Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

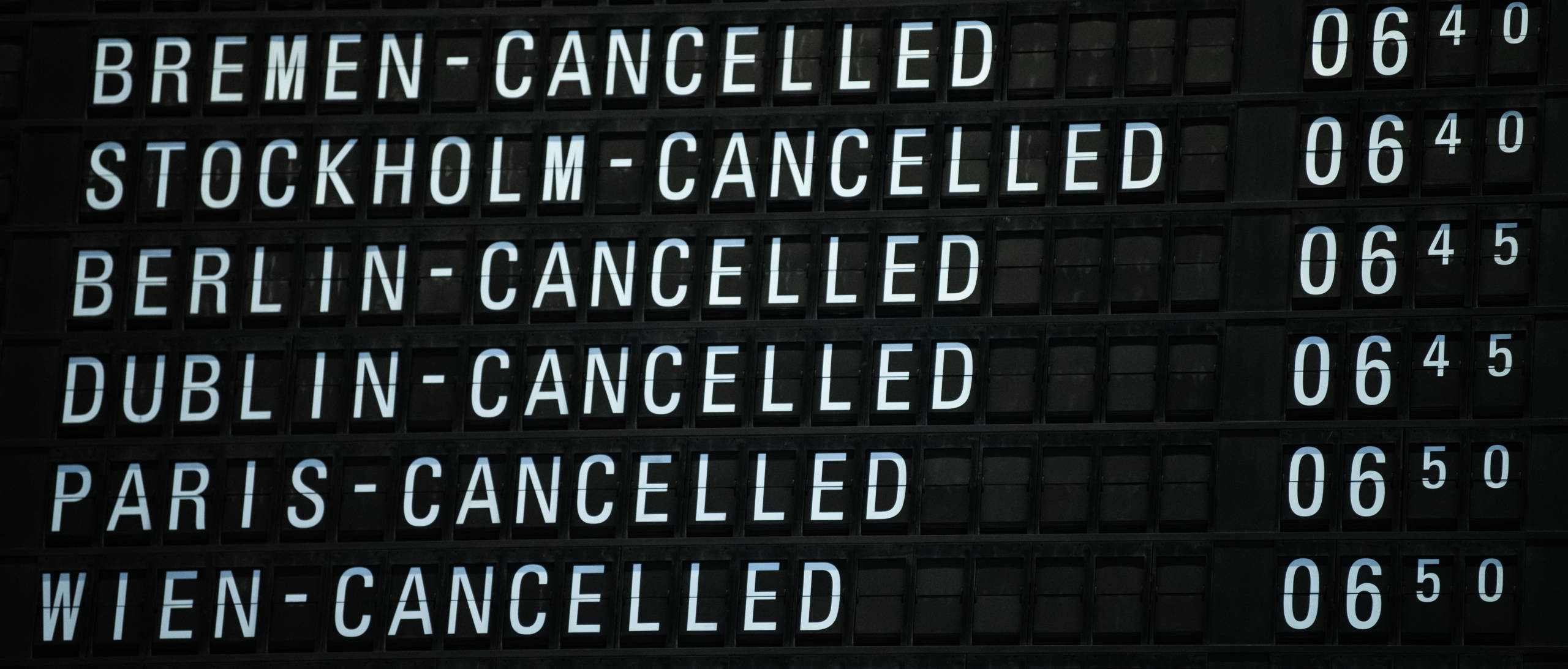

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

Card Accounts

Business Accounts

Other Accounts and Payments

Credit Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Personal Financial Management

Business Banking

Personal Travel

Travel Inspiration

Business Travel

Other Travel Services

Benefits and Offers

Manage Membership

Business Solutions

Checking & Payment Products

Funding Products

Merchant Services

Do I need credit card travel insurance?

Key takeaways.

- S ome typical travel insurance benefits include trip cancellation and interruption insurance, trip delay reimbursement, emergency medical coverage, emergency medical evacuation, lost or damaged baggage insurance, delayed baggage insurance and car rental insurance

- Many top travel credit cards provide enough travel insurance benefits to protect you in an emergency or if your plans change, so purchasing extra travel coverage likely won’t be necessary

- However, if you plan to book an expensive trip or travel abroad for an extended period of time, you might want to purchase travel coverage. Check with your card issuer to confirm any coverage terms and conditions before purchasing any additional policies

Now that travel is back in full swing, it’s time to plan your next exciting getaway. With all the fun that comes with traveling to new locales, you always risk running into expensive problems far from home. Lost luggage, canceled flights, injuries, rental car mishaps — all sorts of inconveniences can occur when traveling. One way to soften the blow of travel disasters — at least financially — is to have travel insurance.

What is travel insurance?

Travel insurance helps provide financial compensation for mishaps like lost or stolen luggage or if you need to cancel a trip for reasons that are beyond your control. In the event of a qualifying incident, you can file a claim with the insurance company to get money back for certain expenses, up to a previously agreed-upon limit. You can purchase travel insurance policies from insurance providers — or you can take advantage of travel insurance benefits offered by your credit card provider.

Fortunately for travelers, many credit cards offer some form of travel insurance to cardholders, and some of the top travel credit cards offer an impressive lineup of travel protections. However, credit card travel insurance works a bit differently than a travel insurance policy you purchase .

As a rule, credit card travel insurance doesn’t typically offer the same level of comprehensive coverage you’d get from a purchased policy. You also can’t choose what type of coverage you receive. That said, many travel credit cards offer some level of coverage for issues like trip cancellation and interruption , trip delays, lost luggage, baggage delays , rental cars and travel accidents.

If you’re considering buying separate travel insurance, it’s worth learning what type of coverage your credit card offers before paying for protection you may already have. One easy way to find out what your credit card covers is to call your credit card provider and have them walk you through your card’s benefits guide.

What is credit card travel insurance?

Credit card travel insurance is a complimentary benefit that commonly comes with credit cards. While it isn’t the most robust coverage, this protection can help out with various travel-related emergencies and inconveniences. When cardholders use their credit cards to book travel arrangements such as flights, hotels or rental cars, they may automatically become eligible for these insurance benefits. The key element here is to book at least your flights or other transportation using the credit card, or you won’t qualify for the coverage.

Typically, credit card travel insurance includes coverage for trip cancellations, trip interruptions and delays, as well as lost or delayed baggage. Some cards may also provide coverage for emergency medical expenses, evacuation and rental car insurance. The extent of coverage varies among credit cards and may depend on factors such as the card type, the issuer and the terms and conditions outlined in the card agreement.

It’s important for cardholders to review the specific details of the travel insurance offered by their credit cards, including any limitations, exclusions and requirements for activation. While credit card travel insurance can be a valuable perk, you may want to consider purchasing additional coverage for more thorough coverage.

What does travel insurance cover?

To make it easier to understand what travel insurance covers, we’re breaking down the most common types of coverage.

Coverage for canceled, interrupted or delayed trips

If you need to cancel your trip, having trip cancellation and interruption coverage can provide reimbursement for the cost of your trip, including expenses like transportation, hotels and prepaid activities. Qualifying reasons might include events such as the death of a family member, terrorism, natural disasters and unforeseen illnesses or injuries. Check your policy to see what’s included as each policy differs. In some cases, events like jury duty or being laid off from your job qualify.

Generally, your trip needs to be delayed unexpectedly by six to 12 hours (but this varies by each policy) to qualify for trip delay reimbursement. This benefit typically offers $150 to $200 per day for a certain number of days — though sometimes, this benefit offers a certain amount per ticket — to cover necessary expenses like lodgings or food.

Getting stranded far from home and having to pay for extra nights in a hotel you didn’t budget for, having to change flights at the last minute or canceling some or all of a nonrefundable trip before you even hit the road can all cost a pretty penny. If you’re traveling somewhere prone to major weather incidents and have multiple flights (increasing the possibility of missed connections), this is an important type of insurance to have.

Coverage for emergency medical situations

Emergency medical benefits can come in handy if you’re injured or become ill while traveling and require hospitalization, medication or treatment. This type of coverage is more necessary if you’re traveling internationally or on a cruise where you may not have access to medical care covered by your health insurance plan. Unfortunately, in most cases, you’ll need to pay for your medical care out of pocket and file a claim later for reimbursement.

If you have a medical emergency while traveling that requires transportation to the nearest medical facility, medical evacuation coverage can help with those costs. This is often add-on coverage for travel medical insurance, but it can come in handy if your treating physician recommends you go home to receive medical treatment or if a death occurs and there are costs associated with transporting the traveler’s remains.

Are you traveling out of network? How about out of the country or to a remote locale where it’s difficult to access medical care? If you need medical attention when you’re traveling and your health insurance won’t cover your costs, having travel insurance that pays for medical emergencies and medical transportation can save you a lot of money.

Coverage for lost, damaged or delayed baggage

Generally, lost or damaged baggage protection only covers up to a certain value, but your belongings are covered throughout your entire trip. Some policies only reimburse for luggage that is lost or damaged when it is checked with a common carrier. If your bag is permanently lost, having the right type of insurance can save you a lot of money. If you’ll be carrying more expensive items, you may want to pursue a third-party plan that will reimburse more expensive items, such as a camera or computer. Additionally, note that you may need to file a police report within a certain timeframe to receive coverage.

Even if your belongings eventually arrive in one piece, baggage delay protection can reimburse you for any costs you incur while waiting to be reunited with your belongings. You may face a daily limit on how much you can purchase to replace your delayed goods, along with a limit on what you can purchase. Additionally, these benefits don’t typically kick in unless your luggage is delayed for a specified period of time (usually six to 24 hours).

If you’re checking a bag while flying, you may want coverage for lost, damaged or delayed baggage. This coverage can help you pay for clothing, toiletries and any other items you need to replace if your luggage goes missing or is harmed, especially if it gets lost by the time you arrive at your destination. If you’re driving, however, you probably won’t need this type of coverage.

Coverage for rental cars

Many credit cards offer rental car coverage for collisions, loss and damage. It’s usually secondary coverage, meaning it kicks in after your primary auto insurance, and it usually excludes liability for damage to other property or for injuries to others. However, some credit cards offer primary coverage, which typically provides reimbursement up to a certain amount for theft and collision damage. Note that you’ll typically need to decline the car rental company’s insurance in order to receive coverage through your credit card.

For domestic travel, your existing auto insurance policy may cover any issues with rental cars, and it’ll likely kick in before an additional collision policy anyway. Check out what your insurer covers first before getting an additional policy. It’s also worth noting that your credit card rental car insurance may apply overseas. However, it would be wise to look into additional car rental protections, whether with a third-party insurer or at the rental counter, since some countries are excluded from credit card rental car coverage.

How to use credit card travel insurance

If a trip is partially or fully booked on your credit card — be sure to confirm booking standards with your card provider first — you may be able to access travel insurance benefits that come with your credit card . Here’s how to use your credit card travel insurance:

- Confirm your coverage. Before you file a claim, it’s helpful to brush up on your coverage. Your card should come with a benefits guide that outlines what type of travel coverage you have, including the maximum amount they’ll cover, exceptions to your coverage and how long you have to submit a claim (typically less than 60 days).

- Show receipts and necessary documentation. You’ll likely need to provide receipts when you file your claim if you want to get your money back. You might also need to provide key documentation such as showing how a loss occurred, correspondence with travel providers proving they won’t reimburse you, doctors’ notes, police reports or any other applicable paperwork.

- File the claim. Report any losses or situations to the benefits administrator within your policy’s claim time frame. Generally, you’ll download a claim form from the credit card provider’s website and submit evidence of the losses or situations for which you’re seeking reimbursement.

- Wait for a decision. Your credit card provider will contact you with a decision regarding your claim and, if approved, explain how it plans to distribute your funds.

When is travel insurance worth it?

Traveling is expensive, so it’s understandable if you’re wondering — is trip insurance worth it? Where or not you should purchase travel insurance in addition to the benefits your credit card offers depends on how much coverage you already have and what your risk tolerance is. Some premium credit cards offer robust travel coverage — such as emergency evacuation coverage, lost baggage coverage or trip cancellation and interruption insurance — whereas no-annual-fee credit cards typically offer basic coverage like roadside assistance.

Note that travel insurance policies tend to get more expensive as you age. So the flat annual fees you’ll pay for premium travel credit cards such as The Platinum Card® from American Express ($695 annual fee) and the Chase Sapphire Reserve® ($550 annual fee) make their travel coverage more valuable the older you get.

Consider what type of travel insurance you may need and what events and belongings you need to have insured. If you want basic coverage for smaller issues, such as covering costs incurred if your flight is delayed, then your credit card policy may do the trick. But if you have ambitious travel plans that involve bigger risks — like booking a nonrefundable international trip — then you’ll likely want to purchase a travel insurance policy that will allow you to cancel a trip for any reason.

When is travel insurance not worth it?

Depending on where you’re traveling and the type of trip you’re taking, travel insurance might not be necessary. For example, if your trip is completely refundable, trip interruption and cancellation insurance is likely not necessary. You may also not need any type of travel insurance if you’re taking a cheap or short domestic trip.

Additionally, if you’re traveling within the U.S., you likely won’t need additional medical coverage beyond your existing health insurance plan (though it would be good to check your policy first). If you’re traveling outside of the U.S., however, additional medical coverage — whether purchased or provided through a credit card — can be helpful in an emergency situation.

Should you get a top credit card for travel insurance?

Many travel credit cards can provide you with enough travel insurance benefits to protect you in an emergency or if your plans change, so purchasing extra travel coverage likely won’t be necessary. Of course, this depends on the type of trip you’re taking, among other factors.

If you’re looking for a new credit card and want one that provides solid travel insurance coverage, here are some of the best cards for travel insurance to consider:

Although travel insurance can be a great cardholder perk, it probably won’t be the main factor you’re considering when picking out a new credit card . While it’s nice for frequent travelers, you’ll want to look for a credit card that offers benefits you’ll use, such as a great rewards program, a sign-up bonus or intro APR offers. A card that rewards you for your regular spending may be more valuable in the long run than one that comes with a limited amount of travel insurance to cover the occasional trip.

While you can’t predict the exact cost of every future trip you plan, you probably have an idea of what kind of trips you take and what type of coverage they require. For example, if you love taking road trips in your trusty SUV and rarely rent a car or book a flight for a vacation, then you’re less likely to need car rental or baggage delay coverage. But having roadside assistance as a perk may give you much-needed peace of mind when you hit the open road. Look for a credit card that offers coverage in line with the way you travel most often.

There is no worse feeling than thinking you have insurance coverage, only to find you’re going to need to pay more out of pocket than you realized when something does go wrong. Double-check the fine print for the travel insurance coverage before relying on a credit card’s insurance perks. You’ll likely come across some potential exclusions.

Frequently asked questions (FAQs)

Travel insurance costs vary depending on the type of plan you select: Basic, middle tier or comprehensive. They also typically depend on factors like your trip’s total cost, how long you’re traveling for, where you’re traveling, how many people require coverage and travelers’ ages. In general, you can expect to pay anywhere from 4 percent to 11 percent of the total cost of your trip.

Consumers typically run into two primary problems with travel insurance: not having enough coverage or not actually qualifying for the coverage they do have. When dealing with travel insurance that you gain access to as a cardholder perk, you’ll want to read through your policy before booking your trip to ensure you know exactly what you have coverage for and whether you need any extra coverage. Take note of what your coverage limits are. For example, your credit card travel insurance may cover medical treatment, but there may be a limit as to how much they’re willing to cover. The type of vacation you take can also impact your insurance. Most basic travel insurance does not cover activities that can be viewed as dangerous, like skydiving or rock climbing, or it will contain exclusions for travel to specific areas, like those prone to extreme weather events or with current travel warnings. As for car rental insurance, your credit card coverage may not be applicable in certain countries, or it may not cover certain situations. Credit card car rental coverage is also usually secondary coverage, which means your credit card company only pays what your primary car insurance policy won’t cover. However, some premium travel credit cards do offer primary car insurance, like the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve.

You often need to pay for all travel expenses with an eligible credit card if you want to potentially use that card’s travel insurance offerings. In many cases, you’ll need to pay for the common carrier fare on the plane, train, bus or cruise ship you plan on traveling with in order to gain access to your travel insurance offerings. Note that some credit card providers may require you to book the entirety of your trip on their card, whereas others simply need you to book the main transportation to your destination in order to qualify. Because these requirements can vary so much, it’s important to confirm how to qualify for your insurance benefits before you book your trip.

The bottom line

Credit card travel insurance benefits can offer travelers solutions to frustrating and costly travel problems. Because you don’t need to pay for this cardholder perk, it’s a great bit of extra protection to have in your back pocket. However, if you’re spending a lot on an upcoming trip and you’re worried about travel issues that may require expensive solutions, then purchasing a separate travel insurance policy may be worth it.

Already planning your next vacation? Check out Bankrate’s travel toolkit for tips and tricks on how to maximize travel with a credit card.

Issuer-required disclosure statement For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to Baggage Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How does baggage insurance work?

What does baggage insurance cover, what is not covered by baggage insurance, how much does baggage insurance cost, how do i get baggage insurance, which baggage insurance coverage is best for me, is baggage insurance worth it.

Travel can be a lot of fun but if your bags are lost or stolen or your luggage is delayed for a significant amount of time, it can be a bad start to the trip. Before you travel, you’ll want to familiarize yourself with baggage insurance, which is offered on travel insurance policies and on premium travel credit cards.

How often does luggage get lost? According to LuggageHero, an airline's chances of losing your bag are slim – just 0.4% in 2021. And if that happens, the airline is responsible for compensating you for your lost bags and contents. But they may have different liability limits than separate insurance, and there are plenty of other ways luggage can disappear after you leave the airport.

"Baggage insurance" is a general term that encompasses two key benefits: baggage loss and baggage delay. Here’s what you need to know about baggage insurance and how to get it.

Baggage insurance can generally be divided into two broad categories: Baggage loss and baggage delay.

Suppose you arrive at baggage claim to get your two pieces of luggage, but they are nowhere to be found. You file a lost report with the airline and head to your Airbnb. However, when you arrive, you find that it doesn’t have many toiletries or even a spare toothbrush. On the third day, one of your pieces of luggage arrives but the other one is lost.

If you purchased a travel insurance policy (or have a premium travel card ) that offers baggage insurance benefits, the baggage delay coverage will reimburse you for the purchase of essential items such as a toothbrush, toiletries, change of clothes, etc. for each of the days that you didn’t have your belongings.

Because you only received one of your pieces of luggage, baggage loss coverage will reimburse you for the missing piece, along with the contents up to a specific dollar amount. If you have valuables in your lost luggage, it's likely that they are covered by your homeowners insurance policy, so you’d want to check with that company before seeking reimbursement from the travel insurance provider, which limits the amount you can claim for the high-end items.

If you don’t have baggage insurance benefits, you’re still in luck because the airline carrier has procedures in place to reimburse for lost luggage and baggage delay. Still though, having an extra layer of protection is helpful, especially if your luggage is expensive and/or the baggage insurance benefits on the travel insurance policy are higher than the airline's.

When booking your trip, check the airline’s baggage loss and delay policies to ensure you understand what level of coverage you’re comfortable with.

Certain premium travel credit cards offer baggage insurance benefits. For example, the Chase Sapphire Reserve® offers baggage delay insurance of $100 per day for up to five days if your bags are delayed for more than six hours and lost luggage reimbursement of $3,000 per person and up to $500 for luxury items.

» Learn more: Your guide to Chase Sapphire Reserve's travel insurance benefits

Baggage loss

Baggage loss will reimburse you for luggage and personal belongings that are lost or stolen while you’re on your trip. This coverage usually includes three limits:

Per-person overall limit.

Per item limit.

A specific limit for high-end items.

In case your luggage is lost, you’ll need to notify the appropriate local authorities, which will happen when you file your claim with the airline. To get reimbursement for luxury items (such as watches, jewelry, furs, cameras), some insurers may require you to submit original receipts.

» Learn more: How lost luggage insurance works

Baggage delay

Baggage delay lets you purchase necessary items while you’re waiting for delayed bags. This benefit usually kicks in after a specified amount of time and has two limits:

A per-person dollar limit.

A daily limit.

You will need to wait until the minimum amount of time has passed before you can be eligible for reimbursement. Some policies also state that this benefit is available only on the outward leg of your trip, so you’ll want to read the fine print of the policy to know when the coverage applies. Also, make sure to keep your receipts for items you purchase while you wait for your bags, as you will need to submit them with your claim.

For baggage loss and baggage delay, the coverage is usually secondary, which means that the benefits only kick in after the common carrier (airline) provides reimbursement.

» Learn more: How to find the best travel insurance

Each insurer will have its own list of exclusions for baggage delay and baggage loss, however, some common exclusions are:

Auto equipment.

Household items.

Perishables.

In addition, losses related to a policy’s general exclusions (self-harm, war, illegal acts, etc.) also aren't covered. As always, check the fine print so you’re aware of what is covered.

Coverage included with the Chase Sapphire Preferred® Card , for example, covers up to $500 for jewelry and watches. And plans from World Nomads cover sports equipment and documents like passports.

Before making assumptions, you should always check to ensure lost luggage is covered and for how much, as different plans offer different coverage types and amounts.

There are other exclusions. For example, you can't be reckless with your luggage or where you leave it, like in the back of an open pickup or on a curbside while you enter a cafe.

In addition, you typically must first file a report with the airline or local authorities in the case of theft or loss to file a claim with your travel insurance company. It's also best if you can provide receipts for high-value items to receive full reimbursements.

» Learn more: Blue Ribbon Bags reunites you and your bags in 4 days — or pays

Baggage insurance is usually included within comprehensive travel insurance plans. For a two-week trip to Australia that costs $5,000, a search of policies on travel insurance broker Squaremouth ranged from $198 to $447, representing 4.0% to 8.9% of the total trip cost.

One international week-long vacation may run from around $37 to $100 or more based on how much protection you want for the items you're traveling with.

A $63 plan, for example, may cover up to $750 of lost or stolen luggage, while a $103 plan might cover up to $2,500.

As you can see, prices range widely, which makes it easy to find a policy that applies to your individual situation.

If you hold a premium travel credit card that offers trip baggage insurance benefits, this coverage is offered free of charge as long as the trip is purchased with the applicable credit card.

The two main ways to get baggage insurance benefits are by purchasing a trip insurance policy or applying for a premium travel card that offers these benefits.

As mentioned previously, the Chase Sapphire Reserve® covers baggage delay and baggage loss. The Platinum Card® from American Express and many other American Express cards provide coverage for lost luggage only, with a $3,000 per person limit and a $1,000 per high-end item limit. There is no coverage for baggage delay. Terms apply.

» Learn more: Travel insurance benefits on American Express credit cards

These premium cards also offer other travel insurance benefits like trip cancellation, trip interruption, trip delay, emergency assistance and more. If you often buy trip insurance, applying for one of these travel cards could be advantageous, since they offer a lot of useful perks and statement credits that will typically offset at least part of the annual fee.

However, if your luggage and belongings are more expensive than the limits provided by the credit card, purchasing a separate travel insurance policy could make a lot of sense.

If you’re traveling with expensive clothes or have high-end luggage, purchasing a comprehensive travel insurance policy that offers baggage insurance benefits is a good idea. If your belongings are relatively low-cost, you’re traveling with a carry-on or backpack or you’re already covered through your credit card, you may not need to purchase a travel insurance policy.

However, if you’d like additional coverage like Cancel For Any Reason (CFAR) , travel medical insurance and/or your credit card doesn’t offer sufficient limits, consider a comprehensive travel insurance policy from providers such as AAA , Allianz , AIG or World Nomads .

» Learn more: The best travel insurance companies

If you're traveling with high-value personal belongings, baggage insurance can be worth it.

However, you might not need to pay out of pocket to get coverage. For example, if you used a travel credit card with robust trip protection and luggage insurance to book and pay for your vacation and don't require additional or specialized coverage, that may be sufficient.

Purchasing coverage separately is probably best if you don't have baggage insurance benefits through a credit card or want to customize your coverage. But, again, the right option will depend on your needs and will likely vary from trip to trip.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance For Canada: What You Need To Know Before You Go

Updated: Apr 30, 2024, 1:13pm

Table of Contents

Do you need travel insurance for canada, what type of travel insurance do you need, what does travel insurance for canada cover, what does travel insurance exclude, best travel insurance for canada, frequently asked questions (faqs).

From hiking trails in Ontario to traversing the slopes of the famous ski resort town of Whistler, there is no shortage of places to visit in Canada.

The vast North American country is a popular destination for travel-loving Aussies. In addition to a growing share of business travelers, more than 350,000 Australian tourists typically visit Canada each year.

While visitor numbers faded during the Covid-19 pandemic, the multitude of Australians heading to the Great White North has picked up in the last two years, particularly to experience the country’s stunning landscape.

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

Travel insurance for Canada isn’t compulsory, but it’s highly recommended to cover for any lost or stolen baggage, the possibility of your trip getting cancelled due to an emergency, illness such as Covid-19 or bereavement, and to cover medical expenses.

The Australian Government’s Smartraveller website recommends that travellers purchase travel insurance before any overseas trip.

As in any foreign country, medical care in Canada can be expensive for visitors, with a visit to a doctor potentially setting you back by hundreds of dollars.

The Australian government won’t cover these costs, and there is no reciprocal healthcare agreement between Australia and Canada, so you aren’t covered by Australian Medicare either.

In addition, given the large geography of the country covering a variety of destinations from beaches to mountains to national parks, it is wise to hold insurance cover for a multitude of events and a variety of potential risks including natural disasters, crime or other types of emergencies.

International travel cover for Canada is generally available in the following ways:

Basic travel insurance

This type of policy is broadly focused on cover for unlimited overseas emergency medical expenses, but also includes insurance for luggage, personal liability and other essential benefits. It is usually the cheapest option available and is suitable for those traveling on a budget or for single trips.

Comprehensive travel insurance

This type of insurance typically includes higher amounts of cover for the essentials benefits such as medical expenses, luggage, personal liability, and so on. In addition, it includes cover for travel delays, rental vehicle excess, loss of passports and credit cards, hijacking, disability, accidental death, and more, depending on your policy.

Some insurers offer variations of the comprehensive policy that are suitable for multiple trips within a 12-month period.

Optional add-on policies

Given the growing number of Australians heading to Canada for cruises, road trips or to the ski slopes, some insurers have come up with add-on policies specifically tailored for a variety of adventure sports and transport options available. These include cruise packs, winter sports packs and even higher cover for rental vehicles.

Related: How Much Does Travel Insurance Cost?

Most international travel insurance policies will cover medical and hospital expenses, ambulance transportation, repatriation flights, as well as personal liability if you injure someone, or damage property while you’re in the country.

Policies will also cover, within limits, lost or delayed luggage and possessions, the costs of trip delays, interruptions or cancellations, and lost or stolen travel documents.

Comprehensive policies usually offer a broader cover to include personal accident cover in case of an injury during your trip that leads to permanent disability or death, and insurance excess payment if your rental car meets with an accident.

If you are planning to take advantage of Canada’s vast offering of adventure sports and activities, make sure these are covered by your policy—or that there is an option to add it on.

Most comprehensive policies will include popular sporting and leisure activities such as hiking, surfing, kayaking, and so on. However, more extreme activities such as skydiving, scuba diving, snow skiing or snowboarding will generally require an additional adventure sports cover at extra cost.

Most travel insurance policies to Canada will not provide cover in the following cases:

- Illegal activities: Insurers will reject any claims arising if you knowingly act illegally or dangerously.

- If you are under the influence: Insurance cover is specifically void if you cause a disturbance through drunken behaviour or under the influence of drugs.

- Unattended luggage: Insurers will ignore any claim for loss if your luggage is stolen while it was left unattended in public.

- Pre-existing medical conditions: Insurers can avoid claims for any major medical conditions, if they have not been made aware of these before taking out a policy.

- Extreme sports: International travel insurance policies generally don’t provide automatic coverage for things like extreme sports, snowboarding or surfing. An optional add-on cover is required for these activities.

Most travel insurers in Australia offer insurance policies for travel to Canada. What policy suits you best will depend on your requirements including duration, age, and the type of cover.

It will also be determined by your specific needs, such as whether you are taking part in snow sports or other adventure activities.

An easy way to compare travel insurance policies is to use an online comparison tool, or read through our leading picks of travel insurance policies for Australians . However, always consider whether or not they include the extras you will require for your trip, and any pre-existing medical conditions you would require cover for.

Featured Partners

Do I need travel insurance to travel to Canada?

Travel insurance for Canada isn’t mandatory, but is highly recommended.

The Australian Government urges travellers to purchase travel insurance before any overseas trip, especially for medical cover.

Medical costs can be extremely expensive in a foreign country, especially if you have to visit a doctor, dentist or hospital in an emergency, so travel insurance is very handy.

Does my visa card have travel insurance?

Not every credit card comes with travel insurance. Complimentary travel insurance is typically offered on premium credit or rewards cards that have higher annual fees. In addition, this may not cover all circumstances or emergencies. By comparison, a travel insurance policy will offer more comprehensive coverage that includes emergency medical expenses.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Best Family Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance Cancellation Cover

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

- Travel Insurance For Singapore

- Travel Insurance For Indonesia

- Travel Insurance For Vietnam

- Travel Insurance For South Africa

- Cover-More Travel Insurance Review

- Fast Cover Travel Insurance Review

- Travel Insurance Saver Review

- Allianz Comprehensive Travel Insurance Review

- 1Cover Comprehensive Travel Insurance Review

- Australia Post Comprehensive Travel Insurance Review

- Tick Travel Insurance Review

More from

Do frequent flyer points expire, travel insurance for south africa: everything you need to know, travel insurance for vietnam: everything you need to know, tick travel insurance top cover review: features, pros and cons, was discovery travel insurance review: features, pros and cons, fast cover comprehensive travel insurance review: pros and cons.

Prashant Mehra is a freelance journalist based in Sydney. He has more than 20 years of international experience covering financial news, including with Reuters and the Australian Associated Press (AAP). He writes about business, markets, the economy and investing.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AXA Travel Insurance Review — Is it Worth It?

Jessica Merritt

Editor & Content Contributor

85 Published Articles 485 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3151 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Why Get Travel Insurance?

Travel insurance and covid-19, types of policies available with axa, how to get a quote, axa vs. credit card travel insurance, axa vs. other travel insurance companies, how to file a claim with axa travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Whether you’re traveling the world or crossing state lines, travel insurance such as the policies offered by AXA Travel Insurance can offer a safety net in case you have to cancel or interrupt your trip or need support along the way for medical emergencies, lost bags, or missed connections.

For more than 60 years, AXA Travel Insurance has provided peace of mind and financial stability to travelers. With solid ratings and underwriting by Nationwide Mutual Insurance, travel insurance plans sold by AXA are backed by an A.M. Best Excellent financial strength rating. AXA offers travel insurance with trip interruption and cancellation coverage, medical emergency and evacuation benefits, lost or delayed baggage, and more.

Let’s examine AXA’s travel insurance coverage options, benefits, and service and compare it to alternatives such as credit card travel coverage and other travel insurance providers.

Travel insurance can protect what you’ve invested in an upcoming trip. When the unexpected occurs, such as a trip cancellation or medical need , travel insurance can offer the benefits you need to cover it.

You might choose travel insurance for these reasons:

- Your trip has deposits or payments that you can’t get refunded if you need to cancel your trip.

- The health insurance you use at home doesn’t work at your destination.

- You’re planning activities that aren’t covered by your health insurance.

- Medical care is subpar at your destination and you may need to be evacuated to another location with adequate medical facilities.

- You’re concerned about the possibility of lost bags, delays, or missed connections, especially if you have multiple flights or transfers.

Travel insurance isn’t necessary for every trip, such as if you’re traveling domestically where your health insurance works and you don’t have major nonrefundable expenses. But travel insurance is worth it if you’ve got a lot of nonrefundable expenses invested in your trip or you’ll need medical coverage at your destination.

COVID-19 can interrupt your travel plans, whether you get sick and have to cancel a trip, need to quarantine or get medical treatment while traveling, or plan to visit a destination with high COVID-19 numbers. While some travel insurance companies exclude COVID-19 from insurance coverage , AXA offers COVID-19 coverage as part of its travel protection plans , including trip cancellation and trip interruption and emergency medical and evacuation coverage.

Why Purchase Travel Insurance From AXA?

Any travel insurance company you purchase a policy from should be reputable, reliable, and stable. After all, you’re relying on the company to be there for you when you need it most. It pays to verify reviews and ratings — AXA offers good reassurance in this area.

With 64 years in business, AXA has an A- Better Business Bureau rating . On the travel insurance website Squaremouth , AXA has an overall 4.22/5 rating , with 0.1% negative reviews among more than 69,000 policies sold . AXA’s travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best. With 6 decades in business and solid ratings , AXA is a travel insurance company you can trust.

AXA offers travel insurance with medical and emergency evacuation benefits, trip cancellation and interruption, baggage loss, and Cancel for Any Reason (CFAR) options. Let’s look at the details of AXA travel insurance policies.

AXA offers 3 levels of travel insurance : Silver, Gold, and Platinum . Each level offers different limits, but all of AXA’s policies have 100% trip cancellation coverage, emergency medical coverage and medical evacuation, baggage delay and loss, and missed connection coverage.

Let’s compare what you get with each policy:

With plans as low as $16 and minimal coverage, AXA recommends the Silver plan for domestic travel. You can cover 100% of your trip cost for trip cancellation and interruption coverage. If your travel is delayed, you can get up to $100 per day for expenses, up to $500 total, and $200 for delayed baggage.

There’s also $500 in missed connection coverage. The $25,000 in emergency medical expense coverage isn’t much, but it might be adequate for domestic travel if you’re using your primary health insurance first.

Gold plans start at $36 but add more coverage and are appropriate for cruises or Schengen travel . Like the Silver plan, the Gold plan offers up to 100% trip cancellation coverage but bumps trip interruption to 150% of your trip cost. Limits for all coverages are higher, with $200 per day and $1,000 maximum in trip delay coverage and $1,000 for missed connections. Baggage delays offer up to $300, and you can get up to $1,500 for lost baggage and personal effects.

The health coverage is also much higher at $100,000, and it adds a $50,000 non-medical emergency evacuation option on top of the $500,000 medical emergency evacuation benefit. This plan also offers an optional $35,000 collision damage waiver.

The Platinum plan , starting at $52, steps up coverage and offers additional options. You’ll get 100% trip cost coverage for trip cancellation and 150% for trip interruption. Trip delay coverage offers up to $300 per day and a $1,250 maximum, plus $600 for baggage delays and $3,000 for lost baggage and personal effects.

Emergency medical treatment is also higher at $250,000, and you’re covered for $1 million in emergency medical evacuation — $100,000 for non-medical evacuation.

The Platinum plan also offers additional coverage for sports, with $25 per day for lost skier days, $500 for lost golf rounds, and $1,000 for sports equipment rental. It also offers optional coverage for up to 75% of trip cost with Cancel for Any Reason coverage and a $50,000 collision damage waiver.

You can get a quote directly from AXA by visiting the AXA Travel Insurance website . The quote form is the first thing you’ll see on the homepage.

To start your quote, you’ll fill out the quote form, including your state of residence, destination country, travel dates, first deposit date, total trip cost, number of travelers (up to 10), and the age of travelers.

Once you fill out the form, you’ll be presented with plan options. For a 60-year-old visiting Japan and spending $2,500, we were offered a Silver ($155), Gold ($183), or Platinum ($218) plan .

If you select a Platinum plan, you will be able to add CFAR optional coverage for up to 75% of your trip cost.

With your plan and options selected, the next and final step to secure coverage is entering your traveler information including your name and contact information, then making your payment for the policy.

How AXA Compares — Summary

AXA is a good option for travel insurance, but it’s not your only option. Let’s see how AXA compares to the coverage you can get from popular travel credit cards and travel insurance competitors .

Many travel credit cards offer travel insurance as a complimentary benefit, whether it’s car rental collision waivers , trip cancellation coverage , or emergency medical and evacuation benefits. This coverage can be helpful if you’re using your card to pay for your travel expenses, but it’s often not as comprehensive as the coverage you can get from a travel insurance policy like what AXA offers .

Let’s compare AXA’s best travel insurance policy against The Platinum Card ® from American Express and the Chase Sapphire Reserve ® , which both offer some of the best travel protections available with credit card benefits.

Unless you’re taking a trip with expenses higher than $10,000, the trip cancellation coverage should be about the same whether you’re using an Amex Platinum card, Chase Sapphire Reserve card, or the AXA Platinum plan. However, the AXA Platinum plan comes out ahead with 150% of your trip cost for trip interruption.

We see a major difference in coverage for emergency medical treatment and evacuation. The Amex Platinum card doesn’t offer emergency medical coverage, but you can arrange an emergency medical evacuation using the Premium Global Assist Hotline. The Chase Sapphire Reserve card offers up to $2,500 in emergency medical coverage and $100,000 for emergency evacuation. Neither of these offerings compares to the $250,000 in emergency medical coverage and $1 million in emergency medical evacuation coverage you can get from AXA Platinum.

Credit card travel insurance coverage is complimentary if you already have the card, but it is lacking in some areas. It’s a good idea to use your card’s travel insurance as a backup for trip cancellation, interruption, travel delays, or lost baggage, but use the AXA Platinum plan for its superior emergency medical and evacuation coverage.

It’s always a good idea to compare travel insurance quotes across multiple providers so you can find the best price and coverage. We used Squaremouth , a travel insurance comparison website, to see how AXA’s policies compare to those of other companies.

As with the initial price quotes we pulled from AXA’s website, our sample trip on Squaremouth had:

- Traveling to Japan a month from now

- Trip cost: $2,500

- Initial trip deposit paid within the last 24 hours

- State of residence: Texas

We limited results to policies that offer at least as much coverage as the AXA Platinum policy does on major benefits:

- COVID-19 coverage

- Minimum $250,000 emergency medical benefit

- Minimum $1 million emergency medical benefit

- 100% trip cancellation

- 150% trip interruption

Each policy offered nearly identical coverage for these major benefits, and Tin Leg ‘s Silver plan had the lowest cost at $164.35, followed closely by $165.84 from HTH Worldwide ‘s TripProtector Classic plan.

If you’re mainly concerned with full coverage for trip cancellation and interruption along with $250,000 in emergency medical and $1 million for emergency medical evacuation, you can save if you go with Tin Leg .

However, the higher-priced policies offer additional coverage and options. For example, AXA Platinum offers the option to add Cancel for Any Reason coverage and includes sports equipment rentals and missed ski days or golf rounds. Tin Leg doesn’t have missed connection coverage, but Seven Corners Trip Protection Choice and AXA Platinum offer up to $1,500 for missed connections on cruises or tours.

All of the policies we quoted except for Tin Leg Silver offer employment layoff as a covered cancellation reason, and AXA Platinum allows you to cancel your trip for work reasons, though none of the other policies do. AXA Platinum also offers $100,000 in non-medical evacuation , which Tin Leg Silver and HTH Worldwide TripProtector Classic policies do not, and is much higher than the $20,000 benefit offered by the Seven Corners Trip Protection Choice policy.

AXA Platinum has a higher cost than competitors but offers more robust coverage. If you’re mainly concerned with major coverage for trip cancellation and interruption, emergency medical, and emergency evacuation, other travel insurance companies may offer a better quote. But if you want additional coverage and options such as non-medical evacuation and expanded cancellation reasons, check out the details on what AXA Platinum offers.

You can file a claim with AXA in a few ways:

- Using the claim administrator portal

If you’d like to file your claim online, you can visit the portal for Co-Ordinated Benefit Plans and enter your policy number and last name to get started.

Alternatively, you can call AXA toll-free at 888-957-5015 or collect at 727-450-8794 .

If you’d like to submit your claim via email or mail, you can download claim forms on the AXA website.

Once you download the claim form, you’ll get a list of documents required for submitting your travel insurance claim, along with mail or email info. For example, on a trip interruption claim form, AXA requires you to send in:

- Completed claim form

- Policy verification

- Booking confirmation, such as a ticket or proof of purchase

- Your original unused, nonrefundable tickets

- Your new ticket with confirmation of early return

- A cancellation statement from travel suppliers

- A medical report or physician statement if you interrupted the trip due to medical necessity

- Death certificate, if applicable

- Documentation of circumstances that led to trip interruption

- Documentation of reimbursement request expenses, such as receipts or credit card statements

You can email the form and other required documents to [email protected] or mail to:

AXA Assistance USA On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies P.O. Box 26222 Tampa, FL 33623

AXA Travel Insurance is a reliable option with more than 6 decades of experience and solid ratings. There are 3 levels of coverage to choose from — Silver, Gold, and Platinum — that offer varying levels of coverage and options. AXA Travel Insurance isn’t the cheapest option, but it offers robust coverage options and reputable service, so it can be a good choice if you’re looking for enhanced travel protection.

For the premium global assist hotline benefit of The Platinum Card ® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the car rental loss and damage insurance benefit of The Platinum Card ® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the baggage insurance plan benefit of The Platinum Card ® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the trip delay insurance benefit of The Platinum Card ® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the axa silver travel insurance plan provide coverage for a safari.

Yes, AXA’s travel insurance policies offer coverage for safaris, including emergency medical expenses. Safaris are under the sports and activities covered for emergency medical and repatriation costs and personal accidents.

Is AXA travel insurance worth it?

AXA travel insurance can be worth it if you need coverage for significant nonrefundable expenses or your health coverage doesn’t extend to your destination. Competitors may offer lower cost policies for similar major coverage, but AXA may have greater policy options, so it’s a good idea to compare your options.

Is AXA travel insurance good for a Schengen visa?

AXA recommends its Gold plan or higher for Schengen travel.

Is AXA an international insurance?

Yes, you can use AXA for international travel , with coverage for countries in Europe, Asia and Pacific islands, the U.S. and Canada, Africa and the Middle East, Latin America, and the Caribbean.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation