Language selection

- Français fr

What type of insurance do I need for International Experience Canada?

For International Experience Canada , you must have health insurance for the entire time you are in Canada. The health insurance must cover

- medical care;

- hospitalization; and

- repatriation.

We recommend you buy this insurance only after you receive your port of entry (POE) letter. We can’t recommend specific insurance companies or plans, but you can search online for something that meets your needs.

You may be refused entry if you don’t have insurance. If your insurance policy is valid for less time than your expected stay in Canada, you may be issued a work permit that expires at the same time as your insurance.

Did you find what you were looking for?

If not, tell us why:

You will not receive a reply. Telephone numbers and email addresses will be removed. Maximum 300 characters

Thank you for your feedback

Answers others found useful

- Can I come to Canada before I receive my POE Letter?

- Can I change employers if I have an International Experience Canada work permit?

- Can I extend my International Experience Canada work permit?

- Can I stay in Canada as a tourist after my work permit expires?

How to video

Form and guide

- Application to work in Canada

Glossary term

- Work permit

IEC Travel Insurance

If you’re going to be travelling to Canada through International Experience Canada (IEC) then one of the requirements to be allowed to enter Canada is that you have IEC travel insurance (IEC health insurance).

But what exactly does the IEC travel insurance need to cover and how can you make sure to get the best deal?

We’ll cover everything you need to know in this article.

International Experience Canada

Iec travel insurance, iec travel insurance requirements, when do i need to purchase iec travel insurance, best iec travel insurance, what to look for in iec travel insurance, iec travel insurance cost, working in quebec.

If you’re figuring out what to do about IEC travel insurance, I’m sure you’re already familiar with what the International Experience Canada program is.

But just to confirm the context around the insurance:

IEC is what Canada calls its working holiday visas program for people aged between 18 and 35.

There are three different types of visa covered by IEC and which ones you can apply for depends on your country of citizenship.

The most common visa is the working holiday visa which is an open work permit. The working holiday visa lets you come to Canada without a job offer and work for almost any employer in Canada.

There are various requirements for each type of visa but, regardless of which visa you get, the IEC insurance requirements are the same.

If you get an IEC visa then one of the requirements you need to meet to be allowed to actually enter Canada on that visa is having IEC travel insurance, or IEC health insurance.

The IEC travel insurance that is required for entry into Canada on an IEC visa is insurance that covers you for medical matters, it’s not travel insurance that covers things like lost baggage.

So a more accurate term for the insurance you need is probably IEC health insurance.

There are a number of requirements that your IEC health insurance needs to cover, otherwise you might be denied entry to Canada.

In terms of the policy coverage, the IEC heath insurance must cover:

- Medical care

- Hospitalization

- Repatriation which includes getting you to a medical facility, and returning you or your remains to your home country

The insurance policy must be for the full duration of the time you plan to spend in Canada. So if you want to stay in Canada for the full two years (or three years for some countries), the policy will need to cover two (or three) years.

If the policy is shorter than two years, when you arrive in Canada the border agent will only give you a permit for the duration of the policy – so your work permit will expire on the day your health insurance does.

Keep in mind you won’t be able to extend your work permit at a later date. So if you want to have the option of staying in Canada for the full length that your visa allows, you need to already have insurance that covers that full time period when you land in Canada.

This is where it’s a good idea to buy insurance that allows you to do partial refunds. So if you leave Canada before you’ve used the whole duration of the policy you can get a refund for the unused duration.

Many of the Canadian insurers offered on the price comparison website we recommend offer partial refunds on time that’s not been used.

One last point on getting insurance to cover your full length of stay – if you can’t get one insurance policy that covers the full time, it’s acceptable to get two consecutive policies instead.

It’s important to note that having IEC travel insurance is not required to apply to IEC or to be approved for the visa. But it is required before you arrive in Canada.

So when you arrive in Canada the border agent will check your insurance and if everything isn’t in order you might be denied entry to Canada.

As with most insurance, there isn’t one insurer I can recommend that is always going to be the best or the cheapest.

What’s best for you will depend on your circumstances and what you want from a policy.

That’s why I recommend the best way of finding your insurance is to use a price comparison website .

The site I use for travel insurance when my family is visiting Canada is BestQuote .

It compares across a whole host of insurers and provides you with various options.

The results page also nicely displays the key components of each policy so you can quickly see which options look good for you.

You can then go ahead and purchase the policy through the BestQuite website.

You can check them out here .

When you’re comparing quotes, some of the key things to look out for are:

Coverage amount . What is the maximum amount the policy will pay out if you need to claim on it? Keep in mind the headline maximum figure will be further broken down into maximum amounts for individual things.

Coverage . What elements does the policy actually cover? Obviously you’ll want to make sure it covers the minimum requirements for IEC travel insurance as outlined above. But also make sure it covers anything else you think you might need and the coverage amount per item is sufficient. A big one here (with this being Canada!) is to consider if you want winter sports coverage.

The deductible . This is how much you’ll need to pay out your own pocket before the insurer will cover the rest. This can range from zero up to thousands, so pick which is right for you. Basically the higher the deductible the lower the insurance premium.

If you’re wanting some ballpark figures of what IEC health insurance might cost I’ve outlined a few ranges below.

I’ve given the costs for a 27 year old, but the insurance cost doesn’t really vary significantly for anyone in the visa age range.

Here’s what some typical IEC travel insurance policies will cost:

- $1,200. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $0 deductible. No pre-existing medical conditions and no winter sports.

- $2,700. Same criteria as above but with a stable pre-existing medical condition.

- $1,025. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible . No pre-existing medical conditions and no winter sports.

- $1,450. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible. No pre-existing medical conditions and winter sports included .

You can use a price comparison website to quickly get an idea of the cost of IEC health insurance for your circumstances.

Some countries have agreements with the province of Quebec that makes you eligible for health coverage. In which case you wouldn’t need IEC travel insurance that covers the medical care component of the requirements.

But the agreement doesn’t cover the repatriation part of the IEC travel insurance requirements so you’ll still need to buy separate insurance for that part. You can find out more if your country has agreements with Quebec here .

* All of the products and services I recommend on Canada for Newbies are independently selected based upon what I’ve personally found to be useful. I f you buy insurance through BestQuote using one of the links in this article, I might earn a small affiliate commission. Rest assured it won’t cost you anything and I would never recommend something I don’t believe in or use myself.

So that’s my overview of IEC health insurance. I hope you’ve found it useful.

Please feel free to drop me a comment on anything below.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Signup for new content and exclusive extras in your inbox.

The Best Travel Insurance for Canada: IEC Working Holiday

The International Experience Canada (IEC) Working Holiday program offers young people the chance to live and work in Canada for up to two years. It is an amazing opportunity but there is a couple of rules to abide by when taking part in the IEC.

One of these is the program requirement to have comprehensive health insurance while in Canada.

This article will help you find the best travel insurance for Canada. I moved to Canada on the IEC program and I’ve helped thousands of people do the same since then.

Last updated November 2023 . This post includes some affiliate links – if you make a purchase via one of these, we may receive a small percentage of the sale.

The importance of travel insurance for Canada

As mentioned, it is a mandatory part of the IEC program to have health insurance for the length of your stay in Canada.

If you go to Canada without appropriate IEC travel insurance, you may receive a shortened work permit and/or be refused one altogether.

Those who do receive a shortened work permit are unable to extend or adjust the work permit later. This happens to more people than you would think!

As per the IEC rules , your health insurance for Canada must cover:

- medical care,

- hospitalization, and

- repatriation (returning you to your country in the event of severe illness, injury or death).

Be sure to buy the best travel insurance for Canada.

Taking part in the IEC program is a once-in-a-lifetime opportunity for most people – don’t waste this opportunity.

Thinking beyond the IEC requirement for insurance, you should also be aware that medical care in Canada can be very expensive.

Emergency room visits for relatively simple injuries can easily run up a bill of thousands of dollars.

Saving money on buying travel insurance for Canada can turn out to be an expensive mistake.

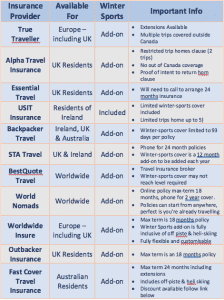

Options for IEC travel insurance

Read on for my research into the best IEC travel insurance for Canada.

Please research each company to ensure that the coverage is right for you. The specifics of the coverage can change at any time. Read the policy wording to make sure that you are covered.

UK and EU citizens – True Traveller

I used True Traveller insurance for my working holiday in Canada.

Travel insurance policies with True Traveller are available up to 24 months in length. Policies can be started if you are already travelling.

Unlimited visits home are also allowed, with the insurance cover being suspended when in your home country. Winter sports coverage is available and there are no minimum residency requirements.

92 activities are covered as standard with True Traveller, including horse riding and bungee jumping. If you need coverage for more activities (such as rock climbing), an additional activity pack can be selected.

An alternative to True Traveller for UK citizens is Go Walkabout . Working Holiday cover is available for 2 years with 3 years available soon. Unlimited visits home are allowed with ski coverage available for an additional premium (Activity Pack 4).

Australian citizens – Fast Cover and HeyMondo

With Fast Cover , an initial IEC 12-month policy can be purchased and then extended for another 12 months on the departure date.

Optional winter sports coverage is available for an additional fee. Fast Cover policies cannot be started when already abroad.

HeyMondo offers single trip policies up to 12 months in length. Coverage for Covid-19 is included as standard as well as up to $10 million for emergency medical and dental expenses.

To have coverage for a full 24 month IEC working holiday, simply purchase 2 x one-year policies before leaving for Canada. For the second policy, you’ll need to tick the ‘already travelling’ box for it to be valid.

There is a 5% discount available for HeyMondo if you use the below link when purchasing. Note that HeyMondo does not offer winter sports coverage.

Alternatively, look at BestQuote (note lower medical coverage), Cover More (phone call required to buy a 2 year policy) or World Nomads.

New Zealand citizens – HeyMondo

HeyMondo includes coverage for Covid and up to $10 million of medical expenses. There is, however, no ski cover available.

For 23 months of coverage with HeyMondo, you’ll need to purchase a 12 month policy and then another 11 month policy. Make sure to tick the ‘already travelling’ box when purchasing the second policy.

Alternatively, look at BestQuote (note lower medical coverage) or World Nomads.

For citizens of 100+ countries – BestQuote

BestQuote are travel insurance specialists, partnered with some of the largest and most reputable insurance providers in Canada. Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

The 2 year IEC policies cover basic (non-competitive) ski cover as standard. Some options also include coverage for Covid19 related claims.

There are various medical coverage amounts available (most starting at $100,000), and adjustable excess levels as well. Please note that this medical coverage is lower than the other insurance providers mentioned on this page.

Buying the best IEC Travel Insurance

There is not one perfect working holiday travel insurance policy for Canada. Everyone has different requirements and circumstances.

The best working holiday travel insurance for Canada is the one that suits your own needs.

Before purchasing travel insurance for Canada, you may want to check factors such as:

- The type of activities that are covered. Climbing, kayaking and even hiking may have an additional premium

- Whether it is possible to return home for a short time and still have valid insurance coverage on return . Some policies become invalidated as soon as you reach home

- Residency requirements to purchase. Some IEC travel insurance policies require a minimum time spent resident in your home country before purchase

- Whether the policy can be started abroad if you are already travelling elsewhere. Most insurers are limited to only covering those who haven’t left home yet

- Winter sports coverage options. Even if you do not plan to work a ski season or live in a mountainous area, things can change

- The excess (deductible) on the policy. This is the amount you have to pay when making a claim

Finding Travel Insurance for Canada

Canada’s IEC program offers some of the longest working holiday options available in the world.

For this reason, one of the biggest problems with buying the best IEC travel insurance is finding a company that offers two-year travel insurance for Canada.

It can be such a rare occurrence that some working holiday companies advise their clients that there is no such thing. This is absolutely not true.

Another thing to remember is that the cheapest travel insurance for Canada may not be the best travel insurance for you. Be sure to look at the coverage limits and whether the policy is suitable for your travel plans.

Working Holiday Travel Insurance for Canada: The Small Print

Always read the policy wording to decide which IEC travel insurance provider and policy is right for you. As noted above, the best travel insurance for Canada isn’t necessarily perfect for everyone.

All details of IEC travel insurance providers mentioned above are correct at the time of writing but are subject to change.

The above companies also offer standard travel insurance for short-term holidays as well as working holiday insurance for Canada.

Found this post helpful? Subscribe to our IEC newsletter ! Working holiday advice and updates delivered straight to your inbox, with a FREE printable IEC packing list

Check out these other posts about working holidays in Canada

IEC Working Holiday Canada Extension Guide

IEC Working Holiday Canada: Arrival Checklist

Working Holiday Visa 2024 Canada IEC: Ultimate Application Guide

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Sunday 14th of May 2023

Hey Gemma, we are NZ residents coming to Canada on an IEC, coming through the US first. We have insurance confirmed for the first 12-months of our travel. Ideally we want to book the second year of our insurance, however, our current insurance company won't do that - they will only extend near the end of our current policy.. Do you know any options for us that would provide insurance for that second year (i.e., provide a policy so far in advance). Alternatively, do you know if it is doable/easy to get our visas extended/updated once we are able to confirm a further 12-months of travel insurance? Hope this makes sense!! Thank you :)

Sunday 21st of May 2023

Hi Annelise,

For your first question, I would look at World Nomads or BestQuote (the latter mentioned in this article). For your second question, you MUST have 23 months of insurance on entry into Canada to receive your full 23 month work permit. There is no way to extend your work permit if you did not have the appropriate insurance on arrival in Canada OR apply again. So make sure you have the full 23 months before you arrive in Canada!

Tuesday 5th of November 2019

Hi Gemma! Currently helping my British fiance figure out flights since he has been accepted for IEC. A little anxious that he will not receive his full 24 month permit if we buy return flights (since return flights only go aprox. 10 months ahead). Should we just splurge and buy the stupidley expensive one way ticket, or can we purchase a round trip ticket and just not use the return ticket? Do the border agents even ask for a return ticket or do they just expect that we won't have one since its an open 24 month work permit? Do you think he would just be able to tell the border agent, if asked, that he does have a return flight 3 days after his arrival flight but plans to cancel it because it's cheaper, then proceed to show the agent proof of funds for a return flight?

Monday 11th of November 2019

The good news is that you don't need a return ticket at all, just proof to be able to purchase one if needed. And for that, a credit card can be shown. Hope that helps!

Thursday 16th of May 2019

Hi Gemma, the question I have, do you have to pay the one year insurance all upfront or is it possible to pay monthly? My travel insurance offered it and I am wondering now if this would be accepted.

Saturday 18th of May 2019

Hi Jessica,

It needs to be upfront, not monthly. A monthly policy can be cancelled at any time so hence is not proof of insurance for the entire length of your trip.

Wednesday 14th of June 2017

Hi Gemma I am going to Canada from New Zealand and looking for travel insurance options...and a bit lost. The link for 'Down Under Insurance' under New Zealand doesn't seem to work, even when I searched it on Google. Would you please be able to recommend a travel insurance company / companies for someone going from New Zealand for the full 23 month period? Thank you :)

Thursday 15th of June 2017

The link to Down Under insurance goes directly to the booking page. As mentioned in the description on my page, you will need to call them to purchase the 23/24 month IEC policy. Alternatively, you could also book 2 x 1 year policies with World Nomads who are also linked on this page.

Saturday 14th of January 2017

Hi Gemma, I have been granted an IEC visa, I want it to be valid for the two years but I don't want to necessary stay there for two years. The idea is I go for 3/4 months say, before returning home. However, I would like to keep my options open and be able to return to Canada in the two year period. I also don't want to be paying for insurance for the full two years if I am not there. I assume It's possible to enter and leave Canada as many times as I like during the two year period?

I applied on my U.K. Passport but I have been living in Australia as a resident, and have become an Australian citizen since being granted my IEC Visa so will be travelling from oz(my Australian address and residency was on my IEC application). So another option I am looking at is if it's possible to reapply on an Australian passport now I can obtain one, even thought I have been granted the IEC on my uk passport. The reason being is I have to enter Canada by end of June 2017, however I am still in two minds financially as paying off debts and it would be more suitable for me to leave at a later date(I was granted my IEC a lot quicker then anticipated). I will be 31 in November 17 so would have to apply by then with Australian passport.

Otherwise 3rd option is to go on a holiday before end of June to validate and get the two years granted and then return later(rather then quitting my job and going for 3/4 months as per option one), but again that will go back to my intial question on insurance options to get a visa for two years to come and go as I please, and also if it's possible to enter and re-enter during the two years.

Thanks for any input or advice. Sorry it's long winded but wanted to include all the facts. You run a great site and I have been finding your ebook on whv in Canada most helpful. :-)

Tuesday 17th of January 2017

Wow, a lot of questions! OK, let's see if I don't miss anything. You can enter and re-enter Canada with the IEC subject to normal entry requirements (i.e. it is not technically a visa and as such does not guarantee entry). The usual problem with entering and leaving is with insurance. Most insurance policies do not allow you to return to your home country for 10 or more days. Some do not even allow you to return at all without invalidating the policy. To receive the full 2 year work permit on arrival it is necessary to have 2 years insurance - if you do not, then you risk being given a work permit to the length of your insurance (or no permit at all if you don't have any insurance).

Australian insurance by the way (as in, coverage for Australians) is VERY expensive, much more expensive than insurance for UK residents/citizens. Be aware though that you may not be eligible for many UK insurance policies as you have not been resident there for a while.

It seems like you have two options -

Go to Canada before your POE expires, activate your work permit with two years insurance. If you need to go home directly afterwards, that is OK, provided your insurance provider allows it (as mentioned, not many do and only for a short time). True Traveller allows you to return home for an indefinite time period without invalidating your policy is True Traveller. With your living situation, they are also one of the few UK insurers that you may be eligible to get a policy with.

Second option is to apply for the Australian quota. I would do this before September as the pools closed in early autumn last year. You must receive an invite before your 31st birthday to be eligible.

Our partner, Cigna, offers newcomers peace of mind. Get a free quote !

Find the best immigration program for you. Take our free immigration quiz and we’ll tell you the best immigration programs for you!

How To Choose The Best Travel Insurance For Canada

By Hugo O'Doherty

Updated 7 days ago

Find the best immigration programs for you

Advertisement

Rate article

Share article, whether you're planning a temporary visit or temporary move (with a temporary work permit), there are many companies offering travel insurance for canada -- and health insurance as well. but which policy will meet your needs.

Not all travel insurance or health insurance policies are created equal for your stay in Canada. Your plans will dramatically impact the type of coverage you need, so you will need to consider the following (amongst other factors):

- The length of your stay.

- Which provinces and territories you plan to visit.

- Your age and health status.

- Your planned activities while you stay (snow sports and other adventure sports may require specific coverage).

- Any supplementary coverage you might need.

- Whether you need specific insurance to receive your work permit .

It’s important that you find coverage that’s tailored, meets your needs, and is affordable.

What you'll find on this page

Start your IEC working holiday with a free Moving2Canada account

Do you have IEC health insurance?

What’s the difference between travel insurance for canada vs. health insurance.

Health insurance is designed specifically to cover medical expenses. Travel insurance can cover a range of different costs, which may include things like trip cancellation, lost luggage, medical costs, and repatriation. Notably, some travel insurance packages actually include health insurance coverage, so you may not need to buy them separately.

Health Insurance for Permanent Residents in Canada

If you are moving to Canada through a permanent residence program, you may eventually enjoy publicly-funded healthcare in Canada — but you won’t be covered for the first few months after landing. The reason for this is that it often takes a few months for your provincial or territorial health coverage to kick in. This means that you should consider health insurance for these first months in case of any emergencies.

Health Insurance for Temporary Residents in Canada

While you may get coverage in the province or territory you settle in, you may also need to wait several months for the coverage to kick in if you are moving to Canada on a study permit or on a work permit (with some exceptions, see below). It’s important for you and your family, if applicable, to get quality health insurance for those early months, both Cigna Global and BestQuote are leaders in these policies. Get a quote from Cigna and a quote from BestQuote to begin comparing your options!

IEC Work Permit

If you’re participating in the IEC Working Holiday Visa in Canada program, you are required to have health insurance that covers the full duration of your work permit and insurance that will cover repatriation costs. Oftentimes, you can purchase a package for travel insurance for Canada which will cover all IEC requirements, including for health insurance.

You need this insurance even if you become eligible for provincial healthcare and medical cover from your employment in due course.

We always recommend beginning with BestQuote as they will offer you a comparison of rates for many different options on the market. Get your free quote from BestQuote today !

Quick note: British Columbia and Alberta are world-famous for skiing and snowboarding. If you want to hit the slopes, make certain your Canadian travel insurance policy contains coverage for any potential injuries.

Where will you be buying your travel insurance or health insurance for Canada?

Select the region you’ll be in when you’re buying your travel insurance for Canada, or your health insurance.

BestQuote Travel Insurance

A full service Canadian travel insurance broker offering the widest selection of travel insurance plans for visitors to Canada. Available plans may include health coverage, coverage for up to 24 months, and coverage related to pre-existing medical conditions. Plans are available before or after leaving home. Get your quote from BestQuote today !

True Traveller

For years True Traveller has been a popular option for Europeans seeking mandatory insurance for International Experience Canada (IEC) including the Working Holiday program. True Traveller’s IEC insurance includes medical care, hospitalization, and repatriation which exceeds IRCC’s requirements. Get your quote from True Traveller today !

BestQuote Travel Insurance A full service Canadian travel insurance broker offering the widest selection of travel insurance plans for visitors to Canada. Available plans may include health coverage, coverage for up to 24 months, and coverage related to pre-existing medical conditions. Plans are available before or after leaving home. Get your quote from BestQuote today !

Fast Cover Travel Insurance The company of choice for Australian IEC participants seeking travel insurance for Canada. Options for 12 and 24 months, and a range of products from medical only to comprehensive, snow sports, and adventure activities. Duo policies, for couples or two friends travelling together, get 5% off. Get a quote from Fast Cover .

New Zealand

Rest of the world (including canada), canadian health insurance.

Permanent residence applicants can consider more comprehensive health insurance policies, above typical plans for travel insurance for Canada.

Expatriate health insurance ensures access to the best possible healthcare while living and working abroad. Cigna Global is a leader in these policies and provides 12-month cover for those moving to Canada, regardless of nationality or age.

Click here to get a free online quote, which should take less than 60 seconds to complete.

Why IEC work permit holders need health insurance (and may want travel insurance for Canada)

1. It’s mandatory for IEC work permits.

Every year, we hear countless stories from people who aren’t issued with an IEC work permit because they didn’t buy Canadian health insurance. The rules clearly state that you must have insurance for the full duration of your work permit (e.g. two years).

2. You can’t buy a short policy, and then extend it later.

Again, the rules are clear: you can’t buy a three-month policy and agree to extend it to a two-year policy just to appease the immigration officer.

For example, if you only buy health insurance on a three-month or six-month policy, then the immigration officer is within their rights to issue only a three-month or six-month visa. This cannot be extended at a later date.

3. Provincial insurance doesn’t give the coverage you need.

Provincial insurance that’s on offer is not accepted as adequate by federal immigration officers. This is because it will not cover repatriation costs, i.e. flying you to your home country in the event of death.

Other costs not included in provincial cover included: dental accidents, ambulance, medications, medical devices like casts and crutches, and trips to the US and Mexico. BestQuote has these options and will enable you to compare rates from many different insurance providers. Get your quote from BestQuote today !

4. Nobody likes paying for insurance, but the alternative could be a lot worse.

You buy insurance in case the worst happens. Often, we feel it’s a waste if that big event does not happen. As an adult, we encourage you to be responsible, as your family would not appreciate a $20,000 hospital bill in the event of serious injury or death and your repatriation home.

Where to next?

- Get your Canadian adventure off to the best start! Download our free Getting Started Guide magazine .

- Learn how to shop around: see our 7 easy questions to ask your travel insurance provider article.

- Find work in construction and engineering. Visit our Outpost Recruitment agency .

Related Content

Express Entry Draw Weekly Recap – April 22 to 26, 2024

Latest IEC Working Holiday Canada News

Canada changes travel requirements for Mexican citizens

Latest Express Entry Draws Results

About the author.

Hugo O'Doherty

Get immigration help you can trust

Book a consultation with one of Moving2Canada's recommended Canadian immigration consultants. You deserve the best in the business.

Get the latest news & updates

Sign up for the Moving2Canada newsletter to get the latest immigration news and other updates to help you succeed in Canada.

Popular Topics

Search results

results for “ ”

Immigration

Learn everything you need to know about Canadian immigration

If you need help with your immigration, one of our recommended immigration consultant partners can help.

Calculate your estimated CRS score and find out if you're in the competitive range for Express Entry.

Take the quiz

Your guide to becoming a student in Canada

Take our quiz and find out what are the top programs for you.

Watch on YouTube

This guide will help you choose the best bank in Canada for your needs.

Get your guide

News & Features

latest articles

Our Partners

Privacy overview.

Where do you live

All persons to be insured must reside at a permanent address within the EEC ( Excluding Switzerland, Russia, Belarus, Montenegro and the Ukraine) to be eligible for cover.

Can I take out this insurance if I am already travelling?

When cover is purchased after an Insured Person has departed their home to commence their journey, there is a fixed period of 48 hours prior to cover commencing. Any illness arising during this initial 48 hour period will be an excluded Pre-existing Medical Condition. In the event of serious injury in connection with an accident, you will be covered from the date you take out cover subject to the accident being independently witnessed and also verified by a Medical Practitioner.

There is no 14 Day Cooling off Period and no premium refund will be made if the insured Person has already travelled.

family family

Definition of a couple

A couple is defined as 2 adults who have been permanently living together at the same address for more than six months, who intend to travel together.

If you do not qualify as a couple, please select individual(s)

Annual Multi-Trip Durations

Annual Multi Trip policies are designed for multiple short holidays leaving from and returning to your home country.

Annual Multi Trip trip limits:

Standard policy - 30 days

Premier policy - 70 days

If you need continuous cover for a year (home visits allowed on policies over 4 months long) select Single Trip or One Way. You can travel around as much as you like, to as many different countries as you like, with a Single Trip or One Way policy.

One Way Trip

Please note a Single Trip policy can cover travels with no return ticket booked, a One Way policy is intended for:

Emigrating to new country where you intend to permanently live

Returning to your home country permanently

All cover ceases upon arrival at final destination

Select the type of policy most suitable for your needs.

Single Trip: A flexible policy with no limits on how many countries you visit or how long you’re away for. Suitable for all types of travel whether it be short term/long stay or backpacking. No return ticket required and unlimited home visits offered on policies over 4 months long.

One Way Trip: Means you are Emigrating to a new country where you intend to live permanently or, returning to your home country permanently. Cover will end upon arrival at your final destination. Please note: There is no cover for emergency return travel expenses if you do not have an original return ticket.

Annual Multi-Trip: This policy covers an unlimited number of trips throughout the 12 month Period of Insurance. Each trip has a maximum stay validity depending on the type of policy chosen. For example, for Standard Policies, the maximum duration of any trip shall not exceed 30 days and for Premier policies, the maximum duration of any trip must not exceed 70 days.

If you are already travelling it is not possible to purchase the annual multi-trip policy.

Geographical Areas

Europe: Europe means the continent of Europe West of the Ural Mountains, and includes the Isle of Man, the Channel Islands, Iceland, Jordan, Madeira, the Canary Islands, the Azores and Mediterranean Islands as well as all countries bordering the Mediterranean. Australia & New Zealand: a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide excluding North America & Mexico: (North America means the USA, Canada & Mexico.) a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide including North America & Mexico: Worldwide means anywhere in the World including the USA, Canada & Mexico.

Automatic Trip Extension If the Insured Person is prevented from completing their travel before the expiration of this Insurance as stated under the Period of Insurance on the Booking Invoice or Validation Certificate (as applicable) for reasons which are beyond their control, including ill health or failure of public transport, this Insurance will remain in force until completion but not exceeding a further 31 days on a day by day basis, without additional premium. In the event of an Insured Person being hijacked, cover shall continue whilst the Insured Person is subject to the control of the person(s) or their associates making the hijack during the Period of Insurance of a period not exceeding twelve months from the date of the hijack. Please ensure you arrange cover for the entire duration of your travel

Where you normally reside

Where do you normally reside? Where do you normally reside? Please use the drop down box to choose your country of residence. Note we can only insure residents of the UK & EEA Countries. Can I take out this Insurance if I’m already abroad? If you are normally a resident of the UK or EEA Countries and your insurance has run out, you may take out cover online with us. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim. Note you cannot take out our Multi-Trip Insurance if you are already abroad. Do you have minimum residency requirements? No. If you are, for example, a British Passport holder and have right of abode in the UK, we are not concerned as to how many months in the past year you have been in the UK provided at the time of arranging this insurance you have a UK residential address.

Age Restriction Error

We are unable to quote, Please ring our Offices on 0333 0033 161 for further assistance.

Get a Quote

Medical & Repatriation

All of our policies exceed the International Experience Canada (IEC) requirements. Our Premier policy covers you for up to £10m for hospitalisation, medical and repatriation expenses ; up to £5m for our standard policy; and up to £2m for our budget policy. All our policies also include emergency dental treatment to relieve pain and suffering (limited to £350).

Winter Sports

We have 4 different options for our winter sports add-on. You can include cover for 14, 28 or 56 days of consecutive or non-consecutive winter sports activities, or you can include cover for the entire duration of your policy with our Unlimited add-on.

Free Home Visits

If you feel homesick at any time, so long as your policy duration is more than 4 months, you can pop home to see family and friends at any time, however many times you choose. Covers stops as soon as you arrive home and starts again as soon as you depart.

Early Return Refund

Decide Canada’s not for you and want to return earlier than your full period of insurance? Other insurers will tell you to wave goodbye to your money, but Big Cat lets you claim a partial premium refund for the unused time you didn’t stay in Canada.

Easy to Re-new or Extend

Big Cat allows you to re-new or extend your travel insurance whether you are at home or abroad. It doesn't matter if you are already travelling you can buy or re-new your policy from anywhere in the world via online access to our system.

No Return Ticket Required

Unlike most other Insurers we don't require you purchase a return airline ticket. Our IEC policy allows stays for up to 2 years, so presenting IEC insurance for 2 years at the Canadian border on entry means that you can receive the maximum 2 year visa. Show up with just 6 months insurance and you'll only get a visa for 6 months!

Up to £10m Medical Cover

No return ticket required, 24 hour emergency helpline, claim while still travelling, iec travel insurance.

For British citizens aged between 18 and 30 years you can travel to Canada for a working holiday under the IEC visa programme. This will allow you to find temporary paid employment to help pay for your trip (up to 24 months). That means, for example, you could work in a ski resort in Banff, a restaurant in Quebec, or gain work experience at a business in Toronto.

Key Features of the Big Cat IEC Travel Insurance :

- Emergency Medical and Repatriation Expenses up to £10 million.

- Emergency Dental Cover up to £350.

- Cover duration of up to 2 years.

- Baggage Cover.

- Gadgets & Valuables Cover up to £1000.

- Free Home visits.

- Policy Extensions whilst still travelling.

- 156+ Sports and Activities.

- You can claim whilst Travelling.

- Winter Sports Cover.

- Loss of Passports & Visas replacement costs.

- Early Return Refund scheme, conditions apply, please see FAQ page.

Frequently Asked Questions:

If you get sick while travelling or you're seriously injured you are covered for emergency medical treatment including:

- Hospitalisation

- Ambulance costs

- Surgery and follow up treatment

- Visits to the Doctor

- Repatriation

- Prescribed Medicine

- Emergency dental treatment to relieve pain and suffering (limited to £350)

24hrs Medical Emergency Assistance.

Decide Canada’s not for you, and want to return earlier than your full period of insurance?

Other insurers will tell you to wave goodbye to your money, but Big Cat lets you claim a partial premium refund for the unused time you didn’t stay in Canada.

How does the EARLY RETURN REFUND work?

Let’s say you buy a 24-month policy to cover your time in Canada. But after nine months, you decide that Canada’s not for you, and you want to return home. You may have invested a substantial amount for your 24 months Big Cat policy, most of which you’ll now no longer need. Unlike most insurers, Big Cat is happy to offer you a partial refund on the redundant portion of your insurance as a fair’s fair consolation. Please note that travel insurance premiums are not calculated on a pro-rata basis, as such, no refund is calculated in this manner either.

How does Big Cat calculate the amount of EARLY RETURN REFUND?

We take the length of time of the original policy and subtract the actual amount of time you have used, and payout the difference, deducting a £50 Cancellation Charge.

Are there other conditions that apply to my EARLY RETURN REFUND?

- Only applicable to 24 month IEC policies.

- We are not able to offer refunds to cover the first 6 months of the policy.

- No refund can be given on a policy where a claim has been made or is likely to be made prior to the cancellation of your Big Cat policy.

- You must be back in your home country and notify us by email of your wish to cancel the policy within 14 days of your arrival, please also provide us with proof of your return to the UK (flight ticket / e-ticket / boarding pass).

- All refund calculations are based on the base premium paid only. Add-ons are non-refundable.

Can you give an example of how much I could receive back in my EARLY RETURN REFUND?

Say you took out a 24-month budget IEC policy costing £525.24, then you wish to cancel the policy after 9 months. Our 9-month budget IEC policy costs £312.55. So we deduct £312.55 from £525.24 = £212.99

Then we apply the £50 Cancellation Charge, refunding you a total of £162.99.

Temporary return to home country (Single trip policies only) Where cover has been purchased for a total duration of 4 months or more, and you want to return to your home country during the period of insurance for any reason that is not directly or indirectly caused by arising or resulting from, or in connection with a claim under this insurance all cover under this policy will be suspended from the time that you clear customs in your home country and restarts after the baggage check in at the international departure point for the return flights, international train or ferry to the overseas destination. Any illness, disease, injuries, accidents which existed, showed symptoms or were diagnosed in the previous trip(s) during this period of insurance will not be covered in the restarted period of insurance.

To add any of our Activity Packs, just follow the Quote form - to stage 3 - there you will find all of the optional extras.

You do not need to call the medical screening helpline in respect of the following automatically covered pre-existing medical conditions, as they are automatically covered at no additional premium provided you do not also have a pre-existing medical condition. If you have a pre-existing medical condition in addition to any of the following automatically covered pre-existing medical conditions all conditions will be excluded from cover, unless disclosed to the medical screening helpline and additional cover agreed in writing.

A cne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication),

B lindness or partial sightedness,

C arpal tunnel syndrome, Cataracts, Chicken pox – if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis – provided there is no on-going treatment,

D eafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting – if completely resolved,

E czema, Enlarged prostate – benign only, Essential tremor,

G laucoma, Gout,

H aemorrhoids, Hay fever,

L igament or tendon injury – provided you are not currently being treated,

M acular degeneration, Menopause, Migraine – provided there are no on-going investigations,

N asal polyps,

R SI, Sinusitis – provided there is no on-going treatment,

S kin or wound infections that have completely resolved with no current treatment,

U nder active Thyroid (Hypothyroidism), Urticaria,

V aricose veins in the legs.

To declare any pre-existing medical conditions,

please visit our online medical screening

If you would rather undergo your medical screening by telephone,

please get in touch with us on 01702 427237 and any of our agents will be happy to assist you.

This is a secure and confidential service which allows you to declare any pre-existing medical conditions you may have,

as defined by your Big Cat policy wording.

For more information about the (IEC) International Experience Canada insurance requirements, visit the Canadian Immigration & Citizenship .

Big Cat Travel Insurance Services, a trading name of Flynow.com Ltd (registration No.FRN 745388) is an Appointed Representative of Campbell Irvine Ltd (registration No.306242) who are authorised and regulated by the Financial Conduct Authority. You may check this on the Financial Services register www.fca.org.uk or by contacting them on (0) 800 111 6768. © 2023 Big Cat Travel Insurance Services. All rights reserved.

A fantastic plugin that allows you to display age restriction message to the visitors while visiting site

List of automatically covered medical conditions that do not need to be declared

Acne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication), Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox - if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis - provided there is no on-going treatment, Deafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting - if completely resolved, Eczema, Enlarged prostate - benign only, Essential tremor, Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury - provided you are not currently being treated, Macular degeneration, Menopause, Migraine - provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis - provided there is no on-going treatment, Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid (Hypothyroidism), Urticaria, Varicose veins in the legs.

Important information

If you have a medical condition in addition to any of the automatically covered medical conditions, all conditions will be excluded from cover unless declared to the medical screening helpline.

What is classed as a medical condition?

a Any respiratory condition (relating to the lungs or breathing), heart condition, stroke, Crohn’s disease, epilepsy, allergy, or cancer for which you have ever received treatment (including surgery, tests or investigations by your doctor or a consultant/ specialist or prescribed medication).

b Any psychiatric or psychological condition (including anxiety, stress and depression) for which you have suffered which you have received medical advice or treatment or been prescribed medication for in the last five years.

c Any medical condition for which you have received surgery, in-patient treatment or investigations in a hospital or clinic within the last 12 months, or for which you are prescribed medication.

Any premium for medical screening quoted can be paid directly. This can be done either before or after taking out a policy with us. The policy and medical extension connect automatically, no reference numbers need to be exchanged.

Choosing not to declare a medical condition will not invalidate cover, but any costs incurred in relation to an undeclared condition will not be covered.

If making a declaration all medical conditions must be declared, you can't choose to only declare certain conditions.

Medical conditions can only be declared for up to 12 months at a time. A second declaration will have to be made after 12 months if necessary.

You are about to leave the site, this text will be refined later.

Best IEC Travel Insurance: Our Best Travel Insurance for Canada 2024

By: Author Sunset Travellers

Posted on Last updated: January 12, 2024

Categories Canada , Travel

In this post, we cover the Best IEC Travel Insurance: Our Best Travel Insurance for Canada – IEC Working Holiday Insurance.

If you’re moving to Canada under the International Experience Canada (IEC) program, you NEED to take out the right IEC health insurance policy.

After you receive your POE (point of entry) letter, it’s time to find the best travel insurance for Canada. Trust us, we spent a few weeks researching and trying to find the best one. So, having spent two years on our own IEC visa in Canada, we decided to share our travel insurance recommendations so you can pick the best option for you.

So, what is the best IEC Travel Insurance you recommend?

Loved these views in Vancouver!

You can read further down about why we chose these companies and what the guidelines are from the Canadian government. Based on all the important factors, we have found these companies to have the best travel insurance for Canada:

- True Traveller (for Europe and UK residents)

- Fast Cover insurance (for Australian residents)

- BestQuote Travel Insurance (for all nationalities, pre or post-departure)

There are a lot of companies out there which can make things quite hard when choosing the appropriate travel insurance for your Working Holiday Visa in Canada. Depending on the country you are from, your IEC visa might be approved for one or two years. For example, Steve has received a two-year work permit with an Irish passport. Sabina, with a Polish passport, was able to receive a work permit that was valid for one year only.

But thankfully, I have dual citizenship and got approved for a second IEC visa with my other passport. Otherwise, I was unable to stay for two years with Steve in Canada.

We have used these companies not only personally but also in our IEC Facebook group .

Navigating Insurance Requirements for the 2024 IEC Working Holiday:

Understanding the correct insurance for your 2024 IEC Working Holiday in Canada can be a bit perplexing. In the past, even the Canadian Government referred to the necessary coverage as ‘travel insurance’ in its communications with IEC applicants. This terminology led many insurance providers and information sources to promote travel insurance policies specifically for IEC participants.

However, the Government’s recent communications have shifted to a more precise term: IEC health insurance. This change aligns more closely with the actual requirements, as the essential coverage you need is health-related, not just general travel insurance. We’ll delve into the specifics of this coverage in the following section.

Despite this clarification, some insurance providers might still market their policies as IEC travel insurance. But, often, these policies are essentially health insurance. It’s crucial, therefore, to thoroughly examine any policy you’re considering to ensure it meets the specific health coverage requirements for your IEC Working Holiday.

This is why we worked hard to double-check with these companies that they are acceptable as the IEC travel insurance.

So, if you are coming from:

True Traveller Insurance

A favourite (and the one we used!) among Europeans for the International Experience Canada (IEC) program, including the Working Holiday initiative, True Traveller stands out for its comprehensive coverage. Our IEC-specific insurance not only meets but exceeds IRCC requirements, encompassing medical care, hospitalization, and repatriation. Trust True Traveller for your IEC journey – get your quote today!

BestQuote , a premier Canadian travel insurance broker, offers an extensive range of travel insurance options tailored for visitors to Canada. Our plans, which can be obtained either before or after departure, may cover health-related needs, extend up to 24 months, and even include pre-existing medical conditions. Secure your peace of mind with BestQuote’s comprehensive travel insurance plans – get your quote now!

Australia And New Zealand IEC insurance cover 🦘 :

Fast Cover(AUSTRALIA ONLY) is the go-to insurance provider for Australian participants in the International Experience Canada (IEC) program. Catering to your travel needs in Canada, we offer flexible policies for both 12 and 24 months. Our diverse range includes everything from basic medical to comprehensive coverage, as well as specialized options for snow sports and adventure activities. Travelling as a couple or with a friend? Our Duo policies offer a 5% discount for pairs. Start your Canadian adventure with confidence – get a quote from Fast Cover today.

BestQuote (NZ + AUSTRALIA) works for Australians as it is a premier Canadian travel insurance broker that offers an extensive range of travel insurance options tailored for visitors to Canada . Our plans, which can be obtained either before or after departure, may cover health-related needs, extend up to 24 months, and even include pre-existing medical conditions. Secure your peace of mind with BestQuote’s comprehensive travel insurance plans – get your quote now!

Rest of the world:

BestQuote is a premier Canadian travel insurance broker that offers an extensive range of travel insurance options tailored for visitors to Canada . Our plans, which can be obtained either before or after departure, may cover health-related needs, extend up to 24 months, and even include pre-existing medical conditions. Secure your peace of mind with BestQuote’s comprehensive travel insurance plans – get your quote now!

The International Experience Canada website states the following requirements:

For an iec working holiday visa in canada , you must have health insurance for the entire time you are in canada..

Therefore, we both needed 24-month insurance for Canada. If we were to get travel insurance for Canada for any shorter period than our intended stay, we would have received a work permit only valid until our insurance is.

This rule applies to everyone.

It is very important to get the appropriate travel insurance for Canada.

If you get asked at the border for proof of your travel insurance, make sure that it is valid for the entire duration of your intended stay.

Many people get only six months or one year of insurance and receive shortened work permits. When choosing the best travel insurance for your IEC visa in Canada, make sure that it also covers all the government requirements .

As per the IEC rules , health insurance must cover you for the following:

- medical care

- hospitalisation and

- repatriation (returning you to your country in the event of severe illness, injury or death).

If you go to Canada without appropriate IEC travel insurance, your work permit might be shortened and/or you might be refused one entirely.

A note from the government website :

“ We recommend you buy this insurance only after you receive your port of entry (POE) letter of introduction. We can’t recommend specific insurance companies or plans, but you can search online for something that meets your needs. You may be refused entry if you don’t have insurance. If your insurance policy is valid for less time than your expected stay in Canada, your work permit may expire at the same time as your insurance .”

Provincial Canadian healthcare or medical cover from your employment typically does not cover repatriation costs.

After you land your dream job, it takes time to get enrolled in the healthcare system, and there’s usually a cool-off period.

Therefore, you need to get separate 2-year travel insurance for Canada.

Don’t make the mistake of thinking you will be fine without one. We personally know a few people who decided to get the most basic insurance and ended up in a hospital with a broken bone and a huge medical bill to take care of. Many companies have policies built especially for the IEC visa, but it is essential to find the best travel insurance for Canada suitable for you.

We had to do our research based on several criteria and important inclusions.

What is the best IEC travel insurance?

That great feeling when you are fully insured!

Great question!

Depending on where you are travelling from and what you want to do in Canada, there will be certain criteria you might be looking for.

Based on all the important factors, we have found these companies to have the best travel insurance for Canada:

There are a lot of companies on the market, but based on our own experience and friends’ recommendations, these are the best companies to go with.

When choosing your coverage, there are a few important questions you need to ask the insurance company before buying your 24-month travel insurance for Canada.

Let’s face it: 24 months is a LONG time, and you don’t want to pick the wrong company!

Buying the best travel insurance for Canada

Along with the Canadian government rules, there are a few different things you might want to consider when choosing your insurance.

To put it simply, these are the most common things you want to check before buying IEC travel insurance:

- What is the level of my coverage?

If you are planning to hit the slopes or go hiking or kayaking, make sure that your insurance covers you. Most insurance companies will have an additional premium for covering you for extra activities. Who knew that cage shark diving isn’t included in the basic cover!?

- Am I covered for trips outside of Canada?

Travelling to the US, Central America, or any location outside of Canada might not be covered by some companies. If you are planning to explore the world, check if the places you are heading to while in Canada are covered. BestQuote has options to include trips outside of Canada to the USA, Mexico or elsewhere.

- What is your policy if you wish to take a trip back home for a holiday?

Some insurers have a limit on trips to your home country, others only allow a couple, and some enable unlimited trips back and forth. Whether you plan to stay in Canada or visit home regularly, find out how your insurer covers you for home visits.

True Traveller , for example, allows you to go home as many times as you like!

- Is there any excess?

You need to know how much you have to put out of your pocket to make a claim. The best coverages are no excess ones- but usually, you will have to pay a bit more for these.

- Are your items and luggage covered?

It is critical for the company to cover you in case of luggage delay, bags lost by the carrier in transit (it happens!), stolen luggage, stolen passports etc.

- Are you covered for activities like winter sports?

While we didn’t plan on snowboarding when we first landed in Vancouver, we were glad we opted for the additional cover when we decided to try snowboarding. We ended up doing a whole winter season in Whistler, and True Traveller completely covered us! You might also want to hike the Rocky Mountains , so make sure to get the right cover.

- Whether the policy can be started abroad if you are already travelling elsewhere.

Most insurers are limited to only covering those who haven’t left home yet.

- How do I contact the insurance company in case of an emergency in Canada and abroad?

Save the phone number on our phone as soon as you purchase your coverage.

So what are the best two-year IEC travel insurance options and why?

Relaxing again because kayaking is included in your policy.

Before you get overwhelmed with contacting every travel insurance company asking the above questions, we have done the hard work for you.

If you prefer to do your own research, remember that buying the cheapest travel insurance for Canada usually isn’t a good idea.

Cheap insurance will have a lot of coverage limits, and keep in mind this is the next two years of your life!

The best travel insurance options for Canada

Flying high over Toronto!

True Traveller – Available for EU citizens (including the UK)

These guys have been incredible, and we have continued to use them as we travel around the world. They offer you not only unlimited trips home but also fantastic coverage.

Travel insurance policies with True Traveller are available for up to 24 months, which covers you for the entire duration of your visa!

Winter sports coverage is available, and there are no minimum residency requirements.

You can claim while you’re still in Canada, as there is no need to wait to return home.

True Traveller covers you for over 92 activities on their standard cover.

These include bungee jumping, horse riding, safari touring, scuba diving to 18 meters and lots more activities you may end up doing on your trip.

For those extreme travellers out there, you can easily add more options at very reasonable prices.

We both used them for our 2-year IEC travel insurance and always recommended them to others.

We found True Traveller, the best and cheapest IEC insurance for Canada from Europe .

Get a quote here for your IEC travel insurance.

“Oh, so you went with Fast cover to!? Woo”

Fast Cover – Available for Australians

Our family, friends and many other people we met who have come from Australia went with Fast Cover.

They offer initial cover for 12 months but then it can be easily extended for another 12 months on the day of departure.

This totals the full 24 months needed for the IEC working holiday for Australians.

You simply purchase the first 12 months of travel insurance, and then you can log in and purchase the next 12 months.

Simply log in to the ‘Your Policy’ section of their website and extend it up to the full two years.

They also allow unlimited trips home, and it is not necessary to have a return ticket home in order to submit your claim.

Winter sports cover is also available, and their basic cover includes a whole host of activities!

Also worth noting is that their Ski & Snowboarding cover is one of the best we have ever seen!

They even include off-piste activities, which are often not included.

Fast Cover policies also include 24-hour overseas emergency assistance for IEC travellers.

Whale watching in Vancouver!

BestQuote Travel Insurance

With BestQuote , you can view and compare the best insurance options available for your IEC visa.

We really like them as their website is very clear and you can easily view and compare insurance prices, benefits, refund policies and much more.

Simply start your quote by:

- choosing the dates of your intended stay in Canada,

- adding any additional countries, you wish to visit

- indicating the number of travellers included in the cover

- adding dates of birth

- filling your email address

And your quote will appear instantly!

BestQuote Travel Insurance also offers several IEC policies that allow for up to two years of coverage.

Whether you are from Ireland, Australia, the UK, France, Portugal or New Zealand (max 23 months), you can get covered for the two years of your IEC visa.

The BestQuote policy is issued through Lloyd’s Underwriters and has been specifically designed for IEC travellers (which means peace of mind for you).

With BestQuote, you get the required health and repatriation benefits.

They also include basic skiing/snowboarding cover and allow unlimited trips outside of Canada for up to 35 days.

Final tips for Working Holiday Insurance for Canada ( th e small print)

Finding travel insurance for canada.

While we have used most of the companies above, it is always worth spending that little bit extra just to read the fine print.

It is important to pick the IEC travel insurance provider and policy that is right for you.

As we mentioned above, you will be with them for the next 12 to 24 months, so it is worth spending that little bit of extra time to read through everything.

Please always double-check cover details directly with your insurance policy provider, as any of the above information may change at any time.

Thank you so much for reading, and if you have any questions at all, please reach out to us!

You will also find a great selection of useful links and discounts on other services below:

Other useful links for your IEC visa:

Booking.com – This is the perfect alternative to Airbnb when you need a short place to stay.

Hostelworld – If you need a cheap place to stay where you can meet other travellers, Hostelworld is the best.

OFX – Another great money transfer company for larger transfers. We usually use them for larger sums. Follow the link for free transfers for life.

CurrencyFair – Our favourite money transfer company. They are 8x cheaper than banks. Follow the link for 10 free transfers with CurrencyFair.

Best Quote and TrueTraveller – The best travel insurance companies on the market! We personally used them both and can highly recommend them.

Taxback.com – Every time we have to do our taxes or claim Superannuation, we use these guys.

Sendmybag – The best company to ship your excess luggage to and from Australia. Follow our link for a 5% discount on your shipment.

If you need more info on moving to Canada, make sure to check out our Canada posts here .

Like what you are reading? Pin the image below!

Thanks for stopping by

Steve and Sabina

Notify me of follow-up comments by email.

Notify me of new posts by email.

Sunset Travellers

Sunday 13th of October 2019

Thanks a lot for letting us know!

Gerphil Galleto

Good day! I already found a travel insurance company they said that if something happens on me at work in canada they can't cover anything that happened to me because of my work. Is this reasonable from Insurance company?

Hi Gerphil,

Travel insurance is not a health insurance. It's designed for emergencies only. Once you are in Canada you most likely will be able to get health insurance via your employer. Best of luck!

- Choosing an IEC Travel Insurance Policy

Essential Requirements

Choosing the right insurer, questions to ask, 24 month travel insurance providers.

Don’t forget to check out our Youtube channel or WSC Ski-Tok for those wanting more visually appealing content!

Use our free instant-call back or Whatsapp widgets to get in touch. Check out our FAQ’s. for answers to all your questions.

But if you have any unanswered concerns we are always on hand to help via our free instant call-back , mail & Whatsapp widgets.

IEC Travel Insurance Options

Choosing a 2 year IEC Travel Insurance Policy

The IEC working holiday visa for Canada is 24 months for most countries, which means you need a 2 year IEC travel insurance policy. In this article, we’ll tell you what to look out for, the essential requirements of travel insurance, questions to ask, and at the very end, we list and link to the companies which offer 24-month travel insurance policies.

- The policy must cover the entire length of your stay. The immigration officer who issues your work permit on arrival will only issue a visa for the length of your travel insurance policy. So, if you’re trying to save money and only opt for a 1-year policy, be aware that you will only be issued a 1-year work permit, and it can’t be extended once it’s issued.

- Your IEC travel insurance policy must cover medical care, hospitalization and repatriation to your home country.

- Comprehensive winter sports cover is essential for all Winter Sports Company clients. We recommend taking a high level of winter sports cover, especially if you expect to ski or snowboard in the back-country or snow park.

- You are looking for a ‘long-stay’ or a ‘single trip’ policy. A multi-trip policy is standard travel insurance for holidays but usually, it only insures you for trips 30 days or less and is not suitable for IEC travel insurance.

- The added extras – consider everything! This insurance may save you tens of thousands of dollars in the long run.

Insurance companies all have different terms and conditions – before you commit to a policy, read the fine print. For example, some policies may include a clause of proof of intent to return to your home country at the end of your visa. If you can’t prove this, any claims you make may be rejected.

Trips home and further travelling – some companies have a condition written into their policies that you can only travel outside of Canada once or twice (this includes trips home). If you are planning further travel or may extend your stay after your visa expires, look for an IEC travel insurance policy with ‘extensions possible’.

Pre-existing medical conditions will need to be declared and checked to see if they are covered in your policy. If you need medical attention during travel, paying more for insurance to cover pre-existing conditions will be worthwhile.

Don’t forget, Travel Insurance companies are smart – and they will investigate. This can include checking your travel records and medical records to refuse pay-outs if you break the terms of your insurance.

What is the level of cover before I travel?

It is a good idea to opt for a policy with cancellation cover from the date you purchase insurance until the day you travel – most policies will include this as standard.

How are claims handled?

Some insurance companies require you to pay for things upfront and then claim reimbursement. Others deal with claims directly – be clear on this policy. It will cause you less stress if you have an unexpected trip to the hospital and you know what proof you need to make a claim.

Where can I view my documents?

You need a printed proof of insurance for IEC to enter the country. Most insurance companies offer digital proof of insurance – so save it to your computer.

Does the policy have financial failure protection?

This means you can claim if a company that is providing you with part of your trip goes into liquidation.

Is there a free-phone claims line, and what is the number for calling outside the country?

Put this number in your phone – then you have quick access to it in emergencies.

Am I covered for trips outside of Canada?

If you think you’ll take impromptu trips south of the border to the USA, or holidays further afield, make sure your insurance covers these.

What is your policy on trips home?

Some insurers do not allow trips home, others only allow a couple, and some allow unlimited trips back and forth. Be wise and realistic; returning to your home country may seem unlikely. However, you don’t want to void your insurance if you need to make a trip home for a family emergency.

Are luggage and personal items covered?

This includes ski and snowboard equipment – if you’ve got a lot of expensive stuff, find out if it’s covered and how much for.

Can I make changes to my policy?

Do you think you might extend your trip or want to add an extra level of cover at a later date? If so, check if this is possible – some insurance policies are iron clad after the initial cooling off period.

What is your policy on pre-existing medical conditions?

If you need cover for existing conditions, ask as many questions as possible about it, and get something in writing before you commit to the policy.

Is there an excess waiver, and how much is it?

Insurance companies usually offer an excess waiver which means if you need to claim, you don’t have to pay anything towards your claim.

Is this the best price you can do?

This is always worth an ask! Travel insurance can be expensive, but never be afraid to phone up. Ask if there is an active discount code or if you can have a discount for booking insurance well in advance.

True Traveller BigCat Travel insurance Fast Cover Travel Insurance

For short term travel and winter sports cover, check out our insurance page .

Canada , IEC , Insurance , Internships , Visa , Work Permit

Privacy Overview

- Trustpilot Reviews

- Instructor Courses

- Internships

- Career Break

- Progression

- Instructor courses

- All Mountain Experience

- Ski Patrol | Snowboard Patrol

- The Wintersports Knowledge Base

- Snow Ready Fitness Program

- Sun Peaks – Canada

- Panorama- B.C Canada

- Hidden Valley-Canada

- Verbier- Switzerland

- Queenstown – New Zealand

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis dapibus rutrum vulputate. Mauris sed eros nec est vehicula mattis ac vitae ligula. Maecenas vitae tristique sapien, vitae pellentesque lectus.

Get a free one hour consultation

Phone: (+1) 800 697 7717

Email: [email protected]

VISITOR TO CANADA | EMERGENCY MEDICAL INSURANCE

Compare the best quotes & buy online, cost friendly packages on your way, we offer you best deals, exciting packages just a click away, easy and quick way of insurance.

Find Your Plan

Your personal information is safe with us

What is IEC Working Holiday Visa in Canada Program?

We’ve made a life that will change you.

IEC Working Holiday Visa provides temporary work permits to young people from over 30 countries, so they can legally live and get a job in Canada. The permits are valid for either 12 or 24 months, depending on your country of citizenship.

Eligibility Your country of citizenship must have an agreement with Canada that allows you to apply for an IEC work permit, or You may be able to use a Recognized Organization.

Our IEC Insurance Partners