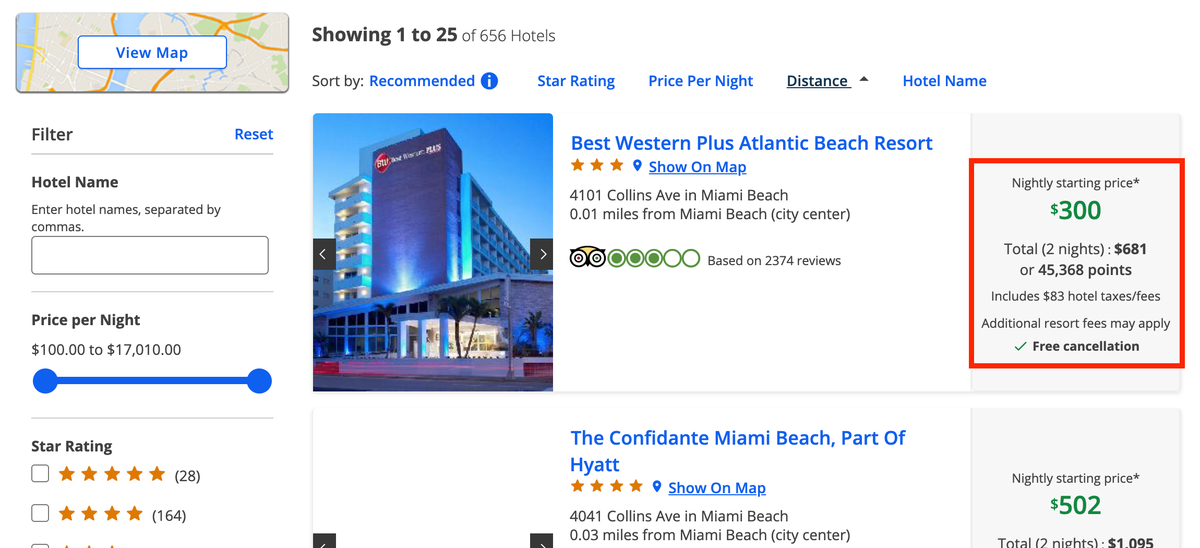

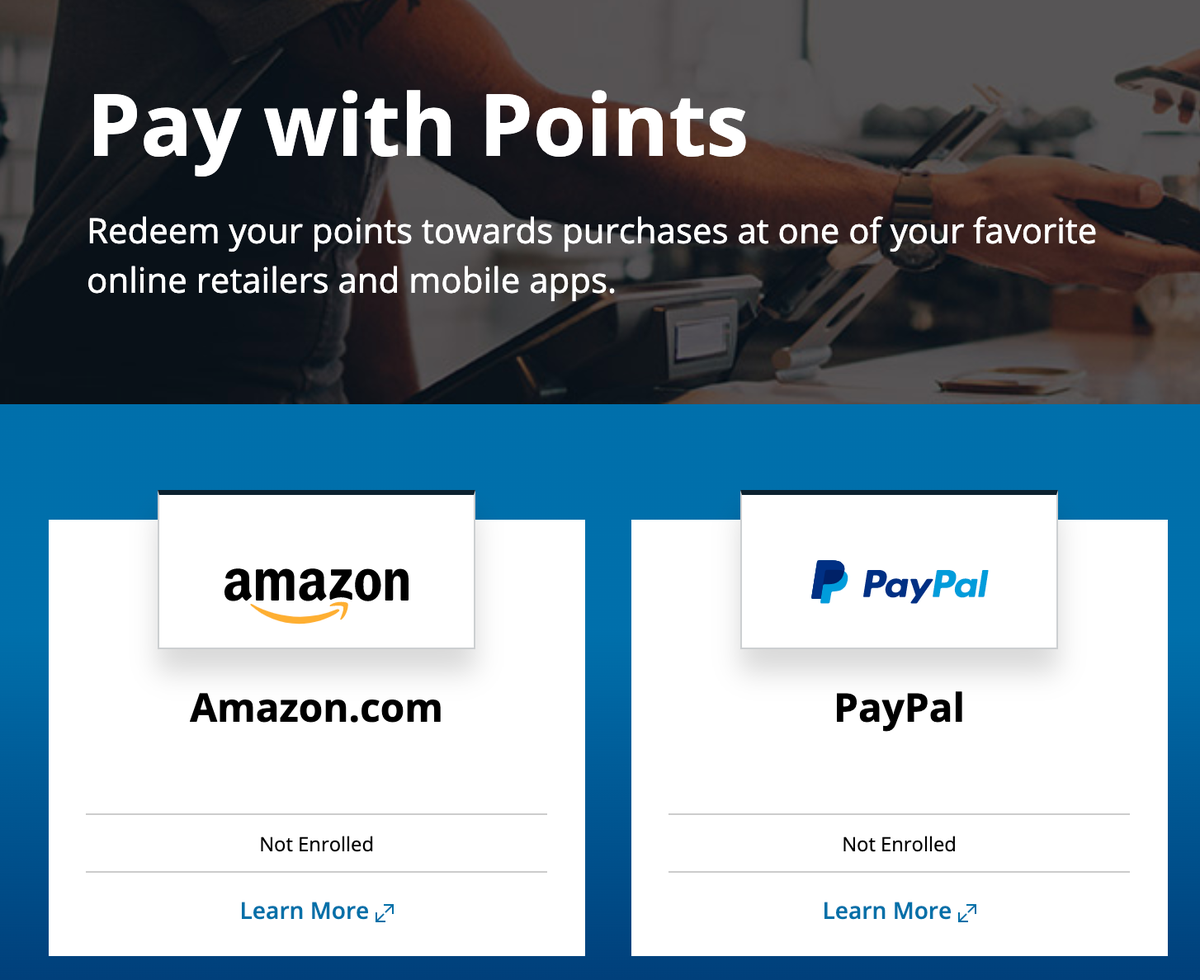

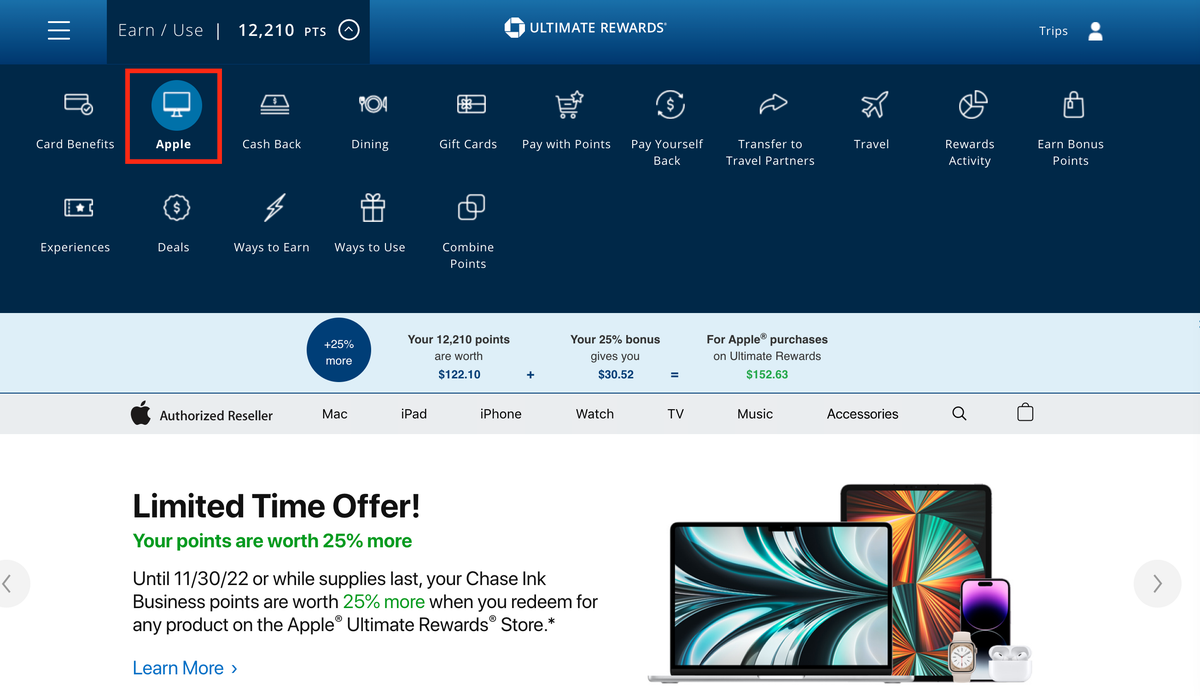

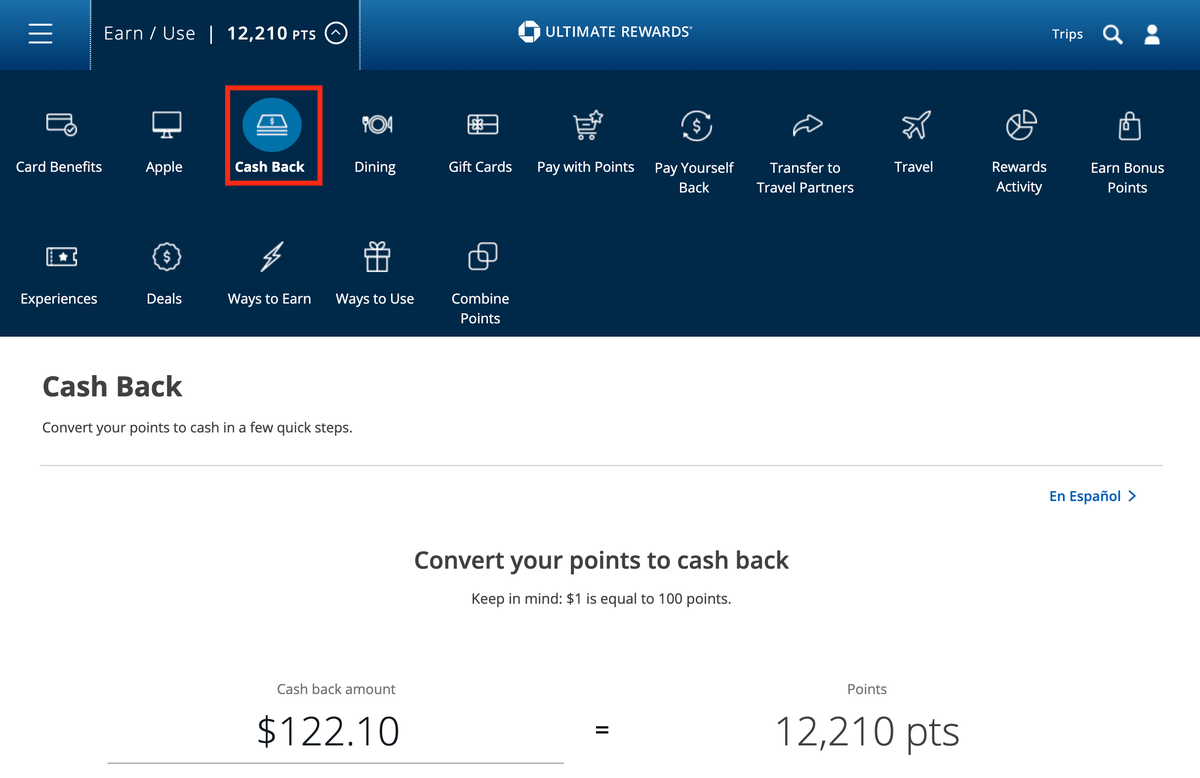

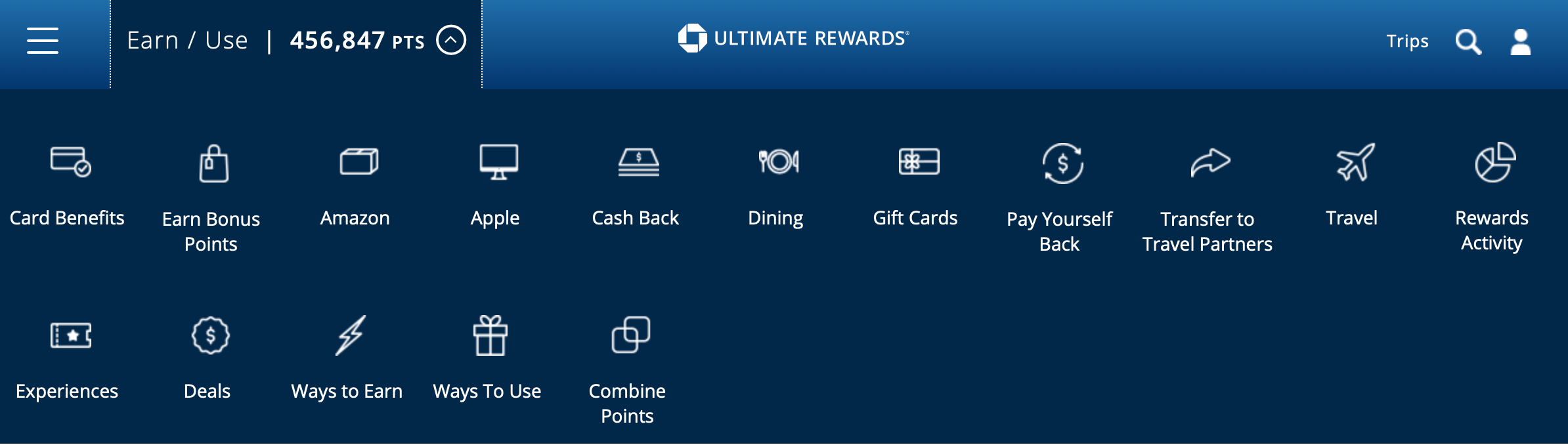

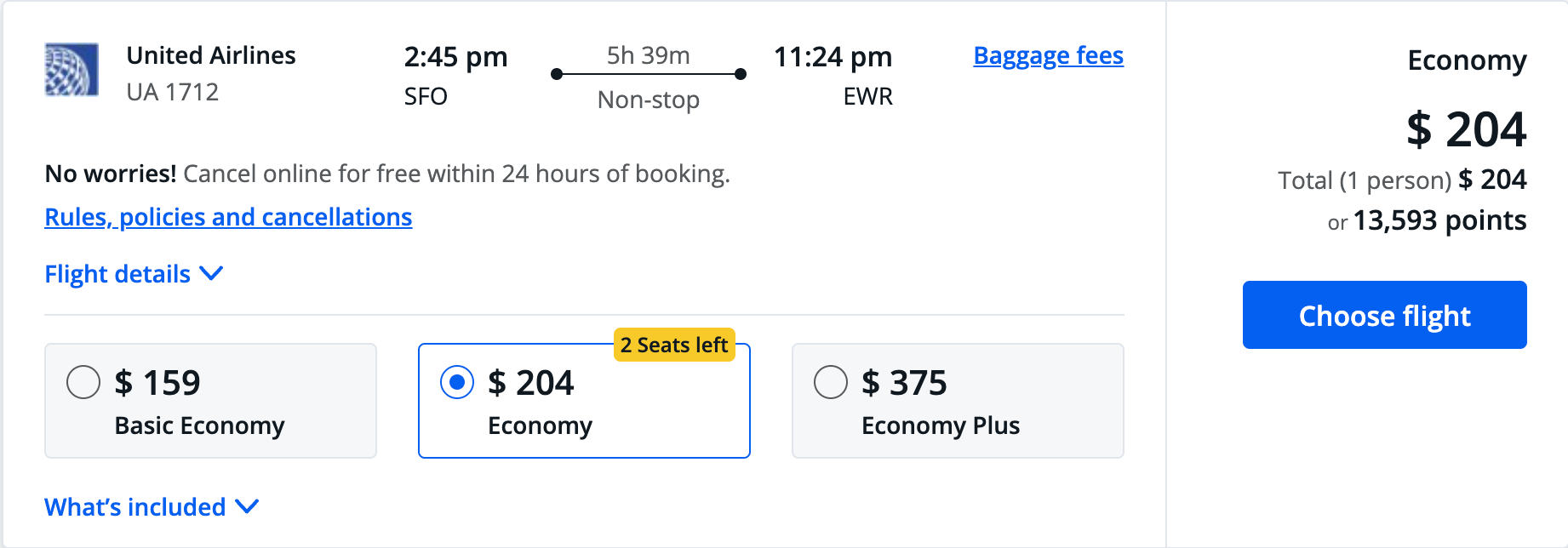

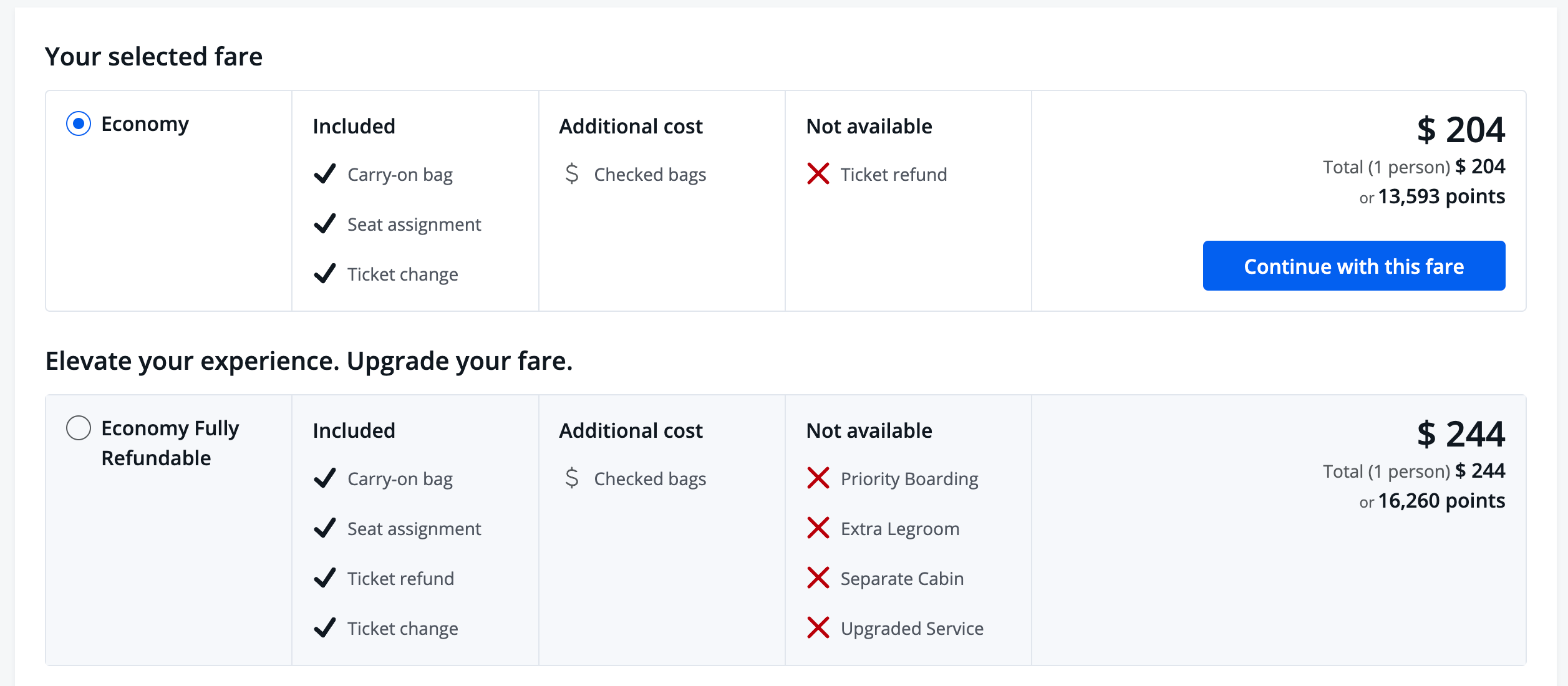

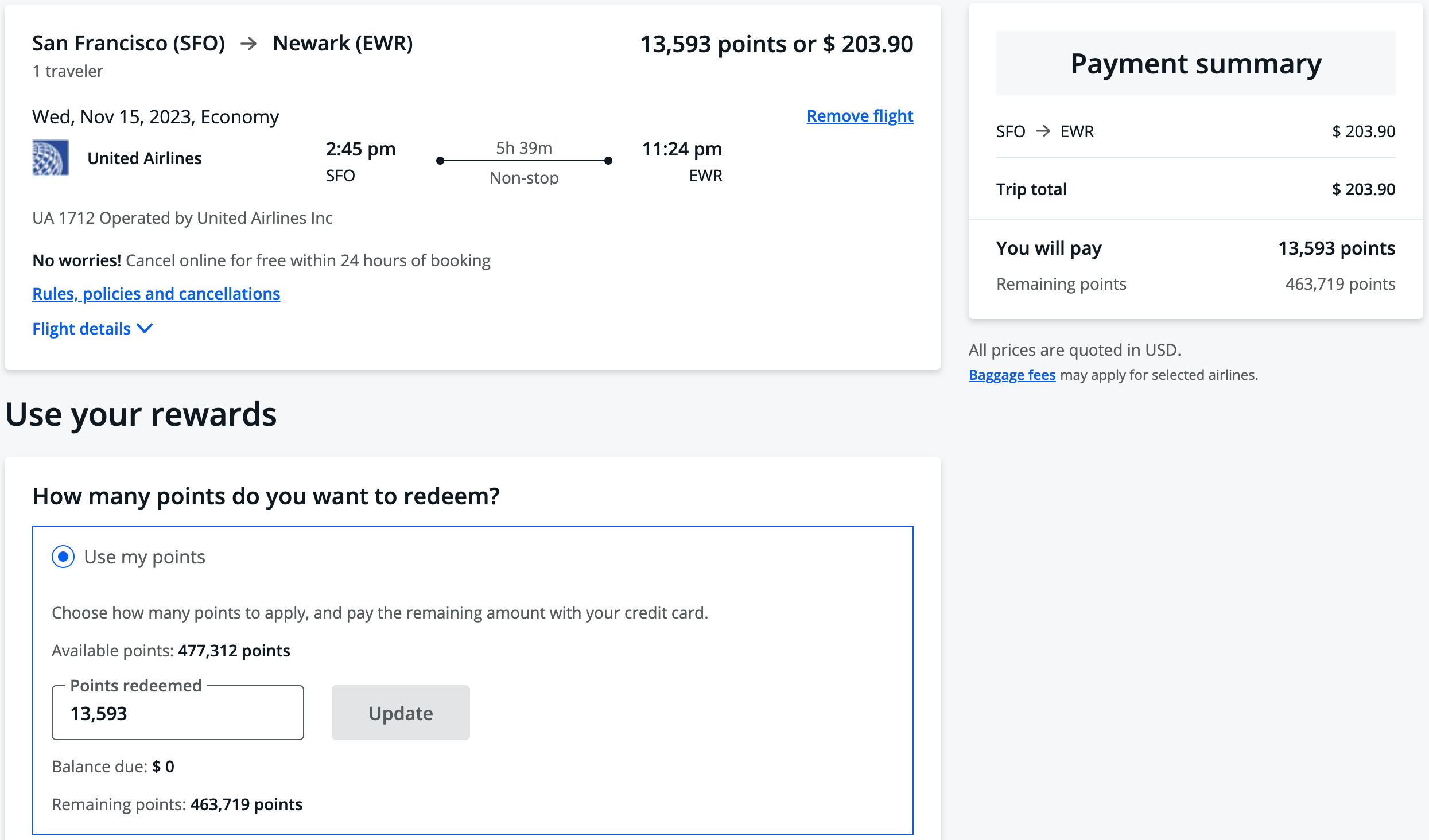

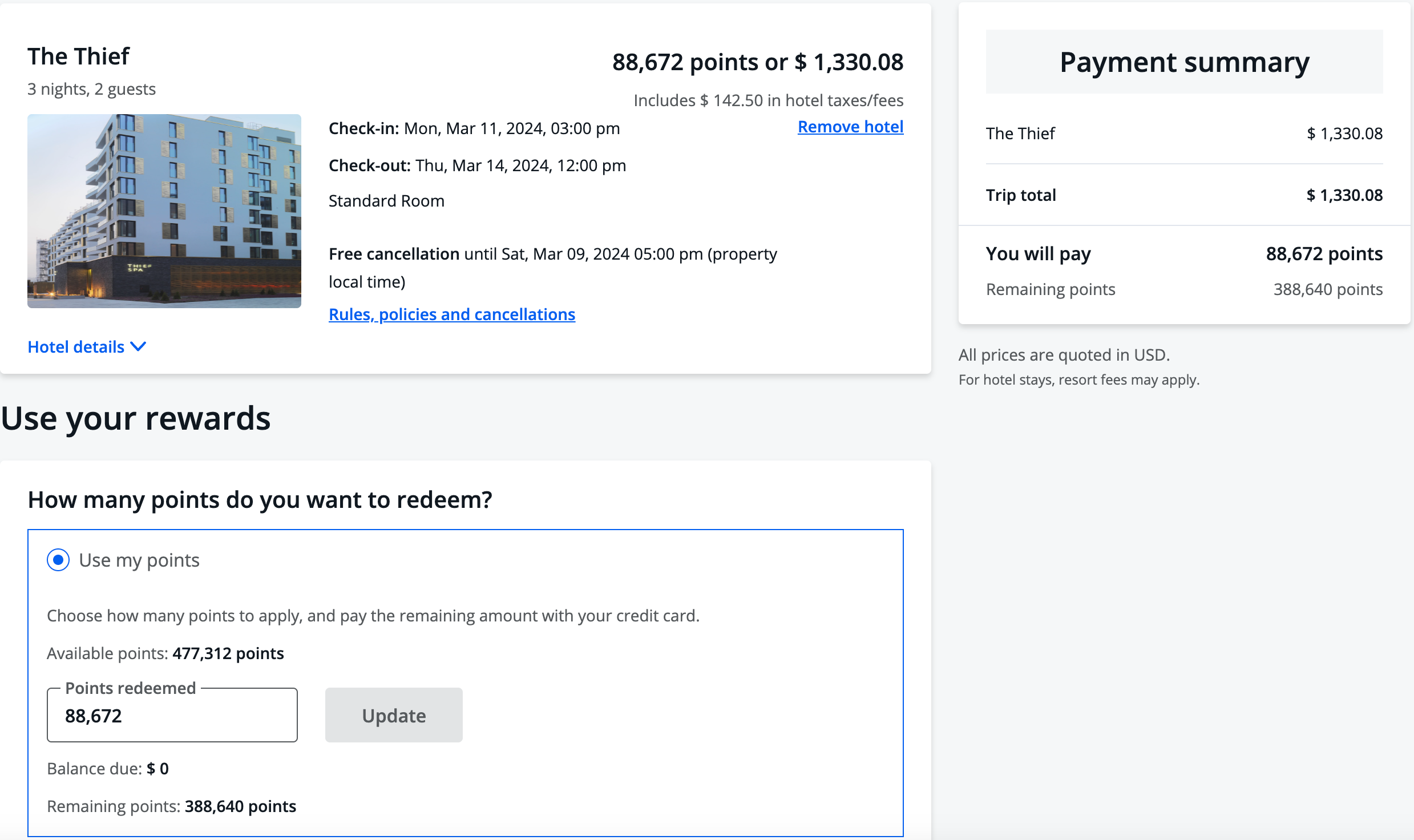

- The standard rate for Ultimate Rewards points when redeemed for travel through the Chase travel portal is 1 UR point = 1 cent, but can be worth significantly more with the UR-earning cards. The Chase Sapphire Reserve gets a redemption value of 1.5 cents per point through the Chase Travel℠ portal while the Chase Sapphire Preferred and Chase Ink Business Preferred cards each get 1.25 cents per point.

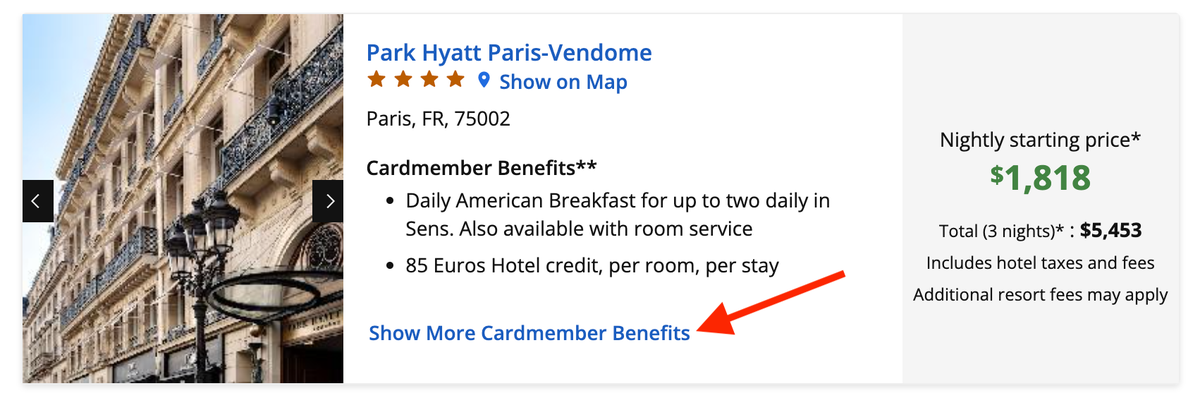

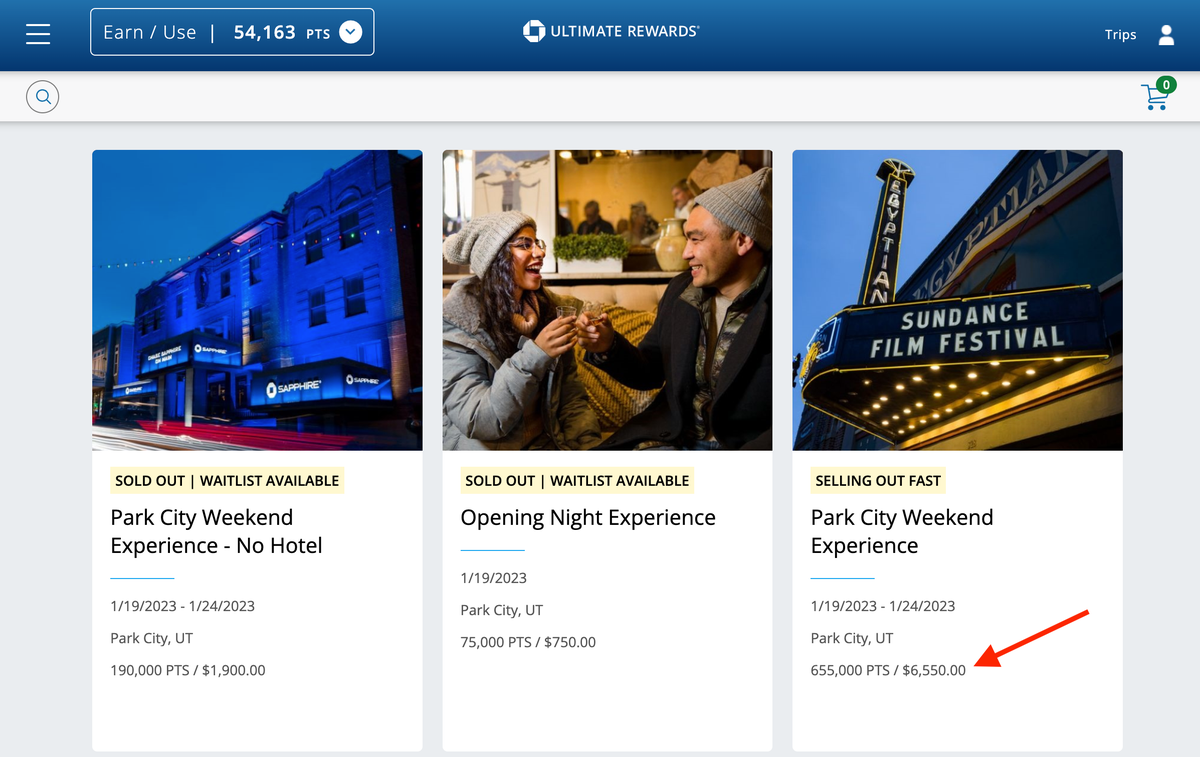

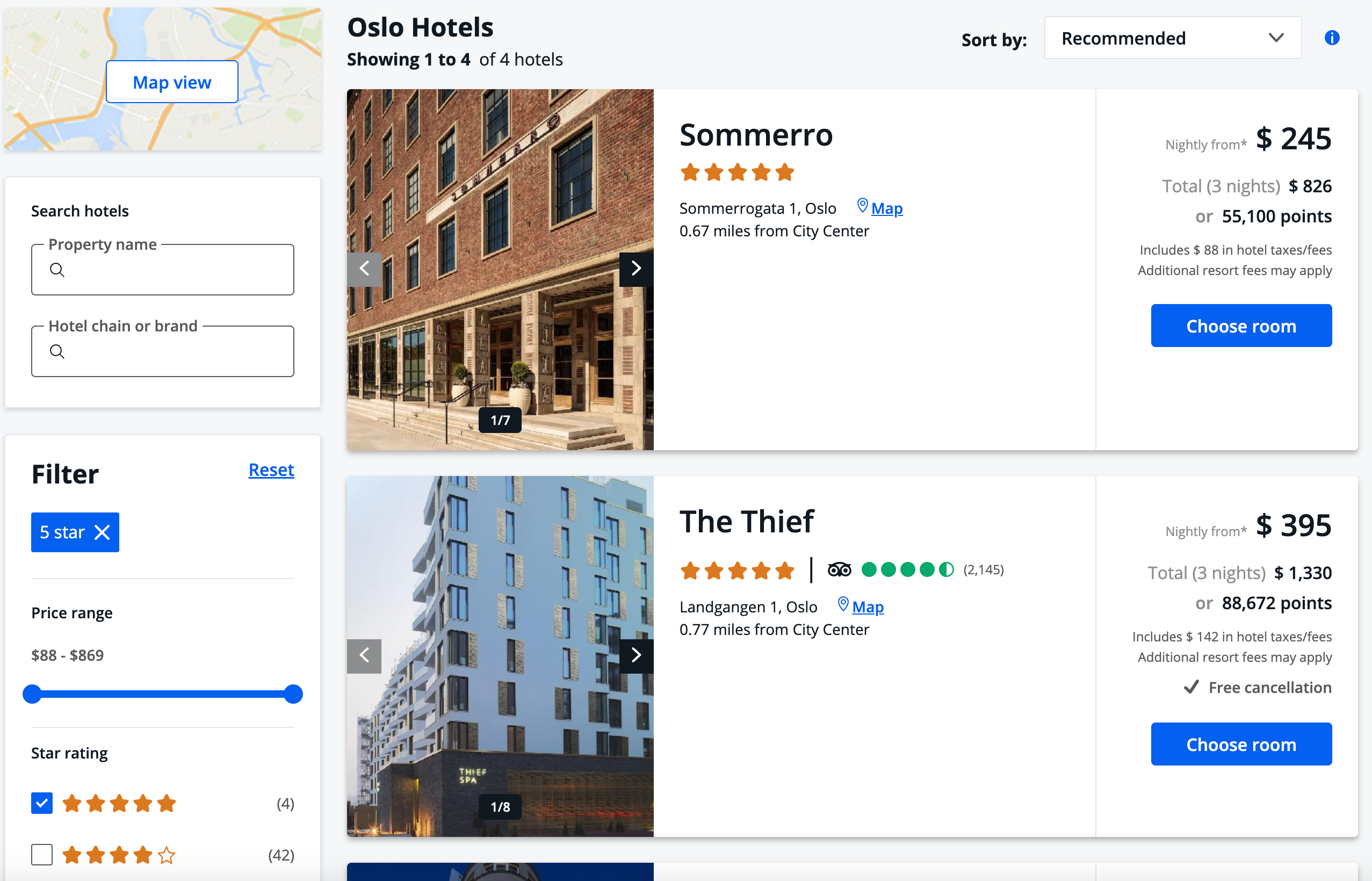

- Since you’re not limited to any loyalty programs, you can use your UR points to book boutique hotels that you’d otherwise only be able to book with cash.

- Flights booked through the Chase travel portal can earn frequent flyer miles and can be used toward advancing your elite status.

- You can earn a substantial amount of bonus points when booking through the Chase portal depending on the card you’re using.

- You can use a combination of points plus cash to purchase your reservation.

- Hotels booked through the Chase travel portal do not earn hotel points or credits toward elite status. Any elite status perks you’d receive if booking directly with the hotel will likely be forgone.

- If you experience any issues while traveling, you’d have to go through Chase to resolve the issue. For example, if there is a problem with your hotel reservation, you’ll have to contact a Chase representative for help resolving it since you didn’t book directly with the hotel. Dealing with a middleman during travel emergencies is less than ideal and something to be wary of when considering booking through the portal.

- Southwest Airlines flights do not show up in the UR travel portal, but can be reserved by calling the Chase Travel Center at 855-233-9462.

How to book travel through the Chase travel portal

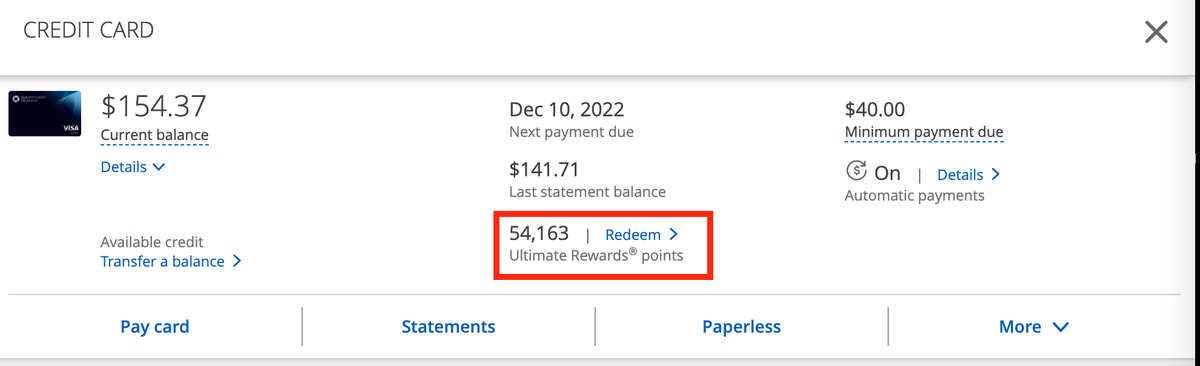

You can access the Chase travel portal by logging into your Chase account and clicking on the Rewards balance on the right or by going to the Chase Ultimate Rewards website .

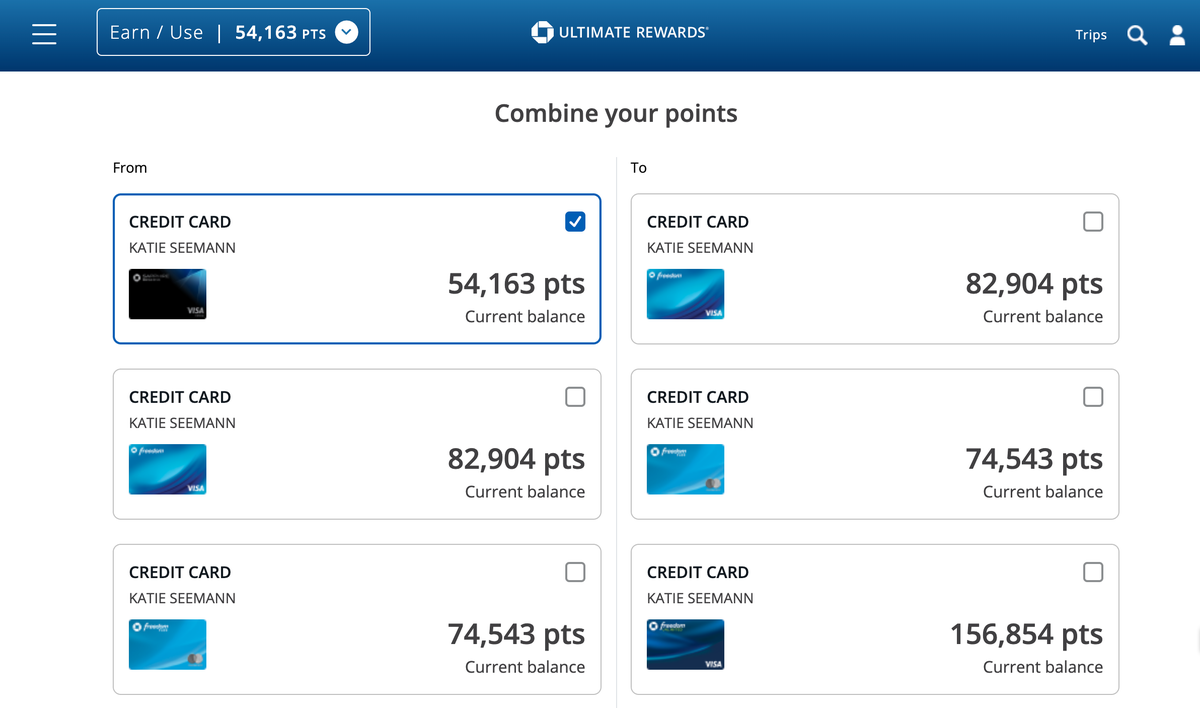

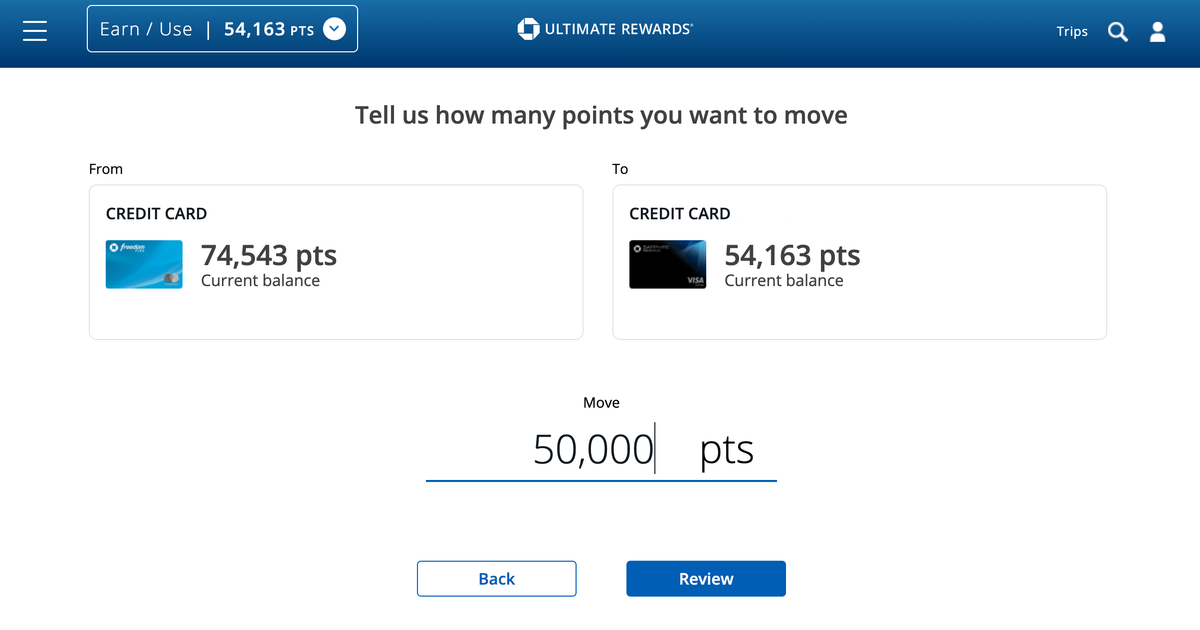

Once you’re logged in, if you have more than one UR-earning Chase card, you’ll be asked to select one to proceed with — a crucial step as each card has different earning and redemption rates.

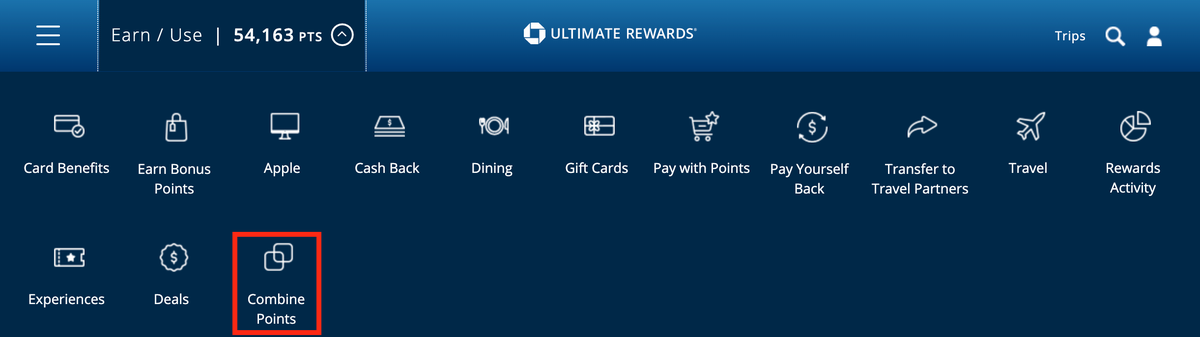

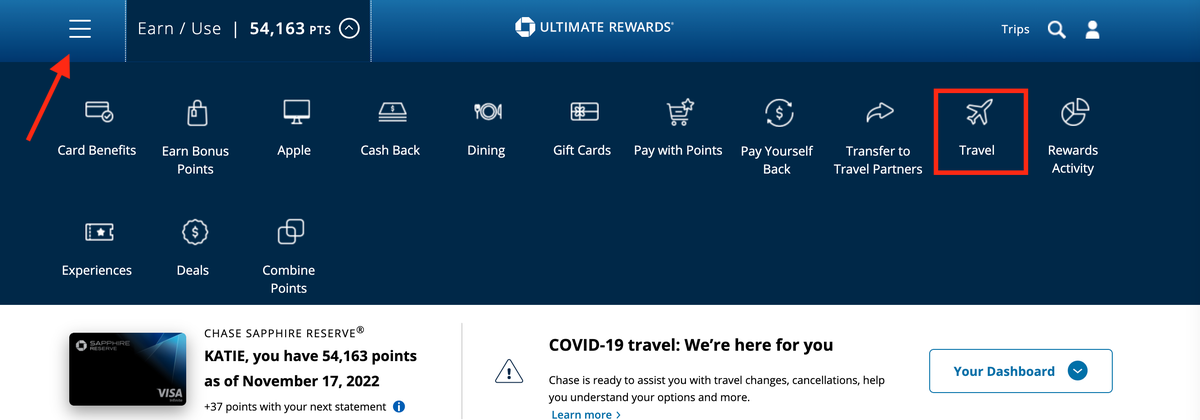

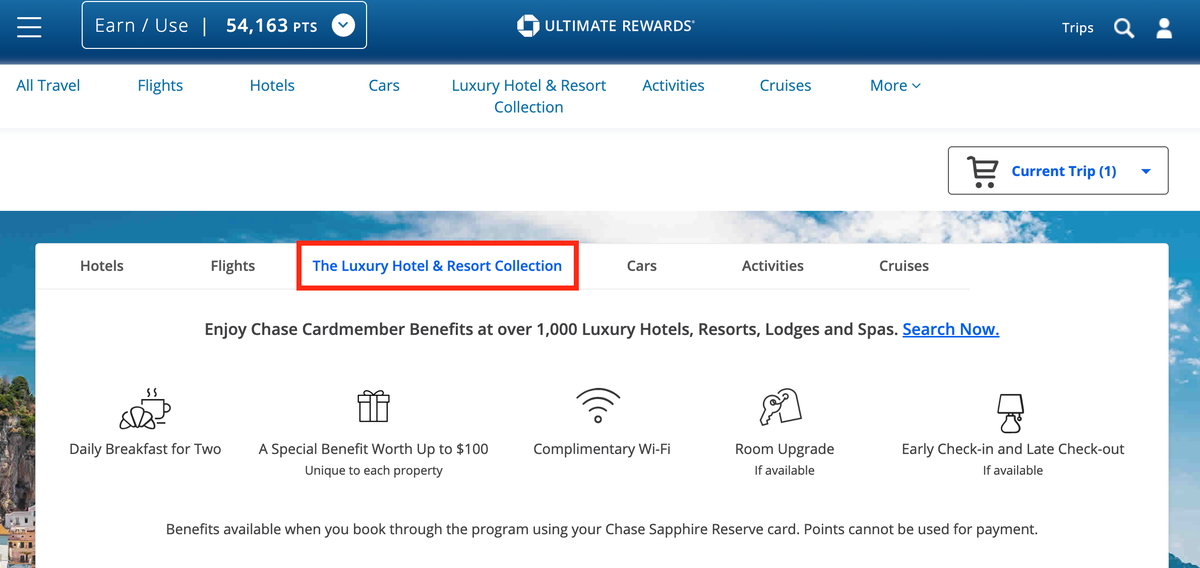

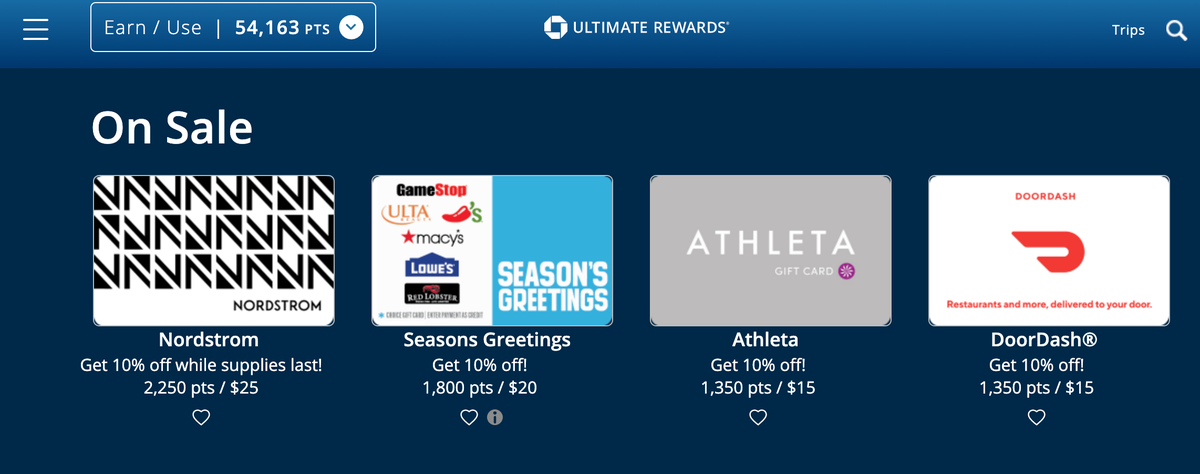

After clicking on your selection, you will be taken to the Ultimate Rewards dashboard. If you click on the Earn / Use dropdown button, all of your Ultimate Rewards options will be presented. Click on Travel to proceed to the portal.

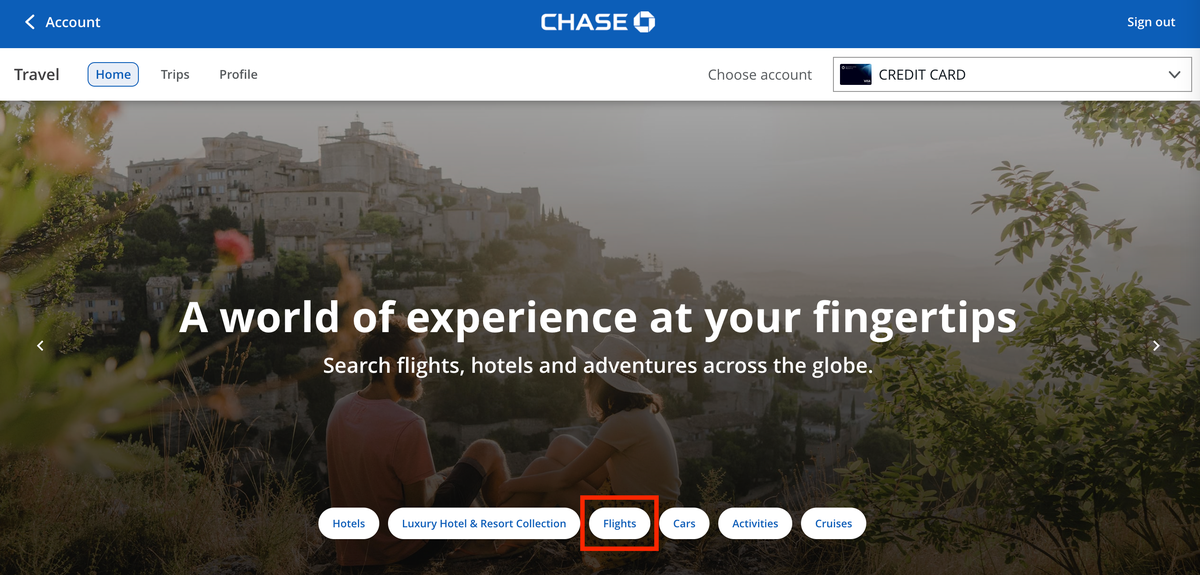

Once in the travel portal, you’ll have the option of selecting the type of booking you’d like to make.

From there, your user experience will be similar to any other OTA where you can search your travel options.

Because the Chase travel portal doesn’t limit you to transfer partners or loyalty programs, you’ll be able to search almost all major airlines. One notable exception is Southwest Airlines, which is still bookable using UR points but will require a phone call to the Chase Travel Center to reserve your flight.

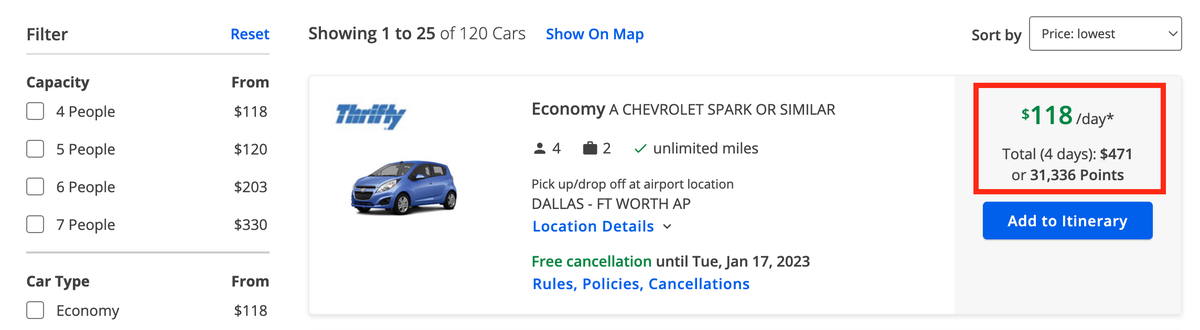

One difference compared to a traditional OTA is the option to buy in cash, points or a combination of both.

If you’re short on points or if you’d like to offset the cash price with some points, you’re given the option to choose how to pay.

After that, you’ll be prompted to enter your traveler information and you’re all booked. However, you will have to log into the specific airline with your reservation code in order to reserve seats.

Booking hotels through the Chase travel portal is a similar process. And with the portal’s easy-to-use search function, you can find boutique hotels that would otherwise be unbookable with loyalty-program-based points.

However, if you have elite status with a hotel chain, you’ll want to book directly rather than going through the Chase portal in order to access status benefits and have that hotel stay count toward achieving a higher status. Or, you can transfer UR points to one of three UR hotel loyalty program transfer partners, including Marriott Bonvoy, World of Hyatt or IHG One Rewards.

Rental cars can also be booked through the portal in a similar fashion. And as in many cases, being aware of which card you’re booking your car rental with can make a big difference in case of an accident as both the Chase Sapphire Reserve and Chase Sapphire Preferred offer primary car insurance , an uncommon, money-saving benefit, which saves you from having to file a claim with your private car insurance carrier first.

A quick guide to the Chase Ultimate Rewards program

As some of the most sought-after flexible points, Chase Ultimate Rewards can be accrued through several avenues. The most lucrative way is by applying for Chase credit cards and earning their respective welcome bonuses — but be wary of Chase’s 5/24 rule , which blocks applicants from opening a Chase credit card if they’ve opened five or more cards from any issuer in the past 24 months.

If you have two Chase cards that earn UR points, you can then transfer the rewards earned to the card that carries the most redemption value. For example, you can open the Chase Sapphire Preferred card and then the Chase Freedom Flex and move any points earned on the Flex card to the Preferred card, which has a boosted value of 25% more when redeemed through the portal.

Looking to add more than one new credit card to your wallet? Here’s why you shouldn’t apply for multiple cards at the same time.

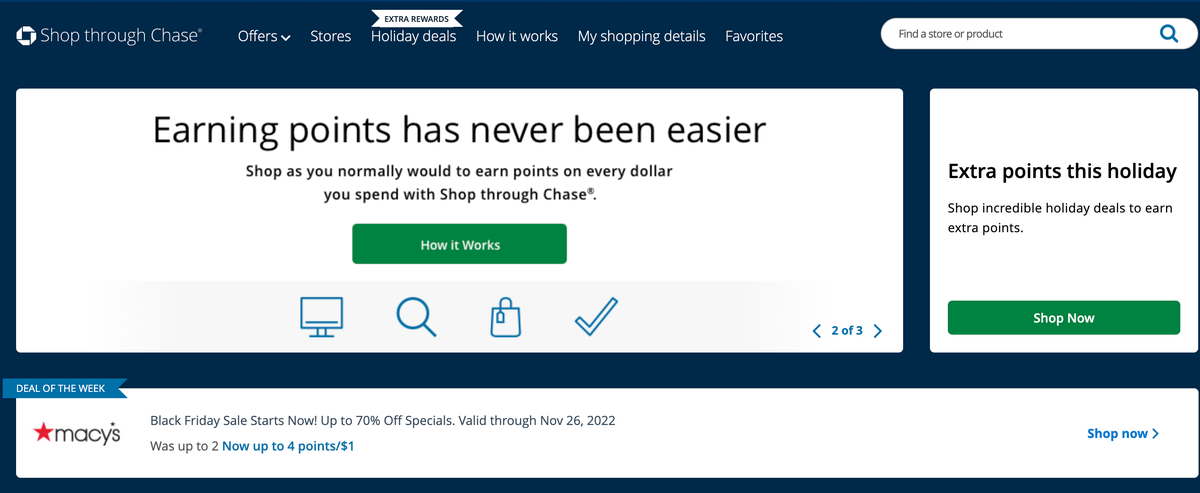

Outside of regular credit card spending, you can also grow your Ultimate Rewards pile by using the Chase shopping portal. By adding just one extra step to your online shopping, you can earn bonus points for your future travels.

While transferring points to partners is one option to maximize the value of your Chase Ultimate Rewards points, there are numerous other ways to use the Chase Ultimate Rewards program to your benefit. Whether it’s redeeming your points as a statement credit for eligible, rotating categories throughout the year through the “Pay Yourself Back” feature, booking special dining experiences with your points or using the portal to book your next vacation, the Chase Ultimate Rewards program’s flexibility makes it a great option regardless of your lifestyle.

Frequently asked questions (FAQs)

Chase Ultimate Rewards (UR) are Chase Bank’s flexible rewards currency that can be earned on several of its credit cards.

The Chase travel portal can be accessed through the Chase app or the Chase website. After logging in, you can select the option to book travel.

You can use your Chase travel credit, like the up to $50 annual hotel statement credit offered by the Chase Sapphire Preferred, by booking your travel through the Chase travel portal. The statement credit will automatically be applied to your account within one to two billing cycles after your purchase posts to your account — up to an annual maximum accumulation of $50.

You can redeem your Chase Ultimate Rewards directly through the travel portal with almost all major airlines with the exception of Southwest Airlines, which can be booked over the phone. With Southwest, select the flight you want at Southwest.com and then call Chase Travel Center at 855-233-9462 with the flight details.

The value you receive from the Chase travel portal will depend on the credit card you’re using. For example, if you have either the Chase Sapphire Reserve or the Chase Sapphire Preferred, your points are worth either 50% or 25% more, respectively, when redeemed for travel.

*The information for the Chase Freedom Flex℠, Ink Business Preferred® Credit Card and Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Capital One Quicksilver benefits guide 2024

Credit Cards Lee Huffman

United Airlines credit cards have a secret perk that makes it easier to book awards

Credit Cards Jason Steele

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

- 1.32.4.1.1 Background

- 1.32.4.1.2 Authority

- 1.32.4.1.3.1 CFO and Deputy CFO

- 1.32.4.1.3.2 Credit Card Services Office

- 1.32.4.1.3.3 Managers

- 1.32.4.1.3.4 Travel Cardholders

- 1.32.4.1.3.5 Authorized Centrally Billed Account Users

- 1.32.4.1.3.6 Travel Management Office

- 1.32.4.1.4 Program Management and Review

- 1.32.4.1.5 Program Controls

- 1.32.4.1.6 Terms/Definitions

- 1.32.4.1.7 Acronyms

- 1.32.4.1.8 Related Resources

- 1.32.4.2.1.1.1 Exemption for Mandatory Use for International Travel

- 1.32.4.2.1.1.2 Payment Sources for Travelers with Exemptions

- 1.32.4.2.2.1 Authorized/Unauthorized Uses

- 1.32.4.2.2.2 National Treasury Employees Union Use of the Travel Card

- 1.32.4.2.2.3 Inappropriate Use of the Travel Card

- 1.32.4.2.3.1 Card Limits

- 1.32.4.2.3.2 Relocation Employees (Special Privileges)

- 1.32.4.2.3.3 Merchant Category Codes and Templates

- 1.32.4.2.4 Cash from Automatic Teller Machines Access

- 1.32.4.2.5 Record Retention Period for Travel Card Documentation

- 1.32.4.2.6.1 Electronic Credit Review

- 1.32.4.2.6.2 Activating the Travel Card

- 1.32.4.2.6.3 Ordering a Replacement Card

- 1.32.4.2.6.4.1 Travel Card Refresher Training

- 1.32.4.2.7.1 Statement Explanation

- 1.32.4.2.7.2 Dispute Process

- 1.32.4.2.7.3 Trip Cancellation

- 1.32.4.2.7.4.1 Payment Methods

- 1.32.4.2.7.4.2 Making/Expediting Payment

- 1.32.4.2.7.5 Travel Vouchers: Relationship to Travel Cards

- 1.32.4.2.8.1 Past Due Accounts

- 1.32.4.2.8.2 Suspension and Reactivation

- 1.32.4.2.8.3 Multiple Suspensions

- 1.32.4.2.8.4 Payments Returned for Non-Sufficient Funds

- 1.32.4.2.8.5 Cancellation

- 1.32.4.2.8.6 Cancelled Card and Need to Travel

- 1.32.4.2.8.7 Salary Offset for Undisputed Travel Card Debt

- 1.32.4.2.8.8 Reinstatement Process

- 1.32.4.2.9 Travel Card Account Changes

- 1.32.4.2.10 Travel Card Problems

- 1.32.4.3.1.1 Authorized Uses of the Centrally Billed Account

- 1.32.4.3.1.2 Unauthorized Uses of the Centrally Billed Account

- 1.32.4.3.1.3 Centrally Billed Account Ticket Authorization Process

- 1.32.4.3.1.4 Travel Voucher Considerations

- 1.32.4.3.1.5 Unused Tickets

- 1.32.4.3.1.6 Ticket Cancellation

- 1.32.4.3.1.7 Special Travel Considerations

Part 1. Organization, Finance, and Management

Chapter 32. servicewide travel policies and procedures, section 4. government travel card program, 1.32.4 government travel card program, manual transmittal.

October 19, 2023

(1) This transmits revised IRM 1.32.4, Servicewide Travel Policies and Procedures, Government Travel Card Program.

Material Changes

(1) IRM 1.32.4.1.6, Terms/Definitions, deleted the definition for Chip and PIN. A computer chip embedded in the card and personal identification number (PIN) used to enhance security.

(2) IRM 1.32.4.1.6 w), Terms/Definitions, revised the definition for Travel Management center (TMC).

(3) IRM 1.32.4.2.1.1(4)(g), Exemptions to Mandatory Use of Travel Card Policy, added text “Employees who have relocated and staying in temporary quarters.” Use of the government travel card for temporary quarters is encouraged but not required, per IRM 1.32.12.2 (16).

(4) IRM 1.32.4.2.2.1(1), Authorized/Unauthorized Uses, added Lyft and Photos for Passports/Visas to expense type category and text “Alcohol purchase without food is not authorized” to Meals expense category.

(5) IRM 1.32.4.2.2.1(4), Authorized/Unauthorized Uses, updated text “Lodging expenses are not authorized for local travel within a 50-mile radius of the employee’s official station and residence without approval from Director,Travel Management” to clarify policy.

(6) IRM 1.32.4.2.4(3), Cash from Automatic Teller Machine Access, the cash advance fee charged by the government credit card contractor was updated from 2% to 2.5% for the service.

(7) IRM 1.32.4.2.7.3(2), Trip Cancellation, added text “The cardholder must contact the hotel to cancel reservations booked directly with the hotel when booked via a block of rooms. Car and/or hotel only reservations invoice on the day the authorization is approved or on the day of arrival if not cancelled timely incurring a CGE reservation fee.”

(8) IRM 1.32.4.3.1.7, Special Travel Considerations, added bullet (8), Official Travel Paid by Other Federal Agencies or Entity.

(9) IRM 1.32.4.3.1.7 (7)(c), Special Travel Considerations, deleted first sentence and added text “Duluth will then book the personal travel portion”.

(10) Minor editorial changes made throughout the IRM for clarity and link updates.

Effect on Other Documents

Effective date.

Teresa R. Hunter Chief Financial Officer

Program Scope and Objective

Purpose : This IRM provides information regarding the Government Travel Card Program, including the Individually Billed Account (IBA) and Centrally Billed Account (CBA) programs.

Audience : All business units

Policy Owner : The CFO is responsible for travel card program policy, and related audits.

Program Owner : Credit Card Services is responsible for travel card-related administration, procedures and audits.

Primary Stakeholders : The CFO, Credit Card Services, travel cardholders, CBA users and managers.

Program Goals : Provide an effective travel card program that enables IRS employees to conduct official government travel to carry out their tax administration duties and ensure effective internal controls as outlined in OMB Circular A-123, Appendix B: Improving the Management of Government Charge Card Programs. The mandatory use of the travel card enables the IRS to obtain rebates offered by the credit card contractor.

This IRM provides information for the Government Travel Card Program including the IBA and the CBA programs. It applies to IRS employees who perform official government travel and supervisory and administrative personnel who direct or review and approve, official travel or reimbursement of expenses.

The Travel and Transportation Reform Act of 1998 (Pub. L. No. 105–264)

Responsibilities

The CFO, Deputy CFO, and Credit Card Services share joint responsibility for the Government Travel Card Program.

This section provides responsibilities for the following:

CFO and Deputy CFO

Credit Card Services office

Managers and approving officials

Travel cardholders

Authorized CBA users

Travel Management office

The CFO and Deputy CFO are responsible for Government Travel Card Program policy.

Credit Card Services Office

The Credit Card Services office is responsible for administration, procedures and oversight of the government travel card program.

Responsibilities for IBA and CBA accounts include:

Providing guidance and direction to travel cardholders and managers.

Assisting travel cardholders with travel card account maintenance changes.

Reviewing travel authorizations for appropriate information and approvals.

Performing reviews and monitoring travel card program activity.

Initiating appropriate action to notify Labor/Employee Relations and Negotiations of delinquent accounts and inappropriate use.

Safeguarding the CBA cardholder account numbers.

Authorizing the TMC to issue tickets that are charged to the CBA.

Reviewing, reconciling and certifying monthly CBA statements of account for payment and sending them to the CFO, Travel Management, Travel Operations office.

Ensuring payments to the government credit card contractor are properly and timely posted to the account.

Initiating and completing the dispute resolution process when unauthorized or erroneous/duplicate charges appear on the statements of account.

Reviewing the activity on the CBA to ensure: 1) travelers are not seeking reimbursement for CBA charges; 2) erroneous/duplicate charges are identified and resolved; 3) all charges are for travelers authorized to use the CBA for official government travel.

Maintaining statistical and narrative information related to the travel card program.

Providing CBA expenditure information to the business units.

Managers are responsible for:

Ensuring all employees obtain and use the government travel card for all official travel, except where specifically exempted.

Reviewing travel documents to ensure travel card expense claims are appropriate and business related.

Approving requests for travel card account maintenance changes such as card limits and cancellations.

Ensuring their employees are aware of the government travel card requirements.

Consulting with Labor/Employee Relations and Negotiations before meeting with a travel cardholder who is delinquent in paying their government travel card bill or who may have inappropriately used the travel card.

Concurring with or rejecting employee requests to use the CBA.

Ensuring that travel authorizations have the correct funding codes when the CBA is used to pay for the transportation.

Approving or disapproving employee travel authorization requests.

Ensuring that airfare/train and reservation fees charged to the CBA have the form of payment shown as CBA (not personal or Government Travel Card) on the employee’s travel voucher.

Travel Cardholders

Travel cardholders are responsible for:

Becoming familiar with the current IRS IRM 1.32.1, IRS Local Travel Guide and IRM 1.32.11, IRS City- to-City Travel Guide.

Using the government travel card only for travel-related expenses while performing official government travel.

Promptly filing travel vouchers.

Paying all charges and fees associated with the account timely.

Disputing any incorrect or unauthorized charges that may appear on the monthly statement of account timely.

Safeguarding the government travel card and account number from unauthorized use.

Complying with the terms and conditions of the Cardholder Account Agreement.

Authorized Centrally Billed Account Users

Authorized CBA users are responsible for:

Contacting the TMC to make a reservation.

Informing the TMC that the CBA will be used to purchase the common-carrier transportation tickets.

Obtaining the cost of the transportation ticket, the cost of the Concur Government Edition (CGE) fee and the reservation locator code from the TMC.

Notifying the TMC and Credit Card Services if an authorized trip is cancelled.

Identifying "CBA" as the method of payment for transportation costs charged to the CBA when filing travel vouchers.

Travel Management Office

The Travel Management office is responsible for IRS policies governing the travel card program.

Program Management and Review

Program Reports : Credit Card Services uses reports obtained from the credit card contractor’s electronic reporting system and from the Integrated Financial System (IFS) to monitor accounts and review transactions.

Program Effectiveness : Credit Card Services measures the effectiveness of travel card program oversight by performing continuous reviews of account data and monthly and quarterly reviews of travel card transactions to measure compliance and mitigate the risk of fraud and abuse.

Program Controls

The following chart describes the internal controls in place for using the government travel card:

Terms/Definitions

The following terms and definitions apply to this program.

Automatic teller machine (ATM) - The contractor provides this service allowing cash withdrawals from participating ATMs. The cash withdrawal and associated fees are charged to the standard travel card account. Cash from ATMs is only authorized for expenses that cannot be charged to the travel card while in official IRS travel status.

Billing cycle - The period of time commencing on the fourth day of the month and ending on the third day of the following month. All transactions that post to an account during a cycle are summarized on a statement of account issued by the government credit card contractor.

Card limit - The maximum cumulative amount that can be charged to an individually billed government travel card in any one billing cycle.

Concur Government Edition (CGE) reservation fee - A vendor fee that will auto-populate in a document when reservations are booked through Concur or by contacting the TMC directly. If a reservation is cancelled prior to ticketing, no transaction fee is incurred.

Centrally billed account (CBA) - A corporate travel card account set up for travelers who do not have an individually billed account to use for official IRS travel expenses (airline and train tickets only).

Delinquent account - Individually billed account with a balance due that remains unpaid for a period of 61 days or more from the closing date of the statement of account on which the charges first appeared.

Disputed item - An erroneous, duplicate, or over charge that appears as a transaction on an individually billed travel cardholder's statement of account. Travel cardholders are responsible for disputing timely any incorrect or unauthorized charges that may appear on their statement of account.

Electronic credit review - An electronic credit check performed by the government credit card contractor to research the applicants credit score, assessing creditworthiness based on credit history and current credit accounts.

Electronic travel system (ETS) - A web-based, integrated travel booking and reimbursement system that includes authorizations, vouchers and travel reservations for both domestic and foreign travel. The system's split disbursement function allows travelers to allocate the payment of individual expenses directly to the government credit card contractor.

Government credit card contractor - The bank that issues the travel card used by authorized IRS employees to pay for official travel expenses.

Inappropriate use - Use of the IRS government credit card to make purchases not approved, funded and authorized by or in conformance with applicable IRS travel card and CBA guidelines.

Individually billed account (IBA) - A government contractor-issued travel card used by authorized individuals to pay for official travel and transportation related expenses for which the contractor (bank) bills the employee and for which the employee is liable for paying.

Merchant category code (MCC) - A standard code assigned to every merchant that accepts a credit card identifying the category of goods, services, or activity they are involved with. The accuracy of the assigned MCC is the function of the merchant and MasterCard.

Merchant category code templates - A grouping of MCCs assigned to each individually billed travel cardholder's account based on the travel cardholder's anticipated purchasing activity. MCC templates are an element of the system of internal controls for the credit card program, designed to reduce the potential for inappropriate credit card use.

Restricted travel cardholder - A travel cardholder who did not consent to an electronic credit check or had a credit score of less than 660. A restricted travel card does not include a MCC template for miscellaneous expenses. In addition, restricted travel cardholders also do not have ATM privileges.

Split disbursement - An electronic travel system (ETS) functionally dividing a travel voucher reimbursement between the credit card contractor and the traveler. The balance owed to each is sent directly to the applicable party.

Standard travel cardholder - A travel card applicant who agreed to an electronic credit review and had a credit score of 660 or more. A standard travel card includes the MCC template for miscellaneous expenses and ATM access.

Statement of account - A summary of transactions (debits and credits) posted to the individually billed travel cardholder’s account during the billing cycle. The government credit card contractor will send a statement of account to the individually billed travel cardholder within five business days after the end of the billing cycle. Statements of account can be accessed through the government credit card contractor’s website.

Travel advance - A prepayment of estimated travel expenses paid to an IRS employee in advance of authorized official IRS travel. Travel advances are not available to standard travel cardholders.

Travel card - A credit card used to pay for authorized official IRS travel and allowable travel-related expenses. Each travel card reflects an individual billed account established in the travel cardholder's name. The term "individually billed" account is synonymous with travel card, credit card, government issued travel card and IBA.

Travel authorization - An electronic or written document submitted for approval to authorize official travel. The travel authorization obligates funds and must be submitted and approved before traveling, except in emergency situations.

Travel cardholder - The IRS employee who has been trained and authorized to use the individually billed account. The travel cardholder is the only authorized user of the travel card and is responsible for safeguarding the travel card and account number to minimize the opportunity for theft or unauthorized use.

Travel management center (TMC) - A travel agency contracted by the IRS or the electronic travel system (ETS) to provide services to book and ticket transportation, lodging and rental car services to IRS employees on official travel.

Travel voucher - A written request or electronic submission supported by documentation and receipts, where applicable, for reimbursement of expenses incurred in the performance of official IRS and relocation travel.

The following acronyms apply to this program.

Related Resources

IRM 1.32.1, IRS Local Travel Guide

IRM 1.32.11, IRS City-to-City Travel Guide

Federal Travel Regulation

5 U.S.C. 5514, Installment deduction for indebtedness to the United States

The Inappropriate Use Guide offers specific instances of misuse and their resolutions.

IRS Manager’s Guide to Penalty Determinations provides Labor/Employee Relations and Negotiations guidance for penalty determinations for the misuse of the travel card.

Individually Billed Account Travel Card Program

The Individually billed account (IBA) travel card is a government contractor-issued travel card used by authorized individuals to pay for official travel and transportation related expenses for which the contractor (bank) bills the employee and for which the employee is liable for paying.

All employees are required to obtain and use the IBA travel card for all official travel unless:

A vendor does not accept the travel card;

The director, Credit Card Services, has granted an exemption (see IRM 1.32.4.2.1.1 (1), Exemptions to Mandatory Use of Travel Card Policy;

The manager, International Travel and Visitor’s Program/Official Passports, in LB&I has granted an exemption; or

The employee qualifies for an exemption under IRM 1.32.4.2.1.1 (4), Exemptions to Mandatory Use of the Travel Card Policy.

Mandatory Use of Individually Billed Account

The Federal Travel Regulation (FTR), 41 CFR Part 301-51.1 and 301-51.2, Paying Travel Expenses, requires use of the travel card for official travel unless the employee has an exemption.

All employees who are required to travel must obtain and use the travel card for all official travel and transportation-related expenses. The credit card contractor will bill the employee directly and the employee is required to pay the statement timely.

Exemptions to Mandatory Use of Travel Card Policy

Delegation Order 1-49, Exemption to Travel Card Mandatory Use Policy, grants authority to the director, Credit Card Services, to grant exemptions to the mandatory use policy to employees who believe they would incur a hardship if required to obtain and use the government issued travel card.

The Letter of Understanding between the director, Labor/Employee Relations and Negotiations, and NTEU defines hardship as employees who have a history of personal or work-related credit card problems and employees whose religious tenets object to the use of credit cards in general.

Employees may request an exemption by sending an email with justification to their immediate manager. If the manager determines the requirements are met, the manager will forward the approved request to the Credit Card Services mailbox. The subject line of the message should be adjusted to read "Exemption Request" before forwarding.

The IRS exempts the following groups of travelers from the mandatory use of the government travel card:

Employees who have a government travel card application pending.

Employees for whom the issuance of a government travel card would adversely affect the mission of IRS or put the employee at risk.

Employees who are not eligible to receive a government travel card.

New employees who are exempt until they obtain a government travel card. New employees who will travel are expected to obtain and use the government travel card within 45 days after they report to duty.

International travelers.

Employees with suspended or cancelled government travel cards.

Employees who have relocated and are staying in temporary quarters.

Exemption for Mandatory Use for International Travel

The LB&I International Travel Office has been delegated the authority to grant exemptions to the mandatory use of the government issued travel card for IRS business outside the United States, except for Chief Counsel employees. Chief Counsel employees arrange travel through their respective travel office.

Information for submitting requests for exemption from the mandatory use of the travel card requirement for international travel can be found in the CFO Travel Resources section on the IRS Source website.

Payment Sources for Travelers with Exemptions

The following payment sources for allowable travel expenses are authorized for travelers who receive an exemption from the mandatory use of the travel card:

CBA (for common carrier transportation expenses only).

Personal funds/personal charge card (except for purchases of common carrier tickets over $100).

Travel advances through ETS for IRS employees only.

Use of the Individually Billed Account

The travel card can only be used for official government travel and travel-related expenses while in official travel status.

The ATM feature must only be used to obtain cash for official IRS travel expenses that cannot be charged using the travel card. The ATM may be used three calendar days prior to the start of travel through the last travel day.

Some states provide a lodging tax exemption for federal employees on official business. GSA provides a list of participating states with their applicable forms. See State Tax Information. Travelers must present the form to the hotel at check-in.

The travel card is non-transferable and may only be used by the employee whose name appears on the travel card.

Employees should use the travel card to the maximum extent possible. At a minimum, employees must use the government travel card to pay for transportation, lodging, rental cars and rental car gas.

The travel card can be used to purchase fuel for a privately-owned vehicle (POV) for travel between places of official business or other authorized points no more than one calendar day prior to the start of official travel through one calendar day after the official travel ends.

Authorized/Unauthorized Uses

The travel card can only be used for official IRS travel and allowable travel-related expenses while in travel status away from an employee’s official station.

Expense Type Authorized For City to City Travel Authorized for Local Travel When Expense is Authorized, Card Use is: Auto rental Yes Yes Mandatory Baggage fees Yes No Mandatory Common carrier transportation tickets Yes No Mandatory Companion/personal airline tickets and additional charges for premium seats No No Unauthorized Emergency purchases (maps when traveling in a POV or a rental car, and a GPS attached to a rental car) Yes Yes Optional Gasoline for a government vehicle No No Unauthorized Gasoline for a POV Yes Yes Optional Gasoline for a rental car Yes Yes Mandatory Incidental expenses (such as laundry or dry cleaning - for domestic travel only) Yes No Optional Lodging (hotel, motel, corporate housing) Yes No Mandatory Long distance calling (except when billed to hotel room) No No Unauthorized Meals (including grocery stores) - Alcohol purchase without food is not authorized. Yes No (Unless in travel status for 12 hours or more) Mandatory if $15 or greater; Optional if less than $15 Meeting space and conference fees or reserving rooms for other travelers No No Unauthorized Non-travel related expenses (lien fees, investigator expenses, administrative summons expenses, copies third party records or Right to Financial Privacy Act expenses) Yes Yes Optional Office supplies No No Unauthorized Parking (long term, daily, hotel) Yes Yes Optional Photos for Passports/Visas (keep the receipt to claim the expense on the voucher) Yes Yes Optional Postage (stamps, certified mail, etc.) No No Unauthorized Taxi, Uber, Lyft and shuttle service Yes Yes Optional Vehicle repairs No No Unauthorized

Travel cards may not be used to purchase personal items like clothing, toiletries, or gifts unless agency guidance is issued for specific items.

Employees may not use their government travel card for any alcohol and alcoholic beverage for which a separate charge is made.

Lodging expenses are not authorized for local travel within a 50-mile radius of the employee’s official station and residence without approval from Director, Travel Management. See IRM 1.32.1.8, Per Diem Expenses for Local Travel, for more information.

Refer to the "Mandatory Use of Travel Cards" – Frequently Asked Questions on the IRS Source website for additional guidance.

National Treasury Employees Union Use of the Travel Card

The travel card cannot be used to pay for travel expenses of employees performing NTEU business unless the IRS has approved it. For example, if NTEU officials travel using NTEU funds rather than government funds, a government travel card cannot be used.

Inappropriate Use of the Travel Card

Credit Card Services is responsible for reviewing travel card transaction reports to ensure charges are appropriate and business-related. Questionable charges on a travel cardholder's statement of account will be referred to management through the appropriate Labor/Employee Relations and Negotiations office for further investigation and resolution. Travel cardholders who use their government travel card for personal charges could be in violation of the Rules of Conduct. The task order with the government credit card contractor requires that travel cards be used only for official government travel and related expenses and that resulting statements be paid in full within the statement period. Examples of inappropriate use include:

Purchasing items for personal use;

Using the card without prior travel authorization;

Using the incorrect credit card;

Use of the travel card by a non-authorized user;

Purchasing meals within the official work location/commuting area (unless employee is in official travel status entitled to meals and incidental expenses (M&IE));

Renting automobile without prior authorization; and

Charging travel expenses of several travelers on one travel card.

Card Controls

The controls and restrictions on travel card accounts are discussed below. If a travel card is declined because of a restriction, refer to the IRS Source website.,

Card Limits

The card limit is the maximum cumulative amount that can be charged to a travel card account in a billing cycle. For most travel cardholders, the card limit is $5,000 per billing cycle. The travel card limit considers unpaid charges from prior monthly billing cycles as part of the card limit. As a result, the actual available card limit fluctuates as charges and payments are posted.

Higher limits are provided for special circumstances such as extended travel. Requests for a higher limit must be made with the approval of the travel cardholder's manager. Requests must be specific as to the need for the increased limit and the duration. The duration may be permanent or for a specific time period and should reflect the traveler’s business needs. It is not appropriate to request an increase in the card limit if there is an outstanding balance. More information about requests to change card and ATM limits is available on the IRS Source website.

Relocation Employees (Special Privileges)

Employees with relocation expense authorizations are required to use the government travel card for house hunting and en-route travel expenses to the new official station. Use of the travel card for temporary quarters is mandatory.

Special privileges for travel cardholders with relocation expense authorization include an increased card limit and enhanced merchant category code templates. Special privileges are removed from the travel cardholder's account at the end of the relocation travel period.

Merchant Category Codes and Templates

Merchant category codes (MCC) are four-digit numerical standard codes that identify the type of goods and/or services the merchant provides. The codes limit purchases to travel-related expenses. Travel card activity is restricted by the MCC assigned to the travel cardholder's account.

A template is a grouping of MCCs assigned to a travel cardholder's account based on anticipated use. The travel card will then be accepted at merchants, such as airlines and hotels, whose MCC is included in the template for that travel card. Travel cards will be declined at merchants whose MCC is not included in the template.

Requests for MCC changes for miscellaneous expenses (non-travel related expenses for lien fees, investigator expenses, administrative summons expenses or Right to Financial Privacy Act expenses) on a restricted travel card account will not be considered.

Cash from Automatic Teller Machines Access

The ATM feature (available only to standard travel cardholders) may be used to obtain cash for official IRS travel expenses. The travel card should be used to the maximum extent possible to charge travel expenses. At a minimum, the travel card must be used to pay for transportation, lodging, rental cars and rental car gas.

The ATM withdrawals are limited to $100 per day with an overall withdrawal limit of $1,000 per billing cycle. The travel cardholders can withdraw cash from an ATM three days prior to the official travel date of departure through the last day of official travel.

The government credit card contractor charges a fee of 2.5% of the amount of the cash advance for the service. In addition, an ATM fee of varying amounts can be charged as an access fee. These fees are charged to the standard travel cardholders account. Both fees are reimbursable to the standard travel cardholder.

Restricted travel cardholders are not granted ATM privileges.

Standard travel cardholders cannot request a travel advance.

Standard travel cardholders can establish or change their card’s PIN at any time by calling the government credit card contractor. PINs are used to obtain cash for official IRS travel expenses that cannot be charged using the travel card. Changes are effective immediately after confirmation.

Information regarding ATM access is available on the IRS Source website.

Record Retention Period for Travel Card Documentation

Travel cardholders are responsible for ensuring that their travel documents have been correctly uploaded into ETS and are legible. The ETS retains copies of the receipts for six years after fiscal year in which travel occurred. See IRM 1.32.11.7.7, Claiming Reimbursements. Managers are not required to retain original receipts and vouchers if the voucher is filed using ETS. Managers must retain copies of approved manual travel authorizations and vouchers, and all supporting documents for six years. Manual travel voucher records may then be destroyed according to the guidelines for records retention and disposition.

Record retention guidance is available on the IRS Source website.

Training and Application Process

Training is a prerequisite for obtaining a travel card. All potential travel cardholders must first complete the travel card self-study training course. The instructions for completing the government credit card contractor's on-line travel card application form can be accessed at the end of the course. All travel card applications must be in the applicant's name as shown in IRS official personnel records or in approved pseudonym names and must be signed by the applicant.

A travel card will be mailed in a plain envelope to the applicant at the statement billing mailing address indicated on the application form. It should be received within five to seven business days from the date the properly completed application is entered in the government credit card contractor's on-line application system.

Travel cardholders will need to call the government credit card contractor at the number on the back of the travel card to establish a PIN. The PIN will be used at chip enabled merchant terminals and for standard travel cardholders to obtain cash from the ATM for official IRS travel expenses that cannot be charged using the travel card. Information regarding the training and application process for obtaining a travel card is available on the IRS Source website.

Electronic Credit Review

The Office of Management and Budget (OMB) Circular A-123, Appendix B, Chapter 6, Creditworthiness, requires all agencies to perform a credit check on new travel card applicants using a Fair Isaac Corporation (FICO) credit score. A new travel card applicant is an employee who has not had a government-issued travel card within the last 12 months. Creditworthiness reviews are an important internal control to ensure that travel cardholders are financially responsible.

The option of consenting to an electronic review by the government credit card contractor is offered at the end of the travel card self-study training course. A new travel card applicant with a credit score of 660 or higher will receive a standard travel card. Applicants with a FICO credit score of less than 660, or who do not consent to an electronic credit review will receive a restricted travel card. Information regarding electronic credit checks is available on the IRS Source website.

Activating the Travel Card

Upon receipt of the travel card, travel cardholders must verify the accuracy of the information on the transmittal document and on the travel card.

If there is an error on the transmittal document or travel card, the cardholder should contact Credit Card Services via IRS Service Central to correct the problem.

If the information is correct, the travel cardholder should activate the travel card by calling the government credit card contractor at the telephone number on the activation sticker. When the call is completed, the card will be activated and ready for use.

Travel cardholders will need to call the government credit card contractor at the number on the back of the travel card to establish a PIN. The PIN will be used at chip enabled merchant terminals and for standard travel cardholders to obtain cash from the ATM for official IRS travel expenses that cannot be charged using the travel card.

Ordering a Replacement Card

If the travel card becomes worn, damaged, or defective in any way, the travel cardholder can order a replacement card by contacting the government credit card contractor at the telephone number listed on the back of the card.

Card Renewal Process

When the expiration date shown on the face of the travel card draws near, the government credit card contractor will send the travel cardholder a renewal card automatically. This generally, will occur two to four weeks prior to the expiration date. The renewal card will require activation. Activation instructions will be provided on a sticker affixed to the renewal card. Activating the renewal card automatically cancels the expiring card. The expired card should be properly disposed of by cutting it up.

Travel Card Refresher Training

Travel cardholders are required to complete refresher training every two years. The objectives of refresher training are to:

Ensure all travel cardholders are made aware of current program rules, regulations, guidelines and changes.

Strengthen the IRS travel card program internal controls.

Travel cardholders will be notified via email with detailed instructions when they are required to complete the refresher course. Travel cardholders will have approximately 45 calendar days to complete the training after being notified.

Monthly Statements

Travel cardholders receive a statement from the government credit card contractor if there is activity on the account or an outstanding balance, unless the travel cardholder has selected "Go Paperless" on the government credit card contractor’s website.

The billing cycle for travel card accounts closes on the third day of each month.

Travel cardholders are responsible for timely payment of all undisputed charges.

Statement Explanation

Travel cardholders will receive a statement of account from the government credit card contractor if there is activity on the account or an outstanding balance. The statement of account is available electronically if the travel cardholder selects "Go Paperless" on the government credit card contractor’s website or is mailed to the statement billing mailing address provided by the travel cardholder. This will usually be the travel cardholder’s home address, unless the travel cardholder has specified a different mailing address.

The monthly statement of account reflects activity on the account for the billing cycle. The billing cycle for travel cards closes on the third of each month. Each charge and credit transaction that posts to the travel cardholder's account during the billing cycle will be itemized on the statement of account. The statement of account will show the total amount due and the payment due date.

The travel cardholder must review the statement of account for erroneous or unauthorized charges. If any of these charges are identified, the travel cardholder must take prompt action to resolve the dispute. More Information is available on the IRS Source website.

Dispute Process

The travel cardholders are responsible for disputing any incorrect or unauthorized charges that appear on their monthly statements of account timely. Travel cardholders must contact the government credit card contractor representative within 90 days from the "transaction date" of the erroneous charge(s).