Chase Ultimate Rewards travel portal review: A messy trip, but not their fault

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Credit cards

- • Credit scores

- • Rewards credit cards

- • Travel credit cards

- • Rewards strategy

- • Small business marketing

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Booking travel through a credit card issuer’s portal — which is essentially their version of an online travel agency (OTA) such as Expedia or Orbitz — has its pros and cons.

The main advantage is extra rewards. That’s what convinced me to book a recent trip through the Chase Ultimate Rewards portal using my Chase Freedom Flex℠ *.

I earned 5 percent cash back on those flights, whereas I would have only earned 1 percent if I booked directly with the airline. I bought $1,137.26 worth of airfare, so there was a significant difference between 5 percent ($56.86) and 1 percent ($11.37).

Sometimes it can also make sense to use a card issuer’s travel portal if you’re redeeming rewards for the trip. That’s especially compelling if you have a card such as the Chase Sapphire Preferred® Card , which boosts the value of your rewards by 25 percent if you use them in this fashion.

The main drawback of any OTA — card issuer portals included — is that booking travel this way introduces an intermediary into the transaction. If anything goes wrong with your trip, you need to deal with the travel agency’s customer service instead of (or sometimes in addition to) the hotel or airline provider. This can make things more complicated.

Another important note is that hotel bookings made through OTAs typically do not earn loyalty points or count toward elite status. Airline reservations, on the other hand, are generally eligible for frequent flyer miles and elite status qualification.

In my case, I decided that an extra $45.49 in cash back was worth giving the Chase travel portal a shot. I also viewed it as a professional development opportunity to see how this works in the real world.

What happened with my trip

A Bankrate survey revealed that 79 percent of travelers who’ve taken an overnight trip outside their local area so far this year experienced at least one travel-related problem. These included high prices (57 percent), long waits (29 percent), poor customer service (27 percent), hard-to-find availability (26 percent) and lost money due to canceled or disrupted plans (14 percent). I experienced every single one of those things the night before my wife and daughter were scheduled to leave on the trip I booked through Chase.

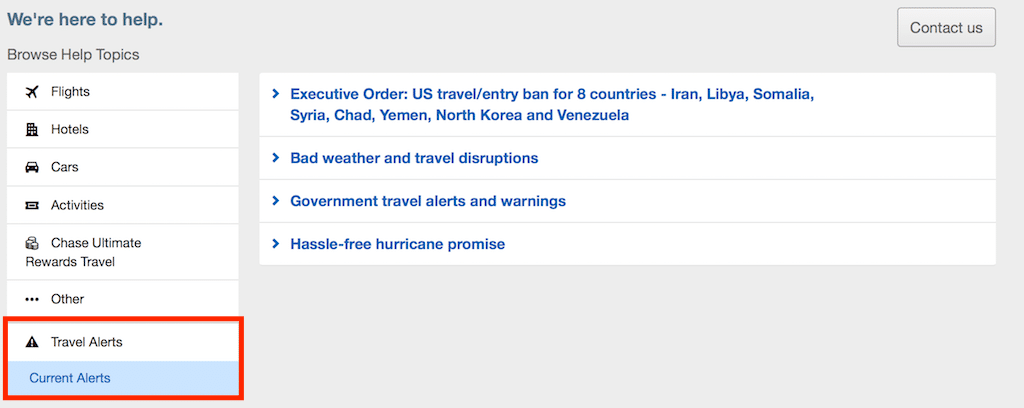

Actually, I should back up. The problems started even earlier than that. Weeks before the trip, American Airlines made a schedule change that jeopardized my wife Chelsea and daughter Ashleigh’s chances of making their connecting flight. The new layover seemed impossibly short.

This was my first test of the customer service for the Chase travel portal. They passed with flying colors, efficiently rebooking Chelsea and Ashleigh at no extra cost and arranging the flights in such a way that it seemed much more likely they would be able to get from one plane to the other. It was fairly complicated because the connecting city needed to change, but the whole process was smooth. I was impressed.

Fast-forward to the night before the trip

We received an email from American Airlines that Chelsea and Ashleigh’s flight from Newark to Phoenix was canceled. There was no explanation, but we assume it had to do with either a staffing or equipment shortage since the weather was calm on both ends; the airline offered to rebook them on the same itinerary two days later. That was far from ideal, since the whole trip was only supposed to last five days (the ultimate destination was Monterey, California, where Chelsea’s parents live).

We simultaneously reached out to both Chase and American. Chelsea reported that the wait to speak with someone at the airline was listed at four hours. I got through to a Chase representative almost immediately.

I explained the situation, and the customer service agent and I started brainstorming alternatives. Was there a different way to get to Phoenix in time for the connecting flight to Monterey? We looked at Newark, JFK, LaGuardia — even as far away as Philadelphia and Hartford, but no dice. How about an entirely new routing? Could they fly from somewhere in the New York area to San Francisco, San Jose or Oakland, California? Those cities are all within a couple hours’ drive of Monterey.

After several attempts to find something that would work, we gave up. Nothing seemed to work. The Chase representative was great, and I feel like he did everything he could to try and solve our dilemma. American Airlines just didn’t have any availability.

We eventually got through to American Airlines and confirmed there were only two options: Travel two days later or cancel. We opted to cancel but — plot twist — we still found a way for Chelsea to visit her parents and for Ashleigh to see her grandparents. We rolled the dice and made an entirely new reservation with JetBlue. They had an early-morning flight from JFK to San Francisco with a few available seats.

The backup plan

The trip ended up costing $700 more due to higher-priced, last-minute plane tickets and a rental car to get them from San Francisco to Monterey, but the trip had a happy ending. It was ironic, too, because we had sworn off JetBlue after experiencing significant issues with them during family trips in the past. This time, they saved the day, and American Airlines dropped the ball.

I’ve heard that some people have taken to making backup flight reservations, especially on carriers such as Southwest, which have particularly generous cancellation policies. I’m not sure I would go that far, but there’s no doubt air travel has been a mess lately. In my view, airlines need to do a much better job of setting their schedules and sticking to them. Unfortunately, there’s little that passengers can do to protect themselves.

Travel insurance might help, and some credit cards provide travel insurance benefits at no added cost. But, at the end of the day, the airlines are the ones responsible for getting us from point A to point B.

The Chase portal wasn’t the problem; I would use it again. But given the current state of the airline industry, I’m going to be anxiously waiting to see if my next flight takes off as planned.

Have a question about credit cards? E-mail me at [email protected] and I’d be happy to help.

*The information about the Chase Freedom Flex℠ has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

Chase Freedom Unlimited benefits guide

How to use the Chase Ultimate Rewards travel portal

Best Barclays business cards

Not a rewards junkie? That’s OK

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest news

- Stock market

- Premium news

- Biden economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal loans

- Student loans

- Car insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The offers on this page are from advertisers who pay us. That may influence which products we write about, but it does not affect what we write about them. Here's an explanation of how we make money.

Chase Sapphire Preferred review: A standout travel card with impressive perks

Whether you just learned about travel credit cards on TikTok or are a seasoned pro at using rewards to reduce vacation costs, the Chase Sapphire Preferred® card is an excellent option to help you save on travel. It has a generous rewards program and new cardmember bonus and, if you use your card to book your airfare and accommodations, it also provides you with significant protections and added benefits.

However, the card has an annual fee and no promotional annual percentage rate (APR) for purchases or balance transfers. Whether the Chase Sapphire Preferred card would be a worthwhile addition to your wallet depends on your spending and travel habits.

Chase Sapphire Preferred Card

Annual fee : $95

Welcome offer : Earn 60,000 bonus points after spending $4,000 in the first three months

5x points on travel booked through Chase

5x points on Lyft rides (through March 31, 2025)

5x points on Peloton purchases over $150 (through March 31, 2025)

3x points on dining, select streaming services, and online grocery purchases

2x points on other travel purchases

1x points on everything else

More details : $50 annual hotel credit, 25% higher redemption value when you use points to book travel through Chase, and perks at partners like DoorDash, Instacart, Lyft, and Peloton.

The Sapphire Preferred’s variable APR ranges from 21.49% to 28.49%, depending on your credit.

The Chase Sapphire Preferred Card has an annual fee of $95. Even occasional travelers may find it easy to recoup that cost with the card’s added benefits.

Welcome offer

New card members can earn 60,000 bonus points after spending at least $4,000 on purchases within the first three months of opening an account. Those points are worth $750 if you use them to book travel through Chase.

You're only eligible for the bonus if you haven't received another Chase Sapphire card member bonus — such as from the Chase Sapphire Reserve Card — within the past 48 months.

This card doesn’t offer a 0% introductory APR on purchases or balance transfers. The standard APR applies right away.

Rewards rate

You can earn the following rewards with the Chase Sapphire Preferred Card :

5x points on travel purchased through Chase Travel

3x points on dining, including qualifying delivery services and takeout

3x points on groceries purchased online (excluding wholesale clubs, Target , or Walmart )

3x points on select streaming services

1x points on all other purchases

How to earn rewards

You’ll earn points on every purchase you make with the Sapphire Preferred Card . However, you can maximize your earnings by booking travel like flights, hotels, and rental cars through Chase — this nets you 5x points, compared to the 2x points you earn when booking elsewhere.

In addition, dining will net you 3x points, whether you dine in a restaurant, drop in for takeout, or order through an eligible delivery service. If you frequently purchase groceries online, you could also reap larger rewards. However, popular retailers like Target or Walmart don’t qualify.

You don’t earn rewards on any credits, cash advances, or balance transfers .

How to redeem rewards

The Chase Ultimate Rewards program offers several ways to cash in your points, offering more flexibility than some other cards. But, using your points to book travel through Chase or transferring them to a loyalty program partner can maximize your point value.

If you redeem your points through Chase Travel, you’ll receive a 25% bonus on your points’ value. But if you don’t find what you’re looking for there, you can transfer your points directly to a partner airline or hotel. Points transfer at a 1:1 ratio to over a dozen travel partners.

In addition, you can cash in your points via:

Statement credits

Credits for qualifying purchases

Amazon and Apple purchases

Bookings made through Chase Experiences or Chase Dining

Additional benefits

You’ll earn an annual $50 credit after booking a hotel through Chase Travel. Maxing out that perk alone essentially cuts the annual fee in half.

In addition, you earn bonus points on your account anniversary each year. Get a bonus equal to 10% of your spending over the last 12 months. If you spent $20,000 on the card last year, for example, you’ll get a 2,000-point anniversary bonus.

The Chase Sapphire Preferred Card is an excellent card to take with you when you travel. It doesn't charge foreign transaction fees, making it especially useful if you're traveling outside of the U.S. Plus, it provides the following travel benefits:

Trip cancellation/interruption insurance: If you use your card to pay for your travel and your trip is canceled or interrupted due to weather, illness, or other covered events, you'll be reimbursed up to $10,000 per person and up to $20,000 per trip for non-refundable expenses like fares and hotel stays.

Baggage delay insurance: If your baggage is delayed by six hours or more when traveling by a passenger carrier, get reimbursed up to $100 per day for up to five days.

Auto rental collision damage waiver: The card provides primary coverage against theft or collision damage if you decline the car rental company's insurance and pay for the entire cost with your card.

Trip delay reimbursement: If your travel on a common carrier is delayed by 12 hours or more, the card will reimburse you for food and lodgings, up to a maximum of $500 per ticket.

Travel and emergency assistance: If you need help while traveling, you can call a benefits administrator for legal and medical referrals, but you're responsible for the cost of any services provided.

The Sapphire Preferred also provides the following benefits:

Purchase protection: New purchases made with the card are covered against theft or damage for up to 120 days for up to $500 per claim and $50,000 per account.

Extended warranty: On purchases with warranties of three years or less, the card will extend the warranty.

Partner benefits: For a limited time, you can take advantage of the following:

5x points on Lyft rides through March 31, 2025

5x points on purchases of $150 or more of Peloton equipment (up to a maximum of 25,000 points) through March 31, 2025

Six months of complimentary membership to Instacart+ if you enroll by July 31, 2024

Get a complimentary DoorDash and Caviar membership and take advantage of $0 delivery fees if you enroll by Dec. 31, 2024

Who is the Chase Sapphire Preferred best for?

While frequent travelers should easily recoup their costs with the rewards they earn, you don’t need to travel every month to get good use out of the Sapphire Preferred . Even occasional vacationers can come out ahead with a little planning.

Consider the card’s welcome bonus of 60,000 points after spending at least $4,000 in the first three months. Those points are worth $750 when redeemed through Chase Travel — enough to offset the $95 annual fee for the first seven years. Add in the card’s numerous other perks, including an annual $50 hotel credit, and it’s easy to see how many people could use this card to their advantage.

However, if you rarely travel or don’t often spend in the card’s bonus reward categories, you may not have much use for this card. The same goes for applicants who aren’t eligible for the welcome bonus or who might struggle to spend the $4,000 necessary to earn it. If you fall into any of these categories, you may have to work a little harder to make this card worthwhile.

Chase Sapphire Preferred pros

Competitive earning categories: This card offers solid rewards for both travel and everyday categories. If you can maximize these on a regular basis, you could quickly rack up points.

Bonus redemption value : Redeeming your points through Chase Travel offers a 25% bonus in your points’ value. That means you can stretch your rewards farther and get more bang for your buck.

Transfer partners : If you prefer to book travel directly with the provider, it’s easy to transfer your points to more than a dozen airline and hotel partners. Doing so could increase the value of your rewards even more, depending on what you redeem them for.

Travel protections: Frequent travelers may be put at ease by the Sapphire Preferred’s ample travel insurance and reimbursement opportunities. Notably, the card offers primary rental car coverage ; many travel cards only offer secondary coverage for rentals, meaning any claims must go through your personal car insurance first before the card’s insurance will kick in.

Chase Sapphire Preferred potential cons

No promotional APR: Unlike many cards, the Sapphire Preferred doesn't have a promotional APR offer on purchases or balance transfers.

Annual fee: While there are many rewards cards without annual fees , this card has a $95 annual fee. Make sure the rewards and perks you earn outweigh that cost.

High-value redemption options may be limited: You must redeem your points for travel through Chase or transfer points to a travel partner to get the most value for your rewards. Other redemption methods, such as gift cards or statement credits, give you less value for your points.

High spending requirement for new cardmember bonus: The new cardmember bonus is relatively high, but it requires you to spend at least $4,000 within three months of opening an account. That works out to about $1,330 a month in purchases, which may be out of some cardholders’ typical budgets.

Where can you use the Chase Sapphire Preferred Card?

The Chase Sapphire Preferred Card is a Visa card, meaning it belongs to the largest credit card network. It's accepted by most physical and online retailers.

How to make a Chase Sapphire Preferred payment

You can make a payment online, through the Chase mobile app, over the phone or by mail:

Online or in-app: Visit chase.com/paycard or download the Chase app and log into your account to make a payment via a linked checking or savings account.

Phone: You can make a payment 24 hours a day, seven days per week, through Chase's automated phone line at 1-800-436-7958.

Mail: Mail a check or money order to the following address: Cardmember Services P.O. Box 6294 Carol Stream, IL 60197-6294

Chase Sapphire Preferred customer service info

To get help with your account, contact customer support through the following methods:

Phone: 1-800-432-3117

Chase’s credit card resource center

Chase Sapphire Preferred login page

Alternative cards to consider

Capital one quicksilver cash rewards credit card.

Why we like it: The Quicksilver Cash Rewards card stands out for its straightforward 1.5% cash back on all purchases, offering simplicity compared to the Chase Sapphire Preferred's category-based reward system. With no annual fee, it’s also a more cost-effective option for those who prefer a hassle-free experience. Additionally, its flexible redemption options, allowing cash back to be redeemed in any amount at any time, provide greater accessibility and convenience for users.

Read a comparison of the Quicksilver Cash Rewards card .

Chase Sapphire Reserve®

Why we like it : The Chase Sapphire Reserve offers significantly higher rewards, particularly with its 3x points on travel and dining worldwide, compared to the Sapphire Preferred's 2x points in these categories. Its inclusion of a $300 annual travel credit — the first $300 spent goes toward the $300 annual travel credit — effectively offsets a substantial portion of the higher annual fee, making it more valuable for frequent travelers. Additionally, the Reserve provides superior travel benefits like access to over 1,300 airport lounges worldwide through Priority Pass Select, enhancing the overall travel experience.

Read our full review of the Chase Sapphire Reserve .

Blue Cash Everyday® Card from American Express

Why we like it : The Blue Cash Everyday Card from American Express is appealing for its strong cash-back rates in everyday spending categories, offering 3% at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%). This is more beneficial for typical shoppers compared to the Sapphire Preferred, which only offers bonus grocery rewards for online orders.

It also stands out with a $0 annual fee, making it a cost-effective choice for budget-conscious consumers. Plus, the card’s introductory 0% APR on purchases and balance transfers for the first 15 months is a significant perk that the Sapphire Preferred doesn’t offer. (See rates and fees .)

This article was edited by Alicia Hahn

Editorial Disclosure: The information in this article has not been reviewed or approved by any advertiser. The details on financial products, including card rates and fees, are accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information. This site doesn't include all currently available offers.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

343 Published Articles 50 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

90 Published Articles 664 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Flexibility

You can earn frequent flyer miles, cards that earn chase ultimate rewards points, transfer your points between credit cards for maximum value, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, the luxury hotel and resort collection, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, car rentals, earn bonus ultimate rewards points, pay with points, apple purchases, experiences, pay yourself back, transfer to travel partners, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Why Book Travel Through the Chase Travel Portal?

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Ink Business Preferred ® Credit Card

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- Trip cancellation and interruption insurance

- Rental car insurance

- Extended warranty coverage

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

- Best Business Credit Cards

- The Chase Ink Business Preferred 100k Bonus Offer

- Benefits of the Ink Business Preferred

- Chase Ink Business Preferred Cell Phone Protection

- Chase Ink Business Preferred vs Amex Business Gold

- Ink Business Cash vs Ink Business Preferred

- Amex Business Platinum vs. Chase Ink Business Preferred

- Ink Business Preferred vs Ink Business Unlimited

- Best Chase Business Credit Cards

- Best Business Credit Card for Advertising

- High Limit Business Credit Cards

- Best Credit Cards with Travel Insurance

- Best Credit Cards for Car Rental Insurance

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

What Are Chase Ultimate Rewards Points Worth?

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

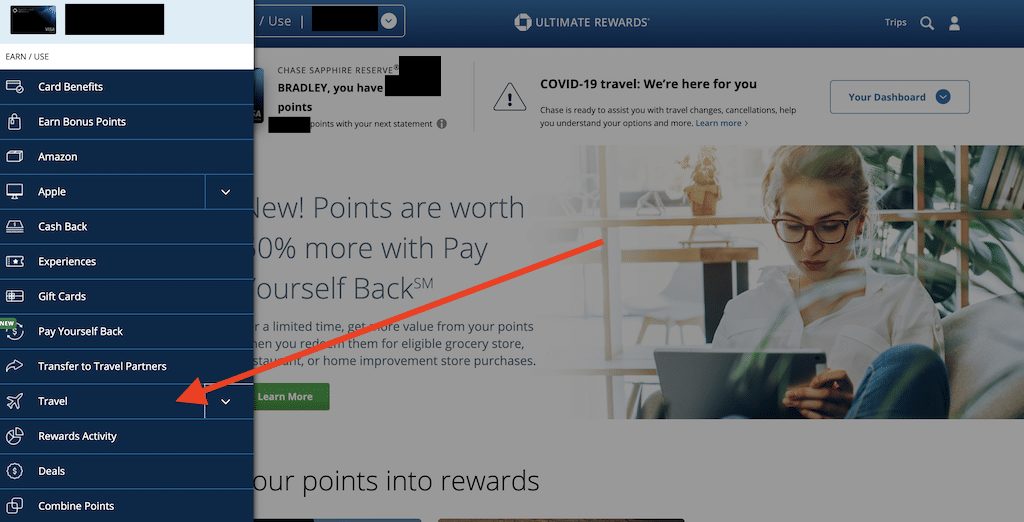

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

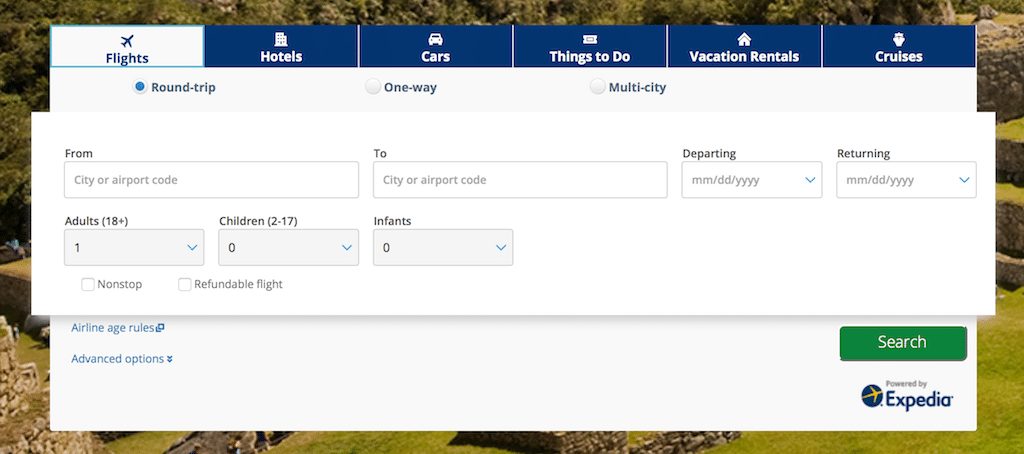

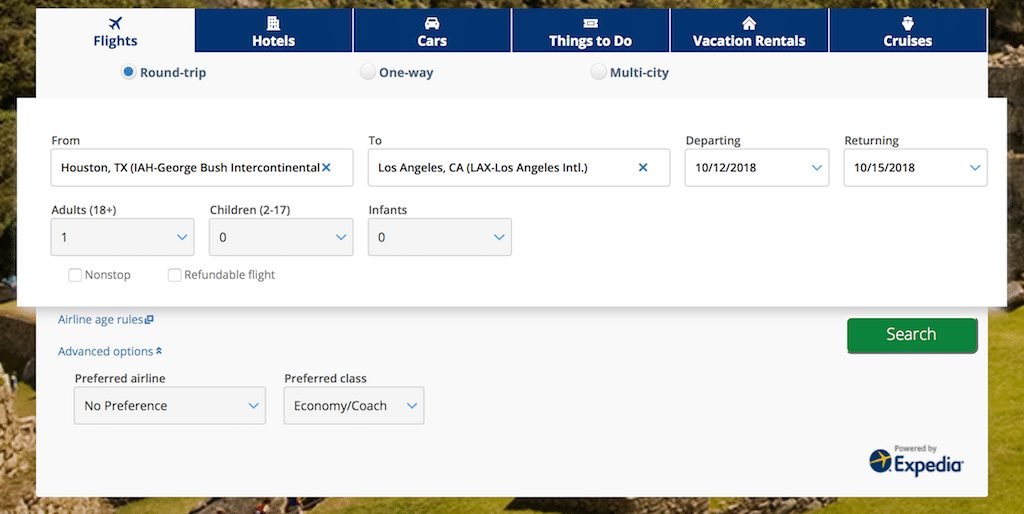

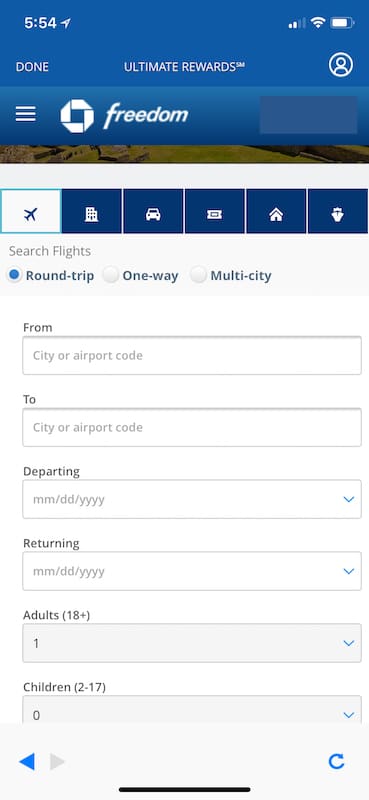

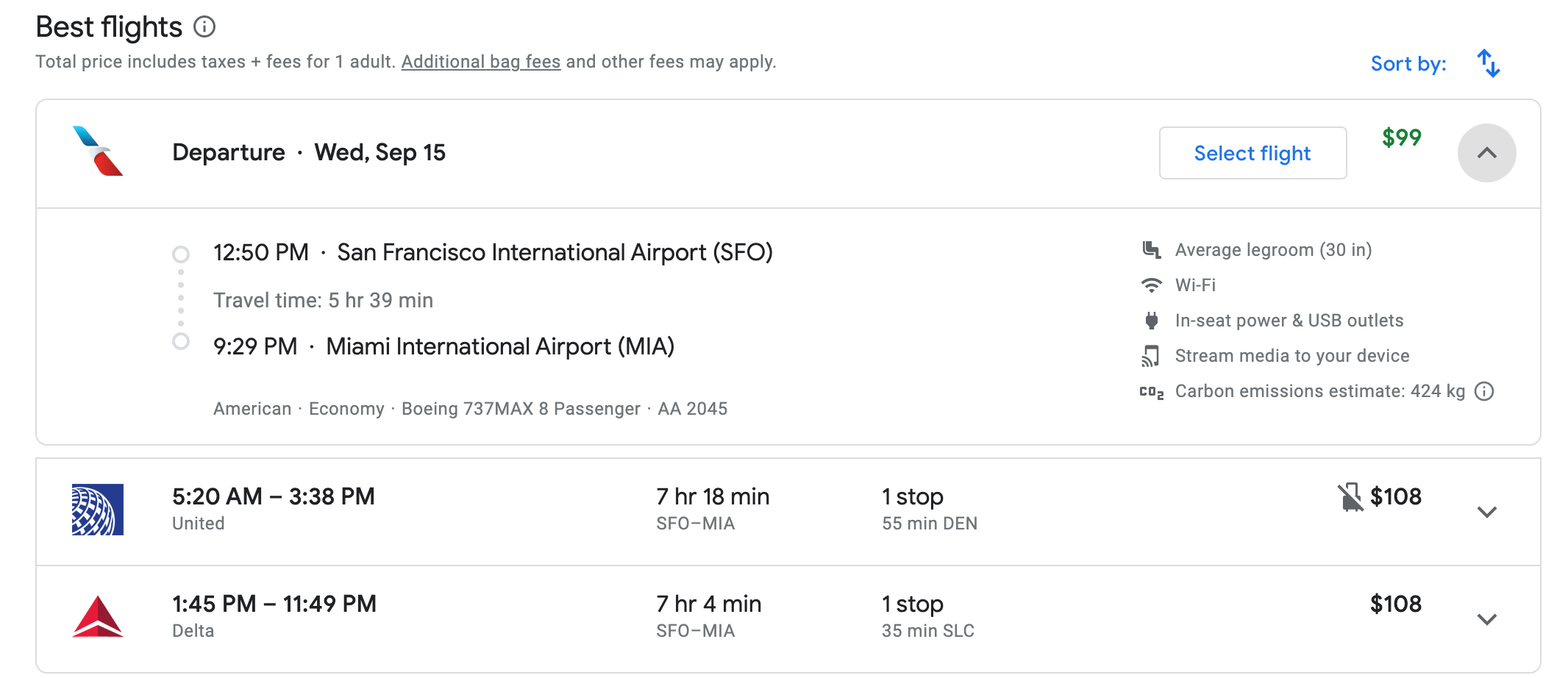

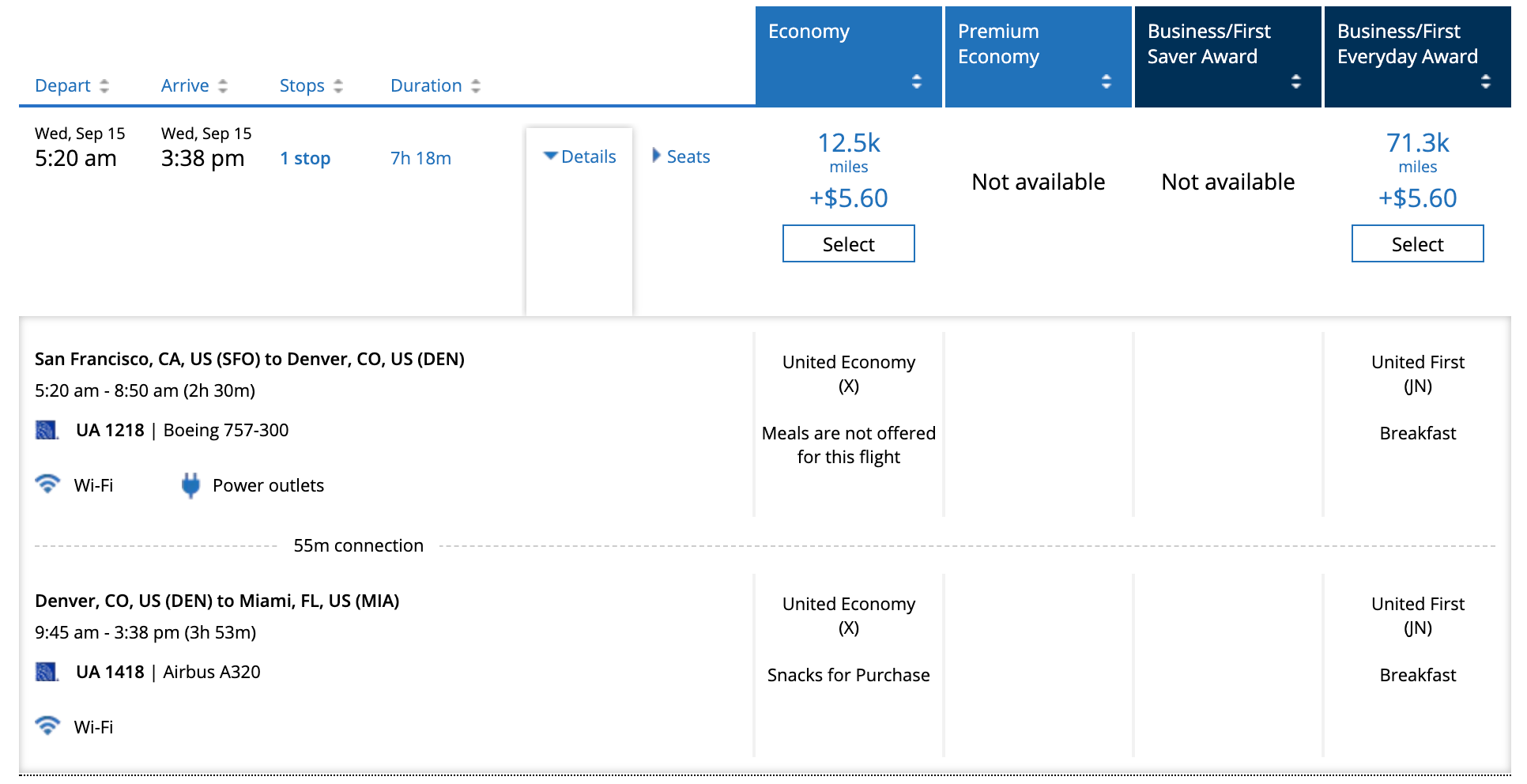

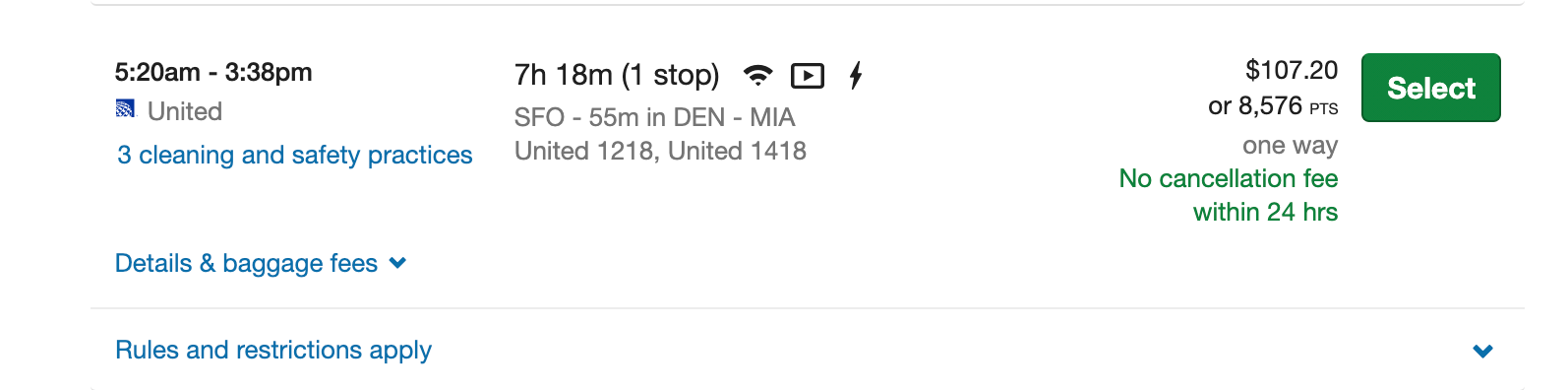

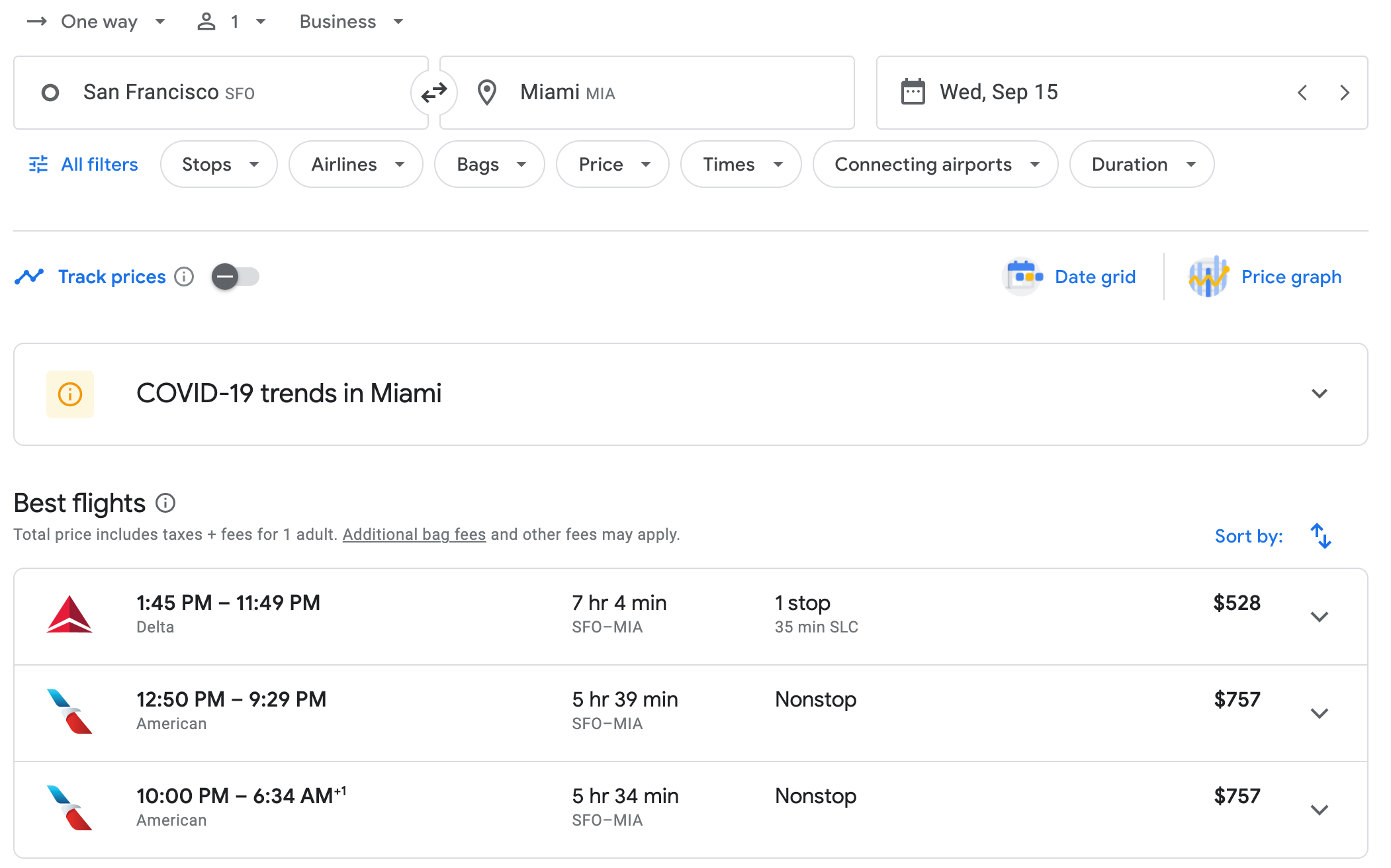

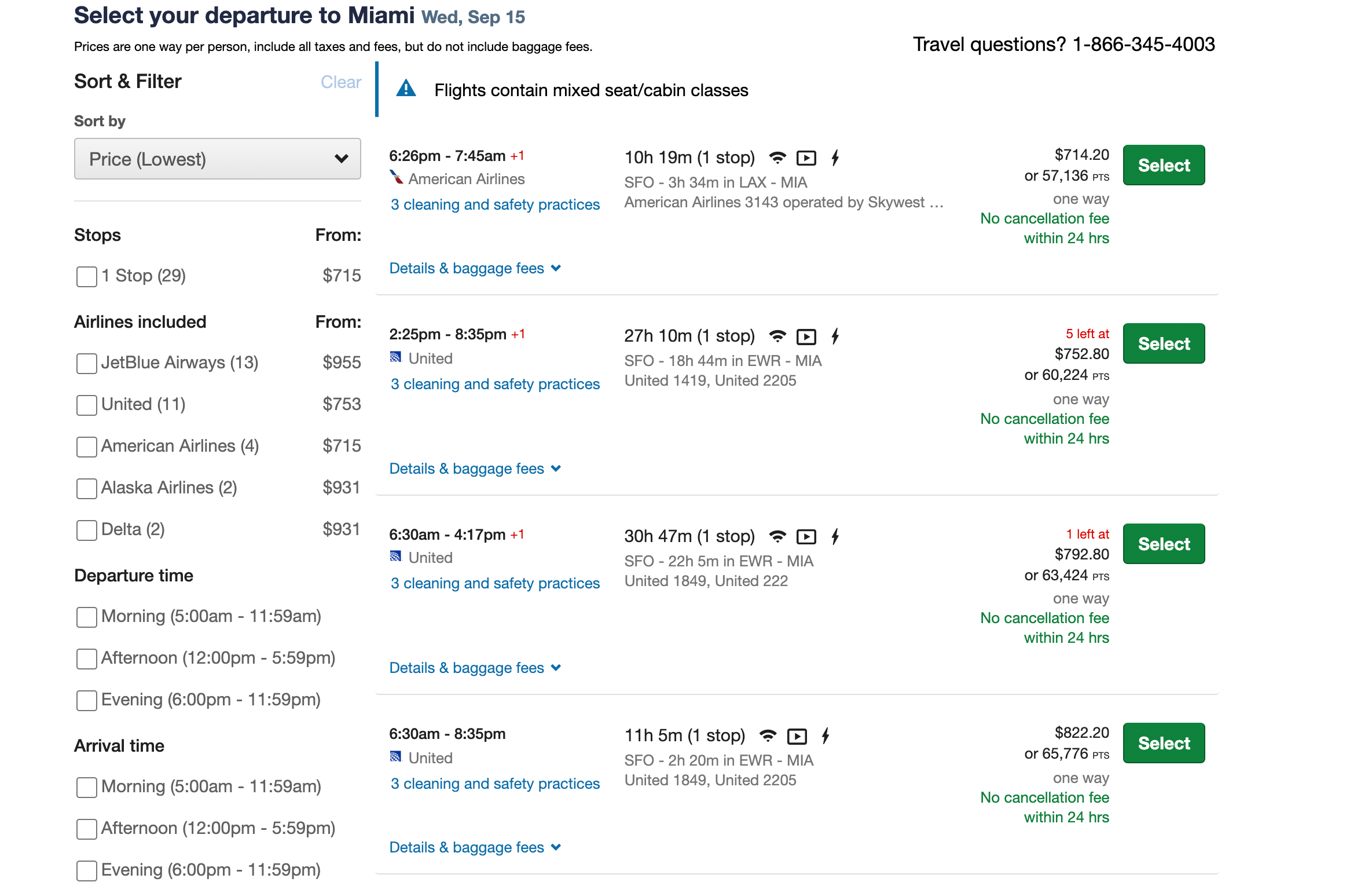

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

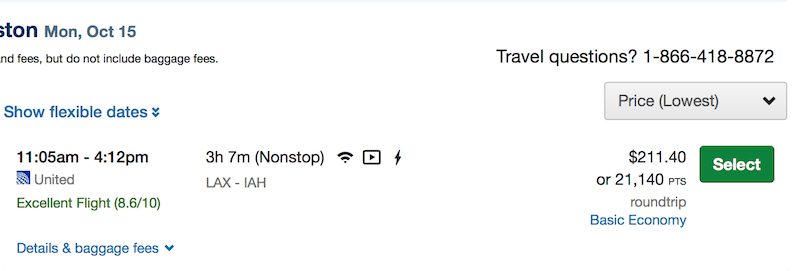

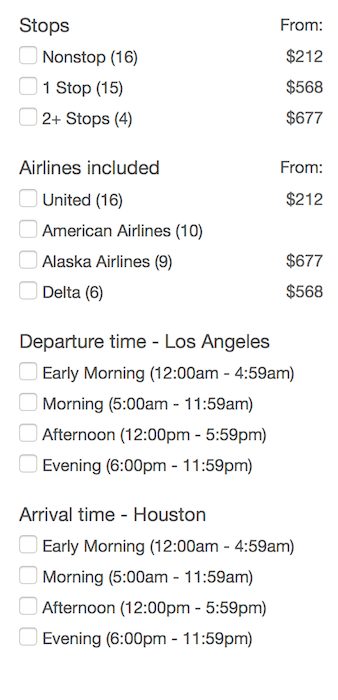

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

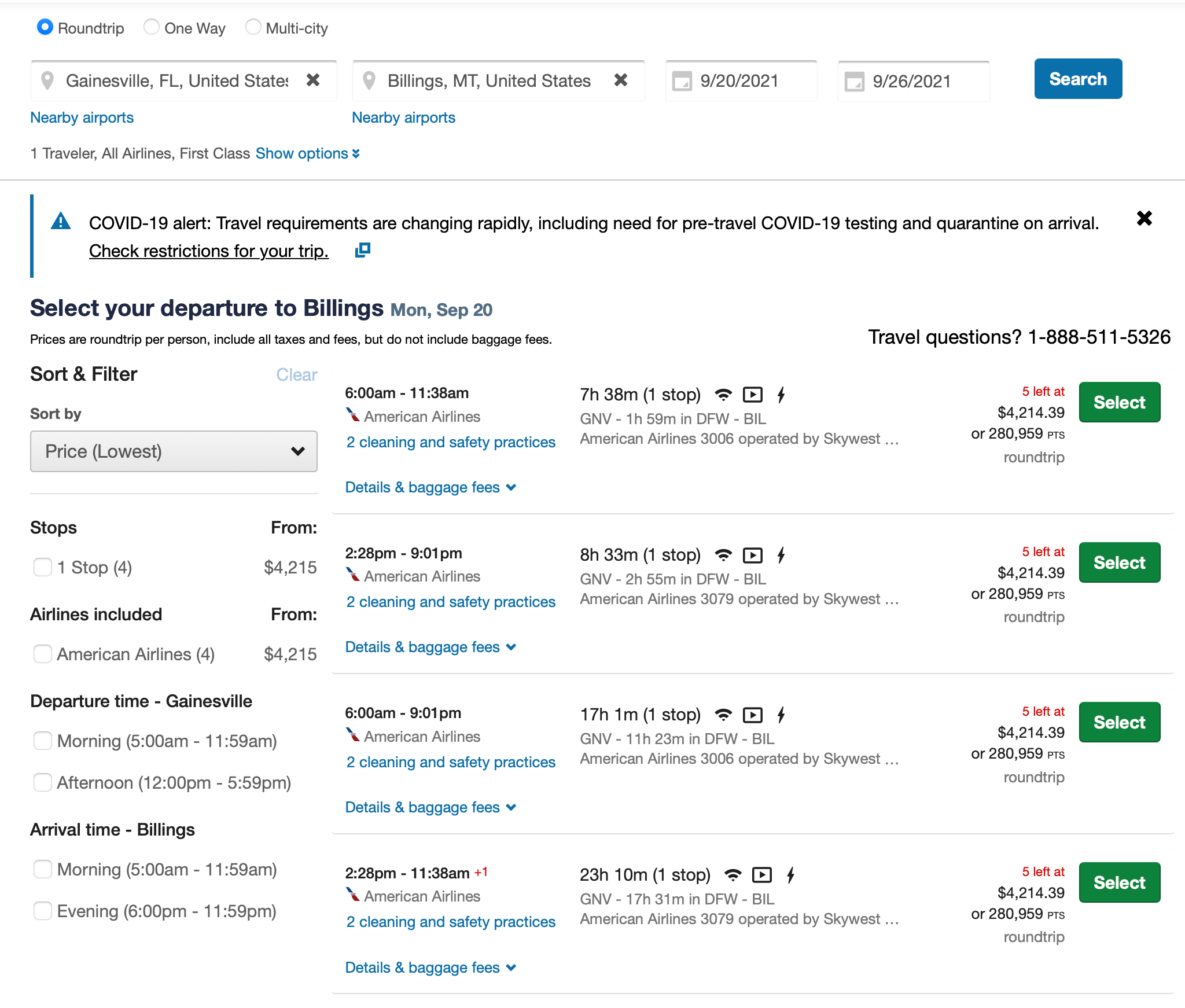

How To Book a Hotel Through Chase Travel

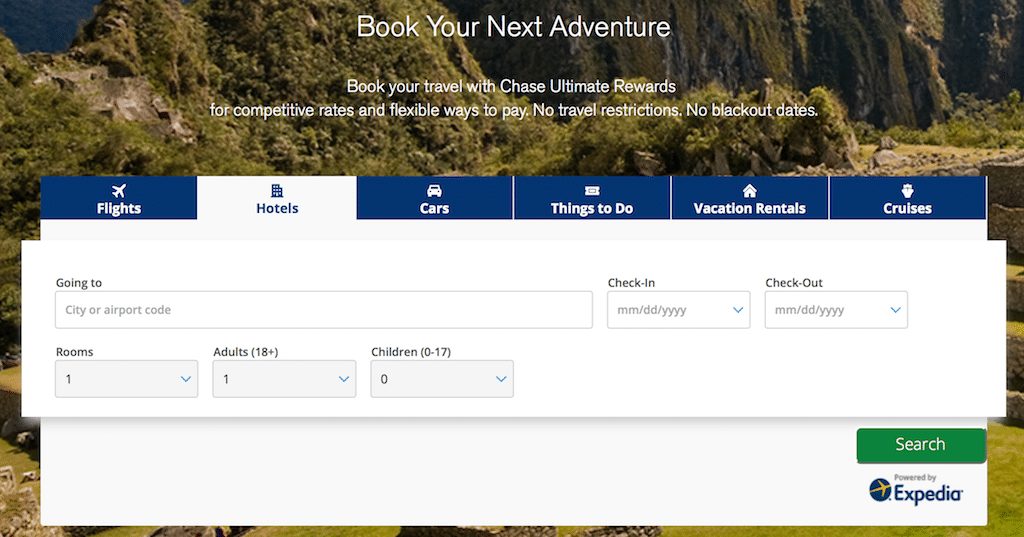

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

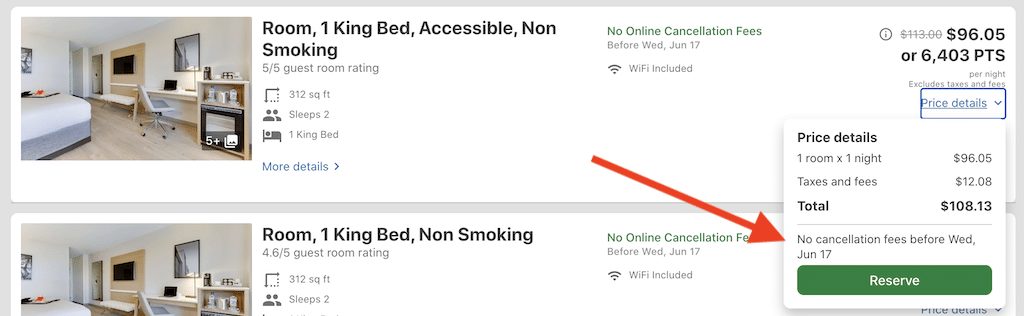

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

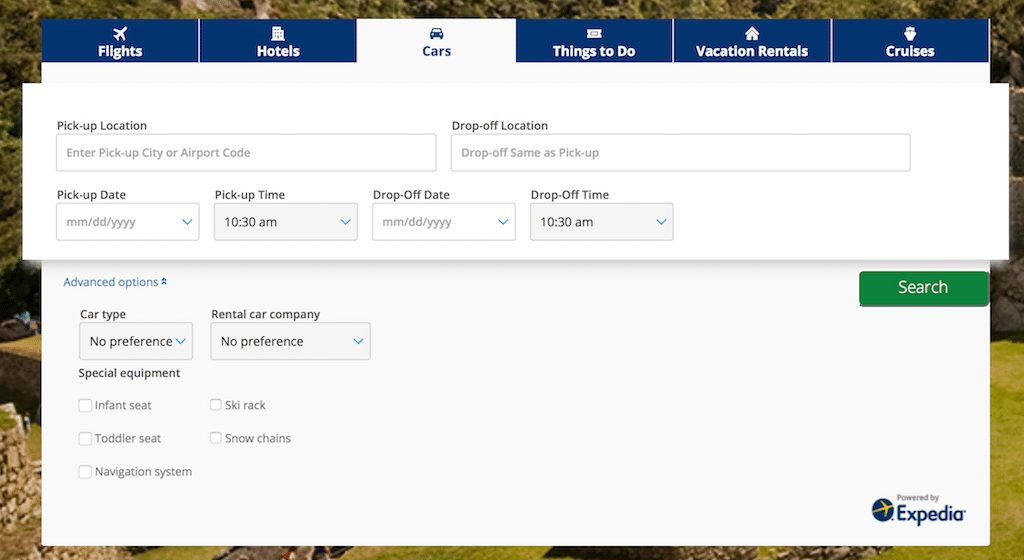

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.

2. You can then narrow your search with the filtering options on the left-hand side of the page.

3. For each car option, you will be able to see the car details, rental company, and price in both dollars and Chase Ultimate Rewards points. Once you have selected the car you want to rent, click on Add to Itinerary .

4. You can pay for the entire purchase with points or a Chase credit card or split your payment in any amount. Double-check all of the details before completing your purchase.

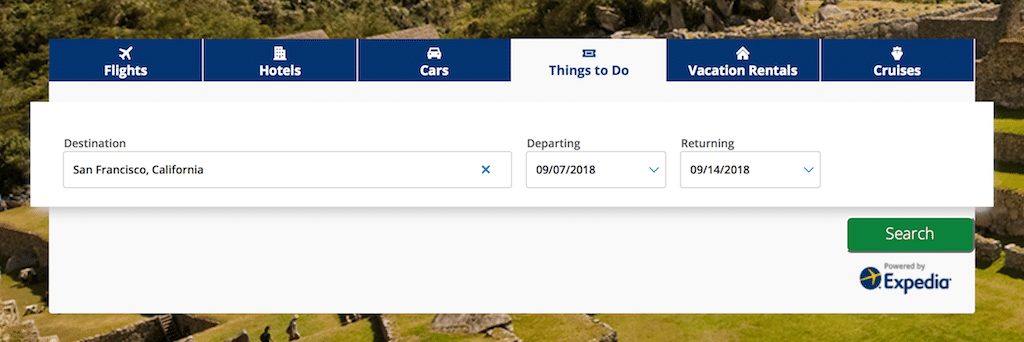

Did you know you can also book activities through Chase Travel?

1. Click the Activities tab on the Ultimate Rewards travel homepage to get started. Then, input your destination and travel dates and click the Search button to continue.

2. You can narrow your search by selecting 1 or more categories at the left-hand side of the page. Categories can include things like:

- Classes & workshops

- Cruises & sailing

- Food & drink

- Outdoor activities

- Seasonal & special occasions

- Tickets & passes

- Tours & sightseeing

- Transfers & ground transport

- Unique experiences

3. Each activity will show the price in both dollars and points to the right side of the screen. Click on Show Details and Pricing for more information and to book the activity.

6. Double-check all of the details on the final page before completing your purchase. Click the box confirming you understand the travel disclosures, then click Complete Checkout to finish your purchase.

Bottom Line: You can book lots of activities through the Chase Travel portal, including airport transfers!

If you’re a fan of cruises, you’ll be pleased to know you can book them through your Chase Travel portal. To get started, click on the Cruises tab on the Ultimate Rewards travel homepage.

This will bring up a list of available cruises, but there’s also a search box at the top of the screen, so you can input a specific destination or cruise line.

Each listing will display the cruise line, ship, ports of call, sailing dates, and baseline pricing for an interior or oceanview cabin. Unfortunately, if you want any more specific information or if you want to book, you will need to call 855-234-2542 .

You’ll notice that only cash prices are listed for cruises, however, they can be booked using your Chase Ultimate Rewards points, too.

Hot Tip: You can book a cruise through Chase Travel but you’ll have to call to make your reservation as they can’t be booked online.

How Do the Prices Compare to Other Sites?

Are you getting a good deal by booking through Chase? Let’s look at how the prices available through the Chase Travel portal stack up to other OTAs and search engines including Hotwire , Kayak , and Expedia .

We did some flight searches and found there’s no clear-cut pattern on prices between the Chase portal to other websites.

Example #1: Round-trip flight between Philadelphia (PHL) and San Francisco (SFO) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between Alaska Airlines and Delta Air Lines for $526.20. This worked out to be the cheapest price we found, and Priceline had the same low price. Expedia and Hotwire both charge booking fees, making the price a little higher. Each airline’s own website couldn’t split the itinerary between different airlines, so those ended up being much more expensive.

If you are in doubt or would like to check prices yourself, Kayak is a great place to start. Kayak will show you prices for a flight on all of the OTAs as well as the airline’s website. It’s a great one-stop shop to compare flight prices.

Example #2: Round-trip flight between New York City (JFK) and Paris, France (CDG) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between American Airlines and British Airways for $689.78. This wasn’t the overall best price we found, though. That award goes to Expedia and Priceline.

Hot Tip: You will earn frequent flyer miles when you book your flight through the Chase Travel portal.

Example #1: Here’s how prices looked for a week-long stay at the JW Marriott Cancun Resort & Spa in Mexico for 2 people including all taxes and fees. The $291.55 resort fee can’t be paid with points.

In this example, the best cash rate by far was through Marriott. However, if you wanted to pay with points, booking with Chase Ultimate Rewards points through the travel portal would be your best bet.

Keep in mind that Marriott doesn’t have an award chart, so different time periods can have different point costs. A 7-night stay at this hotel can dip down to 240,000 points for a 7-night stay. If you’re going to pay for your hotel stay in points, it’s always smart to calculate how many points it would cost to book through Chase versus transferring points . This information can help you make the best and least expensive choice.

Hot Tip: You won’t earn hotel loyalty points when booking a hotel through Chase and any elite status you have may not be recognized.

Example #2: Let’s look at an example of a hotel that doesn’t have a loyalty program. We priced out a 2-night stay at Almond Tree Inn Hotel in Key West, FL for 2 people. The highest prices were direct via the hotel with all other websites surveyed being cheaper.

Here’s how the prices stacked up:

Chase’s low price matched the other online travel websites and was actually lower than the hotel’s own website, so it would be a great option in this case. It also affords the opportunity to use points for a hotel that doesn’t have its own loyalty program.

In many cases, car rental prices found through the Chase Travel portal were similar to prices found on the rental agency’s own website.

The main difference in booking through Chase vs. directly through a car rental agency is that the car rental agency often has the ability to book the car without paying up front. With the Chase portal, you will be paying at the time of booking and there may be change or cancellation fees if you need to modify your reservation.

In both of these examples, Chase Travel didn’t offer the lowest price, however, that won’t always necessarily be the case. Of course, the advantage of booking through Chase is the ability to use your Chase Ultimate Rewards points. It’s always a good idea to price out your car rental on a few different websites before booking to ensure you’re getting the best price.

Chase actually offered the lowest prices on activities for both examples:

Other Ways To Use the Chase Travel Portal

The Chase Travel portal also helps you earn bonus points. With the Shop through Chase feature, you can earn extra Ultimate Rewards points through your online shopping.

Just click Earn Bonus Points in the top search bar to access the shopping portal. Click on a featured store or search for a specific one. Then simply click through the portal to your website of choice to make your purchase. Your bonus points will be added to your Chase Ultimate Rewards points total within 3 to 5 days in most cases.

Did you know you can use your Chase Ultimate Rewards points to make purchases at Amazon and PayPal? Click on Pay with Points in the top search bar, then select either Amazon or PayPal to enroll and shop.

Unfortunately, the redemption value you get when shopping through Amazon or PayPal is pretty bad — only 0.8 cents per point. While it’s great to have this as an option, we don’t recommend using points to shop at Amazon or PayPal as your main use of Chase Ultimate Rewards points.

Bottom Line: The value of using your Chase Ultimate Rewards points to shop through Amazon or PayPal isn’t great: you will only get 0.8 cents per point!

By clicking on Apple in the main search box in your Ultimate Rewards account, you can use your Chase points to make purchases. Normally, you’ll get 1 cent per point in value when using your points for Apple purchases, but there are occasional bonuses offered to get a better redemption rate.

You can also redeem your Ultimate Rewards points for cash-back. To do this, simply select Cash-back from the main search bar at the top of the screen. You will then be able to see choose how many points you’d like to redeem for cash-back at a value of 1 cent per point .

You can choose to have your cash direct deposited into a checking or savings account or as a statement credit. The deposit or statement credit will be posted within 3 days.

Bottom Line: Your Chase Ultimate Rewards points are worth 1 cent each when redeemed as cash-back. We do not recommend this as a primary redemption option because you can get more value via the Chase Travel portal, and a lot more when transferring to airline and hotel partners.

This is a really cool section of the Chase Travel portal. When you click on Experiences in the main search bar, you’ll see a list of exclusive events, preferred seating, and other offers for select Chase cardmembers.

Experiences can be purchased with a credit card or with points. You will get 1 cent per point in value when redeeming points for experiences. Some experiences are only available to cardholders of specific cards so be sure to check all of your cards if you have more than 1 to make sure you don’t miss anything.

If you prefer gift cards, you can purchase them through the Chase Travel portal using points. Just click Gift Cards in the main search bar to get started. From here, you will be able to scroll through all of the available gift cards. You’ll get 1 cent per point in value, with occasional sales offering better redemption rates.

Hot Tip: Points redeemed for gift cards have a 1-cent per point value. However, you might notice some cards offer discounts, so there is the opportunity to get a bit more value!

Another way to use your Ultimate Rewards points is through the Pay Yourself Back feature. This allows you to redeem your points for a statement credit for purchases in select categories. The current categories include groceries, dining, select charities, credit card annual fee, internet, cable, phone, and shipping and the redemption value varies by card.

Transferring points to travel partners is the best way to get the most value out of your points . By transferring, you can potentially get 2, 3, or more cents per point value.

Chase Airline Transfer Partners

Chase Hotel Transfer Partners

To transfer your Chase Ultimate Rewards points to any of the above airline and hotel partners, log on to your account and click on Transfer To Travel Partners in the top search box. Choose your airline or hotel and then select Transfer Points . You’ll need to fill out your frequent flyer information or hotel loyalty membership number to complete the transfer.

Bottom Line: You can currently transfer your Chase Ultimate Rewards points to 14 different hotel and airline partners.

There are many ways to use your Chase Ultimate Rewards points. While transferring points to one of Chase’s airline and hotel travel partners can get you maximum value, there are a lot of benefits for booking travel directly through the Chase Travel portal .

In addition to hotels and flights, you can book car rentals, activities, and cruises. Or, you can use your points for cash back, shopping, gift cards, or Chase exclusive experiences. With so many ways to use your Chase Ultimate Rewards points, your next trip is only a few clicks away!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Ink Business Plus ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Do chase ultimate rewards points expire.

No. As long as you keep your Chase credit card open, your points will not expire.

Can I transfer my Chase points to someone else?

Yes. You can transfer your points to another member of your household who also has a Chase Ultimate Rewards account.

What are Chase Ultimate Rewards points worth?

When redeeming points through the Chase travel portal, the credit card you hold will determine your points’ value.

When redeeming for travel, your points have the following value:

- 1 cent : Freedom card, Freedom Flex card, Freedom Unlimited card, Ink Business Cash card, Ink Business Premier card, Ink Business Unlimited card

- 1.25 cents : Chase Sapphire Preferred card or Ink Business Preferred card

- 1.5 cents : Chase Sapphire Reserve card

When using your points to shop through Amazon or Chase Pay, they are worth 0.8 cents per point.

When redeeming your points for cash back, gift cards, or experiences they are worth 1 cent per point.

What airline partners can I transfer my Chase Ultimate Rewards points to?

Chase airline partners include Air Canada, Air France-KLM, British Airways, Iberia, Aer Lingus, Emirates, JetBlue, Singapore Airlines, Southwest Airlines, United Airlines, and Virgin Atlantic.

What hotel partners can I transfer my Chase Ultimate Rewards Points to?

You can transfer your Chase Ultimate Rewards points to the following hotels at a 1:1 ratio: IHG, Marriott, and Hyatt.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase travel customer service reviews How To Earn 100k+ Chase Ultimate Rewards Points [In 90 Days]](https://upgradedpoints.com/wp-content/uploads/2023/01/Chase-bank-branch-new-york.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

UponArriving

Chase Travel Portal Review: (Airlines, Hotels, Car Rentals, Cruises) [2021]

The Chase Travel Portal can be one of the best ways to utilize your hard-earned reward points.

But how exactly does the Chase Travel Portal work and is it worth using?

This review article will walk you through step-by-step on how to use the portal for all forms of travel (airlines, hotels, rental cars, cruises) and I’ll also look at if travel through the portal is more expensive.

But most importantly, I’ll show you when to use and NOT use the Chase Travel Portal in order to maximize the value of your points!

Table of Contents

What is the Chase Travel Portal?

The Chase Travel Portal is an exclusive online travel agency (OTA) powered by Expedia that allows select Chase cardholders to book travel with their Ultimate Rewards or by paying via a credit card.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How do I get access to the Chase Travel Portal

This travel portal is only for Individuals with Ultimate Rewards earning Chase cards. So if you had a card like a Chase Southwest credit card you would not get access. Instead, you would need one of the following cards:

- Chase Freedom

- Chase Freedom Unlimited

- Chase Ink Cash

- Chase Ink Business Preferred

- Chase Ink Unlimited

- Chase Sapphire Preferred

- Chase Sapphire Reserve

Chase Travel Portal redemption values

When you use your Ultimate Rewards points to book travel you’ll get different levels of value from your Chase Ultimate Rewards earning credit cards, depending on the type of card that is used.

Take a look at how each point is valued based on the card you are using:

- Chase Freedom : 1 cent per point

- Chase Freedom Unlimited: 1 cent per point

- Chase Ink Cash: 1 cent per point

- Chase Ink Unlimited: 1 cent per point

- Chase Ink Business Preferred: 1.25 cents per point

- Chase Sapphire Preferred: 1.25 cents per point

- Chase Sapphire Reserve: 1.5 cents per point

Keep in mind that you can transfer Ultimate Rewards between spouses and household members so you can also use the card between you and others that has the best redemption rates for your travels.

The Sapphire Reserve with the 1.5 cents per point redemption rate is one of the top benefits of the Sapphire Reserve. It makes it much more tempting (and worthwhile) to use your points for travel redemptions when using the Chase Travel Portal.

But the Sapphire Reserve comes with a number of other stout perks including:

- $300 travel credit

- DoorDash $60 Credit

- 3X on dining and travel

- Priority Pass (with restaurant credits )

- TSA Pre-Check / Global Entry $100 credit

- Primary rental car insurance

- Annual fee: $550 (not waived first year)

All of these perks make the Sapphire Reserve one of the top travel credit cards on the market without a doubt.

Point values compared to to other programs (Amex)

You can get a sense of how great the value is with the Sapphire Reserve’s portal redemption rate by comparing its rate to other programs.

Just take a look at the Amex Travel porta l. For airfare you can redeem Amex Membership Rewards at a rate of 1 cent per point but things aren’t as good for other travel redemptions. For hotels, vacations, and cruises you’ll be redeeming at 0.7 cent per point.

So as you can see, redeeming points through the Chase Travel Portal with the Sapphire Reserve is much more lucrative than utilizing points with some other travel portals.

Chase Travel partners

Chase allows you to use your points to travel in different ways. You can either use the Chase Travel Portal or you can transfer your points out to transfer partners.

Chase travel partners

Chase has a great line-up of airlines and also has the best hotel selection out of any other major transferrable points program, in my opinion.

Here are all of the current Chase transfer partners:

Chase Ultimate Rewards Airlines

- British Airways Executive Club

- Flying Blue (Air France/KLM)

- Iberia Airways

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Chase Ultimate Rewards Hotels

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

Whether or not you should transfer points to these partners depends on a few factors and I will discuss those below when giving advice on when to use and not use the travel portal.

How do I use the Chase Travel Portal?

- Log-in to your Chase Ultimate Rewards dashboard

- Click on the travel button on the side panel

- Select your type of travel

- Book and enjoy!

Log-in to your Chase account

The first step to access the travel portal is to simply log-in to your Ultimate Rewards dashboard. You can log-in to the travel portal here .

Click on the travel button on the side bar

Once you are in the Ultimate Rewards dashboard you need to pull up the Chase Travel Portal by selecting travel. Simply navigate to the side panel and you will see the travel menu button.

Select for your type of travel

Once you are in the travel portal, you will need to select the type of travel that you were interested in booking. Here are the different types of travel that you can choose from:

- Flights

- Cruises

Things to do

Vacation rentals.

The last step is to simply book your travel.

Keep reading below for more details on how to get to that step.

When to NOT use the Chase Travel Portal

There are a number of reasons why you might not want to use the portal.

Outsized value

One of the biggest reasons to NOT use the Chase Travel Portal is because you can get so much more value when transferring points to travel partners.

When you book through the Chase Travel Portal you are limited to the point value of the credit card account that you are using for the portal.

So if you have the Chase Sapphire Reserve, you’re only going to get 1.5 cents per point out of your redemptions. That sounds impressive until you realize that if you transfer your points out to travel partners you could be getting redemptions at well over 10 cents per point.

So the benefit of transferring points is that you can receive amazing outsized value for your points that’s just not possible with the Chase Travel Portal.

Unforgettable travel experiences

And it’s just not about the monetary value, transferring points out to airlines allows you to experience some truly unforgettable flying experiences.

That’s because you’re able to fly in business class and first class cabins in some of the top airlines. You can experience your own private suites and live the high life rather than being stuck in economy.

These tickets can also get you access into some of the top airline lounges in the world for an unforgettable luxury experience. I’ve had some of my most memorable flights because of Chase Ultimate Rewards and some of the experiences that stick out are:

- First Class on the Korean Air A380

- First Class on the new Singapore Airlines A380

- Upper Class on the Virgin Atlantic 787

- First Class on the British Airways 747

If I would have used my points to book travel through the Chase Travel Portal, I would have never gotten a chance to experience those amazing flights.

Hotels can offer cases of outsized value, too. I recently finished a stay at the Park Hyatt Paris-Vedome and received over 3 cents per point in value.

I would have been limited to 1.5 cents per point with the Chase Travel Portal so transferring points would have made a lot more sense.

Hotel perks

One of the main reasons why you’d want to avoid the travel portal is when booking hotel stays.

That’s because when you use an OTA, there’s a chance that you won’t receive all of your elite benefits/credits and you won’t earn hotel points for the stay.

So if you’re a Hilton Gold member for example you might not receive your free breakfast and potential upgrade that you would have had. Some programs won’t even allow you to get complimentary wifi unless you book directly.

The good news is that sometimes you can still get these perks.

You just need to call into the hotel beforehand and give them your elite information. If you do that and work a little charm at check-in you might be surprised to receive your elite benefits.

When to use the Chase Travel Portal

There are sometimes when it really makes sense to use the Chase Travel Portal.

Cheap domestic flights

Sometimes flights are pretty cheap and it makes way more sense to just use the portal to book them.

For example, if you wanted to fly on United Airlines from Houston to Orlando, you may have to transfer 25,000 Chase Ultimate Rewards for a roundtrip flight in economy.

But if you used the travel portal, you’d be able to book that Orlando flight for much cheaper during many times of the year and potentially save thousands of points.

You will still earn your frequent flyer miles, too, so there’s no loss in value there.

Cheaper hotels

The same principle applies to hotel stays as well. Sometimes it will just be cheaper to book through the portal than to transfer your reward points.

The major exception to this is Hyatt which often has point redemptions worth over 1.5 cents per point.

You’ve also got to really think about the value you might be losing out on if you don’t receive your elite benefits. It’s not hard for two free breakfasts to add up quick on a trip and if you’re giving that up, it might be more worthwhile to ditch the portal for that booking.

Not good with points

The thing about transferring points is that you need to aware of how the process works. You need to know how to transfer your points and how to use those points efficiently once you have them.

Then you’ve got to deal with finding award inventory, black-out dates, and the actual booking process which can be tricky with some foreign airlines.

Not everybody has the time to learn how to do that (or even the desire to do it). And for those people, the Chase Travel Portal is often a much better suited option.

Booking different travel types

Since this is powered by Expedia , you’ll find robust filters for searching and filtering your particular type of travel. But just to give you an idea of all the possibilities, I’ve broken down some example search filters below for the different types of travel.

Chase Travel Portal Flights

The Chase Travel Portal allows you to easily search for flights.

Simply input your departure location and your destination, along with dates and passengers. You can also choose to search with your preferred airline or preferred class by using the “Advanced options.”

When I searched, the Chase Travel Portal pulled prices listed from the cheapest flights (which was directly on par with the lowest prices found in Google Flights).

I should note that many people complain about the pricing found on the portal and claim that many flights are also missing. So I would always double check the pricing with Google Flights and if I still had questions then I would just call the Chase Travel Portal number at 1-866-418-8872.

Also, be on the lookout for basic economy fares like the one below which state “Basic Economy” under Select.

You can utilize several filters to narrow down the results including nonstop flights and also by airlines and preferences for departure time and arrival time.

You can also search the prices with the flexible dates feature. I prefer this search feature as it’s easy to spot the cheapest roundtrip prices and compare them to other websites.

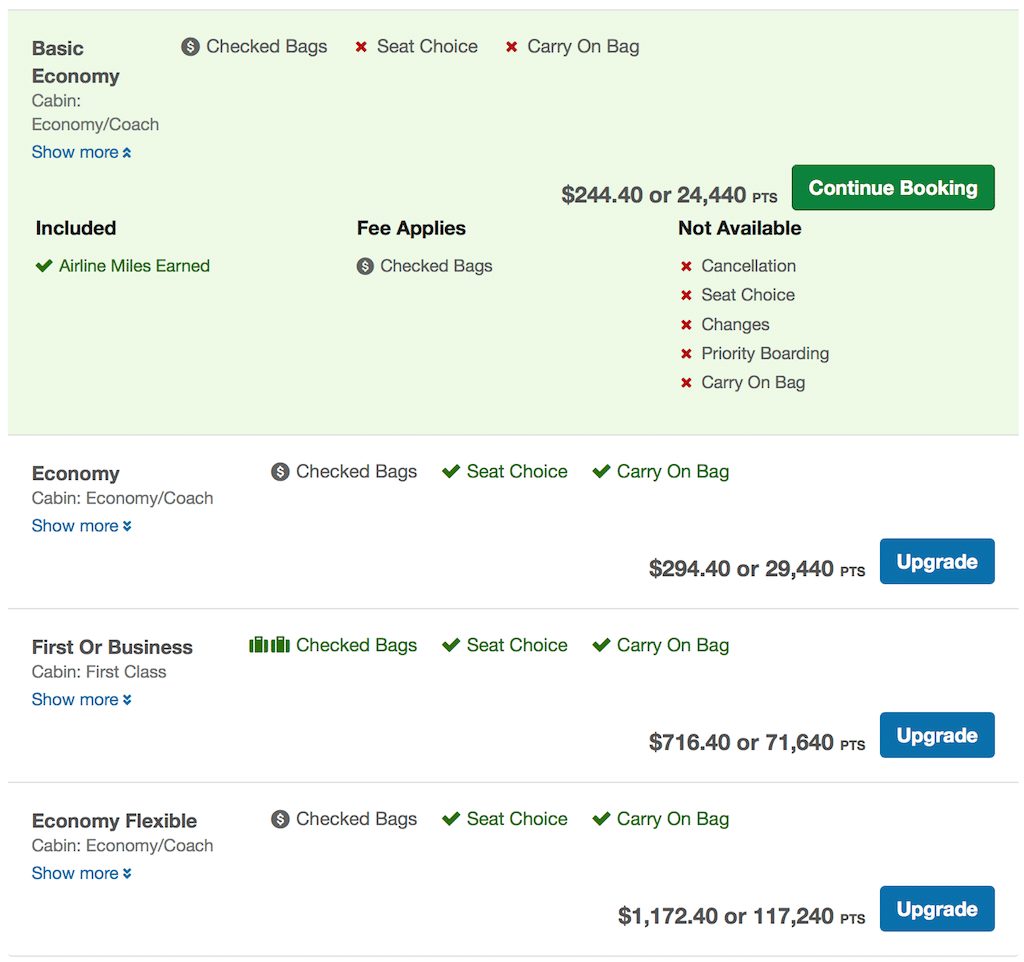

Once you select your flights, you’ll be taken to another screen where you’ll need to confirm or upgrade your fare class. You’ll see the prices for upgrades and be able to confirm the options that your fare has or doesn’t have, such as seat choice.

At the next screen you’ll need to enter the names of the travelers and you’ll have a chance to enter in credentials for things like TSA Pre-Check and frequent flyer information.

You’ll also be able to choose how you want to pay for the travel. You can choose to pay with points, credit card, or a combination of the two. You’ll then confirm your booking on that screen.

Note that all booked flights can be canceled within 24 hours.

Booking flights on Southwest

Southwest flights do not show up on the Chase Travel Portal. However, you can call in to request a booking with Southwest Airlines if you’d like.

Where can I view my flight booking confirmation?

- Go to My Trips to view, email, or print your itinerary or receipt.

- View your confirmation email.

How to change your seat

For most flights, you can choose your seat during booking. Chase should send your seat selection to the airline at the time of booking, but they note that they cannot guarantee your seat assignment.

You can access your seat assignment for most flights in your itinerary , or when you view your flight booking confirmation .

Your seat selection may not be confirmed if you:

- Booked a fare with an airline that assigns seats at the gate

- Booked a Basic Economy fare which doesn’t allow seat selection

Chase Travel Portal Hotels

The search feature for hotels is pretty standard as well.

There are a lot of helpful filters that you can apply to help you efficiently search for the right hotel.

Some of these include:

Property Class

This allows you to sort by star ratings.

Price Per Night

Sort properties based on price.

Vacation Rental Bedrooms

- Bedrooms 4+ Bedrooms

Guest Rating

- Exceptional!

Neighborhood

Sort through many local neighborhoods.

- High-speed Internet

- Air conditioning

- Swimming pool

- Breakfast Included

- Babysitting service

- Business services

- Childcare Children’s club

- Fitness equipment

- Airport Transportation

- Included Newspaper

- Included Parking

- Included Hair dryer

- Kitchenette

- Laundry facilities

- Dry cleaning/laundry service

- Pets allowed(conditions apply)

- Restaurant in hotel

- Room service

- Spa services on site

Property Type

- Apartment Hotel

- Private vacation home

- Guest house

- Bed & Breakfast Hostel/Backpacker accommodation

- Apart-hotel

- Country House

- Chalet Hotel resort

- Hostel (Budget Hotel)

Popular Locations

You can even search based on popular locations. Here are some examples from London that I found when searching for a hotel.

- Tower of London

- University of London

- London Bridge

- London Dungeon

- Buckingham Palace

- St. Paul’s Cathedral

- Olympic Stadium

- University College London

- East London Mosque

- Museum of London

- Natural History Museum

- Wembley Stadium

- London Stock Exchange

- Chessington World of Adventures

Accessibility

Accessible bathroom In-room accessibility roll-in shower.

Hotel pricing might be on the cheaper side sometimes or it may not.

For the most part, I’ve always found competitive prices but I would highly recommend that you check the prices with other OTAs before booking. Just like with airfare, there are plenty of reports of the portal not displaying the best prices for hotels.

Whenever you finally find the hotel you were interested in, be sure to view the cancellation policy. You should find it in green next to the room description and also under “price details.”

Chase Travel Portal Rental Cars

Searching for rental cars is pretty straightforward as well.