HSBC VIP Travel and Expense Card

HSBC VIP Travel and Expense Card: Introducing the perfect travel companion – your new HSBC VIP Travel & Expense Mastercard© credit card.

Designed to make your business travel as convenient and seamless as possible, your new card includes exclusive benefits, such as airport lounge access, trip delay and cancellation insurance, complementary Boingo Wi-Fi in all major airports, premier customer service access and more.

Travel boldly with the card that offers benefits beyond the ordinary with the HSBC name that is instantly recognized and respected around the globe.

Introducing the perfect travel companion – your new HSBC VIP Travel & Expense Mastercard© credit card.

Mastercard© Coverage Brochure (PDF, 1.29MB)

Mastercard© Guide to Benefits (PDF, 389KB)

Mastercard© Guide to Benefits – Trip Cancellation & Trip Interruption (PDF, 1.43MB)

To file a claim visit: www.mycardbenefits.com or call 1-800-Mastercard

Mastercard Concierge

Priority Pass Registration

Priority Pass Member Support (FAQs, Priority Pass App, Contact)

Flight Delay Pass Registration

Flight Delay Pass Terms of Use (PDF, 438KB)

Boingo Wi-Fi for Mastercard Cardholders

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

HSBC Elite Credit Card

Unlimited rewards points with no expiration.

Earn 50,000 Rewards Bonus Points worth $750 in airfare – when booked online through HSBC Travel from Rewards – after spending $4,000 in the first 3 months of account opening 1

You’ll earn 3× Rewards Points on new travel purchases – including airline, hotels, and car rentals

2× dining Points

You’ll earn 2× Points on new dining purchases

1× Points on all other purchases

You’ll earn 1× Points on all other purchases

- Add authorized users for $65 each 2

No Foreign Transaction Fees

- Competitive, variable APR of 21.24% to 25.24% † 2 on Purchases and Balance Transfers

Redeem your points for rewards

Redemption options.

- Redeem Points for flights, hotel reservations and car rentals using our online travel site 3

- Book your own airline travel, and receive a statement credit to reimburse the cost 3

- Transfer your Points to air miles with participating airline partner 3

Cash Rewards

- Reward yourself with cash back 4

- Direct deposit to your HSBC bank account

- Statement credits can be applied to your HSBC card account

- More than 100 brands in variable denominations 3

- Find the perfect fit across dining, travel, shopping, and entertainment 3

- Macy's, Starbucks, Home Depot®, Amazon.com, and Best Buy® are a few of the most popular in this vast collection 3

Merchandise

- A collection of over 3,000 items with new ones added every week 3

- Shop categories from luggage to electronics, kitchenware to fashion, and everything in-between 3

- Find top brands including Bose, Apple, Tumi, Dyson, Kate Spade New York, and many more 3

Explore this card

Travel benefits, everyday values and experiences, peace of mind.

$400 in Travel Credits

Up to $400 per year for all airfare, hotels and car rentals booked through HSBC Travel.

Unlimited Lounge Access

You and one guest get complimentary, unlimited access to 1,000+ airport lounges provided by LoungeKey™.

Mastercard Travel Rewards

Get exclusive offers from top brands in over 15 countries outside the U.S. including France, Hong Kong, U.K. and more when you use your HSBC Elite or Premier Credit Card. 3

Rewards For Miles

Transfer your Points into any of the Rewards for Miles partners’ loyalty programs. We have expanded the program to now include 11 airlines and 2 hotel partners.

- How to use How to use Modal link

View more travel benefits

There are no added costs when using your card to make purchases in a foreign country.

Trusted Traveler

You are eligible for either one Global Entry® Application Fee Statement Credit, up to a maximum of $100, or one TSA Precheck Application Fee Statement Credit, up to a maximum of $85, every 54 months 8 .

MasterRental TM Coverage Provides protection for physical damage and theft to most rental vehicles 5 .

Mastercard Travel & Lifestyle Services TM Connects you with access to luxury travel benefits, amenities and upgrades at some of the most sought-after travel destinations either by phone, email or a personalized online platform 5 .

Travel Accident Insurance Receive accidental death or dismemberment coverage of up to $1,000,000 when traveling 5 .

Trip Cancelation Insurance Reimburses you for your prepaid, non-refundable expenses in case you have to cancel your trip for a covered reason 5 .

Hotel and Motel Burglary Insurance Get reimbursed up to $1,500 per claim for personal property stolen or damaged from your hotel or motel room as a result of burglary by forcible entry 5 .

Lost Luggage Insurance Get reimbursed up to $1,500 per claim for checked or carry-on luggage that is lost or damaged while traveling on a common carrier 5 .

Baggage Delay Insurance Get reimbursed up to $250 per claim for the cost of essential items such as clothing and toiletries if your luggage is delayed in getting to your scheduled destination 5 .

Mastercard ® Airport Concierge Enjoy a 15% savings on Airport Meet and Greet services. Arrange for a personal, dedicated Meet and Greet agent to escort you through the airport on departure, arrival or any connecting flights at over 450 destinations worldwide 6 .

World Elite Concierge Service Enjoy complimentary, 24/7 concierge service that acts like a personal assistant. Receive help with all your tasks, big and small: from travel planning, dining reservations, sporting events and show ticket reservations 6 .

Priceless Golf®

Discounted access to select golf courses, complimentary grounds passes for PGA Tournaments, Priceless Lessons with PGA Tour professional and much more.

Priceless Experiences

Get exclusive, once in a lifetime experiences in the cities where you live, shop and travel.

Complimentary ShopRunner membership for unlimited, free 2-day shipping and free return shipping at over 140 online stores.

Take 3 rides per month and receive a $5 Lyft App credit 5 .

Mastercard ID Theft Protection TM

If your identity is compromised, you’ll receive one-on-one support until your claim is resolved 5

Identity Fraud Expense Reimbursement

Provides expense reimbursement in the event your identity is compromised through identity fraud 5

Cellular Wireless Telephone Protection

Provides reimbursements up to $800 per claim if your cellphone is stolen or damaged 5

More peace of mind

Purchase Assurance Covers most purchases from damage or theft within 90 days of purchase up to $1,000 5

Tap & Go® with any HSBC Credit Card

Tap & Go® contactless payments are faster than swiping or inserting your card for payment.

- Place – Simply place your HSBC Credit Card close to a contactless payment terminal

- Hold – Briefly hold your card close to the terminal until it confirms the payment with a green light or beep,

- Done – Follow the prompts, and you're done!

Thousands of merchants accept contactless payments – use your card wherever you see the contactless symbol.

† Summary of Terms can be accessed here

HSBC Elite World Elite Mastercard credit card Rewards & Benefits and Mastercard Guide to Benefits brochure can be accessed here .

How to apply

To apply for an HSBC Elite Credit Card, you must have a qualifying Premier or Private Bank relationship 7 .

New to HSBC

To apply for an HSBC Elite Mastercard credit card 7 , you must have an existing U.S. HSBC Premier checking account relationship. Explore the benefits today.

Existing HSBC Customer

Log on to Personal Internet Banking to apply for an HSBC Elite Mastercard credit card.

For Private Bank relationships, please see your Relationship Manager.

Phone Contact our 24/7 Premier Customer Relationship Center.

888.662.4722 (HSBC)

If you’re calling from outside the US or Canada, call

716.841.6866

Find the Wealth Center closest to you to apply in person.

- Wealth Center locator

- Fraud Protection

As an HSBC customer, you’re automatically enrolled in our fraud alert program.

- FICO®

See your FICO® score for free, along with key score factors, on your monthly statement.

- Mobile Pay

All HSBC credit cards are compatible with Apple Pay®, Google Pay TM , Fitbit Pay TM , Garmin Pay TM and Samsung Pay TM .

1 The 50,000 Rewards Bonus Points offer applies when you open a new HSBC Elite World Elite Mastercard credit card and charge the qualifying amount or more in new purchases (minus returns, credits and adjustments) within the first three (3) months from Account opening (“Promotional Period”). The 50,000 Bonus Points offer does not apply to account upgrades, account transfers, balance transfers, credit card checks, cash advances or overdrafts. Your HSBC Elite World Elite Mastercard credit card must be open and in good standing at the time of Bonus Points fulfillment. Allow 4-6 weeks after the Promotional Period has ended for the Bonus Points to post to your Account. Customers who have opened the same credit card product within the last 36 months are not eligible to receive the Rewards Program Bonus Points offer.

2 The information about the costs and benefits of the card described is accurate as of {{currentDate}}. The information may have changed after that date. To find out what may have changed, call 888.662.4722 (HSBC). A variable Purchase APR applies to credit card purchases and will be 21.24% to 25.24%, depending on your credit worthiness. A variable Balance Transfer APR applies to balance transfers and will be 21.24% to 25.24%, depending on your credit worthiness, for the HSBC Elite World Elite Mastercard credit card . The variable Cash APR applies to cash advances and is 30.24%. These APRs will vary with the market based on the Prime Rate. For each billing cycle, variable APRs are calculated by adding a specified amount (“Spread”) to the U.S. Prime Rate published in the Money Rates table of The Wall Street Journal that is in effect on the last day of the month (“Prime Rate”). If the Prime Rate changes, the new APRs will take effect on the first day of your billing cycle beginning in the next month. The Minimum Interest Charge is $1.00. A Balance Transfer Fee of either $10 or 4%, whichever is greater, will apply on each balance transfer. A check fee of either $10 or 4%, whichever is greater, will apply on each check written for purposes other than Balance Transfer. A Cash Advance Fee of either $10 or 5%, whichever is greater, will apply on each cash advance transaction. There is no Foreign Transaction Fee. The Annual Fee for the HSBC Elite World Elite Mastercard credit card is $395 plus $65 for each authorized user; the Annual Fee is waived ($0) for customers who hold a U.S. HSBC Premier Elite customer status (qualification required)* or Private Bank relationship. See Summary of Terms for details .

* For more information regarding U.S. HSBC Premier Elite customer status eligibility requirements please visit https://www.us.hsbc.com/checking-accounts/products/premier/ or speak with your Relationship Manager.

3 As an HSBC Elite or HSBC Premier credit cardholder, you do not need to enroll or register for the Mastercard Travel Rewards program. This program is available to you automatically, at no additional cost. Merchants may provide to eligible HSBC Elite and HSBC Premier Mastercard credit cardholders (“cardholder”) certain discounts, rebates or other benefits on the purchases of goods and services ("Offers") that will be available on the Mastercard Site. Merchants may also have different payment acceptance criteria for online purchases (e.g., debit or prepaid cards may not be accepted). Such Offers are subject to certain Terms & Conditions and may change at any time without notice to you. Payment acceptance criteria is determined by the merchant in its discretion and may be visible on the Merchant website. HSBC or Mastercard will not be liable for any loss or damage incurred as a result of any interaction between you and a merchant with respect to such Offers. Except as set forth herein, all matters, including but not limited to delivery of goods and services, returns, and warranties are solely and strictly between you and the applicable merchants. You acknowledge that HSBC or Mastercard does not endorse or warrant the merchants that are accessible through the Mastercard Site nor the Offers that they provide. If applicable, all offer redemption is dependent on merchant shipping policies and availability to cardholder's shipping address. For all offers that are specified as “unlock additional online offers” cashback is not earned on shipping, handling, tax or the purchase and/or use of gift vouchers, which for avoidance of doubt, includes gift cards, gift certificates, or any other similar cash equivalents. Terms and conditions apply, see https://www.us.hsbc.com/credit-card-resource-center/premier/#rewards for additional information. All third party-trademarks are the property of the respective owners.

4 Customers can choose to receive cash back redemptions as a direct deposit into their HSBC Bank USA, N.A. Checking or Savings Account, or as a statement credit on their HSBC Credit Card. For complete eligibility details, refer to the HSBC Elite World Elite Mastercard credit card Guide to Benefits brochure.

5 Certain restrictions, limits and exclusions apply. Visit https://www.lyft.com/mastercard for a full list of current merchant offers and applicable terms & conditions.

6 The Mastercard® Concierge Service is provided by Aspire Lifestyles. Certain restrictions, limitations and exclusions may apply. This service is administered by a company not affiliated with HSBC Bank USA, N.A

7 HSBC Elite World Elite Mastercard® requires a qualifying Premier or Private Bank relationship. For a complete list of HSBC Premier Relationship eligibility requirements please visit https://www.us.hsbc.com/checking-accounts/products/premier/ or speak with your Relationship Manager.

8 Certain restrictions, limits and exclusions apply. Benefits may not be offered in every state. Coverage may be underwritten and managed by companies that are not affiliated with Mastercard, or HSBC Bank USA, N.A. Please see your HSBC Elite World Elite Mastercard credit card Rewards & Benefits and Mastercard Guide to Benefits brochure for full details.

How you earn Rewards Points or Cash Rewards : You earn Points or Cash Rewards when you use your card to make new purchases (minus returns, credits and adjustments).

HSBC credit cards are issued by HSBC Bank USA, N.A., subject to credit approval and require a U.S. HSBC checking account relationship. To learn more, speak with an HSBC representative.

Deposit products offered in the U.S. by HSBC Bank USA, N.A. Member FDIC.

Mastercard®, Tap & Go and the circles design are registered trademarks of Mastercard International Incorporated.

Mastercard® and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC.

Apple Pay works with iPhone 6 and later in stores, apps, and websites in Safari; with Apple Watch in stores and apps; with iPad Pro, iPad Air 2, and iPad mini 3 and later in apps and websites; and with Mac in Safari with an Apple Pay enabled iPhone 6 or later or Apple Watch. For a list of compatible Apple Pay devices, see https://support.apple.com/km207105 .

Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, Mac, Safari, and Touch ID are trademarks of Apple, Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

Samsung, Samsung Pay, Galaxy S7 and Samsung Knox are trademarks or registered trademarks of Samsung Electronics Co., Ltd. Other company and product names mentioned may be trademarks of their respective owners. Screen images are simulated; actual appearance may vary. Samsung Pay is available on select Samsung devices.

Fitbit, Fitbit Pay and the Fitbit Logo are trademarks, service marks and/or registered trademarks of Fitbit, Inc. in the Unites States and in other countries.

Garmin and Garmin logo are trademarks of Garmin, Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Connect with us

- Book Travel

- Credit Cards

HSBC Travel Rewards Mastercard: A New No-Fee Travel Card

Today, HSBC is introducing a brand-new credit card: the HSBC Travel Rewards Mastercard .

Let’s take a look at the features of this new product, and how this entry-level card with no annual fee might be valuable for you.

New HSBC Travel Rewards Mastercard

The HSBC Travel Rewards Mastercard is the bank’s new no-fee credit card for travel rewards. The card earns HSBC Rewards points, the same travel points currency as its higher-fee variants, the HSBC World Elite Mastercard and the HSBC +Rewards Mastercard .

As a welcome bonus, new cardholders who apply before May 2, 2022 will earn 20,000 points upon spending $2,000 in the first six months (with no spending requirement for Quebec residents ).

You’ll earn rewards on everyday spending as follows:

- 3 HSBC Rewards points per dollar spent on travel (up to $6,000 spent per year)

- 2 HSBC Rewards points per dollar spent on gas and transit

- 1 HSBC Rewards point per dollar spent on other purchases

The welcome bonus and earning rates are similar to the card’s entry-level peers from other big banks with a no-fee card which earns an in-house rewards currency, such as the CIBC Aventura Visa Card , the TD Rewards Visa Card , or the RBC Rewards+ Visa , with slight variations on which merchant categories earn at bonus rates.

The HSBC Travel Rewards Card also has decent insurance coverage for a no-fee card. It offers purchase protection for 90 days, and extended warranty of double the manufacturer’s warranty up to one year – both common on no-fee cards.

In addition, you’ll be covered for trip interruption, baggage delay, and hotel burglary when you book travel arrangements with this card – the latter being particularly notable for a no-fee credit card.

Unfortunately, the card levies the industry-standard 2.5% FX fee on foreign transactions, keeping the popular No FX Fee benefit in the domain of the more premium HSBC World Elite Mastercard.

- Earn 3 x HSBC Rewards points on eligible travel expenses *

- Redeem against travel purchases charged to the card *

- Annual fee: $0

How to Use HSBC Rewards Points

HSBC Rewards are one of our favourite points currencies because they’re very easy to use. You don’t have to book through their travel portal – instead, you can simply pay for any travel expense with your credit card, and later apply your rewards as a statement credit to cover the expense.

Used this way, HSBC Rewards have a fixed value of 0.5 cents per point (cpp), or 200 points = $1. Effectively, this means you’ll earn 1.5% back on travel purchases, 1% back on gas and transit, and 0.5% back on everything else with the new HSBC Travel Rewards Mastercard.

With the higher-tier HSBC World Elite and +Rewards cards, points can also be transferred to three airline partners: British Airways Avios , Cathay Pacific Asia Miles , and Singapore KrisFlyer . However, this option isn’t available with the HSBC Travel Rewards Card, so the fixed value of 0.5cpp is the only meaningful way to redeem points for travel.

Lastly, note that you’ll need a minimum of 25,000 HSBC Rewards points in order to redeem for anything. With the welcome bonus of 20,000 points from the HSBC Travel Rewards Mastercard, you’ll need to top-up with some further spending before you’ll be able to put your points to a good use.

The HSBC Credit Card Portfolio

Long-term, as a card with no annual fee, the HSBC Travel Rewards Mastercard would be a good downgrade option if you are thinking about cancelling your HSBC World Elite Mastercard or HSBC +Rewards Mastercard but want to keep your points alive or preserve an old credit account .

However, either of the higher-tier cards would be a better choice for a new signup if you qualify for them, with larger welcome bonuses and a first year annual fee waiver on both products.

After that, you can reevaluate the value proposition in the second year, and consider switching to the no-fee HSBC Travel Rewards Card.

While the HSBC World Elite Mastercard is one of my favourite cards in Canada, it has always stuck out like a sore thumb in that it’s long been the only compelling card offered by a rather large bank. With a new basic travel credit card in the market, HSBC is less looking to make a splash, and more looking to round out their portfolio.

Ultimately, while the HSBC Travel Rewards Mastercard fills a useful supporting role, it isn’t remarkably inspiring for a savvy points collector.

The card offers a modest welcome bonus with comparable earning rates for those who are seeking a basic travel rewards credit card, while bringing a long-awaited no-fee downgrade option for longtime cardholders who may be looking to retire their World Elite card.

*Terms and Conditions apply

®/TM Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Used pursuant to license.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Amex Aeroplan Reserve Status Offer: Earn Extra eUpgrades and SQM

Deals Apr 25, 2024

The Beginner’s Guide to TD

Guides Apr 24, 2024

Mr & Mrs Smith Properties Now Bookable through Hyatt Channels

News Apr 24, 2024

Recent Discussion

Fnt delta diamond, air canada signature class: which seat should you choose, korean air and westjet strengthen codeshare agreement, prince of travel elites.

Points Consulting

- Credit Cards

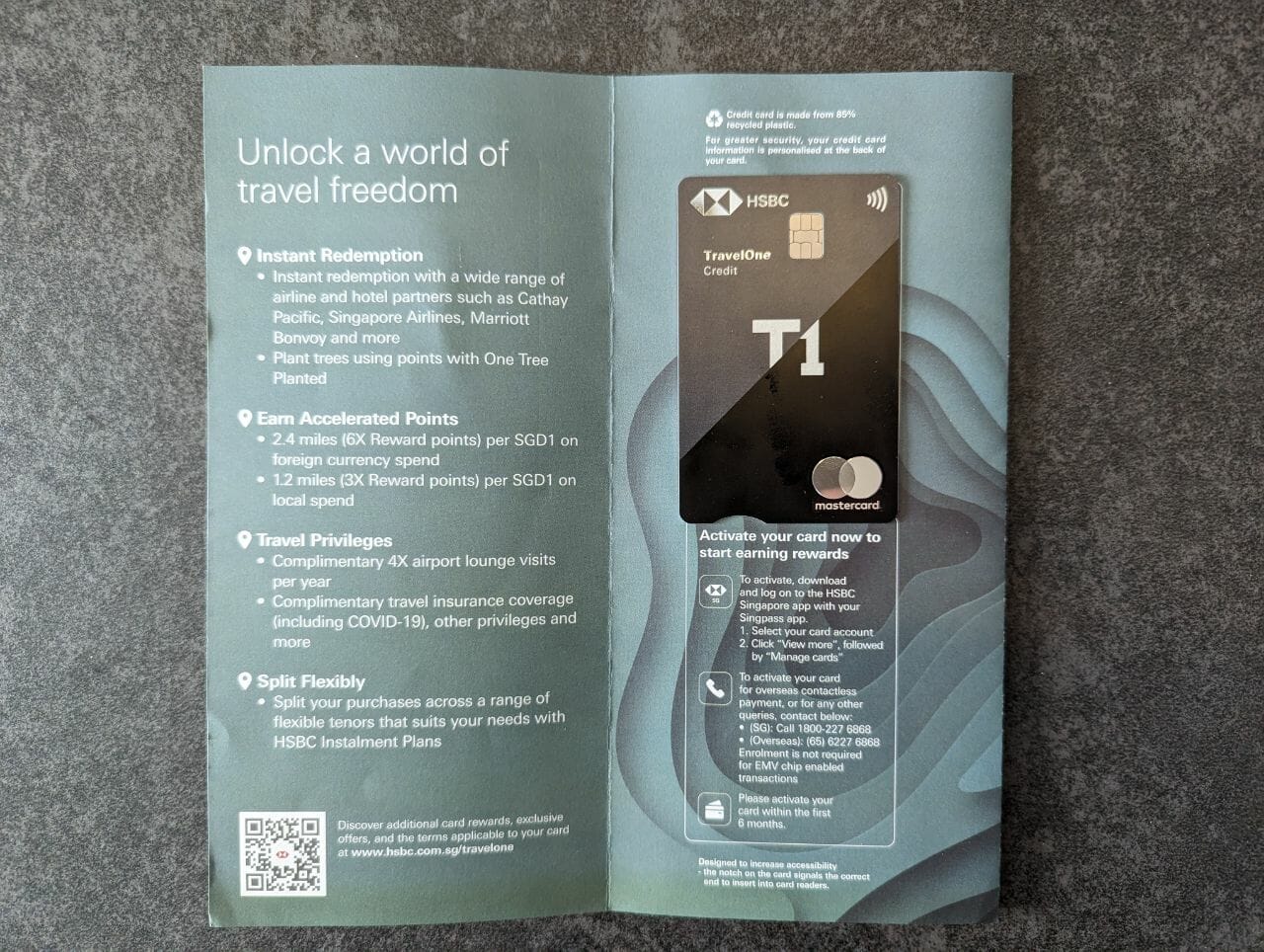

First Impressions: HSBC TravelOne Credit Card

HSBC just announced their latest travel credit card offering, the HSBC TravelOne (T1) Credit Card.

This is probably one of the most exciting credit card launches in Singapore in recent years. There haven’t been many revolutions or improvements, even with the recent lacklustre launch of the DBS Vantage Card.

As such, when HSBC suddenly released their much-awaited travel card, many travellers (including us!) in Singapore were really excited about it.

This post is my first impression of the HSBC TravelOne Credit Card .

Sign up bonus

This bonus applies to new-to-bank customers only! To be eligible for the promotion, you’ll need to activate and spend S$500 and pay the annual fee of S$196.20.

Miles Earn Rates

The HSBC TravelOne Card has a fairly standard travel credit card earning rate. It is comparable to other general spend cards in the market such as the DBS Altitude Card and the Citi Premiermiles Card.

Free Lounge Access

As a travel credit card, the HSBC TravelOne Credit Card provides complimentary lounge access via the DragonPass lounge membership (also known as the Mastercard Travel Pass).

The 4 yearly complimentary limit is much better than many of its counterparts. However, this limit only applies to the primary cardholder. Supplementary cardholders and guests have to purchase their lounge access through the mobile app.

The membership provided is DragonPass instead of the typical Priority Pass provided by other cards. The downside of this is that there are fewer lounges in the network.

In Singapore’s Changi Airport, you can access almost every lounge that Priority Pass members have access to. In addition, you can also access the Plaza Premium Lounge in Terminal 1 which is one of our favourite lounges in the terminal.

Instant Points Transfers

Perhaps the biggest selling point of the HSBC TravelOne Card is its ability to instantly transfer points to its various transfer partners. HSBC promises that points transfers will go through instantly or latest within 1 business day.

This can come in very useful whenever people are booking high in demand seats. Although I don’t think by itself, this perk is applicable to people most of the time.

Huge Range of Transfer Partners

Another big selling point of the HSBC TravelOne Credit Card is its huge number of transfer partners.

There is a lot of value in having a lot of travel transfer partners to choose from. The value of each mile in different loyalty programs varies widely. Different loyalty programs have different award availabilities, and sometimes you can get only book certain redemptions on one program and not on another.

For travellers who prefer luxury hotels to business class flights, the HSBC TravelOne also provides 3 hotel partners which is unheard of in Singapore.

From the initial list of partners, there aren’t any that stand out in particular in terms of great value. Hotel redemptions are also usually of lower value than flight redemptions. However, we remain hopeful while the list of partners expands as promised by HSBC.

Requirements

The HSBC TravelOne credit card has a typical “entry-level” credit card requirement.

For Singaporeans , a minimum of S$30,000 annual income. For foreigners or permanent residents, a minimum of S$40,000 annual income.

Our Thoughts

The HSBC TravelOne Credit Card is certainly an interesting new addition to the travel hacking space in Singapore. Its headline features are very intriguing and the benefits can really only be verified after using the card for a while.

However, I wouldn’t be using the card, in general, to earn miles as it doesn’t have the highest earning rates. For that, I’ll be using my trusty HSBC Revolution Card or the Citi Rewards Card .

Overall, I think that this is a good sign for what’s to come from both HSBC and the other banks!

- Telegram icon Telegram

- Facebook icon Facebook

- Pinterest icon Pinterest

Filed under

- Credit Cards 26

- credit-cards

- travel-hacking

Related posts

HSBC Revolution will have 21 Transfer Partners and Points Pooling

Citi Rewards Great Sign-Up Bonus for February 2024

Amazing HSBC Credit Card Sign Up Offers

There are 4 comments.

can the annual fee be waived on first year?

Yes, you can request to have the annual fee waived. However, in that case you won’t be able to get the welcome bonus of 20,000 miles.

You wrote 4 lounge visits are also applicable guest but it’s only for cardholders.

Also, how does this compare with DBS Altitude? If I value different airlines I should definitely take the HSBC card, correct? And assuming we don’t need to guest any visits to the lounge. (Also ignoring the points expiry because we always use it before 3 years is up since miles devaluation can happen anytime)

Thank you for catching it! Yes, the 4 lounge visits by HSBC TravelOne are only applicable to primary cardholders.

I would say it really depends when comparing the DBS Altitude Card. Since DBS points can be pooled, and if you have the DBS Woman’s World Card, you can actually rack up points pretty fast and redeem them in 1 go.

The HSBC Card only has free redemptions until the end of 2023. If you do not spend a lot of money, earning just 1.2/2.4 mpd might not be fast enough to redeem anything meaningful.

Personally, I would still go for the DBS Altitude Card given that I have the WWMC.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Username or Email Address

Remember Me

Our website doesn't support your browser so please upgrade.

Premier Mastercard

Online credit card applications temporarily unavailable

While we update our credit card application process, you won’t be able to apply online. You can still apply for new cards on the phone via your Relationship Manager. We're unable to accept applications for supplementary cards online or over the phone.

If you have any generic queries you can also call us on +44 1534 616 313 .

Enjoy a world of benefits and rewards

The Premier Mastercard gives you access to a world of travel benefits and privileges – including worldwide assistance, Priority Pass airport lounge access, and rewards when you spend. And all for no annual fee.

Representative example

Representative 18.9% APR

Purchase rate 18.9% pa

Based on an assumed credit limit of GBP 1,200

Why choose a Premier Mastercard?

0% interest introductory offer

Get 0% interest on purchases for 9 months and 0% interest on balance transfers for 18 months.[@balancetransfer]

Exclusive offers

Enjoy travel benefits and earn rewards.

No annual fee

All the benefits you'd expect with no annual fee.

Premier Rewards Programme

Earn points when you spend to redeem on shopping or travel. T&Cs apply .

- Earn 1 point for every GBP 1 spent in sterling in the UK, offshore and overseas, and earn 2 points for every GBP 1 you spend in eligible non-sterling currency.[@sterlingtransactions]

- How you redeem your points is up to you, choose from a range of rewards including shopping vouchers for stores like Amazon and Boots, or even donating your points to charity

- Every 2 points are worth the equivalent of 1 Frequent Flyer Mile. Simply redeem with our selected partner airlines and you could be jetting off to your favourite destination. T&Cs apply

- View our Premier Credit Card Rewards programme View our Premier Credit Card Rewards programme This link will open in a new window

Travel benefits

Access discounts on hotels and Priority Pass airport lounge access.

- 10% discount on selected hotels booked with your card through Expedia

- 12 months complimentary Expedia+ Gold membership

- 10% discount on over 180,000 hotels booked with your card through Agoda

- Access to over 750 airport lounges worldwide with Priority Pass

Online account management

Suit yourself with round-the-clock online or phone access.

- Manage your account day to day - check real-time statements, report a lost or stolen card or block it temporarily, activate cards, make payments

- Redeem Premier Points

- Register and add your card to Global View to see your global HSBC accounts in one place

- Register for online banking

Your Premier Mastercard also comes with

- Contactless Pay for items worth GBP 100 or less with a single tap.

- Additional free cardholder Get an additional card for free.

- Up to 56 days interest-free Get up to 56 days interest-free on purchases when you pay your balance in full on time.

- Withdraw up to GBP 1,000 cash per day Take out up to GBP 1,000 for a fee of 2.99%[@cashwithdrawal]

Things to know

Who can apply.

You can apply for a Premier Credit Card if you're:

- an HSBC Expat Premier customer

- aged 18 or over

All credit applications are subject to status, our lending criteria and an assessment of the circumstances of the applicant.

Minimum credit limit GBP 500. Maximum credit limit subject to status.

Important documents

- Premier Credit Card Terms & Conditions (PDF) Premier Credit Card Terms & Conditions (PDF) Download

Ready to apply?

Already with expat.

Contact your Relationship Manager directly or call us on +44 1534 616 313 to schedule an appointment with your Relationship Manager.

New to Expat?

You can apply for a Premier Credit Card once you've opened an Expat Bank Account with us.

You might be interested in

Premier world elite mastercard.

A Premier credit card with rewards at home and abroad.

HSBC Credit Card

The HSBC Credit Card is a GBP card accepted at over 24 million locations around the world.

Additional information

Disclaimer .

Credit cards are provided by HSBC Bank plc, which is authorised by the Prudential Regulatory Authority and regulated by Financial Conduct Authority and the Prudential Regulatory Authority. HSBC Bank plc, Card Services, PO Box 6001, Coventry, CV3 9FP, United Kingdom.

Connect with us

Our website doesn't support your browser so please upgrade .

Premier World Elite Mastercard

Designed for the dedicated traveller - exclusive to existing hsbc premier (including retained jade benefits) and private banking account customers, representative example.

Purchase rate 18.9% p.a. (variable)

Representative 59.3% APR (variable)

Based on an assumed credit limit of £1,200

With an annual fee of £195

Key benefits

Welcome reward points

Receive 40,000 reward points when you spend 1 £2,000 on your card in the first 90 days of card membership.

Anniversary reward points

Spend £12,000 or more on your card within your first 12 months of membership to receive a further 40,000 reward points at the anniversary 2 of card membership.

Earn rewards on purchases

For every £1 of eligible spend 1 you’ll earn 2 reward points if it’s in sterling 3 , or 4 reward points if it’s in another currency 4 (fees apply to non-sterling transactions).

Your Premier World Elite Mastercard also comes with

- Airport lounge access Get access to more than 1,300 airport lounges worldwide with Priority Pass . Just show your Premier World Elite Mastercard at the lounge door.

- Mastercard Priceless Access unforgettable experiences and everyday value in the cities where you live and travel with Mastercard Priceless .

- Use your credit card abroad You can use your HSBC credit card in all countries and regions supported by the Visa and Mastercard networks. Fees apply , and non-HSBC cash machines may also charge a fee.

- Additional cardholders Get additional cards for up to 3 members of your family, or friends. Fees apply (refunded for Private Banking Account customers).

- Additional cardholder information Additional cardholder information Opens in overlay

- Enjoy 24/7 worldwide assistance Help is at hand if your card is lost or stolen. Call our dedicated support team about getting an emergency cash advance.

- Purchase protection Section 75 protects credit card purchases of £100 to £30,000 if the supplier breaches a contract, or misrepresents goods.

- No-fuss card management Use online banking or the HSBC Mobile Banking app to check your balance, make payments, freeze your card, and stay in control.

- Go digital All HSBC credit cards are contactless and can be used with a digital wallet . For immediate access to spending, you can add your card to Apple Pay or Google Pay directly from the HSBC UK Mobile Banking app before your new card arrives.

Things to know

Who can apply.

You can apply for a Premier World Elite Mastercard if you:

- are over 18

- are a UK resident

- hold an HSBC Premier Account

Important documents

- Summary Box (PDF, 144KB) Summary Box (PDF, 144KB) Download

- Privacy Notice (PDF, 638KB) Privacy Notice (PDF, 638KB) Download

- Standards of Lending Practice (PDF, 1.12MB) Standards of Lending Practice (PDF, 1.12MB) Download

- Premier World Elite Mastercard Terms & Conditions (PDF, 234KB) Premier World Elite Mastercard Terms & Conditions (PDF, 234KB) Download

- Reward Programme Rules (PDF, 261KB) Reward Programme Rules (PDF, 261KB) Download

Ready to apply for a Premier World Elite Mastercard?

Existing customers.

On your mobile device? If you've downloaded our app and have an HSBC Premier account, you can apply now by selecting 'Apply in app'.

If you're on a desktop, scan the QR code with your mobile device.

More ways to apply

Apply in browser .

If you have an HSBC Premier account and you're registered for online banking, you can start your application right away. You'll be able to see your pre-filled application form, submit it, and get an instant decision.

- Register for online banking

Apply in branch

t’s usually easiest to apply through the app or online banking, but if you need support you can visit one of our branches and we’ll help you with your application.

Please bring your mobile phone with you (or a similar device, like a tablet) if you have one.

- Find your nearest branch

New to the UK?

We may be able to access your international credit history in selected countries to help you apply for an HSBC UK credit card.

- Find out about credit cards for international customers

Frequently asked questions

What is a world elite mastercard .

The Premier World Elite Mastercard is our most sophisticated card, offering double reward points and enhanced travel benefits.

How do reward points work on a World Elite Mastercard?

You can redeem these reward points for retail e-vouchers, airline miles and fine wines. You'll also earn welcome and anniversary points with the Premier World Elite Mastercard.

Does a World Elite Mastercard have airport lounge access?

The HSBC Premier World Elite Mastercard allows you unlimited access to more than 1,300 airport lounges worldwide with membership of the Priority Pass programme.

You might also be interested in

Not the right card for you.

Discover our range of credit cards and find the one that matches your needs.

Reward points

Find out how your rewards credit card can pay you back.

Credit card rewards explained

Get to know what a reward credit card can offer you, and how much it could cost you to use one.

How to avoid credit card charges

Get to know the different types of credit card charges and how you can reduce the amount you pay.

Standards of Lending Practice

HSBC adheres to the standards of lending practice guidelines.

Additional information

1. Eligible spend excludes cash advances, fees, balance transfers, cheques, refunds, interest or any other charges.

2. To get these anniversary bonus points on your Premier World Elite Mastercard, you need to make £12,000+ worth of eligible spending over 12 months from the date you opened your account.

3. Sterling currency includes transactions made in the UK, Jersey, Guernsey and Isle of Man as well as transactions overseas where you choose to pay in sterling rather than local currency.

4. These transactions are subject to a non-sterling transaction fee, currently 2.99% of the amount of the transaction.

Balances can’t be transferred from all cards, for example those issued by members of HSBC Group, including HSBC UK, first direct and M&S Bank.

If you have an HSBC UK credit card, you’re eligible to apply for another if you haven’t applied for an HSBC credit card within the past 6 months, and the card isn’t the one you currently have.

Please note, if you currently hold a Student or Premier World Elite Credit Card with us, you will not be eligible for this card.

Customer support

Important notice

To comply with BSP Circular 1160, we have updated the terms and conditions for our cards, personal loan, home loan, and AssetLink products. Please refer to the updated terms and conditions .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

HSBC Premier Mastercard® benefits

At HSBC Premier, we continue to focus on the most important economy in the world. Yours. That’s why we would like you to enrich your traveling experience by making your HSBC Premier Mastercard Credit Card your travel partner.

We would like to Introduce to you these exclusive travel benefits you get to enjoy as an HSBC Premier Mastercard Credit Cardholder:

Mastercard Travel Pass

Enjoy access to more than 1,300 airport lounges worldwide through its app, a first-of-its kind digital solution for a seamless airport experience. This is an opt-in benefit for our HSBC Premier Mastercard cardholders.

- Access to over 1,300 airport lounges worldwide

- Lounge access fee of USD 32 per person, per visit, which will be chargeable to your card

- Easy access with a seamless Mastercard Travel Pass mobile app with QR code that you can present to access the lounge

How To Access Your Benefits

- Download the “Mastercard Travel Pass” app from “Google Play” or “App Store”.

- Register your Premier Mastercard Credit Card

- To access participating lounges, find lounges near you through the Mastercard Travel Pass Mobile App

- Generate and present the app QR code or membership number to the lounge receptionist to access the lounge

- Aside from participating lounges, you can also view exclusive offers from top airport dining and spa merchants

- Terms and Conditions Terms and Conditions for LoungeKey.

Connect with us

HSBC: How do I use the $100 HSBC Annual Travel Credit?

Following the acquisition of HSBC Bank by RBC , the HSBC World Elite ® Mastercard ® has now been discontinued since October 2023. For another great card with no conversion fees , consider the Scotiabank Passport™ Visa Infinite* Card.

$100 Annual Travel Enhancement Credit

With the HSBC World Elite MD Mastercard MD , you benefit from an annual $100 Travel Privilege credit . You must wait until the eligible travel expense has been charged to your account before you can use it, 60 days after the date of purchase.

You can use this travel credit for any purchase related to an airline ticket upgrade, baggage fees, seat selection or airport lounge admission. Some travel agencies may also qualify (such as Expedia ).

This credit must be used between the card purchase date and the annual renewal date (this credit is based on the anniversary date of your card account, not on the calendar year). If it is not used, it is lost.

You get this Travel-Privilege credit when subscribing to the HSBC World Elite ® Mastercard ® . This is in addition to the card’s other benefits, including the welcome bonus .

Access the HSBC Rewards portal

To use the Travel Privilège credit on your HSBC World Elite ® Mastercard ® , you must log in to your HSBC online account.

Then click on the link for your HSBC credit card. Another way is to go directly to the HSBC Rewards portal at this address .

Then click on ” View more details “.

When the details drop-down menu opens, click on ” Reward Points “. A page will open and you will be directed to the HSBC Rewards portal. Please make sure that your browser does not block this new window.

Choose the expense to apply the travel credit

Once on the HSBC Rewards portal, select “Travel Enhancement Credit ” from the” Travel ” menu. Alternatively, you can click on this link to go to this page.

Then all you have to do is check off the eligible expense( s) such as this Easyjet ticket upgrade. Then indicate the amount you would like to use.

This can be useful if you have several small fees (such as baggage fees, seat selection or airport lounge admissions).

Then click on “Add to shopping cart.”

Then, once in your cart, you will have to confirm once by clicking on “Proceed to checkout” .

Then a second time by entering your email address and clicking on “Redeem” .

The travel credit will then appear directly on your credit card account within 48 hours.

Note that travel expenses, such as with Expedia can also be accepted. Convenient for 100% cancelable hotel reservations .

Bottom Line

The HSBC World Elite ® Mastercard ® had an annual fee of $149. Using this $100 Annual Travel Privilège credit each year, you virtually lower your annual fee to $49 . What’s unique about a credit card :

- Mastercard World Elite (with insurance and accepted everywhere)

- No foreign currency conversion fees

- Earning 6 points per dollar on all travel purchases

- Earning 4 points per dollar for grocery, gas and drugstore purchases

- Earning 2 points per dollar on all purchases (including Costco)

And with reward points you can use on any travel purchase .

The HSBC World Elite MD Mastercard MD will be converted to an RBC credit card by the end of March 2024. Use your travel credit as soon as you can!

All posts by Audrey

Suggested Reading

Our website doesn't support your browser so please upgrade .

Advance Credit Card

We're ending the complimentary valet parking benefit with effect from 31 March 2024. Until then, you’ll be able to enjoy 2 valet parking visits a month when you spend at least AED 3,000 a month.

Earn rewards every time you spend

With the HSBC Advance Credit Card, you’re never far from a reward. Collect Air Miles every time you spend and get a host of travel, lifestyle and dining benefits. Just for Advance customers.

To apply, you'll need to have an Advance Account.

Cash withdrawals and purchases

44.28% APR (fixed)[@aproverduepayments]

Have AED 600 cashback on us

Get AED 600 cashback when you apply for this card by 30 April 2024 and spend AED 5,000 within the first 60 days.

Why get an Advance Credit Card?

Earn Air Miles on all your spends

Spend anytime, anywhere and earn 1 Air Mile for every AED 1 you spend on your credit card.

Purchase protection

Shop confidently knowing your purchases are protected for up to 90 days in case of theft or damage, and covered for up to USD 5,000 a year (up to 2,000 per claim)[@purchaseprotectionadvance].

Interest free days

Enjoy no interest on purchases for up to 56 days when you pay your monthly balance in full.

Careem Plus

Get a complimentary 12-month Careem Plus subscription . Simply add and use your HSBC credit card on the Careem app.

Discover more Advance features

Enjoy more of the things you love.

A range of rewards on shopping, eating out and more, worldwide.

- Enjoy thousands of offers and access to top lifestyle and entertainment venues with the HSBC ENTERTAINER app.

- Get discounts at over 400 restaurants across the UAE when you pay with your credit card.

- Get deals on shopping, travel, dining and more worldwide with home&Away .

- Buy 1 Get 1 Free movie tickets every month, plus 20% off food and drink at cinemas across the UAE .

- Get a free 2-year MyUS membership for up to 30% off international shipping.

- VIP lounge access, 15% off shopping and more at Bicester Villages worldwide. Read terms .

Travel the world for less

Book flights and hotels with your credit card to enjoy discounts all year round.

- Get 8% off on roundtrips, flights or hotels with Cleartrip . Enter code ‘MCPLATINUM’ when you pay.

- Earn 10% money back when you book your next Booking.com stay on your credit card. Learn more .

- Enjoy 15% off at over 5,500 IHG hotels worldwide, with free late checkout and the best available rates.

Complimentary airport lounge access

Enjoy unlimited complimentary access to selected airport lounges worldwide with the Mastercard Travel Pass app. You can add guests for USD 32 each.

- Download the Mastercard Travel Pass app and register your HSBC credit card

- See the lounges near you, and whether they offer complimentary access

- Once you choose a lounge, book your visit to generate a QR code

- Present the app QR code or your membership number to access the lounge

- Find out more about Mastercard's Travel Pass Find out more about Mastercard's Travel Pass This link will open in a new window

Your Advance card also comes with

- Save on Avis car rentals Get 20% off your next car rental with Avis and a complimentary upgrade with every rental, worldwide.

- Save on Budget truck and car rentals Save up to 10% on your next car or truck rental with Budget in over 3,350 locations worldwide.

- Digital cards Add your HSBC UAE cards to your digital wallet for instant contactless purchases. You don't even need to wait for them to be delivered - just access your card details in the HSBC UAE app.

Things to know

Who can apply.

You can apply for an Advance Credit Card if you:

- have an Advance Account

- are aged between 21 and 65

- live in the UAE

Documents you'll need

All proofs of ID, including your:

- Emirates ID

- residence visa if you're a non-GCC national

Proof you're a UAE resident. Choose one of the following:

- a tenancy agreement or EJARI

- title deeds if you’re a homeowner

- a utility bill no more than 2 months old

All proofs of income, including:

- the last 2 bank statements from the account your salary is paid into, or 2 salary credits into your HSBC account

- a salary certificate from your employer issued in the last month

If you're applying for an additional card, you'll also need to provide the passport and Emirates ID information for the additional cardholder.

Once you've been accepted, we'll also ask for a security cheque in the value of 120% of your credit facility.

Additional cardholders

Extra cardholders will usually enjoy the same benefits as you. We'll let you know when that's not the case.

Important documents

- Schedule of Services and Tariffs Schedule of Services and Tariffs Download link

- Credit Card Agreement Terms Credit Card Agreement Terms Download link

- Air Miles Terms and Conditions Air Miles Terms and Conditions Download link

- Balance Transfer Terms and Conditions Balance Transfer Terms and Conditions Download link

- Cash Instalment Terms and Conditions Cash Instalment Terms and Conditions Download link

- Key Facts Statement Credit Cards Key Facts Statement Credit Cards Download link

- Flexi Instalment Terms and Conditions

If you do not meet the repayments/payments on your loan/financing, your account will go into arrears. This may affect your credit rating, which may limit your ability to access financing in the future.

Get started

New to hsbc.

Check your eligibility online and get an approval in principle in just 5 minutes.

Once we've approved your application, your card could be with you within 24 hours.

Already an HSBC customer?

Apply for your card in minutes in the HSBC UAE app. Just open the app, scroll to 'Products & services', then select 'Apply for credit card'.

Other ways to apply

Apply via callback

Request a callback and a member of our team will help you to apply for your card.

We'll get back to you during working hours, Monday to Friday, 09:00 to 16:30. If you contact us outside these times, we aim to get back to you on the next working day. We may record calls to help improve our service to you.

- Get a callback Get a callback This link will open in new window This link will open in a new window

Frequently asked questions

How do i pay my credit card .

You can pay your credit card at an HSBC branch or ATM:

- online with HSBC or another bank

- with mobile or phone banking if you have an account with us

Are there payment plans available?

Yes, you can pay your credit card using a Flexi instalment or cash instalment plan.

A Flexi instalment plan lets you convert big purchases you make with your credit card into smaller monthly payments. This option offers:

- low interest rates

- no processing or early repayment fees

- the option to spread costs over 3 to 36 months

Apply for a plan on every eligible purchase in the HSBC UAE app.

A cash instalment plan lets you access cash up to your credit limit. You can apply online or by phone for competitive rates, with no need for proof of income.

You can also transfer balances from other credit cards in the UAE to your HSBC Credit Card and:

- save on interest

- enjoy competitive pricing

- get control of your finances by consolidating and repaying your balances more easily

You can apply in online banking, by calling us or by using the instructions we send you. We'll call you within 2 working days.

A Balance Transfer fee applies. Pleese refer to the Schedule of Services and Tariffs for more details.

You might also be interested in

Discover more about our Air Miles rewards on selected credit cards. Earn and exchange them for flights, hotels, shopping and even airline loyalty programmes.

Zero Credit Card

A simple credit card with zero fees and plenty of rewards.

Premier Credit Card

Unlock premium rewards and travel benefits.

Additional information

Connect with us.

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

HSBC TravelOne Credit Card: The missing manual

My tips for hitting the sign-up bonus and earning extra cashback, plus how to register for lounge access, avoid orphan miles, track your points and more.

The HSBC TravelOne Credit Card has just passed the one month mark, and while I’ve already shared some detailed thoughts on the product, there’s a few things well worth reiterating.

HSBC now offers 12 airline and hotel transfer partners , the widest variety among any bank in Singapore, and they’re just getting started. The target is to have more than 20 by the end of 2023.

And even though most of these partners are currently TravelOne exclusives, the HSBC team has confirmed that points pooling is coming, which means that HSBC Visa Infinite and HSBC Revolution credit cardholders can soon join in the fun too.

Throw in instant conversions with no fees (till 31 December 2023), plus transfer blocks of just 2 miles after the first 10,000 mile block, and that was reason enough for me to hop onboard.

I applied for a HSBC TravelOne Credit Card on 12 May, one day after launch, and received approval on 18 May. The physical card arrived one day later, and I’ve been putting it through the paces over the past month.

Here’s a few pointers I hope you find useful for getting the most out of your card.

Secure your 20,000 miles welcome offer

One of the first things to do upon getting your HSBC TravelOne Credit Card is to figure out how you’re going to clock the minimum spend required for the 20,000 miles welcome offer.

This is valid for cardholders who:

- Apply by 31 August 2023

- Pay the annual fee of S$194.40

- Spend at least S$800 during the qualifying spend period (see below)

- Opt-in for marketing communications during the sign-up process

The offer is valid for both new and existing HSBC credit cardholders, which means that holding other HSBC credit cards does not disqualify you from participating.

The qualifying spending period is as follows:

Therefore, my advice would be to apply at the start of the month, in order to give yourself the most time to meet the S$800 minimum spend threshold. You’ll have anywhere from 1-2 months to do this, depending on approval date.

Now, given that the HSBC TravelOne Credit Card earns a flat rate of 1.2/2.4 miles per dollar (mpd) on local/overseas spend, it’s inevitable that there’ll be some opportunity cost in your spending (compared to using a 4 mpd card). That said, there are certain transactions which are more “worthwhile” to make, because you enjoy additional benefits on top of the miles.

(1) Buy airline tickets (or pay for taxes/surcharges on awards)

HSBC TravelOne credit cardholders receive complimentary travel insurance when they:

- Use their TravelOne Credit Card to purchase air tickets, or

- Use their TravelOne Credit Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This includes coverage of up to US$100,000 for both the cardholder and their family. COVID-19 related medical treatment and trip cancellation is also provided for.

(2) Book HSBC WOW Weekend deals

HSBC WOW Weekends offer a range of 1-for-1 dining offers, discounted staycations, savings on attraction tickets and other retail perks.

Some examples of past and current deals include:

- S$120 off Cathay Pacific tickets, with a minimum spend of S$1,000

- S$50 off 15 Stamford by Alvin Leung, with a minimum spend of S$100 nett

- 20% off Agoda hotel bookings (capped at S$200 per booking)

- 50% off Singapore Zoo/Night Safari/River Wonders park admission tickets

Some deals are in limited quantity, so be sure to monitor the WOW Weekend page and act quickly when you see something you like.

All these deals must be booked with a HSBC credit card, so you could kill two birds with one stone by spending on the HSBC TravelOne Credit Card.

(3) ENTERTAINER with HSBC app redemptions

HSBC TravelOne Credit Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

Just like WOW Weekend, all deals must be paid for with a HSBC credit card, so this is another opportunity to clock that minimum spend while also enjoying additional savings.

Set up an HSBC Everyday Global Account (EGA) for bonus rewards

HSBC TravelOne credit cardholders can earn an additional 1% cashback on all eligible transactions when they open an HSBC Everyday Global Account (EGA) and meet the qualifying criteria for the Everyday+ Rewards programme.

This involves:

- HSBC Personal Banking: S$2,000

- HSBC Premier: S$5,000

- Performing at least five eligible transactions of any amount each calendar month on their card

Eligible transactions simply refer to anything not on the exclusions list (Point 3 of T&Cs ), such as GrabPay top-ups, government transactions, insurance premiums, utilities bills. All other retail spend (e.g. dining, groceries, clothing and apparel) is fair game.

Cardholders who meet the eligibility criteria will earn 1% cashback, capped at S$300 per month for HSBC Personal Banking and S$500 per month for HSBC Premier.

This means your effective return for spending will be:

- Local Spend: 1.2 mpd + 1 % cashback

- Overseas Spend: 2.4 mpd + 1% cashback

All this requires is a one-time setup of the EGA, plus a recurring instruction to transfer the minimum fresh funds every month.

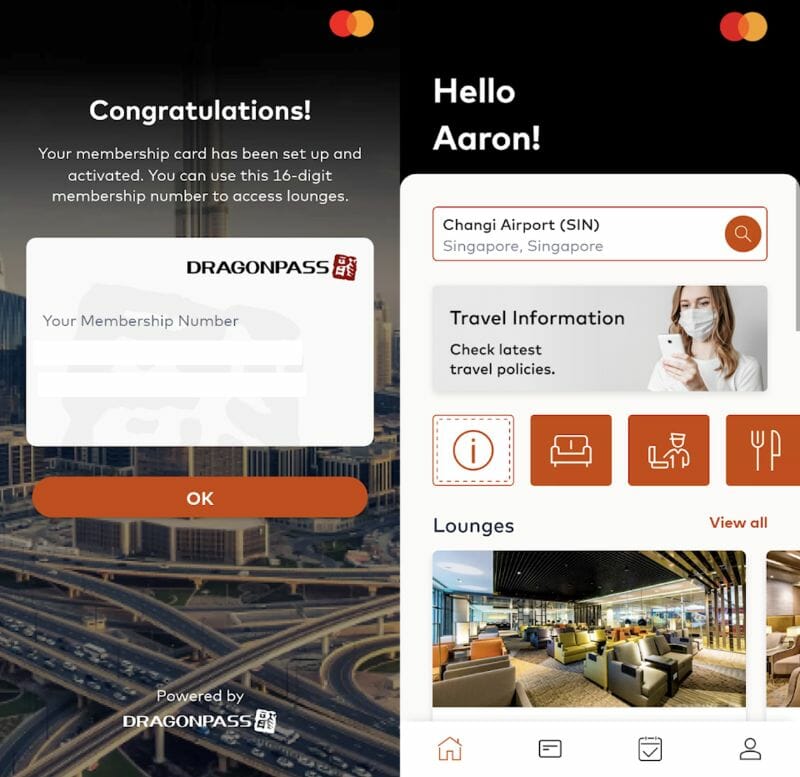

Register for DragonPass lounge visits

Principal HSBC TravelOne credit cardholders enjoy four complimentary lounge visits per year, provided via Mastercard Travel Pass by DragonPass.

Allowances are awarded by calendar year , which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in June 2023, you will be awarded:

- On date of approval: 4 visits (expires 31 December 2023)

- On 1 January 2024: 4 visits (expires 31 December 2024)

Allowances cannot be rolled over, so be sure to fully utilise your visits by the end of the calendar year.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app ( Android | iOS )

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Credit Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

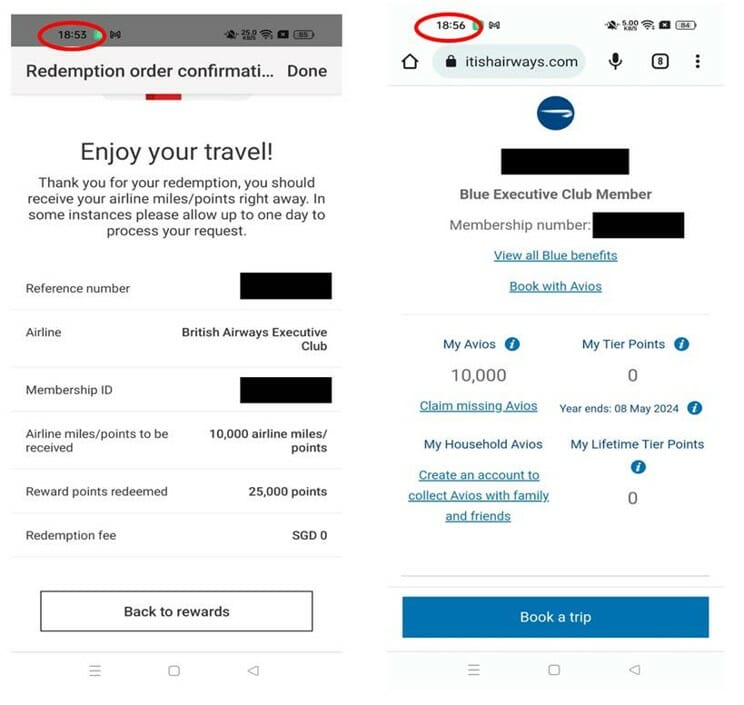

Enjoy instant conversions

HSBC TravelOne Credit Cardholders can transfer their points to 12 different airline and hotel partners, with free conversions until 31 December 2023.

While HSBC advertises “instant reward redemption”, there’s been some concern because the footnotes on the website say “instantly or within one business day”. Obviously, the two aren’t one and the same, and could be all the difference between snapping up that last pair of award seats or narrowly missing out.

Some good news: I can confirm that, barring any technical issues, transfers are instant for all partners except Accor Live Limitless (which take up to five business days).

Here’s an example showing an instant transfer from TravelOne to British Airways Executive Club.

On a separate note, there’s another crucial detail that may have been overlooked initially: While HSBC has a minimum conversion block of 25,000 points (10,000 miles) , the subsequent intervals are a mere 5 points (2 miles).

This is confirmed in the FAQs:

For example, you could convert 25,005 points to 10,002 air miles, or 43,010 points to 17,204 air miles. More granular control means fewer orphan points, both on the bank and airline side.

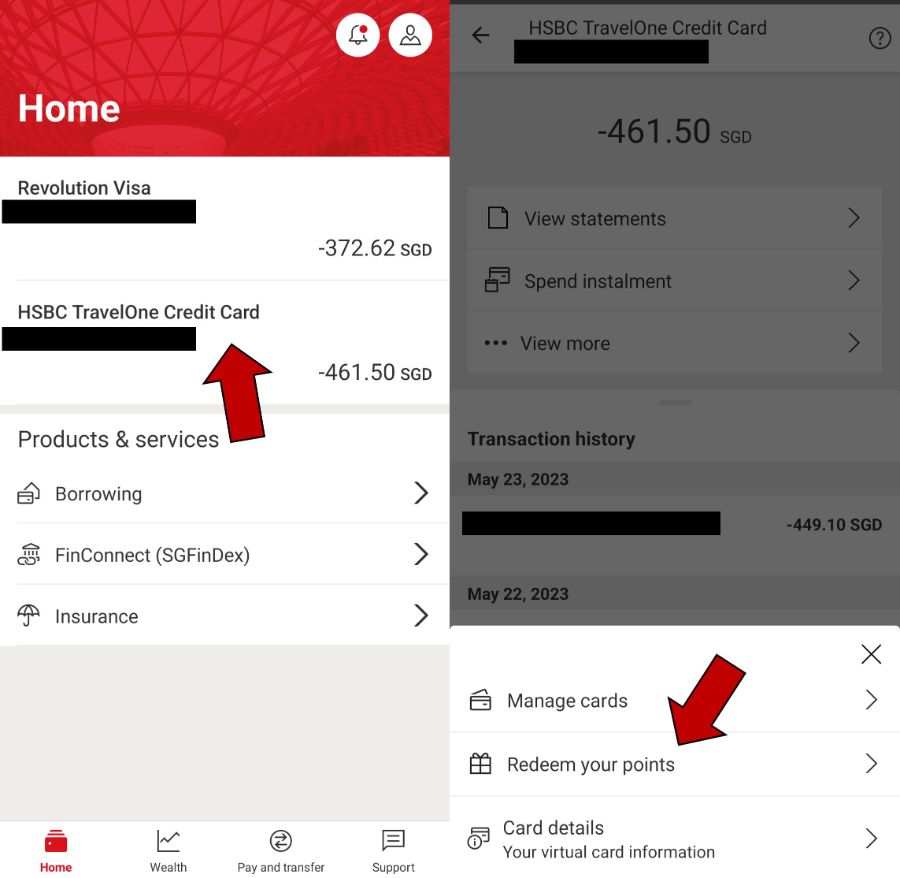

Monitor your points with transaction-level breakdowns

I’ve previously written about how regularly checking your points balance is part of good miles game hygiene, but depending on your bank, it can either be straightforward or a right pain.

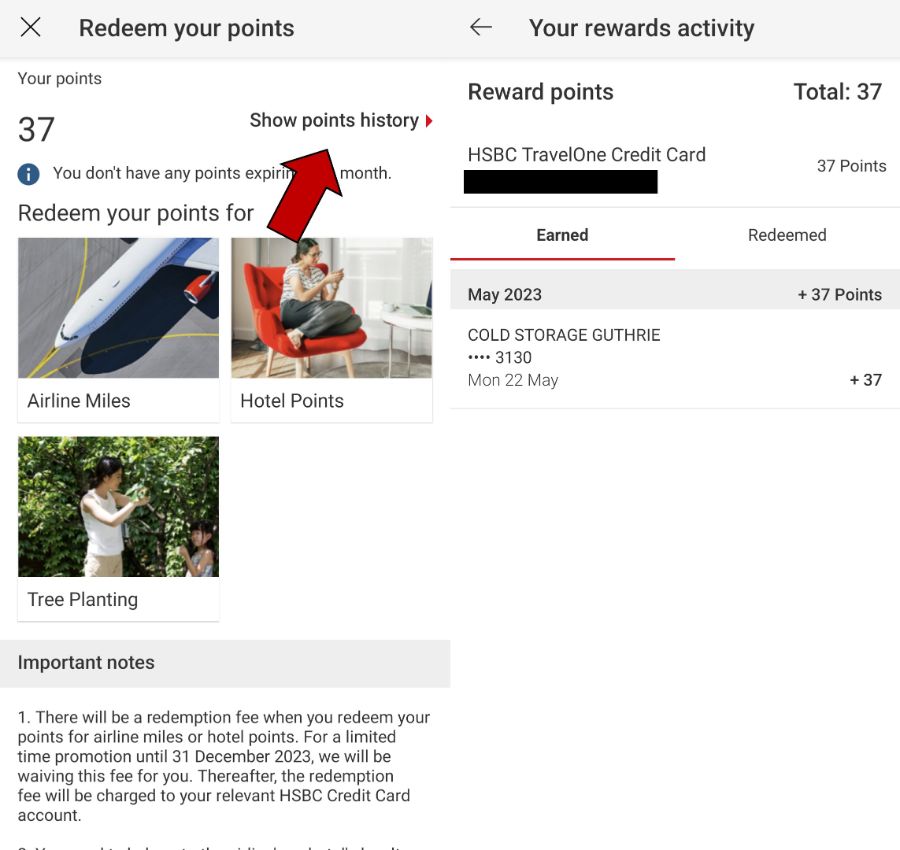

HSBC previously only displayed total points balances, but with the launch of the TravelOne Card they’re now providing transaction-level points breakdowns.

To view this, login to the HSBC mobile app and tap on your HSBC TravelOne Credit Card > View More > Redeem Your Points

On the next screen, tap ‘Show points history’, and you’ll see a breakdown of points earned per transaction.

Points breakdowns are arguably not as essential for general spending cards, since you already know that all transactions will earn points at a fixed rate (unless they fall into the list of exclusions). Still, it’s nice to be able to track your points at this level, if only for reconciliation purposes.

The HSBC TravelOne Credit Card offers a wide range of transfer partners, complimentary travel insurance and lounge access, as well as instant conversions with no fees till 31 December 2023.

More exciting developments are on the horizon, as HSBC adds additional airline and hotel loyalty programmes, introduces points pooling, and makes features like transaction-level points breakdowns available to other HSBC credit cardholders.

There’s no point beating around the bush here: as a general spending card, the TravelOne will never offer the same kind of earn rates you could get with specialised spending alternatives. But the key here is knowing how best to integrate the TravelOne into an overall miles collection strategy, leveraging transfer partner variety and instant conversions while still enjoying the category bonuses offered by specialised spending cards like the Revolution. Think of it like adding another tool to your Swiss Army knife, as it were.

If you’re interested in signing up, be sure to do so by 31 August 2023 to enjoy the welcome offer of 20,000 miles.

- credit cards

Similar Articles

Hsbc offering full refund of mileage programme annual fee, citi payall offer: 2 mpd on tax payments, 1.6 mpd on non-tax payments.

Got your bonus points yet? Still waiting for mine…

Hi there, would like to know if I apply the card back in Jun, will I still be able to enjoy Dragonpass for 2024 if I cancel it in 2023?

Hi Aaron, this is a great article! Quick questions for the EGA cashback eligibility, referring to HSBC EGA T&C art 5a (i), ( https://www.hsbc.com.sg/content/dam/hsbc/sg/documents/accounts/everyday-global/terms-and-conditions-governing-everydayrewards-programme.pdf )

Eligible Customers shall receive a cashback of 1% of the spend amount for successful posted: (i) transactions (excluding Excluded Transactions) in SGD made with a HSBC personal Credit Card

From above T&C, it seems only transactions in SGD are eligible for 1% cashback, not the FCY transactions. Kindly advise. Thank you!

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Which Credit Cards Have Priority Pass Restaurant Access?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Priority Pass partners with dozens of restaurants in airports around the world. At these partner restaurants, eligible Priority Pass Select members get a $28 credit toward food and beverage purchases per guest.

However, just because your travel rewards credit card offers a Priority Pass Select membership doesn't mean that you'll be able to get a free or discounted airport meal before or after your flight. That's because some credit card issuers have removed Priority Pass restaurants from their Priority Pass lounge benefit.

For those of us who appreciate a real meal before a flight — instead of just snacks from a lounge — let's focus on credit cards with Priority Pass restaurant benefits.

» Learn more: The best travel credit cards right now

An overview of credit cards with Priority Pass restaurant benefits

Before we get into details below, here's an overview of the most popular travel rewards credit cards that provide Priority Pass restaurant access:

Credit cards that offer Priority Pass restaurant benefits

Chase Sapphire Reserve®

The Chase Sapphire Reserve® card is perhaps the best-known travel rewards credit card that still offers Priority Pass restaurant benefits, though it is ending July 1, 2024. For now, the card's terms, Chase states that the Priority Pass Select membership that Chase Sapphire Reserve® cardholders receive "includes access to airport lounges, restaurants, cafes and markets."

Chase Sapphire Reserve® cardholders get up to two accompanying guests per visit at no additional cost. Additional guests cost $27 per guest per visit.

A Priority Pass Select membership is just one of the card's many travel benefits. Cardholders also get:

An annual $300 travel credit.

TSA PreCheck or Global Entry application fee statement credit.

Two complimentary years of Lyft Pink All Access.

Access to Luxury Hotel & Resort Collection

These are a few of the perks you will find among the card's slew of benefits.

» Learn more: Is the Chase Sapphire Reserve worth its annual fee?

Bank of America® Premium Rewards® Elite credit card

The Bank of America® Premium Rewards® Elite credit card offers perhaps the most unique and generous Priority Pass restaurant benefit of any card on the list.

Premium Rewards Elite cardholders get up to four complimentary Priority Pass Select memberships with restaurant access per account. Even better, Bank of America doesn't restrict how many guests each Priority Pass member can bring into a lounge or restaurant on each visit — and there's no cost associated with bringing guests into a lounge with you.

That indicates that cardholders get up to four unlimited Priority Pass Select memberships, each with unlimited guests.

If you have a large family, this Priority Pass Select membership can easily justify the card's $550 annual fee. And that's before you factor in the card's other travel benefits, which include:

TSA PreCheck or Global Entry application fee credit.

Up to $300 annually in airline incidental statement credits.

Up to $150 annually for purchases such as rideshare services.

» Learn more: The best Bank of America credit cards available right now

Emirates Skywards Premium World Elite Mastercard®

This little-known premium Emirates rewards card offers primary cardmembers and authorized users "unlimited visits for yourself as well as guests" — with no fee listed for guests over a set limit. That seems to indicate that there's no limit to the number of guests cardholders can bring into a Priority Pass lounge or restaurant with them.

In addition to this Priority Pass lounge benefit, Emirates Skywards Premium World Elite Mastercard® cardholders get Emirates Skywards Gold tier membership for their first year plus 10,000 bonus Skywards miles each account anniversary. The card charges a $499 annual fee.

» Learn more: Are the Emirates Mastercards worth their annual fee?

UBS Visa Infinite Card

UBS offers an unlimited Priority Pass Select membership with restaurants for cardholders of the UBS Visa Infinite Card and the UBS Visa Infinite Business Card.

Unfortunately, details such as guest access and Priority Pass benefits for authorized users are absent from the UBS website. So, it's unclear how many guests cardholders can bring into Priority Pass lounges or restaurants with them.

However, even without guest access, this card may be a good fit for luxury travelers. Cardholders get:

A $250 credit for qualifying air travel expenses.

Premium benefits at select hotels through the Visa Infinite Luxury Hotel Collection.

VIP amenities at select Ritz-Carlton properties, Fairmont and Park Hyatt properties.

Plus, cardholders unlock a $500 annual credit by spending $25,000 in either the current or prior calendar year.

Use your credit card for Priority Pass restaurant meals

Using your Priority Pass membership at participating airport restaurants is a great way to get a full meal before or after your flight.

However, it's important to remember that some card issuers — such as American Express — don't include "non-lounge airport experiences" such as restaurants in their Priority Pass lounge benefits. That means it's important to check your card's terms before counting on this benefit.

Regardless of which card you have, you'll likely need to enroll with your bank before you can take advantage of this Priority Pass Select membership benefit. Also, keep in mind that Priority Pass doesn't cover gratuity on meals. So, remember to have cash on hand to tip your waitstaff.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Watch CBS News

California Governor Newsom launches abortion travel ban ad campaign in Alabama

By Dave Pehling

Updated on: April 22, 2024 / 1:41 PM PDT / CBS San Francisco

California Governor Gavin Newsom is taking aim at states considering abortion travel bans with the launch of a new ad campaign.

Newsom's Campaign for Democracy ad is set to air in Alabama starting Monday. The governor tweeted out the ad in a social media post Sunday morning.

Alabama’s abortion ban has no exceptions for rape or incest. Now, Republicans are trying to criminalize young women’s travel to receive abortion care. We cannot let them get away with this. pic.twitter.com/gHbYJYlEXk — Gavin Newsom (@GavinNewsom) April 21, 2024

The text with the video post reads, "Alabama's abortion ban has no exceptions for rape or incest. Now, Republicans are trying to criminalize young women's travel to receive abortion care. We cannot let them get away with this."

The 30-second commercial shows two nervous young women driving in a car passing a sign that reads "State Line 1 Mile."

"We're almost there. You're gonna make it," the passenger tells the woman behind the wheel just before they hear a siren and are pulled over by a state trooper.

"Trump Republicans want to criminalize young Alabama women who travel for reproductive care," a voiceover says as the state trooper walks up to the car.

"Miss, I'm going to need you to step out of the vehicle and take a pregnancy test," the trooper says, waving a test stick in one hand. The next shot shows the driver leaning on the hood of her car as the trooper puts her in handcuffs.

"Stop them by taking action at RightToTravel.org ," the voiceover intones as the ad ends.

Alabama is currently weighing a bill that would make it a crime to help women travel outside the state in order to receive an abortion. The ad is part of a larger effort to combat travel bans across the United States. Newsom was behind a similar ad that ran in Tennessee.

The RightToTravel.org website says that those two states and Oklahoma are considering bills that ban minors from traveling out of state to get an abortion without parental consent, even if it's a case of incest or if there is abuse in the family.

It isn't the first action the governor has taken in the political battle over abortion since the U.S. Supreme Court overturned Roe v. Wade in June of 2022. Two days after the ruling, Newsom partnered with the governors of Oregon and Washington to issue a multi-state commitment promising to defend access to reproductive health care, including abortion and contraceptives.

In September of that year, he launched a billboard campaign in seven of the most restrictive anti-abortion states urging women seeking the procedure to come to California for treatment. He also signed more than a dozen new abortion laws protecting women's reproductive rights and ordered the state to end its contract with Walgreens after the pharmacy giant indicated it would not sell an abortion pill by mail in some conservative-led states .

- Gavin Newsom

- Roe v. Wade

Dave Pehling started his journalism career doing freelance writing about music in the late 1990s, eventually working as a web writer, editor and producer for KTVU.com in 2003. He moved to CBS to work as the station website's managing editor in 2015.

Featured Local Savings

More from cbs news.

Bay Area air travelers welcome new refund rules on canceled flights, lost luggage

Harvey Weinstein's 2020 rape conviction overturned by New York court

Supporters of Alameda County DA Pamela Price recall renew push for special election

Advocates seeking rent control in San Pablo submit signatures for ballot measure

Advertisement

Coming to Alabama: Newsom’s Abortion-Access Ad, Depicting an Arrest