A guide to the best credit cards for Airbnb stays

Home rentals are a popular alternative to hotels, and you may be considering an Airbnb for your next trip. While the topic of the best credit cards for hotel stays gets a lot of attention, it's a different matter for Airbnb stays. That's especially true when you consider that hotel chains have their own credit cards, yet Airbnb does not.

If you've decided to go the Airbnb route, which travel rewards credit card should you use to make the purchase? Let's take a closer look at your best options.

What is Airbnb?

If you're unfamiliar with Airbnb , the site offers a wide variety of lodging options when traveling. In many cases, Airbnb provides privately owned rooms, apartments, houses, boathouses and hotel rooms. They're available for both short- and long-term stays.

While prices are sometimes more affordable than equivalent hotel rooms, it should be noted that Airbnb is not exactly a hotel on a budget. There are tradeoffs: things such as room service, daily housekeeping and other full-service amenities aren't usually found. However, if you are searching for unique accommodations — or want the feeling of being in a home while away from home — Airbnb could be a good option. Groups and those traveling with others also tend to prefer Airbnb, since it's easy to reserve multi-bedroom lodging.

Beyond stays, Airbnb offers experiences. These can include tours, outdoor activities like whale watching, cooking classes or even a great photographer to snap photos for your Instagram during your next vacation.

Airbnb doesn't have a loyalty program, so the best way to make the most of these types of purchases is by using the right credit card.

Related reading: How to find the best Airbnb

Which credit card is best for Airbnb stays and experiences?

American express green card, chase sapphire reserve, chase sapphire preferred card.

- Chase Ink Business Preferred Credit Card

Capital One Venture Rewards Credit Card

Capital one venture x rewards credit card.

You may see some familiar names among the cards listed above. That's because several of the best credit cards for Airbnb are on our list of the best credit cards for travel .

The information for the American Express Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Earning rates on the top cards for Airbnb

A closer look at the best credit cards for airbnb.

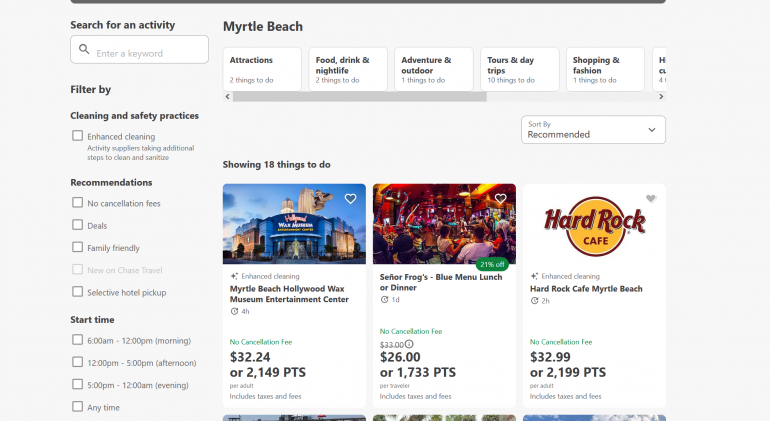

Airbnb typically codes as "travel" on your credit card statement. This means it will trigger any bonus points or annual credits offered in the travel category . Here's a deep dive into the best cards for Airbnb.

Annual fee: $150 (see rates and fees)

Welcome offer: Earn 40,000 Membership Rewards points after spending $3,000 on purchases in the first six months of card membership

Earning rates: You'll get 3 Membership Rewards points per dollar on restaurant purchases , 3 points per dollar on transit including ride shares, subway swipes, tolls — and most importantly for Airbnb — plus 3 points per dollar on the broad category of travel, which includes things from flights, car rentals, hotels and home shares (yes, including Airbnb). You'll earn 1 point per dollar on all other purchases.

Why we like it: Other cards, including The Platinum Card® from American Express and American Express® Gold Card , have more limited travel categories that don't go beyond the scope of airfare and hotels . While the Platinum card has a higher bonus earning on airfare (5 points per dollar), it only applies to airfare booked directly with airlines or through the American Express Travel Portal (and the bonus earning potential is limited to the first $500,000 of these purchases per calendar year). In the Platinum's case, you'll also get 5 points per dollar spent on prepaid hotels booked through Amex Travel.

The Amex Green is the most flexible of the bunch when it comes to earning 3 Membership Rewards points for every dollar spent on Airbnb. Those 3 points equate to a 6% return based on TPG valuations . If you're flying to get to your Airbnb, you can also take advantage of an up to $189 Clear Plus annual statement credit and a $100 LoungeBuddy annual statement credit . Enrollment required for select benefits.

To learn more, read our full review of the Amex Green card .

Related: The best cards for airport lounge access

Annual fee: $550

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Earning rates: Besides getting a $300 annual travel credit (that can be used toward Airbnb), you'll get 3 Ultimate Rewards points per dollar on travel — after using the $300 credit — and 3 points per dollar on dining at restaurants worldwide. Other bonus categories include 10 points per dollar on hotels and car rentals booked through the Chase Ultimate Rewards portal and 5 points per dollar on flights booked in the portal. You can also earn 10 points per dollar on Chase Dining purchases and 1 point per dollar on everything else.

Why we like it: First and foremost, you get to use the card's $300 travel credit toward a broad range of travel purchases , including Airbnb. Earning 3 points per dollar on Airbnb makes this card is useful for earning maximum Ultimate Rewards on your purchases after exhausting your $300 travel credit. Those 3 points equate to a 6% return based on TPG valuations — the same as the Amex Green . Additionally, the 60,000 Ultimate Rewards points sign-up bonus is worth $1,200 based on TPG valuations.

To learn more, read our full review of the Sapphire Reserve .

Apply here: Chase Sapphire Reserve

Related: 4 things to do once you get your Chase Sapphire Reserve

Annual fee: $95

Earning rates: You'll earn 2 Ultimate Rewards points per dollar on travel — which doesn't apply to the card's $50 hotel credit , though you must use this in the Chase travel portal , so Airbnb bookings aren't eligible — and also earn 5 points per dollar on travel purchases in the Chase travel portal. You can also earn 3 points per dollar on dining , select streaming services and online grocery (excluding Target, Walmart and wholesale clubs). Through March 2025, you can also earn 5 points per dollar on Lyft rides . Cardmembers earn 1 point per dollar on everything else.

Why we like it: Firstly, the card has a low annual fee while still possessing strong earning categories. This includes a broad range of travel purchases, such as bonus points on bookings made directly with Chase or Lyft rides, as well as 2 points per dollar with Airbnb. Those 2 points provide a 4% return based on TPG valuations . Additionally, the 60,000 Ultimate Rewards points sign-up bonus is worth $1,200 based on TPG valuations.

To learn more, read our full review of the Sapphire Preferred .

Apply here: Chase Sapphire Preferred

Related: Why the Chase Sapphire Preferred is more than just a starter card

Ink Business Preferred Credit Card

Sign-up bonus: Earn 100,000 Ultimate Rewards points after you spend $8,000 on purchases in the first three months after account opening.

Earning rates: You'll earn 3 Ultimate Rewards points per dollar on the first $150,000 of combined spend on the card each anniversary year in the following categories: shipping purchases; internet, cable and phone services; advertising with social media and search engines and — most importantly for this discussion — on travel.

Why we like it: This is another Chase card that earns a fantastic 3 Ultimate Rewards points on travel, including Airbnb stays. Although the huge 100,000 Ultimate Rewards sign-up bonus is a great perk, it's important to note the card's hefty initial spending requirement. While this isn't a consumer card, getting approved for a business card may be easier than you think.

To learn more, read our full review of the Ink Business Preferred .

Apply here: Ink Business Preferred

Related: The best business credit cards

Annual fee: $95 (see rates and fees )

Sign-up bonus: Earn 75,000 bonus miles after you spend $4,000 on purchases within the first three months of account opening.

Earning rates: You'll earn 2 Capital One miles per dollar spent on almost everything with no annual cap, which means you're getting 3.7 cents' value (factoring in TPG's latest valuation ) every dollar in purchases.

Why we like it: The Venture card is an excellent choice for those who value a straightforward earning rate on all purchases, including vacation rental bookings and anything else you buy. In exchange for a $95 annual fee, this Capital One credit card earns you a flat 2 miles per dollar spent on every purchase you make, and you can even redeem your rewards to cover your Airbnb stay at a rate of 1 cent per mile. If you decide not to use your rewards for Airbnb bookings, you can use them to cover any travel purchases made with your card in the last 90 days or transfer them to its 15+ airline and hotel transfer partners .

Plus, the card currently offers a 75,000-mile bonus offer worth $1,388, according to TPG valuations . Add in the fact that Capital One has made some exciting additions to its program, and it's no surprise that this card is still one of our favorites here at TPG.

To learn more, read our full review of the Venture .

Apply here: Capital One Venture Rewards

Related: Tips and tricks to get maximum value from your Capital One miles

Annual fee: $395 (see rates and fees )

Earning rates: You'll earn 2 Capital One miles per dollar spent on almost everything with no annual cap, which means you're getting 3.7 cents' value (factoring in TPG's latest valuation ) for every dollar in purchases. You can earn at higher rates when booking in the Capital One Travel portal , including 10 miles per dollar on hotel and rental car bookings and 5 miles per dollar on flights.

Why we like it: The Venture X card offers a straightforward 2 miles per dollar spent on all purchases not booked in the travel portal, which includes a pack of gum or your next Airbnb booking. You can also redeem your rewards to cover your Airbnb stay at a rate of 1 cent per mile. If you decide not to use your rewards for Airbnb bookings, you can use them to cover any travel purchases made with your card in the last 90 days or transfer them to its 18 airline and hotel transfer partners . The card also provides numerous perks, such as a $300 annual travel credit for Capital One Travel bookings, reimbursement for your Global Entry or TSA PreCheck fee and rental car elite status.

To learn more, read our full review of the Venture X .

Apply here: Capital One Venture X

Related: 6 things to do when you get the Capital One Venture X

Annual fee: $0, but you must have an Amazon Prime membership

Sign-up bonus: $100 Amazon gift card immediately upon approval.

Earning rates: You'll get 5% back on Amazon and Whole Foods purchases and 2% back at restaurants , gas stations and local transit and commuting (including rideshare). You will earn 1% back on other purchases.

Why we like it: How does the Amazon card make our list of best cards for Airbnb? Two words: Gift cards. Airbnb gift cards are available on Amazon, and you can easily get 3% back this way. First, use this card to buy Airbnb gift cards; then, use those cards to pay for your upcoming stay. You can redeem your 3% back on cash back, gift cards or travel rewards, and it's all worth the same. Note that Airbnb restricts, in fine print, the use of gift cards for long-term stays (28+ days).

To learn more, read our full review of the Amazon Prime Visa .

Apply here: Prime Visa

Related: Best credit cards for Amazon purchases

Maximizing your next Airbnb stay

One of the most important factors in making the most of your everyday spending is choosing the best travel rewards credit card for every purchase. This isn't always an easy task, as some cards earn valuable transferable points while others give bonus points for certain categories of purchases . Deciding what is more important is a personal decision.

For any Airbnb stay, though, see if you can double dip. For instance, you can easily earn bonus points or miles with programs like British Airways Executive Club, Delta SkyMiles or Qantas Frequent Flyer by clicking through their Airbnb shopping portals , regardless of what credit card you use to book.

These cards are all great options for Airbnb, but there are many others out there. For instance, if your local grocery store also sells Airbnb gift cards, you can use a card that earns bonuses at grocery stores to maximize your purchase. The same applies to office supply stores .

Since several credit cards offer annual travel credits , consider these as well. Using these credits can be a way to offset your travel costs when staying at Airbnb, since you can't transfer your points to Airbnb for award bookings.

Bottom line

Airbnb is a great lodging option for trips, as the platform represents a nice alternative to traditional hotels. I've personally stayed in dozens of Airbnbs throughout my travels and usually favor it over a chain hotel.

In addition to the unique properties you can book, there are also some solid credit card options that allow you to earn a decent haul of points or cash back. Just remember to review each listing's cancellation policy and reviews carefully before booking.

See also: 15 tips that will help you score the perfect Airbnb every time

Additional reporting by Ryan Wilcox, Juan Ruiz and Ryan Smith.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

The 11 Best Credit Cards for Booking Airbnb or Vrbo Stays [2024]

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

31 Published Articles 3102 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Stella Shon

News Managing Editor

85 Published Articles 618 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

![chase travel points airbnb The 11 Best Credit Cards for Booking Airbnb or Vrbo Stays [2024]](https://upgradedpoints.com/wp-content/uploads/2021/02/Airbnb.jpg?auto=webp&disable=upscale&width=1200)

What To Look For in a Credit Card for Airbnb or Vrbo Stays

Card summary, chase sapphire reserve card (best for earning points & travel insurance), amex green card (best mid-tier card for travel), chase sapphire preferred card (best for overall value & travel insurance), capital one venture x card (best for premium benefits & travel insurance), capital one venture card (best for earning miles on every purchase), double cash card (best for cash-back & no annual fee), ink business preferred card (best for earning points & travel insurance), amex blue business plus card (best for cash-back & no annual fee), ink business unlimited card (best for earning points & no annual fee ), capital one spark miles card (best for earning miles), capital one spark miles select card (best for earning miles & no annual fee), final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1024+ Expert Credit Card Guides

Booking an Airbnb or Vrbo stay? Both companies offer an online marketplace for vacation rentals as an alternative to hotel bookings. But in addition to short-term rentals, you can also book experiences or long-term rentals.

Whether you use Airbnb or Vrbo, you’ll want to maximize every dollar you spend. But since both of these don’t fall under traditional hotel categories, it can be confusing to determine whether your bookings would earn bonus points.

This guide will show you the best credit cards for booking Airbnb or Vrbo stays.

The 11 Best Credit Cards for Booking Airbnb or Vrbo Stays

- Chase Sapphire Reserve ® — Best for Earning Points & Travel Insurance

- American Express ® Green Card — Best Mid-tier Card for Travel

- Chase Sapphire Preferred ® Card — Best for Overall Value & Travel Insurance

- Capital One Venture X Rewards Credit Card — Best for Premium Benefits & Travel Insurance

- Capital One Venture Rewards Credit Card — Best for Earning Miles on Every Purchase

- Citi Double Cash ® Card — Best for Cash-back & No Annual Fee

- Ink Business Preferred ® Credit Card — Best for Earning Points & Travel Insurance

- The Blue Business ® Plus Credit Card from American Express — Best for Cash-back & No Annual Fee

- Ink Business Unlimited ® Credit Card — Best for Earning Points & No Annual Fee

- Capital One Spark Miles for Business — Best for Earning Miles

- Capital One Spark Miles Select for Business — Best for Earning Miles & No Annual Fee

Airbnb and Vrbo (and other competing platforms) rarely count as hotels , so vacation rental stays don’t allow for hotel bonus earnings.

When looking for the best credit card for vacation rentals, find one that offers the highest rewards on general travel purchases. The definition of general travel is comprehensive and can vary from bank to bank.

Few credit cards offer bonus categories for general travel, so after these categories are exhausted, look next for the best credit cards for non-bonused spending.

After looking at rewards accrual structures, you should focus on the best travel benefits for your needs, including travel and purchase protections.

With that in mind, let’s get into our best credit cards for Airbnb or Vrbo stays. We’ll start with the best personal cards. Then, we’ll walk you through the best business credit cards for Airbnb or Vrbo stays should your business require travel.

The 6 Best Personal Cards for Airbnb or Vrbo Stays

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Member FDIC

Financial Snapshot

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

- Chase Ultimate Rewards

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

- Chase Sapphire Preferred vs Reserve

The best personal credit card to use for Airbnb or Vrbo stays is the Chase Sapphire Reserve card . The biggest reason why this specific card is the best choice for Airbnb or Vrbo is that it earns 3x Ultimate Rewards points per dollar spent on dining and travel.

Chase defines travel very broadly, meaning your bookings on Airbnb and Vrbo will count and earn 3x Ultimate Rewards points .

The Chase Sapphire Reserve card offers an excellent welcome bonus offer, a generous up to $300 travel credit (which can be used for Airbnb and Vrbo stays), and numerous other benefits.

This credit card comes with up to $100 Global Entry, TSA PreCheck, or NEXUS application fee credit , the ability to earn 10x points per dollar on Chase Dining purchases, 10x points on hotel and car rentals purchased through Ultimate Rewards , 10x points on Lyft purchases through March 2025 (plus 2 complimentary years of Lyft Pink All Access and a third year at 50% off when you activate by December 31, 2024), and a Priority Pass Select membership .

Also, you’ll enjoy a complimentary subscription to DoorDash DashPass (when activated by December 31, 2023) and car rental elite status benefits at Avis, National, and Audi on demand.

It doesn’t end there because you’ll enjoy the best travel protections offered by a single credit card, consisting of primary auto rental collision damage coverage , trip cancellation and interruption insurance, baggage delay insurance, lost luggage reimbursement, trip delay reimbursement, travel accident insurance, emergency medical and dental coverage, and emergency evacuation and transportation coverage.

Regarding other card benefits, you can utilize roadside assistance , purchase protection , return protection, and extended warranty coverage.

Why We Like Earning Chase Ultimate Rewards Points

At Upgraded Points, we are huge fans of Chase Ultimate Rewards points because they can be used for various redemptions. This includes statement credits and cash-back, gift cards, merchandise, and booking travel through the Chase travel portal.

With the Chase Sapphire Reserve card, you will receive 50% more value for travel booked through the Chase travel portal, which will net you a 1.5 cents per point value.

But our favorite way to redeem Chase Ultimate Rewards points is to transfer them to the Chase airline and hotel partners for business or first-class flights and luxury hotel stays . Indeed, transferring points to travel partners is one of the reasons why these points are some of the most valuable in the world, worth around 2 cents per point based on our estimations.

American Express ® Green Card

This card can provide a great way to accumulate Membership Rewards points on eligible travel, transit, and at restaurants.

The American Express ® Green Card is an excellent all-around travel rewards card thanks to earning 3x Membership Rewards ® points on eligible travel and transit purchases and at restaurants, access to American Express transfer partners, and a reasonable annual fee.

- 3x points per $1 spent at restaurants worldwide, on all eligible travel purchases, and transit purchases

- Up to $189 per calendar year in statement credits after you pay for a CLEAR ® Plus membership with the Card.

- Up to $100 in statement credits annually when you purchase airport lounge access through LoungeBuddy with the Card.

- Access to American Express transfer partners

- No foreign transaction fees

- $150 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 40,000 Membership Rewards ® Points after you spend $3,000 in eligible purchases on your American Express ® Green Card within the first 6 months of Card Membership.

- Earn 3X Membership Rewards ® points on travel including airfare, hotels, cruises, tours, car rentals, campgrounds, and vacation rentals.

- Earn 3X Membership Rewards ® Points on transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways.

- Earn 3X Membership Rewards ® points on eligible purchases at restaurants worldwide, including takeout and delivery in the US.

- $189 CLEAR Plus Credit: Receive up to $189 per calendar year in statement credits when you pay for your CLEAR Plus membership (subject to auto-renewal) with the American Express ® Green Card.

- $100 LoungeBuddy: No airport lounge membership? No problem! Purchase lounge access through the LoungeBuddy app using the American Express ® Green Card and receive up to $100 in statement credits annually.

- Payment Flexibility: When it comes to paying your bill, you have options. You can always pay in full. You also have the flexibility to carry a balance with interest or use Plan It ® to split up large purchases into monthly payments with a fixed fee, up to your Pay Over Time Limit. You may be able to keep spending beyond your limit – you’ll just need to pay for any new purchases in full when your bill is due.

- Trip Delay Insurance: If a round-trip is paid for entirely with your Eligible Card and a covered reason delays your trip more than 12 hours, Trip Delay Insurance can help reimburse certain additional expenses purchased on the same Eligible Card, up to $300 per trip, maximum 2 claims per eligible account per 12 consecutive month period. Terms, conditions and limitations apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- No Foreign Transaction Fees: No matter where you’re traveling, when you use your American Express ® Green Card there are no foreign transaction fees.

- $150 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

- Benefits of the Amex Green Card

- Travel Insurance Benefits of the Amex Green

- Amex Green CLEAR Plus Credit

- The Amex Green $100 LoungeBuddy Credit

- Is the Amex Green a Good Card for Frequent Travelers?

- Amex Gold vs Amex Green

- Chase Sapphire Preferred vs Amex Green

- Amex Transfer Partners

- Best American Express Credit Cards

- Best Credit Cards for CLEAR

The Amex Green card is one of our favorite cards because it offers rich rewards, unique travel perks, and more.

This premium card offers a great introductory welcome bonus offer to start your points accrual. The Amex Green card earns 3x Membership Rewards points at restaurants worldwide, on transit, and on all eligible travel purchases .

This card is the only card from American Express that offers bonus points on travel as a broad category. It includes airfare, hotels, cruises, tours, car rentals, and vacation rentals like Airbnb and Vrbo.

It also boasts up to $189 in statement credits per year towards a CLEAR Plus membership and up to $100 in statement credits per year on LoungeBuddy purchases.

If you’re looking for travel coverage , you’ll find tons of value in this card thanks to its trip delay insurance, secondary car rental loss and damage insurance, and baggage insurance plan. Of course, you’ll find purchase protection and extended warranty coverage, which are common for these cards.

Why We Like Earning Amex Membership Rewards Points

The points you’ll earn on the Amex Green card are Amex Membership Rewards points .

Earning Amex Membership Rewards points is one of the most lucrative things you can do regarding rewards. In short, Amex has the most valuable transferable points, which can be used for incredible value when transferred to airline and hotel partners .

Other ways to redeem Amex points include travel booked through AmexTravel.com , gift cards, Amazon, cash-back, charitable donations, and more. However, we recommend transferring your points to airline and hotel partners.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- APR: 21.49%-28.49% Variable

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Amex Gold vs Chase Sapphire Preferred

The Chase Sapphire Preferred card is one of the world’s most popular travel rewards credit cards and for a good reason!

This card is one of the best “starter” rewards credit cards because of its incredible welcome bonus, access to Chase Ultimate Rewards partnerships, and of course, the ability to earn 5x points on travel purchased through Chase Ultimate Rewards, 3x points on dining and on online grocery purchases (excluding Target, Walmart and wholesale clubs), and 2x points on all other travel purchases (including Airbnb and Vrbo, which is why this is one of our top choices).

The Chase Sapphire Preferred card also offers a complimentary DoorDash DashPass subscription (when activated by December 31, 2023) and no foreign transaction fees.

You’d be hard-pressed to find a card with better coverage for travel benefits . The Chase Sapphire Preferred card has primary rental car insurance , complimentary travel delay insurance, trip cancellation and interruption insurance, baggage delay insurance, travel accident insurance, roadside dispatch, and travel and emergency assistance.

And as you’re making purchases on the card, you’ll rest easy with purchase protection and an extended warranty on all your purchases.

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Amex Platinum

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

The Capital One Venture X card is Capital One’s ultra-premium credit card. It can earn 2x miles on Airbnb and Vrbo bookings, as this card earns 2x on all eligible purchases.

In addition, there’s a annual credit of $300 for all bookings made through Capital One Travel .

Here is the earning structure on this card:

Every account anniversary, holders of this card will get 10,000 bonus Capital One miles, too!

The Capital One Venture X card confers a Priority Pass Select membership, access to Capital One Lounges and Plaza Premium Lounges , a Global Entry or TSA PreCheck application fee credit, complimentary Hertz Gold Plus Rewards President’s Circle status, travel insurance and protections , primary rental car insurance , cell phone insurance , extended warranty, no foreign transaction fees ( rates & fees ), and no-additional-charge for up to 4 authorized users ( rates & fees ).

Why We Like Earning Capital One Miles

Capital One miles are one of the major transferable currencies, which means that you can transfer your Capital One miles to airline partners for amazing flights in premium cabins.

You can redeem your miles for statement credits, travel purchases, gift cards, and more. However, we believe the best way to redeem your Capital One miles is for airline partner transfers.

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

The Capital One Venture card is one of our favorite credit cards for simple transferable rewards. With the Capital One Venture card, you’ll earn unlimited 2x Capital One miles on your purchases with no caps!

Since you don’t have to worry about bonus categories, you can bet that Airbnb and Vrbo stays will count!

This card also offers up to $100 Global Entry or TSA PreCheck application fee credit and solid travel protections , including secondary car rental insurance, travel accident insurance, lost luggage coverage, roadside dispatch, and more.

Plus, you’ll enjoy cardholder benefits like zero fraud liability, purchase security, and extended warranty coverage.

Citi Double Cash ® Card

Great card for the average spender with no specific focus category; worry-free cash-back earning on everything!

The Citi Double Cash ® Card has long been one of the top cash-back credit cards on the market, and the card now has the ability to earn Citi ThankYou Points!

This means that cardholders of the Double Cash card will now earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Cash back is earned in the form of ThankYou Points . This means each billing cycle, you will earn 1 ThankYou point per $1 spent on purchases and an additional ThankYou point for every $1 paid on your purchase balance as long as there is a corresponding balance in your Purchase Tracker.

Citi has turned the Double Cash card into a top choice for those who are looking for an everyday, no-fuss credit card.

- Uncapped 2% for every $1 spent (1% when you buy and another 1% when you pay)

- Flexible redemption options

- No annual fee

- No bonus categories

- 3% foreign transaction fees

- Lack of premium travel benefits

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- APR: 0% Intro APR for 18 months on balance transfers, then 19.24% - 29.24% Variable

- Foreign Transaction Fees: 3% of the U.S. dollar amount of each purchase

- Cash Back Credit Cards

- No Annual Fee Cards

Citi ThankYou Rewards

- Capital One Venture vs Citi Double Cash

- The 8 Best 2% Cash-back Credit Cards [2024]

- Best 0% Interest Credit Cards

- Best Citi Credit Cards

- Best Credit Cards for Bills and Utilities

- Citi Transfer Partners

The Double Cash card is one of our favorite credit cards because it earns 2% cash-back . You’ll earn 1% when you purchase and 1% when you pay it off (earned as ThankYou Points), with no caps!

That means that for your Airbnb and Vrbo stays, you can potentially earn 2% with no caps!

You can redeem points for cash-back in the form of a statement credit, direct deposit, or mailed check. Alternatively, you can redeem them for gift cards, travel, or shop with points at Amazon.com and more.

Other benefits include zero liability for unauthorized purchases and fraud protection.

Why We Like Earning Citi ThankYou Rewards Points

The ability to earn 2% with a $0 annual fee on Airbnb or Vrbo is fantastic.

When you pair your Double Cash card with a premium card like the Citi Premier ® Card , you can transfer ThankYou Points to the full catalog of travel partners and redeem them for flights like Singapore Airlines first class or Delta One Suites !

The 5 Best Business Cards for Airbnb or Vrbo Stays

It’s easy to fall in love with any of the personal credit cards above and use them for Airbnb or Vrbo stays.

But if you happen to be traveling for business, you’ll want to use a business credit card that can keep your personal and business expenses separate. So in this next section, we’ll show you our favorite business credit cards for Airbnb or Vrbo stays.

Ink Business Preferred ® Credit Card

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- Trip cancellation and interruption insurance

- Rental car insurance

- Extended warranty coverage

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

- Best Business Credit Cards

- The Chase Ink Business Preferred 100k Bonus Offer

- Benefits of the Ink Business Preferred

- Chase Ink Business Preferred Cell Phone Protection

- Chase Ink Business Preferred vs Amex Business Gold

- Ink Business Cash vs Ink Business Preferred

- Amex Business Platinum vs. Chase Ink Business Preferred

- Ink Business Preferred vs Ink Business Unlimited

- Best Chase Business Credit Cards

- Best Business Credit Card for Advertising

- High Limit Business Credit Cards

- Best Credit Cards with Travel Insurance

- Best Credit Cards for Car Rental Insurance

Our favorite business credit card for Airbnb and Vrbo is the Ink Business Preferred card .

This card offers a massive welcome bonus offer worth around $2,000. And as you look deeper, you’ll find that you will earn 3x Ultimate Rewards points per dollar spent, on up to $150,000 every cardmember year in these bonus categories:

- Advertising on social media and search engines

- Internet, cable, and phone

That means you’ll experience the same earning structure for Airbnb and Vrbo as you would with the Chase Sapphire Reserve card. The main difference is that the Ink Business Preferred card has a cap of $150,000 in combined purchases, while the Chase Sapphire Reserve card doesn’t have a cap.

The other big difference is that this card’s annual fee is just $95 , which is just a fraction of the Chase Sapphire Reserve card’s $550 annual fee.

The Ink Business Preferred card also offers cell phone insurance , primary rental car insurance, trip interruption and cancellation coverage, trip delay coverage, purchase protection, extended warranty, and no foreign transaction fees. You can also add employee cards for no additional fee.

Between the huge welcome bonus offer, the best-in-class 3x earning categories on travel (up to $150,000 across all bonus categories), the travel benefits, and the modest $95 annual fee, it’s easy to see why the Ink Business Preferred card is our favorite business credit card for Airbnb and Vrbo stays.

The Blue Business ® Plus Credit Card from American Express

Earn Membership Rewards for your business spending the easy way: get 2x points for the first $50,000 in purchases per year.

As a business owner, getting a credit card that maximizes each dollar you spend does not have to be complicated or expensive. Especially when you opt for The Blue Business ® Plus Credit Card from American Express .

With the Amex Blue Business Plus card, you’ll earn 2x Membership Rewards points on everyday business purchases throughout the year (up to $50,000; 1x thereafter) and receive purchase protections and no-additional-charge employee cards all for no annual fee (see rates and fees ).

The simple and straightforward earning structure makes it a great fit for those looking to earn flexible rewards, without having to fixate on which purchases earn the most points.

Let’s take look at all that the Amex Blue Business Plus card has to offer.

- 2x Membership Rewards points per $1 on everyday business purchases (up to $50,000; 1x thereafter)

- Purchase protection and extended warranty protection

- No annual fee and employee cards at no additional cost

- No unique bonus categories and 2x earnings are capped at $50,000 in annual spend

- No elite travel benefits like lounge access or elite status

- Charges foreign transaction fees

- Earn 15,000 Membership Rewards ® points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership.

- 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 18.49% - 26.49%, based on your creditworthiness and other factors at account opening. APR will not exceed 29.99%

- Earn 2X Membership Rewards ® points on everyday business purchases such as office supplies or client dinners. 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter.

- You’ve got the power to use your Card beyond its credit limit* with Expanded Buying Power.

- *The amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors.

- No Annual Fee

- Terms Apply

- APR: 18.49% - 26.49% Variable,0% on purchases for 12 months from date of account opening

- Foreign Transaction Fees: 2.7% of each transaction after conversion to US dollars.

- Benefits of the Blue Business Plus

- Best American Express Business Credit Cards

- Best 0% APR Business Credit Cards

- Best Business Credit Cards with No Annual Fee

- Best Business Credit Cards for Nonprofits

- Best Credit Cards for Landlords

- Best Business Credit Cards for Real Estate Investors

The Amex Blue Business Plus card is our runner-up choice for Airbnb and Vrbo stays. This superb credit card earns 2x Membership Rewards points on everyday business purchases, up to $50,000 spent every calendar year. Then, the card earns 1x thereafter.

This means that your first $50,000 in purchases every calendar year would earn 2x points, including Airbnb and Vrbo.

This card also offers no-additional-cost employee cards ( rates & fees ).

If you maxed out the $50,000 in bonus spending every year, you’d end up with 100,000 Amex points, worth around $2,200, according to our valuations. That’s equivalent to a 4.4% return on spend!

Ink Business Unlimited ® Credit Card

The Ink Business Unlimited card is a stellar option for business owners looking for a no-fuss uncapped 1.5% cash-back card without an annual fee.

As a business owner, you likely keep pretty busy and probably prefer a credit card that just keeps things simple.

If so, the Ink Business Unlimited ® Credit Card might be just the card for you. From zero annual fee to a flat cash-back rate, the card is a no-frills option that you don’t have to think twice about.

Don’t forget too, 0% intro APR on purchases for 12 months; variable 18.49% - 24.49% thereafter

- 1.5% cash-back on all purchases

- 0% intro APR on purchases for 12 months; variable 18.49% - 24.49% thereafter

- Employee cards at no additional cost

- Earn flexible rewards

- 3% foreign transaction fee

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards ® .

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- 0% introductory APR for 12 months on purchases

- APR: 0% intro APR on purchases for 12 months; variable 18.49% - 24.49% thereafter

- Foreign Transaction Fees: 3% of each transaction in U.S. dollars

- The Ink Business Unlimited $900 Welcome Bonus Offer

- Benefits of the Ink Business Unlimited Credit Card

- Ink Business Cash vs Ink Business Unlimited

- Best Business Credit Cards for Multiple Employees

The Ink Business Unlimited card offers superb benefits with $0 annual fee. With this card, you’ll earn 1.5% cash-back with no caps on every purchase made for your business.

In addition, this credit card offers a fantastic welcome bonus offer and 0% intro APR on purchases for 12 months; variable 18.49% - 24.49% thereafter .

If you have an Ultimate Rewards credit card, you can convert your 1.5% cash-back to 1.5x Ultimate Rewards points.

The card also has purchase protection, zero liability fraud protection, extended warranty coverage, unlimited employee cards with no additional fees, primary rental car coverage when traveling for business, and more.

Capital One Spark Miles for Business

The Capital One Spark Miles card is a low-annual-fee business card that earns 2x transferable miles on every $1 you spend. (Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles for Business is a great option for business owners looking for an uncomplicated rewards card that earns double miles on every purchase they make and offers access to transfer partners, all for a low annual fee.

- Unlimited 2x miles per $1 spent on all purchases

- 5x miles per $1 spent on hotel and rental cars purchased through Capital One Travel

- 2 complimentary visits to a Capital One Lounge per year

- Up to a $100 Global Entry or TSA PreCheck credit

- Free employee cards

- Annual fee: $0 intro for the first year, $95 after that

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry

- $0 intro annual fee for the first year; $95 after that

- Free employee cards which also earn unlimited 2X miles from their purchases

- APR: 26.24% (Variable)

- Business Credit Cards

- Best Capital One Business Credit Cards

- Best Ways To Redeem Capital One Miles

- Capital One Miles Program Review

- Capital One Transfer Partners

- How Much Are Capital One Miles Worth?

- Best High Limit Business Credit Cards

The Capital One Spark Miles card is a great business credit card that earns straightforward 2x Capital One miles with no cap for Airbnb and Vrbo stays, similar to the Capital One Venture cards above.

You’ll also earn 5x miles on hotel and rental car bookings through Capital One Travel (does not include Airbnb or Vrbo), and receive a Global Entry or TSA PreCheck application fee credit.

The Capital One Spark Miles card also has zero fraud liability, purchase protection, extended warranty, no foreign transaction fees, and roadside assistance.

Capital One Spark Miles Select for Business

(Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles Select for Business is an excellent option for business owners looking for straightforward earning with no blackout dates, no seat restrictions, and no minimum when redeeming your miles.

- Earn a one-time bonus of 20,000 miles once you spend $3,000 on purchases within the first 3 months from account opening.

- Get unlimited 1.5 miles on every purchase with your business credit card with no blackouts or seat restrictions, and no minimum to redeem.

- Earn 5X miles on hotel and rental car bookings through Capital One Travel.

- Use your miles on flights, hotels, vacation packages and more—you can even transfer miles to any of our 15+ travel partners.

- We’ve got you covered with zero fraud liability if your card is lost or stolen. Plus, get automatic fraud alerts via text, email or phone call.

- 0% intro APR for 9 months; 18.24% – 28.24% variable APR after that.

- APR: 0% Intro APR for the first 9 months after account opening,Ongoing APR: 18.24% - 28.24% Variable

- Foreign Transaction Fees:

The Capital One Spark Miles Select card is the $0 -annual-fee variant of the Capital One Spark Miles card. Instead of earning 2x Capital One miles with no cap, you’ll earn 1.5x Capital One miles with no cap.

The welcome bonus offer is usually lower than the Capital One Spark Miles card. However, the card still offers zero fraud liability, transfer partnerships, roadside assistance, extended warranty, purchase protection, and more.

There are plenty of credit cards out there. Finding the best credit card for Airbnb and Vrbo stays isn’t as easy as it looks.

There aren’t a lot of credit cards that offer bonus points for general travel, which Airbnb and Vrbo both fall under.

The best personal and business credit cards for these purposes belong to American Express and Chase, though Capital One and Citi offer decent options.

We hope you’ve found this detailed guide useful to help you figure out the best credit cards for Airbnb rewards and Vrbo stays.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Enrollment is required through Capital One website or mobile app. Upon enrollment, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

For the car rental loss and damage insurance benefit of the American Express ® Green Card, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Spark Miles Select for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the American Express ® Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Blue Business ® Plus Credit Card from American Express, click here . Information regarding the Capital One Spark Miles for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Is airbnb considered travel for credit cards.

In general, yes. That means that if you find a card that offers bonus points on general travel, then you should be able to earn bonus points on Airbnb purchases.

Do you need a credit card for Airbnb?

No, you do not. However, using a credit card is a spectacular way to earn rewards on spending you’d make anyway!

Which credit card is best for Airbnb?

We love the Chase Sapphire Reserve card, the Chase Sapphire Preferred card, Amex Green card, Capital One Venture X card, Capital One Venture card, and Double Cash card for personal Airbnb purchases. If you’re booking an Airbnb for business, the best cards are the Ink Business Preferred card or the Amex Blue Business Plus card. Other cards are available, like the Ink Business Unlimited card, Capital One Spark Miles card, and Capital One Spark Miles Select card. Still, these generally don’t have excellent rewards like the Ink Business Preferred card would.

Can you use Chase points for Airbnb?

You can’t redeem Chase points for all Airbnb stays, but you might be able to do so at specific Airbnb properties that are listed on other websites and online travel agencies. You can also buy Airbnb gift cards at a value of 1 cent per point, but your points could be worth more with other redemptions.

Does Airbnb charge a foreign transaction fee?

Yes, Airbnb charges a 3% fee if the currency of your booking differs from your home currency. This is a currency conversion fee separate from a foreign transaction fee you might charge on your credit card. For example, if you’re based in the U.S. and stay in a property in France, you will pay a 3% conversion fee from U.S. dollars to euros. Unfortunately, there’s also no way around it — it’s entirely done on Airbnb’s end.

Was this page helpful?

About Stephen Au

Stephen is an established voice in the credit card space, with over 70 to his name. His work has been in publications like The Washington Post, and his Au Points and Awards Consulting Services is used by hundreds of clients.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase travel points airbnb CareCredit® Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2020/05/Synchrony-CareCredit-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the portal?

Benefits of booking travel in the portal, is chase's travel portal worth using, does chase's travel portal price match, how to use chase's travel portal, what else you need to know, chase travel portal tips, recapped.

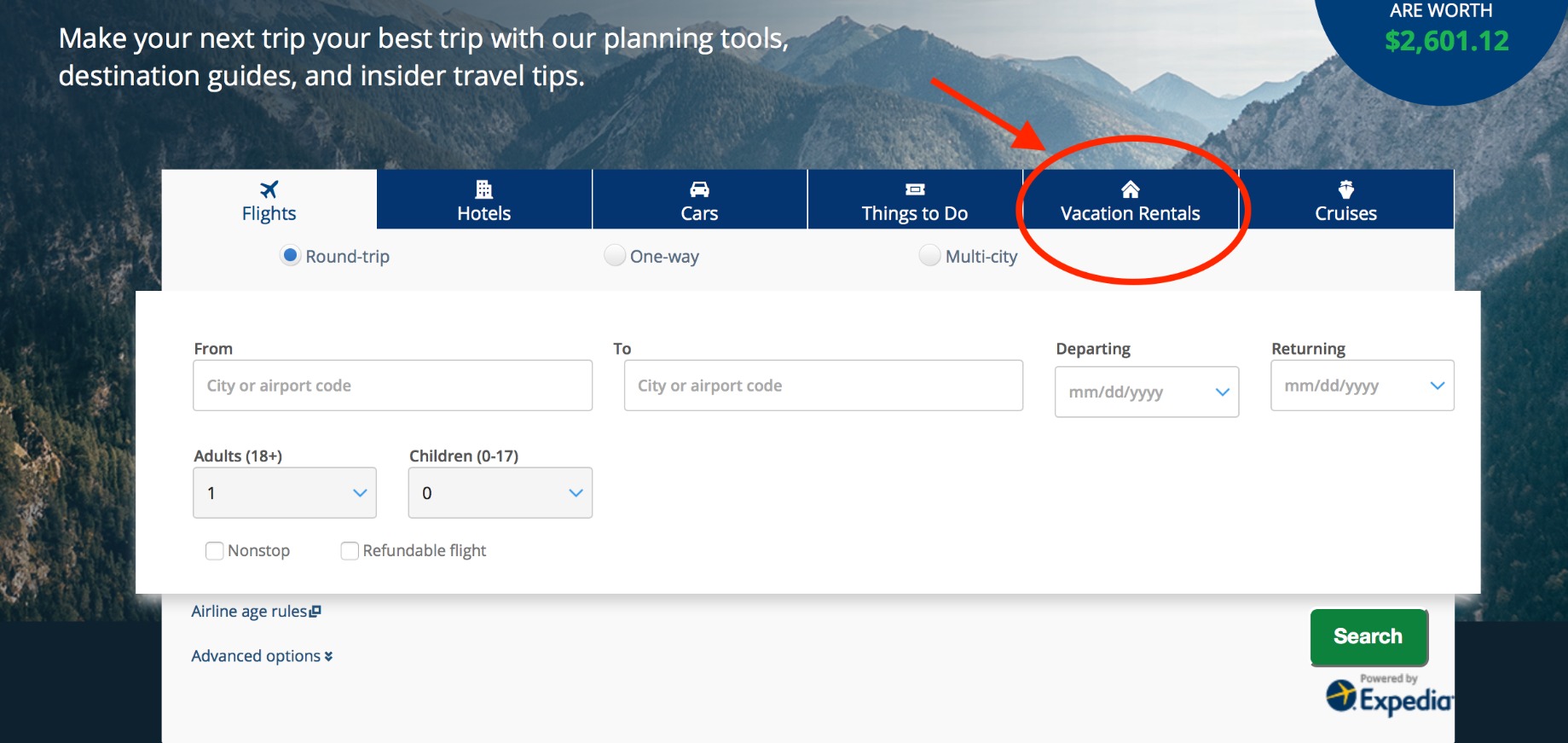

Chase's travel portal is one of the best features of having a Chase credit card. Earning Ultimate Rewards® with credit cards like Chase Sapphire Preferred® Card and Chase Sapphire Reserve® can deliver big value if you know how to navigate Chase's travel portal.

Much like third-party booking sites like Orbitz or Expedia , you can use Chase's travel portal to book flights, hotels and cruises, among other things. You can redeem points to offset the cost of the trip or pay in cash. You won’t have to worry about blackout dates or award inventory caps like you may find when using airline miles or hotel points for the same trip since you are essentially buying travel with cash.

Within the portal, you can also redeem points for merchandise or transfer them to other travel loyalty programs if you are short on miles and points there. In short, having a flexible points currency like Chase Ultimate Rewards® is one of the smartest routes you can take in the miles and points game. Booking travel through Chase's travel portal is simple. Here’s what you need to know about the portal.

» Learn more: Chase Ultimate Rewards®: How to earn and use them

Not all Chase cards have the same benefits. Only some cards earn Ultimate Rewards® points; others may earn loyalty miles and points with an affiliated partner. For example, the United℠ Explorer Card earns United MileagePlus miles.

These are examples of cards that earn Chase Ultimate Rewards® and give access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Chase Freedom Unlimited® .

Chase Freedom Flex℠ .

Ink Business Preferred® Credit Card .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in the travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in the travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in the travel portal: 1 cent apiece.

Point value in Chase travel portal: 1 cent apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Earn points on paid reservations

The primary reason you may want to book travel via Chase's travel portal is that you earn Chase Ultimate Rewards® on paid reservations. You can earn 5x points on airfare booked within the portal and 10x points on hotels and car rentals.

That can really add up, but beware that when booking hotels with Chase Ultimate Rewards®, you are not eligible to earn points with the hotel loyalty program or reap elite status benefits since it is using a third-party service. The tradeoff can vary by property, but using Chase's travel portal is especially helpful when booking unaffiliated hotels or hotel brands where you usually do not collect points or have elite status. In those instances, you are less likely to be passing up the perks of points earning and elite status.

Earn points on airfare even for redemptions

When booking airfare through Chase, you do earn miles no matter if you pay with cash or points. This makes using points for airfare via the travel portal more beneficial than redeeming for a hotel.

Earn bonus points for restaurant bookings

You can even earn bonus points when making restaurant bookings through the portal. This can be a great way to enhance your trips with great dining in advance rather than chatting with your hotel concierge.

Shop for the best value redemption

Since the value per Chase Ultimate Rewards® points is relatively constant, using the travel portal may not always be the best option. You may be able to spend fewer points if you book the same trip with the specific airline or hotel's points instead of Chase Ultimate Rewards® points. This is more common with itineraries with high cash prices, like a hotel night that's particularly expensive. Always compare the cost of using traditional miles and points over using Chase points to see which offers better value. In some cases, you may want to transfer Chase points to partner programs to squeeze more value from them.

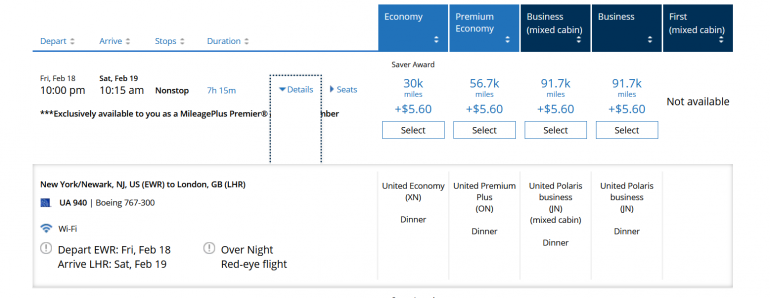

One example where that could be exceptional value is for expensive business class tickets that also have award availability. Let’s say you’re looking for a United business class ticket between Newark and London. If the cash cost of a one-way ticket is $2,505, that will cost you 250,500 Ultimate Rewards® points when redeeming at a value of one penny per point. In this example, it may be worth redeeming MileagePlus miles instead.

For this flight, the one-way mileage cost is 91,700 miles. Even if you don’t have enough United miles, you could transfer that amount from Chase Ultimate Rewards® (since they are partners), and save yourself a nice chunk of Chase points in the process. It is always best to compare the cash cost with the redemption cost using both Chase and the airline or hotel’s own loyalty program.

» Learn more: The best Chase transfer partners — and the ones to avoid

Chase's travel portal can be worth using in specific scenarios.

Redemptions: You hold the Chase Sapphire Reserve® , the Ink Business Preferred® Credit Card or the Chase Sapphire Preferred® Card and want to make a redemption. The first two cards get an elevated point value of 1.5 cents apiece when redeeming points and booking travel in the portal; the latter gets 1.25 cents apiece.

Bookings. You hold the Chase Sapphire Preferred® Card , the Chase Freedom Unlimited® or the Chase Sapphire Reserve® and want to earn bonus points. The Chase Sapphire Preferred® Card and the Chase Freedom Unlimited® typically earn 5x points per $1 spent on all travel purchased through Chase's travel portal, while the Chase Sapphire Preferred® Card earns 5-10 points per $1 spent on Chase Dining, hotel stays, rental cars and air travel purchased through Chase's travel portal.

Otherwise, you might be wise to book travel directly with the airline, hotel or rental car company, which can simplify cancellations or changes to your bookings. You can do this with cash, card or by transferring points to one of Chase's transfer partners.

» Learn more: The guide to Chase transfer partners

Despite being powered by Expedia — an online travel agency that includes a Price Match Promise — Chase's travel portal does not offer customers a price matching benefit.

Capital One Travel has price drop protection that will advise you when to buy and refund you if the price of your flight drops by a certain amount after purchase.

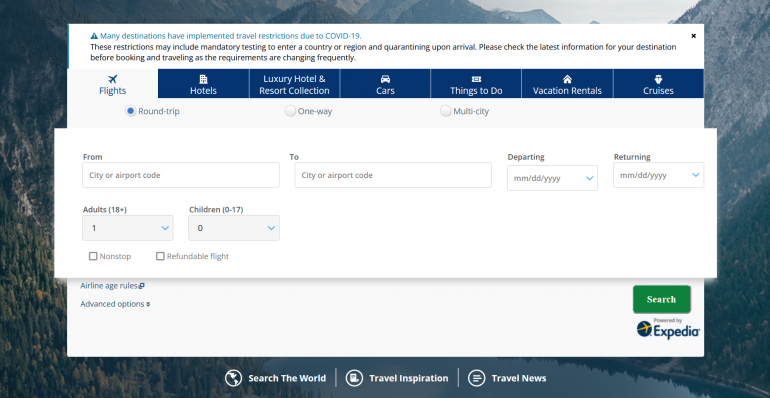

Once logged into your Chase account, you’ll find a sidebar on the right of the page with your Chase Ultimate Rewards® balance. Once you click on it, it brings up a variety of options for how to spend your points. Choose “travel” to take you to the standard booking page where you can enter your plans for flights, cruises, rental cars, hotels or other activities.

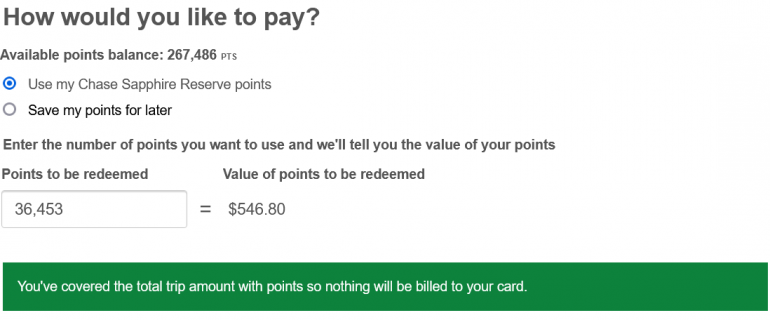

Depending on the card you have, your points are worth between 1-1.5 cents per point. The best value card is the Chase Sapphire Reserve® , which offers 1.5 cents in value per point to redeem through the portal, while the Chase Freedom Unlimited® only values points at a penny per point. This means that Chase determines the number of points you’ll need to redeem for an award based on the cash cost of the travel you are trying to book.

It’s easy to search for the travel you want. Chase has partnered with Expedia to run the search engine, but this has limited the search function a bit with some low-cost airlines no longer appearing. Be mindful of this when making a reservation (perhaps check to see if the airfare is similar to the basic economy or main cabin price on the airline’s website first).

The advanced options button lets you sort by airline and class of service.

Much like other online booking engines, once you find the travel plans you like, you enter your personal details. The best part of using the travel portal is that you can pay in full with points, cash or use a mix of points and cash. You can adjust the amount of points you want to spend for your trip and the website will display how much remaining cash you owe. If you need more points, you can transfer them from other Chase Ultimate Rewards® earning accounts you may have to boost your balance.

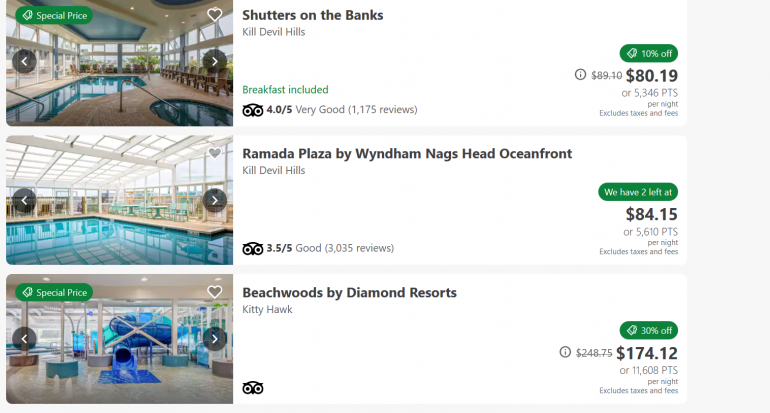

The process for booking hotels or car rentals is similar to reserving a flight, giving you the option to use a mix of cash or points.

To book a cruise with points, however, you’ll have to call Chase directly.

Another exception is when making a reservation at Luxury Hotel and Resort Collection properties, you can only make a cash reservation (you pay upon checkout) and cannot redeem Ultimate Rewards® points. You may still want to reserve through the portal, though, since it means you are eligible for additional perks like daily breakfast for two and a special amenity that varies by the hotel.

You can also reserve activities at home or your destination and pay for them in cash or with points. These include tours, museum visits and other local experiences.

Chase may charge a service fee on certain reservations. You will want to weigh whether this small charge is worth the benefit in Chase Ultimate Rewards® points you may use.

Many hotel companies offer member-only rates to entice you to book directly with them rather than through a third party. You’ll want to weigh whether earning Chase Ultimate Rewards® points is more valuable than the difference in the lowest rate booked directly with the hotel company.

When making any reservation through Chase's travel portal, you will be at the mercy of its own policies when it comes to changing or canceling a ticket. You will have to contact Chase directly to adjust your plans since you made it independently of the airline or hotel company. This can make it especially difficult with last-minute travel plan changes.

» Learn more: Advanced tips for redeeming Chase Ultimate Rewards

With a little comparison shopping for your travel plans, you can squeeze exceptional value from points via the Chasee's travel portal. They can be redeemed like cash for travel, but always be sure to compare a reservation using Chase points to the cost of using hotel or airline points.