Your Journey to Financial Freedom

A step by step guide to achieving wealth and happiness!

Unlock The Life Of Your Dreams. Have Financial Freedom On Your Journey To Financial Independence

Imagine being able to quit your job, ditch your horrible commute, have passive streams of income, and choose how you want to spend your time.

Financial Independence is not having to work for money anymore. But Financial Freedom is about having options. You can have financial freedom while on your journey to financial independence and this book will show you exactly how to achieve that.

Shift your money mindset so that you can live your best life today and say goodbye to a job that determines how you live your life and hello to living on your own terms

What could you do with your time when: you no longer stick to the status quo and retire in your 50s, 40s, and even 30s?

If you no longer want to be held back by your current financial situation, be stuck in a horrible commute to a job where you are under-valued, or in a relationship that no longer serves you, this book, Your Journey To Financial Freedom, is for you.

You can in fact spend and save responsibly all while enjoying that spicy margarita and guacamole.

Financially independent & retired early.

You would spend your energy with the people and things you love .

You would have more power to fulfill all your desires and live your best life fulfilling your wildest dreams.

You would shine as your best self which then inspires those around you to do the same.

Order your copy today!

I’m jamila souffrant.

As a wife, mother of three and first-generation Jamaican immigrant, I know all too well the struggles of saving for tomorrow while spending liberally today.

I’ve been exactly where you are — living the most okay life. I didn’t hate my job or life, but I didn’t love it either. I longed for more but pushed my dreams down because I couldn’t figure out how to make my dream life happen – until I discovered the Financial Independent Retire Early (F.I.R.E.) movement. My husband and I saved $169,000 in two years, are debt free. I was able to quit my full-time corporate job to do work that lights me up.

I used to think that the only way to become wealthy was to win the lottery, get a fat inheritance, or start a multi-million-dollar company. I almost gave up on my desires because I didn’t know how I could achieve the freedom over my time that I longed for. Then I discovered the concept of Financial Independence and found a pathway out of the paycheck to paycheck cycle and dreadful commute.

Fast forward years later, I’ve achieved more freedom and have more money that I ever thought was possible.

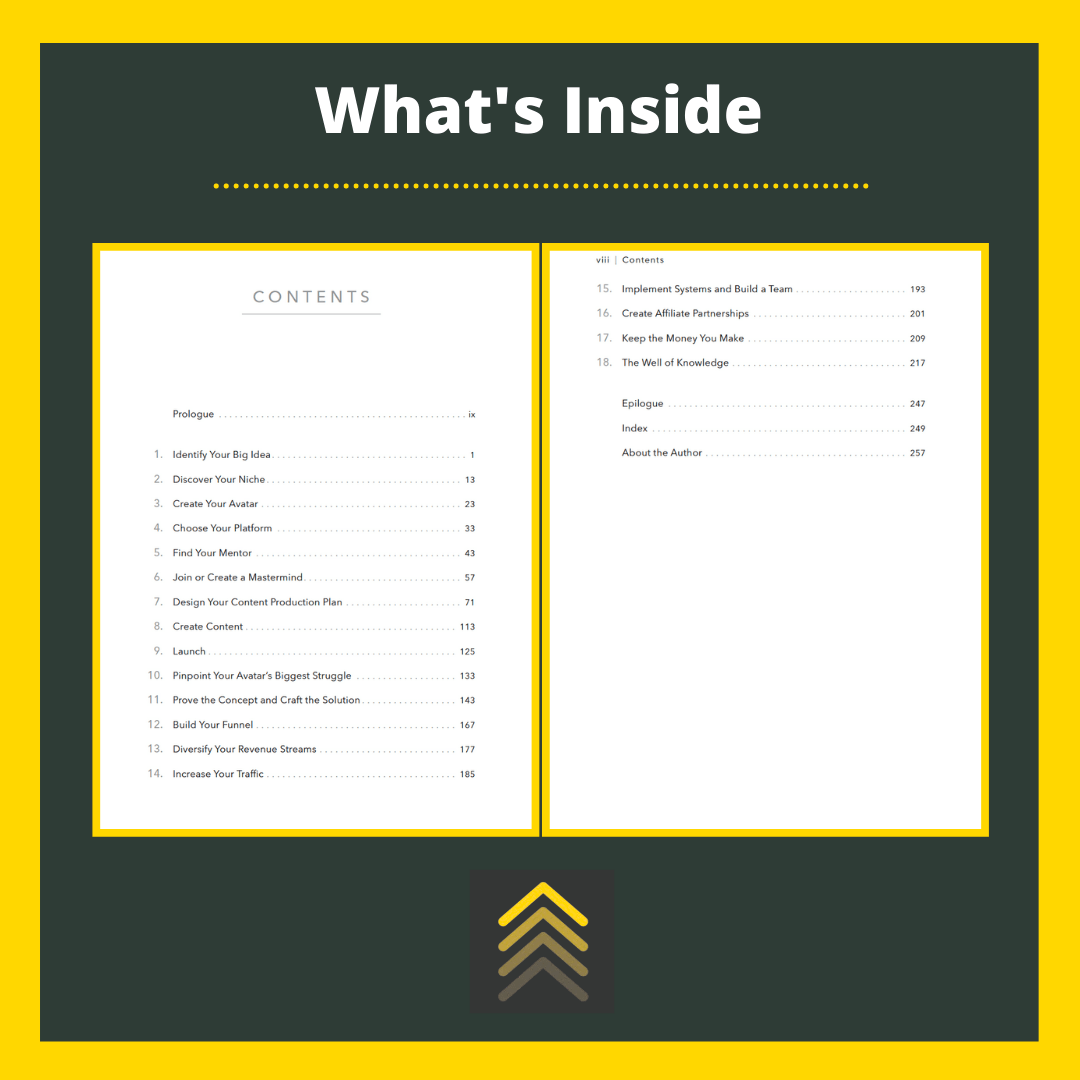

This book is the guide I wished I would’ve had . I have gained a wealth of knowledge through my personal experiences and conducting hundreds of interviews for the Journey to Launch podcast, in which I interviewed experts and individuals who are on their own journey toward achieving FI. I have distilled this information, along with my own experiences, into frameworks and steps that you can follow. These guidelines will help you avoid making common mistakes and achieve success along the way. In this book, I want to equip you with the necessary tools to design your own unique, enjoyable journey.

Order now + get free bonuses

Purchase a copy from your favorite retailer below (be sure to grab the order #, you’ll need that for the next step!)

Come back to this page and pop your order number and other details below

Share this book with anyone you know who might be interested in the journey to financial freedom

2 Months FREE of Freedom Quest

The path to financial freedom requires the right inspiration, information, & accountability.

That’s why I’m opening the doors to Freedom Quest, a premiere community where you can turn your dreams of financial independence into reality. You don’t have to go on this journey alone. I’ll be sharing expert advice from top personal finance pros & exclusive content to help you achieve your goals. You’ll be surrounded by like-minded people who share your passion for achieving financial freedom.

Grab your copy now & get 2 months in the community for free once we launch in 2024!

Plus, Immediately Receive Fire Starter: The Financial Independence Blueprint Course

Are you ready to embark on a transformative journey towards financial freedom & independence right now? Imagine a life where you have the power to make choices based on passion, not necessity.

The Financial Independence Blueprint Course

Are you ready to embark on a transformative journey towards financial freedom & independence right now?

- Define (FI) Financial Independence & Financial Freedom

- Work On the FI Components & FI Formula

- Calculate Your FI number

- Map Out Your FI Path + More

- 4 Video Lessons

- Complimentary Workbook

Praise For The Book

Brandon The Mad Fientist

Author, Founder & CEO, Clever Girl Finance

Author of Financial Freedom & Creator of Millennial Money

Author of the Broke Millennial Series

International Bestselling Author of The Simple Path to Wealth and Pathfinders

Author, A Healthy State of Panic

New York Times Best Selling Author of, Get Good with Money

- © 2024 Journey to Launch

Speaker | writer | financial educator

I am an award-winning podcaster, writer, and personal finance educator.

I’m the founder and host of the Journey To Launch platform and podcast where I share my journey to reaching financial freedom while helping & inspiring others to do the same. Along with a being a passionate financial educator and content curator, I’m also a wife & mom to 3 young children.

Work With Me

My client list includes established brands such as; Amazon, Fidelity, DCU, General Assembly & more.

Learn how you can book me to be the keynote at your next event, for brand partnership & ambassador opportunities, SMT/VMT tours and more.

I am a thought leader and sought after speaker & content creator in the personal finance space.

My work has been featured in the NY Times, Money Magazine, BuzzFeed, Essence Magazine , Refinery 29, Good Morning America & More.

financial freedom

Join the Journeyers who are Launching their way to financial freedom .

The Journey to Launch platform provides the ideas and resources to help you skyrocket your savings, blast through your debt and ultimately launch you on your journey to Financial Freedom & Independence .

Copyright © 2021 Itour. All rights reserved.

- want a website like mine? check shirley t

- back to top

My new book, Your Journey to Financial Freedom, is officially here! If you want to accelerate your unique & truly epic journey to financial freedom & independence, learn more about the book and get a free bonus for ordering by heading over to:

Yourjourneytofinancialfreedom.com.

- Search Search Please fill out this field.

1. Set Life Goals

2. make a monthly budget, 3. pay off credit cards in full, 4. create automatic savings, 5. start investing now, 6. watch your credit score, 7. negotiate for goods and services.

- 8. Get Educated on Financial Issues

9. Maintain Your Property

10. live below your means.

- 11. Get a Financial Advisor

12. Take Care of Your Health

The bottom line.

- Personal Finance

- Budgeting & Savings

How to Reach Financial Freedom: 12 Habits to Get You There

Set yourself on the path to financial freedom with these 12 habits

:max_bytes(150000):strip_icc():format(webp)/Pic1-KhadijaKhartit-cc5b57fba2bd46ed87bdb3ddbcd2ef69.jpg)

Financial freedom—having enough savings, investments, and cash on hand to afford the lifestyle you want for yourself and your family—is an important goal for many people. It also means growing a nest egg that will allow you to retire or pursue any career you want—without being driven by the need to earn a certain amount each year.

Unfortunately, too many people fall far short of financial freedom. Even without occasional financial emergencies, escalating debt due to overspending is a constant burden that keeps them from reaching their goals. When a major crisis—such as a hurricane, an earthquake, or a pandemic—completely disrupts all plans, additional holes in safety nets are revealed.

Trouble happens to nearly everyone, but these 12 habits can put you on the right path.

Key Takeaways

- Set life goals—big and small, financial and lifestyle—and create a blueprint for achieving those goals.

- Make a budget to cover all your financial needs and stick to it.

- Pay off credit cards in full, carry as little debt as possible, and keep an eye on your credit score.

- Create automatic savings by setting up an emergency fund and contributing to your employer’s retirement plan.

- Take care of your belongings—maintenance is cheaper than replacement—but most importantly, take care of your health.

Being Financially Independent

Being financially independent means having sufficient income, savings, or investments to live comfortably for life and meet all of one's obligations without relying on a paycheck. That is the ultimate goal of a long-term financial plan.

What is financial freedom to you? Everyone has a general desire for it, but that's too vague a goal. You need to get specific about amounts and deadlines. The more specific your goals, the higher the likelihood of achieving them.

Write down these three objectives:

- What your lifestyle requires

- How much you should have in your bank account to make that possible

- What age is the deadline to save that amount

Next, count backward from your deadline age to your current age and establish financial mileposts at regular intervals between the two dates. Write all amounts and deadlines down carefully and put the goal sheet at the front of your financial binder.

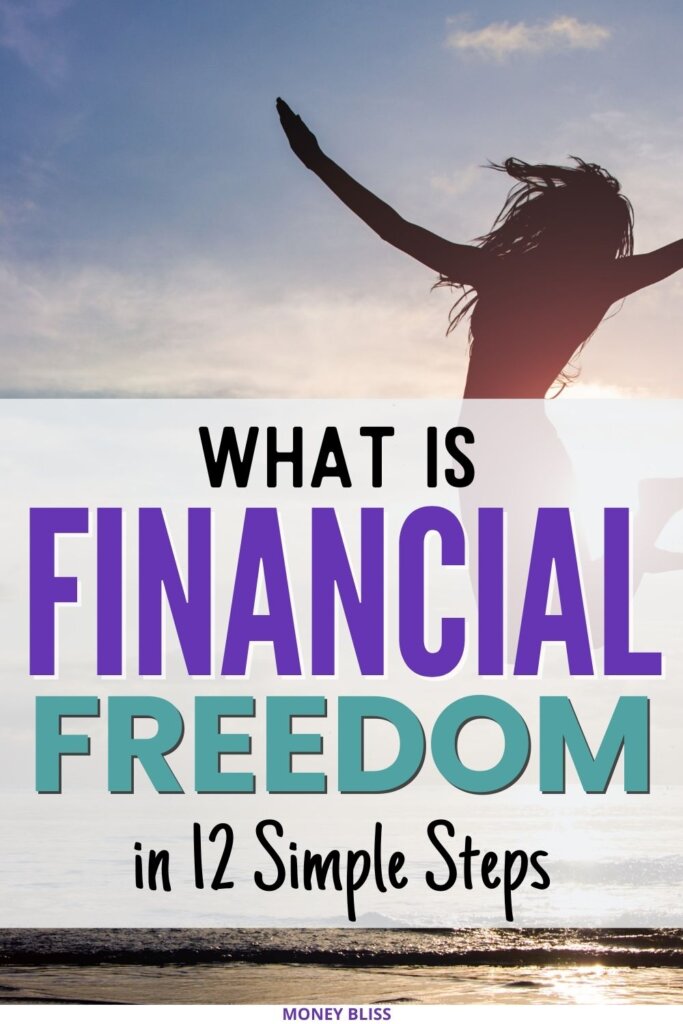

Making a monthly household budget —and sticking to it —is the best way to guarantee that all bills are paid and savings are on track. It’s also a regular routine that reinforces your goals and bolsters resolve against the temptation to splurge.

Credit cards and other high-interest consumer loans are toxic to wealth-building. Make it a point to pay off the full balance each month. Student loans, mortgages, and similar loans typically have much lower interest rates; paying them off is not an emergency. However, paying these lower-interest loans on time is still important—and on-time payments will build a good credit rating .

Pay yourself first. Enroll in your employer’s retirement plan and make full use of any matching contribution benefit , which is essentially free money. It’s also wise to have an automatic withdrawal into an emergency fund, which can be tapped for unexpected expenses, as well as an automatic contribution to a brokerage account or something similar.

Ideally, the money for the emergency fund and the retirement fund should be pulled out of your account the same day you receive your paycheck, so it never even touches your hands.

Keep in mind that the recommended amount to save in an emergency fund depends on your individual circumstances. Also, tax-advantaged retirement accounts come with rules that make it difficult to get your hands on your cash should you suddenly need it, so that account should not be your only emergency fund .

Bad stock markets—known as bear markets —can make people question the wisdom of investing, but historically there has been no better way to grow your money. The magic of compound interest alone will grow your money exponentially, but you do need a lot of time to achieve meaningful growth.

However, remember that—for everyone except professional investors—it would be a mistake to attempt the kind of stock picking made famous by billionaires like Warren Buffett . Instead, open an online brokerage account that makes it easy for you to learn how to invest , create a manageable portfolio, and make weekly or monthly contributions to it automatically. We’ve ranked the best online brokers for beginners to help you get started.

Achieving financial freedom can be very difficult in the face of growing debt, cash emergencies, medical issues, and overspending, but—with discipline and careful planning—it is possible. That is the ultimate goal of

Your credit score is a very important number that determines the interest rate you are offered when buying a new car or refinancing a home. It also impacts the amount you pay for a range other essentials, from car insurance to life insurance premiums.

The reason credit scores have so much weight is that someone with reckless financial habits is considered likely to be reckless in other areas of life, such as not looking after their health—or even driving and drinking.

This is why it’s important to get a credit report at regular intervals to make sure that there are no erroneous black marks ruining your good name. It may also be worth looking into a reputable credit monitoring service to protect your information.

Many Americans are hesitant to negotiate for goods and services, because they're afraid that it makes them seem cheap. Conquer this fear and you could save thousands each year. Small businesses, in particular, tend to be open to negotiation, so buying in bulk or positioning yourself as a repeat customer can open the door to good discounts.

8. Stay Educated on Financial Issues

Review relevant changes in tax law to ensure that all adjustments and deductions are maximized each year. Keep up with financial news and developments in the stock market and do not hesitate to adjust your investment portfolio accordingly. Knowledge is also the best defense against fraudsters who prey on unsophisticated investors to turn a quick buck.

Taking good care of property makes everything from cars and lawnmowers to shoes and clothes last longer. The cost of maintenance is a fraction of the cost of replacement, so it’s an investment not to be missed.

Learn to know the difference between the things you want and the things you need.

Mastering a frugal lifestyle means developing a mindset focused on living a good life with less—and it's easier than you think. In fact, before rising to affluence, many wealthy individuals developed the habit of living below their means.

This isn’t a challenge to adopt a minimalist lifestyle. It simply means learning to distinguish between the things you need and the things you want—and then making small adjustments that drive big gains for your financial health.

11. Get a Financial Advisor

Once you’ve gotten to a point where you’ve amassed a decent amount of wealth—either liquid assets (cash or anything easily converted to cash) or fixed assets (property or anything not easily converted to cash)—get a financial advisor to help you stay on the right path.

The principle of proper maintenance also applies to your body—and taking excellent care of your physical health has a significant positive impact on your financial health as well.

Investing in good health is not difficult. It means making regular visits to doctors and dentists, and following health advice about any problems you encounter. Many medical issues can be helped—or even prevented—with basic lifestyle changes, such as more exercise and a healthier diet.

Poor health maintenance, on the other hand, has both immediate and long-term negative consequences on your financial goals. Some companies have limited sick days, which means a loss of income once paid days are used up. Obesity and other dietary illnesses make insurance premiums skyrocket, and poor health may force early retirement with lower monthly income for the rest of your life.

What Is Financial Freedom?

Everyone defines financial freedom in terms of their own goals. For most people, it means having the financial cushion (savings, investments, and cash) to afford a certain lifestyle—plus a nest egg for retirement or the freedom to pursue any career without the need to earn a certain salary.

What Is the 50/30/20 Budget Rule?

The 50/30/20 budget rule , popularized by Senator Elizabeth Warren , is a guideline to achieve financial stability by dividing after-tax income into 3 categories of spending: 50% for needs, 30% for wants, and 20% for savings and paying down debt. We have built an easy-to-follow budgeting calculator to help you categorize and control your spending and saving—which is the essential first step toward financial freedom.

Will a Bad Credit Score Make My Car Insurance Higher?

Although some states—including California, Hawaii, Washington, Massachusetts, and Michigan—limit or prohibit the use of credit scores to determine auto insurance rates, many companies do use a credit-based scoring system to decide whether to insure you and how much you will pay.

These 12 steps won’t solve all your money problems, but they will help you develop the good habits that get you on the path to financial freedom . Simply making a plan with specific target amounts and dates reinforces your resolve to reach your goal and guards you against the temptation to overspend. Once you start to make real progress, relief from the constant pressure of escalating debt and the promise of a nest egg for retirement kick in as powerful motivators—and financial freedom is in your sights.

Consumer Financial Protection Bureau. " Seven Factors That Determine Your Mortgage Interest Rate ."

Experian. “ How Much Does Credit Score Affect Auto Insurance Rates? ”

- Guide to Emergency-Proofing Your Finances 1 of 23

- 10 Ways to Prepare for a Personal Financial Crisis 2 of 23

- Stock Market Down? One Thing Never to Do 3 of 23

- 5 Rules to Improve Your Financial Health 4 of 23

- How to Reach Financial Freedom: 12 Habits to Get You There 5 of 23

- Emergency Fund 6 of 23

- How to Build an Emergency Fund 7 of 23

- How to Invest Your Emergency Fund for Liquidity 8 of 23

- 7 Smart Ways to Raise Cash Fast 9 of 23

- How Much Cash Should I Keep in the Bank? 10 of 23

- 7 Places to Keep Your Money 11 of 23

- What Are the Withdrawal Limits for Savings Accounts? 12 of 23

- Safe Deposit Boxes: Store This, Not That 13 of 23

- The Financial Effects of a Natural Disaster 14 of 23

- Disaster Loss: What It Is, How It Works, Calculation 15 of 23

- If Your Kid Is 18, You Need These Documents 16 of 23

- Power of Attorney: When You Need One 17 of 23

- Financial vs. Medical Power of Attorney: What’s the Difference? 18 of 23

- What Is a Special Power of Attorney vs. Other Powers of Attorney 19 of 23

- What's the Average Cost of Making a Will? 20 of 23

- 6 Estate Planning Must-Haves 21 of 23

- Letter of Instruction: Don't Leave Life Without One 22 of 23

- 5 Things to Consider Before Becoming an Estate Executor 23 of 23

:max_bytes(150000):strip_icc():format(webp)/FinanceYourFuture-The503020budgetruleexplained-v12-d31df9286a384a9a8907ed5297443835.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Your Journey to Financial Freedom: A Step-by-Step Guide to Achieving Wealth and Happiness

Jamila souffrant. hanover square, $25 (320p) isbn 978-1-335-00779-7.

Reviewed on: 09/19/2023

Genre: Nonfiction

- Apple Books

- Barnes & Noble

Featured Nonfiction Reviews

Your Journey to Financial Freedom

- A Step-by-Step Guide to Achieving Wealth and Happiness

- By: Jamila Souffrant

- Narrated by: Jamila Souffrant

- Length: 8 hrs and 12 mins

- 5.0 out of 5 stars 5.0 (7 ratings)

Failed to add items

Add to cart failed., add to wish list failed., remove from wishlist failed., adding to library failed, follow podcast failed, unfollow podcast failed.

$14.95/month after 30 days. Cancel anytime.

Buy for $25.19

No default payment method selected.

We are sorry. we are not allowed to sell this product with the selected payment method, listeners also enjoyed....

Personal Finance for Young Adults

By: R.M. Collective

- Narrated by: Arielle Morisot

- Length: 3 hrs

- Overall 5 out of 5 stars 50

- Performance 5 out of 5 stars 50

- Story 5 out of 5 stars 50

Over 80 percent of Americans under the age of 43 are stressed about money, especially during this unprecedented inflation, according to the American Psychological Association. You could blame the pandemic or the collapse of the economy, but blaming something you can’t control only hurts your peace of mind.

- 5 out of 5 stars

Loved this book for stepping my foot into the door of investments and savings!

- By Bhody on 09-19-23

The Black Girl's Guide to Financial Freedom

- Build Wealth, Retire Early, and Live the Life of Your Dreams

By: Paris Woods

- Narrated by: Paris Woods

- Length: 5 hrs and 21 mins

- Overall 5 out of 5 stars 480

- Performance 5 out of 5 stars 441

- Story 5 out of 5 stars 441

Are you tired of spinning your wheels following financial advice that leaves you feeling broker than before? Are you pulling your hair out trying to follow the complicated instructions offered by the gurus? In The Black Girl's Guide to Financial Freedom , Paris Woods takes the guesswork out of wealth-building and presents a plan that anyone can follow. This audiobook is perfect for Black women of any age, including young professionals just starting to set financial goals and mid-career women who are tired of following the same old rules.

- 1 out of 5 stars

If you want to hear stories.

- By Melissa H. on 10-21-22

Building Financial Habits

- A Teenager's Quickstart to Financial Literacy

By: F.C. Ramirez

- Narrated by: Michael F. Ward

- Length: 3 hrs and 40 mins

- Overall 5 out of 5 stars 20

- Performance 5 out of 5 stars 20

- Story 5 out of 5 stars 20

When it comes to financing and saving, many teenagers don’t seem to understand the kind of power and responsibility that comes with money. Whether you have a part-time job or you get an allowance from your parents, saving and budgeting are a huge part of what makes you independent.

Interesting and informative

- By IVONNE Ramirez on 03-28-23

Financial Literacy for Young Adults Simplified

- Discover How to Manage, Save, and Invest Money to Build a Secure & Independent Future

By: Raman Keane

- Narrated by: Alan I Ross

- Length: 3 hrs and 22 mins

- Overall 5 out of 5 stars 30

- Performance 5 out of 5 stars 30

- Story 5 out of 5 stars 30

Investing in your future is easier than you think—discover how and achieve financial security more quickly than you can possibly imagine. Young adults are especially financially vulnerable because they’re just starting out, want a lot of “stuff,” and are not earning the big bucks yet. So, they’re borrowing too much and saving too little (if at all), and they’re in a financial mess. But it doesn’t have to be like that. Instead, imagine a life where you have peace of mind, because your financial affairs are in order, and you’re on the right path to building wealth.

- By Nya on 03-04-24

The Young Adults Guide: 5 Steps to Managing Money

- Eliminate Financial Stress, Never Miss a Bill Payment Again, Savings Made Easy. Bonus: Savings Challenge

By: Kendall Patterson

- Narrated by: Hedy Parks

- Overall 5 out of 5 stars 27

- Performance 5 out of 5 stars 27

- Story 5 out of 5 stars 27

Whether you are single and struggling or fighting with your partner over finance, Young Adults Guide: 5 Steps to Managing Money is the only money management guide you need that has proven results.

Perfect money management guide for me in my 20s

- By Dan on 01-02-23

Cashing Out

- Win the Wealth Game by Walking Away

- By: Julien Saunders, Kiersten Saunders

- Narrated by: Julien Saunders, Kiersten Saunders

- Length: 6 hrs and 2 mins

- Overall 5 out of 5 stars 191

- Performance 5 out of 5 stars 171

- Story 5 out of 5 stars 169

When it comes to our finances, we’re told to follow the same script as our white colleagues: work hard, make money, save, and invest. Yet despite putting in twice the effort, you end up making less and are routinely passed up for career opportunities. Here’s the truth: financial freedom is within your reach, but playing by corporate America’s rules will only take you halfway there. To win, you must eventually walk away—and take up an entirely different model of wealth accumulation.

A letter to the Black community about financial se

- By Anonymous User on 06-24-22

By: Julien Saunders , and others

Personal Finance for Women

- 101 Must-Know Financial Literacy Tips to Get Rid of Debt, Repair Your Credit, and Create Financial Independence

By: Dlina J. Depina

- Narrated by: Lori K. Petrie

- Length: 4 hrs and 21 mins

- Overall 5 out of 5 stars 32

- Performance 5 out of 5 stars 32

- Story 5 out of 5 stars 32

We are seeing more women in the workforce than ever before, but despite reaching high-paying successful positions, women struggle with growing their wealth and maintaining finances. Most of the time, this struggle stems not from the inability to monitor and budget the money; rather, it originates from the lack of education and recourses that are available for young women or women in general. For some, financial education might be Everest, but even the most dangerous mountains can be conquered with the right information, patience, and resilience.

A Must-Listen for Women

- By Joyce Bui on 05-10-24

The 7-Steps from Money Slave to Money Master

- The Young Adult's Guide to Personal Finance 101: A Quick Start Guide for Teens and College Students

By: Learn2Thrive Press

- Narrated by: Luke Oldham

- Length: 3 hrs and 16 mins

- Overall 5 out of 5 stars 24

- Performance 5 out of 5 stars 24

- Story 5 out of 5 stars 24

Tired of constant financial stress? Take charge of your future with expert strategies to build wealth and achieve true financial freedom. Discover the secrets to financial mastery, escape the paycheck-to-paycheck cycle, crush debt, and transform your money mindset. Don't let money control you - take control of your money!

Great advice

- By Darrell Dillon on 03-28-24

The Double Monetary Hourglass

- 11 Strategies for Finding Balance in Money Management for 20 and 30 Somethings, and Eliminating Student Loan Debt Quickly During or After College for Beginners

By: Lou Vachon

- Narrated by: John J. Grace

- Length: 3 hrs and 51 mins

- Overall 5 out of 5 stars 35

- Performance 5 out of 5 stars 35

- Story 5 out of 5 stars 35

Do you find yourself worrying about what you’re going to do once you get out of college? 70 percent of college graduates enter the workforce with over $30,000 in debt. But this doesn't have to be you. You don't have to become part of yet another statistic. Being financially independent as you walk off that graduation stage is not a far-fetched fantasy. This is not a reality reserved solely for those who have very wealthy parents. You can achieve financial success even while in school, and can carry this forward with you throughout the rest of your life.

- By Marc Bourbonnais on 09-13-22

The Simple Path to Wealth

- Your Road Map to Financial Independence and a Rich, Free Life

By: JL Collins

- Narrated by: JL Collins, Peter Adeney

- Length: 6 hrs and 38 mins

- Overall 5 out of 5 stars 9,127

- Performance 5 out of 5 stars 7,710

- Story 5 out of 5 stars 7,644

This book grew out of a series of letters to my daughter concerning various things - mostly about money and investing - she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we've created, understanding it is critical.

Misleading, heavily biased

- By Cody Peralta on 07-19-19

Rest Is Resistance

- A Manifesto

By: Tricia Hersey

- Narrated by: Tricia Hersey

- Length: 5 hrs and 26 mins

- Overall 5 out of 5 stars 856

- Performance 5 out of 5 stars 779

- Story 5 out of 5 stars 775

What would it be like to live in a well-rested world? Far too many of us have claimed productivity as the cornerstone of success. Brainwashed by capitalism, we subject our bodies and minds to work at an unrealistic, damaging, and machine‑level pace—feeding into the same engine that enslaved millions into brutal labor for its own relentless benefit. In Rest Is Resistance , Tricia Hersey, aka the Nap Bishop, casts an illuminating light on our troubled relationship with rest and how to imagine and dream our way to a future where rest is exalted.

What an experience

- By makeba jones on 10-26-22

I Will Teach You to Be Rich

- No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)

By: Ramit Sethi

- Narrated by: Ramit Sethi

- Length: 12 hrs and 8 mins

- Overall 4.5 out of 5 stars 9,251

- Performance 5 out of 5 stars 7,777

- Story 4.5 out of 5 stars 7,692

Buy as many lattes as you want. Spend extravagantly on the things you love. Live your rich life instead of tracking every last expense with Ramit Sethi’s simple, powerful, and effective six-week program for gaining control over your finances. This isn’t typical advice from a money expert. In this completely updated second edition, Ramit teaches you how to choose long-term investments and the right bank accounts. With his characteristic no-BS perspective, he shows how to squeeze every hidden benefit out of your credit cards.

- 3 out of 5 stars

Repetitive - should be retitled.

- By Truth on 06-20-19

Get Good with Money

- Ten Simple Steps to Becoming Financially Whole

By: Tiffany the Budgetnista Aliche

- Narrated by: Tiffany the Budgetnista Aliche

- Length: 12 hrs and 23 mins

- Overall 5 out of 5 stars 1,015

- Performance 5 out of 5 stars 846

- Story 5 out of 5 stars 842

Tiffany Aliche was a successful pre-school teacher with a healthy nest egg when a recession and advice from a shady advisor put her out of a job and into a huge financial hole. As she began to chart the path to her own financial rescue, the outline of her 10-step formula for attaining both financial security and peace of mind began to take shape. These principles have now helped more than one million women worldwide save and pay off millions in debt, and begin planning for a richer life.

Goodbye SWEET 16. Hello ROTH IRA!

- By Will Smith on 04-12-21

- The Counterintuitive Approach to Getting Everything You Want from Your Relationship

- By: Khadeen Ellis, Devale Ellis

- Narrated by: Khadeen Ellis, Devale Ellis

- Length: 6 hrs and 40 mins

- Overall 5 out of 5 stars 891

- Performance 5 out of 5 stars 840

- Story 5 out of 5 stars 839

After twelve years of marriage, twenty years together, and four kids, Devale and Khadeen Ellis have been through a lot. They’ve loved their way through a long-distance relationship, financial instability, parenthood, Khadeen’s near-death, and their near-divorce, chronicling their day-to-day life with their boys online. After much trial and error, they hit upon one surprising, essential truth: If you’re looking for a healthy relationship and a fulfilling life, focus on your partner’s needs instead of your wants.

I enjoyed every minute of this book

- By Freddrick Smooth on 04-30-23

By: Khadeen Ellis , and others

Playing with FIRE (Financial Independence Retire Early)

- How Far Would You Go for Financial Freedom?

By: Scott Rieckens

- Narrated by: Scott Rieckens

- Length: 4 hrs and 37 mins

- Overall 4.5 out of 5 stars 729

- Performance 4.5 out of 5 stars 626

- Story 4.5 out of 5 stars 624

A successful entrepreneur living in Southern California, Scott Rieckens had built a “dream life”: a happy marriage, a two-year-old daughter, a membership to a boat club, and a BMW in the driveway. But underneath the surface, Scott was creatively stifled, depressed, and overworked trying to help pay for his family’s beach-town lifestyle. Then one day, Scott listened to a podcast interview that changed everything.

Unrelatable and nauseatingly privileged

- By Phil Royer on 03-25-19

Set for Life, Revised Edition

- An All-Out Approach to Early Financial Freedom

By: Scott Trench

- Narrated by: Scott Trench

- Length: 9 hrs and 22 mins

- Overall 4.5 out of 5 stars 4,974

- Performance 4.5 out of 5 stars 4,271

- Story 4.5 out of 5 stars 4,234

Scott Trench—real estate investor, co-host of the BiggerPockets Money Podcast , and CEO of BiggerPockets—demonstrates how to accumulate a lifetime of wealth over a short period of time. Even starting with zero savings, you can go from a five-figure income to six figures, from an active job to passive income, then finally to the ultimate goal of financial independence.

- 4 out of 5 stars

Set for American life

- By Anonymous User on 05-11-17

Financial Feminist

- Overcome the Patriarchy’s Bullsh*t to Master Your Money and Build a Life You Love

By: Tori Dunlap

- Narrated by: Tori Dunlap, Samantha Tan, Shayna Small, and others

- Length: 8 hrs and 3 mins

- Overall 4.5 out of 5 stars 381

- Performance 4.5 out of 5 stars 337

- Story 4.5 out of 5 stars 336

From the globally-recognized personal finance educator and social media star behind Her First $100K, an inclusive guide to all things money—from managing debt to investing and voting with your dollars.

If you believe in Manifesting

- By Julia on 01-21-23

My Money My Way

- Taking Back Control of Your Financial Life

By: Kumiko Love

- Narrated by: Kumiko Love

- Length: 6 hrs and 43 mins

- Overall 5 out of 5 stars 369

- Performance 5 out of 5 stars 312

- Story 5 out of 5 stars 311

As a newly divorced single mom making $24,000 per year and facing down $77,000 in debt, Kumiko Love worried constantly about money. She saw what other moms had—vacations, birthday parties, a house full of furniture—and felt ashamed that she and her son lived in a small apartment and ate dinner on the floor. Worse, when her feelings began to exhaust her, she binge-shopped, reasoning that she’d feel better after a trip to the mall.

- By Amazon Customer on 03-02-23

Publisher's summary

*A Next Big Idea Club December 2023 Must-Read*

Podcaster Jamila Souffrant shows how to skyrocket your savings, blast through debt and ultimately accelerate your unique and truly epic journey to financial freedom and independence

Our fast-paced world prioritizes the productive busybody—financial security always seems to rule over the insatiable hankering for a Friday night splurge. However, Jamila Souffrant argues that you can in fact spend and save responsibly, all while enjoying that extra side of guacamole. In this book, Jamila will teach you how to:

- Determine which of the 4 “Journeyer” stages you fall into and how you should be evaluating your spending and saving goals accordingly

- Map out different scenarios to quit your job, retire early, and reach financial independence

- Downsize costly daily expenses in ways you never considered, and spend more in ways that bring you joy

- Create an effective debt payoff plan that works for you

As a wife, mother of three and first-generation Jamaican immigrant, Jamila knows all too well the struggles of saving for tomorrow while spending liberally today. Now, in her first book, Jamila offers her seasoned expertise in Your Journey to Financial Freedom , providing listeners with the resources they need to not only save for cake but eat it, too.

Supplemental enhancement PDF accompanies the audiobook.

PLEASE NOTE: When you purchase this title, the accompanying PDF will be available in your Audible Library along with the audio.

- Unabridged Audiobook

- Categories: Money & Finance

Related to this topic

Can't Hurt Me

- Master Your Mind and Defy the Odds

By: David Goggins

- Narrated by: David Goggins, Adam Skolnick

- Length: 13 hrs and 37 mins

- Overall 5 out of 5 stars 199,021

- Performance 5 out of 5 stars 175,711

- Story 5 out of 5 stars 175,112

For David Goggins, childhood was a nightmare--poverty, prejudice, and physical abuse colored his days and haunted his nights. But through self-discipline, mental toughness, and hard work, Goggins transformed himself from a depressed, overweight young man with no future into a US Armed Forces icon and one of the world's top endurance athletes. The only man in history to complete elite training as a Navy SEAL, Army Ranger, and Air Force tactical air controller, he went on to set records in numerous endurance events.

Opting for the book instead

- By S David on 12-24-18

The Art of War

By: Sun Tzu

- Narrated by: Aidan Gillen

- Length: 1 hr and 7 mins

- Overall 4.5 out of 5 stars 40,512

- Performance 4.5 out of 5 stars 33,502

- Story 4.5 out of 5 stars 33,083

The 13 chapters of The Art of War , each devoted to one aspect of warfare, were compiled by the high-ranking Chinese military general, strategist, and philosopher Sun-Tzu. In spite of its battlefield specificity, The Art of War has found new life in the modern age, with leaders in fields as wide and far-reaching as world politics, human psychology, and corporate strategy finding valuable insight in its timeworn words.

The actual book The Art of War, not a commentary

- By Fred271 on 12-31-19

The 6 Habits of Growth

By: Brendon Burchard

- Narrated by: Brendon Burchard

- Length: 5 hrs and 4 mins

- Original Recording

- Overall 4.5 out of 5 stars 5,778

- Performance 5 out of 5 stars 5,088

- Story 4.5 out of 5 stars 5,045

The world’s leading high-performance coach and multiple New York Times best-selling author Brendon Burchard delivers the six habits of personal growth that will help you create the life of your dreams. Forged from Brendon Burchard’s personal experiences, data from his GrowthDay app, and his many years as a high-performance coach, The 6 Habits of Growth presents the tools you need to construct the life of your dreams.

- 2 out of 5 stars

Don’t bother

- By B. Sharpe on 10-30-22

The 5 Second Rule

- Transform your Life, Work, and Confidence with Everyday Courage

By: Mel Robbins

- Narrated by: Mel Robbins

- Length: 7 hrs and 35 mins

- Overall 4.5 out of 5 stars 51,050

- Performance 4.5 out of 5 stars 44,422

- Story 4.5 out of 5 stars 44,085

How to enrich your life and destroy doubt in five seconds. Throughout your life, you've had parents, coaches, teachers, friends, and mentors who have pushed you to be better than your excuses and bigger than your fears. What if the secret to having the confidence and courage to enrich your life and work is simply knowing how to push yourself?

I turned it off after an hour.

- By Zac on 04-08-17

Maybe You Should Talk to Someone

- A Therapist, HER Therapist, and Our Lives Revealed

By: Lori Gottlieb

- Narrated by: Brittany Pressley

- Length: 14 hrs and 21 mins

- Overall 4.5 out of 5 stars 42,713

- Performance 5 out of 5 stars 37,603

- Story 4.5 out of 5 stars 37,466

One day, Lori Gottlieb is a therapist who helps patients in her Los Angeles practice. The next, a crisis causes her world to come crashing down. Enter Wendell, the quirky but seasoned therapist in whose office she suddenly lands. With his balding head, cardigan, and khakis, he seems to have come straight from Therapist Central Casting. Yet he will turn out to be anything but.

It was like a hallmark movie being waterboarded into my ears for 15 hours

- By Amazon Customer on 10-01-19

12 Months to $1 Million

- How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur

By: Ryan Daniel Moran

- Narrated by: Ryan Daniel Moran

- Length: 7 hrs and 38 mins

- Overall 5 out of 5 stars 3,559

- Performance 5 out of 5 stars 3,068

- Story 5 out of 5 stars 3,052

By cutting out the noise and providing a clear and proven plan, this road map helps even brand-new entrepreneurs make decisions quickly, get their product up for sale, and launch it to a crowd that is ready and waiting to buy. This one-year plan will guide you through the three stages to your first $1 million: the Grind (months 0-4), the Growth (months 5-8), and the Gold (months 9-12). If your goal is to be a full-time entrepreneur, get ready for one chaotic, stressful, and rewarding year. If you have the guts to complete it, you will be the proud owner of a million-dollar business.

Good, but a Little Misleading

- By Chris Love on 11-28-20

How to Train Your Mind

- Exploring the Productivity Benefits of Meditation

By: Chris Bailey

- Narrated by: Chris Bailey

- Length: 3 hrs and 18 mins

- Overall 4.5 out of 5 stars 8,216

- Performance 4.5 out of 5 stars 6,971

- Story 4.5 out of 5 stars 6,910

Meditation makes you more productive because it lets you earn back time. For each minute you spend meditating, you'll earn around nine minutes back, as Chris Bailey - author of The Productivity Project and Hyperfocus - will show in this candid and counter-intuitive guide to the productivity benefits of meditation.

Started Listening By Accident

- By T.D.Willis on 01-17-21

The Daily Stoic

- 366 Meditations on Wisdom, Perseverance, and the Art of Living

- By: Ryan Holiday, Stephen Hanselman

- Narrated by: Brian Holsopple

- Length: 10 hrs and 6 mins

- Overall 5 out of 5 stars 3,113

- Performance 4.5 out of 5 stars 2,608

- Story 5 out of 5 stars 2,573

Why have history's greatest minds - from George Washington to Frederick the Great to Ralph Waldo Emerson along with today's top performers, from Super Bowl-winning football coaches to CEOs and celebrities - embraced the wisdom of the ancient Stoics? Because they realize that the most valuable wisdom is timeless and that philosophy is for living a better life, not a classroom exercise. The Daily Stoic offers a daily devotional of Stoic insights and exercises, featuring all-new translations.

Not well made as audio

- By Andreas on 12-27-16

By: Ryan Holiday , and others

Emotional Investment

By: Fresh Produce Media

- Narrated by: Amanda Clayman

- Length: 5 hrs and 36 mins

- Overall 5 out of 5 stars 21

- Story 4.5 out of 5 stars 20

In Emotional Investment , therapist-turned-financial coach Amanda Clayman works with a range of people and couples to unravel money dilemmas. Along the way, Clayman gives us practical tools—both financial and emotional—that we can all use in our own lives.

So honest and engaging to hear people’s money stories.

- By Jc on 04-12-24

How to Release Anxiety

By: Gabrielle Bernstein

- Narrated by: Gabrielle Bernstein

- Length: 1 hr and 29 mins

- Overall 4.5 out of 5 stars 859

- Performance 4.5 out of 5 stars 751

- Story 4.5 out of 5 stars 742

It’s not just you. Stress levels are at an all-time high—so much so that a recently convened panel of medical experts in the US has recommended that all adults under the age of 65 be screened for anxiety. In How to Release Anxiety , Gabby Bernstein offers simple, actionable steps for feeling better, living with more ease, and showing up for those around us. Gabby’s unusual advice: Rather than manage your anxiety, what if you befriended it? Gabby posits that what we befriend, we can ultimately be at ease with. So she invites us to get curious.

Not my thing, but one good point

- By Scott on 10-22-22

How to Say It: Words That Make a Difference

- By: Allison Friederichs Atkison, The Great Courses

- Narrated by: Allison Friederichs Atkison

- Length: 4 hrs and 44 mins

- Overall 4.5 out of 5 stars 1,478

- Performance 4.5 out of 5 stars 1,267

- Story 4 out of 5 stars 1,247

Words. We use them all the time, every day, mostly without giving them much thought at all. We take for granted that they’re here at our disposal whenever we need them. But if you’ve ever wished you could communicate more effectively, words are the place to start. It’s incumbent upon you to choose the best words to accomplish your goals, because how you choose to communicate influences—well, everything! The power of communication shapes our professional goals, our relationships, and our lives—so the words we choose to use carry a great deal of power.

Meh. Glad I didn't pay for it.

- By Paula on 07-23-22

By: Allison Friederichs Atkison , and others

Push Back: Assert Yourself in Relationships

- By: Monica Johnson, The Great Courses

- Narrated by: Monica Johnson

- Length: 2 hrs and 30 mins

- Overall 3.5 out of 5 stars 2

- Performance 3 out of 5 stars 2

- Story 3 out of 5 stars 2

Holding boundaries and asserting yourself are crucial skills for maintaining healthy relationships and a sense of self-respect. In Push Back: Assert Yourself in Relationships , professional clinical psychologist Dr. Monica Johnson teaches you how to clearly define your limits, communicate those limits to others, and foster mutual respect and understanding in your everyday interactions.

very slow content - speed of voice and amount of content

- By Kevin Swalberg on 05-13-24

By: Monica Johnson , and others

A Quiet Life in 7 Steps

By: Susan Cain

- Narrated by: Susan Cain

- Length: 4 hrs and 38 mins

- Overall 4.5 out of 5 stars 524

- Performance 4.5 out of 5 stars 503

- Story 4.5 out of 5 stars 503

In a world of distraction, overcommitment, and often overwhelming social expectations, are you craving depth, meaning, and true connection? Join Susan Cain, an international best-selling author on the power of introverts who will help you tune out all of your everyday stresses and conflicts and tune into living a Quiet Life. In seven steps, Susan will show you exactly how to lead your own Quiet Life. She’ll help you connect with the part of yourself that’s drawn to the quiet, the deep, the beautiful, and the kind.

A great reminder to once again listen to our inner voice…

- By Amazon Customer on 01-14-24

- Attract Women Through Honesty

By: Mark Manson

- Narrated by: Austin Rising

- Length: 7 hrs and 52 mins

- Overall 5 out of 5 stars 9,085

- Performance 4.5 out of 5 stars 7,602

- Story 5 out of 5 stars 7,527

Models is the first book ever written on seduction as an emotional process rather than a logical one, a process of connecting with women rather than impressing them. It's the most mature and honest guide on how a man can attract women without faking behavior, without lying and without emulating others. A game-changer.

The content is great but the reader is awful

- By Mark Speener on 06-24-14

How to Be a 3% Man

By: Corey Wayne

- Narrated by: Corey Wayne

- Length: 7 hrs and 33 mins

- Overall 4.5 out of 5 stars 14,655

- Performance 4.5 out of 5 stars 12,091

- Story 4.5 out of 5 stars 11,985

My book covers both the dating world and long-term relationships. You will learn how to meet and date the type of women you've always dreamed of. The best part is you can do this while remaining who you truly are inside. The book teaches you how to create sexual attraction in women and get women to chase and pursue you! It takes you step by step with easy-to-follow instructions. You will be able to meet women anytime, anyplace, and anywhere. This will give you choice with women.

- By Anonymous User on 07-07-17

I Can't Make This Up

- Life Lessons

- By: Neil Strauss - contributor, Kevin Hart

- Narrated by: Kevin Hart

- Length: 11 hrs and 15 mins

- Overall 4.5 out of 5 stars 55,735

- Performance 5 out of 5 stars 50,215

- Story 4.5 out of 5 stars 49,959

Superstar comedian and Hollywood box-office star Kevin Hart turns his immense talent to the written word by writing some words. Some of those words include: the , a , for , above , and even even . Put them together and you have the funniest, most heartfelt, and most inspirational memoir on survival, success, and the importance of believing in yourself since Old Yeller .

Best Audiobook I Ever Listened To

- By Sam Clear on 07-13-17

By: Neil Strauss - contributor , and others

The Gift of Fear

- Survival Signals That Protect Us from Violence

By: Gavin de Becker

- Narrated by: Gavin de Becker

- Length: 12 hrs and 50 mins

- Overall 5 out of 5 stars 1,615

- Performance 5 out of 5 stars 1,407

- Story 5 out of 5 stars 1,398

These days, no one in America feels immune to violence. But now, in this extraordinary, groundbreaking book, the nation's leading expert on predicting violent behavior unlocks the puzzle of human violence and shows that, like every creature on earth, we have within us the ability to predict the harm others might do us and get out of its way. Contrary to popular myth, human violence almost always has a discernible motive and is preceded by clear warning signs.

Decent book severely undermined by last chapter.

- By zachary on 11-01-22

- Stop People Pleasing, Staying Silent, & Feeling Guilty... And Start Speaking up, Saying No, Asking Boldly, and Unapologetically Being Yourself

By: Dr. Aziz Gazipura PsyD

- Narrated by: Dr. Aziz Gazipura PsyD

- Length: 18 hrs and 2 mins

- Overall 4.5 out of 5 stars 1,453

- Performance 4.5 out of 5 stars 1,217

- Story 4.5 out of 5 stars 1,205

Are you too nice? If you find it hard to be assertive, directly ask for what you want, or say "no" to others, then you just might be suffering from too much niceness. In this controversial book, world-renowned confidence expert, Dr. Aziz Gazipura, takes an incisive look at the concept of nice. Through his typical style, Dr. Aziz uses engaging stories, humor, and disarming vulnerability to cut through the nice conditioning and liberate the most bold, expressive, authentic version of you.

Changed my life forever

- By Shannon Slater on 12-07-18

People who viewed this also viewed...

- The Practical Guide to Reaching Your Financial Goals

- Length: 6 hrs and 25 mins

- Overall 5 out of 5 stars 14

- Performance 5 out of 5 stars 13

- Story 5 out of 5 stars 13

We all want to live within our means, save for retirement, invest a little, and yet still have some left over each month for fun. But as most people know, real life can get in the way of even our best intentions! To help us set realistic goals and keep us on track to meeting them, New York Times bestselling financial educator Tiffany “The Budgetnista” Aliche has an invaluable 10-step action plan: Made Whole.

Just what I needed!

- By Lekeya A Irby on 12-11-23

Your First Million

- Why You Don't Have to Be Born into a Legacy of Wealth to Leave One Behind

- By: Arlan Hamilton, Rachel L. Nelson

- Narrated by: Arlan Hamilton

- Length: 4 hrs and 29 mins

- Overall 5 out of 5 stars 61

- Performance 5 out of 5 stars 60

- Story 5 out of 5 stars 60

Having lived nearly her entire life below the poverty line before going on to attain wealth and success as an entrepreneur and investor, Arlan Hamilton knows that money is power—but not for the reasons most people believe. Money is power, she says, because it provides us with options : to pursue our passions, take risks, and change our situation in life.

Advice + Action steps

- By Melanie Jones on 02-07-24

By: Arlan Hamilton , and others

Financially Lit!

- The Modern Latina's Guide to Level Up Your Dinero & Become Financially Poderosa

By: Jannese Torres

- Narrated by: Jannese Torres

- Length: 10 hrs and 1 min

- Overall 5 out of 5 stars 3

- Performance 5 out of 5 stars 3

- Story 5 out of 5 stars 3

In many immigrant households, money isn’t often a topic of discussion, so financial education can be minimal—especially when a family is just trying to survive the day-to-day. Despite being the largest minority group in the United States, the Latino community still faces cultural and systemic barriers that prevent them from building wealth. As a first-generation Latina, Jannese Torres, award-winning money expert, educator, and podcaster, knows these unique challenges well.

Clarity and Inspiration

- By MamaG LTA75 on 05-05-24

Financial Freedom for Black Women

- A Girl's Guide to Winning With Your Wealth, Career, Business, & Retiring Early—With Real Estate, Cryptocurrency, Side Hustles, Stock Market Investing, & More!

By: Brandy Brooks

- Narrated by: Keyonni James

- Length: 4 hrs and 18 mins

- Overall 4.5 out of 5 stars 28

- Performance 5 out of 5 stars 22

- Story 4.5 out of 5 stars 22

Maybe you’ve been dreaming of landing a higher-paying career, or starting a profitable online business? Perhaps you want to finally learn what you were never taught about real estate or the stock market? Or maybe you want to take a chance on Bitcoin and Crypto—without losing everything. Regardless of your current age or net worth or any financial errors you’ve made in the past, I’ll reveal the exact strategies we've used to grow our wealth from $0 to over $2M and counting.

Good basic advice. Good foundation

- By tailorchick on 10-31-23

Money Is Not a Math Problem

By: Jade Warshaw

- Narrated by: Jade Warshaw

- Length: 1 hr and 45 mins

- Overall 4.5 out of 5 stars 64

- Performance 4.5 out of 5 stars 61

- Story 4.5 out of 5 stars 61

It’s not a book about numbers, percentages or decimals. It’s a book that drives to the heart of the money problems many people deal with—because those problems are usually symptoms of a bigger issue. The issue is our inaccurate beliefs, fears and flat-out lies about budgeting. Ramsey Personality and debt elimination expert Jade Warshaw candidly shares how she and her husband, Sam, shifted their mindset around money and paid off over $460,000 in debt—including $280,000 of student loans!

Good motivation for Teens and YA

- By Courtney C. on 12-18-23

A Healthy State of Panic

- Follow Your Fears to Build Wealth, Crush Your Career, and Win at Life

By: Farnoosh Torabi

- Narrated by: Farnoosh Torabi

- Length: 9 hrs and 5 mins

- Overall 5 out of 5 stars 19

- Performance 4.5 out of 5 stars 18

- Story 5 out of 5 stars 18

Farnoosh Torabi is familiar with fear. Growing up in the 1980s as the daughter of Iranian immigrants, she was warned to proceed with caution and play it safe. She spent her childhood immersed in fear—of rejection, loneliness, missed opportunities, and falling short of her potential. But Farnoosh came to the realization that fear never limited her. Instead, it has become a friend. Now, Farnoosh pairs stories from her immigrant upbringing with hard-won industry knowledge and data to show how leaning into your fears can help you take control of your financial future.

Such a powerful (and entertaining!) message.

- By Stephanie Schendel on 11-27-23

Get the Hell Out of Debt

- The Proven 3-Phase Method That Will Radically Shift Your Relationship to Money

By: Erin Skye Kelly

- Narrated by: Erin Skye Kelly

- Length: 7 hrs and 19 mins

- Overall 4.5 out of 5 stars 84

- Performance 4.5 out of 5 stars 72

- Story 4.5 out of 5 stars 72

Erin Skye Kelly wrote Get the Hell Out of Debt after her own struggle to become consumer-debt free. She was tired of listening to middle-aged men in suits tell her to consolidate and refinance her debt when all that seemed to happen was she’d end up in more of it while they profited from it. When Kelly figured out the two most important tools to money management - and started achieving massive results- other women wanted to join in on the debt-free journey. With her sense of humor and straight-shooting sensibilities, Erin began transforming lives.

This was painful

- By Anonymous User on 12-06-22

Pillars of Wealth

- How to Make, Save, and Invest Your Money to Achieve Financial Freedom

By: David M Greene

- Narrated by: Clifford Ponder

- Length: 10 hrs and 49 mins

- Overall 4.5 out of 5 stars 34

- Performance 4.5 out of 5 stars 34

- Story 4.5 out of 5 stars 34

Break free from the slow grind of budgeting and rethink your wealth-building strategy with this award-winning Wall Street Journal bestseller: the ultimate playbook for financial freedom. Building wealth isn't complicated but its also not easy. Abandon the get-rich-quick-schemes and take the guesswork out of financial freedom with a strategy perfected by countless self-made millionaires.

Lots of bragging

- By Dr. DJ Polzin on 04-19-24

Fearless Finances

- A Timeless Guide to Building Wealth

By: Cassandra Cummings

- Narrated by: Cassandra Cummings

- Length: 7 hrs and 25 mins

Historically, women of color have been shut out of the wealth-building game. Cassandra Cummings has made it her mission to change that by creating a vibrant and successful online community of more than 100,000 women investors. In her new book, Cassandra brings the powerful lessons of their achievements to you.

Motivational

- By Amazon Customer on 01-08-23

The One Week Budget

- Learn to Create Your Money Management System in 7 Days or Less!

- Length: 3 hrs and 20 mins

- Overall 4.5 out of 5 stars 88

- Performance 4.5 out of 5 stars 73

- Story 4.5 out of 5 stars 74

Hate paying bills? So do I, and that’s why I stopped! What if I told you that I haven’t paid a bill in more than a decade and that my credit score is higher than 800? Would you call me a liar, or would you want to know how I did it? In this audiobook, I will teach you what took me years to learn. The One Week Budget is for anyone who wants to manage his or her day-to-day money without the day-to-day hassle. Does this sound like you? What are you waiting for? Listen to the audiobook already!

Missed the Mark

- By Arcilicia T. Oliver on 01-01-21

- The Winning Money Mindset That Will Change Your Life

By: Vivian Tu

- Narrated by: Vivian Tu

- Length: 8 hrs and 5 mins

- Overall 4.5 out of 5 stars 435

- Performance 4.5 out of 5 stars 400

- Story 4.5 out of 5 stars 400

When Vivian Tu started working on Wall Street fresh from undergrad, all she knew was that she was making more money than she had ever seen in her life. But it wasn’t until she found a mentor of her own on the trading floor that she began to understand what wealthy people knew intuitively. Building on the lessons she learned on Wall Street about money and the markets, Vivian now offers her best personal finance tips and tricks to listeners of all ages and demographics, so that anyone can get rich, whether you grew up knowing the rules to the game or not.

Good information

- By Joseph Gall on 12-28-23

Make Money Move

- A Guide to Financial Wellness

By: Lauren Simmons

- Narrated by: Lauren Simmons

- Length: 5 hrs and 1 min

- Overall 4.5 out of 5 stars 10

- Performance 4.5 out of 5 stars 9

- Story 4.5 out of 5 stars 9

In 2017, when she was only twenty-two, Lauren Simmons became the youngest full-time female trader at the New York Stock Exchange, and the second African American woman in the Exchange's 228-year history to hold such a position. Driven by a passion for empowering women, Millennials, Gen Zs, and minorities to become more financially savvy, she now shares her experience and knowledge in this savvy financial guide. Simmons brings a fresh perspective to personal finance.

A Nice-Listen for Financial Empowerment

- By Coach P on 03-30-24

Girls Just Wanna Have Impact Funds

- A Feminist's Guide to Changing the World with Your Money

- By: Camilla Falkenberg, Emma Due Bitz, Anna-Sophie Hartvigsen

- Narrated by: Charlotte Gosling

- Length: 4 hrs and 17 mins

- Overall 5 out of 5 stars 1

- Performance 5 out of 5 stars 1

- Story 5 out of 5 stars 1

Put your money where your mouth is when it comes to handling your finances and join the Female Invest trio on a mission to investigate sustainable stocks and funds, angel investing, and empowering initiatives—for both you and the planet. Cutting through the noise, this trusted resource will rationalize the vast scope of the term "sustainable investing", and consider how investments, funds, stocks, and shares can be responsible, ethical, green, and impactful—enabling you to partake in a truly circular economy.

By: Camilla Falkenberg , and others

The Wealth Decision

- 10 Simple Steps to Achieve Financial Freedom and Build Generational Wealth

By: Dominique Broadway

- Narrated by: Dominique Broadway

- Length: 6 hrs and 45 mins

Demystify the path to wealth once and for all with Dominique Broadway’s unique strategy for taking control of your finances and becoming a millionaire. Written with millennials and Gen Zers in mind, The Wealth Decision first shows you how to make that one decision to be wealthy. It then takes you through the most important decisions you need to live a life of financial freedom and ensuing strategies to build generational wealth and become a millionaire.

More autobiography than investment guidebook

- By Jessica on 07-03-23

We Should All Be Millionaires

- A Woman’s Guide to Earning More, Building Wealth, and Gaining Economic Power

By: Rachel Rodgers

- Narrated by: Rachel Rodgers

- Length: 8 hrs and 40 mins

- Overall 5 out of 5 stars 2,602

- Performance 4.5 out of 5 stars 2,200

- Story 5 out of 5 stars 2,190

Only 10 percent of the world’s millionaires are women, making it difficult for women to wield the economic power that will create lasting equality. Whatever is stopping you from having seven figures in the bank - whether it’s shaky confidence, knowledge gaps when it comes to wealth-building tactics, imposter syndrome, a janky mindset about money (it’s okay, we’ve all been there!), or simply not knowing where to begin - this book shows you how to clear every obstacle in your way, show up, and glow up.

Some Good Content In Between the Opinions

- By bhdhlh on 05-26-21

What listeners say about Your Journey to Financial Freedom

- 5 out of 5 stars 5.0 out of 5.0

- 4.5 out of 5 stars 4.7 out of 5.0

Reviews - Please select the tabs below to change the source of reviews.

Audible.com reviews, amazon reviews.

- Overall 5 out of 5 stars

- Performance 3 out of 5 stars

- Story 5 out of 5 stars

- M. Mansoura

Good for those starting out

Jamila clearly lays out a plan for you to follow based based on your stage of investing. Everything is clearly explained, which is great as investing can be very intimidating when first starting out. Her narration is a bit stiff. I also recommend her podcast.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

- Performance 5 out of 5 stars

So helpful and timely

I heard about this book on Therapy for Black Girls. I plan to send it to everyone I love and most folks I like

- Tamika Marie

Financial Freedom

Excellent book, excellent narration. I also enjoy listening to the podcast, too. Do yourself a favor and purchase this book.

- Amazon Customer

Book covers so such a simple and easy to digest manner!

Everything was simple! I enjoyed listening to Jamila’s steps and her explanation on internal reflections we each need to individually make on this journey.

Please sign in to report this content

You'll still be able to report anonymously.

What is Financial Freedom? 12 Steps to Achieve It

Inside: Are you looking to achieve financial freedom? This guide teaches you the 12 habits you need along the journey. Learn how people changed their lives with simple steps of savings and minimized expenses.

Achieving financial freedom is often misconceived as simply accumulating great wealth.

However, as David Bach, a renowned financial expert and top-selling author emphasizes, “Financial Freedom is about a lot more than money, it’s about living a richer life.” Indeed, true financial freedom is not solely dictated by the figures in your bank account, but more by the ability to live life on your terms, unencumbered by financial restraints.

There are reasons financial freedom is a coveted goal for many . Having more than enough monetary resources to finance your desired lifestyle without being driven by the need to earn a certain amount every year can be liberating.

This post will explain financial freedom in-depth, its benefits, the keys, and simple strategies to attain it.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here .

What is Financial Freedom?

Financial freedom is understood in various ways depending on people’s personal goals and values. Essentially, it’s having ample savings, cash, and investments to live as desired , both presently and in the future.

Those who reach financial freedom find themselves in control of their money , not allowing it to control them. Imagine enjoying your favorite hobby, traveling, or simply relaxing without stressing about money .

That’s the essence of financial freedom .

Why is Financial Freedom Good?

Financial freedom is a game-change r. It gives you complete control over your finances, allowing you to make choices that align with your values and long-term plans .

Financial independence reduces anxiety tied to unforeseen expenses and offers a safety net during unexpected hardship. It also allows you to work on your terms , pursue passions, take risks, and ultimately, leads to a more fulfilling and happier life.

This is something I can attest to when my husband was able to leave a toxic work environment on his terms.

What is the key to financial freedom?

The key to financial freedom lies in attaining financial literacy, prioritizing your goals, and cultivating good financial habits.

This involves setting and being adamant about your life goals, living within your means, saving diligently, investing wisely, diversifying income streams, and regularly reviewing and adjusting your financial plan.

Control over your finances and informed decisions pave the way toward financial freedom.

12 Simple Strategies for Financial Freedom

Achieving financial freedom requires strategic planning and disciplined execution . It’s not just about earning more, but about saving wisely, spending judiciously, and investing intelligently.

This section introduces you to key strategies for securing financial independence, illustrating their importance and demonstrating their role in paving the way toward a stress-free financial future.

Remember, financial freedom is not just about an affluent lifestyle, but about taking control of your finances, making your money work for you, and living a life on your own terms.

Something we emphasize around here at Money Bliss.

1. Set Life Goals

Setting clear, tangible life goals — both big and small, financial and lifestyle — is the first step towards achieving financial freedom. These smart goals form the backbone of your financial plan.

For instance, you may aspire to own a house, increase your liquid net worth , or retire early. The more specific your goals, with concrete amounts and deadlines, the higher the likelihood of achieving them.

2. Create a Monthly Budget

Creating a monthly budget is an instrumental step towards financial freedom.

- Start by taking account of all your income like your paycheck and expenses.

- Identify non-essential items you can cut down, and set money aside for emergencies and savings.

- Focus on mindful spending and curb the urge to splurge.

Following a monthly budget guarantees that all bills are paid, and savings are progressing at a solid pace. Get solid budgeting advice to help you get started.

3. Spend Less Than You Earn

To reach financial freedom, it’s fundamental to spend less than you earn . This tip may seem overly simple, but it lays the foundation for wealth accumulation.

I cannot stress this concept of spending less and saving more enough. By reducing discretionary expenses and embracing frugality where possible, you maximize savings.

This doesn’t mean an austere life but simply cutting back on unnecessary expenses to create more room for savings and investments.

4. Invest in Your Future

Investing is a path towards creating wealth for your future. Even small amounts invested wisely can have big results, thanks to the power of compound interest.

Whether it’s real estate, the stock market, or mutual funds, investing can generate an income stream and significant long-term growth. This also means increasing your financial literacy to bring direction and discipline to your investment journey.

Learn how to start investing 10K .

Learn to trade stocks with confidence.

Whether you want to:

- Retire in peace without financial anxiety

- Pay your bills without taking on a side hustle

- Quit your 9-5 and do what you love

- Or just make more than your current income....

Making $1,000 every.single.day is NOT a pie-in-the-sky goal.

It’s been done over and over again, and the 30,000 students that Teri has helped to be financially independent and fulfill their financial dreams are my witnesses…

5. Stay Educated on Financial Issues

Staying attentive to financial news and developments is crucial. Knowing current trends can aid in timely adjustments to your investment portfolio.

Staying educated on financial issues and increasing financial literacy is an effective step toward achieving financial freedom. This includes acquiring competencies in areas such as understanding debt, budgeting, keeping track of cash flow, and investing wisely.

From changes in tax law to swings in the stock market, keep informed to make well-rounded financial decisions. Remember, knowledge is your best protection against fraud or investing missteps.

6. Develop Passive Income Streams

In your hunt for financial freedom, developing passive income streams can be a great advantage.

Passive income refers to earnings derived from a rental property, selling printables, or other enterprises in which you’re not actively involved. This could be writing a book, starting a blog, or investing in stocks.

These income streams can dramatically boost your earnings and aid your journey to financial freedom.

7. Diversify Your Investments

Diversifying your investments is a key strategy to mitigate risk and potentially increase returns. Remember the statement of don’t put all of your eggs in one basket.

Portfolio diversification involves spreading investments across different asset classes – such as cash, stocks, bonds, and real estate. Diversification ensures downturns in a single area won’t devastate your finances.

The best tool to track your investments would be Empower and you can use it for free.

Empower offers powerful tools to help you plan your investment strategy along with basic budgeting features and a great net worth tool.

As a free app, Empower can help you to save money, save time, and even make more money.

8. Maintain Your Property and Health

Maintaining your property and health is vital to your financial wellness . Regular care and maintenance for your properties, like homes and cars, help prevent expensive repair costs in the future.

Investing time and effort in your health, with regular doctor visits, a healthy diet, and exercise, prevents long-term costly health issues, securing your financial future. This is why I decided to share my spinal fusion journey to help others because your health is vital to your wealth.

This investment is integral to a life of financial freedom.

9. Build a Retirement Savings Plan

Building a robust retirement savings plan is a significant step towards financial freedom. Contributing to a 401(k) or an IRA can lead to tax advantages while saving for retirement.

Here is the key to success: don’t wait to start saving for retirement until you feel like you have extra money lying around. Because that will never happen.

Start simple by maxing out your Roth IRAs and contributing enough to your employer’s 401k to receive any matching. Initiate early and let the compounding interest work in your favor for a secure retirement fund.

10. Calculate Your Financial Independence Number

Your financial independence number is a benchmark for your financial freedom goals. I’ll be honest this is one of the hardest things to do is calculate how much you need to retire.

Recently, I had a conversation with someone who retired early and she said it is so hard to know how much you need and then also live off your savings.

However, calculating this FI number can provide a roadmap for your financial freedom journey.

11. Increase Your Income

Increasing your income can expedite your journey to financial freedom. Around here at Money Bliss, we stress the need for multiple streams of income.

- Consider asking for a raise, taking on more responsibility at work, or learning new skills to command a higher salary.

- Explore side hustles fitting your skills and interests. This may lead to a new career for you!

- And don’t forget about passive income.

Generating more income not only enhances your lifestyle today but also boosts your savings and investments for a financially free tomorrow.

12. Regularly Review and Adjust Your Financial Plan

Your financial plan is not a static document but a living, changing guide. As your life and goals evolve, so should your financial strategy.

Regularly reviewing your plan helps assess your progress, make necessary adjustments, and keep you focused on your financial freedom journey.

This is something you need to prioritize on your calendar.

Dealing with Debt in the Path of Financial Freedom

Our journey of student loans was deeply intertwined with our pursuit of financial independence as we wanted more money in our budget. This systematic approach not only expedited our progress but also instilled a discipline that prepared us for a future of responsible financial decisions.

While not easy, it is best to pay off debt sooner than later.

Prioritize Paying Off Debts

Addressing debt is imperative on your financial freedom journey. Prioritize paying off debts, particularly high-interest ones. This could mean scaling back your lifestyle temporarily.

You might find strategies like the debt snowball method, paying off the smallest debts first, effective. Or the debt avalanche as we chose. Find out which way to debt payments is best for your situation.

Clearing debts reduces monthly bills and creates more room in your budget for saving and investing.

Minimize Reliance on Borrowings

If you are consistently relying on debt methods to make ends meet, that needs to stop. Instead of taking loans for significant purchases, it’s more beneficial to accumulate savings first and then purchase in cash. For instance, when looking at car loans, the interest rate is pretty high, so this is a great example to save first.

This is backward of what most people do. However, it provides wise decisions with your money like having an emergency fund to fall back on.

Just to note… for most people, a mortgage may be cheaper than renting in their area.

Commit to Debt Free Living

Committing to a debt-free lifestyle is not about sacrificing everything today for tomorrow, but about making smarter financial choices. These include fully paying off credit cards each month, preparing a budget and sticking to it, and systematically paying off any existing debts.

Over time, these actions lead to a reduction or elimination of debt contributing significantly to your financial freedom.

Just remember… being debt free is your path to wealth .

Achieving Financial Freedom: Success Stories

There is no shortage of inspiring stories of people going from rags to riches or overcoming financial hardships to achieve financial freedom.

- One notable example is the story of Grant Sabatier , who went from having only $2.26 in his bank account to reaching financial independence in just five years.

- Similarly, Kristy Shen was an ordinary programmer who quit her job and, with calculated financial decisions, managed to retire as a millionaire.

- Farnoosh Torabi, a celebrated financial correspondent, was once overwhelmed by $30,000 in student loan debt. Through disciplined budgeting and effective money management, she was able to shake off the chains of debt and now leads a financially free life.

- Likewise, Robert Kiyosaki , the author of “Rich Dad Poor Dad,” started his journey with little and is now known for his financial education organization.

There are numerous success stories affirming the attainability of financial freedom. These success stories inspire and offer valuable insights into achieving financial freedom.

Frequently Asked Questions (FAQ)