Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

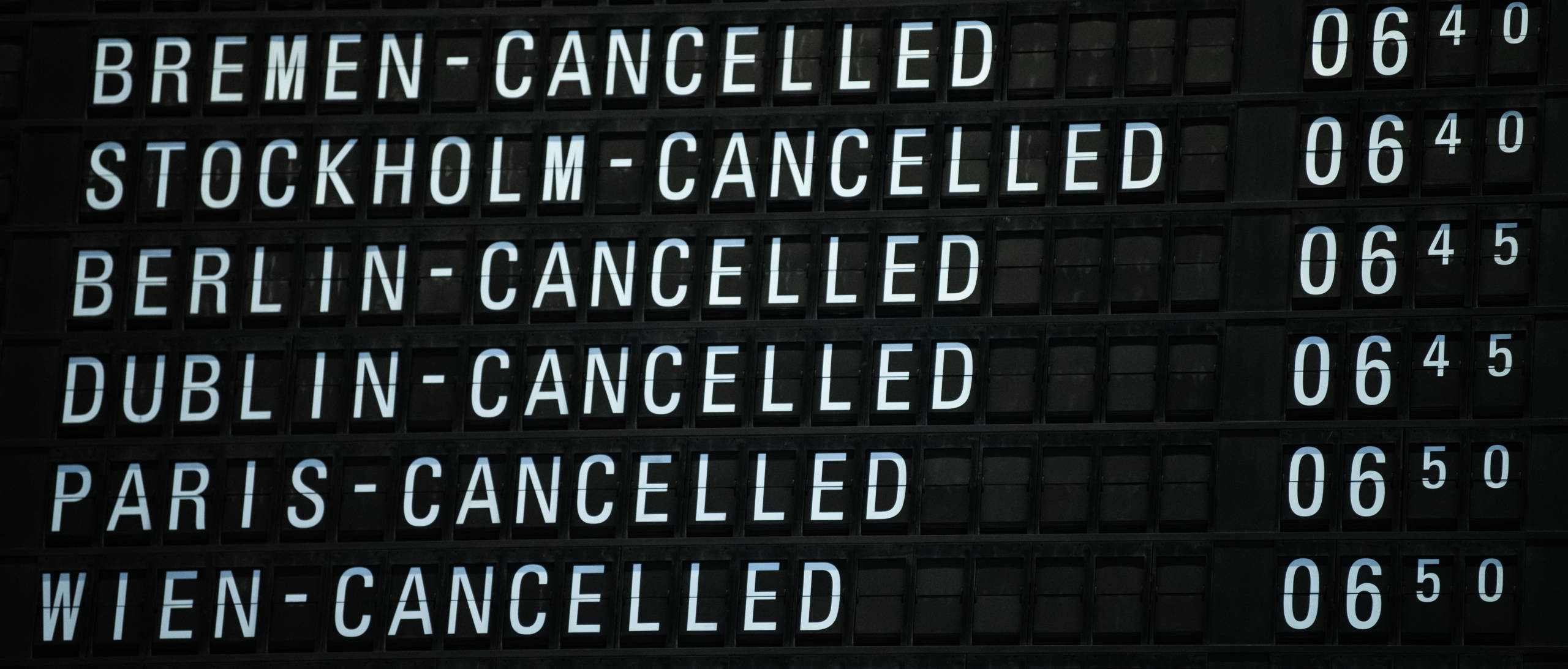

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Full List of Travel Insurance Benefits for the Amex Gold Card [2023]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

85 Published Articles 484 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

90 Published Articles 666 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![american express travel insurance missed flight Full List of Travel Insurance Benefits for the Amex Gold Card [2023]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Gold-Upgraded-Points-LLC-19-Large.jpg?auto=webp&disable=upscale&width=1200)

Why We Like the Card Overall

Car rental loss and damage insurance, trip delay insurance, baggage insurance plan, travel accident insurance, emergency travel assistance, no foreign transaction fees, additional travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The American Express ® Gold Card is known for being a go-to card for everyday purchases at restaurants and at U.S. supermarkets. The card also doubles as a travel rewards card offering elevated earnings on select flight purchases and a nice selection of flexible travel redemption options.

The card is far less known for its travel insurance benefits. Today, we’re turning the spotlight on some of the useful travel insurance benefits that come with the card and talking about how these benefits can add value to the cardholder.

First, let’s look at the overall earning and redemption features of the Amex Gold card, then jump right into the list of travel insurance benefits you can expect to find on the card.

Amex Gold Card — Snapshot

American Express ® Gold Card

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at Amex Travel

- Up to $120 annual dining credit: up to $10 monthly statement credit when you pay with the Amex Gold card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar and select Shake Shack locations

- Up to $120 in annual Uber Cash : get $10 monthly in Uber Cash for Uber Eats orders or Uber rides in the U.S. when you add your Gold Card to your Uber account

- No foreign transaction fees (see rates and fees )

- Access to Amex’s The Hotel Collection

- Access to American Express transfer partners

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Find the Amex Gold 75k or 90k Welcome Bonus Offer

- Benefits of the Amex Gold

- Upgrade Amex Gold to Amex Platinum

- Amex Gold Benefits for Military

- Amex Gold vs Blue Cash Preferred

- Amex Platinum vs Amex Gold

- Amex Gold vs Delta Gold

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 90,000 points with the Amex Gold card. The current public offer is 60,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

We like that you can jumpstart your earnings with a generous welcome bonus after meeting minimum spending requirements in the first 6 months after card approval.

The Amex Gold card also strikes a nice balance between functioning as an everyday spending card and offering accelerated earnings on flights. It also offers flexible travel redemption options.

You’ll earn 4x Membership Rewards points at restaurants worldwide and at U.S. supermarkets (on up to $25,000 in purchases each year). Plus, you’ll receive 3x earnings on flights purchased directly with the airline and via AmexTravel.com .

With monthly statement credits for select purchases, it’s easy to find enough value to offset the annual fee.

When it’s time to use your rewards, you’ll have options such as redeeming points for flights via AmexTravel.com or transferring your points to the American Express transfer partners for even more potential value.

Amex Gold Card — Travel Insurance Benefits

While the Amex Gold card doesn’t come with a long list of comprehensive travel benefits, you’ll find these core travel insurance benefits useful for saving money and for access to assistance should something go wrong during your journey.

Having car rental insurance can save you money and provide a level of peace of mind when renting a vehicle . The Amex Gold card comes with secondary car rental insurance that would require you to first file a claim with any other applicable insurance before card coverage kicks in.

Secondary coverage can still be valuable coverage, but there is another car rental coverage option included on the card that is a much better choice.

Premium Protection

The option to purchase Premium Protection car rental insurance on the Amex Gold card is a game changer.

You’ll pay one low price of $12.25 to $24.95 for the entire period, up to 42 total days, for primary theft and damage coverage. The actual rate will depend on your state of residence and the level of coverage chosen. Note that this is not a per-day rate like the car rental agencies charge.

Just enroll in the coverage via your online card account, then whenever you charge your rental car to your card, you’ll have the coverage automatically. You are not charged prior to renting a car.

There is no deductible. Accidental death/dismemberment coverage is included. Liability coverage, uninsured/under-insured motorist coverage, or disability coverage is not included.

Cardholders and authorized listed drivers are covered.

Applicable coverages for both secondary and Premium Protection include rental car damage, theft, and loss of use.

Coverage is not available when renting vehicles in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand.

There are several additional exclusions, including the theft of an unlocked vehicle, illegal activity, intoxication of the driver, and war. Access the Guide to Benefits for a complete list of exclusions, terms, and conditions.

Filing a Claim

You can file a claim online or call 800-338-1670. You must file the claim within 30 days of the event and submit the required claim form within an additional 15 days. You’ll then have 60 days to submit the required documentation.

Bottom Line: The Amex Gold card comes with secondary car rental insurance with the option to purchase primary Premium Protection for one low rate that covers the entire rental period.

To be eligible for trip delay insurance, you must pay for your entire trip with your Amex Gold card, associated rewards, or a combination of the 2. Using airline vouchers, certificates, or discounts, such as those associated with your frequent flyer account, in combination with your card, are also acceptable. Eligible travelers include family members, travel companions, and a spouse or domestic partner.

Trip delay insurance reimburses an eligible traveler for incidental expenses incurred after a 12-hour or greater trip delay. Eligible expenses can include lodging, meals, toiletries, medication, and necessary personal items.

Eligible Losses and Coverage Limits

The following types of losses are eligible covered losses :

- Inclement weather preventing a traveler from beginning a trip or continuing on a trip

- Terrorism or hijacking

- A common carrier’s equipment failure (documented)

- Lost/stolen travel documents, such as passports

You could receive up to $300 per trip with a limit of 2 claims per card, per 12-month period. Coverage is secondary to any other applicable coverage including reimbursement by the airline.

Loss exclusions include prepaid expenses, losses that were known to the public or the traveler prior to the trip, and intentional acts by the covered traveler. Access the card’s Guide to Benefits for more details on loss exclusions under trip delay coverage.

You’ll have 60 days from the date of the loss to file a claim. You can do so by calling 844-933-0648 or the number on the back of your card to be directed to the claims department.

You’ll then have 180 days to submit the required documentation, which can include a statement from the common carrier validating the delay, receipts, your card statement showing the trip charge, and other requested supporting information.

Bottom Line: The Amex Gold card comes with trip delay insurance that provides up to $300 per trip for eligible expenses incurred after a 12-hour or greater delay due to a covered loss.

To be eligible for baggage insurance, pay for your common carrier ticket entirely with your Amex Gold card and/or associated rewards. Trips paid for, in full or in part, with non-American Express rewards such as airline loyalty programs are not eligible.

You, your spouse or domestic partner, children under 23, and certain dependent handicapped children are covered for baggage insurance as long as the trip is paid for in full with your card and/or associated rewards.

Lost, damaged, or stolen baggage is covered, except in the event of war, government confiscation, or acts arising out of customer actions, for the following coverage limits.

High-risk items such as jewelry, gold, silver, platinum, electronics, furs, and sporting equipment, are limited to $250 per item maximum, per trip.

Certain items are not covered under baggage insurance — here is a condensed list of those items:

- Credit cards, cash, securities, or money equivalents (such as money orders or gift cards)

- Travel documents, tickets, passports, or visas

- Plants, animals, or food

- Glasses, contact lenses, hearing aids, prosthetic devices, and prescription or non-prescription drugs

- Property shipped prior to departure

You’ll have 30 days from the date of the loss to file a claim. To file a claim, you can go online or call 800-228-6855 within the U.S. To call from outside of the U.S., call 303-273-6498 collect.

You’ll then have 60 days to submit supporting documentation including a list of items lost, receipts, a statement showing the trip was purchased with the card or associated rewards, and common carrier reports.

Please note that we have abbreviated coverage descriptions and all terms and conditions are not spelled out in their entirety. You’ll want to access the benefits guide for full information.

Bottom Line: You and certain family members are covered for baggage insurance of up to $1,250 per person when traveling with a common carrier. You’ll need to pay for your entire trip with your card or rewards associated with your card for coverage to be valid.

Travel accident insurance that comes with the Amex Gold card pays a benefit in the unlikely event of accidental death or dismemberment of the primary card member, additional card member, spouse or domestic partner, or children under the age of 23.

The trip must be paid for with the Amex Gold card and/or associated Membership Rewards points (Pay With Points).

The coverage pays a benefit for death or severe injury suffered as a result of riding in, boarding, exiting from, or being struck by a common carrier.

The benefit paid is based on a table provided and can be up to $100,000.

Travel Benefits

While not travel insurance specifically, these additional benefits can provide assistance when planning a trip or if an unexpected event should disrupt your trip.

The Amex Global Assist Hotline provides important 24/7 assistance when traveling more than 100 miles from home. Receive help finding medical, legal, and translation referrals as well as assistance securing emergency transportation.

In addition, you could receive help securing a replacement passport or finding missing luggage.

You can reach the Global Assist Hotline at 800-333-2639. Outside the U.S., call 715-343-7977.

Actual services provided by third parties that incur costs are the responsibility of the cardholder.

Services are also not available in areas such as Cuba, Iran, Syria, North Korea, or the Crimea region.

You’ll want to include the Amex Gold card during your next trip, as the card does not charge foreign transaction fees ( rates & fees ).

Receive help planning your trip with Insider Fares via AmexTravel.com, upgrade your flights with points , American Express Travel Insurance , onsite benefits at The Hotel Collection , Amex Offers , and more.

While the Amex Gold card comes with several valuable travel insurance benefits, you would not select the card for this specific reason. The card shines when it comes to earning on select everyday purchases, for purchasing airline tickets, and its flexible travel redemption options. Those should be key reasons for selecting the card.

The fact that there are travel insurance benefits that come complimentary with the card is just one more reason to consider the card.

If having premium travel insurance benefits is a priority for you, you might consider the Chase Sapphire Preferred ® Card , The Platinum Card ® from American Express , the Chase Sapphire Reserve ® , or the Capital One Venture X Rewards Credit Card , all of which offer some of the best travel insurance benefits.

You can read about more credit cards with travel insurance in our article on this specific topic.

For the car rental collision damage coverage benefit of the American Express Gold Card, car rental loss and damage insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip delay insurance benefit of the American Express Gold Card, up to $300 per covered trip that is delayed for more than 12 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of the American Express Gold Card, baggage insurance plan coverage can be in effect for eligible persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier (e.g. plane, train, ship, or bus) when the entire fare for a common carrier vehicle ticket for the trip (one-way or round-trip) is charged to an eligible account. Coverage can be provided for up to $1,250 for carry-on baggage and up to $500 for checked baggage, in excess of coverage provided by the common carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the global assist hotline benefit of the American Express Gold Card, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Card members may be responsible for the costs charged by third-party service providers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the amex gold card have travel insurance benefits.

While the list of travel insurance benefits on the Amex Gold card is not extensive, you will find coverage such as secondary car rental insurance, the option to purchase Premium Protection car rental insurance, trip delay, baggage insurance, a Global Assist Hotline, and travel accident insurance.

Does the Amex Gold card have trip interruption or trip cancellation insurance?

No. The Amex Gold card does not offer trip interruption or trip cancellation insurance. The card does come with trip delay insurance.

Does the Amex Gold card charge foreign transaction fees?

No. You will not be charged foreign transaction fees when using the Amex Gold card for foreign purchases ( rates & fees) .

Does the Amex Gold card cover lost luggage?

Yes, the Amex Gold card can cover lost, stolen, or damaged luggage. The coverage is secondary to any coverage or reimbursement received by the airline or other applicable insurance.

Does the Amex Gold card have good car rental insurance?

The Amex Gold card comes with secondary car rental insurance, which means that you must first file a claim with any other applicable insurance before card coverage kicks in. You will have the option, however, to purchase Premium Protection for one low rate that covers the entire rental period, up to 42 days.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![american express travel insurance missed flight Amex Gold Card vs. Amex Rose Gold Card [Are They Different?]](https://upgradedpoints.com/wp-content/uploads/2022/08/Amex-Gold-vs-Amex-Rose-Gold-Upgraded-Points-LLC.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

American Express Will Now Allow Card Holders to Cancel a Flight for Any Reason — What to Know

The new benefit extends to all American Express card holders, regardless of which card they have.

:max_bytes(150000):strip_icc():format(webp)/alison-fox-author-pic-15f25761041b477aaf424ceca6618580.jpg)

American Express will now allow customers to cancel a flight for any reason, allowing card holders to book their next trip with a little more peace of mind.

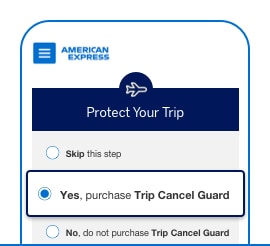

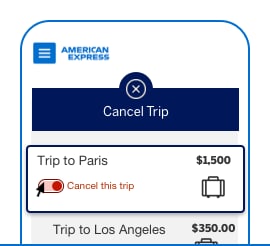

Going forward, travelers who book a flight through the Amex Travel will be able to cancel that flight for any reason and receive up to a 75% reimbursement of the nonrefundable flight costs, according to the credit card company . To take advantage of the new benefit, called "Trip Cancel Guard," travelers must cancel at least two calendar days before their departure date.

However, it's worth noting that the "Trip Cancel Guard" option must be purchased at the time of booking.

The new benefit extends to all American Express card holders, regardless of which card they have, a company spokeswoman told Travel + Leisure .

"People are eager to travel, and as demand increases there is a greater need to plan ahead. At the same time, a level of uncertainty still exists in this [ever changing] travel environment," Audrey Hendley, the president of American Express Travel, said in a statement. "With 'Trip Cancel Guard,' we're continuing to back our customers by giving them the value we know they want, along with the confidence to book flights with the flexibility to cancel for any reason if their plans change."

Even before offering this new benefit, American Express has always allowed Platinum card holders to cancel a trip due to things like illness or injury. The card also covers trips that are canceled due to COVID-19 quarantines.

Gold card holders are also covered for a trip delay for things like inclement weather and if their passport is lost or stolen.

Recently, American Express increased the annual fee for the Platinum Card to $695, from $550, and included a slew of new travel-related benefits like a $200 hotel credit, a $179 credit to cover a year-long membership in Clear , and free access to more than 1,300 airport lounges around the world, including more than 40 Centurion Lounges .

For travelers who don't have a credit card that offers trip cancellation, purchasing trip insurance is still a good idea with several policies also offering the chance to cancel for any reason .

Alison Fox is a contributing writer for Travel + Leisure. When she's not in New York City, she likes to spend her time at the beach or exploring new destinations and hopes to visit every country in the world. Follow her adventures on Instagram .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

4 Things to Know About AmEx Trip Cancellation Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As a card issuer, American Express is well-known for its generous benefits. So whether you’re looking for statement credits , elevated earnings on dining or hotel elite status , AmEx probably has a card that’ll fit.

Among these perks is travel insurance, which can cover you when things go awry. But how does AmEx trip cancellation insurance work, and what does it cover? Let’s take a look.

1. What does American Express trip cancellation insurance cover?

AmEx has different levels of trip insurance depending on the card you hold. Its high-end cards, such as The Platinum Card® from American Express , provide the best benefits, including trip cancellation travel insurance . Terms apply.

Generally speaking, trip cancellation insurance from AmEx will cover your trip's prepaid, nonrefundable costs under eligible circumstances. The coverage maximum for reimbursement is $10,000 per trip and $20,000 per 12-month period. To be covered for trip cancellation, you’ll need to have paid the full amount of the trip with your eligible AmEx card or a combination of your card and other certificates, vouchers or miles.

Covered circumstances in which AmEx will reimburse you for trip cancellation include:

Accidental injury, sickness or loss of life concerning you, a traveling companion or a family member.

Inclement weather prevents you from traveling.

A change in military orders for either you or your spouse.

Hijacking or terrorist acts.

Jury duty or a subpoena if they cannot be postponed or waived.

If your dwelling becomes uninhabitable (e.g., your home catches fire).

Quarantine as imposed by a doctor.

» Learn more: How to find the best travel insurance

Finally, the trip must be round-trip, though the travel can consist of round-trip, one-way and open-jaw tickets . AmEx will reimburse more than your flight costs if you have a covered loss. Other types of purchases that AmEx will cover include:

Any other common carriers.

Common carriers are companies licensed to transport passengers across land, sea or air and require passengers to obtain a ticket before travel. This means rental cars, taxis, ride-share, and commuter travel services don’t qualify. However, tickets for regular bus lines, commercial airlines and standard rail lines do.

Be aware that AmEx’s trip cancellation insurance is secondary; it’ll pay out after other insurance and providers have made their payments.

» Learn more: How does credit card travel insurance work?

2. Which AmEx cards include trip cancellation insurance?

We’ve already mentioned The Platinum Card® from American Express as one that provides trip cancellation insurance, but there are plenty of others that do so as well.

These include both consumer and small business cards, such as the:

Business Centurion Card from American Express.

Centurion Card From American Express.

Delta SkyMiles® Reserve American Express Card .

Delta SkyMiles® Reserve Business American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant® American Express® Card .

The American Express Platinum Card for Schwab.

The Business Platinum Card® from American Express .

The Corporate Platinum Card.

The Platinum Card from American Express for Ameriprise Financial.

The Platinum Card from American Express for Goldman Sachs.

The Platinum Card from American Express for Morgan Stanley.

The Corporate Centurion Card from American Express.

Terms apply.

Other AmEx cards have different types of travel insurance , including trip delay reimbursement, rental car insurance and lost luggage compensation.

» Learn more: The best travel credit cards right now

3. Who is covered?

When using your eligible AmEx card to pay for your travel, you’re not the only person covered by trip cancellation insurance. These benefits likewise cover you, your family members and any traveling companions.

American Express defines family members as your domestic partner, spouse or unmarried child up to the age of 19 (or under the age of 26 if your child is a full-time college student). Traveling companions are those who have made advanced arrangements with you or your family to travel together.

» Learn more: Credit cards that provide travel insurance

4. How to file a claim

To file a claim for reimbursement through AmEx’s trip cancellation insurance coverage, you’ll need to notify your benefits administrator. This must be done within 60 days of the covered loss or you’ll run the risk of your claim not being honored.

To contact your benefits administrator and open a claim, call 844-933-0648.

You’ll also need to complete the cancellation procedures for your travel provider. For example, if you’ve booked a flight with, say, Delta Air Lines, you’ll want to navigate Delta’s website to be sure that your ticket has been appropriately canceled.

You’ll then need to furnish written proof of your loss within 180 days of its occurrence. Gather various paperwork, such as:

Copies of your common carrier and travel supplier receipts.

Your card statement showing that you used your AmEx card to pay for the trip.

A copy of the travel supplier’s cancellation policy.

Proof of your covered loss; this may include military orders, a note from your physician or jury duty.

AmEx might extend the deadline for documentation up to one year after your loss if it isn't possible for you to provide it in a timely manner.

AmEx may require other paperwork depending on your situation, but you'll want to coordinate with your benefits administrator to see if this is necessary.

» Learn more: Airline travel insurance versus your credit card's

Trip cancellation insurance from AmEx recapped

AmEx's high-end credit cards provide many benefits, including the protection of trip cancellation insurance. To be eligible for coverage, you'll need to use your card to pay for a covered trip. You'll also need to have a qualifying reason for cancellation.

AmEx will pay you up to $10,000 in losses for approved claims.

All information about the Business Centurion Card from American Express, Centurion Card From American Express, The American Express Platinum Card for Schwab, The Corporate Platinum Card, The Platinum Card from American Express for Ameriprise Financial, The Platinum Card from American Express for Goldman Sachs, The Platinum Card from American Express for Morgan Stanley and The Corporate Centurion Card from American Express has been collected independently by NerdWallet. These cards are no longer available through NerdWallet.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

American Express® Trip Cancel Guard™

Book with optimism., cancel with confidence..

With Trip Cancel Guard, you can cancel your flight for any reason up to 2 full calendar days before departure and receive up to 75% reimbursement when an airline credit or voucher is not available or expires. Available exclusively with flights booked on AmexTravel.com.

Please review the FAQs below to learn more.

Purchase and Use Trip Cancel Guard in 3 easy steps ✝ :

1. Purchase Your Trip and Trip Cancel Guard

Purchase Trip Cancel Guard when booking an eligible flight itinerary through AmexTravel.com

2. If You Cancel Your Trip

Contact your airline or American Express Travel® to cancel your flight for any reason at least two calendar days before your departure date

3. Make A Request for Reimbursement

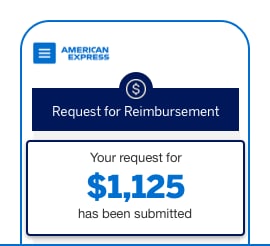

Once your trip is cancelled, submit a request online through the Digital Claims Center* or by phone and you may receive up to 75% reimbursement of nonrefundable flight costs

✝ Illustration only

Watch To Learn More

Terms apply. click here for terms and conditions..

QUICK FACTS:

Available for purchase with all US American Express® Cards

Cancel for any reason you choose at least 2 days before departure

Up to 75% reimbursement with a convenient digital process*

*Currently available for American Express Card Members only

American Express® Trip Cancel Guard™

The flexibility to change your mind.

There are some things you just can't plan for. Luckily, there's Trip Cancel Guard.

HOW IT WORKS:

Add Trip Cancel Guard and get up to 75% reimbursement if you cancel your eligible flight at least two full calendar days before. Available exclusively through AmexTravel.com at the time of booking.

Trip Cancel Guard is in effect until you cancel your benefit, submit a request for reimbursement on a canceled flight, or you reach your benefit end date. This benefit applies only before your trip starts and does not offer coverage during your trip or return flight. If you want to update or change your trip, you must call the Benefit Administrator to determine if the benefit can be applied to your updated itinerary. If you get a travel credit or airline voucher for your cancelled trip, Trip Cancel Guard can provide reimbursement once the credit or voucher has expired or is forfeited by its own terms and conditions.

Trip Cancel Guard is not insurance and may be purchased in addition to any other travel insurance.

Click here for Terms & Conditions

Ready to book your travel?

Purchase Trip Cancel Guard when booking an eligible flight itinerary through AmexTravel.com.

Frequently Asked Questions

What is Trip Cancel Guard?

Trip Cancel Guard is an optional add-on benefit available for certain travel itineraries booked through American Express TRS that allows You to receive reimbursement when You cancel Your trip for any reason at least two (2) full calendar days before Your Departure Date and before the Benefit End Date, as defined by the benefit terms & conditions. You may receive reimbursement of up to the amount stated on Your Schedule of Benefits, which is up to 75% of Your Nonrefundable Prepaid Expenses. This benefit is a cancellation fee waiver and is not an insurance product .

When do I need to cancel my trip Itinerary by to be eligible for Trip Cancel Guard reimbursement?

You must cancel Your trip with American Express TRS or Your airline carrier prior to the restricted period, which includes the 2 full calendar days before Your original scheduled Departure Date. The Benefit End Date is the date by which You need to cancel before 11:59 PM in order to be eligible for benefits and is listed on Your Schedule of Benefits. Below are illustrative examples of eligible and non-eligible trip cancellation:

- This cancellation meets eligibility requirements

- This cancellation does not meet eligibility requirements. July 13th is one of the 2 full calendar days prior to the trip Departure Date

Can I purchase Trip Cancel Guard in addition to Travel Insurance?

Yes! You may purchase Trip Cancel Guard in addition to any other travel insurance. Trip Cancel Guard will provide reimbursement if You decide to cancel Your trip for any reason at least two (2) full calendar days before Your Departure Date and before the Benefit End Date, as defined by the benefit terms & conditions. Please review Your travel insurance policy details for the specific reasons that trip cancellation insurance coverage is different from Trip Cancel Guard and whether You are eligible for benefits under one or both.

Will I receive reimbursement from Trip Cancel Guard if I receive a travel credit or voucher for my cancelled trip?

If You have purchased Trip Cancel Guard and receive a travel credit or airline voucher for Your cancelled itinerary, Your eligibility for reimbursement from Trip Cancel Guard may be delayed until the credit or voucher expires or is forfeited by its own terms and conditions. If the credit or voucher expires or is forfeited, You may reopen Your request for benefit.

If You are charged and pay an additional penalty fee due to cancellation to receive or use a travel credit or voucher provided for Your cancelled itinerary, You may make a request to receive reimbursement for those penalty fees charged and paid due to cancellation, regardless of credit or voucher status or when fee is charged.

Cancellation fees charged by airlines may go by different names, but only fees that were charged and paid directly as a result of trip cancellation will be eligible for reimbursement.

Am I eligible to receive this benefit for itineraries purchased with frequent flyer points or other travel credits?

This benefit is available for itineraries paid with American Express Membership Rewards® points only when used through the Pay with Points Program. This benefit is not available, however, for travel purchased with travel award credits such as loyalty points, vouchers, credits, coupons or similar programs offered by travel suppliers including airlines or American Express Travel & Lifestyle Services. Additionally, this benefit is not available for travel purchased with travel supplier credits obtained by exchanging American Express Membership Rewards points for those travel supplier credits.

Can I add Trip Cancel Guard to an existing itinerary?

No, this benefit may only be purchased at the time of booking the itinerary and cannot be added after the booking is completed.

If I experience a website error, can I call in to purchase Trip Cancel Guard?

If You are experiencing a website error, please check back later as the Trip Cancel Guard is not available for purchase offline.

What if I change my original flight itinerary after the purchase date?

If You change Your original flight itinerary, it is Your responsibility to call the Benefit Administrator as soon as possible to determine if Your enrollment in this benefit can be reissued. Please note, Trip Cancel Guard only applies to the one original Eligible Trip Itinerary unless the Benefit Administrator is able to reissue the benefit for an updated itinerary. In some cases, the Benefit Administrator may be able to reissue Your benefit for Your updated itinerary. If the Benefit Administrator is not able to reissue Your benefit OR You do not contact the Benefit Administrator, reimbursement may only be provided based on the original amount as stated in Your original Schedule of Benefits. Please see below for illustrative, non-exhaustive examples of itinerary changes:

Benefit Administrators may be able to amend Your benefit for flight-related changes, like: · Upgrade seat or fare class · Change in trip Departure Date · Change in trip length · Adding additional travelers (Eligible Beneficiaries) · Added WiFi, seat selection, or specialty meal

Trip Cancel Guard only applies to flight-related purchases. Therefore, Benefit Administrators cannot amend Your benefit to include newly added itinerary components or costs, like:

· Add on hotel to itinerary · Add on car rental to itinerary · Add on cruise to itinerary · Add on tour package or excursion to itinerary · Add on train to itinerary

Is Trip Cancel Guard available for purchase in all states?

Yes, Trip Cancel Guard is available for purchase in all fifty (50) US States and US territories. American Express reserves the right to limit purchase of Trip Cancel Guard at any time.

Is Trip Cancel Guard available for all itineraries?

No, Trip Cancel Guard is not available for all itineraries. Currently, Trip Cancel Guard is only available for stand-alone airfare purchases made on AmexTravel.com and does not include packaged travel purchases such as flight + hotel, cruise and/or car rentals. Other factors such as the total trip cost may impact the availability of the benefit for Your itinerary. American Express also reserves the right to limit purchase of Trip Cancel Guard at any time.

When does the Trip Cancel Guard benefit end?

The Trip Cancel Guard benefit is in effect unless You cancel Your benefit, or until You or Eligible Beneficiary(ies) submit a request for reimbursement on a cancelled flight, or You reach Your Benefit End Date. The Trip Cancel Guard benefit does not apply during travel or to travel interruptions or return flights.

How is the price of Trip Cancel Guard calculated?

The fee for Trip Cancel Guard is a percentage of the total flight cost, inclusive of taxes and fees.

Learn more about other American Express Travel Protections and Benefits.

Benefit Overview and Eligible Cards

Learn more about your embedded Card travel benefits.

American Express Travel Insurance

Help protect your trip with American Express Travel Insurance. Learn More .

Premium Car Rental Protection

Accidents happen, enroll in Premium Car Rental Protection. Learn more .

Terms and Conditions

American Express® Trip Cancel Guard TM

Cancellation Fee Waiver

Terms & Conditions

Revised May 2022

The American Express Trip Cancel Guard is an optional benefit enabling Eligible Beneficiaries to receive partial reimbursement for Eligible Trip Itineraries purchased through American Express TRS that are cancelled for any reason at least 2 full calendar days before the Departure Date and before the Benefit End Date . This benefit is a cancellation fee waiver and is not an insurance product. Trip Cancel Guard is only available for purchase through American Express TRS at the time of the Eligible Trip Itinerary booking. With this benefit, the Eligible Beneficiaries may receive reimbursement for up to 75% of Nonrefundable Prepaid Expenses listed on the Eligible Trip Itinerary purchased through American Express TRS as stated on Your Schedule of Benefits . Reimbursement is subject to requirements and restrictions.

Trip Cancellation and Reimbursement Process

Eligible Trip Itinerary Cancellation 1. You may cancel all or part of Your Eligible Trip Itinerary and may receive reimbursement for up to the amount stated on Your Schedule of Benefits , subject to the notice and timing requirements of this benefit. You may also cancel itineraries for each Eligible Beneficiary listed on the Eligible Trip Itinerary . 2. In order to be eligible for this benefit, You must cancel your Eligible Trip Itinerary with TLS or the airline carrier before your Benefit End Date . • If You cancel Your trip after Your Benefit End Date during the two (2) full day restricted period before Your Departure Date, You will no longer be eligible to make a Request for Reimbursement. If You are no longer eligible to make a Request for Reimbursement , any trip cancellation penalties or lost Nonrefundable Prepaid Expenses are not eligible for reimbursement under American Express Trip Cancel Guard. Eligible Trip Itinerary Request for Reimbursement 1. You may complete a Request for Reimbursement at www.americanexpress.com/protectionbenefits or by calling the Benefit Administrator at 1-800-228-6855. The Benefit Administrator must be notified no more than thirty (30) days after trip cancellation, or as soon as reasonably possible. 2. The Benefit Administrator will review the Request for Reimbursement and may request additional materials from You to support the Request for Reimbursement . Additional information must be submitted no more than sixty (60) days from the time of request, or as soon as reasonably possible. • In order for the Benefit Administrato r to evaluate a Request for Reimbursement , You must cooperate by providing any requested documents or statements that determine the amount of Nonrefundable Prepaid Expenses and whether the Eligible Trip Itinerary cancellation is eligible for reimbursement by another benefit or plan. 3. If a Request for Reimbursement is approved by the Benefit Administrator , reimbursement will be paid directly and separately to each of the Eligible Beneficiaries included in the Request for Reimbursement at the address provided for each Eligible Beneficiary in the Request for Reimbursemen t. • If You receive a travel voucher and/or credit from Your travel supplier, Your Request for Reimbursement may not be eligible for reimbursement until the travel voucher and/or credit is forfeited or has expired. You may contact the Benefit Administrator to reopen the Request for Reimbursement once Your travel voucher and/or credit is forfeited or has expired. • Any amount payable to a minor will be paid to a guardian of that minor

Benefit Communication

General Administration We will communicate directly with the purchaser of this benefit on behalf of all Eligible Beneficiaries , unless We are told to communicate directly with any Eligible Beneficiary by that Eligible Beneficiary . Request for Reimbursement When completing a Request for Reimbursement , an individual may indicate that they are authorized to provide the address and contact information for other Eligible Beneficiaries listed in the Schedule of Benefits , in which case we will communicate with those Eligible Beneficiaries unless directed otherwise. Benefit Cancellation The purchaser of this benefit may cancel for a full refund of the fees paid for Trip Cancel Guard within fourteen (14) calendar days after the date of purchase. The purchaser of this benefit will not be eligible for a refund of fees paid if: • You have cancelled Your Eligible Trip Itinerary and made a Request for Reimbursement during this period OR • The request for refund occurs after the Benefit End Date stated on Your Schedule of Benefits To request a refund of the fees paid for Trip Cancel Guard, please call the Benefit Administrator at 1-800-228- 6855.

What do the Defined Terms mean?

Capitalized and Bolded terms have the meanings set forth below. The singular includes the plural and the plural includes the singular, as the context requires. The singular includes the possessive, as the context requires. “Including” and any derivative form means “including but not limited to”. American Express TRS means American Express Travel Related Services Company, Inc. Benefit Administrator means the administrator of this benefit for American Express TRS . Benefit Effective Date means the date on which Trip Cancel Guard was purchased, as stated in Your Schedule of Benefits . Benefit End Date means 11:59 PM on the date listed on Your Schedule of Benefits at Your city of departure that is listed on Your Eligible Trip Itinerary . Departure Date means the date on which an Eligible Beneficiary is originally scheduled to depart on the Eligible Trip Itinerary . Eligible Beneficiary means any traveler listed on the Eligible Trip Itinerary and named on the Schedule of Benefits who is eligible to receive reimbursement through Trip Cancel Guard. This benefit only applies to Eligible Trip Itineraries with 10 or fewer listed travelers. Eligible Trip Itinerary or Trip means the one original itinerary containing standalone airfare only and trip ID purchased through American Express TRS’ travel website, AmexTravel.com, at the same time you purchased this optional benefit and that has no more than 10 named Eligible Beneficiaries . Nonrefundable Prepaid Expenses are: • Forfeited payments or deposits (including expired or forfeited travel credit and vouchers) • Airline cancellation or penalty fees charged to and paid by You caused by Eligible Trip Itinerary cancellation Request for Reimbursement means a request made by You to the Benefit Administrator to reimburse Eligible Beneficiaries for loss of up to 75% of Nonrefundable Prepaid Expenses linked to an Eligible Trip Itinerary that You cancel at least two (2) full calendar days before the Departure Date . You can make a request by providing notice and documentation required by the Benefit Administrator that states the amount of Nonrefundable Prepaid Expenses to be reimbursed up to the amount stated on Your Schedule of Benefits . If the purchaser of this benefit is not a traveler then they are not an Eligible Beneficiary and are not eligible to receive reimbursement. Schedule of Benefits means the summary of benefits for all Eligible Beneficiaries under Trip Cancel Guard. TLS means the American Express Travel & Lifestyle Services division of American Express TRS You means the purchaser of Trip Cancel Guard and Eligible Beneficiaries entitled to cancel all or part of an Eligible Trip Itinerary and complete a Request for Reimbursement .

Integrated Document

The terms and conditions of Trip Cancel Guard are stated in this terms and conditions document and the Schedule of Benefits . This terms and conditions document and the Schedule of Benefits , plus the Eligible Trip Itinerary are the integrated benefit contract.

American Express TRS’s Right of Recovery

If payment is made under this benefit, American Express TRS shall be subrogated, to the extent of such payment, to all rights of recovery, and any person(s) receiving payment shall not waive American Express TRS’s rights and shall cooperate to enable American Express TRS to bring suit or otherwise pursue subrogation. American Express TRS is entitled to recover any amount from other responsible parties or persons (excluding You when correctly provided benefits under Trip Cancel Guard) up to the amount of American Express TRS’s payment. Any party or person recovering such amounts from other parties or persons shall reimburse American Express TRS to the extent of American Express TRS’s payment.

Fraud Warning

If any Request for Reimbursement made under this benefit is determined to be fraudulent, or if any fraudulent means or devices are used by You or a person requesting benefits, all benefits will be forfeited.

ARBITRATION CLAUSE

MOST CONCERNS CAN BE RESOLVED QUICKLY AND TO YOUR SATISFACTION BY CALLING BENEFIT ADMINISTRATOR AT 1-800-228-6855. IN THE UNLIKELY EVENT THAT BENEFIT ADMINISTRATOR IS UNABLE TO RESOLVE A COMPLAINT YOU MAY HAVE TO YOUR SATISFACTION (OR IF AMERICAN EXPRESS TRS HAS NOT BEEN ABLE TO RESOLVE A DISPUTE IT HAS WITH YOU AFTER ATTEMPTING TO DO SO INFORMALLY), YOU AND AMERICAN EXPRESS TRS EACH AGREE TO RESOLVE THOSE COMPLAINTS OR DISPUTES THROUGH BINDING ARBITRATION INSTEAD OF IN COURTS OF GENERAL JURISDICTION TO THE FULLEST EXTENT PERMITTED BY LAW.

ARBITRATION IS MORE INFORMAL THAN A LAWSUIT IN COURT. ARBITRATION USES A NEUTRAL ARBITRATOR INSTEAD OF A JUDGE OR JURY, ALLOWS FOR MORE LIMITED DISCOVERY THAN IN COURT, AND IS SUBJECT TO VERY LIMITED REVIEW BY COURTS. ARBITRATORS CAN AWARD THE SAME DAMAGES AND RELIEF THAT A COURT CAN AWARD. ANY ARBITRATION UNDER THIS AGREEMENT WILL TAKE PLACE ON AN INDIVIDUAL BASIS; CLASS ARBITRATIONS AND CLASS ACTIONS ARE NOT PERMITTED.

(a) American Express TRS and You agree to arbitrate all complaints and disputes relating to the benefit, except any complaints and disputes which under governing law are not subject to arbitration. This agreement to arbitrate (the “ Agreement ”) is intended to be broadly interpreted and to make all complaints and disputes relating to the benefit subject to arbitration to the fullest extent permitted by law.

You agree that You and American Express TRS are each waiving the right to a trial by jury or to participate in a class action. This Agreement evidences a transaction in interstate commerce, and thus the Federal Arbitration Act governs the interpretation and enforcement of this arbitration provision. This arbitration provision shall survive termination of this Agreement . (b) A party whointends to seek arbitration must first send to the other, by certified mail, a written Notice of Dispute (" Arbitration Notice "). The Arbitration Notice to American Express TRS should be addressed to:

American Express ADR c/o CT Corporation System, 111 Eighth Avenue, New York, NY 10011

(the “ Arbitration Notice Address ”). The Arbitration Notice must describe the nature and basis of the complaint or dispute and set forth the specific relief You seek from American Express TRS (the “ Demand ”). Please retain a copy of the Demand for Your records.

If American Express TRS and You do not reach an agreement to resolve the complaint or dispute within 30 days after the Arbitration Notice is received, You or American ExpressTRS may commence an arbitration proceeding. During the arbitration, the amount of any settlement offer made by American Express TRS or You shall not be disclosed to the arbitrator until after the arbitrator determines the amount, if any, to which You or American Express TRS is entitled. (c) After American Express TRS receives notice at the Arbitration Notice Address that You have commenced arbitration, it will promptly reimburse You for Your payment of the filing fee. If You are unable to pay this fee, American Express TRS will pay it directly upon receiving a written request at the Arbitration Notice Address . Arbitration may be referred to either JAMS (1-800-352-5267, jamsadr.com) or the American Arbitration Association (“AAA”) (1-800-778-7879, www.adr.org), as selected by the party electing arbitration. Complaints and disputes will be resolved pursuant to this Arbitration provision and the selected organization's rules in effect when the complaint or dispute is filed, except where those rules conflict with this Agreement . If we choose the organization, You may select the other within 30 days after receiving notice of our selection. Contact JAMS or AAA to begin an arbitration or for other information.

The arbitrator shall be bound by the terms of this Agreement . The arbitrator shall have the power and authority to award any relief that would have been available in court, including equitable relief (e.g., injunction, specific performance) and, cumulative with all other remedies, shall grant specific performance whenever possible. The arbitrator shall have no power or authority to alter the Agreement or any of its separate provisions, including this section, nor to determine any matter or make any award except as provided in this section. Unless American Express TRS and You agree otherwise, any arbitration hearings will take place in the county (or parish) of Your billing address. If Your complaint is for $10,000 or less, we agree that You may choose whether the arbitration will be conducted solely on the basis of documents submitted to the arbitrator, through a telephonic hearing, or by an in-person hearing as established by the selected organization’s rules. If Your complaint exceeds $10,000, the right to a hearing will be determined by the selected organization’s rules. Except as otherwise provided for herein, American Express TRS will pay all of selected organization’s filing fees, however, the parties will be equally responsible for any administration and arbitrator fees for any arbitration initiated in accordance with the notice requirements above. If, however, the arbitrator finds that either the substance of Your complaint or dispute or the relief sought in the Arbitration Demand is frivolous or brought for an improper purpose (as measured by the standards set forth in Federal Rule of Civil Procedure 11(b)), then the payment of all such fees will be governed by the selected organization’s rules. In such case, You agree to reimburse American Express TRS for all monies previously disbursed by it that are otherwise Your obligation to pay under the AAA Rules. (d) The arbitrator may make rulings and resolve complaints and disputes as to the payment and reimbursement of fees and expenses at any time during the proceeding or in the final award, pursuant to applicable law and the selected organization’s rules.

(e) Discovery and/or the exchange of non-privileged information relevant to the complaint or dispute will be governed by the selected organization’s rules. (f) YOU , AND AMERICAN EXPRESSTRS AGREE THAT EACH MAY BRING COMPLAINTS OR DISPUTES AGAINST THE OTHER ONLY IN YOUR OR ITS INDIVIDUAL CAPACITY, AND NOT AS A PLAINTIFF OR CLASS MEMBER IN ANY PURPORTED CLASS OR REPRESENTATIVE PROCEEDING. Further, unless both You and American Express TRS agree otherwise, the arbitrator may not consolidate more than one person's claims and may not otherwise preside over any form of a representative or class proceeding. The arbitrator may award injunctive relief only in favor of the individual party seeking relief and only to the extent necessary to provide relief warranted by that party's individual claim. If this specific subparagraph (f) is found to be unenforceable, then the entirety of this arbitration provision shall be null and void.

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit www.americanexpress.com/travelterms.

California CST#1022318; Washington UBI#600-469-694

IMAGES

VIDEO

COMMENTS

Trip Cancellation and Interruption Insurance is effective for round-trip purchases made entirely with your eligible Card and protects against Covered Losses (e.g. Sickness or Injury of the traveler or traveling companion). If your Card is not listed on this page or if you are an Additional Card Member, please call the number on the back of your ...

How to make an AmEx travel insurance claim. To file a claim, you'll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you ...

Then, you'll need to go through a two-step process to file a claim for reimbursement. First, you must notify the benefit administrator of your claim within 60 days of the trip delay. You can do ...

Covered amount. The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is ...

Level 1: Higher-end cards. Some of American Express' top products offer baggage insurance coverage of up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage. This coverage is in excess of coverage provided by the common carrier.

Hilton Honors American Express Aspire Card *. $10,000 per covered trip, up to $20,000 in a 12-month period. Up to $500 per trip for delays above 6 hours. Secondary. Up to $2,000 per person for checked bags and $3,000 per person for carry-ons, up to $3,000 per person. N/A.

5x on flights booked directly or with Amex Travel, 5x on hotels booked through Amex Travel, 1.5x points on eligible purchases in select business categories and eligible purchases of $5,000 or more; on up to $2 million of these purchases per calendar year), 1x on all other purchases. Terms apply. Trip cancellation, interruption and delay Insurance.

Round trip travel only nixes the idea of me ever using the Amex card to purchase airline tickets. I had a flight diverted from Cincinnati to Houston and missed my connection. It was simple to submit a claim to Chase for the hotel and dinner. Apart from waiting for United to send me a statement, the process was simple.